Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENT BANK CORP | a8-kcoverdadavidsoninv.htm |

D.A. Davidson Financial Institutions Virtual Conference May 7 & 8, 2020 Chris Oddleifson - Chief Executive Officer Robert Cozzone - Executive Vice President and Chief Operating Officer Mark Ruggiero - Chief Financial Officer and Chief Accounting Officer

Who We Are • Main Sub: Rockland Trust • Market: Eastern Massachusetts • Loans: $8.9B • Deposits: $9.4B • AUA: $4.0B • Market Cap: $2.5B • Nasdaq: INDB (2)

Key Messages - Core Franchise • Extensive history of strong financial performance • Healthy loan and core deposit originations • Growing Investment Management business • Expanding footprint in growth markets • Proven integrator of acquired banks • Increased size providing scale advantages • Tangible book value steadily growing* • Strong operating efficiency • Disciplined risk management culture (3) *See appendix A for reconciliation

Recent Accomplishments • Seven consecutive years of record operating earnings** • Fully integrated Blue Hills Bancorp acquisition • Increased presence in Worcester County • Capitalizing on expansion moves in vibrant Greater Boston market • Growth initiatives – online account opening, credit card launch, de novo branches, expanded digital offerings, enhanced mortgage capabilities, senior talent adds • Completed 1.5M share repurchase program (4) **See appendix B for reconciliation

Expanding Company Footprint % of Market Share INDB Dep. Plymouth County Rank 2019 1 24.1% 33% Norfolk County Rank 2019 3 6.1% 19% Barnstable County (Cape Cod) Rank 2019 4 10.9% 10% Bristol County Rank 2019 7 7.2% 9% Middlesex County Rank 2019 22 1.0% 7% Suffolk County Rank 2019 9 1.2% 14% Dukes County (MV) Rank 2019 2 19.3% 2% Worcester County Rank 2019 20 1.7% 3% (5) Nantucket County Rank 2019 1 39.6% 3% Source: SNL Financial; Deposit/Market Share data as of June 30, 2019

COVID-19 Pandemic - Key Messages • Customer support a key priority • Maintaining high service levels and operational availability • Focused intensely on physical and financial well-being of employees • Resilient, as proven over prior crises • Have the people, business model, and balance sheet to persevere and regain business and financial momentum (6)

COVID-19 Pandemic - Action Steps • Revised initial CECL assumptions ◦ Incorporated Moody's S4 scenario as baseline ◦ Added qualitative analyses of various exposures • Granted relief to customers ◦ Delayed payments, waived fees, etc. • Participated in PPP program ◦ Received over 5,000 loan applications ◦ Processed approx $815M through 5/4/20 • Enhanced liquidity profile ◦ Improved on-balance sheet liquidity position 3/31 (7) ◦ Additional sources available: $2.7B

Commercial Diversification Total C&I Loan Portfolio Total Commercial Real Estate Portfolio $1.4B as of 3/31/2020 $4.6B as of 3/31/2020 All Other (11 Sectors): 15.1% Accommodation and food services: All Other 13.9% 4.1% Administrative Support/Waste Retail Trade: Residential - Related Mgmt/Remediation Services: 20.3% * Strip Malls 5.8% 29.0% 6.3% Finance and Insurance: 7.1% Hotels/Motels 9.0% Industrial Warehouse Real Estate/ 10.6% Manufacturing: 8.8% Rental and Office Buildings 16.4% Leasing: Commercial Buildings 15.8% 15.3% Construction: 9.7% Wholesale Trade: 12.8% *Includes 1-4 Family, multifamily, Condos and Approved Land CRE C&I ($ Bil.) ($ Bil.) CRE NOO CRE/Capital** $1.6 $1.4 $1.4 $1.4 $1.2 $1.1 $5.0 $4.5 $4.6 340% $1.0 $0.9 $4.0 $3.5 $3.6 320% $0.8 $3.0 315% 300% $0.6 (8) $2.0 290% 280% $0.4 $1.0 269% 268% 260% $0.2 $0.0 240% $0.0 2017 2018 2019 1Q20 2017 2018 2019 1Q20 **Non-Owner Occupied Commercial Real Estate divided by Total Capital

Potentially Impacted COVID-19 Industries The table below provides total outstanding balances of commercial loans as of March 31, 2020 within industries that could potentially be more impacted by the COVID-19 pandemic: Potentially Impacted COVID-19 Industries (Dollars in thousands) % of total % Secured by Balance Loans Real Estate Additional commentary: The accommodation portfolio consists of 70 properties representing a combination of flagged (60%) and non-flagged hotels, motels and inns (40%). Approximately 90% of the balances outstanding are secured by properties located within New England states with the largest concentration in Massachusetts (61%). The average borrower loan size is $4.1 million and the portfolio balance weighted average loan-to- Accommodation $ 411,384 4.6% 98.0% value is 54.8%. The food services portfolio includes full-service restaurants (67%), limited service restaurants including fast food (30%) and other types of food service (caterers, bars, mobile food service, 3%). The average borrower loan size is approximately $388 thousand and approximately 61% of the loan balances outstanding are secured by real estate assets with a portfolio Food Services 155,415 1.7% 61.3% balance weighted average loan-to-value of 46.7%. The Retail Trade portfolio consists broadly of food and beverage stores (39%), motor vehicle and parts dealers (29%), gasoline stations (13%), non-store retail fuel dealers (7%), furniture and home furnishing stores (6%) and other types of retailers (7%). Collateral for these loans varies and may consist of real estate, motor vehicles inventories, other types of inventories and general business assets. Approximately 43% of the Retail Trade portfolio is secured by real estate with a portfolio balance weighted average loan-to-value of 54.0%. Retail Trade 526,711 5.9% 43.1% The average borrower loan size is $466 thousand. The healthcare portfolio consists of nursing and residential (9) care facilities (38%), ambulatory care (29%), social assistance (19%) and Hospitals (14%). Approximately 70% of this portfolio is secured by real estate with a portfolio balance weighted average loan-to-value of 46.9%. The average Health Care and Social Assistance 206,484 2.3% 69.7% borrower loan size in the healthcare portfolio is $652 thousand.

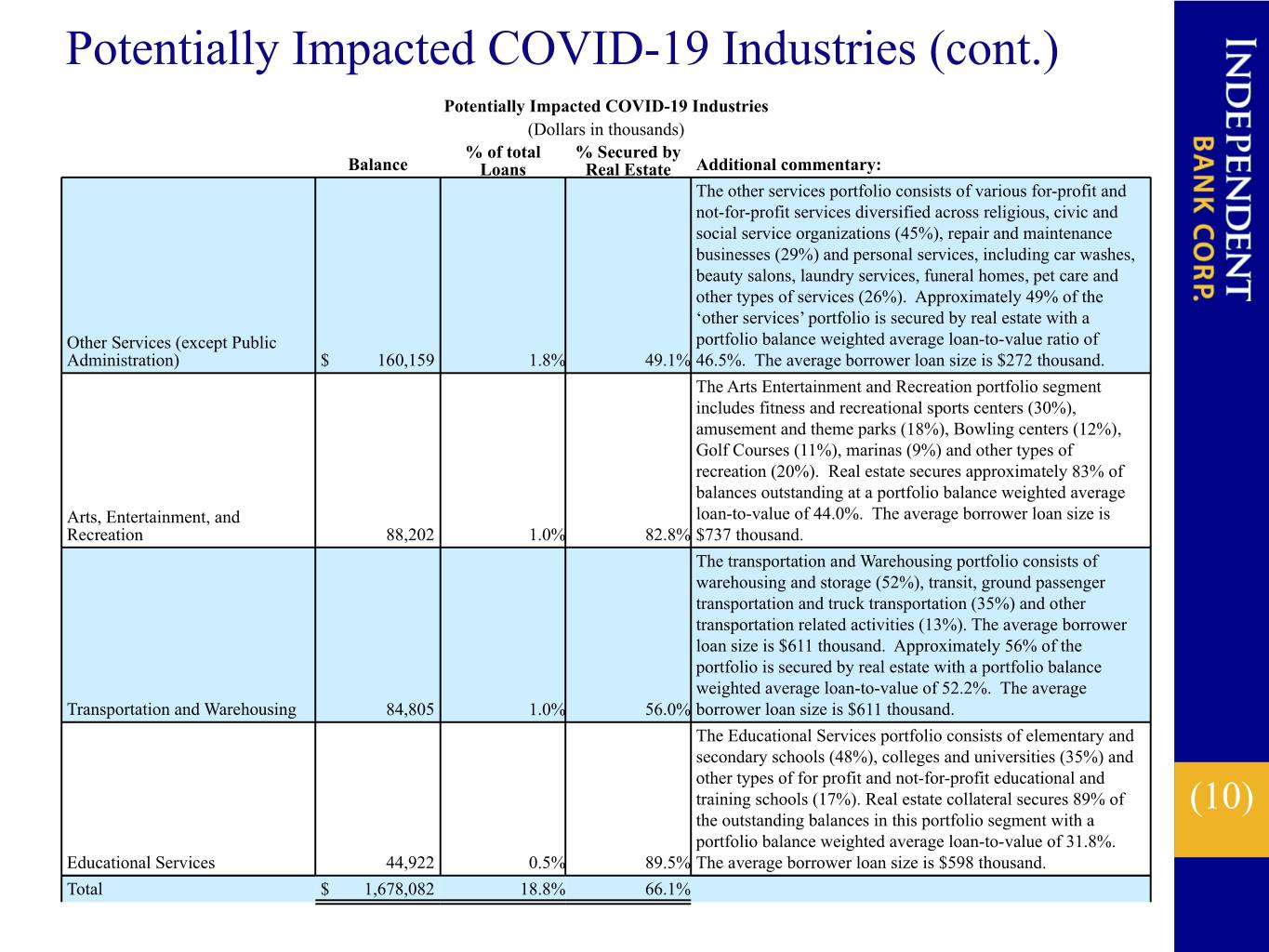

Potentially Impacted COVID-19 Industries (cont.) Potentially Impacted COVID-19 Industries (Dollars in thousands) % of total % Secured by Balance Loans Real Estate Additional commentary: The other services portfolio consists of various for-profit and not-for-profit services diversified across religious, civic and social service organizations (45%), repair and maintenance businesses (29%) and personal services, including car washes, beauty salons, laundry services, funeral homes, pet care and other types of services (26%). Approximately 49% of the ‘other services’ portfolio is secured by real estate with a Other Services (except Public portfolio balance weighted average loan-to-value ratio of Administration) $ 160,159 1.8% 49.1% 46.5%. The average borrower loan size is $272 thousand. The Arts Entertainment and Recreation portfolio segment includes fitness and recreational sports centers (30%), amusement and theme parks (18%), Bowling centers (12%), Golf Courses (11%), marinas (9%) and other types of recreation (20%). Real estate secures approximately 83% of balances outstanding at a portfolio balance weighted average Arts, Entertainment, and loan-to-value of 44.0%. The average borrower loan size is Recreation 88,202 1.0% 82.8% $737 thousand. The transportation and Warehousing portfolio consists of warehousing and storage (52%), transit, ground passenger transportation and truck transportation (35%) and other transportation related activities (13%). The average borrower loan size is $611 thousand. Approximately 56% of the portfolio is secured by real estate with a portfolio balance weighted average loan-to-value of 52.2%. The average Transportation and Warehousing 84,805 1.0% 56.0% borrower loan size is $611 thousand. The Educational Services portfolio consists of elementary and secondary schools (48%), colleges and universities (35%) and other types of for profit and not-for-profit educational and training schools (17%). Real estate collateral secures 89% of (10) the outstanding balances in this portfolio segment with a portfolio balance weighted average loan-to-value of 31.8%. Educational Services 44,922 0.5% 89.5% The average borrower loan size is $598 thousand. Total $ 1,678,082 18.8% 66.1%

Strong Fundamentals Driving Performance Longer Term Trends Net Income ($Mil)* $165.2 +38% CAGR $150.0 $5.5 • Robust loan/deposit $121.6 originations $125.0 $5.03 $4.5 $100.0 $87.2 $4.40 • Strong core deposit base $3.5 $75.0 • Low funding costs $3.19 $2.5 $50.0 • $26.8 Powerful mortgage platform $25.0 $0.78 $1.5 • Asset management growth $0.0 $0.5 • Low credit loss rates 2017 2018 2019 1Q20 • Strong operating efficiency • Accretive acquisitions Net Income Diluted EPS • TBV steadily growing* Operating Earnings ($Mil)** 1Q 2020 Factors $184.6 +42% CAGR • Elevated loan loss provision; $6 $150.0 $129.8 $25MM $5.62 $91.7 • Pressured net interest margin $100.0 $4.69 $4 • Lower fee income $3.35 $50.0 $26.8 $2 (11) $0.0 $0.78 $0 2017 2018 2019 1Q20 * See appendix A for reconciliation Operating Earnings Operating EPS **See appendix B for reconciliation

Low Cost Deposit Base Total Deposits $9.4B • Sizable demand deposit component 1Q 2020 • <1% of HH's are CD only CDs 13% Demand • Valuable source of liquidity Deposits 30% • Relationship-based approach Savings/Now 37% Money Market • Expanded digital access 20% • Growing commercial base Core Deposits Cost of Deposits ($ Bil.) 0.50% $10.0 90.1% 88.7% 100.0% 0.47% 0.48% 79.9% 82.6% 0.40% $8.0 80.0% 0.30% $6.0 60.0% 0.29% 0.20% $4.0 $7.6 $7.8 40.0% $6.1 $6.6 0.19% $2.0 20.0% 0.10% (12) $0.0 0.0% 0.00% 2017 2018 2019 1Q20 2017 2018 2019 1Q20 Core Deposits Core to Total

Investment Management: Transformed Into High Growth Business Longer Term Trends AUAs • Successful business model ($ Bil.) CAGR+6% • Growing source of fee revenues • $4.6 Strong feeder business from Bank $3.5 $3.6 $4.0 • Expanding investment center locations 2017 2018 2019 1Q20 • Adding experienced professionals Revenues • Capitalizing on cross-sell opportunity in ($ Mil.) acquired bank markets CAGR+10% • Exceeded $500 mil. in AUM on Cape Cod $23.8 $26.2 $28.7 1Q 2020 Factors $6.8 2017 2018 2019 1Q20 (13) • Reflects steep decline in equity markets

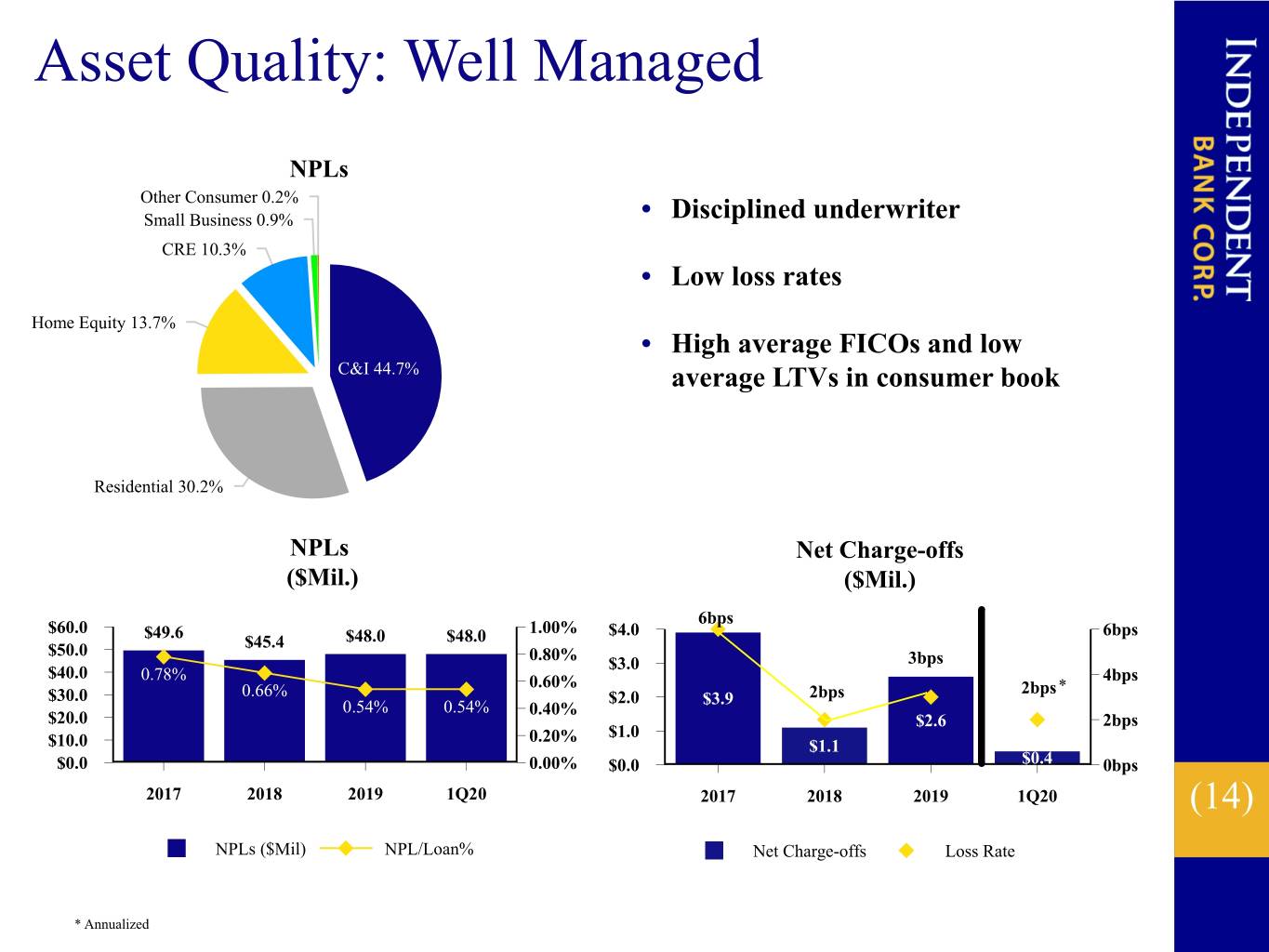

Asset Quality: Well Managed NPLs Other Consumer 0.2% Small Business 0.9% • Disciplined underwriter CRE 10.3% • Low loss rates Home Equity 13.7% • High average FICOs and low C&I 44.7% average LTVs in consumer book Residential 30.2% NPLs Net Charge-offs ($Mil.) ($Mil.) 6bps $60.0 $49.6 1.00% $4.0 6bps $45.4 $48.0 $48.0 $50.0 0.80% $3.0 3bps $40.0 0.78% 4bps 0.60% 2bps* $30.0 0.66% $2.0 $3.9 2bps 0.54% 0.54% 0.40% $20.0 $2.6 2bps 0.20% $1.0 $10.0 $1.1 $0.0 0.00% $0.0 $0.4 0bps 2017 2018 2019 1Q20 2017 2018 2019 1Q20 (14) NPLs ($Mil) NPL/Loan% Net Charge-offs Loss Rate * Annualized

Strong Capital Position Cash Dividends Declared Per Share • Strong internal capital generation $2.00 $1.76 $1.52 • History of healthy dividend increases $1.50 $1.28 • TBV rising even with multiple acquisitions $1.00 $0.46 $0.50 • No storehousing of excess capital $0.00 • Completed 1.5 million share repurchase for 2017 2018 2019 1Q20 $95.1MM (avg $63.39 per share) Book Value Tangible Book Value* $49.69 $50.50 $34.11 $34.46 $50 25% $35.0 $28.57 14% $45 $38.23 $30.0 $40 $34.38 20% $25.60 12% $35 14.99% 14.02% $25.0 10% $30 11.68% 12.13% 15% $20.0 10.80% 10.01% $25 8.96% 9.35% 8% $20 10% $15.0 6% 10.69% 11.28% 10.74% $15 10.04% $10.0 4% $10 5% $5 $5.0 2% $0 0% $0.0 0% 2017 2018 2019 1Q20 2017 2018 2019 1Q20 (15) Book Value Per Share Equity/Assets % TBV Per Share Tier 1 Leverage Tangible Equity/Tangible Assets % * See appendix A for reconciliation

Building Franchise Value Disciplined Acquisitions Slade’s Ferry Benjamin Central Mayflower Peoples Federal Bancorp Franklin Bancorp Bancorp Bancorp Bancshares Mar '08 Apr '09 Nov '12 Nov '13 Feb '15 $630mm Assets $994mm Assets $537mm Assets $243mm Assets $640 mm Assets $411mm Deposits $701mm Deposits $357mm Deposits $219mm Deposits $432mm Deposits 9 Branches 11 Branches 10 Branches 8 Branches 8 Branches Deal Value: $102.2 MM Deal Value: $84.5MM Deal Value: $52.0MM Deal Value: $40.3MM Deal Value: $141.8MM New England Bancorp Island Bancorp MNB Bancorp Blue Hills Bancorp Nov '16 May '17 Nov '18 Apr '19 $276mm Assets $194mm Assets $369mm Assets $2.5B Assets $176mm Deposits $171mm Deposits $278mm Deposits $1.9B Deposits 4 Branches 4 Branches 3 Branches 11 Branches Deal Value: $41.7MM Deal Value: $29.0MM Deal Value: $56.12MM Deal Value: $667.7 MM (16) All Acquisitions Immediately Accretive Deal metrics based on closing price and actual acquired assets

Major Opportunities in Acquired Bank Markets: Capitalizing on Rockland Trust Brand Investment Commercial Banking Management • Sophisticated products • $4.0 billion AUA • Expanded capacity • Wealth/Institutional • In-depth market • Strong referral knowledge network Acquired Bank Customer Bases (17) Retail/Customer • Expanded digital & product offerings • Extensive mortgage origination capacity • Award-winning customer service

Sustaining Business Momentum Business Line Focal Points • Expand Market Presence/Recruit Seasoned Lenders • Grow Client Base • Expand Specialty Products, e.g. ABL • Increased Lending Capacity • Continue to Drive Household Growth • Expand Digital Offerings • Optimize Branch Network • Capitalize on Strong Market Demographics • Continue Strong Branch/Commercial Referrals • Recruit Senior Professionals • Expand COI Relationships • Scalable Resi Mortgage Origination Platform (18) • Capitalize on New Credit Card Offerings • Continue Aggressive H.E. Marketing

INDB Investments Merits • High quality franchise in attractive markets • Regained momentum following prior crises • Consistent, strong financial performance • Strong organic business volumes All Acquisitions Immediately • Growing brand recognitionAccretive • Leverageable operating platform • Capitalizing on in-market consolidation opportunities • Diligent stewards of shareholder capital • Grounded management team (19) All Acquisitions Immediately Accretive

Appendix A: Non-GAAP Reconciliation of Capital Metrics The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which is a non-GAAP based measure. It also reconciles the ratio of Equity to Assets, which is a GAAP based measure, to Tangible Equity to Tangible Assets, a non-GAAP measure, for the dates indicated: 2017 2018 2019 1Q20 Tangible common equity Stockholders' equity (GAAP) $ 943,809 $ 1,073,490 $ 1,708,143 $ 1,679,656 (a) Less: Goodwill and other intangibles 241,147 271,355 535,492 533,672 Tangible common equity 702,662 802,135 1,172,651 1,145,984 (b) Tangible assets Assets (GAAP) 8,082,029 8,851,592 11,395,165 11,980,240 (c) Less: Goodwill and other intangibles 241,147 271,355 535,492 533,672 Tangible assets 7,840,882 8,580,237 10,859,673 11,446,568 (d) Common shares 27,450,190 28,080,408 34,377,388 33,260,005 (e) Common equity to assets ratio (GAAP) 11.68% 12.13% 14.99% 14.02% (a/c) Tangible common equity to tangible assets ratio 8.96% 9.35% 10.80% 10.01% (b/d) (Non-GAAP) Book Value per share (GAAP) $ 34.38 $ 38.23 $ 49.69 $ 50.50 (a/e) Tangible book value per share (Non-GAAP) $ 25.60 $ 28.57 $ 34.11 $ 34.46 (b/e) (20)

Appendix B: Non-GAAP Reconciliation of Earnings Metrics The following table reconciles net income and diluted EPS, which are GAAP measures, to operating earnings and diluted EPS on an operating basis, which are Non-GAAP Measures as of the time periods indicated: 2017 2018 2019 1Q20 (Dollars in thousands, except per share data) Net income available to common shareholders (GAAP) $ 87,204 $ 3.19 $ 121,622 $ 4.40 $ 165,175 $ 5.03 $ 26,751 $ 0.78 (a) Non-GAAP adjustments Noninterest income components Gain on sale of loans — — — — 951 0.03 — — Noninterest expense components Merger and acquisition expenses 3,393 0.12 11,168 0.40 26,433 0.80 — — Total impact of noncore items 3,393 0.12 11,168 0.40 27,384 0.77 — — Less - net tax benefit associated with noncore items (1) (1,241) (0.05) (2,967) (0.11) (6,686) (0.20) — — 2017 Tax Act: revaluation of net deferred tax assets 1,895 0.07 — — — — — — 2017 Tax Act: revaluation of LIHTC investments 466 0.02 — — — — — — Add - adjustment for tax effect of previously incurred merger and acquisition expense — — — — 650 0.02 — — Total tax impact 1,120 0.04 (2,967) (0.11) (6,036) (0.18) — — Net operating earnings (Non-GAAP) $ 91,717 $ 3.35 $ 129,823 $ 4.69 $ 184,621 $ 5.62 $ 26,751 $ 0.78 (b) Average assets $ 7,890,765 $ 8,305,174 $ 10,875,297 $ 11,469,589 (c) Average equity $ 912,984 $ 987,988 $ 1,521,921 $ 1,729,192 (d) Return on average assets 1.11% 1.46% 1.52% 0.94% (a/(c)) Return on average assets on an operating basis 1.16% 1.56% 1.70% 0.94% (b)/(c)) Return on average common equity 9.55% 12.31% 10.85% 6.22% (a)/(d)) (21) Return on average common equity on an operating basis 10.05% 13.14% 12.13% 6.22% (b)/(d)) (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income.

Appendix C: Current Expected Credit Loss ("CECL") • Adoption: ◦ January 1, 2020 adoption of CECL resulted in a minimal change to the allowance as compared to the previous incurred loss methodology. ◦ The table below details the changes in composition of the allowance by portfolio, which are primarily driven by life of loan assumptions. ◦ All former purchased credit impaired loans transition to the new guidance as purchase credit deteriorated loans, with a day one allowance gross up recorded to reflect estimated loss on these loans. • Regulatory capital implications: the Company chose not to delay the impact of CECL implementation on capital. • Quarter end assumptions: ◦ Reasonable and supportable forecast period of 1 year; reversion period of 6 months. ◦ Incorporated the Moody's Scenario 4 (S-4) for economic outlook, which includes the following assumptions related to the COVID-19 pandemic: ▪ Assumes that the COVID-19 crisis will persist and continue to meaningfully impact the economy ▪ Unemployment rate peaks at 16.9% in Q2 2020 and remains elevated throughout the remainder of the year. ▪ 50% of industries will be on lock down throughout Q2 2020 creating additional downward pressure on spending ▪ No sustained economic recovery expected until Q4 2021 ▪ Federal funds rates will remain at or near 0% for foreseeable future. ◦ Additional qualitative analysis performed over certain industries & relationships considered "at risk" due to the COVID-19 pandemic. December 31 January 1 March 31 2019 2020 2020 Incurred Loss Methodology CECL Methodology CECL Methodology (Dollars in thousands) Commercial and industrial $ 17,594 $ 15,659 $ 21,649 Commercial real estate 32,935 20,224 29,498 Commercial construction 6,053 2,401 3,747 Small business 1,746 2,241 3,829 Residential real estate 3,440 13,691 14,847 Home equity 5,576 12,907 17,910 Other consumer 396 637 896 (22) Total allowance for credit losses $ 67,740 $ 67,760 $ 92,376

Appendix D: Rockland Trust COVID-19 Response Colleagues • We have maintained full time compensation for employees despite reduced work schedules; • We have not laid off or furloughed any employees due to COVID-19 to date; • We have rapidly provided almost 600 employees, or about 86% of our non-retail workforce, with the capability to work remotely and implemented "work from home" protocols without any material degradation to customer service or operations; • We implemented a new retail branch service format, with drive up service only at the 89 bank branches with drive up windows; • We have 37 branch lobbies open by appointment only to handle customer service needs that cannot be addressed at a drive up window and installed Plexiglas screens in those lobbies; • We implemented physical distancing, safety, and hygiene protocols for colleagues not working remotely; • We increased colleague education over appropriate hygiene and proper measures to take if feeling ill in accordance with public health guidelines; • We increased cleaning frequency for our branches and offices; • We have significantly increased our communication via email and video conferencing to build and strengthen community among our colleagues; and, • We have shared communications regarding mental health and morale strengthening, including resources available to all colleagues and their families. Customer Accommodations • We increased Automated Teller Machine and Debit card limits; • We increased mobile deposit limits for individuals and businesses; • We are waiving early withdrawal fees for all Certificates of Deposits; • We are also waiving late charges for consumer, small business, and commercial loans until further notice; • We have accommodated requests for payment deferrals and modifications (refer to Appendix E for more details); • We implemented a 90 day foreclosure moratorium for residential mortgage loans; and, • We mobilized over 350 colleagues, or about 25% of our workforce, by temporarily revising primary work responsibilities in order to rapidly implement the PPP authorized by the CARES Act (refer to Appendix F for more details). Community Support (23) In March Rockland Trust announced that, in addition to already planned community support, Rockland Trust and its affiliated charitable foundations will donate an additional $500,000 to support those affected by the pandemic. Phase one of that support, which involves $140,000 of grants in the aggregate from our affiliated foundations to nine intermediary organizations in Eastern Massachusetts, Worcester, Cape Cod, Martha’s Vineyard and Nantucket Islands, and Rhode Island to support key nonprofit organizations meeting urgent/basic needs has been distributed.

Appendix E: COVID-19 Related Modifications through April 17,2020 Rockland Trust has offered needs based payment relief options for commercial and small business loans, residential mortgages, and home equity loans and lines of credit and monitors loan modification requests daily. The following table summarizes the loan modification requests which Rockland Trust has received as of April 17, 2020 and anticipates will be approved: Loan Modification Requests by Loan Category: % of Total Loans Balance as of % of Total Loans # of Loans (#) March 31, 2020 ($) (Dollars in thousands) Commercial and industrial 306 0.69% $ 142,354 1.60% Commercial real estate 472 1.06% 778,793 8.73% Construction 10 0.02% 14,617 0.16% Small Business 274 0.62% 19,936 0.22% Residential real estate 390 0.88% 161,961 1.82% Home equity 284 0.64% 41,482 0.47% Other consumer 22 0.05% 434 —% Total 1,758 3.96% $ 1,159,577 13.00% (24)

Appendix F: Paycheck Protection Program (PPP) and Liquidity Monitoring PPP Information As of Wednesday, May 6, 2020 Rockland Trust Company had: • Received over 5,000 PPP loan applications; • Processed an SBA guarantee for over 5,100 PPP loans, with an aggregate dollar value of approximately $818.9 million; • The average and median loan sizes of the PPP loans for which we have obtained an SBA guarantee are approximately $160,000 and $41,000, respectively; and • The closing of the PPP loans for which we have received an SBA guarantee is estimated to result in approximately $25.9 million of processing fee income, which will be deferred through net interest income over the life of the loans. Liquidity Monitoring PPP fundings and loan modifications will put a temporary strain on our liquidity, however we have sufficient sources of liquidity through various channels as noted in the table below as of March 31, 2020: Additional Borrowing Outstanding Capacity (Dollars in thousands) Federal Home Loan Bank of Boston $ 358,591 $ 1,179,248 Federal Reserve Bank of Boston — 692,179 Unpledged Securities — 754,494 Line of Credit — 50,000 Long-term borrowing 74,920 — Customer repurchase agreements — — Junior subordinated debentures 62,849 — Subordinated debt 49,625 — (25) Reciprocal deposits 218,971 — Brokered deposits 197,436 — $ 962,392 $ 2,675,921

NASDAQ Ticker: INDB www.rocklandtrust.com Mark Ruggiero – CFO & Chief Accounting Officer Shareholder Relations: (781) 982-6737 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from (26) time to time.