Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Joway Health Industries Group Inc | f10k2019ex32-2_joway.htm |

| EX-32.1 - CERTIFICATION - Joway Health Industries Group Inc | f10k2019ex32-1_joway.htm |

| EX-31.2 - CERTIFICATION - Joway Health Industries Group Inc | f10k2019ex31-2_joway.htm |

| EX-31.1 - CERTIFICATION - Joway Health Industries Group Inc | f10k2019ex31-1_joway.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Joway Health Industries Group Inc | f10k2019ex21-1_joway.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 333-108715

Joway Health Industries Group Inc.

(Exact Name of Registrant as Specified in Its Charter)

Nevada |

98-0221494 | |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

No. 2, Baowang Road, Baodi Economic Development Zone, Tianjin, PRC 301800 |

86-22-22533666 | |

| (Address of Principal Executive Offices) | (Issuer’s Telephone Number) | |

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

(Note: The registrant is a voluntary filer of reports under Section 13 or 15(d) of the Securities Exchange Act of 1934 and has filed during the preceding 12 months all reports it would have been required to file by Section 13 or 15(d) of the Securities Exchange Act of 1934 if the registrant had been subject to one of such Sections.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock par value $0.001 per share | GTVI | OTCQB marketplace of OTC Markets Inc. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of December 31, 2019, the aggregate market value of the voting stock held by non-affiliates of the registrant was $195,900. For purposes of this information, the outstanding shares of Common Stock owned by directors and executive officers of the registrant were deemed to be shares of the voting stock held by affiliates.

As of March 30, 2020, there were 20,054,000 shares of the issuer’s common stock, $0.001 par value, issued and outstanding.

JOWAY HEALTH INDUSTRIES GROUP INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

i

Information Regarding Forward-Looking Statements

In addition to historical information, this report contains predictions, estimates and other forward-looking statements that relate to future events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. These risks and other factors include those listed under “Risk Factors” and elsewhere in this report. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. We discuss many of these risks in this report in greater detail under the heading “Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of March 30, 2020. You should read this annual report on Form 10-K and the documents that we have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

ii

Overview

Through our PRC Operating Entities, Joway Health Industries Group Inc. (the “Company” or “Joway Health”) is engaged in the manufacture, distribution and sale of tourmaline-related healthcare products. We are incorporated in the state of Nevada. Our principal executive offices are located at No. 19. Baowang Road, Baodi Economic Development Zone, Tianjin City, PRC 301800. Our website address is www.jowayhealth.com.

Corporate History

Joway Health Industries Group, Inc.

Until October 1, 2010, we were a “shell company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended. We were originally formed as a Texas corporation on March 21, 2003 to acquire most of the assets and certain liabilities of and succeed to the business of G2 Companies, Inc., (formerly Hartland Investment, Inc.), as an independent recording company and artist management company. The acquisition of G2 Companies, Inc. was consummated on April 1, 2003. On May 13, 2008, through a registered offering, we sold 1,284,574 shares of our common stock raising an aggregate of $128,457, before costs of the Offering. Our common stock began trading on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “GTVI” on September 11, 2009. Prior to the Share Exchange Transaction, discussed below, we were a development stage music recording, production and artist management company that had limited operations, primarily due to our inability to raise sufficient capital.

On September 28, 2010, Mr. Kepler, our former Chief Executive Officer and majority shareholder, sold to Crystal Globe Limited, a British Virgin Islands company (“Crystal Globe”) 3,300,000 shares of common stock in the Company, which at that time represented 68.97% of the issued and outstanding capital stock of the Company. In connection with the sale, Mr. Kepler resigned as our sole officer and director and appointed Crystal Globe’s nominees, Mr. Jinghe Zhang, as our new President, Chief Executive Officer and sole director and Mr. Yuan Huang as our new Chief Financial Officer, Secretary and Treasurer. As a result, on September 28, 2010, there was a change in control of the Company.

On October 1, 2010, as a result of a transaction with Dynamic Elite (the “Share Exchange”), Dynamic Elite became our wholly-owned subsidiary and we ceased to be a shell company. Dynamic Elite is the holding company of all the equity of Tianjin Junhe Management Consulting Co., Ltd. (“Junhe Consulting”).

Share Exchange Transaction

On October 1, 2010, we entered into a Share Exchange Agreement with Crystal Globe, the sole shareholder of Dynamic Elite International Limited, pursuant to which Crystal Globe transferred all of its shares in Dynamic Elite to us in exchange for 15,215,426 shares of our common stock. As a result, Dynamic Elite became our wholly-owned subsidiary and we ceased to be a shell company, and Crystal Globe held a total of 18,515,426 shares (approximately 92.6%) of our issued and outstanding common stock.

The Share Exchange was treated for accounting purposes as a reverse acquisition. Therefore, the Company’s financial statements after the Share Exchange were those of Dynamic Elite and its subsidiaries and controlled companies on a consolidated basis, as if the Share Exchange had been in effect retroactively for all periods presented.

Change of State of Incorporation; Name Change

In December 2010, the Company changed its jurisdiction of incorporation from the State of Texas to the State of Nevada and changed its name to Joway Health Industries Group, Inc. In connection with these changes, the Company adopted new Articles of Incorporation and Bylaws.

1

Dynamic Elite

Dynamic Elite was founded on June 2, 2010 under the laws of the British Virgin Islands by Crystal Globe and Evan Liu, the sole shareholder of Crystal Globe, at the request of Mr. Jinghe Zhang. Mr. Liu is a friend of Mr. Jinghe Zhang. On September 15, 2010, Dynamic Elite established a wholly-owned subsidiary — Tianjin Junhe Management Consulting Co., Ltd. (“Junhe Consulting”), as a wholly foreign-owned enterprise (WOFE) under the laws of the PRC for the purposes of acquiring Tianjin Joway Shengshi Group Co., Ltd. and engaging in the manufacture, distribution and sale of tourmaline products in China. Under Article 6 of the Law of the People’s Republic of China on Wholly Foreign-Owned Enterprises, adopted April 12, 1986 at the 4th Sess. of the 6th National People’s Congress and as amended on October 31, 2000 (“PRC WOFE Law”) and Article 7 of the Detailed Rules for the Implementation, any person or entity that intends to establish an enterprise in the PRC with foreign capital is required to submit an application for examination and approval to the appropriate department under the State Council. On September 9, 2010, the local Tianjin City government issued a certificate of approval approving the foreign ownership of Junhe Consulting by Dynamic Elite. Mr. Jinghe Zhang was appointed as the Executive Director of Junhe Consulting.

PRC Operating Entities

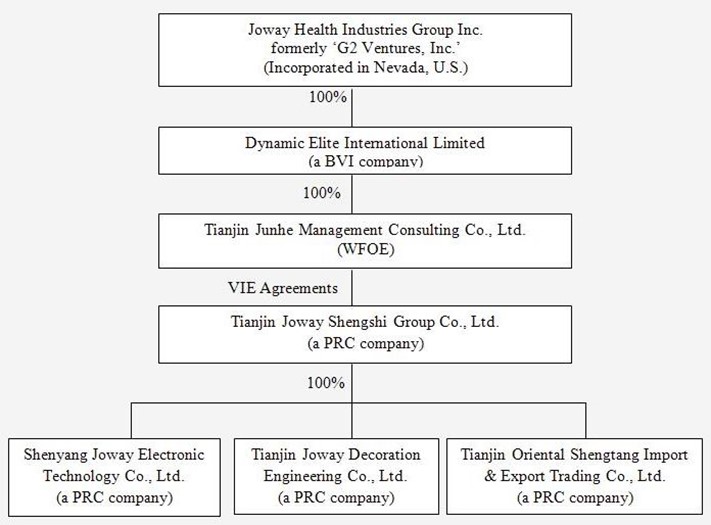

All of our business operations are conducted through our PRC Operating Entities. The chart below sets forth our corporate structure.

Joway Shengshi

On May 17, 2007, Mr. Jinghe Zhang, Mr. Lijun Si and Mr. Baogang Song founded Tianjin Joway Textile Co., Ltd. as a limited liability company under the PRC law. On November 24, 2009, the company changed its name to Tianjin Joway Shengshi Group Co., Ltd. (“Joway Shengshi”). The registered capital of Joway Shengshi is RMB 50,000,000 and its term of operation will expire on May 16, 2022. Mr. Jinghe Zhang is the Executive Director and General Manager of Joway Shengshi. On July 1, 2010, Mr. Lijun Si transferred 4% of the equity interest in Joway Shengshi to Mr. Jinghe Zhang. As a result, Mr. Zhang owns 99% of the equity interest in Joway Shengshi and Mr. Baogang Song owns the remaining 1% of the equity interest of Joway Shengshi. As of December 31, 2019 and 2018, Joway Shengshi was the sole shareholder of Joway Technology, Joway Decoration, and Shengtang Trading.

2

Joway Technology

Joway Technology was incorporated under PRC law on March 28, 2007, with a registered capital of RMB 1,100,000. It was formed to engage in intelligent engineering design and construction, development and sales of electronics, water filters, and other similar products. Prior to July 25, 2010, Joway Shengshi held 90.91% of Joway Technology. On July 25, 2010 Joway Shengshi acquired the remaining 9.09% of Joway Technology from Mr. Jingyun Chen for RMB 100,000 in cash. As a result of the acquisition, Joway Shengshi became the sole shareholder of Joway Technology.

Joway Decoration

Joway Decoration was cofounded by Joway Shengshi and Mr. Jingyun Chen under PRC law on April 22, 2009, with a registered capital of RMB 2,000,000. It was formed to engage in the business of intelligent electric heating project design and construction, development and sales of electronics technology and water filters, and the manufacture and sales of wood products. Prior to July 9, 2010, Joway Shengshi owned 90% of Joway Decoration. On July 9, 2010, Joway Shengshi entered into a share acquisition agreement with Mr. Jingyun Chen to acquire the remaining 10% of the shares of Joway Decoration for RMB 200,000 in cash. As a result of the acquisition, Joway Shengshi became the sole shareholder of Joway Decoration.

Shengtang Trading

Shengtang Trading was cofounded by Joway Shengshi and Mr. Jingyun Chen under PRC law on September 18, 2009, with a registered capital of RMB 2,000,000. It was formed to engage in the business of importing and exporting merchandise and technology; knitwear, biochemistry (excluding toxic chemicals and drugs), and the wholesale and retail sale of hardware. Prior to July 28, 2010, Joway Shengshi owned 95% of Shengtang Trading. On July 28, 2010, Joway Shengshi entered into a share acquisition agreement with Mr. Aiying Wang to acquire the remaining 5% of the shares of Shengtang Trading for RMB 100,000 in cash. As a result of the acquisition, Joway Shengshi became the sole shareholder of Shengtang Trading.

VIE Agreements

On September 16, 2010, prior to the Share Exchange, Junhe Consulting, Dynamic Elite’s wholly owned subsidiary had entered into a series of control agreements with Joway Shengshi and all of the owners of Joway Shengshi, which agreements allow Junhe Consulting to control Joway Shengshi. Through our ownership of Dynamic Elite, Dynamic Elite’s ownership of Junhe Consulting and Junhe Consulting’s agreements with Joway Shengshi, we believe that Joway Health controls Joway Shengshi and therefore, we consolidate the results of operations of Joway Shengshi and its subsidiaries with ours as variable interest entities.

In connection with the Share Exchange and as consideration for entering into the VIE Agreements, Mr. Jinghe Zhang and Mr. Baogang Song, the shareholders of Joway Shengshi, entered into a Call Option Agreement with the sole shareholder of Crystal Globe, pursuant to which the shareholders of Joway Shengshi have the right to purchase up to 100% of the shares of Crystal Globe at an aggregate price equal to $20,000 over the next three years. The Call Option vested as to 34% of the shares of Crystal Globe on April 2, 2011, and vests as to 33% on April 2 of 2012 and 2013. As a result, the shareholders of Joway Shengshi became the indirect beneficial owners of the shares of the Company held by Crystal Globe.

Under PRC law the acquisition of Joway Shengshi by Junhe Consulting must be structured as a cash transaction with the purchase price based on the appraised value of the equity interest or assets to be sold. Neither Junhe Consulting nor Dynamic Elite had sufficient cash to pay the appraised value of the equity interest or assets of Joway Shengshi. Alternatively, the shareholders of Joway Shengshi entered into a series of contractual agreements (the “VIE Agreements”) which enabled Dynamic Elite to gain control of Joway Shengshi and be entitled to receive 100% of the profits of Joway Shengshi and is obligated for 100% of the losses of Joway Shengshi. As a result of the VIE agreements, we are able to consolidate Joway Shengshi’s financial statements, including the results of operations, assets and liabilities of Joway Shengshi and its subsidiaries without triggering the regulatory requirements of PRC law. Under PRC law the VIE Agreements are considered commercial transactions among legal entities and individuals, and do not trigger the PRC requirements that apply to acquisitions, although the pledge by Joway Shengshi’s equity holders of all their equity in Joway Shengshi to Junhe Consulting pursuant to the Equity Pledge Agreement (the “Equity Pledge”) must be registered with the appropriate governmental agency. The Equity Pledge was registered with local administration department for industry and commerce pursuant to the Section 1 of Article 226 of PRC Property Law passed by National People’s Congress on March 16, 2007.

Through Junhe Consulting, we effectively and substantially control Joway Shengshi and its three wholly owned subsidiaries Joway Technology, Shengtang Trading and Joway Decoration.

3

The VIE Agreements include:

| ● | a Consulting Services Agreement through which Junhe Consulting has the right to advise, consult, manage and operate Joway Shengshi and collect and own all of the net profits or losses of Joway Shengshi; | |

| ● | an Operating Agreement through which Junhe Consulting has the right to recommend director candidates and appoint the senior executives of Joway Shengshi, approve any transactions that may materially affect the assets, liabilities, rights or operations of Joway Shengshi, and guarantee the contractual performance by Joway Shengshi of any agreements with third parties, in exchange for a pledge by Joway Shengshi of its accounts receivable and assets; | |

| ● | a Proxy Agreement under which the two shareholders of Joway Shengshi have vested their collective voting control over Joway Shengshi to Junhe Consulting and may only transfer their respective equity interests in Joway Shengshi to Junhe Consulting or its designee(s); | |

| ● | an Option Agreement under which the shareholders of Joway Shengshi have granted to Junhe Consulting the irrevocable right and option to acquire all of their equity interests in Joway Shengshi with a consideration equal to the capital paid in by the shareholders in the amount of RMB 50 million (approximately USD $7.52 million). As executive director of Junhe Consulting, Mr. Jinghe Zhang has the power to exercise the option in his sole discretion; and | |

| ● | an Equity Pledge Agreement under which the owners of Joway Shengshi have pledged all of their rights, titles and interests in Joway Shengshi to Junhe Consulting to guarantee Joway Shengshi’s performance of its obligations under the Consulting Services Agreement. |

Terms of the VIE Agreements

Consulting Agreement

Under the Consulting Agreement, Joway Shengshi retained Junhe Consulting to (i) provide general advice and assistance relating to the management and operation of Joway Shengshi’s business; (ii) provide general advice and assistance with respect to employment and staffing issues, including recruiting and training of management personnel, administrative personnel and other staff, establishing an efficient payroll management system, and relocation assistance; (iii) provide business development advice and assistance; and (iv) such other advice and assistance as may be agreed upon by the parties. In return, Joway Shengshi agreed to pay Junhe Consulting quarterly a consulting fee in an amount equal to all of Joway Shengshi’s net income for that quarter within fifteen (15) days after receipt of Joway Shengshi’s quarterly financial statements. Joway Shengshi shall cause the owners of Joway Shengshi to pledge their equity interests in Joway Shengshi to Junhe Consulting to secure the payment of the foregoing consulting fee.

Joway Shengshi is subject to a number of covenants typical for this type of transaction, including the obligation to provide monthly, quarterly and annual reports, and other information requested by Junhe Consulting. In addition, Joway Shengshi is subject to a number of negative covenants, including the agreement that it will not (i) issue, purchase or redeem any equity or debt, or equity or debt securities; (ii) create, incur, assume or suffer to exist any liens upon any of its property or assets (except certain enumerated liens); (iii) wind up, liquidate or dissolve its affairs or enter into any transaction of merger or consolidation, or sale of all or substantially all of its assets; (iv) declare or pay any dividends; (v) incur, assume or suffer to exist any indebtedness, (other than certain enumerated exceptions); (vi) lend money or credit or make advances to any Person, or purchase or acquire any stock, obligations or securities of, or any other interest in, or make any capital contribution to, any other Person, except receivables in the ordinary course of business; (vii) enter into any transaction or series of related transactions, whether or not in the ordinary course of business, with any of its affiliates or related parties, other than on terms and conditions substantially as favorable to Joway Shengshi as would be obtainable in a comparable arm’s-length transaction; (viii) make any expenditure for fixed or capital assets (including, without limitation, expenditures for maintenance and repairs which are capitalized in accordance with generally accepted accounting principles in the PRC and capitalized lease obligations) during any quarterly period which exceeds the aggregate the amount contained in the budget; (ix) amend or modify or change its Articles of Association or business license, or any agreement entered into by it, with respect to its capital stock, or enter into any new agreement with respect to its capital stock; or (x) engage (directly or indirectly) in any business other than those types of business prescribed within the business scope of its business license.

The Consulting Agreement may be terminated by Junhe Consulting for any reason at any time. In addition, the Consulting Agreement may be terminated by Junhe Consulting by written notice in the event of a material breach by Joway Shengshi which, in the case of breach of a non-financial obligation, has not been remedied within fourteen (14) days following the receipt of such written notice. Either party may terminate the Consulting Agreement by written notice to the other party if (i) the other party becomes bankrupt or insolvent or is the subject of proceedings or arrangements for liquidation or dissolution or ceases to carry on business or becomes unable to pay its debts as they become due; (ii) if the operations of Junhe Consulting are terminated; or (iii) if circumstances arise which materially and adversely affect the performance or the objectives of the Consulting Agreement.

4

Operating Agreement

Under the Operating Agreement, Junhe Consulting agreed to guarantee Joway Shengshi’s performance of contracts, agreements or transactions with third parties in consideration for the pledge by Joway Shengshi to Junhe Consulting of all of Joway Shengshi’s assets. In addition, Joway Shengshi and its shareholders agreed that Joway Shengshi would not, without the prior written consent of Junhe Consulting, enter into any transactions which may materially affect the assets, obligations, rights or the operations of Joway Shengshi (excluding transactions entered into in the ordinary course of business and the lien obtained by relevant counter parties due to such agreements), including transactions involving (i) the borrowing of money or assumption of any debt; (ii) the sale or purchase from any third party any asset or right, including, but not limited to, any intellectual property rights; (iii) the provision of any guarantees to any third parties using its assets or intellectual property rights; or (iv) the assignment of any business agreements to any third party. Joway Shengshi and its shareholders also agreed to appoint to Joway Shengshi’s board of directors, and Joway Shengshi’s General Manager, Chief Financial Officer, and other senior officers those persons recommended or selected by Junhe Consulting.

Voting Rights Proxy Agreement

Under the Proxy Agreement, the Shareholders irrevocably granted to Junhe Consulting, for the maximum period of time permitted by law, all of their voting rights as shareholders of Joway Shengshi. In addition, the Shareholders agreed not to transfer their equity interest in Joway Shengshi to any third party (other than Junhe Consulting or a designee of Junhe Consulting). The Proxy Agreement may not be terminated without the unanimous consent of all Parties, except Junhe Consulting, which may terminate the Proxy Agreement with or without cause on thirty (30) days prior written notice.

Option Agreement

Under the Option Agreement, the Shareholders irrevocably granted to Junhe Consulting or its designee an exclusive option to purchase at any time, to the extent permitted under PRC Law, all or a portion of the Shareholders’ Equity Interest in Joway Shengshi for a price equal to the capital paid in by the Shareholders on a pro rata basis in accordance with the percentage of the Shareholders’ Equity Interest acquired, subject to applicable PRC laws and regulations.

Equity Pledge Agreement

Under the Equity Pledge Agreement, the Shareholders pledged all of their right, title and interest in their equity interests in Joway Shengshi to Junhe Consulting to guarantee Joway Shengshi’s performance of its obligations under the Consulting Services Agreement. The pledge expires two (2) years after the satisfaction by Joway Shengshi of all of its obligations under the Consulting Services Agreement. During the term of the Equity Pledge Agreement, Junhe Consulting is entitled to vote, control, sell, or dispose of the Pledged Collateral in the event the Company does not perform its obligations under the Consulting Services Agreement. In addition, Junhe Consulting is entitled to collect any and all dividends declared or paid in connection with the Pledged Collateral.

Through these contractual arrangements, we have the ability to substantially influence the daily operations and financial affairs of Joway Shengshi and to receive, through our subsidiaries, all of its profits. As a result, we are considered the primary beneficiary of Joway Shengshi and its operations, and Joway Shengshi and its subsidiaries are deemed to be our variable interest entities. Accordingly, we are able to consolidate into our financial statements the results, assets and liabilities of Joway Shengshi and its subsidiaries.

Call Option Agreement

As part of the reorganization of Joway Shengshi, Mr. Liu and the shareholders of Joway Shengshi entered into a Call Option Agreement, pursuant to which the shareholders of Joway Shengshi have the right to purchase up to 100% of the shares of Crystal Globe at an aggregate price equal of $20,000 over the next three years. In addition, the Option Agreement also provides that Mr. Liu shall not dispose any of the shares of Crystal Globe without consent of Mr. Jinghe Zhang and Mr. Baogang Song. Upon the consummation of the Share Exchange Transaction, Crystal Globe became the principal shareholder of Joway Health (f/k/a G2 Ventures, Inc.) and Mr. Zhang and Mr. Song became indirect beneficial owners of the shares in Joway Health held by Crystal Globe pursuant to this Call Option Agreement.

On November 13, 2016, Mr. Jinghe Zhang exercised his Call Option as to 99% of the shares of Crystal Globe and Mr. Baogang Song exercised his Call Option as to 1% of the shares of Crystal Globe. As a result of exercising his Call Option, Mr. Zhang became the controlling shareholder of Crystal Globe and in turn, the controlling shareholder of the Company. On November 20, 2016, Mr. Song transferred his1% of the shares of Crystal Globe to Mr. Zhang. Mr. Zhang now controls 17,408,000 shares, or 86.81%, of the issued and outstanding shares of the Company’s common stock.

5

Business Description

We are, through our PRC Operating Entities, engaged in the manufacture and sales of tourmaline-related healthcare products. As of December 31, 2019, we had 32 employees. Our principal executive offices are located at No. 19Baowang Road, Baodi Economic Development Zone, Tianjin, PRC 301800.

Introduction to Tourmaline

Tourmaline is a crystal silicate mineral compounded with elements such as aluminium, iron, magnesium, sodium, lithium, or potassium. Tourmaline is classified as a semi-precious stone and the gem comes in a wide variety of colors. (Source: http://en.wikipedia.org/wiki/Tourmaline)

Tourmaline has the ability to become its own source of electric charge, as it is both pyroelectric, as well as piezoelectric. When it is put under pressure or when it is dramatically heated or cooled, tourmaline creates an electrical charge capable of emitting far infrared rays (“FIR”) and negative ions. (Source: http://www.globalhealingcenter.com/tourmaline.html)

FIRs are invisible waves of energy capable of penetrating deep into the human body. Negative ions are atoms that have a negative electric charge. FIRs and negative ions are perceived to have certain health benefits. (Source: http://www.globalhealingcenter.com/tourmaline.html)

Because it is a permanent source of FIRs and negative ions, tourmaline is perceived to have certain health benefits (Source: Niwa Institute for Immunology, Japan. Int J. Biometeorol 1993 Sep; 37(3) 133-8). In view of its perceived health benefits, tourmaline has been used to manufacture a wide range of healthcare products, including apparel, bedding, water purifiers, sauna rooms, and personal care products.

While tourmaline has perceived health benefits, the actual benefits of tourmaline to human health are unknown. The full efficacy of tourmaline to human health requires further significant clinical study. We are not aware of any formal clinical studies which have validated the health benefits of tourmaline.

We purchase liquid tourmaline from domestic Chinese companies which, in turn, import it from South Korea. Liquid tourmaline is readily available and its price has remained relatively stable. We have not experienced any shortage in tourmaline but as a precaution, we closely monitor its price and have several back-up suppliers.

China’s Tourmaline Health-Related Products Market

The use of tourmaline in health-related products in China began in 2001. Although more and more companies are producing tourmaline health-related products every year, the market for these products in China is still in its infancy and highly fragmented. (Source: 2010-2012 China’s tourmaline market and investment prospects research report, Institute of China Uniway Economics, August, 2010).

Currently, there are numerous kinds of tourmaline health-related products on the market, including tourmaline clothes, tourmaline mattresses, tourmaline water machines, etc. In China, users of tourmaline health-related products are typically middle-aged and elderly people and demand for tourmaline health-related products is still relatively low compared to the size of the Chinese population.

In 2015, New Material is listed in the state development strategies in the State Council Report by Premier Keqiang Li. Tourmaline is defined as New Material and Tourmaline Processing Technology is designated as New Material Application Technology.

We believe that the main challenge for the tourmaline health-related product companies is market development rather than competition. With rising living standards, increasing disposable income, higher health consciousness and the greater awareness of the health benefits of tourmaline, we believe that the tourmaline health products market will grow rapidly in the next few years.

Manufacturing Process

We have two manufacturing processes.

One manufacturing process consists of applying or infusing raw textiles with liquid or granular tourmaline and then producing products from these tourmaline-infused textiles. This process is used to produce Male and Female Underpants, Tourmaline Scarves and Tourmaline Pillowcases.

6

Our second manufacturing process consists of applying or infusing already finished products with liquid or granular tourmaline. We purchase finished products, such as clothing, bedding, and mattresses and then, using one or more of the techniques described below, coat and/or infuse the products with liquid or granular tourmaline.

We coat or infuse liquid or granular tourmaline into our products using one or more of the following methods:

The Spray Method

We use special high-pressure nozzles to spray liquid tourmaline onto the surface of the product. Through this process, the tourmaline particles attach onto the surface of the product. We then use a high-temperature ironing machine to embed the tourmaline particles into the fibers of the product. This method is used in the manufacture of large pieces of textile products, such as mattresses.

The Dip Method

We completely immerse fabrics into liquid tourmaline and then stir the fabrics in the liquid tourmaline to ensure the tourmaline particles attach to the surface of the fabrics. Finally, we embed the tourmaline particles into the fibers by applying heat with our special high-temperature ironing machine. This method is used in the manufacture of smaller products, such as underwear, scarves, and shirts.

The Filling Method

We fill the products with tourmaline particles. This method is used to make activated water machines and other water treatment products.

The three methods mentioned above are keys to our manufacturing process. We protect our manufacturing methods via confidentiality agreements entered into between us and our employees. Pursuant to the confidentiality agreement, the employees are prohibited from unlawfully revealing and using our confidential technology during his/her term of employment and ten years after the termination of employment.

Our Products and Services

We primarily manufacture the following three series of tourmaline-related healthcare products:

| 1. | Healthcare Knit Goods Series |

For the fiscal years ended December 31, 2019 and 2018, our healthcare knit goods series of products accounted for approximately 11.3% and 14.2% of our annual sales revenue, respectively. This series of products is comprised of tourmaline treated mattresses, bed linen, underwear, and shirts. We use either the spray or dip method to embed tourmaline particles into the fabric of this series of products.

Set forth below is a list of our major healthcare knit goods products, the trademarks or marks under which they are marketed and the manufacturing method employed:

No. |

Products | Trademark/Mark | Manufacturing Method | |||||

| 1 | Golden Mattress |  |

|

Spray Method | ||||

| 2 | Tourmaline Mattress |  |

|

Spray Method | ||||

| 3 | Tourmaline Underwear |  |

Dip Method | |||||

| 4 | Tourmaline Bed Linens |  |

|

Spray Method | ||||

| 5 | Tourmaline Pillow |  |

Spray Method | |||||

| 2. | Daily Healthcare and Personal Care Series |

For the fiscal years ended December 31, 2019 and 2018, our daily healthcare and personal care series of products accounted for approximately 34.7% and 29.9% of our annual sales revenue, respectively. This series is comprised of tourmaline-treated waist protectors, knee protectors, scarves, and shampoo and soap products. We use all three production methods to embed tourmaline particles into these products. We believe these tourmaline-treated daily healthcare products and personal care products produce FIRs and negative ions which have perceived health benefits. This series is also comprised of four edible products without tourmaline treatment, including Xin-Nao-Ling Fish Oil Soft Gel,Zhi-Li-Bao Fish Oil Soft Gel, Glucosamine Chondroitin Sulfate & Calcium Capsule and Vegetable and Fruit Enzyme Juice, which are subject to CFDA regulation.

7

Set forth below is a list of our major products in the daily healthcare and personal care series, the trademarks or marks under which they are marketed and the manufacturing method employed:

No. |

Products | Trademark/Mark | Manufacture Method | |||

| 1 | Tourmaline Waist Protector |  |

Spray Method | |||

| 2 | Tourmaline Scarves |  |

Dip Method | |||

| 3 | Tourmaline Shampoo |

|

Filling Method | |||

| 4 | Tourmaline Soap | Filling Method | ||||

| 5 | Tourmaline Toothpaste |  |

Filling Method | |||

| 6 | Xin-Nao-Ling Fish Oil Soft Gel |  |

N/A | |||

| 7 | Zhi-Li-Bao Fish Oil Soft Gel |  |

N/A |

| 3. | Wellness House and Activated Water Machine |

For the years ended December 31, 2019 and 2018, our wellness house and activated water machine series of products accounted for approximately 54.0% and 55.9% of our annual sales revenue, respectively. This series of products is comprised mainly of tourmaline wellness houses, foot sauna bucket, tourmaline activated water machines and drinking mugs. Our tourmaline wellness house resembles a regular sauna room in which users experience heat sessions. However, the inner layer of our wellness house is coated with tourmaline, which emits FIRs and negative ions when heated. Tourmaline is perceived to have certain health benefits. We supply two types of wellness houses: one for family use, which is designed to be installed in the corner of a room and can contain three people; the other is customized and constructed on site for commercial bathrooms or spas according to their specifications. Our tourmaline activated water machines and drinking mugs are infused tourmaline particles into filters. Our Foot Sauna Bucket is filled with tourmaline particles on the bottom.

Set forth below is a list of our major products in the wellness house and activated water machine series, the trademarks or marks under which they are marketed and the manufacturing method employed:

| No. | Products | Trademark/Mark | Manufacturing Method | |||

| 1 | Wellness House for family use |  |

Spray Method | |||

|

||||||

| 2 | Tourmaline Water Mug |  |

Filling Method | |||

| 3 | Tap Water Purifier |  |

Filling Method | |||

| 4 | Foot Sauna Bucket |  |

Filling Method |

8

Return Policy

It is our normal commercial practice to only allow the return of goods that do not conform to the customer’s order due to some occasional error in packaging or shipment. The return should be requested within seven days of purchase. Customers may also request a free repair of defective products within 15 days of purchase. For products purchased more than 15 days previously, we charge a service fee of 110% of the cost of repaired or replaced parts. During the years of 2019 and 2018, we did not have sales return occurred.

Services: Wellness House Maintenance

Our wellness house products generally carry a one-year warranty. When the warranty expires, we provide our customers the option to engage us to service and maintain their wellness houses for a fee equal to 200% of the cost of the repaired or replaced parts.

There has been very little demand for our wellness house maintenance services in 2019 and 2018.

Manufacturing Facilities

Our manufacturing facilities are located in Baodi District, Tianjin City, PRC, and occupy an area of approximately 2,500 square meters. We have 3 employees engaged in manufacturing as of December 31, 2019. We had our own design team comprising 3 designers who are responsible for designing new styles for our products every quarter. They are also responsible for product packaging design.

Customers and Suppliers

Customers

Below is a list of our top ten customers for the years 2019 and 2018, respectively.

Top Ten Customers in 2019

| No. | Name | Amount (RMB) | Amount (US$) | Products Sold | Percentage of Sales | |||||||||||

| 1 | Tianjin Baicheng Yitong Technology Co., Ltd. | ¥ | 643,938 | $ | 93,345 | Xin-Nao-Ling Fish Oil Soft Gel, Tourmaline Mask, Sanitary Napkins, etc. | 15.3 | % | ||||||||

| 2 | Miao Li Store | 587,515 | 85,166 | Foot Sauna Bucket, Tourmaline Mattress, Tap Water Purifier, etc. | 14.0 | % | ||||||||||

| 3 | Xu Xiangyun Store | 556,624 | 80,688 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 13.2 | % | ||||||||||

| 4 | Li Xiaojun Store | 282,436 | 40,942 | Foot Sauna Bucket, Tap Water Purifier, Tourmaline Mattress, etc. | 6.7 | % | ||||||||||

| 5 | Xie Weijing Store | 256,230 | 37,143 | Foot Sauna Bucket, Tourmaline Soap, Tourmaline Toothpaste, etc. | 6.1 | % | ||||||||||

| 6 | Zhu Cuiliu Store | 164,868 | 23,899 | Foot Sauna Bucket, Tap Water Purifier, Skincare Series, etc. | 3.9 | % | ||||||||||

| 7 | Guo Laijin Store | 140,009 | 20,296 | Tourmaline Mattress, Foot Sauna Bucket, Tap Water Purifier, etc. | 3.3 | % | ||||||||||

| 8 | Wang Huiru Store | 138,630 | 20,096 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 3.3 | % | ||||||||||

| 9 | Wen Zhanhe Store | 129,958 | 18,839 | Tourmaline Mattress, Tourmaline Soap, Tourmaline Toothpaste, etc. | 3.1 | % | ||||||||||

| 10 | Zhang Xiangyue Store | 120,084 | 17,407 | Wellness House, Foot Sauna Bucket, Tourmaline Toothpaste, etc. | 2.9 | % | ||||||||||

| ¥ | 3,020,292 | $ | 437,821 | 71.8 | % | |||||||||||

9

Top Ten Customers in 2018

| No. | Name | Amount (RMB) | Amount (US$) | Products Sold | Percentage of Sales | |||||||||||

| 1 | Tianjin Baicheng Yitong Technology Co., Ltd | ¥ | 1,238,149 | $ | 187,183 | Xin-Nao-Ling Fish Oil Soft Gel, Tourmaline Bed Linens, Tourmaline NuBra, etc. | 11.2 | % | ||||||||

| 2 | Xu Xiangyun Store | 1,051,160 | 158,914 | Foot Sauna Bucket, Wellness House, Tourmaline Scarf, etc. | 9.5 | % | ||||||||||

| 3 | Li Xiaojun Store | 707,341 | 106,936 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 6.4 | % | ||||||||||

| 4 | Miao Li Store | 637,118 | 96,319 | Tourmaline Bed Linens, Foot Sauna Bucket, Tourmaline NuBra, etc. | 5.8 | % | ||||||||||

| 5 | Xie Weijing Store | 617,272 | 93,319 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 5.6 | % | ||||||||||

| 6 | Wang Huiru Store | 442,332 | 66,872 | Golden Mattress, Wellness House, Tourmaline Waist Protector, etc. | 4.0 | % | ||||||||||

| 7 | Zhang Xiangyue Store | 426,547 | 64,485 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 3.9 | % | ||||||||||

| 8 | Zhu Cuiliu Store | 382,215 | 57,783 | Wellness House, Foot Sauna Bucket, Tap Water Purifier, etc. | 3.5 | % | ||||||||||

| 9 | Wen Zhanhe Store | 271,879 | 41,103 | Tap Water Purifier, Wellness House, Tourmaline Scarf, etc. | 2.5 | % | ||||||||||

| 10 | Zhang Aiyun Store | 240,365 | 36,338 | Wellness House, Foot Sauna Bucket, Tourmaline Soap, etc. | 2.2 | % | ||||||||||

| ¥ | 6,014,378 | $ | 909,252 | 54.6 | % | |||||||||||

10

Our main customers are franchisees that are authorized to sell our products exclusively. In 2019, we had three customers accounted for more than 10% of our annual sales revenue and in 2018. We had one customer accounted for 11.2% of our annual sales revenue.

Suppliers

Below is a list of our top ten suppliers in 2019 and 2018, respectively.

Top Ten Suppliers in 2019

| No. | Name | Amount (RMB) | Amount (US$) | Product Purchased | Percentage of Purchase | |||||||||||

| 1 | Xuchang Baichang Nanotechnology Co., Ltd. | ¥ | 695,000 | $ | 100,747 | Terahertz equipment | 18.5 | % | ||||||||

| 2 | Jiangmen Sangjian Sauna Equipment Co., Ltd. | 265,000 | 38,414 | Foot Sauna Bucket | 7.0 | % | ||||||||||

| 3 | Cosmaker (Tianjin) Biotechnology Co., Ltd. | 174,250 | 25,259 | Tourmaline Mask and Skincare Series | 4.6 | % | ||||||||||

| 4 | Chongqing Shuigu Technology Co., Ltd. | 167,800 | 24,324 | Water Purifier | 4.5 | % | ||||||||||

| 5 | Foshan Jabon Hygiene Products Co., Ltd. | 165,416 | 23,979 | Sanitary Napkins | 4.4 | % | ||||||||||

| 6 | Wuhan Senlan Biotechnology Co., Ltd. | 154,836 | 22,445 | Vegetable and Fruit Enzyme Juice | 4.1 | % | ||||||||||

| 7 | Penglai Huakang Health Products Co., Ltd. | 141,600 | 20,526 | Xin-Nao-Ling Fish Oil Soft Gel and Zhi-Li-Bao Fish Oil Soft Gel | 3.8 | % | ||||||||||

| 8 | Weihai Biohigh Biotechnology Co., Ltd. | 132,448 | 19,200 | Glucosamine Chondroitin Sulfate & Calcium Capsule | 3.5 | % | ||||||||||

| 9 | Emeishan Jintao Ceramics Industry Development Co., Ltd. | 131,220 | 19,022 | Wellness House Materials | 3.5 | % | ||||||||||

| 10 | Tianjin Beicheng Huasheng Hardware Products Company | 95,248 | 13,807 | Wellness House Materials | 2.5 | % | ||||||||||

| ¥ | 3,766,521 | $ | 545,991 | 56.4 | % | |||||||||||

11

Top Ten Suppliers in 2018

| No. | Name | Amount (RMB) | Amount (US$) | Product Purchased | Percentage of Purchase | |||||||||||

| 1 | Xuzhou Hailante Sauna Equipment Co. Ltd. | ¥ | 941,398 | $ | 142,320 | Wellness House for family use | 13.2 | % | ||||||||

| 2 | Penglai Huakang Health Products Co. Ltd. | 664,000 | 100,383 | Xin-Nao-Ling Fish Oil Soft Gel and Zhi-Li-Bao Fish Oil Soft Gel | 9.3 | % | ||||||||||

| 3 | Jiangmen Sangjian Sauna Equipment Co. Ltd. | 532,265 | 80,468 | Foot Sauna Bucket | 7.5 | % | ||||||||||

| 4 | Hangzhou Siluhua Home Spinning Co. Ltd. | 387,341 | 58,558 | Mattress Products and Other Bedding Articles | 5.4 | % | ||||||||||

| 5 | Tianjin Wuyi Kangjian Network Technology Co., Ltd. | 360,000 | 54,425 | Intelligent Component Analyzer | 5.1 | % | ||||||||||

| 6 | Tianjin Zhengxinglong Packing Products Co., Ltd. | 250,014 | 37,797 | Wood Materials for Wellness house construction | 3.5 | % | ||||||||||

| 7 | Nanjing Tianmai Yuanhongdi Warm Technology Co., Ltd. | 174,028 | 26,310 | Far-infrared Heating Flooring | 2.4 | % | ||||||||||

| 8 | Langfang Qingzhu Paper Products Co. Ltd. | 172,340 | 26,054 | Package | 2.4 | % | ||||||||||

| 9 | Tianjin Ruigao Construction Materials Sales Co., Ltd. | 158,067 | 23,897 | Fireproof Calcium Silicate Board | 2.2 | % | ||||||||||

| 10 | Zhejiang Taikang Biotechnology Co. Ltd. | 108,712 | 16,435 | Tourmaline Toothpaste | 1.5 | % | ||||||||||

| ¥ | 3,748,165 | $ | 566,647 | 52.5 | % | |||||||||||

In 2019 and 2018, we had one supplier accounted for 18.5%and 13.2% of our annual raw materials purchases, respectively. We do not have long term contracts with any of our suppliers since the raw materials we use are readily available on the market at generally stable prices.

Franchise Stores

Approximately 78% and 71% of our annual sales in 2019 and 2018, respectively, were made to our franchisees.

As of December 31, 2019, there were approximately 82 franchise stores across the PRC that were authorized to sell our products exclusively. Set forth below is a geographical breakdown of the franchise stores:

| Region | Number of Franchise Stores | |||

| Northeastern China (Liaoning, Jilin, Heilongjiang) | 3 | |||

| Northern China (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia) | 56 | |||

| Eastern China (Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi) | 2 | |||

| Southern China (Guangdong, Hainan, Guangxi) | 2 | |||

| Central China (Henan, Hubei, Hunan, Jiangxi) | 15 | |||

| Southwestern China (Chongqing, Sichuan, Guizhou, Yunnan, Tibet) | 4 | |||

| Total | 82 | |||

We use multiple criteria to select our franchisees, including financial condition, sales network, sales personnel, and facilities. Generally we approve applicants that meet a minimum working capital requirement of RMB 40,000 and have the requisite business facilities and resources.

12

We typically enter into a standard franchising agreement with the applicant. Pursuant to the agreement, the franchisee is authorized to sell our products exclusively at a predetermined retail price. In exchange, we provide them with products at a discounted price, geographical exclusivity, and marketing, training and technological support. The franchisee is also required to adhere to certain standards of product merchandising, promotion and presentment. No initial franchise fees are required from the franchisee, nor is the franchisee required to pay any continuing royalties. The agreement is generally for a term of three years and is renewable on the mutual agreement of both parties.

Marketing and Sales

Our primary marketing strategies are directed towards both our franchisees and end users, and the marketing efforts of our franchisees are directed towards end users. We assist franchisees on monthly product introduction seminars, which are open to both our franchisees and to the general public.

The franchise stores are responsible for the cost of organizing the monthly product introduction seminars and meetings and we are responsible for the travel expenses of our employees who attend these meetings and seminars to explain and promote our various product lines. There are on average 3 such seminars and meetings each month nationwide. Generally, we choose the venue for the product seminars and meetings based on market prospects, sales volume and the extent of meeting preparation. During the year ended December 31, 2019, we held product seminars and meetings in approximately 18 cities in the PRC.

Below is a breakdown of our marketing expenses in the fiscal years 2019 and 2018.

| 2019 | 2018 | |||||||||||||||

| Expenses | RMB | US$ | RMB | US$ | ||||||||||||

| Promotion | ¥ | 19,396 | $ | 2,812 | ¥ | 466,204 | $ | 70,481 | ||||||||

| Printing | 2,313 | 335 | 40,955 | 6,192 | ||||||||||||

| Travelling | 289,640 | 41,986 | 1,824,361 | 275,807 | ||||||||||||

| Salaries | 655,443 | 95,012 | 1,393,672 | 210,695 | ||||||||||||

| Total | ¥ | 966,792 | $ | 140,145 | ¥ | 3,725,192 | $ | 563,175 | ||||||||

For the fiscal year 2020, we have a marketing and sales budget of $143,345 (RMB 1,000,000), of which, $93,174 (RMB 650,000) for sales personnel, and the remainder for travel, training and other expenses of our sales and marketing department.

Seasonality

Because our products are for daily use, seasonal variations do not have meaningful impact on the market demand for our products.

Competition

Competitive Environment

China’s tourmaline health products market is highly segmented and is in the stage with great demand.

However, given the highly segmented nature of the market, we are unable to locate any information on the size of the tourmaline healthcare-related market in China. Currently, Japanese and Korean companies are leaders in tourmaline technology. However, they have not yet developed a sizeable market share for their products in the PRC (Source: 2010-2012 China’s tourmaline market and investment prospects research report, Institute of China Uniway Economics, August 2010). Therefore, we believe that there is a great opportunity for us to create demand and market share and establish ourselves as a leader in the tourmaline-related healthcare products field.

Our Competitors

Our major competitors in the PRC are as follows:

| ● | Hanya Nano Technology Co., Ltd. operates in Changsha, Hunan province, PRC. They mainly focus on manufacturing tourmaline sauna rooms and tourmaline health products. | |

| ● | Harbin Handu Tourmaline Nano Technology Development Co., Ltd. operates in PRC. They mainly focus on manufacturing tourmaline sauna rooms and tourmaline health products. |

13

Our Competitive Advantages

We believe that by leveraging the following strengths, we can effectively compete and enhance our market position:

| ● | Brand Advantage: We are one of the first companies to manufacture, distribute and sell tourmaline health-related products in the PRC and we believe that our trademark, “Joway”, is the most established and well-known brand in the market. | |

| ● | Technology Advantage: We possess several patents for tourmaline health-related products. We also invest a significant amount of time and expense in new product research and development. In 2016, we applied for a new patent on tourmaline after researching with Tianjin University of Technology. In addition, we have 3 types of products put on record of the Class 1 Medical devices in Tianjin Market and Quality Supervision and Administration Commission which lay a foundation of making health care products listed in Tianjin catalogue of medical system. | |

| ● | Product Diversification Advantage: Most of our competitors concentrate on the one of the tourmaline segments. On the contrary, our products cover diversified tourmaline related catalogue such as tourmaline daily health-related products, water treatment products and tourmaline home accessories. |

| ● | Sales Channels Advantage: As of December 31, 2019, we had approximately 82 franchise stores in most of the big cities in the PRC and we continue to expand our franchise network. We believe our extensive franchisee network will assure that our sales continue to grow. | |

| ● | Talent Advantage: We have recruited additional employees in the fields of marketing, franchise and training, who have several years of relevant experience in their previous careers. We plan to focus the efforts of these individuals to enhance our marketing and sales. | |

| ● | Public Relation Advantage: We enjoy the benefits of a membership at China Health Care Association and China Home Textile Association. For example, as a member, we are entitled to obtain the fist-hand technology related to tourmaline and apply such technology to our business when necessary. |

Business Strategy

We believe the market for tourmaline health-related products in the PRC will grow rapidly. In order to benefit from the market opportunities, we plan to implement the following strategies:

| ● | We will focus on expanding our sales and franchise network in the PRC. Over the past few years, most of our franchises are located in north of China, our target is to cover the most provinces in China especially the southern part in which economy remains high development. | |

| ● | We will continue to expand our product offerings and seek to optimize our product portfolio to include more products with higher profit margins. For example, we believe that tourmaline daily health-related products, water treatment products and tourmaline home accessories have more profit potential and we plant on investing more research and development dollars into developing these products. | |

| ● | We intend to improve our operations, exploit our competitive strengths, and look for ways to expand our business, including through the acquisition of other existing businesses. | |

| ● | We have participated in the Tourmaline Application Committee in 2016. Our goal is to improve the purity of tourmaline and diversify tourmaline products related to our daily lives. |

14

Research and Development

As of December 31, 2019, we had three employees engaged in research and development activities. Our research and development focus on developing new products in the daily health-related, tourmaline products, including tourmaline undergarment, tourmaline scarf and shawl, wellness room for family use.

During 2019 and 2018, we spent $33,048 (RMB 227,984) and $109,373 (RMB 723,464), respectively, on research and development activities. The following is a breakdown of our research and development expenses for 2019 and 2018 as well as our budget for 2020.

| 2019 | 2018 | 2020 (Budget) | ||||||||||||||||||||||

| Item | RMB | US$ | RMB | US$ | RMB | US$ | ||||||||||||||||||

| Equipment | 6,690 | 970 | 17,669 | 2,671 | 10,000 | 1,433 | ||||||||||||||||||

| Samples | 130,619 | 18,934 | 253,568 | 38,334 | 100,000 | 14,334 | ||||||||||||||||||

| Travel Expense | 5,038 | 730 | 12,023 | 1,818 | 10,000 | 1,433 | ||||||||||||||||||

| Salary | 60,902 | 8,828 | 417,959 | 63,187 | 70,000 | 10,034 | ||||||||||||||||||

| Inspection Fee | 24,735 | 3,586 | 22,245 | 3,363 | 25,000 | 3,584 | ||||||||||||||||||

| Total | 227,984 | 33,048 | 723,464 | 109,373 | 215,000 | 30,818 | ||||||||||||||||||

Intellectual Property

We regard our trademarks, trade secrets, patents and similar intellectual property as critical factors to our success. We rely on patent, trademark and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights.

The trademarks we currently use include the “Joway” trademark, which is owned by our President, Chief Executive Officer and director, Mr. Jinghe Zhang. We are permitted to use the “Joway” trademark pursuant to a license agreement with Mr. Jinghe Zhang dated December 1, 2009 for a term of ten years. The agreement was renewed at the end of its respective term. There is no license fee to Mr. Jinghe Zhang for the use of the trademark.

Set forth below is a detailed description of the trademarks we use.

| Mark |

Registration/ |

Class | Effective Date |

Expiration Date |

Owner/Applicant | |||||

|

4794111 |

Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

February 21, 2009 | February 20, 2029 | Jinghe Zhang | |||||

|

6104256 |

Class 3: Cosmetics and Cleaning Preparations. Bleaching preparations and other substances for laundry use; cleaning, polishing, scouring and abrasive preparations; soaps; perfumery, essential oils, cosmetics, hair lotions; dentifrices. |

March 21, 2010 | March 20, 2030 | Tianjin Joway Shengshi Group Co., Ltd. | |||||

|

6104253 |

Class 11: Environmental control apparatus. Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes. |

February 14, 2010 | February 13, 2030 | Tianjin Joway Shengshi Group Co., Ltd. |

15

|

8467175 |

Class 30: Staple foods. Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces (condiments); spices; ice. |

July 21, 2011 | July 20, 2021 | Tianjin Joway Shengshi Group Co., Ltd. | |||||

|

8236524 |

Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

April 28, 2011 | April 27, 2021 | Tianjin Joway Shengshi Group Co., Ltd. | |||||

|

8029052 | Class 5:Pharmaceuticals. | April 14, 2011 | April 13, 2021 | Tianjin Joway | |||||

| Pharmaceutical, veterinary and sanitary preparations; dietetic substances adapted for medical use, food for babies; plasters, materials for dressings; material for stopping teeth, dental wax; disinfectants; preparations for destroying vermin; fungicides, herbicides. | Shengshi Group Co., Ltd. | |||||||||

|

8029009 |

CLASS 2: Paints Paints, varnishes, lacquers; preservatives against rust and against deterioration of wood; colorants; mordents; raw natural resins; metals in foil and powder form for painters, decorators, printers and artists. |

April 14, 2011 | April 13, 2021 | Tianjin Joway Shengshi Group Co., Ltd. | |||||

|

8236733 |

Class 30: Staple foods. Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces (condiments); spices; ice. |

December 14, 2011 | December 13, 2021 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

8236538 |

Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

June 7, 2011 | June 6, 2021 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

8236684 |

Class 11: Environmental control apparatus. Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes |

June 21, 2011 | June 20, 2021 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

8236641 |

Class 3: Cosmetics and Cleaning Preparations. Bleaching preparations and other substances for laundry use; cleaning, polishing, scouring and abrasive preparations; soaps; perfumery, essential oils, cosmetics, hair lotions; dentifrices. |

May 28, 2011 | May 27, 2021 | Tianjin Joway Shengshi Group Co., Ltd |

16

|

11275200 |

Class 30: Staple foods. Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces (condiments); spices; ice. |

December 28, 2013 | December 27, 2023 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

11232054 |

Class 33: Alcoholic beverages. Fruit extracts [alcoholic], aperitifs, distilled beverages, cider, digesters [liqueurs and spirits], wine, clear wine, alcoholic beverages [except beer] and sake. |

December 14, 2013 | December 13, 2023 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

11203446 |

Class 5: Pharmaceuticals. Glue ball, Reducing tea, air purifying preparations, mosquito-repellent incense, sanitary pads, sanitary towels, antisepsis paper and babies’ diapers. |

December 7, 2013 | December 6, 2023 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

16579737 |

Class 3: Cosmetics and Cleaning Preparations. Bleaching preparations and other substances for laundry use; cleaning, polishing, scouring and abrasive preparations; soaps; perfumery, essential oils, cosmetics, hair lotions; dentifrices. |

June 7, 2016 | June 6, 2026 | TianjinJoway Shengshi Group Co., Ltd | |||||

|

16579738 |

Class 3: Cosmetics and Cleaning Preparations. Cleansing lotion, cleanser, facial mask, cosmetics, complexion cream, wrinkle cream. |

June 7, 2016 | June 6, 2026 | Tianjin Joway Shengshi Group Co., Ltd | |||||

|

16966456 |

Class 3: Cosmetics and Cleaning Preparations. Cleansing lotion, cleanser, facial mask, cosmetics, complexion cream, wrinkle cream. |

July 21, 2016 | July 20, 2026 | Tianjin Joway Shengshi Group Co., Ltd |

Currently, the patents that we are using are owned by our Chief Executive Officer, Mr. Jinghe Zhang. Pursuant to a license agreement with our President, Chief Executive Officer and director, Mr. Jinghe Zhang, we are permitted to use the following two patents for free from the effective date to the expiration date of each patent.

| No. | Product | Type | Patent No. | Application Date | Effective Date | Term |

Owner & Inventor | |||||||

| 1 | Water Purifier |

Utility Model |

ZL201620164704.7 | March 3, 2016 | July 6, 2016 | Ten years | Jinghe Zhang | |||||||

| 2 |

Tourmaline Wellness House |

Utility Model | ZL201620839876.X | August 3, 2016 | April 26, 2017 | Ten years | Jinghe Zhang |

Insurance

We do not carry property insurance on our buildings, facilities, and major operating assets, but on our vehicles, and we do not have any business interruption insurance due to the limited availability of this type of coverage in the PRC. During 2019 and 2018, we had no product liability claims.

Employees

As of December 31, 2019, the Company, including its subsidiaries, had a total of 32 full time employees.

Joway Shengshi

As of December 31, 2019, Joway Shengshi had 15 full-time employees based in Tianjin City, PRC. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

17

Below is a breakdown of Joway Shengshi’s employees:

| Departments | Number of Employees |

||

| Management | 6 | ||

| Sales | 2 | ||

| Distribution | 3 | ||

| Franchising | 1 | ||

| Finance | 3 |

Joway Decoration

As of December 31, 2019, Joway Decoration had 14 full-time employees based in Tianjin City, PRC. There were no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

Below is a breakdown of Joway Decoration’s employees:

| Departments | Number of Employees | ||

| Management | 7 | ||

| Distribution | 2 | ||

| Production | 3 | ||

| Franchising | 1 | ||

| Finance | 1 |

Shengtang Trading

As of December 31, 2019, Shengtang trading had 3 full-time employees based in Tianjin, PRC. There were no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

We are required to contribute a portion of our employees’ total salaries to the PRC government’s social insurance funds, including pension insurance, medical insurance, unemployment insurance, work-related injury insurance, and maternity insurance, in accordance with relevant regulations. We have purchased work injury insurance and medical insurance for all our employees.

Effective January 1, 2008, the PRC introduced a new labor contract law that enhances rights for the nation’s workers, including open-ended work contracts and severance pay. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary laborers and makes it harder to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed twice. Although the new labor contract law will increase our labor costs, we do not anticipate there will be any significantly effects on our overall profitability in the near future since such amount was historically not material to our operating cost. Management anticipates this may be a step toward improving candidate retention for skilled workers.

18

Government Regulations and Compliance with Applicable Laws

Below is a list of agencies which may have jurisdiction over our business:

| Agency | Functions | |

| State Food and Drug Administration (“CFDA”)(1) | Supervise the entire process from research and development, manufacturing, and distribution to utilization of drugs; supervise and coordinate the safety management of food, health food and cosmetics and organize investigations of serious accidents. | |

| National Development and Reform Commission (“NDRC”) | Make strategic and mid- to long-term plans for the PRC healthcare industry; regulate drug prices; manage disaster relief funds and carry out healthcare development projects sponsored by the government. | |

| Ministry of Commerce (“MOFCOM”) | Formulate regulations and policies on foreign trade, foreign direct investments, consumer protection, and market competition; negotiate bilateral and multilateral trade agreements. | |

| Ministry of Science and Technology (“MST”) | Lay out science and technology development plans and policies; draft relevant regulations and rules and guarantee implementation of regulations and rules |

| General Administration of Quality Supervision, Inspection and Quarantine (“AQSIQ”) | Manage national quality, metrology, entry-exit commodity inspection, entry-exit health quarantine, entry-exit animal and plant quarantine, import-export food safety, certification, accreditation, and standardization, as well as enforce administrative laws | |

| State Administration of Taxation (“SAT”) | Draft tax regulations and implementation rules and propose tax policies. | |

| State Administration of Foreign Exchange (“SAFE”) | Make regulations and policies governing foreign exchange market activities and manage state foreign exchange reserves. |

| (1) | The PRC State Food and Drug Administration is responsible for (i) regulating the research and development, manufacturing, distribution and utilization of drugs; (ii) supervising and coordinating the safety management of food, health food and cosmetics; and (iii) investigating serious accidents with respect to the foregoing. The products we manufacture are not regulated by the CFDA as they are not drugs, diet supplements or food consumed by humans. There are no existing laws or regulations in China governing the manufacture and sale of tourmaline health care products such as those sold by the Company nor are there any inspection requirements applicable to our products. |

We act as a distributor for four edible products including Xin-Nao-Ling Fish Oil Soft Gel, Zhi-Li-Bao Fish Oil Soft Gel, Glucosamine Chondroitin Sulfate& Calcium Capsule and Vegetable and Fruit Enzyme Juice, which are subject to CFDA regulation. These products are manufactured by Penglai Huakang Healthcare Industries, Ltd., Wuhan Senlan Biotechnology Co., Ltd. and Weihai Biohigh Biotechnology Co., Ltd., which have obtained the necessary manufacturing licenses and certifications from the CFDA.

Environmental Regulations

The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. To date, our costs to comply with applicable environmental laws have been minimal.

According to Article 32 of the PRC Environmental Protection Law, a project that may cause pollution to the environment cannot be undertaken until an environmental impact statement has been approved by the applicable department of environmental protection administration.

In March 2008, Joway Shengshi submitted an environmental impact statement with respect to the manufacturing of 300,000 sets of knitwear annually to the Tianjin Baodi Environmental Protection Bureau. The environmental impact statement assesses the pollution that the manufacturing is likely to produce and its impact on the environment. In addition, the report stipulates the preventive and curative measures the company will undertake. Tianjin Baodi Environmental Protection Bureau approved the environmental impact statement on March 12, 2008 and on April 22, 2009. The Tianjin Baodi Environmental Protection Bureau approved the manufacture of 300,000 sets of knitwear annually.

19

The Company’s production process does not produce industrial waste water or waste gas emissions of a type that is regulated by current PRC laws and regulations. The Company’s other emissions, including noise, waste water, solid waste and atmospheric pollutants meet regulatory standards. According to the Letter regarding Environment Protection of Tianjin Joway Shengshi Group Co, Ltd. issued by Tianjin Baodi Environmental Protection Bureau dated August 6, 2014, Joway Shengshi complies with applicable environmental protection laws and regulations and its discharge of pollutants meets with the standards of the state and Tianjin City.

In addition, Joway Shengshi obtained ISO 140001 International Environmental Management System Certification on January 15, 2009. ISO 140001 was first published as a standard in 1996 and specifies the requirements for an organization’s environmental management system. It applies to those environmental aspects over which an organization has control and where it can be expected to have an influence. Joway Shengshi passed each annual inspection of the ISO 140001. Such Certification covers the production and service of tourmaline health-related products such as underwear, bras, scarves, hats, knee-protectors, waist-protectors, socks, bedding and daily commodities.

We have not been named as a defendant in any legal proceedings alleging violation of environmental laws and have no reasonable basis to believe that there is any threatened claim, action or legal proceedings against us that would have a material adverse effect on our business, financial condition or results of operations due to any non-compliance with environmental laws.

To date, we have not incurred any significant costs in connection with complying with PRC national or local environmental laws.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this report before deciding to invest in our common stock.

Risks Related To Our Business

Our losses in 2019 and may need additional financing to support our daily operations raise doubt as to whether we can continue as a going concern.

As of December 31, 2019, we had an accumulated deficit of $5.3 million and a working capital deficit of $0.9 million. In addition, our revenues decreased by $1,060,143 to$609,174 in 2019 compared with 2018, mainly due to the slowdown in the growth of the health product industry in China. Our cash as of December 31, 2019, was $99,979. It is not likely that our operations will increase sufficiently in the immediate future to support the expenses associated with being a public company. These factors among others indicate that we may be unable to continue as a going concern, particularly in the event that we cannot generate revenues, obtain additional financing and/or obtain profitable operations. As such, there is substantial doubt as to our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty and if we cannot continue as a going concern, your investment in us could become devalued or worthless.

If our business plans are not successful, we may not be able to continue operations as a going concern and our stockholders may lose their entire investment in us.

We have limited revenues and limited cash. The report of our independent registered public accountants on our financial statements for the year ended December 31, 2019 states that these conditions, among others, raise substantial doubt about our ability to continue as a going concern. In addition, the impact of COVID-19 on the Chinese economy may negatively affect our business in the near future. Our ability to continue as a going concern is dependent upon our continued operations, which is dependent in turn upon our ability to meet our financial requirements, raise additional capital, and the success of our future operations.

The purchase of many of our products is discretionary, and may be particularly affected by adverse trends in the general economy; therefore challenging economic conditions may make it more difficult for us to generate revenue.

Our business is affected by global, national and local economic conditions since many of the products we sell are discretionary and we depend, to a significant extent, upon a number of factors relating to discretionary consumer spending in the PRC. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers’ disposable income, business conditions, interest rates, consumer debt levels, availability of credit and levels of taxation in regional and local markets in the PRC where we sell such products. There can be no assurance that consumer spending on the products we sell, will not be adversely affected by changes in general economic conditions in the PRC and globally.

The outbreak of novel coronavirus diseases could adversely affect our operations.

An occurrence of serious diseases or any outbreak of other epidemics in the PRC might result in material disruptions to our operations, to the operations of our customers or suppliers or a decline in our industry or a slowdown in economic growth in the PRC and surrounding regions, any of which could have a material adverse effect on our operations. In late 2019 and early 2020, a novel coronavirus disease, COVID-19, suddenly spread in China and the disease outbreak directly and indirectly caused domestic travel restrictions, quarantine on villages, cities, and provinces, and business closure all over China, including our operations in China. While we take measures at our operations to prevent the outbreak of disease, there can be no assurance that our facilities or products will not be affected by an outbreak of disease in the future, or that the market for health products in the PRC will not decline as a result of fear of disease. In either case, our business, results of operations and financial condition would be adversely and materially affected.

20

The success of our business depends on our ability to market and advertise the products we sell effectively.

Our ability to establish effective marketing and advertising campaigns is the key to our success. Our advertisements promote our corporate image, our merchandise and the pricing of such products. If we are unable to increase awareness of our brands and our products, we may not be able to attract new customers. Our marketing activities may not be successful in promoting the products we sell or pricing strategies or in retaining and increasing our customer base. We cannot assure you that our marketing programs will be adequate to support our future growth, which may result in a material adverse effect on our results of operations.

If we fail to maintain optimal inventory levels, our inventory holding costs could increase or cause us to lose sales, either of which could have a material adverse effect on our business, financial condition and results of operations.