Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - COLUMBUS MCKINNON CORP | exhibit99107302020.htm |

| 8-K - 8-K - COLUMBUS MCKINNON CORP | cmco-20200730.htm |

July 30, Q1 FISCAL YEAR 2021 2020 FINANCIAL RESULTS CONFERENCE CALL David J. Wilson President and Chief Executive Officer Gregory P. Rustowicz Vice President – Finance & Chief Financial Officer PARTNERS IN MOTION CONTROL

SAFE HARBOR STATEMENT These slides, and the accompanying oral discussion, contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning future sales and earnings, involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including the impact of Covid-19 and the Company’s efforts to reduce costs, maintain liquidity and generate cash in the current pandemic, the effectiveness of the Company’s 80/20 Process to simplify operations, the ability of the Company’s Operational Excellence initiatives to drive profitability, the Company’s ability to grow market share, the ability to achieve revenue expectations, global economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries, conditions affecting the Company's customers and suppliers, competitor responses to the Company's products and services, the overall market acceptance of such products and services, the ability to expand into new markets and geographic regions, and other factors disclosed in the Company's periodic reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update the forward- looking information contained in this release. Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The non- GAAP (“adjusted”) measures are notated and we have provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation. © 2020 Columbus McKinnon Corporation 2

SELF-HELP STRATEGY DELIVERS IN DOWNTURN Positive operating income & cash generation despite 35% decline in revenue Solid gross margin of 32.2% due to strategic pricing initiatives, footprint consolidations, overhead reductions and aggressive cost actions Business operating system (E-PAS™) continues to drive performance Operating income of $1.8 million; adjusted operating income of $5.0 million and adjusted operating margin of 3.6% Diluted loss per share was $(0.12); positive adjusted earnings per share of $0.07 Strong cash from operations and free cash flow Generated $9.5 million in cash from operations; free cash flow of $8.4 million Net debt leverage ratio(1) at 1.2x provides financial flexibility Better business model today than previous recession (1)Net debt leverage ratio is defined as Net Debt / Adjusted TTM EBITDA © 2020 Columbus McKinnon Corporation 3

BLUEPRINT STRATEGY PHASE II DELIVERING RESULTS Business operating system, E-PAS™, driving performance FY 21 Fiscal 2021 Savings Potential Annualized Savings 80/20 Process including footprint consolidations $6+ million Structural RSG&A and indirect overhead cost reductions $5 million TOTAL $11+ million E-PAS offsetting impacts of challenging environment: Achieved $1.9 million in contributions to operating income in Q1 FY21 from 80/20 Process Completed closures of Lisbon, OH and small facility in France Rapidly flexed workforce to match declining volume . 238 personnel remained furloughed at 6/30/2020 Continuing to pro-actively manage costs in line with demand © 2020 Columbus McKinnon Corporation 4

NET SALES ($ in millions) Q1 sales down 33.7%, or $71.6 million Q1 FY21 Sales Bridge (adjusted for FX) U.S.: Pricing of 1.2% partially offset 37.2% Quarter volume decline Q1 FY20 Sales $ 212.7 Non-U.S: Pricing of 1.1% partially offset 32.0% volume decline and 2.0% FX headwind Volume (74.0) (34.8)% Pricing 2.4 1.1% Foreign currency translation (2.0) (0.9)% $212.7 $207.6 $199.4 Total change $ (73.6) (34.6)% $189.5 Q1 FY21 Sales $ 139.1 $139.1 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 COVID-19 severely impacted Q1 FY21 volume © 2020 Columbus McKinnon Corporation 5

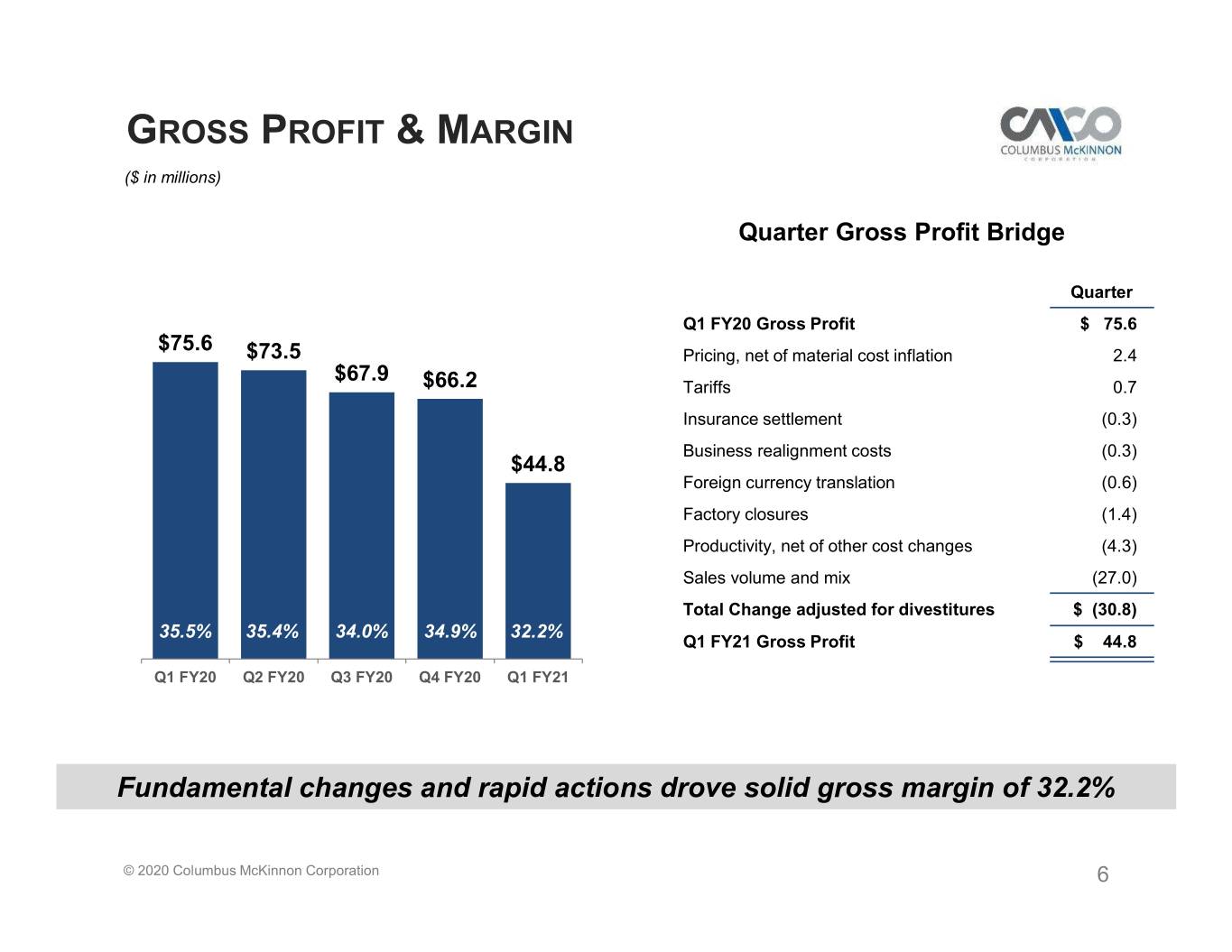

GROSS PROFIT & MARGIN ($ in millions) Quarter Gross Profit Bridge Quarter Q1 FY20 Gross Profit $ 75.6 $75.6 $73.5 Pricing, net of material cost inflation 2.4 $67.9 $66.2 Tariffs 0.7 Insurance settlement (0.3) Business realignment costs (0.3) $44.8 Foreign currency translation (0.6) Factory closures (1.4) Productivity, net of other cost changes (4.3) Sales volume and mix (27.0) Total Change adjusted for divestitures $ (30.8) 35.5%35.4% 34.0% 34.9% 32.2% Q1 FY21 Gross Profit $ 44.8 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Fundamental changes and rapid actions drove solid gross margin of 32.2% © 2020 Columbus McKinnon Corporation 6

RSG&A ($ in millions) RSG&A at 28.7% of sales RSG&A Reduced by: as % of 21.2% 21.7% 21.9% 24.4% 28.7% sales . $0.6 million for FX $46.3 . $6.7 million of net cost reductions $45.1 $45.0 $43.8 $39.9 Increased by: $2.9 $2.8 $3.0 $2.6 . $1.0 million CEO expenses $2.8 . $1.1 million bad debt expense $19.6 $19.2 $18.0 $21.2 $18.4 Q2 FY21 RSG&A estimate of approximately $38.5 million* $22.8 $22.9 $23.2 $22.3 $18.7 Approximately $2 million in annualized Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 savings from structural changes Selling G&A R&D implemented in Q1 Note: Components may not add to totals due to rounding Agile management response to dramatic change in market conditions *RSG&A guidance provided July 30, 2020 excludes business realignment costs © 2020 Columbus McKinnon Corporation 7

OPERATING INCOME & ADJUSTED OI MARGIN ($ in millions) Q1 FY21 operating income of $1.8 million $28.1 Began rapid cost reduction efforts in March $26.3 Q1 FY21 expected to be trough $27.0 $23.1 $25.2 $20.2 $20.9 Adjusted operating margin of 3.6% Reduced footprint $16.7 Lowered overhead Strategic pricing initiatives $5.0 Improved decremental adjusted 13.2% 12.7% 11.6% 10.7% 3.6% operating leverage to (31)% $1.8 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Income from Operations Non-GAAP Adjustments Positive operating income despite severely challenged global markets © 2020 Columbus McKinnon Corporation 8

EARNINGS PER SHARE ($ in millions) GAAP Diluted EPS Net income impacted by following adjustments: $0.78$0.83 $0.69 $0.63 $2.7 million, or $0.09 per diluted share, $0.39 pension settlement expense related to termination of U.S. pension plan Factory closure costs of $2.3 million ($0.12) Business realignment costs of $0.8 million Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Adjusted EPS $0.81 $0.74 $0.64 FY21 expected tax rate: 21% to 22%* $0.58 $0.07 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Continued focus on execution coming out of trough *Tax rate guidance provided July 30, 2020 © 2020 Columbus McKinnon Corporation 9

ADJUSTED EBITDA & ROIC Adjusted EBITDA Margin Solid adjusted EBITDA margin given market conditions 15.7% 15.1% Continuing to target 19% Adjusted EBITDA margin post COVID-19 recession 14.1% FY19 FY20 Q1 FY21 TTM Return on Invested Capital Return on Invested Capital expected (ROIC)(1) to improve Continuing to target mid-teen ROIC post 11.2% 11.5% Covid-19 recession 8.9% FY19 FY20 Q1 FY21 TTM Long-term objectives remain unchanged; timing subject to economic recovery (1)ROIC is defined as adjusted income from operations, net of taxes, for the trailing 12 months divided by the average of debt plus equity less cash (average capital) for the trailing 13 months. A 22% tax rate was used for fiscal years 2019, 2020 & 2021. © 2020 Columbus McKinnon Corporation 10

CASH FLOW ($ in millions) Three Months Ended Free Cash Flow(1) 6/30/20 6/30/19 Net cash provided by $9.5 $(2.2) operating activities $109.8 $97.4 CapEx (1.1) (1.9) Free cash flow $8.4 $(4.0) (FCF) $67.2 Note: Components may not add to totals due to rounding $55.1 Strong cash generation in Q1 FY21 FY21 expected CapEx: approximately $15 million . Maintaining expectation of $5 million in 1H FY21 . Will adjust 2H FY21 based on project economics and market conditions FY18 FY19 FY20 Q1 FY21 TTM Outstanding FCF generation; opportunity to improve inventory turns Capital expenditure guidance provided July 30, 2020 (1)Free cash flow is defined as cash provided by operating activities minus capital expenditures © 2020 Columbus McKinnon Corporation 11

CAPITAL STRUCTURE ($ in millions) CAPITALIZATION Debt leverage ratio(1) of 1.2x June 30, March 31, Net debt to net total capital 20.9% 2020 2020 Cash and cash equivalents $ 152.2 $ 114.5 Maintaining financial flexibility in uncertain macroeconomic Total debt 275.7 251.3 environment Total net debt 123.5 136.9 Shareholders’ equity 466.6 463.6 Total liquidity of $210.5 million at quarter end Total capitalization $ 742.3 $ 714.9 Debt/total capitalization 37.1% 35.2% Net debt/net total 20.9% 22.8% capitalization Note: Amounts may not foot because of rounding Strong capital structure positioned for offense (1)Debt leverage ratio is defined as Net Debt / Adjusted TTM EBITDA © 2020 Columbus McKinnon Corporation 12

OUTLOOK AND PERSPECTIVE Q2 FY21 outlook 31% drop in orders in Q1 FY21 Y/Y Expect revenue in Q2 FY21 in range of $150 million to $160 million Expect growth in operating income from Q1 FY21 and positive cash flow Prepared to respond to changes in demand Continuing to carefully monitor customer and market landscape Prepared to take additional actions if necessary Long-term capital allocation priorities remain unchanged Maintaining dividend at current level Evolution of Blueprint for Growth strategy Evolving Phase III of strategy Refining opportunities for organic and acquisitive growth Focused on increased strategic clarity and execution © 2020 Columbus McKinnon Corporation 13

Supplemental Information © 2020 Columbus McKinnon Corporation 14

BLUEPRINT FOR GROWTH STRATEGY Growth Phase III Oriented Evolve business model Industrial • Portfolio optimization Technology • Mergers & acquisitions Phase II Simplify the business Drive profitable growth • 80/20 Process • Operational Excellence • Ramp the Growth Engine Phase I Get control Achieve results Cyclical • New organization Industrial • Operating system Today Future Further pivot to growth oriented Industrial Technology company © 2020 Columbus McKinnon Corporation 15

ADJUSTED INCOME FROM OPERATIONS RECONCILIATION ($ in thousands) Quarter Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Income from operations $ 27,043 $ 25,231 $ 20,886 $ 16,664 $ 1,789 Add back (deduct): Factory closures 1,027 470 1,592 1,621 2,256 Business realignment costs — 413 662 1,755 821 Insurance recovery legal costs 139 220 66 160 141 Loss on sales of businesses 169 7 — — — Insurance settlement (290) — (77) (15) — Non-GAAP adjusted income from operations $ 28,088 $ 26,341 $ 23,129 $ 20,185 $ 5,007 Sales 212,712 207,609 199,355 189,486 139,070 Adjusted operating margin 13.2% 12.7% 11.6% 10.7% 3.6% Adjusted income from operations is defined as income from operations as reported, adjusted for certain items. Adjusted income from operations is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted income from operations, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations, as well as facilitates a more meaningful comparison of the Company’s income from operations to that of other companies. © 2020 Columbus McKinnon Corporation 16

ADJUSTED NET INCOME RECONCILIATION ($ in thousands, except per share data) Quarter Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Net income (loss) $ 18,579 $ 16,599 $ 15,250 $ 9,244 $ (2,969) Add back (deduct): Non-cash pension settlement expense — — — — 2,722 Factory closures 1,027 470 1,592 1,621 2,256 Business realignment costs — 413 662 1,755 821 Insurance recovery legal costs 139 220 66 160 141 Loss on sales of businesses 169 7 — — — Insurance settlement (290) — (77) (15) — Normalize tax rate to 22%(1) (291) 114 (2,106) 1,050 (1,405) Non-GAAP adjusted net income $ 19,333 $ 17,823 $ 15,387 $ 13,815 $ 1,566 Average diluted shares outstanding 23,777 23,926 24,031 23,938 23,922 Diluted income per share – GAAP $0.78 $0.69 $0.63 $0.39 $(0.12) Diluted income per share - Non-GAAP $0.81 $0.74 $0.64 $0.58 $0.07 (1) Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and at a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. © 2020 Columbus McKinnon Corporation 17

ADJUSTED EBITDA RECONCILIATION ($ in thousands) Quarter Fiscal Year Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 2020 2019 Net income (loss) $ 18,579 $ 16,599 $ 15,250 $ 9,244 $ (2,969) $ 59,672 $ 42,577 Add back (deduct): Income tax expense (benefit) 5,162 5,141 2,234 4,947 (963) 17,484 10,321 Interest and debt expense 3,852 3,759 3,423 3,200 3,188 14,234 17,144 Investment (income) loss (302) (229) (408) 48 (577) (891) (727) Foreign currency exchange (gain) loss (410) (296) (188) (996) 84 (1,514) 843 Other (income) expense, net 162 257 199 221 3,026 839 (716) Depreciation and amortization expense 7,403 7,344 7,244 7,135 7,081 29,126 32,675 Factory closures 1,027 470 1,592 1,621 2,256 4,709 1,473 Business realignment costs — 413 662 1,755 821 2,831 1,906 Insurance recovery legal costs 139 220 66 160 141 585 1,282 Loss on sales of businesses 169 7 — — — 176 25,672 Insurance settlement (290) — (77) (15) — (382) — Non-GAAP adjusted EBITDA $ 35,491 $ 33,685 $ 30,373 $ 27,320 $ 12,088 $ 126,869 $ 132,450 Sales $ 212,712 $ 207,609 $ 199,355 $ 189,486 $ 139,070 $ 809,162 $ 876,282 Adjusted EBITDA margin 16.7% 16.2% 15.2% 14.4% 8.7% 15.7% 15.1% Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted EBITDA, is important for investors and other readers of the Company’s financial statements. © 2020 Columbus McKinnon Corporation 18

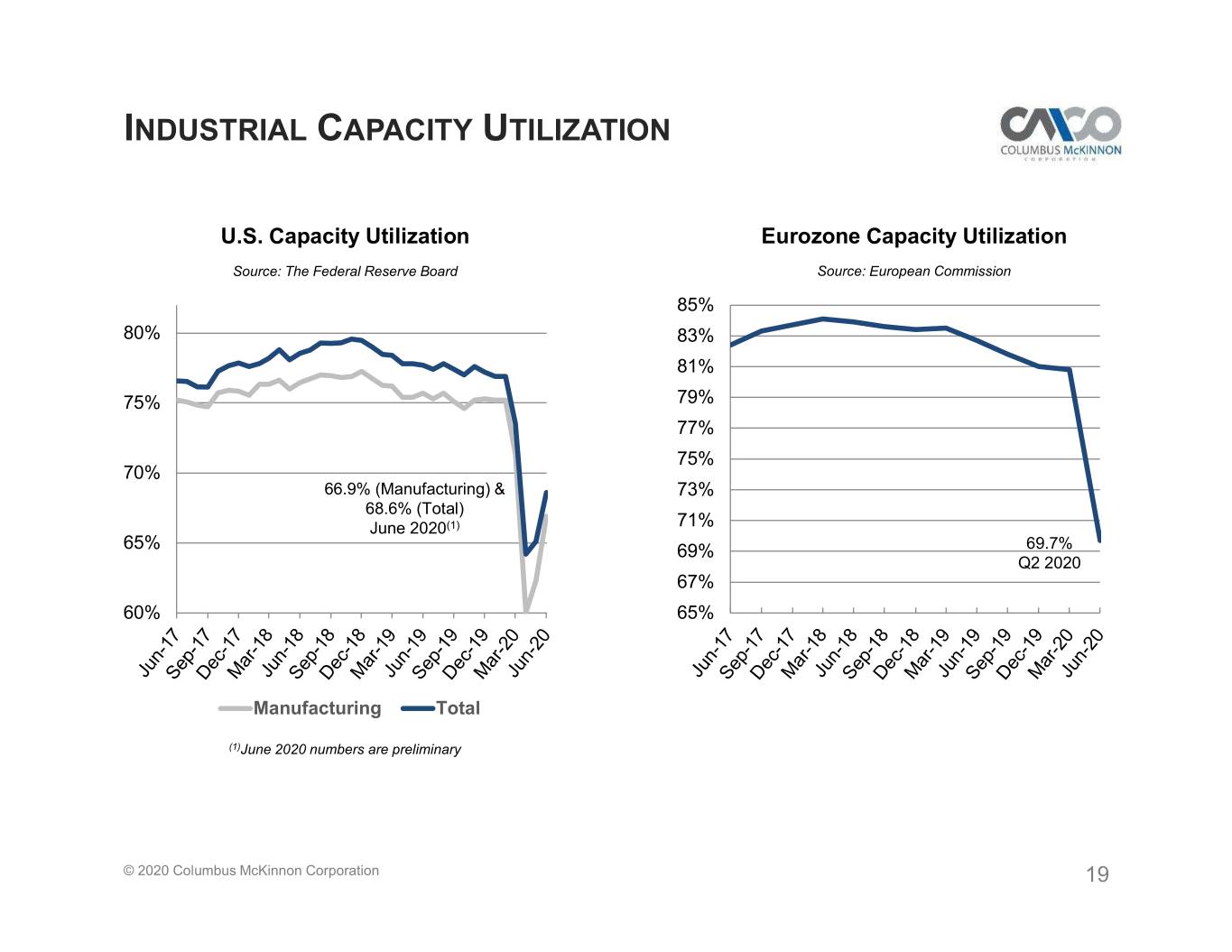

INDUSTRIAL CAPACITY UTILIZATION U.S. Capacity Utilization Eurozone Capacity Utilization Source: The Federal Reserve Board Source: European Commission 85% 80% 83% 81% 75% 79% 77% 75% 70% 66.9% (Manufacturing) & 73% 68.6% (Total) June 2020(1) 71% 65% 69% 69.7% Q2 2020 67% 60% 65% Manufacturing Total (1)June 2020 numbers are preliminary © 2020 Columbus McKinnon Corporation 19

ISM PRODUCTION INDEX Source: Institute of Supply Chain Management 70% 65% 57.3% June 2020 60% 55% 50% 45% 40% 35% 30% 25% © 2020 Columbus McKinnon Corporation 20

CONFERENCE CALL PLAYBACK INFO Replay Number: 412-317-6671 passcode: 13705871 Telephone replay available through August 6, 2020 Webcast / PowerPoint / Replay available at investors.columbusmckinnon.com Transcript, when available, at investors.columbusmckinnon.com © 2020 Columbus McKinnon Corporation 21

July 30, Q1 FISCAL YEAR 2021 2020 FINANCIAL RESULTS CONFERENCE CALL PARTNERS IN MOTION CONTROL