Attached files

| file | filename |

|---|---|

| EX-99.1 - 1ST QTR 2020 EARNINGS PRESS RELEASE - WESBANCO INC | wsbc-ex991_6.htm |

| 8-K - 8-K ON 1ST QTR 2020 EARNINGS RELEASE - WESBANCO INC | wsbc-8k_20200427.htm |

28 April 2020 First Quarter 2020 Earnings Conference Call

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s Form 10-K for the year ended December 31, 2019 and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC), which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.WesBanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including, without limitation, the effects of changing regional and national economic conditions including the effects of the COVID-19 pandemic; changes in interest rates, spreads on earning assets and interest-bearing liabilities, and associated interest rate sensitivity; sources of liquidity available to WesBanco and its related subsidiary operations; potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities; actions of the Federal Reserve Board, the Federal Deposit Insurance Corporation, the SEC, the Financial Institution Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investors Protection Corporation, and other regulatory bodies; potential legislative and federal and state regulatory actions and reform, including, without limitation, the impact of the implementation of the Dodd-Frank Act; adverse decisions of federal and state courts; fraud, scams and schemes of third parties; cyber-security breaches; competitive conditions in the financial services industry; rapidly changing technology affecting financial services; marketability of debt instruments and corresponding impact on fair value adjustments; and/or other external developments materially impacting WesBanco’s operational and financial performance. WesBanco does not assume any duty to update forward-looking statements. In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco's management uses, and this presentation contains or references, certain non-GAAP financial measures, such as tangible common equity/tangible assets; net income excluding after-tax merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco believes that these non-GAAP financial measures enhance investors' understanding of WesBanco's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, as well as other filings that the company has made with the SEC.

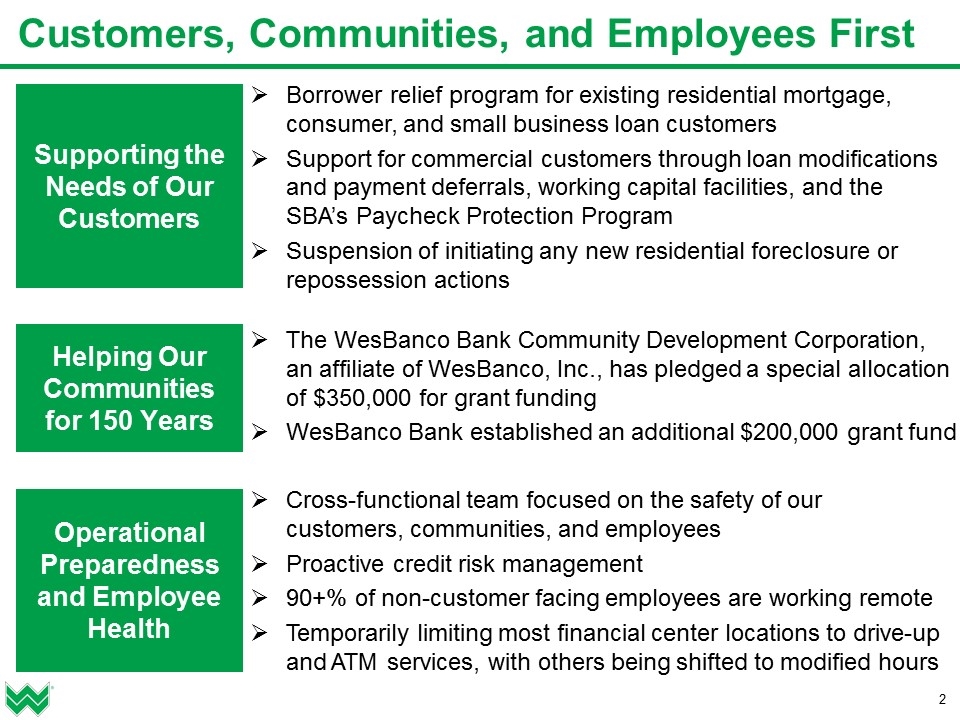

Customers, Communities, and Employees First Cross-functional team focused on the safety of our customers, communities, and employees Proactive credit risk management 90+% of non-customer facing employees are working remote Temporarily limiting most financial center locations to drive-up and ATM services, with others being shifted to modified hours Operational Preparedness and Employee Health Borrower relief program for existing residential mortgage, consumer, and small business loan customers Support for commercial customers through loan modifications and payment deferrals, working capital facilities, and the SBA’s Paycheck Protection Program Suspension of initiating any new residential foreclosure or repossession actions Supporting the Needs of Our Customers The WesBanco Bank Community Development Corporation, an affiliate of WesBanco, Inc., has pledged a special allocation of $350,000 for grant funding WesBanco Bank established an additional $200,000 grant fund Helping Our Communities for 150 Years

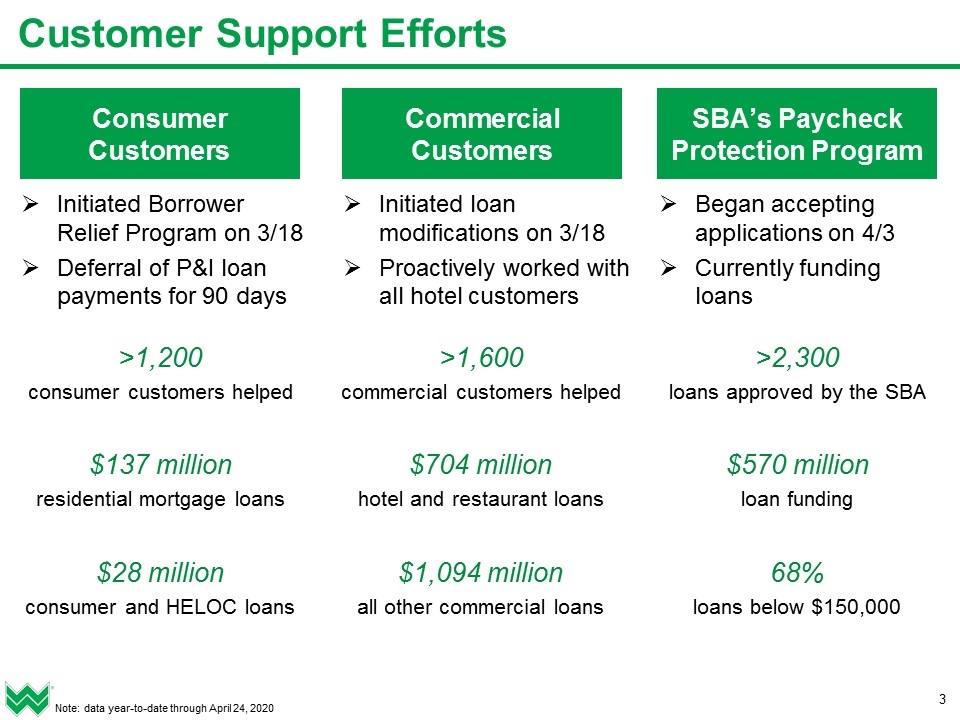

>1,200 consumer customers helped $137 million residential mortgage loans $28 million consumer and HELOC loans >2,300 loans approved by the SBA $570 million loan funding 68% loans below $150,000 Customer Support Efforts Consumer Customers Commercial Customers SBA’s Paycheck Protection Program Note: data year-to-date through April 24, 2020 Initiated Borrower Relief Program on 3/18 Deferral of P&I loan payments for 90 days Initiated loan modifications on 3/18 Proactively worked with all hotel customers Began accepting applications on 4/3 Currently funding loans >1,600 commercial customers helped $704 million hotel and restaurant loans $1,094 million all other commercial loans

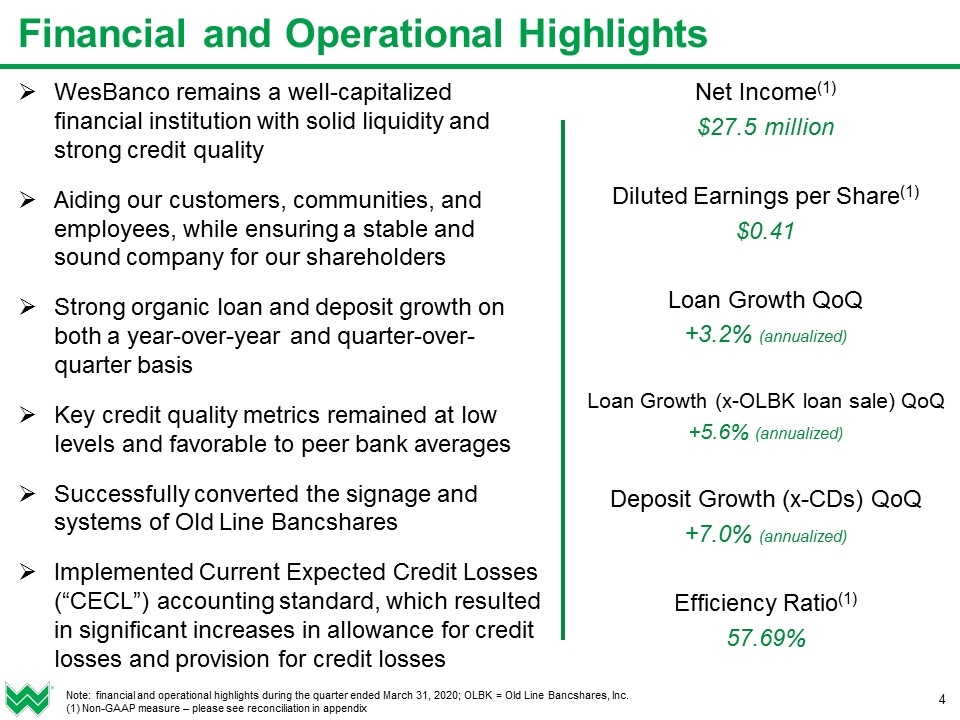

Financial and Operational Highlights Note: financial and operational highlights during the quarter ended March 31, 2020; OLBK = Old Line Bancshares, Inc. (1) Non-GAAP measure – please see reconciliation in appendix WesBanco remains a well-capitalized financial institution with solid liquidity and strong credit quality Aiding our customers, communities, and employees, while ensuring a stable and sound company for our shareholders Strong organic loan and deposit growth on both a year-over-year and quarter-over-quarter basis Key credit quality metrics remained at low levels and favorable to peer bank averages Successfully converted the signage and systems of Old Line Bancshares Implemented Current Expected Credit Losses (“CECL”) accounting standard, which resulted in significant increases in allowance for credit losses and provision for credit losses Net Income(1) $27.5 million Diluted Earnings per Share(1) $0.41 Loan Growth QoQ +3.2% (annualized) Loan Growth (x-OLBK loan sale) QoQ +5.6% (annualized) Deposit Growth (x-CDs) QoQ +7.0% (annualized) Efficiency Ratio(1) 57.69%

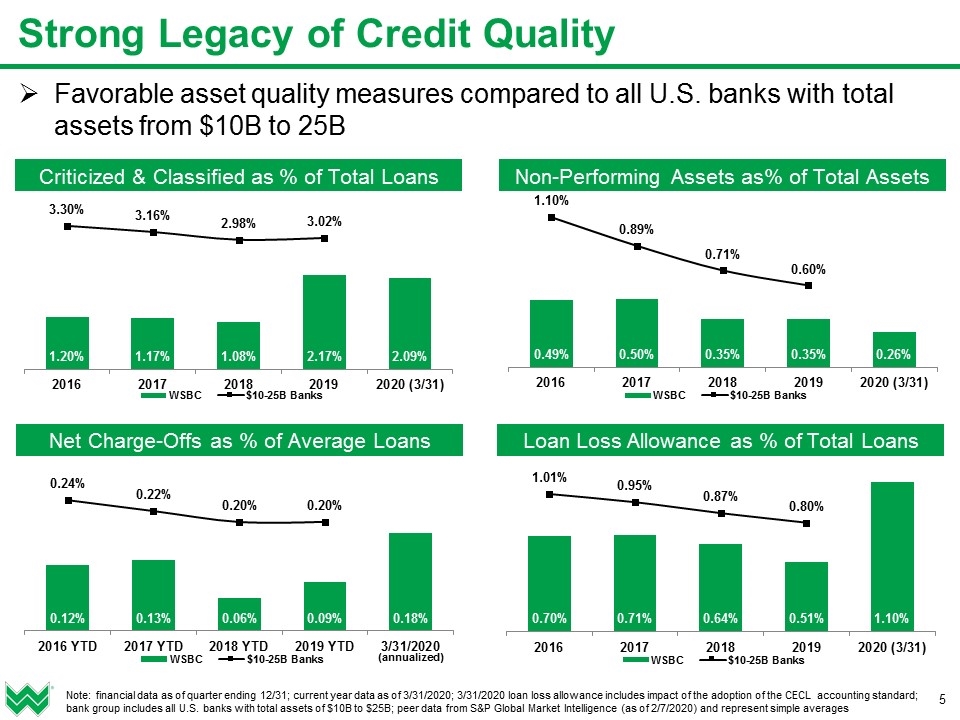

Non-Performing Assets as% of Total Assets Net Charge-Offs as % of Average Loans (annualized) Loan Loss Allowance as % of Total Loans Criticized & Classified as % of Total Loans Favorable asset quality measures compared to all U.S. banks with total assets from $10B to 25B Strong Legacy of Credit Quality Note: financial data as of quarter ending 12/31; current year data as of 3/31/2020; 3/31/2020 loan loss allowance includes impact of the adoption of the CECL accounting standard; bank group includes all U.S. banks with total assets of $10B to $25B; peer data from S&P Global Market Intelligence (as of 2/7/2020) and represent simple averages

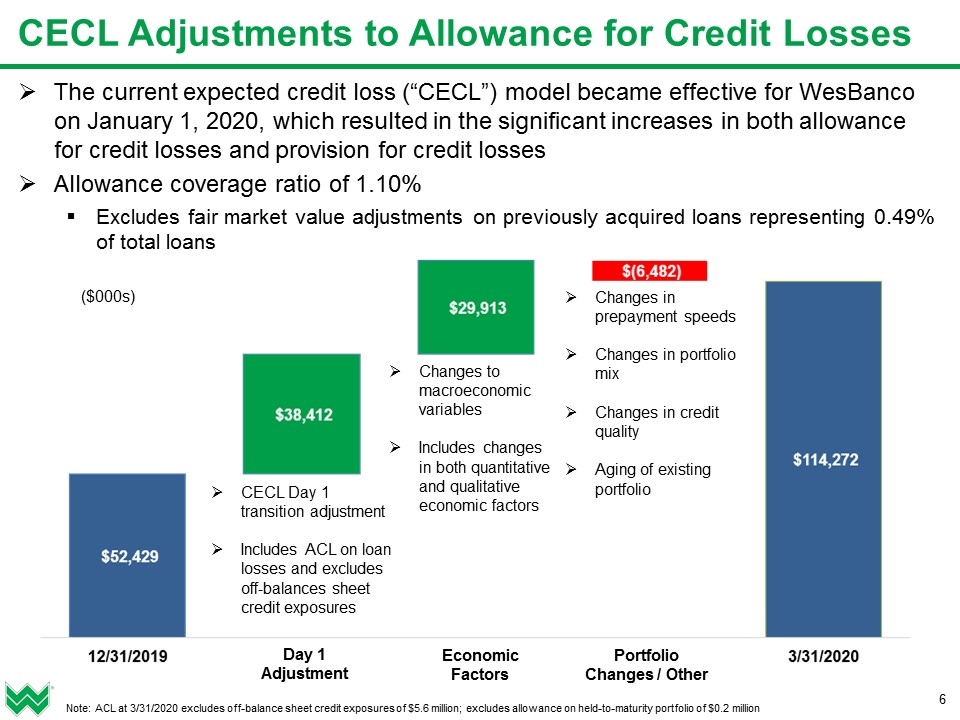

CECL Adjustments to Allowance for Credit Losses The current expected credit loss (“CECL”) model became effective for WesBanco on January 1, 2020, which resulted in the significant increases in both allowance for credit losses and provision for credit losses Allowance coverage ratio of 1.10% Excludes fair market value adjustments on previously acquired loans representing 0.49% of total loans Note: ACL at 3/31/2020 excludes off-balance sheet credit exposures of $5.6 million; excludes allowance on held-to-maturity portfolio of $0.2 million Day 1 Adjustment Portfolio Changes / Other Economic Factors CECL Day 1 transition adjustment Includes ACL on loan losses and excludes off-balances sheet credit exposures Changes to macroeconomic variables Includes changes in both quantitative and qualitative economic factors Changes in prepayment speeds Changes in portfolio mix Changes in credit quality Aging of existing portfolio ($000s)

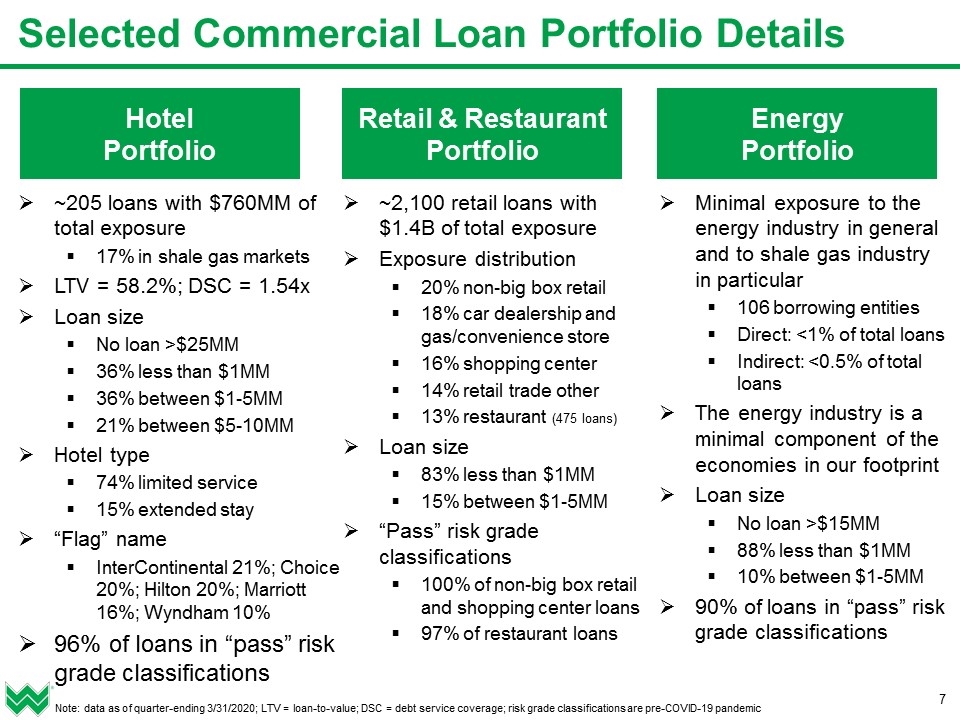

Selected Commercial Loan Portfolio Details Hotel Portfolio Retail & Restaurant Portfolio Energy Portfolio ~205 loans with $760MM of total exposure 17% in shale gas markets LTV = 58.2%; DSC = 1.54x Loan size No loan >$25MM 36% less than $1MM 36% between $1-5MM 21% between $5-10MM Hotel type 74% limited service 15% extended stay “Flag” name InterContinental 21%; Choice 20%; Hilton 20%; Marriott 16%; Wyndham 10% 96% of loans in “pass” risk grade classifications ~2,100 retail loans with $1.4B of total exposure Exposure distribution 20% non-big box retail 18% car dealership and gas/convenience store 16% shopping center 14% retail trade other 13% restaurant (475 loans) Loan size 83% less than $1MM 15% between $1-5MM “Pass” risk grade classifications 100% of non-big box retail and shopping center loans 97% of restaurant loans Minimal exposure to the energy industry in general and to shale gas industry in particular 106 borrowing entities Direct: <1% of total loans Indirect: <0.5% of total loans The energy industry is a minimal component of the economies in our footprint Loan size No loan >$15MM 88% less than $1MM 10% between $1-5MM 90% of loans in “pass” risk grade classifications Note: data as of quarter-ending 3/31/2020; LTV = loan-to-value; DSC = debt service coverage; risk grade classifications are pre-COVID-19 pandemic

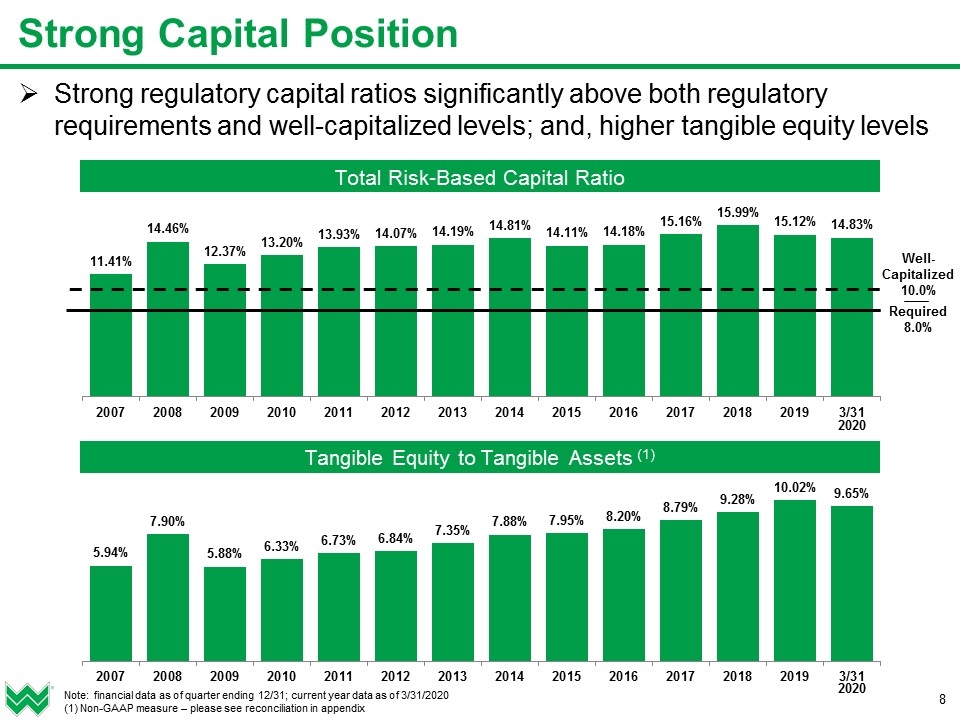

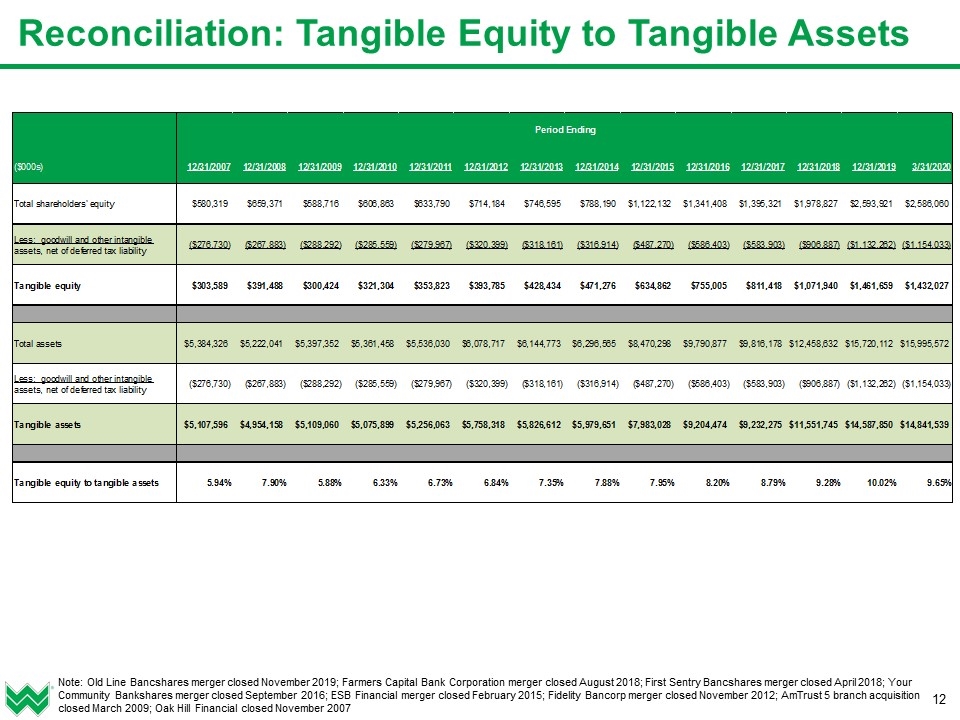

Strong Capital Position Strong regulatory capital ratios significantly above both regulatory requirements and well-capitalized levels; and, higher tangible equity levels Note: financial data as of quarter ending 12/31; current year data as of 3/31/2020 (1) Non-GAAP measure – please see reconciliation in appendix Tangible Equity to Tangible Assets (1) Total Risk-Based Capital Ratio Well-Capitalized 10.0% Required 8.0% 2020 2020

Appendix

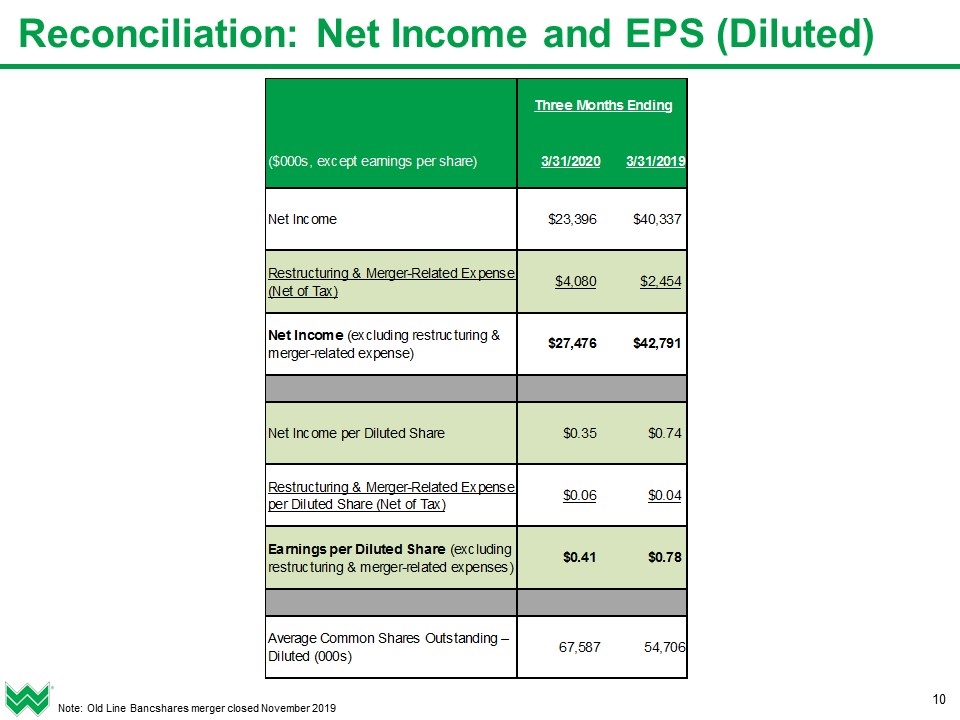

Reconciliation: Net Income and EPS (Diluted) Note: Old Line Bancshares merger closed November 2019

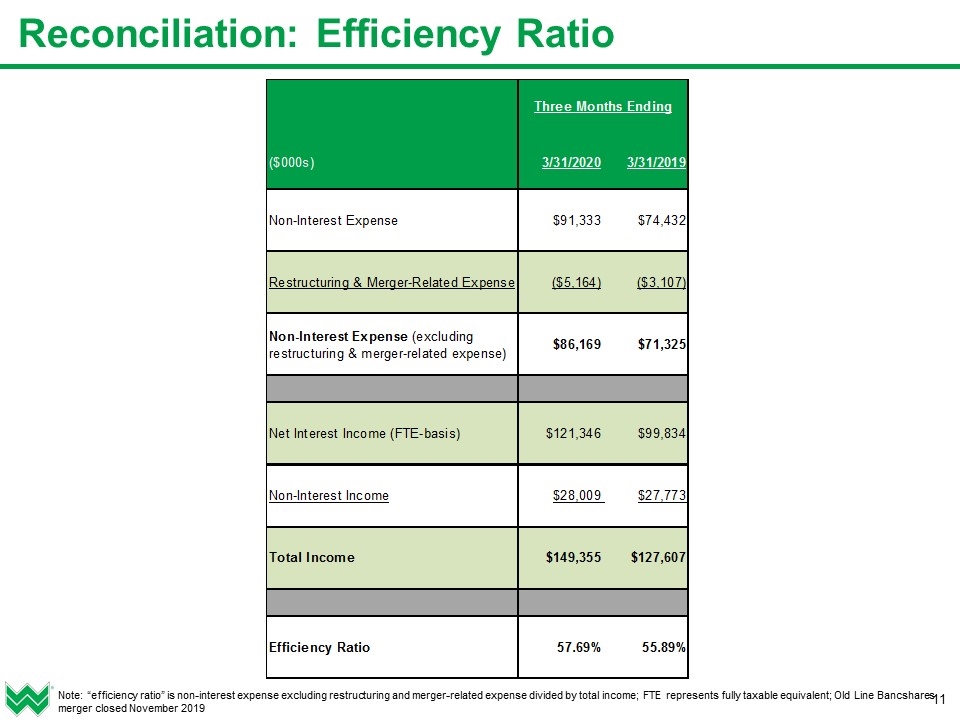

Reconciliation: Efficiency Ratio Note: “efficiency ratio” is non-interest expense excluding restructuring and merger-related expense divided by total income; FTE represents fully taxable equivalent; Old Line Bancshares merger closed November 2019

Reconciliation: Tangible Equity to Tangible Assets Note: Old Line Bancshares merger closed November 2019; Farmers Capital Bank Corporation merger closed August 2018; First Sentry Bancshares merger closed April 2018; Your Community Bankshares merger closed September 2016; ESB Financial merger closed February 2015; Fidelity Bancorp merger closed November 2012; AmTrust 5 branch acquisition closed March 2009; Oak Hill Financial closed November 2007