Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP | d919435dex991.htm |

| 8-K - 8-K - WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP | d919435d8k.htm |

Wabtec 1st Quarter 2020 Financial Results & Company Highlights May 4, 2020 Exhibit 99.2

Forward looking statements & non-GAAP financial information This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the acquisition by Wabtec of GE Transportation (the “GE Transportation merger”), statements regarding Wabtec’s expectations about future sales and earnings and statements about the impact of evolving global conditions on Wabtec’s business. All statements, other than historical facts, including statements synergies from the GE Transportation merger; statements regarding Wabtec’s plans, objectives, expectations and intentions; and statements regarding macro-economic conditions and evolving production and demand conditions; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) unexpected costs, charges or expenses resulting from the GE Transportation merger; (2) uncertainty of Wabtec’s expected financial performance; (3) failure to realize the anticipated benefits of the GE Transportation merger, including as a result of integrating GE Transportation into Wabtec; (4) Wabtec’s ability to implement its business strategy; (5) difficulties and delays in achieving revenue and cost synergies; (6) inability to retain and hire key personnel; (7) evolving legal, regulatory and tax regimes; (8) changes in general economic and/or industry specific conditions, including the impacts of tax and tariff programs, industry consolidation and changes in the financial condition or operating strategies of our customers; (9) changes in the expected timing of projects; (10) a decrease in freight or passenger rail traffic; (11) an increase in manufacturing costs; (12) actions by third parties, including government agencies; (13) the severity and duration of the evolving COVID-19 pandemic and the resulting impact on the global economy and, in particular, our customers, suppliers and end-markets; and (14) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. This presentation as well as Wabtec’s earnings release and 2020 financial guidance mention certain non-GAAP financial performance measures, including adjusted gross profit, [adjusted operating expenses,] adjusted income from operations, [adjusted interest and other expense, adjusted operating margin, adjusted income tax expense, adjusted effective tax rate, adjusted net income,] adjusted earnings per diluted share, EBITDA and adjusted EBITDA, and net debt. Wabtec defines EBITDA as [income from operations plus depreciation and amortization] [earnings before interest, taxes, depreciation and amortization]. While Wabtec believes these are useful supplemental measures for investors, they are not presented in accordance with GAAP. Investors should not consider non-GAAP measures in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have inherent material limitations as performance measures because they add back certain expenses incurred by the company to GAAP financial measures, resulting in those expenses not being taken into account in the applicable non-GAAP financial measure. Because not all companies use identical calculations, Wabtec’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Included in this presentation are reconciliation tables that provide details about how adjusted results relate to GAAP results. This presentation also presents a leverage ratio of [Debt to EBITDA][Net Debt to Adjusted EBITDA] for purposes of tracking compliance with the covenants in Wabtec’s Credit Agreement, which requires Wabtec to comply with a leverage ratio based on substantially similar performance metrics. Management uses this specific performance metric to measure Wabtec’s reduction in debt and other balance sheet liabilities and to assist in the appropriate allocation of capital. Net debt is defined as total debt less unrestricted cash and cash equivalents. See the reconciliations included in the Appendix for this presentation for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

Response to COVID-19 Protect health & safety of employees 1. Taking significant measures to protect our employees 2. Maintain operational capabilities Rail transportation deemed essential service Majority of Wabtec manufacturing sites remained open and operational throughout crisis Monitoring customer / supplier operations for disruptions Managing cash & preserving financial strength 3. Total available liquidity at end of 1Q20 was ~$1.2B Took actions post quarter to further enhance liquidity Actions to reduce working capital Delivering synergies & taking further cost actions Reducing capex by >40%; shrinking operational footprint and reducing headcount 4.

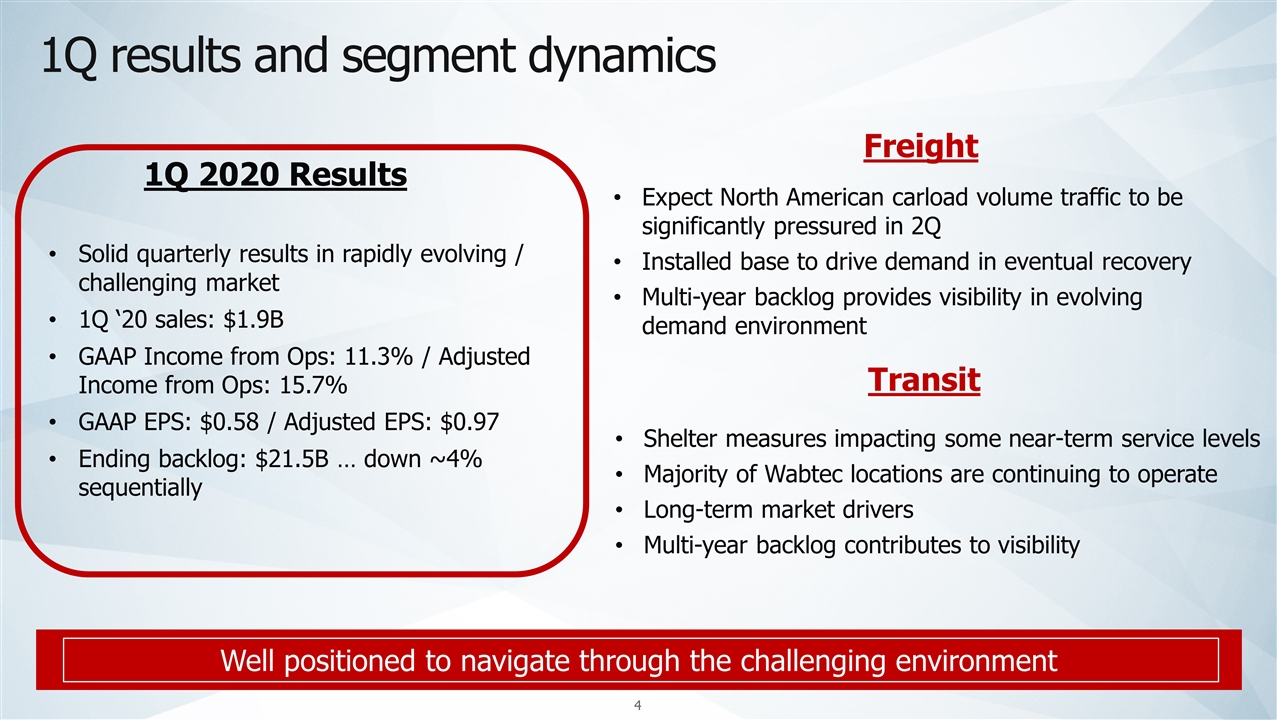

1Q results and segment dynamics Expect North American carload volume traffic to be significantly pressured in 2Q Installed base to drive demand in eventual recovery Multi-year backlog provides visibility in evolving demand environment Well positioned to navigate through the challenging environment Shelter measures impacting some near-term service levels Majority of Wabtec locations are continuing to operate Long-term market drivers Multi-year backlog contributes to visibility Transit Freight Solid quarterly results in rapidly evolving / challenging market 1Q ‘20 sales: $1.9B GAAP Income from Ops: 11.3% / Adjusted Income from Ops: 15.7% GAAP EPS: $0.58 / Adjusted EPS: $0.97 Ending backlog: $21.5B … down ~4% sequentially 1Q 2020 Results

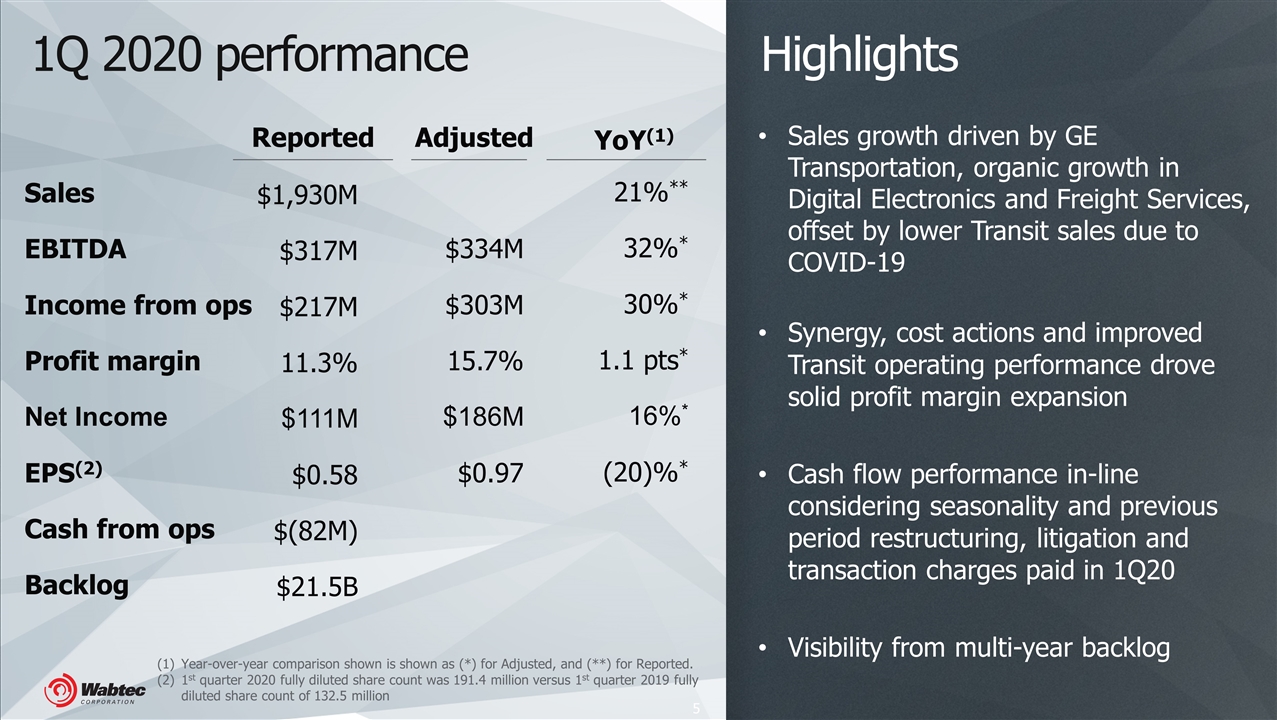

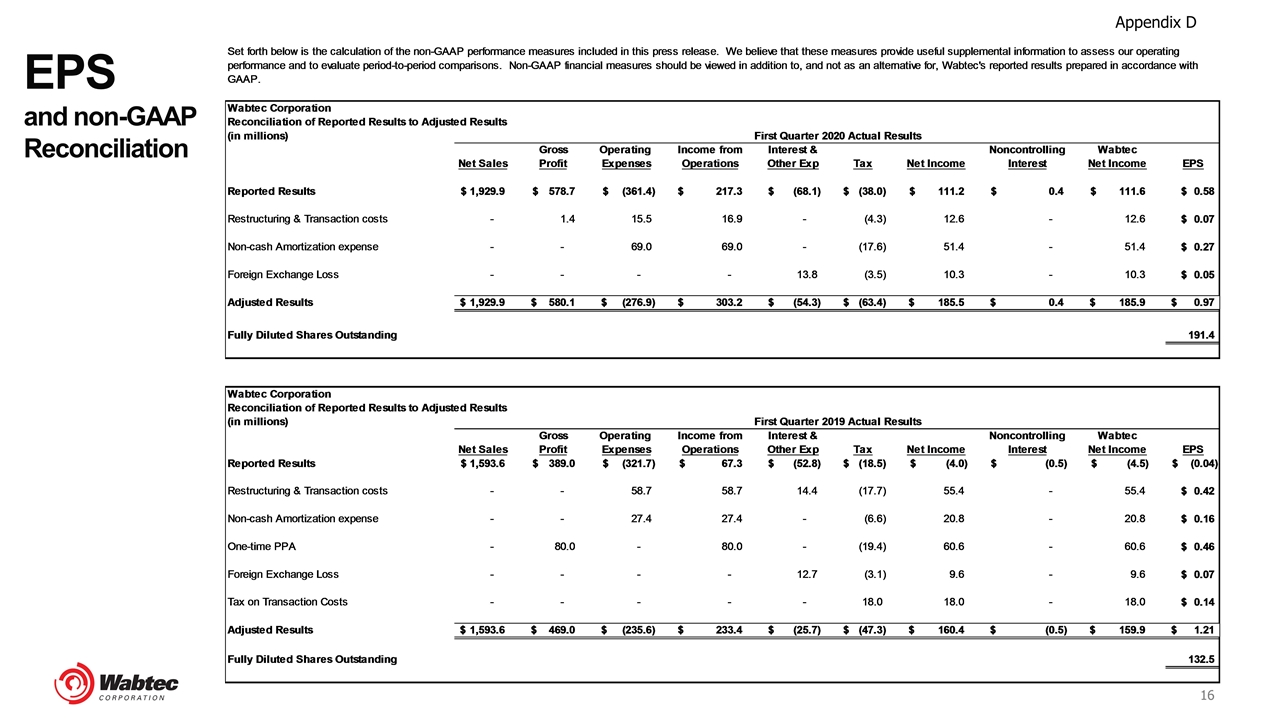

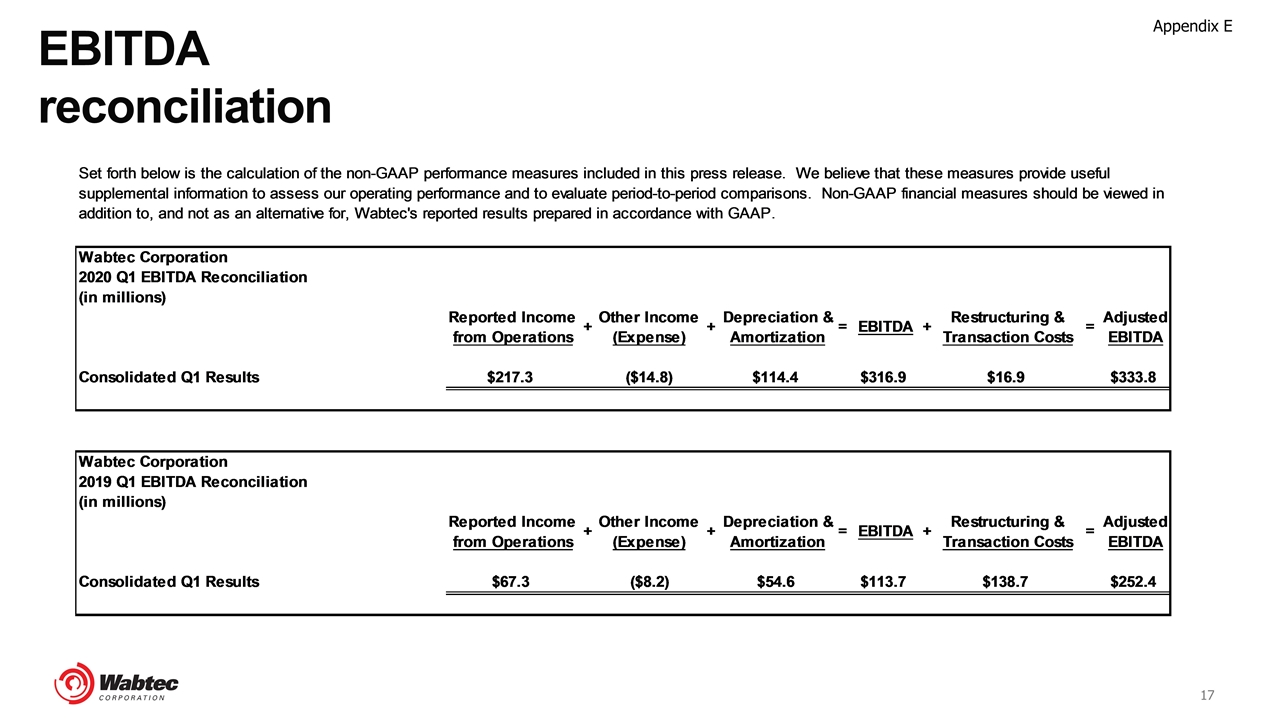

1Q 2020 performance Highlights Sales growth driven by GE Transportation, organic growth in Digital Electronics and Freight Services, offset by lower Transit sales due to COVID-19 Synergy, cost actions and improved Transit operating performance drove solid profit margin expansion Cash flow performance in-line considering seasonality and previous period restructuring, litigation and transaction charges paid in 1Q20 Visibility from multi-year backlog Sales EBITDA Income from ops Profit margin Net Income EPS(2) Cash from ops Backlog Reported $1,930M $317M $217M 11.3% $111M $0.58 $(82M) $21.5B YoY(1) 21%** 32%* 30%* 1.1 pts* 16%* (20)%* Adjusted $334M $303M 15.7% $186M $0.97 Year-over-year comparison shown is shown as (*) for Adjusted, and (**) for Reported. 1st quarter 2020 fully diluted share count was 191.4 million versus 1st quarter 2019 fully diluted share count of 132.5 million

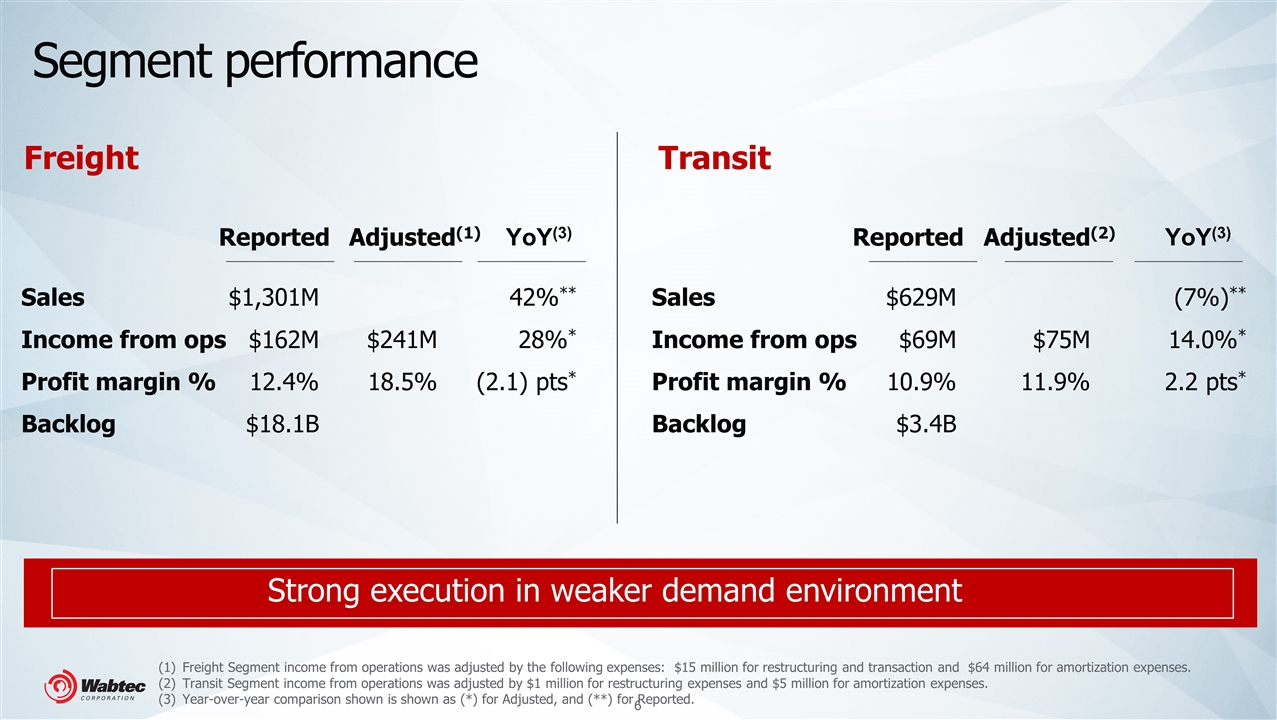

Segment performance Transit Sales Income from ops Profit margin % Backlog Adjusted(2) $75M 11.9% (7%)** 14.0%* 2.2 pts* Reported $629M $69M 10.9% $3.4B YoY(3) Freight Sales Income from ops Profit margin % Backlog Adjusted(1) $241M 18.5% Reported $1,301M $162M 12.4% $18.1B YoY(3) 42%** 28%* (2.1) pts* Strong execution in weaker demand environment Freight Segment income from operations was adjusted by the following expenses: $15 million for restructuring and transaction and $64 million for amortization expenses. Transit Segment income from operations was adjusted by $1 million for restructuring expenses and $5 million for amortization expenses. Year-over-year comparison shown is shown as (*) for Adjusted, and (**) for Reported.

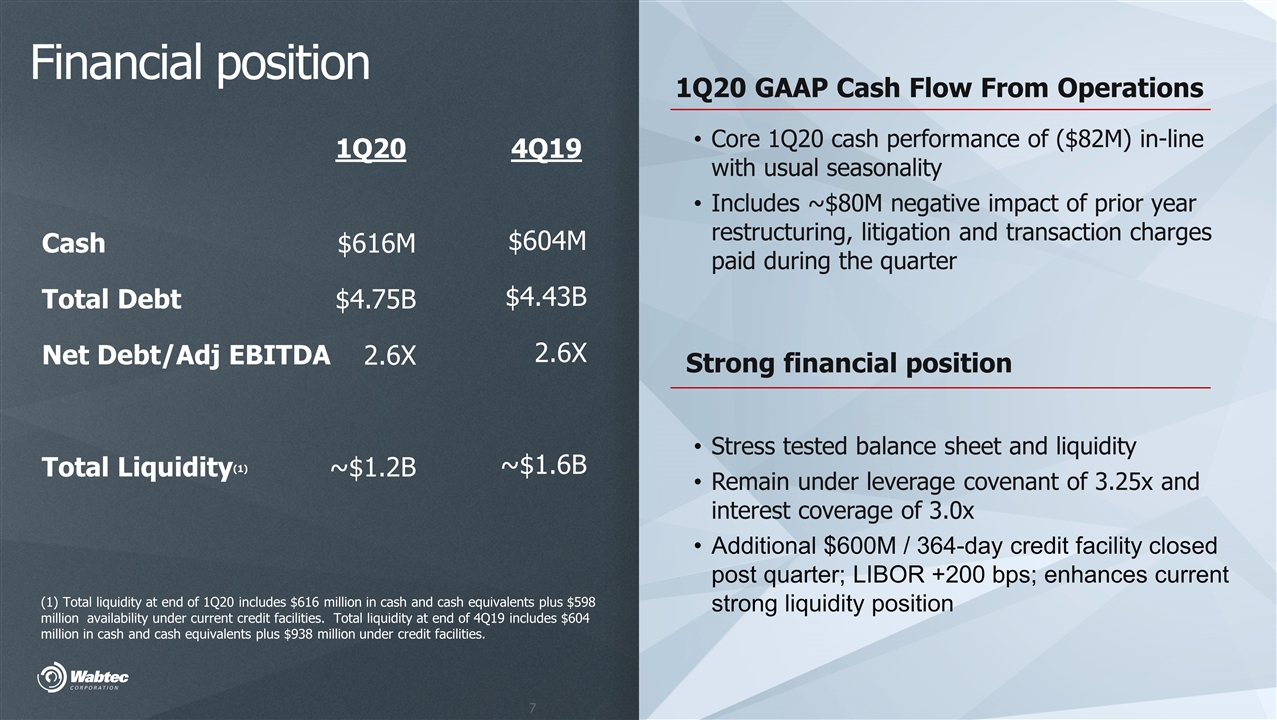

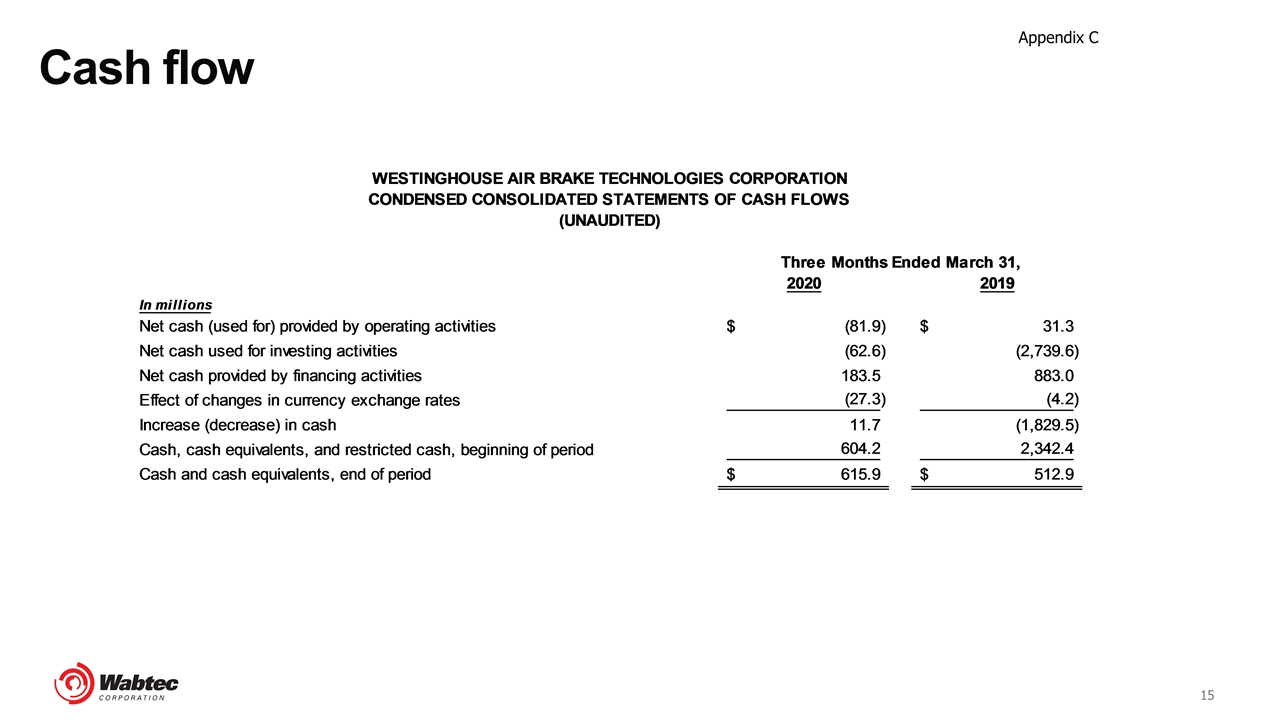

1Q20 4Q19 Cash Total Debt Net Debt/Adj EBITDA Total Liquidity(1) $616M $4.75B 2.6X ~$1.2B $604M $4.43B 2.6X ~$1.6B Financial position 1Q20 GAAP Cash Flow From Operations Core 1Q20 cash performance of ($82M) in-line with usual seasonality Includes ~$80M negative impact of prior year restructuring, litigation and transaction charges paid during the quarter Strong financial position Stress tested balance sheet and liquidity Remain under leverage covenant of 3.25x and interest coverage of 3.0x Additional $600M / 364-day credit facility closed post quarter; LIBOR +200 bps; enhances current strong liquidity position (1) Total liquidity at end of 1Q20 includes $616 million in cash and cash equivalents plus $598 million availability under current credit facilities. Total liquidity at end of 4Q19 includes $604 million in cash and cash equivalents plus $938 million under credit facilities.

Prudent cost actions Swiftly aligning operating costs with volume realities Committed to deliver synergy targets; driving reduction in SG&A Eliminated discretionary spend; suspended merit increases; hiring freeze since Jan 1 Managing cash flow Reducing working capital in-line with volumes Targeting >40% reduction in capex versus prior guidance of $200M Capital allocation prioritized on business & balance sheet strength Strong cash conversion Strong financial position Executing on plan to preserve financial flexibility Strong liquidity position No major debt maturities till June 2021 Decisive actions to strengthen the financial position

Summary Company performed well in 1Q despite unprecedented market conditions … leveraging significant installed base, scale and diversity of business Prudently managing cost and cash amidst volume environment … tightly managing structural costs Strong financial position … taking action to further enhance liquidity and strengthen balance sheet Proven leadership team delivering strong financial performance through challenging conditions Strong company fundamentals are a testament to Wabtec’s long-term strength

Appendix

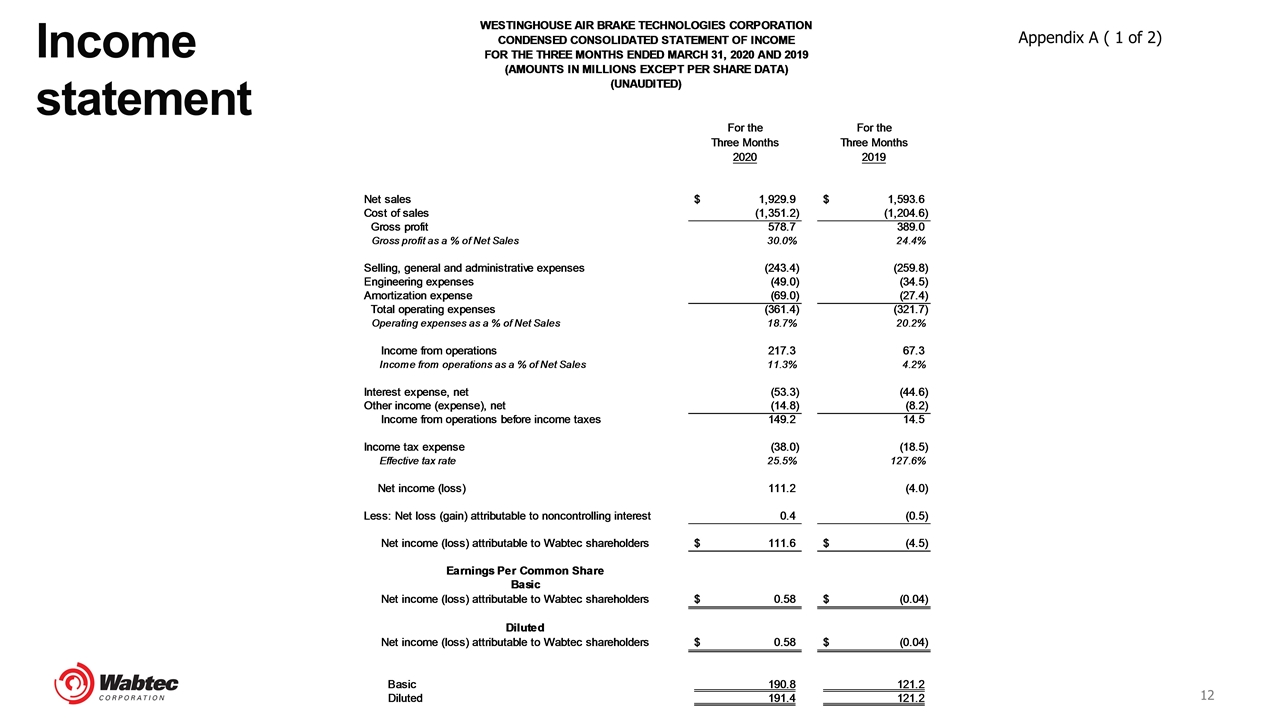

Income statement Appendix A ( 1 of 2)

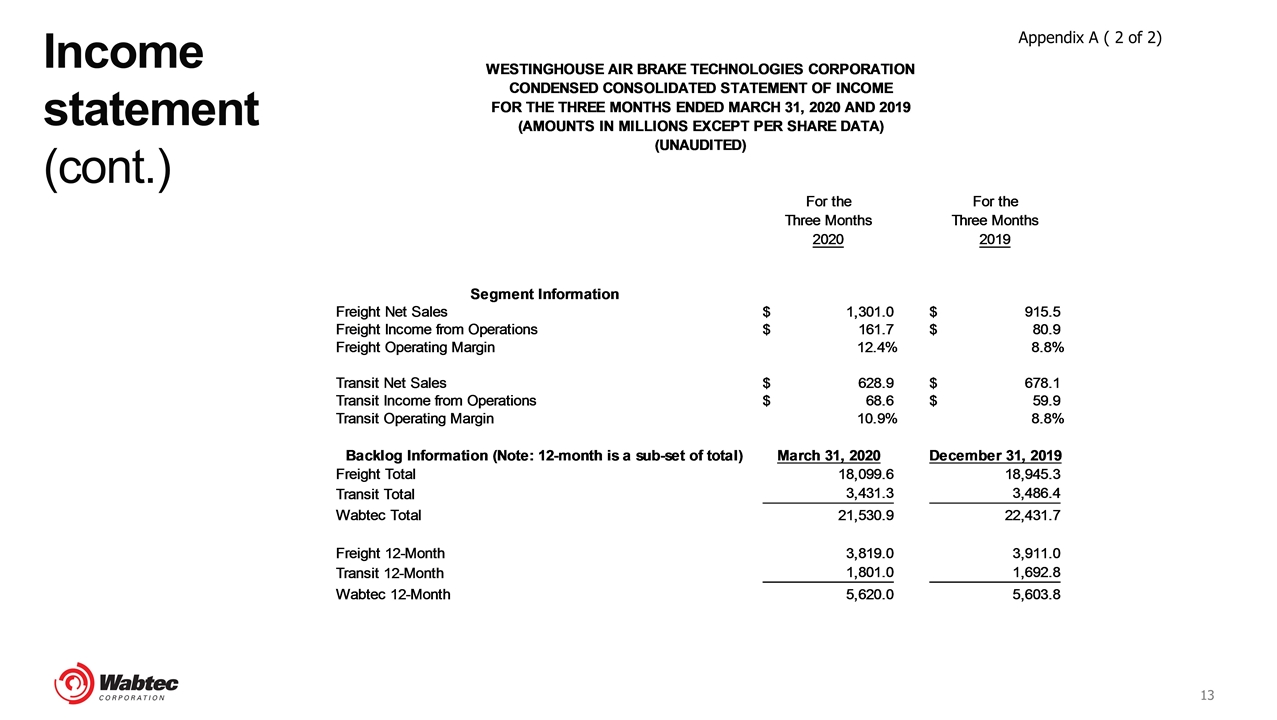

Income statement (cont.) Appendix A ( 2 of 2)

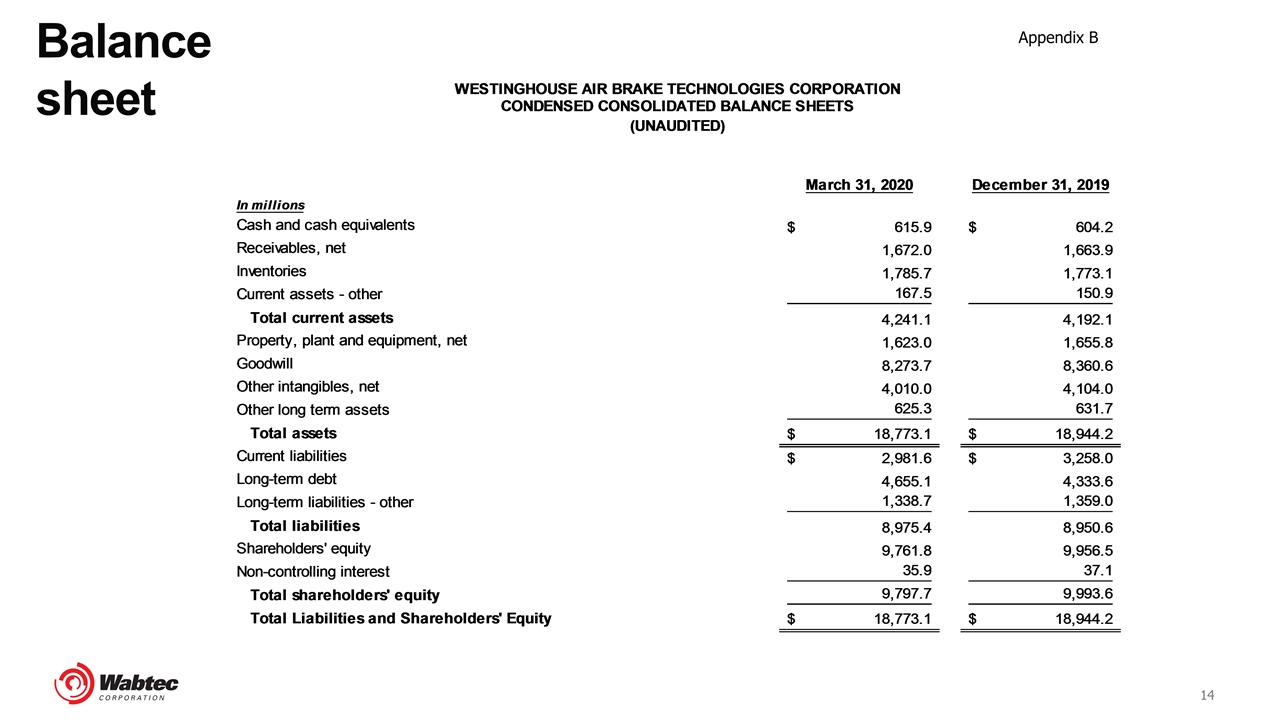

Balance sheet Appendix B

Cash flow Appendix C

EPS and non-GAAP Reconciliation Appendix D

EBITDA reconciliation Appendix E