Attached files

| file | filename |

|---|---|

| EX-4.5 - EXHIBIT 4.5 - HUMANIGEN, INC | ex4_5.htm |

| EX-32.2 - EXHIBIT 32.2 - HUMANIGEN, INC | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - HUMANIGEN, INC | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - HUMANIGEN, INC | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - HUMANIGEN, INC | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - HUMANIGEN, INC | ex23_1.htm |

| EX-21.1 - EXHIBIT 21.1 - HUMANIGEN, INC | ex21_1.htm |

| EX-10.20 - EXHIBIT 10.20 - HUMANIGEN, INC | ex10_20.htm |

| EX-10.19 - EXHIBIT 10.19 - HUMANIGEN, INC | ex10_19.htm |

| EX-10.18 - EXHIBIT 10.18 - HUMANIGEN, INC | ex10_18.htm |

| EX-10.17 - EXHIBIT 10.17 - HUMANIGEN, INC | ex10_17.htm |

| EX-10.16 - EXHIBIT 10.16 - HUMANIGEN, INC | ex10_16.htm |

| EX-10.15 - EXHIBIT 10.15 - HUMANIGEN, INC | ex10_15.htm |

| EX-10.14 - EXHIBIT 10.14 - HUMANIGEN, INC | ex10_14.htm |

| EX-10.5 - EXHIBIT 10.5 - HUMANIGEN, INC | ex10_5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended December 31, 2020 | |

| Or | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-35798

HUMANIGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

77-0557236 (I.R.S. Employer Identification No.) |

533 Airport Boulevard, Ste. 400

Burlingame, CA 94005

(Address of Principal Executive Offices) (Zip Code)

(650) 243-3100

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | HGEN | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ☒ | Smaller reporting company x | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ¨ No x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s voting stock held by non-affiliates as of June 30, 2020, was approximately $370,406,889 based on the closing price of $24.55 of the Common Stock of the registrant as reported on the OTCQB Venture Market operated by OTC Markets Group, Inc. on such date. As of March 5, 2021, there were 53,482,364 shares of the registrant’s Common Stock, par value $0.001 per share, outstanding.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’s Annual Meeting of Stockholders to be held on June 17, 2021, is incorporated by reference in Part III to the extent described therein.

Humanigen, Inc.

Form 10-K

Index

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements that discuss future events or expectations, projections of results of operations or financial condition, trends in our business, business prospects and strategies and other “forward-looking” information. In some cases, you can identify “forward-looking statements” by words like “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “intends,” “potential” or “continue” or the negative of those words and other comparable words. These statements may relate to, among other things, our expectations regarding the scope, progress, expansion, and costs of researching, developing and commercializing our product candidates; our opportunity to benefit from various regulatory incentives; expectations for our financial results, revenue, operating expenses and other financial measures in future periods; and the adequacy of our sources of liquidity to satisfy our working capital needs, capital expenditures, and other liquidity requirements. Actual events or results may differ materially due to known and unknown risks, uncertainties and other factors such as:

| · | the evolution of scientific discovery around the coronavirus, COVID-19 and the lung and other organ and systems dysfunction resulting in some patients may indicate that cytokine storm is caused by or results from something other than elevated GM-CSF levels; |

| · | the results of our Phase 3 trial of lenzilumab for the prevention and treatment of cytokine storm in patients hospitalized with COVID-19; |

| · | the enrollment, timing and results of the ACTIV-5/BET study sponsored by NIH for the use of lenzilumab and remdesivir in patients hospitalized with COVID-19; |

| · | the possibility that FDA might not grant an EUA for lenzilumab or, if one were granted, that its duration might be shorter than anticipated or the EUA might be conditioned to a greater degree than anticipated; |

| · | the duration and impact of the COVID-19 pandemic; |

| · | our ability to timely source adequate supply of bulk drug substance for our development and if approved, commercial products from third-party manufacturers on which we depend; |

| · | the negative impact that may result from manufacturing delays due to displacement of scheduled production at certain of our Contract Manufacturing Organizations (CMO) as mandated from Rated Orders issued under the Defense Production Act (DPA) or the shortage of raw materials and critical components we are experiencing and expect to continue to experience relating to Rated Orders and increased demand for production at our CMOs; |

| · | if an EUA is granted for lenzilumab, our ability to accurately forecast and predict future revenues in the U.S. and outside the U.S. coupled with our ability to produce sufficient quantities on a timely basis to meet demand; |

| · | our ability to research, develop and commercialize our product candidates, including our ability to do so before our competitors develop and commercialize competing products or alternative therapies or vaccines that may reduce the demand for our product candidates; |

| · | our ability to execute our strategy and business plan focused on developing our proprietary monoclonal antibody portfolio and our GM-CSF knockout gene-editing CAR-T platform; |

| · | our ability to enter into partnerships with potential collaborators with development, regulatory and commercialization expertise to enable us to pursue the other initiatives in our development pipeline; |

| · | our ability to successfully pursue the Kite collaboration and the enrollment, timing and results of pending and planned clinical trials contemplated by the collaboration; |

| · | the initiation and successful completion of the acute GvHD study in the UK with the IMPACT Partnership; |

| · | our ability to attain the additional financing we will need to pursue our development initiatives, manufacturing requirements and commercialize our product candidates on favorable terms or at all; |

| · | our ability to successfully maintain the listing of our common stock on the Nasdaq Capital Market; |

| · | the timing of the initiation, enrollment and completion and results of planned clinical trials; |

| 3 |

| · | the potential, if any, for future development of any of our present or future products; |

| · | increasing levels of market acceptance of CAR-T therapies and stem cell transplants and the development of a market for lenzilumab in these therapies; |

| · | our ability to successfully progress, partner or complete further development of our programs; |

| · | the potential timing and outcomes of development, preclinical and clinical studies of lenzilumab, ifabotuzumab, HGEN005, any of our CAR-T projects and the uncertainties inherent in development, preclinical and clinical testing; |

| · | our ability to identify and develop additional uses for our products; |

| · | our ability to attain market exclusivity and/or to obtain, maintain, protect and enforce our intellectual property and to operate our business without infringing, misappropriating or otherwise violating, the intellectual property rights of others; |

| · | the outcome of pending, threatened or future litigation; |

| · | acquisitions or in-licensing or out-licensing transactions that we may pursue may fail to perform as expected; |

| · | our ability to obtain and maintain regulatory approval of our product candidates, and any related restrictions; |

| · | limitations and/or warnings in the label of an approved product candidate or one that is granted an EUA; |

| · | changes in the regulatory landscape that may prevent us from pursuing or realizing any of the expected benefits from the various regulatory incentives, or the imposition of regulations that affect our products; |

| · | the success, progress, timing and costs of our efforts to evaluate or consummate various strategic alternatives if in the best interests of our stockholders; and |

| · | the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing. |

These are only some of the factors that may affect the forward-looking statements contained in this annual report. For a discussion identifying additional important factors that could cause actual results to vary materially from those anticipated in the forward-looking statements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in this Annual Report on Form 10-K. You should review these risk factors for a more complete understanding of the risks associated with an investment in our securities. However, we operate in a competitive and rapidly changing environment and new risks and uncertainties emerge, are identified or become apparent from time to time. It is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this annual report. You should be aware that the forward-looking statements contained in this annual report are based on our current views and assumptions. We undertake no obligation to revise or update any forward-looking statements made in this annual report to reflect events or circumstances after the date hereof or to reflect new information or the occurrence of unanticipated events, except as required by law.

| 4 |

PART I

Overview

We are a clinical stage biopharmaceutical company, developing our portfolio of immuno-oncology and immunology monoclonal antibodies. We are focusing our efforts on the development of our lead product candidate, lenzilumab™, our proprietary Humaneered® (“Humaneered”) anti-human granulocyte-macrophage colony-stimulating factor (“GM-CSF”) monoclonal antibody. Lenzilumab is a monoclonal antibody that has been demonstrated in animal models to neutralize GM-CSF, a cytokine that we believe is of critical importance in the hyperinflammatory cascade, sometimes referred to as cytokine release syndrome (“CRS”) or cytokine storm, associated with COVID-19, chimeric antigen receptor T-cell (“CAR-T”) therapy and acute Graft versus Host Disease (“GvHD”) associated with bone marrow transplants. GM-CSF neutralization with lenzilumab has been shown to reduce downstream inflammatory cytokines, prevent CRS and reduce its associated neurologic toxicities in-vivo in validated preclinical human xenograft models (Blood. 2019 Feb 14;133(7):697-709).

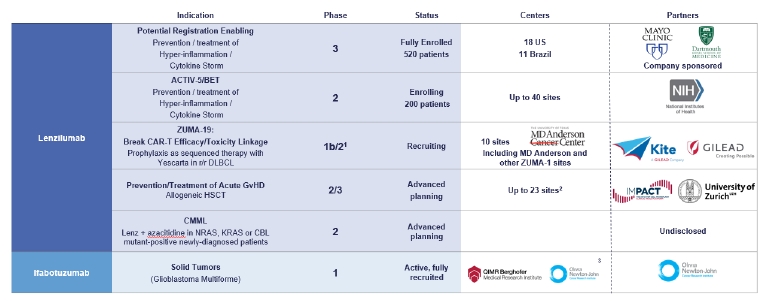

Lenzilumab has completed full enrollment in a Phase 3, multi-center, double-blind, placebo-controlled potential registrational trial for hospitalized, hypoxic patients with COVID-19 pneumonia. If the data from the trial are favorable, based on our discussions with the U.S. Food and Drug Administration (“FDA”), including a Type B meeting, and in consultation with the regulatory experts at Operation Warp Speed, we plan on filing an Emergency Use Authorization (“EUA”) application in the second quarter of 2021. If the EUA is granted, we could begin to commercialize lenzilumab for the treatment of hospitalized COVID-19 pneumonia patients. We also intend to file a Biologics License Application (“BLA”) in 2021, again assuming the data from the Phase 3 trial are favorable and support such an application. Based on discussions with FDA, we understand that a BLA will require us to generate and present more clinical and manufacturing data than would be required to support an EUA. If the ACTIV-5/BET study described below is successful and completed on a timely basis, we plan to include the results in our BLA filing. COVID-19 infections are widespread and as of February 26, 2021 in the United States, there were over 28 million cases, nearly 1.8 million hospitalizations and over 510 thousand deaths. Several vaccines have been developed which show efficacy in excess of 90%, however the slow rollout of inoculations and the emergence of numerous COVID-19 variants lead us to believe the need for therapeutics to treat COVID-19 currently exists and will continue to exist.

Lenzilumab has been selected to be part of the ACTIV-5 “Big Effect Trial” (ACTIV-5/BET NCT). This study is sponsored by the National Institutes of Health (“NIH”). ACTIV-5/BET is designed to determine whether certain approved therapies or investigational drugs in late-stage clinical development show promise against COVID-19 and, therefore, merit advancement into larger clinical trials. ACTIV-5/BET, currently has 17 active U.S. sites enrolling and is expected to enroll in up to 40 U.S. sites, will evaluate lenzilumab with remdesivir, compared to placebo and remdesivir, in hospitalized COVID-19 patients, with approximately 100 patients expected to be assigned to each study arm. We are providing lenzilumab for the study, which is fully funded by NIH.

Lenzilumab is also being studied in a multicenter phase 1b/2 potential registrational trial as a sequenced therapy with Yescarta® (axicabtagene ciloleucel) to reduce CRS and neurotoxicity in patients with relapsed or refractory diffuse large B-cell lymphoma (“DLBCL”) (NCT04314843). This trial currently has 10 active sites and is being conducted in partnership with Kite Pharmaceuticals, Inc., a Gilead company (“Kite”), which markets Yescarta. We are also in the final planning stages for a Phase 2/3 trial for lenzilumab to treat patients who have undergone allogeneic hematopoietic stem cell therapy (“HSCT”) who are at high and intermediate risk for acute GvHD. The trial is expected to be conducted by the IMPACT Partnership, a collection of 22 stem cell transplant centers located in the United Kingdom.

Our proprietary, patented Humaneered technology platform is a method for converting existing antibodies (typically murine) into engineered, high-affinity human antibodies designed for therapeutic use, particularly with acute and chronic conditions. We have developed or in-licensed targets or research antibodies, typically from academic institutions, and then applied our Humaneered technology to produce them. Lenzilumab and our other two product candidates, ifabotuzumab and HGEN005, are Humaneered monoclonal antibodies. Our Humaneered antibodies are closer to human antibodies than chimeric or conventionally humanized antibodies and have a high affinity for their target but low immunogenicity. We believe our Humaneered antibodies offer additional advantages, such as high potency, a slow off-rate and a lower likelihood to induce an inappropriate immune response or infusion related reactions.

| 5 |

Scientific Rationale and Background on Lenzilumab

Lenzilumab neutralizes GM-CSF. The coronavirus pandemic, which has been triggered by the SARS-CoV-2 virus and leads to the condition referred to as COVID-19, is characterized in the later and sometimes fatal stages by lung dysfunction and, in many patients, multi-organ impairment, which is triggered by Cytokine Release Syndrome (“CRS”), or cytokine storm. Publications have pointed to GM-CSF as being a signature cytokine in this process, with elevated GM-CSF levels correlated to poorer outcomes and sometimes ventilator use and Intensive Care Unit (“ICU”) admission.

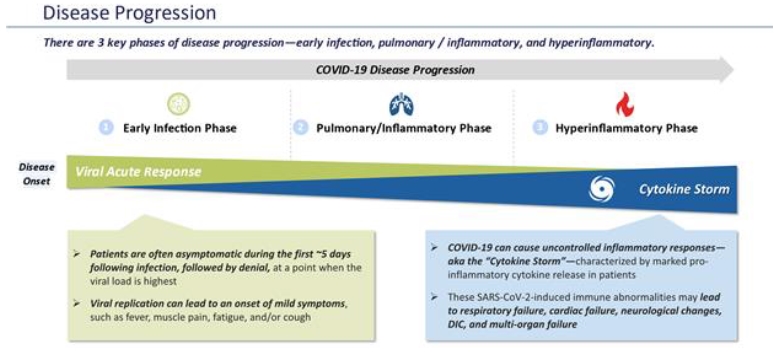

COVID-19 has three distinct phases: early infection, pulmonary/inflammatory and hyperinflammatory. As shown on the diagram below, lenzilumab is being studied for use in patients that are in the pulmonary/inflammatory phase who are hospitalized and hypoxic.

The severe clinical features associated with some COVID-19 infections result from an inflammation-induced lung injury which may require supplemental oxygen through a nasal cannula, non-invasive or invasive mechanical ventilation or Extra Corporeal Mechanical Oxygenation (ECMO) and sometimes ICU care. This lung injury is a result of a hyperinflammatory dysregulation of the immune system and associated with cytokine storm. The lung injury that leads to death is not directly related to the virus but appears to be a result of a hyper-reactive immune response to the virus triggering a cytokine storm that can continue even after viral titers remain stable or even begin to fall.

CRS is characterized by an elevation of inflammatory cytokines resulting in fever, hypotension, capillary leak syndrome, pulmonary edema, disseminated intravascular coagulation, respiratory failure, and Acute Respiratory Distress Syndrome (“ARDS”). The development of CRS as a direct result of immune hyper-stimulation has been previously described in patients with autoimmune and lymphoproliferative diseases, as well as in patients with B-cell malignancies receiving CAR-T therapy. Over the last five years, preclinical studies and correlative science from clinical trials in CAR-T therapy have shed light on the pathophysiology, development, characterization, and management of CRS.

| 6 |

CRS is characterized by activation of myeloid cells and release of inflammatory cytokines, including GM-CSF, monocyte chemoattractant protein -1 (MCP-1), macrophage inflammatory protein 1α (MIP-1α), Interferon gamma-induced protein 10 (IP-10), interleukin-6 (IL-6), and interleukin-1 (IL-1). The cascade, once initiated, can quickly evolve into a cytokine storm, resulting in further activation, expansion and trafficking of myeloid cells, leading to abnormal endothelial activation, increased vascular permeability, and disseminated intravascular coagulation.

Data from National Scientific Review (2020, Vol. 7, No. 6) titled “Pathogenic T-cells and inflammatory monocytes incite inflammatory storms in severe COVID-19 patients”, supports the hypothesis that GM-CSF induced cytokine storm immune mechanisms have contributed to patient mortality with the current pandemic strain and, we believe, in multiple variants, of coronavirus, and there is increasing acceptance that this pathophysiology may be responsible for worsening of clinical status and poor outcomes. The authors noted that steroid treatment in such cases has been disappointing in terms of outcome but suggested that a monoclonal antibody that targets GM-CSF may prevent or curb the hyper-active immune response caused by COVID-19 in this setting. Three recent publications point to GM-CSF as a so-called ‘signature cytokine’ including the largest inflammatory marker study in over 600 patients from a multicenter study in the UK. (Uncontrolled Innate and Impaired Adaptive Immune Responses in Patients with COVID-19 ARDS, deProst et al, AJRCCM Articles in Press., American Thoracic Society, August 31, 2020, 10.1164/rccm.202005-1885OC) (The dysregulated innate immune response in severe COVID-19 pneumonia that could drive poorer outcome, Blot et al. J Transl Med (2020) 18:457) (Elevated antiviral, myeloid and endothelial inflammatory markers in severe COVID-19, Openshaw et al, MedRxIV, doi).

While early studies demonstrated elevated GM-CSF levels in both ICU and non-ICU treated COVID-19 patients, one of these three more recent studies showed a positive association with disease severity and outcome, in agreement with reports of elevated frequencies of GM-CSF+ Th1 cells in patients with COVID-19 requiring ICU treatment. The authors analyzed serial plasma samples from patients hospitalized with COVID-19 recruited through the prospective multicenter ISARIC clinical characterization protocol in the UK. Elevated levels of numerous mediators including angiopoietin-2, IP-10, and GM-CSF were seen at recruitment in patients who later died. This analysis shows that, at the time of enrollment, different COVID-19 outcome groups were already identifiable and associated with distinct patterns of inflammatory mediators and that markers such as GM-CSF were particularly associated with enhanced disease severity and strikingly elevated in fatal cases of COVID-19. An influx of monocytes/macrophages has been described in the lung parenchyma in fatal COVID-19, combined with a mononuclear cell pulmonary artery vasculitis, and presence of pro-inflammatory monocyte-derived macrophages in bronchoalveolar lavage fluid from patients with severe COVID-19. The elevation of GM-CSF in severe disease could contribute to monocyte recruitment and activation leading to this vasculitis, alongside the role of GM-CSF in the recruitment of neutrophils to the pulmonary vasculature.

A second independent study reported serum concentrations of GM-CSF were significantly higher in COVID-19 patients. In this study, increased serum concentrations of IL-8, IL-10 and GM-CSF were associated with disease severity. Strikingly, in this study the serum concentrations of IL-6, IL-1Ra and IL-8 not only showed no, or only marginally, significant differences between COVID-19 and non-COVID-19 ARDS patients but were also not associated with day-28 mortality in COVID-19 patients. Further, the serum concentrations of IL-6 and IL-1Ra correlated with the SOFA score, indicating that these cytokines rather behave as biomarkers of organ-failure-associated hyper-inflammation, consistent with their previously reported association with patient severity and outcome in cohort studies merging patients with mild to severe disease. Interestingly, the concentrations of CCL19/MIP/3b, CCL20/MIP-3a and CCL5/RANTES, which recruit monocytes and T cells, remained stable over time. These chemokines are secreted by CD14+CD16+ inflammatory monocytes, which are enriched in the blood of COVID-19 patients with severe disease. In line with this observation, the serum concentrations of GM-CSF were significantly higher in COVID-19 patients.

A third independent study reported a significant correlation between the duration of mechanical ventilation (“MV”) and GM-CSF (p < 0.0001), IL-10 (p < 0.0001), IP-10 (p < 0.0001), MCP-1 (p = 0.001), CX3CL1 (p = 0.0233), and Granzyme B (p = 0.0143). Based on these results, they performed a multivariate linear regression to identify factors associated with the duration of MV in the first 30 days, using two models (i.e., SOFA score (model 1) or PaO2: FiO2 ratio (model 2) as the variable of adjustment to account for severity). Only GM-CSF was independently associated with a longer duration of MV in both models. The authors estimated an excess of 22.11 ± 8.36 min of MV per increase of 1 pg/mL of GM-CSF (p = 0.0105, model 1; and p < 0.0001, model 2).

| 7 |

Similar to patients receiving CAR-T therapy, the development of CRS in patients with COVID-19 has been associated with elevation of CRP, ferritin, MCP-1, MIP-1 alpha, INF-gamma, TNF-alpha, and IL-6, as well as correlating with respiratory failure, ARDS, and adverse clinical outcomes. Most significantly, high levels of GM-CSF-secreting Th17 T-cells have been associated with disease severity, myeloid cell trafficking to the lungs, and ICU admission. This indicates that post-COVID-19 CRS is caused by a similar mechanism, induced by activation of myeloid cells and their trafficking to the lung, resulting in lung injury and ARDS. Tissue CD14+ myeloid cells produce GM-CSF and IL-6, further triggering a cytokine storm cascade. Single-cell RNA sequencing of bronchoalveolar lavage samples from COVID-19 patients with severe ARDS demonstrated an overwhelming infiltration of newly-arrived inflammatory myeloid cells compared to mild COVID-19 disease and healthy controls, consistent with a hyperinflammatory CRS-mediated pathology. We believe that these new data suggest that GM-CSF may be a critical triggering cytokine in the increased mortality in COVID-19.

Lenzilumab has been shown to prevent cytokine storm in animal models and this work has been published in peer reviewed journals. These data demonstrate that GM-CSF neutralization results in a reduction in IL-6, MCP-1, MIP-1α, IP-10, vascular endothelial growth factor (VEGF), and tumor necrosis factor-α (TNFα) levels, demonstrating that GM-CSF is an upstream regulator of many inflammatory cytokines that are important in the pathophysiology of CRS. GM-CSF depletion results in modulation of myeloid cell behavior, a specific decrease in their inflammatory cytokines, and a reduction in tissue trafficking, while enhancing T-cell expansion and effector functions.

The Phase 3 program in COVID-19 is complementary to the programs in CAR-T and GvHD, which are also focused on preventing or reducing cytokine storm in those disease states. Positive results from the Phase 3 trial in COVID-19 may be predictive of results in these other settings, which are also characterized by cytokine storm.

As a leader in GM-CSF pathway science, we believe that we have the ability to transform prevention and treatment of CRS in SARS-CoV-2 infection. SARS-Cov-2, is one of a group of several betacoronaviruses, which includes the viruses responsible for Severe Acute Respiratory Syndrome (SARS-CoV) and Middle East Respiratory Syndrome (MERS-CoV). These viruses infect predominantly the lower lung and cause fatal pneumonia. Other coronaviruses infect the upper respiratory tract and cause some cases of the common cold. Initially, the clinical course of COVID-19 could be mistaken for influenza infection – patients in both cases often suffer from aches and pains throughout the body, fever, cough and general malaise. However, rapid nasal or throat swab tests for SARS-CoV-2 infection have been developed and are in widespread use. Exposure to people who are known to have suffered from the condition or carriers of SARS-CoV-2 also increases the clinical suspicion of possible infection. Data generated during the SARS and MERS outbreaks point to cytokine storm as a phase of the illness which is characterized by an immune hyperactive phase, which can progress to lung dysfunction and death. In patients who clinically deteriorate, there can be multi-system effects, including hematologic and coagulation disorders, renal, cardiovascular and neurologic impairment, some of which may further complicate respiratory compromised patients. The natural history of SARS infection shows viral load decreases as patients enter the second phase of the illness, which is often characterized by cytokine storm and the elevation of certain biomarkers.

We also believe we have the ability to transform CAR-T therapy and a broad range of other T-cell engaging therapies, including both autologous and allogeneic cell transplantation. There is a direct correlation between the efficacy of CAR-T therapy and the incidence of life-threatening toxicities (referred to as the efficacy/toxicity linkage). We have begun enrolling patients in ZUMA-19, in collaboration with our partner Kite, to assess effect of the sequential therapy of lenzilumab with Yescarta, the leading CAR-T, in reducing or minimizing cytokine storm and neurotoxicity in patients receiving CAR-T, and potentially building further on Yescarta’s current category-leading efficacy. Depending on the final number of patients enrolled, this may serve as a Phase 1b/2 potential registration study.

We believe that our GM-CSF neutralization and gene-editing CAR-T platform technologies have the potential to reduce the inflammatory cascade associated with serious and potentially life-threatening CAR-T therapy-related side-effects while preserving and potentially improving the efficacy of the CAR-T therapy itself, thereby breaking the efficacy/toxicity linkage. Clinical correlative analysis and preclinical in vivo evidence points to GM-CSF as the key initiator of the inflammatory cascade resulting in CAR-T therapy’s side-effects, including CRS and NT. GM-CSF has also been linked to the suppressive myeloid cell axis through recruitment of myeloid-derived suppressor cells (“MDSCs”) that reduce CAR-T cell expansion and hamper CAR-T cell efficacy. Our strategy is to continue to pioneer the use of GM-CSF neutralization and GM-CSF gene knockout technologies to improve efficacy and prevent or significantly reduce the serious side-effects associated with CAR-T therapy.

| 8 |

We believe that our GM-CSF pathway science, assets and expertise create two technology platforms to assist in the development of next-generation CAR-T therapies:

| · | Lenzilumab has the potential to be used in combination with any FDA-approved or development stage T-cell therapy, including CAR-T therapy, as well as in combination with other cell therapies such as allogeneic HSCT such as bone marrow transplants, to make these treatments safer and more effective |

| · | In addition, our GM-CSF knockout gene-editing CAR-T platform has the potential to create next-generation CAR-T therapies that may inherently avoid any efficacy/toxicity linkage, thereby potentially preserving the benefits of the CAR-T therapy while reducing or altogether avoiding its serious and potentially life-threatening side-effects. |

We have utilized a precision medicine approach and personalized the development of lenzilumab based on specific genetic mutations or biomarkers at baseline. We are collaborating with IMPACT, a clinical trial partnership of 22 transplant centers in the United Kingdom, in planning a randomized, placebo controlled, Phase 2/3 study focused on early intervention with lenzilumab in patients at high risk or intermediate risk for steroid-refractory acute GvHD based on specific biomarkers. The goal of the trial, as it is currently contemplated, would be to determine the efficacy and safety of lenzilumab in reducing non-relapse mortality at six months.

We have completed enrollment and reported on a Phase 1 study of lenzilumab as monotherapy in refractory chronic myelomonocytic leukemia (CMML) and are planning a Phase 2 study of lenzilumab in combination with azacitidine (current standard therapy) in newly-diagnosed CMML patients with certain genetic mutations. The Phase 1 clinical trial in patients with CMML identified the MTD or recommended Phase 2 dose of lenzilumab, and assessed lenzilumab’s safety, pharmacokinetics, and clinical activity. The results were reported at the 2019 American Society of Hematology (ASH) conference.

We have also reported on a Phase 2 study with lenzilumab in severe asthma in patients uncontrolled on high-dose steroid therapy.

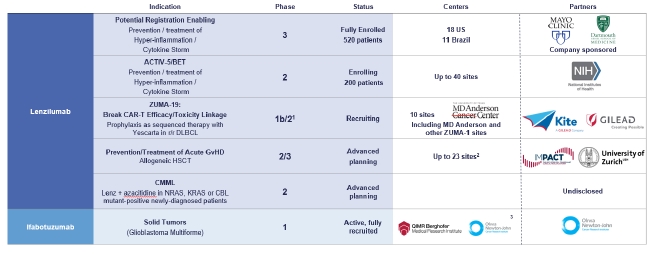

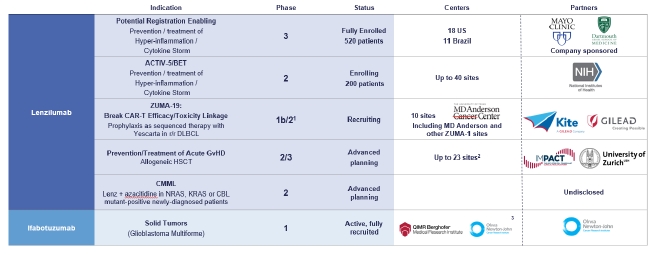

Our Pipeline

Our lenzilumab-based clinical-stage pipeline comprises a Phase 3 potential registration study in COVID-19 which has fully enrolled, the NIH-sponsored and funded ACTIV-5/BET program in COVID-19, a currently enrolling Phase 1b/2 study (ZUMA-19) as sequenced therapy of lenzilumab and Yescarta, a planned Phase 2/3 study in acute GvHD, and a planned Phase 2 study in CMML, the latter two of which we expect will be majority funded by partners. While the majority of our clinical programs involve lenzilumab, we have also fully enrolled an ifabotuzumab Phase 1 study in GBM.

| 9 |

Except for the potential of lenzilumab for COVID-19 under an EUA, our product candidates are in the clinical stage of development and will require substantial time, resources, research and development, and regulatory approval prior to commercialization. Furthermore, it may be years before any of our products are approved for use, if at all. Our current pipeline is depicted below:

1 Phase 3 may not be necessary for approval in ZUMA-19; precedent CAR-Ts to date have been approved on Phase 2 data

2 UK

3 US, EU, Australia

Lenzilumab

Lenzilumab neutralizes human GM-CSF and has the potential to prevent or reduce poor outcomes associated with COVID-19. We have completed enrollment in a Phase 3 multi-center, randomized, placebo-controlled, double-blinded, clinical trial in the setting of COVID-19. There were 18 clinical sites across the US and 11 sites in Brazil involved in the study. This trial will assess the safety and efficacy of lenzilumab in improving ventilator-free survival in hospitalized hypoxic adult patients with confirmed COVID-19 pneumonia.

There are currently no products approved by the FDA for the prevention of CRS/cytokine storm associated with COVID-19. There are numerous products currently in development for COVID-19 which can be broadly categorized as direct acting antivirals, immunomodulators, anticoagulants and other preventative strategies such as vaccines and neutralizing antibodies. Remdesivir (a direct acting antiviral) was approved by FDA for COVID-19. There is no evidence that remdesivir offers a mortality benefit and the largest remdesivir-based global study conducted by the World Health Organization failed to show benefit from remdesivir treatment. Other direct acting antiviral agents such as lopinavir/ritonavir and hydroxychloroquine (with or without a macrolide) have not demonstrated efficacy in randomized controlled trials. Other treatments available under EUA include baricitinib (Olumiant) in combination with remdesivir (Veklury), bamlanivimab alone and with Etesevimab, and REGEN-COV (casirivimab and imdevimab). Published data to date from randomized controlled clinical trials in the setting of COVID-19 and the two leading IL-6 inhibitors, Actemra (tocilizumab) and Kevzara (sarilumab) has been mixed. Recently published results from the The Randomised Evaluation of COVID-19 Therapy (RECOVERY) trial has demonstrated that an anti-inflammatory treatment, tocilizumab, reduces the risk of death when given to hospitalized patients with severe COVID-19.

This is an open label study. The study also showed that tocilizumab shortens the time until patients are successfully discharged from hospital and reduces the need for a mechanical ventilator. The relative reduction in mortality was 14% and the relative reduction in progressing to IMV or death was 15%. A total of 2,022 patients were randomly allocated to receive tocilizumab by intravenous infusion and were compared with 2,094 patients randomly allocated to usual care alone. 82% of patients were taking a systemic steroid such as dexamethasone. Treatment with tocilizumab significantly reduced deaths: 596 (29%) of the patients in the tocilizumab group died within 28 days compared with 694 (33%) patients in the usual care group (rate ratio 0·86; [95% confidence interval [CI] 0·77 to 0·96]; p=0·007), a 14% relative risk reduction and an absolute difference of 4%. Tocilizumab also increased the probability of discharge alive within 28 days from 47% to 54% (rate ratio 1·23, [95% CI 1·12 to 1·34], p<0·0001). These benefits were seen in all patient subgroups, including those requiring oxygen via a simple face mask through to those requiring mechanical ventilators in an intensive care unit. Among patients not on invasive mechanical ventilation when entered into the trial, tocilizumab significantly reduced the chance of progressing to invasive mechanical ventilation or death from 38% to 33% (risk ratio 0·85, [95% CI 0·78 to 0·93], p=0·0005) a 15% relative risk reduction. However, there was no evidence that tocilizumab had any effect on the chance of successful cessation of invasive mechanical ventilation. In June 2020, the RECOVERY trial found that the inexpensive and widely available steroid dexamethasone reduces death for patients with severe COVID-19. Dexamethasone became part of standard-of-care given to all such patients. In this trial, the benefits of tocilizumab were seen to be in addition to those of steroids.

| 10 |

In addition, IL-1 and IL-1 receptor inhibitors, respectively Ilaris (canakinumab) and Kineret (anakinra) have both failed to demonstrate benefit in Phase 3 studies, as has the oral JAK inhibitor Jakafi (ruxolitinib) and the BTK inhibitor Calquence (acalabrutinib). The anti-GM-CSF agent, otilimab failed in an 806-patient randomized controlled study sponsored by GlaxoSmithKline (“GSK”). In a post-hoc analysis of a subgroup of patients older than 70, there was an apparent benefit in the proportion of patients alive and free of respiratory failure at day 28 and mortality at day 60. A 350-patient follow-on Phase 3 study is planned to determine if the benefit in the patients older than 70 can be confirmed. It is unclear whether the anti-GM-CSF agents, gimsilumab and namilumab are continuing development for COVID-19 and the primary endpoint for mavrilimumab for COVID-19 in a 40-patient study was recently missed, though there were some promising data in this small Phase 2 study.

As an upstream regulator of cytokine storm, GM-CSF neutralization with lenzilumab may offer advantages over other immunomodulator strategies that either target other downstream cytokines such as IL-1, IL-6, CCR5 or MIP-1a or are broadly immunosuppressive and target cytokine signaling pathways non-selectively through JAK inhibition. In addition, lenzilumab is the only immunomodulator that was in an active clinical trial to prevent cytokine storm prior to COVID-19 and is currently the only agent in an active Phase 3 trial targeting GM-CSF, with other such agents in earlier stage studies.

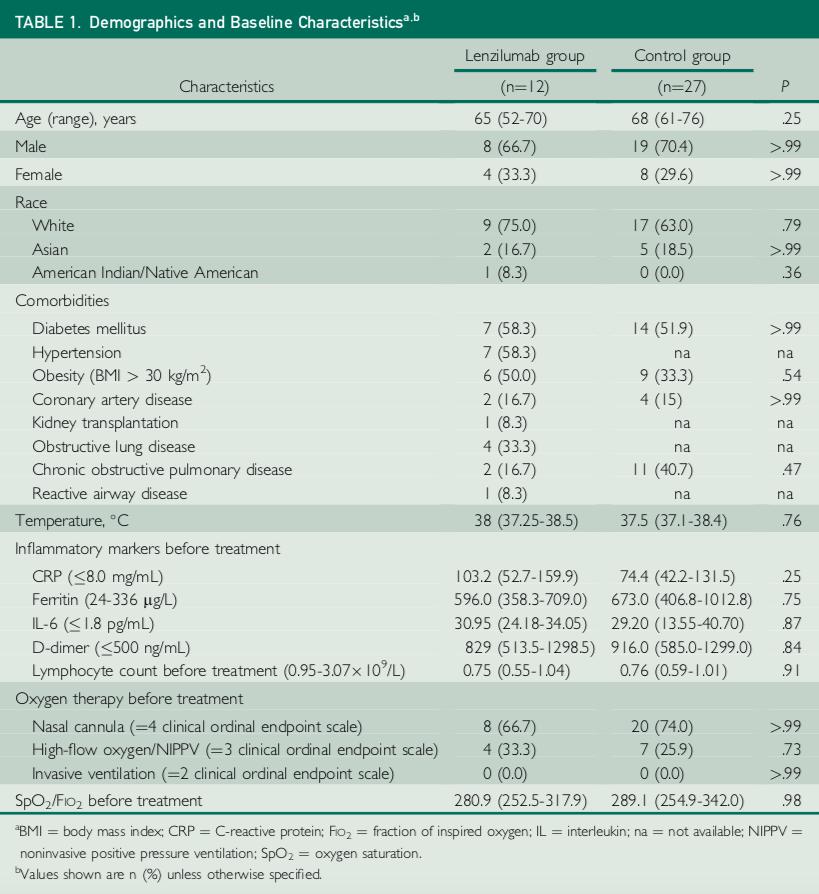

During 2020, we achieved several significant milestones relating to lenzilumab. In April 2020 lenzilumab was granted emergency single use IND authorization from the FDA (often referred to as compassionate use) to treat patients with COVID-19. On June 15, 2020, we announced that Mayo Clinic published data derived from the compassionate use of lenzilumab in the treatment of 12 patients hospitalized in the Mayo Clinic system. Under applicable FDA rules, a patient cannot receive a compassionate use drug unless FDA has issued an individual patient emergency IND authorization, which the Mayo Clinic requested and received from FDA prior to each individual patient dosing of lenzilumab. Accordingly, there was no randomized control group in the Mayo Clinic program. We did not pre-select patients to receive lenzilumab through the compassionate use program and did not deny any requests for compassionate use. Mayo Clinic clinicians solely determined which patients for which they would request emergency IND authorization from the FDA. As discussed below the results of the compassionate use lenzilumab compared to the contemporaneous control group were recently published in the Mayo Clinic Proceedings.

The patients receiving lenzilumab were hospitalized, required oxygen supplementation (hypoxic) as a result of COVID-19 but did not include any patients on invasive mechanical ventilation. They were also viewed as being at high risk of further disease progression. All patients had elevation in at least one inflammatory biomarker prior to receiving lenzilumab. All patients had at least one co-morbidity associated with poor outcomes in COVID-19 and several patients had multiple co-morbidities.

On September 1, 2020, we announced that Mayo Clinic Proceedings, a premier peer-reviewed journal, had published a manuscript reporting the first case-cohort data of lenzilumab in COVID-19 patients. Control patients were identified from an electronic registry of COVID-19 patients in the same centers as cases and matched for age, sex, disease severity, and baseline oxygen requirements. At the time of selection, the clinical outcomes for the matched control patients were not known.

| 11 |

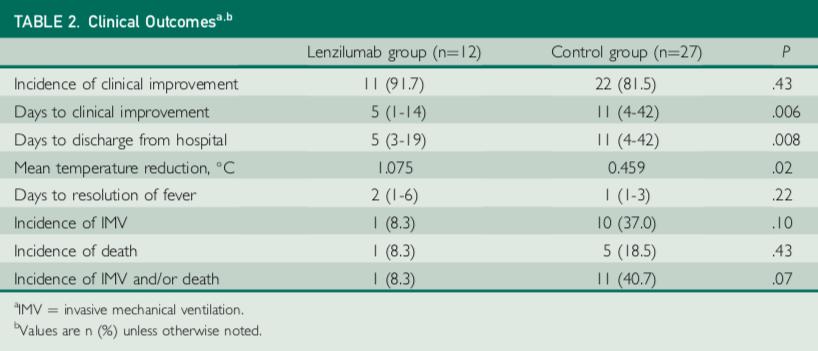

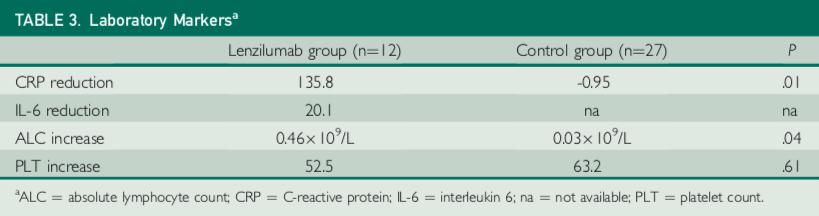

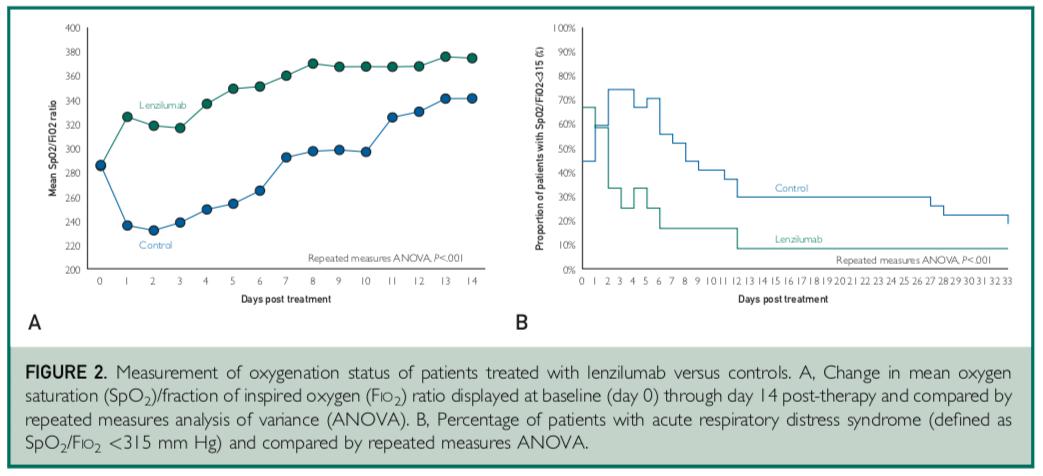

The study involved a total of 39 patients, 12 treated with lenzilumab, and 27 contemporaneous matched control patients who received standard of care treatment. Lenzilumab treatment was associated with an 80% relative reduction in risk of progression to IMV and/or death compared to matched controls (8% vs. 41%, p=0.07). Median time to a 2-point clinical improvement on the 8-point hospital ordinal scale was five days versus 11 days in the control arm (p=0.006). Ventilator-free survival favored lenzilumab versus controls (p=0.06). Median time to resolution of acute respiratory distress syndrome (ARDS) was one day in the lenzilumab treatment arm versus eight days in the control group (p<0.001). Mean SpO2/FiO2 ratios post-therapy were significantly improved in the lenzilumab patients versus controls (p<0.001). Patients treated with lenzilumab were discharged in a median of five days versus 11 days in the control arm (p=0.008).

Lenzilumab treatment was also associated with a significant reduction in the inflammatory marker CRP relative to the control group (p=0.01) and an improvement in lymphocyte counts relative to the control group (p=0.04). There were no treatment-emergent adverse events attributable to lenzilumab.

The data from the case-control study suggest that GM-CSF neutralization with lenzilumab may have an effect through a dual mechanism of action to restore balance to dysregulated immune response induced by SARS-CoV-2 by suppressing myeloid inflammatory response and improving T-cell counts thought to be responsible for viral clearance.

| 12 |

| 13 |

| 14 |

On October 29, 2020, we announced that National Institute of Allergy and Infectious Diseases (“NIAID”), a part of National Institutes of Health (“NIH”), which is part of the U.S. Department of Health and Human Services (“HHS”) as represented by the Division of Microbiology and Infectious Diseases (“DMID”), and Humanigen enrolled the first patient in the NIAID-sponsored ACTIV-5/Big Effect Trial (“BET”) in hospitalized patients with COVID-19. BET will help advance NIAID’s strategic plan for COVID-19 research, which includes conducting studies to advance high-priority therapeutic candidates. Identification of agents with novel mechanisms of action for therapy is a strategic priority.

ACTIV-5 will evaluate the combination of lenzilumab and remdesivir on treatment outcomes versus placebo and remdesivir in hospitalized COVID-19 patients. The trial is expected to enroll 100 patients in each arm of the study with an interim analysis for efficacy after 50 patients have been enrolled in each arm. With data from ACTIV-5 and our ongoing Phase 3 study, we expect to have data from more than 700 hospitalized COVID-19 patients, in the aggregate.

Lenzilumab also has the potential to prevent or reduce serious and sometime fatal side-effects associated with CAR-T therapy (CRS and neurotoxicity), a cancer therapy; See “--CAR-T Overview” later in this Item 1 for a fuller description of the therapy. Preclinical data generated in collaboration with the Mayo Clinic (the “Mayo Clinic”), which was published in ‘blood®’, a premier journal in hematology, indicates that the use of lenzilumab in combination with CAR-T therapy may also enhance the proliferation and improve the efficacy of CAR-T therapy. This may also result in durable, or longer term, responses in CAR-T therapies. There are currently no products approved by the FDA for the prevention of CAR-T therapy-related side effects, nor are there any approved therapies for the treatment of CAR-T therapy related NT.

We are advancing the development of lenzilumab in combination with CAR-T therapy through a non-exclusive clinical collaboration with Kite, pursuant to which we are conducting a multi-center potential registration Phase 1b/2 study of lenzilumab with Kite’s Yescarta in patients with relapsed or refractory B-cell lymphoma, including DLBCL (the “Study”). The Study has been designated the nomenclature ‘ZUMA-19’, consistent with the other Kite CAR-T studies, which also receive a ‘ZUMA’ designation, including ZUMA-1, the study that served as the registrational study for Yescarta. The primary objective of ZUMA-19 is to determine the effect of lenzilumab on the safety and efficacy of Yescarta. Kite’s Yescarta is one of four CAR-T therapies that have been approved by the FDA and is the CAR-T therapy market leader. Our collaboration with Kite is currently the only clinical collaboration which is now enrolling patients with the potential to improve both the safety and efficacy of CAR-T therapy, including in 5 centers that were participants in ZUMA-1. We also plan to measure other potentially beneficial effects on efficacy and healthcare resource utilization. In addition, lenzilumab’s success in preventing serious and potentially life-threatening side-effects could offer economic benefits to medical system payers by making the CAR-T therapy capable of being administered, and follow-up care subsequently monitored and managed, potentially on an out-patient basis in certain patients and circumstances. In turn, we believe that delivering such provider and payer benefits might accelerate the use of the CAR-T therapy itself, and thereby permit us to generate further revenues from sales of lenzilumab.

| 15 |

In addition to COVID-19 and CAR-T therapy, we are committed to advancing our diverse platform for GM-CSF axis suppression for a broad range of other T-cell engaging therapies, including both autologous and allogeneic next generation CAR-T therapies, bi-specific antibody therapies, as well as other cell-based immunotherapies in development, including allogeneic HSCT, with our current and future partners.

In July 2019, we entered into an exclusive worldwide license agreement (the “Zurich Agreement”) with UZH. Under the Zurich Agreement, we have in-licensed certain technologies that we believe may be used to prevent or treat GvHD a serious and potentially fatal condition associated with transplantation, thereby expanding our development platform to include improving the safety and effectiveness of allogeneic HSCT, a potentially curative therapy for patients with hematological cancers. We believe that cytokine storm may be responsible, at least in part, for the emergence of GvHD in this setting. There are currently no FDA-approved agents for the prevention of GvHD nor treatment of GvHD in patients identified as high risk by certain biomarkers. We believe that GM-CSF neutralization with lenzilumab has the potential to prevent or treat GvHD without compromising, and potentially improving, the beneficial GvL effect in patients undergoing allogeneic HSCT, thereby making allogeneic HSCT safer. Several recent papers have been published which support this approach, including in Science Translational Medicine in November 2018 and in ‘blood advances’ in October 2019.

We aim to position lenzilumab as a necessary companion product to any allogeneic HSCT and as a part of the standard pre-conditioning that all patients receiving allogeneic HSCT should receive or as an early treatment option in patients identified as high risk for GvHD.

Given our interest in developing lenzilumab to prevent CRS/cytokine storm in COVID-19 as well as in the treatment of rare cancers and other orphan conditions such as GvHD, we believe that we have the opportunity to benefit from various regulatory incentives, such as coronavirus treatment acceleration program (CTAP), orphan drug exclusivity, breakthrough therapy designation, fast track designation, priority review and accelerated approval.

GM-CSF Gene Knockout

We are advancing our GM-CSF knockout gene-editing CAR-T platform through an exclusive worldwide license agreement (the “Mayo Agreement”) that we entered into in June 2019 with the Mayo Foundation for Medical Education and Research (the “Mayo Foundation”). Under the Mayo Agreement, we have in-licensed certain technologies that we believe may be used to create CAR-T cells lacking GM-CSF expression through various gene-editing tools, including CRISPR-Cas9. We believe that our GM-CSF knockout gene-editing CAR-T platform has the potential to create next-generation CAR-T therapies that improve the efficacy and safety profile of CAR-T therapy. In addition, we have and continue to file intellectual property encompassing a broad range of gene-editing approaches related to GM-CSF knockout.

Preclinical data indicates that GM-CSF gene knockout CAR-T cells show improved overall survival in animals compared to wild-type CAR-T cells in addition to the expected benefits of reduced serious side-effects associated with CAR-T therapy. We are establishing a platform of next-generation combinatorial gene knockout CAR-T cells that have potential to be applied across both autologous and allogeneic approaches and we are also investigating multiple CAR-T cell designs using precise dual and triple gene editing to significantly enhance the anti-tumor activity while simultaneously preventing CAR-T therapy induced toxicities. Through targeted gene expression and modulating cytokine activation signaling, we may be able to increase the proportion of fitter T-cells produced during expansion, increase their proliferative potential, and inhibit activation-induced cell death, thereby improving the cancer killing activity of our engineered CAR-T cells thereby making them more effective and safer in the treatment of cancers. Initial data were published in an abstract that was presented at the December 2019 American Society of Hematology (ASH) meeting and also won an ASH Abstract Achievement award.

| 16 |

We plan to continue development of this technology in combination approaches that could add to the observed efficacy benefits of current generation CAR-T products. In addition, we anticipate that our GM-CSF knockout gene-editing CAR-T platform may be a future backbone for controlling the serious side-effects that hamper CAR-T therapy that lead to serious and sometimes fatal outcomes for patients as a result of the CAR-T therapy itself.

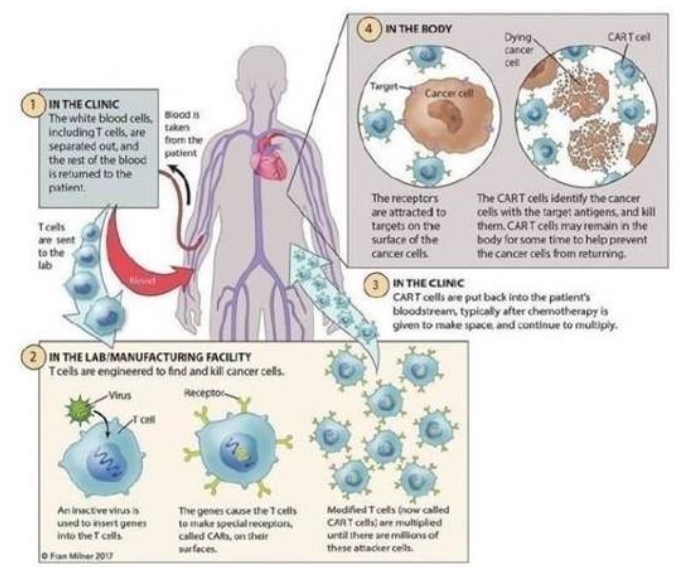

CAR-T Overview

As of the date of this filing, four CAR-T therapies that have been approved by the FDA, Gilead/Kite’s Yescarta, and Tecartus, Novartis’s Kymriah and Bristol Myers Squibb’s Breyanzi (lisocabtagene maraleucel; liso-cel), seek to treat forms of B-cell cancers such as various types of Non-Hodgkin Lymphoma (“NHL”), including DLBCL and acute lymphoblastic leukemia (“ALL”) and Mantle Cell Lymphoma (“MCL”) that are refractory or in second or later stage relapse. Although patients suffering from these aggressive cancers frequently undergo multiple treatments, including chemotherapy, radiation and targeted therapy including stem cell transplants, the five-year survival rate has been severely limited and patients who do not respond to, or have relapsed following at least two courses of standard treatment, have no other treatment options and a very poor outcome. According to the Surveillance, Epidemiology, and End Results (“SEER”) program of the National Cancer Institute, which is a source of epidemiologic information on the incidence and survival rates of cancer in the U.S., it is estimated that up to 10,000 patients per year in the U.S. with relapsed or refractory (r/r) B-cell NHL and ALL who have failed at least two prior systemic therapies may be eligible for CAR-T therapy. In addition, if CAR-T therapy is approved as an earlier second line option versus stem cell transplantation, an additional 10,000 to 12,000 patients may be eligible for treatment. However, this is predicated on improving the benefit-to-risk profile of CAR-T therapy, addressing the severe life-threatening adverse events currently associated with these agents and breaking the efficacy/toxicity linkage.

The FDA-approved CAR-T therapies have demonstrated the effectiveness of using targeted immuno-cellular engineering to cause a patient’s own T-cells to fight certain cancers that have not responded to standard therapies. T-cells are often called the “workhorses” of the immune system because of their role in coordinating the immune response and killing cells infected by pathogens and cancer cells. As depicted below, each of the FDA-approved CAR-T therapies is currently a one-time treatment that involves multiple steps:

| · | Harvesting white blood cells from the patient’s blood, also known as apheresis; |

| · | Engineering T-cells within this population to express cancer-specific receptors; |

| · | Increasing and purifying the number of genetically re-engineered T-cells; and |

| · | Infusing the functional cancer-specific T-cells back into the patient to allow for expansion and targeting the cancer cells. |

| 17 |

Kymriah, Yescarta and Tecartus each received FDA approval for adults with r/r DLBCL on the basis of one pivotal, single-arm Phase 2 study (ZUMA-1, in the case of Yescarta, and ZUMA-2, in the case of Tecartus) which served as the pivotal registration trial for each product in this indication, a markedly accelerated process that indicates the FDA’s view of the strong potential of these novel CAR-T therapy treatments to address an unmet need and improve patient outcomes. The number of evaluable patients in the studies that led to FDA approval for Kymriah, Yescarta and Tecartus in large B-cell lymphoma was 68, 101 and 68 respectively. Moreover, Kymriah also received FDA approval for the treatment of pediatrics and adolescents with relapsed refractory (“r/r”) acute lymphoblastic leukemia (“ALL”) based on a single phase 2 study. In the Kymriah registration study in the DLBCL population, 160 patients were enrolled and 68 were evaluable.

ZUMA-1, the single Phase 2 study that led to the FDA approval of Yescarta in r/r DLBCL, showed similarly positive results. The study enrolled 111 patients (101 were evaluable) with large B-cell lymphoma at advanced stages despite having undergone at least two previous treatments, with approximately 20% of patients already having undergone a stem cell transplant. The CR rate within three months of CAR-T treatment, given as a single infusion, was 58%, which dropped to 46% after six months. The CR rate after two years of CAR-T treatment, given as a single infusion, has been reported as 37%.

ZUMA-2, a single-arm, open-label Phase 2 study that led to the FDA approval of Tecartus for treatment of adult patients with relapsed or refractory mantle cell lymphoma (MCL), enrolled a total of 74 patients (68 were evaluable) that had received BTK inhibitor therapy previously. In an intention-to-treat analysis of all 74 patients enrolled, 85% of patients were reported to have had an objective response, and 59% had a complete response (https://www.nejm.org/doi/10.1056/NEJMoa1914347)

| 18 |

The FDA approval of Breyanzi is based on data from the TRANSCEND NHL 001 (017001) trial in which 268 patients with R/R LBCL received Breyanzi, the largest pivotal trial in third-line plus R/R LBCL that included patients with a broad range of histologies and high-risk disease. In the trial, Breyanzi was administered in the inpatient and outpatient settings.

Encouraged by the success of the Phase 2 studies, since the initial FDA approvals were granted to Novartis for Kymriah, the CAR-T therapy market has seen rapid expansion, with Gilead/Kite and Novartis and scores of other biotechnology companies actively working to progress CAR-T therapies as potential treatments for numerous blood and solid tumor cancers. The fourth entrant to the US market, Brevanzi from BMS has been recently approved.

Kymriah, Yescarta, Tecartus and Brevanzi are autologous individualized CD19 targeted CAR-T therapies. Development is also ongoing to move each agent to earlier lines of therapy for DLBCL (rather than as salvage therapy for patients who have exhausted other options), in other types of B-cell NHL and for the treatment of chronic lymphocytic leukemia (“CLL”). According to SEER, as well as the American Cancer Society's Cancer Statistics Center and World Health Organization Union for International Cancer Control, it is estimated that up to 10,000 patients with r/r B-cell hematologic malignancies (including DLBCL, ALL, CLL) per year may potentially benefit from CD19 targeted CAR-T therapies. In addition, if CAR-T therapy is approved as an earlier second-line option versus stem cell transplantation, an additional 10,000 to 12,000 patients may be eligible for treatment. Moreover, there are two B-cell maturation antigen (“BCMA”) targeted CAR-T therapies in phase 2 development for relapsed or refractory multiple myeloma and several other novel CAR-T therapies targeting various antigens and neo-antigens in development for a number of hematologic and solid cancers. While there may be individual differences between CAR-T therapy products, the overall toxicity profile is generally expected to be generally consistent with that reported for Yescarta, Tescarta and for Kymriah and it is known that various development-stage BCMA and other CAR-T therapies are hampered by the emergence of cytokine storm and other serious and potentially fatal side-effects.

CAR-T Therapy

The four FDA-approved CAR-T therapies are not without significant limitations. Despite the exciting prospects for treating patients with limited options, significant and potentially life-threatening side-effects associated with CAR-T therapy, including NT and CRS, remain a significant unmet need that must be addressed. Because NT and CRS can be life-threatening and have proven fatal in many instances, and because each product bears a “Boxed” warning from the FDA (the strictest FDA warning label intended to alert patients and providers about serious and life-threatening risks associated with a particular drug), patients seeking to benefit from Yescarta, Tescartus, Kymriah or Brevanzi generally may only do so if the treatment center is in compliance with the Risk Evaluation and Mitigation Strategy (“REMS”) program required by FDA.

REMS is a drug safety program that the FDA can require for certain medications with serious safety concerns to help ensure the benefits of the medication outweigh its risks and are intended to assist and train certified treatment centers on the management of these serious side-effects. For example, each hospital and its associated clinics have a minimum of two doses of tocilizumab available on-site for each patient for the potential treatment of moderate to severe cases of CRS. We believe the REMS requirement may have adversely impacted both market uptake and usage to date. Both CRS and NT are caused by a large-scale release of pro-inflammatory cytokines and chemokines induced by the CAR-T therapy, sometimes referred to as a “cytokine storm”. The first placebo-controlled, randomized study evaluating tocilizumab for the treatment of cytokine storm, in this case in COVID-19 patients with cytokine storm, failed to demonstrate an effect. However, the Recovery study, an open-label, randomized trial conducted in the UK demonstrated an improvement in mortality (HR=.86, 14% relative risk reduction) and an improvement in progression to IMV and/or death (HR=.85, 15% relative risk reduction).

According to the package inserts for Yescarta and Kymriah, up to 94% of patients treated with Yescarta or Kymriah in the clinical trial setting experienced CRS (with up to 49% of cases being severe or grade >3 in nature) and up to 87% experienced NT (with up to 31% of cases being severe or grade >3 in nature) despite the availability and utilization of tocilizumab. Moreover, based on feedback from leading treatment centers in the US, approximately 30 to 60% of patients receiving CAR-T therapy require admission to the ICU and in some cases require an extended stay, with multiple interventions, including ventilator support and other supportive measures, to be urgently administered to manage these side-effects. Some patients can suffer seizures, coma, brain swelling, heart arrhythmias, organ failure and serious and life-threatening clotting disorders, not only causing more complex and potentially fatal medical consequences, but significantly adding to cost of patient care. These can be particularly challenging and concerning issues, especially in younger and pediatric patients.

| 19 |

It is important to note that patients suffering from severe or critical COVID-19 pneumonia can often suffer similar medical conditions and extended hospitalization and ICU care.

Researchers who evaluated 1,254 patients who underwent CAR-T therapy at 86 hospitals over the past two years reported that the median ICU stay was 15 to 19 days with a median overall cost ranging from $85,726 to $242,730, not including the cost of the CAR-T therapy itself (Harris, et al. TCT 2019 Abstracts 500, 501). In addition, there have also been deaths reported as a result of these serious side-effects. A publication assessing 636 patients who had received either of the two FDA-approved CAR-T therapies (348 patients on Yescarta and 288 on Kymriah) authored by Anand and Burns, et al. in the Journal of Clinical Oncology (37, 2019 (suppl; abstract 2540)) reported that 15% of CAR-T treated patients (10% receiving Yescarta and 21% receiving Kymriah) died from factors not associated with disease progression (i.e., non-relapse mortality) and the primary driver of non-relapse mortality was NT and/or CRS. Therefore, these serious side-effects are associated with significant mortality rates, despite the availability of approved supportive care measures, even as CAR-T therapies are administered only in trained and certified treatment centers staffed by experts in the field. If such side-effects can be ameliorated or eradicated, and adequate data is submitted to FDA, the “Black Box” warning and REMS program could potentially be scaled back or removed. Further, this may allow a larger proportion of patients to receive CAR-T administration in the out-patient setting. This could convey significant medical and financial benefits and also change the reimbursement dynamic in favor of providers, while opening up a larger cohort of potentially suitable patients.

There are currently no FDA-approved products for the prevention or treatment of NT or for the prevention of CRS associated with CAR-T therapy. Medicines used to manage NT and CRS, such as tocilizumab and corticosteroids, have not adequately controlled the side-effects, and steroids may have a detrimental impact on the efficacy of the CAR-T therapy itself while tocilizumab may increase the risk of CAR-T therapy induced NT and is correlated with an increased risk of infections, including severe infections. Further, these medicines have not undergone prospective clinical trials for use in this patient population. Tocilizumab is only approved for the treatment of severe cases of CRS, but is not approved for prevention of CRS, nor is it approved for either prevention or treatment of NT.

The approval of tocilizumab in CRS was granted as a result of case studies and not as a result of a planned, prospective clinical study in this patient population, as would be typical. Studies testing tocilizumab for the prevention of CRS have shown tocilizumab to significantly worsen the rate of NT across all grades as well as the more serious grades 3 and above, as compared to the rate in patients who did not receive tocilizumab prophylactically. In addition, recent publications question the efficacy of tocilizumab in CRS. For example, studies testing tocilizumab as a prophylactic therapy for CRS have shown the rates of overall CRS remained unaltered as compared to the rate in patients who did not receive tocilizumab prophylactically (Locke et al. American Society of Hematology (“ASH”) 2017, Abstract 1547). Further, a publication authored by Le, et al. in The Oncologist (2018, 28(8); 943-947) assessing 60 patients who had received either Yescarta or Kymriah and had suffered from CRS having received tocilizumab and/or steroids after the onset of CRS, reported that only approximately half of the patients responded at day 11.

These data, along with the Anand/Burns data and the Locke data discussed above, demonstrate that improvements in the ability to prevent or mitigate NT and CRS are needed. Such improvements would help remove these major impediments to uptake and utility of CAR-T therapies, improve healthcare utilization and improve overall patient outcomes. Managing patients with these side-effects can consume a significant amount of in-hospital resources, including extended stays in the ICU. The primary driver of non-drug related costs associated with CAR-T therapy is the length of stay in the hospital, particularly if this includes ICU admission. Non-drug related costs for patients who develop CRS and/or NT are approximately double that of patients who do not develop these serious toxicities. Further, as the potential benefit of CAR-T therapies are explored in earlier lines of hematologic cancers (rather than as salvage therapy for patients who have exhausted other options), as well as moving use of CAR-T therapies into solid tumors, the need to address serious side-effects becomes paramount.

| 20 |

In addition to improving patient outcomes, the ability to significantly reduce the incidence and severity of NT and prevent CRS associated with CAR-T therapy may offer significant benefits in making these treatments more cost-effective. Hospital reimbursement for patients who are treated only as an out-patient is profoundly different from, and more favorable to the hospital than, the reimbursement afforded to treatments for patients who are admitted or re-admitted to the hospital within a 72-hour period. Unfortunately, at present, the need to identify, treat and manage NT and CRS generally has prevented CAR-T therapies from being administered, and follow-up care monitored and managed, on an out-patient basis. Again, 30-60% of patients receiving CAR-T therapy require admission to the ICU, in some cases requiring an extended stay, with multiple interventions, investigations and treatments needing to be urgently administered. As a result, in some institutions, the treating physician may require the hospital to reserve a bed in the ICU as a prerequisite to administering the CAR-T therapy in case the patient needs to be hospitalized in an attempt to manage the adverse effects from NT and CRS. This is especially challenging in the context of the COVID-19 pandemic where many ICU units are already overwhelmed with COVID-19 patients. At other institutions, the patient is admitted as an in-patient and is required to remain in the hospital for at least a week, with discharge being subject to satisfactory short-term outcomes and no emergence of complications. Even in institutions where the CAR-T therapy is initially administered in an out-patient setting, the patient is closely monitored daily for several weeks and is required to stay within a short distance from the hospital in case the patient needs to be admitted to the hospital on an emergency basis, requiring additional lodging, food and other costs to be incurred by the patient, the payer, or both. In some situations, these patients are re-admitted to the hospital on an emergency basis as an in-patient if complications ensue. If a patient is admitted or re-admitted to the hospital as an in-patient, the hospital reimbursement dynamics may change in a manner which is negative for the hospital, the payer and the patient. This dynamic also changes typical hospital reimbursement, depending on when in the treatment cycle the patient is admitted or re-admitted. In addition, certain treatment centers do not accept patients who are not potentially able to be treated as an out-patient and refer such patients to other centers who may be willing to treat them as in-patients, primarily as a result of the reimbursement handicap that would accrue as a result of in-patient coding, billing and reimbursement, which generally leads to the hospital system losing money because of the in-patient care reimbursement. Further, the COVID-19 pandemic has placed further stress on the hospital, ICU and broader healthcare systems of almost all countries affected by the outbreak.

While both Kymriah and Yescarta have been approved by European regulators for market authorization, prescriptions have been limited as Kite and Novartis work to establish reimbursement arrangements intended to facilitate access to the treatments on a discounted basis consistent with the governmental mandates to curb healthcare spending. These dynamics, and the additional complexity of treating patients with serious and potentially life-threatening side-effects in the hospital and/or ICU, mean that enabling true out-patient administration and follow-up would confer significant benefits to patients, payers and the hospital system. Lenzilumab, if proven to be able to abrogate these serious side-effects as well as improve efficacy, may offer a solution.

Other T-cell Engaging Therapies

In addition to CAR-T therapy, we are committed to advancing our diverse platform for GM-CSF axis suppression for a broad range of other T-cell engaging therapies, including both autologous and allogeneic next generation CAR-T therapies, bi-specific antibody therapies, as well as other cell-based immunotherapies in development, to break the efficacy/toxicity linkage, including for the prevention and/or treatment of GvHD in patients undergoing allogeneic HSCT. Many of these treatment options may lead to serious side-effects and have ample room for improved efficacy.

We believe that GM-CSF neutralization with lenzilumab has the potential to prevent or reduce GvHD without compromising, and potentially improving, the beneficial GvL effect in patients undergoing allogeneic HSCT, thereby making allogeneic HSCT safer. Allogeneic HSCT is a potentially curative therapy for patients with hematological cancers. Although a potentially life-saving treatment for patients suffering from hematological cancers, between 40-60% of patients receiving HSCT treatments experience acute or chronic GvHD, which together carries a 50% mortality rate. After being transplanted into the patient, donor-derived T cells are responsible for mediating the beneficial GvL effect. In many cases, however, donor-derived T cells that remain within the graft itself have also been linked to destruction of healthy tissue in the patient (the host), with particular risk of destroying cells in the patient’s skin, gut, and liver, resulting in GvHD. Although depleting donor grafts of T cells can prevent or reduce the risk of GvHD, this results in a reduced GvL effect, thereby having a detrimental impact on the efficacy of the allogeneic HSCT treatment itself and leading to increased relapse rates. We expect that the use of allogeneic HSCT may be hampered by GvHD complications. A recent study published in ‘blood advances’ an official journal of the American Society of Hematology, suggests that neutralizing or blocking GM-CSF may limit or prevent GvHD in the gastrointestinal tract (Gartlan, K., et al, October 8, 2019, vol. 3, no.19).

| 21 |

There are currently no FDA-approved agents for the prevention of GvHD, and there is a significant unmet medical need for an agent that can uncouple the beneficial GvL effect from harmful GvHD. At this time, pre-conditioning regimens for HSCT treatments vary significantly by treatment centers, including by unapproved, or “off-label”, use of agents that have been approved by the FDA for other uses only. We believe there to be a significant unmet medical need and lenzilumab, if proven to be able to prevent GvHD in allogeneic HSCTs, may offer a solution.

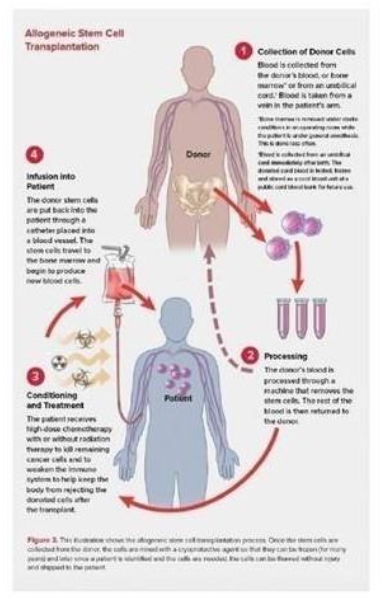

Allogeneic HSCT Overview

Allogeneic HSCT, which involves transferring stem cells from a healthy donor to the patient, has demonstrated effectiveness in treating hematological cancers. As depicted below, allogeneic HSCT involves multiple steps:

| · | Collecting blood from a healthy donor; |

| · | Processing the donor’s blood to remove the stem cells before returning the rest of the donor’s blood back to the donor; |

| · | Pre-conditioning the patient with high-dose chemotherapy and/or radiation; and |

| · | Infusing the donor’s stem cells into the patient to allow for the production of new blood cells. |

| 22 |

The overall number of allogeneic HSCT treatments continues to increase annually in the US and abroad. In 2019, approximately 10,000 allogeneic HSCT treatments are expected to be performed in the US, with similar trends expected in Europe.

Combining CAR-T Therapies with Lenzilumab

We believe lenzilumab has the potential to improve the efficacy and safety of CAR-T therapy and that the use of lenzilumab may minimize or eradicate the incidence, frequency, duration and/or severity of NT and/or CRS that frequently appear in CAR-T patients. Further, GM-CSF neutralization may enhance CAR-T proliferation and effector functions and potentially confer additional benefits in terms of durable efficacy and healthcare resource utilization.

We also believe lenzilumab may improve the value proposition of CAR-T and allogeneic HSCT therapies and facilitate their use and acceptance throughout the healthcare systems in the US and abroad.

Our current clinical and regulatory development plan in marketed CAR-T therapies is focused on a collaboration agreement we executed with Kite in May 2019 (the “Kite Agreement”), with Kite marketing two of only four approved CAR-T therapies (Yescarta) is the market leader by a large margin. Pursuant to the Kite Agreement, the parties have agreed to conduct a multi-center Phase 1b/2 study (ZUMA-19) of lenzilumab with Kite’s Yescarta in patients with relapsed or refractory B-cell lymphoma. The primary objective of ZUMA-19 is to determine the effect of lenzilumab on the safety of Yescarta. In addition, efficacy and healthcare resource utilization will be assessed. The Kite Agreement is non-exclusive. Depending upon FDA feedback, we believe ZUMA-19 may serve as the basis for registration for lenzilumab. On June 30, 2020, we announced that the first patient had been infused in the ZUMA-19 study.

| 23 |

Combining Allogeneic HSCT with Lenzilumab

In addition to CAR-T therapy, we are committed to advancing our diverse platform for GM-CSF axis suppression for a broad range of other T-cell engaging therapies, including both autologous and allogeneic next generation CAR-T therapies, bi-specific antibody therapies as well as other cell-based immunotherapies in development, with our current and future partners.

We believe that GM-CSF neutralization using lenzilumab has the potential to make allogeneic HSCT safer and more effective. Similar to GM-CSF neutralization with lenzilumab breaking the efficacy/toxicity linkage with CAR-T therapy, GM-CSF neutralization has demonstrated potential to attenuate GvHD while maintaining the beneficial GvL effect in patients undergoing allogeneic HSCT.

In July 2019, we entered into the Zurich Agreement with UZH. Under the Zurich Agreement, we have in-licensed certain technologies that we believe may be used to prevent or treat GvHD, thereby expanding our development platform to include improving the safety and effectiveness of allogeneic HSCT, a potentially curative therapy for patients with hematological cancers. The technology was recently featured in a November 2018 research article published in Science Translational Medicine, where the authors demonstrated in a murine model of GvHD, that donor T cell-derived GM-CSF drives GvHD through activation, expansion, and trafficking of myeloid cells but has no effect on the GvL response. Neutralization of GM-CSF (either using a neutralizing antibody or through GM-CSF gene knock-out) was able to uncouple the myeloid-mediated immunopathology resulting in GvHD from the T cell-mediated control of leukemic cells. This discovery provides a clear mechanistic proof-of-concept for neutralizing GM-CSF to prevent GvHD without compromising, and potentially improving, the GvL effect in patients undergoing allogeneic HSCT. Corroborating data related to the critical effect GM-CSF has on GvHD development in HSCT was published recently by Gartlan et al.

The strong link between T cell-mediated efficacy and myeloid cell mediated toxicity mirrors the findings that have been reported with CAR-T therapies where T cell-produced GM-CSF has emerged as a key driver of the myeloid inflammatory cascade resulting in NT and CRS and potentially impairing improved CAR-T therapy efficacy through effects on myeloid-derived suppressor cells. GM-CSF neutralization has the potential to eliminate or reduce the off-target inflammatory cascade while preserving the on-target efficacy of T cell therapies, thereby breaking the efficacy/toxicity linkage.