Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ISTAR INC. | star-09302020earningsr.htm |

| EX-99.1 - EXHIBIT 99.1 - ISTAR INC. | istarreportsq320resultsf.htm |

Q3 ‘20 Earnings Results (NYSE: STAR)

Forward-Looking Statements and Other Matters Statements in this presentation which are not historical fact may be deemed forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although iStar believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its expectations will be attained. The Company undertakes no obligation to update or publicly revise any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation should be read in conjunction with our consolidated financial statements and related notes in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and our Annual Report on Form 10-K for the year ended December 31, 2019. In assessing all forward-looking statements herein, readers are urged to read carefully all cautionary statements in our Form 10-K and Form 10-Q. Factors that could cause actual results to differ materially from iStar’s expectations include general economic conditions and conditions in the commercial real estate and credit markets, the effect of the COVID-19 pandemic on our business and growth prospects, the Company’s ability to grow its ground lease business directly and through SAFE, the Company’s ability to generate liquidity and to repay indebtedness as it comes due, additional loan loss provisions and asset impairments, the market demand for legacy assets the Company seeks to sell and the pricing and timing of such sales, changes in NPLs, repayment levels, the Company's ability to make new investments, the Company’s ability to maintain compliance with its debt covenants, the Company’s ability to generate income and gains from its portfolio and other risks detailed in “Risk Factors” in our 2019 Annual Report on Form 10-K, and any updates thereto made in our subsequent fillings with the SEC. Important Note re COVID-19: Readers of this presentation are cautioned that, due to the uncertainty created by the COVID-19 pandemic, our results for the quarter may not be indicative of our results for the remainder of 2020. Readers are urged to read our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 when it is filed with the SEC for a more fulsome discussion of our quarterly results, including the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" sections included therein. Note: Please refer to the “Glossary” section in the Appendix for a list of defined terms and metrics. Investor Relations Contact Jason Fooks Senior Vice President 212.930.9400 investors@istar.com 1

I. Highlights 2

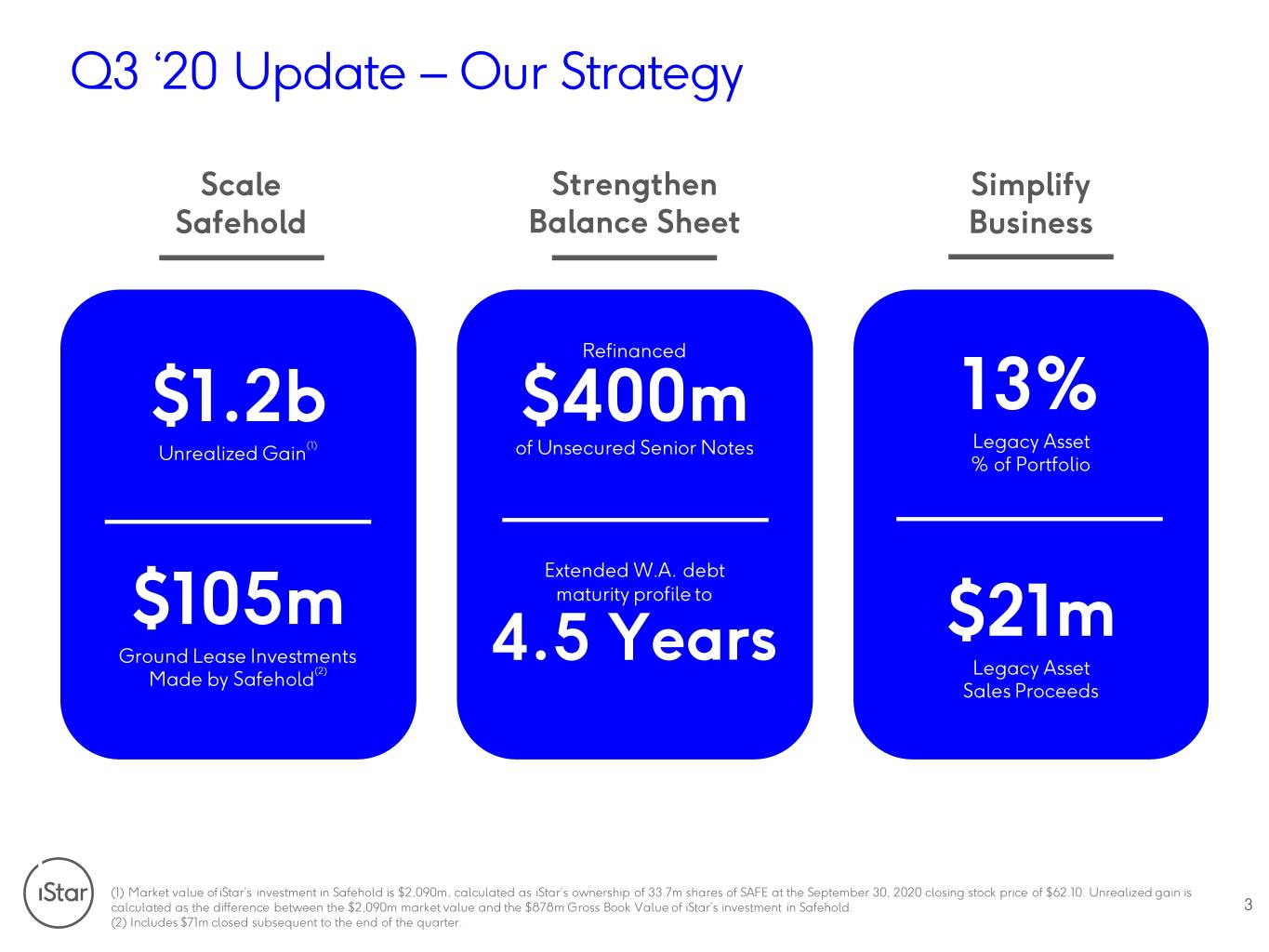

Q3 ‘20 Update – Our Strategy Scale Strengthen Simplify Safehold Balance Sheet Business Refinanced $1.2b $400m 13% (1) Legacy Asset Unrealized Gain of Unsecured Senior Notes % of Portfolio Extended W.A. debt $105m maturity profile to $21m Ground Lease Investments 4.5 Years (2) Legacy Asset Made by Safehold Sales Proceeds (1) Market value of iStar’s investment in Safehold is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Unrealized gain is calculated as the difference between the $2,090m market value and the $878m Gross Book Value of iStar’s investment in Safehold. 3 (2) Includes $71m closed subsequent to the end of the quarter.

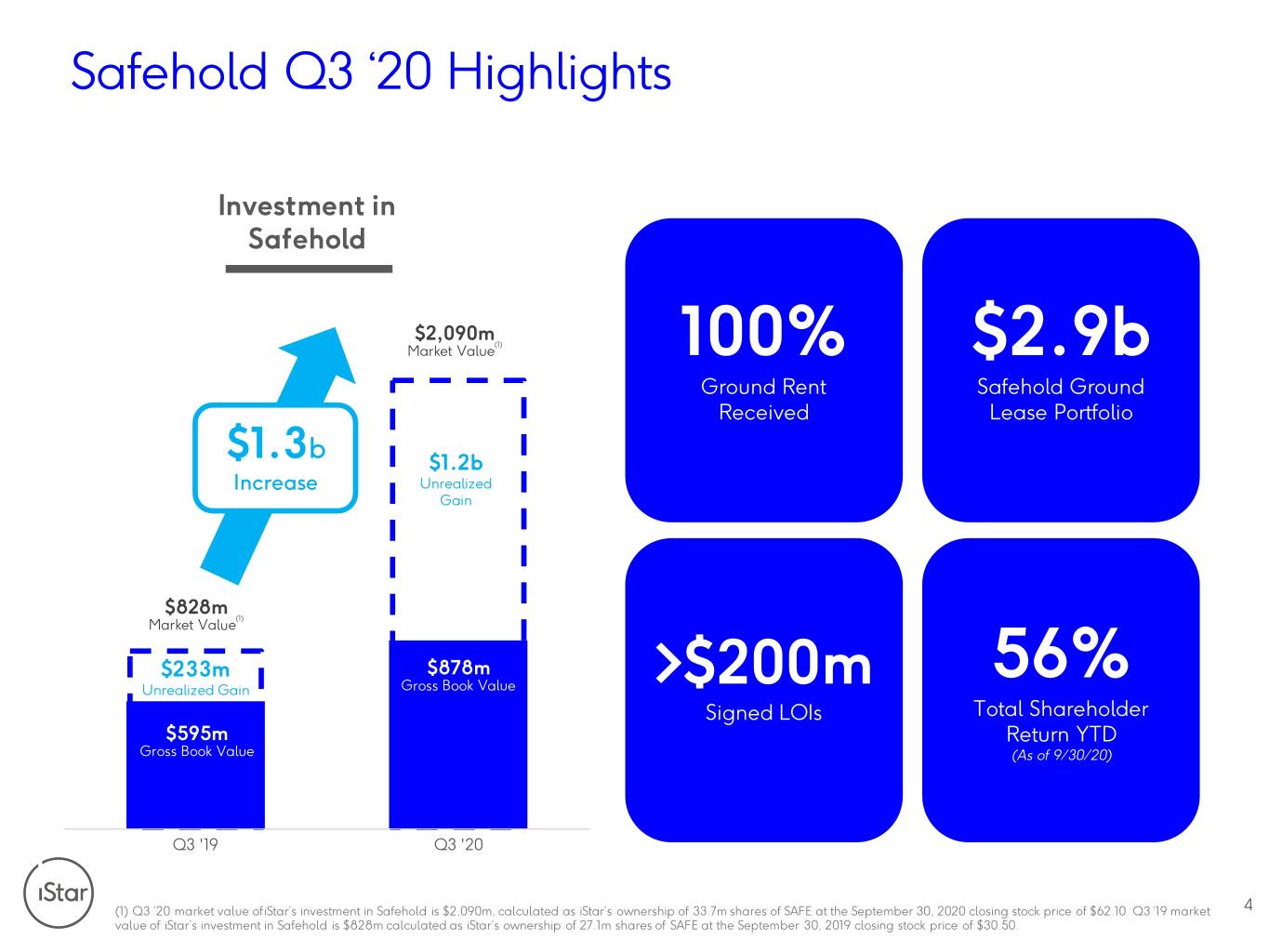

Safehold Q3 ‘20 Highlights Investment in Safehold $2,090m (1) Market Value 100% $2.9b Ground Rent Safehold Ground Received Lease Portfolio $1.3b $1.2b Increase Unrealized Gain $828m (1) Market Value $233m $878m Gross Book Value 56% Unrealized Gain >$200m Signed LOIs Total Shareholder $595m Return YTD Gross Book Value (As of 9/30/20) Q3 '19 Q3 '20 (1) Q3 ‘20 market value of iStar’s investment in Safehold is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Q3 ‘19 market 4 value of iStar’s investment in Safehold is $828m calculated as iStar’s ownership of 27.1m shares of SAFE at the September 30, 2019 closing stock price of $30.50.

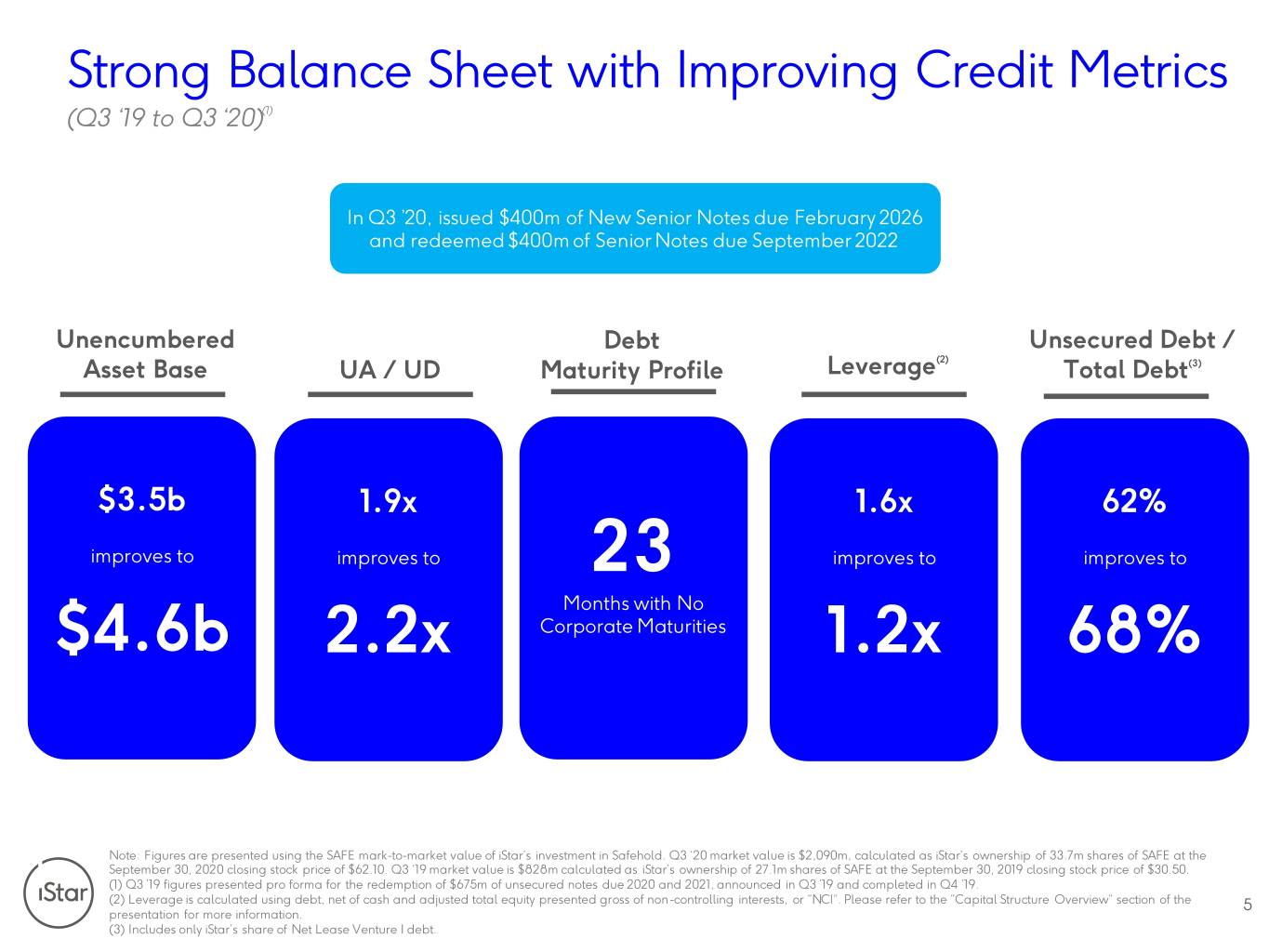

Strong Balance Sheet with Improving Credit Metrics (Q3 ‘19 to Q3 ‘20)(1) In Q3 ’20, issued $400m of New Senior Notes due February 2026 and redeemed $400m of Senior Notes due September 2022 Unencumbered Debt Unsecured Debt / Asset Base UA / UD Maturity Profile Leverage(2) Total Debt(3) $3.5b 1.9x 1.6x 62% improves to improves to 23 improves to improves to Months with No $4.6b 2.2x Corporate Maturities 1.2x 68% Note: Figures are presented using the SAFE mark-to-market value of iStar’s investment in Safehold. Q3 ‘20 market value is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Q3 ‘19 market value is $828m calculated as iStar’s ownership of 27.1m shares of SAFE at the September 30, 2019 closing stock price of $30.50. (1) Q3 ’19 figures presented pro forma for the redemption of $675m of unsecured notes due 2020 and 2021, announced in Q3 ’19 and completed in Q4 ’19. (2) Leverage is calculated using debt, net of cash and adjusted total equity presented gross of non-controlling interests, or “NCI”. Please refer to the “Capital Structure Overview” section of the 5 presentation for more information. (3) Includes only iStar’s share of Net Lease Venture I debt.

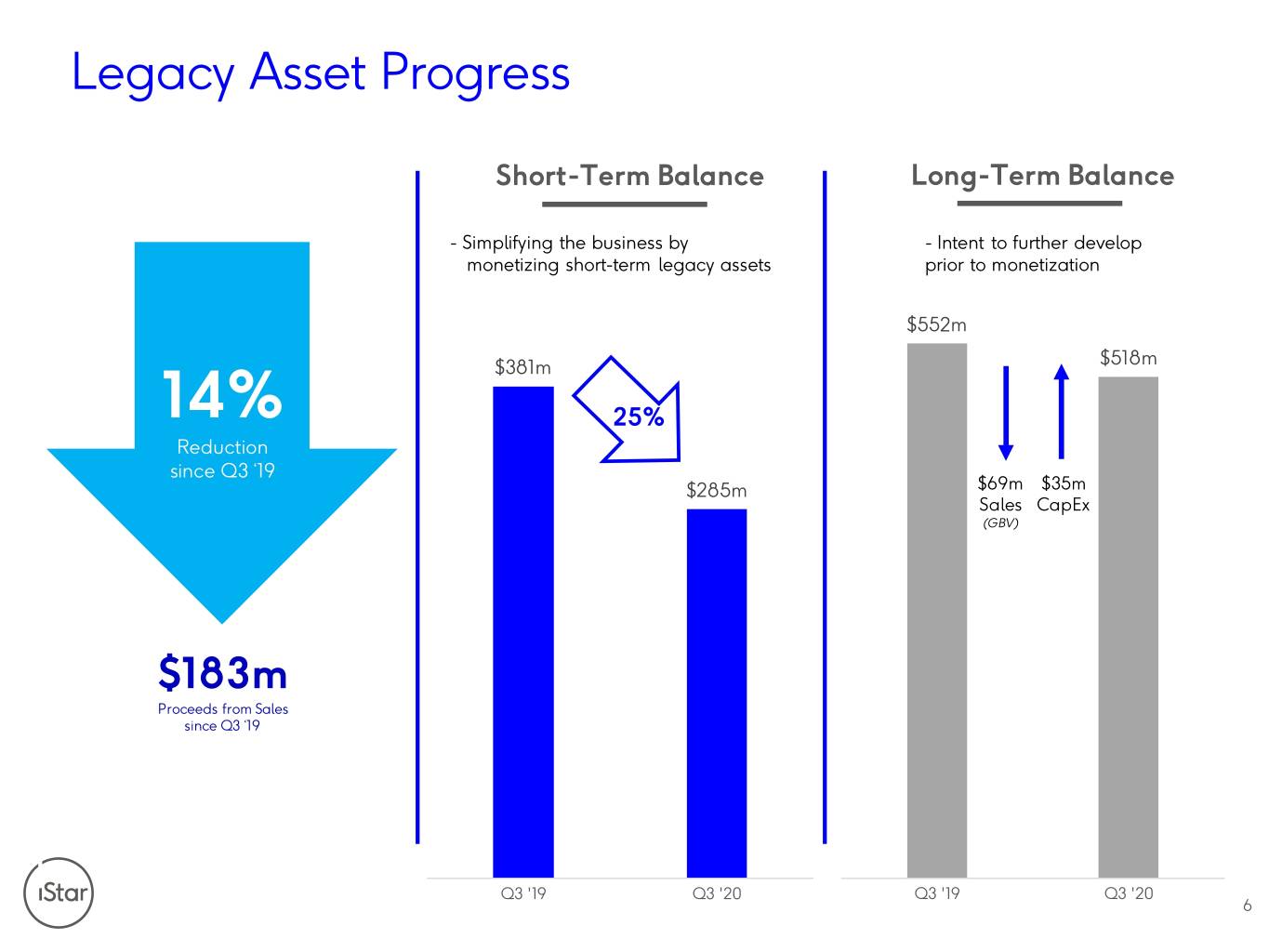

Legacy Asset Progress Short-Term Balance Long-Term Balance - Simplifying the business by - Intent to further develop monetizing short-term legacy assets prior to monetization $552m $381m $518m 14% 25% Reduction since Q3 ‘19 $285m $69m $35m Sales CapEx (GBV) $183m Proceeds from Sales since Q3 ‘19 Q3 '19 Q3 '20 Q3 '19 Q3 '20 6

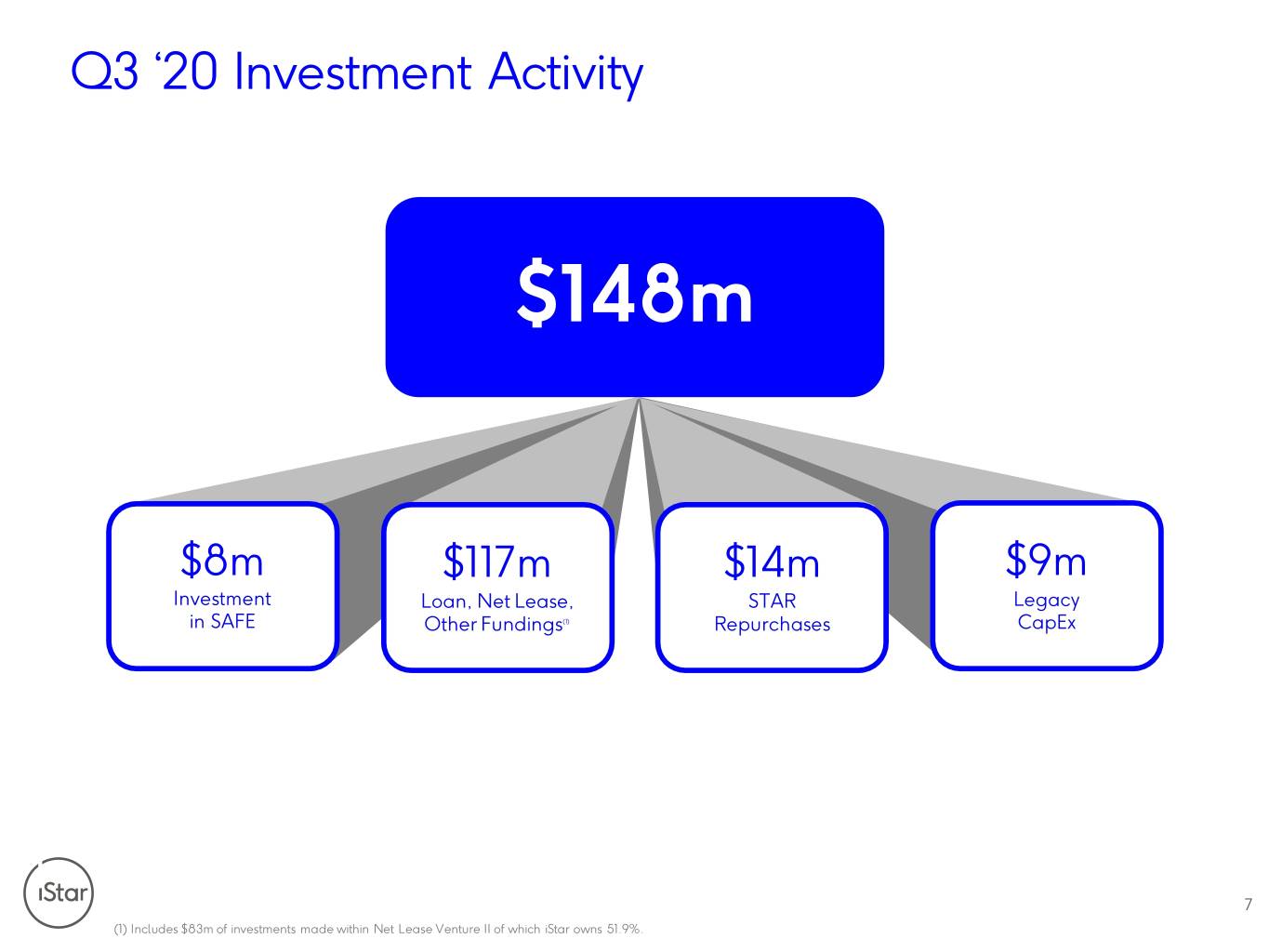

Q3 ‘20 Investment Activity $148m $8m $117m $14m $9m Investment Loan, Net Lease, STAR Legacy in SAFE Other Fundings( 1) Repurchases CapEx 7 (1) Includes $83m of investments made within Net Lease Venture II of which iStar owns 51.9%.

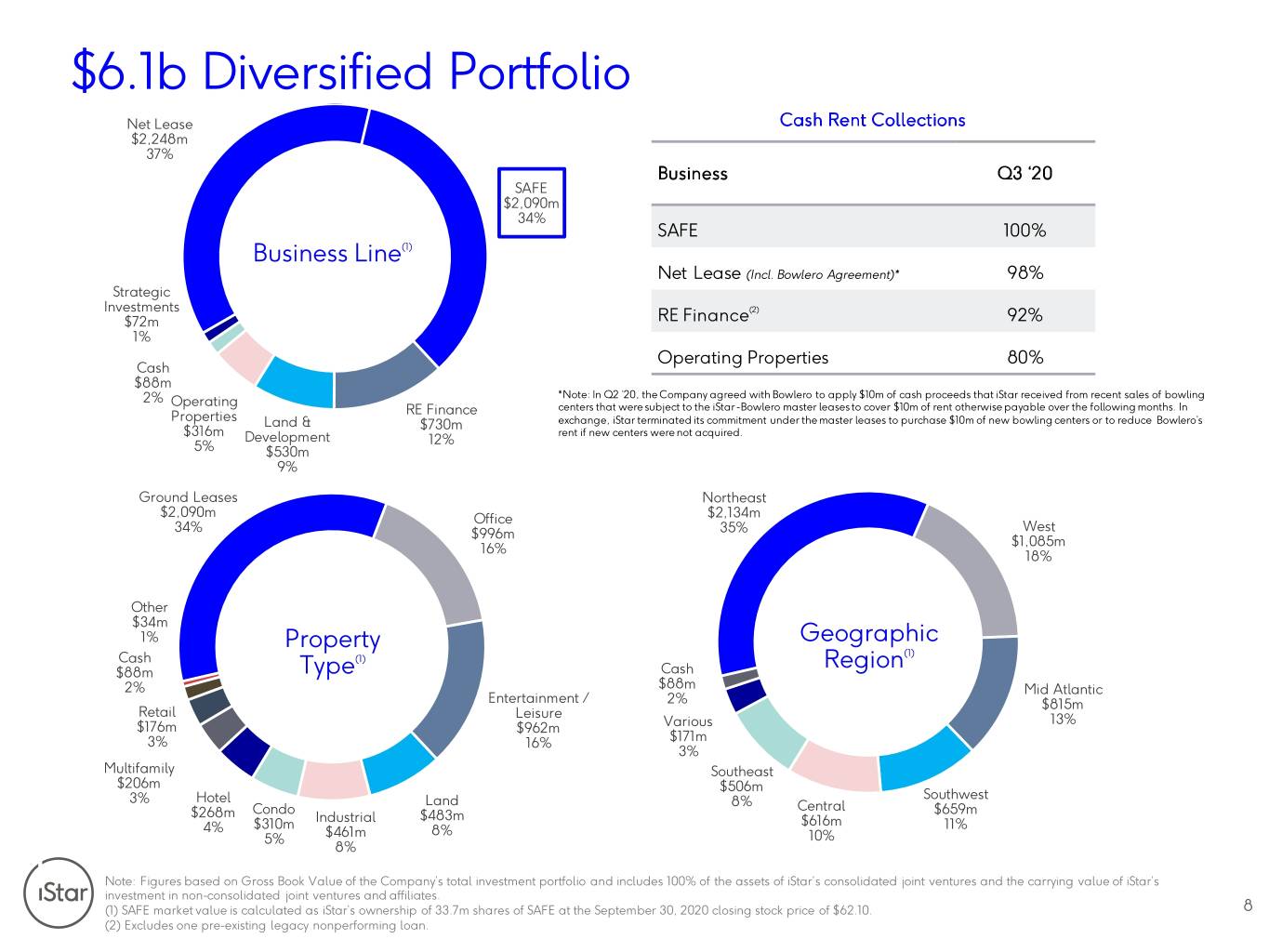

$6.1b Diversified Portfolio Net Lease Cash Rent Collections $2,248m 37% Business Q3 ‘20 SAFE $2,090m 34% SAFE 100% Business Line(1) Net Lease (Incl. Bowlero Agreement)* 98% Strategic Investments (2) $72m RE Finance 92% 1% Operating Properties 80% Cash $88m 2% *Note: In Q2 ’20, the Company agreed with Bowlero to apply $10m of cash proceeds that iStar received from recent sales of bowling Operating centers that were subject to the iStar-Bowlero master leases to cover $10m of rent otherwise payable over the following months. In Properties RE Finance Land & $730m exchange, iStar terminated its commitment under the master leases to purchase $10m of new bowling centers or to reduce Bowlero’s $316m rent if new centers were not acquired. Development 12% 5% $530m 9% Ground Leases Northeast $2,090m Office $2,134m West 34% $996m 35% $1,085m 16% 18% Other $34m 1% Property Geographic (1) Cash (1) $88m Type Cash Region 2% $88m Mid Atlantic Entertainment / 2% $815m Retail Leisure 13% $176m $962m Various 3% 16% $171m 3% Multifamily Southeast $206m $506m Southwest 3% Hotel Land 8% $268m Condo Central $659m Industrial $483m $616m 4% $310m 8% 11% 5% $461m 10% 8% Note: Figures based on Gross Book Value of the Company’s total investment portfolio and includes 100% of the assets of iStar’s consolidated joint ventures and the carrying value of iStar’s investment in non-consolidated joint ventures and affiliates. (1) SAFE market value is calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. 8 (2) Excludes one pre-existing legacy nonperforming loan.

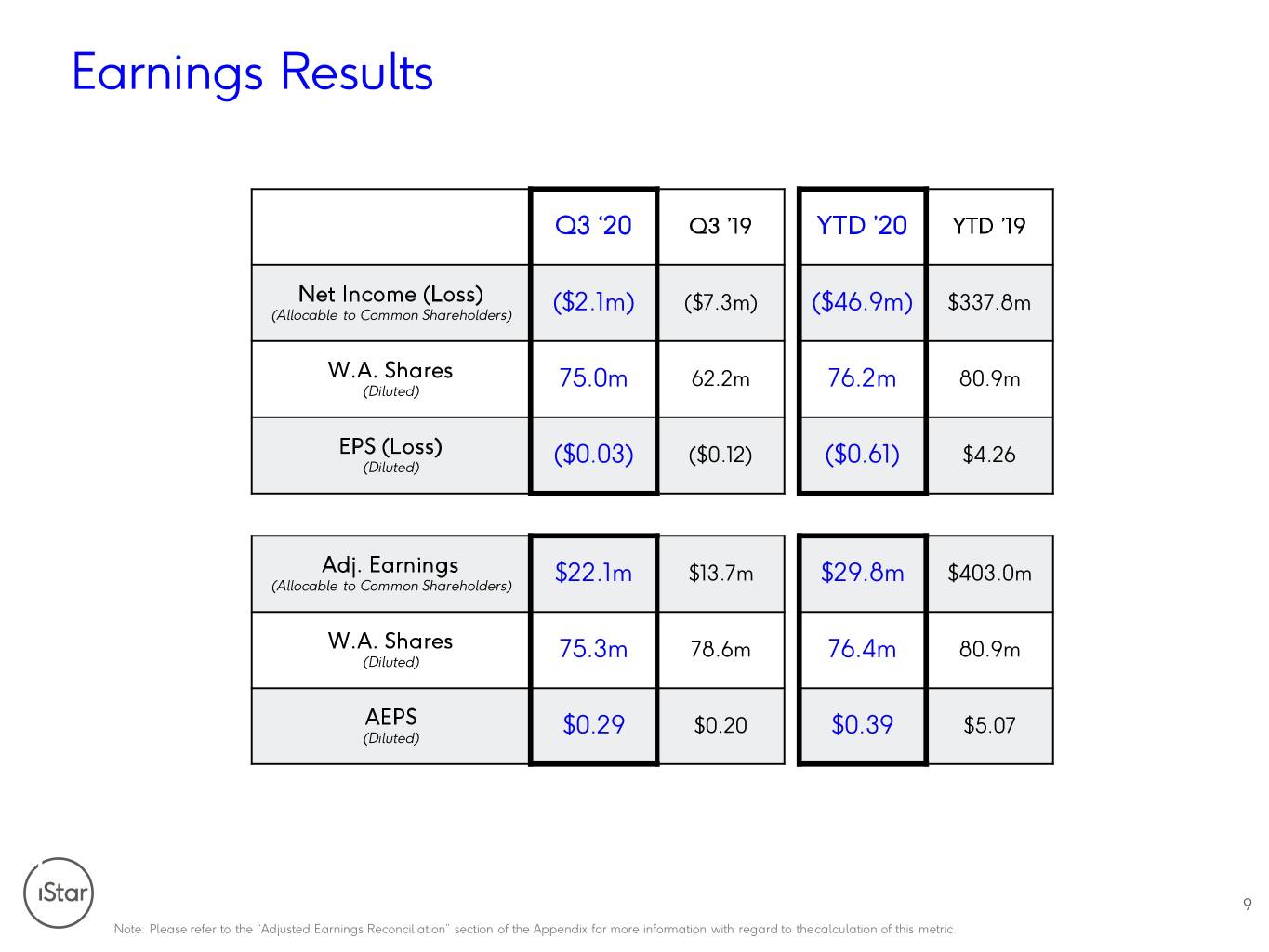

Earnings Results Q3 ‘20 Q3 ’19 YTD ’20 YTD ’19 Net Income (Loss) ($7.3m) $337.8m (Allocable to Common Shareholders) ($2.1m) ($46.9m) W.A. Shares 62.2m 80.9m (Diluted) 75.0m 76.2m EPS (Loss) ($0.12) $4.26 (Diluted) ($0.03) ($0.61) Adj. Earnings $13.7m $403.0m (Allocable to Common Shareholders) $22.1m $29.8m W.A. Shares 78.6m 80.9m (Diluted) 75.3m 76.4m AEPS $0.20 $5.07 (Diluted) $0.29 $0.39 9 Note: Please refer to the “Adjusted Earnings Reconciliation” section of the Appendix for more information with regard to the calculation of this metric.

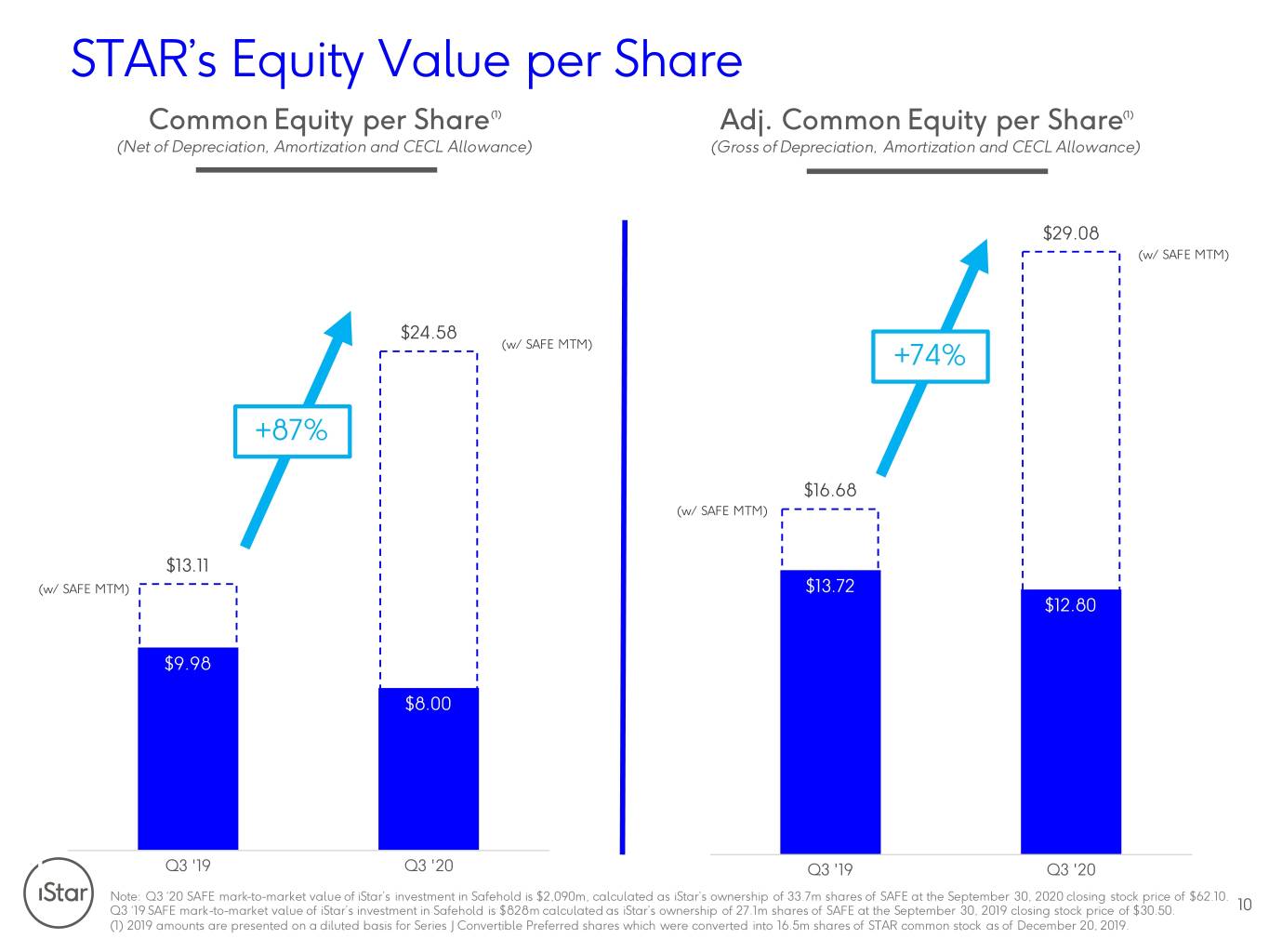

STAR’s Equity Value per Share Common Equity per Share(1) Adj. Common Equity per Share(1) (Net of Depreciation, Amortization and CECL Allowance) (Gross of Depreciation, Amortization and CECL Allowance) $29.08 (w/ SAFE MTM) $24.58 (w/ SAFE MTM) +74% +87% $16.68 (w/ SAFE MTM) $13.11 (w/ SAFE MTM) $13.72 $12.80 $9.98 $8.00 Q3 '19 Q3 '20 Q3 '19 Q3 '20 Note: Q3 ‘20 SAFE mark-to-market value of iStar’s investment in Safehold is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Q3 ‘19 SAFE mark-to-market value of iStar’s investment in Safehold is $828m calculated as iStar’s ownership of 27.1m shares of SAFE at the September 30, 2019 closing stock price of $30.50. 10 (1) 2019 amounts are presented on a diluted basis for Series J Convertible Preferred shares which were converted into 16.5m shares of STAR common stock as of December 20, 2019.

II. Portfolio Overview 11

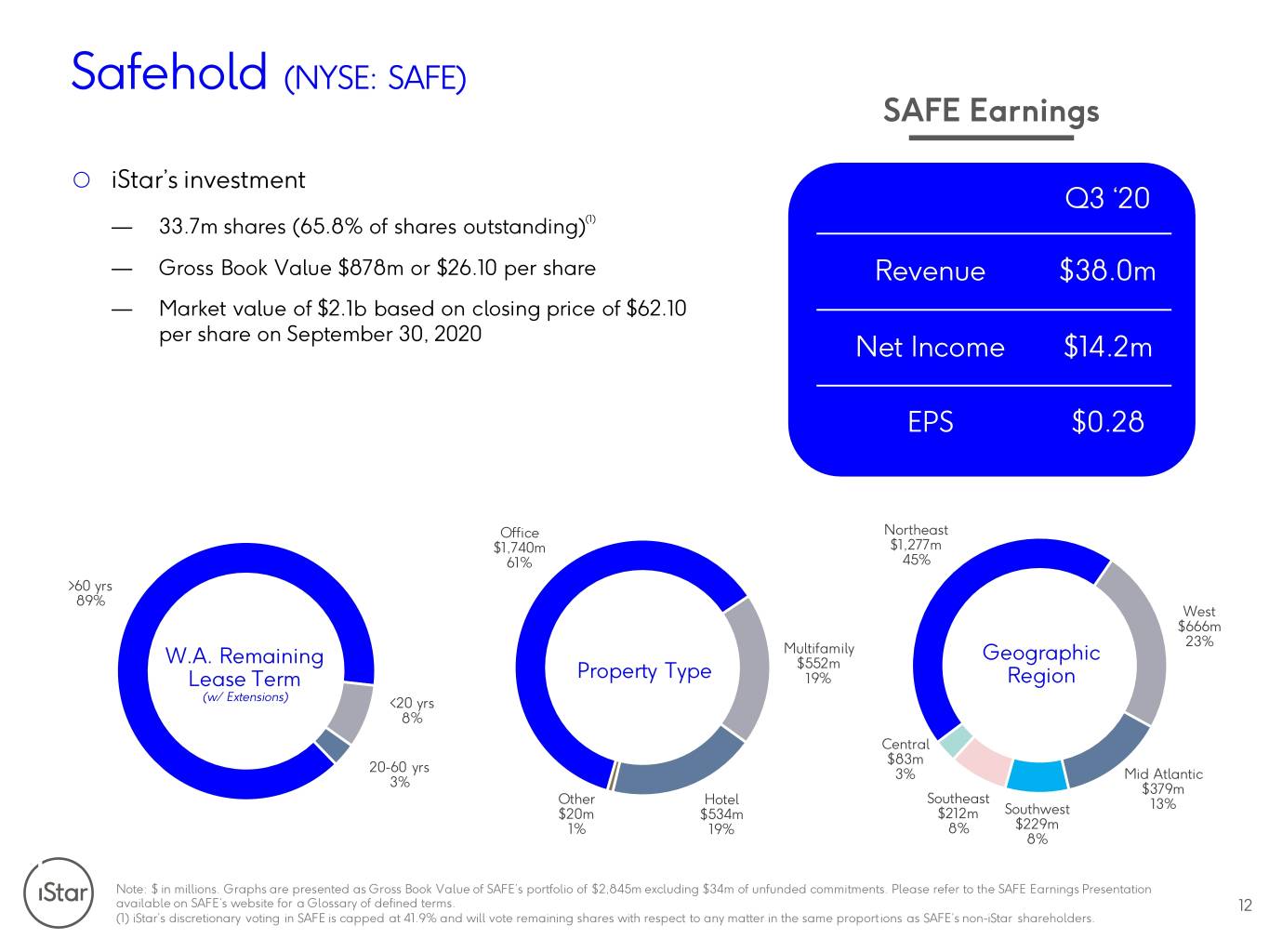

Safehold (NYSE: SAFE) SAFE Earnings iStar’s investment Q3 ‘20 — 33.7m shares (65.8% of shares outstanding)(1) — Gross Book Value $878m or $26.10 per share Revenue $38.0m — Market value of $2.1b based on closing price of $62.10 per share on September 30, 2020 Net Income $14.2m EPS $0.28 Office Northeast $1,740m $1,277m 61% 45% >60 yrs 89% West $666m Multifamily 23% W.A. Remaining $552m Geographic Lease Term Property Type 19% Region (w/ Extensions) <20 yrs 8% Central $83m 20-60 yrs 3% Mid Atlantic 3% $379m Other Hotel Southeast 13% $20m $534m $212m Southwest 1% 19% 8% $229m 8% Note: $ in millions. Graphs are presented as Gross Book Value of SAFE’s portfolio of $2,845m excluding $34m of unfunded commitments. Please refer to the SAFE Earnings Presentation available on SAFE’s website for a Glossary of defined terms. 12 (1) iStar’s discretionary voting in SAFE is capped at 41.9% and will vote remaining shares with respect to any matter in the same proportions as SAFE’s non-iStar shareholders.

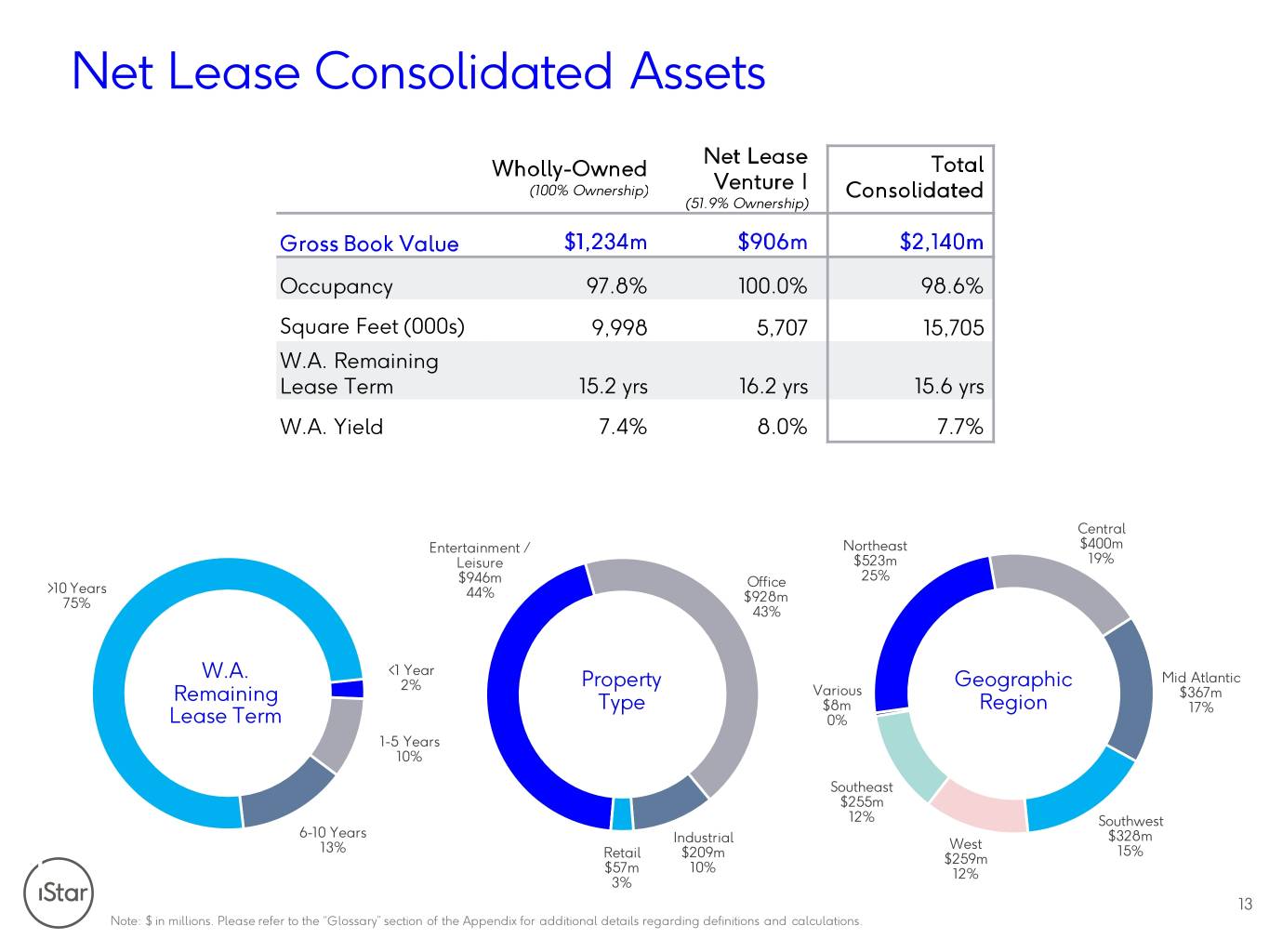

Net Lease Consolidated Assets Net Lease Wholly-Owned Total (100% Ownership) Venture I Consolidated (51.9% Ownership) Gross Book Value $1,234m $906m $2,140m Occupancy 97.8% 100.0% 98.6% Square Feet (000s) 9,998 5,707 15,705 W.A. Remaining Lease Term 15.2 yrs 16.2 yrs 15.6 yrs W.A. Yield 7.4% 8.0% 7.7% Central Entertainment / Northeast $400m Leisure $523m 19% $946m Office 25% >10 Years 44% 75% $928m 43% <1 Year W.A. Mid Atlantic 2% Property Geographic Remaining Various $367m Type $8m Region 17% Lease Term 0% 1-5 Years 10% Southeast $255m 12% Southwest 6-10 Years Industrial $328m 13% West 15% Retail $209m $259m $57m 10% 12% 3% 13 Note: $ in millions. Please refer to the “Glossary” section of the Appendix for additional details regarding definitions and calculations.

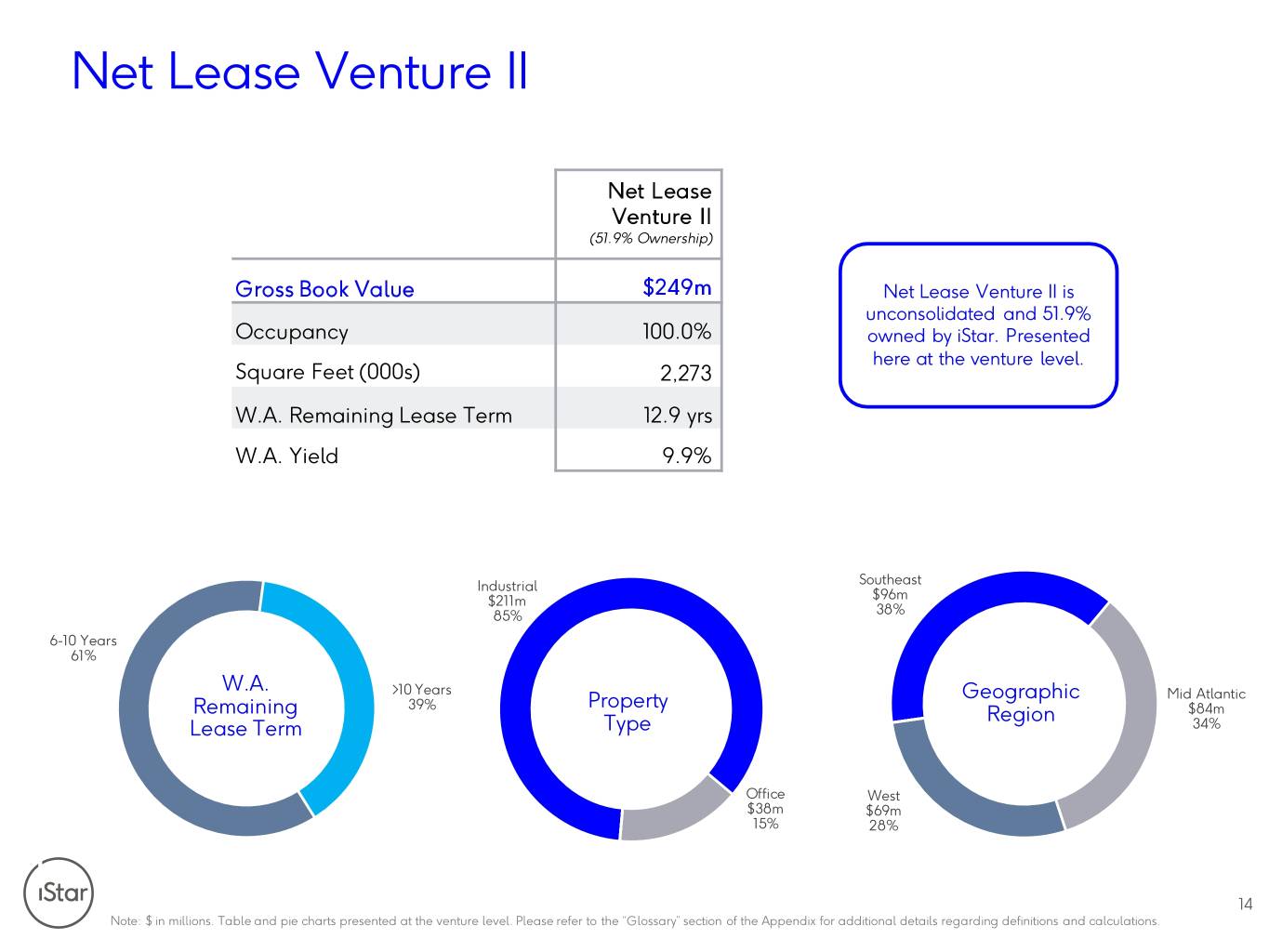

Net Lease Venture II Net Lease Venture II (51.9% Ownership) Gross Book Value $249m Net Lease Venture II is unconsolidated and 51.9% Occupancy 100.0% owned by iStar. Presented here at the venture level. Square Feet (000s) 2,273 W.A. Remaining Lease Term 12.9 yrs W.A. Yield 9.9% Industrial Southeast $211m $96m 85% 38% 6-10 Years 61% W.A. >10 Years Property Geographic Mid Atlantic Remaining 39% Region $84m Lease Term Type 34% Office West $38m $69m 15% 28% 14 Note: $ in millions. Table and pie charts presented at the venture level. Please refer to the “Glossary” section of the Appendix for additional details regarding definitions and calculations.

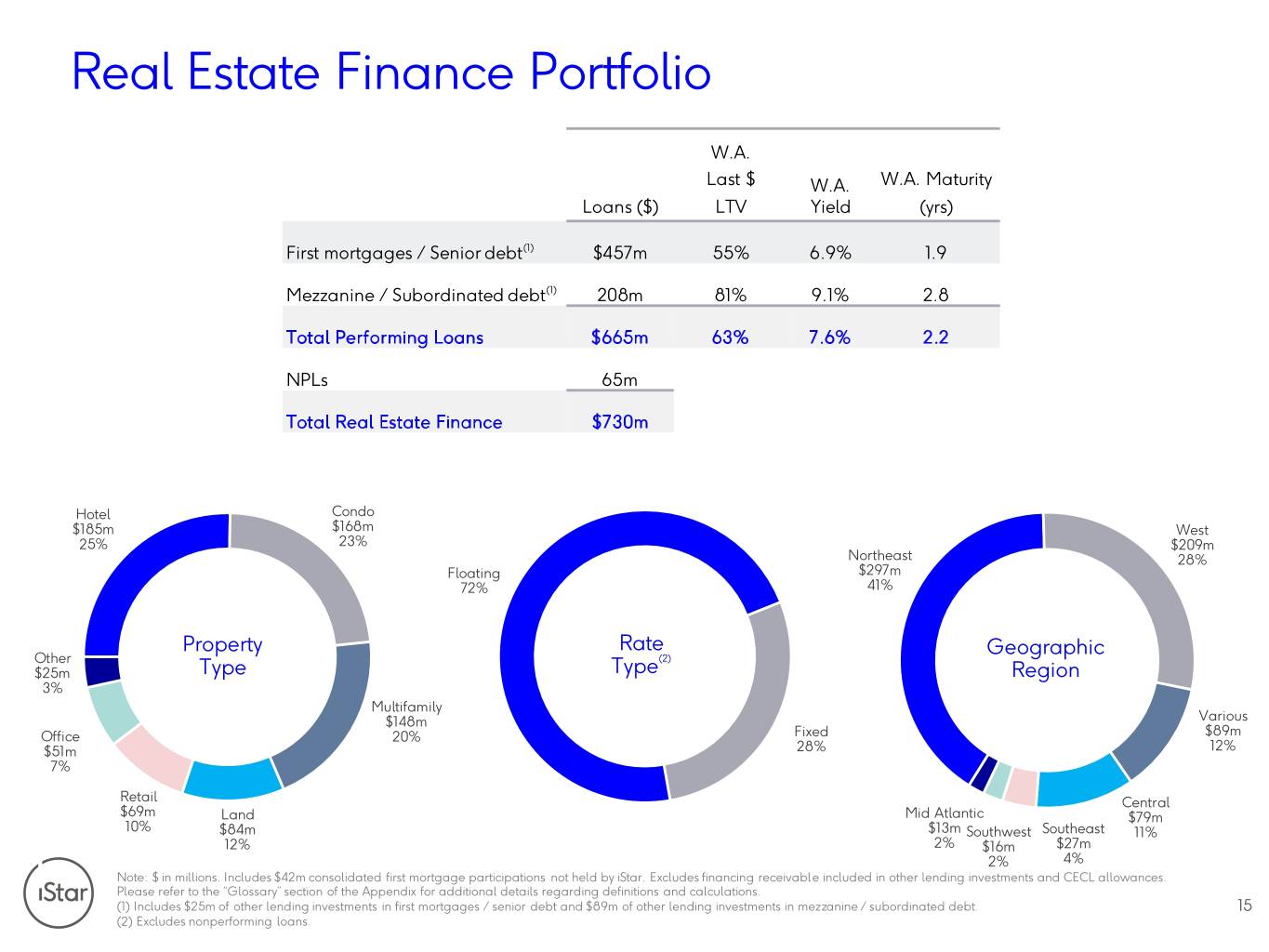

Real Estate Finance Portfolio W.A. Last $ W.A. W.A. Maturity Loans ($) LTV Yield (yrs) First mortgages / Senior debt(1) $457m 55% 6.9% 1.9 Mezzanine / Subordinated debt(1) 208m 81% 9.1% 2.8 Total Performing Loans $665m 63% 7.6% 2.2 NPLs 65m Total Real Estate Finance $730m Hotel Condo $185m $168m West 25% 23% $209m Northeast 28% Floating $297m 72% 41% Property Rate Geographic Other (2) $25m Type Type Region 3% Multifamily $148m Various Office 20% Fixed $89m $51m 28% 12% 7% Retail Central $69m Land Mid Atlantic $79m 10% $84m $13m Southwest Southeast 11% 12% 2% $16m $27m 2% 4% Note: $ in millions. Includes $42m consolidated first mortgage participations not held by iStar. Excludes financing receivabl e included in other lending investments and CECL allowances. Please refer to the “Glossary” section of the Appendix for additional details regarding definitions and calculations. (1) Includes $25m of other lending investments in first mortgages / senior debt and $89m of other lending investments in mezzanine / subordinated debt. 15 (2) Excludes nonperforming loans.

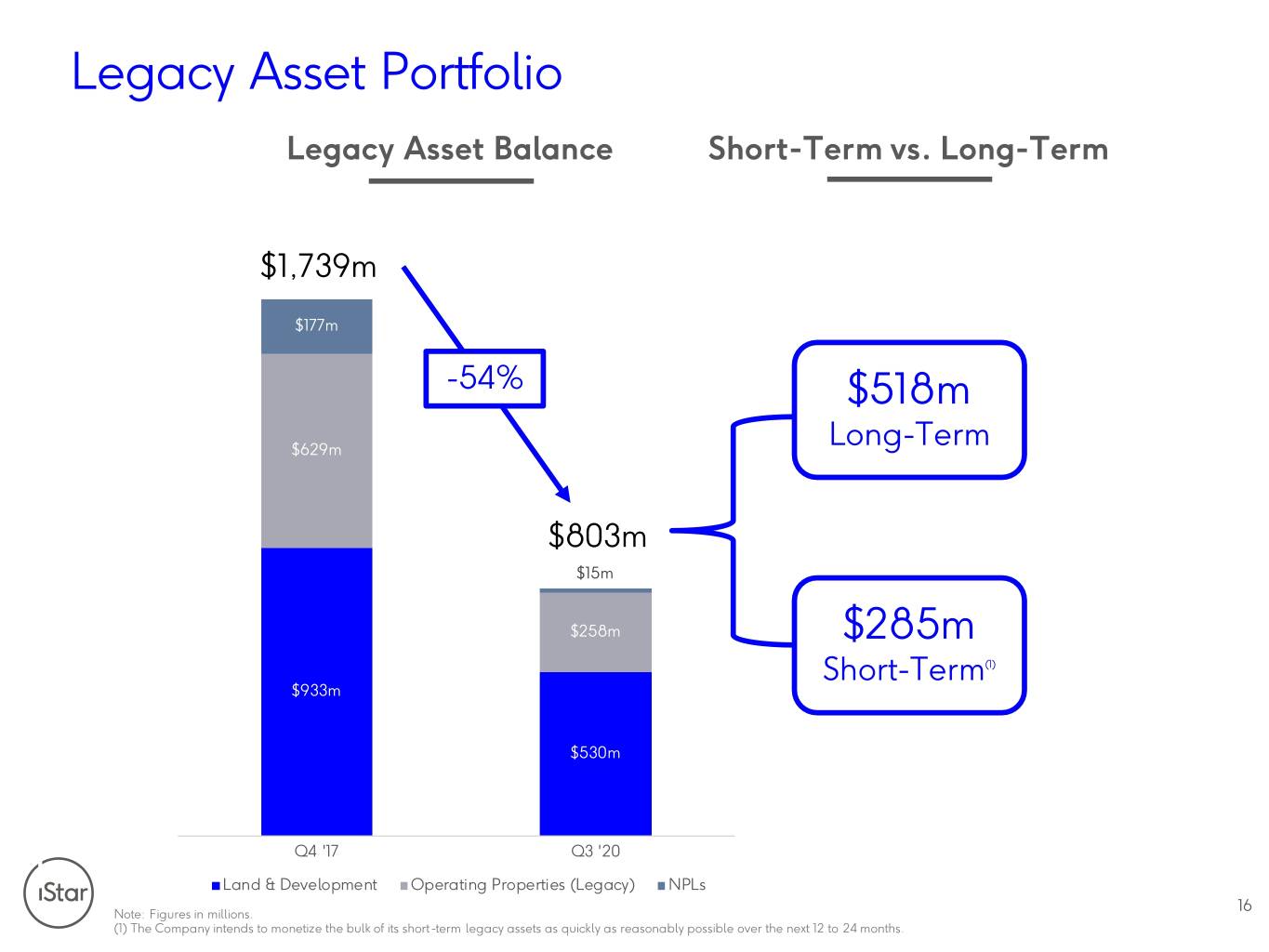

Legacy Asset Portfolio Legacy Asset Balance Short-Term vs. Long-Term $1,739m $177m -54% $518m $629m Long-Term $803m $15m $258m $285m Short-Term(1) $933m $530m Q4 '17 Q3 '20 Land & Development Operating Properties (Legacy) NPLs 16 Note: Figures in millions. (1) The Company intends to monetize the bulk of its short-term legacy assets as quickly as reasonably possible over the next 12 to 24 months.

III. Capital Structure 17

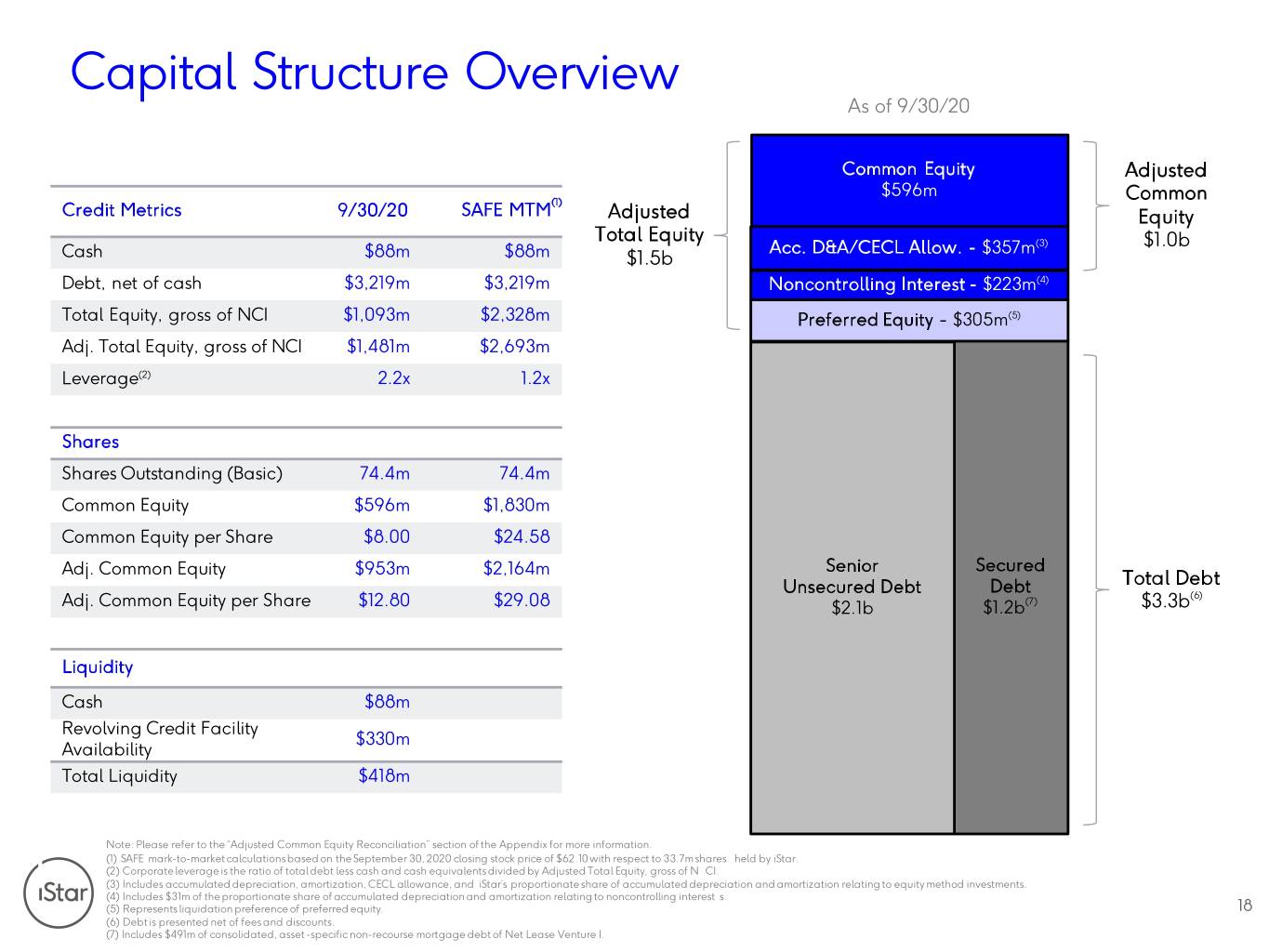

Capital Structure Overview As of 9/30/20 Common Equity Adjusted $596m (1) Common Credit Metrics 9/30/20 SAFE MTM Adjusted Equity Total Equity Acc. D&A/CECL Allow. - $357m(3) $1.0b Cash $88m $88m $1.5b Debt, net of cash $3,219m $3,219m Noncontrolling Interest - $223m(4) Total Equity, gross of NCI $1,093m $2,328m Preferred Equity - $305m(5) Adj. Total Equity, gross of NCI $1,481m $2,693m Leverage(2) 2.2x 1.2x Shares Shares Outstanding (Basic) 74.4m 74.4m Common Equity $596m $1,830m Common Equity per Share $8.00 $24.58 Senior Secured Adj. Common Equity $953m $2,164m Total Debt Unsecured Debt Debt (6) Adj. Common Equity per Share $12.80 $29.08 $2.1b $1.2b(7) $3.3b Liquidity Cash $88m Revolving Credit Facility $330m Availability Total Liquidity $418m Note: Please refer to the “Adjusted Common Equity Reconciliation” section of the Appendix for more information. (1) SAFE mark-to-market calculations based on the September 30, 2020 closing stock price of $62.10 with respect to 33.7m shares held by iStar. (2) Corporate leverage is the ratio of total debt less cash and cash equivalents divided by Adjusted Total Equity, gross of N CI. (3) Includes accumulated depreciation, amortization, CECL allowance, and iStar’s proportionate share of accumulated depreciation and amortization relating to equity method investments. (4) Includes $31m of the proportionate share of accumulated depreciation and amortization relating to noncontrolling interest s. (5) Represents liquidation preference of preferred equity. 18 (6) Debt is presented net of fees and discounts. (7) Includes $491m of consolidated, asset -specific non-recourse mortgage debt of Net Lease Venture I.

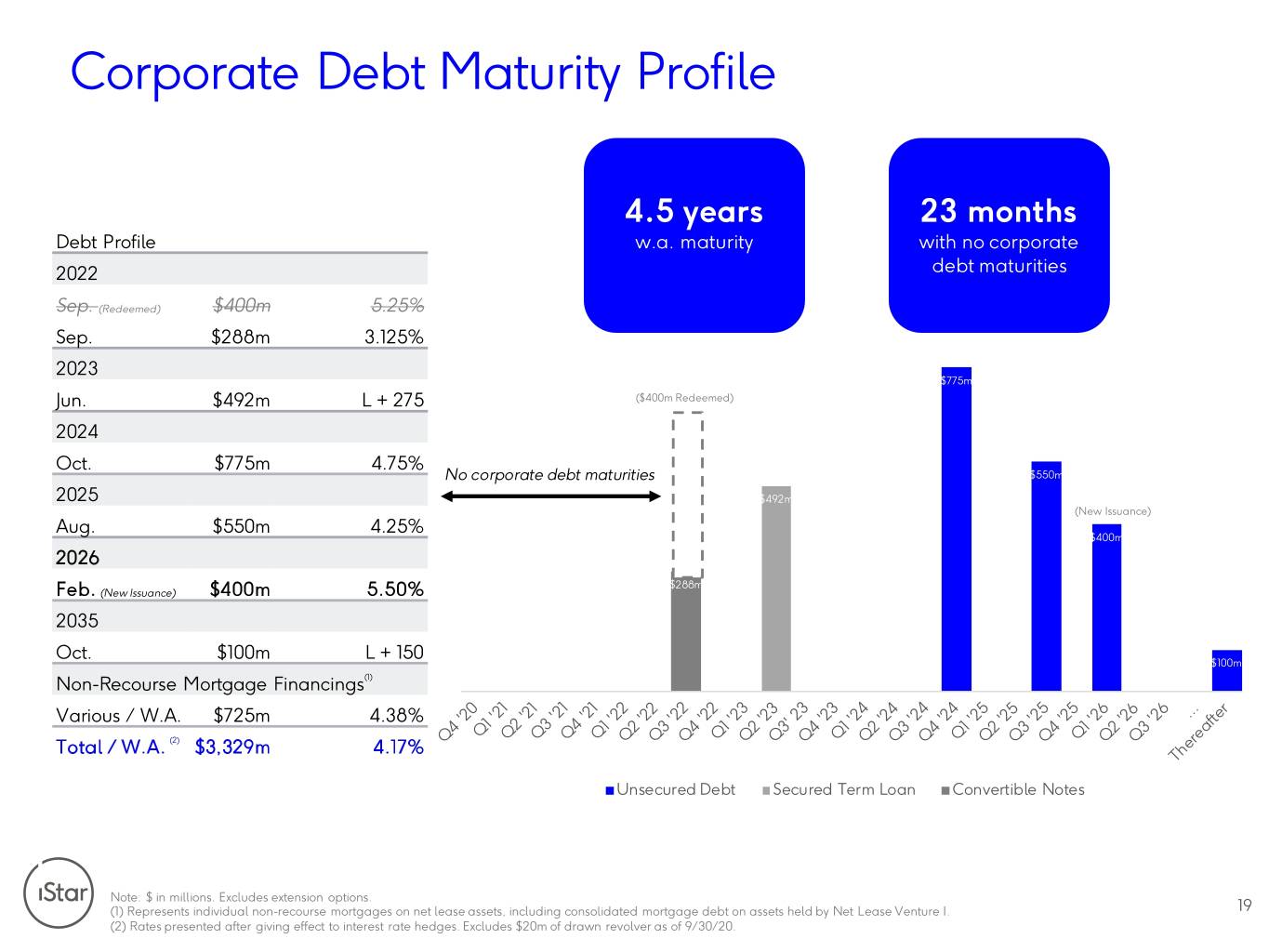

Corporate Debt Maturity Profile 4.5 years 23 months Debt Profile w.a. maturity with no corporate 2022 debt maturities Sep. (Redeemed) $400m 5.25% Sep. $288m 3.125% 2023 $775m Jun. $492m L + 275 ($400m Redeemed) 2024 Oct. $775m 4.75% No corporate debt maturities $550m 2025 $492m (New Issuance) Aug. $550m 4.25% $400m 2026 $288m Feb. (New Issuance) $400m 5.50% 2035 Oct. $100m L + 150 $100m Non-Recourse Mortgage Financings(1) $0m Various / W.A. $725m 4.38% Total / W.A. (2) $3,329m 4.17% Unsecured Debt Secured Term Loan Convertible Notes Note: $ in millions. Excludes extension options. (1) Represents individual non-recourse mortgages on net lease assets, including consolidated mortgage debt on assets held by Net Lease Venture I. 19 (2) Rates presented after giving effect to interest rate hedges. Excludes $20m of drawn revolver as of 9/30/20.

IV. Appendix 20

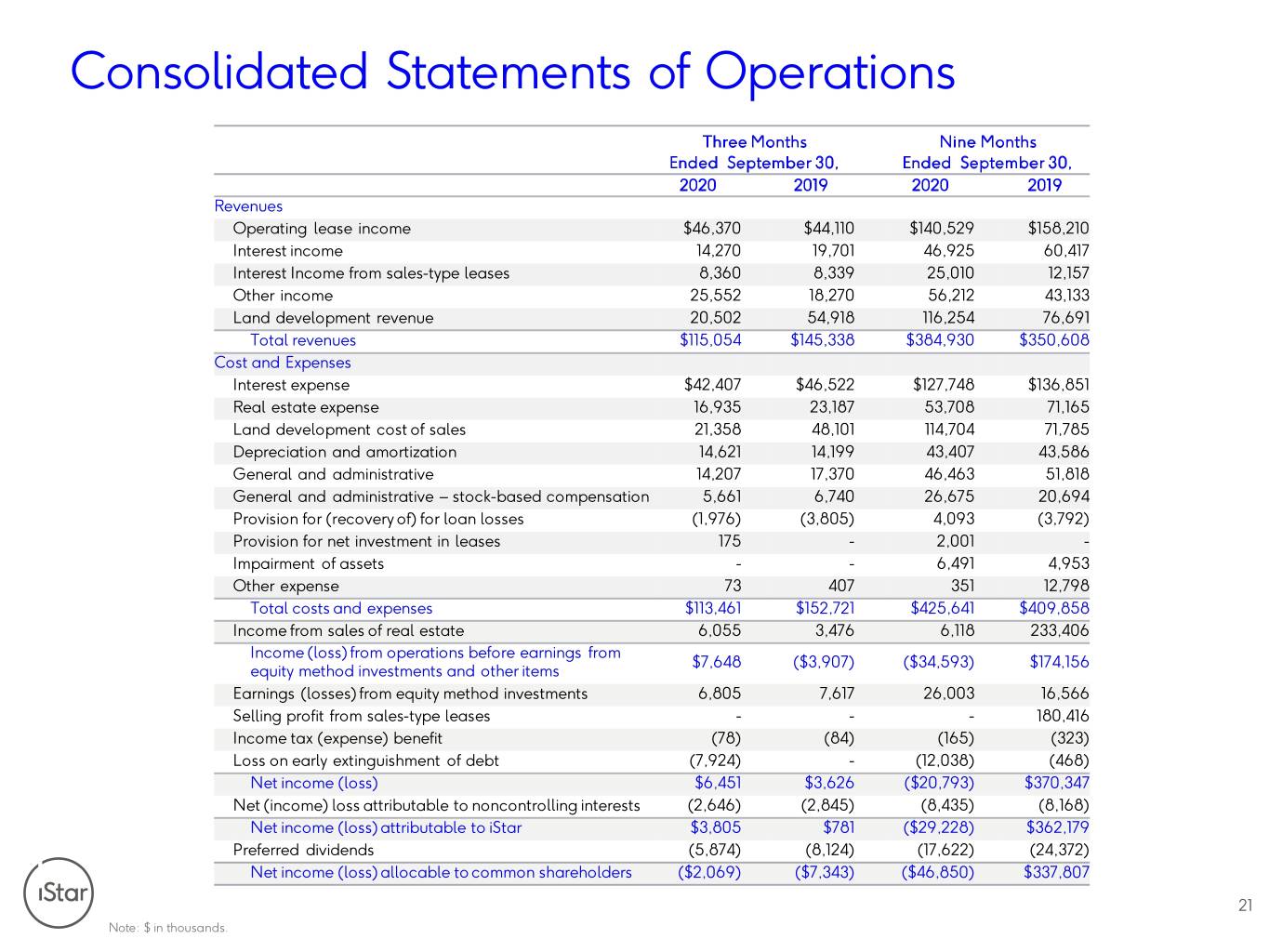

Consolidated Statements of Operations Three Months Nine Months Ended September 30, Ended September 30, 2020 2019 2020 2019 Revenues Operating lease income $46,370 $44,110 $140,529 $158,210 Interest income 14,270 19,701 46,925 60,417 Interest Income from sales-type leases 8,360 8,339 25,010 12,157 Other income 25,552 18,270 56,212 43,133 Land development revenue 20,502 54,918 116,254 76,691 Total revenues $115,054 $145,338 $384,930 $350,608 Cost and Expenses Interest expense $42,407 $46,522 $127,748 $136,851 Real estate expense 16,935 23,187 53,708 71,165 Land development cost of sales 21,358 48,101 114,704 71,785 Depreciation and amortization 14,621 14,199 43,407 43,586 General and administrative 14,207 17,370 46,463 51,818 General and administrative – stock-based compensation 5,661 6,740 26,675 20,694 Provision for (recovery of) for loan losses (1,976) (3,805) 4,093 (3,792) Provision for net investment in leases 175 - 2,001 - Impairment of assets - - 6,491 4,953 Other expense 73 407 351 12,798 Total costs and expenses $113,461 $152,721 $425,641 $409,858 Income from sales of real estate 6,055 3,476 6,118 233,406 Income (loss) from operations before earnings from $7,648 ($3,907) ($34,593) $174,156 equity method investments and other items Earnings (losses) from equity method investments 6,805 7,617 26,003 16,566 Selling profit from sales-type leases - - - 180,416 Income tax (expense) benefit (78) (84) (165) (323) Loss on early extinguishment of debt (7,924) - (12,038) (468) Net income (loss) $6,451 $3,626 ($20,793) $370,347 Net (income) loss attributable to noncontrolling interests (2,646) (2,845) (8,435) (8,168) Net income (loss) attributable to iStar $3,805 $781 ($29,228) $362,179 Preferred dividends (5,874) (8,124) (17,622) (24,372) Net income (loss) allocable to common shareholders ($2,069) ($7,343) ($46,850) $337,807 21 Note: $ in thousands.

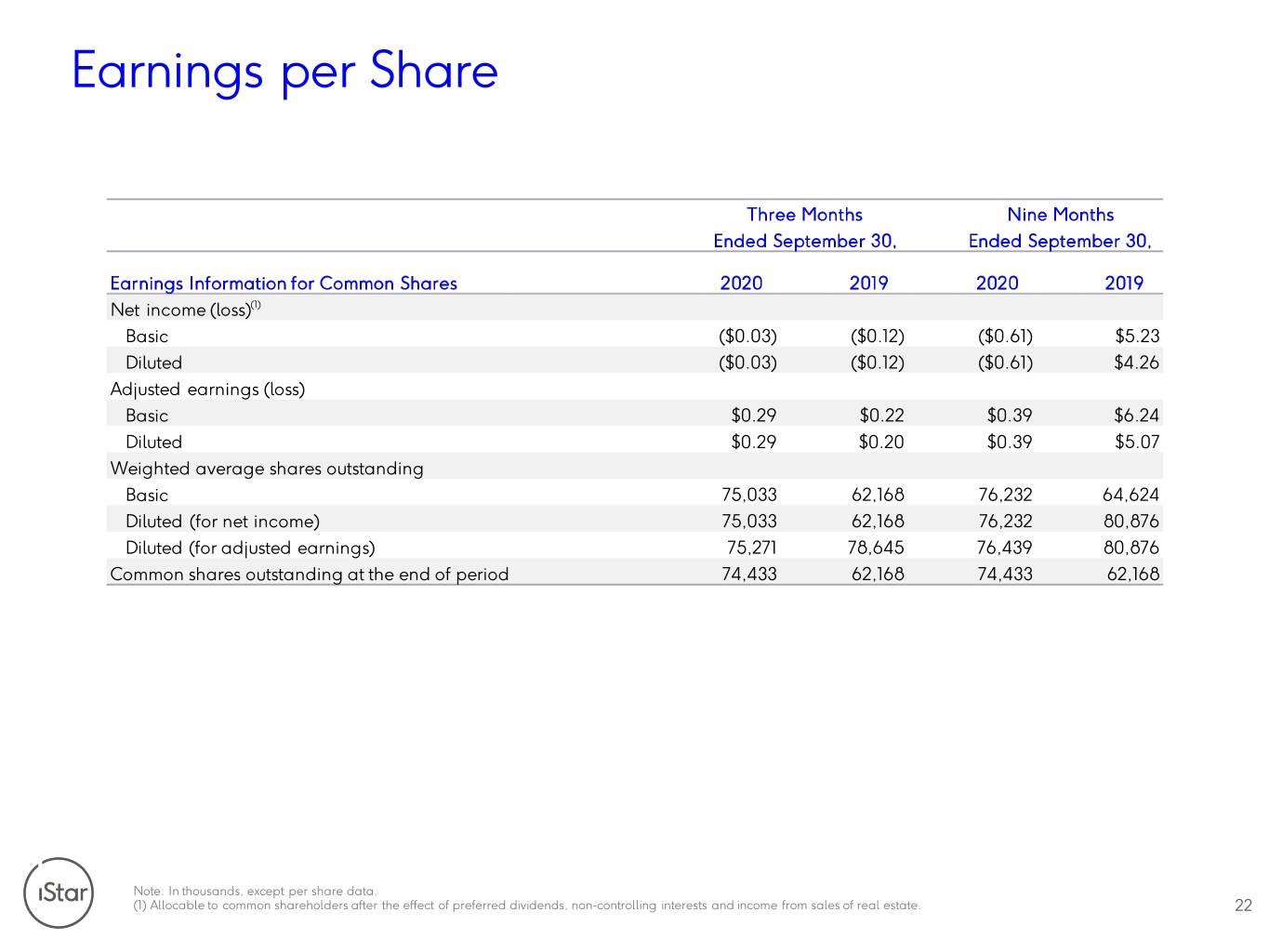

Earnings per Share Three Months Nine Months Ended September 30, Ended September 30, Earnings Information for Common Shares 2020 2019 2020 2019 Net income (loss)(1) Basic ($0.03) ($0.12) ($0.61) $5.23 Diluted ($0.03) ($0.12) ($0.61) $4.26 Adjusted earnings (loss) Basic $0.29 $0.22 $0.39 $6.24 Diluted $0.29 $0.20 $0.39 $5.07 Weighted average shares outstanding Basic 75,033 62,168 76,232 64,624 Diluted (for net income) 75,033 62,168 76,232 80,876 Diluted (for adjusted earnings) 75,271 78,645 76,439 80,876 Common shares outstanding at the end of period 74,433 62,168 74,433 62,168 Note: In thousands, except per share data. (1) Allocable to common shareholders after the effect of preferred dividends, non-controlling interests and income from sales of real estate. 22

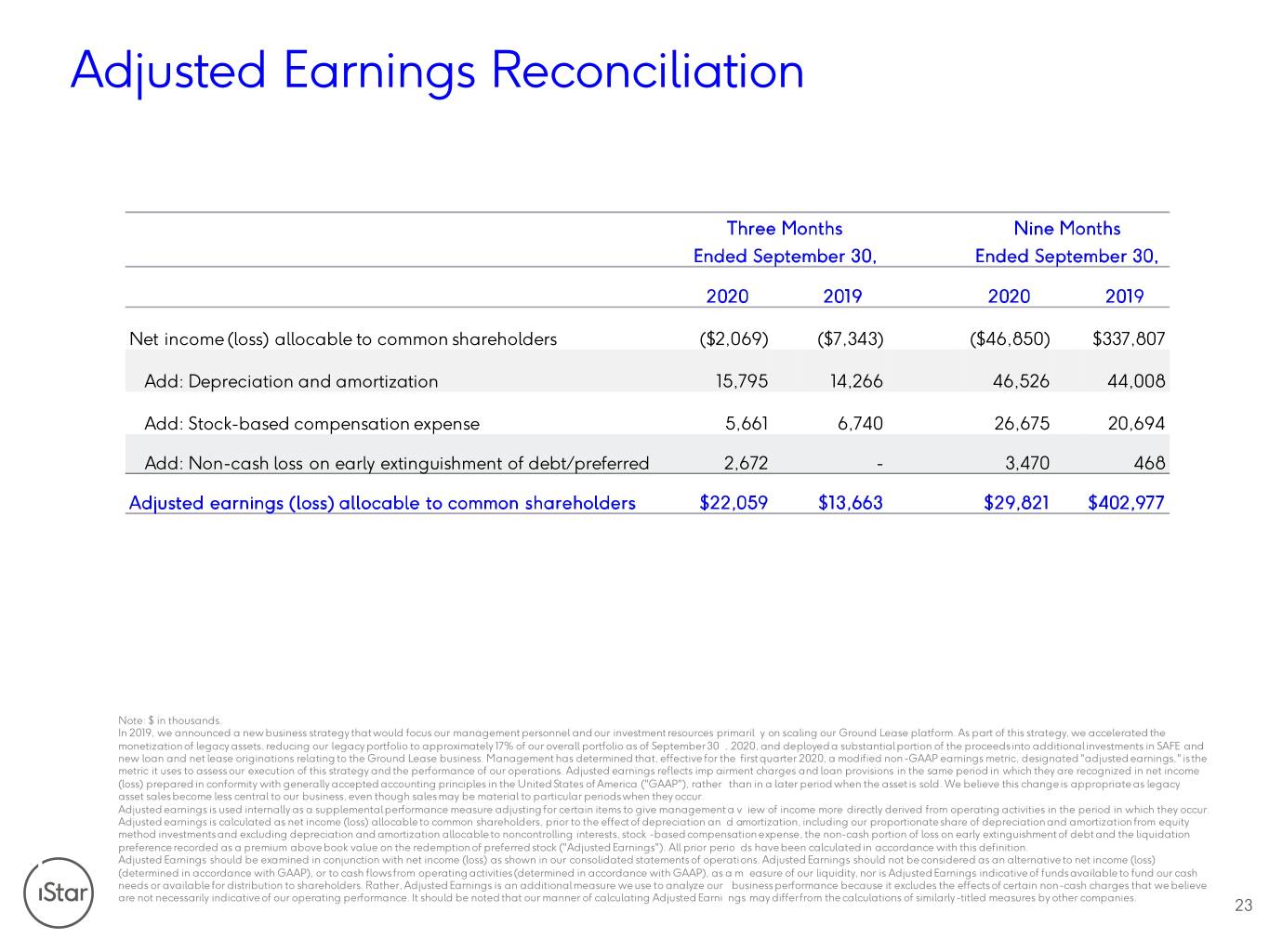

Adjusted Earnings Reconciliation Three Months Nine Months Ended September 30, Ended September 30, 2020 2019 2020 2019 Net income (loss) allocable to common shareholders ($2,069) ($7,343) ($46,850) $337,807 Add: Depreciation and amortization 15,795 14,266 46,526 44,008 Add: Stock-based compensation expense 5,661 6,740 26,675 20,694 Add: Non-cash loss on early extinguishment of debt/preferred 2,672 - 3,470 468 Adjusted earnings (loss) allocable to common shareholders $22,059 $13,663 $29,821 $402,977 Note: $ in thousands. In 2019, we announced a new business strategy that would focus our management personnel and our investment resources primaril y on scaling our Ground Lease platform. As part of this strategy, we accelerated the monetization of legacy assets, reducing our legacy portfolio to approximately 17% of our overall portfolio as of September 30 , 2020, and deployed a substantial portion of the proceeds into additional investments in SAFE and new loan and net lease originations relating to the Ground Lease business. Management has determined that, effective for the first quarter 2020, a modified non-GAAP earnings metric, designated "adjusted earnings," is the metric it uses to assess our execution of this strategy and the performance of our operations. Adjusted earnings reflects imp airment charges and loan provisions in the same period in which they are recognized in net income (loss) prepared in conformity with generally accepted accounting principles in the United States of America ("GAAP"), rather than in a later period when the asset is sold. We believe this change is appropriate as legacy asset sales become less central to our business, even though sales may be material to particular periods when they occur. Adjusted earnings is used internally as a supplemental performance measure adjusting for certain items to give management a v iew of income more directly derived from operating activities in the period in which they occur. Adjusted earnings is calculated as net income (loss) allocable to common shareholders, prior to the effect of depreciation an d amortization, including our proportionate share of depreciation and amortization from equity method investments and excluding depreciation and amortization allocable to noncontrolling interests, stock -based compensation expense, the non-cash portion of loss on early extinguishment of debt and the liquidation preference recorded as a premium above book value on the redemption of preferred stock ("Adjusted Earnings"). All prior perio ds have been calculated in accordance with this definition. Adjusted Earnings should be examined in conjunction with net income (loss) as shown in our consolidated statements of operations. Adjusted Earnings should not be considered as an alternative to net income (loss) (determined in accordance with GAAP), or to cash flows from operating activities (determined in accordance with GAAP), as a m easure of our liquidity, nor is Adjusted Earnings indicative of funds available to fund our cash needs or available for distribution to shareholders. Rather, Adjusted Earnings is an additional measure we use to analyze our business performance because it excludes the effects of certain non-cash charges that we believe are not necessarily indicative of our operating performance. It should be noted that our manner of calculating Adjusted Earni ngs may differ from the calculations of similarly-titled measures by other companies. 23

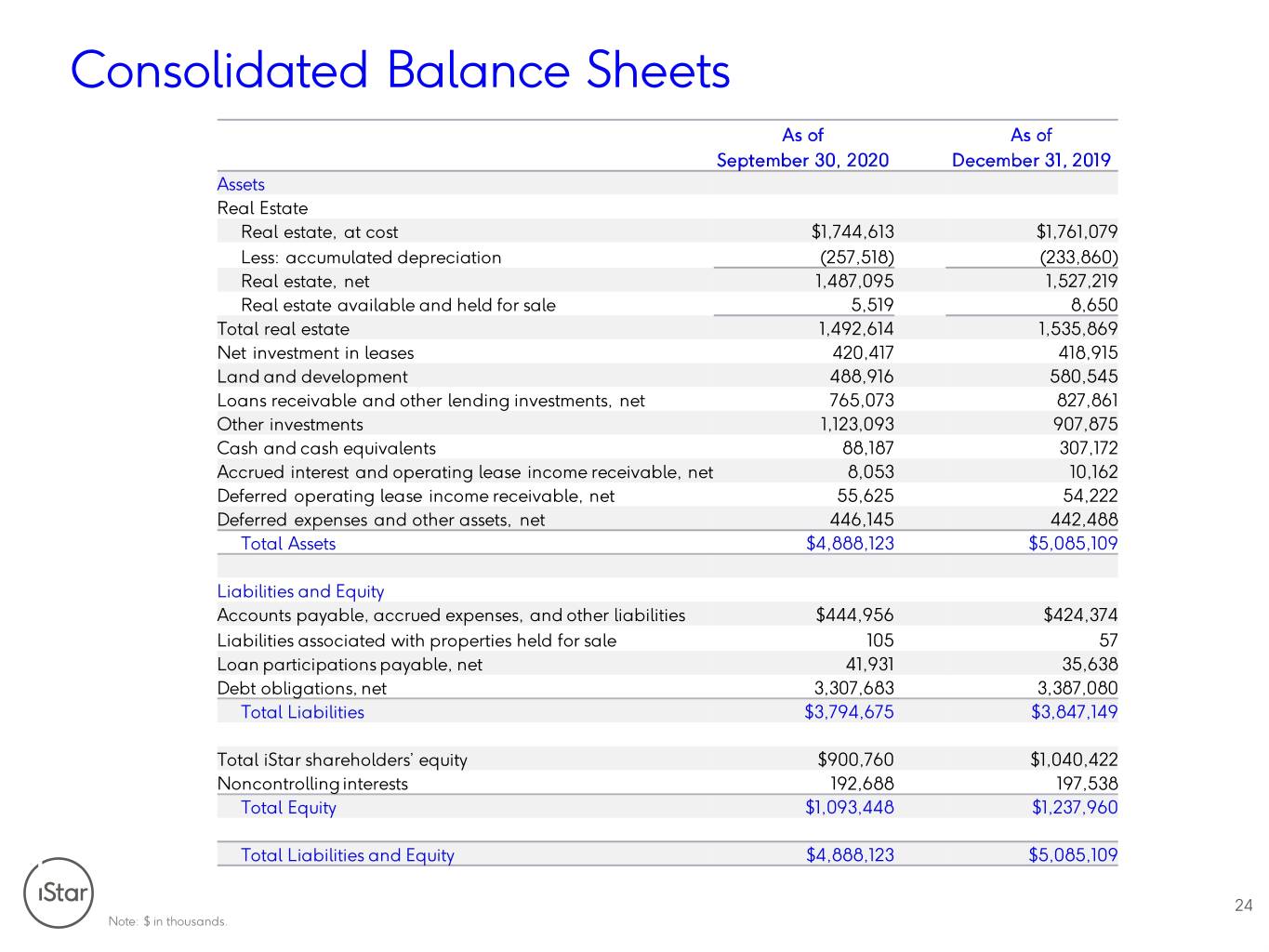

Consolidated Balance Sheets As of As of September 30, 2020 December 31, 2019 Assets Real Estate Real estate, at cost $1,744,613 $1,761,079 Less: accumulated depreciation (257,518) (233,860) Real estate, net 1,487,095 1,527,219 Real estate available and held for sale 5,519 8,650 Total real estate 1,492,614 1,535,869 Net investment in leases 420,417 418,915 Land and development 488,916 580,545 Loans receivable and other lending investments, net 765,073 827,861 Other investments 1,123,093 907,875 Cash and cash equivalents 88,187 307,172 Accrued interest and operating lease income receivable, net 8,053 10,162 Deferred operating lease income receivable, net 55,625 54,222 Deferred expenses and other assets, net 446,145 442,488 Total Assets $4,888,123 $5,085,109 Liabilities and Equity Accounts payable, accrued expenses, and other liabilities $444,956 $424,374 Liabilities associated with properties held for sale 105 57 Loan participations payable, net 41,931 35,638 Debt obligations, net 3,307,683 3,387,080 Total Liabilities $3,794,675 $3,847,149 Total iStar shareholders’ equity $900,760 $1,040,422 Noncontrolling interests 192,688 197,538 Total Equity $1,093,448 $1,237,960 Total Liabilities and Equity $4,888,123 $5,085,109 24 Note: $ in thousands.

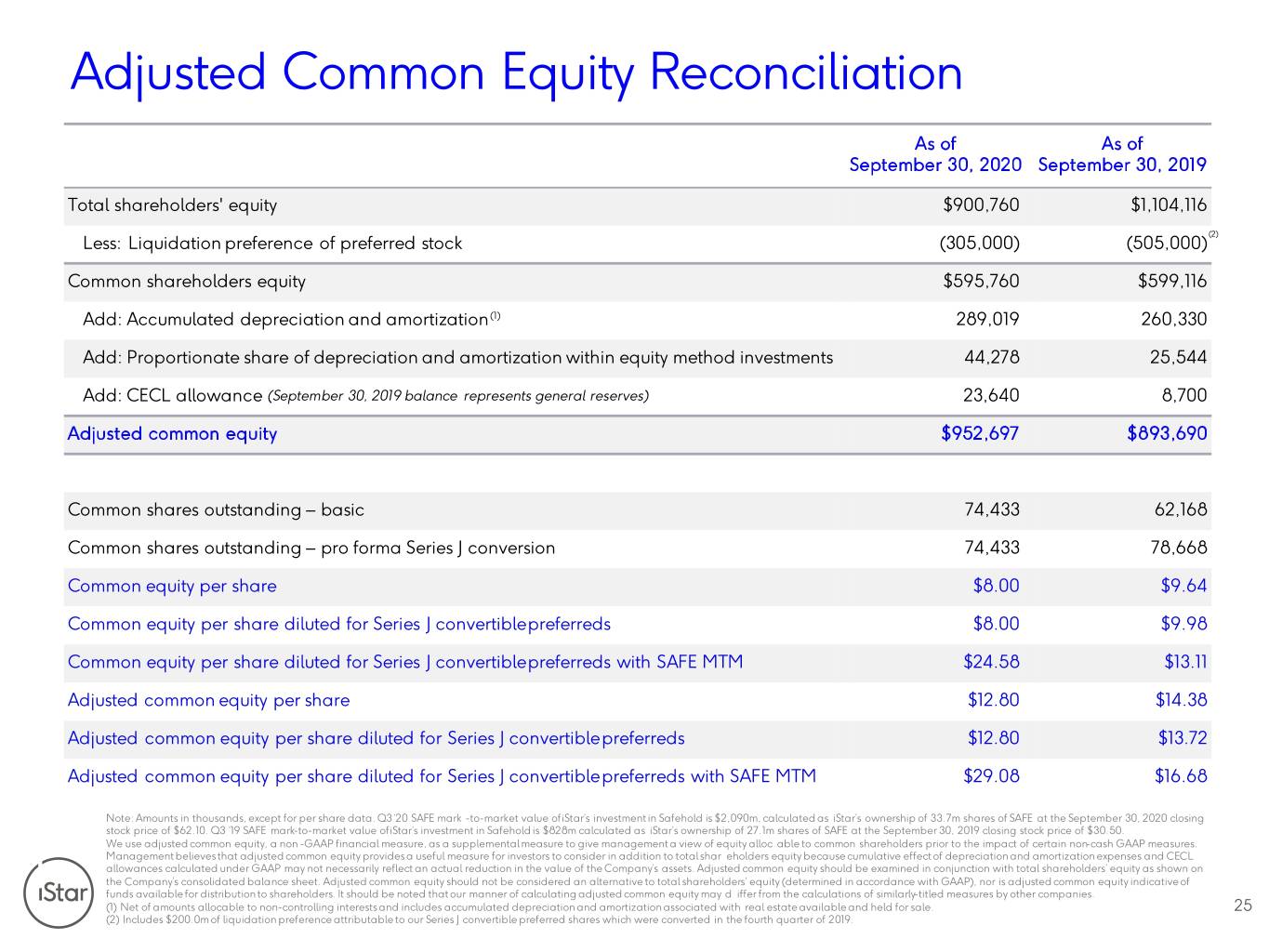

Adjusted Common Equity Reconciliation As of As of September 30, 2020 September 30, 2019 Total shareholders' equity $900,760 $1,104,116 (2) Less: Liquidation preference of preferred stock (305,000) (505,000) Common shareholders equity $595,760 $599,116 Add: Accumulated depreciation and amortization(1) 289,019 260,330 Add: Proportionate share of depreciation and amortization within equity method investments 44,278 25,544 Add: CECL allowance (September 30, 2019 balance represents general reserves) 23,640 8,700 Adjusted common equity $952,697 $893,690 Common shares outstanding – basic 74,433 62,168 Common shares outstanding – pro forma Series J conversion 74,433 78,668 Common equity per share $8.00 $9.64 Common equity per share diluted for Series J convertible preferreds $8.00 $9.98 Common equity per share diluted for Series J convertible preferreds with SAFE MTM $24.58 $13.11 Adjusted common equity per share $12.80 $14.38 Adjusted common equity per share diluted for Series J convertible preferreds $12.80 $13.72 Adjusted common equity per share diluted for Series J convertible preferreds with SAFE MTM $29.08 $16.68 Note: Amounts in thousands, except for per share data. Q3 ‘20 SAFE mark -to-ma rk et va lue of iStar’s investment in Safehold is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Q3 ‘19 SAFE mark-to-ma rk et va lue of iStar’s investment in Safehold is $828m calculated as iStar’s ownership of 27.1m shares of SAFE at the September 30, 2019 closing stock price of $30.50. We use adjusted common equity, a non -GAAP financial measure, as a supplemental measure to give management a view of equity alloc able to common shareholders prior to the impact of certain non-cash GAAP measures. Management believes that adjusted common equity provides a useful measure for investors to consider in addition to total shar eholders equity because cumulative effect of depreciation and amortization expenses and CECL allowances calculated under GAAP may not necessarily reflect an actual reduction in the value of the Company’s assets. Adjusted common equity should be examined in conjunction with total shareholders’ equity as shown on the Company’s consolidated balance sheet. Adjusted common equity should not be considered an alternative to total shareholders’ equity (determined in accordance with GAAP), nor is adjusted common equity indicative of funds available for distribution to shareholders. It should be noted that our manner of calculating adjusted common equity may d iffer from the calculations of similarly-titled measures by other companies. (1) Net of amounts allocable to non-controlling interests and includes accumulated depreciation and amortization associated with real estate available and held for sale. 25 (2) Includes $200.0m of liquidation preference attributable to our Series J convertible preferred shares which were converted in the fourth quarter of 2019.

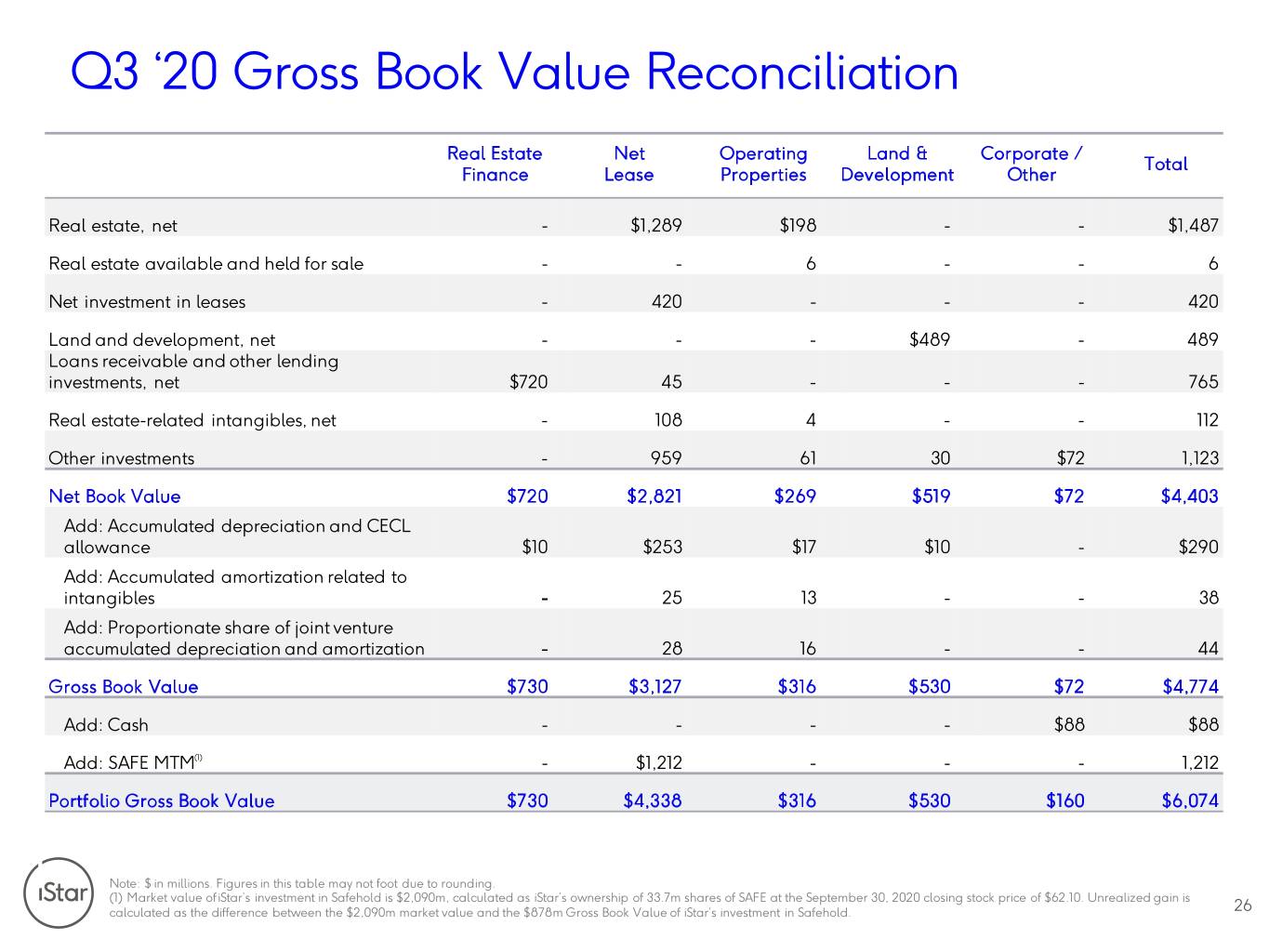

Q3 ‘20 Gross Book Value Reconciliation Real Estate Net Operating Land & Corporate / Total Finance Lease Properties Development Other Real estate, net - $1,289 $198 - - $1,487 Real estate available and held for sale - - 6 - - 6 Net investment in leases - 420 - - - 420 Land and development, net - - - $489 - 489 Loans receivable and other lending investments, net $720 45 - - - 765 Real estate-related intangibles, net - 108 4 - - 112 Other investments - 959 61 30 $72 1,123 Net Book Value $720 $2,821 $269 $519 $72 $4,403 Add: Accumulated depreciation and CECL allowance $10 $253 $17 $10 - $290 Add: Accumulated amortization related to intangibles - 25 13 - - 38 Add: Proportionate share of joint venture accumulated depreciation and amortization - 28 16 - - 44 Gross Book Value $730 $3,127 $316 $530 $72 $4,774 Add: Cash - - - - $88 $88 Add: SAFE MTM(1) - $1,212 - - - 1,212 Portfolio Gross Book Value $730 $4,338 $316 $530 $160 $6,074 Note: $ in millions. Figures in this table may not foot due to rounding. (1) Market value of iStar’s investment in Safehold is $2,090m, calculated as iStar’s ownership of 33.7m shares of SAFE at the September 30, 2020 closing stock price of $62.10. Unrealized gain is calculated as the difference between the $2,090m market value and the $878m Gross Book Value of iStar’s investment in Safehold. 26

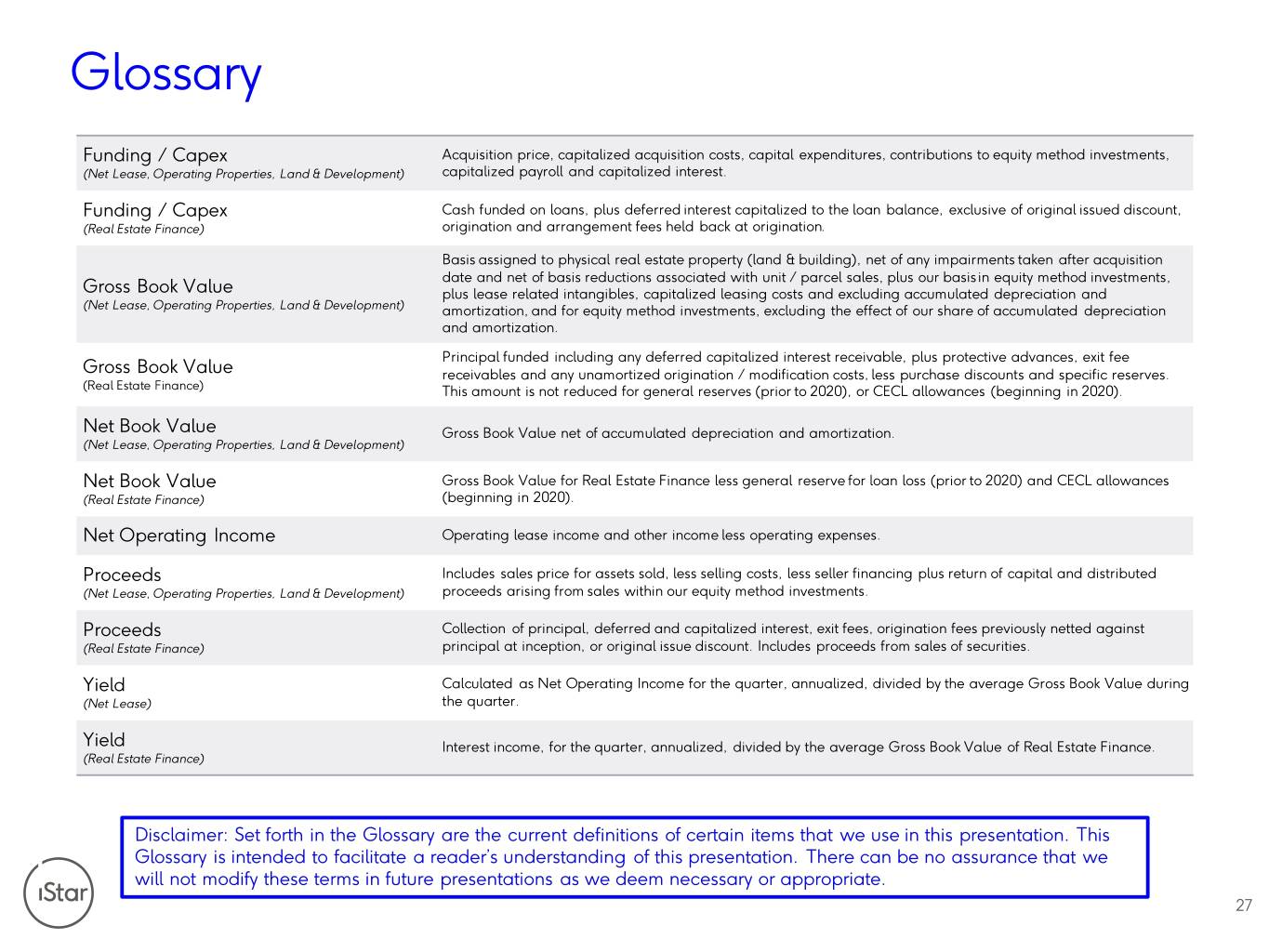

Glossary Funding / Capex Acquisition price, capitalized acquisition costs, capital expenditures, contributions to equity method investments, (Net Lease, Operating Properties, Land & Development) capitalized payroll and capitalized interest. Funding / Capex Cash funded on loans, plus deferred interest capitalized to the loan balance, exclusive of original issued discount, (Real Estate Finance) origination and arrangement fees held back at origination. Basis assigned to physical real estate property (land & building), net of any impairments taken after acquisition date and net of basis reductions associated with unit / parcel sales, plus our basisin equity method investments, Gross Book Value plus lease related intangibles, capitalized leasing costs and excluding accumulated depreciation and (Net Lease, Operating Properties, Land & Development) amortization, and for equity method investments, excluding the effect of our share of accumulated depreciation and amortization. Principal funded including any deferred capitalized interest receivable, plus protective advances, exit fee Gross Book Value receivables and any unamortized origination / modification costs, less purchase discounts and specific reserves. (Real Estate Finance) This amount is not reduced for general reserves (prior to 2020), or CECL allowances (beginning in 2020). Net Book Value Gross Book Value net of accumulated depreciation and amortization. (Net Lease, Operating Properties, Land & Development) Net Book Value Gross Book Value for Real Estate Finance less general reserve for loan loss (prior to 2020) and CECL allowances (Real Estate Finance) (beginning in 2020). Net Operating Income Operating lease income and other income less operating expenses. Proceeds Includes sales price for assets sold, less selling costs, less seller financing plus return of capital and distributed (Net Lease, Operating Properties, Land & Development) proceeds arising from sales within our equity method investments. Proceeds Collection of principal, deferred and capitalized interest, exit fees, origination fees previously netted against (Real Estate Finance) principal at inception, or original issue discount. Includes proceeds from sales of securities. Yield Calculated as Net Operating Income for the quarter, annualized, divided by the average Gross Book Value during (Net Lease) the quarter. Yield Interest income, for the quarter, annualized, divided by the average Gross Book Value of Real Estate Finance. (Real Estate Finance) Disclaimer: Set forth in the Glossary are the current definitions of certain items that we use in this presentation. This Glossary is intended to facilitate a reader’s understanding of this presentation. There can be no assurance that we will not modify these terms in future presentations as we deem necessary or appropriate. 27