Attached files

| file | filename |

|---|---|

| EX-12.1 - EX-12.1 - ISTAR INC. | a2201748zex-12_1.htm |

| EX-12.2 - EX-12.2 - ISTAR INC. | a2201748zex-12_2.htm |

| EX-31.0 - EX-31.0 - ISTAR INC. | a2201748zex-31_0.htm |

| EX-23.1 - EX-23.1 - ISTAR INC. | a2201748zex-23_1.htm |

| EX-32.0 - EX-32.0 - ISTAR INC. | a2201748zex-32_0.htm |

| EX-21.1 - EX-21.1 - ISTAR INC. | a2201748zex-21_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplemental Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 1-15371 |

||

iSTAR FINANCIAL INC.

(Exact name of registrant as specified in its charter)

| Maryland | 95-6881527 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

1114 Avenue of the Americas, 39th Floor New York, NY |

10036 |

|

| (Address of principal executive offices) | (Zip code) |

Registrant's telephone number, including area code: (212) 930-9400

Securities registered pursuant to Section 12(b) of the Act:

Title of each class:

|

Name of Exchange on which registered:

|

|

|---|---|---|

| Common Stock, $0.001 par value | New York Stock Exchange | |

| 8.000% Series D Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.875% Series E Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.8% Series F Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.65% Series G Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.50% Series I Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports); and (ii) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer o | Accelerated filer ý | |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2010 the aggregate market value of the common stock, $0.001 par value per share of iStar Financial Inc. ("Common Stock"), held by non-affiliates (1) of the registrant was approximately $395.5 million, based upon the closing price of $4.46 on the New York Stock Exchange composite tape on such date.

As of March 11, 2011, there were 92,461,668 shares of Common Stock outstanding.

- (1)

- For purposes of this Annual Report only, includes all outstanding Common Stock other than Common Stock held directly by the registrant's directors and executive officers.

DOCUMENTS INCORPORATED BY REFERENCE

- 1.

- Portions of the registrant's definitive proxy statement for the registrant's 2011 Annual Meeting, to be filed within 120 days after the close of the registrant's fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Explanatory Note for Purposes of the "Safe Harbor Provisions" of Section 21E of the Securities Exchange Act of 1934, as amended

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are included with respect to, among other things, iStar Financial Inc.'s current business plan, business strategy, portfolio management, prospects and liquidity. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results or outcomes to differ materially from those contained in the forward-looking statements. Important factors that iStar Financial Inc. believes might cause such differences are discussed in the section entitled, "Risk Factors" in Part I, Item 1a of this Form 10-K or otherwise accompany the forward-looking statements contained in this Form 10-K. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In assessing all forward-looking statements, readers are urged to read carefully all cautionary statements contained in this Form 10-K.

Overview

iStar Financial Inc., or the "Company," is a fully-integrated finance and investment company focused on the commercial real estate industry. The Company provides custom-tailored investment capital to high-end private and corporate owners of real estate and invests directly across a range of real estate sectors. The Company, which is taxed as a real estate investment trust, or "REIT," has invested more than $35 billion over the past two decades. The Company's three primary business segments are lending, net leasing and real estate investment.

The lending portfolio is primarily comprised of senior and mezzanine real estate loans that typically range in size from $20 million to $150 million and have original terms generally ranging from three to ten years. These loans may be either fixed-rate (based on the U.S. Treasury rate plus a spread) or variable-rate (based on LIBOR plus a spread) and are structured to meet the specific financing needs of borrowers. The Company's portfolio also includes senior and subordinated loans to corporations, particularly those engaged in real estate or real estate related businesses. These financings may be either secured or unsecured, typically range in size from $20 million to $150 million and have initial maturities generally ranging from three to ten years. The Company's loan portfolio includes whole loans, loan participations and debt securities.

The Company's net lease portfolio is primarily comprised of properties owned by the Company and leased to single creditworthy tenants, where the properties are generally mission critical headquarters or distribution facilities that are subject to long-term leases. Most of the leases provide for expenses at the facility to be paid by the tenant on a triple net lease basis. Net lease transactions have initial terms generally ranging from 15 to 20 years and typically range in size from $20 million to $150 million.

The Company's real estate investment portfolio includes real estate held for investment ("REHI") and other real estate owned ("OREO") properties acquired through foreclosure or through deed-in-lieu of foreclosure in full or partial satisfaction of non-performing loans. Through the infusion of capital and/or intensive asset management, the Company generally seeks to reposition these distressed assets with the

1

objective of maximizing its recovery with respect to the investments. The Company has developed significant expertise in the ownership and repositioning of multifamily, condominium, master planned and development properties.

The Company's primary sources of revenues are interest income, which is the interest that borrowers pay on loans, and operating lease income, which is the rent that corporate customers pay to lease its properties. The Company primarily generates income through the "spread" or "margin," which is the difference between the revenues generated from loans and leases and interest expense and the cost of its net lease operations. Going forward, the Company also expects to earn income from its other real estate investments. Income from real estate investments may include operating revenues as well as income from sales of properties either in bulk or through unit sales. This income will be reduced by holding costs while the real estate investments are redeveloped, repositioned and eventually sold.

The Company began its business in 1993 through private investment funds and became publicly traded in 1998. Since that time, the Company has grown through the origination of new lending and leasing transactions, as well as through corporate acquisitions, including the acquisitions of TriNet Corporate Realty Trust, Inc. in 1999, Falcon Financial Investment Trust in 2005, a significant non-controlling interest in Oak Hill Advisors, L.P. and affiliates in 2005, and the commercial real estate lending business and loan portfolio, or "Fremont CRE," of Fremont Investment and Loan, or "Fremont," a division of Fremont General Corporation, in 2007.

Current Market Conditions

The economic recession and tightening of capital markets adversely affected the Company's business. The Company experienced significant provisions for loan losses and impairments resulting from high levels of non-performing loans and increasing amounts of real estate owned as the Company took title to assets of defaulting borrowers. The economic conditions and their effect on the Company's operations also resulted in increases in its financing costs and an inability to access the unsecured debt markets. Since the beginning of the crisis, the Company has significantly curtailed asset originations and has focused primarily on resolving problem assets, generating liquidity, retiring debt, decreasing leverage and preserving shareholder value.

The Company saw early signs of an economic recovery during 2010, including some improvements in the commercial real estate market and greater stability in the capital markets. These conditions resulted in reduced additions to non-performing loans, reductions in provisions for loan losses and increased levels of liquidity to fund operations. Despite improvement, these factors continue to have an effect on the Company's operations and operating costs. A more detailed discussion of how current market conditions have impacted the Company is provided in Item 7—"Management's Discussion and Analysis of Financial Condition and Results of Operations."

Risk Management

The Company's risk management team is a vertically integrated organization comprised of in-house professionals with expertise in asset management, legal, corporate credit, loan servicing, project and construction management and engineering. The risk management team includes a rated loan servicer, iStar Asset Services, or "iSAS," that is focused on preserving and maximizing returns from the Company's investments while providing the Company's customers with comprehensive post-closing support. The Company employs a proactive risk management strategy centered on information sharing and customer contact.

The Company has a quarterly risk rating process that enables it to evaluate, monitor and manage asset-specific credit issues and identify credit trends on a portfolio-wide basis. The quarterly risk rating process allows the Company to create a common language and framework to evaluate risk and the adequacy of the loan loss provision and reserves. A credit review of each asset is performed quarterly with

2

ratings of "1" to "5" assigned ("1" represents the lowest level of risk, "5" represents the highest level of risk).

The Company also has collateral and customer monitoring risk management systems that enable it to review the performance of its asset base. Risk management information is generated from collateral-level controls, customer reporting requirements and on-site asset and market monitoring programs.

iSAS, the Company's rated loan servicing subsidiary, and the Company's asset management personnel are responsible for managing the Company's asset base, including monitoring customers' compliance with their respective loan and leasing agreements, collecting customer payments and analyzing and distributing customer performance information. In addition, these individuals manage the construction oversight and disbursement process. iSAS performs servicing responsibilities primarily for Company owned assets.

The Company's risk management team employs an asset specific approach to managing and resolving loans that may become non-performing as well as REHI and OREO assets. Asset performance or collectability can deteriorate due to a variety of factors, including adverse market conditions, construction delays and overruns, or a borrower's financial condition or managerial capabilities. Once an asset's performance or collectability begins deteriorating and we believe the asset will become a non-performing loan ("NPL"), the team will formulate an asset resolution strategy.

For resolutions where title to collateral is obtained, the risk management team puts in place an asset-specific plan designed to maximize the value of the collateral. The plan may include completing the construction or renovation of the property, continuing the sale of condominium units, leasing or increasing the occupancy of the property, engaging a third party property manager or selling the entire asset or a partial interest to a third party. The Company may also seek to collect under guarantees of the loan.

The risk management team responsible for a non-performing loan or REHI/OREO resolution presents its proposed plan to the Company's senior management team for discussion and approval. The resolution plan is monitored on a quarterly basis and may be monitored more frequently, as necessary. Asset resolution strategies may be modified as conditions change.

Financing Strategy

The Company has utilized a wide range of debt and equity capital resources to finance its investment and growth strategies. Prior to the onset of the credit crisis, the Company's primary sources of liquidity were its unsecured bank credit facilities, issuances of unsecured debt and equity securities in capital markets transactions and repayments of loans. During 2008 and 2009, liquidity in the capital markets was severely constrained. Conditions improved somewhat in 2010, but have continued to impact the Company's cost of funds. As a result, the Company has sought alternative sources of liquidity primarily through secured debt financings and asset sales. The Company has sought, and may continue to seek, to raise capital through all means including secured financing, unsecured financing, asset sales, issuance of equity, joint ventures and other third party capital arrangements. A more detailed discussion of the Company's current liquidity and capital resources is provided in Item 7—"Management's Discussion and Analysis of Financial Condition and Results of Operations."

Investment Strategy

The Company has historically focused its investment strategy on the following:

- •

- Targeting the origination of large, custom-tailored mortgage, corporate and lease financings where customers require

flexible financial solutions and "one-call" responsiveness post-closing;

- •

- Avoiding commodity businesses where there is significant direct competition from other providers of capital;

3

- •

- Developing direct relationships with borrowers and corporate customers as opposed to sourcing transactions solely through

intermediaries;

- •

- Adding value beyond simply providing capital by offering borrowers and corporate customers specific lending expertise,

flexibility, certainty of closing and continuing relationships beyond the closing of a particular financing transaction;

- •

- Taking advantage of market anomalies in the real estate financing markets when, in the Company's view, credit was

mispriced by other providers of capital; and

- •

- Evaluating relative risk adjusted returns across multiple investment markets.

The Company's portfolio is generally characterized by:

- •

- Diversity by asset type, property type, obligor, loan/lease maturity and geography; and

- •

- Larger assets located in major metropolitan markets.

The Company significantly curtailed its new investment activity since the onset of the recent financial crisis. During this time, the Company has continued to fund pre-existing commitments to assets in its portfolio. In addition, the Company made a limited number of new investments in 2010 in assets already in its portfolio. The Company believes that it has a competitive advantage in such opportunities because of existing relationships with the customer and in-depth knowledge of the asset. The Company believes that investment opportunities within its existing $9.2 billion portfolio present attractive risk-adjusted return opportunities for the Company and expects to make additional investments of this type in the future.

4

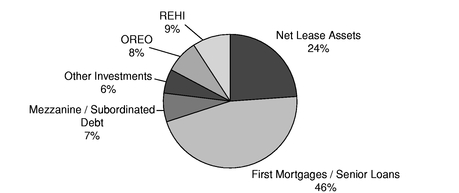

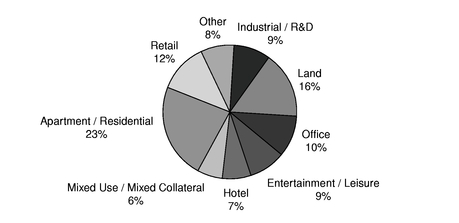

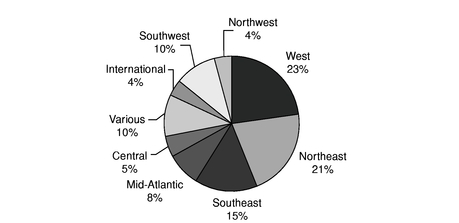

As of December 31, 2010, based on current gross carrying values, the Company's total investment portfolio has the following characteristics:

Asset Type

Property Type

Geography

5

Underwriting Process

The Company discusses and analyzes investment opportunities in meetings which are attended by its investment professionals, as well as representatives from its legal, credit, risk management and capital markets areas. The Company has developed a process for screening potential investments called the Six Point Methodologysm. Through this process, the Company evaluates an investment opportunity prior to beginning its formal due diligence process by: (1) evaluating the source of the opportunity; (2) evaluating the quality of the collateral or corporate credit, as well as its market or industry dynamics; (3) evaluating the equity or corporate sponsor; (4) determining whether it can implement an appropriate legal and financial structure for the transaction given its risk profile; (5) performing an alternative investment test; and (6) evaluating the liquidity of the investment and its ability to match fund the asset.

The Company's underwriting process provides for feedback and review by key disciplines within the Company, including investments, legal, credit, risk management and capital markets. Participation is encouraged from professionals in these disciplines throughout the entire origination process, from the initial consideration of the opportunity, through the Six Point Methodologysm and into the preparation and distribution of a memorandum for the Company's internal and/or Board of Directors investment committees.

Any commitment to make an investment of $25 million or less ($50 million or less in the case of a corporate debt instrument or aggregate debt instruments issued by a single corporate issuer) in any transaction or series of related transactions requires the approval of the Chief Executive Officer and Chief Investment Officer. Any commitment in an amount in excess of $25 million (or $50 million, in the case of a corporate debt instrument) but less than or equal to $75 million requires the further approval of the Company's internal investment committee, consisting of senior management representatives from all of the Company's key disciplines. Any commitment in an amount in excess of $75 million but less than or equal to $150 million requires the further approval of the Investment Committee of the Board of Directors. Any commitment in an amount in excess of $150 million, and any strategic investment such as a corporate merger, acquisition or material transaction involving the Company's entry into a new line of business, requires the approval of the full Board of Directors.

Hedging Strategy

The Company has variable-rate lending assets and variable-rate debt obligations. These assets and liabilities create a natural hedge against changes in variable interest rates. This means that, as interest rates increase, the Company earns more on its variable-rate lending assets and pays more on its variable-rate debt obligations and, conversely, as interest rates decrease, the Company earns less on its variable-rate lending assets and pays less on its variable-rate debt obligations. When the Company's variable-rate debt obligations differ significantly from its variable-rate lending assets, the Company may utilize derivative instruments to limit the impact of changing interest rates on its net income. The Company does not use derivative instruments for speculative purposes. The derivative instruments the Company uses are typically in the form of interest rate swaps and foreign currency hedges.

Industry Segments

The Company has three reportable operating segments: Real Estate Lending, Net Leasing and Real Estate Investment. The Real Estate Lending segment includes all of the Company's activities related to senior and mezzanine real estate debt and corporate capital investments. The Net Leasing segment includes all of the Company's activities related to the ownership and leasing of corporate facilities. The Real Estate Investment segment includes all of the Company's activities related to the repositioning and ultimate disposition of distressed or non-performing REHI and OREO assets. Segment revenue and profit information is presented in Item 8—"Financial Statements and Supplementary Data—Note 17."

6

Real Estate Lending

The Company's Real Estate Lending segment includes loans and other lending investments, which primarily consist of senior mortgage loans that are secured by commercial and residential real estate assets. A smaller portion of the portfolio consists of subordinated mortgage loans that are secured by subordinated interests in commercial and residential real estate assets and corporate/partnership loans, which may be senior or subordinate and corporate debt securities.

As of December 31, 2010, a portion of the Company's loan portfolio was designated as non-performing. Non-performing loans are placed on non-accrual status and reserves for loan losses are recorded to the extent these loans are determined to be impaired. See Item 8—"Financial Statements and Supplemental Data—Note 3" for a discussion of the Company's policies regarding non-performing loans and reserves for loan losses.

As of December 31, 2010, the Company's Real Estate Lending segment included the following ($ in thousands):

| |

|

% of Total |

||||||

|---|---|---|---|---|---|---|---|---|

Performing loans: |

||||||||

Senior mortgages |

$ | 2,382,875 | 44.2 | % | ||||

Subordinate mortgages |

305,245 | 5.7 | % | |||||

Corporate/Partnership loans |

678,241 | 12.6 | % | |||||

Subtotal |

3,366,361 | 62.5 | % | |||||

Non-performing loans: |

||||||||

Senior mortgages |

2,007,895 | 37.3 | % | |||||

Corporate/Partnership loans |

11,294 | 0.2 | % | |||||

Subtotal |

2,019,189 | 37.5 | % | |||||

Total gross carrying value of loans |

5,385,550 | 100.0 | % | |||||

Reserve for loan losses |

(814,625 | ) | ||||||

Total carrying value of loans |

4,570,925 | |||||||

Other lending investments—securities |

16,427 | |||||||

Total loans and other lending investments, net |

$ | 4,587,352 | ||||||

During the year ended December 31, 2010, the Company funded $356.3 million under existing loan commitments, received gross principal repayments of $2.06 billion and sold loans with a total carrying value of $808.8 million.

7

Summary of Collateral Types—As of December 31, 2010, the Company's real estate lending segment was comprised of the following collateral types ($ in thousands):

Collateral Type

|

Performing Loans and Securities(1) |

Non- performing Loans(1) |

Total | % of Total |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Apartment/Residential |

$ | 1,009,817 | $ | 588,918 | $ | 1,598,735 | 34.0 | % | |||||

Retail |

596,344 | 214,873 | 811,217 | 17.2 | % | ||||||||

Land |

379,105 | 268,536 | 647,641 | 13.7 | % | ||||||||

Hotel |

399,262 | 20,847 | 420,109 | 8.9 | % | ||||||||

Mixed Use/Mixed Collateral |

267,623 | 93,658 | 361,281 | 7.7 | % | ||||||||

Entertainment/Leisure |

193,353 | 77,801 | 271,154 | 5.8 | % | ||||||||

Office |

212,771 | 53,007 | 265,778 | 5.6 | % | ||||||||

Industrial/R&D |

98,721 | 21,330 | 120,051 | 2.6 | % | ||||||||

Other |

199,146 | 12,440 | 211,586 | 4.5 | % | ||||||||

Carrying value |

$ | 3,356,142 | $ | 1,351,410 | 4,707,552 | 100.0 | % | ||||||

General reserve for loan losses |

(120,200 | ) | |||||||||||

Total loans and other lending investments, net |

$ | 4,587,352 | |||||||||||

Explanatory Note:

- (1)

- Performing loans and securities and non-performing loans are presented net of asset-specific loan loss reserves of $26.6 million and $667.8 million, respectively.

Summary of Loan Interest Rate Characteristics—As of December 31, 2010, the Company's loans and other lending investments had the following interest rate characteristics ($ in thousands):

| |

Carrying Value |

% of Total |

Weighted Average Accrual Rate |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Fixed-rate loans |

$ | 1,362,332 | 25.2 | % | 8.42 | % | ||||

Variable-rate loans(1) |

2,020,456 | 37.4 | % | 5.64 | % | |||||

Non-performing loans |

2,019,189 | 37.4 | % | N/A | ||||||

Gross carrying value of loans |

5,401,977 | 100.0 | % | |||||||

Reserve for loan losses |

(814,625 | ) | ||||||||

Total loans and other lending investments, net |

$ | 4,587,352 | ||||||||

Explanatory Note:

- (1)

- As of December 31, 2010, amount includes $823.5 million of loans with a weighted average interest rate floor of 3.55%.

8

Summary of Loan Maturities—As of December 31, 2010, the Company's loans and other lending investments had the following maturities ($ in thousands):

Year of Maturity

|

Number of Loans Maturing |

Carrying Value |

% of Total |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

2011 |

35 | $ | 971,844 | 18.0 | % | |||||

2012 |

20 | 818,162 | 15.1 | % | ||||||

2013 |

13 | 508,495 | 9.4 | % | ||||||

2014 |

9 | 292,352 | 5.4 | % | ||||||

2015 |

6 | 258,510 | 4.8 | % | ||||||

2016 and thereafter |

26 | 533,425 | 9.9 | % | ||||||

Total performing loans |

109 | 3,382,788 | 62.6 | % | ||||||

Non-performing loans |

47 | 2,019,189 | 37.4 | % | ||||||

Gross carrying value |

156 | 5,401,977 | 100.0 | % | ||||||

Reserve for loan losses |

(814,625 | ) | ||||||||

Total loans and other lending investments, net |

$ | 4,587,352 | ||||||||

Net Leasing

The Company has pursued the origination of net lease transactions by structuring purchase/leasebacks and by acquiring facilities subject to existing long-term net leases. In a typical purchase/leaseback transaction, the Company purchases a corporation's facility and leases it back to that corporation subject to a long-term net lease. This structure allows the corporate customer to reinvest the proceeds from the sale of its facilities into its core business, while the Company benefits from a long-term income stream. The Company generally intends to hold its net lease assets for long-term investment. However, subject to certain tax restrictions, the Company may dispose of assets if it deems the disposition to be in the Company's best interests.

Under a typical net lease agreement, the corporate customer agrees to pay a base monthly operating lease payment and all facility operating expenses (including taxes, maintenance and insurance). The Company generally seeks corporate customers that are established companies with stable core businesses or market leaders in growing or stable industries with commitments to the facilities that are mission-critical to their ongoing businesses.

During the year ended December 31, 2010, the Company sold net lease assets with a carrying value of $1.17 billion including a $1.05 billion portfolio of 32 net lease assets that represented approximately 30% of the net book value of the Company's net lease portfolio at the time of disposition. These sales resulted in gains of $270.4 million for the year ended December 31, 2010.

9

Summary of Portfolio Characteristics—As of December 31, 2010, the Company owned 311 facilities, comprising 25.2 million square feet in 35 states with a carrying value of $1.78 billion. In addition, net lease assets were 88.9% leased with a weighted average remaining lease term of approximately 13 years.

As of December 31, 2010, the Company's Net Leasing segment was comprised of the following property types:

Property Type

|

# of Leases |

% of In-Place Operating Lease Income(1) |

% of Total Revenue(2) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Industrial/R&D |

24 | 29.6 | % | 9.4 | % | |||||

Entertainment/Leisure |

6 | 26.4 | % | 8.4 | % | |||||

Office |

40 | 25.9 | % | 8.2 | % | |||||

Retail |

10 | 9.1 | % | 2.9 | % | |||||

Hotel |

4 | 9.0 | % | 2.9 | % | |||||

Total |

84 | 100.0 | % | |||||||

Explanatory Notes:

- (1)

- Reflects

a percentage of annualized GAAP operating lease income for leases in-place at December 31, 2010.

- (2)

- Reflects annualized GAAP operating lease income for leases in-place at December 31, 2010 as a percentage of annualized total revenue for the quarter ended December 31, 2010.

Summary of Lease Expirations—As of December 31, 2010, lease expirations on the Company's net lease assets are as follows ($ in thousands):

Year of Lease Expiration

|

Number of Leases Expiring |

Annualized In-Place Operating Lease Income(1) |

% of In-Place Operating Lease Income |

% of Total Revenue(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2011 |

4 | $ | 2,919 | 1.7 | % | 0.5 | % | ||||||

2012 |

10 | 9,933 | 5.7 | % | 1.8 | % | |||||||

2013 |

4 | 1,897 | 1.1 | % | 0.3 | % | |||||||

2014 |

4 | 823 | 0.5 | % | 0.2 | % | |||||||

2015 |

5 | 3,607 | 2.0 | % | 0.7 | % | |||||||

2016 |

5 | 6,660 | 3.8 | % | 1.2 | % | |||||||

2017 |

6 | 2,627 | 1.5 | % | 0.5 | % | |||||||

2018 |

7 | 5,884 | 3.4 | % | 1.1 | % | |||||||

2019 |

3 | 2,073 | 1.2 | % | 0.4 | % | |||||||

2020 |

6 | 19,934 | 11.4 | % | 3.6 | % | |||||||

2021 and thereafter |

30 | 118,222 | 67.7 | % | 21.5 | % | |||||||

Total |

84 | $ | 174,579 | 100.0 | % | ||||||||

Weighted average remaining lease term |

12.9 years |

Explanatory Notes:

- (1)

- Reflects

annualized GAAP operating lease income for leases in-place at December 31, 2010.

- (2)

- Reflects the percentage of annualized GAAP operating lease income for leases in-place at December 31, 2010 as a percentage of annualized total revenue for the quarter ended December 31, 2010.

10

Real Estate Investment

The Real Estate Investment segment includes all of the Company's activities related to the repositioning and ultimate disposition of distressed assets. Real estate investment includes REHI and OREO properties that are acquired through foreclosure or through deed-in-lieu of foreclosure in full or partial satisfaction of non-performing loans. Properties are designated as REHI or OREO depending on the Company's business plan to realize the maximum value from the collateral received. When the Company intends to hold, operate or develop a property for a period of at least 12 months, assets are classified as REHI, and when it intends to market these properties for sale in the near term, assets are classified as OREO.

As of December 31, 2010, the Company's Real Estate Investment segment included the following ($ in thousands):

| |

Property Count |

Carrying Value |

% of Total |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Real estate held for investment, net |

25 | $ | 833,060 | 52.8 | % | ||||||

Other real estate owned |

30 | 746,081 | 47.2 | % | |||||||

Total REHI and OREO |

55 | $ | 1,579,141 | 100.0 | % | ||||||

The Company generally seeks to reposition the distressed assets within this portfolio through the infusion of capital and/or intensive asset management, with the objective of maximizing its recovery with respect to the investments.

Summary of Property Types—As of December 31, 2010, the Company's Real Estate Investment segment was comprised of the following property types ($ in thousands):

Property Type

|

REHI | OREO | Total | % of Total |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Land |

$ | 637,701 | $ | 114,162 | $ | 751,863 | 47.6 | % | |||||

Apartment/Residential |

11,224 | 476,658 | 487,882 | 30.9 | % | ||||||||

Mixed Use/Mixed Collateral |

24,956 | 72,135 | 97,091 | 6.1 | % | ||||||||

Retail |

49,344 | 44,204 | 93,548 | 5.9 | % | ||||||||

Hotel |

43,058 | 15,000 | 58,058 | 3.7 | % | ||||||||

Industrial/R&D |

49,625 | 6,300 | 55,925 | 3.6 | % | ||||||||

Office |

17,152 | 16,422 | 33,574 | 2.1 | % | ||||||||

Entertainment/Leisure |

— | 1,200 | 1,200 | 0.1 | % | ||||||||

Carrying value |

$ | 833,060 | $ | 746,081 | $ | 1,579,141 | 100.0 | % | |||||

Policies with Respect to Other Activities

The Company's investment, financing and conflicts of interests policies are managed under the ultimate supervision of the Company's Board of Directors. The Company can amend, revise or eliminate these policies at anytime without a vote of shareholders. The Company currently intends to make investments in a manner consistent with the requirements of the Internal Revenue Code of 1986, as amended (the "Code") for the Company to qualify as a REIT.

Investment Restrictions or Limitations

The Company does not have any prescribed allocation among investments or product lines. Instead, the Company focuses on corporate and real estate credit underwriting to develop an analysis of the risk/reward ratios in determining the pricing and advisability of each particular transaction.

11

The Company believes that it is not, and intends to conduct its operations so as not to become, regulated as an investment company under the Investment Company Act. The Investment Company Act generally exempts entities that are "primarily engaged in purchasing or otherwise acquiring mortgages and other liens on and interests in real estate" (collectively, "Qualifying Interests"). The Company intends to rely on current interpretations of the Securities and Exchange Commission in an effort to qualify for this exemption. Based on these interpretations, the Company, among other things, must maintain at least 55% of its assets in Qualifying Interests and at least 25% of its assets in real estate- related assets (subject to reduction to the extent the Company invests more than 55% of its assets in Qualifying Interests). The Company's senior mortgages, net lease assets and certain of its subordinated mortgages generally constitute Qualifying Interests. Subject to the limitations on ownership of certain types of assets and the gross income tests imposed by the Code, the Company also may invest in the securities of other REITs, other entities engaged in real estate activities or other issuers, including for the purpose of exercising control over such entities.

Competition

The Company operates in a competitive market. See Item 1a—"Risk factors—We compete with a variety of financing and leasing sources for our customers," for a discussion of how we may be affected by competition.

Regulation

The operations of the Company are subject, in certain instances, to supervision and regulation by state and federal governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (1) regulate credit granting activities; (2) establish maximum interest rates, finance charges and other charges; (3) require disclosures to customers; (4) govern secured transactions; and (5) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. Although most states do not regulate commercial finance, certain states impose limitations on interest rates and other charges and on certain collection practices and creditor remedies, and require licensing of lenders and financiers and adequate disclosure of certain contract terms. The Company is also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to commercial loans.

In the judgment of management, existing statutes and regulations have not had a material adverse effect on the business conducted by the Company. It is not possible at this time to forecast the exact nature of any future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon the future business, financial condition or results of operations or prospects of the Company.

The Company has elected and expects to continue to qualify to be taxed as a REIT under Section 856 through 860 of the Code. As a REIT, the Company must generally distribute at least 90% of its net taxable income, excluding capital gains, to its shareholders each year. In addition, the Company must distribute 100% of its net taxable income each year to avoid paying federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT qualification. These requirements include specific share ownership tests and asset and gross income tests. If the Company fails to qualify as a REIT in any taxable year, the Company will be subject to federal income tax (including any applicable alternative minimum tax) on its net taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, the Company may be subject to state and local taxes and to federal income tax and excise tax on its undistributed income.

Code of Conduct

The Company has adopted a code of business conduct for all of its employees and directors, including the Company's chief executive officer, chief financial officer, other executive officers and personnel. A

12

copy of the Company's code of conduct has been previously filed with the SEC and is incorporated by reference in this Annual Report on Form 10-K as Exhibit 14.0. The code of conduct is also available on the Company's website at www.istarfinancial.com. The Company intends to post on its website material changes to, or waivers from, its code of conduct, if any, within two days of any such event. As of December 31, 2010, there were no waivers or changes since adoption of the current code of conduct in October 2002.

Employees

As of January 31, 2011, the Company had approximately 200 employees and believes its relationships with its employees to be good. The Company's employees are not represented by any collective bargaining agreements.

Other

In addition to this Annual Report, the Company files quarterly and special reports, proxy statements and other information with the SEC. All documents are filed with the SEC and are available free of charge on the Company's corporate website, which is www.istarfinancial.com. Through the Company's website, the Company makes available free of charge its annual proxy statement, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those Reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. You may also read and copy any document filed at the public reference facilities at 100 F Street, N.E., Washington, D.C. 25049. Please call the SEC at (800) SEC-0330 for further information about the public reference facilities. These documents also may be accessed through the SEC's electronic data gathering, analysis and retrieval system ("EDGAR") via electronic means, including on the SEC's homepage, which can be found at www.sec.gov.

13

In addition to the other information in this document, you should consider carefully the following risk factors in evaluating an investment in our securities. Any of these risks or the occurrence of any one or more of the uncertainties described below could have a material adverse effect on our business, financial condition, results of operations, cash flows, and trading price of our common stock. For purposes of these risk factors, the terms "we," "our" and "us" refer to iStar Financial Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

Changes in general economic conditions have and may continue to adversely affect our business.

Our success is generally dependent upon economic conditions in the U.S. and, in particular, the geographic areas in which a substantial number of our investments are located. Substantially all businesses, including ours, were negatively affected by the 2008/2009 economic recession and illiquidity and volatility in the commercial real estate and credit markets. Although there were early signs of an economic recovery and greater stability in the commercial real estate and credit markets beginning in 2010, it is not possible for us to predict whether these trends will continue in the future or quantify the impact of these or other trends on our financial results. A deterioration in economic trends could have a material adverse effect on our financial performance and our ability to meet our debt obligations.

We have significant indebtedness and limitations on our liquidity and ability to raise capital may adversely affect us.

Sufficient liquidity is critical to the management of our balance sheet and our ability to meet our scheduled debt payments. However, liquidity in the capital markets has been constrained since the beginning of the credit crisis, and our cost of funds has increased. During this time, we have primarily relied on secured borrowings, repayments on our loan assets and proceeds from asset sales to fund our operations and meet our debt maturities, and we expect to continue to rely on these sources of liquidity for the foreseeable future. After giving effect to the new secured credit Facility and subsequent repayments of debt (see Item 8—"Financial Statements and Supplemental Data—Note 19"), we will have approximately $882 million of debt maturing and minimum required amortization payments due on or before December 31, 2011. Failure to repay or refinance our borrowings as they come due would have a material adverse effect on our business and stock price.

We have suffered adverse consequences as a result of our credit ratings being downgraded.

Our borrowing costs and our access to the debt capital markets depend significantly on our credit ratings. Our unsecured corporate credit ratings from major national credit rating agencies are currently below investment grade. Having below investment grade credit ratings has increased our borrowing costs and caused restrictive covenants in our public debt instruments to become operative. These factors have adversely impacted our financial performance and will continue to do so unless our credit ratings improve.

Covenants in our indebtedness could limit our flexibility and adversely affect our financial condition.

Our outstanding unsecured debt securities contain covenants that include fixed charge coverage and unencumbered assets to unsecured indebtedness ratios. The fixed charge coverage ratio in our debt securities is an incurrence test. While we expect that our ability to incur new indebtedness under the coverage ratio will be limited for the foreseeable future, we will continue to be permitted to incur indebtedness for the purpose of refinancing existing indebtedness and for other permitted purposes under the indentures. The unencumbered assets to unsecured indebtedness covenant is a maintenance covenant. If any of our covenants is breached and not cured within applicable cure periods, the breach could result in

14

acceleration of our debt securities unless a waiver or modification is agreed upon with the requisite percentage of the bondholders.

Our new secured credit Facility (see Item 8—"Financial Statements and Supplemental Data—Note 19") contains certain covenants, including covenants relating to the delivery of information to the lenders, collateral coverage, dividend payments, restrictions on fundamental changes, transactions with affiliates and matters relating to the liens granted to the lenders. In particular, we are required to maintain collateral coverage of 1.25x outstanding borrowings. In addition, for so long as we maintain our qualification as a REIT, the new secured credit Facility permits us to distribute 100% of our REIT taxable income on an annual basis. We may not pay common dividends if we cease to qualify as a REIT.

Our new secured credit Facility contains cross default provisions that would allow the lenders to declare an event of default and accelerate our indebtedness to them if we fail to pay amounts due in respect of our other recourse indebtedness in excess of specified thresholds or if the lenders under such other indebtedness are otherwise permitted to accelerate such indebtedness for any reason. The indentures governing our unsecured public debt securities permit the lenders and bondholders to declare an event of default and accelerate our indebtedness to them if we fail to pay amounts due at maturity in respect of other recourse indebtedness in excess of specified thresholds or if such indebtedness is accelerated. Our unsecured credit facilities permit the lenders to accelerate our indebtedness to them if our other recourse indebtedness in excess of specified thresholds is accelerated.

The covenants described above could limit our flexibility. In addition, a default by us on our indebtedness would have a material adverse effect on our business and the market price of our Common Stock.

Our reserves for loan losses may prove inadequate, which could have a material adverse effect on our financial results.

We maintain loan loss reserves to protect against potential losses and conduct a review of the adequacy of these reserves on a quarterly basis. Our general loan loss reserve reflects management's then-current estimation of the probability and severity of losses within our portfolio, based on this quarterly review. In addition, our determination of asset-specific loan loss reserves relies on material estimates regarding the fair value of loan collateral. Estimation of ultimate loan losses, provision expenses and loss reserves is a complex and subjective process. As such, there can be no assurance that management's judgment will prove to be correct and that reserves will be adequate over time to protect against potential future losses. Such losses could be caused by factors including, but not limited to, unanticipated adverse changes in the economy or events adversely affecting specific assets, borrowers, industries in which our borrowers operate or markets in which our borrowers or their properties are located. In particular, our non-performing loans increased materially during the financial crisis, driven by the weak economy and the disruption of the credit markets which adversely impacted the ability and willingness of many of our borrowers to service their debt and refinance our loans to them at maturity. If our reserves for credit losses prove inadequate we may suffer additional losses which would have a material adverse effect on our financial performance and results of operations.

We are required to make a number of judgments in applying accounting policies, and different estimates and assumptions could result in changes to our financial condition and results of operations.

Material estimates that are particularly susceptible to significant change relate to our determination of the reserve for loan losses, which is based primarily on the estimated fair value of loan collateral, as well as the valuation of net lease, OREO and REHI assets and intangible assets. While we have identified those accounting policies that are considered critical and have procedures in place to facilitate the associated judgments, different assumptions in the application of these policies could have a material adverse effect

15

on our financial performance and results of operations and actual results may differ materially from our estimates.

We have suffered losses when a borrower defaults on a loan and the underlying collateral is not sufficient, and we may suffer additional losses in the future.

We have suffered significant losses arising from borrower defaults on our loan assets and we may suffer additional losses in the future. In the event of a default by a borrower on a non-recourse loan, we will only have recourse to the real estate-related assets collateralizing the loan. If the underlying collateral value is less than the loan amount, we will suffer a loss. Conversely, we sometimes make loans that are unsecured or are secured only by equity interests in the borrowing entities. These loans are subject to the risk that other lenders may be directly secured by the real estate assets of the borrower. In the event of a default, those collateralized lenders would have priority over us with respect to the proceeds of a sale of the underlying real estate. In cases described above, we may lack control over the underlying asset collateralizing our loan or the underlying assets of the borrower prior to a default, and as a result the value of the collateral may be reduced by acts or omissions by owners or managers of the assets.

We sometimes obtain individual or corporate guarantees from borrowers or their affiliates, which are not secured. In cases where guarantees are not fully or partially secured, we typically rely on financial covenants from borrowers and guarantors which are designed to require the borrower or guarantor to maintain certain levels of creditworthiness. Where we do not have recourse to specific collateral pledged to satisfy such guarantees or recourse loans, we will only have recourse as an unsecured creditor to the general assets of the borrower or guarantor, some or all of which may be pledged to satisfy other lenders. There can be no assurance that a borrower or guarantor will comply with its financial covenants, or that sufficient assets will be available to pay amounts owed to us under our loans and guarantees. As a result of these factors, we may suffer additional losses which could have a material adverse effect on our financial performance.

In the event of a borrower bankruptcy, we may not have full recourse to the assets of the borrower in order to satisfy our loan. In addition, certain of our loans are subordinate to other debts of the borrower. If a borrower defaults on our loan or on debt senior to our loan, or in the event of a borrower bankruptcy, our loan will be satisfied only after the senior debt receives payment. Where debt senior to our loan exists, the presence of intercreditor arrangements may limit our ability to amend our loan documents, assign our loans, accept prepayments, exercise our remedies (through "standstill" periods) and control decisions made in bankruptcy proceedings relating to borrowers. Bankruptcy and borrower litigation can significantly increase collection costs and losses and the time necessary to acquire title to the underlying collateral, during which time the collateral may decline in value, causing us to suffer additional losses.

If the value of collateral underlying our loan declines or interest rates increase during the term of our loan, a borrower may not be able to obtain the necessary funds to repay our loan at maturity through refinancing. Decreasing collateral value and/or increasing interest rates may hinder a borrower's ability to refinance our loan because the underlying property cannot satisfy the debt service coverage requirements necessary to obtain new financing. If a borrower is unable to repay our loan at maturity, we could suffer additional loss which may adversely impact our financial performance.

We are subject to additional risks associated with loan participations.

Some of our loans are participation interests or co-lender arrangements in which we share the rights, obligations and benefits of the loan with other lenders. We may need the consent of these parties to exercise our rights under such loans, including rights with respect to amendment of loan documentation, enforcement proceedings in the event of default and the institution of, and control over, foreclosure proceedings. Similarly, a majority of the participants may be able to take actions to which we object but to

16

which we will be bound if our participation interest represents a minority interest. We may be adversely affected by this lack of full control.

We are subject to additional risk associated with foreclosed assets

We have obtained title to several assets that have served as collateral on defaulted loans. These assets are classified as REHI or OREO, based on our intention to either hold the properties over a longer period or to market them for sale in the near term. The assets are predominantly land and substantially completed condominium/multi-family projects. We must incur costs to carry these assets and in some cases make improvements to or complete the assets. These activities require additional liquidity and also result in additional expenses that impact our operating results. In addition, to the extent we need to raise liquidity through asset sales, we may be limited in our ability to sell these assets in a short time frame. We currently have several loans that are in default and to the extent the borrowers cannot cure the default, we could take title to these assets, which would require additional liquidity and further increase our expenses.

We may experience losses if the creditworthiness of our net lease asset tenants deteriorates and they are unable to meet their lease obligations.

We own the properties leased to the tenants of our net lease assets and receive rents from the tenants during the contracted term of such leases. A tenant's ability to pay rent is determined by its creditworthiness, among other factors. If a tenant's credit deteriorates, the tenant may default on its obligations under our lease and may also become bankrupt. The bankruptcy or insolvency of our tenants or other failure to pay is likely to adversely affect the income produced by our net lease assets. If a tenant defaults, we may experience delays and incur substantial costs in enforcing our rights as landlord. If a tenant files for bankruptcy, we may not be able to evict the tenant solely because of such bankruptcy or failure to pay. A court, however, may authorize a tenant to reject and terminate its lease with us. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In addition, certain amounts paid to us within 90 days prior to the tenant's bankruptcy filing could be required to be returned to the tenant's bankruptcy estate. In any event, it is highly unlikely that a bankrupt or insolvent tenant would pay in full amounts it owes us under a lease. In other circumstances, where a tenant's financial condition has become impaired, we may agree to partially or wholly terminate the lease in advance of the termination date in consideration for a lease termination fee that is likely less than the total contractual rental amount. Without regard to the manner in which the lease termination occurs, we are likely to incur additional costs in the form of tenant improvements and leasing commissions in our efforts to lease the space to a new tenant. In any of the foregoing circumstances, our financial performance could be materially adversely affected.

Lease expirations, lease defaults and lease terminations may adversely affect our revenue.

Lease expirations and lease terminations may result in reduced revenues if the lease payments received from replacement tenants are less than the lease payments received from the expiring or terminating corporate tenants. In addition, lease defaults or lease terminations by one or more significant tenants or the failure of tenants under expiring leases to elect to renew their leases could cause us to experience long periods of vacancy with no revenue from a facility and to incur substantial capital expenditures and/or lease concessions in order to obtain replacement tenants.

We are subject to risks relating to our asset concentration.

Our portfolio consists primarily of large balance commercial real estate loans and net lease, OREO and REHI assets. Our asset base is generally diversified by asset type, obligor, property type and geographic location. However, as of December 31, 2010, approximately 23.2% of the carrying value of our assets related to apartment/residential assets, 16.3% related to land, 12.1% related to retail properties and

17

10.0% related to office properties. All of these types of collateral have been adversely affected by the financial crisis. In addition, as of December 31, 2010, approximately 22.7% of the carrying value of our assets related to properties located in the western U.S., 20.7% related to properties located in the northeastern U.S., 10.2% related to properties located in the southwest U.S and 15.1% related to properties located in the southeastern U.S. These regions include areas such as Florida, California and Nevada that were particularly hard hit by the downturn in the residential real estate markets. We may suffer additional losses on our assets based on these concentrations.

We underwrite the credit of prospective borrowers and customers and often require them to provide some form of credit support such as corporate guarantees, letters of credit and/or cash security deposits. Although our loans and other lending investments and net lease assets are geographically diverse and the borrowers and customers operate in a variety of industries, to the extent we have a significant concentration of interest or operating lease revenues from any single borrower or customer, the inability of that borrower or customer to make its payment could have an adverse effect on us. As of December 31, 2010, our five largest borrowers or tenants of net lease assets collectively accounted for approximately 23.7% of our aggregate annualized interest and operating lease revenue, of which no single customer accounts for more than 6.0%.

We compete with a variety of financing and leasing sources for our customers.

The financial services industry and commercial real estate markets are highly competitive. Our competitors include finance companies, other REITs, commercial banks and thrift institutions, investment banks and hedge funds. Our competitors seek to compete aggressively on the basis of a number of factors including transaction pricing, terms and structure. We may have difficulty competing to the extent we are unwilling to match our competitors' deal terms in order to maintain our interest margins and/or credit standards. To the extent that we match competitors' pricing, terms or structure, we may experience decreased interest margins and/or increased risk of credit losses, which could have an adverse effect on our financial performance.

We face significant competition within our net leasing business from other owners, operators and developers of properties, many of which own properties similar to ours in markets where we operate. Such competition may affect our ability to attract and retain tenants and reduce the rents we are able to charge. These competing properties may have vacancy rates higher than our properties, which may result in their owners being willing to rent space at lower rental rates than we would or providing greater tenant improvement allowances or other leasing concessions. This combination of circumstances could adversely affect our revenues and financial performance.

We are subject to certain risks associated with investing in real estate, including potential liabilities under environmental laws and risks of loss from earthquakes and terrorism.

Under various U.S. federal, state and local environmental laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, under or in its property. Those laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of such hazardous or toxic substances. The costs of investigation, remediation or removal of those substances may be substantial. The owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners of real properties for personal injuries associated with asbestos-containing materials. While a secured lender is not likely to be subject to these forms of environmental liability, when we foreclose on real property, we become an owner and are subject to the risks of environmental liability.

18

Additionally, under our net lease assets we require our tenants to undertake the obligation for environmental compliance and indemnify us from liability with respect thereto. There can be no assurance that our tenants will have sufficient resources to satisfy their obligations to us.

As of December 31, 2010, approximately 26.8% of the carrying value of our assets was located in the Western and Northwestern United States, geographic areas at higher risk for earthquakes. In addition, a significant number of our properties are located in New York City and other major urban areas which, in recent years, have been high risk geographical areas for terrorism and threats of terrorism. Future earthquakes or acts of terrorism could adversely impact the demand for, and value of, our assets and could also directly impact the value of our assets through damage, destruction or loss, and could thereafter materially impact the availability or cost of insurance to protect against these events. Although we believe our owned real estate and the properties collateralizing our loan assets are adequately covered by insurance, we cannot predict at this time if we or our borrowers will be able to obtain appropriate coverage at a reasonable cost in the future, or if we will be able to continue to pass along all of the costs of insurance to our tenants. Any earthquake or terrorist attack, whether or not insured, could have a material adverse effect on our financial performance, the market price of our Common Stock and our ability to pay dividends. In addition, there is a risk that one or more of our property insurers may not be able to fulfill its obligations with respect to claims payments due to a deterioration in its financial condition.

From time to time we make investments in companies over which we do not have sole control. Some of these companies operate in industries that differ from our current operations, with different risks than investing in real estate.

From time to time we make debt or equity investments in other companies that we may not control or over which we may not have sole control. These investments include but are not limited to: LNR Property Corporation ("LNR"), Oak Hill Advisors and other equity and mezzanine investments. Although these businesses generally have a significant real estate component, some of them operate in businesses that are different from our primary business segments including, without limitation, advising corporate credit funds and special servicing of securitized debt. Consequently, investments in these businesses, among other risks, subject us to the operating and financial risks of industries other than real estate and to the risk that we do not have sole control over the operations of these businesses. From time to time we may make additional investments in or acquire other entities that may subject us to similar risks. Investments in entities over which we do not have sole control, including joint ventures, present additional risks such as having differing objectives than our partners or the entities in which we invest, or becoming involved in disputes, or competing with those persons. In addition, we rely on the internal controls and financial reporting controls of these entities and their failure to maintain effectiveness or comply with applicable standards may adversely affect us.

Declines in the market values of our equity investments may adversely affect periodic reported results.

Most of our equity investments are in funds or companies that are not publicly traded and their fair value may not be readily determinable. We may periodically estimate the fair value of these investments, based upon available information and management's judgment. Because such valuations are inherently uncertain, they may fluctuate over short periods of time. In addition, our determinations regarding the fair value of these investments may be materially higher than the values that we ultimately realize upon their disposal, which could result in losses that have a material adverse effect on our financial performance, the market price of our common stock and our ability to pay dividends.

We may utilize derivative instruments to hedge risk, which may adversely affect our borrowing cost and expose us to other risks.

The derivative instruments we use are typically in the form of interest rate swaps and foreign currency swaps. Interest rate swaps effectively change variable-rate debt obligations to fixed-rate debt obligations or

19

fixed-rate debt obligations to variable-rate debt obligations. Foreign currency swaps limit our exposure to changes in currency rates in respect of certain investments denominated in foreign currencies.

Our use of derivative instruments also involves the risk that a counterparty to a hedging arrangement could default on its obligation and the risk that we may have to pay certain costs, such as transaction fees or breakage costs, if a hedging arrangement is terminated by us. As a matter of policy, we enter into hedging arrangements with counterparties that are large, creditworthy financial institutions typically rated at least "A/A2" by S&P and Moody's, respectively.

Developing an effective strategy for dealing with movements in interest rates and foreign currencies is complex and no strategy can completely insulate us from risks associated with such fluctuations. There can be no assurance that any hedging activities will have the desired beneficial impact on our results of operations or financial condition.

Quarterly results may fluctuate and may not be indicative of future quarterly performance.

Our quarterly operating results could fluctuate; therefore, reliance should not be placed on past quarterly results as indicative of our performance in future quarters. Factors that could cause quarterly operating results to fluctuate include, among others, variations in loan and net lease portfolio performance, levels of non-performing assets and related provisions, market values of investments, costs associated with debt, general economic conditions, the state of the real estate and financial markets and the degree to which we encounter competition in our markets.

Our ability to retain and attract key personnel is critical to our success.

Our success depends on our ability to retain our senior management and the other key members of our management team and recruit additional qualified personnel. We rely in part on equity compensation to retain and incentivize our personnel. In addition, if members of our management join competitors or form competing companies, the competition could have a material adverse effect on our business. Efforts to retain or attract professionals may result in additional compensation expense, which could affect our financial performance.

We are highly dependent on information systems, and systems failures could significantly disrupt our business.

Our business is highly dependent on communications, information, financial and operational systems. Any failure or interruption of our systems could cause delays or other problems in our business activities, which could have a material adverse effect on our operations and financial performance.

We may change certain of our policies without stockholder approval.

Our charter does not set forth specific percentages of the types of investments we may make. We can amend, revise or eliminate our investment financing and conflict of interest policies at any time at our discretion without a vote of our shareholders. A change in these policies could adversely affect our financial condition or results of operations or the market price of our common stock.

Certain provisions in our charter may inhibit a change in control.

Generally, to maintain our qualification as a REIT under the Code, not more than 50% in value of our outstanding shares of stock may be owned, directly or indirectly, by five or fewer individuals at any time during the last half of our taxable year. The Code defines "individuals" for purposes of the requirement described in the preceding sentence to include some types of entities. Under our charter, no person may own more than 9.8% of our outstanding shares of stock, with some exceptions. The restrictions

20

on transferability and ownership may delay, deter or prevent a change in control or other transaction that might involve a premium price or otherwise be in the best interest of the security holders.

We would be subject to adverse consequences if we fail to qualify as a REIT.

We believe that we have been organized and operated in a manner so as to qualify for taxation as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 1998. However, our qualification as a REIT has depended and will continue to depend on our ability to meet various requirements concerning, among other things, the ownership of our outstanding stock, the nature of our assets, the sources of our income and the amount of our distributions to our shareholders. As a result of the current credit crisis, it may be difficult for us to meet one or more of the requirements for qualification as a REIT including, but not limited to, our distribution requirement.

If we were to fail to qualify as a REIT for any taxable year, we would not be allowed a deduction for distributions to our shareholders in computing our net taxable income and would be subject to U.S. federal income tax, including any applicable alternative minimum tax, or "AMT," on our net taxable income at regular corporate rates, as well as applicable state and local taxes. Unless entitled to relief under certain Code provisions, we would also be disqualified from treatment as a REIT for the four subsequent taxable years following the year during which our REIT qualification was lost. As a result, cash available for distribution would be reduced for each of the years involved. Furthermore, it is possible that future economic, market, legal, tax or other considerations may cause our REIT qualification to be revoked.

Our new secured credit Facility (see Item 8—"Financial Statements and Supplemental Data—Note 19") prohibits us from paying dividends on our common stock if we no longer qualify as a REIT.

To qualify as a REIT, we may be forced to borrow funds, sell assets or take other actions during unfavorable market conditions.

To qualify as a REIT, we generally must distribute to our shareholders at least 90% of our net taxable income, excluding net capital gains each year, and we will be subject to U.S. federal income tax, as well as applicable state and local taxes, to the extent that we distribute less than 100% of our net taxable income each year. In addition, we will be subject to a 4% nondeductible excise tax on the amount, if any, by which distributions paid by us in any calendar year are less than the sum of 85% of our ordinary income, 95% of our capital gain net income and 100% of our undistributed income from prior years. Our net taxable income could exceed our available cash flow as a result of, among other things, a difference in timing between the actual receipt of cash and inclusion of income for U.S. federal income tax purposes, the recognition of non-cash taxable income, the effect of non-deductible capital expenditures or required debt principal repayments.

In order to qualify as a REIT and avoid the payment of income and excise taxes, we may need to borrow funds on a short-term, or possibly long-term, basis, sell assets or pay distributions in the form of taxable dividends of our common stock to meet our REIT distribution requirement, even if prevailing market conditions are not favorable for these borrowings, asset dispositions or stock distributions.

Certain of our activities are subject to taxes and could result in taxes allocated to our shareholders.

Even if we qualify as a REIT for U.S. federal income tax purposes, we will be required to pay some U.S. federal, state, local and non-U.S. taxes on our income and property. We would be required to pay taxes on net taxable income that we fail to distribute to our shareholders. In addition, our "taxable REIT subsidiaries" are fully taxable corporations, and there are limitations on the ability of taxable REIT subsidiaries to make interest payments to affiliated REITs. Furthermore, we will be subject to a 100% penalty tax to the extent our economic arrangements with our tenants or our taxable REIT subsidiaries are not comparable to similar arrangements among unrelated parties. We will also be subject to a 100% tax to the extent we derive income from the sale of assets to customers in the ordinary course of business. To the

21

extent we or our taxable REIT subsidiaries are required to pay U.S. federal, state, local or non-U.S. taxes, we will have less cash available for distribution to our shareholders.

We do not intend to invest a material portion of our assets in real estate mortgage investment conduits, or "REMICs," or taxable mortgage pools. In the event we were to own REMIC or taxable mortgage pool residual interests, or treated as owning such residual interests, a portion of our income from these assets could be treated as "excess inclusion income."

IRS guidance indicates that our excess inclusion income will be allocated among our shareholders in proportion to our dividends paid. A shareholder's share of our excess inclusion income (i) would not be allowed to be offset by any net operating losses otherwise available to the shareholder, (ii) would be subject to tax as unrelated business taxable income in the hands of most tax-exempt shareholders, and (iii) would result in the application of U.S. federal income tax withholding at a rate of 30%, without reduction for any otherwise applicable income tax treaty, in the hands of a non-U.S. shareholder.