Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | pgc-8k_20201028.htm |

Q3 2020 Investor Update (and Supplemental Financial Information) 09.30.2020 Peapack-Gladstone Bank The Q3 2020 Investor Update (and Supplemental Financial Information) should be read in conjunction with the Form 8-K Q3 2020 Earnings Release. Exhibit 99.1

Statement Regarding Forward-Looking Information This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) our inability to successfully grow our business and implement our strategic plan, including an inability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the impact of anticipated higher operating expenses in 2020 and beyond; 3) our inability to successfully integrate wealth management firm acquisitions; 4) our inability to manage our growth; 5) our inability to successfully integrate our expanded employee base; 6) an unexpected decline in the economy, in particular in our New Jersey and New York market areas; 7) declines in our net interest margin caused by the interest rate environment (including the shape of yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) higher than expected increases in our allowance for loan and lease losses; 10) higher than expected increases in loan and lease losses or in the level of nonperforming loans; 11) unexpected changes in interest rates; 12) an unexpected decline in real estate values within our market areas; 13) legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Basel III and related regulations) that may result in increased compliance costs; 14) changes in monetary policy by the Federal Reserve Board; 15) changes to legislation or policy, including tax or accounting matters; 16) successful cyberattacks against our IT infrastructure and that of our IT providers; 17) higher than expected FDIC insurance premiums; 18) adverse weather conditions; 19) our inability to successfully generate business in new geographic markets; 20) our inability to execute upon new business initiatives; 21) our lack of liquidity to fund our various cash obligations; 22) reduction in our lower-cost funding sources; 23) our inability to adapt to technological changes; 24) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 25) effects related to a prolonged shutdown of the federal government that could impact SBA and other government lending programs; and 26) other unexpected material adverse changes in our operations or earnings. Further, given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated and whether the gradual reopening of businesses will result in a meaningful increase in economic activity. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: 1) demand for our products and services may decline, making it difficult to grow assets and income; 2) if the economy is unable to substantially reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; 3) collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; 4) our allowance for loan losses may have to be increased if borrowers experience financial difficulties, which will adversely affect our net income; 5) the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; 6) as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; 7) a material decrease in net income or a net loss over several quarters could result in a decrease in the rate of our quarterly cash dividend; 8) our wealth management revenues may decline with continuing market turmoil; 9) our cyber security risks are increased as the result of an increase in the number of employees working remotely; and 10) FDIC premiums may increase if the agency experience additional resolution costs. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements.

Trading at a substantial discount to tangible book value creates a significant upside. Niche wealth management and commercial banking strategy with a proven track record of delivering strong organic growth. Demonstrated ability to acquire and integrate wealth management businesses that are immediately accretive to earnings. High level of fee and other income – 33% of total revenue for the nine months ended September 30, 2020. Attractive geographic franchise; we operate in three of the top ten most affluent counties in the U.S. Highly efficient branch network with deposit balances averaging $256MM per branch. Strong ALLL coverage of 1.56% of total loans (excluding PPP loans). Talented team of professionals with extensive large bank experience focused on delivering an exceptional client experience. Robust digital strategy launched to enable clients to conduct business when, where, and with whom they want. Moody’s investment grade of Baa3; Kroll investment grade of BBB-. Investment Considerations

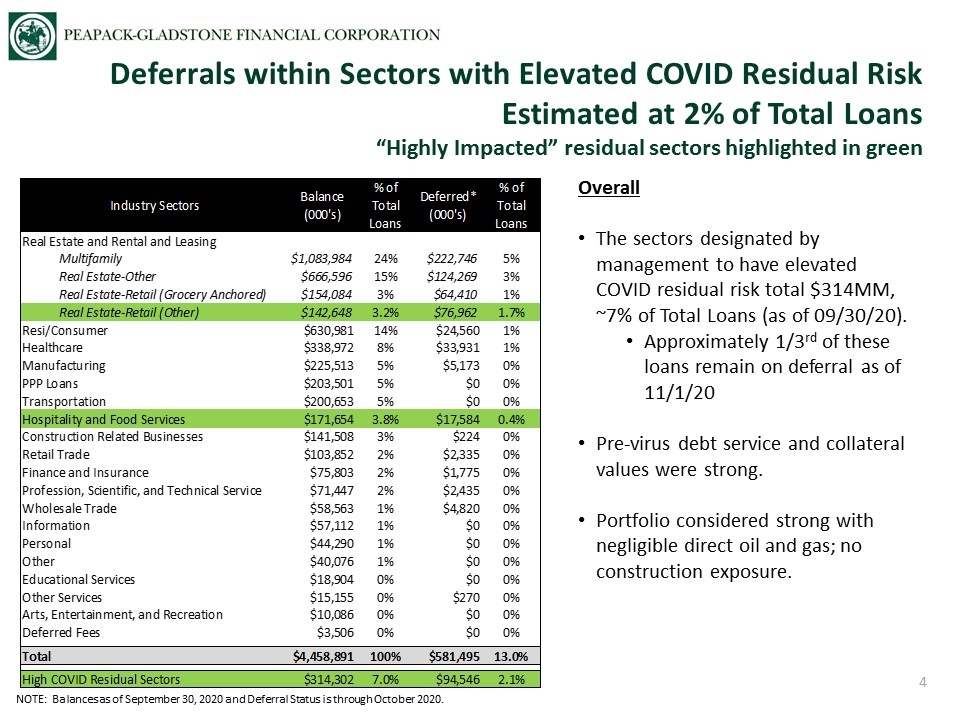

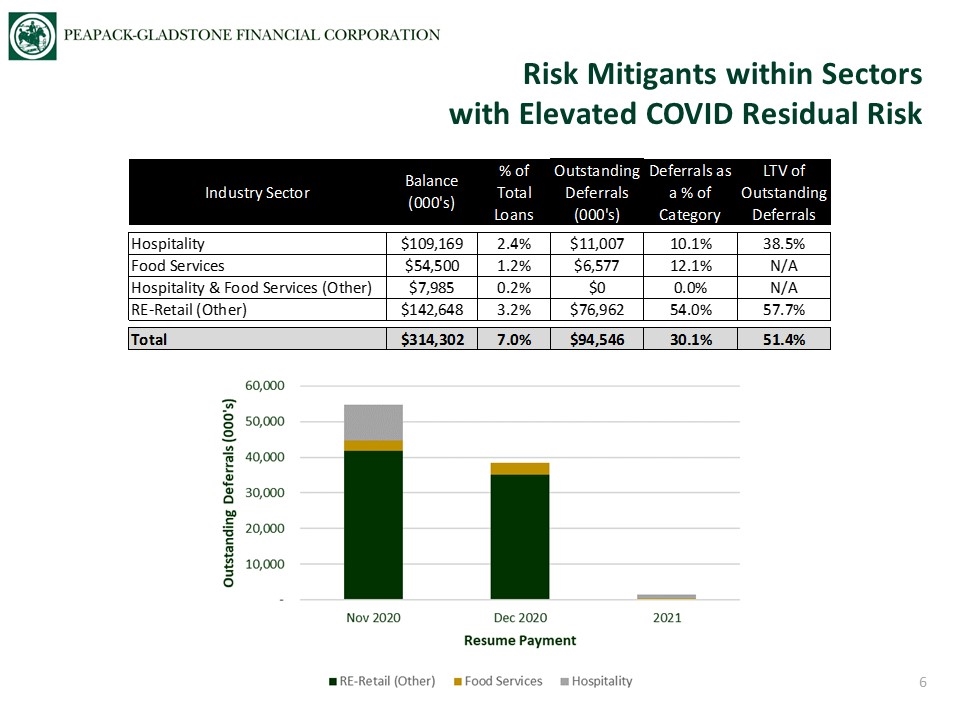

Deferrals within Sectors with Elevated COVID Residual Risk Estimated at 2% of Total Loans “Highly Impacted” residual sectors highlighted in green Overall The sectors designated by management to have elevated COVID residual risk total $314MM, ~7% of Total Loans (as of 09/30/20). Approximately 1/3rd of these loans remain on deferral as of 11/1/20 Pre-virus debt service and collateral values were strong. Portfolio considered strong with negligible direct oil and gas; no construction exposure. NOTE: Balances as of September 30, 2020 and Deferral Status is through October 2020.

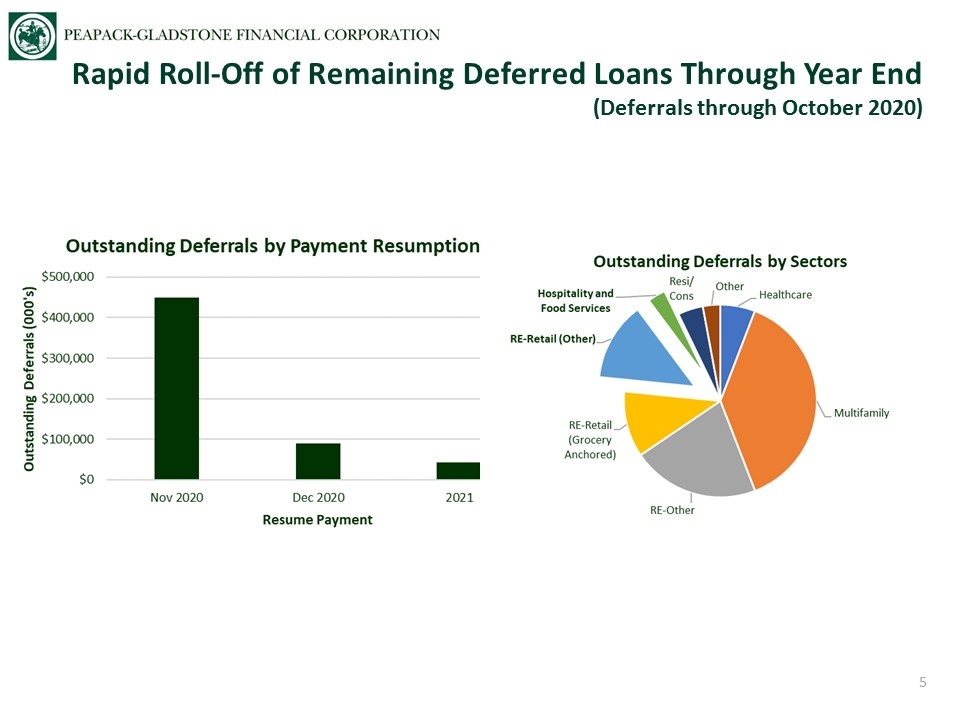

Rapid Roll-Off of Remaining Deferred Loans Through Year End (Deferrals through October 2020)

Risk Mitigants within Sectors with Elevated COVID Residual Risk

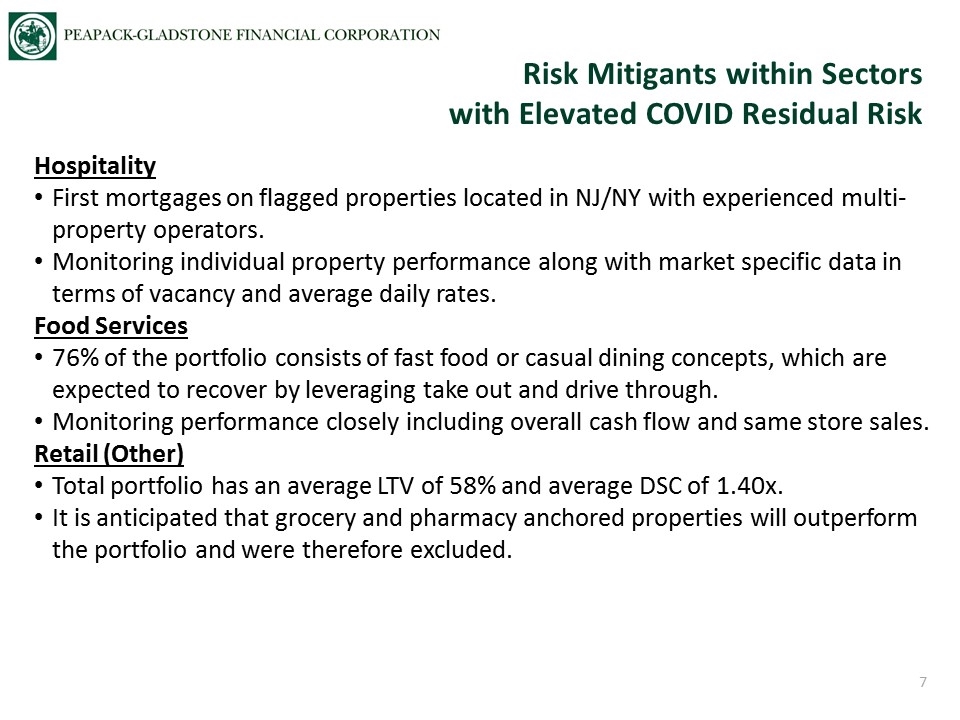

Risk Mitigants within Sectors with Elevated COVID Residual Risk Hospitality First mortgages on flagged properties located in NJ/NY with experienced multi-property operators. Monitoring individual property performance along with market specific data in terms of vacancy and average daily rates. Food Services 76% of the portfolio consists of fast food or casual dining concepts, which are expected to recover by leveraging take out and drive through. Monitoring performance closely including overall cash flow and same store sales. Retail (Other) Total portfolio has an average LTV of 58% and average DSC of 1.40x. It is anticipated that grocery and pharmacy anchored properties will outperform the portfolio and were therefore excluded.

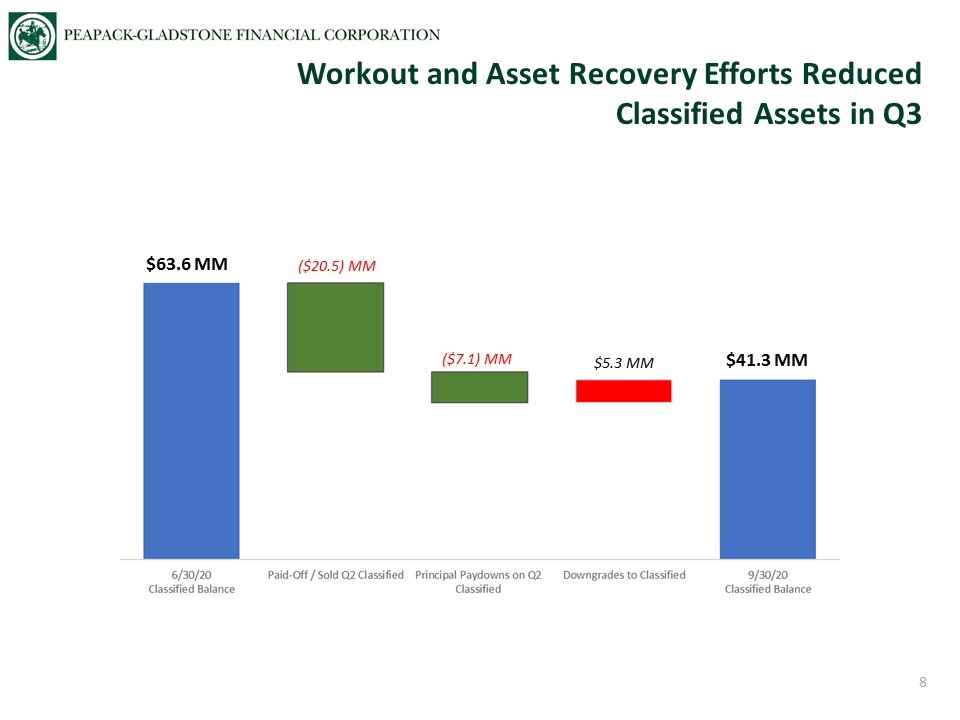

$63.6 MM $41.3 MM ($20.5) MM ($7.1) MM $5.3 MM Workout and Asset Recovery Efforts Reduced Classified Assets in Q3

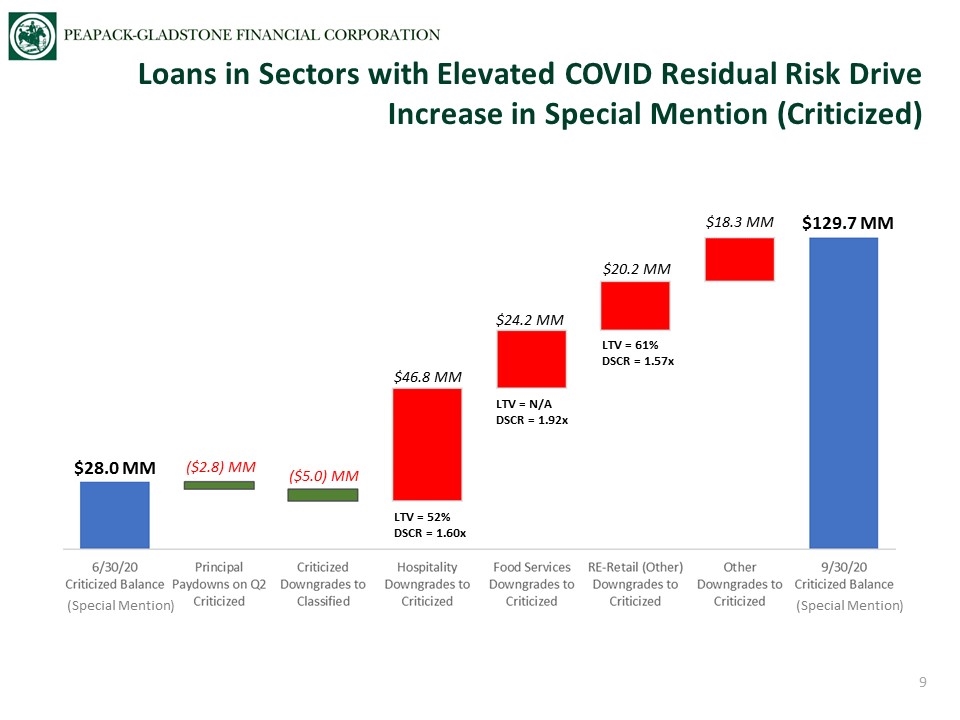

Loans in Sectors with Elevated COVID Residual Risk Drive Increase in Special Mention (Criticized) $28.0 MM $129.7 MM ($2.8) MM $24.2 MM $46.8 MM ($5.0) MM $20.2 MM $18.3 MM LTV = 52% DSCR = 1.60x LTV = N/A DSCR = 1.92x LTV = 61% DSCR = 1.57x (Special Mention) (Special Mention)

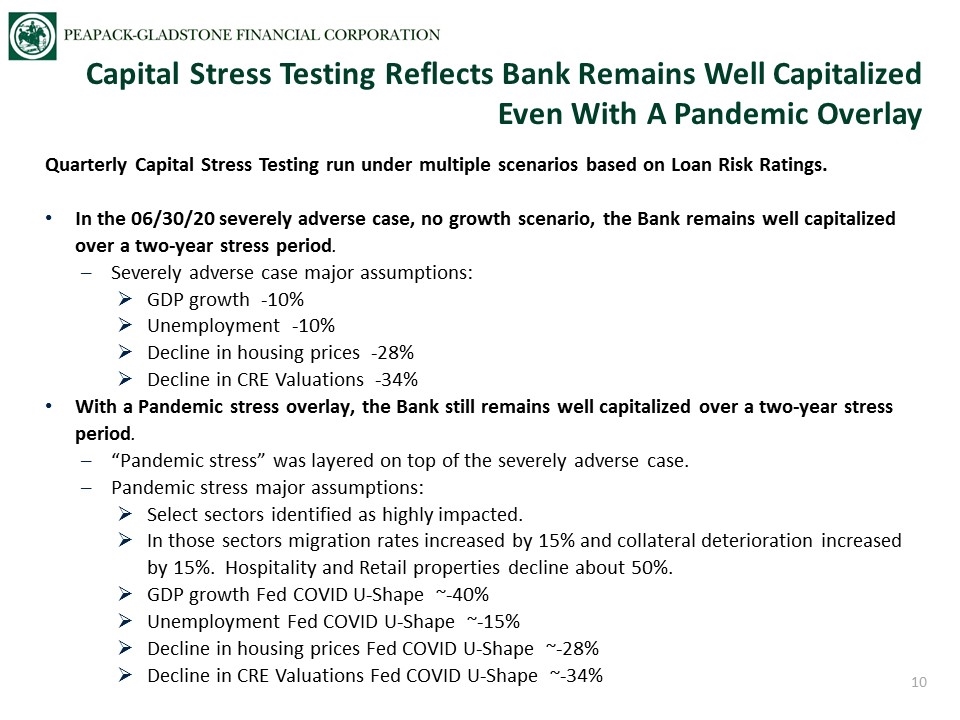

Capital Stress Testing Reflects Bank Remains Well Capitalized Even With A Pandemic Overlay Quarterly Capital Stress Testing run under multiple scenarios based on Loan Risk Ratings. In the 06/30/20 severely adverse case, no growth scenario, the Bank remains well capitalized over a two-year stress period. Severely adverse case major assumptions: GDP growth -10% Unemployment -10% Decline in housing prices -28% Decline in CRE Valuations -34% With a Pandemic stress overlay, the Bank still remains well capitalized over a two-year stress period. “Pandemic stress” was layered on top of the severely adverse case. Pandemic stress major assumptions: Select sectors identified as highly impacted. In those sectors migration rates increased by 15% and collateral deterioration increased by 15%. Hospitality and Retail properties decline about 50%. GDP growth Fed COVID U-Shape ~-40% Unemployment Fed COVID U-Shape ~-15% Decline in housing prices Fed COVID U-Shape ~-28% Decline in CRE Valuations Fed COVID U-Shape ~-34%

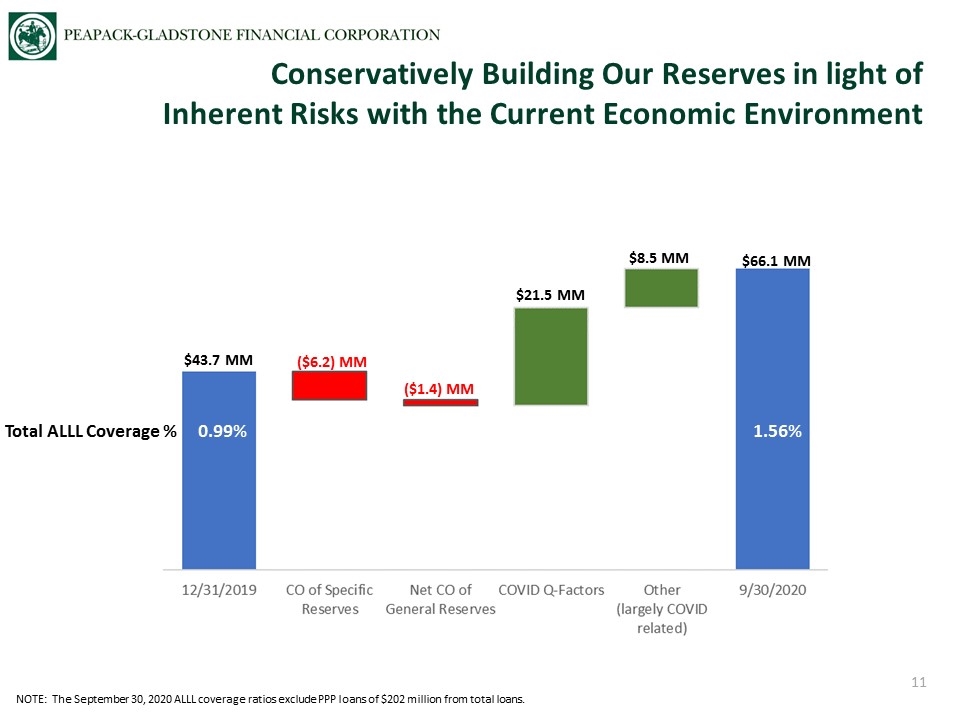

Conservatively Building Our Reserves in light of Inherent Risks with the Current Economic Environment NOTE: The September 30, 2020 ALLL coverage ratios exclude PPP loans of $202 million from total loans. $43.7 MM $66.1 MM ($6.2) MM $8.5 MM $21.5 MM 0.99% 1.56% Total ALLL Coverage % ($1.4) MM

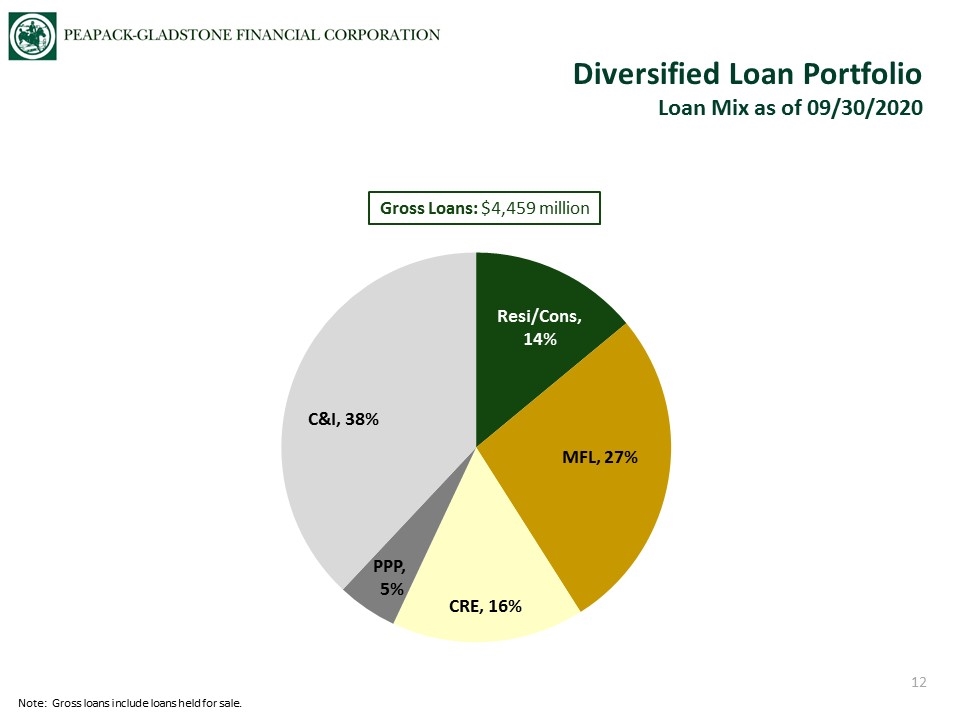

Diversified Loan Portfolio Loan Mix as of 09/30/2020 Gross Loans: $4,459 million Note: Gross loans include loans held for sale.

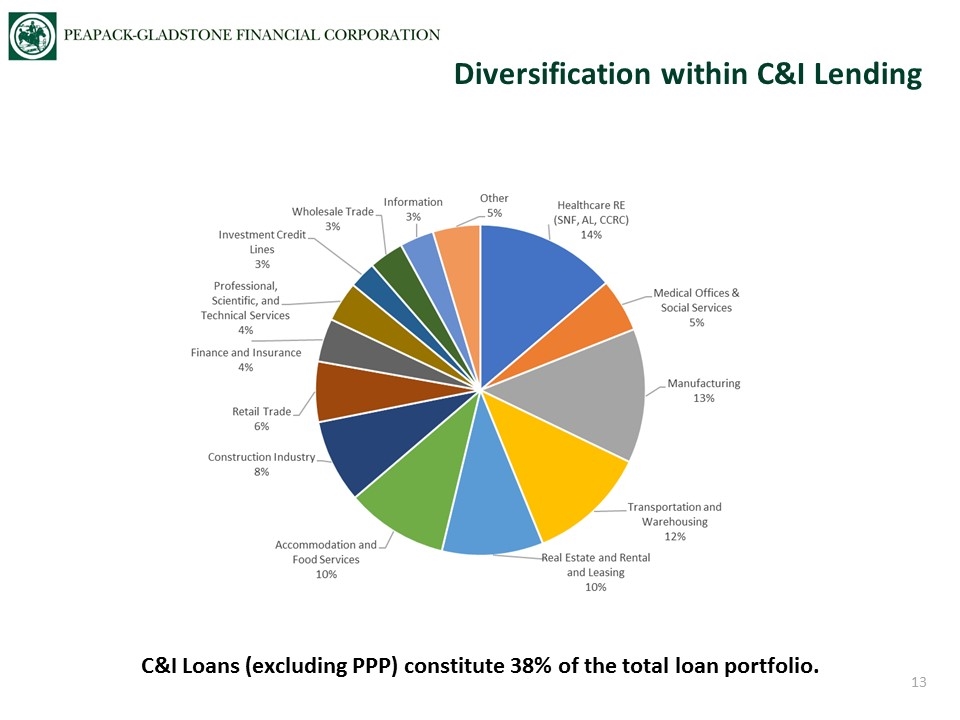

Diversification within C&I Lending C&I Loans (excluding PPP) constitute 38% of the total loan portfolio.

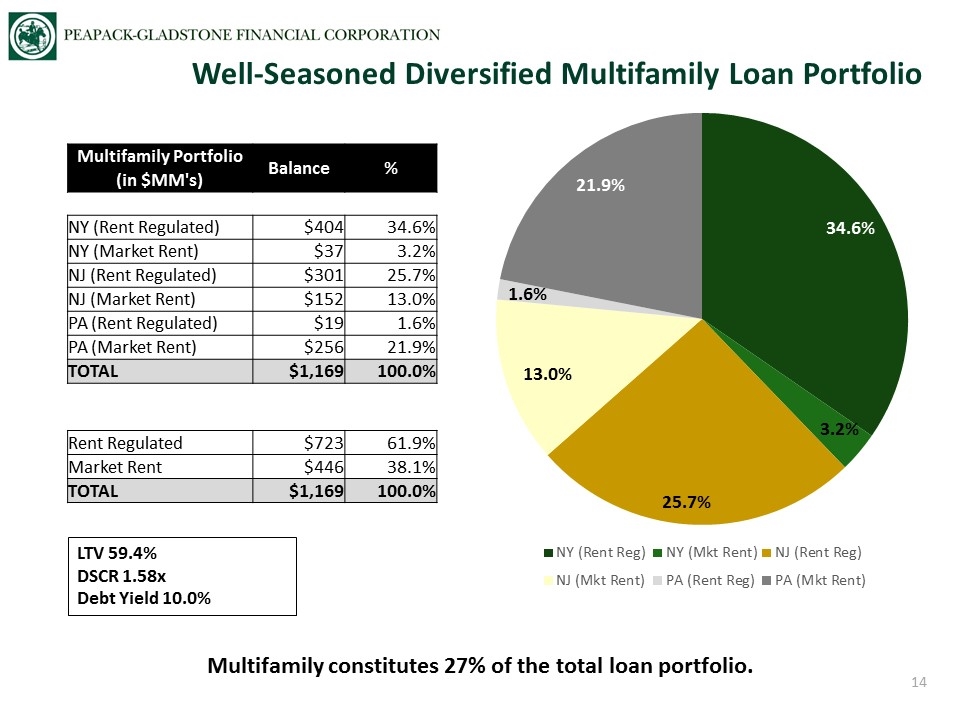

Well-Seasoned Diversified Multifamily Loan Portfolio Multifamily Portfolio Balance % (in $MM's) NY (Rent Regulated) $404 34.6% NY (Market Rent) $37 3.2% NJ (Rent Regulated) $301 25.7% NJ (Market Rent) $152 13.0% PA (Rent Regulated) $19 1.6% PA (Market Rent) $256 21.9% TOTAL $1,169 100.0% Rent Regulated $723 61.9% Market Rent $446 38.1% TOTAL $1,169 100.0% LTV 59.4% DSCR 1.58x Debt Yield 10.0% Multifamily constitutes 27% of the total loan portfolio.

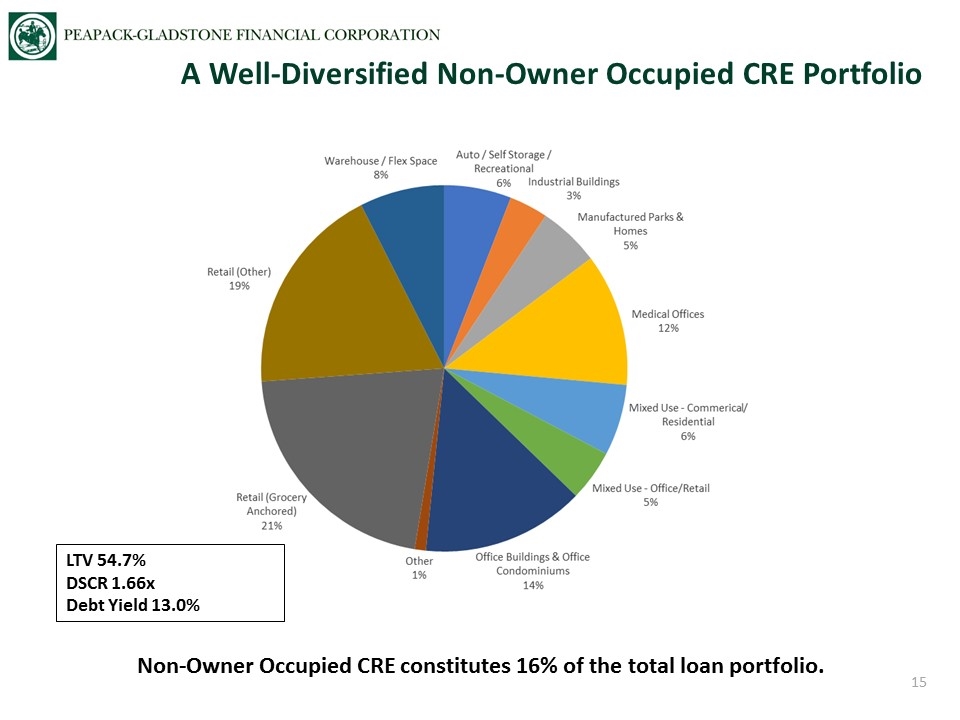

A Well-Diversified Non-Owner Occupied CRE Portfolio Non-Owner Occupied CRE constitutes 16% of the total loan portfolio. LTV 54.7% DSCR 1.66x Debt Yield 13.0%

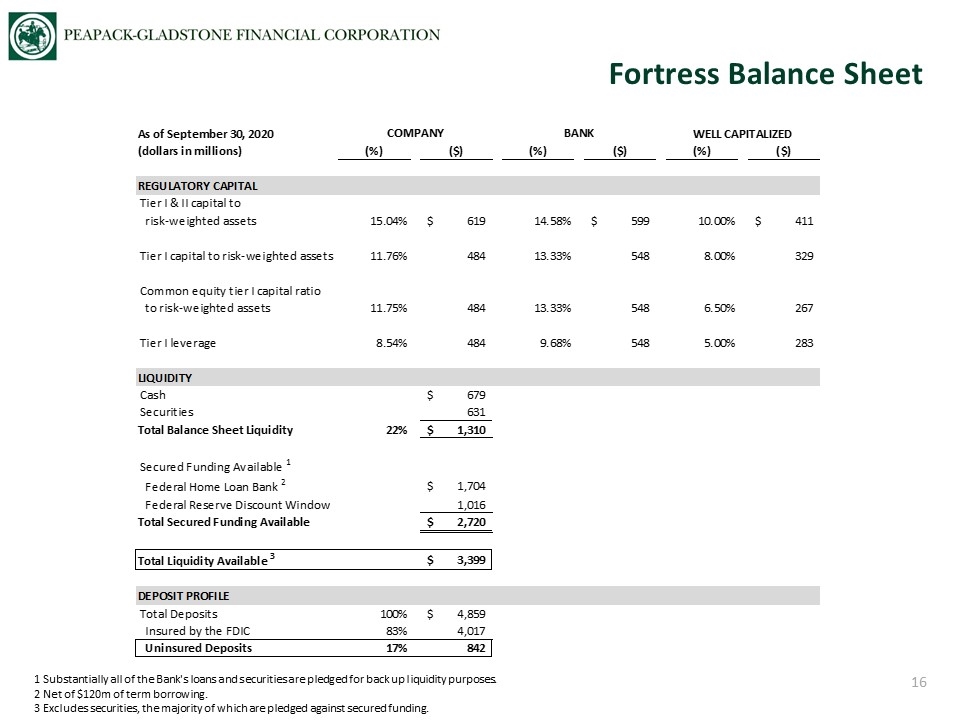

Fortress Balance Sheet 1 Substantially all of the Bank's loans and securities are pledged for back up liquidity purposes. 2 Net of $120m of term borrowing. 3 Excludes securities, the majority of which are pledged against secured funding. Peapack-Gladstone Financial Corp. Fortress Balance Sheet as of September 30, 2020 (dollars in millions) As of September 30, 2020 COMPANY BANK WELL CAPITALIZED STANDARD (dollars in millions) (%) ($) (%) ($) (%) ($) REGULATORY CAPITAL Tier I & II capital to risk-weighted assets 0.15040000000000001 $619 0.14580000000000001 $599 0.1 $411 Tier I capital to risk-weighted assets 0.1176 484 0.1333 548 0.08 329 Common equity tier I capital ratio to risk-weighted assets 0.11749999999999999 484 0.1333 548 6.5000000000000002E-2 267 Tier I leverage 8.5400000000000004E-2 484 9.6799999999999997E-2 548 0.05 283 LIQUIDITY Cash $679 Securities 631 Total Balance Sheet Liquidity 0.22 $1,310 Secured Funding Available 1 Federal Home Loan Bank 2 $1,704 Federal Reserve Discount Window 1,016 Total Secured Funding Available $2,720 Total Liquidity Available 3 $3,399 DEPOSIT PROFILE Total Deposits 1 $4,859 Insured by the FDIC 0.82673389586334634 4,017.1 Uninsured Deposits 0.17326610413665366 841.90000000000009 Notes: 1 Substantially all of the Bank's loans and securities are pledged for back up liquidity purposes 2 Net of $120m of term borrowing

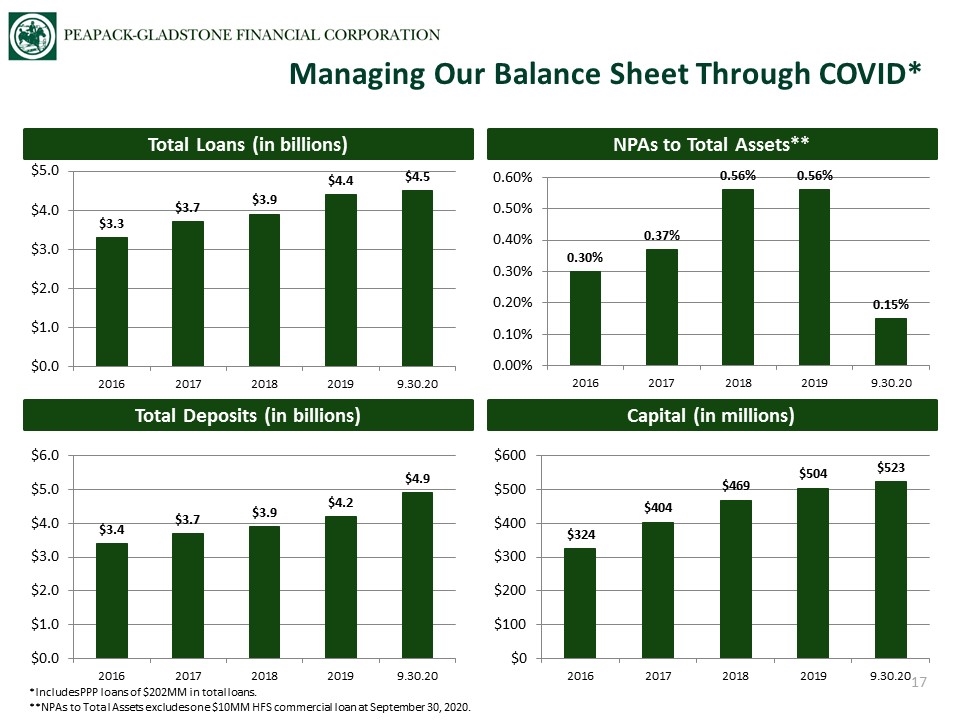

NPAs to Total Assets** Total Loans (in billions) Capital (in millions) Total Deposits (in billions) Managing Our Balance Sheet Through COVID* *Includes PPP loans of $202MM in total loans. **NPAs to Total Assets excludes one $10MM HFS commercial loan at September 30, 2020.

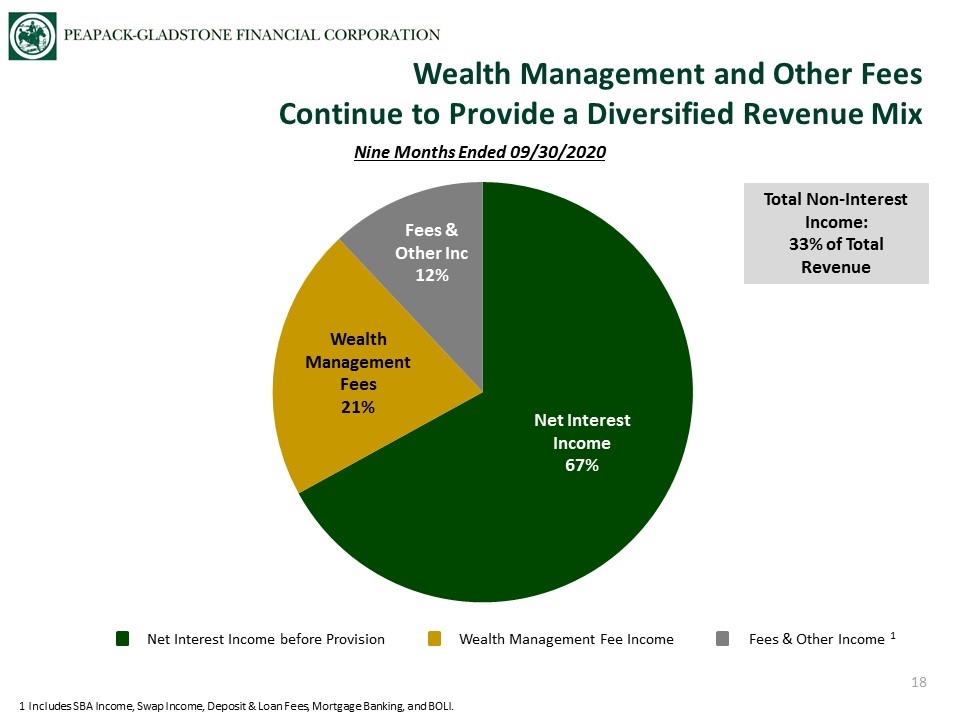

1 Includes SBA Income, Swap Income, Deposit & Loan Fees, Mortgage Banking, and BOLI. Net Interest Income 67% Wealth Management Fees 21% Fees & Other Inc 12% Nine Months Ended 09/30/2020 Net Interest Income before Provision Wealth Management Fee Income Fees & Other Income 1 Total Non-Interest Income: 33% of Total Revenue Wealth Management and Other Fees Continue to Provide a Diversified Revenue Mix

Our Vision: A leading wealth management boutique, offering superior advice delivered by top quality professionals, with a differentiated client experience compared to large bank competitors. Q3 2020: AUMs/AUAs at 09/30/2020 were a record $7.6B, which includes YTD gross client inflows of $528MM. Wealth fees totaled $10MM reflecting an increase of $618K vs Q3 2019 (+7%). Wealth fee revenue comprised 21% of total bank revenue on a YTD basis. 2020 Client retention remains excellent – no discernable COVID-19 impact. AUM/AUA gross client inflows of approximately $241MM for Q3 (and $528MM YTD). Strong pipeline heading in to Q4 2020. We continue to pursue acquisition opportunities in the NY metro area and in FL. Integration of recently acquired RIAs continues: Lassus Wherley and Point View subs will be combined into the Bank legal entity effective 01/01/2021. Q4 start of conversion to new consolidated trading and reporting platform. Consolidated Fairfield and Gladstone wealth management locations into other NJ wealth offices. Peapack Private Wealth Management

Continued emphasis on the health and safety of our employees and clients. Actively manage credit risk associated with the COVID-19 pandemic. Grow and expand our core Wealth Management and Commercial Banking businesses. Prudently manage costs, capital and liquidity, but remain opportunistic for accretive wealth M&A and talent lift-outs. Evaluate office space and branch requirements. Accelerate digital enhancement initiatives to improve the client experience. Grow fee income to 35% - 45% of total bank revenue. Priorities

Appendix Peapack-Gladstone Bank

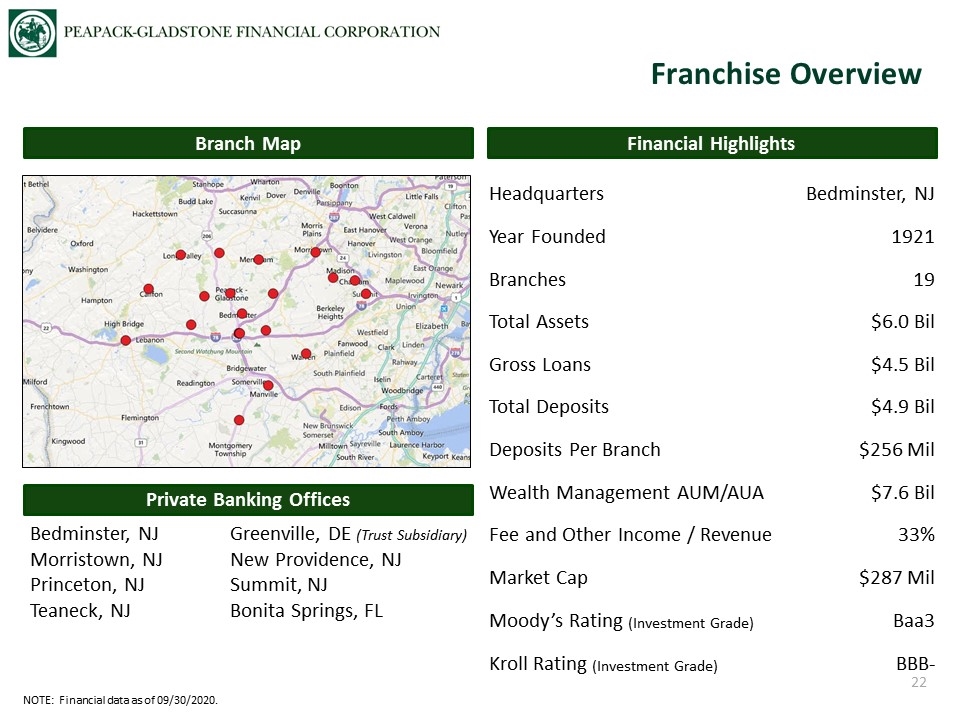

Financial Highlights Branch Map Franchise Overview NOTE: Financial data as of 09/30/2020. Private Banking Offices Bedminster, NJ Morristown, NJ Princeton, NJ Teaneck, NJ Greenville, DE (Trust Subsidiary) New Providence, NJ Summit, NJ Bonita Springs, FL Headquarters Bedminster, NJ Year Founded 1921 Branches 19 Total Assets $6.0 Bil Gross Loans $4.5 Bil Total Deposits $4.9 Bil Deposits Per Branch $256 Mil Wealth Management AUM/AUA $7.6 Bil Fee and Other Income / Revenue 33% Market Cap $287 Mil Moody’s Rating (Investment Grade) Baa3 Kroll Rating (Investment Grade) BBB-

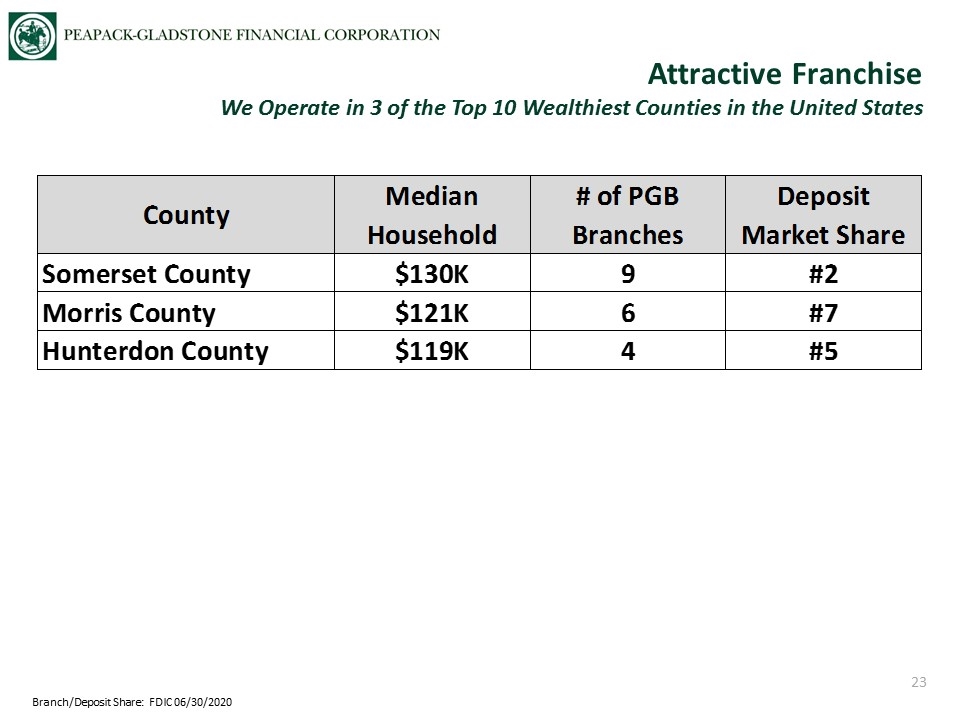

Attractive Franchise We Operate in 3 of the Top 10 Wealthiest Counties in the United States Branch/Deposit Share: FDIC 06/30/2020

A high-performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for our unparalleled client service, integrity and trust. Professionalism Clients First Compete to Win Invested in Our Community One Team Vision Senior Private Bankers lead a team-based approach. PGB offers a full suite of banking, commercial, advisory and wealth management services to support client financial needs. Team members focus on understanding needs, goals, and aspirations with consideration of risk tolerance, time horizon, and other traditional variables. Deliver exceptional client experience. For our high net worth individual clients, we develop, optimize, and deliver customized financial solutions aimed at helping clients create, grow, protect, and ultimately transition their wealth. For privately-owned businesses, we provide customized lending, advisory, treasury management and capital market solutions. We also provide comprehensive wealth management advice and services that includes investment, estate, tax and wealth planning considerations for business owners. “All Banking Should Be Private Banking” Private Banking Model Core Principles Our Foundation

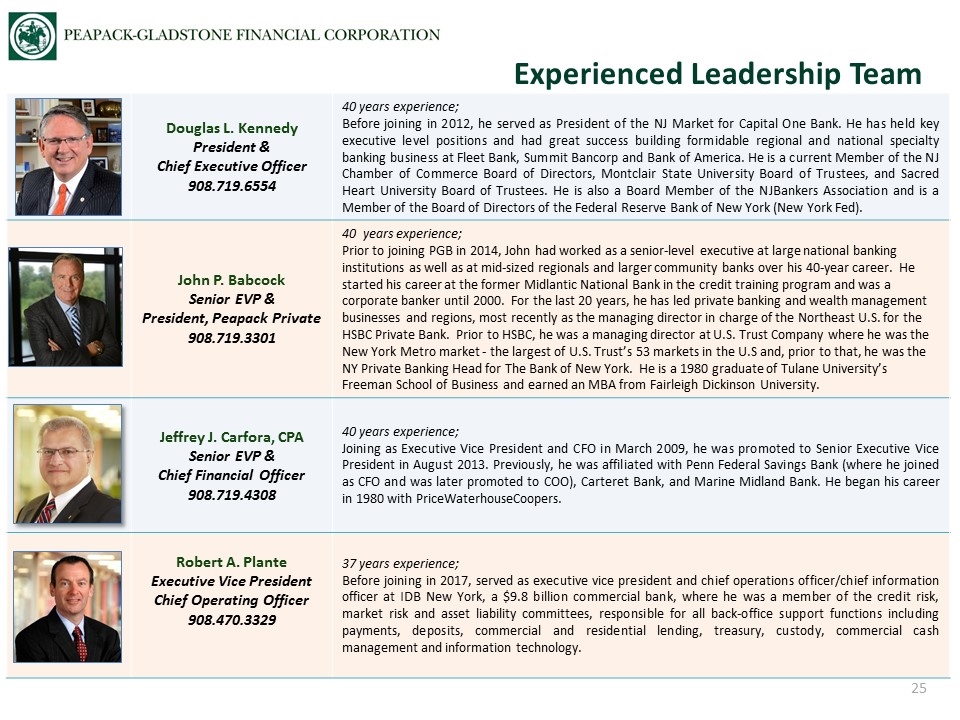

Douglas L. Kennedy President & Chief Executive Officer 908.719.6554 40 years experience; Before joining in 2012, he served as President of the NJ Market for Capital One Bank. He has held key executive level positions and had great success building formidable regional and national specialty banking business at Fleet Bank, Summit Bancorp and Bank of America. He is a current Member of the NJ Chamber of Commerce Board of Directors, Montclair State University Board of Trustees, and Sacred Heart University Board of Trustees. He is also a Board Member of the NJBankers Association and is a Member of the Board of Directors of the Federal Reserve Bank of New York (New York Fed). John P. Babcock Senior EVP & President, Peapack Private 908.719.3301 40 years experience; Prior to joining PGB in 2014, John had worked as a senior-level executive at large national banking institutions as well as at mid-sized regionals and larger community banks over his 40-year career. He started his career at the former Midlantic National Bank in the credit training program and was a corporate banker until 2000. For the last 20 years, he has led private banking and wealth management businesses and regions, most recently as the managing director in charge of the Northeast U.S. for the HSBC Private Bank. Prior to HSBC, he was a managing director at U.S. Trust Company where he was the New York Metro market - the largest of U.S. Trust’s 53 markets in the U.S and, prior to that, he was the NY Private Banking Head for The Bank of New York. He is a 1980 graduate of Tulane University’s Freeman School of Business and earned an MBA from Fairleigh Dickinson University. Jeffrey J. Carfora, CPA Senior EVP & Chief Financial Officer 908.719.4308 40 years experience; Joining as Executive Vice President and CFO in March 2009, he was promoted to Senior Executive Vice President in August 2013. Previously, he was affiliated with Penn Federal Savings Bank (where he joined as CFO and was later promoted to COO), Carteret Bank, and Marine Midland Bank. He began his career in 1980 with PriceWaterhouseCoopers. Robert A. Plante Executive Vice President Chief Operating Officer 908.470.3329 37 years experience; Before joining in 2017, served as executive vice president and chief operations officer/chief information officer at IDB New York, a $9.8 billion commercial bank, where he was a member of the credit risk, market risk and asset liability committees, responsible for all back-office support functions including payments, deposits, commercial and residential lending, treasury, custody, commercial cash management and information technology. Experienced Leadership Team

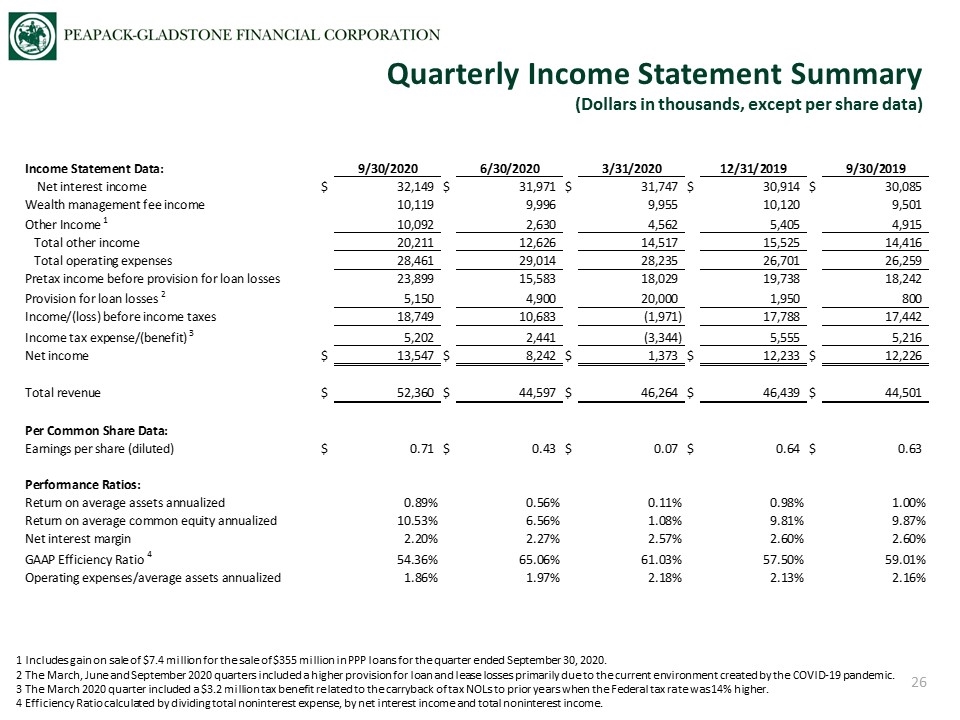

Quarterly Income Statement Summary (Dollars in thousands, except per share data) 1 Includes gain on sale of $7.4 million for the sale of $355 million in PPP loans for the quarter ended September 30, 2020. 2 The March, June and September 2020 quarters included a higher provision for loan and lease losses primarily due to the current environment created by the COVID-19 pandemic. 3 The March 2020 quarter included a $3.2 million tax benefit related to the carryback of tax NOLs to prior years when the Federal tax rate was 14% higher. 4 Efficiency Ratio calculated by dividing total noninterest expense, by net interest income and total noninterest income.

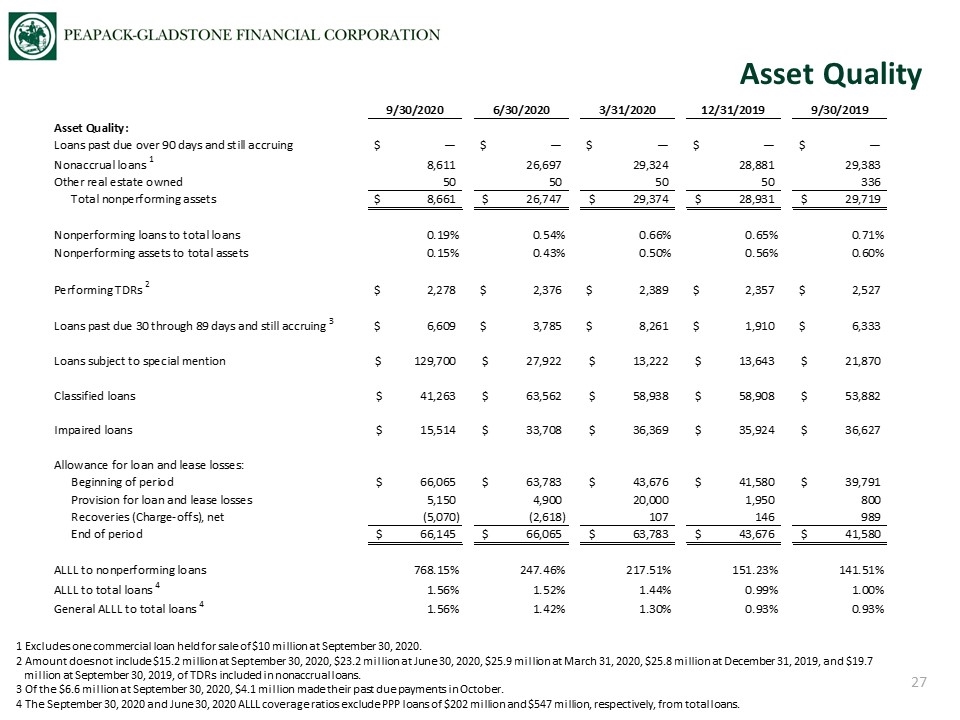

Asset Quality 1 Excludes one commercial loan held for sale of $10 million at September 30, 2020. 2 Amount does not include $15.2 million at September 30, 2020, $23.2 million at June 30, 2020, $25.9 million at March 31, 2020, $25.8 million at December 31, 2019, and $19.7 million at September 30, 2019, of TDRs included in nonaccrual loans. 3 Of the $6.6 million at September 30, 2020, $4.1 million made their past due payments in October. 4 The September 30, 2020 and June 30, 2020 ALLL coverage ratios exclude PPP loans of $202 million and $547 million, respectively, from total loans.

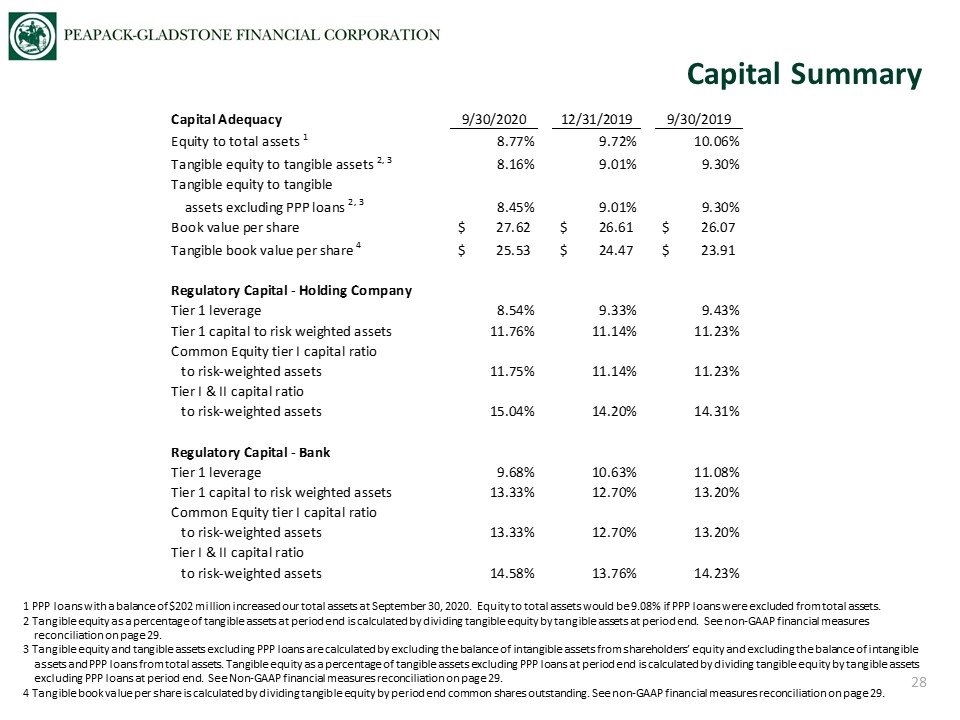

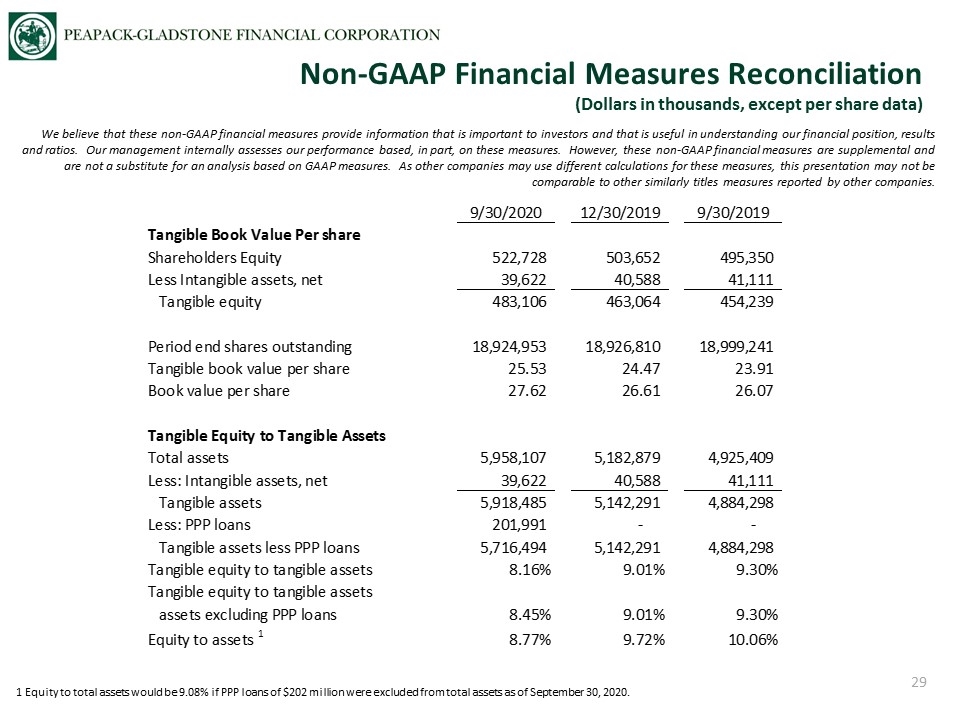

Capital Summary 1 PPP loans with a balance of $202 million increased our total assets at September 30, 2020. Equity to total assets would be 9.08% if PPP loans were excluded from total assets. 2 Tangible equity as a percentage of tangible assets at period end is calculated by dividing tangible equity by tangible assets at period end. See non-GAAP financial measures reconciliation on page 29. 3 Tangible equity and tangible assets excluding PPP loans are calculated by excluding the balance of intangible assets from shareholders’ equity and excluding the balance of intangible assets and PPP loans from total assets. Tangible equity as a percentage of tangible assets excluding PPP loans at period end is calculated by dividing tangible equity by tangible assets excluding PPP loans at period end. See Non-GAAP financial measures reconciliation on page 29. 4 Tangible book value per share is calculated by dividing tangible equity by period end common shares outstanding. See non-GAAP financial measures reconciliation on page 29.

Non-GAAP Financial Measures Reconciliation (Dollars in thousands, except per share data) We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titles measures reported by other companies. 1 Equity to total assets would be 9.08% if PPP loans of $202 million were excluded from total assets as of September 30, 2020.

Peapack-Gladstone Financial Corporation 500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234-0700 www.pgbank.com Douglas L. Kennedy President & Chief Executive Officer (908) 719-6554 dkennedy@pgbank.com Jeffrey J. Carfora Senior EVP & Chief Financial Officer (908) 719-4308 jcarfora@pgbank.com John P. Babcock Senior EVP & President of Peapack Private Wealth Management (908) 719-3301 jbabcock@pgbank.com Contacts Corporate Headquarters Contact