Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CAMDEN NATIONAL CORP | ex992shareholderletterq220.htm |

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | ex991earningsreleaseq220.htm |

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_063020earnings.htm |

Second Quarter 2020 Earnings Conference Call July 28, 2020 1

Forward Looking Statements and Non- GAAP Financial Measures FORWARD LOOKING STATEMENTS This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,” “may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals, plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters. Further, statements about the potential effects of the COVID-19 pandemic on the Company’s businesses and results of operations and financial conditions may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, action taken by government authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and the Company. You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2019, as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements. These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes, except to the extent required by applicable law or regulation. NOTE REGARDING PRESENTATION OF NON-GAAP FINANCIAL MEASURES This presentation includes certain non-GAAP financial measures. Management uses these non-GAAP financial measures for purposes of measuring our performance against our peer group and other financial institutions and analyzing our internal performance. These non-GAAP financial measures also help investors better understand the Company’s operating performance and trends and allow for better performance comparisons to other financial institutions. These measures are not a substitute for GAAP operating results and may not be comparable to non-GAAP measures used by other financial institutions. Schedules that reconcile the non-GAAP financial measures to GAAP financial information are included in our Annual Report on Form 10-K and earnings releases filed with the SEC. 2

Responding to Our Employees, Customers and Communities • Majority of non-banking center employees continue to work remotely • Continue to provide swift and confidential economic support to our employees through our special Stakeholder Emergency Fund for personal or family circumstances • Provided special premium pay for banking center employees through June 30th • All Maine banking centers are now open (with limited hours) and 68 ATMs remain accessible • Continue to offer consumer and business loan payment relief and support • Continue to assist business customers with the SBA Paycheck Protection Program (PPP) • Continue to support nonprofit organizations • Increased support to an organization that supports victims of domestic abuse • Continue to fund homeless shelters through Hope@Home program All data is presented as of June 30, 2020. 3

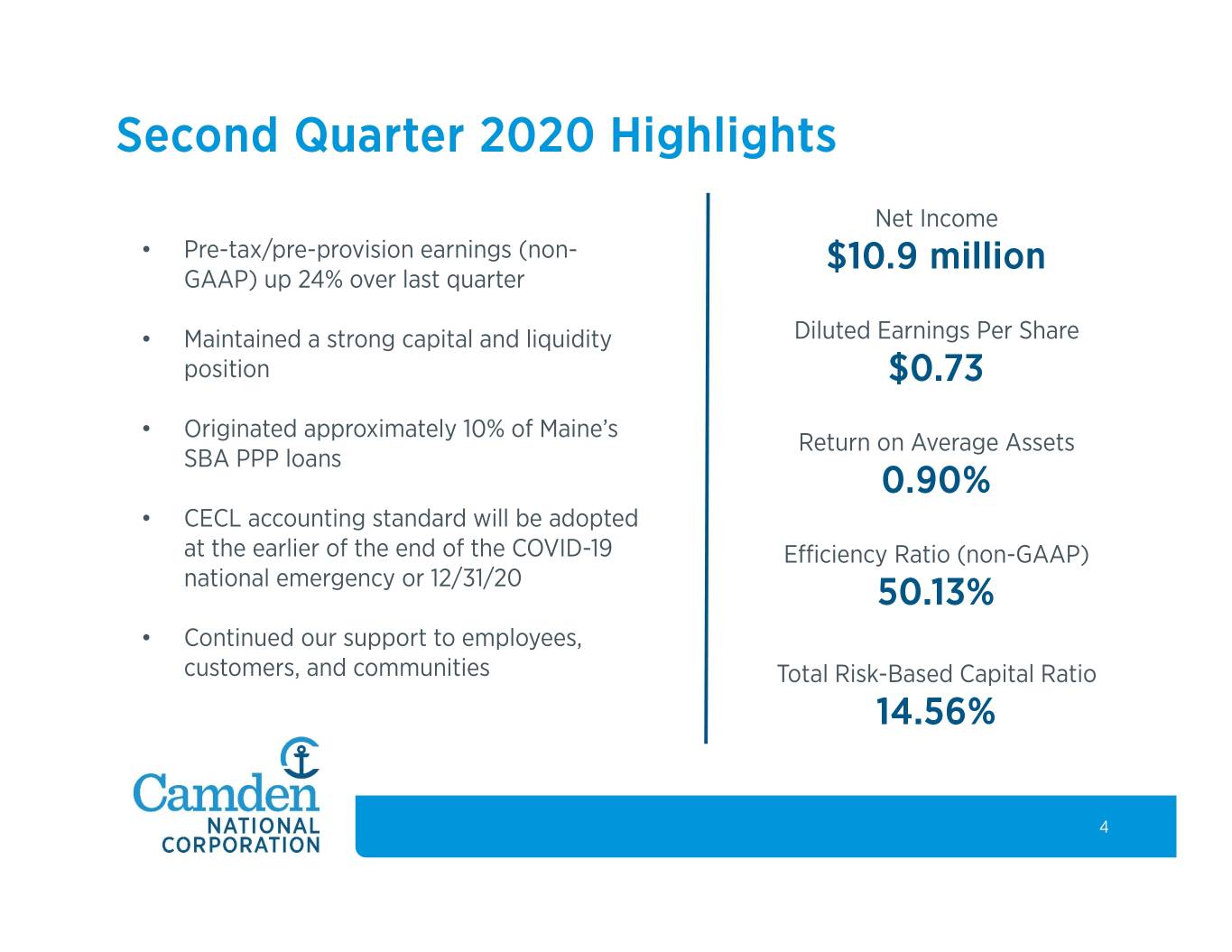

Second Quarter 2020 Highlights Net Income • Pre-tax/pre-provision earnings (non- $10.9 million GAAP) up 24% over last quarter • Maintained a strong capital and liquidity Diluted Earnings Per Share position $0.73 Originated approximately 10% of Maine’s • Return on Average Assets SBA PPP loans 0.90% • CECL accounting standard will be adopted at the earlier of the end of the COVID-19 Efficiency Ratio (non-GAAP) national emergency or 12/31/20 50.13% • Continued our support to employees, customers, and communities Total Risk-Based Capital Ratio 14.56% 4

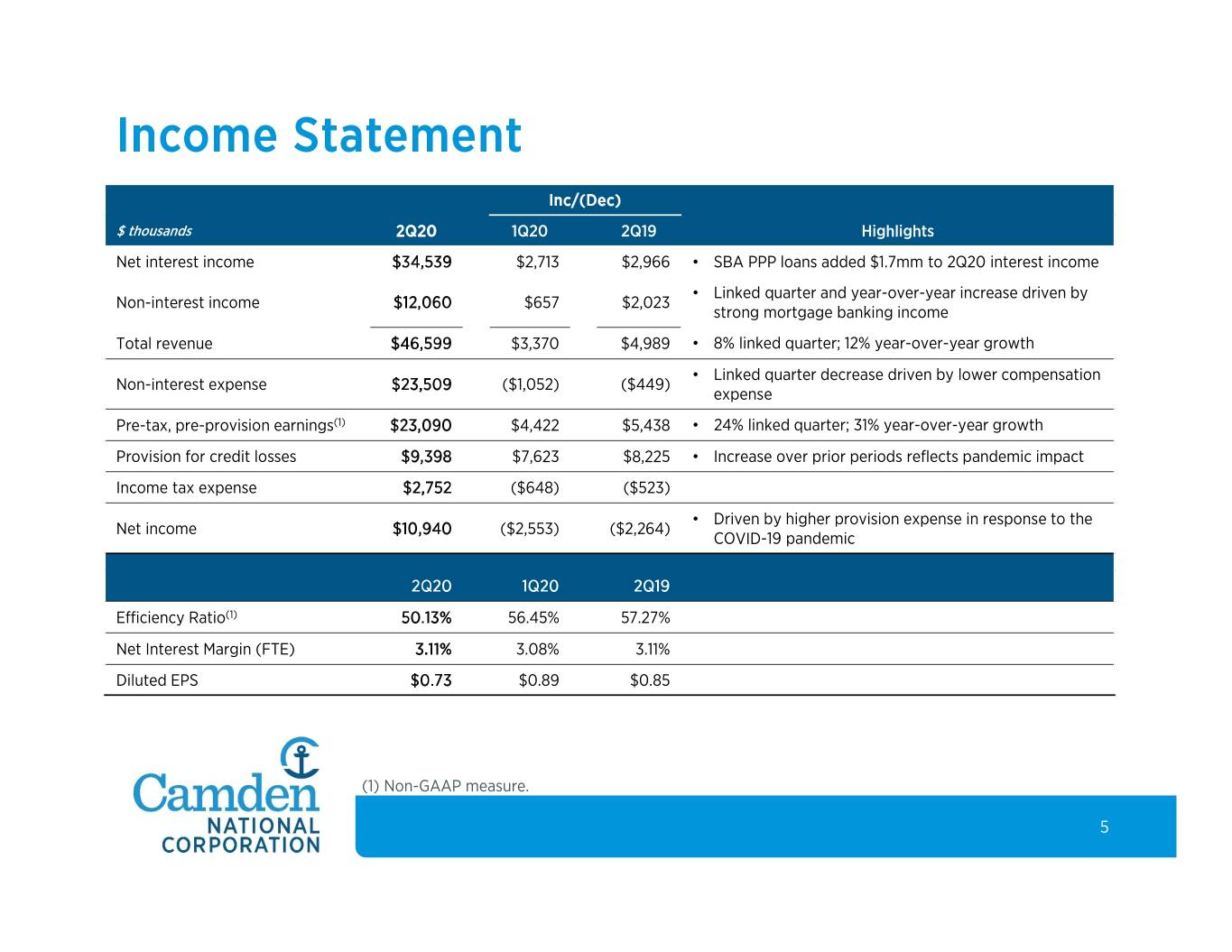

Income Statement Inc/(Dec) $ thousands 2Q20 1Q20 2Q19 Highlights Net interest income $34,539 $2,713 $2,966 • SBA PPP loans added $1.7mm to 2Q20 interest income • Linked quarter and year-over-year increase driven by Non-interest income $12,060 $657 $2,023 strong mortgage banking income Total revenue $46,599 $3,370 $4,989 • 8% linked quarter; 12% year-over-year growth • Linked quarter decrease driven by lower compensation Non-interest expense $23,509 ($1,052) ($449) expense Pre-tax, pre-provision earnings(1) $23,090 $4,422 $5,438 • 24% linked quarter; 31% year-over-year growth Provision for credit losses $9,398 $7,623 $8,225 • Increase over prior periods reflects pandemic impact Income tax expense $2,752 ($648) ($523) • Driven by higher provision expense in response to the Net income $10,940 ($2,553) ($2,264) COVID-19 pandemic 2Q20 1Q20 2Q19 Efficiency Ratio(1) 50.13% 56.45% 57.27% Net Interest Margin (FTE) 3.11% 3.08% 3.11% Diluted EPS $0.73 $0.89 $0.85 (1) Non-GAAP measure. 5

Net Interest Income and Net Interest Margin NII and NIM Total deposit costs 2020 ($ in millions) $34.5 5.00% $35 0.76% 0.75% $31.6 $31.8 0.60% $30 4.00% 3.11% 3.08% 3.11% 0.41% $25 3.00% 0.34% 0.31% $20 2.00% $15 1.00% 2Q19 1Q20 2Q20 NII NIM Jan Feb Mar Apr May Jun Estimated Changes in Net Interest Income(1) Recent actions and continued focus Year 1 Year 2 • Continue to manage deposit rates lower +200 bps 0.28% 6.04% • CD maturities: -100 bps 0.55% -4.44% • $108 million in next 90 days at average cost of 1.06% $81 million 4 to 6 months at average cost of 1.34%. (1) Assumes flat balance sheet, no changes in asset/funding mix, • and a parallel and pro rata shift in rates over a 12 month period. • $124 million 7 to 12 months at average cost of 1.16% In the down -100 bps scenarios, Prime is floored at 3.00%, Fed Funds and Treasury rates at 0.01%, and all other market rates at • Floors on new loan production 0.25%. As of June 30, 2020. • Q4 19 investment portfolio restructuring 6

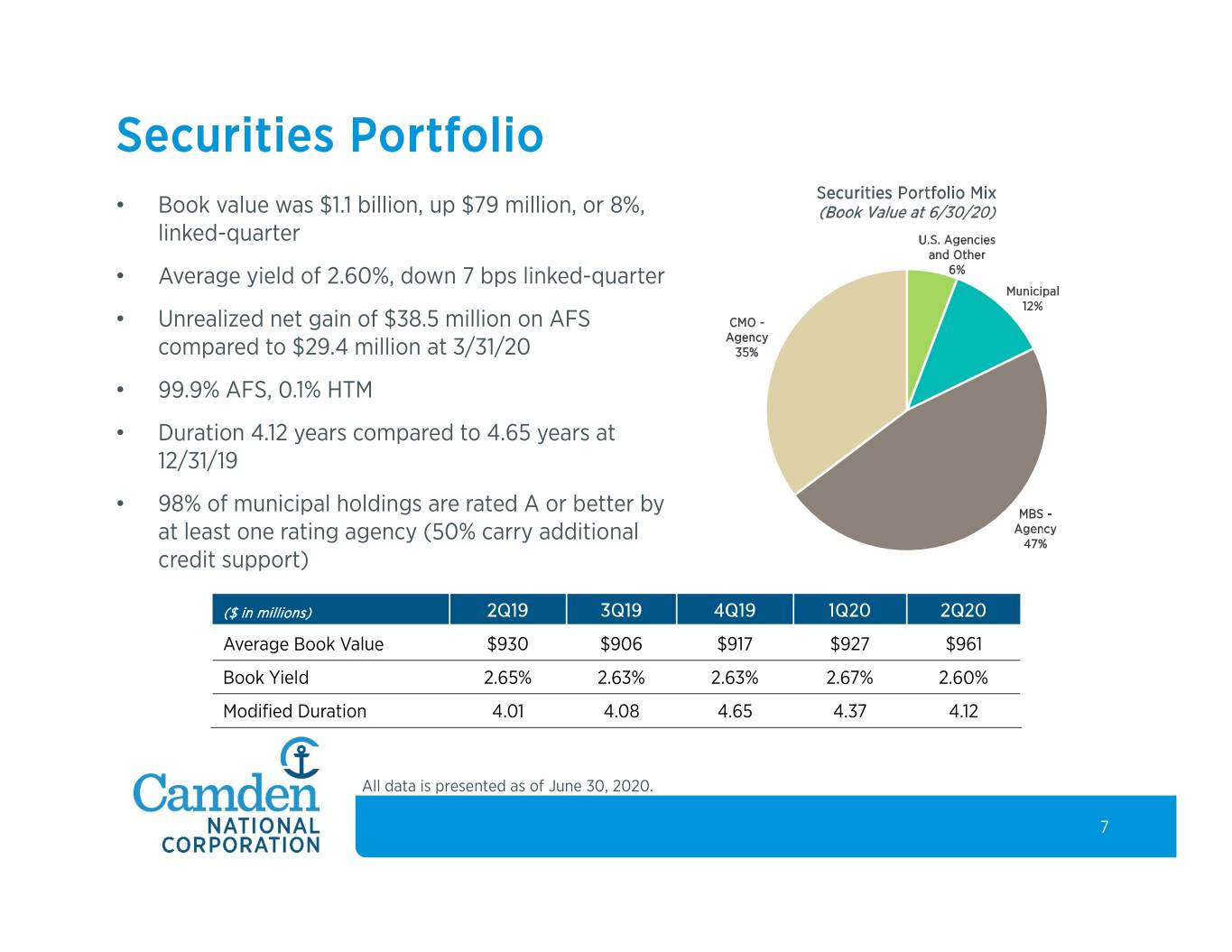

Securities Portfolio Securities Portfolio Mix • Book value was $1.1 billion, up $79 million, or 8%, (Book Value at 6/30/20) linked-quarter U.S. Agencies and Other • Average yield of 2.60%, down 7 bps linked-quarter 6% Municipal 12% • Unrealized net gain of $38.5 million on AFS CMO - Agency compared to $29.4 million at 3/31/20 35% • 99.9% AFS, 0.1% HTM • Duration 4.12 years compared to 4.65 years at 12/31/19 • 98% of municipal holdings are rated A or better by MBS - at least one rating agency (50% carry additional Agency 47% credit support) ($ in millions) 2Q19 3Q19 4Q19 1Q20 2Q20 Average Book Value $930 $906 $917 $927 $961 Book Yield 2.65% 2.63% 2.63% 2.67% 2.60% Modified Duration 4.01 4.08 4.65 4.37 4.12 All data is presented as of June 30, 2020. 7

Balance Sheet: Strong Liquidity Position Well Positioned to Support Liquidity Needs Liquidity Sources (6/30/20) Amount ($ millions) Unpledged Investment Securities $243.0 Unpledged Municipal Securities $98.0 Over Collateralized Securities Pledging Position $145.1 Lines of Credit Exposure FHLB Borrowing Capacity $482.8 3% Increase in Utilization YoY Current Fed Discount Window Availability $60.0 $1,251.1 $1,292.4 $1,269.1 Unsecured Borrowing Lines $69.9 Total $1,098.8 Brokered Deposit Access of $762.5 million 49% 53% 50% • Planned construction funding represents the entire increase in outstanding balance at 6/30/2020 over the 47% 51% 50% year-ago balance • Daily credit line monitoring shows declining utilization in non-construction lines since 3/31/2020 6/30/2019 3/31/2020 6/30/2020 Outstanding Unfunded 8

Loan Portfolio Residential Real Estate Balances of $3.3 Billion (as of 6/30/20) • 71% located in Maine and 24% in Massachusetts Home Equity • 65% are primary residences, 25% second homes and 10% and Consumer investment property 9% Commercial 13% • 97% of balances at </= 80% LTV(1) (or supplemented with private mortgage insurance) SBA PPP Commercial Real Estate 7% • 71% of real estate located in Maine, 15% in New Hampshire, and 10% in Massachusetts (1) • 91% of balances at </= 80% LTV Residential Real Estate Commercial 32% • SBA PPP production of $237.0 million added $178.1 million to average loans for Q2 with an average yield of 3.79% Loan Repricing Commercial Real Estate • $1.0 billion repricing in the next 12 months (average yield 39% 3.07%) • Floating rate: $944.8 million, 19% with in-the-money floors, and 74% without floors • Adjustable rate: $95.8 million, 2% with in-the-money floors, and 51% without floors All data is presented as of June 30, 2020. (1) At origination date 9

Commercial Diversification CRE and Commercial Loans by Industry Real Estate Investment Breakdown (as of 6/30/20) (as of 6/30/20) Other (12 Industries Other Nonresidential <2%) Buildings 16% 7% 1-4 Family 8% Professional, Scientific, & Office Buildings Technical Services 29% 3% Real Estate Industrial / Warehouse Finance / Investment 11% Insurance 37% 3% $731 Restaurants 3% $2.0 million Construction 4% billion Retail Store 20% Manufacturing 5% Multi-Family / Apartments 25% Retail Trade 7% Exposure to COVID-19 impacted industries Lodging Health Care / Social 14% • $406.8 million, or 12% of total loan portfolio, is within Lodging, Sr. Asst. Living & Care Facilities, Restaurants, and Travel & Recreation 8% • Approximately 53% of Lodging are nationally branded franchises. 56% of Lodging located in Maine, 22% in Massachusetts, and 13% in New Hampshire 10

Loan Assistance Programs SBA PPP SBA Paycheck Protection Program (as of 6/30/2020) • Funded 10% of Maine’s SBA PPP loans by Balances dollar amount Units (in millions) Total Production 2,919 $237.0 Total Outstanding 2,893 $225.8 Loan Deferral Program Loan Deferral Program – granted extensions (as of 6/30/2020) and deferrals Balances Units • Businesses: 30 – 180 day grace period (in millions) Business 992 $410.3 • Consumer: 90 – 180 deferral Consumer 489 $101.3 • Not reporting payment deferrals to credit Original Original bureaus and waiving certain fees Deferment Total 1,481 $511.6 Business 31 $5.3 Consumer 251 $29.8 Second Deferment Total 282 $35.1 Total Deferrals 1,763 $546.7 11

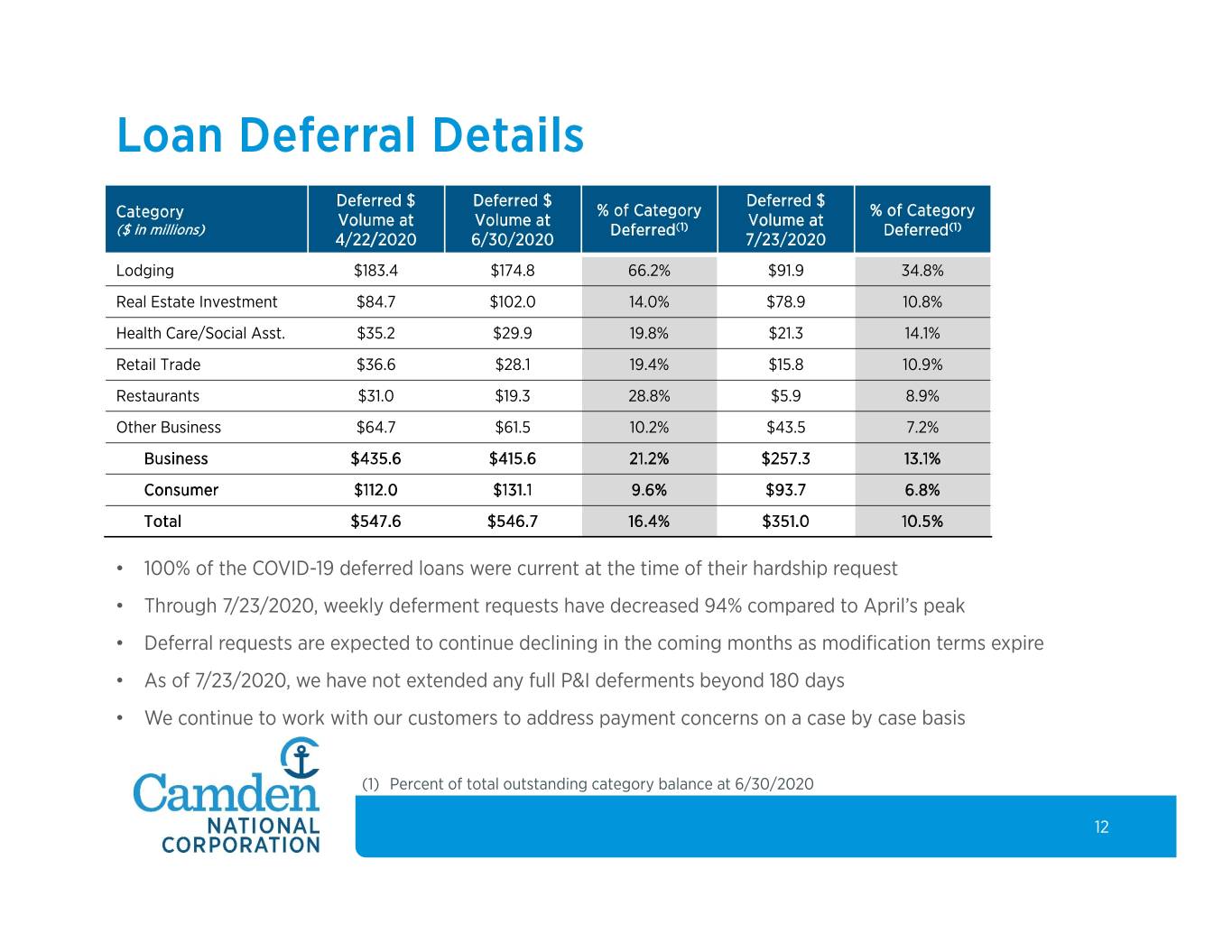

Loan Deferral Details Deferred $ Deferred $ Deferred $ Category % of Category % of Category Volume at Volume at Volume at ($ in millions) Deferred(1) Deferred(1) 4/22/2020 6/30/2020 7/23/2020 Lodging $183.4 $174.8 66.2% $91.9 34.8% Real Estate Investment $84.7 $102.0 14.0% $78.9 10.8% Health Care/Social Asst. $35.2 $29.9 19.8% $21.3 14.1% Retail Trade $36.6 $28.1 19.4% $15.8 10.9% Restaurants $31.0 $19.3 28.8% $5.9 8.9% Other Business $64.7 $61.5 10.2% $43.5 7.2% Business $435.6 $415.6 21.2% $257.3 13.1% Consumer $112.0 $131.1 9.6% $93.7 6.8% Total $547.6 $546.7 16.4% $351.0 10.5% • 100% of the COVID-19 deferred loans were current at the time of their hardship request • Through 7/23/2020, weekly deferment requests have decreased 94% compared to April’s peak • Deferral requests are expected to continue declining in the coming months as modification terms expire • As of 7/23/2020, we have not extended any full P&I deferments beyond 180 days • We continue to work with our customers to address payment concerns on a case by case basis (1) Percent of total outstanding category balance at 6/30/2020 12

Solid Credit Quality NPAs / Total Assets ALL / NPLs 310.87% 12/31/2009 1.07% 225.77% 0.67% 171.17% 0.50% 118.92% 0.34% 92.28% 12/31/2009 0.25% 0.23% 109.31% 2016 2017 2018 2019 2Q20 2016 2017 2018 2019 2Q20 NCOs / Average Loans ALL / Total Loans 12/31/2009 12/31/2009 0.37% 1.33% 1.07% 0.89% 0.87% 0.82% 0.81% 0.13% 0.07% 0.08% 0.05% 0.01% 2016 2017 2018 2019 2Q20(1) 2016 2017 2018 2019 2Q20 Data presented does not reflect the impact of CECL, as the Company has elected to delay implementation of CECL pursuant to the CARES Act. (1) Annualized 13

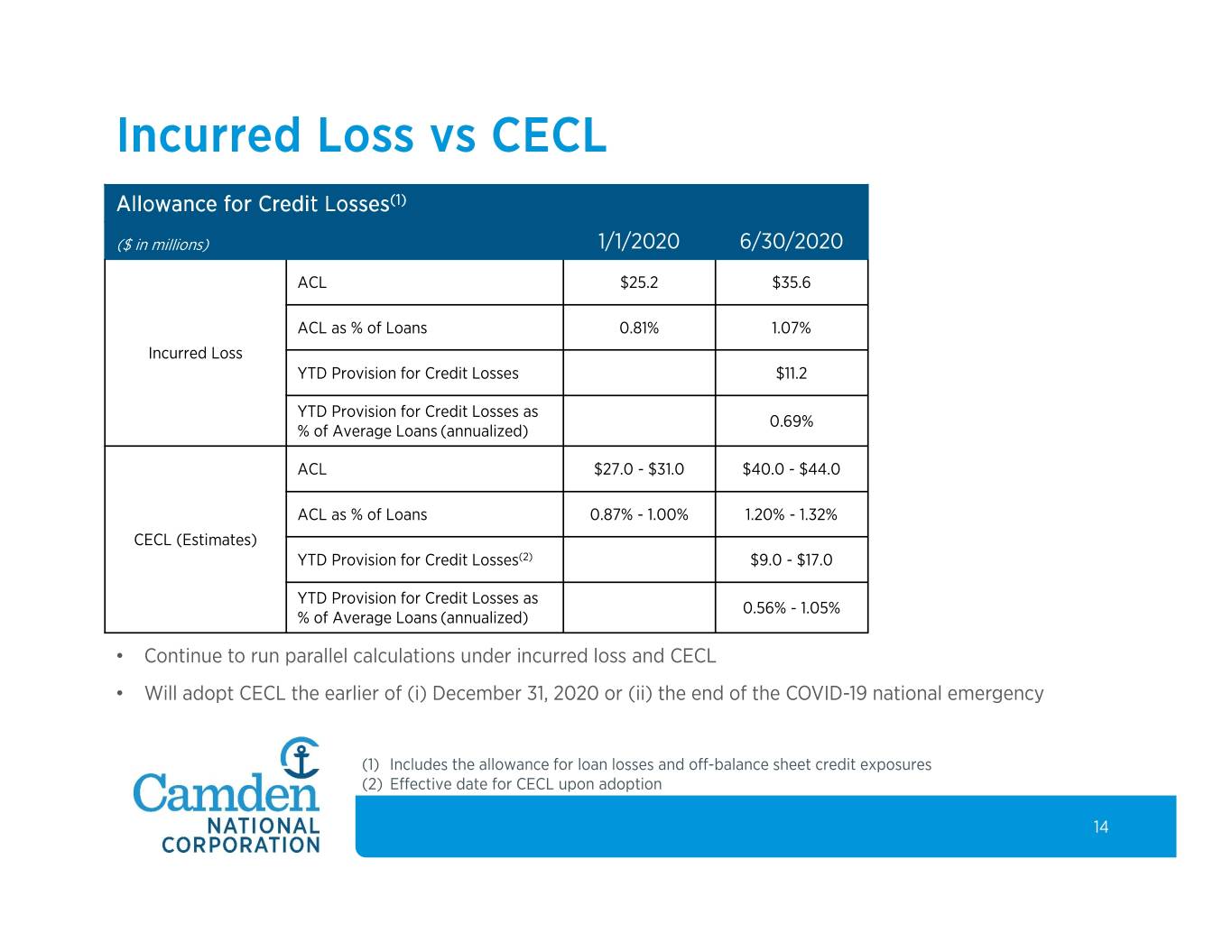

Incurred Loss vs CECL Allowance for Credit Losses(1) ($ in millions) 1/1/2020 6/30/2020 ACL $25.2 $35.6 ACL as % of Loans 0.81% 1.07% Incurred Loss YTD Provision for Credit Losses $11.2 YTD Provision for Credit Losses as 0.69% % of Average Loans (annualized) ACL $27.0 - $31.0 $40.0 - $44.0 ACL as % of Loans 0.87% - 1.00% 1.20% - 1.32% CECL (Estimates) YTD Provision for Credit Losses(2) $9.0 - $17.0 YTD Provision for Credit Losses as 0.56% - 1.05% % of Average Loans (annualized) • Continue to run parallel calculations under incurred loss and CECL • Will adopt CECL the earlier of (i) December 31, 2020 or (ii) the end of the COVID-19 national emergency (1) Includes the allowance for loan losses and off-balance sheet credit exposures (2) Effective date for CECL upon adoption 14

Strong Capital Position Tier 1 Leverage Ratio Total Risk Based Capital Ratio Common Equity Tier 1 (CET1) Ratio 14.56% 11.80% 9.53% 9.55% 14.04% 14.14% 14.36% 14.44% 11.27% 11.30% 11.62% 11.69% 8.83% 9.07% 8.95% Required Minimum(1), 10.50% Required Minimum(1), Required 7.00% Minimum(1), 4.00% 2016 2017 2018 2019 2Q20 2016 2017 2018 2019 2Q20 2016 2017 2018 2019 2Q20 Cushion Required Ratios at Capital Above Amount Minimum(1) Asset 6/30/20 Required Growth ($ in millions) Minimum Tier 1 Leverage 8.95% $423.7 4.00% $234.3 $5,857.6 Total Assets for Leverage Ratio $4,734.1 Common Equity Tier 1 11.69% $380.7 7.00% $152.7 $2,181.3 Total Risk Based Capital 14.56% $474.2 10.50% $132.3 $1,259.6 Total Risk Weighted Assets $3,256.8 Repurchased 488,052 shares in 2019 at an average price of $42.61. In March of 2020, as the COVID-19 pandemic expanded, the Company suspended its current share buyback program after repurchasing 217,031 shares at an average price of $36.74 in the first quarter of 2020. (1) “Required Minimum” ratios represent minimum required capital ratios plus, for the risk based ratios, the fully phased-in 2.50% CET1 capital conservation buffer. 15