Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Territorial Bancorp Inc. | tmb-20191231xex31d2.htm |

| EX-31.1 - EX-31.1 - Territorial Bancorp Inc. | tmb-20191231xex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2019

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001‑34403

Territorial Bancorp Inc.

(Name of Registrant as Specified in its Charter)

|

Maryland |

|

26‑4674701 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

1132 Bishop Street, Suite 2200, Honolulu, Hawaii |

|

96813 |

|

(Address of Principal Executive Office) |

|

(Zip Code) |

(808) 946‑1400

(Registrant’s Telephone Number including area code)

Securities Registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading symbol |

Name of each exchange on which registered |

|

Common stock |

TBNK |

The Nasdaq Stock Market LLC |

Securities Registered Under Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☒ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☒ |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided persuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act) ☐ Yes ☒ No

The aggregate value of the voting common equity held by nonaffiliates of the registrant, computed by reference to the closing price of the registrant’s shares of common stock as of June 30, 2019 ($30.90) was $269.9 million.

As of February 29, 2020, there were 9,686,048 shares outstanding of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

INDEX

| 2 | ||

|

|

|

|

|

|

||

|

|

|

|

| 3 | ||

| 7 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

20 | |

|

Certain Relationships and Related Transactions, and Director Independence |

21 | |

| 22 | ||

|

|

|

|

|

|

||

|

|

|

|

| 22 | ||

1

Territorial Bancorp Inc. (the “Company”) is filing this Amendment No. 1 on Form 10‑K/A to its Annual Report on Form 10‑K for the year ended December 31, 2019, as filed with the Securities and Exchange Commission on March 13, 2020. The Company would normally only include the information that is required to be filed pursuant to Part III of Form 10‑K in the proxy statement for the Annual Meeting of Stockholders. However, the Company is filing an amendment at this time due the Company’s determination to delay the Annual Meeting of Stockholders until June 11, 2020. Other than the inclusion of information for Part III of the Form 10‑K, the Form 10‑K remains unchanged.

2

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The Board of Directors of Territorial Bancorp Inc. is presently composed of seven members. The Board is divided into three classes, each with three-year staggered terms, with approximately one-third of the directors elected each year.

The table below sets forth certain information regarding our directors and executive officers. Shares beneficially owned include shares of common stock over which a person has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, none of the shares listed are pledged as security, and each of the named individuals has sole voting power and sole investment power with respect to the number of shares shown. Percentages of common stock owned are based on 9,658,548 shares of Company common stock issued and outstanding as of March 13, 2020.

|

Name |

|

Position(s) Held With |

|

Age |

|

Director |

|

Current |

|

Shares |

|

Percent of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOMINEES |

|||||||||||||

|

|

|||||||||||||

|

Howard Y. Ikeda |

|

Director |

|

74 |

|

1988 |

|

2020 |

|

40,300 |

(3) |

* |

|

|

David S. Murakami |

|

Director |

|

80 |

|

2006 |

|

2020 |

|

27,640 |

(4) |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTINUING DIRECTORS |

|||||||||||||

|

|

|||||||||||||

|

Allan S. Kitagawa |

|

Chairman of the Board, President and Chief Executive Officer |

|

74 |

|

1986 |

|

2021 |

|

232,014 |

(5) |

2.4 |

% |

|

John M. Ohama |

|

Director |

|

61 |

|

2019 |

|

2021 |

|

10,000 |

(6) |

* |

|

|

Kirk W. Caldwell |

|

Director |

|

67 |

|

2007 |

|

2022 |

|

65,724 |

(7) |

* |

|

|

Jennifer Isobe |

|

Director |

|

61 |

|

2018 |

|

2022 |

|

— |

|

* |

|

|

Francis E. Tanaka |

|

Director |

|

74 |

|

2011 |

|

2022 |

|

4,839 |

(8) |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS |

|||||||||||||

|

|

|||||||||||||

|

Vernon Hirata |

|

Vice Chairman, Co-Chief Operating Officer, General Counsel and Corporate Secretary |

|

67 |

|

|

|

|

|

183,031 |

(9) |

1.9 |

% |

|

Ralph Y. Nakatsuka |

|

Vice Chairman and Co-Chief Operating Officer |

|

64 |

|

|

|

|

|

193,194 |

(10) |

2.0 |

% |

|

Karen J. Cox |

|

Senior Vice President-Administration |

|

74 |

|

|

|

|

|

40,300 |

(11) |

* |

|

|

Richard K.C. Lau |

|

Senior Vice President and Chief Lending Officer |

|

77 |

|

|

|

|

|

65,202 |

(12) |

* |

|

|

Melvin M. Miyamoto |

|

Senior Vice President, Treasurer and Chief Financial Officer |

|

66 |

|

|

|

|

|

44,437 |

(13) |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Directors and Executive Officers as a Group (12 persons) |

|

|

|

|

|

906,681 |

|

9.4 |

% |

||||

* Less than 1%.

|

(1) |

As of December 31, 2019. |

|

(2) |

Includes service with Territorial Savings Bank. |

|

(3) |

Includes 3,200 shares held by an individual retirement account and 10,022 shares owned by Mr. Ikeda’s spouse. |

|

(4) |

Includes 900 shares held jointly by Mr. Murakami’s spouse and his children. |

|

(5) |

Includes 31,435 shares held through the Territorial Savings Bank 401(k) Plan, 11,695 shares held through the Territorial Savings Bank Employee Stock Ownership Plan, 10,000 shares owned by Mr. Kitagawa’s spouse and 7,554 restricted stock units. |

|

(6) |

All of such shares are owned by Mr. Ohama’s parent, with Mr. Ohama holding power of attorney to direct the investment of such shares. |

|

(7) |

Includes 31,497 exercisable stock options. |

|

(8) |

Includes 3,085 exercisable stock options. |

3

|

(9) |

Includes 42,969 shares held through the Territorial Savings Bank 401(k) Plan, 11,695 shares held through the Territorial Savings Bank Employee Stock Ownership Plan, 15,600 shares held in trust, 415 shares owned by Mr. Hirata’s spouse, 32,410 exercisable stock options and 3,224 restricted stock units. |

|

(10) |

Includes 1,695 shares held through the Territorial Savings Bank Employee Stock Ownership Plan, 26,870 exercisable stock options and 3,457 restricted stock units. |

|

(11) |

Includes 10,848 shares held through the Territorial Savings Bank 401(k) Plan, 10,488 shares held through the Territorial Savings Bank Employee Stock Ownership Plan and 500 shares held as trustee for two grandchildren. |

|

(12) |

Includes 13,018 shares held through the Territorial Savings Bank 401(k) Plan, 10,998 shares held through the Territorial Savings Bank Employee Stock Ownership Plan, 1,500 shares held by a corporation and 244 restricted stock units. |

|

(13) |

Includes 16,914 shares held through the Territorial Savings Bank 401(k) Plan, 10,011 shares held through the Territorial Savings Bank Employee Stock Ownership Plan and 192 restricted stock units. |

Directors

The business experience for at least the past five years of each of our directors is set forth below. The biographies of each of the board members below contain information regarding the person’s business experience and the experiences, qualifications, attributes, or skills that caused the Nominating Committee and the Board of Directors to determine that the person should serve as a director. Each director is also a director of Territorial Savings Bank. Unless otherwise indicated, directors and executive officers have held their positions for the past five years.

All of the directors are long-time residents of the communities served by Territorial Bancorp Inc. and its subsidiaries and many of such individuals have operated, or currently operate, businesses located in such communities. As a result, each director has significant knowledge of the businesses that operate in Territorial Bancorp Inc.’s market area, an understanding of the general real estate market, values and trends in such communities, and an understanding of the overall demographics of such communities. Additionally, as residents of such communities, each director has direct knowledge of the trends and developments occurring in such communities. As the holding company for a community banking institution, Territorial Bancorp Inc. believes that the local knowledge and experience of its directors assists Territorial Bancorp Inc. in assessing the credit and banking needs of its customers, developing products and services to better serve its customers, and assessing the risks inherent in its lending operations, and provides Territorial Bancorp Inc. with greater business development opportunities. As local residents, our directors are also exposed to the advertising, product offerings, and community development efforts of competing institutions which, in turn, assists Territorial Bancorp Inc. in structuring its marketing efforts and community outreach programs.

The following directors have terms ending at the 2020 annual meeting of stockholders:

Howard Y. Ikeda is the President of Ikeda and Wong, CPA, Inc., an independent public accounting firm in the State of Hawaii. Mr. Ikeda is a Certified Public Accountant licensed to practice in the State of Hawaii. He began his career with what is now KPMG LLP. In 1973, he founded Ikeda and Wong, which is now one of the largest independent accounting firms in Hawaii. Mr. Ikeda’s professional and business experience provide the Board of Directors with valuable insight into the accounting issues Territorial Bancorp Inc. faces and in assessing strategic transactions involving Territorial Bancorp Inc. and Territorial Savings Bank. His employment experience and experience as a Certified Public Accountant qualifies him to be a member of the Audit Committee as a “financial expert” for purposes of the rules and regulations of the Securities and Exchange Commission.

David S. Murakami was a Certified Residential Appraiser in the State of Hawaii, and was the owner of DSM Appraisal Company from 1982 until 2011, when he retired. His firm focused on appraising residential real property. Mr. Murakami previously worked as a Senior Vice President-Loan Administrator with financial institutions in the State of Hawaii beginning in 1962. Mr. Murakami’s business experience, both with financial institutions and as a Certified Residential Appraiser, gives him extensive insights into Territorial Savings Bank’s challenges and opportunities in its overall operations and lending activities. He is also well-known in the local community as he was a long-time assistant coach for the highly visible University of Hawaii-Manoa baseball program.

4

The following directors have terms ending in 2021:

Allan S. Kitagawa has served as Chairman of the Board and Chief Executive Officer of Territorial Savings Bank since 1986, and was named President in 2007. Mr. Kitagawa worked for American Savings and Loan Association from 1974 to 1986, including service as Executive Vice President and Chief Executive Officer of the Hawaii Division. Mr. Kitagawa was a Certified Public Accountant who began his career with what is now KPMG LLP. Under Mr. Kitagawa’s leadership, Territorial Savings Bank has grown significantly while the Bank’s conservative lending practices have resulted in continued low levels of nonperforming assets.

John M. Ohama is the Principal Broker for Honolulu Land Company, LLC, a firm he founded in 2012. His firm is engaged in the sale of real estate in Hawaii, with some property management services, with such activity primarily in residential real estate sales. Prior to founding his current firm, he was, for almost six years, the co-owner of another real estate firm, where he was the broker-in-charge of the sales side of the firm that also conducted property management. Prior to this co-venture, Mr. Ohama was the owner and principal of a larger real estate sales firm for over two decades that represented buyers and sellers of mostly residential real estate. That firm also conducted commercial real estate transactions and property management. He has served, for eight years, on the Hawaii State Real Estate Commission, the state entity that oversees the real estate brokers and salespeople in Hawaii. He was appointed by two different Governors of the State of Hawaii and served as its chair for five of those years. He also remains an active member of the Honolulu Board of Realtors and has served in various capacities on their ethics and professional responsibility committees. Mr. Ohama’s daily involvement in residential real estate provides the Board of Directors with significant insight into the activity that constitutes the significant majority of Territorial Savings Bank’s lending activities.

The following directors have terms ending in 2022:

Kirk W. Caldwell was re-elected Mayor of the City and County of Honolulu in 2016. He was first elected Mayor in 2012. He previously held this position as acting Mayor from July 2010 to October 2010. Mr. Caldwell served as Managing Director of the City and County of Honolulu, Hawaii, from January 2009 until July 2010. Mr. Caldwell was Of Counsel to the law firm of Ashford & Wriston from 2011 until December 31, 2012, where he had worked from 1984 until 2009, including as partner. Much of his practice consisted of representing financial institutions, including Territorial Savings Bank. Prior to his appointment as Managing Director of the City and County of Honolulu, Mr. Caldwell also served as the majority leader of the State of Hawaii House of Representatives, and had served as a state representative since 2002. Mr. Caldwell provides the Board of Directors with a significant understanding of the communities in which we operate. Moreover, his experience as an attorney that represented financial institutions continues to provide value to the Board since the Bank is regulated by both the state and federal banking regulators.

Francis E. Tanaka retired as the Executive Vice President – Controller of Haseko (Hawaii), Inc., the U.S. subsidiary of a large Japanese publicly-traded company that is in the engineering, construction, real estate development, investment, and property management business throughout the world. For 18 years, Mr. Tanaka was in charge of the financial management of the Hawaii subsidiary, which still does residential, office, and commercial development in Hawaii. For a portion of Mr. Tanaka’s career at Haseko (Hawaii), he supervised the preparation of financial statements for a Securities and Exchange Commission-registered real estate venture of the Hawaii subsidiary. Prior to Haseko (Hawaii), he was the controller of a Hawaii construction company. He was a Certified Public Accountant and was employed by national and local certified public accounting firms early in his career. He continues to provide the Board with knowledge of real estate development in Hawaii and of Japanese companies doing business in Hawaii.

Jennifer Isobe is a principal with the Hawaii accounting firm, KKDLY LLC, which is one of the largest Hawaii accounting firms. Prior to joining KKDLY LLC in 2014, she was a senior audit manager at KPMG LLP. During the course of her career, she has had many clients that have been registered with or were subsidiaries of companies registered with the Securities and Exchange Commission. She has also been part of the audit team for several large Hawaii nonprofit entities, including the largest multi-billion dollar trust in Hawaii and one of the largest non-profit hospitals in Hawaii. She has served on the board of a number of large non-profit organizations and is very active in the business community in Hawaii. She is a Certified Public Accountant in Hawaii. Her presence adds depth to the financial expertise on the Board and, as an active practitioner, adds to the Board’s knowledge on current accounting

5

developments. In addition, her experience qualifies her to be a member of the Audit Committee as a “financial expert” for purposes of the rules and regulations of the Securities and Exchange Commission.

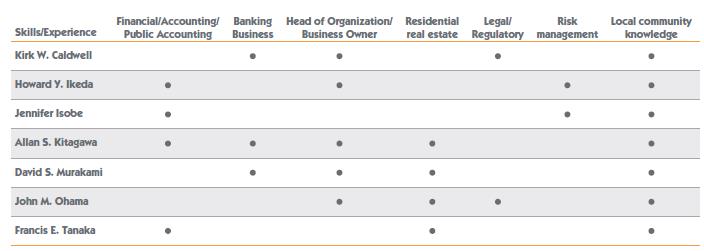

The following table describes our directors’ qualifications and experience.

Information about Executive Officers

The following provides information regarding our executive officers who are not directors of the Company.

Vernon Hirata has served as Territorial Savings Bank’s Vice Chairman, Co-Chief Operating Officer, General Counsel and Corporate Secretary since 2007. Mr. Hirata joined Territorial Savings Bank in 1986 as Senior Vice President/General Counsel, and was named Executive Vice President/General Counsel and Corporate Secretary in 1987. Previously, Mr. Hirata was employed at American Savings and Loan Association from 1978 to 1986, including service as Senior Vice President and Staff Attorney.

Ralph Y. Nakatsuka joined Territorial Savings Bank in 2007 as Vice Chairman and Co-Chief Operating Officer, and was employed at American Savings Bank from 1980 to 2007, including service as Executive Vice President of Lending and Chief Lending Officer from 1997 to 2007 and Chief Financial Officer from 1987 to 1997. Mr. Nakatsuka is a Certified Public Accountant.

Karen J. Cox has served as Senior Vice President of Administration of Territorial Savings Bank since 1984, and has been employed by Territorial Savings Bank since 1968. Ms. Cox is in charge of various areas, including human resources, information technology, and branch development and maintenance. Ms. Cox previously worked with other financial institutions in the State of Hawaii beginning in 1964.

Richard K.C. Lau has served as Senior Vice President and Chief Lending Officer of Territorial Savings Bank since 1985. Mr. Lau was employed at other financial institutions in the State of Hawaii beginning in 1970.

Melvin M. Miyamoto was named Chief Financial Officer in June 2015, having served as Senior Vice President and Treasurer of Territorial Savings Bank since 1986, and has been employed by Territorial Savings Bank since 1984. Mr. Miyamoto is a Certified Public Accountant.

Delinquent Section 16(a) Reports

Our executive officers and directors, and beneficial owners of greater than 10% of our outstanding shares of common stock are required to file reports with the Securities and Exchange Commission disclosing beneficial ownership and changes in beneficial ownership of our common stock. Securities and Exchange Commission rules require disclosure if an executive officer, director, or 10% beneficial owner fails to file these reports on a timely basis.

6

Based solely on the review of copies of the reports we have received and written representations provided to us from the individuals required to file the reports, each of our executive officers other than Ms. Cox filed a late form 4 to report the withholding of shares of common stock to pay for taxes, and we believe that each of our executive officers and directors otherwise complied with applicable reporting requirements for transactions in Territorial Bancorp Inc. common stock during the year ended December 31, 2019.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that is designed to promote the highest standards of ethical conduct by our directors, executive officers, and employees. The Code of Ethics and Business Conduct requires that our directors, executive officers, and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in our best interest. Under the terms of the Code of Ethics and Business Conduct, directors, executive officers, and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Ethics and Business Conduct. A copy of the Code of Ethics and Business Conduct can be found in the “About Us—Investor Relations—Corporate Governance” section of our website, www.territorialsavings.net. Amendments to and waivers from our Code of Ethics and Business Conduct will be disclosed in the “About Us—Investor Relations—Corporate Governance” section of our website.

As a mechanism to encourage compliance with the Code of Ethics and Business Conduct, we have established procedures to receive, retain, and treat complaints regarding accounting, internal accounting controls, and auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Business Conduct also prohibits us from retaliating against any director, executive officer, or employee who reports actual or apparent violations of the Code of Ethics and Business Conduct.

In addition, we have adopted a Code of Ethics for Senior Officers that is applicable to our senior financial officers, including our principal executive officer, principal financial officer, principal accounting officer, and all officers performing similar functions. A copy of the Code of Ethics for Senior Officers can be found in the “About Us—Investor Relations—Corporate Governance” section of our website, www.territorialsavings.net. Amendments to and waivers from our Code of Ethics for Senior Officers will be disclosed in the “About Us—Investor Relations—Corporate Governance” section of our website.

Procedures for the Recommendation of Director Nominees by Stockholders

There have been no changes to the procedures by which stockholders can recommend nominees to the Board of Directors since such procedures were previously disclosed in the Company’s Proxy Statement for its 2019 Annual Meeting of Stockholders.

Audit Committee

The Audit Committee is comprised of Directors Ikeda, Ohama, Murakami and Isobe. In addition to meeting the independence requirements of the NASDAQ Stock Market, Inc., each member of the Audit Committee meets the audit committee independence requirements of the Securities and Exchange Commission. The Board of Directors has designated Directors Ikeda and Isobe as audit committee financial experts under the rules of the Securities and Exchange Commission.

ITEM 11. EXECUTIVE COMPENSATION

Director Fees

Each of Territorial Savings Bank’s outside directors receives an annual retainer for board meetings of $32,650 per year and an annual retainer for committee meetings of $2,450 per year. Each of Territorial Bancorp Inc.’s outside directors

7

receives an annual retainer for board meetings of $5,100 per year and an annual retainer for committee meetings of $615 per year. The retainer fees are increased to the following amounts for the following committees: the Chairman of Territorial Savings Bank’s Audit Committee receives a committee retainer of $2,650 and the Chairman of Territorial Bancorp Inc.’s Audit Committee receives a committee retainer of $8,570; the Chairman of Territorial Savings Bank’s Compensation Committee receives a committee retainer of $4,900; and the Chairman of Territorial Bancorp Inc.’s Compensation Committee receives a committee retainer of $1,225. Receipt of full retainer payments is based upon a director attending at least 75% of board or committee meetings, as applicable, with reductions for the failure to attend such number of board or committee meetings.

The following table sets forth for the year ended December 31, 2019, certain information as to the total remuneration we paid to our directors. Mr. Kitagawa does not receive separate fees for service as a director.

|

Director Compensation Table for the Year Ended |

|

||||||

|

Name |

|

Fees earned or paid |

|

All other |

|

Total ($) |

|

|

David S. Murakami |

|

40,812 |

|

— |

|

40,812 |

|

|

Richard I. Murakami (1) |

|

27,208 |

|

— |

|

27,208 |

|

|

Howard Y. Ikeda |

|

48,960 |

|

11,780 |

(2) |

60,740 |

|

|

Kirk W. Caldwell |

|

43,872 |

|

— |

|

43,872 |

|

|

Francis E. Tanaka |

|

40,812 |

|

— |

|

40,812 |

|

|

Jennifer Isobe |

|

40,812 |

|

— |

|

40,812 |

|

|

John M. Ohama |

|

11,700 |

|

— |

|

11,700 |

|

|

(1) |

Mr. Richard Murakami retired from the board of directors on August 28, 2019. |

|

(2) |

Consists of participation fees in two charitable sporting events. |

At December 31, 2019, Directors Ikeda and Caldwell had 11,275 and 31,497 vested but unexercised stock options, respectively, each with an exercise price of $17.36 per option. Director Tanaka had 3,085 vested but unexercised stock options with an exercise price of $23.62 per option.

The Company has no stock ownership guidelines for directors. However, for previous grants under our 2010 Equity incentive Plan each director must retain an amount equal to 50% of each restricted stock or stock option award (net of taxes) until their service on the Board ends.

Narrative Discussion of Executive Compensation

We qualify as a "smaller reporting company" under revised rules of the Securities and Exchange Commission. As a result, we are not required to provide a compensation discussion and analysis in this Proxy Statement. Instead, we are providing this Narrative Discussion of Executive Compensation in order to summarize key aspects of our executive compensation programs, policies and pay decisions related to the “Named Executive Officers” as defined below.

This discussion describes our 2019 executive compensation program and pay decisions. Our compensation program and practices are designed to reward our executives based on our performance against our short- and long-term goals in a risk appropriate manner that enhances the long-term value of the Company. The following pages explain the process, objectives, and structure of the executive compensation decisions undertaken by our Compensation Committee and our Board of Directors during 2019, as well as provide some historical perspective on our evolving pay program.

8

For 2019, our Named Executive Officers are:

|

Name |

|

Title |

|

Allan S. Kitagawa |

|

Chairman of the Board, President, and Chief Executive Officer |

|

Vernon Hirata |

|

Vice Chairman, Co-Chief Operating Officer, General Counsel, and Corporate Secretary |

|

Ralph Y. Nakatsuka |

|

Vice Chairman and Co-Chief Operating Officer |

Company Background and Performance Highlights

Territorial Savings Bank has been serving customers in our Hawaii market for nearly one hundred years. We are a traditional thrift institution that focuses on retail customers, including originating long-term, fixed-rate residential mortgage loans. Well over half of our deposits are savings deposits (as opposed to certificates of deposit or checking accounts), and over 95% of our loan portfolio consists of fixed-rate residential mortgage loans. Our objective is to provide key banking services at a reasonable price to our customers, while growing organically. We also recognize our responsibility to provide a reasonable return to our stockholders.

|

· |

In 2019, we paid two special dividends in addition to our quarterly dividends. The special dividends totaled $0.60 per share and the total dividends paid for the year were $1.49 per share. |

|

· |

Since going public, we have paid 40 consecutive quarterly dividends. |

|

· |

Net income increased 14.5% to $22.00 million for the year ended December 31, 2019 compared to $19.21 million for the year ended December 31, 2018. |

|

· |

The Company did not have any delinquent mortgage loans 90 days past due and not accruing at December 31, 2019. Mortgage loans represent over 95% of Territorial Savings Bank’s loans. |

|

· |

Our total shareholder return was 25.24% during 2019. |

2019 Compensation Program Summary

Our executive compensation program has evolved following our conversion from a mutual ownership structure to a more mature publicly traded institution.

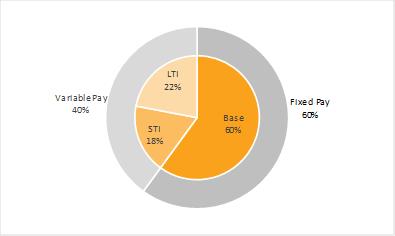

In 2019, similar to prior years, a significant portion of our Named Executive Officers’ pay was provided in the form of performance-based incentives. For the Named Executive Officers, our long-term incentive program represented 55% of total variable pay based on long-term performance and 45% based on annual performance objectives. This mix was designed to support our focus on long-term profitability results. The pie chart below illustrates our average target total compensation mix for the Named Executive Officers.

9

Our incentive performance metrics are designed to reward profitability and return to our stockholders that preserves our focus on strong credit portfolio. Below is a summary of the measures and weights for our annual and long-term incentive programs.

|

Performance Plan |

|

Goal |

|

Weighting Per Plan |

|

Annual Incentive Plan (cash) |

|

Net Income |

|

60% |

|

|

Return on Average Assets |

|

20% |

|

|

|

Non-Performing Assets/Total Assets |

|

20% |

|

|

|

|

|

|

|

|

Long-Term Incentive Program(equity) |

|

Return on Equity |

|

80% |

|

|

Total Shareholder Return |

|

20% |

The total compensation for 2019 set forth in the Summary Compensation Table for our Named Executive Officers includes grants of restricted stock units. The following summarizes the key features of our annual and long-term incentive programs.

|

· |

Our Long-Term Incentive Program (“LTIP”) consists of 50% performance units that vest based on pre-defined three-year performance goals and 50% granted as time-vested units that vest over a three-year period. Our cash-based LTIP awards phased out in 2018. |

|

· |

Our LTIP vests based on our return on average equity (“ROAE”) and total stockholder return (“TSR”) relative to an objective industry index (i.e. SNL Thrift Index). We believe this is a better representation of our investors’ view of our performance and eliminates the challenges relative to the changing size of the peer group over a three-year period due to industry consolidation. |

|

· |

Our LTIP performance metrics are measured over a three-year period. |

|

· |

Our Annual Incentive Plan (“AIP”) is based on absolute performance goals primarily based on our budget and pre-approved by the Compensation Committee. The 2019 AIP had three measures: net income, return on average assets (“ROAA”), and asset quality (non-performing assets/assets). |

Our Compensation Philosophy and Program Components

Our Compensation Committee is responsible for establishing and monitoring our compensation philosophy and programs. Key Objectives of our Compensation Program include:

|

· |

Rewarding executives for sustained high-level performance that delivers long-term value to our stockholders. |

|

· |

Ensuring our executives have a significant equity interest in the Company through robust equity ownership and retention guidelines. |

|

· |

Achieving the proper balance between incentive compensation and maintaining an appropriate risk profile. |

|

· |

Retaining a seasoned management team who have been through the various real estate cycles in Hawaii. |

2019 Base Salary Decisions

The Compensation Committee reviews base salaries annually and adjusts them from time to time to align with competitive market levels, as well as individual responsibilities, performance, and experience.

The Compensation Committee considers the recommendation of Mr. Kitagawa (for all executives other than himself) in making base salary adjustments. The base salary for Mr. Kitagawa is recommended by the Compensation Committee and approved by the full Board of Directors.

10

Based on the Compensation Committee’s review, the following base salaries were approved and effective January 1, 2019. Mr. Hirata’s and Mr. Nakatsuka’s salaries increased by 3%. For the sixth consecutive year, Mr. Kitagawa again requested that he not receive an increase in salary.

In addition, because of concerns related to the recent outbreak of the coronavirus, the Named Executive Officers have requested that they not be given increases in base salaries for 2020.

Base salaries for each of the Named Executive Officers are shown in the tables below.

|

Name |

|

2018 |

|

2019 and |

|

% Change |

|

|

Allan S. Kitagawa |

|

851,124 |

|

851,124 |

|

0 |

% |

|

Vernon Hirata |

|

337,454 |

|

347,578 |

|

3 |

% |

|

Ralph Y. Nakatsuka |

|

337,454 |

|

347,578 |

|

3 |

% |

2019 Annual Incentive Plan

The AIP is designed to motivate senior executives to attain superior annual performance in key areas that we believe create long-term value to us and our stockholders. Awards under the AIP are determined based upon absolute performance metrics usually contained in the business plan, adopted by the Board of Directors and selected by the Compensation Committee.

All Named Executive Officers had a threshold, target and stretch opportunity as shown below. Target opportunities are conservative relative to market median to place more focus on long-term compensation.

|

Named Executive Officer |

|

Threshold |

|

Target |

|

Maximum |

|

|

Allan S. Kitagawa |

|

15 |

% |

30 |

% |

45 |

% |

|

Vernon Hirata |

|

15 |

% |

30 |

% |

45 |

% |

|

Ralph Y. Nakatsuka |

|

15 |

% |

30 |

% |

45 |

% |

The Compensation Committee selected net income, ROAA and non-performing assets/assets (“NPA”) as the quantitative corporate performance factors for the 2019 AIP. ROAA is a profitability measure while the NPA ratio reinforces our goal of maintaining strong credit quality. A lower NPA ratio mitigates the risk of lowering loan underwriting standards to increase loan production through increased residential mortgage loan volume.

The table below provides the performance required for payouts at the threshold, target and maximum levels, performance level achieved and the resulting payout.

|

2019 AIP Performance Goals |

||||||||||||

|

Measure |

|

Weighting |

|

Threshold |

|

Target |

|

Maximum |

|

|||

|

Net Income (thousands) |

|

60 |

% |

$ |

15,300 |

|

$ |

17,000 |

|

$ |

18,700 |

|

|

ROAA |

|

20 |

% |

|

0.73 |

% |

|

0.81 |

% |

|

0.89 |

% |

|

Non-performing assets/total assets (1) |

|

20 |

% |

|

0.32 |

% |

|

0.26 |

% |

|

0.21 |

% |

|

Payout Range (% of target) |

|

100 |

% |

|

50 |

% |

|

100 |

% |

|

150 |

% |

|

(1) |

Lower levels of non-performing assets/total assets represent better performance. |

11

Performance for 2019 resulted in the following payouts:

|

Measure |

|

Weight |

|

2019 Results |

|

Performance (as % of |

|

|

|

Net Income (thousands) |

|

60 |

% |

$ |

20,012 |

* |

150 |

% |

|

ROAA |

|

20 |

% |

|

0.96 |

%* |

150 |

% |

|

Non-performing assets/total assets |

|

20 |

% |

|

0.04 |

% |

150 |

% |

|

Total (weighted) |

|

100 |

% |

|

|

|

150 |

% |

*The Compensation Committee excluded a one-time gain from the sale of impaired trust preferred securities from the 2019 net income results and the calculation of the ROAA.

The Compensation Committee chose to use NPA ratios from the 2018 performance goals as the same goals for 2019 since it continues to represent superior performance. The Committee believed that the prior goal still reflected the importance of maintaining a low level NPAs but with a targeted ratio closer to our ratio for previous years (e.g. NPA ratio for previous five years was 0.22%).

Performance on these measures resulted in a payout of 150% of the target level and resulted in payments to the NEOs of $383,006 for Mr. Kitagawa and $156,410 for each of Messrs. Hirata and Nakatsuka.

LTIP Program

Beginning in 2017, the Compensation Committee changed the LTIP from cash to equity in response to stockholder feedback and best practices. The current program has been the same since 2017 and consists of performance-based restricted stock units and time-vested restricted stock units, each weighted at 50%.

Each participant had an annual target award opportunity (defined as a percentage of base salary at the start of the grant cycle) that reflects a competitive total compensation package for their role. Threshold performance earns 18.3% of base salary, target earns 36.6% of base salary and stretch performance earns 55% of base salary. These values were based on a maximum of award of 55% with threshold equivalent to 50% of maximum and target mid-way between threshold and stretch.

LTIP awards are allocated as follows:

|

· |

Performance-vested Restricted Stock Units - PRSUs (50% of target award value) are intended to reward future performance (i.e. 2019 to 2021); awards will vest based on achievement of pre-defined performance goals. Grants are earned and cliff vest after three years based on actual performance. PRSUs will vest within 120 days after the end of each performance period (once performance can be calculated and reviewed and approved by the Committee). |

|

· |

Time-vested Restricted Stock Units - TRSUs (50% of target awards) reinforce retention and share ownership/alignment with stockholders as well as provide reward for contributions/performance. Grants vest ratably over three years. |

The table below reflects the performance metrics selected for the PRSUs for the 2019 to 2021 performance cycle and resulting payout/vesting. Performance was measured based on our performance relative to financial institutions included in the SNL US Thrift Indices with assets between $1 billion and $10 billion.

|

Measure |

|

Weight |

|

Threshold |

|

Target |

|

Stretch |

|

3‑year TSR– Relative to index |

|

20% |

|

35th Percentile |

|

55th Percentile |

|

75th Percentile |

|

3‑year Avg. Return on Average Equity – Relative to index |

|

80% |

|

35th Percentile |

|

55th Percentile |

|

75th Percentile |

|

Payout Range (% of Target) |

|

100% |

|

50% |

|

100% |

|

150% |

12

2017 to 2019 LTIP Performance Results

PRSUs are granted at the start of each performance period. For this LTIP cycle, the performance period ran from January 1, 2017 to December 31, 2019. The vesting (i.e. earning) of the award was contingent on actual performance of pre-defined measures at the end of the performance period (i.e. third year).

In order for PRSUs to be vested/earned, performance must be at or above the threshold performance set by the Committee. Actual vesting after three years was interpolated on a straight-line basis between threshold, target and stretch to reward incremental performance. Vesting will range from 50% of target for achieving threshold performance and 150% of target for achieving stretch performance.

The table below reflects the performance metrics selected for the PRSUs for the 2017 to 2019 performance cycle and resulting payout/vesting. Performance was measured based on our performance relative to financial institutions included in the SNL US Thrift Index with assets between $1 billion and $10 billion.

|

Measure |

|

Wt. |

|

Threshold |

|

Target |

|

Stretch |

|

Actual |

|

Payout as % |

|

3‑year TSR-Relative to Industry Index |

|

20% |

|

35th Percentile |

|

55th Percentile |

|

75th Percentile |

|

40th Percentile (62.5%) |

|

12.5% |

|

3‑year Average Return on Average Equity- Relative to Industry Index |

|

80% |

|

35th Percentile |

|

55th Percentile |

|

75th Percentile |

|

55th Percentile (100%) |

|

80% |

|

Payout Range (% of Target) |

|

100% |

|

50% |

|

100% |

|

150% |

|

|

|

92.5% |

Based on the performance above, the Committee awarded the performance RSUs below to the Named Executive Officers.

|

Name |

|

2017 – 2019 |

|

Payout as % of |

|

Earned Shares |

|

Kitagawa |

|

4,971 |

|

92.5 |

% |

4,598 |

|

Hirata |

|

1,876 |

|

92.5 |

% |

1,735 |

|

Nakatsuka |

|

1,876 |

|

92.5 |

% |

1,735 |

Note: The number of shares are rounded down to the nearest whole share

Stockholder Engagement and Changes Resulting

from our Say on Pay Results

We have actively engaged with stockholders since 2013. Each year we reach out to our largest investors (representing approximately 35% to 40% of our outstanding shares) to request feedback on our executive compensation programs. While a significant number of institutional stockholders do not feel the need to engage with us, we appreciate the feedback from those that do participate. All feedback received is summarized by the Director of Investor Relations and shared with the Compensation Committee and the Board of Directors. As a result, our corporate governance and compensation programs have evolved over the years, in part in direct response to this feedback. We have made many changes to our executive compensation program over the last several years in response to suggestions by institutional investors and feedback from proxy advisory firms. Significant changes were made in 2016 and 2017. In 2019, institutional investors provided positive affirmation of our previous compensation program changes.

The formal stockholder advisory votes on pay (“Say-on-Pay”) provides a valuable barometer for how our programs are perceived by the full spectrum of our investors. We take this advisory vote seriously and work diligently to understand the stockholder and proxy advisory firm perspectives. Over 93% of the votes cast by stockholders were cast in favor of our Say-on-Pay vote in 2019. We will continue to consider feedback from our stockholders.

13

Gender Diversity

In response to feedback expressed by several institutional investors, the Board amended its criteria for directors to emphasize gender diversity. Furthermore, as suggested by one large institutional investor, the Board increased its members by one and, in 2018, added a new female director.

Executive Benefits

We offer various benefits to all of our employees, including medical, dental, vision, group life, accidental death and dismemberment and long-term disability insurance. We provide individual coverage to employees, with the employee being responsible for a portion of the premium. In addition, for our Named Executive Officers, we pay or furnish transportation services, parking, club dues, long-term care insurance, spousal travel, and up to $5,000 in personal tax and financial planning assistance (up to $6,000 for Mr. Kitagawa) annually. The Compensation Committee believes these benefits are appropriate and assist these officers in fulfilling their employment obligations.

Executive Agreements

We maintain employment agreements with Messrs. Kitagawa, Hirata and Nakatsuka, which provide severance payments in the event of involuntary or good reason termination of employment or termination following a change in control. The rationale for providing these payments is to provide security for our key executives and stability among our senior management team. For a discussion of these agreements, see “—Executive Officer Compensation— Employment Agreements” below.

Other Policies and Practices

Deductibility of Compensation. For 2017, Section 162(m) of the Internal Revenue Code generally provided that no deduction is allowed for compensation in excess of $1 million paid by a public company to its chief executive officer or any of its other three most highly paid executive officers (other than the chief financial officer). Compensation that qualifies as “performance-based” compensation is not subject to the deductibility limit. The Compensation Committee attempted to maximize the deductibility of compensation under Section 162(m) to the extent doing so was reasonable and consistent with our strategies and goals. To that end, in 2012 and 2017, we received stockholder approval related to the Annual Incentive Plan, and at our 2017 annual meeting, we received stockholder approval to re-approve the performance goals under the 2010 Equity Plan so that awards would continue to qualify as performance-based compensation under Section 162(m) of the Code. This allowed us to continue to maximize the deductibility of our executive compensation programs. The Tax Cuts and Jobs Act eliminated the ability to deduct “performance-based” compensation. Accordingly, the Committee recognizes that paying certain compensation that is not tax- deductible may sometimes be in our best interest, and to that end we do not have a policy requiring that all compensation must be deductible.

Annual Risk Review of Compensation Policies and Procedures

The Compensation Committee is responsible for the oversight of employee compensation policies and procedures, including the determination of whether any material risk arises from our compensation policies and procedures. The Compensation Committee has reviewed our compensation policies and procedures, including those related to the payment of commissions and bonuses to any of our employees, and believes that any risks arising from our compensation policies and practices are not reasonably likely to have a material adverse effect on Territorial Bancorp Inc. and Territorial Savings Bank. The Committee has evaluated the risks of its incentive compensation arrangements in accordance with published bank regulatory guidance on safety and soundness of incentive compensation. The Committee also works with an independent compensation consultant when designing the compensation of our Named Executive Officers.

14

Stock Ownership Guidelines

The Board of Directors adopted the following stock ownership guidelines for Named Executive Officers. The Chief Executive Officer is required to own stock of at least five times (5x) his base salary. The two Co-Chairs are required to own stock of at least two times (2x) their base salary. As of December 31, 2019, all executives met their ownership goals.

Hedging and Pledging Policies

Our Insider Trading Policy prohibits, for all of our directors, executive officers with the title of senior vice president and above, all employees in our accounting department, and any other employee with access to material non-public information, the hedging of stock and pledging of stock, which further encourages the retention of grants of restricted stock and shares acquired on the exercise of stock options.

Executive Officer Compensation

Summary Compensation Table. The table below summarizes the total compensation paid to or earned by our Named Executive Officers for the years ended December 31, 2019 and 2018, as calculated under Securities and Exchange Commission rules. Cash compensation earned for the applicable year is reported in the “Salary,” “Nonequity Incentive Plan Compensation” and the “All Other Compensation” columns. The “Bonus” column has been omitted as no compensation that would be disclosed in that column was earned during the applicable years.

|

Name and Principal Position |

Year |

Salary |

Stock |

Option ($) |

Non-Equity |

Nonqualified |

All Other |

Total |

||||||||

|

Allan S. Kitagawa |

2019 |

851,124 | 308,268 |

— |

383,006 |

— |

218,778 |

(4) |

1,761,176 | |||||||

|

2018 |

851,124 | 309,066 |

— |

508,631 |

— |

156,815 | 1,825,636 | |||||||||

|

Vernon Hirata |

2019 |

347,578 | 125,890 |

— |

156,410 | 67,185 | 128,324 |

(5) |

825,387 | |||||||

|

2018 |

337,454 | 122,537 |

— |

201,663 | 65,729 | 108,714 | 836,097 | |||||||||

|

Ralph Y. Nakatsuka |

2019 |

347,578 | 125,890 |

— |

156,410 | 159,935 | 138,485 |

(6) |

928,298 | |||||||

|

2018 |

337,454 | 122,537 |

— |

201,663 | 164,141 | 98,953 | 924,748 |

|

(1) |

Reflects the aggregate grant date fair value of restricted stock units, half of which have performance-based vesting and half of which have time-based vesting, with such awards calculated at the “Target” level. The assumptions used in the valuation of these awards are included in Note 19 to our audited financial statements included in our Annual Report on Form 10‑K for the year ended December 31, 2019, as filed with the Securities and Exchange Commission. At the “Maximum” level, the aggregate grant date fair value was $384,516, $157,030 and $157,030 for Messrs. Kitagawa, Hirata and Nakatsuka, respectively. |

|

(2) |

The amounts in this column represent the dollar value of the cash incentives earned under the Annual Incentive Plan. The amounts for 2018 include the 2016 Long-Term Incentive Plan. |

|

(3) |

The amounts in this column depend heavily on changes in actuarial assumptions, such as discount rates. For 2019, the amount in this column for Mr. Hirata represents a change in value of $67,185 for the supplemental executive retirement agreement and for Mr. Nakatsuka a change in value of $159,935 for the supplemental executive retirement agreement. |

|

(4) |

Includes $962 for 401(k) plan matching contributions, $1,840 for long-term care premiums, $5,847 for personal use of company automobile, $1,800 for parking, $20,288 for club dues and fees, $31,321 for ESOP allocations, $135,973 for non-qualified supplemental ESOP allocations, $3,424 for life insurance, $14,850 for participation fees in a charitable sporting event and $2,473 for spousal travel. |

15

|

(5) |

Includes $962 for 401(k) plan matching contributions, $18,031 for personal use of company automobile, $1,800 for parking, $6,596 for club dues and fees, $31,321 for ESOP allocations, $64,199 for non-qualified supplemental ESOP allocations, $1,799 for life insurance and $3,616 for spousal travel. |

|

(6) |

Includes $962 for 401(k) plan matching contributions, $1,481 for long-term care premiums, $11,836 for personal use of company automobile, $1,800 for parking, $10,098 for club dues and fees, $31,321 for ESOP allocations, $79,864 for non-qualified supplemental ESOP allocations and $1,123 for life insurance. |

For the year ended December 31, 2019, cash payments under our Annual Incentive Plan were paid in March 2020 in the amounts listed in the “Summary Compensation Table.” For a discussion of this plan, see “Narrative Discussion of Executive Compensation—2019 Annual Incentive Plan.”

Outstanding Equity Awards at Year End. The following table sets forth information with respect to outstanding equity awards as of December 31, 2019 for the Named Executive Officers.

|

Outstanding Equity Awards At December 31, 2019 |

||||||||||||||||

|

Option Awards |

Stock Awards |

|||||||||||||||

|

Equity |

Equity |

|||||||||||||||

|

Incentive |

Incentive |

|||||||||||||||

|

Plan Awards: |

Plan Awards: |

|||||||||||||||

|

Number of |

Number of |

Number |

Market Value |

|||||||||||||

|

Securities |

Securities |

Number of |

Market Value |

of Unearned |

of Unearned |

|||||||||||

|

Underlying |

Underlying |

Shares or |

of Shares or |

Shares, Units |

Shares, Units |

|||||||||||

|

Unexercised |

Unexercised |

Units of |

Units of |

or Other |

or Other |

|||||||||||

|

Options |

Options |

Option |

Option |

Stock That |

Stock That |

Rights That |

Rights That |

|||||||||

|

Exercisable |

Unexercisable |

Exercise |

Expiration |

Have Not |

Have Not |

Have Not |

Have Not |

|||||||||

|

Name |

(#) |

(#) |

Price ($) |

Date |

Vested (#)(1) |

Vested ($)(2) |

Vested ($)(3) |

Vested ($)(2) |

||||||||

|

Allan S. Kitagawa |

— |

— |

— |

08/19/2020 |

10,743 | 332,388 | 15,744 | 487,119 | ||||||||

|

Vernon Hirata |

32,410 |

— |

17.36 |

08/19/2020 |

4,296 | 132,918 | 6,215 | 192,292 | ||||||||

|

Ralph Y. Nakatsuka |

26,870 |

— |

17.36 |

08/19/2020 |

4,296 | 132,918 | 6,215 | 192,292 | ||||||||

|

(1) |

Time-vested restricted stock units vest May 25, 2020 as follows: Mr. Kitagawa, 1,658 shares; Messrs. Hirata and Nakatsuka, 626 shares. Additional time-vested restricted stock units vest March 8, 2020 and 2021 as follows: Mr. Kitagawa, 1,690 shares and 1,689 shares; Messrs. Hirata and Nakatsuka, 670 shares on each date. Additional time-vested restricted stock units vest March 7, 2020 as follows: Mr. Kitagawa, 1,902 shares and Messrs. Hirata and Nakatsuka, 776 shares. Additional time-vested restricted stock units vest March 7, 2021 as follows: Mr. Kitagawa, 1,902 shares and Messrs. Hirata and Nakatsuka, 776 shares. Additional time-vested restricted stock units vest March 7, 2022 as follows: Mr. Kitagawa, 1,902 shares and Messrs. Hirata and Nakatsuka, 778 shares. |

|

(2) |

Computed using the fair market value of the shares based on the Company’s closing stock price of $30.94 on December 31, 2019. |

|

(3) |

Performance-based restricted stock units vest within 120 days from the performance period ends upon the achievement of performance goals, as measured over a three-year period (2017 to 2019, 2018 to 2020 and 2019 to 2021). |

Employment Agreements. Territorial Savings Bank has entered into separate employment agreements with Messrs. Kitagawa, Hirata, and Nakatsuka (referred to below as the “executives” or “executive”). Territorial Bancorp Inc. has entered into separate employment agreements with each executive, which have essentially identical provisions as the Territorial Savings Bank agreements, except that the employment agreements will provide that Territorial Bancorp Inc. will make any payments not made by Territorial Savings Bank under its agreements with the executives and that the executives will not receive any duplicate payments. Our continued success depends to a significant degree on the skills and competence of these officers, and the employment agreements are intended to ensure that we maintain a stable management base following the offering.

The employment agreements each provide for three-year terms, subject to annual renewal by the Board of Directors for an additional year beyond the then-current expiration date. The current base salaries under the employment agreements

16

are $851,124 for Mr. Kitagawa, $347,578 for Mr. Hirata, and $347,578 for Mr. Nakatsuka. The agreements also provide for participation in employee benefit plans and programs maintained for the benefit of senior management personnel, including discretionary bonuses, participation in stock-based benefit plans, and certain fringe benefits as described in the agreements.

Upon termination of an executive’s employment for cause, as defined in each of the agreements, the executive will receive no further compensation or benefits under the agreement. If we terminate the executive for reasons other than for cause or if the executive terminates voluntarily under specified circumstances that constitute constructive termination, the executive will receive an amount equal to the base salary and cash bonus and employer contributions to benefit plans that would have been payable for the remaining term of the agreement. We will also continue to pay for each executive’s life, health, and dental coverage for up to three years, with the executive responsible for his share of the employee premium.

If the executive terminates employment for any reason other than for cause within 12 months following a change in control, the executive will receive the greater of (a) the amount he would have received if we terminated the executive for a reason other than for cause or if the executive voluntarily terminated under specified circumstances that constitute constructive termination (as described in the immediately preceding paragraph), or (b) three times his prior five-year average of taxable compensation less one dollar. We will also continue to pay for each executive’s life, health, and dental coverage for up to three years, with the executive responsible for his share of the employee premium.

Upon termination of employment (other than a termination in connection with a change in control), each executive will be required to adhere to a one-year noncompetition provision. The executive will be required to release us from any and all claims in order to receive any payments and benefits under his agreement. We will agree to pay all reasonable costs and legal fees of the executives in relation to the enforcement of the employment agreements, provided the executives succeed on the merits in a legal judgment, arbitration proceeding, or settlement. The employment agreements also provide for indemnification of the executives to the fullest extent legally permissible.

Separation Pay Plan. The Territorial Savings Bank Separation Pay Plan provides severance benefits to eligible employees whose employment is involuntarily terminated within 24 months after a change in control of Territorial Bancorp Inc. All regular employees who do not receive severance pay under an employment or change in control agreement are participants in this plan. Terminated employees will receive a severance payment of one month of base compensation for each year of service, up to a maximum of 24 months of base compensation, and employees who are at the level of Senior Vice President or above will receive a minimum severance payment of 12 months of base compensation. In addition, terminated employees who are at the level of Senior Vice President and above will also be eligible to continue to participate in our health insurance plan for up to one year, with the employee responsible for their share of the employee premium.

Pension Plan. Territorial Savings Bank sponsors the Territorial Savings Bank Employee Retirement Plan, a defined benefit pension plan that covers a significant portion of our employees. Employees become eligible for participation in the pension plan on the first day of the calendar month on or after completing one year of service and attaining age 21. Effective December 31, 2008, the pension plan was frozen, such that no further benefit accruals will be earned after that date; however, participants will continue to earn vesting credit.

Participants in the pension plan become fully vested in their retirement benefits upon completion of five years of service. They also become 100% vested upon attaining age 65 or upon death. A participant who terminates employment on or after reaching age 65 is entitled to the full retirement benefit. A participant’s normal retirement benefit is generally based on a formula that takes into account the amount credited under the pension plan for service before January 1, 1984, and the amount credited under the pension plan for service from 1984 to 1998 and the amount credited from 1998 to 2008, as well as salary and certain other compensation. The plan does not grant additional years of service for any purpose.

The pension plan permits early retirement at age 55. Participants who retire after age 65 will be entitled to the full amount of their benefit, generally calculated through their late retirement date. Eligible participants who elect an early retirement benefit will receive a reduced normal retirement benefit. As of December 31, 2019, Mr. Nakatsuka was eligible for early retirement, and Messrs. Kitagawa and Hirata were each eligible for normal retirement.

17

The normal form of retirement for participants who are not married is a single life annuity. The normal form of retirement benefit for participants who are married is a 50% joint and survivor annuity. Other optional forms of benefit are available, such as an early retirement benefit, and all optional forms of benefit are the actuarial equivalent of the normal form (e.g., a participant does not receive more or less by selecting an optional form of benefit). In the event of the participant’s death, benefits normally will be paid to the participant’s spouse unless the spouse consents to an alternative beneficiary in writing. In the event of death any time after a participant is vested or eligible for a pension benefit, provided the participant has been married for at least one year and provided that benefits have not commenced at the time of death, the participant’s spouse may either receive the full benefit when the participant would have reached age 65 or receive a reduced benefit any time after the deceased participant would have attained age 55.

Supplemental Executive Retirement Agreements. We provide supplemental executive retirement benefits to each of Messrs. Kitagawa, Hirata, and Nakatsuka. Under Mr. Kitagawa’s agreement, he is entitled to receive an amount equal to the present value of $600,000 per year for 15 years payable in a lump sum on the first day of the month upon retirement after attaining age 66. Under the agreements with Messrs. Hirata and Nakatsuka, each executive will receive an annual benefit upon retirement after age 66 equal to 65% of the average of his compensation for the three years immediately preceding his termination of employment reduced by the sum of the benefits payable under the pension plan and Social Security benefits. Mr. Hirata’s benefits will be paid in monthly installments for 15 years and Mr. Nakatsuka will receive a lump sum equal to the present value of installments over 15 years.

Each executive may also retire early, before attaining age 66, and receive a reduced benefit. Mr. Kitagawa will receive the amount accrued for accounting purposes as of the end of the calendar year before his termination of employment, payable in a lump sum. Mr. Hirata will receive the benefit as described above, as he has reached age 66. Mr. Nakatsuka’s benefits are reduced by a fraction, the numerator of which is completed years of service and the denominator of which is the executive’s potential years of service if he had remained employed until age 66, with such benefits paid by lump sum.

For Mr. Kitagawa and Mr. Hirata, if their employment is terminated within three years following a change in control, they will receive their normal retirement benefit without any reduction for amounts payable under the pension plan or Social Security. Mr. Nakatsuka will receive 65% of his final average compensation projected to age 66, without any reduction for amounts payable under the pension plan or Social Security. All amounts are paid as a lump sum, except Mr. Hirata will receive installments for 15 years. The agreements contain change of control “tax gross up” provisions such that if a payment to any of the three executives exceeds the limit on such payments pursuant to Internal Revenue Code Section 280G, and thereby imposes an excise tax on the officer, Territorial Savings Bank, or its successor, will pay such executive additional amounts to compensate for the excise tax.

In the event of disability or death, Messrs. Hirata and Nakatsuka will receive the same benefit as if they had terminated employment following a change in control. Upon death, Mr. Kitagawa’s designee will receive a lump-sum payment equal to the present value of his projected normal retirement benefit and upon disability Mr. Kitagawa will receive a lump sum equal to the amount accrued for accounting purposes under the plan.

No benefits are payable in the event of a termination for cause.

Supplemental Employee Stock Ownership Plan. Territorial Savings Bank adopted the Supplemental Employee Stock Ownership Plan (“Supplemental ESOP”) effective January 1, 2009, to provide certain executives with benefits that they otherwise would be entitled to under the tax-qualified Employee Stock Ownership Plan (“ESOP”), but for limitations imposed by the Internal Revenue Code. During 2019, three employees participated in the Supplemental ESOP. The Compensation Committee of the Board of Directors of Territorial Savings Bank administers the Supplemental ESOP. Each year, participants in the Supplemental ESOP are credited with a dollar amount equal to the difference between the value of the shares of our common stock that would have been allocated to the participant under the tax-qualified ESOP, but for the limitations imposed by the Internal Revenue Code, and the actual value of shares of our common stock allocated to the participant under the ESOP for the relevant plan year. Participants in the Supplemental ESOP may direct the investment of their Supplemental ESOP accounts among a select group of broadly diversified mutual funds selected by the Compensation Committee. Benefits are generally payable in a cash lump sum within 90 days of the first to occur of: (i) the participant’s separation from service; (ii) the participant’s death; (iii) the participant’s disability; or (iv) a

18

change in control of Territorial Savings Bank or Territorial Bancorp Inc., but, in order to comply with Section 409A of the Internal Revenue Code, payments will be delayed for six months for any “specified employee” (as defined in Section 409A of the Internal Revenue Code).

Tax-Qualified Benefit Plans

Territorial Savings Bank 401(k) Plan. We sponsor the Territorial Savings Bank 401(k) Plan, a tax-qualified defined contribution plan, for all employees who have satisfied the plan’s eligibility requirements. Employees may begin deferring their compensation and are eligible to receive matching contributions and profit-sharing contributions as of the first day of the month following the completion of 12 months of employment during which they worked at least 1,000 hours. All contributions are 100% vested.

Employee Stock Ownership Plan. Effective January 1, 2009, Territorial Savings Bank adopted an employee stock ownership plan for eligible employees. Eligible employees who have attained age 21 generally begin participation in the ESOP on the later of the effective date of the ESOP on or after the eligible employee’s completion of 1,000 hours of service during a continuous 12‑month period.

The ESOP trustee purchased, on behalf of the ESOP, 978,650 shares of our common stock issued in the offering. The ESOP funded its stock purchase with a loan from us equal to the aggregate purchase price of the common stock. The loan will be repaid principally through Territorial Savings Bank’s contribution to the ESOP and dividends payable on common stock held by the ESOP over the anticipated 20‑year term of the loan. The interest rate for the ESOP loan is an adjustable rate equal to the prime rate, as published in The Wall Street Journal, which adjusts annually.

The trustee holds the shares purchased by the ESOP in an unallocated suspense account, and shares will be released from the suspense account on a pro-rata basis as we repay the loan. The trustee will allocate the shares released among participants on the basis of each participant’s proportional share of compensation relative to all participants. Participants become 100% vested upon the completion of three years of service. Participants who were employed by Territorial Savings Bank immediately prior to the offering received credit for vesting purposes for years of service prior to adoption of the ESOP. Participants also will become fully vested automatically upon normal retirement, death, or disability, a change in control, or termination of the ESOP. Generally, participants will receive distributions from the ESOP upon separation from service. The ESOP reallocates any unvested shares forfeited upon termination of employment among the remaining participants.

The ESOP permits participants to direct the trustee as to how to vote the shares of common stock allocated to their accounts. The trustee votes unallocated shares and allocated shares for which participants do not provide instructions on any matter in the same ratio as those shares for which participants provide instructions, subject to fulfillment of the trustee’s fiduciary responsibilities.

Under applicable accounting requirements, Territorial Savings Bank records compensation expense for the ESOP at the fair market value of the shares as they are committed to be released from the unallocated suspense account to participants’ accounts. The compensation expense resulting from the release of the common stock from the suspense account and allocation to plan participants results in a corresponding reduction in our earnings.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee determines the salaries to be paid each year to the Chief Executive Officer and those executive officers who report directly to the Chief Executive Officer. The Compensation Committee consists of Directors Caldwell, who serves as Chairman, Ikeda, Isobe and Ohama. None of these individuals was an officer or employee of Territorial Bancorp Inc. during the year ended December 31, 2019, or is a former officer of Territorial Bancorp Inc. For the year ended December 31, 2019, none of the members of the Compensation Committee had any relationship requiring disclosure under “Transactions with Certain Related Persons.”

During the year ended December 31, 2019, (i) no executive officer of Territorial Bancorp Inc. served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such

19

committee, the entire Board of Directors) of another entity, one of whose executive officers served on the Compensation Committee of Territorial Bancorp Inc.; (ii) no executive officer of Territorial Bancorp Inc. served as a director of another entity, one of whose executive officers served on the Compensation Committee of Territorial Bancorp Inc.; and (iii) no executive officer of Territorial Bancorp Inc. served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) of another entity, one of whose executive officers served as a director of Territorial Bancorp Inc.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Stock Ownership

The following table provides information as of March 13, 2020, with respect to persons known by the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power. Percentages are based on 9,658,548 shares of Company common stock issued and outstanding as of March 13, 2020.

|

Name and Address |

|

Number of |

|

Percent |

|

|

|

|

|

|

|

Territorial Savings Bank Employee Stock |

|

907,204 |

|

9.39% |

|

|

|

|

|

|

|

Renaissance Technologies LLC (1) |

|

686,613 |

|

7.11% |

|

|

|

|

|

|

|

Dimensional Fund Advisors LP (2) |

|

580,471 |

|

6.01% |

|

|

|

|

|

|

|

The Vanguard Group (3) |

|

529,693 |

|

5.48% |

|

(1) |

As disclosed in Schedule 13G/A filed with the Securities and Exchange Commission on February 13, 2020. |

|

(2) |

As disclosed in Schedule 13G filed with the Securities and Exchange Commission on February 12, 2020. |

|

(3) |

As disclosed in Schedule 13G filed with the Securities and Exchange Commission on February 12, 2020. |