Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SCANSOURCE, INC. | a2021-q1ex99109302020.htm |

| 8-K - 8-K - SCANSOURCE, INC. | scsc-20201109.htm |

Exhibit 99.2 ScanSource, Inc. CFO COMMENTARY Q1 FY2021 CFO COMMENTARY Q1 FY 2021 FINANCIAL INFORMATION AND CONFERENCE CALL Please see the accompanying earnings press release available at www.scansource.com in the Investor Relations section. The information included in this CFO commentary is unaudited and should be read in conjunction with the Company’s SEC filings on Form 10-Q for the quarter ended September 30, 2020. All results reflect continuing operations only unless otherwise noted. ScanSource will present additional information about its financial results and outlook in a conference call on Monday, November 9, 2020 at 5:00 pm ET. A webcast of the call is available and can be accessed at www.scansource.com (Investor Relations section). The webcast will be Q1 FY2021: available for replay for 60 days. Strong operating FIRST QUARTER SUMMARY cash flow For the first quarter of our fiscal year, we built back sales volumes with strong and 19% Q/Q sales growth and gained operating leverage on SG&A expenses. We Q/Q net delivered net sales of $757.3 million (down 10% Y/Y, or down 7% Y/Y for sales growth organic growth). This represents 19% sequential quarter growth from the June quarter, driven by growth across key technologies in North America and Brazil. We accelerated our shift to more recurring revenue with 11% Y/Y revenue growth for Intelisys and 46% Y/Y revenue growth for SaaS and subscriptions. At the end of July, we implemented our $30 million annualized expense reduction plan, and our lower non-GAAP SG&A expenses reflect a partial Please see Appendix for quarter impact. We continued to strengthen our balance sheet, reducing calculation of non-GAAP measures and working capital by $56 million Q/Q (down $198 million Y/Y) and generating reconciliations to GAAP measures. In August 2019, strong cash flow of $71 million for the quarter and $226 million for the trailing ScanSource announced plans to divest its products 12-month period. distribution business outside of the United States, Canada and Brazil On October 30, 2020, we completed the sale of our products business in (“Divestitures”). Latin America, outside of Brazil to Intcomex. scansource.com 1 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 QUARTERLY HIGHLIGHTS Q/Q Y/Y $ in millions, except EPS Q1 FY21 Q4 FY20 Q1 FY20 Change Change Net sales $757.3 $636.5 $842.7 +19% -10% Gross profit $80.8 $74.1 $98.5 +9% -18% Gross profit margin % 10.7% 11.7% 11.7% -98 bps -103 bps SG&A expenses $62.1 $58.2 $68.5 +7% -9% Non-GAAP SG&A expenses $61.6 $62.6 $67.8 -2% -9% Operating income $1.6 ($113.4) $19.5 n/m -92% Operating income % 0.2% -17.8% 2.3% n/m -210 bps Non-GAAP operating income $15.8 $8.2 $27.4 +92% -43% Non-GAAP operating income % 2.1% 1.3% 3.3% +79 bps -117 bps GAAP net income ($0.1) ($108.9) $12.3 n/m n/m Non-GAAP net income $10.7 $4.9 $18.5 +120% -42% GAAP diluted EPS ($0.01) ($4.29) $0.48 n/m n/m Non-GAAP diluted EPS $0.42 $0.19 $0.72 +121% -42% • Net sales of $757.3 million, up 19% Q/Q; • GAAP operating income, net income and down 10% Y/Y diluted EPS reflect $8.3M of restructuring costs - FX impact of $(25) million; organic growth down 7% Y/Y • Non-GAAP SG&A expenses down 9.1% Y/Y, reflecting partial quarter impact for $30 - Lower Y/Y sales volumes from the million annualized expense reduction COVID-19 pandemic program - Q/Q growth across key technologies in • Non-GAAP operating income of $15.8 million North America and Brazil - Decreases primarily from lower Y/Y sales - Intelisys revenue up 11% Y/Y; volumes and lower margin from sales mix SaaS/subscription revenue grew 46% Y/Y - Partially offset by lower SG&A expenses • Gross profit margin of 10.7% - Reflects lower supplier program recognition - Lower margin sales mix, including large deals Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income, non-GAAP net income, and non-GAAP diluted EPS exclude amortization of intangibles, change in fair value of contingent consideration, impairment charges, restructuring charges, acquisition/divestiture costs, and other non-GAAP items. scansource.com 2 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 WORLDWIDE BARCODE, NETWORKING & SECURITY Q1 FY21 Q4 FY20 Q1 FY20 $ in millions Net sales $523.6 $447.8 $581.2 Gross profit $41.1 $37.3 $50.3 Gross profit margin % 7.8% 8.3% 8.7% Operating income $2.1 $(112.7) $11.1 Operating income % 0.4% (25.2)% 1.9% Non-GAAP operating income $4.1 $3.7 $13.0 Non-GAAP operating income % 0.8% 0.8% 2.2% • Net sales of $523.6 million, up 17% Net Sales, $ in millions Q/Q; down 10% Y/Y (organic growth down 9% Y/Y) Y/Y Growth -10% - Lower Y/Y volumes from the Y/Y Organic Growth -8.6% 1 COVID-19 pandemic; strong growth in Brazil across technologies $700 - Q/Q growth across key technologies including mobility, self- checkout, and video surveillance $600 $581 $575 • Gross profit margin of 7.8%, down $524 $489 both Y/Y and Q/Q $500 $448 - Lower supplier program recognition - Lower margin sales mix, including $400 large deals • Operating income and non-GAAP $300 operating income lower Y/Y Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 - Reflects lower gross profits from lower sales volumes and gross profit margin declines Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income excludes amortization of intangibles, impairment charges and other non-GAAP items. scansource.com 3 November 9, 2020

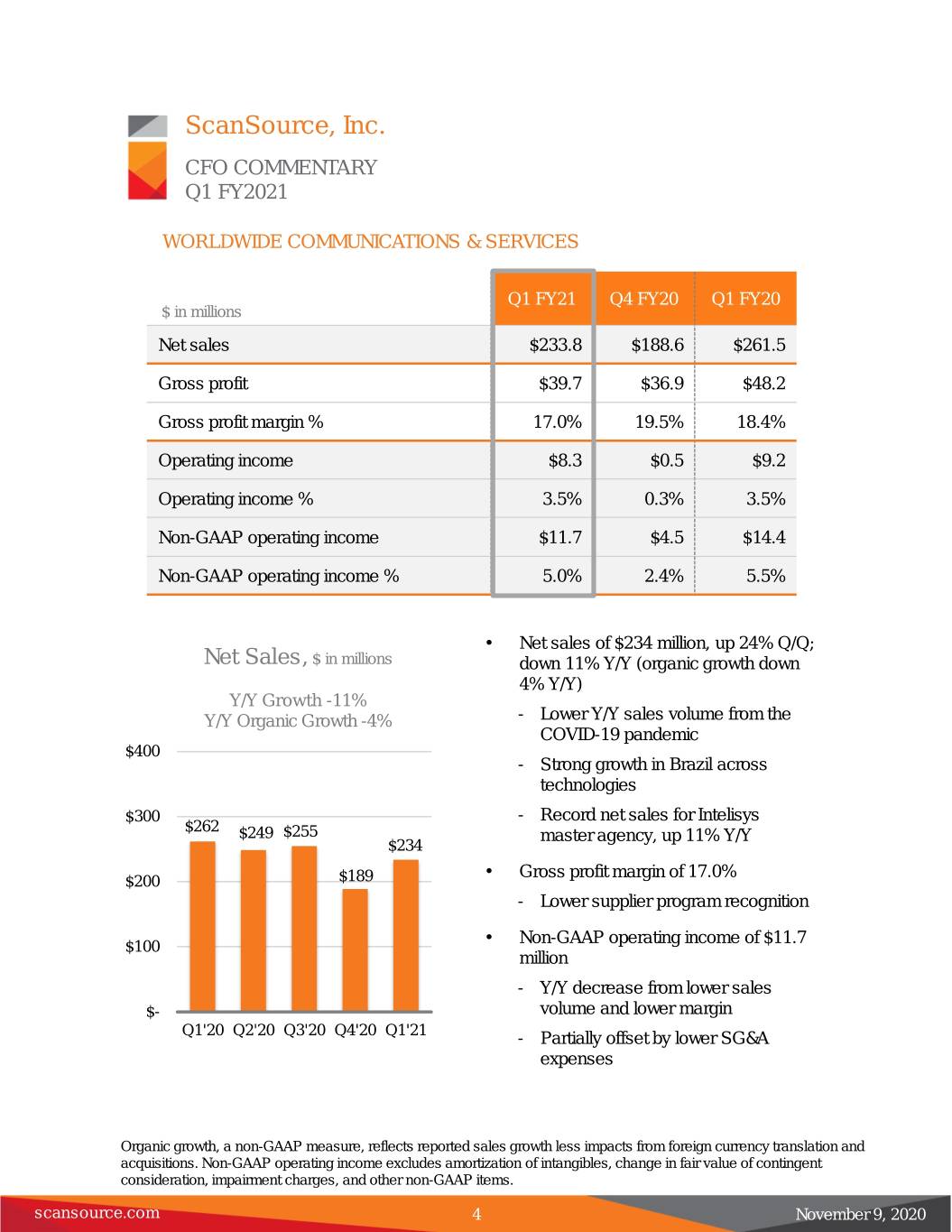

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 WORLDWIDE COMMUNICATIONS & SERVICES Q1 FY21 Q4 FY20 Q1 FY20 $ in millions Net sales $233.8 $188.6 $261.5 Gross profit $39.7 $36.9 $48.2 Gross profit margin % 17.0% 19.5% 18.4% Operating income $8.3 $0.5 $9.2 Operating income % 3.5% 0.3% 3.5% Non-GAAP operating income $11.7 $4.5 $14.4 Non-GAAP operating income % 5.0% 2.4% 5.5% • Net sales of $234 million, up 24% Q/Q; Net Sales, $ in millions down 11% Y/Y (organic growth down 4% Y/Y) Y/Y Growth -11% Y/Y Organic Growth -4% - Lower Y/Y sales volume from the COVID-19 pandemic $400 - Strong growth in Brazil across technologies $300 - Record net sales for Intelisys $262 $249 $255 master agency, up 11% Y/Y $234 • Gross profit margin of 17.0% $200 $189 - Lower supplier program recognition • Non-GAAP operating income of $11.7 $100 million - Y/Y decrease from lower sales $- volume and lower margin Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 - Partially offset by lower SG&A expenses Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income excludes amortization of intangibles, change in fair value of contingent consideration, impairment charges, and other non-GAAP items. scansource.com 4 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 WORKING CAPITAL Q1 FY21 Q4 FY20 Q1 FY20 $ in millions Accounts receivable (Q/E) $509.8 $443.2 $567.9 Days sales outstanding in receivables 61 63 61 Inventory (Q/E) $423.1 $454.9 $599.6 Inventory turns 6.2 4.5 5.2 Accounts payable (Q/E) $544.9 $454.2 $581.7 Paid for inventory days* (7.2) 10.9 9.3 Working capital (Q/E) (AR+INV–AP) $388.0 $443.8 $585.8 * Paid for inventory days represent Q/E inventory days less Q/E accounts payable days • Working capital of $388.0 million, down • Inventory of $423.1 million, down 7% 13% Q/Q and down 34% Y/Y Q/Q and down 29% Y/Y - Decreases from lower inventory - Inventory turns increased to 6.2x levels • Paid for inventory days of (7.2) driven by • Days sales outstanding in receivables of reduction in inventory and timing of 61 days, in line with typical levels accounts payable scansource.com 5 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 CASH FLOW AND BALANCE SHEET HIGHLIGHTS Q1 FY21 Q4 FY20 Q1 FY20 $ in millions Adjusted EBITDA (QTR)* $19.7 $12.3 $31.9 Adjusted ROIC (QTR)* 8.4% 4.0% 9.6% Operating cash flow (QTR) $71.2 $74.0 $27.6 Operating cash flow, trailing 12 months $225.6 $182.0 ($18.6) Cash and cash equivalents (Q/E), including $55.6 $34.5 $25.9 discontinued operations Debt (Q/E), including discontinued operations $168.7 $247.0 $370.3 Net debt, including discontinued operations to 1.3x 2.2x 2.4x adjusted EBITDA, trailing 12 months* Shares repurchased – # of shares (QTR) -- -- 168,068 Shares repurchased – dollars (QTR) -- -- $5.4 Remaining share repurchase authorization -- -- -- (as of Q/E) * Excludes non-GAAP adjustments and change in fair value of contingent consideration • Adjusted EBITDA of $19.7 million • Cash and cash equivalent balances from continuing operations of $49.9 million at - Up 60% Q/Q from higher sales 9/30/20, including $38.2 million held volumes and lower SG&A expenses outside of the U.S. - Down 38% Y/Y primarily from lower sales volumes • Net debt to trailing 12-month adjusted EBITDA is 1.3x (target range:1.5x to • Operating cash flow of $71.2 million for 2.5x) the quarter and $225.6 million for the trailing-12 months - Primarily from lower working capital, including higher accounts payable and lower inventory scansource.com 6 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 FORWARD-LOOKING STATEMENTS This CFO Commentary contains certain Although ScanSource believes the comments that are “forward-looking” expectations in its forward-looking statements statements, including statements about the are reasonable, it cannot guarantee future Divestitures, impact of the COVID-19 results, levels of activity, performance or pandemic and our operating strategies that achievement. ScanSource disclaims any involve plans, strategies, economic obligation to update or revise any forward- performance and trends, projections, looking statements, whether as a result of new expectations, costs or beliefs about future information, future events, or otherwise, except events and other statements that are not as may be required by law. descriptions of historical facts. Forward- looking information is inherently subject to risks NON-GAAP FINANCIAL INFORMATION and uncertainties. In addition to disclosing results that are determined in accordance with United States Any number of factors could cause actual Generally Accepted Accounting Principles results to differ materially from anticipated or (“GAAP”), the Company also discloses certain forecasted results, including but not limited to, non-GAAP measures, including non-GAAP the impact of the COVID-19 pandemic on our operating income, non-GAAP operating operations and financial condition and the income margin, non-GAAP net income, non- potential prolonged economic weakness GAAP diluted EPS, non-GAAP net sales, non- brought on by COVID-19, our ability to GAAP gross profit, non-GAAP gross margin, complete the Divestitures on acceptable terms non-GAAP SG&A expenses, adjusted EBITDA, or otherwise dispose of the operations, the ROIC and net sales excluding the Divestitures failure to manage and implement our organic less impacts from foreign currency translation growth strategy, credit risks involving our larger and acquisitions (organic growth). A customers and suppliers, changes in interest reconciliation of the Company's non-GAAP and exchange rates and regulatory regimes financial information to GAAP financial impacting our international operations, risk to information is provided in the Appendix and in our business from a cyber-security attack, a the Company’s Form 8-K, filed with the SEC, failure of our IT systems, failure to hire and with the quarterly earnings press release for retain quality employees, loss of our major the period indicated. customers, termination of our relationship with key suppliers or a significant modification of the terms under which we operate with a key supplier, changes in our operating strategy, and other factors set forth in the “Risk Factors” contained in our annual report on Form 10-K for the year ended June 30, 2020, and subsequent reports on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”). scansource.com 7 November 9, 2020

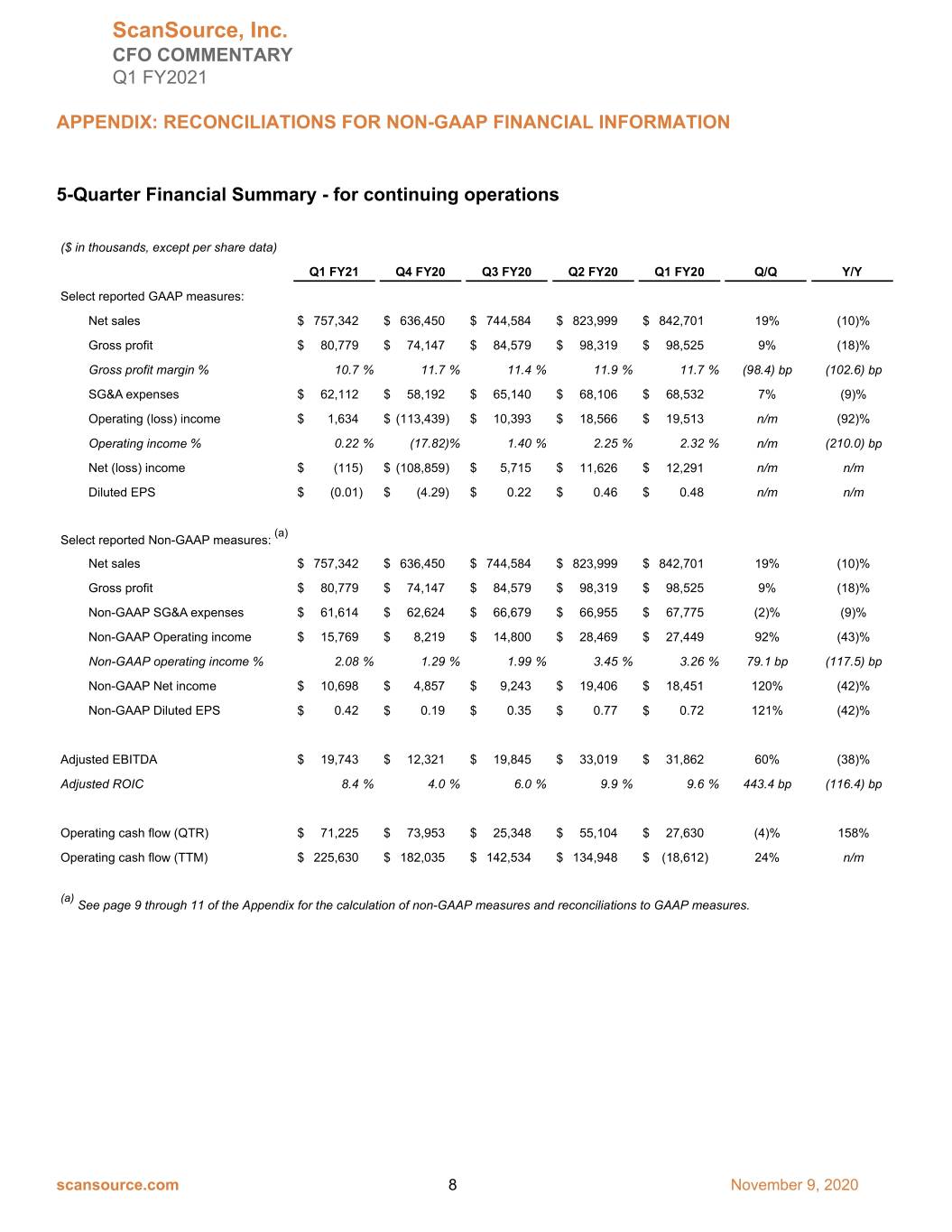

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION 5-Quarter Financial Summary - for continuing operations ($ in thousands, except per share data) Q1 FY21 Q4 FY20 Q3 FY20 Q2 FY20 Q1 FY20 Q/Q Y/Y Select reported GAAP measures: Net sales $ 757,342 $ 636,450 $ 744,584 $ 823,999 $ 842,701 19% (10)% Gross profit $ 80,779 $ 74,147 $ 84,579 $ 98,319 $ 98,525 9% (18)% Gross profit margin % 10.7 % 11.7 % 11.4 % 11.9 % 11.7 % (98.4) bp (102.6) bp SG&A expenses $ 62,112 $ 58,192 $ 65,140 $ 68,106 $ 68,532 7% (9)% Operating (loss) income $ 1,634 $ (113,439) $ 10,393 $ 18,566 $ 19,513 n/m (92)% Operating income % 0.22 % (17.82) % 1.40 % 2.25 % 2.32 % n/m (210.0) bp Net (loss) income $ (115) $ (108,859) $ 5,715 $ 11,626 $ 12,291 n/m n/m Diluted EPS $ (0.01) $ (4.29) $ 0.22 $ 0.46 $ 0.48 n/m n/m (a) Select reported Non-GAAP measures: Net sales $ 757,342 $ 636,450 $ 744,584 $ 823,999 $ 842,701 19% (10)% Gross profit $ 80,779 $ 74,147 $ 84,579 $ 98,319 $ 98,525 9% (18)% Non-GAAP SG&A expenses $ 61,614 $ 62,624 $ 66,679 $ 66,955 $ 67,775 (2)% (9)% Non-GAAP Operating income $ 15,769 $ 8,219 $ 14,800 $ 28,469 $ 27,449 92% (43)% Non-GAAP operating income % 2.08 % 1.29 % 1.99 % 3.45 % 3.26 % 79.1 bp (117.5) bp Non-GAAP Net income $ 10,698 $ 4,857 $ 9,243 $ 19,406 $ 18,451 120% (42)% Non-GAAP Diluted EPS $ 0.42 $ 0.19 $ 0.35 $ 0.77 $ 0.72 121% (42)% Adjusted EBITDA $ 19,743 $ 12,321 $ 19,845 $ 33,019 $ 31,862 60% (38)% Adjusted ROIC 8.4 % 4.0 % 6.0 % 9.9 % 9.6 % 443.4 bp (116.4) bp Operating cash flow (QTR) $ 71,225 $ 73,953 $ 25,348 $ 55,104 $ 27,630 (4)% 158% Operating cash flow (TTM) $ 225,630 $ 182,035 $ 142,534 $ 134,948 $ (18,612) 24% n/m (a) See page 9 through 11 of the Appendix for the calculation of non-GAAP measures and reconciliations to GAAP measures. scansource.com 8 November 9, 2020

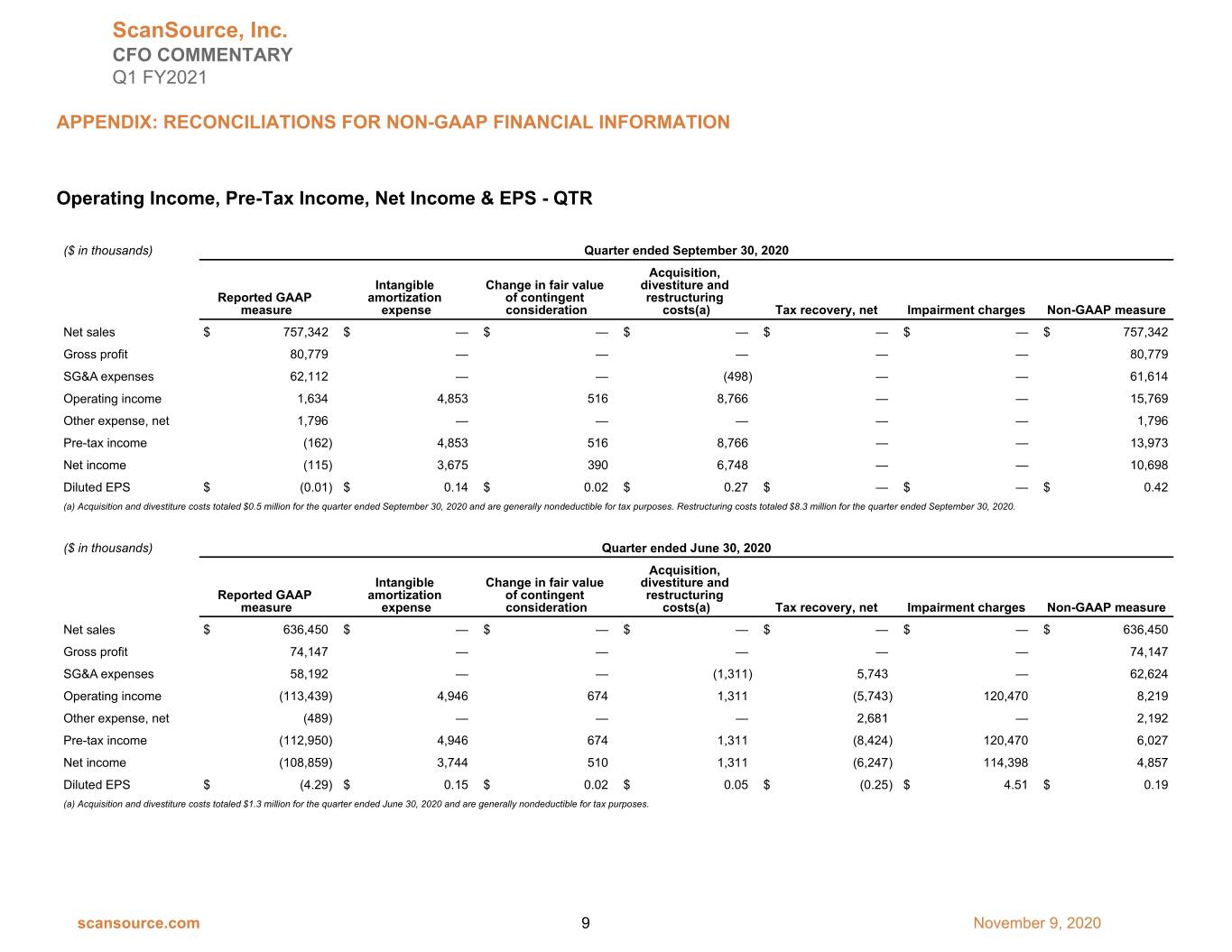

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Operating Income, Pre-Tax Income, Net Income & EPS - QTR ($ in thousands) Quarter ended September 30, 2020 Acquisition, Intangible Change in fair value divestiture and Reported GAAP amortization of contingent restructuring measure expense consideration costs(a) Tax recovery, net Impairment charges Non-GAAP measure Net sales $ 757,342 $ — $ — $ — $ — $ — $ 757,342 Gross profit 80,779 — — — — — 80,779 SG&A expenses 62,112 — — (498) — — 61,614 Operating income 1,634 4,853 516 8,766 — — 15,769 Other expense, net 1,796 — — — — — 1,796 Pre-tax income (162) 4,853 516 8,766 — — 13,973 Net income (115) 3,675 390 6,748 — — 10,698 Diluted EPS $ (0.01) $ 0.14 $ 0.02 $ 0.27 $ — $ — $ 0.42 (a) Acquisition and divestiture costs totaled $0.5 million for the quarter ended September 30, 2020 and are generally nondeductible for tax purposes. Restructuring costs totaled $8.3 million for the quarter ended September 30, 2020. ($ in thousands) Quarter ended June 30, 2020 Acquisition, Intangible Change in fair value divestiture and Reported GAAP amortization of contingent restructuring measure expense consideration costs(a) Tax recovery, net Impairment charges Non-GAAP measure Net sales $ 636,450 $ — $ — $ — $ — $ — $ 636,450 Gross profit 74,147 — — — — — 74,147 SG&A expenses 58,192 — — (1,311) 5,743 — 62,624 Operating income (113,439) 4,946 674 1,311 (5,743) 120,470 8,219 Other expense, net (489) — — — 2,681 — 2,192 Pre-tax income (112,950) 4,946 674 1,311 (8,424) 120,470 6,027 Net income (108,859) 3,744 510 1,311 (6,247) 114,398 4,857 Diluted EPS $ (4.29) $ 0.15 $ 0.02 $ 0.05 $ (0.25) $ 4.51 $ 0.19 (a) Acquisition and divestiture costs totaled $1.3 million for the quarter ended June 30, 2020 and are generally nondeductible for tax purposes. scansource.com 9 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Operating Income, Pre-Tax Income, Net Income & EPS - QTR, continued ($ in thousands) Quarter ended March 31, 2020 Acquisition, Intangible Change in fair value divestiture and Reported GAAP amortization of contingent restructuring measure expense consideration costs(a) Tax recovery, net Impairment charges Non-GAAP measure Net sales $ 744,584 $ — $ — $ — $ — $ — $ 744,584 Gross profit 84,579 — — — — — 84,579 SG&A expenses 65,140 — — (781) 2,320 — 66,679 Operating income 10,393 5,159 618 950 (2,320) — 14,800 Other expense, net 1,881 — — — — — 1,881 Pre-tax income 8,513 5,159 618 950 (2,320) — 12,920 Net income 5,715 3,909 467 906 (1,754) — 9,243 Diluted EPS $ 0.22 $ 0.15 $ 0.02 $ 0.04 $ (0.07) $ — $ 0.35 (a) Acquisition and divestiture costs totaled $0.8 million for the quarter ended March 31, 2020 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.2 million for the quarter ended March 31, 2020. ($ in thousands) Quarter ended December 31, 2019 Acquisition, Intangible Change in fair value divestiture and Reported GAAP amortization of contingent restructuring measure expense consideration costs(a) Tax recovery, net Impairment charges Non-GAAP measure Net sales $ 823,999 $ — $ — $ — $ — $ — $ 823,999 Gross profit 98,319 — — — — — 98,319 SG&A expenses 68,106 — — (1,151) — — 66,955 Operating income 18,566 5,310 3,176 1,417 — — 28,469 Other expense, net 2,534 — — — — — 2,534 Pre-tax income 16,032 5,310 3,176 1,417 — — 25,935 Net income 11,626 4,032 2,401 1,347 — — 19,406 Diluted EPS $ 0.46 $ 0.16 $ 0.09 $ 0.05 $ — $ — $ 0.77 (a) Acquisition and divestiture costs totaled $1.2 million for the quarter ended December 31, 2019 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.3 million for the quarter ended December 31, 2019. scansource.com 10 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Operating Income, Pre-Tax Income, Net Income & EPS - QTR, continued ($ in thousands) Quarter ended September 30, 2019 Acquisition, Intangible Change in fair value divestiture and Reported GAAP amortization of contingent restructuring measure expense consideration costs(a) Tax recovery, net Impairment charges Non-GAAP measure Net sales $ 842,701 $ — $ — $ — $ — $ — $ 842,701 Gross profit 98,525 — — — — — 98,525 SG&A expenses 68,532 — — (757) — — 67,775 Operating income 19,513 4,538 2,472 926 — — 27,449 Other expense, net 2,884 — — — — — 2,884 Pre-tax income 16,629 4,538 2,472 926 — — 24,565 Net income 12,291 3,406 1,869 885 — — 18,451 Diluted EPS $ 0.48 $ 0.13 $ 0.07 $ 0.04 $ — $ — $ 0.72 (a) Acquisition and divestiture costs totaled $0.8 million for the quarter ended September 30, 2019 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.2 million for the quarter ended September 30, 2019. scansource.com 11 November 9, 2020

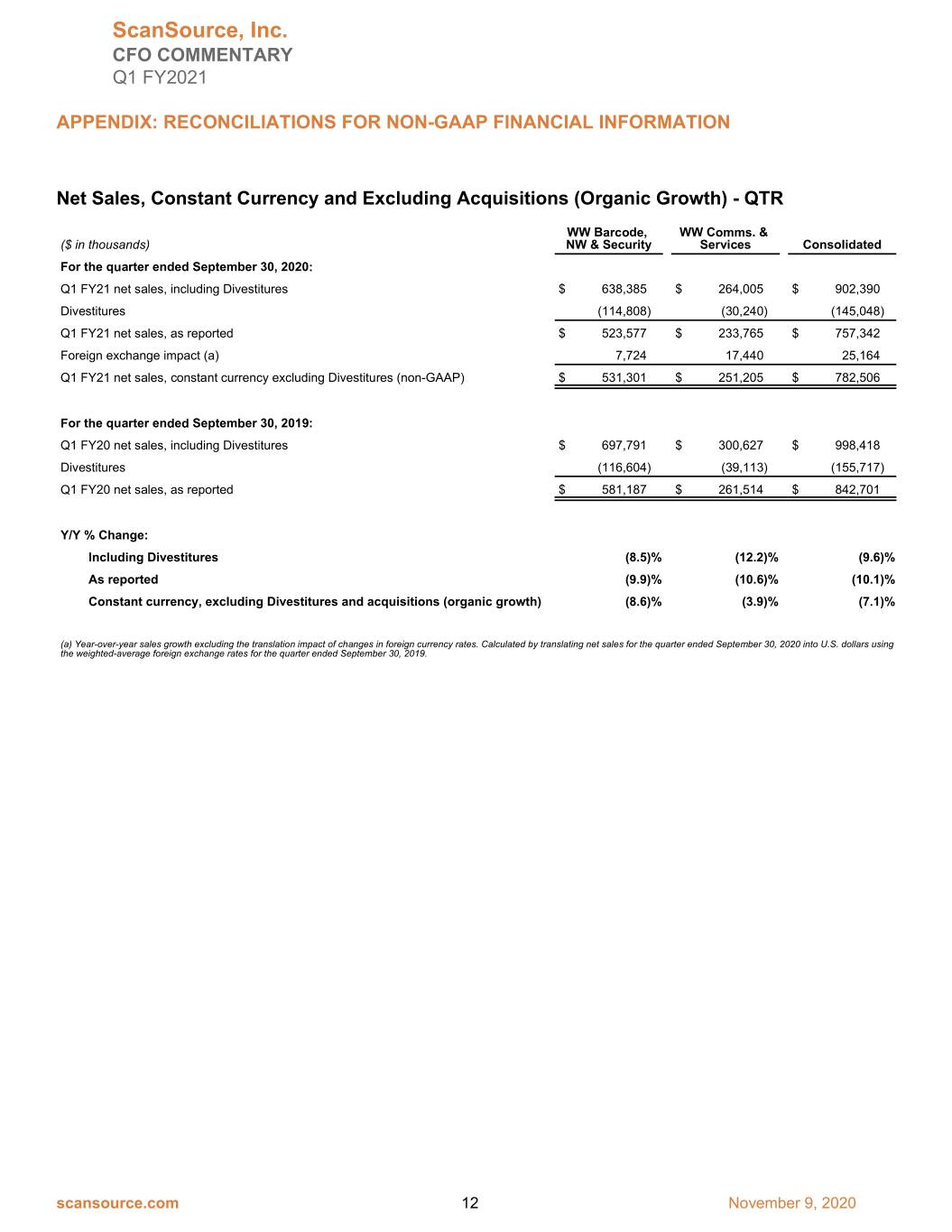

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Sales, Constant Currency and Excluding Acquisitions (Organic Growth) - QTR WW Barcode, WW Comms. & ($ in thousands) NW & Security Services Consolidated For the quarter ended September 30, 2020: Q1 FY21 net sales, including Divestitures $ 638,385 $ 264,005 $ 902,390 Divestitures (114,808) (30,240) (145,048) Q1 FY21 net sales, as reported $ 523,577 $ 233,765 $ 757,342 Foreign exchange impact (a) 7,724 17,440 25,164 Q1 FY21 net sales, constant currency excluding Divestitures (non-GAAP) $ 531,301 $ 251,205 $ 782,506 For the quarter ended September 30, 2019: Q1 FY20 net sales, including Divestitures $ 697,791 $ 300,627 $ 998,418 Divestitures (116,604) (39,113) (155,717) Q1 FY20 net sales, as reported $ 581,187 $ 261,514 $ 842,701 Y/Y % Change: Including Divestitures (8.5) % (12.2) % (9.6) % As reported (9.9) % (10.6) % (10.1) % Constant currency, excluding Divestitures and acquisitions (organic growth) (8.6) % (3.9) % (7.1) % (a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for the quarter ended September 30, 2020 into U.S. dollars using the weighted-average foreign exchange rates for the quarter ended September 30, 2019. scansource.com 12 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Highlights by Segment - QTR ($ in thousands) Quarter Ended September 30, 2020 Acquisition, Intangible Change in fair Divestiture, and Reported GAAP amortization value of contingent Restructuring Tax reform and Impairment Non-GAAP measure expense consideration costs settlement charges measure Worldwide Barcode, NW & Security: Net sales 523,577 — — — — — $ 523,577 Gross Profit 41,085 — — — — — $ 41,085 Gross profit margin % 7.8 % — % — % — % — % — % 7.8 % Operating income 2,147 1,968 — — — — $ 4,115 Operating income margin % 0.4 % — % — % — % — % — % 0.8 % Worldwide Communications & Services: Net sales 233,765 — — — — — $ 233,765 Gross Profit 39,694 — — — — — $ 39,694 Gross profit margin % 17.0 % — % — % — % — % — % 17.0 % Operating income 8,253 2,885 516 — — — $ 11,654 Operating income margin % 3.5 % — % — % — % — % — % 5.0 % ($ in thousands) Quarter Ended June 30, 2020 Acquisition, Intangible Change in fair Divestiture, and Reported GAAP amortization value of contingent Restructuring Tax reform and Impairment Non-GAAP measure expense consideration costs settlement charges measure Worldwide Barcode, NW & Security: Net sales 447,812 — — — — — $ 447,812 Gross Profit 37,289 — — — — — $ 37,289 Gross profit margin % 8.3 % — % — % — % — % — % 8.3 % Operating income (112,669) 1,968 — — (4,648) 119,037 $ 3,688 Operating income margin % (25.2) % — % — % — % — % — % 0.8 % scansource.com 13 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Worldwide Communications & Services: Net sales 188,638 — — — — — $ 188,638 Gross Profit 36,858 — — — — — $ 36,858 Gross profit margin % 19.5 % — % — % — % — % — % 19.5 % Operating income 540 2,978 674 — (1,095) 1,433 $ 4,530 Operating income margin % 0.3 % — % — % — % — % — % 2.4 % ($ in thousands) Quarter Ended September 30, 2019 Acquisition, Intangible Change in fair Divestiture, and Reported GAAP amortization value of contingent Restructuring Tax reform and Impairment Non-GAAP measure expense consideration costs settlement charges measure Worldwide Barcode, NW & Security: Net sales 581,187 — — — — — $ 581,187 Gross Profit 50,289 — — — — — $ 50,289 Gross profit margin % 8.7 % — % — % — % — % — % 8.7 % Operating income 11,071 1,968 — — — — $ 13,039 Operating income margin % 1.9 % — % — % — % — % — % 2.2 % Worldwide Communications & Services: Net sales 261,514 — — — — — $ 261,514 Gross Profit 48,236 — — — — — $ 48,236 Gross profit margin % 18.4 % — % — % — % — % — % 18.4 % Operating income 9,199 2,570 2,472 169 — — $ 14,410 Operating income margin % 3.5 % — % — % — % — % — % 5.5 % scansource.com 14 November 9, 2020

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Average Return on Invested Capital - QTR ($ in thousands) Q1 FY21 Q4 FY20 Q3 FY20 Q2 FY20 Q1 FY20 Adjusted return on invested capital (ROIC), annualized (a) 8.4 % 4.0 % 6.0 % 9.9 % 9.6 % Reconciliation of Net Income to Adjusted EBITDA Net (loss) income from continuing operations - GAAP $ (115) $ (108,859) $ 5,716 $ 11,626 $ 12,291 Plus: Interest expense 1,913 2,497 3,098 3,312 3,317 Income taxes (47) (4,091) 2,797 4,407 4,338 Depreciation and amortization 8,710 8,743 8,986 9,081 8,518 EBITDA 10,461 (101,710) 20,597 28,426 28,464 Adjustments: Change in fair value of contingent consideration 516 674 618 3,176 2,472 Tax recovery, net — (8,424) (2,320) — — Acquisition and divestiture costs 498 1,311 781 1,151 757 Restructuring costs 8,268 — 169 266 169 Impairment charges — 120,470 — — — Adjusted EBITDA (numerator for ROIC) (non-GAAP) $ 19,743 $ 12,321 $ 19,845 $ 33,019 $ 31,862 Invested Capital Calculation Equity - beginning of the quarter $ 678,246 $ 897,678 $ 927,580 $ 905,751 $ 914,129 Equity - end of quarter 671,227 678,246 897,678 927,580 905,751 Adjustments: Change in fair value of contingent consideration, net of tax 390 510 467 2,401 1,869 Tax recovery, net and related interest income, net of tax — (6,247) (1,754) — — Acquisition and divestiture costs 498 1,311 781 1,151 757 Asset impairment, net of tax — 114,398 — — — Restructuring costs, net of tax 6,250 — 125 196 128 Impact of Planned Divestitures, net of tax 11,704 108,403 4,003 260 761 Average equity 684,158 897,150 914,440 918,670 911,698 Average funded debt (b) 243,268 337,973 405,533 411,614 407,306 Invested capital (denominator for ROIC) (non-GAAP) $ 927,426 $ 1,235,123 $ 1,319,973 $ 1,330,284 $ 1,319,004 (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average funded debt, which includes both continuing and discontinued operations, is calculated as the daily average amounts outstanding on our short-term and long-term interest-bearing debt. scansource.com 15 November 9, 2020

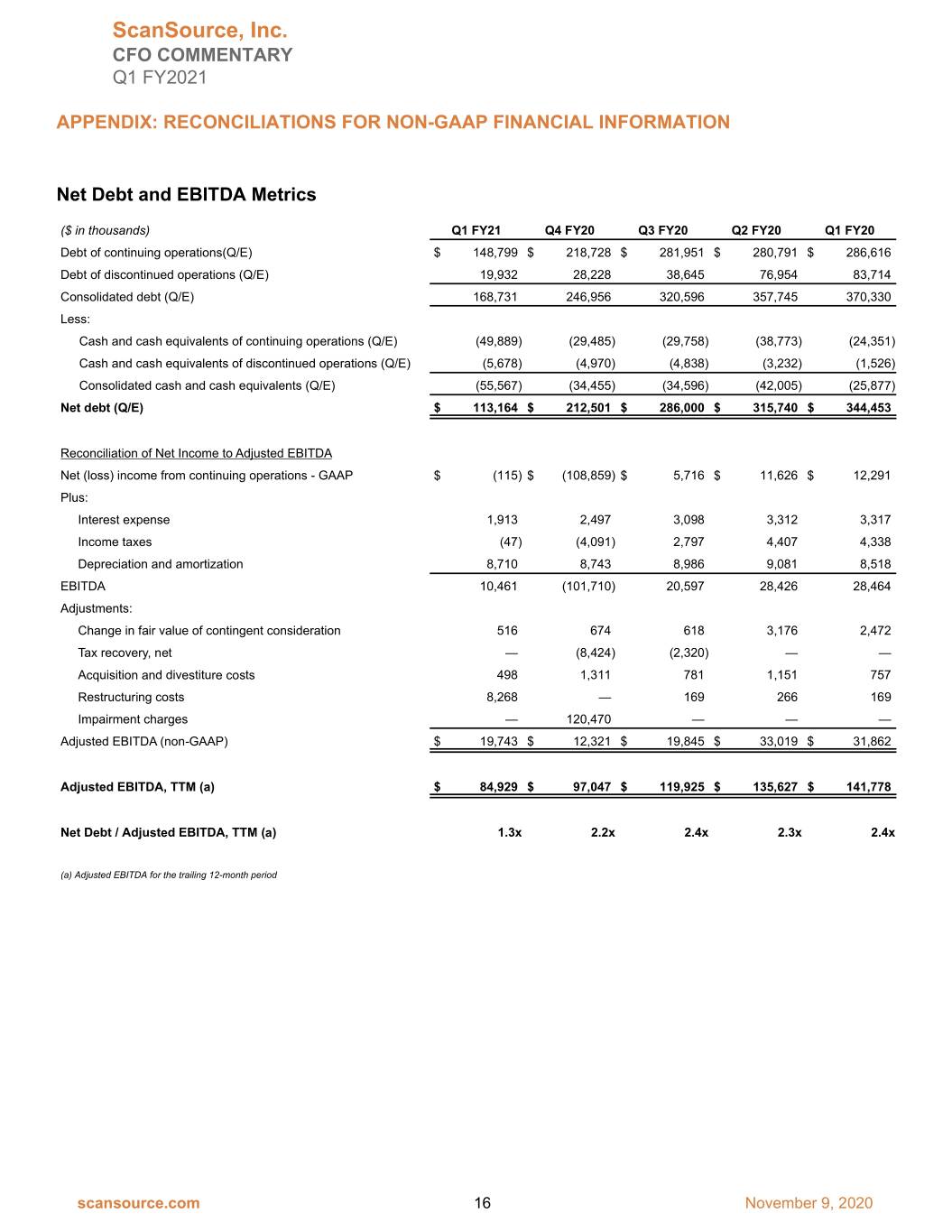

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Debt and EBITDA Metrics ($ in thousands) Q1 FY21 Q4 FY20 Q3 FY20 Q2 FY20 Q1 FY20 Debt of continuing operations(Q/E) $ 148,799 $ 218,728 $ 281,951 $ 280,791 $ 286,616 Debt of discontinued operations (Q/E) 19,932 28,228 38,645 76,954 83,714 Consolidated debt (Q/E) 168,731 246,956 320,596 357,745 370,330 Less: Cash and cash equivalents of continuing operations (Q/E) (49,889) (29,485) (29,758) (38,773) (24,351) Cash and cash equivalents of discontinued operations (Q/E) (5,678) (4,970) (4,838) (3,232) (1,526) Consolidated cash and cash equivalents (Q/E) (55,567) (34,455) (34,596) (42,005) (25,877) Net debt (Q/E) $ 113,164 $ 212,501 $ 286,000 $ 315,740 $ 344,453 Reconciliation of Net Income to Adjusted EBITDA Net (loss) income from continuing operations - GAAP $ (115) $ (108,859) $ 5,716 $ 11,626 $ 12,291 Plus: Interest expense 1,913 2,497 3,098 3,312 3,317 Income taxes (47) (4,091) 2,797 4,407 4,338 Depreciation and amortization 8,710 8,743 8,986 9,081 8,518 EBITDA 10,461 (101,710) 20,597 28,426 28,464 Adjustments: Change in fair value of contingent consideration 516 674 618 3,176 2,472 Tax recovery, net — (8,424) (2,320) — — Acquisition and divestiture costs 498 1,311 781 1,151 757 Restructuring costs 8,268 — 169 266 169 Impairment charges — 120,470 — — — Adjusted EBITDA (non-GAAP) $ 19,743 $ 12,321 $ 19,845 $ 33,019 $ 31,862 Adjusted EBITDA, TTM (a) $ 84,929 $ 97,047 $ 119,925 $ 135,627 $ 141,778 Net Debt / Adjusted EBITDA, TTM (a) 1.3x 2.2x 2.4x 2.3x 2.4x (a) Adjusted EBITDA for the trailing 12-month period scansource.com 16 November 9, 2020

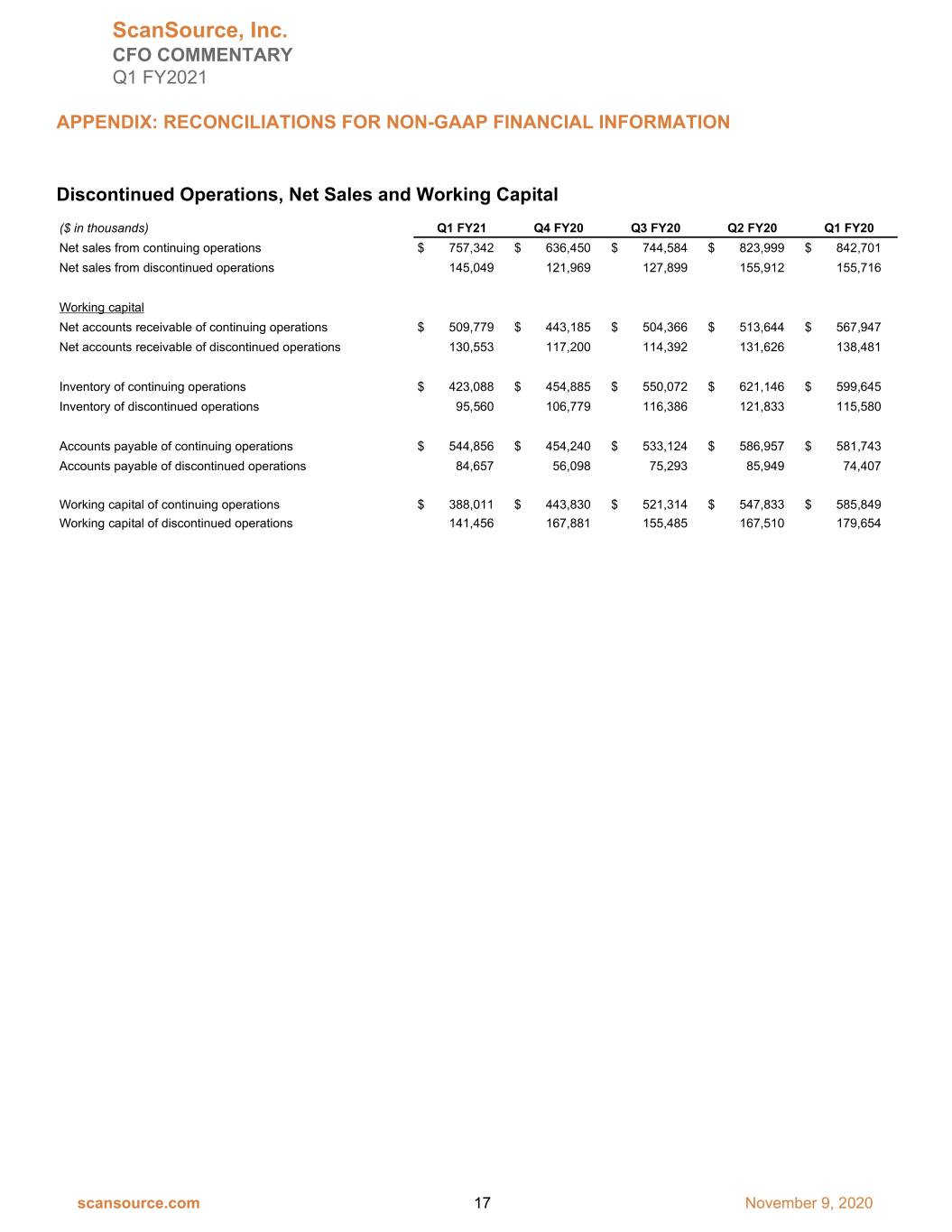

ScanSource, Inc. CFO COMMENTARY Q1 FY2021 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Discontinued Operations, Net Sales and Working Capital ($ in thousands) Q1 FY21 Q4 FY20 Q3 FY20 Q2 FY20 Q1 FY20 Net sales from continuing operations $ 757,342 $ 636,450 $ 744,584 $ 823,999 $ 842,701 Net sales from discontinued operations 145,049 121,969 127,899 155,912 155,716 Working capital Net accounts receivable of continuing operations $ 509,779 $ 443,185 $ 504,366 $ 513,644 $ 567,947 Net accounts receivable of discontinued operations 130,553 117,200 114,392 131,626 138,481 Inventory of continuing operations $ 423,088 $ 454,885 $ 550,072 $ 621,146 $ 599,645 Inventory of discontinued operations 95,560 106,779 116,386 121,833 115,580 Accounts payable of continuing operations $ 544,856 $ 454,240 $ 533,124 $ 586,957 $ 581,743 Accounts payable of discontinued operations 84,657 56,098 75,293 85,949 74,407 Working capital of continuing operations $ 388,011 $ 443,830 $ 521,314 $ 547,833 $ 585,849 Working capital of discontinued operations 141,456 167,881 155,485 167,510 179,654 scansource.com 17 November 9, 2020