Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIVE STAR SENIOR LIVING INC. | a9302020-exhibit991.htm |

| 8-K - 8-K - FIVE STAR SENIOR LIVING INC. | fve-20201105.htm |

Investor Presentation November 2020 “To honor and enrich the journey of life, one experience at a time.”

Warning Concerning Forward-Looking Statements This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and our actual results may differ materially from those contained in, or implied by, our forward-looking statements. Forward-looking statements in this presentation relate to various aspects of our business, including our ability to operate our senior living communities profitably, our ability to grow revenues at the senior living communities we manage and to increase the fees we earn from managing senior living communities, our expectation to focus our expansion activities on internal growth from our existing senior living communities and the ancillary services that we may provide, our ability to increase the number of senior living communities we operate and residents we serve, and to grow our other sources of revenues, including rehabilitation and wellness services and other services we may provide, whether the aging U.S. population and increasing life spans of older adults will increase the demand for senior living communities, health and wellness centers and other healthcare related properties and services, our ability to comply and to remain in compliance with applicable Medicare, Medicaid and other federal and state regulatory, rulemaking and rate-setting requirements, our ability to access or raise debt or equity capital and our ability to sell communities we own and Diversified Healthcare Trust’s (DHC) ability to sell communities we manage, that we or DHC as applicable, may offer for sale. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, such as the impact of conditions in the economy and the capital markets on us and our residents and other customers, competition within the senior living and other health and wellness related services businesses, older adults delaying or forgoing moving into senior living communities or purchasing health and wellness services from us, increases in our labor costs or in costs we pay for goods and services, increases in tort and insurance liability costs, our operating and debt leverage, actual and potential conflicts of interest with our related parties, changes in Medicare or Medicaid policies and regulations, or the possible repeal, replacement or modification of Medicare, Medicaid or other existing or proposed legislation or regulations, which could result in reduced Medicare or Medicaid rates or a failure of such rates to cover our costs or limit the scope or funding of either or both programs, or reductions in private insurance utilization and coverage, delays or non-payments of government payments to us, compliance with, and changes to, federal, state and local laws and regulations that could affect our services or impose requirements, costs and administrative burdens that may reduce ourabilitytooperateourbusiness profitably, our exposure to litigation and regulatory and government proceedings, continued efforts by third party payers to reduce costs, and acts of terrorism, outbreaks of pandemics, including COVID-19, or other manmade or natural disasters. For example: (a) challenging conditions in the senior living industry continue to exist and our business and our operations remain subject to substantial risks, many of which are beyond our control; as a result, our operations may not be profitable in the future and we may realize losses; (b) we may not successfully execute our strategic growth initiatives, (c) we268 may not be able to successfully integrate, operate and profitably manage our senior living communities; (d) we cannot be sure that we will enter additional management arrangements23,500 with DHC; (e) our belief that the aging of the U.S. population and increasing life spans of older adults will increase demand for senior living communities and services may not be realized or may not result in increased demand for our services; (f) our investments in our workforce and continued focus on reducing our employee turnover level by enhancing our competitiveness32 in the marketplace with respectTEAM to cash compensation and other benefits may not be successfulCMPANY and may not result in the benefits we expect to achieve throughTOTAL such $ investments; RAISED (g) our marketing initiatives may not succeed in increasing our occupancy and revenues, and they may cost more than any increased revenues they may generate; (h) our strategic investments to enhance efficiencies in and benefits from our purchasing of servicesMEMBERS may not be successful or generate the returns or savings we expect;BEGAN (i) circumstances that adversely affect the ability of olderFOR adults WALK or their familiesTO to pay for our services, such as economic downturns, weakening housing market conditions, higher levels of unemployment among our residents’ or potential residents’ family members,END lower ALZHEIMER’S levels of consumer confidence, stock market volatility and/or changes in demographics generally, could affect the revenues and profitability of our senior living communities; (j) residents who pay for our services with their private resources may become unable to afford our services, resulting in decreased occupancy and decreased revenues at our senior living communities; (k) the various federal and stateSINCE government 2017 agencies that pay us for the services we provide to some of our residents are experiencing budgetary constraints and may lower the Medicare, Medicaid and other rates they pay us; (l) we may be unable to repay or refinance our debt obligations when they become due; (m) certain aspects of our operations and future growth we may pursue in our business may require significant amounts of working capital and require us to make significant capital expenditures; accordingly, we may not have sufficient cash liquidity; (n) the amount of available borrowings under our credit facility is subject to our having qualified collateral, which is primarily based on the value of the assets securing our obligations under our credit4 facility; (o) the availability of borrowings under our credit facility is subject to our satisfying certain financial covenants and other conditions that we may be unable to satisfy; (p) our actions and approachRANKING to managing ON 2019 our insurance costs may not be successful and could result in our incurring significant costs and liabilities that we will be responsible for funding; (q) contingencies in any applicable acquisition or sale agreements we or DHC have entered into, or may enter into, may not be satisfied and our and DHC's applicable acquisitions or sales, and any related management arrangements we may expectLIST to enterOF 50 into, LARGEST may not occur, may be delayed3 or the terms may change; (r) we may not be able to sell communities that we may seek to sell on terms acceptable to us or otherwise;236 (s) the advantages we believe we may realize from our relationships with related parties may not materialize; (t) operating deficiencies or a license revocation at one or more of our senior living communities may have an adverse impactU.S. on SENIR our ability to operate, obtain licenses for, or attract residents to, our other communities; (u) the various initiatives and programs we implement to improve our business operations and financial resultsHOUSING may notOPERATORS be successful; and (v)RANKING the COVID-19 ON pandemic 2019 may continue to adversely affect our business,32 operating results and financial condition for an indefinite period ofAGEILITY time, including by decreasing the occupancy of our senior living communities, causing staffing and supply shortages and increasing the costs of operating our senior living facilities.25,80 COMPILED BY J.D. POWER STATES WHERE RESIDENTS PHYSICAL THERAPY Our Annual Report on Form 10-K for the year ended December 31, 2019, our QuarterlySOLUTIONS’ Reports on CLINICS Form 10-Q for the periodsAMERICAN ended March 31, 2020, JuneSENIOR 30, 2020 and LIVING September 30, 2020, and our other filings with theIN Securities OUR andCARE Exchange CommissionIN (SEC)OUR identify CARE other important factors that could cause differences fromSENIORS our forward-looking HOUSING statements.SATISFACTION The filings with STUDY the SEC of Five Star Senior Living Inc. (Five Star or Five Star Senior Living) are available on the SEC’s website at www.sec.gov. You should not place undueASSOCIATION reliance upon (ASHA) our forward-loo king statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures including earnings before interest, income tax, depreciation and amortization (EBITDA) and Adjusted EBITDA. Reconciliations for these metrics to the closest U.S. generally accepted accounting principles (GAAP) metrics are included later in this investor presentation. We believe the non-GAAP financial measures included in this investor presentation are meaningful supplemental disclosures because they may help investors better understand changes in our operating results and ability to pay rent or service debt, make capital expenditures and expand our business. These non-GAAP financial measures may also help investors make comparisons between us and other companies on both a GAAP and non-GAAP basis. We believe that EBITDA and Adjusted EBITDA are meaningful financial measures that may help investors better understand our financial performance, including by allowing investors to compare our performance between periods and to the performance of other companies. Note: Data throughout this presentation is as of and for the three months ended September 30, 2020, unless otherwise noted. Also, statements about the 2 industry and demographics relate to the United States.

Business at a Glance Five Star Senior Living National Operator with . Ranks fourth on the 2020 American Seniors Housing Scale and Diversification Association’s (ASHA) list of largest U.S. senior housing operators. . Serves approximately 23,000 older adult residents in 262(1) senior living communities with 30,413(1) living units across 31 states, offering Independent Living (IL), Assisted Living (AL), Alzheimer’s/Memory Care (ALZ), Continuing Care Retirement Communities (CCRC) and Stand-Alone Skilled Nursing (SNF). Phoe . Ageility, a Five Star division, provides rehabilitation and wellness nix Top 10 states services to approximately 10,000 older adult clients in 249 clinics across 28 states. All other states . Employs nearly 21,000 team members. Ageility Presence Revenue Mix(1) Senior Living Unit Mix(1) Owned and Leased SNF Senior Living • Operates 209 outpatient CCRC 4% Communities rehabilitation clinics, 21% more than 7% 34% a year ago. ALZ • Operates 40 inpatient clinics within AL 12% 41% Rehabilitation Five Star communities. Management Fees and Wellness from Senior Living Services • Significant opportunity for IL Communities 38% accelerated growth serving older 36% 28% adult demographic. 3 (1) Excludes one senior living community we managed for DHC that DHC sold on November 1, 2020 and is no longer managed by us.

Senior Living Spectrum Alzheimer’s (ALZ)/ Continued Care Retirement Stand-Alone Skilled Nursing Independent Living (IL) Assisted Living (AL) Memory Care(1) Community (CCRC) (SNF) . Residents have a high . One bedroom . A dedicated, secure . Accommodations for . High level of medical degree of functional units with unit in assisted living independent living, care provided by independence in large, kitchenettes. or a stand alone assisted living and licensed health private units. community. nursing care, offering a professions. . Services include continuum of care. . . Daily meals, laundry, medication . Bridge to Rediscovery™ Short term care for management and housekeeping and program. . Healthcare units with rehabilitation from assistance with social activities are intensive rehabilitation illness or injury, or activities of daily living. provided. capabilities. long-term care for chronic medical . Nursing care available. conditions. Total Living Units: 10,996 Total Living Units: 2,124 Total Living Units: 12,588 Total Living Units: 3,494 Total Living Units: 1,211 Managed(2)(3)(4): Managed(2)(4)(5): Managed(2)(4): 11,137 Managed(2)(4): 3,197 Managed(2)(4): 1.211 10,432 2,124 Owned: 1,274 Owned: 270 Owned: - Owned: 564 Owned: - Leased(6): 177 Leased(6): 27 Leased: - Leased: - Leased: - (1) ALZ/memory care is included within AL in our Q3 2020 Quarterly Report on Form 10-Q and our press release included in our Current Report on Form 8-K dated November 5, 2020. (2) Excludes data from one senior living community we managed for DHC that DHC sold on November 1, 2020. (3) Includes one active adult community with 168 units. (4) Managed on behalf of DHC. (5) The unit count represents only the SNF units at our CCRCs. (6) Leased from Healthpeak Properties Inc. (NYSE: PEAK). 4

The Five Star Value Our success is built on four foundational elements that drive performance, customer loyalty and competitiveness. Exceptional Resident Experience: . A holistic approach to elevate, enhance and enrich the lives of our residents. Team Member Engagement: . Achieve continual reduction in turnover rates. . Commitment to team members through rewards and recognition and learning and development. . Recruiting toolkit and national network in place to support our communities in the acquisition of talent uniquely suited to be successful at Five Star. Operational Efficiency: . Drive RevPAR(1) and RevPOR(2) accretion. . Execute rate optimization as we navigate through COVID-19 impacts on census. . Improved operating cost structure for targeted savings of $8-$10 million annually in our senior living segment upon stabilization of implemented programs. Focus on Continued Growth: . Grow rehabilitation and wellness services segment through opening new Ageility clinics and adding fitness platform capabilities to expand beyond rehabilitation services. In the third quarter of 2020, Ageility experienced revenue growth of 16% over the prior year quarter on a pro forma basis(3), and contributed 38% of our overall operating revenues. . Continue to focus on opportunities to drive our senior living revenues, including expanding management of active adult and senior living communities. (1) RevPAR, or average monthly senior living revenue per available unit, is defined by us as resident fee revenues for the portfolio for the period divided by the average number of available units for the period, divided by the number of months in the period. Average number of available units for the period includes only living units categorized as in service. (2) RevPOR, or average monthly rate of senior living revenue per occupied unit, is defined by us as resident fee revenues for the portfolio divided by the average number of occupied units for the period, divided by the number of months in the period. (3) Compared to Pro Forma Q3 2019. For a reconciliation of Pro Forma data, refer to the Pro Forma Condensed Consolidated Statement of Operations within our press release included in our Current Report on 5 Form 8-K dated November 5, 2020.

Exceptional Resident Experience Our focus on the resident experience is grounded in market research and a deep understanding of our customer. Resident Engagement and Services: . We provide comprehensive resident programming, including Lifestyle 360, our signature resident enrichment program, and Bridge to Rediscovery™, our award-winning memory care program designed to provide our residents fulfilling lives and positive experiences. . Our culinary experience offers exceptional and creative chef crafted meals, focusing on nutritional health, seasonal variety and social engagement. . Local excellence, design and flair is supported by a central facilities function and a robust capital management program. COVID-19 Resident Support(1): . We have continued to prioritize the safety and well-being of our residents, with survey data confirming the majority of residents feel positively or neutrally about their care and well- being, the frequency and efficacy of our communication and the quality, flavor and variety of our in-room dining options. . We have implemented new group activities that allow for engagement while maintaining social distancing. . We continue to provide devices and connectivity options for interaction with family members, as well as virtual programming opportunities and distance learning. . We offer complimentary counseling and support services for residents. (1) In response to a resident and family member survey conducted during the COVID-19 pandemic, 95% of responders replied favorably or neutrally to feeling well supported or cared for during this time, 91% replied favorably or neutrally to the frequency and efficacy of communication in keeping resident and family members informed and 83% replied favorably or neutrally that Five Star's in-room dining program 6 continued to provide quality, flavor and variety during this time.

Team Member Engagement Attracting, inspiring and retaining great talent remains the biggest challenge and opportunity in our industry. We are a service organization and our team members are our most important asset. Investing in our team members will drive an exceptional resident and client experience. Key initiatives: . Attract and select talented individuals uniquely suited to be successful at Five Star. . Build upon our new learning management platform to provide training and development opportunities for all team members. . Execute on recognition through rewards and career advancement. . Grow and foster a culture of accountability, transparency and innovation. 7

Operational Efficiency National company with the ability to support communities at scale. . Five Star's internal operational excellence framework is founded on the operational best practices outlined in the J.D. Power Senior Living Community Certification Program and is intended to drive an exceptional resident experience along with consistently high performance across our portfolio. . Revenue management program to execute dynamic pricing by combining internal data points in conjunction with external market research to optimize revenue at each community. . Strategic sourcing designed to govern consistency in spend practices throughout the organization, leverage scale for better pricing and tighten controls to achieve maximum cost efficiencies. 8

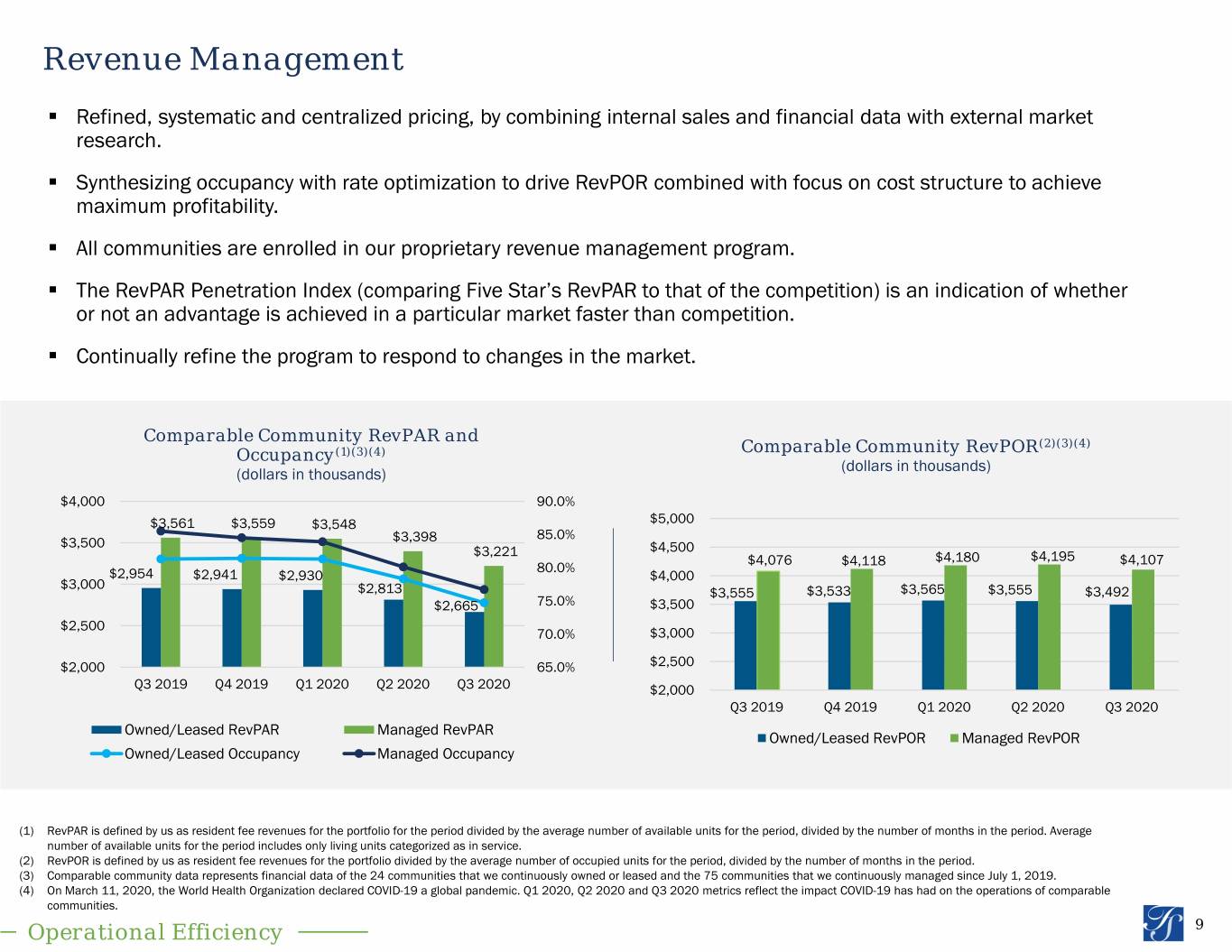

Revenue Management . Refined, systematic and centralized pricing, by combining internal sales and financial data with external market research. . Synthesizing occupancy with rate optimization to drive RevPOR combined with focus on cost structure to achieve maximum profitability. . All communities are enrolled in our proprietary revenue management program. . The RevPAR Penetration Index (comparing Five Star’s RevPAR to that of the competition) is an indication of whether or not an advantage is achieved in a particular market faster than competition. . Continually refine the program to respond to changes in the market. Comparable Community RevPAR and (2)(3)(4) Occupancy(1)(3)(4) Comparable Community RevPOR (dollars in thousands) (dollars in thousands) $4,000 90.0% $3,561 $3,559 $3,548 $5,000 85.0% $3,500 $3,398 $3,221 $4,500 $4,076 $4,180 $4,195 $4,107 80.0% $4,118 $2,954 $2,941 $2,930 $4,000 $3,000 $2,813 $3,555 $3,533 $3,565 $3,555 $3,492 $2,665 75.0% $3,500 $2,500 70.0% $3,000 $2,000 65.0% $2,500 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 $2,000 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Owned/Leased RevPAR Managed RevPAR Owned/Leased RevPOR Managed RevPOR Owned/Leased Occupancy Managed Occupancy (1) RevPAR is defined by us as resident fee revenues for the portfolio for the period divided by the average number of available units for the period, divided by the number of months in the period. Average number of available units for the period includes only living units categorized as in service. (2) RevPOR is defined by us as resident fee revenues for the portfolio divided by the average number of occupied units for the period, divided by the number of months in the period. (3) Comparable community data represents financial data of the 24 communities that we continuously owned or leased and the 75 communities that we continuously managed since July 1, 2019. (4) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020, Q2 2020 and Q3 2020 metrics reflect the impact COVID-19 has had on the operations of comparable communities. Operational Efficiency 9

Owned and Leased Senior Living Other Operating Expenses(1)(2)(3) Strategic Sourcing $6,717 $7,000 $5,858 $6,000 Initiatives to Manage Costs $5,000 $4,000 . Evaluate spend practices throughout the $3,294 organization. $3,000 . Leverage scale for efficient pricing. $2,000 $1,000 . Streamline sourcing opportunities within senior $- living operating costs. Q1 2020 Q2 2020 Q3 2020 . Benefits include enhanced governance, tightened controls and improved vendor relationships. Managed Senior Living Other Operating Focus on Improved Outcomes Expenses(1)(3)(4) $120,000 . Plan to achieve $8-$10 million annually in cost $97,205 $95,621 $100,943 savings in senior living segment, including costs $100,000 incurred by the communities we manage for DHC, $80,000 upon completion of roll-out of initiatives in 6 to 9 $60,000 months. Full cost savings is expected in 2021. $40,000 $20,000 $- Q1 2020 Q2 2020 Q3 2020 (1) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020, Q2 2020 and Q3 2020 metrics reflect the impact COVID-19 has had on the operations of senior living communities. (2) Reflects adjustments to arrive at Adjusted EBITDA that impact owned and leased senior living operating expenses. As a result, Q2 2020 expenses do not include $2.5 million in costs associated with the agreed upon settlement of a lawsuit. (3) Other senior living operating expenses excludes wages and benefits. (4) Managed senior living operating expenses represent financial data of communities we manage for the account of DHC and do not represent financial results of Five Star. Managed communities data is included to provide supplemental information regarding the operating results of the communities from which we earn management fees. Operational Efficiency 10

Continued Growth . Expansion into new business lines like active adult communities is providing new opportunities for accelerated growth. . We continue to see significant growth in our Ageility division, which operates in 28 states, and the number of clinics opened has a 5-year CAGR(1) of 18%. . Has the ability to expand through fitness offerings that are beyond traditional rehabilitation service offerings. Fitness offerings represented 3.0% of our rehabilitation and wellness services revenues for Q3 2020 and growth of 60.5% over Q3 2019. . Average investment in new clinic startups ranges between $20 - $30 thousand over the past three quarters. Clinics and Affiliations Impatient and Outpatient Visits(2) (in thousands) 300 231 244 246 249 218 300 251 233 243 223 237 200 200 100 100 - - Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Five Star Communities Non-Five Star Communities Inpatient Visits Outpatient Visits Revenues and Operating Margin by Quarter(2)(3) Revenues and Operating Margin by Clinic (dollars in thousands) (dollars in thousands) $22,000 35% $90 35% $21,043 $20,797 $85 $86 $84 $20,000 25% $85 $18,218 $18,879 $79 25% $17,914 $80 $77 $18,000 15% $75 15% $16,000 5% $70 5% Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Revenues Operating Margin Revenues Operating Margin (1) Compound annual growth rate, or CAGR, represents the annualized growth rate of the number of Ageility clinics determined by net new clinics for the period from October 1, 2015 through September 30, 2020. (2) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020, Q2 2020 and Q3 2020 metrics reflect the impact COVID-19 has had on the operations of Ageility clinics. (3) Revenues and operating margin exclude elimination adjustments upon consolidation, COVID-19 relief funds and the results of our home health operations. Continued Growth 11

Unwavering Focus on our Customers Five Star's management expertise lies in our ability to understand and internalize national trends, work through challenges and leverage long-term partnerships to continuously evolve our product and capitalize on future opportunities. We leverage several innovative strategic partners to drive the ongoing evolution of our service offerings to meet changing consumer preferences. MIT Agelab™ . Access to insightful research. . Network of potential strategic partners. . Branding and differentiation opportunities. . Hosted MIT AgeLab’s first national OMEGA Summit (Opportunities for Multigenerational Exchange, Growth and Action) to inspire innovative and differentiated programming for our communities and career opportunities in the senior living industry for the students involved. National Senior Games™ . Demonstrated affinity with wellness of older adults. . Strategic positioning opportunities for both Five Star and Ageility. Aging2.0™ . Platform for Five Star to collaborate with other industry leaders in aging services and related fields to address biggest challenges and opportunities focused on older adult demographic. . Strategic alignment across industries and related fields will create an interdisciplinary, intergenerational and interactive ecosystem of innovative products and services for older adults. 12

COVID-19 Life is a Journey. Who you travel with matters.

COVID-19 Impacts Communities with COVID-19 Cases(1) 11% 18% 71% Communities with zero active cases Communities with 1-2 active cases Communities with 3+ active cases New Confirmed Resident Cases of COVID-19(1) 120 107 90 100 84 79 75 80 66 71 70 66 67 60 59 60 50 40 40 40 44 35 39 36 39 34 40 29 32 17 18 22 20 0 0 (1) Includes all senior living communities that were owned, leased or managed by Five Star as of September 30, 2020. 14

COVID-19 Impacts 96% of communities are accepting new residents in at least one service line of business (IL, AL, SNF or ALZ). Leads, Move-Ins and Move-Outs(1) 15,200 16,000 14,000 12,160 12,000 10,000 8,806 8,000 5,328 6,000 4,743 3,982 4,168 4,000 3,075 2,710 2,000 - Q1 2020 Q2 2020 Q3 2020 Leads Move-Ins Move Outs (1) Includes all senior living communities that were owned, leased or managed by Five Star as of September 30, 2020. 15

Financial Overview

Key Financial Metrics Strong Balance Sheet . Liquidity: . $95.8 million of unrestricted cash and cash equivalents on hand. . No borrowings outstanding under $65.0 million(1) revolving credit facility secured by 11 communities with a net book value of $95.8 million. . Own eight unencumbered AL/IL communities with 742 living units and a net book value of $40.9 million. Financial Performance . Generated Adjusted EBITDA of $6.8 million. . Achieved $2.9 million, or 16%(2), growth in Ageility primarily due to the stabilization of clinics opened in 2019. COVID-19 Expected Impact in Q4 2020 . Declines in census. . Higher costs related to personal protective equipment, labor, insurance and other operating costs. . Delayed construction management projects, including planned openings of new Ageility clinics. (1) The amount of available borrowings under our revolving credit facility is subject to qualifying collateral and reduced by issued letters of credit. At September 30, 2020, we had letters of credit issued of $2.4 million and $42.7 million available for borrowings under our revolving credit facility. (2) Compared to Pro Forma Q3 2019. For a reconciliation of Pro Forma data, refer to the Pro Forma Condensed Consolidated Statement of Operations within our press release included in our Current Report on Form 8-K dated November 5, 2020. Financial Overview 17

Condensed Consolidated Statement of Operations Compared to Q3 2019 Pro Forma Results (in thousands) (unaudited) Three Months Ended Actual Pro Forma September 30, September 30, 2020 2019 Revenues Senior living $ 18,525 $ 20,499 Management fees 15,302 17,801 Rehabilitation and wellness services 21,124 18,248 Total management and operating revenues 54,951 56,548 Reimbursed community-level costs incurred on behalf of managed communities 233,783 263,029 Other reimbursed expenses 6,589 - Total revenues 295,323 319,577 Operating expenses Senior living wages and benefits 11,128 9,815 Other senior living operating expenses 6,717 7,334 Rehabilitation and wellness services expenses 16,124 16,213 Community-level costs incurred on behalf of managed communities 233,783 263,029 General and administrative 19,916 15,051 Rent 1,282 1,044 Depreciation and amortization 2,680 2,754 Toal operating expenses 291,630 315,240 Other income 487 355 Provision for income taxes (465) (1,225) Net income $ 3,715 $ 3,467 Financial Overview 18

EBITDA and Adjusted EBITDA (in thousands) (unaudited) Three Months Ended Actual Pro Forma Actual September 30, September 30 June 30, March 31, December 31, September 30, 2020 2019 2020 2020 2019 2019 Net income (loss) $ 3,715 $ 3,467 $ 3,002 $ (17,209) $ 16,105 $ (7,066) Add (less): Interest and other expense 379 281 409 382 419 384 Interest, dividend and other income (104) (414) (182) (339) (379) (414) Provision (benefit) for income taxes 465 1,225 (902) 1,408 (42) (687) Depreciation and amortization 2,680 2,754 2,703 2,701 2,716 2,818 EBITDA 7,135 7,313 5,030 (13,057) 18,819 (4,965) Add (less): Long-lived asset impairment - - - - 4 18 Loss on sale of senior living - - - - 6 749 communities Unrealized (gain) loss on equity (435) (148) (867) 1,462 (306) (148) investments Severance - - 282 - - - Loss on termination of leases(1) - - - 22,899 - - Lease inducement(2) - - - - (12,423) - Deferred resident fees and deposits(3) - - - - (4,242) - Transaction costs(4) 142 - 175 1,095 1,814 1,330 Litigation settlement - - 2,473 - - - Adjusted EBITDA $ 6,842 $ 7,165 $ 7,093 $ 12,399 $ 3,672 $ (3,016) (1) Represents the excess of the fair value of the Share Issuances of $97,899 compared to the consideration of $75,000 paid by DHC. (2) Lease inducement recognized for Q4 2019 as a result of the completion of the Restructuring Transactions. (3) Deferred resident fees and deposits related to senior living communities Five Star previously leased from, and now manages for the account of, DHC, as a result of the completion of the Restructuring Transactions. (4) Costs incurred related to the Restructuring Transactions. Financial Overview 19

Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Nine Months Ended Three Months Ended September 30, September 30, June 30, March 31, 2020 2020 2020 2020 CASH FLOW FROM OPERATING ACTIVITIES: Net (loss) income $ (10,492) $ 3,715 $ 3,002 $ (17,209) Adjustments to reconcile net (loss) income to cash provided by operating activities Non-cash income and expense adjustments, net 32,536 2,124 2,670 27,742 Changes in assets and liabilities(1)(2) 39,996 16,043 29,019 (5,066) Net cash provided by investing activities 62,040 21,882 34,691 5,467 CASH FLOW FROM INVESTING ACTIVITIES: Acquisition of property and equipment(2) (4,132) (1,011) (1,108) (2,013) Purchases of debt and equity investments (5,688) (596) (3,504) (1,588) Proceeds from sale of property and equipment 2,725 - - 2,725 Distributions in excess of earnings from Affiliates Insurance Company 287 - 287 - Proceeds from sale of debt and equity investments 9,078 4,227 3,398 1,453 Net cash provided by (used in) investing activities 2,270 2,620 (927) 577 CASH FLOW FROM FINANCING ACTIVITIES: Costs related to issuance of common stock (559) - - (559) Repayments of mortgage note payable (288) (98) (95) (95) Targeted SNF distribution funds received on behalf of others - (4,715) 4,715 - Net cash (used in) provided by financing activities (847) (4,813) 4,620 (654) Change in cash and cash equivalents and restricted cash and restricted cash equivalents 63,463 19,689 38,384 5,390 Cash and cash equivalents and restricted cash and restricted cash equivalents at beginning of period 56,979 100,753 62,369 56,979 Cash and cash equivalents and restricted cash and restricted cash equivalents at end of period $ 120,442 $ 120,442 $ 100,753 $ 62,369 Reconciliation of cash and cash equivalents and restricted cash and cash equivalents: Cash and cash equivalents $ 95,779 $ 95,779 $ 76,114 $ 36,641 Current restricted cash and cash equivalents 23,842 23,842 23,858 24,290 Other restricted cash and cash equivalents 821 821 781 1,438 Cash and cash equivalents and restricted cash and cash equivalents at end of period $ 120,442 $ 120,442 $ 100,753 $ 62,369 (1) Changes in assets and liabilities includes the receipt of $23.5 million of cash from DHC related to the Restructuring Transactions. (2) Net cash provided by operating activities, net cash provided by investing activities and CapEx spend for the three months ended March 31, 2020 reflect reclassification adjustments of certain DHC reimbursements from the prior period to conform to the current period presentation. Financial Overview 20

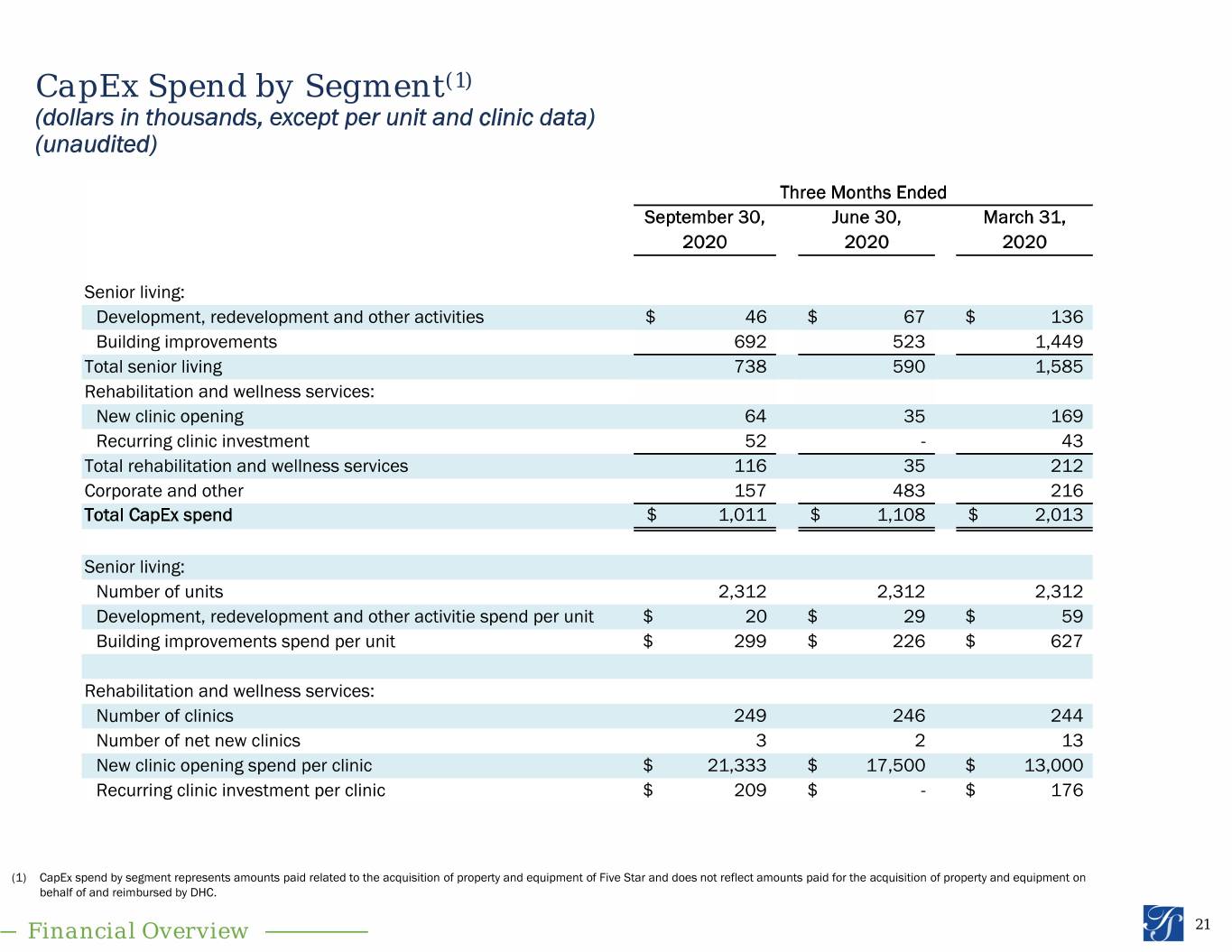

CapEx Spend by Segment(1) (dollars in thousands, except per unit and clinic data) (unaudited) Three Months Ended September 30, June 30, March 31, 2020 2020 2020 Senior living: Development, redevelopment and other activities$ 46 $ 67 $ 136 Building improvements 692 523 1,449 Total senior living 738 590 1,585 Rehabilitation and wellness services: New clinic opening 64 35 169 Recurring clinic investment 52 - 43 Total rehabilitation and wellness services 116 35 212 Corporate and other 157 483 216 Total CapEx spend $ 1,011 $ 1,108 $ 2,013 Senior living: Number of units 2,312 2,312 2,312 Development, redevelopment and other activitie spend per unit$ 20 $ 29 $ 59 Building improvements spend per unit$ 299 $ 226 $ 627 Rehabilitation and wellness services: Number of clinics 249 246 244 Number of net new clinics 3 2 13 New clinic opening spend per clinic$ 21,333 $ 17,500 $ 13,000 Recurring clinic investment per clinic$ 209 $ - $ 176 (1) CapEx spend by segment represents amounts paid related to the acquisition of property and equipment of Five Star and does not reflect amounts paid for the acquisition of property and equipment on behalf of and reimbursed by DHC. Financial Overview 21

Appendix

Strong Management Team Katherine Potter President and Chief Executive Officer Katherine is President and Chief Executive Officer of Five Star. Katherine previously served as Executive Vice President and General Counsel since 2018, Senior Vice President and General Counsel since 2016, and Vice President and General Counsel since 2012. Prior to joining Five Star, Katherine practiced law at Sullivan & Worcester LLP and Burns & Levinson LLP, where she focused on corporate law matters, including securities, mergers and acquisitions, corporate governance and other transactional matters. Jeff Leer Executive Vice President, Chief Financial Officer and Treasurer Jeff is Executive Vice President, Chief Financial Officer and Treasurer of Five Star. Prior to joining Five Star, Jeff served as Chief Financial Officer and Treasurer of Office Properties Income Trust and he has been serving as Senior Vice President of The RMR Group LLC, where he has been responsible for the day to day oversight of the accounting and finance support functions of The RMR Group and its various affiliates. Prior to joining The RMR Group LLC, Jeff held various accounting and finance positions at several multi-national Fortune 500 companies as well as the public accounting firm, Vitale, Caturano PC (predecessor to RSM US LLP). Jeff is also a certified public accountant. Margaret Wigglesworth Senior Vice President and Chief Operating Officer Margaret is Senior Vice President and Chief Operating Officer of Five Star. Margaret has held various executive roles at large organizations over the past three decades where she was responsible for operations and change management. Prior to joining Five Star, Margaret held positions at International Council of Shopping Centers, Cresa and Colliers International USA. 23

A New Transition Completed Transaction with DHC Completed the restructuring of Five Star’s business arrangements with DHC. On January 1, 2020, entered into new management agreements to operate all senior living communities we leased from and managed for the account of DHC as of December 31, 2019. Financial restructuring immediately improved Five Star’s financial position and liquidity. Highlights of New Management Agreements. A 15-year term commenced on January 1, 2020, with two, five-year extensions at Five Star’s option, subject to maintaining portfolio financial performance. A base management fee of 5% of community gross revenues and a 3% fee on capital projects managed by Five Star. An incentive fee of 15% of annual property level EBITDA on a combined basis for the total portfolio in excess of an EBITDA-based performance target, subject to a limit of up to 1.5% of portfolio gross annual revenues, beginning in 2021. Performance target increases annually based on the greater of the annual increase of the Consumer Price Index (CPI) or 2%, plus 6% of any capital investments funded at the managed senior living communities in excess of capital investment target. Unless otherwise agreed, capital investment target increases annually based on the greater of the annual increase of CPI or 2%. 24

Thank You