Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - GATX CORP | gatx-202011068xkex231.htm |

| 8-K - 8-K - GATX CORP | gatx-20201106.htm |

Exhibit 99.1

Item 6. Selected Financial Data

The following financial information has been derived from our audited consolidated financial statements for the years ended December 31 (in millions, except per share data, recourse leverage, and return on equity). This information should be read in conjunction with "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and accompanying notes thereto included elsewhere herein.

1

| 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||||||||

Results of Operations | |||||||||||||||||||||||||||||

Revenue | $ | 1,202.1 | $ | 1,175.1 | $ | 1,204.4 | $ | 1,418.3 | $ | 1,449.9 | |||||||||||||||||||

Net gain on asset dispositions | 51.6 | 72.7 | 56.0 | 98.0 | 79.2 | ||||||||||||||||||||||||

Share of affiliates’ pre-tax income | 94.5 | 61.1 | 55.9 | 53.1 | 45.4 | ||||||||||||||||||||||||

Net income from continuing operations (GAAP) | 180.8 | 190.5 | 467.8 | n/a | n/a | ||||||||||||||||||||||||

Net income from discontinued operations, net of tax (GAAP) | 30.4 | 20.8 | 34.2 | n/a | n/a | ||||||||||||||||||||||||

| Net income from consolidated operations, net of tax (GAAP) | 211.2 | 211.3 | 502.0 | 257.1 | 205.3 | ||||||||||||||||||||||||

Net income from continuing operations, excluding tax adjustments and other items (non-GAAP) (1) | 178.0 | 178.8 | 173.5 | n/a | n/a | ||||||||||||||||||||||||

Net income from discontinued operations, excluding tax adjustments and other items (non-GAAP) (1) | 22.3 | 21.0 | 11.5 | n/a | n/a | ||||||||||||||||||||||||

Net income from consolidated operations, excluding tax adjustments and other items (non-GAAP) (1) | 200.3 | 199.8 | 185.0 | 235.9 | 234.9 | ||||||||||||||||||||||||

Per Share Data | |||||||||||||||||||||||||||||

Basic earnings from continuing operations (GAAP) | 5.07 | 5.07 | 12.07 | n/a | n/a | ||||||||||||||||||||||||

Basic earnings from discontinued operations (GAAP) | 0.85 | 0.55 | 0.88 | n/a | n/a | ||||||||||||||||||||||||

Total | 5.92 | 5.62 | 12.95 | 6.35 | 4.76 | ||||||||||||||||||||||||

Diluted earnings from continuing operations (GAAP) | 4.97 | 4.98 | 11.88 | n/a | n/a | ||||||||||||||||||||||||

Diluted earnings from discontinued operations (GAAP) | 0.84 | 0.54 | 0.87 | n/a | n/a | ||||||||||||||||||||||||

Total | 5.81 | 5.52 | 12.75 | 6.29 | 4.69 | ||||||||||||||||||||||||

Diluted earnings from continuing operations, excluding tax adjustments and other items (non-GAAP) (1) | 4.89 | 4.67 | 4.41 | n/a | n/a | ||||||||||||||||||||||||

Diluted earnings from discontinued operations, excluding tax adjustments and other items (non-GAAP) (1) | 0.62 | 0.55 | 0.29 | n/a | n/a | ||||||||||||||||||||||||

Total | 5.51 | 5.22 | 4.70 | 5.77 | 5.37 | ||||||||||||||||||||||||

Dividends declared | 1.84 | 1.76 | 1.68 | 1.60 | 1.52 | ||||||||||||||||||||||||

Financial Condition | |||||||||||||||||||||||||||||

Operating assets and facilities, net of accumulated depreciation | $ | 6,457.3 | $ | 6,275.6 | $ | 5,940.3 | $ | 5,804.7 | $ | 5,698.4 | |||||||||||||||||||

Investments in affiliated companies | 512.6 | 464.5 | 441.0 | 387.0 | 348.5 | ||||||||||||||||||||||||

Assets from discontinued operations | 291.1 | 297.8 | 286.7 | n/a | n/a | ||||||||||||||||||||||||

Total assets | 8,285.1 | 7,616.7 | 7,422.4 | 7,105.4 | 6,894.2 | ||||||||||||||||||||||||

Off-balance sheet assets (1)(2) | — | 430.2 | 435.7 | 459.1 | 495.5 | ||||||||||||||||||||||||

Short-term borrowings | 15.8 | 110.8 | 4.3 | 3.8 | 7.4 | ||||||||||||||||||||||||

Long-term debt | 4,780.4 | 4,429.7 | 4,371.7 | 4,253.2 | 4,178.4 | ||||||||||||||||||||||||

Operating lease obligations | 429.4 | — | — | — | — | ||||||||||||||||||||||||

Finance lease obligations | 7.9 | 11.3 | 12.5 | 14.9 | 18.4 | ||||||||||||||||||||||||

Off-balance sheet recourse debt (1)(2) | — | 430.2 | 435.7 | 459.1 | 495.5 | ||||||||||||||||||||||||

Shareholders’ equity (3) | 1,835.1 | 1,788.1 | 1,792.7 | 1,347.2 | 1,280.2 | ||||||||||||||||||||||||

Other Data | |||||||||||||||||||||||||||||

Average number of common shares and common share equivalents | 36.4 | 38.3 | 39.4 | 40.9 | 43.8 | ||||||||||||||||||||||||

Net cash provided by operating activities from continuing operations | $ | 425.8 | $ | 485.2 | $ | 454.3 | $ | 629.4 | $ | 541.8 | |||||||||||||||||||

Portfolio proceeds from continuing operations | $ | 250.3 | $ | 234.4 | $ | 165.6 | $ | 223.7 | $ | 482.2 | |||||||||||||||||||

Portfolio investments and capital additions from continuing operations | $ | 722.8 | $ | 927.6 | $ | 589.4 | $ | 620.7 | $ | 714.7 | |||||||||||||||||||

Recourse leverage (4) | 2.8 | 2.7 | 2.5 | 3.3 | 3.5 | ||||||||||||||||||||||||

Return on equity (GAAP) | 11.7 | % | 11.8 | % | 32.0 | % | 19.6 | % | 15.8 | % | |||||||||||||||||||

Return on equity, excluding tax adjustments and other items (non-GAAP) (1)(5) | 13.5 | % | 13.6 | % | 13.1 | % | 18.0 | % | 18.1 | % | |||||||||||||||||||

_________

Note: The information above for 2016 and 2015 has not been recast for discontinued operations presentation.

2

(1) See "Non-GAAP Financial Measures" included in "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" of this Exhibit for an explanation of tax adjustments and other items, as well as a reconciliation to the most directly comparable GAAP measures.

(2) Off-balance sheet assets and off-balance sheet recourse debt, which relate to operating leases, are applicable for 2015 through 2018. In accordance with the new lease accounting standard, off-balance sheet assets and recourse debt are no longer applicable beginning in 2019.

(3) Balances for 2019, 2018 and 2017 reflect increases in shareholders' equity resulting from the impact of the Tax Cuts and Jobs Act of 2017 ("Tax Act").

(4) The reduction in recourse leverage beginning with 2017 is due to the increase in shareholders' equity resulting from the impact of the Tax Act.

(5) Shareholder's equity used in this calculation for 2019, 2018 and 2017 excludes the impact of the Tax Act.

3

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through three primary business segments: Rail North America, Rail International, and Portfolio Management. Historically, we also reported financial results for American Steamship Company ("ASC") as a fourth segment.

On February 7, 2020, we announced our intention to sell our ASC business segment to Rand Logistics, Inc. On May 14, 2020, we completed the sale of our ASC business, subject to customary post-closing adjustments. The divestiture was intended to provide us with greater ability to focus on our core franchise in global railcar and aircraft spare engine leasing. As a result, ASC is now reported as discontinued operations, and financial data for the ASC segment has been segregated and presented as discontinued operations for all periods presented. See "Note 26. Discontinued Operations" in Item 8 of this Exhibit for additional information. Unless otherwise indicated, the following information relates to continuing operations. A more complete description of our business is included in "Item 1. Business," in Part I of the 2019 Form 10-K.

The following discussion and analysis should be read in conjunction with the audited financial statements included in "Item 8. Financial Statements and Supplementary Data" in this Exhibit. We based the discussion and analysis that follows on financial data we derived from the financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP") and on certain other financial data that we prepared using non-GAAP components. For a reconciliation of these non-GAAP measures to the most comparable GAAP measures, see “Non-GAAP Financial Measures” at the end of this item.

DISCUSSION OF OPERATING RESULTS

The following table shows a summary of our reporting segments and consolidated financial results relating to continuing operations and discontinued operations for years ended December 31 (dollars in millions, except per share data):

4

| 2019 | 2018 | 2017 | |||||||||||||||

| Segment Revenues | |||||||||||||||||

| Rail North America | $ | 964.5 | $ | 941.5 | $ | 977.4 | |||||||||||

| Rail International | 227.7 | 217.5 | 197.1 | ||||||||||||||

| Portfolio Management | 9.9 | 16.1 | 29.9 | ||||||||||||||

| $ | 1,202.1 | $ | 1,175.1 | $ | 1,204.4 | ||||||||||||

| Segment Profit | |||||||||||||||||

| Rail North America | $ | 276.2 | $ | 307.9 | $ | 299.3 | |||||||||||

| Rail International | 78.9 | 68.6 | 68.8 | ||||||||||||||

| Portfolio Management | 62.4 | 38.7 | 56.3 | ||||||||||||||

| 417.5 | 415.2 | 424.4 | |||||||||||||||

| Less: | |||||||||||||||||

| Selling, general and administrative expense | 180.4 | 182.5 | 172.4 | ||||||||||||||

| Unallocated interest (income) expense | (5.8) | (8.6) | (8.5) | ||||||||||||||

| Other, including eliminations | 3.2 | 9.5 | 7.1 | ||||||||||||||

Income taxes ($18.0, $10.8 and $12.0 related to affiliates' earnings) | 58.9 | 41.3 | (214.4) | ||||||||||||||

| Net Income from Continuing Operations (GAAP) | $ | 180.8 | $ | 190.5 | $ | 467.8 | |||||||||||

| Income from Discontinued Operations, Net of Taxes (GAAP) | 30.4 | $ | 20.8 | $ | 34.2 | ||||||||||||

| Net Income (GAAP) | $ | 211.2 | $ | 211.3 | $ | 502.0 | |||||||||||

| Net income from continuing operations, excluding tax adjustments and other items (non-GAAP) | $ | 178.0 | $ | 178.8 | $ | 173.5 | |||||||||||

| Net income from discontinued operations, excluding tax adjustments and other items (non-GAAP) | $ | 22.3 | $ | 21.0 | $ | 11.5 | |||||||||||

| Net income from consolidated operations, excluding tax adjustments and other items (non-GAAP) | $ | 200.3 | $ | 199.8 | $ | 185.0 | |||||||||||

| Diluted earnings per share from continuing operations (GAAP) | $ | 4.97 | $ | 4.98 | $ | 11.88 | |||||||||||

| Diluted earnings per share from discontinued operations (GAAP) | $ | 0.84 | $ | 0.54 | $ | 0.87 | |||||||||||

| Diluted earnings per share from consolidated operations (GAAP) | $ | 5.81 | $ | 5.52 | $ | 12.75 | |||||||||||

| Diluted earnings per share from continuing operations, excluding tax adjustments and other items (non-GAAP) (1) | $ | 4.89 | $ | 4.67 | $ | 4.41 | |||||||||||

| Diluted earnings per share from discontinued operations, excluding tax adjustments and other items (non-GAAP) (1) | $ | 0.62 | $ | 0.55 | $ | 0.29 | |||||||||||

| Diluted earnings per share from consolidated operations, excluding tax adjustments and other items (non-GAAP) (1) | $ | 5.51 | $ | 5.22 | $ | 4.70 | |||||||||||

| Return on equity (GAAP) | 11.7 | % | 11.8 | % | 32.0 | % | |||||||||||

| Return on equity, excluding tax adjustments and other items (non-GAAP) | 13.5 | % | 13.6 | % | 13.1 | % | |||||||||||

| Investment Volume | $ | 722.8 | $ | 927.6 | $ | 589.4 | |||||||||||

_________

(1) See "Non-GAAP Financial Measures" at the end of this item for further details.

5

2019 Summary

Net income from continuing operations was $180.8 million, or $4.97 per diluted share, for 2019 compared to $190.5 million, or $4.98 per diluted share, for 2018, and $467.8 million, or $11.88 per diluted share, for 2017. Results for 2019 included a net benefit of $2.8 million from tax adjustments and other items, compared to a net benefit of $11.7 million in 2018 and a net benefit of $294.3 million in 2017 (see "Non-GAAP Financial Measures" at the end of this item for further details).

•At Rail North America, segment profit was lower in 2019. The decrease was attributable to lower net gains on asset dispositions, higher maintenance expense, resulting from more tank qualifications, and lower lease revenue, partially offset by higher other revenue.

•At Rail International, segment profit was higher in 2019, largely due to the absence of the railcar maintenance facility closure costs recorded in the prior year, as well as higher revenue from more railcars on lease. These positive drivers were partially offset by the negative impact of foreign exchange rates.

•At Portfolio Management, segment profit increased in 2019, primarily due to higher share of affiliate income from the Rolls-Royce & Partners Finance joint ventures (collectively the "RRPF affiliates"), offset by a lower contribution from the marine operations.

Total investment volume was $722.8 in 2019, compared to $927.6 million in 2018, and $589.4 million in 2017.

2020 Outlook

Given the general economic and political uncertainty we see in North America today, our outlook for Rail North America is guarded. Despite the challenging environment, a substantial portion of the new railcars to be delivered in 2020 are committed to customer leases. Our strong balance sheet also offers us flexibility to pursue secondary market acquisitions as attractive opportunities arise.

•Rail North America's segment profit in 2020 is expected to decrease from 2019. Lease rates for railcars scheduled to renew in 2020 will likely be lower than expiring lease rates, and we anticipate a small decrease in fleet utilization due to a continued oversupply of railcars in the market. As a result, we project revenue in 2020 to decline compared to the prior year. We also project higher maintenance expense in 2020, primarily resulting from costs associated with transitioning cars between customers due to our expectation of a lower renewal success rate.

•We anticipate Rail International's segment profit in 2020 to increase from 2019 as the demand for railcars in Europe continues to be strong. Lease revenue is expected to be higher in 2020, resulting from higher lease rates and more railcars on lease. In addition, our railcar fleet in India grew significantly in 2019, and we expect additional revenue from these railcars and additional railcar investment in 2020.

•We believe Portfolio Management's segment profit in 2020 will be higher than 2019. Strong operating results at the RRPF affiliates are expected to continue. In addition, we anticipate improved financial performance from our marine operations.

•On February 7, 2020, we entered into an agreement to sell ASC, and on May 14, 2020 we completed the sale, subject to customary closing conditions. See "Note 26. Discontinued Operations" in Item 8 of this Exhibit for additional information.

Segment Operations

Segment profit is an internal performance measure used by the Chief Executive Officer to assess the profitability of each segment. Segment profit includes all revenues, expenses, pre-tax earnings from affiliates, and net gains on asset dispositions that are directly attributable to each segment. We allocate interest expense to the segments based on what we believe to be the appropriate risk-adjusted borrowing costs for each segment. Segment profit excludes selling, general and administrative expenses, income taxes, and certain other amounts not allocated to the segments. These amounts are included in Other.

6

RAIL NORTH AMERICA

Segment Summary

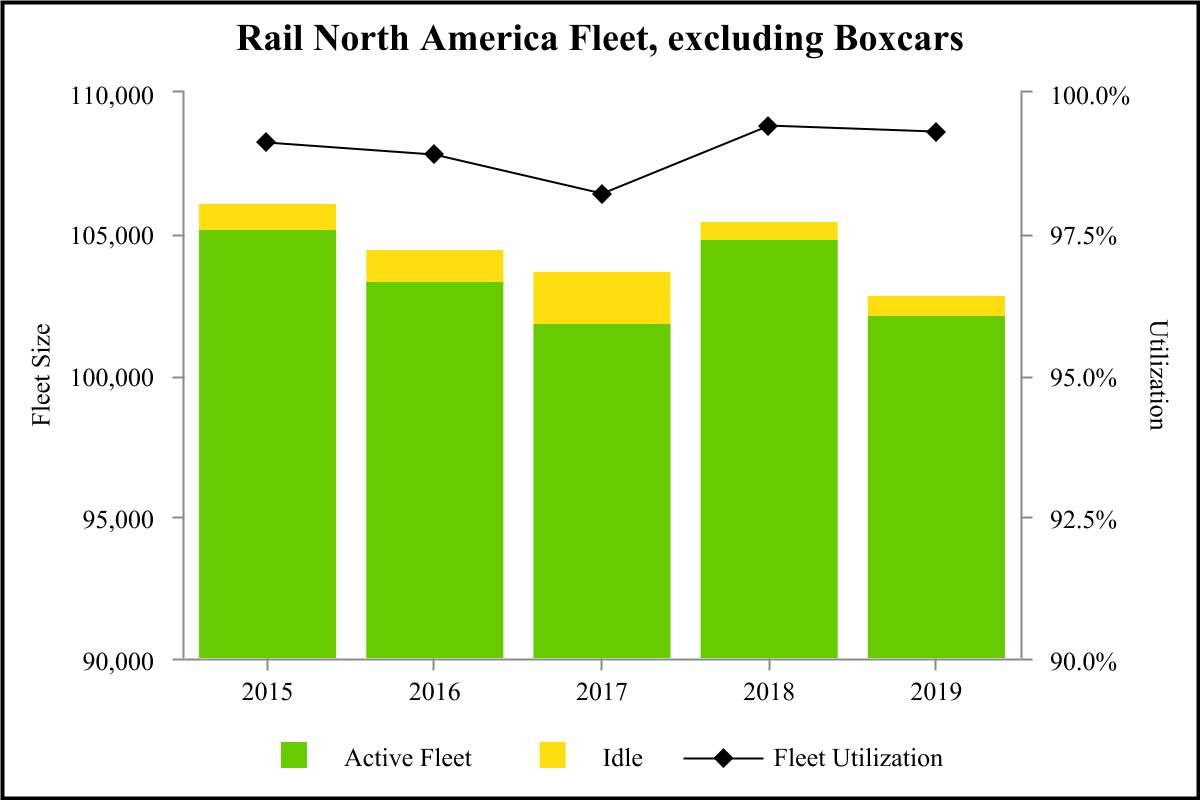

The operating environment for Rail North America was challenging in 2019 as a continued market oversupply of railcars, coupled with reduced carload volume and increased railroad velocity, put pressure on lease rates throughout the year. Despite this environment, Rail North America was able to maintain high fleet utilization and renewal success. At December 31, 2019, Rail North America's wholly owned fleet, excluding boxcars, consisted of approximately 102,800 cars. Fleet utilization, excluding boxcars, was 99.3% at the end of 2019, compared to 99.4% at the end of 2018, and 98.2% at the end of 2017. Fleet utilization for approximately 15,300 boxcars was 95.0% at the end of 2019 compared to 94.2% at the end of 2018, and 92.6% at the end of 2017. Utilization is calculated as the number of railcars on lease as a percentage of total railcars in the fleet.

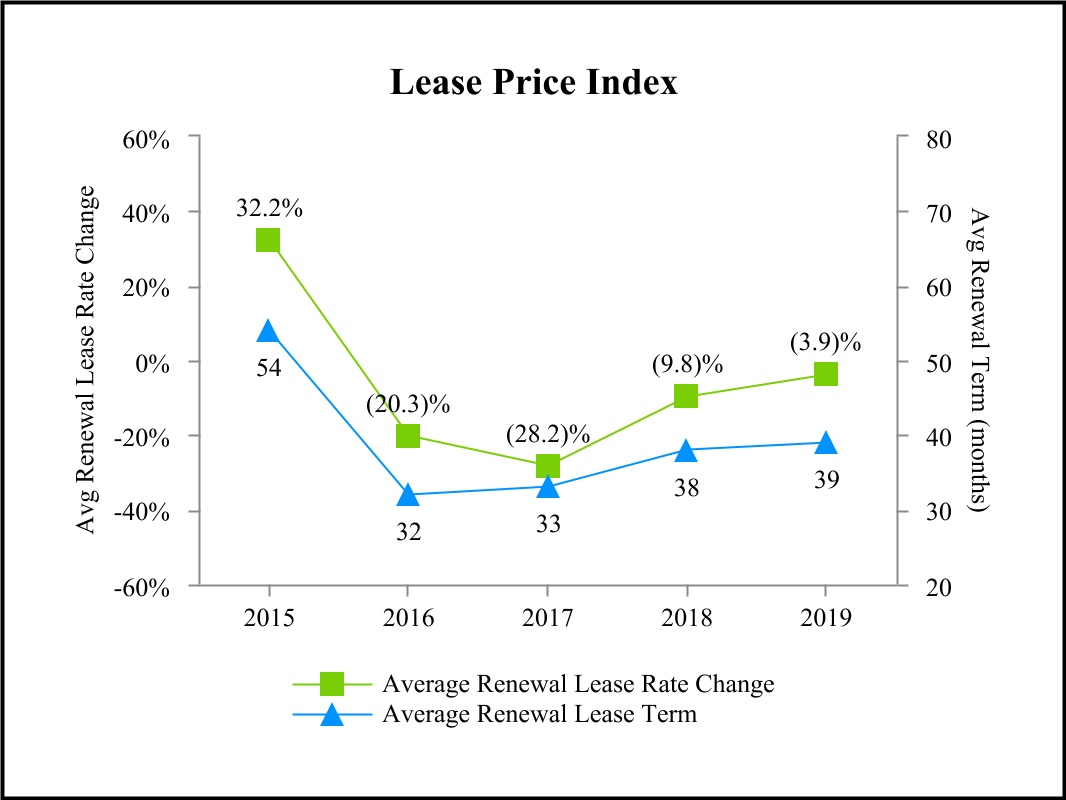

During 2019, an average of approximately 103,500 railcars, excluding boxcars, were on lease, compared to 102,100 in 2018, and 102,600 in 2017. Changes in railcars on lease compared to prior periods are impacted by the utilization of new railcars purchased under our supply agreements, the utilization of the railcars acquired from ECN Capital Corporation at the end of 2018, and the disposition of railcars that were sold or scrapped. During 2019, the renewal rate change of the Lease Price Index (the "LPI", see definition below) was negative 3.9%, compared to negative 9.8% in 2018 and negative 28.2% in 2017. Lease terms on renewals for cars in the LPI averaged 39 months in 2019, compared to 38 months in 2018, and 33 months in 2017. Additionally, the renewal success rate, which represents the percentage of railcars on expiring leases that were renewed with the existing lessee, was 82.2% in 2019, compared to 82.9% in 2018, and 74.7% in 2017. The renewal success rate is an important metric because railcars returned by our customers may incur transition costs, including additional repairs and related service prior to being leased to new customers, which may increase maintenance and associated expenses.

In 2014, we entered into a long-term supply agreement with Trinity Rail Group, LLC ("Trinity") a subsidiary of Trinity Industries. Under the terms of that agreement, we agreed to order 8,950 newly built railcars. As of December 31, 2019, all 8,950 railcars have been ordered, of which 7,678 railcars have been delivered. On May 24, 2018, we amended our long-term supply agreement with Trinity to extend the term to December 2023, and we agreed to purchase an additional 4,800 tank cars (1,200 per year) beginning in January 2020 and continuing through the expiration of the extended term. At December 31, 2019, 1,128 railcars have been ordered pursuant to the amended terms of the agreement.

In 2018, we entered into a multi-year railcar supply agreement with American Railcar Industries, Inc. ("ARI"), pursuant to which we will purchase 7,650 newly built railcars. The order encompasses a mix of tank and freight cars that are to be delivered over a five-year period, beginning in April 2019. ARI's railcar manufacturing business was subsequently acquired by The Greenbrier Companies, Inc. ("Greenbrier") on July 26, 2019, and Greenbrier assumed all of ARI's obligations under our long-term supply agreement. Under this agreement, 450 railcars were to be delivered in 2019, with the remaining 7,200 to be delivered ratably over the four-year period of 2020 to 2023. As of December 31, 2019, 2,129 railcars have been ordered. The agreement also includes an option to order up to an additional 4,400 railcars subject to certain restrictions.

Additionally, we acquired a fleet of 3,098 railcars from ECN Capital Corporation, with 2,832 of the railcars acquired in 2018 and the remaining 266 railcars in early 2019.

As of December 31, 2019, leases for approximately 17,800 tank cars and freight cars and approximately 3,200 boxcars are scheduled to expire in 2020. These amounts exclude railcars on leases expiring in 2020 that have already been renewed or assigned to a new lessee.

7

The following table shows Rail North America's segment results for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Revenues | |||||||||||||||||

| Lease revenue | $ | 868.3 | $ | 873.4 | $ | 899.9 | |||||||||||

| Other revenue | 96.2 | 68.1 | 77.5 | ||||||||||||||

| Total Revenues | 964.5 | 941.5 | 977.4 | ||||||||||||||

| Expenses | |||||||||||||||||

| Maintenance expense | 267.9 | 254.7 | 265.0 | ||||||||||||||

| Depreciation expense | 256.9 | 248.5 | 239.4 | ||||||||||||||

| Operating lease expense | 54.4 | 49.6 | 60.7 | ||||||||||||||

| Other operating expense | 23.9 | 27.3 | 28.7 | ||||||||||||||

| Total Expenses | 603.1 | 580.1 | 593.8 | ||||||||||||||

| Other Income (Expense) | |||||||||||||||||

| Net gain on asset dispositions | 54.6 | 76.3 | 45.2 | ||||||||||||||

| Interest expense, net | (134.5) | (125.2) | (121.2) | ||||||||||||||

| Other expense | (5.3) | (5.2) | (5.9) | ||||||||||||||

| Share of affiliates' pre-tax income (loss) | — | 0.6 | (2.4) | ||||||||||||||

Segment Profit | $ | 276.2 | $ | 307.9 | $ | 299.3 | |||||||||||

| Investment Volume | $ | 502.2 | $ | 737.4 | $ | 460.9 | |||||||||||

The following table shows the components of Rail North America's lease revenue for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Railcars | $ | 759.8 | $ | 757.8 | $ | 785.1 | |||||||||||

| Boxcars | 72.2 | 76.8 | 75.7 | ||||||||||||||

| Locomotives | 36.3 | 38.8 | 39.1 | ||||||||||||||

| Total | $ | 868.3 | $ | 873.4 | $ | 899.9 | |||||||||||

Lease Price Index

Our LPI is an internally-generated business indicator that measures lease rate pricing on renewals for our North American railcar fleet, excluding boxcars. We calculate the index using the weighted-average lease rate for a group of railcar types that we believe best represents our overall North American fleet, excluding boxcars. The average renewal lease rate change is reported as the percentage change between the average renewal lease rate and the average expiring lease rate, weighted by fleet composition. The average renewal lease term is reported in months and reflects the average renewal lease term of railcar types in the LPI, weighted by fleet composition.

8

Rail North America Fleet Data

The following table shows fleet activity for Rail North America railcars, excluding boxcars, for the years ended December 31:

| 2019 | 2018 | 2017 | |||||||||||||||

| Beginning balance | 105,472 | 103,730 | 104,522 | ||||||||||||||

| Cars added | 3,145 | 6,958 | 3,442 | ||||||||||||||

| Cars scrapped | (2,172) | (2,211) | (2,900) | ||||||||||||||

| Cars sold | (3,600) | (3,005) | (1,334) | ||||||||||||||

| Ending balance | 102,845 | 105,472 | 103,730 | ||||||||||||||

| Utilization rate at year end | 99.3 | % | 99.4 | % | 98.2 | % | |||||||||||

| Active railcars at year end | 102,127 | 104,864 | 101,849 | ||||||||||||||

| Average (monthly) active railcars | 103,452 | 102,061 | 102,600 | ||||||||||||||

9

The following table shows fleet statistics for Rail North America boxcars for the years ended December 31:

| 2019 | 2018 | 2017 | |||||||||||||||

| Ending balance | 15,264 | 16,220 | 16,398 | ||||||||||||||

| Utilization rate at year end | 95.0 | % | 94.2 | % | 92.6 | % | |||||||||||

The following table shows fleet activity for Rail North America locomotives for the years ended December 31:

| 2019 | 2018 | 2017 | |||||||||||||||

| Beginning balance | 680 | 665 | 660 | ||||||||||||||

| Locomotives added, net of scrapped or sold | (51) | 15 | 5 | ||||||||||||||

| Ending balance | 629 | 680 | 665 | ||||||||||||||

| Utilization rate at year end | 90.3 | % | 91.5 | % | 92.5 | % | |||||||||||

| Active locomotives at year end | 568 | 622 | 615 | ||||||||||||||

| Average (monthly) active locomotives | 608 | 622 | 623 | ||||||||||||||

Segment Profit

In 2019, segment profit of $276.2 million decreased 10.3% compared to $307.9 million in 2018. The decrease was driven by lower net gains on asset dispositions, higher maintenance expense, and lower lease revenue, partially offset by higher other revenue. Asset remarketing income is dependent on a number of factors and will vary from year to year.

In 2018, segment profit of $307.9 million increased 2.9% compared to $299.3 million in 2017. The increase was driven by higher asset disposition gains and lower maintenance expense, partially offset by lower lease revenue and lower lease termination fees.

10

Revenues

In 2019, lease revenue decreased $5.1 million, or 0.6%. The decrease was due to lower lease rates, higher rental abatement attributable to more railcars in the maintenance network, and fewer locomotives on lease in the current year, partially offset by more railcars on lease. Other revenue increased $28.1 million, due to higher repair revenue and higher lease termination fees in 2019.

In 2018, lease revenue decreased $26.5 million, or 2.9%, primarily due to lower lease rates and fewer railcars on lease. Other revenue decreased $9.4 million, largely a result of lower lease termination fees in 2018. Other revenue in 2017 included $7.8 million as compensation for damage to returned railcars. The expenses to repair these railcars were recognized as incurred.

Expenses

In 2019, maintenance expense increased $13.2 million, driven by more tank qualifications in 2019, as expected, as well as higher repairs performed by the railroads on GATX-owned railcars. Depreciation expense increased $8.4 million due to new railcar investments, including the railcars acquired from ECN Capital Corporation in 2018. Operating lease expense increased $4.8 million, primarily a result of the elimination of deferred gain amortization for sale-leaseback transactions in accordance with the new lease accounting standard. See "Note 2. Accounting Changes" and "Note 5. Leases" in Item 8 of this Exhibit for further detail regarding the impact of the new lease accounting standard. Other operating expense decreased $3.4 million, primarily due to lower switching, storage, and freight costs as a result of continued high utilization.

In 2018, maintenance expense decreased $10.3 million, driven by fewer repairs performed by the railroads, as well as fewer tank qualifications and lower costs from assigning railcars to new lessees. Depreciation expense increased $9.1 million due to railcar investments and the purchase of railcars previously on operating leases. Operating lease expense decreased $11.1 million, resulting from the purchase of railcars previously on operating leases. Other operating expense decreased $1.4 million, due to lower switching, storage, and freight costs, reflective of lower assignment activity.

Other Income (Expense)

In 2019, net gain on asset dispositions decreased $21.7 million, resulting from lower asset remarketing gains and lower net scrapping gains. Net scrapping gains were lower in the current year due to certain railcars and locomotives scrapped at a loss, as well as lower scrap prices per ton. See "Note 23. Financial Data of Business Segments", Item 8 of this Exhibit, for further details of the components of net gain on asset dispositions. The amount and timing of disposition gains is dependent on a number of factors and will vary from year to year. Net interest expense increased $9.3 million, driven by a higher average debt balance and a higher average interest rate.

In 2018, net gain on asset dispositions increased $31.1 million, attributable to more railcars sold in 2018, as well as higher scrapping gains resulting primarily from a higher scrap price per ton. Net interest expense increased $4.0 million, driven by a higher average interest rate and a higher average debt balance.

Investment Volume

During 2019, investment volume was $502.2 million compared to $737.4 million in 2018, and $460.9 million in 2017. We acquired 3,225 railcars in 2019, compared to 7,489 railcars, including 2,832 railcars purchased as part of the ECN Capital Corporation transaction in 2018, and 3,613 railcars in 2017.

Our investment volume is predominantly composed of acquired railcars, but also includes certain capitalized repairs and improvements to owned railcars and our maintenance facilities. As a result, the dollar value of investment volume does not necessarily correspond to the number of railcars acquired in any given period. In addition, the comparability of amounts invested and the number of railcars acquired in each period is impacted by the mix of railcars purchased, which may include tank cars and freight cars, as well as newly manufactured railcars or those purchased in the secondary market.

11

RAIL INTERNATIONAL

Segment Summary

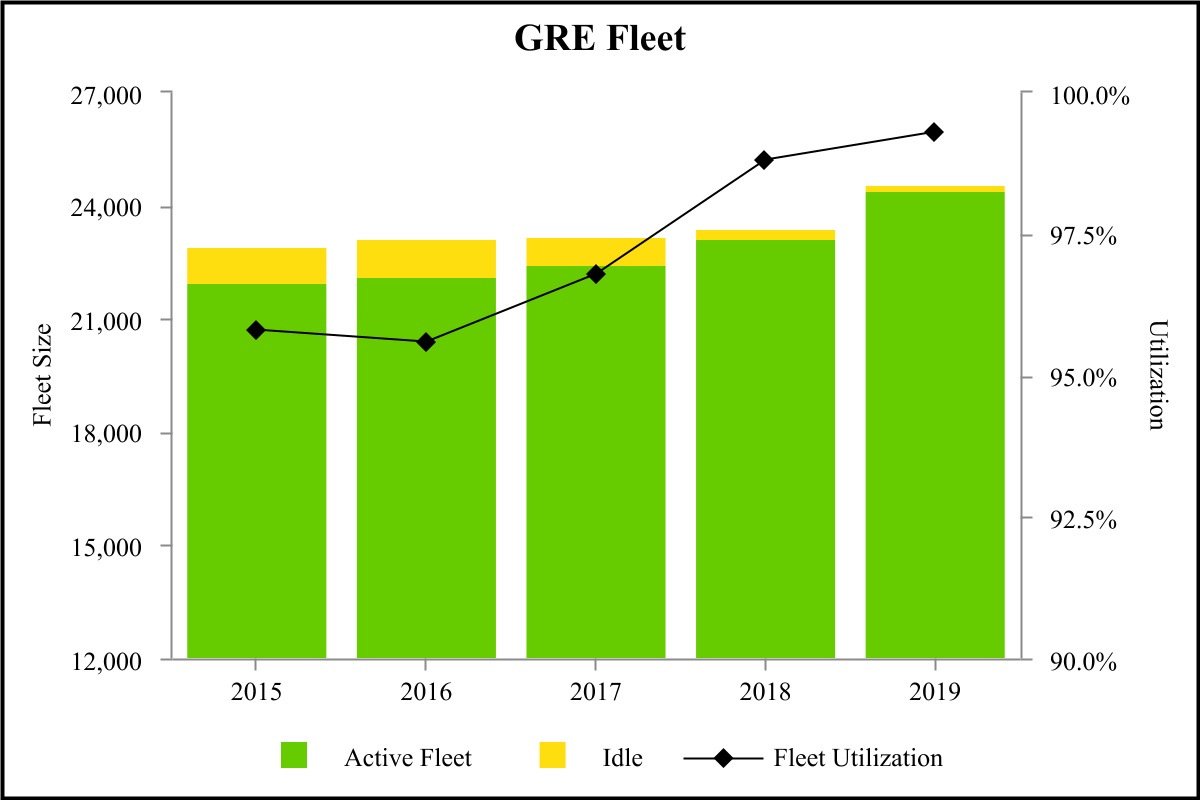

Rail International, composed primarily of GATX Rail Europe ("GRE"), produced solid operating results in 2019. Strong replacement demand and increasing new railcar production backlogs drove record utilization and strong lease rates at GRE. Railcar utilization for GRE was 99.3% at the end of 2019, compared to 98.8% at the end of 2018, and 96.8% at the end of 2017. Utilization is calculated as the number of railcars on lease as a percentage of total railcars in the fleet. In addition, our operations in India ("GRI") benefited from more cars on lease as it continued to significantly expand its fleet.

In 2018, GRE recorded $9.5 million of expenses attributable to the closure of a railcar maintenance facility in Germany.

GRI continued to focus on investment opportunities, diversification of its fleet, and developing relationships with customers, suppliers and the Indian Railways. In 2019, GRI added 1,626 railcars, compared to 1,001 in 2018 and 275 in 2017. GRI expects continued fleet growth and diversification in 2020.

Rail Russia focused on managing its existing fleet and maintaining strong relationships with its customer base. In 2019, Rail Russia added 26 railcars, compared to 184 in 2018 and zero in 2017.

The following table shows Rail International's segment results for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Revenues | |||||||||||||||||

| Lease revenue | $ | 219.2 | $ | 209.3 | $ | 190.3 | |||||||||||

| Other revenue | 8.5 | 8.2 | 6.8 | ||||||||||||||

| Total Revenues | 227.7 | 217.5 | 197.1 | ||||||||||||||

| Expenses | |||||||||||||||||

| Maintenance expense | 46.5 | 44.5 | 41.1 | ||||||||||||||

| Depreciation expense | 57.8 | 55.5 | 48.9 | ||||||||||||||

| Other operating expense | 6.8 | 5.8 | 4.7 | ||||||||||||||

| Total Expenses | 111.1 | 105.8 | 94.7 | ||||||||||||||

| Other Income (Expense) | |||||||||||||||||

| Net gain (loss) on asset dispositions | 1.7 | (0.2) | 3.1 | ||||||||||||||

| Interest expense, net | (40.6) | (35.9) | (33.4) | ||||||||||||||

| Other income (expense) | 1.2 | (7.0) | (3.2) | ||||||||||||||

| Share of affiliates' pre-tax loss | — | — | (0.1) | ||||||||||||||

Segment Profit | $ | 78.9 | $ | 68.6 | $ | 68.8 | |||||||||||

| Investment Volume | $ | 215.7 | $ | 152.7 | $ | 90.9 | |||||||||||

12

The following table shows fleet activity for GRE railcars for the years ended December 31:

| 2019 | 2018 | 2017 | |||||||||||||||

| Beginning balance | 23,412 | 23,166 | 23,122 | ||||||||||||||

| Cars added | 1,417 | 847 | 871 | ||||||||||||||

| Cars scrapped or sold | (268) | (601) | (827) | ||||||||||||||

| Ending balance | 24,561 | 23,412 | 23,166 | ||||||||||||||

| Utilization rate at year end | 99.3 | % | 98.8 | % | 96.8 | % | |||||||||||

| Active railcars at year end | 24,392 | 23,124 | 22,422 | ||||||||||||||

| Average (monthly) active railcars | 23,665 | 22,619 | 22,137 | ||||||||||||||

\

\Foreign Currency

Rail International's reported financial results are impacted by fluctuations in the exchange rates of the U.S. dollar versus foreign currencies in which it conducts business, primarily the euro. In 2019, a weaker euro, relative to the U.S. dollar, negatively impacted lease revenue by approximately $10.6 million and segment profit, excluding other income (expense), by approximately $5.0 million compared to 2018. In 2018, a stronger euro, relative to the U.S. dollar, positively impacted lease revenue by approximately $8.2 million and segment profit, excluding other income (expense), by approximately $4.3 million compared to 2017.

Segment Profit

In 2019, segment profit of $78.9 million increased 15.0% compared to $68.6 million in 2018. Segment profit in 2018 included expenses of approximately $9.5 million attributable to the closure of the railcar maintenance facility in Germany. Excluding these costs, results for Rail International were $0.8 million higher than 2018, primarily due to higher revenue from more railcars on lease, partially offset by higher maintenance expense and the negative impact of foreign exchange rates.

In 2018, segment profit of $68.6 million decreased 0.3% compared to $68.8 million in 2017. Excluding the impact of the closure of the railcar maintenance facility in Germany noted above, results for Rail International were $9.3 million higher than 2017, primarily due to more railcars on lease and the positive impact of foreign exchange rates.

13

Revenues

In 2019, lease revenue increased $9.9 million, or 4.7%, primarily due to more railcars on lease, partially offset by the impact of foreign exchange rates. Other revenue increased $0.3 million, driven by higher repair revenue.

In 2018, lease revenue increased $19.0 million, or 10.0%, due to more railcars on lease and the impact of foreign exchange rates. Other revenue increased $1.4 million, driven by higher repair revenue.

Expenses

In 2019, maintenance expense increased $2.0 million, primarily due to higher wheelset costs and other repairs. These negative drivers were partially offset by lower workshop costs, due in part to the elimination of expenses associated with the maintenance facility in Germany that was closed in 2018, as well as the impact of foreign exchange rates. Depreciation expense increased $2.3 million, primarily due to new railcars added to the fleet.

In 2018, maintenance expense increased $3.4 million, primarily due to higher wheelset costs and the impact of foreign exchange rates, partially offset by lower regulatory compliance costs. Depreciation expense increased $6.6 million, driven by the impact of new railcars added to the fleet, as well as the impact of foreign exchange rates.

Other Income (Expense)

In 2019, net gain on asset dispositions increased $1.9 million, attributable to the absence of the impairment for the maintenance facility in Germany recorded in the prior year, partially offset by lower railcar scrapping gains, as a result of fewer railcars scrapped in 2019. Net interest expense increased $4.7 million, due to a higher average interest rate and a higher average debt balance. Other expense decreased $8.2 million, driven by the absence of the railcar maintenance facility closure costs recorded in 2018 and lower net litigation costs related to the Viareggio matter, which reflected insurance proceeds received in 2019. See "Note 22. Legal Proceedings and Other Contingencies" in Item 8 of this Exhibit for further details about the Viareggio matter. This was partially offset by the negative impact of changes in foreign exchange rates on non-functional currency items.

In 2018, net gain on asset dispositions decreased $3.3 million, attributable to the impairment recorded for the maintenance facility in Germany. Net interest expense increased $2.5 million, due to a higher average debt balance and a higher average interest rate. Other expense increased $3.8 million, driven by the railcar maintenance facility closure costs and higher legal expenses, partially offset by the favorable impact of changes in foreign exchange rates on non-functional currency items.

Investment Volume

Investment volume was $215.7 million in 2019, $152.7 million in 2018, and $90.9 million in 2017. During 2019, GRE acquired 1,417 railcars (including 384 assembled at the GRE Ostroda, Poland facility), GRI acquired 1,626 rail cars, and Rail Russia acquired 26 railcars, compared to 847 railcars at GRE (including 316 assembled at the GRE Ostroda, Poland facility), 1,001 railcars at GRI, and 184 railcars at Rail Russia in 2018, and 871 railcars at GRE (including 272 assembled at the GRE Ostroda, Poland facility) and 275 railcars at GRI in 2017.

Our investment volume is predominantly composed of acquired railcars, but may also include certain capitalized repairs and improvements to owned railcars. As a result, the dollar value of investment volume does not necessarily correspond to the number of railcars acquired in any given period. In addition, the comparability of amounts invested and the number of railcars acquired in each period is impacted by the mix of the various car types acquired, as well as fluctuations in the exchange rates of the foreign currencies in which Rail International conducts business.

14

PORTFOLIO MANAGEMENT

Segment Summary

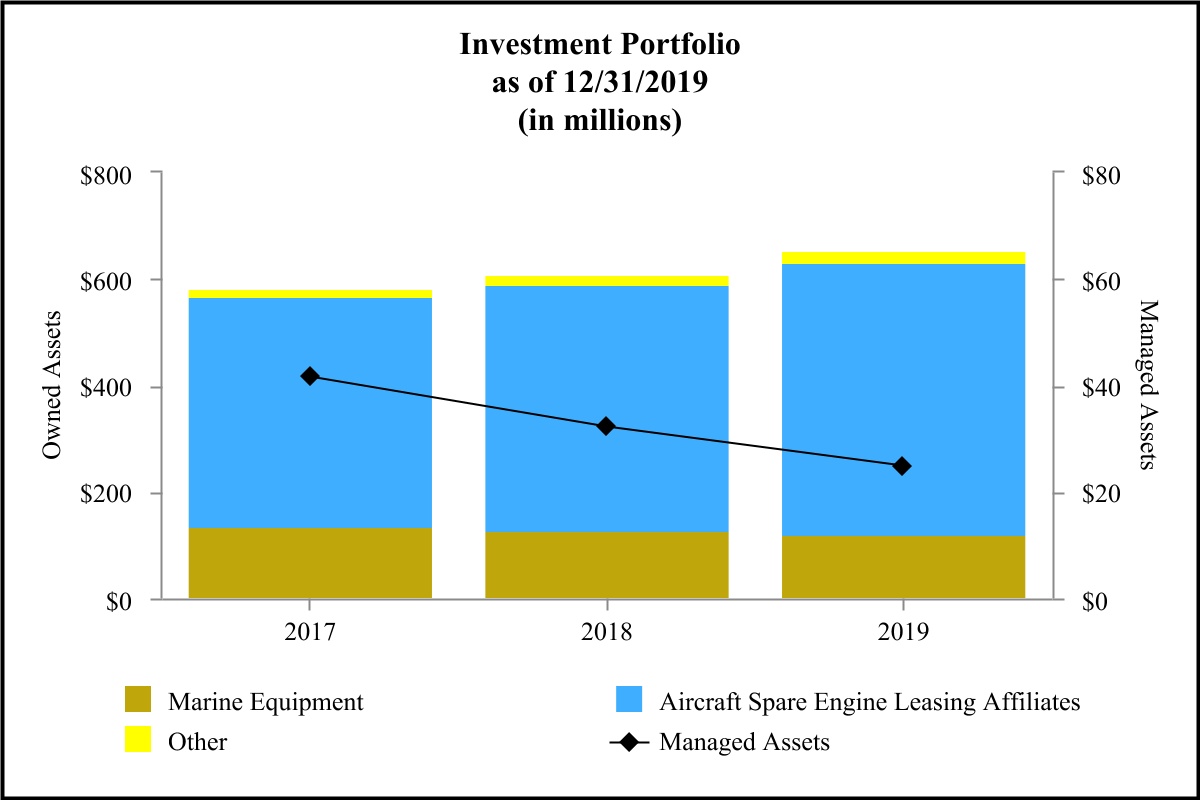

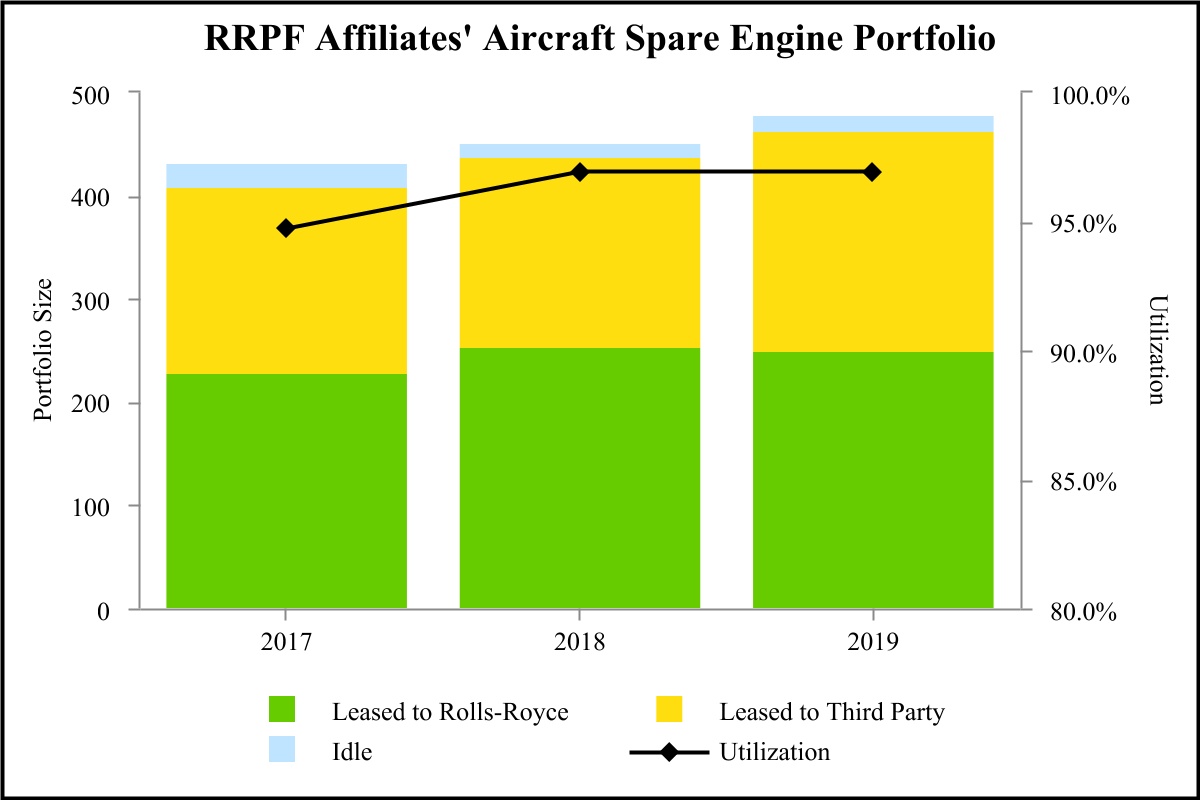

Portfolio Management's segment profit is attributable primarily to income from the RRPF affiliates, a group of 50% owned domestic and foreign joint ventures with Rolls-Royce plc (or affiliates thereof, collectively “Rolls-Royce”), a leading manufacturer of commercial aircraft jet engines. Segment profit included earnings from the RRPF affiliates of $94.5 million for 2019, $60.5 million for 2018, and $57.3 million for 2017. Portfolio Management did not make any additional investment in the RRPF affiliates in 2019, compared to $14.1 million in 2018 and $36.6 million in 2017. Dividend distributions from the RRPF affiliates totaled $27.5 million in 2019, compared to $35.2 million in 2018 and $30.2 million in 2017. The RRPF affiliates owned 478 aircraft spare engines with a net book value of approximately $5,036.4 million at the end of 2019 compared to 452 aircraft spare engines with a net book value of approximately $4,435.6 million at the end of 2018 and 432 aircraft spare engines with a net book value of $3,764.5 million at the end of 2017.

As we have disclosed previously, we have exited the majority of Portfolio Management's marine investments. As of December 31, 2017, we had completed all planned sales of the marine assets, including our 50% interest in the Cardinal Marine joint venture. In 2017, we received proceeds of $46.8 million, resulting in net gains of $1.8 million.

Portfolio Management continues to own marine assets, consisting primarily of five liquefied gas-carrying vessels (the "Specialized Gas Vessels"), previously referred to as the Norgas Vessels. During the second quarter of 2019, the prior commercial management agreement with Norgas Carriers Private Limited, and related pooling arrangement, was terminated, and we entered into a new agreement with Anthony Veder Group B.V. ("Veder") to commercially manage these vessels. During this transition, the Specialized Gas Vessels were idle for a significant portion of the second quarter of 2019. However, we realized increased utilization during the second half of 2019 and expect continuing improvement in future operating performance resulting from this new commercial agreement.

Portfolio Management's total asset base was $653.7 million at December 31, 2019, compared to $606.8 million at December 31, 2018, and $582.8 million at December 31, 2017.

The following table shows Portfolio Management’s segment results for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Revenues | |||||||||||||||||

| Lease revenue | $ | 1.0 | $ | 1.0 | $ | 3.8 | |||||||||||

| Marine operating revenue | 8.2 | 14.3 | 25.0 | ||||||||||||||

| Other revenue | 0.7 | 0.8 | 1.1 | ||||||||||||||

| Total Revenues | 9.9 | 16.1 | 29.9 | ||||||||||||||

| Expenses | |||||||||||||||||

| Marine operating expense | 18.9 | 16.8 | 24.8 | ||||||||||||||

| Depreciation expense | 6.6 | 7.3 | 7.0 | ||||||||||||||

| Other operating expense | 0.6 | — | 1.0 | ||||||||||||||

| Total Expenses | 26.1 | 24.1 | 32.8 | ||||||||||||||

| Other Income (Expense) | |||||||||||||||||

| Net (loss) gain on asset dispositions | (4.7) | (3.4) | 7.7 | ||||||||||||||

| Interest expense, net | (11.2) | (10.4) | (9.2) | ||||||||||||||

| Other income | — | — | 2.3 | ||||||||||||||

| Share of affiliates' pre-tax income | 94.5 | 60.5 | 58.4 | ||||||||||||||

Segment Profit | $ | 62.4 | $ | 38.7 | $ | 56.3 | |||||||||||

Investment Volume | $ | — | $ | 14.1 | $ | 36.6 | |||||||||||

15

The following table sets forth the approximate net book value of Portfolio Management’s assets as of December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Investment in RRPF Affiliates | $ | 512.4 | $ | 464.3 | $ | 434.2 | |||||||||||

| Owned assets | 141.3 | 142.5 | 148.6 | ||||||||||||||

| Managed assets (1) | 24.8 | 32.3 | 41.6 | ||||||||||||||

________

(1) Amounts shown represent the estimated net book value of assets managed for third parties and are not included in our consolidated balance sheets.

RRPF Affiliates Engine Portfolio Data

The following table shows portfolio activity for the RRPF affiliates' aircraft spare engines for the years ended December 31:

| 2019 | 2018 | 2017 | |||||||||||||||

| Beginning balance | 452 | 432 | 407 | ||||||||||||||

| Engine acquisitions | 46 | 48 | 35 | ||||||||||||||

| Engine dispositions | (20) | (28) | (10) | ||||||||||||||

| Ending balance | 478 | 452 | 432 | ||||||||||||||

| Utilization rate at year end | 96.9 | % | 96.9 | % | 94.7 | % | |||||||||||

16

Comparison of Reported Results

Comparisons of reported results for 2018 and 2017 are impacted by the sale of marine investments.

Segment Profit

In 2019, segment profit was $62.4 million compared to $38.7 million in 2018. The increase reflects stronger results at the RRPF affiliates, partially offset by a lower contribution from the Specialized Gas Vessels.

In 2018, segment profit was $38.7 million compared to $56.3 million in 2017. Segment profit for 2017 included net gains of approximately $1.8 million associated with the exit of marine investments. Excluding this item, results for the Portfolio Management segment were $15.8 million lower in 2018 compared to 2017, primarily due to the absence of operating income from the marine assets sold during 2017, lower residual sharing fees from the managed portfolio, and a lower contribution from the Specialized Gas Vessels.

Revenues

In 2019, lease revenue was comparable to the same period in 2018. Marine operating revenue decreased $6.1 million, due to lower revenue from the Specialized Gas Vessels. In 2019, utilization of the vessels was lower due to idle time associated with the transition to a new commercial manager, as discussed previously.

In 2018, lease revenue decreased $2.8 million, primarily due to the impact of the sales of assets in 2017. Marine operating revenue decreased $10.7 million, largely due to lower revenue from the Specialized Gas Vessels and the absence of revenue from the marine assets that were sold in 2017. The revenue from the Specialized Gas Vessels declined due to continued pressure on charter rates and lower utilization, resulting from weak demand and oversupply of vessels in the market.

Expenses

In 2019, marine operating expense increased $2.1 million. This increase was driven by the write-off of residual net assets as part of the wind-up of activities under the prior commercial management pooling agreement, partially offset by lower expenses from the Specialized Gas Vessels.

17

In 2018, marine operating expense decreased $8.0 million, primarily due to the absence of the marine assets that were sold in 2017, as well as lower expenses from the Specialized Gas Vessels, which included higher dry-docking costs in the prior year.

Other Income (Expense)

In 2019, net loss on asset dispositions increased $1.3 million, largely due to higher impairment losses for certain offshore supply vessels, partially offset by higher residual sharing fees from the managed portfolio.

In 2018, net gain (loss) on asset dispositions decreased $11.1 million. Net gains of approximately $1.8 million were recorded in 2017 associated with the planned exit of marine investments. Excluding this item, net gain (loss) on asset dispositions decreased $9.3 million due to lower residual sharing fees from the managed portfolio, as well as well as higher impairment losses for certain offshore supply vessels.

In 2019, income from our share of affiliates' earnings increased $34.0 million. The increase was due to more engines on lease and increased residual realization at the RRPF affiliates.

In 2018, income from our share of affiliates' earnings increased $2.1 million, primarily from earnings at the RRPF affiliates due to higher operating income, driven by engines added to the fleet in 2018, partially offset by lower net disposition gains on engines sold.

Investment Volume

Portfolio Management did not make any investments in 2019. Investment volume of $14.1 million in 2018 and $36.6 million in 2017 consisted primarily of equity investments in the RRPF affiliates.

18

OTHER

Other comprises selling, general and administrative expenses (“SG&A”), unallocated interest expense, and miscellaneous income and expense not directly associated with the reporting segments and eliminations.

The following table shows components of Other for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Selling, general and administrative expense | $ | 180.4 | $ | 182.5 | $ | 172.4 | |||||||||||

| Unallocated interest (income) expense | (5.8) | (8.6) | (8.5) | ||||||||||||||

| Other expense (income), including eliminations | 3.2 | 9.5 | 7.1 | ||||||||||||||

SG&A, Unallocated Interest and Other

During 2017, we exercised our option to terminate the office lease at our corporate headquarters early. As a result, accelerated depreciation on leasehold improvements was recorded in SG&A in 2017 and 2018, and lease termination costs were recorded in other expense (income) in 2017.

In 2019, SG&A of $180.4 million decreased $2.1 million from 2018. The decrease was primarily due to the absence of accelerated depreciation recorded in 2018 related to the early termination of the corporate headquarters office lease, partially offset by higher compensation and other employee benefits costs.

In 2018, SG&A of $182.5 million increased $10.1 million from 2017. The increase was primarily due to higher compensation and other employee benefits and higher information technology expense. SG&A was also negatively impacted by a full year of accelerated depreciation of leasehold improvements resulting from the early termination of the office lease.

Unallocated interest expense (the difference between external interest expense and interest expense allocated to the reporting segments) in any year is affected by our consolidated leverage position, the timing of debt issuances and investing activities, and intercompany allocations.

In 2019, other expense (income), including eliminations, decreased $6.3 million, driven by lower non-service pension expense. Specifically, certain lump sum distributions paid to retirees in 2018 triggered a non-recurring adjustment to pension expense for $2.1 million. In addition, lower provisions recorded for litigation and environmental accruals contributed to the decrease.

In 2018, other expense (income), including eliminations, increased $2.4 million, driven by provisions recorded for environmental and litigation accruals, as well as incremental pension expense associated with certain lump sum distributions in 2018, partially offset by the absence of costs recorded in 2017 associated with the early termination of the office lease.

Consolidated Income Taxes

In 2017, the Tax Cuts and Jobs Act (the “Tax Act”) made broad and complex changes to the U.S. federal income tax laws. The Tax Act had a significant impact on our earnings in 2017, as we recorded a one-time net tax benefit of $315.9 million, which represented our provisional estimate of the impact of the Tax Act. This amount included a net benefit of $371.4 million associated with the remeasurement of our net deferred tax liability utilizing the lower U.S. federal income tax rate. The Tax Act also imposed a one-time transitional repatriation tax of $57.2 million on certain undistributed earnings of our non-U.S. subsidiaries and affiliates. Additional guidance was issued by the Internal Revenue Service, the U.S. Department of the Treasury, and state taxing authorities during 2018 and, as a result, we recorded an adjustment to our provisional estimates. Specifically, in the fourth quarter of 2018, we recorded an additional net tax benefit of $16.5 million based on this clarifying guidance, the filing of our 2017 income tax returns, and the final determination of our foreign undistributed earnings and associated tax attributes. We do not expect to record any future material adjustments associated with the Tax Act. As part of the Tax Act, the U.S. corporation income tax rate was reduced to 21% from 35%, and this reduction favorably impacted our consolidated effective tax rate, net income, and diluted earnings per share; however, the Tax Act has not had a material impact on our consolidated cash flows from operations. See "Note 12. Income Taxes" in Item 8 of this Exhibit for additional information on income taxes.

19

Discontinued Operations

Segment Summary

On February 7, 2020, we entered into an agreement to sell ASC. On May 14, 2020, we completed the sale of our ASC business, subject to customary post-closing adjustments. As a result, ASC is now reported as discontinued operations, and financial data for the ASC segment has been segregated and presented as discontinued operations in the consolidated financial statements in this Exhibit for all periods presented. See "Note 26. Discontinued Operations" in Item 8 of this Exhibit for additional information. The ASC business comprises the entirety of GATX's discontinued operations.

The following table shows the income from discontinued operations, net of taxes (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Income from discontinued operations, net of taxes | $ | 30.4 | $ | 20.8 | $ | 34.2 | |||||||||||

BALANCE SHEET DISCUSSION

Assets

Total assets (including on- and off-balance sheet) were $8.3 billion at December 31, 2019, compared to $8.0 billion at December 31, 2018. A portion of our North American railcar fleet is financed through sale-leasebacks that are accounted for as operating leases. Prior to 2019, these railcar assets were not recorded on the balance sheet. Under the new lease accounting standard adopted on January 1, 2019, GATX records these railcar operating leases on the balance sheet as right-of-use assets. As such, we no longer have any assets that qualify as off-balance sheet assets beginning in 2019. The increase in total assets was primarily driven by an increase in operating assets at Rail International, higher investment in the RRPF affiliates, and an increase in cash and cash equivalents at Corporate.

The following table shows on- and off-balance sheet assets by segment as of December 31 (in millions):

| 2019 | 2018 | ||||||||||||||||||||||||||||||||||

| | On-Balance Sheet | Off-Balance Sheet (1) | Total | On-Balance Sheet | Off-Balance Sheet | Total | |||||||||||||||||||||||||||||

| Rail North America | $ | 5,646.7 | $ | — | $ | 5,646.7 | $ | 5,236.6 | $ | 430.2 | $ | 5,666.8 | |||||||||||||||||||||||

| Rail International | 1,486.7 | — | 1,486.7 | 1,363.2 | — | 1,363.2 | |||||||||||||||||||||||||||||

| Portfolio Management | 653.7 | — | 653.7 | 606.8 | — | 606.8 | |||||||||||||||||||||||||||||

| Other | 206.9 | — | 206.9 | 112.3 | — | 112.3 | |||||||||||||||||||||||||||||

| Discontinued Operations | 291.1 | — | 291.1 | 297.8 | — | 297.8 | |||||||||||||||||||||||||||||

| Total | $ | 8,285.1 | $ | — | $ | 8,285.1 | $ | 7,616.7 | $ | 430.2 | $ | 8,046.9 | |||||||||||||||||||||||

_________

(1) In accordance with the new lease accounting standard, we no longer have any assets that qualify as off-balance sheet assets beginning in 2019. The adoption of this new standard required us to recognize operating lease assets on our balance sheet. See “Non-GAAP Financial Measures” at the end of this item.

Gross Receivables

Receivables of $156.2 million at December 31, 2019 decreased $35.5 million from December 31, 2018, primarily due to the timing of payments by customers.

Allowance for Losses

As of December 31, 2019, allowance for losses totaled $6.2 million, or 9.4% of rent and other receivables, compared to $6.4 million, or 9.8%, at December 31, 2018. Both balances related entirely to general allowances.

20

See "Note 17. Allowance for Losses" in Item 8 of this Exhibit.

Operating Assets and Facilities

Net operating assets and facilities increased $181.7 million from 2018. The increase was primarily due to investments of $715.1 million offset by depreciation of $325.9 million, asset dispositions of $176.4 million, and negative foreign exchange rate effects of $21.9 million.

Investments in Affiliated Companies

Investments in affiliated companies increased $48.1 million in 2019 (see table below). The increase was driven by our share of earnings from the RRPF affiliates partially offset by distributions from the RRPF affiliates.

The following table shows our investments in affiliated companies by segment as of December 31 (in millions):

| 2019 | 2018 | ||||||||||

| Rail North America | $ | 0.2 | $ | 0.2 | |||||||

| Portfolio Management | 512.4 | 464.3 | |||||||||

| Total | $ | 512.6 | $ | 464.5 | |||||||

See "Note 6. Investments in Affiliated Companies" in Item 8 of this Exhibit.

Goodwill

In 2019 and 2018, changes in the balance of our goodwill, all of which is attributable to the Rail North America and Rail International segments, resulted from fluctuations in foreign currency exchange rates. We tested our goodwill for impairment in the fourth quarter of 2019, and no impairment was indicated.

See "Note 16. Goodwill" in Item 8 of this Exhibit.

Debt

Total debt increased $255.7 million from the prior year. Issuances of long-term debt of $748.5 million were offset by maturities and principal payments of $504.6 million and the effects of foreign exchange on foreign debt balances.

The following table shows the details of our long-term debt issuances in 2019 ($ in millions):

| Type of Debt | Term | Interest Rate | Principal Amount | |||||||||||||||||

| Recourse Unsecured | 10.2 Years | 4.70% Fixed | $ | 500.0 | ||||||||||||||||

| Recourse Unsecured | 5.0 Years | 0.96% Fixed | 110.2 | |||||||||||||||||

| Recourse Unsecured | 7.0 Years | 1.07% Fixed | 82.6 | |||||||||||||||||

| Recourse Unsecured | 5.0 Years | 0.90% Floating (1) | 55.7 | |||||||||||||||||

| $ | 748.5 | |||||||||||||||||||

________

(1)Floating interest rate at December 31, 2019.

As of December 31, 2019, our outstanding debt had a weighted-average remaining term of 8.7 years and a weighted-average interest rate of 4.08%, compared to 8.9 years and 4.01% at December 31, 2018.

The following table shows the carrying value of our debt and lease obligations by major component, including off-balance sheet debt, as of December 31 (in millions):

21

| 2019 | 2018 | ||||||||||||||||||||||

| Secured | Unsecured | Total | Total | ||||||||||||||||||||

| Commercial paper and borrowings under bank credit facilities | $ | — | $ | 15.8 | $ | 15.8 | $ | 110.8 | |||||||||||||||

| Recourse debt | — | 4,780.4 | 4,780.4 | 4,429.7 | |||||||||||||||||||

| Operating lease obligations | 429.4 | — | 429.4 | — | |||||||||||||||||||

| Finance lease obligations | 7.9 | — | 7.9 | 11.3 | |||||||||||||||||||

| Balance sheet debt and lease obligations | 437.3 | 4,796.2 | 5,233.5 | 4,551.8 | |||||||||||||||||||

| Recourse off-balance sheet debt (1) | — | — | — | 430.2 | |||||||||||||||||||

| Total | $ | 437.3 | $ | 4,796.2 | $ | 5,233.5 | $ | 4,982.0 | |||||||||||||||

________

(1) Prior to 2019, off-balance sheet debt represented the estimated present value of committed operating lease payments for certain railcars that have been financed through sale-leasebacks and was equal to the amount reported as off-balance sheet assets. In accordance with the new lease accounting standard, we no longer have any assets that qualify as off-balance sheet assets beginning in 2019. The adoption of this new standard required us to recognize operating lease liabilities on our balance sheet. See “Non-GAAP Financial Measures” at the end of this item.

See "Note 7. Debt" in Item 8 of this Exhibit.

Equity

Total equity increased $47.0 million in 2019, primarily due to net income of $211.2 million, $39.4 million from the impact of adoption of new accounting standards as of January 1, 2019, $13.7 million from the effects of share-based compensation, $7.2 million from the effects of post-retirement benefit plan adjustments, and $3.9 million of net unrealized gains on derivatives. These increases were offset by stock repurchases of $150.0 million, dividends of $68.5 million, and $10.1 million of foreign currency translation adjustments due to the balance sheet effects of a stronger U.S. dollar relative to the foreign currencies in which our subsidiaries conduct business, primarily the euro, Canadian dollar, and Polish zloty.

See "Note 19. Shareholders’ Equity" in Item 8 of this Exhibit.

CASH FLOW DISCUSSION

We generate a significant amount of cash from operating activities and investment portfolio proceeds. We also access domestic and international capital markets by issuing unsecured or secured debt and commercial paper. We use these resources, along with available cash balances, to fulfill our debt, lease, and dividend obligations, to support our share repurchase programs, and to fund portfolio investments and capital additions. We primarily use cash from operations to fund daily operations.

The timing of asset dispositions and changes in working capital impact cash flows from portfolio proceeds and operations. As a result, these cash flow components may vary materially from year to year. As of December 31, 2019, we had an unrestricted cash balance of $151.0 million.

22

The following table shows our principal sources and uses of cash from continuing operations for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

Principal sources of cash | |||||||||||||||||

Net cash provided by operating activities | $ | 425.8 | $ | 485.2 | $ | 454.3 | |||||||||||

Portfolio proceeds | 250.3 | 234.4 | 165.6 | ||||||||||||||

Other asset sales | 23.0 | 37.3 | 30.3 | ||||||||||||||

Proceeds from sale-leasebacks | — | 59.1 | 90.6 | ||||||||||||||

Proceeds from issuance of debt, commercial paper, and credit facilities | 743.0 | 800.2 | 792.6 | ||||||||||||||

Total | $ | 1,442.1 | $ | 1,616.2 | $ | 1,533.4 | |||||||||||

Principal uses of cash | |||||||||||||||||

Portfolio investments and capital additions | $ | (722.8) | $ | (927.6) | $ | (589.4) | |||||||||||

Repayments of debt, commercial paper, and credit facilities | (504.6) | (632.8) | (703.3) | ||||||||||||||

Purchases of assets previously leased | (1.0) | (66.6) | (87.8) | ||||||||||||||

Payments on finance lease obligations | (11.3) | (1.2) | (1.3) | ||||||||||||||

Stock repurchases | (150.0) | (115.5) | (100.0) | ||||||||||||||

Dividends | (69.3) | (69.3) | (68.2) | ||||||||||||||

Total | $ | (1,459.0) | $ | (1,813.0) | $ | (1,550.0) | |||||||||||

Additionally, net cash from discontinued operations was $(0.1) million, $0.0 million, and $0.0 million for the years ended December 31, 2019, 2018, and 2017.

Net Cash Provided by Operating Activities

Net cash provided by operating activities of $425.8 million decreased $59.4 million compared to 2018. Comparability among reporting periods is impacted by the timing of changes in working capital items. Specifically, cash payments were higher in 2019 for interest expense, operating leases, maintenance expense, and compensation. This was partially offset by higher repair revenues and lower income tax payments in the current year.

Portfolio Investments and Capital Additions

Portfolio investments and capital additions primarily consist of purchases of operating assets, investments in affiliates, and capitalized asset improvements. Portfolio investments and capital additions of $722.8 million decreased $204.8 million compared to 2018, primarily due to fewer railcars acquired at Rail North America, including $204.2 million for the purchase of 2,832 railcars from ECN Capital Corporation in 2018, as well as lower equity investments in the RRPF affiliates at Portfolio Management. These decreases were partially offset by more railcars acquired at Rail International. The timing of investments depends on purchase commitments, transaction opportunities, and market conditions.

The following table shows portfolio investments and capital additions by segment for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

| Rail North America | $ | 502.2 | $ | 737.4 | $ | 460.9 | |||||||||||

| Rail International | 215.7 | 152.7 | 90.9 | ||||||||||||||

| Portfolio Management | — | 14.1 | 36.6 | ||||||||||||||

| Other | 4.9 | 23.4 | 1.0 | ||||||||||||||

| Total | $ | 722.8 | $ | 927.6 | $ | 589.4 | |||||||||||

Additionally, portfolio investments and capital additions for discontinued operations were $18.9 million, $15.8 million, and $14.0 million for the years ended December 31, 2019, 2018, and 2017.

23

Portfolio Proceeds

Portfolio proceeds primarily consist of proceeds from sales of operating assets, loan and finance lease receipts, as well as capital distributions from affiliates. Portfolio proceeds of $250.3 million increased $15.9 million compared to 2018, primarily due to higher proceeds from railcar and locomotive sales at Rail North America. Portfolio proceeds included $46.8 million in 2017 associated with the exit of the majority of the marine assets at our Portfolio Management segment.

The following table shows portfolio proceeds for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

Proceeds from sales of operating assets | $ | 239.6 | $ | 217.3 | $ | 145.9 | |||||||||||

Finance lease rents received, net of earned income | 8.4 | 9.7 | 11.3 | ||||||||||||||

Loan principal received | — | — | 5.4 | ||||||||||||||

Capital distributions and proceeds related to affiliates | 2.3 | 6.3 | 3.0 | ||||||||||||||

Other portfolio proceeds | — | 1.1 | — | ||||||||||||||

Total | $ | 250.3 | $ | 234.4 | $ | 165.6 | |||||||||||

Other Investing Activity

We purchased 49 railcars that were previously leased in 2019 compared to 3,412 railcars in 2018, and 3,970 railcars in 2017. Proceeds from sales of other assets for all periods were primarily related to railcar scrapping. Rail North America completed sale-leaseback financings for 467 railcars in 2018 and 699 railcars in 2017.

The following table shows other investing activity for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

Purchases of assets previously leased | $ | (1.0) | $ | (66.6) | $ | (87.8) | |||||||||||

Proceeds from sales of other assets | 23.0 | 37.3 | 30.3 | ||||||||||||||

Proceeds from sale-leasebacks | — | 59.1 | 90.6 | ||||||||||||||

| Other | 2.7 | 3.1 | 0.4 | ||||||||||||||

Total | $ | 24.7 | $ | 32.9 | $ | 33.5 | |||||||||||

Additionally, other investing activity for discontinued operations was $27.0 million, $0.0 million, and $(24.0) million for the years ended December 31, 2019, 2018, and 2017.

24

Net Cash Provided by (Used in) Financing Activities

The following table shows net cash provided by (used) in financing activities for the years ended December 31 (in millions):

| 2019 | 2018 | 2017 | |||||||||||||||

Net proceeds from issuances of debt (original maturities longer than 90 days) | $ | 743.0 | $ | 693.7 | $ | 792.6 | |||||||||||

Repayments of debt (original maturities longer than 90 days) | (410.0) | (632.8) | (703.0) | ||||||||||||||

Net (decrease) increase in debt with original maturities of 90 days or less | (94.6) | 106.5 | (0.3) | ||||||||||||||

Payments on finance lease obligations | (11.3) | (1.2) | (1.3) | ||||||||||||||

Stock repurchases (1) | (150.0) | (115.5) | (100.0) | ||||||||||||||

Dividends | (69.3) | (69.3) | (68.2) | ||||||||||||||

Other | 59.1 | 4.7 | 0.8 | ||||||||||||||

Total | $ | 66.9 | $ | (13.9) | $ | (79.4) | |||||||||||

________

(1) During 2019, we repurchased 2.0 million shares of common stock for $150.0 million, compared to 1.5 million shares for $115.5 million in 2018 and 1.7 million shares for $100.0 million in 2017.

Cash Flows from Discontinued Operations

The following table shows cash flow information for our discontinued operations (in millions):

| Year Ended December 31 | |||||||||||||||||

| 2019 | 2018 | 2017 | |||||||||||||||

Net Cash Used in Operating Activities | $ | 36.8 | $ | 23.3 | $ | 42.5 | |||||||||||

Net Cash Provided By (Used In) Investing Activities | 8.1 | (15.8) | (38.0) | ||||||||||||||

Net Cash Provided By Financing Activities | (45.0) | (7.5) | (4.5) | ||||||||||||||

Cash Provided By Discontinued Operations, Net | $ | (0.1) | $ | — | $ | — | |||||||||||

25

LIQUIDITY AND CAPITAL RESOURCES

General

We fund our investments and meet our debt, lease, and dividend obligations, using our available cash balances, as well as cash generated from operating activities, sales of assets, commercial paper issuances, committed revolving credit facilities, distributions from affiliates, and issuances of secured and unsecured debt. We primarily use cash from operations to fund daily operations. We use both domestic and international capital markets and banks to meet our debt financing needs.

Contractual and Other Commercial Commitments

The following table shows our contractual commitments, including debt principal and related interest payments, lease payments, and purchase commitments at December 31, 2019 (in millions):

| Payments Due by Period | |||||||||||||||||||||||||||||||||||||||||

| Total | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | |||||||||||||||||||||||||||||||||||

Recourse debt | $ | 4,813.9 | $ | 350.0 | $ | 600.0 | $ | 250.0 | $ | 250.0 | $ | 529.9 | $ | 2,834.0 | |||||||||||||||||||||||||||

Interest on recourse debt (1) | 1,897.9 | 180.4 | 168.6 | 147.9 | 136.5 | 124.3 | 1,140.2 | ||||||||||||||||||||||||||||||||||

Commercial paper and credit facilities | 15.8 | 15.8 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Operating lease obligations | 508.2 | 65.8 | 64.2 | 56.2 | 54.2 | 49.8 | 218.0 | ||||||||||||||||||||||||||||||||||

Finance lease obligations, including interest | 7.9 | 7.9 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Purchase commitments (2) | 1,838.3 | 737.8 | 362.4 | 365.3 | 372.8 | — | — | ||||||||||||||||||||||||||||||||||

Total | $ | 9,082.0 | $ | 1,357.7 | $ | 1,195.2 | $ | 819.4 | $ | 813.5 | $ | 704.0 | $ | 4,192.2 | |||||||||||||||||||||||||||

__________

(1) For floating rate debt, future interest payments are based on the applicable interest rate as of December 31, 2019.

(2) Primarily railcar purchase commitments. The amounts shown for all years are based on management's estimates of the timing, anticipated car types, and related costs of railcars to be purchased under its agreements.

In 2014, we entered into a long-term supply agreement with Trinity Rail Group, LLC ("Trinity") a subsidiary of Trinity Industries. Under the terms of that agreement, we agreed to order 8,950 newly built railcars. As of December 31, 2019, all 8,950 railcars have been ordered, of which 7,678 railcars have been delivered. On May 24, 2018, we amended our long-term supply agreement with Trinity to extend the term to December 2023, and we agreed to purchase an additional 4,800 tank cars (1,200 per year) beginning in January 2020 and continuing through the expiration of the extended term. At December 31, 2019, 1,128 railcars have been ordered pursuant to the amended terms of the agreement.

In 2018, we entered into a multi-year railcar supply agreement with American Railcar Industries, Inc. ("ARI"), pursuant to which we will purchase 7,650 newly built railcars. The order encompasses a mix of tank and freight cars that are to be delivered over a five-year period, beginning in April 2019. ARI's railcar manufacturing business was subsequently acquired by The Greenbrier Companies, Inc. ("Greenbrier") on July 26, 2019, and Greenbrier assumed all of ARI's obligations under our long-term supply agreement. Under this agreement, 450 railcars were to be delivered in 2019, with the remaining 7,200 to be delivered ratably over the four-year period of 2020 to 2023. As of December 31, 2019, 2,129 railcars have been ordered. The agreement also includes an option to order up to an additional 4,400 railcars subject to certain restrictions.

The following table shows our future contractual cash receipts arising from our direct finance leases and future rental receipts from noncancelable operating leases as of December 31, 2019 (in millions):

| Contractual Cash Receipts by Period | |||||||||||||||||||||||||||||||||||||||||

| Total | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | |||||||||||||||||||||||||||||||||||

| Operating leases | $ | 3,139.1 | $ | 933.8 | $ | 721.7 | $ | 532.9 | $ | 399.3 | $ | 261.5 | $ | 289.9 | |||||||||||||||||||||||||||

| Finance leases | 84.4 | 19.7 | 13.7 | 21.9 | 7.2 | 7.7 | 14.2 | ||||||||||||||||||||||||||||||||||

| Total | $ | 3,223.5 | $ | 953.5 | $ | 735.4 | $ | 554.8 | $ | 406.5 | $ | 269.2 | $ | 304.1 | |||||||||||||||||||||||||||

26

Our aggregate future contractual cash receipts at December 31, 2019 decreased $124.5 million compared to 2018, primarily as a result of lease receipts in 2019, committed lease receipts associated with railcars sold in the current year, lower lease rates, and shortened lease terms for new leases and renewals completed during 2019 on existing railcars in the fleet, partially offset by the impact of the new railcars added to the fleet.

2020 Liquidity Outlook

In addition to our contractual obligations, expenditures in 2020 may also include the purchase of railcars that are currently leased and other discretionary capital spending for opportunistic asset purchases or strategic investments. We plan to fund these expenditures in 2020 using available cash at December 31, 2019 in combination with cash from operations, portfolio proceeds, long-term debt issuances, and our revolving credit facilities.

Short-Term Borrowings

We primarily use short-term borrowings as a source of working capital and to temporarily fund differences between our operating cash flows and portfolio proceeds, and our capital investments and debt maturities. We do not maintain or target any particular level of short-term borrowings on a permanent basis. Rather, we will temporarily utilize short-term borrowings at levels we deem appropriate until we decide to pay down these balances.

The following table shows additional information regarding our short-term borrowings:

| North America (1) | Europe (2) | ||||||||||||||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2019 | 2018 | 2017 | ||||||||||||||||||||||||||||||

Balance as of December 31 (in millions) | $ | — | $ | 100.0 | $ | — | $ | 15.8 | $ | 10.8 | $ | 4.3 | |||||||||||||||||||||||

Weighted-average interest rate | — | % | 3.0 | % | — | % | 0.7 | % | 0.6 | % | 1.0 | % | |||||||||||||||||||||||

Euro/dollar exchange rate | n/a | n/a | n/a | 1.12 | 1.15 | 1.20 | |||||||||||||||||||||||||||||

Average daily amount outstanding during year (in millions) | $ | 25.6 | $ | 3.3 | $ | — | $ | 16.7 | $ | 3.8 | $ | 9.2 | |||||||||||||||||||||||

Weighted-average interest rate | 2.4 | % | 3.0 | % | — | % | 0.7 | % | 0.9 | % | 0.7 | % | |||||||||||||||||||||||

Average Euro/dollar exchange rate | n/a | n/a | n/a | 1.12 | 1.18 | 1.13 | |||||||||||||||||||||||||||||

Average daily amount outstanding during 4th quarter (in millions) | $ | 47.2 | $ | 13.0 | $ | — | $ | 19.9 | $ | 4.2 | $ | 12.0 | |||||||||||||||||||||||

Weighted-average interest rate | 2.1 | % | 3.0 | % | — | % | 0.7 | % | 0.8 | % | 0.6 | % | |||||||||||||||||||||||

Average Euro/dollar exchange rate | n/a | n/a | n/a | 1.11 | 1.14 | 1.18 | |||||||||||||||||||||||||||||

Maximum daily amount outstanding (in millions) | $ | 130.0 | $ | 100.0 | $ | — | $ | 161.1 | $ | 84.8 | $ | 78.2 | |||||||||||||||||||||||

Euro/dollar exchange rate | n/a | n/a | n/a | 1.11 | 1.13 | 1.18 | |||||||||||||||||||||||||||||

__________

(1)Short-term borrowings in North America are composed of commercial paper issued in the U.S.

(2)Short-term borrowings in Europe are composed of borrowings under bank credit facilities.

Credit Lines and Facilities

We have a $600 million, 5-year unsecured revolving credit facility in the U.S. that matures in May 2024. This credit facility contains two one-year extension options. As of December 31, 2019, the full $600 million was available under this facility. Additionally, we have a $250 million 3-year unsecured facility in the U.S. that matures in May 2022 and also has two one-year extension options. As of December 31, 2019, the full $250 million was available under this facility.

Our European subsidiaries have unsecured credit facilities with an aggregate limit of €35.0 million. As of December 31, 2019, €20.9 million was available under these credit facilities.

27

Restrictive Covenants

Our credit facility and certain other debt agreements contain various restrictive covenants. See "Note 7. Debt" in Item 8 of this Exhibit.

Credit Ratings

The global capital market environment and outlook may affect our funding options and our financial performance. Our access to capital markets at competitive rates depends on our credit rating and rating outlook, as determined by rating agencies. As of December 31, 2019, our long-term unsecured debt was rated BBB by Standard & Poor's and Baa2 by Moody’s Investor Service and our short-term unsecured debt was rated A-2 by Standard & Poor's and P-2 by Moody’s Investor Service. Our rating outlook from both agencies was stable.

Shelf Registration Statement

During 2019, we filed an automatic shelf registration statement that enables us to issue debt securities and pass-through certificates. The registration statement is effective for three years and does not limit the amount of debt securities and pass-through certificates we can issue.

Commercial Commitments

We have entered into various commercial commitments, including standby letters of credit and performance bonds, related to certain transactions. These commercial commitments require us to fulfill specific obligations in the event of third-party demands. Similar to our balance sheet investments, these commitments expose us to credit, market, and equipment risk. Accordingly, we evaluate these commitments and other contingent obligations using techniques similar to those we use to evaluate funded transactions.

The following table shows our commercial commitments at December 31, 2019 (in millions):

| Amount of Commitment Expiration by Period | |||||||||||||||||||||||||||||||||||||||||

| Total | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | |||||||||||||||||||||||||||||||||||

| Standby letters of credit and performance bonds | $ | 9.3 | $ | 9.2 | $ | 0.1 | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||

We are parties to standby letters of credit and performance bonds, which primarily relate to contractual obligations and general liability insurance coverages. No material claims have been made against these obligations, and no material losses are anticipated.

Defined Benefit Plan Contributions

In 2019, we contributed $4.8 million to our defined benefit pension plans and other post-retirement benefit plans. In 2020, we expect to contribute approximately $6.2 million. As of December 31, 2019, our funded pension plans were 100.0% funded in aggregate. Additional contributions will depend primarily on plan asset investment returns and actuarial experience, and subject to the impact of these factors, we may make additional material plan contributions.

Separately, the shipboard personnel at ASC participate in various multiemployer benefit plans that provide pension, health care, and post-retirement and other benefits to active and retired employees. We contributed $9.1 million to these plans in 2019 and recognized that amount as marine operating expense. See "Note 10. Pension and Other Post-Retirement Benefits" in Item 8 of this Form 10-K for additional information on our benefit plans. On February 7, 2020, we entered into an agreement to sell ASC. On May 14, 2020, we completed the sale of our ASC business, subject to customary post-closing adjustments. See "Note 26. Discontinued Operations" in Item 8 of this Exhibit for additional information.

28

GATX Common Stock Repurchases