Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31 - ISTAR INC. | a2196363zex-31.htm |

| EX-32 - EXHIBIT 32 - ISTAR INC. | a2196363zex-32.htm |

| EX-12.1 - EXHIBIT 12.1 - ISTAR INC. | a2196363zex-12_1.htm |

| EX-21.1 - EXHIBIT 21.1 - ISTAR INC. | a2196363zex-21_1.htm |

| EX-23.1 - EXHIBIT 23.1 - ISTAR INC. | a2196363zex-23_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2009 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 1-15371 |

||

iSTAR FINANCIAL INC.

(Exact name of registrant as specified in its charter)

| Maryland | 95-6881527 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

1114 Avenue of the Americas, 39th Floor New York, NY |

10036 |

|

| (Address of principal executive offices) | (Zip code) |

Registrant's telephone number, including area code: (212) 930-9400

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: Name of Exchange on which registered:

|

Name of Exchange on which registered:

|

|

|---|---|---|

| Common Stock, $0.001 par value | New York Stock Exchange | |

| 8.000% Series D Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.875% Series E Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.8% Series F Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.65% Series G Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange | |

| 7.50% Series I Cumulative Redeemable Preferred Stock, $0.001 par value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports); and (ii) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | |

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2009 the aggregate market value of the common stock, $0.001 par value per share of iStar Financial Inc. ("Common Stock"), held by non-affiliates (1) of the registrant was approximately $267.1 million, based upon the closing price of $2.84 on the New York Stock Exchange composite tape on such date.

As of February 16, 2010, there were 94,195,478 shares of Common Stock outstanding.

- (1)

- For purposes of this Annual Report only, includes all outstanding Common Stock other than Common Stock held directly by the registrant's directors and executive officers.

DOCUMENTS INCORPORATED BY REFERENCE

- 1.

- Portions of the registrant's definitive proxy statement for the registrant's 2010 Annual Meeting, to be filed within 120 days after the close of the registrant's fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Explanatory Note for Purposes of the "Safe Harbor Provisions" of Section 21E of the Securities Exchange Act of 1934, as amended

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are included with respect to, among other things, iStar Financial Inc.'s (the "Company's") current business plan, business strategy, portfolio management and liquidity. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results or outcomes to differ materially from those contained in the forward-looking statements. Important factors that the Company believes might cause such differences are discussed in the section entitled, "Risk Factors" in Part I, Item 1A of this Form 10-K or otherwise accompany the forward-looking statements contained in this Form 10-K. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In assessing all forward-looking statements, readers are urged to read carefully all cautionary statements contained in this Form 10-K.

Overview

iStar Financial Inc., or the "Company," is a publicly-traded finance company focused on the commercial real estate industry. The Company primarily provides custom-tailored financing to high-end private and corporate owners of real estate, including senior and mezzanine real estate debt, senior and mezzanine corporate capital, as well as corporate net lease financing and equity. The Company, which is taxed as a real estate investment trust, or "REIT," seeks to generate attractive risk-adjusted returns on equity to shareholders by providing innovative and value-added financing solutions to its customers. The Company delivers customized financing products to sophisticated real estate borrowers and corporate customers who require a high level of flexibility and service. The Company's two primary lines of business are lending and corporate tenant leasing.

The lending business is primarily comprised of senior and mezzanine real estate loans that typically range in size from $20 million to $150 million and have original terms generally ranging from three to ten years. These loans may be either fixed-rate (based on the U.S. Treasury rate plus a spread) or variable-rate (based on LIBOR plus a spread) and are structured to meet the specific financing needs of the borrowers. The Company also provides senior and subordinated capital to corporations, particularly those engaged in real estate or real estate related businesses. These financings may be either secured or unsecured, typically range in size from $20 million to $150 million and have initial maturities generally ranging from three to ten years. As part of the lending business, the Company also acquires whole loans, loan participations and debt securities which present attractive risk-reward opportunities.

The Company's corporate tenant leasing business provides capital to corporations and other owners who control facilities leased to single creditworthy customers. The Company's net leased assets are generally mission critical headquarters or distribution facilities that are subject to long-term leases with public companies, many of which are rated corporate credits. Most of the leases provide for expenses at the facility to be paid by the corporate customer on a triple net lease basis. Corporate tenant lease, or

1

"CTL," transactions have initial terms generally ranging from 15 to 20 years and typically range in size from $20 million to $150 million.

The Company's primary sources of revenues are interest income, which is the interest that borrowers pay on loans, and operating lease income, which is the rent that corporate customers pay to lease CTL properties. The Company primarily generates income through the "spread" or "margin," which is the difference between the revenues generated from loans and leases and interest expense and the cost of CTL operations.

The Company began its business in 1993 through private investment funds and became publicly traded in 1998. Since that time, the Company has grown through the origination of new lending and leasing transactions, as well as through corporate acquisitions, including the acquisition of TriNet Corporate Realty Trust, Inc. in 1999, the acquisitions of Falcon Financial Investment Trust and of a significant non-controlling interest in Oak Hill Advisors, L.P. and affiliates in 2005, and the acquisition of the commercial real estate lending business and loan portfolio which we refer to as the "Fremont CRE," of Fremont Investment and Loan, or "Fremont," a division of Fremont General Corporation, in 2007.

Current Market Conditions

The financial market conditions that began in late 2007, including the economic recession and tightening of credit markets, continued to significantly impact the commercial real estate market and financial services industry in 2009. The severe economic downturn led to a decline in commercial real estate values which, combined with a lack of available debt financing for commercial and residential real estate assets, limited borrowers' ability to repay or refinance their loans. Further, the ability of many of the Company's borrowers to sell units in residential projects has been adversely impacted by current economic conditions and the lack of end loan financing available to residential unit purchasers. The combination of these factors continued to adversely affect the Company's business, financial condition and operating performance in 2009, resulting in significant additions to non-performing assets, increases in the related provision for loan losses and a reduction in the level of liquidity available to finance its operations. These economic factors and their effects on the Company's operations have resulted in increases in its financing costs, a continuing inability to access the unsecured debt markets, depressed prices for its Common Stock, the continued suspension of quarterly Common Stock dividends and has narrowed the Company's margin of compliance with debt covenants. In addition, we have significantly curtailed our asset origination activities, reduced operating expenses and focused on asset management in order to maximize recoveries from existing asset resolutions. A more detailed discussion of how current market conditions have impacted the Company is provided in Item 7—"Management's Discussion and Analysis of Financial Condition and Results of Operations."

Risk Management

The Company's risk management team is comprised of over 120 professionals with in-house experience in asset management, legal, corporate credit, loan servicing, project and construction management and engineering. The risk management team includes a rated loan servicer, iStar Asset Services, or "iSAS," that provides the Company's customers with responsive post-closing support. The Company employs a proactive risk management strategy centered on information sharing and frequent customer contact.

The Company has a quarterly risk rating process that enables it to evaluate, monitor and manage asset-specific credit issues and identify credit trends on a portfolio-wide basis. The quarterly risk rating process allows the Company to create a common language and framework to evaluate risk and the adequacy of the loan loss provision and reserves. A detailed credit review of each asset is performed quarterly with ratings of "1" to "5" assigned ("1" represents the lowest level of risk, "5" represents the

2

highest level of risk). Risk ratings provide the Company with a means of identifying assets that warrant a greater degree of monitoring and senior management attention.

The Company also has collateral and customer monitoring risk management systems that enable it to proactively review the performance of its asset base. Risk management information is generated from collateral-level controls, customer reporting requirements and on-site asset monitoring programs.

iSAS, the Company's rated loan servicing subsidiary, and the Company's corporate tenant lease asset management personnel are responsible for managing the Company's asset base, including monitoring customers' compliance with their respective loan and leasing agreements, collecting customer payments and analyzing and distributing customer performance information throughout the Company. iSAS performs servicing responsibilities primarily for Company owned assets and is currently rated "strong" by Standard & Poor's.

Loan customers are required to comply with periodic covenant tests and typically must submit collateral performance information, such as monthly operating statements and operating budgets, to the Company. The Company may also require customers to deposit cash into escrow accounts to cover major capital expenditures, such as expected re-tenanting costs, and typically requires approval rights over major decisions impacting collateral cash flows. In some cases, collateral cash receipts must be deposited into lock-box bank accounts with the Company before the net cash, after debt service, is distributed to its customers. In addition, the Company has a formal annual inspection program designed to ensure that its corporate tenant lease customers are complying with their lease terms.

The Company's risk management team employs an asset specific approach to managing and resolving loans that may become non-performing as well as other real estate owned assets ("OREO") and real estate held for investment assets ("REHI"). Asset performance or collectability can deteriorate due to a variety of factors, including adverse market conditions, construction delays and overruns, or a borrower's financial condition or managerial capabilities. Once an asset's performance or collectability begins deteriorating and we believe the asset will become a non-performing loan ("NPL"), the team seeks to formulate asset resolution strategies which may include, but are not limited to the following:

- •

- Foreclosing on a loan to gain title to the underlying property collateral. Once title is obtained, the risk management

team puts in place an asset-specific plan designed to maximize the value of the collateral—which can include completing the construction or renovation of the property, continuing the sale

of condominium units, leasing or increasing the occupancy of the property, engaging a third party property manager or selling the entire asset or a partial interest to a third party. In appropriate

circumstances the Company may also seek to collect under guarantees of the loan;

- •

- Selling the existing mortgage note to a third party;

- •

- Entering into a restructuring discussion with the borrower. Typical loan terms that may be changed or modified in a restructuring include: the interest rate, loan amount, maturity date or the level of borrower support through guarantees or letters of credit.

The risk management team responsible for a non-performing loan or OREO/REHI resolution presents its proposed plan to the Company's senior management team for discussion and approval. The resolution plan is monitored as part of the Company's asset management meetings and its quarterly risk rating process. Asset resolution strategies may be modified as conditions change.

Financing Strategy

The Company has utilized a wide range of debt and equity capital resources to finance its investment and growth strategies. Prior to the onset of the credit crisis, the Company's primary sources of liquidity were its unsecured bank credit facilities, issuances of unsecured debt and equity securities in capital

3

markets transactions and repayments of loans. However, liquidity in the capital markets has been severely constrained since the beginning of the credit crisis, increasing the Company's cost of funds and effectively eliminating its access to the unsecured debt markets—previously its primary source of debt financing. The Company has also seen its stock price decline significantly, which has limited its ability to access additional equity capital. As a result, the Company has sought alternative sources of liquidity primarily through secured debt financings and sales of assets. The Company has sought, and will continue to seek to raise capital through means other than unsecured financing, such as additional secured financing, asset sales, joint ventures and other third party capital arrangements. A more detailed discussion of the Company's current liquidity and capital resources is provided in Item 7—"Management's Discussion and Analysis of Financial Condition and Results of Operations."

Investment Strategy

Given the economic conditions within the commercial real estate market, the uncertainty associated with the timing of scheduled loan repayments and the increased constraints in the financing markets, the Company's new loan and CTL originations were limited during 2008 and 2009. Prior to 2008, the Company's investment strategy targeted specific sectors of the real estate and corporate credit markets in which it believed it could deliver innovative, custom-tailored and flexible financial solutions to its customers, thereby differentiating its financial products from those offered by other capital providers.

The Company implemented its investment strategy by:

- •

- Focusing on the origination of large, structured mortgage, corporate and lease financings where customers require flexible

financial solutions and "one-call" responsiveness post-closing.

- •

- Avoiding commodity businesses in which there is significant direct competition from other providers of capital such as

conduit lending and investments in commercial or residential mortgage-backed securities.

- •

- Developing direct relationships with borrowers and corporate customers as opposed to sourcing transactions solely through

intermediaries.

- •

- Adding value beyond simply providing capital by offering borrowers and corporate customers specific lending expertise,

flexibility, certainty of closing and continuing relationships beyond the closing of a particular financing transaction.

- •

- Taking advantage of market anomalies in the real estate financing markets when the Company believes credit is mispriced by other providers of capital, such as the spread between lease yields and the yields on corporate customers' underlying credit obligations.

The Company seeks to invest in a mix of portfolio financing transactions to create asset diversification and single-asset financings of properties with strong, long-term competitive market positions. The Company's credit process focuses on:

- •

- Building diversification by asset type, property type, obligor, loan/lease maturity and geography.

- •

- Financing commercial real estate assets in major metropolitan markets.

- •

- Underwriting assets using conservative assumptions regarding collateral value and future property performance.

- •

- Evaluating relative risk adjusted returns across multiple investment markets.

- •

- Focusing on replacement costs as the long-term determinant of real estate values.

4

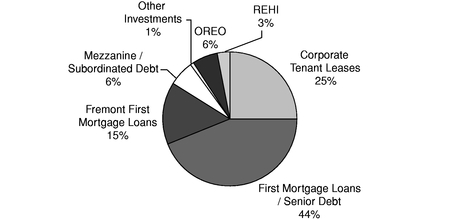

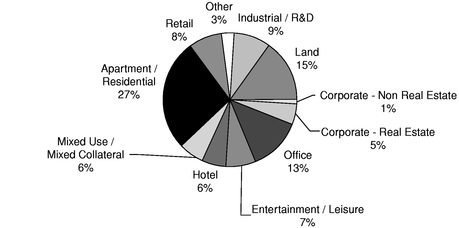

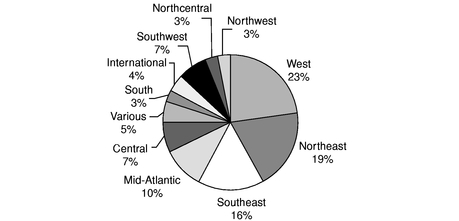

Substantially all of the Company's investments have been in assets with customers based in the United States. As of December 31, 2009, based on current gross carrying values, the Company's total investment portfolio has the following characteristics:

Asset Type

Property Type

Geography

5

Underwriting Process

The Company discusses and analyzes investment opportunities in meetings which are attended by its investment professionals, as well as representatives from its legal, credit, risk management and capital markets areas. The Company has developed a process for screening potential investments called the Six Point Methodologysm. Through this process, the Company evaluates an investment opportunity prior to beginning its formal due diligence process by: (1) evaluating the source of the opportunity; (2) evaluating the quality of the collateral or corporate credit, as well as its market or industry dynamics; (3) evaluating the equity or corporate sponsor; (4) determining whether it can implement an appropriate legal and financial structure for the transaction given its risk profile; (5) performing an alternative investment test; and (6) evaluating the liquidity of the investment and its ability to match fund the asset.

The Company's underwriting process provides for feedback and review by key disciplines within the Company, including investments, credit, risk management, legal/structuring and capital markets. Participation is encouraged from professionals in these disciplines throughout the entire origination process, from the initial consideration of the opportunity, through the Six Point Methodologysm and into the preparation and distribution of a memorandum for the Company's internal and/or Board of Directors investment committees.

Any commitment to make an investment of $25 million or less in any transaction or series of related transactions requires the approval of the Chief Executive Officer and Chief Investment Officer. Any commitment in an amount in excess of $25 million but less than or equal to $75 million requires the further approval of the Company's internal investment committee, consisting of senior management representatives from all of the Company's key disciplines. Any commitment in an amount in excess of $75 million but less than or equal to $150 million requires the further approval of the Investment Committee of the Board of Directors. Any commitment in an amount in excess of $150 million, and any strategic investment such as a corporate merger, acquisition or material transaction involving the Company's entry into a new line of business, requires the approval of the full Board of Directors.

Hedging Strategy

The Company has variable-rate lending assets and variable-rate debt obligations. These assets and liabilities create a natural hedge against changes in variable interest rates. This means that, as interest rates increase, the Company earns more on its variable-rate lending assets and pays more on its variable-rate debt obligations and, conversely, as interest rates decrease, the Company earns less on its variable-rate lending assets and pays less on its variable-rate debt obligations. When the Company's variable-rate debt obligations differ significantly from its variable-rate lending assets, the Company may utilize derivative instruments to limit the impact of changing interest rates on its net income. The Company's interest rate risk management policy requires that it enter into hedging transactions when it is determined, based on sensitivity models, that the impact of various increasing or decreasing interest rate scenarios could have a significant negative effect on its net interest income. The Company does not use derivative instruments for speculative purposes. The derivative instruments the Company uses are typically in the form of interest rate swaps and interest rate caps.

Industry Segments

The Company has determined that it has two reportable operating segments: Real Estate Lending and Corporate Tenant Leasing. The Real Estate Lending segment includes all of the Company's activities related to senior and mezzanine real estate debt and corporate capital investments, OREO and REHI. The Corporate Tenant Leasing segment includes all of the Company's activities related to the ownership and leasing of corporate facilities. Segment revenue and profit information is presented in Note 17 of the Company's Notes to Consolidated Financial Statements.

6

Real Estate Lending

The Company's Real Estate Lending segment includes loans and other lending investments, real estate held for investment and other real estate owned.

Loans and other lending investments primarily consists of senior mortgage loans that are secured by commercial and residential real estate assets. A smaller portion of the portfolio consists of subordinated mortgage loans that are secured by subordinated interests in commercial and residential real estate assets, corporate/partnership loans, which are typically unsecured and may be senior or subordinate and corporate debt securities.

As of December 31, 2009, a significant portion of the Company's loan portfolio was designated as non-performing. Non-performing loans are placed on non-accrual status and reserves for loan losses are recorded to the extent these loans are determined to be impaired. See Note 3 to the Company's Notes to Consolidated Financial Statements for a discussion of the Company's policies regarding non-performing loans and reserves for loan losses.

REHI and OREO consist of properties acquired through foreclosure or through deed-in-lieu of foreclosure in full or partial satisfaction of non-performing loans. Properties are designated as REHI or OREO depending on the Company's strategic plan to realize the maximum value from the collateral received. The Company will designate properties as REHI if it intends to hold, operate or develop a property for a period of at least twelve months and will designate properties as OREO if it intends to market a property for sale in the near term.

As of December 31, 2009, the Company's Real Estate Lending segment included the following ($ in thousands):

| |

Loan/Property Count |

Carrying Value | % of Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Performing loans: |

|||||||||||

Senior mortgages |

108 | $ | 3,616,697 | 40.7 | % | ||||||

Subordinated mortgages |

17 | 401,532 | 4.5 | % | |||||||

Corporate/Partnership loans |

19 | 887,555 | 9.9 | % | |||||||

Subtotal |

144 | 4,905,784 | |||||||||

Non-performing loans: |

|||||||||||

Senior mortgages |

73 | 3,751,050 | 42.0 | % | |||||||

Subordinated mortgages |

4 | 89,798 | 1.0 | % | |||||||

Corporate/Partnership loans |

6 | 70,074 | 0.8 | % | |||||||

Subtotal |

83 | 3,910,922 | |||||||||

Total loans |

227 | 8,816,706 | |||||||||

Reserve for loan losses |

(1,417,949 | ) | (15.9 | )% | |||||||

Total loans, net |

7,398,757 | ||||||||||

Other lending investments—securities |

5 | 262,805 | 2.9 | % | |||||||

Total Loans and other lending investments, net |

232 | 7,661,562 | |||||||||

Real estate held for investment, net |

15 |

422,664 |

4.7 |

% |

|||||||

Other real estate owned |

25 |

839,141 |

9.4 |

% |

|||||||

Total Real estate lending long-lived assets, net |

272 | $ | 8,923,367 | 100.0 | % | ||||||

7

Summary of Collateral/Property Types—As of December 31, 2009, assets in the Company's real estate lending segment had the following collateral and property characteristics ($ in thousands):

Collateral/Property Type

|

Performing Loans and Securities |

Non- performing Loans |

OREO & REHI |

Total | % of Total |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Land |

$ | 482,705 | $ | 1,218,108 | $ | 402,252 | $ | 2,103,065 | 20.3 | % | |||||||

Condo: |

|||||||||||||||||

Construction—Completed |

549,134 | 848,439 | 487,718 | 1,885,291 | 18.2 | % | |||||||||||

Construction—In Progress |

964,654 | 210,165 | — | 1,174,819 | 11.4 | % | |||||||||||

Conversion |

109,824 | 74,664 | 114,400 | 298,888 | 2.9 | % | |||||||||||

Mixed Use/Mixed Collateral |

330,647 | 348,491 | 19,761 | 698,899 | 6.8 | % | |||||||||||

Entertainment/Leisure |

156,983 | 267,399 | — | 424,382 | 4.1 | % | |||||||||||

Retail |

687,458 | 243,915 | 41,587 | 972,960 | 9.4 | % | |||||||||||

Multifamily |

131,653 | 238,089 | 86,936 | 456,678 | 4.4 | % | |||||||||||

Hotel |

372,897 | 234,005 | 83,300 | 690,202 | 6.7 | % | |||||||||||

Office |

203,305 | 107,554 | 7,384 | 318,243 | 3.1 | % | |||||||||||

Corporate—Real Estate |

674,110 | 61,754 | — | 735,864 | 7.1 | % | |||||||||||

Industrial/R&D |

295,555 | 52,817 | — | 348,372 | 3.4 | % | |||||||||||

Other |

209,664 | 5,522 | 18,467 | 233,653 | 2.2 | % | |||||||||||

Gross carrying value |

$ | 5,168,589 | $ | 3,910,922 | $ | 1,261,805 | $ | 10,341,316 | 100.0 | % | |||||||

Summary of Loan Interest Rate Characteristics—As of December 31, 2009, the Company's loans and other lending investments had the following interest rate characteristics ($ in thousands):

| |

Carrying Value |

% of Total |

Weighted Average Accrual Rate |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Fixed-rate loans |

$ | 1,809,703 | 19.9 | % | 9.11 | % | ||||

Variable-rate loans(1) |

3,358,886 | 37.0 | % | 5.99 | % | |||||

Non-performing loans |

3,910,922 | 43.1 | % | N/A | ||||||

Gross carrying value |

$ | 9,079,511 | 100.0 | % | ||||||

Explanatory Note:

- (1)

- As of December 31, 2009, amount includes $1.87 billion of loans with a weighted average interest rate floor of 3.86%.

Summary of Loan Maturities—As of December 31, 2009, the Company's loans and other lending investments had the following maturity characteristics ($ in thousands):

Year of Maturity

|

Number of Loans Maturing |

Carrying Value |

% of Total |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

2010 |

74 | $ | 2,399,853 | 26.4 | % | |||||

2011 |

12 | 517,821 | 5.7 | % | ||||||

2012 |

15 | 1,065,489 | 11.7 | % | ||||||

2013 |

7 | 227,718 | 2.5 | % | ||||||

2014 |

6 | 162,031 | 1.8 | % | ||||||

2015 |

3 | 133,171 | 1.5 | % | ||||||

2016 |

8 | 203,204 | 2.2 | % | ||||||

2017 |

5 | 50,984 | 0.6 | % | ||||||

2018 |

8 | 45,992 | 0.5 | % | ||||||

2019 |

4 | 32,713 | 0.4 | % | ||||||

2020 and thereafter |

7 | 329,613 | 3.6 | % | ||||||

Total performing loans |

149 | 5,168,589 | 56.9 | % | ||||||

Non-performing loans |

83 | 3,910,922 | 43.1 | % | ||||||

Gross carrying value |

232 | $ | 9,079,511 | 100.0 | % | |||||

8

Corporate Tenant Leasing

The Company has pursued the origination of CTL transactions by structuring purchase/leasebacks and by acquiring facilities subject to existing long-term net leases. In a typical purchase/leaseback transaction, the Company purchases a corporation's facility and leases it back to that corporation subject to a long-term net lease. This structure allows the corporate customer to reinvest the proceeds from the sale of its facilities into its core business, while the Company benefits from a long term income stream. The Company generally intends to hold its CTL assets for long-term investment. However, subject to certain tax restrictions, the Company may dispose of assets if it deems the disposition to be in the Company's best interests and may either reinvest the disposition proceeds, use the proceeds to reduce debt, or distribute the proceeds to shareholders.

Under a typical net lease agreement, the corporate customer agrees to pay a base monthly operating lease payment and all facility operating expenses (including taxes, maintenance and insurance).

The Company generally seeks corporate customers with the following characteristics:

- •

- Established companies with stable core businesses or market leaders in growing industries.

- •

- Investment-grade credit strength or appropriate credit enhancements if corporate credit strength is not sufficient on a

stand-alone basis.

- •

- Commitments to the facilities that are mission-critical to their ongoing businesses.

Summary of Tenant Credit Characteristics—As of December 31, 2009, the Company had 95 CTL customers operating in more than 37 major industry sectors, including transportation, business services, recreation, technology and communications. The majority of these customers are well-recognized national and international organizations, such as FedEx, IBM, Google, DirecTV and the U.S. Government.

As of December 31, 2009, the Company's CTL portfolio has the following tenant credit characteristics ($ in thousands):

| |

Annualized In-Place Operating Lease Income(1) |

% of In-Place Operating Lease Income |

|||||

|---|---|---|---|---|---|---|---|

Investment grade(2) |

$ | 91,327 | 30 | % | |||

Implied investment grade(3) |

19,549 | 6 | % | ||||

Non-investment grade |

106,610 | 35 | % | ||||

Unrated |

91,009 | 29 | % | ||||

Total |

$ | 308,495 | 100 | % | |||

Explanatory Notes:

- (1)

- Reflects

annualized GAAP operating lease income for leases in-place at December 31, 2009.

- (2)

- A

tenant's credit rating is considered "Investment Grade" if the tenant or its guarantor has a published senior unsecured credit rating, and if such rating

is not available, a corporate entity rating, of Baa3/BBB- or above by one or more of the three national rating agencies.

- (3)

- We consider a tenant's credit rating to be "Implied Investment Grade" if it is 100% owned by an investment-grade parent or it has no published ratings, but has credit characteristics that the Company believes are consistent with other companies that have an investment grade senior unsecured credit ratings. An example is Google, Inc.

9

Summary of CTL Asset Types—As of December 31, 2009, the Company owned 356 office, industrial, entertainment, hotel and retail facilities principally subject to net leases to 95 customers, comprising 38.8 million square feet in 39 states. Information regarding the Company's CTL assets as of December 31, 2009 is set forth below:

| |

# of Leases |

% of In-Place Operating Lease Income(1) |

% of Total Revenue(2) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Office |

56 | 45.5 | % | 17.6 | % | |||||

Industrial/R&D |

38 | 29.3 | % | 11.3 | % | |||||

Entertainment/Leisure |

10 | 14.9 | % | 5.8 | % | |||||

Retail |

12 | 5.3 | % | 2.0 | % | |||||

Hotel |

3 | 5.0 | % | 1.9 | % | |||||

Total |

119 | 100.0 | % | |||||||

Explanatory Notes:

- (1)

- Reflects

a percentage of annualized GAAP operating lease income for leases in-place at December 31, 2009.

- (2)

- Reflects annualized GAAP operating lease income for leases in-place at December 31, 2009 as a percentage of annualized total revenue for the quarter ended December 31, 2009.

Summary of CTL Asset Lease Expirations—As of December 31, 2009, lease expirations on the Company's CTL assets are as follows ($ in thousands):

Year of Lease Expiration

|

Number of Leases Expiring |

Annualized In-Place Operating Lease Income(1) |

% of In-Place Operating Lease Income |

% of Total Revenue(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2010 |

8 | $ | 12,989 | 4.2 | % | 1.7 | % | ||||||

2011 |

5 | 4,893 | 1.6 | % | 0.6 | % | |||||||

2012 |

16 | 17,791 | 5.8 | % | 2.2 | % | |||||||

2013 |

7 | 9,009 | 2.9 | % | 1.1 | % | |||||||

2014 |

10 | 10,610 | 3.4 | % | 1.3 | % | |||||||

2015 |

8 | 9,830 | 3.2 | % | 1.2 | % | |||||||

2016 |

6 | 23,002 | 7.5 | % | 2.9 | % | |||||||

2017 |

8 | 37,739 | 12.2 | % | 4.7 | % | |||||||

2018 |

6 | 6,255 | 2.0 | % | 0.8 | % | |||||||

2019 |

5 | 7,823 | 2.5 | % | 1.0 | % | |||||||

2020 and thereafter |

40 | 168,554 | 54.7 | % | 21.1 | % | |||||||

Total |

119 | $ | 308,495 | 100.0 | % | ||||||||

Weighted average remaining lease term |

10.9 years | ||||||||||||

Explanatory Notes:

- (1)

- Reflects

annualized GAAP operating lease income for leases in-place at December 31, 2009.

- (2)

- Reflects the percentage of annualized GAAP operating lease income for leases in-place at December 31, 2009 as a percentage of annualized total revenue for the quarter ended December 31, 2009.

Policies with Respect to Other Activities

The Company 's investment, financing and conflicts of interests policies are managed under the ultimate supervision of the Company's Board of Directors. The Company can amend, revise or eliminate these policies at anytime without a vote of shareholders. The Company currently intends to make investments in a manner consistent with the requirements of the Internal Revenue Code of 1986, as amended (the "Code") for the Company to qualify as a REIT.

Investment Restrictions or Limitations

The Company does not have any prescribed allocation among investments or product lines. Instead, the Company focuses on corporate and real estate credit underwriting to develop an analysis of the risk/reward ratios in determining the pricing and advisability of each particular transaction.

10

The Company believes that it is not, and intends to conduct its operations so as not to become, regulated as an investment company under the Investment Company Act. The Investment Company Act generally exempts entities that are "primarily engaged in purchasing or otherwise acquiring mortgages and other liens on and interests in real estate" (collectively, "Qualifying Interests"). The Company intends to rely on current interpretations of the Securities and Exchange Commission in an effort to qualify for this exemption. Based on these interpretations, the Company, among other things, must maintain at least 55% of its assets in Qualifying Interests and at least 25% of its assets in real estate- related assets (subject to reduction to the extent the Company invests more than 55% of its assets in Qualifying Interests). Generally, the Company's senior mortgages, CTL assets and certain of its subordinated mortgages constitute Qualifying Interests. Subject to the limitations on ownership of certain types of assets and the gross income tests imposed by the Code, the Company also may invest in the securities of other REITs, other entities engaged in real estate activities or other issuers, including for the purpose of exercising control over such entities.

Competition

The Company operates in a competitive market. See Item 1a—"Risk factors—We compete with a variety of financing sources for our customers," for a discussion of how we may be affected by competition.

Regulation

The operations of the Company are subject, in certain instances, to supervision and regulation by state and federal governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (1) regulate credit granting activities; (2) establish maximum interest rates, finance charges and other charges; (3) require disclosures to customers; (4) govern secured transactions; and (5) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. Although most states do not regulate commercial finance, certain states impose limitations on interest rates and other charges and on certain collection practices and creditor remedies, and require licensing of lenders and financiers and adequate disclosure of certain contract terms. The Company is also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to commercial loans.

In the judgment of management, existing statutes and regulations have not had a material adverse effect on the business conducted by the Company. It is not possible at this time to forecast the exact nature of any future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon the future business, financial condition or results of operations or prospects of the Company.

The Company has elected and expects to continue to qualify to be taxed as a REIT under Section 856 through 860 of the Code. As a REIT, the Company must generally distribute at least 90% of its net taxable income, excluding capital gains, to its stockholders each year. In addition, the Company must distribute 100% of its net taxable income each year to avoid paying federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT qualification. These requirements include specific share ownership tests and asset and gross income tests. If the Company fails to qualify as a REIT in any taxable year, the Company will be subject to federal income tax (including any applicable alternative minimum tax) on its net taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, the Company may be subject to state and local taxes and to federal income tax and excise tax on its undistributed income.

Code of Conduct

The Company has adopted a code of business conduct for all of its employees and directors, including the Company's chief executive officer, chief financial officer, other executive officers and personnel. A copy of the Company's code of conduct has been previously filed with the SEC and is incorporated by reference in this Annual Report on Form 10-K as Exhibit 14.0. The code of conduct is also available on the Company's website at www.istarfinancial.com. The Company intends to post on its website material changes to, or waivers from, its code of conduct, if any, within two days of any such event. As of

11

December 31, 2009, there were no waivers or changes since adoption of the current code of conduct in October 2002.

Employees

As of January 29, 2010, the Company had 247 employees and believes its relationships with its employees to be good. The Company's employees are not represented by a collective bargaining agreement.

Other

In addition to this Annual Report, the Company files quarterly and special reports, proxy statements and other information with the SEC. All documents are filed with the SEC and are available free of charge on the Company's corporate website, which is www.istarfinancial.com. Through the Company's website, the Company makes available free of charge its annual proxy statement, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those Reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. You may also read and copy any document filed at the public reference facilities at 100 F Street, N.E., Washington, D.C. 25049. Please call the SEC at (800) SEC-0330 for further information about the public reference facilities. These documents also may be accessed through the SEC's electronic data gathering, analysis and retrieval system ("EDGAR") via electronic means, including on the SEC's homepage, which can be found at www.sec.gov.

12

In addition to the other information in this document, you should consider carefully the following risk factors in evaluating an investment in our securities. Any of these risks or the occurrence of any one or more of the uncertainties described below could have a material adverse effect on our business, financial condition, results of operations, cash flows, and trading price of our common stock. For purposes of these risk factors, the terms "we," "our" and "us" refer to iStar Financial Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

Changes in general economic conditions have and may continue to adversely affect our business.

Our success is generally dependent upon economic conditions in the U.S. and, in particular, the geographic areas in which a substantial number of our investments are located. The recessionary changes in national economic conditions and in the economic conditions of the regions in which we conduct operations have had an adverse effect on our business. In addition, the commercial real estate industry and financial markets in general have been negatively impacted by volatility in the capital markets, significant declines in asset values and lack of liquidity. These factors have resulted in numerous negative implications to our business, including the inability of our customers to access capital to repay their obligations to us resulting in material increases in non-performing loans, our limited ability to execute asset sales, declines in the market price of our common stock, and the reduction in our unsecured corporate credit ratings to below investment grade, leading to increases in our financing costs and an inability to access the unsecured debt markets. These market and economic factors have combined to adversely impact our financial performance and our ability to pay dividends and may continue to do so in the future.

We have significant indebtedness and limitations on our liquidity and ability to raise capital may adversely affect us.

Sufficient liquidity is critical to the management of our balance sheet and our ability to meet our financing commitments and scheduled debt payments. Historically, our primary sources of liquidity have been our bank credit facilities, issuances of debt and equity securities in capital markets transactions, repayments of our loans and sales of assets. However, liquidity in the currently dislocated capital markets has been severely constrained since the beginning of the credit crisis, increasing our cost of funds and effectively eliminating our access to the unsecured debt markets—previously our primary source of debt financing. We have sought, and will continue to seek, to raise capital through means other than unsecured debt financing, such as secured debt financing, asset sales, joint ventures and other third party capital arrangements. For the upcoming year, we will require significant capital to repay $586.8 million of our 2010 debt maturities and to fund our investment activities and operating expenses, including approximately $430.0 million of unfunded commitments primarily associated with our construction loan portfolio. Furthermore, if we do not pay down our existing $1.00 billion First Priority Credit Agreement by $500.0 million in September 2010, then under the terms of the credit agreement, we would be required to apply payments of principal and net sale proceeds received by us in respect of assets constituting collateral for our obligations under that agreement toward the mandatory prepayment of the First Priority Credit Agreement, and such prepayment amounts would not be available to us for other purposes. In 2011, we have approximately $4.02 billion of scheduled debt maturities. Continued disruption in the global credit markets or further deterioration in those markets may have a material adverse effect on our ability to repay or refinance our borrowings. Although we currently expect our sources of capital to be sufficient to meet our near term liquidity needs and are actively exploring alternatives to enable us to meet our long-term debt maturities, there can be no assurance that our liquidity requirements will continue to be satisfied or that we will be able to meet our long term liquidity needs.

13

We have suffered adverse consequences as a result of our credit ratings being downgraded.

Our borrowing costs and our access to the debt capital markets depend significantly on our credit ratings. Our unsecured corporate credit ratings were reduced to below investment grade by the major national credit rating agencies, primarily due to concerns over worsening credit metrics in our loan portfolio. These reductions in our credit ratings, together with the current dislocation in the capital markets in general, have increased our borrowing costs, limited our access to the capital markets and caused restrictive covenants in our public debt instruments to become operative. Further, these downgrades could result in a decision by the lenders under our existing bank credit facilities not to extend such credit facilities after their expirations. These reductions in our credit ratings have increased our cost of funds which has reduced our earnings and adversely impacted our liquidity and competitive positions. Further downgrades could have additional adverse consequences on our business.

Covenants in our indebtedness could limit our flexibility and adversely affect our financial condition.

Our ability to borrow under our secured credit facilities is dependent on maintaining compliance with various covenants, including a minimum tangible net worth covenant and specified financial ratios, such as fixed charge coverage, unencumbered assets to unsecured indebtedness, eligible collateral coverage and leverage. All of these covenants on the facilities are maintenance covenants and, if breached, could result in an acceleration of our facilities if a waiver or modification is not agreed upon with the requisite percentage of the unsecured lending group and the lenders on the other facilities.

Our publicly held debt securities also contain covenants for fixed charge coverage and unencumbered assets to unsecured indebtedness ratios and our secured debt securities have an eligible collateral coverage requirement. The fixed charge coverage ratio in our publicly held securities is an incurrence test. If we do not meet the fixed charge coverage ratio, our ability to incur additional indebtedness will be restricted. The unencumbered asset to unsecured indebtedness covenant and the eligible collateral coverage covenant are maintenance covenants and, if breached and not cured within applicable cure periods, could result in acceleration of our publicly held debt unless a waiver or modification is agreed upon with the requisite percentage of the bondholders. Based on our unsecured credit ratings at December 31, 2009, the financial covenants in our publicly held debt securities, including the fixed charge coverage ratio and maintenance of unencumbered assets compared to unsecured indebtedness, are operative.

Our secured credit facilities and our public debt securities contain cross-default provisions which would allow the lenders and the bondholders to declare an event of default and accelerate our indebtedness to them if we fail to pay amounts due in respect of our other recourse indebtedness in excess of specified thresholds. In addition, our secured credit facilities, unsecured credit facilities and the indentures governing our public debt securities provide that the lenders and bondholders may declare an event of default and accelerate our indebtedness to them if there is a nonpayment default under our other recourse indebtedness in excess of specified thresholds and, if the holders of the other indebtedness are permitted to accelerate, in the case of our secured credit facilities, or accelerate, in the case of our unsecured credit facilities and the bond indentures, the other recourse indebtedness.

Our current level of financial performance and credit metrics has put pressure on our ability to meet these financial covenants. In particular, our tangible net worth at December 31, 2009 was approximately $1.7 billion, which is not significantly above the financial covenant minimum requirement in our secured credit facilities of $1.5 billion. While we believe we are in compliance with our covenants as of the date of this report, there can be no assurance that we will be able to stay in compliance if our financial performance and credit metrics do not improve or if we do not have sufficient eligible assets to satisfy our collateral coverage covenants. In addition, we may be forced to take actions outside of management's operating strategy that will enable us to meet our covenants in the near term but may adversely affect our earnings in the longer term.

14

Changes in market conditions could adversely affect the market price of our common stock.

The market value of our common stock is based upon general stock and bond market conditions, as well as the market's perception of our growth potential, current and future expectations of our financial performance and prospects for payment of cash dividends by the Company. Consequently, our common stock may trade at prices that are higher or lower than our book value per share of common stock. The current economic conditions impacting financial markets and the commercial real estate industry combined with the our recent financial performance have resulted in a significant decline in the market price of our Common Stock. If our financial performance does not improve, the market price of our common stock could be further adversely impacted.

Our reserves for loan losses may prove inadequate, which could have a material adverse effect on our financial results.

We maintain financial reserves to protect against potential losses and conduct a review of the adequacy of these reserves on a quarterly basis. Our reserves reflect management's current judgment of the probability and severity of losses within our portfolio, based on this quarterly review. However, estimation of ultimate loan losses, provision expenses and loss reserves is a complex process and there can be no assurance that management's judgment will prove to be correct and that reserves will be adequate over time to protect against potential future losses. Such losses could be caused by factors including, but not limited to, unanticipated adverse changes in the economy or events adversely affecting specific assets, borrowers, industries in which our borrowers operate or markets in which our borrowers or their properties are located. In particular, our non-performing loans have increased materially, driven by the weak economy and the disruption of the credit markets which have adversely impacted the ability and willingness of many of our borrowers to service their debt and refinance our loans to them at maturity. We recorded significant provisions for loan losses in 2009 based upon the performance of our assets and conditions in the financial markets and overall economy. If our reserves for credit losses prove inadequate we may suffer additional losses which would have a material adverse effect on our financial performance and results of operations.

We are required to make a number of judgments in applying accounting policies and different estimates and assumptions could result in changes to our financial condition and results of operations.

Material estimates that are particularly susceptible to significant change relate to our determination of the reserve for loan losses, the fair value of certain financial instruments (including loans and related collateral and investment securities) and the valuation of CTL, OREO and REHI assets and intangible assets. While we have identified those accounting policies that are considered critical and have procedures in place to facilitate the associated judgments, different assumptions in the application of these policies could have a material adverse effect on our financial performance and results of operations and actual results may differ materially from our estimates.

Quarterly results may fluctuate and may not be indicative of future quarterly performance.

Our quarterly operating results could fluctuate; therefore, reliance should not be placed on past quarterly results as indicative of our performance in future quarters. Factors that could cause quarterly operating results to fluctuate include, among others, variations in loan and CTL portfolio performance, levels of non-performing assets, market values of investments, costs associated with debt, general economic conditions, the state of the real estate and financial markets and the degree to which we encounter competition in our markets.

15

We have suffered losses when a borrower defaults on a loan and the underlying collateral is not sufficient, and we may suffer additional losses in the future.

We have suffered significant losses since the onset of the financial crisis arising from several factors, including general market conditions, reductions in collateral values, failures of borrowers to comply with covenants and guarantees, borrower inability and unwillingness to repay their loans and increasing costs of foreclosure. We may continue to suffer from these factors in the future, as discussed below.

In the event of a default by a borrower on a non-recourse loan, we will only have recourse to the real estate-related assets collateralizing the loan. If the underlying collateral value is less than the loan amount, we will suffer a loss. Conversely, we sometimes make loans that are unsecured or are secured only by equity interests in the borrowing entities. These loans are subject to the risk that other lenders may be directly secured by the real estate assets of the borrower. In the event of a default, those collateralized lenders would have priority over us with respect to the proceeds of a sale of the underlying real estate. In cases described above, we may lack control over the underlying asset collateralizing our loan or the underlying assets of the borrower prior to a default, and as a result the value of the collateral may be reduced by acts or omissions by owners or managers of the assets.

We sometimes obtain individual or corporate guarantees from borrowers or their affiliates, which are not secured. In cases where guarantees are not fully or partially secured, we typically rely on financial covenants from borrowers and guarantors which are designed to require the borrower or guarantor to maintain certain levels of creditworthiness. Where we do not have recourse to specific collateral pledged to satisfy such guarantees or recourse loans, we will only have recourse as an unsecured creditor to the general assets of the borrower or guarantor, some or all of which may be pledged to satisfy other lenders. There can be no assurance that a borrower or guarantor will comply with its financial covenants, or that sufficient assets will be available to pay amounts owed to us under our loans and guarantees. As a result of these factors, we may suffer additional losses which could have a material adverse effect on our financial performance.

In the event of a borrower bankruptcy, we may not have full recourse to the assets of the borrower in order to satisfy our loan. In addition, certain of our loans are subordinate to other debt of the borrower. If a borrower defaults on our loan or on debt senior to our loan, or in the event of a borrower bankruptcy, our loan will be satisfied only after the senior debt receives payment. Where debt senior to our loan exists, the presence of intercreditor arrangements may limit our ability to amend our loan documents, assign our loans, accept prepayments, exercise our remedies (through "standstill" periods) and control decisions made in bankruptcy proceedings relating to borrowers. Bankruptcy and borrower litigation can significantly increase collection costs and losses and the time needed for us to acquire title to the underlying collateral, during which time the collateral may decline in value, causing us to suffer additional losses.

If the value of collateral underlying our loan declines or interest rates increase during the term of our loan, a borrower may not be able to obtain the necessary funds to repay our loan at maturity through refinancing. Decreasing collateral value and/or increasing interest rates may hinder a borrower's ability to refinance our loan because the underlying property cannot satisfy the debt service coverage requirements necessary to obtain new financing. If a borrower is unable to repay our loan at maturity, we could suffer additional loss which may adversely impact our financial performance.

We are subject to additional risks associated with loan participations.

Some of our loans are participation interests or co-lender arrangements in which we share the rights, obligations and benefits of the loan with other lenders. We may need the consent of these parties to exercise our rights under such loans, including rights with respect to amendment of loan documentation, enforcement proceedings in the event of default and the institution of, and control over, foreclosure proceedings. Similarly, a majority of the participants may be able to take actions to which we object but to

16

which we will be bound if our participation interest represents a minority interest. We may be adversely affected by this lack of full control.

We are subject to additional risks associated with construction lending.

Our loan portfolio includes loans made to developers to construct commercial and residential projects. The primary risks to us of construction loans are the potential for cost over-runs, the developer's failure to meet a project delivery schedule and the inability of a borrower to sell or refinance the project at completion and repay our loan. Further, the ability of many of our borrowers to sell units in residential projects has been adversely impacted by current economic conditions and lack of end loan financing available to residential unit purchasers. These risks could require us to fund more money than we originally anticipated in order to complete and carry the project and have caused and could continue to cause the developers to lose leases and/or sales contracts, which may cause us to suffer additional losses on our loans.

We may experience losses if the creditworthiness of our corporate tenants deteriorates and they are unable to meet their lease obligations.

We own the properties leased to the tenants of our CTL assets and receive rents from the tenants during the terms of our leases. A tenant's ability to pay rent is determined by its creditworthiness, among other factors. If a tenant's credit deteriorates, the tenant may default on its obligations under our lease and may also become bankrupt. The bankruptcy or insolvency of our tenants or other failure to pay is likely to adversely affect the income produced by our CTL assets. If a tenant defaults, we may experience delays and incur substantial costs in enforcing our rights as landlord. If a tenant files for bankruptcy, we may not be able to evict the tenant solely because of such bankruptcy or failure to pay. A court, however, may authorize a tenant to reject and terminate its lease with us. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In addition, certain amounts paid to us within 90 days prior to the tenant's bankruptcy filing could be required to be returned to the tenant's bankruptcy estate. In any event, it is highly unlikely that a bankrupt or insolvent tenant would pay in full amounts it owes us under a lease. In other circumstances, where a tenant's financial condition has become impaired, we may agree to partially or wholly terminate the lease in advance of the termination date in consideration for a lease termination fee that is likely less than the total contractual rental amount. Without regard to the manner in which the lease termination occurs, we are likely to incur additional costs in the form of tenant improvements and leasing commissions in our efforts to lease the space to a new tenant. In any of the foregoing circumstances, our financial performance could be materially adversely affected.

Lease expirations, lease defaults and lease terminations may adversely affect our revenue.

Lease expirations and lease terminations may result in reduced revenues if the lease payments received from replacement corporate tenants are less than the lease payments received from the expiring or terminating corporate tenants. In addition, lease defaults or lease terminations by one or more significant corporate tenants or the failure of corporate tenants under expiring leases to elect to renew their leases, could cause us to experience long periods of vacancy with no revenue from a facility and to incur substantial capital expenditures and/or lease concessions in order to obtain replacement corporate tenants.

We are subject to risks relating to our asset concentration.

Our portfolio consists primarily of large balance commercial real estate loans, OREO assets, REHI assets and corporate tenant leases. Our asset base is generally diversified by asset type, obligor, property type and geographic location. However, as of December 31, 2009, approximately 27.1% of the gross carrying value of our assets related to apartment/residential assets, 15.4% related to land, 13.3% related to office properties and 9.4% related to industrial properties. All of these types of collateral have been

17

adversely affected by the ongoing financial crisis. In addition, as of December 31, 2009, approximately 33.4% of the gross carrying value of our assets related to properties located in the western U.S., 18.7% related to properties located in the northeastern U.S. and 15.6% related to properties located in the southeastern U.S. These regions include areas such as Florida and California that have been particularly hard hit by the downturn in the residential real estate markets. Additionally, as of December 31, 2009, the Company had loans collateralized by in-progress condo construction assets that represented approximately 10.6% of the total investment portfolio. These loans typically do not generate cash flows and have unique additional risks related to such issues as cost overruns, delays and the ability to repay with proceeds through unit sales. We may suffer additional losses on our assets based on these concentrations.

In addition, our AutoStar business, totaling 4.4% of the portfolio, focuses on customers in the automotive retail industry. To the extent these customers are adversely affected by the current downturn in the U.S. automotive markets, our investments in the automotive retail industry may also be adversely affected. Our financial position and operating performance could be adversely impacted by additional losses based upon these concentrations.

We compete with a variety of financing and leasing sources for our customers.

The financial services industry and commercial real estate markets are highly competitive. Our competitors include finance companies, other REITs, commercial banks and thrift institutions, investment banks and hedge funds. Our competitors seek to compete aggressively on the basis of a number of factors including transaction pricing, terms and structure. We may have difficulty competing to the extent we are unwilling to match our competitors' deal terms in order to maintain our interest margins and/or credit standards. To the extent that we match competitors' pricing, terms or structure, we may experience decreased interest margins and/or increased risk of credit losses, which could have an adverse effect on our financial performance.

We face significant competition within our corporate tenant leasing business from other owners, operators and developers of properties, many of which own properties similar to ours in markets where we operate. Such competition may affect our ability to attract and retain tenants and reduce the rents we are able to charge. These competing properties may have vacancy rates higher than our properties, which may result in their owners being willing to rent space at lower rental rates than we would or providing greater tenant improvement allowances or other leasing concessions. This combination of circumstances could adversely affect our revenues and financial performance.

We are subject to certain risks associated with investing in real estate, including potential liabilities under environmental laws and risks of loss from earthquakes and terrorism.

Under various U.S. federal, state and local environmental laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, under or in its property. Those laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of such hazardous or toxic substances. The costs of investigation, remediation or removal of those substances may be substantial. The owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners of real properties for personal injuries associated with asbestos-containing materials. Absent succeeding to ownership or control of real property, a secured lender is not likely to be subject to any of these forms of environmental liability. Additionally, under our CTL assets we require our tenants to undertake the obligation for environmental compliance and indemnify us from liability with respect thereto. There can be no assurance that our tenants will have sufficient resources to satisfy their obligations to us.

18

Approximately 26.5% of the gross carrying value of our assets as of December 31, 2009, were located in the Western and Northwestern United States, geographic areas at higher risk for earthquakes. In addition, a significant number of our properties are located in New York City and other major urban areas which, in recent years, have been high risk geographical areas for terrorism and threats of terrorism. Future earthquakes or acts of terrorism could adversely impact the demand for, and value of, our assets and could also directly impact the value of our assets through damage, destruction or loss, and could thereafter materially impact the availability or cost of insurance to protect against these events. Although we believe our CTL assets and the properties collateralizing our loan assets are adequately covered by insurance, we cannot predict at this time if we or our borrowers will be able to obtain appropriate coverage at a reasonable cost in the future, or if we will be able to continue to pass along all of the costs of insurance to our tenants. Any earthquake or terrorist attack, whether or not insured, could have a material adverse effect on our financial performance, the market prices of our Common Stock and our ability to pay dividends. In addition, there is a risk that one or more of our property insurers may not be able to fulfill its obligations with respect to claims payments due to a deterioration in its financial condition.

Declines in the market values of our investments may adversely affect periodic reported results.

Current economic conditions and volatility in the securities markets have led to certain of our investments experiencing significant declines in market value, which have adversely impacted our financial position and results of operations. Given the recent volatility of asset prices and economic uncertainty, there is continued risk that further declines in market values could occur, resulting in additional writedowns of assets within our investment portfolio. Any such charges may result in volatility in our reported earnings and may adversely affect the market price of our common stock.

We make investments in leveraged finance directly through our portfolio of corporate loans and debt securities, which had a carrying value of approximately $565.0 million at December 31, 2009, and indirectly through our interest in Oak Hill Advisors, L.P. and its affiliates. The stress in the mortgage and overall financial markets extended to the leveraged finance market and caused the market prices of bank debt and bonds to trade lower. Significant prolonged reductions in the trading prices of debt securities we hold may cause us to reduce the carrying value of our assets by taking a charge to earnings. In addition, the value of our investment in Oak Hill Advisors, L.P. and its affiliates and its ability to earn performance fees are subject to the risks of a material deterioration in the leveraged finance market.

Most of our equity investments and many of our investments in debt securities will be in the form of securities that are not publicly traded. The fair value of securities and other investments that are not publicly traded may not be readily determinable. We may periodically measure the fair value of these investments, based upon available information and management's judgment. Because such valuations are inherently uncertain, may fluctuate over short periods of time and may be based on estimates, our determinations of fair value may differ materially from the values that would have been used if a ready market for these securities existed. In addition, our determinations regarding the fair value of these investments may be materially higher than the values that we ultimately realize upon their disposal, which could result in losses that have a material adverse effect on our financial performance, the market price of our common stock and our ability to pay dividends.

We utilize interest rate hedging arrangements which may adversely affect our borrowing cost and expose us to other risks.

We have variable-rate lending assets and debt obligations. These assets and liabilities create a natural hedge against changes in variable interest rates. This means that as interest rates increase, we earn more on our variable-rate lending assets and pay more on our variable-rate debt obligations and, conversely, as interest rates decrease, we earn less on our variable-rate lending assets and pay less on our variable-rate debt obligations. When our variable-rate debt obligations differ significantly from our variable rate lending assets, we utilize derivative instruments to limit the impact of changing interest rates on our net income. The derivative instruments we use are typically in the form of interest rate swaps and interest rate caps.

19

Interest rate swaps effectively change variable-rate debt obligations to fixed-rate debt obligations or fixed-rate debt obligations to variable-rate debt obligations. Interest rate caps effectively limit the maximum interest rate on variable-rate debt obligations.

Our use of derivative instruments also involves the risk that a counterparty to a hedging arrangement could default on its obligation and the risk that we may have to pay certain costs, such as transaction fees or breakage costs, if a hedging arrangement is terminated by us. As a matter of policy, we enter into hedging arrangements with counterparties that are large, creditworthy financial institutions typically rated at least "A/A2" by S&P and Moody's, respectively.

Developing an effective strategy for dealing with movements in interest rates is complex and no strategy can completely insulate us from risks associated with such fluctuations. There can be no assurance that our hedging activities will have the desired beneficial impact on our results of operations or financial condition.

Our ability to retain and attract key personnel is critical to our success.

Our success depends on our ability to retain our senior management and the other key members of our management team and recruit additional qualified personnel. We rely in part on equity compensation to retain and incentivize our personnel. Declines in our stock price may hinder our ability to pay competitive compensation and may result in the loss of key personnel. In addition, if members of our management join competitors or form competing companies, the competition could have a material adverse effect on our business. Efforts to retain or attract professionals may result in additional compensation expense, which could affect our financial performance.

We are highly dependent on information systems, and systems failures could significantly disrupt our business.

As a financial services firm, our business is highly dependent on communications, information, financial and operational systems. Any failure or interruption of our systems could cause delays or other problems in our business activities, which could have a material adverse effect on our operations and financial performance.

Our growth is dependent on leverage, which may create other risks.