Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STONERIDGE INC | tm2018861d1_ex99-1.htm |

| 8-K - FORM 8-K - STONERIDGE INC | tm2018861d1_8k.htm |

Q1 2020 Results May 7, 2020 Exhibit 99.2

2 Forward - Looking Statements Statements in this presentation that are not historical facts are forward - looking statements, which involve risks and uncertaint ies that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that ma y cause actual results to differ materially from those in the forward - looking statements include, among other factors, the impact of the global COVID - 19 pandemic on our business, results of operations and financial condition; the loss or bankruptcy of a major customer; the cost s a nd timing of facility closures, business realignment or similar actions; a significant change in automotive, commercial, off - highway, motorcy cle and agricultural vehicle production; our ability to achieve cost reductions that offset or exceed customer - mandated selling price re ductions; a significant change in general economic conditions in any of the various countries in which Stoneridge operates; labor disrupt ion s at Stoneridge’s facilities or at any of Stoneridge’s significant customers or suppliers; the ability of suppliers to supply Ston eri dge with parts and components at competitive prices on a timely basis; the amount of Stoneridge’s indebtedness and the restrictive covenants con tai ned in the agreements governing its indebtedness, including its revolving credit facility; customer acceptance of new products; capital ava ilability or costs, including changes in interest rates or market perceptions; the failure to achieve successful integration of any acquir ed company or business; the occurrence or non - occurrence of circumstances beyond Stoneridge’s control; and the items described in “Risk Factor s” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed with the Securities and Exchange Co mmi ssion. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially fro m t hose in the forward - looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and global markets, including as a result of the global COVID - 19 pandemic, (2) changes in economic conditions, housing prices, forei gn currency exchange rates, commodity prices, including shortages of and increases or volatility in the price of oil, (3) changes in laws an d regulations, (4) the state of the credit markets, (5) political stability, (6) international conflicts and (7) the occurrence of force maj eur e events. These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stonerid ge’ s filings with the Securities and Exchange Commission. Forward - looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condit ion and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or sug gested by the forward - looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial co ndition and liquidity, and the development of the industry in which Stoneridge operates ar e consistent with the forward - looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. This presentation contains time - sensitive information that reflects management’s best analysis only as of the date of this prese ntation. Any forward - looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obl igation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future tren ds or indications of future performance, unless expressed as such, and should only be viewed as historical data. Stoneridge does not undertake any obligation to publicly update or revise any forward - looking statement as a result of new infor mation, future events or otherwise, except as otherwise required by law. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared t o w hat is shown in this presentation. The differences are the result of rounding due to the representation of values in millions rathe r t han thousands in public filings.

3 Overview of Achievements x Execution of operational goals led to reduced material and overhead costs – strong 1 st quarter performance prior to impact of global COVID - 19 pandemic x Took decisive actions to right - size our cost structure in response to current events and to position the business for future profitable growth x Cost reductions of $7.5 - $8.5 million in 2020 in response to current events x Annualized str uctural cost reductions of $5 - $6 million beyond 2020 to drive future growth and profitability x Announced Jim Zizelman as President of our Control Devices segment x Awarded 2020 Automotive News PACE Award for MirrorEye Q 1 2020 Financial Performance Updated 2020 Outlook Previously Provided 2020 Guidance (Withdrawn)* Sales $750 - $770 million Adj. Gross Profit 28.0% - 29.0% Adj. Operating Income 5.0% - 6.0% Tax Rate 20.0% - 25.0% Adj. EPS $0.95 - $1.15 EBITDA 9.0% - 10.0% Reported Adjusted Estimated Impact of COVID - 19 Sales $183.0 million -- $16.0 million Gross Profit $45.4 million $47.0 million -- Operating Income $3.7 million $6.0 million $4.7 million Tax Rate 25.8% 22.0% -- EPS $0.13 $0.20 -- EBITDA -- $16.1 million $4.7 million ▸ Announced 2020 guidance withdrawn on March 30 ▸ Updated end - market forecasts implying weighted average end - markets to decline ~23% vs. previously provided guidance ▸ Incremental and decremental margins ~2.5x – 3x EBITDA margins historically. Cost reduction actions expected to drive impact to low - end of the range. ▸ Balance sheet and liquidity remain strong *2020 Guidance provided on Q4 2019 earnings call, withdrawn March 30, 2020. Provided for reference purposes only.

4 Execution of operational goals led to reduced material and overhead costs – strong 1st quarter performance prior to impact of global COVID - 19 pandemic Adjusted Sales* Adjusted Operating Income* ▸ Control Devices sales growth driven primarily by increased sales in our actuation and emission sensing products. Despite growth in the OEM business, reduced demand for aftermarket and mass retail products negatively impacted sales in Brazil. ▸ Sales were negatively impacted by foreign currency by approximately $1.0 million vs. Q4 2019 ▸ The global response to COVID - 19 began impacting China early in the quarter followed by North America and Europe at the end of the quarter ▸ The impact of COVID - 19 on 1 st quarter 2020 sales was estimated to be approximately $16.0 million ▸ Q1 2020 adjusted gross margin exceeded Q4 2019 by 170 basis points ▸ Material costs were reduced by 80 basis points, overhead was reduced by 90 basis points ▸ Tariff costs were reduced by $0.6 million ▸ Electronic component premiums were reduced by $0.7 million ▸ Adjusted operating margin improved by $0.9 million (50 basis points) vs. Q4 2019 ▸ The impact on operating income in the first quarter due to COVID - 19 was estimated to be $4.7 million (210 basis points) *Excluding divested product lines $’s in USD Millions $’s in USD Millions 2020 Q1 Summary 5.1 (0.1) 0.0 - 6.0 4.7 1.9 (0.9) 2019 Q4 Control Devices Electronics Stoneridge Brazil Corporate / Other Q1 2020 Est. Impact of COVID- 19 2.8% 3.3% 183.9 4.7 (2.5) - 183.0 16.0 (0.6) (2.5) 2019 Q4 Control Devices Electronics Stoneridge Brazil Corporate / Other Q1 2020 Est. Impact of COVID- 19

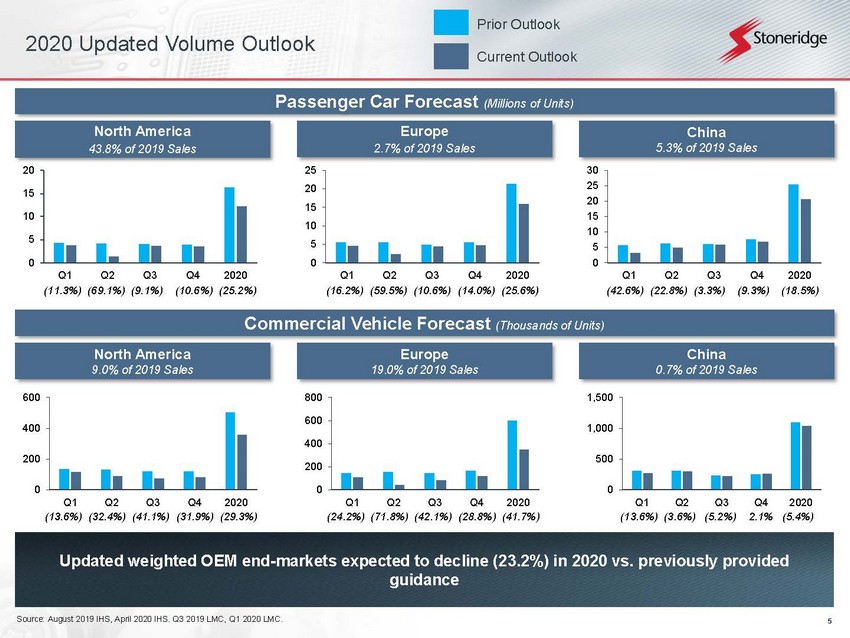

5 Updated weighted OEM end - markets expected to decline (23.2%) in 2020 vs. previously provided guidance 2020 Updated Volume Outlook Prior Outlook Current Outlook Passenger Car Forecast (Millions of Units) Commercial Vehicle Forecast (Thousands of Units) North America 43.8% of 2019 Sales Europe 2.7% of 2019 Sales China 5.3% of 2019 Sales North America 9.0% of 2019 Sales Europe 19.0% of 2019 Sales China 0.7% of 2019 Sales 0 5 10 15 20 Q1 Q2 Q3 Q4 2020 0 5 10 15 20 25 Q1 Q2 Q3 Q4 2020 0 5 10 15 20 25 30 Q1 Q2 Q3 Q4 2020 0 200 400 600 Q1 Q2 Q3 Q4 2020 0 200 400 600 800 Q1 Q2 Q3 Q4 2020 0 500 1,000 1,500 Q1 Q2 Q3 Q4 2020 (11.3%) (69.1%) (9.1%) (10.6%) (25.2%) (16.2%) (59.5%) (10.6%) (14.0%) (25.6%) (42.6%) (22.8%) (3.3%) (9.3%) (18.5%) (13.6%) (32.4%) (41.1%) (31.9%) (29.3%) (24.2%) (71.8%) (42.1%) (28.8%) (41.7%) (13.6%) (3.6%) (5.2%) 2.1% (5.4%) Source: August 2019 IHS, April 2020 IHS. Q3 2019 LMC, Q1 2020 LMC.

6 Operations Update We are committed to ensuring our employees remain safe while we serve our customers and the essential businesses that they support We will continue to adjust our operations to the current business environment North America ▸ Lexington, Ohio facility (primarily Control Devices) has been operating at ~40% of typical utilization since late - March to satisfy on - going customer demand. Planning to ramp - up operations aligned with customer production schedules in the middle of May. ▸ Juarez, Mexico facility (split between Control Devices and Electronics) closed April 9 th and remains closed by order of the Mexican government. We will remain compliant with all government requirements and will continue to support our customers in essential businesses as we are able. Currently expecting mid to late May restart and ramp - up. Europe ▸ Orebro, Sweden plant (primarily Electronics) has been operating at ~40% of typical utilization since beginning of April. Commercial vehicle customers started production in late April. We expect to continue ramping up to support customers back in production. ▸ Tallinn, Estonia plant (primarily Electronics) has been idled since the beginning of April. Restarted and ramping - up operations this week. ▸ Barneveld, Netherlands (Electronics) facility has been running with reduced schedule since the beginning of April. Expecting continued ramp - up over the summer to support on and off - road commercial vehicle customers . Brazil ▸ Manaus, Brazil (Stoneridge Brazil) facility closed for three weeks in April and restarted late April. Running on reduced production schedule inline with customer demand. Asia Pacific ▸ Suzhou, China (primarily Control Devices) facility is operating approximately 80% capacity as local customers are on - line. Negative impacts to export sales as customers in India and Europe remain shut down or operating with reduced demand. ▸ Joint venture facility in Pune, India is currently idled and is expected to restart in mid to late May.

7 ▸ We have taken several actions to align resources with future, profitable growth and right - size our cost structure for the current market outlook ▸ Cash Preservation • Our balance sheet and liquidity remains strong given availability under U.S. revolving credit facility and cash - on - hand • Continue to focus on working capital to optimize cash position (inventory management with plant shutdowns, reviewing payment terms with customers and suppliers) • Delaying or reducing discretionary capital expenditures The actions we have taken are expected to save $7.5 – $8.5 million* for the remainder of 2020 and reduce structural costs going - forward by $5 – $6 million annually Cost Reduction Action 2020 Impact Annualized Impact Beyond 2020 Headcount Reductions (~5% of salaried workforce and furloughs) $3.5 - $4 million ($1.5 - $2 million separation costs) $5 - $6 million Delayed Hiring $1.5 - $2 million -- Reduction in Discretionary Expenses $2.5 million -- Total $7.5 - $8.5 million* $5 - $6 million *Excluding estimated separation costs Cost Actions

8 Leadership Announcement Jim Zizelman joins Stoneridge as President of Control Devices focused on driving product development, innovation strategy and technical vision ▸ Jim Zizelman joined Stoneridge as President of the Control Devices division effective April 1 st ▸ Jim is responsible for driving Stoneridge's product development, innovation strategy and technical vision for Control Devices ▸ He has an extensive understanding of vehicle components and technology, strong global leadership capabilities and experience growing profitable businesses and organizations ▸ Most recently, Zizelman supported Stoneridge as a consultant. Prior to consulting, he was the vice president of engineering and program management for Aptiv, where he had overarching responsibility for the engineering function and supported the company's transition from Delphi. Zizelman spent more than 20 years with Delphi, leading a variety of technical and business teams for the Powertrain and Electronics Divisions, and taking responsibility for the innovation, development and execution of all safety, automated and infotainment programs.

9 Summary Summary x Execution of operational goals led to reduced material and overhead costs – strong 1 st quarter performance prior to impact of global COVID - 19 pandemic x Reduced material costs driven by reduced tariff costs and electronic component premium costs x Overhead reduced due to improved manufacturing efficiency and processes x Took decisive actions to right - size our cost structure in response to current events and to position the business for future profitable growth x Announced Jim Zizelman as President of our Control Devices segment to drive product development, innovation strategy and technical vision x Awarded 2020 Automotive News PACE Award for MirrorEye 2020 Outlook and Beyond ▸ Continued focus on operational improvement – execute on what we can control ▸ Continued refinement of operations and cost structure as necessary – respond to factors that we cannot control efficiently and effectively ▸ Focus on our long - term strategy – balance sheet and structural strength of the business put us in a position where we do not have to make decisions in the short - term that could negatively impact the long - term. We remain well positioned to outperform our underlying markets. Driving shareholder value by executing on variables within our control, responding to factors that are out of our control and executing on our long - term strategy

10 Financial Update

11 1 st Quarter 2020 Financial Summary 1 st Quarter 2020 Financial Results Sales of $183.0 million, a decrease of $0.9 million over Q4 2019* • Control Devices sales of $98.2 million, an increase of 5% over Q4 2019* • Electronics sales of $79.8 million, a decrease of 1% over Q4 2019 • Stoneridge Brazil sales of $14.6 million, a decrease of 15% over Q4 2019 Adjusted operating income of $6.0 million (3.3% adjusted operating margin) an increase of 18% over Q4 2019* • Control Devices adjusted operating income of $9.9 million (10.1% adjusted operating margin), a decrease of 1% over Q4 2019* • Electronics adjusted operating income of $2.9 million (3.6% adjusted operating margin), an increase of $1.9 million over Q4 2 019 • Stoneridge Brazil adjusted operating income of $0.4 million (2.6% adjusted operating margin), an increase of 8% over Q4 2019 The estimated impact of COVID - 19 on first quarter sales and adjusted operating income was $16.0 million and $4.7 million (210 basis points) respectively Updated 2020 Outlook Previously Provided 2020 Guidance (Withdrawn)** Sales $750 - $770 million Adj. Gross Profit 28.0% - 29.0% Adj. Operating Income 5.0% - 6.0% Tax Rate 20.0% - 25.0% Adj. EPS $0.95 - $1.15 EBITDA 9.0% - 10.0% ▸ Announced 2020 guidance withdrawn on March 30 ▸ Updated end - market forecasts implying weighted average end - markets to decline ~23% vs. previously provided guidance ▸ Incremental and decremental margins ~2.5x – 3x EBITDA margins historically. Cost reduction actions expected to drive impact to low - end of the decremental range. ▸ Balance sheet and liquidity remain strong ▸ More than $320 million in cash and undrawn commitments at quarter end * Excluding divested product lines ** 2020 Guidance provided on Q4 2019 earnings call, withdrawn March 30, 2020. Provided for reference purposes only.

12 Control Devices Financial Performance Despite significant reduction in end - market production forecasts for the remainder of the year we expect continued operating improvement in Control Devices *Excluding divested product lines Revenue growth of 5% vs. Q4 2019 – COVID - 19 impact on sales estimated to be $10.9 million in the quarter • Sales in China were approximately flat in Q1 2020 vs. Q1 2019 despite impact of COVID - 19 early in the quarter • Production forecasts in primary Control Devices end - markets expected to decline by ~25% relative to forecast utilized in prior guidance Operating margin declined by 60 basis points – COVID - 19 impact on operating income estimated to be $3.3 million in the quarter (200 basis points) • Tariff expenses improved by $0.6 million vs. Q4 2019 • Expect continued operating performance improvement on controllable factors Q4 2019* vs Q1 2020 Adjusted Sales Adjusted Operating Income $’s in USD Millions Q1 2020 revenue growth of 5%. COVID - 19 impact on sales estimated to be $10.9 million in Q1. COVID - 19 impact on operating income estimated to be $3.3 million (200 bps) in Q1 10.0 9.9 3.3 Q4 2019 Q1 2020 Est. Impact of COVID-19 93.5 98.2 10.9 Q4 2019 Q1 2020 Est. Impact of COVID-19 10.7% 10.1%

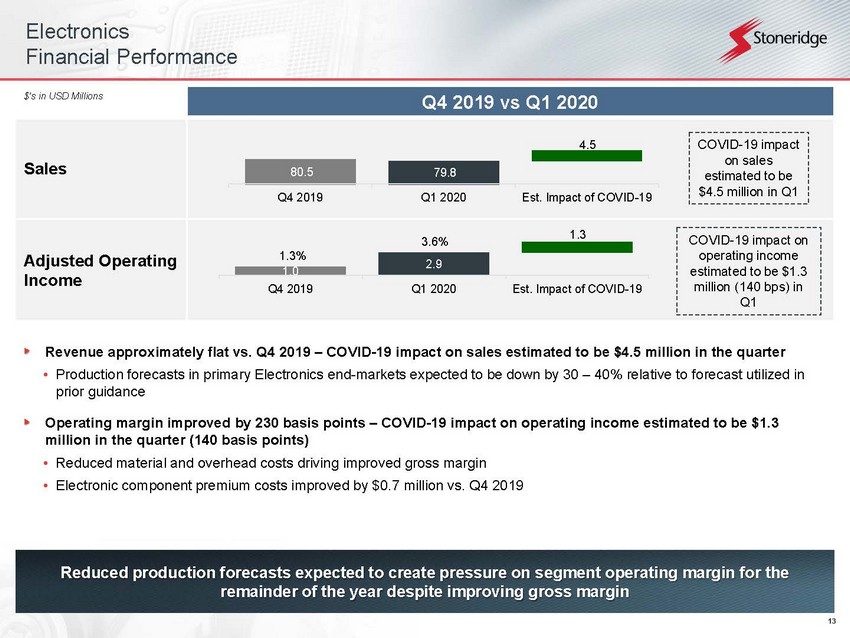

13 Electronics Financial Performance Reduced production forecasts expected to create pressure on segment operating margin for the remainder of the year despite improving gross margin Revenue approximately flat vs. Q4 2019 – COVID - 19 impact on sales estimated to be $4.5 million in the quarter • Production forecasts in primary Electronics end - markets expected to be down by 30 – 40% relative to forecast utilized in prior guidance Operating margin improved by 230 basis points – COVID - 19 impact on operating income estimated to be $1.3 million in the quarter (140 basis points) • Reduced material and overhead costs driving improved gross margin • Electronic component premium costs improved by $0.7 million vs. Q4 2019 Q4 2019 vs Q1 2020 Sales Adjusted Operating Income $’s in USD Millions COVID - 19 impact on sales estimated to be $4.5 million in Q1 COVID - 19 impact on operating income estimated to be $1.3 million (140 bps) in Q1 1.0 2.9 1.3 Q4 2019 Q1 2020 Est. Impact of COVID-19 1.3% 3.6% 80.5 79.8 4.5 Q4 2019 Q1 2020 Est. Impact of COVID-19

14 Stoneridge Brazil Financial Performance Despite reduced sales, operating margin improved vs. Q4 2019. Limited impact of COVID - 19 in the 1st quarter, however impact expected to increase moving forward. OEM sales expected to ramp - up. Stoneridge Brazil OEM sales increased by 48% vs. Q4 2019, however OEM sales growth offset by decline in demand for aftermarket and mass retail products. Q4 typically strongest sales quarter due to holidays. • OEM program launched in late 2019 – expected to continue to ramp - up • Currency negatively impacted sales in the quarter by $0.7 million vs. Q4 2019 • Limited impact of COVID - 19 in the quarter – impact expected to increase for the remainder of the year Operating margin improved by 50 basis points – COVID - 19 impact on operating income estimated to be $0.1 million in the quarter (40 basis points) • Reduced material costs driving improved gross margin • Currency negatively impacted operating income by $0.1 million vs Q4 2019 Q4 2019 vs Q1 2020 Sales Adjusted Operating Income $’s in USD Millions Despite reduced sales, operating income remained flat and margin improved Sales reduction driven by reduced demand in aftermarket and mass retail products 17.0 14.6 0.2 Q4 2019 Q1 2020 Est. Impact of COVID-19 0.4 0.4 0.1 Q4 2019 Q1 2020 Est. Impact of COVID-19 2.1% 2.6%

15 Capital Structure Update We will utilize our available capital as necessary to support operations in response to global impact of COVID - 19 Net Debt and Leverage Ratio Net debt / adjusted trailing - twelve - month EBITDA of 1.1x as of end of Q1 Credit facility has 3.5x net debt / EBITDA covenant with limitations on foreign cash and EBITDA adjustments considered in net debt calculation (current compliance ratio of ~1.6x) $25 million drawn in the 1 st quarter to support operations in response to market disruption related to COVID - 19 Approximately $239 million of undrawn commitments under U.S. revolving credit facility which results in more than $320 million in cash - on - hand and undrawn commitments at quarter end Bought back 242,634 shares in Q1, which was completed March 6, 2020 (~$5 million total value). Temporarily suspending the previously announced share repurchase authorization in response to uncertainty surrounding COVID - 19 pandemic. 0.5x 0.6x 0.6x 0.7x 1.1x Net Debt / EBITDA

16 Summary 2020 Q1 Summary ▸ Control Devices – Strong sales and improving operational execution vs. Q4 2019. Despite significant reduction in end - market production forecasts for the remainder of the year we expect continued operating improvement. ▸ Electronics – Sales remained steady with improving margin. Reduced production forecasts of 30 – 40% in North America and Europe expected to create downward pressure on segment operating margin despite improving gross margin. ▸ Stoneridge Brazil – Despite reduced sales, operating margin improved vs. Q4 2019. Limited impact of COVID - 19 in the 1 st quarter, however impact expected to increase moving forward. OEM sales expected to continue to ramp up. 2020 Outlook ▸ Announced 2020 guidance withdrawn on March 30 ▸ Updated end - market forecasts implying weighted average end - markets to decline ~23% vs. previously provided guidance ▸ Incremental and decremental margins ~2.5x – 3x EBITDA margins historically. Cost reduction actions expected to drive impact to low - end of the decremental range. ▸ Balance sheet and liquidity remain strong Driving shareholder value through strong financial performance and a well - defined long - term strategy

17 Appendix

18 Income Statement Three months ended March 31 (in thousands, except per share data) Net sales $ 182,966 $ 218,297 Costs and expenses: Cost of goods sold 137,569 157,444 Selling, general and administrative 29,503 35,910 Design and development 12,235 13,244 Operating income 3,659 11,699 Interest expense, net 1,030 1,003 Equity in earnings of investee (457) (364) Other income, net (1,617) (432) 4,703 11,492 1,213 1,835 Net income $ 3,490 $ 9,657 Earnings per share: Basic $ 0.13 $ 0.34 Diluted $ 0.13 $ 0.33 Weighted-average shares outstanding: Basic 27,232 28,529 Diluted 27,591 29,085 Income before income taxes Provision for income taxes 2020 2019 CONSOLIDATED STATEMENTS OF OPERATIONS

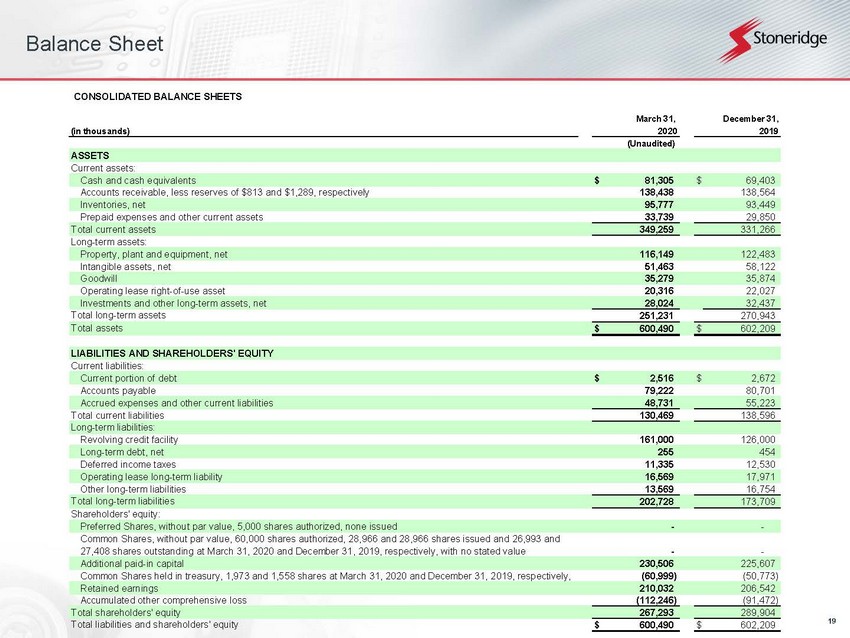

19 Balance Sheet CONSOLIDATED BALANCE SHEETS (in thousands) (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 81,305 $ 69,403 Accounts receivable, less reserves of $813 and $1,289, respectively 138,438 138,564 Inventories, net 95,777 93,449 Prepaid expenses and other current assets 33,739 29,850 Total current assets 349,259 331,266 Long-term assets: Property, plant and equipment, net 116,149 122,483 Intangible assets, net 51,463 58,122 Goodwill 35,279 35,874 Operating lease right-of-use asset 20,316 22,027 Investments and other long-term assets, net 28,024 32,437 Total long-term assets 251,231 270,943 Total assets $ 600,490 $ 602,209 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of debt $ 2,516 $ 2,672 Accounts payable 79,222 80,701 Accrued expenses and other current liabilities 48,731 55,223 Total current liabilities 130,469 138,596 Long-term liabilities: Revolving credit facility 161,000 126,000 Long-term debt, net 255 454 Deferred income taxes 11,335 12,530 Operating lease long-term liability 16,569 17,971 Other long-term liabilities 13,569 16,754 Total long-term liabilities 202,728 173,709 Shareholders' equity: Preferred Shares, without par value, 5,000 shares authorized, none issued - - Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 26,993 and 27,408 shares outstanding at March 31, 2020 and December 31, 2019, respectively, with no stated value - - Additional paid-in capital 230,506 225,607 Common Shares held in treasury, 1,973 and 1,558 shares at March 31, 2020 and December 31, 2019, respectively, (60,999) (50,773) Retained earnings 210,032 206,542 Accumulated other comprehensive loss (112,246) (91,472) Total shareholders' equity 267,293 289,904 Total liabilities and shareholders' equity $ 600,490 $ 602,209 March 31, December 31, 2020 2019

20 Statement of Cash Flows CONSOLIDATED STATEMENTS OF CASH FLOWS Three months ended March 31 (in thousands) OPERATING ACTIVITIES: Net income $ 3,490 $ 9,657 Adjustments to reconcile net income to net cash provided by (used for) operating activities: Depreciation 6,650 5,697 Amortization, including accretion and write-off of deferred financing costs 1,429 1,613 Deferred income taxes 76 (2,979) Earnings of equity method investee (457) (364) Loss (gain) on sale of fixed assets 131 (1) Share-based compensation expense 1,372 1,548 Excess tax deficiency (benefit) related to share-based compensation expense 17 (656) Change in fair value of earn-out contingent consideration (633) 469 Change in fair value of venture capital fund 39 (16) Changes in operating assets and liabilities, net of effect of business combination: Accounts receivable, net (3,730) (17,821) Inventories, net (5,838) (13,655) Prepaid expenses and other assets (3,702) (660) Accounts payable 2,327 16,395 Accrued expenses and other liabilities (7,733) (4,836) Net cash used for operating activities (6,562) (5,609) INVESTING ACTIVITIES: Capital expenditures, including intangibles (7,140) (8,684) Proceeds from sale of fixed assets 8 1 Investment in venture capital fund - (400) Net cash used for investing activities (7,132) (9,083) 2020 2019

21 Statement of Cash Flows (Cont.) CONSOLIDATED STATEMENTS OF CASH FLOWS Three months ended March 31 (in thousands) FINANCING ACTIVITIES: Revolving credit facility borrowings 71,500 - Revolving credit facility payments (36,500) (5,000) Proceeds from issuance of debt 1,958 34 Repayments of debt (2,076) (690) Earn-out consideration cash payment - (3,394) Other financing costs (1) (2) Common Share repurchase program (4,995) - Repurchase of Common Shares to satisfy employee tax withholding (1,687) (2,945) Net cash provided by (used for) financing activities 28,199 (11,997) Effect of exchange rate changes on cash and cash equivalents (2,603) (1,317) Net change in cash and cash equivalents 12,378 (28,006) Cash and cash equivalents at beginning of period 69,403 81,092 Cash and cash equivalents at end of period $ 81,305 $ 53,086 Supplemental disclosure of cash flow information: Cash paid for interest $ 1,150 $ 1,109 Cash paid for income taxes, net $ 1,832 $ 3,327 2020 2019

22 Segment Financial Information Three months ended March 31, Net Sales: Control Devices $ 96,850 $ 110,119 Inter-segment sales 1,347 1,861 Control Devices net sales 98,197 111,980 Electronics 71,546 90,846 Inter-segment sales 8,268 8,722 Electronics net sales 79,814 99,568 Stoneridge Brazil 14,570 17,332 Inter-segment sales - 6 Stoneridge Brazil net sales 14,570 17,338 Eliminations (9,615) (10,589) Total net sales $ 182,966 $ 218,297 Operating Income (Loss): Control Devices $ 7,322 $ 11,948 Electronics 2,872 9,031 Stoneridge Brazil 859 670 Unallocated Corporate (A) (7,394) (9,950) Total operating income $ 3,659 $ 11,699 Depreciation and Amortization: Control Devices $ 3,530 $ 3,094 Electronics 2,481 2,397 Stoneridge Brazil 1,450 1,525 Unallocated Corporate 526 213 Total depreciation and amortization (B) $ 7,987 $ 7,229 Interest Expense, net: Control Devices $ 81 $ 182 Electronics 87 56 Stoneridge Brazil 10 108 Unallocated Corporate 852 657 Total interest expense, net $ 1,030 $ 1,003 Capital Expenditures: Control Devices $ 2,314 $ 3,492 Electronics 2,650 3,738 Stoneridge Brazil 1,133 819 Unallocated Corporate (C) 572 635 Total capital expenditures $ 6,669 $ 8,684 2020 2019

23 Reconciliations to US GAAP

24 Reconciliations to US GAAP This document contains information about Stoneridge's financial results which is not presented in accordance with accounting principles generally accepted in the United States ("GAAP"). Such non - GAAP financial measures are reconciled to their closest GAAP financial measures in the appendix of this document. The provision of these non - GAAP financial measures is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non - GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this document and the adjustments that management can reasonably predict.

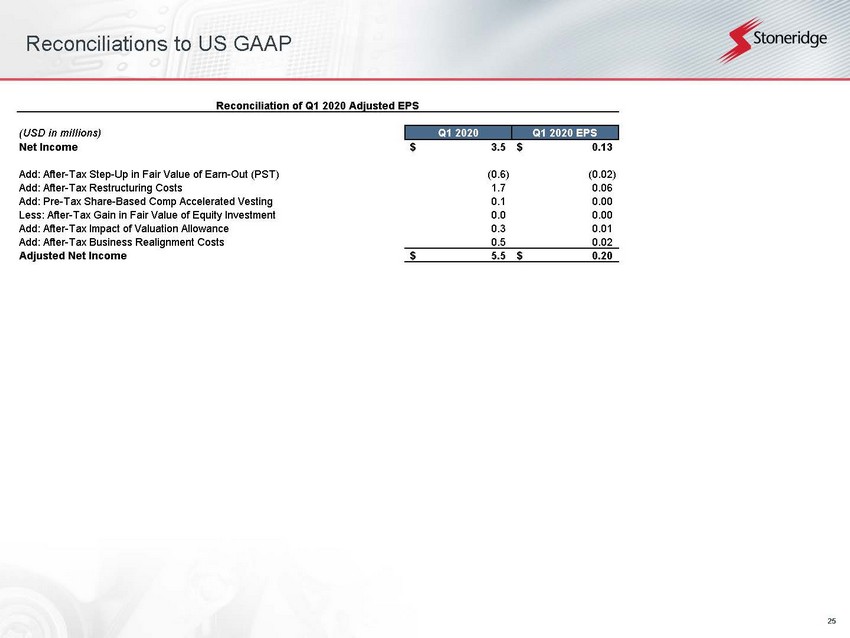

25 Reconciliations to US GAAP (USD in millions) Q1 2020 Q1 2020 EPS Net Income 3.5$ 0.13$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) (0.6) (0.02) Add: After-Tax Restructuring Costs 1.7 0.06 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.1 0.00 Less: After-Tax Gain in Fair Value of Equity Investment 0.0 0.00 Add: After-Tax Impact of Valuation Allowance 0.3 0.01 Add: After-Tax Business Realignment Costs 0.5 0.02 Adjusted Net Income 5.5$ 0.20$ Reconciliation of Q1 2020 Adjusted EPS

26 Reconciliations to US GAAP (USD in millions) Q4 2019 Q1 2020 Gross Profit 44.2 45.4 Add: Pre-Tax Restructuring Costs 1.5 1.5 Add: Pre-Tax Business Realignment Costs 0.1 Adjusted Gross Profit 45.6 47.0 Reconciliation of Adjusted Gross Profit (USD in millions) Q4 2019 Q1 2020 Income Before Tax (0.0)$ 4.7$ Interest expense, net 1.2 1.0 Depreciation and amortization 8.1 8.1 EBITDA 9.3$ 13.8$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.4 (0.6) Less: Pre-Tax Gain in Fair Value of Equity Investment 0.2 0.0 Add: Pre-Tax Restructuring Costs 3.4 2.2 Add: Pre-Tax Business Realignment Costs 0.3 0.6 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.1 Adjusted EBITDA 13.7$ 16.1$ Reconciliation of Adjusted EBITDA (USD in millions) Q4 2019 Q1 2020 Operating Income 1.1$ 3.7$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.4 (0.6) Less: Pre-Tax Change in Fair Value of Equity Investment 0.2 0.0 Add: Pre-Tax Restructuring Costs 3.4 2.2 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.1 Add: Pre-Tax Business Realignment Costs 0.3 0.6 Adjusted Operating Income 5.5$ 6.0$ Reconciliation of Adjusted Operating Income

27 Reconciliations to US GAAP (USD in millions) Q1 2020 Income Before Tax 4.7$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) (0.6) Less: Pre-Tax Change in Fair Value of Equity Investment 0.0 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.1 Add: Pre-Tax Restructuring Costs 2.2 Add: Pre-Tax Business Realignment Costs 0.6 Adjusted Income Before Tax 7.0$ Income Tax Provision 1.2$ Add: Tax Impact From Pre-Tax Adjustments 0.6 Add: After-Tax Impact of Valuation Allowance (0.3) Adjusted Income Tax Provision 1.6$ Adjusted Tax Rate 22.0% Reconciliation of Q1 2020 Adjusted Tax Rate

28 Reconciliations to US GAAP (USD in millions) Q4 2019 Q1 2020 Control Devices Operating Income 7.2$ 7.3$ Add: Pre-Tax Restructuring Costs 3.0 2.2 Add: Pre-Tax Business Realignment Costs 0.2 0.4 Control Devices Adjusted Operating Income 10.4$ 9.9$ Reconciliation of Control Devices Adjusted Operating Income (USD in millions) Q4 2019 Q1 2020 PST Operating Income (0.1)$ 0.9$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.4 (0.6) Add: Pre-Tax Business Realignment Costs 0.2 PST Adjusted Operating Income 0.4$ 0.4$ Reconciliation of Stoneridge Brazil Adjusted Operating Income (USD in millions) Q4 2019 Q1 2020 Electronics Operating Income 0.8$ 2.9$ Add: Pre-Tax Restructuring Costs 0.2 0.0 Add: Pre-Tax Business Realignment Costs 0.1 Electronics Adjusted Operating Income 1.0$ 2.9$ Reconciliation of Electronics Adjusted Operating Income

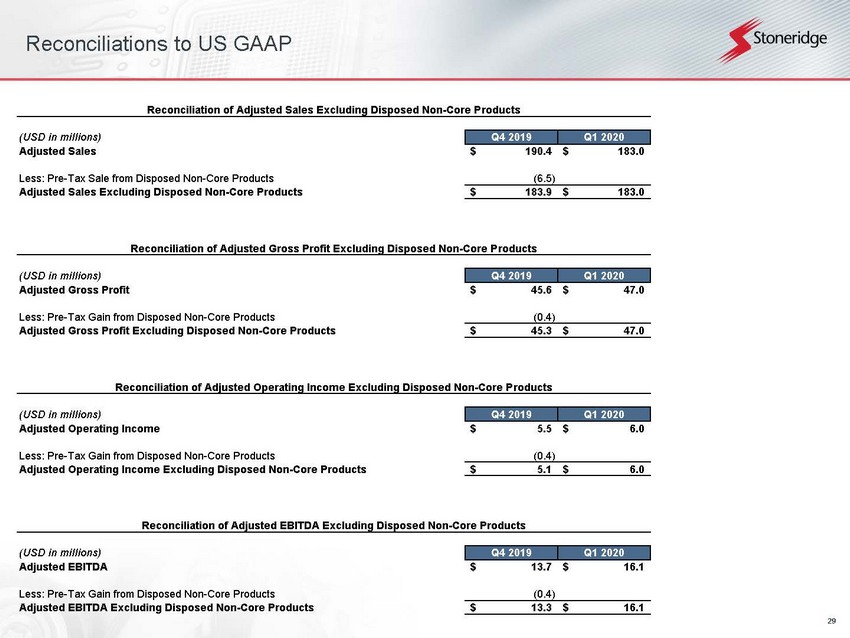

29 Reconciliations to US GAAP (USD in millions) Q4 2019 Q1 2020 Adjusted Sales 190.4$ 183.0$ Less: Pre-Tax Sale from Disposed Non-Core Products (6.5) Adjusted Sales Excluding Disposed Non-Core Products 183.9$ 183.0$ Reconciliation of Adjusted Sales Excluding Disposed Non-Core Products (USD in millions) Q4 2019 Q1 2020 Adjusted Gross Profit 45.6$ 47.0$ Less: Pre-Tax Gain from Disposed Non-Core Products (0.4) Adjusted Gross Profit Excluding Disposed Non-Core Products 45.3$ 47.0$ Reconciliation of Adjusted Gross Profit Excluding Disposed Non-Core Products (USD in millions) Q4 2019 Q1 2020 Adjusted Operating Income 5.5$ 6.0$ Less: Pre-Tax Gain from Disposed Non-Core Products (0.4) Adjusted Operating Income Excluding Disposed Non-Core Products 5.1$ 6.0$ Reconciliation of Adjusted Operating Income Excluding Disposed Non-Core Products (USD in millions) Q4 2019 Q1 2020 Adjusted EBITDA 13.7$ 16.1$ Less: Pre-Tax Gain from Disposed Non-Core Products (0.4) Adjusted EBITDA Excluding Disposed Non-Core Products 13.3$ 16.1$ Reconciliation of Adjusted EBITDA Excluding Disposed Non-Core Products

30 Reconciliations to US GAAP (USD in millions) Q4 2019 Q1 2020 Adjusted Operating Income 10.4$ 9.9$ Less: Pre-Tax Gain from Disposed Non-Core Products (0.4) Adjusted Operating Income Excluding Disposed Non-Core Products 10.0$ 9.9$ Reconciliation of Control Devices Adjusted Operating Income Excluding Disposed Non-Core Products (USD in millions) Q4 2019 Q1 2020 Adjusted Control Devices Sales 100.0$ 98.2$ Less: Sales from Disposed Non-Core Products (6.5) Adjusted Control Devices Sales Excluding Disposed Non-Core Products 93.5$ 98.2$ Reconciliation of Control Devices Adjusted Sales Excluding Disposed Non-Core Products