Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_investorpresentation62.htm |

Stephens’ Investor Presentation Gregory Dufour | President & Chief Executive Officer Gregory White | Chief Financial Officer June 2, 2020 1

Forward Looking Statements and Non- GAAP Financial Measures FORWARD LOOKING STATEMENTS This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,” “may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals, plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters. Further, statements about the potential effects of the COVID-19 pandemic on the Company’s businesses and results of operations and financial conditions may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, action taken by government authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and the Company. You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2019, as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements. These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes, except to the extent required by applicable law or regulation. NOTE REGARDING PRESENTATION OF NON-GAAP FINANCIAL MEASURES This presentation includes certain non-GAAP financial measures. Management uses these non-GAAP financial measures for purposes of measuring our performance against our peer group and other financial institutions and analyzing our internal performance. These non-GAAP financial measures also help investors better understand the Company’s operating performance and trends and allow for better performance comparisons to other financial institutions. These measures are not a substitute for GAAP operating results and may not be comparable to non-GAAP measures used by other financial institutions. Schedules that reconcile the non-GAAP financial measures to GAAP financial information are included in our Annual Report on Form 10-K and earnings releases filed with the SEC. 2

Camden National Corporation Largest publicly traded bank headquartered in Northern New England • $4.6 billion in assets • 58 banking centers located in Maine • 2 loan production offices • New Hampshire • Massachusetts • $500 million market cap • 50 day avg share volume of approximately 70,000 • Analyst Coverage • KBW (market perform) • Raymond James (market perform) • Janney (market perform) 3

Why Camden National? Organic franchise growth, opportunistic acquisitions Focused: Consistent Performance: • Gaining market share • Profitability achieved through • Adherence to strategic plan organic growth • Opportunistically reviewing • Improved productivity complementary acquisitions • Disciplined expense structure • Solid core funding and sticky • Diversified revenue stream deposit base Culture: Credit Quality: • Experienced leadership team • Strong credit culture and • Strong community spirit history • Continued focus on branch • Disciplined structure and optimization process • Low charge-offs 4

Our COVID-19 Response • Over 50% of our employees working remotely • Committed to no COVID-19-related layoffs for at least 90 days • Increased Stakeholder Emergency Fund by $100,000 • Provided special premium pay for banking center employees • Providing financial assistance due to COVID-19 personal or family circumstances • Majority of our banking centers remain open and 68 ATMs remain accessible; moved all banking centers to drive-up and appointment only • Offering consumer and business loan payment relief, up to 180 day deferrals with no reporting to credit bureaus and waiving certain fees • Began accepting SBA Paycheck Protection Program (PPP) applications on April 3, 2020 • Increased funding for food insecurity organizations • Specialized focus on organizations that support victims of domestic abuse • Reached $500,000 milestone for homeless shelters through Hope@Home All data is presented as of April 23, 2020. 5

First Quarter 2020 Highlights Net Income $13.5 million • Entered a challenging environment with strong capital and liquidity Diluted Earnings Per Share $0.89 • Responded swiftly to support employees, customers, and communities Return on Average Assets • Good quarter with solid financial results, 1.21% despite the declining economic conditions Return on Average Tangible Equity • Grew a strong, well positioned balance 14.35% sheet Efficiency Ratio (non-GAAP) • $1.8 million provision for loan losses and 56.45% deferred new CECL accounting standard Total Risk-Based Capital Ratio 13.81% 6

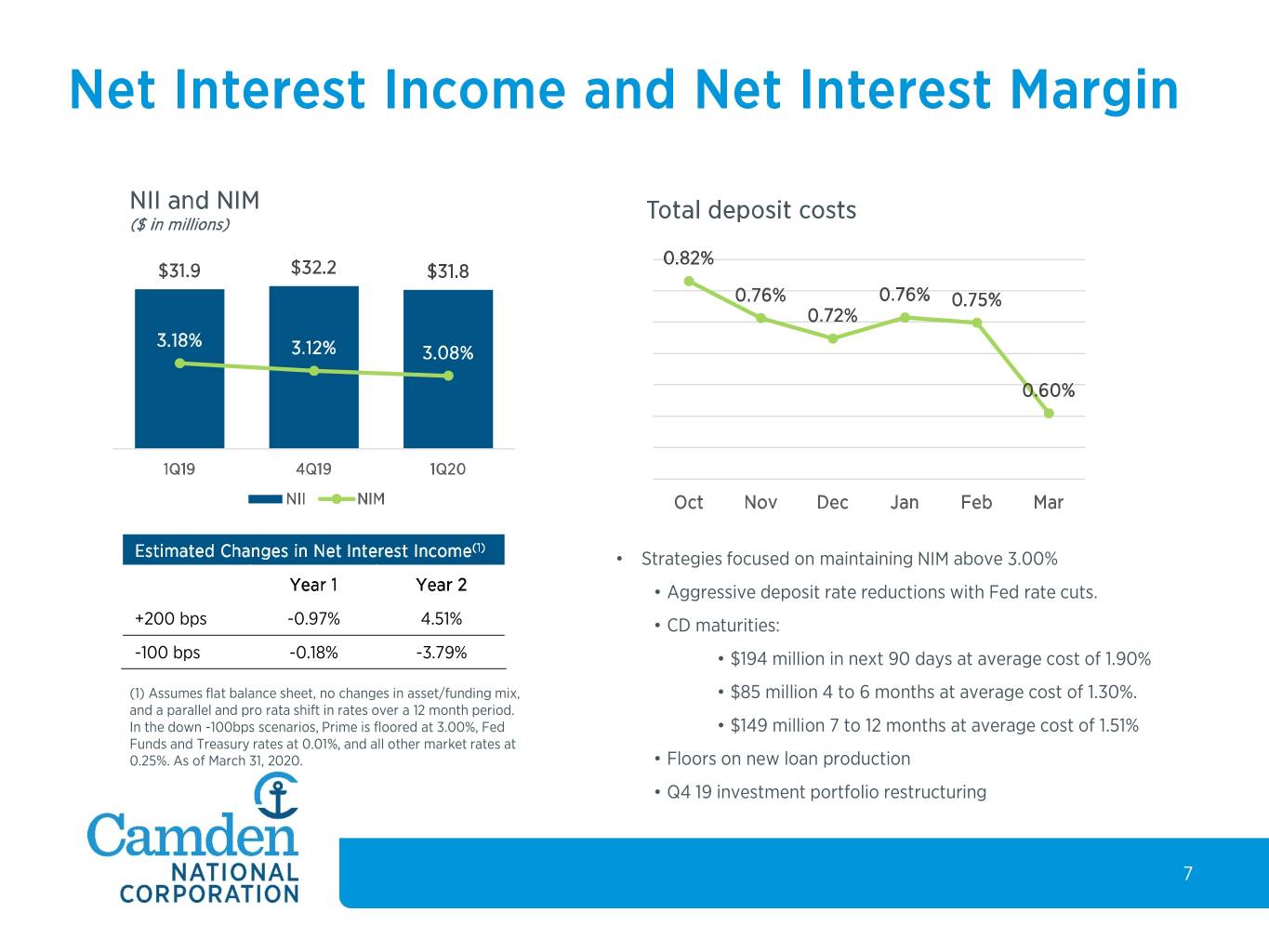

Net Interest Income and Net Interest Margin NII and NIM Total deposit costs ($ in millions) $35.0 0.82% $31.9 $32.2 $31.8 3.90% 3.70% 0.76% 0.76% $30.0 0.75% 3.50% 0.72% 3.18% $25.0 3.12% 3.08% 3.30% 3.10% 0.60% $20.0 2.90% 2.70% $15.0 2.50% 1Q19 4Q19 1Q20 NII NIM Oct Nov Dec Jan Feb Mar Estimated Changes in Net Interest Income(1) • Strategies focused on maintaining NIM above 3.00% Year 1 Year 2 • Aggressive deposit rate reductions with Fed rate cuts. +200 bps -0.97% 4.51% • CD maturities: -100 bps -0.18% -3.79% • $194 million in next 90 days at average cost of 1.90% (1) Assumes flat balance sheet, no changes in asset/funding mix, • $85 million 4 to 6 months at average cost of 1.30%. and a parallel and pro rata shift in rates over a 12 month period. In the down -100bps scenarios, Prime is floored at 3.00%, Fed • $149 million 7 to 12 months at average cost of 1.51% Funds and Treasury rates at 0.01%, and all other market rates at 0.25%. As of March 31, 2020. • Floors on new loan production • Q4 19 investment portfolio restructuring 7

Diversified Revenue Fee income is 26% of total revenue (net interest income plus fee income) 8

Focused on Improving Productivity and Creating Efficiencies Expenses and Efficiency ratio(1) Deposits per Branch $59 Annual Quarterly $56 $100 Millions $53 $80 $50 Millions $47 $60 57.7% 57.3% $44 57.1% 56.5% 55.8% 55.6% 54.9% 55.3% $41 $40 $38 $20 $35 64 61 60 60 61 $32 $0 2015 2016 2017 2018 2019 2017 2018 2019 1Q19 2Q19 3Q19 4Q19 1Q20 Average Deposits per Branch Pro Forma Branch Closures Operating Expenses Efficiency Ratio • Branch Optimization: Consolidated/sold 17 branches from 2013 – May 2020 • Closed three branches in April 2020 (1) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for respective period. 9

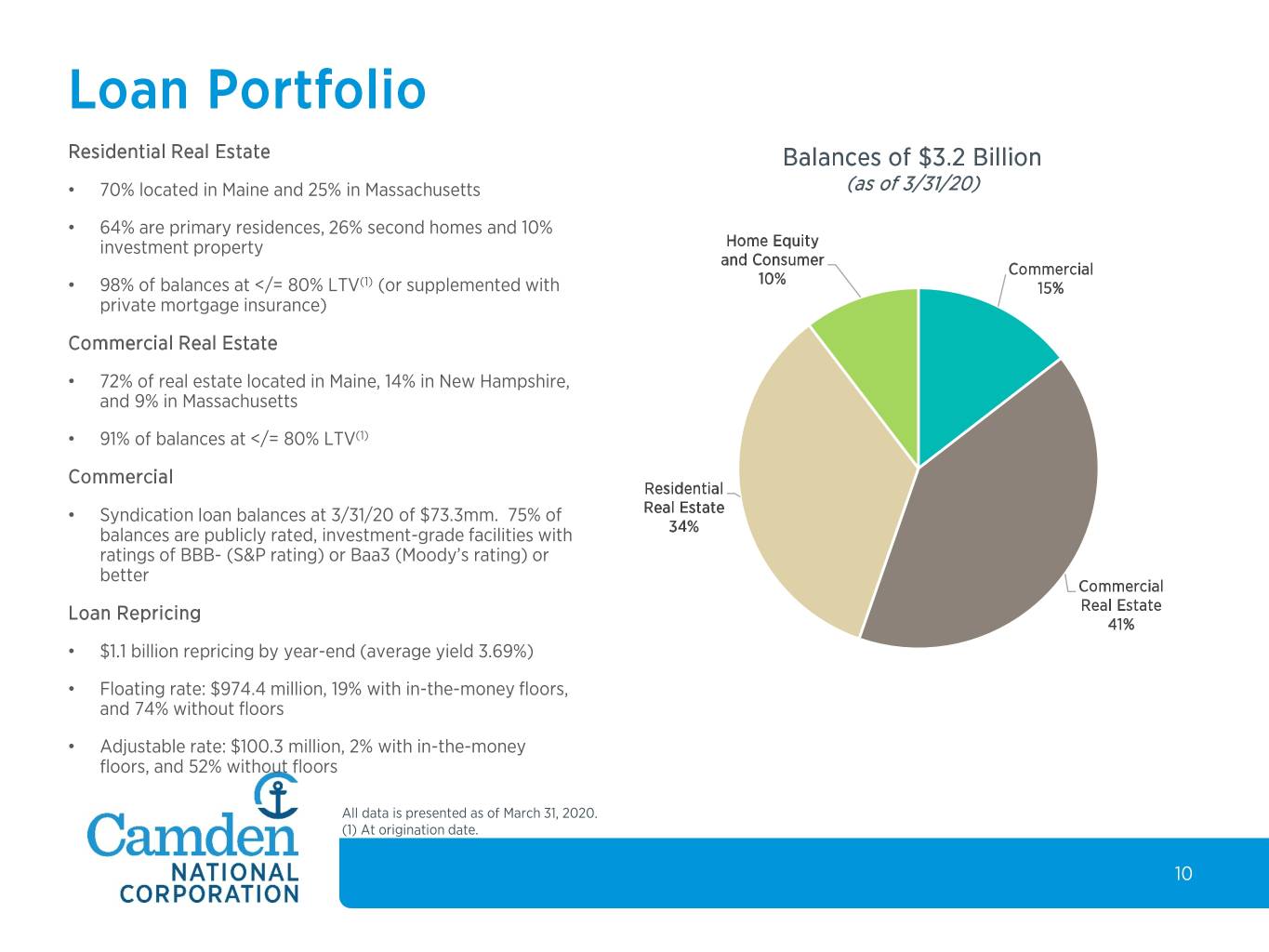

Loan Portfolio Residential Real Estate Balances of $3.2 Billion • 70% located in Maine and 25% in Massachusetts (as of 3/31/20) • 64% are primary residences, 26% second homes and 10% investment property Home Equity and Consumer Commercial 10% • 98% of balances at </= 80% LTV(1) (or supplemented with 15% private mortgage insurance) Commercial Real Estate • 72% of real estate located in Maine, 14% in New Hampshire, and 9% in Massachusetts • 91% of balances at </= 80% LTV(1) Commercial Residential Real Estate • Syndication loan balances at 3/31/20 of $73.3mm. 75% of balances are publicly rated, investment-grade facilities with 34% ratings of BBB- (S&P rating) or Baa3 (Moody’s rating) or better Commercial Loan Repricing Real Estate 41% • $1.1 billion repricing by year-end (average yield 3.69%) • Floating rate: $974.4 million, 19% with in-the-money floors, and 74% without floors • Adjustable rate: $100.3 million, 2% with in-the-money floors, and 52% without floors All data is presented as of March 31, 2020. (1) At origination date. 10

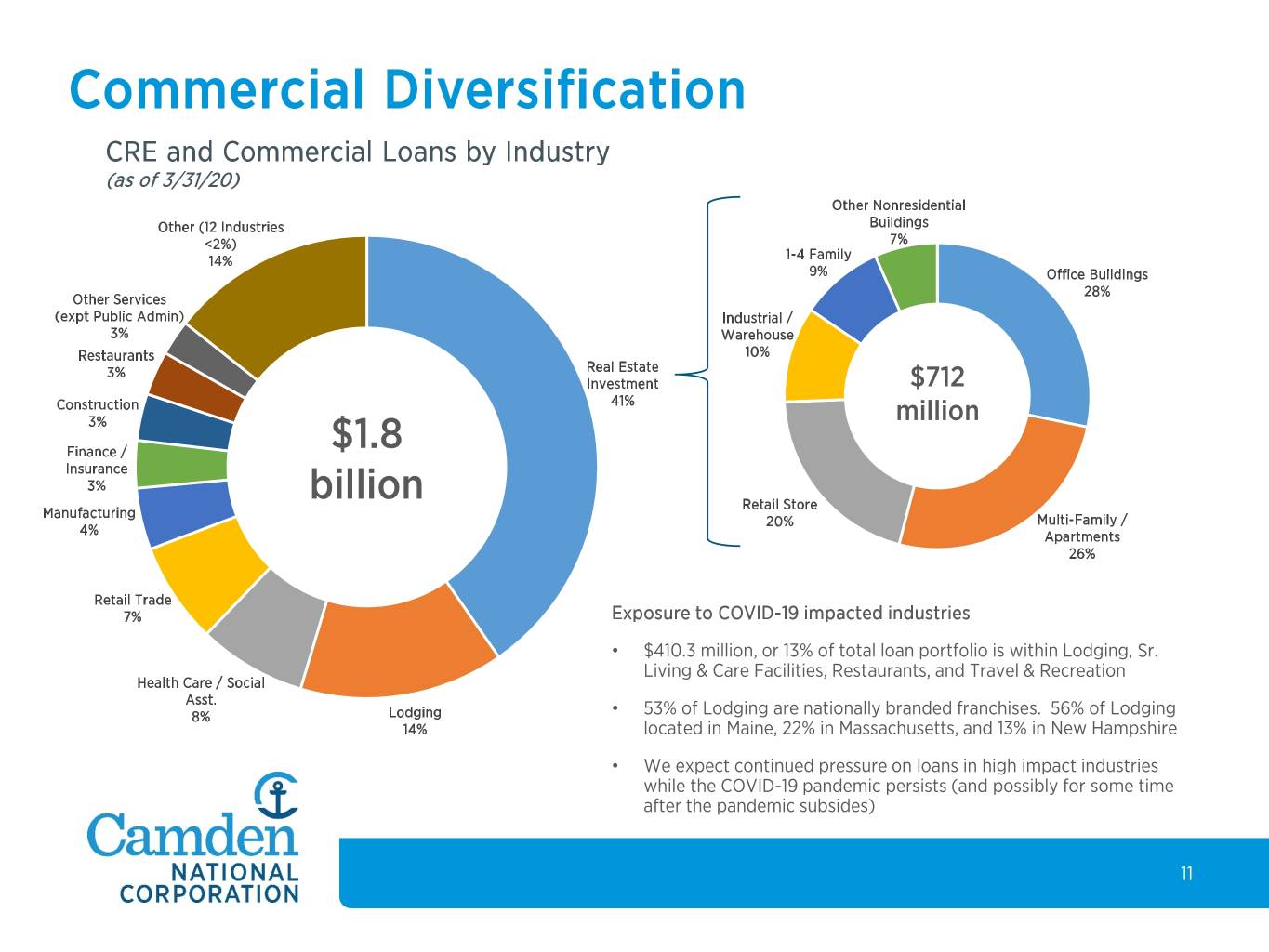

Commercial Diversification CRE and Commercial Loans by Industry (as of 3/31/20) Other Nonresidential Other (12 Industries Buildings <2%) 7% 14% 1-4 Family 9% Office Buildings 28% Other Services (expt Public Admin) Industrial / 3% Warehouse Restaurants 10% 3% Real Estate Investment $712 Construction 41% 3% million Finance / $1.8 Insurance 3% billion Retail Store Manufacturing 20% Multi-Family / 4% Apartments 26% Retail Trade 7% Exposure to COVID-19 impacted industries • $410.3 million, or 13% of total loan portfolio is within Lodging, Sr. Living & Care Facilities, Restaurants, and Travel & Recreation Health Care / Social Asst. 8% Lodging • 53% of Lodging are nationally branded franchises. 56% of Lodging 14% located in Maine, 22% in Massachusetts, and 13% in New Hampshire • We expect continued pressure on loans in high impact industries while the COVID-19 pandemic persists (and possibly for some time after the pandemic subsides) 11

Loan Assistance Programs SBA Payroll Paycheck Program SBA PPP • Automated much of the loan (as of 5/22/2020) application process Balances Units (in millions) • Funded 10% of Maine’s SBA PPP Total 2,765 $228.2 loans by dollar amount Loan Deferral Program – granted extensions and deferrals Loan Deferral Program(1) (as of 5/22/2020) • Businesses: 30 – 180 day grace period Balances % of Total Loan Units (in millions) Portfolio • Consumer: 90 – 180 deferral Business 1,249 $492.8 16% • Not reporting payment deferrals to Consumer 796 $142.9 4% credit bureaus and waiving certain Total 2,045 $635.7 20% fees • Continue to work with customers and process deferrals (1) Excludes 239 loans with balances of $26.7 million within the Company’s serviced loan portfolio that were approved for deferment as of 5/22/2020. 12

Solid Credit Quality NPAs / Total Assets ALL / NPLs 12/31/2009 256.86% 1.07% 225.77% 0.67% 171.17% 0.50% 118.92% 12/31/2009 0.34% 92.28% 109.31% 0.25% 0.23% 2016 2017 2018 2019 1Q20 2016 2017 2018 2019 1Q20 NCOs / Average Loans ALL / Total Loans 12/31/2009 12/31/2009 0.37% 1.33% 0.89% 0.87% 0.82% 0.81% 0.84% 0.13% 0.07% 0.08% 0.05% 0.01% 2016 2017 2018 2019 1Q20(1) 2016 2017 2018 2019 1Q20 (1) Annualized Data presented does not reflect the impact of CECL, as the Company has elected to delay implementations of CECL pursuant to the CARES Act. 13

Securities Portfolio Securities Portfolio Mix • Book value was $947 million (Book Value at 3/31/20) U.S. Agencies • Average yield of 2.67% for 1Q20 and Other 7% • Unrealized net gain of $29.4 million on AFS Municipal CMO - Agency 13% compared to $5.3 million at 12/31/19 34% • 99.9% AFS, 0.1% HTM • Duration 4.37 years compared to 4.65 years at 12/31/19 • 98% of municipal holdings are rated A or better by at least one rating agency (51% carry additional credit support) MBS - Agency 46% ($ in millions) 1Q19 2Q19 3Q19 4Q19 1Q20 Average Book Value $946 $930 $906 $917 $927 Book Yield 2.65% 2.65% 2.63% 2.63% 2.67% Modified Duration 3.72 4.01 4.08 4.65 4.37 All data is presented as of March 31, 2020 unless otherwise noted. 14

Funding Mix Deposits Average Funding Q1 2020 • Average balance of $3.4 billion Borrowings • Average deposit cost of 0.70% for 1Q20 14% • 2nd highest deposit market share in Maine (11.4% of deposits as of 6/30/19) th • 8 highest deposit market share in York and CDs Cumberland counties (5.4% of deposits as of 14% Checking 43% 6/30/19) • Loan / Deposit ratio of 89% at 3/31/20 Borrowings • Average balance of $562.8 million • Average borrowing cost of 1.80% for 1Q20 • 42% of borrowing are customer repurchase Saving/Money Market agreements 29% All data is presented as Q1 2020 averages unless otherwise noted. 15

Strong Liquidity Position Well Positioned to Support Liquidity Needs Liquidity Sources (3/31/20) Amount ($ millions) Unpledged Investment Securities $109.4 Unpledged Municipal Securities $97.5 Over Collateralized Securities Pledging Position $102.8 Lines of Credit Exposure FHLB Borrowing Capacity $505.9 3% Increase in Utilization YoY Current Fed Discount Window Availability $53.8 $1,292.4 $1,272.6 $1,257.8 Unsecured Borrowing Lines $69.9 Total $939.3 Brokered Deposit Access of $725.9 million 49% 52% 54% Increased Borrowing • Planned construction funding represents over half the increase in outstanding balances since 12/31/19 48% 46% 51% • Experienced slightly higher levels of borrowing activity year-over-year as clients reacted to challenges presented by economic impacts of COVID-19 3/31/2019 12/31/2019 3/31/2020 • Daily credit line monitoring shows declining utilization since 3/31/20 Outstanding Unfunded 16

Strong Capital Position Tier 1 Leverage Ratio Total Risk Based Capital Ratio Common Equity Tier 1 (CET1) Ratio 14.44% 11.80% 9.53% 9.55% 9.53% 14.04% 14.14% 14.36% 13.81% 11.27% 11.30% 11.62% 11.27% 8.83% 9.07% Required Minimum(1) 10.50% Required Minimum(1) Required 7.00% Minimum(1) 4.00% 2016 2017 2018 2019 1Q20 2016 2017 2018 2019 1Q20 2016 2017 2018 2019 1Q20 Cushion Required Ratios at Capital Above Amount Minimum(1) Asset 3/31/20 Required Growth ($ in millions) Minimum Tier 1 Leverage 9.53% $416.8 4.00% $242.0 $6,048.9 Total Assets for Leverage Ratio $4,371.9 Common Equity Tier 1 11.27% $373.8 7.00% $141.6 $2,022.4 Total Risk Based Capital 13.81% $458.4 10.50% $110.0 $1,047.4 Total Risk Weighted Assets $3,318.1 Repurchased 488,052 shares in 2019 at an average price of $42.61. In March of 2020, as the COVID-19 pandemic expanded, the Company suspended its current share buyback program after repurchasing 217,031 shares at an average price of $36.74 in the first quarter of 2020. (1) “Required Minimum” ratios represent minimum required capital ratios plus, for the risk based ratios, the fully phased-in 2.50% CET1 capital conservation buffer. 17

Shareholder Value: Long-Term Metrics TBV Per Share(a) $26.39 $10.43 • TBV per share 15 year CAGR of 5.9% • Consistent dividend of 30%+ of annual '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 Q1 '20 earnings • $90 million in share buybacks since 2004 Dividends as a % of Net Income • Suspended 2020 share repurchase program after repurchasing 217,031 shares at an average price of $36.74 due to the COVID-19 pandemic 37% 32% '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 Q1 (b) (b) (c) (d) '20 a) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. b) 2005 and 2011, special dividend of $0.50 per share. c) 2015 increase is due to reduction in net income related to merger and acquisition costs of $7.2 million, after tax. d) 2017 increase is due to reduction in net income from a $14.3 million charge to income tax resulting from the Tax Cuts and Jobs Act of 2017. 18

Shareholder Value: 15 Year Total Return • Stock price appreciation of 43.68% • Average dividend yield of 2.83% 300% 250% 243% 200% 150% 123% 100% 78% 50% 30% 0% -50% CAC SNL U.S. Bank $1B-$5B S&P 500 CAC Peer Group Index Source: S&P Global 19

Investment Summary Proven Management Team • Delivered on previous acquisition commitments • Diverse experience from community and large bank perspectives Strong Market Share and Brand Recognition • 145 year operating history • #2 overall deposit market share in Maine, 1st in community banks • #3 mortgage originator in Maine, with 6.4% of all mortgage originations in the state Quality Growth • Consistent long-term growth both organically and through acquisitions • Expanded presence in higher growth Southern Maine markets and enhanced scale, density, and deposit costs in existing markets Strong Fundamental Operating Metrics • Historically strong credit quality with nonperforming assets consistently less than 1% of total assets • Solid efficiency ratio, ROAA and ROATCE 20

Appendix 21

Seasoned Management Team Years of Year joined Name Position Age Banking Camden Experience Greg Dufour President and CEO 60 30+ 2001 Greg White EVP Chief Financial Officer 55 30+ 2020 Debbie Jordan, CPA(1) EVP Chief Operating Officer 54 25+ 2008 Joanne Campbell EVP Risk Management 57 30+ 1996 William Martel EVP Technology & Support Services 50 20+ 2020 Jennifer Mirabile EVP Director of Wealth Management 60 30+ 2017 Tim Nightingale EVP Senior Loan Officer 62 30+ 2000 Heather Robinson, CPA SVP Chief Human Resources Officer 46 2 2018 Patricia Rose EVP Retail Banking 56 30+ 2017 Renée Smyth EVP Chief Experience & Marketing Officer 49 15+ 2015 (1) Debbie Jordan announced her retirement from the Bank on October 25, 2019, effective June 2020. 22

Income Statement $ thousands 1Q20 4Q19 3Q19 2Q19 1Q19 Net interest income $31,826 $32,239 $31,923 $31,573 $31,895 Non-interest income $11,403 $11,948 $10,739 $10,037 $9,389 Total revenue $43,229 $44,187 $42,662 $41,610 $41,284 Non-interest expense $24,561 $24,814 $23,748 $23,958 $22,783 Pretax, pre-provision earnings $18,668 $19,373 $18,914 $17,652 $18,501 Provision for credit losses $1,775 $214 $730 $1,173 $744 Income tax expense $3,400 $3,921 $3,696 $3,275 $3,484 Net income $13,493 $15,238 $14,488 $13,204 $14,273 1Q20 4Q19 3Q19 2Q19 1Q19 Efficiency Ratio (non-GAAP) 56.45% 55.64% 55.32% 57.27% 54.86% Net Interest Margin 3.08% 3.12% 3.09% 3.11% 3.18% Diluted EPS $0.89 $0.99 $0.94 $0.85 $0.91 23

Balance Sheet $ millions 1Q20 4Q19 3Q19 2Q19 1Q19 Loans $3,185 $3,107 $3,127 $3,113 $3,051 Investment Securities $976 $933 $926 $933 $937 Total Assets $4,595 $4,430 $4,520 $4,447 $4,421 Deposits $3,564 $3,538 $3,618 $3,592 $3,578 Borrowings $421 $338 $342 $311 $325 Shareholders’ Equity $493 $473 $472 $468 $454 1Q20 4Q19 3Q19 2Q19 1Q19 Total Risk-Based Capital Ratio 13.81% 14.44% 13.97% 14.12% 14.46% Tier 1 Leverage Capital Ratio 9.53% 9.55% 9.39% 9.51% 9.47% Loan / Deposit Ratio 89% 87% 86% 86% 85% 24

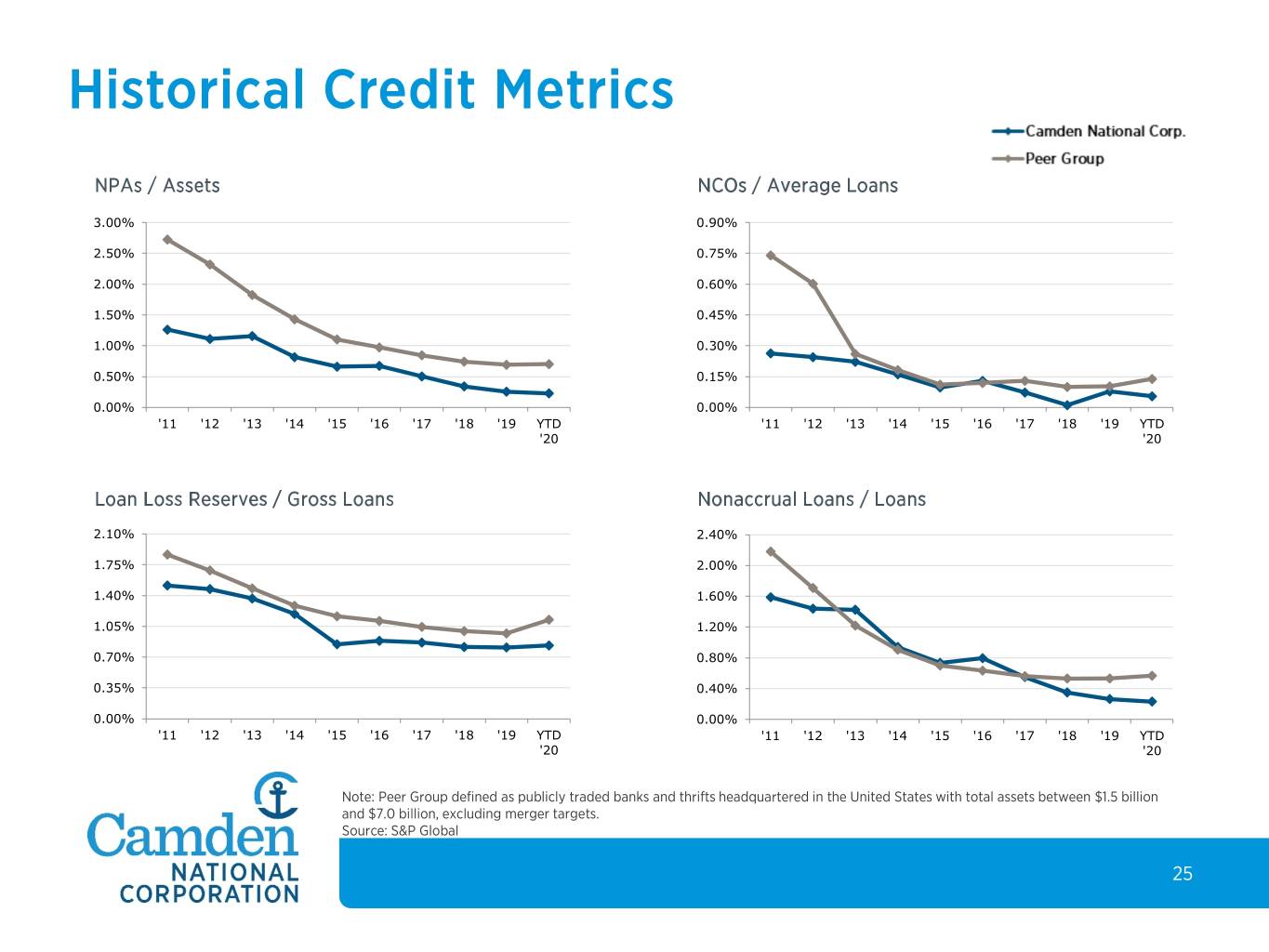

Historical Credit Metrics NPAs / Assets NCOs / Average Loans 3.00% 0.90% 2.50% 0.75% 2.00% 0.60% 1.50% 0.45% 1.00% 0.30% 0.50% 0.15% 0.00% 0.00% '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '20 '20 Loan Loss Reserves / Gross Loans Nonaccrual Loans / Loans 2.10% 2.40% 1.75% 2.00% 1.40% 1.60% 1.05% 1.20% 0.70% 0.80% 0.35% 0.40% 0.00% 0.00% '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '20 '20 Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets. Source: S&P Global 25

Profitability Trends ROAA ROAE 1.50% 15.00% 1.25% 12.50% 1.00% 10.00% 0.75% 7.50% 0.50% 5.00% 0.25% 2.50% 0.00% 0.00% '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '20 '20 Net Interest Margin Efficiency Ratio 4.00% 70.00% 3.75% 65.00% 3.50% 60.00% 3.25% 55.00% 3.00% 50.00% 2.75% 45.00% 2.50% 40.00% '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '11 '12 '13 '14 '15 '16 '17 '18 '19 YTD '20 '20 Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets. Source: S&P Global 26

Mortgage Banking Activity Three Months Ended March 31, 2020 Top 15 Lenders in Maine Originations Rank % of Total Bangor Savings Bank 988 1 9.6% Quicken Loans 658 2 6.4% Camden National Bank 656 3 6.4% Key Bank 500 4 4.8% Residential Mortgage Services Inc. 490 5 4.8% United Wholesale Mortgage 410 6 4.0% First, N.A. 306 7 3.0% Kennebec Savings Bank 301 8 2.9% TD Bank, N.A. 276 9 2.7% Machias Savings Bank 261 10 2.5% Norway Savings Bank 240 11 2.3% Saco & Biddeford Savings Inst. 169 12 1.6% Bank of America 167 13 1.6% Town & Country Federal Credit Union 167 13 1.6% Maine Savings Federal Credit Union 161 15 1.6% Total for All Lenders 6,107 - 100.0% Source: MRS, Inc. Data obtained from registry of deeds throughout the state of Maine. 27