Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOME BANCORP, INC. | hbcp-20201110.htm |

East Coast Financial Services Conference November 10, 2020

Forward Looking Statements Certain comments in this presentation contain certain forward looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of Home Bancorp, Inc. and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumption, many of which are difficult to predict and generally are beyond the control of Home Bancorp, Inc. and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward looking statements: (1) economic and competitive conditions which could affect the volume of loan originations, deposit flows and real estate values; (2) the levels of noninterest income and expense and the amount of loan losses; (3) competitive pressure among depository institutions increasing significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general economic conditions, either nationally or in the markets in which Home Bancorp, Inc. is or will be doing business, being less favorable than expected; (6) political and social unrest, including acts of war or terrorism; (7) we may not fully realize all the benefits we anticipated in connection with our acquisitions of other institutions or our assumptions made in connection therewith may prove to be inaccurate; or (8) legislation or changes in regulatory requirements adversely affecting the business of Home Bancorp, Inc. Home Bancorp, Inc. undertakes no obligation to update these forward looking statements to reflect events or circumstances that occur after the date on which such statements were made. As used in this report, unless the context otherwise requires, the terms “we,” “our,” “us,” or the “Company” refer to Home Bancorp, Inc. and the term the “Bank” refers to Home Bank, N.A., a national bank and wholly owned subsidiary of the Company. In addition, unless the context otherwise requires, references to the operations of the Company include the operations of the Bank. For a more detailed description of the factors that may affect Home Bancorp’s operating results or the outcomes described in these forward-looking statements, we refer you to our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2019 and “Item 1.A. Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. Home Bancorp assumes no obligation to update the forward-looking statements made during this presentation. For more information, please visit our website www.home24bank.com. Non-GAAP Information This presentation contains financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). The Company's management uses this non-GAAP financial information in its analysis of the Company's performance. In this presentation, information is included which excludes acquired loans, intangible assets, impact of the gain (loss) on the sale of assets, Bank owned life insurance (“BOLI”) benefit, lease termination, severance pay, Paycheck Protection Program (“PPP”) loans, provision for unfunded commitments, the impact of merger-related expenses and one-time tax effects. Management believes the presentation of this non-GAAP financial information provides useful information that is helpful to a full understanding of the Company’s financial position and core operating results. This non-GAAP financial information should not be viewed as a substitute for financial information determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial information presented by other companies. 2

Our Company • Headquartered in Lafayette, Louisiana • Founded in 1908 • IPO completed October 2008 • Ticker symbol: HBCP (NASDAQ Global) • Market Cap = $233MM as of November 5, 2020 • Assets = $2.6 billion as of September 30, 2020 • 40 locations across south Louisiana and western Mississippi • Ownership (S&P Global as of November 5, 2020) Institutional = 42% Insider/ESOP = 15% 3

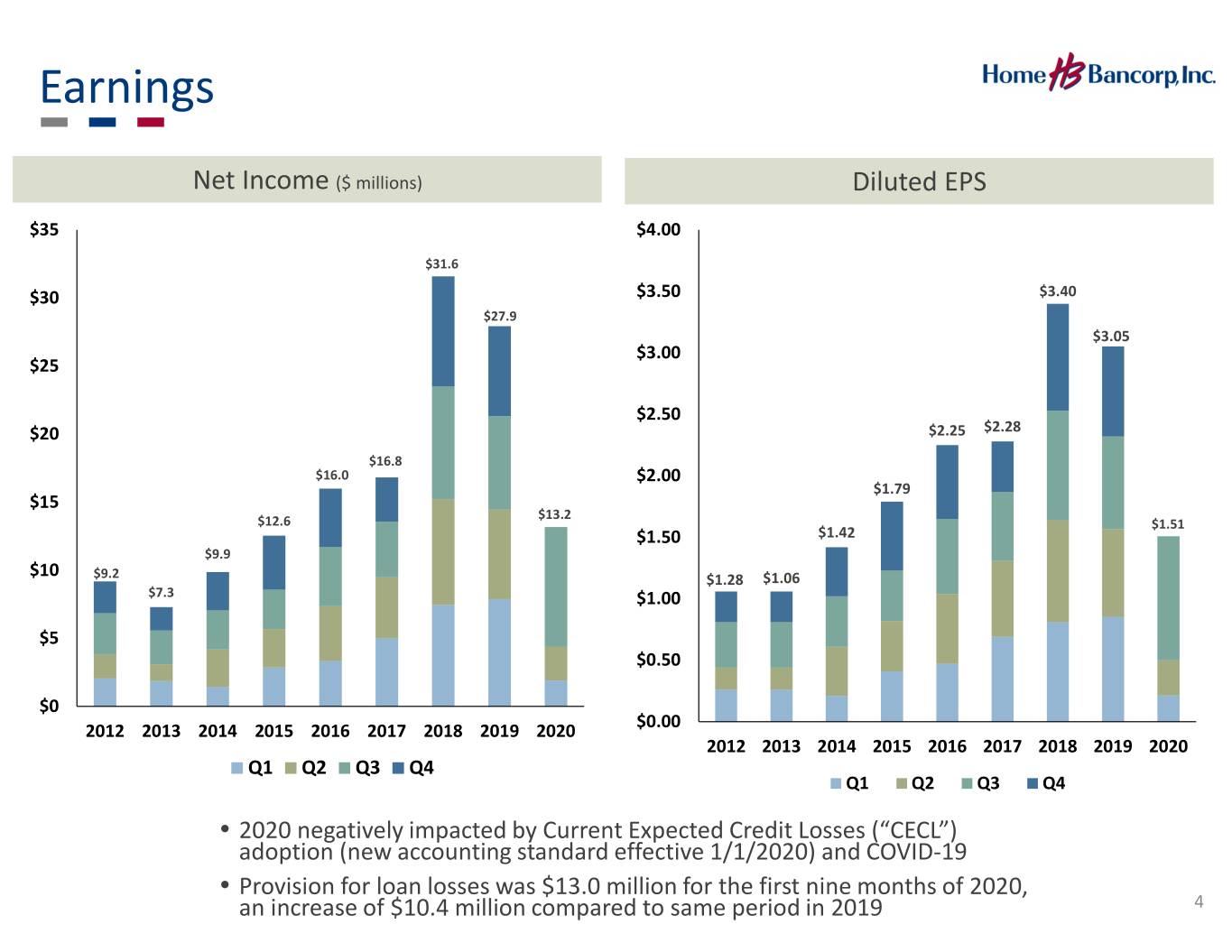

Earnings Net Income ($ millions) Diluted EPS $35 $4.00 $31.6 $30 $3.50 $3.40 $27.9 $3.05 $3.00 $25 $2.50 $20 $2.25 $2.28 $16.8 $16.0 $2.00 $1.79 $15 $13.2 $12.6 $1.51 $1.50 $1.42 $9.9 $10 $9.2 $1.28 $1.06 $7.3 $1.00 $5 $0.50 $0 $0.00 2012 2013 2014 2015 2016 2017 2018 2019 2020 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 • 2020 negatively impacted by Current Expected Credit Losses (“CECL”) adoption (new accounting standard effective 1/1/2020) and COVID-19 • Provision for loan losses was $13.0 million for the first nine months of 2020, an increase of $10.4 million compared to same period in 2019 4

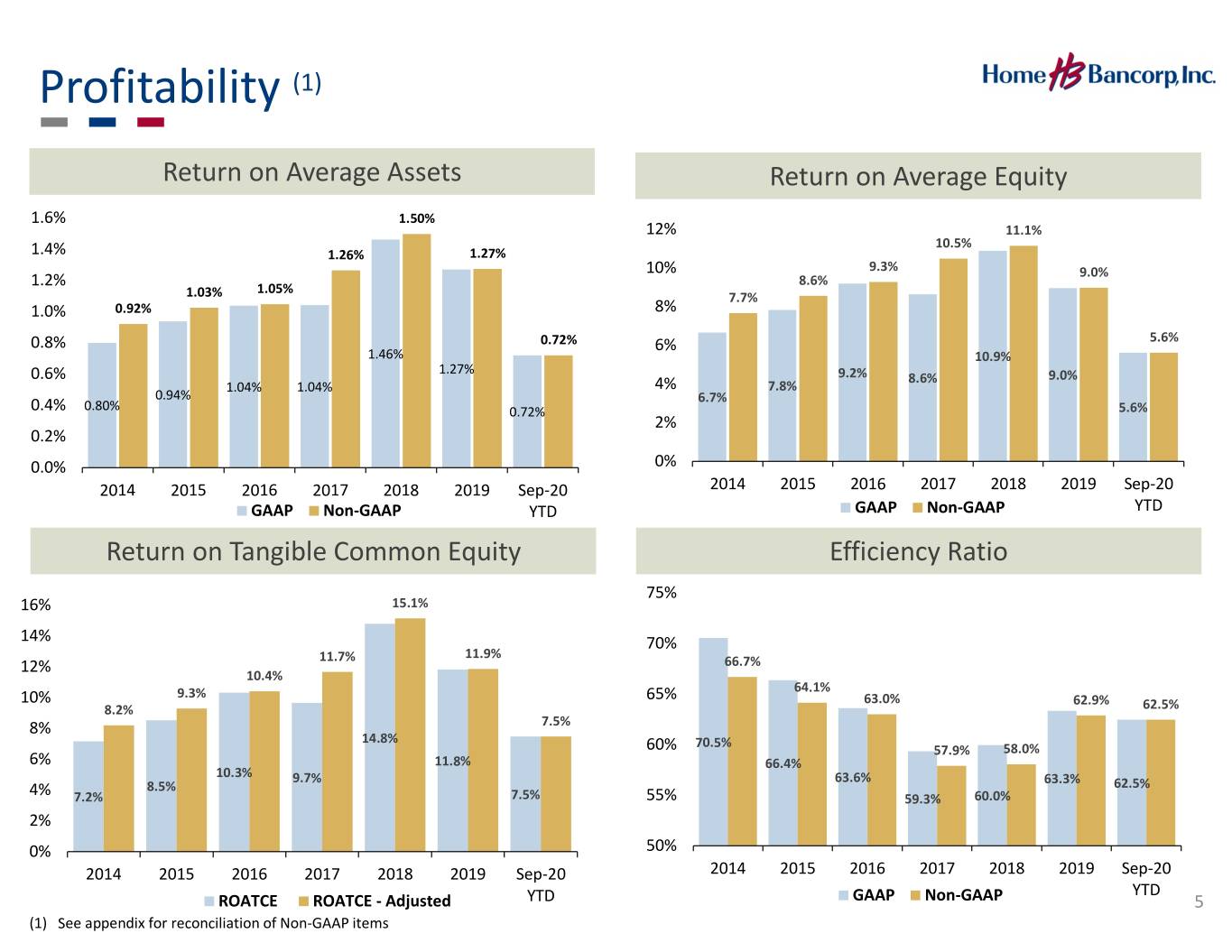

Profitability (1) Return on Average Assets Return on Average Equity 1.6% 1.50% 12% 11.1% 10.5% 1.4% 1.26% 1.27% 10% 9.3% 9.0% 8.6% 1.2% 1.05% 1.03% 7.7% 1.0% 0.92% 8% 0.8% 0.72% 6% 5.6% 1.46% 10.9% 1.27% 0.6% 9.2% 8.6% 9.0% 1.04% 1.04% 4% 7.8% 0.94% 6.7% 0.4% 0.80% 0.72% 5.6% 2% 0.2% 0.0% 0% 2014 2015 2016 2017 2018 2019 Sep-20 2014 2015 2016 2017 2018 2019 Sep-20 GAAP Non-GAAP YTD GAAP Non-GAAP YTD Return on Tangible Common Equity Efficiency Ratio 75% 16% 15.1% 14% 70% 11.7% 11.9% 12% 66.7% 10.4% 64.1% 10% 9.3% 65% 63.0% 62.9% 8.2% 62.5% 8% 7.5% 14.8% 70.5% 60% 57.9% 58.0% 6% 11.8% 66.4% 10.3% 9.7% 63.6% 63.3% 4% 8.5% 62.5% 7.2% 7.5% 55% 59.3% 60.0% 2% 0% 50% 2014 2015 2016 2017 2018 2019 Sep-20 2014 2015 2016 2017 2018 2019 Sep-20 YTD ROATCE ROATCE - Adjusted YTD GAAP Non-GAAP 5 (1) See appendix for reconciliation of Non-GAAP items

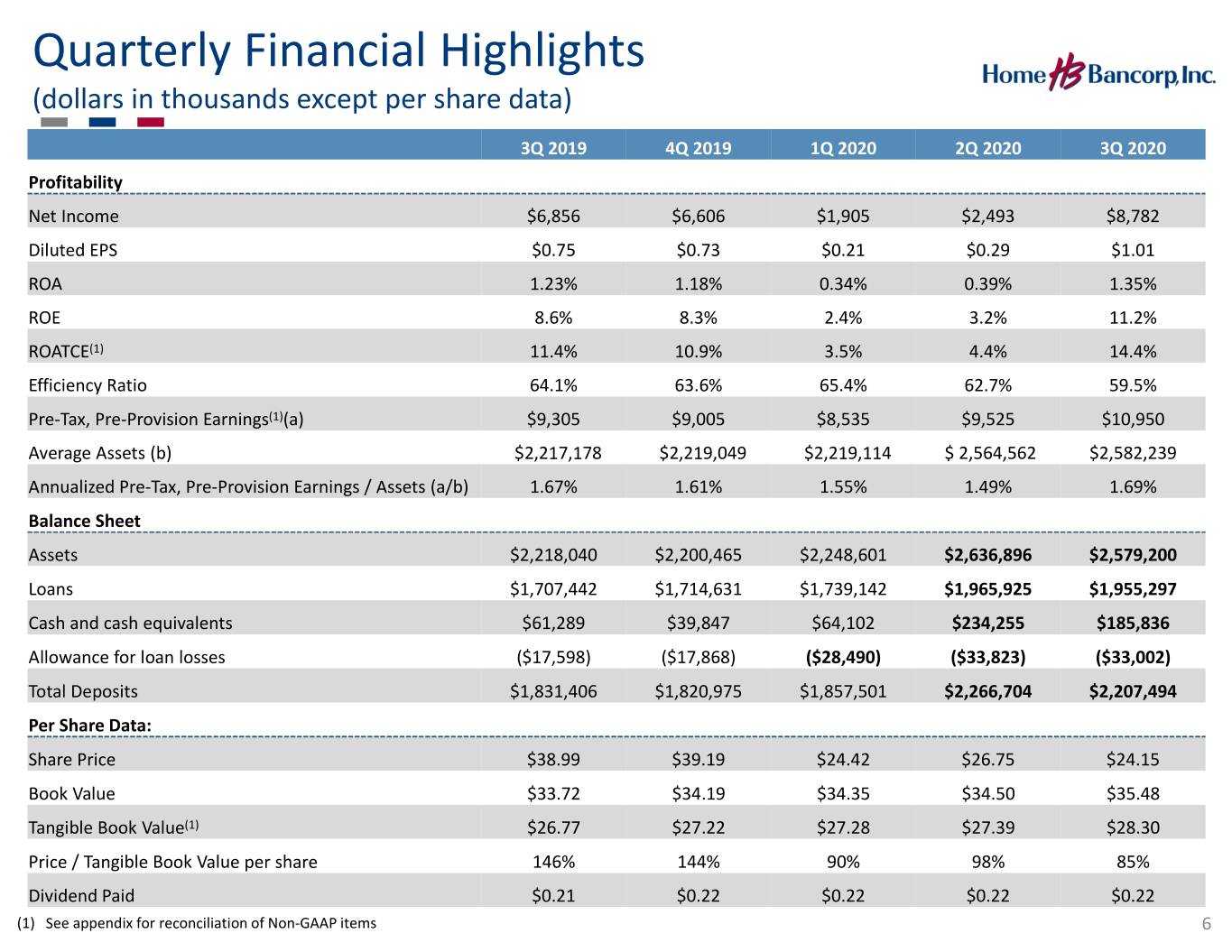

Quarterly Financial Highlights (dollars in thousands except per share data) 3Q 2019 4Q 2019 1Q 2020 2Q 2020 3Q 2020 Profitability Net Income $6,856 $6,606 $1,905 $2,493 $8,782 Diluted EPS $0.75 $0.73 $0.21 $0.29 $1.01 ROA 1.23% 1.18% 0.34% 0.39% 1.35% ROE 8.6% 8.3% 2.4% 3.2% 11.2% ROATCE(1) 11.4% 10.9% 3.5% 4.4% 14.4% Efficiency Ratio 64.1% 63.6% 65.4% 62.7% 59.5% Pre-Tax, Pre-Provision Earnings(1)(a) $9,305 $9,005 $8,535 $9,525 $10,950 Average Assets (b) $2,217,178 $2,219,049 $2,219,114 $ 2,564,562 $2,582,239 Annualized Pre-Tax, Pre-Provision Earnings / Assets (a/b) 1.67% 1.61% 1.55% 1.49% 1.69% Balance Sheet Assets $2,218,040 $2,200,465 $2,248,601 $2,636,896 $2,579,200 Loans $1,707,442 $1,714,631 $1,739,142 $1,965,925 $1,955,297 Cash and cash equivalents $61,289 $39,847 $64,102 $234,255 $185,836 Allowance for loan losses ($17,598) ($17,868) ($28,490) ($33,823) ($33,002) Total Deposits $1,831,406 $1,820,975 $1,857,501 $2,266,704 $2,207,494 Per Share Data: Share Price $38.99 $39.19 $24.42 $26.75 $24.15 Book Value $33.72 $34.19 $34.35 $34.50 $35.48 Tangible Book Value(1) $26.77 $27.22 $27.28 $27.39 $28.30 Price / Tangible Book Value per share 146% 144% 90% 98% 85% Dividend Paid $0.21 $0.22 $0.22 $0.22 $0.22 (1) See appendix for reconciliation of Non-GAAP items 6

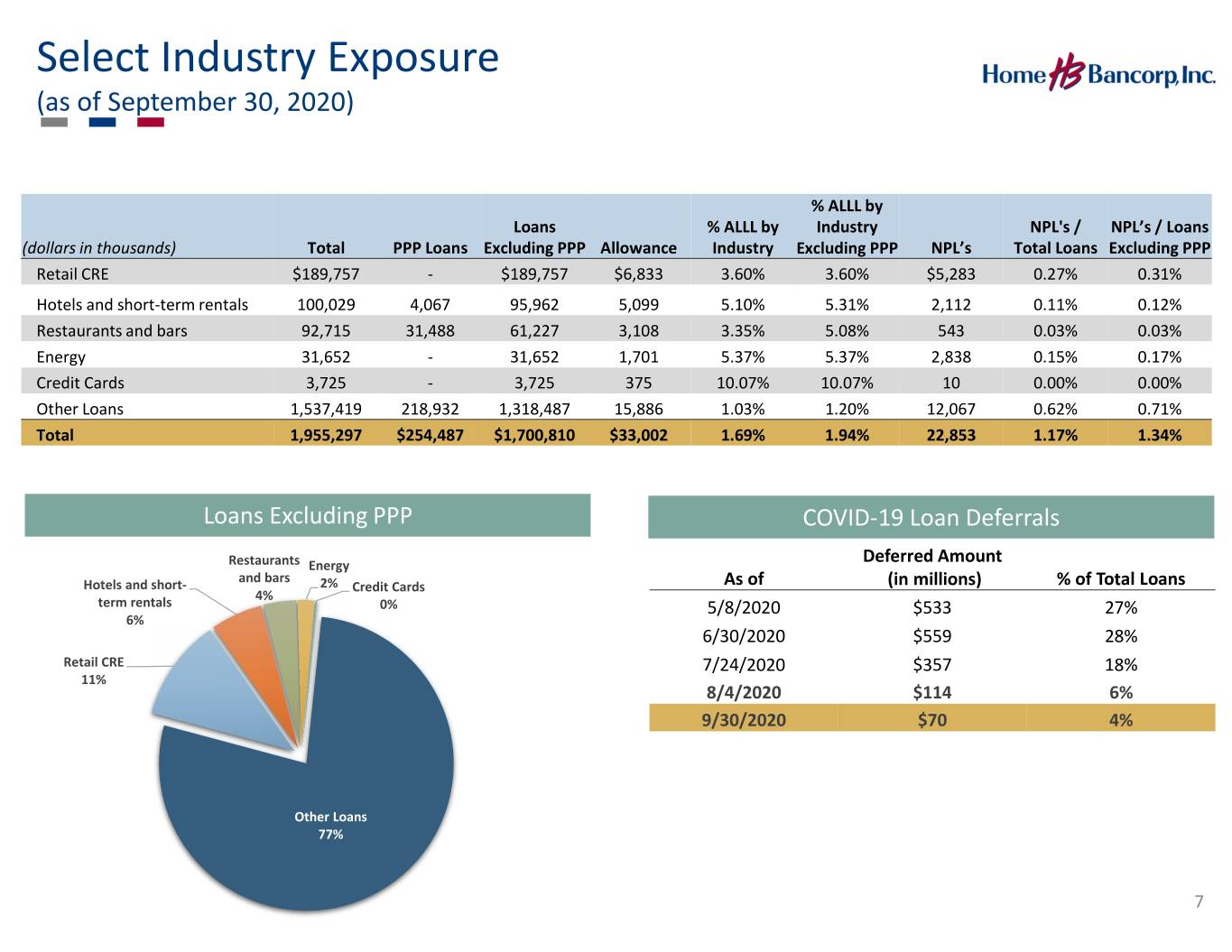

Select Industry Exposure (as of September 30, 2020) % ALLL by Loans % ALLL by Industry NPL's / NPL’s / Loans (dollars in thousands) Total PPP Loans Excluding PPP Allowance Industry Excluding PPP NPL’s Total Loans Excluding PPP Retail CRE $189,757 - $189,757 $6,833 3.60% 3.60% $5,283 0.27% 0.31% Hotels and short-term rentals 100,029 4,067 95,962 5,099 5.10% 5.31% 2,112 0.11% 0.12% Restaurants and bars 92,715 31,488 61,227 3,108 3.35% 5.08% 543 0.03% 0.03% Energy 31,652 - 31,652 1,701 5.37% 5.37% 2,838 0.15% 0.17% Credit Cards 3,725 - 3,725 375 10.07% 10.07% 10 0.00% 0.00% Other Loans 1,537,419 218,932 1,318,487 15,886 1.03% 1.20% 12,067 0.62% 0.71% Total 1,955,297 $254,487 $1,700,810 $33,002 1.69% 1.94% 22,853 1.17% 1.34% Loans Excluding PPP COVID-19 Loan Deferrals Restaurants Energy Deferred Amount and bars Hotels and short- 2% Credit Cards As of (in millions) % of Total Loans 4% term rentals 0% 5/8/2020 $533 27% 6% 6/30/2020 $559 28% Retail CRE 7/24/2020 $357 18% 11% 8/4/2020 $114 6% 9/30/2020 $70 4% Other Loans 77% 7

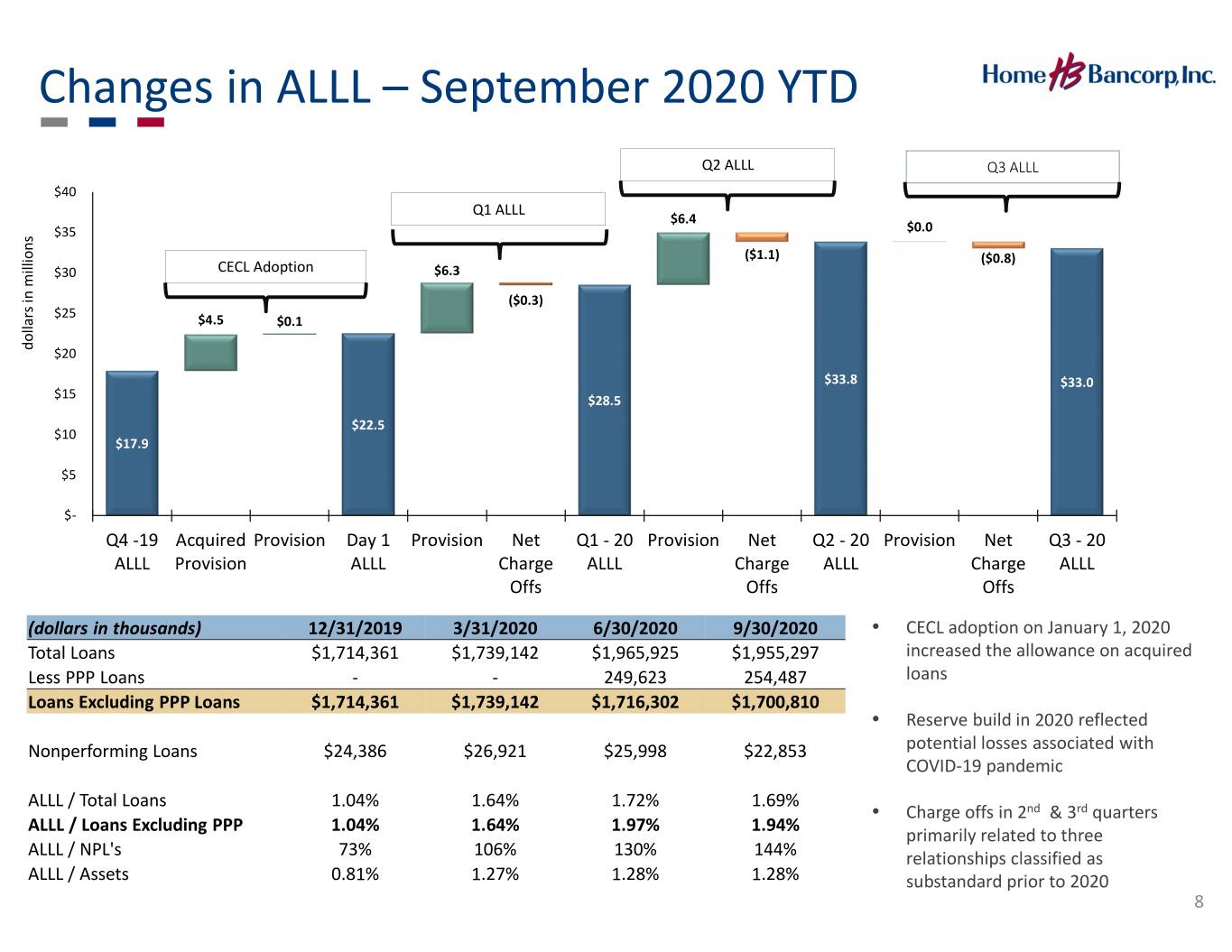

Changes in ALLL – September 2020 YTD Q2 ALLL Q3 ALLL $40 Q1 ALLL $6.4 $35 $0.0 s n o i ($1.1) l ($0.8) l i $30 CECL Adoption $6.3 m n i ($0.3) s r $25 a $4.5 l $0.1 l o d $20 $33.8 $33.0 $15 $28.5 $22.5 $10 $17.9 $5 $- Q4 -19 Acquired Provision Day 1 Provision Net Q1 - 20 Provision Net Q2 - 20 Provision Net Q3 - 20 ALLL Provision ALLL Charge ALLL Charge ALLL Charge ALLL Offs Offs Offs (dollars in thousands) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 • CECL adoption on January 1, 2020 Total Loans $1,714,361 $1,739,142 $1,965,925 $1,955,297 increased the allowance on acquired Less PPP Loans - - 249,623 254,487 loans Loans Excluding PPP Loans $1,714,361 $1,739,142 $1,716,302 $1,700,810 • Reserve build in 2020 reflected Nonperforming Loans $24,386 $26,921 $25,998 $22,853 potential losses associated with COVID-19 pandemic ALLL / Total Loans 1.04% 1.64% 1.72% 1.69% • Charge offs in 2nd & 3rd quarters ALLL / Loans Excluding PPP 1.04% 1.64% 1.97% 1.94% primarily related to three ALLL / NPL's 73% 106% 130% 144% relationships classified as ALLL / Assets 0.81% 1.27% 1.28% 1.28% substandard prior to 2020 8

Credit Quality Trends NPAs / Assets ALLL / NPAs 1.40% 1.30% 140% 1.21% 1.20% 1.16% 120% 133% 1.10% 1.07% 0.96% 1.00% 100% 1.01% 0.80% 0.73% 80% 84% 0.84% 0.60% 0.72% 0.75% 60% 75% 63% 63% 58% 57% 0.40% 0.51% 40% 0.46% 0.20% 0.37% 20% 0.00% 0% 2014 2015 2016 2017 2018 2019 3Q-20 2014 2015 2016 2017 2018 2019 3Q-20 NPAs / Total Assets Originated NPAs / Total Assets ALLL / NPAs Net Charge Offs / YTD Average Loans Loans Past Due 0.24% 3.50% 0.22% 2.87% 3.00% 0.20% 0.17% 0.18% 0.16% 2.50% 0.16% 0.15% 1.94% 0.14% 2.00% 1.74% 1.73% 0.12% 1.32% 1.50% 1.30% 0.10% 0.09% 0.94% 0.08% 1.00% 1.32% 1.17% 0.06% 0.91% 0.87% 0.04% 0.03% 0.50% 0.82% 0.80% 0.02% 0.64% 0.02% 0.00% 0.00% 0.00% 2014 2015 2016 2017 2018 2019 3Q-20 2014 2015 2016 2017 2018 2019 Sep - 2020 Past Due Loans / Loans Originated Past Due / Originated Loans YTD 9

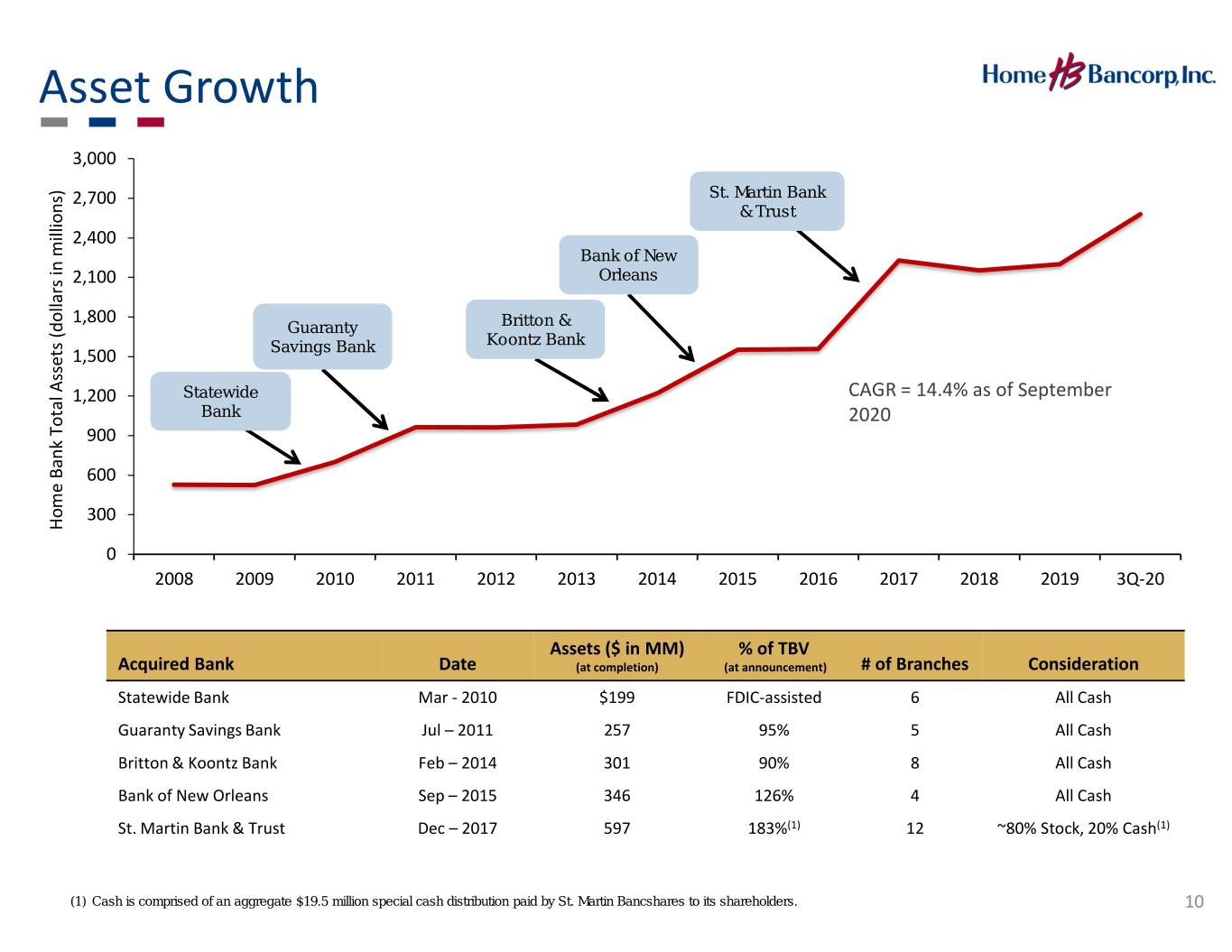

Asset Growth 3,000 ) St. Martin Bank s 2,700 n & Trust o i l l i 2,400 m Bank of New n i Orleans s 2,100 r a l l o 1,800 Britton & d Guaranty ( Koontz Bank s Savings Bank t e 1,500 s s A l 1,200 Statewide CAGR = 14.4% as of September a t Bank 2020 o T 900 k n a B 600 e m o 300 H 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 3Q-20 Assets ($ in MM) % of TBV Acquired Bank Date (at completion) (at announcement) # of Branches Consideration Statewide Bank Mar - 2010 $199 FDIC-assisted 6 All Cash Guaranty Savings Bank Jul – 2011 257 95% 5 All Cash Britton & Koontz Bank Feb – 2014 301 90% 8 All Cash Bank of New Orleans Sep – 2015 346 126% 4 All Cash St. Martin Bank & Trust Dec – 2017 597 183%(1) 12 ~80% Stock, 20% Cash(1) (1) Cash is comprised of an aggregate $19.5 million special cash distribution paid by St. Martin Bancshares to its shareholders. 10

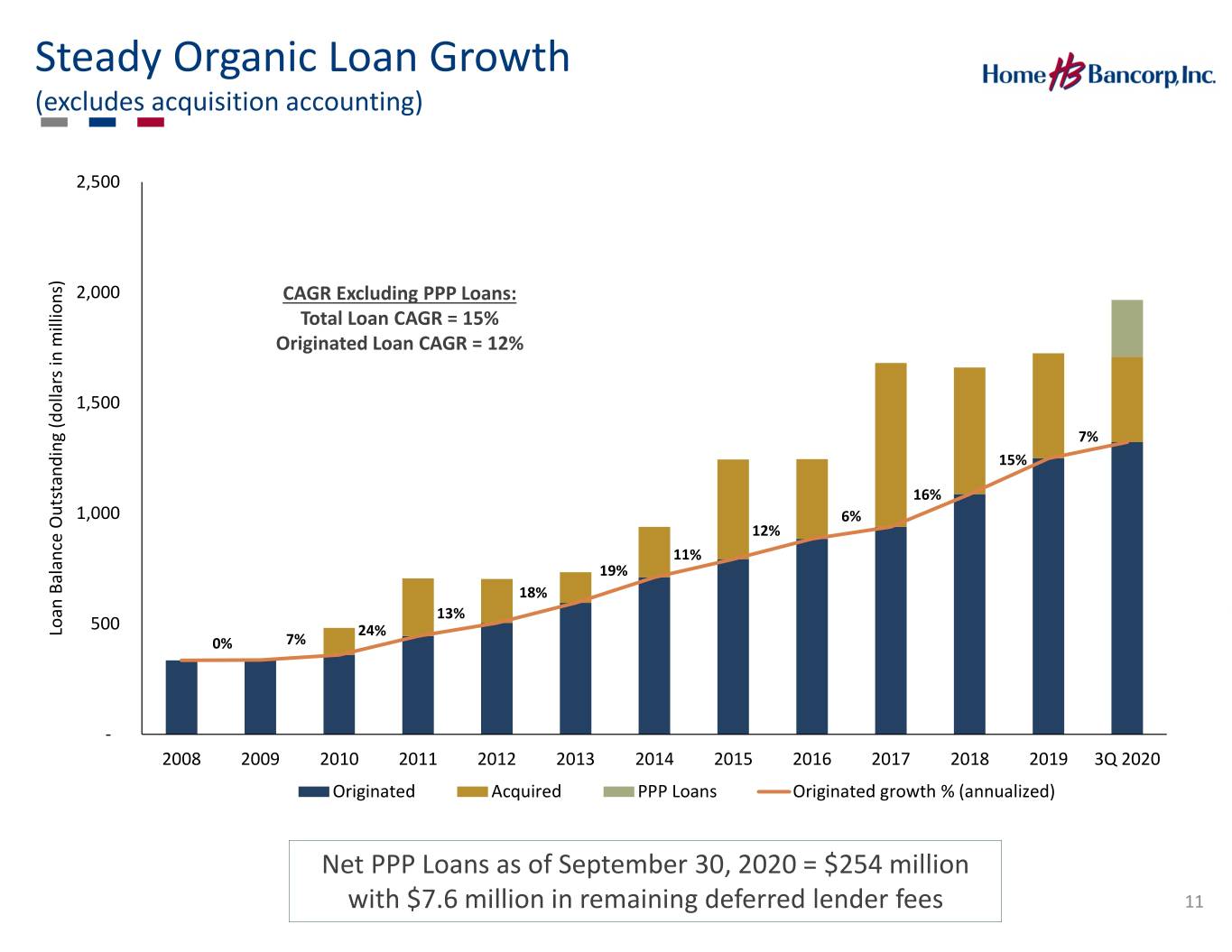

(excludes accounting) acquisition SteadyOrganic Growth Loan Loan Balance Outstanding (dollars in millions) 2,000 2,500 1,000 1,500 500 - 082009 2008 0% Originated LoanCAGR 12% = CAGR Excluding PPP Loans: 7% TotalCAGR Loan15% = 0021 022013 2012 2011 2010 NetPPP Loans of September as $254 2020 30, million = Originated with $7.6 million remainingin $7.6 with deferredmillion feeslender 24% 13% Acquired 18% 19% 0421 062017 2016 2015 2014 PPP Loans PPP 11% 12% Originated growth % (annualized) % growth Originated 6% 16% 2018 2019 3Q 2020 3Q 2019 2018 15% 7% 11

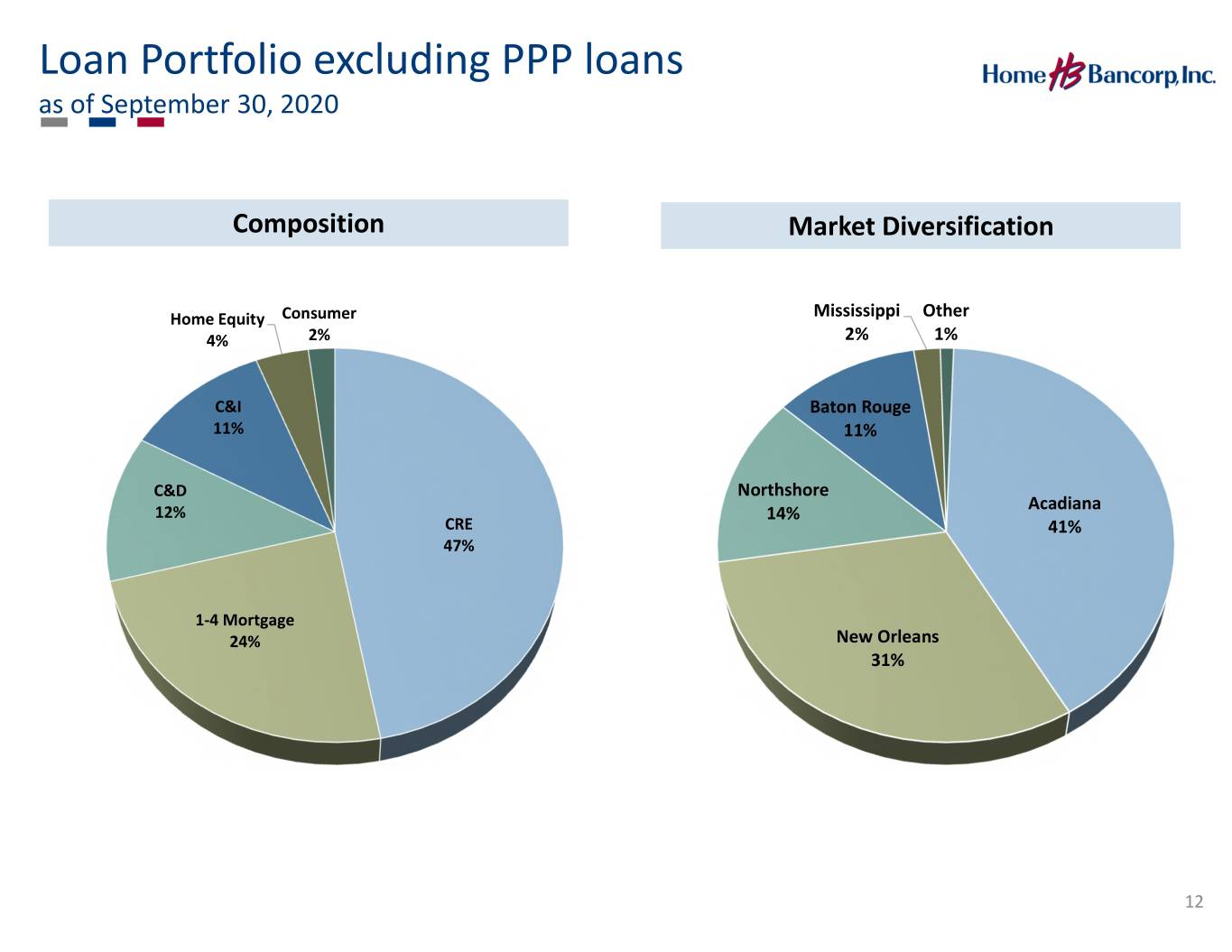

Loan Portfolio excluding PPP loans as of September 30, 2020 Composition Market Diversification Home Equity Consumer Mississippi Other 4% 2% 2% 1% C&I Baton Rouge 11% 11% C&D Northshore Acadiana 12% 14% CRE 41% 47% 1-4 Mortgage 24% New Orleans 31% 12

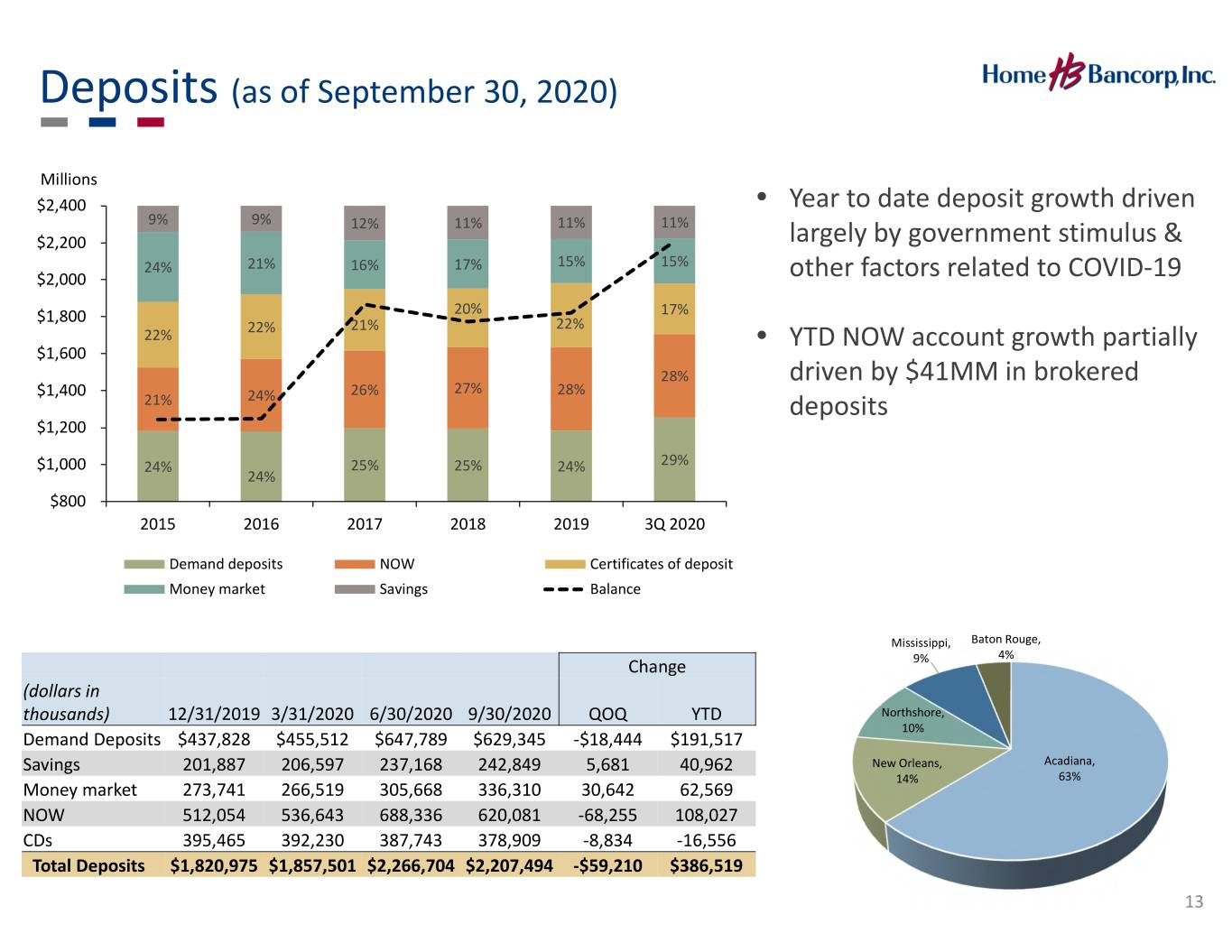

Deposits (as of September 30, 2020) Millions $2,400 • Year to date deposit growth driven 9% 9% 12% 11% 11% 11% $2,200 largely by government stimulus & 24% 21% 16% 17% 15% 15% $2,000 other factors related to COVID-19 20% 17% $1,800 21% 22% 22% 22% • YTD NOW account growth partially $1,600 28% driven by $41MM in brokered $1,400 26% 27% 28% 21% 24% deposits $1,200 $1,000 24% 25% 25% 24% 29% 24% $800 2015 2016 2017 2018 2019 3Q 2020 Demand deposits NOW Certificates of deposit Money market Savings Balance Mississippi, Baton Rouge, 4% Change 9% (dollars in thousands) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 QOQ YTD Northshore, 10% Demand Deposits $437,828 $455,512 $647,789 $629,345 -$18,444 $191,517 Savings 201,887 206,597 237,168 242,849 5,681 40,962 New Orleans, Acadiana, 14% 63% Money market 273,741 266,519 305,668 336,310 30,642 62,569 NOW 512,054 536,643 688,336 620,081 -68,255 108,027 CDs 395,465 392,230 387,743 378,909 -8,834 -16,556 Total Deposits $1,820,975 $1,857,501 $2,266,704 $2,207,494 -$59,210 $386,519 13

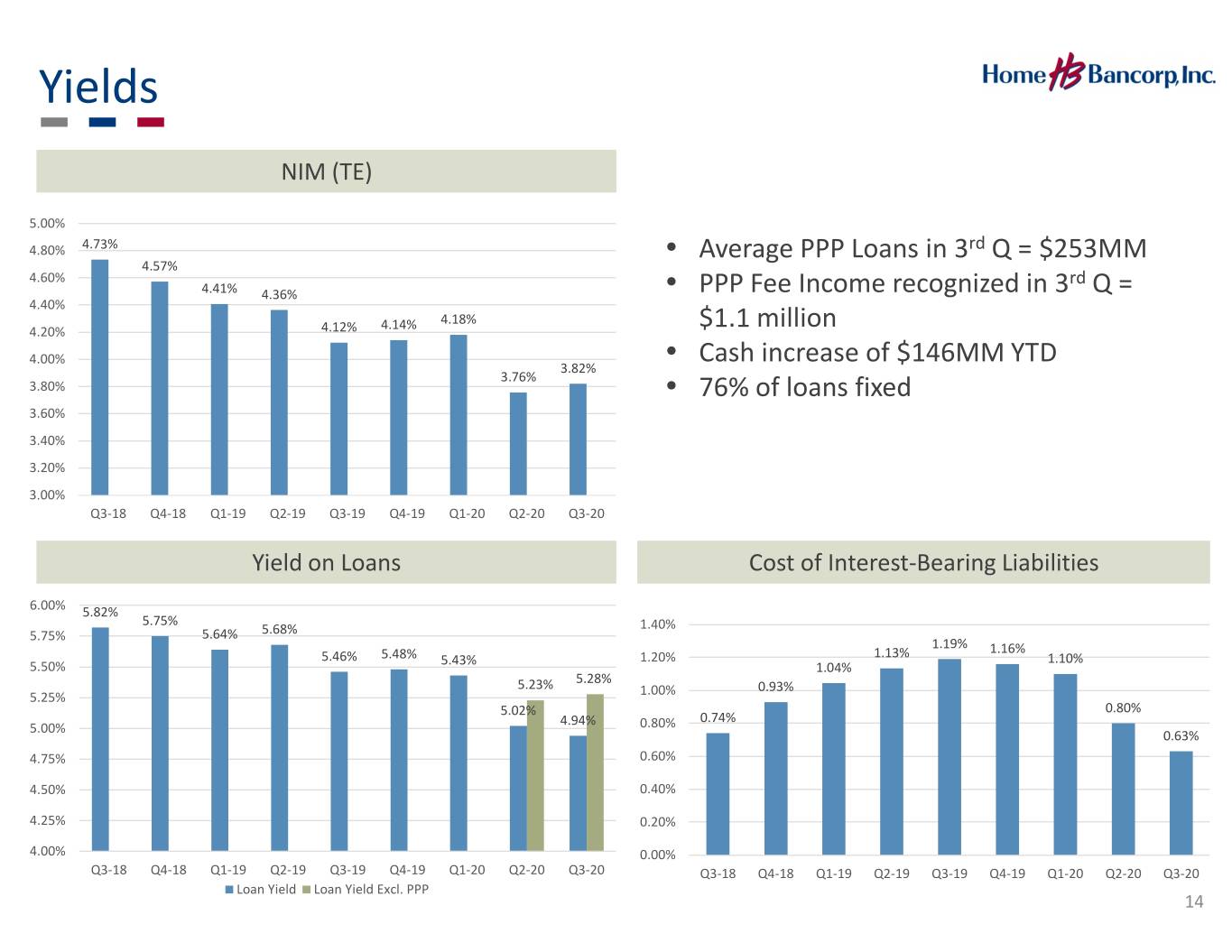

Yields NIM (TE) 5.00% 4.80% 4.73% • Average PPP Loans in 3rd Q = $253MM 4.57% 4.60% rd 4.41% 4.36% • PPP Fee Income recognized in 3 Q = 4.40% 4.14% 4.18% 4.20% 4.12% $1.1 million 4.00% • Cash increase of $146MM YTD 3.82% 3.76% 3.80% • 76% of loans fixed 3.60% 3.40% 3.20% 3.00% Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Yield on Loans Cost of Interest-Bearing Liabilities 6.00% 5.82% 5.75% 1.40% 5.75% 5.64% 5.68% 1.19% 1.13% 1.16% 5.46% 5.48% 5.43% 1.20% 1.10% 5.50% 1.04% 5.28% 5.23% 1.00% 0.93% 5.25% 5.02% 0.80% 4.94% 0.74% 5.00% 0.80% 0.63% 4.75% 0.60% 4.50% 0.40% 4.25% 0.20% 4.00% 0.00% Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Loan Yield Loan Yield Excl. PPP 14

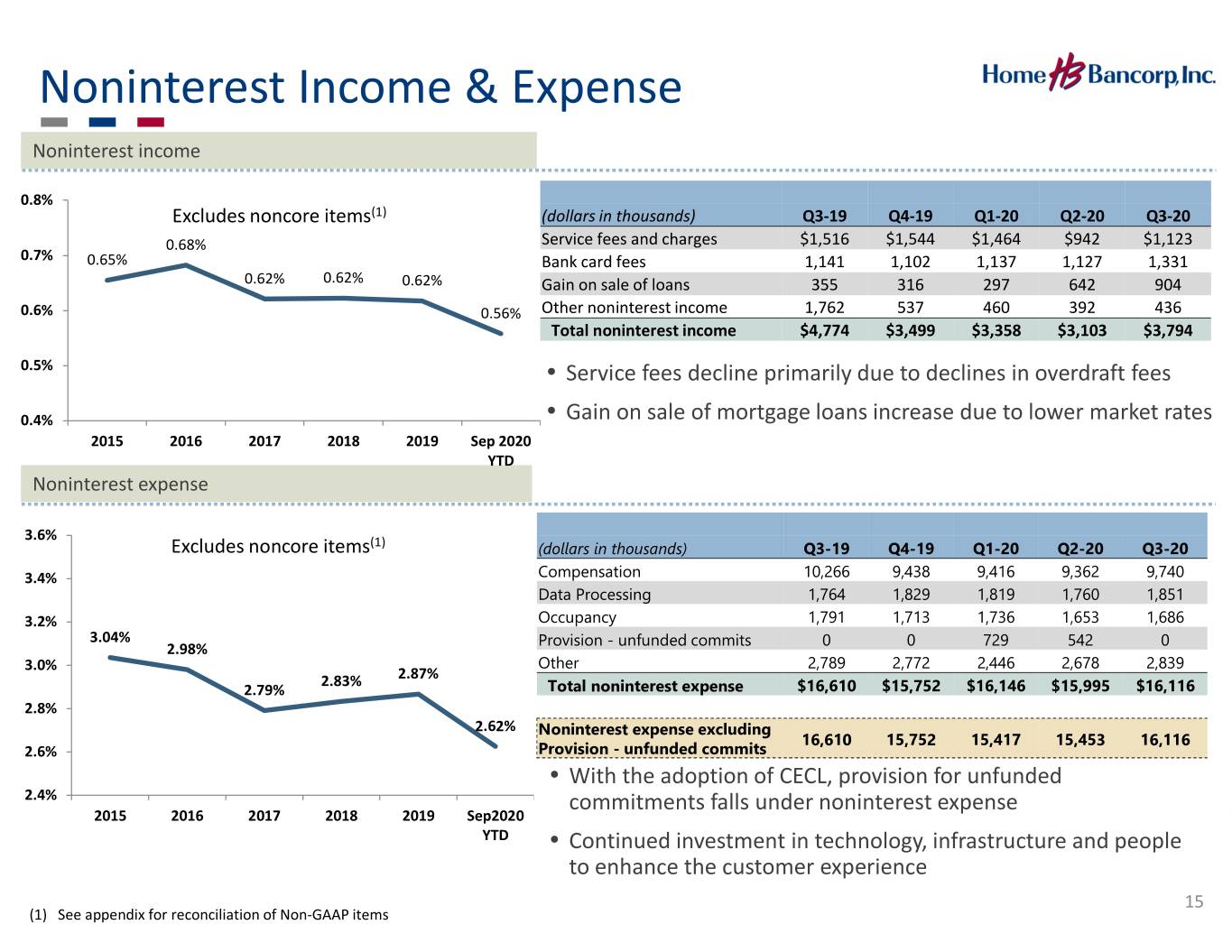

Noninterest Income & Expense Noninterest income 0.8% Excludes noncore items(1) (dollars in thousands) Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 0.68% Service fees and charges $1,516 $1,544 $1,464 $942 $1,123 0.7% 0.65% Bank card fees 1,141 1,102 1,137 1,127 1,331 0.62% 0.62% 0.62% Gain on sale of loans 355 316 297 642 904 0.6% 0.56% Other noninterest income 1,762 537 460 392 436 Total noninterest income $4,774 $3,499 $3,358 $3,103 $3,794 0.5% • Service fees decline primarily due to declines in overdraft fees 0.4% • Gain on sale of mortgage loans increase due to lower market rates 2015 2016 2017 2018 2019 Sep 2020 YTD Noninterest expense 3.6% Excludes noncore items(1) (dollars in thousands) Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 3.4% Compensation 10,266 9,438 9,416 9,362 9,740 Data Processing 1,764 1,829 1,819 1,760 1,851 3.2% Occupancy 1,791 1,713 1,736 1,653 1,686 3.04% Provision - unfunded commits 0 0 729 542 0 2.98% 3.0% Other 2,789 2,772 2,446 2,678 2,839 2.83% 2.87% 2.79% Total noninterest expense $16,610 $15,752 $16,146 $15,995 $16,116 2.8% 2.62% Noninterest expense excluding 16,610 15,752 15,417 15,453 16,116 2.6% Provision - unfunded commits • With the adoption of CECL, provision for unfunded 2.4% commitments falls under noninterest expense 2015 2016 2017 2018 2019 Sep2020 YTD • Continued investment in technology, infrastructure and people to enhance the customer experience 15 (1) See appendix for reconciliation of Non-GAAP items

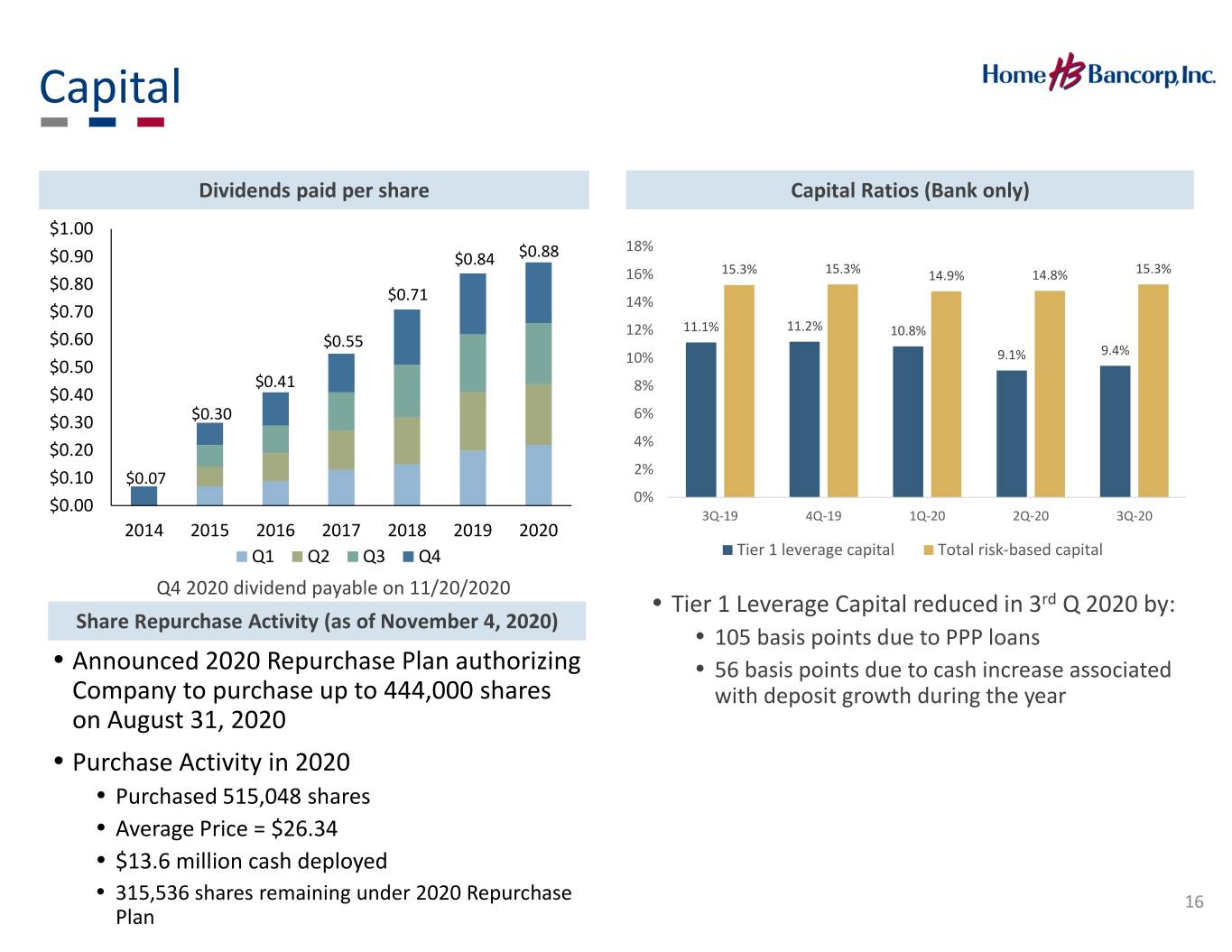

Capital Dividends paid per share Capital Ratios (Bank only) $1.00 18% $0.90 $0.84 $0.88 16% 15.3% 15.3% 15.3% $0.80 14.9% 14.8% $0.71 14% $0.70 12% 11.1% 11.2% 10.8% $0.60 $0.55 9.1% 9.4% $0.50 10% $0.41 $0.40 8% $0.30 $0.30 6% $0.20 4% 2% $0.10 $0.07 $0.00 0% 3Q-19 4Q-19 1Q-20 2Q-20 3Q-20 2014 2015 2016 2017 2018 2019 2020 Q1 Q2 Q3 Q4 Tier 1 leverage capital Total risk-based capital Q4 2020 dividend payable on 11/20/2020 • Tier 1 Leverage Capital reduced in 3rd Q 2020 by: Share Repurchase Activity (as of November 4, 2020) • 105 basis points due to PPP loans • Announced 2020 Repurchase Plan authorizing • 56 basis points due to cash increase associated Company to purchase up to 444,000 shares with deposit growth during the year on August 31, 2020 • Purchase Activity in 2020 • Purchased 515,048 shares • Average Price = $26.34 • $13.6 million cash deployed • 315,536 shares remaining under 2020 Repurchase 16 Plan

Investment Perspective Strong earnings and shareholder returns Conservative, well-managed credit culture Market disruption creates new opportunities Well capitalized with capacity for continued growth Disciplined acquirer Insider owners committed to continual improvement 17

WE ARE ONE TEAM, CREATING EXCEPTIONAL CUSTOMER EXPERIENCES

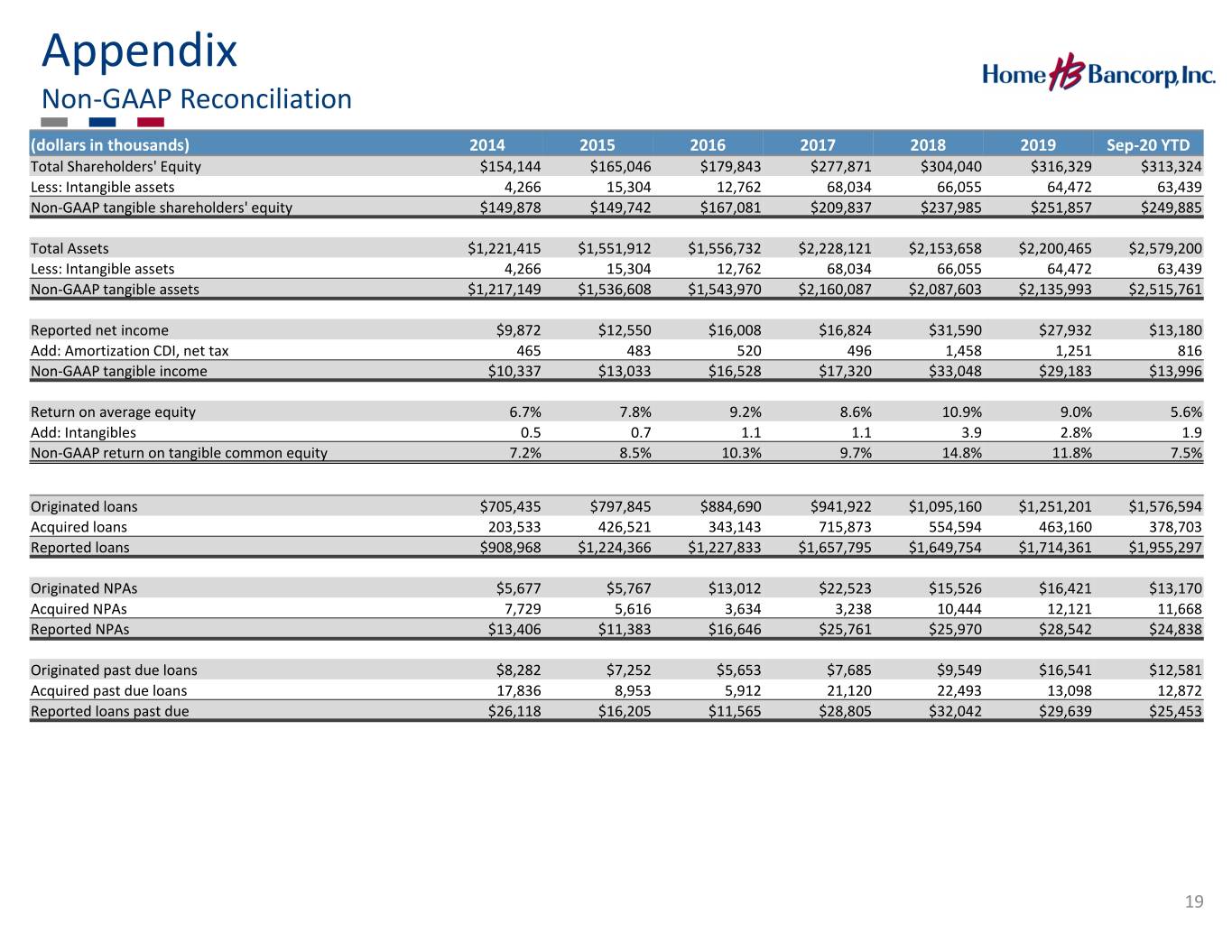

Appendix Non-GAAP Reconciliation (dollars in thousands) 2014 2015 2016 2017 2018 2019 Sep-20 YTD Total Shareholders' Equity $154,144 $165,046 $179,843 $277,871 $304,040 $316,329 $313,324 Less: Intangible assets 4,266 15,304 12,762 68,034 66,055 64,472 63,439 Non-GAAP tangible shareholders' equity $149,878 $149,742 $167,081 $209,837 $237,985 $251,857 $249,885 Total Assets $1,221,415 $1,551,912 $1,556,732 $2,228,121 $2,153,658 $2,200,465 $2,579,200 Less: Intangible assets 4,266 15,304 12,762 68,034 66,055 64,472 63,439 Non-GAAP tangible assets $1,217,149 $1,536,608 $1,543,970 $2,160,087 $2,087,603 $2,135,993 $2,515,761 Reported net income $9,872 $12,550 $16,008 $16,824 $31,590 $27,932 $13,180 Add: Amortization CDI, net tax 465 483 520 496 1,458 1,251 816 Non-GAAP tangible income $10,337 $13,033 $16,528 $17,320 $33,048 $29,183 $13,996 Return on average equity 6.7% 7.8% 9.2% 8.6% 10.9% 9.0% 5.6% Add: Intangibles 0.5 0.7 1.1 1.1 3.9 2.8% 1.9 Non-GAAP return on tangible common equity 7.2% 8.5% 10.3% 9.7% 14.8% 11.8% 7.5% Originated loans $705,435 $797,845 $884,690 $941,922 $1,095,160 $1,251,201 $1,576,594 Acquired loans 203,533 426,521 343,143 715,873 554,594 463,160 378,703 Reported loans $908,968 $1,224,366 $1,227,833 $1,657,795 $1,649,754 $1,714,361 $1,955,297 Originated NPAs $5,677 $5,767 $13,012 $22,523 $15,526 $16,421 $13,170 Acquired NPAs 7,729 5,616 3,634 3,238 10,444 12,121 11,668 Reported NPAs $13,406 $11,383 $16,646 $25,761 $25,970 $28,542 $24,838 Originated past due loans $8,282 $7,252 $5,653 $7,685 $9,549 $16,541 $12,581 Acquired past due loans 17,836 8,953 5,912 21,120 22,493 13,098 12,872 Reported loans past due $26,118 $16,205 $11,565 $28,805 $32,042 $29,639 $25,453 19

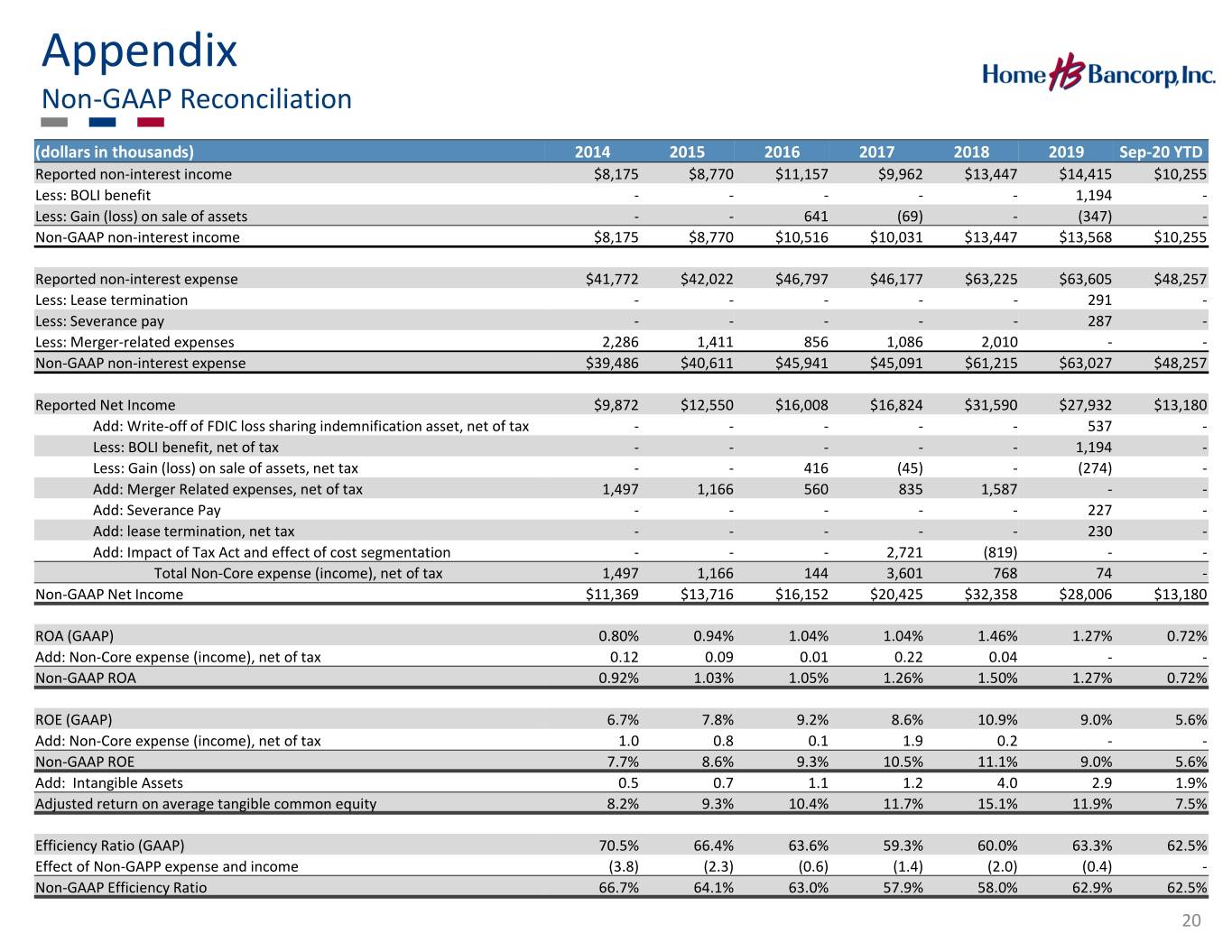

Appendix Non-GAAP Reconciliation (dollars in thousands) 2014 2015 2016 2017 2018 2019 Sep-20 YTD Reported non-interest income $8,175 $8,770 $11,157 $9,962 $13,447 $14,415 $10,255 Less: BOLI benefit - - - - - 1,194 - Less: Gain (loss) on sale of assets - - 641 (69) - (347) - Non-GAAP non-interest income $8,175 $8,770 $10,516 $10,031 $13,447 $13,568 $10,255 Reported non-interest expense $41,772 $42,022 $46,797 $46,177 $63,225 $63,605 $48,257 Less: Lease termination - - - - - 291 - Less: Severance pay - - - - - 287 - Less: Merger-related expenses 2,286 1,411 856 1,086 2,010 - - Non-GAAP non-interest expense $39,486 $40,611 $45,941 $45,091 $61,215 $63,027 $48,257 Reported Net Income $9,872 $12,550 $16,008 $16,824 $31,590 $27,932 $13,180 Add: Write-off of FDIC loss sharing indemnification asset, net of tax - - - - - 537 - Less: BOLI benefit, net of tax - - - - - 1,194 - Less: Gain (loss) on sale of assets, net tax - - 416 (45) - (274) - Add: Merger Related expenses, net of tax 1,497 1,166 560 835 1,587 - - Add: Severance Pay - - - - - 227 - Add: lease termination, net tax - - - - - 230 - Add: Impact of Tax Act and effect of cost segmentation - - - 2,721 (819) - - Total Non-Core expense (income), net of tax 1,497 1,166 144 3,601 768 74 - Non-GAAP Net Income $11,369 $13,716 $16,152 $20,425 $32,358 $28,006 $13,180 ROA (GAAP) 0.80% 0.94% 1.04% 1.04% 1.46% 1.27% 0.72% Add: Non-Core expense (income), net of tax 0.12 0.09 0.01 0.22 0.04 - - Non-GAAP ROA 0.92% 1.03% 1.05% 1.26% 1.50% 1.27% 0.72% ROE (GAAP) 6.7% 7.8% 9.2% 8.6% 10.9% 9.0% 5.6% Add: Non-Core expense (income), net of tax 1.0 0.8 0.1 1.9 0.2 - - Non-GAAP ROE 7.7% 8.6% 9.3% 10.5% 11.1% 9.0% 5.6% Add: Intangible Assets 0.5 0.7 1.1 1.2 4.0 2.9 1.9% Adjusted return on average tangible common equity 8.2% 9.3% 10.4% 11.7% 15.1% 11.9% 7.5% Efficiency Ratio (GAAP) 70.5% 66.4% 63.6% 59.3% 60.0% 63.3% 62.5% Effect of Non-GAPP expense and income (3.8) (2.3) (0.6) (1.4) (2.0) (0.4) - Non-GAAP Efficiency Ratio 66.7% 64.1% 63.0% 57.9% 58.0% 62.9% 62.5% 20

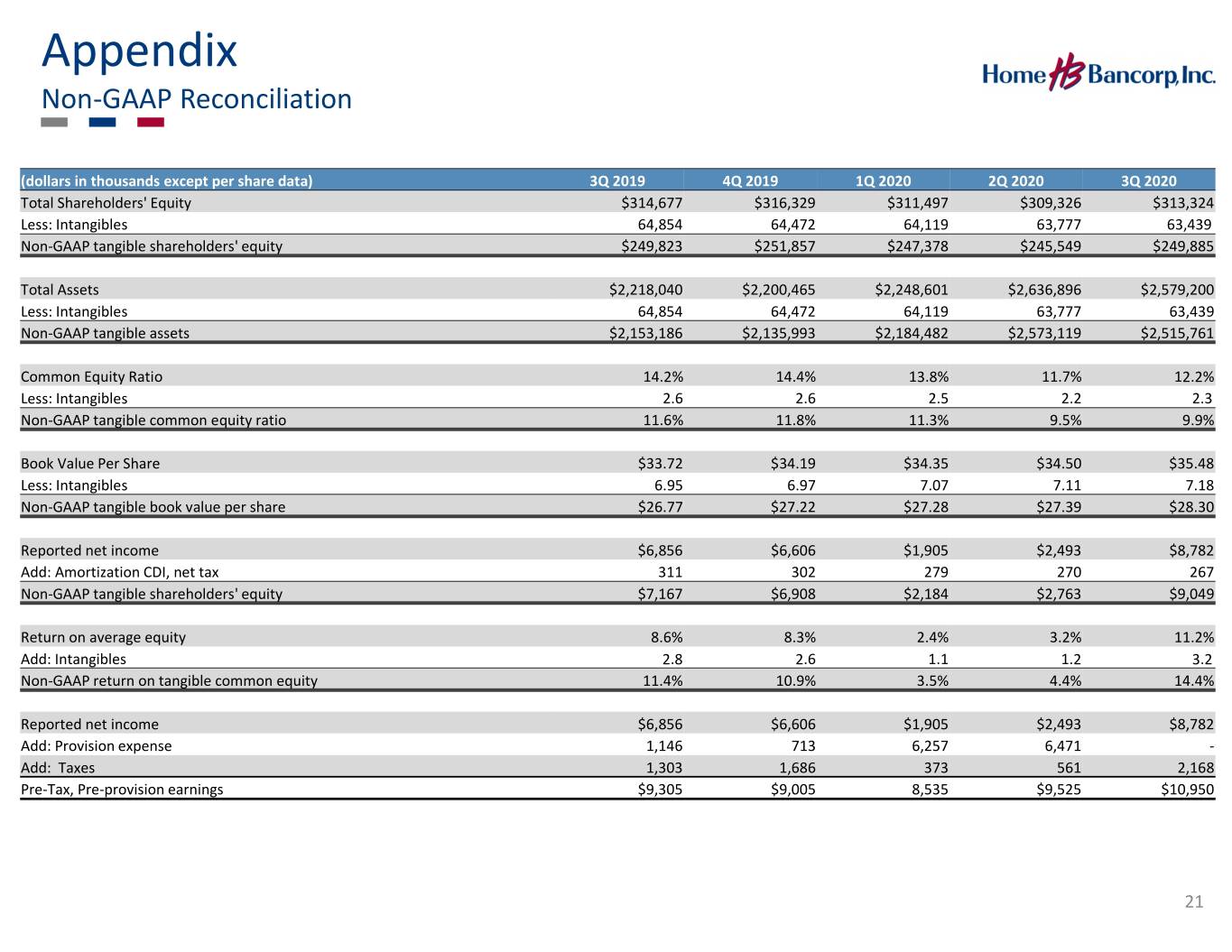

Appendix Non-GAAP Reconciliation (dollars in thousands except per share data) 3Q 2019 4Q 2019 1Q 2020 2Q 2020 3Q 2020 Total Shareholders' Equity $314,677 $316,329 $311,497 $309,326 $313,324 Less: Intangibles 64,854 64,472 64,119 63,777 63,439 Non-GAAP tangible shareholders' equity $249,823 $251,857 $247,378 $245,549 $249,885 Total Assets $2,218,040 $2,200,465 $2,248,601 $2,636,896 $2,579,200 Less: Intangibles 64,854 64,472 64,119 63,777 63,439 Non-GAAP tangible assets $2,153,186 $2,135,993 $2,184,482 $2,573,119 $2,515,761 Common Equity Ratio 14.2% 14.4% 13.8% 11.7% 12.2% Less: Intangibles 2.6 2.6 2.5 2.2 2.3 Non-GAAP tangible common equity ratio 11.6% 11.8% 11.3% 9.5% 9.9% Book Value Per Share $33.72 $34.19 $34.35 $34.50 $35.48 Less: Intangibles 6.95 6.97 7.07 7.11 7.18 Non-GAAP tangible book value per share $26.77 $27.22 $27.28 $27.39 $28.30 Reported net income $6,856 $6,606 $1,905 $2,493 $8,782 Add: Amortization CDI, net tax 311 302 279 270 267 Non-GAAP tangible shareholders' equity $7,167 $6,908 $2,184 $2,763 $9,049 Return on average equity 8.6% 8.3% 2.4% 3.2% 11.2% Add: Intangibles 2.8 2.6 1.1 1.2 3.2 Non-GAAP return on tangible common equity 11.4% 10.9% 3.5% 4.4% 14.4% Reported net income $6,856 $6,606 $1,905 $2,493 $8,782 Add: Provision expense 1,146 713 6,257 6,471 - Add: Taxes 1,303 1,686 373 561 2,168 Pre-Tax, Pre-provision earnings $9,305 $9,005 8,535 $9,525 $10,950 21