Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Professional Holding Corp. | pfhd-20191231ex3220d1c80.htm |

| EX-32.1 - EX-32.1 - Professional Holding Corp. | pfhd-20191231ex32163e955.htm |

| EX-31.2 - EX-31.2 - Professional Holding Corp. | pfhd-20191231ex312372c69.htm |

| EX-31.1 - EX-31.1 - Professional Holding Corp. | pfhd-20191231ex311793556.htm |

| EX-4.1 - EX-4.1 - Professional Holding Corp. | pfhd-20191231ex412544580.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

□ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _________

Commission File No. 001-39215

Professional Holding Corp.

(Exact name of Registrant as specified in its charter)

|

Florida |

|

|

|

46-5144312 |

|

(State or other jurisdiction of |

|

|

|

(I.R.S. Employer |

|

incorporation or organization) |

|

|

|

Identification Number) |

396 Alhambra Circle, Suite 255

Coral Gables, FL 33134 (786) 483-1757

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

|

Trading Symbol |

|

Name of each exchange on which registered: |

|

Class A Common Stock |

|

PFHD |

|

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). ☐ Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the shares of common stock on January 7, 2020 as reported by the Nasdaq Global Select Market on such date was approximately $174.5 million. The registrant has elected to use January 7, 2020, which was the initial trading date on the Nasdaq Global Select Market, as the calculation date because on June 28, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter), the registrant was a privately held company. Shares of the registrant’s common stock held by each executive officer, director and holder of 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

The number of shares outstanding of Professional Holding Corporation common stock, par value $0.01 per share, as of March 30, 2020, was 13,547,565.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s Proxy Statement for the 2020 Annual Meeting of Shareholders (the “2020 Proxy Statement”) are incorporated by reference into Part III of this report.

i

When used in theis report, “the Company,” “we,” and “our” may refer to Professional Holding Corp. individually, Professional Holding Corp. and its subsidiaries, or our wholly owned subsidiary Professional Bank.

AVAILABLE INFORMATION

The public may read and copy any materials the Company files with the Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549 (information on the operation of tht Public Reference Room is available by calling the SEC at 1-800-SEC-0330). The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

The Company makes available on its website www.myprobank.com its code of ethics and charters of the Auidt Committee, Compensation Committee and Nominating and Corporate Governance Committee of the Board of Directors. Neither our website nor the information contained on that site, or connected to that site, is incorporated by referenced inot the Annual Report on Form 10-K.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains certain forward-looking statements, as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements reflect our current opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding, among other things, future events or future results, in contrast with statements that reflect historical facts. These statements are often, but not always, made through the use of conditional words such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should” or the negative versions of these terms or other comparable terminology. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

Important factors related to forward-looking statements may include, among others, risks and assumptions regarding:

|

· |

the strength of the United States economy in general and the strength of the local economies in which we conduct operations; |

|

· |

the duration and severity of the cornona virus COVID 19 pandemic, both in our principal area of operatins and nationally, including the ultimate impact of the pandemic on the economy generally and on our operations; |

|

· |

our ability to successfully manage interest rate risk, credit risk, liquidity risk, and other risks inherent to our industry; |

|

· |

the accuracy of our financial statement estimates and assumptions, including the estimates used for our loan loss reserve and deferred tax asset valuation allowance; |

|

· |

increased competition and its effect on pricing of our products and services as well as our margins; |

|

· |

legislative or regulatory changes; |

|

· |

our ability to comply with the extensive laws and regulations to which we are subject, including the laws for each jurisdiction where we operate; |

|

· |

the Bank’s ability to make cash distributions to us and our ability to declare and pay dividends, the payment of which is subject to our capital and other requirements; |

|

· |

changes in accounting principles, policies, practices or guidelines, including the effects of forthcoming CECL implementation; |

|

· |

the effects of our lack of a diversified loan portfolio and concentration in the South Florida market, including the risks of geographic, depositor, and industry concentrations, including our concentration in loans secured by real estate; |

|

· |

our ability to fund and manage our growth, both organic growth as well as growth through other means, such as future acquisitions; |

1

|

· |

the frequency and magnitude of foreclosure of our loans; |

|

· |

changes in the securities, real estate markets and commodities markets (including fluctuations in the price of oil); |

|

· |

negative publicity and the impact on our reputation; |

|

· |

our ability to attract and retain highly qualified personnel; |

|

· |

technological changes; |

|

· |

cybersecurity risks including security breaches, computer viruses, and data processing system failures and errors; |

|

· |

our ability to manage operational risks, including, but not limited to, client, employee, or third-party fraud; |

|

· |

changes in monetary and fiscal policies of the U.S. Government and the Federal Reserve; |

|

· |

inflation, interest rate, unemployment rate, market, and monetary fluctuations; |

|

· |

the efficiency and effectiveness of our internal control environment; |

|

· |

the ability of our third-party service providers’ to continue providing services to us and clients without interruption; |

|

· |

the effects of harsh weather conditions, including hurricanes, and man-made disasters; |

|

· |

potential business interruptions from catastrophic events such as terrorist attacks, active shooter situations, and advanced persistent threat groups; |

|

· |

potential disruptions from viruses and pandemics, including the spread of the novel coronavirus COVID-19; |

|

· |

the willingness of clients to accept third-party products and services rather than our products and services and vice versa; |

|

· |

changes in consumer spending and saving habits; |

|

· |

growth and profitability of our noninterest income; |

|

· |

anti-takeover provisions under federal and state law as well as our governing documents; |

|

· |

potential business uncertainties as we integrate MBI into our operations. |

If one or more events related to these or other risks or uncertainties materialize or intensify, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this prospectus are made only as of the date of the Annual Report on Form 10-K. New factors emerge from time to time, and it is not possible for us to predict which will arise. We do not undertake, and specifically decline, any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, except as may be required by law.

2

General

Professional Holding Corp. is a Florida corporation and a financial holding company.

We were incorporated in 2014 and headquartered in Coral Gables, Florida. We operate primarily through our wholly owned subsidiary, Professional Bank, a Florida state-chartered bank, which commenced operations in 2008. We focus on providing creative, relationship-driven commercial banking products and services designed to meet the needs of our clients. Our clients are small to medium sized businesses, the owners and operators of these businesses, and other professionals, entrepreneurs and high net worth individuals.

We believe that we have developed a reputation in our market for highly customized services, and we continue to seek new ways to meet our clients’ financial needs. We offer a full line of deposit products, cash management services and commercial and residential loan programs, as well as online/digital and mobile banking capabilities. We firmly believe our clients place value on our local and timely decision-making, coupled with the high-quality service that we provide. Approaching our clients’ challenges from a different point of view is at the heart of our culture, as our bankers are extremely familiar with our clients’ businesses, enabling us to more accurately assess risk, while developing mutually acceptable credit structures for the bank and its clients.

In October 2019, we opened our Digital Innovation Center in Cleveland, Ohio to support our investments in technology and infrastructure and to continue enhancing our service offerings. It is staffed by former employees of national banking institutions and global consulting firms with experience in banking technology and growth strategies. We recently released our first Apple Watch app, a person-to-person, or P2P, payment service with immediate clearing capabilities that can be used with any other bank in the country. We plan to use our technology platform to create a comprehensive digital bank, including enabling the opening of online accounts through our website. We believe that our technology platform will allow us to compete with larger financial institutions by offering a cutting-edge digital client experience that can be specifically tailored to multiple demographics, while also continuing the customized concierge service that our clients have come to expect.

Since February 7, 2020, the principal market on which our Class A Common Stock is traded is the Nasdaq Global Select Marketplace under the symbol “PFHD.” On February 11, 2020, we announced the closing of our initial public offering (“IPO”) of 3,565,000 shares of our Class A Common Stock, which included an additional 465,000 shares in connection with the exercise in full of the underwriters’ option to purchase additional shares. The closing of the IPO resulted in total net proceeds of approximately $61.3 million, after deducting an underwriting discount of 7%, before expenses. The IPO price of the Class A Common Stock was $18.50 per share.

On March 26, 2020, we closed a merger with Marquis Bancorp, Inc., or MBI, and its wholly owned subsidiary, Marquis Bank, a Florida state-chartered bank. Each share of MBI common stock outstanding was converted into 1.2048 shares of our Class A Common Stock, with cash paid in lieu of any fractional shares. At the closing of the merger we issued approximately 4,227,816 shares of our Class A Common Stock. No MBI shareholders exercised appraisal rights. In addition, all stock options of MBI granted and outstanding on the closing date of the merger were converted into an option to purchase shares of our Class A Common Stock based on the exchange ratio. Upon completion of the merger, the pro forma combined institution had approximately $1.7 billion in total assets, excluding purchase accounting adjustments, total net loans of $1.3 billion and total deposits of $1.4 billion as of December 31, 2019, excluding purchase accounting adjustments.

At March 26, 2020 (after the merger with MBI) we conduct our banking operations from eight branches and four loan production offices located exclusively in the Miami-Fort Lauderdale-West Palm Beach or Miami-Dade metropolitan statistical area, or MSA, which encompasses three rapidly growing counties in Florida: Miami-Dade, Broward, and Palm Beach counties. We are now the 12th largest independent community bank in Florida and the fourth largest independent community bank in South Florida.

3

We believe our investments in people, our platform and technology, as well as our ongoing efforts to attract talented banking professionals, will facilitate future growth and enhanced profitability. Our focus, culture, brand and reputation throughout our market enhance our ability to continue to grow organically, successfully recruit talented bankers and pursue opportunistic acquisitions throughout Florida in the future.

Our Business Strategy

Our business strategy is comprised of the following components:

Organic Growth in Our Attractive Market. Our organic growth strategy to date has primarily focused on gaining market share in the South Florida market. For several reasons, including a business friendly and low tax environment, strong population growth, we believe our market provides abundant opportunities to continue to expand our client base, grow loans and deposits and gain overall market share. Our team of bankers has been an important factor contributing to our organic growth by both broadening our bandwidth with existing clients and expanding our client base. Our team has a track record of originating quality loans, evidenced by our relatively low level of nonperforming assets and credit losses since our strategic pivot in 2013, and durable deposit relationships through a variety of channels in our market while maintaining a premier client experience. The depth of our team’s market knowledge and long-term relationships in the South Florida market are the keys to our strong referral network.

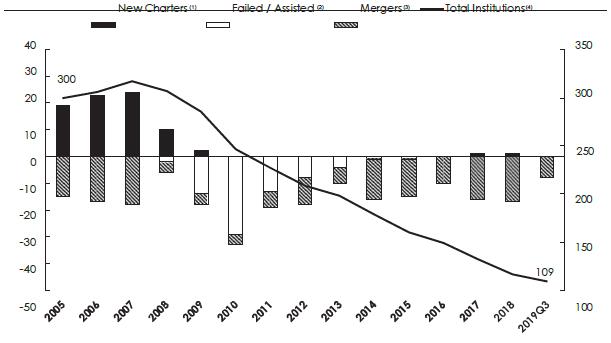

As a result of consolidation in the banking industry in Florida, we believe that there are few locally-based banks that are dedicated to providing our level of sophistication and service to small to medium sized businesses, the owners and operators of these businesses as well as other professionals, entrepreneurs and high net worth individuals in our current and future markets. From 2005 through 2019, the number of Florida-based community banks has decreased from approximately 300 to 109.

Florida Banking Market Overview

Note: Mergers include completed transactions only; New Charters include approved applications only

4

(1)Source: FDIC Decisions on Bank Applications

(2)Source: FDIC Failed Bank List

(3)Source: S&P Global Market Intelligence. Include U.S. Bank, Savings Bank and Thrift completed, whole-entity transactions where the target was headquartered in the state of Florida and the completion date was between 1/1/2005 and 12/31/2019; Excludes acquisitions where the acquired bank was not consolidated into the acquiring financial institution.

(4)Source: FDIC Statistics on Depository Institutions Report

This consolidation has allowed us to hire talented bankers in our market and we will continue to seek out such bankers and teams of bankers who prefer a local, independent, and agile platform to that of a more bureaucratic, regional financial institution. Our goal is to continue our growth to service increasingly larger and sophisticated clients, while remaining agile enough to be a superior, speed-based competitor in acquiring new clients. In an effort to keep our operating costs low while continuing to seek opportunities for growth, we have typically established new banking teams in lower cost loan production offices before committing to opening a more expensive full-service branch. By establishing banking teams in lower cost loan production offices, we are able to avoid long-term lease commitments, costly branch improvements and related costs until our new banking team has attracted a sufficient number of banking relationships and earning assets. Once the newly hired team achieves a certain financial scale, we evaluate the economics of opening a full-service branch. This strategy has allowed us to achieve significant growth while prudently managing our expansion costs and maintaining our strong credit quality.

|

|

|

Date Loan |

|

|

|

Total Deposits as of |

|

|

|

|

Production Office |

|

Date of Branch |

|

12/31/2019 |

|

|

Current Locations |

|

(LPO) Opened |

|

Opening / Conversion |

|

(thousands) |

|

|

South Miami |

|

— |

|

Aug. 2008 |

|

$ |

319,762 |

|

Coral Gables |

|

— |

|

Jan. 2014 |

|

$ |

239,119 |

|

Palm Beach Gardens |

|

Feb. 2016 |

|

Nov. 2017 |

|

$ |

200,006 |

|

Boca Raton |

|

Mar. 2017 |

|

May 2019 |

|

$ |

114,552 |

|

Fort Lauderdale LPO |

|

Oct. 2017 |

|

— |

|

|

— |

|

West Palm Beach LPO |

|

Apr. 2018 |

|

— |

|

|

— |

|

Dadeland |

|

— |

|

May 2019 |

|

$ |

19,434 |

|

Doral LPO |

|

Jul. 2019 |

|

— |

|

|

— |

|

Wellington LPO |

|

Jul. 2019 |

|

— |

|

|

— |

We believe both culture and brand are at the core of our messaging when attracting and retaining both bankers and clients. We believe continued consolidation throughout Florida will provide us with additional opportunities to grow in both our current footprint and beyond into other Florida metropolitan areas. To capitalize on these opportunities, we intend to (i) continue to evaluate lift-outs of high-performing banking teams, (ii) leverage the relationships and contacts of our existing bankers to identify and target suitable business and individual clients, and (iii) develop comprehensive banking relationships with these businesses and individuals by delivering competitive banking products and services comparable to that of larger institutions while providing the superior client service expected of a smaller community bank.

Strategic Acquisitions. We will continue to selectively evaluate acquisitions to complement our organic growth opportunities, and believe having a publicly traded common stock improves our ability to compete for those acquisitions. We believe that many small to medium sized banking organizations in the larger Florida market face significant scale and operational challenges, regulatory pressure, management succession issues and shareholder liquidity needs which may make them potential acquisition targets. According to the FDIC, as of December 31, 2019, there were 92 banks and thrifts headquartered in Florida, each with total assets of less than $1.5 billion, collectively totaling approximately $32.5 billion in assets. Of those 92 institutions, 30 were headquartered in the Miami-Dade MSA with aggregate assets totaling approximately $13.3 billion. We believe that most of the other potential acquirors in our market are significantly larger

5

banking institutions compared to us, which we believe makes us an attractive potential acquiror for many of these small to medium sized banking organizations in the Florida market. As a result, with the option of using our publicly traded stock as currency, we believe we will have a distinct competitive advantage versus most of the larger competitors throughout Florida.

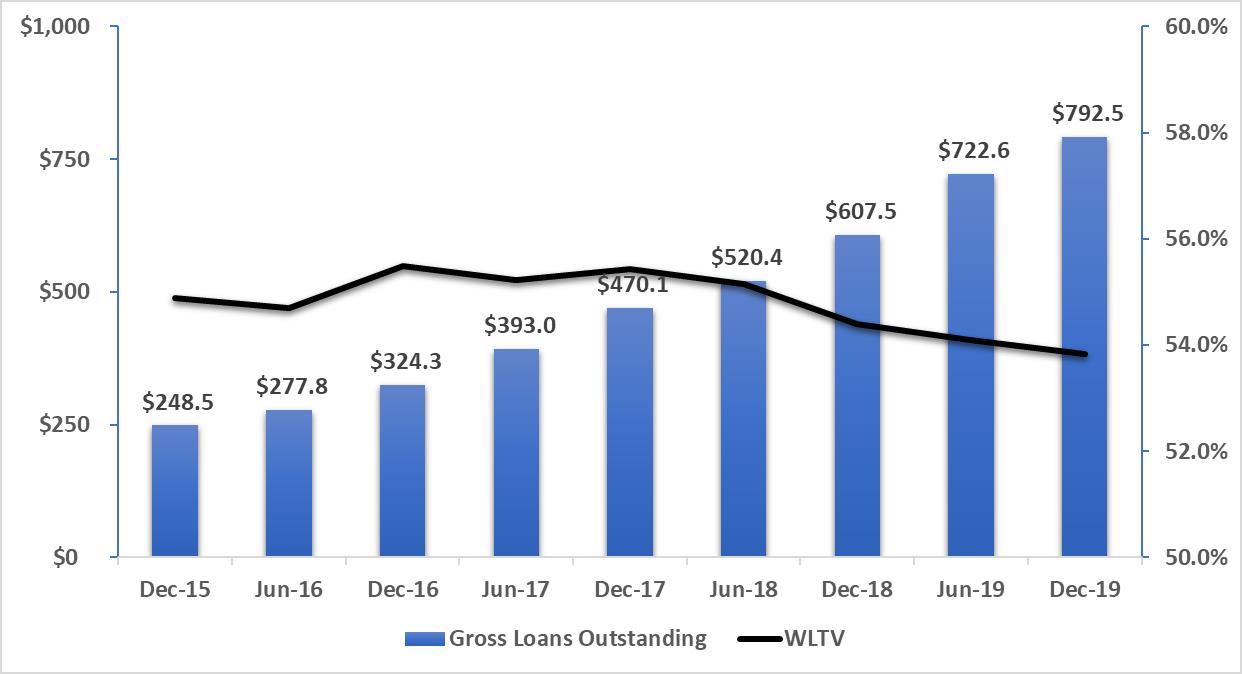

Continue to Improve Operational Efficiency and Increase Profitability. We are committed to enhancing our profitability, which historically has been impacted by our ambitious growth and investments in our platform. Between December 31, 2015 and December 31, 2019, our total assets increased from $302.0 million to $1.1 billion. The growth in total assets was accompanied by a 242.5% increase in full-time employees and the expansion from two branch locations to nine banking locations. As a result of this rapid growth, our average return on average assets and our average efficiency ratio were 0.39% and 76.5%, respectively, for the four fiscal years ended December 31, 2015 to 2018. For the year ended December 31, 2019, our ROAA and efficiency ratio were 0.26% and 87.5%, respectively.

While our investments in personnel and infrastructure have limited our profitability in recent years, we believe we are positioned for continued balance sheet growth and higher profitability without significant additional capital investments. We have also created an operating platform, which is expected to improve our operating efficiencies in the areas of technology, data processing, regulatory compliance and human resources. Our Digital Innovation Center, which is tasked with collaborating with leading-edge financial technology, or fintech, firms, payment vendors, other financial firms and our core provider to develop or integrate best-in-class technology, will also help to improve our productivity, workflows, communication and efficiency, while enhancing our client experience and broadening our digital service offerings.

Furthermore, we believe that our acquisition of MBI will further enhance our efficiency and profitability by improving our ability to achieve operational efficiencies and cost savings by integrating MBI’s operations into our existing operations, including branch locations, leveraging our ability to grow organically through offering our products and services to existing MBI clients, and positioning us to benefit from increased credit portfolio diversity and lending capacity.

Our Market

The Miami-Dade MSA, which encompasses Miami-Dade, Broward, and Palm Beach counties, is among the most vibrant in the United States, characterized by a rapidly growing population, a high level of job growth, an affordable cost of living and a pro-growth business climate. The Miami-Dade MSA is one of the top MSAs in the Southeast as measured by both deposits and by population and is one of the largest business markets in Florida. According to S&P Global Market Intelligence estimates, Florida is the third most populous state in the United States and approximately 29% of the population of Florida resides in the Miami-Dade MSA. Florida continues to experience significant population and employment growth on a statewide basis, with the state’s population increasing from 12.9 million in 1990 to an estimated 21.8 million in 2020. Additionally, according to the Federal Reserve, Florida has the fourth largest contribution to gross domestic product (GDP) by state in the United States, equating to the 17th largest economy in the world. The Miami-Dade MSA has the 12th largest contribution to GDP by MSA in the United States according to the U.S. Bureau of Economic Analysis based on 2017 data, the most recent available. This continued growth of the Florida market, as well as the consolidation in the banking industry within the state is expect to provide us with opportunities for growth.

Supervision and Regulation

We must comply with state and federal banking laws and regulations that control virtually all aspects of our operations. These laws and regulations generally aim to protect our depositors, not necessarily our shareholders or our creditors. Any changes in applicable laws or regulations may materially affect our business and prospects. Proposed legislative or regulatory changes may also affect our operations. The following description summarizes some of the laws and regulations to which we are subject. References to applicable statutes and regulations are brief summaries, do not purport to be complete, and are qualified in their entirety by reference to such statutes and regulations.

6

Professional Holding Corp.

We are registered with the Board of Governors of the Federal Reserve as a financial holding company under the Bank Holding Company Act of 1956, or BHC Act. As a result, we are subject to supervisory regulation and examination by the Federal Reserve. The Gramm-Leach-Bliley Act, the BHC Act, and other federal laws subject financial holding companies to particular restrictions on the types of activities in which they may engage, and to a range of supervisory requirements and activities, including regulatory enforcement actions for violations of laws and regulations.

Permitted Activities

The Gramm-Leach-Bliley Act modernized the U.S. banking system by: (i) allowing bank holding companies that qualify as “financial holding companies,” such as Professional Holding Corp., to engage in a broad range of financial and related activities; (ii) allowing insurers and other financial service companies to acquire banks; (iii) removing restrictions that applied to bank holding company ownership of securities firms and mutual fund advisory companies; and (iv) establishing the overall regulatory scheme applicable to bank holding companies that also engage in insurance and securities operations. The general effect of the law was to establish a comprehensive framework to permit affiliations among commercial banks, insurance companies, securities firms, and other financial service providers. Activities that are financial in nature are broadly defined to include not only banking, insurance, and securities activities, but also merchant banking and additional activities that the Federal Reserve, in consultation with the Secretary of the Treasury, determines to be financial in nature, incidental to such financial activities, or complementary activities that do not pose a substantial risk to the safety and soundness of depository institutions or the financial system generally.

In contrast to financial holding companies, bank holding companies are limited to managing or controlling banks, furnishing services to or performing services for its subsidiaries, and engaging in other activities that the Federal Reserve determines by regulation or order to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. In determining whether a particular activity is permissible, the Federal Reserve must consider whether the performance of such an activity reasonably can be expected to produce benefits to the public that outweigh possible adverse effects. Possible benefits include greater convenience, increased competition, and gains in efficiency. Possible adverse effects include undue concentration of resources, decreased or unfair competition, conflicts of interest, and unsound banking practices. Despite prior approval, the Federal Reserve may order a bank holding company or its subsidiaries to terminate any activity or to terminate ownership or control of any subsidiary when the Federal Reserve has reasonable cause to believe that a serious risk to the financial safety, soundness or stability of any bank subsidiary of that bank holding company may result from such an activity.

Changes in Control

Subject to certain exceptions, the BHC Act and the CBCA, together with the applicable regulations, require Federal Reserve approval (or, depending on the circumstances, no notice of disapproval) prior to any acquisition of “control” of a bank or bank holding company. Under the BHC Act, a company (a broadly defined term that includes partnerships among other things) that acquires the power, directly or indirectly, to direct the management or policies of an insured depository institution or to vote 25% or more of any class of voting securities of any insured depository institution is deemed to control the institution and to be a bank holding company. A company that acquires less than 5% of any class of voting security (and that does not exhibit the other control factors) is presumed not to have control. For ownership levels between the 5% and 25% thresholds, the Federal Reserve has developed an extensive body of law on the circumstances in which control may or may not exist. The current guidance includes a 2008 policy statement on minority equity investments in banks and bank holding companies that generally permits investors to (i) acquire up to 33% of the total equity of a target bank or bank holding company, subject to certain conditions, including (but not limited to) that the investing firm does not acquire 15% or more of any class of voting securities, and (ii) designate at least one director, without triggering the various regulatory requirements associated with control. In April 2019, the Federal Reserve proposed several changes to its control rules under the BHC Act; when or if this proposal will be finalized is unknown.

Under the CBCA, if an individual or a company that acquires 10% or more of any class of voting securities of an insured depository institution or its holding company and either that institution or company has registered securities under Section 12 of the Exchange Act, or no other person will own a greater percentage of that class of voting securities

7

immediately after the acquisition, then that investor is presumed to have control and may be required to file a change in bank control notice with the institution’s or the holding company’s primary federal regulator. Our Class A Common Stock is registered under Section 12 of the Exchange Act.

As a financial holding company, we are required to obtain prior approval from the Federal Reserve before (i) acquiring all or substantially all of the assets of a bank or bank holding company, (ii) acquiring direct or indirect ownership or control of more than 5% of the outstanding voting stock of any bank or bank holding company (unless we own a majority of such bank’s voting shares), or (iii) acquiring, merging or consolidating with any other bank or bank holding company. In determining whether to approve a proposed bank acquisition, federal bank regulators will consider, among other factors, the effect of the acquisition on competition, the public benefits expected to be received from the acquisition, the projected capital ratios and levels on a post-acquisition basis, and the companies records of addressing the credit needs of the communities they serve, including the needs of low and moderate income neighborhoods, consistent with the safe and sound operation of the bank, under the Community Reinvestment Act of 1977.

Under Florida law, a person or entity proposing to directly or indirectly acquire control of a Florida bank must also obtain permission from the Florida Office of Financial Regulation. Florida statutes define “control” as either (i) indirectly or directly owning, controlling or having power to vote 25% or more of the voting securities of a bank; (ii) controlling the election of a majority of directors of a bank; (iii) owning, controlling, or having power to vote 10% or more of the voting securities as well as directly or indirectly exercising a controlling influence over management or policies of a bank; or (iv) as determined by the Florida Office of Financial Regulation. These requirements will affect us because the Bank is chartered under Florida law and changes in control of the Company are indirect changes in control of the Bank.

Tying

Financial holding companies and their affiliates are prohibited from tying the provision of certain services, such as extending credit, to other services or products offered by the holding company or its affiliates, such as deposit products.

Capital; Dividends; Source of Strength

The Federal Reserve imposes certain capital requirements on financial holding companies under the BHC Act, including a minimum leverage ratio and a minimum ratio of “qualifying” capital to risk-weighted assets. These requirements are described below under “Capital Regulations.” Subject to its capital requirements and certain other restrictions, we are generally able to borrow money to make a capital contribution to the Bank, and such loans may be repaid from dividends paid from the Bank to us. We are also able to raise capital for contributions to the Bank by issuing securities without having to receive regulatory approval, subject to compliance with federal and state securities laws.

It is the Federal Reserve’s policy that bank holding companies should generally pay dividends on common stock only out of income available over the past year, and only if prospective earnings retention is consistent with the organization’s expected future needs and financial condition. It is also the Federal Reserve’s policy that bank holding companies should not maintain dividend levels that undermine their ability to be a source of strength to its banking subsidiaries. Additionally, the Federal Reserve has indicated that bank holding companies should carefully review their dividend policies and has discouraged payment ratios that are at maximum allowable levels unless both asset quality and capital are very strong. The Federal Reserve possesses enforcement powers over bank holding companies and their non-bank subsidiaries to prevent or remedy actions that represent unsafe or unsound practices or violations of applicable statutes and regulations. Among these powers is the ability to proscribe the payment of dividends by banks and bank holding companies.

Bank holding companies are expected to consult with the Federal Reserve before redeeming any equity or other capital instrument included in tier 1 or tier 2 capital prior to stated maturity, if such redemption could have a material effect on the level or composition of the organization’s capital base. In addition, a bank holding company may not repurchase shares equal to 10% or more of its net worth if it would not be well-capitalized (as defined by the Federal Reserve) after giving effect to such repurchase. Bank holding companies experiencing financial weaknesses, or that are

8

at significant risk of developing financial weaknesses, must consult with the Federal Reserve before redeeming or repurchasing common stock or other regulatory capital instruments.

In accordance with Federal Reserve policy, which has been codified by the Dodd-Frank Act, we are expected to act as a source of financial strength to the Bank and to commit resources to support the Bank in circumstances in which we might not otherwise do so. In furtherance of this policy, the Federal Reserve may require a financial holding company to terminate any activity or relinquish control of a non-bank subsidiary (other than a non-bank subsidiary of a bank) upon the Federal Reserve’s determination that such activity or control constitutes a serious risk to the financial soundness or stability of any subsidiary depository institution of the financial holding company. Further, federal bank regulatory authorities have additional discretion to require a financial holding company to divest itself of any bank or non-bank subsidiary if the agency determines that divestiture may aid the depository institution’s financial condition.

Safe and Sound Banking Practices

Bank holding companies and their non-banking subsidiaries are prohibited from engaging in activities that represent unsafe and unsound banking practices or that constitute a violation of law or regulations. Under certain conditions the Federal Reserve may conclude that certain actions of a bank holding company, such as a payment of a cash dividend, would constitute an unsafe and unsound banking practice. The Federal Reserve also has the authority to regulate the debt of bank holding companies, including the authority to impose interest rate ceilings and reserve requirements on such debt. Under certain circumstances the Federal Reserve may require a bank holding company to file written notice and obtain its approval prior to purchasing or redeeming its equity securities, unless certain conditions are met.

Professional Bank

Professional Bank is a state-chartered commercial banking institution that is chartered by and headquartered in the State of Florida and is subject to supervision and regulation by the Florida Office of Financial Regulation. The Florida Office of Financial Regulation supervises and regulates all areas of our operations including, without limitation, the making of loans, the issuance of securities, the conduct of our corporate affairs, and the satisfaction of capital adequacy requirements, the payment of dividends, and the establishment or closing of banking centers. We are also a member bank of the Federal Reserve System, which makes our operations subject to broad federal regulation and oversight by the Federal Reserve. In addition, our deposit accounts are insured by the FDIC up to the maximum extent permitted by law, and the FDIC has certain supervisory and enforcement powers over us.

As a state-chartered bank in the State of Florida, we are empowered by statute, subject to the limitations contained in those statutes, to take and pay interest on, savings and time deposits, to accept demand deposits, to make loans on residential and other real estate, to make consumer and commercial loans, to invest, with certain limitations, in equity securities and in debt obligations of banks and corporations and to provide various other banking services for the benefit of our clients. Various consumer laws and regulations also affect our operations, including state usury laws, laws relating to fiduciaries, consumer credit and equal credit opportunity laws, and fair credit reporting. In addition, the Federal Deposit Insurance Corporation Improvement Act of 1991, or FDICIA, prohibits insured state-chartered institutions from conducting activities as principal that are not permitted for national banks. A bank, however, may engage in an otherwise prohibited activity if it meets its minimum capital requirements and the FDIC determines that the activity does not present a significant risk to the Deposit Insurance Fund.

Economic Growth Act

The Economic Growth Act, which was signed into law in May 2018, provides certain limited amendments to the Dodd-Frank Act, as well as certain targeted modifications to prior financial services reform regulatory requirements. As a result of the Economic Growth Act, we expect to experience the rollback of some of the more burdensome requirements resulting from the Dodd-Frank Act. Provisions in the Economic Growth Act generally address access to mortgage credit; consumer access to credit; protections for veterans, consumers, and homeowners; and protections for student borrowers. One of the Economic Growth Act’s highlights with potential implications for us is its increase in the asset threshold under the Federal Reserve’s Small Bank Holding Company Policy Statement from $1.0 billion to $3.0 billion. Another potentially significant provision is the Economic Growth Act’s requirement that the federal bank

9

regulatory agencies adopt a threshold for a community bank leverage ratio, or CBLR, of not less than 8.0% and not more than 10.0% for banking organizations with $10.0 billion or less in total consolidated assets and that meet certain other conditions. A qualifying organization that satisfies the CBLR is deemed to satisfy the capital rules and to be well-capitalized for the purpose of the prompt corrective action regulations, subject to certain exceptions. The agencies have proposed a CBLR of 9.0%, but we do not know if or when the agencies will finalize the proposal. A number of the other specific provisions of this legislation are discussed in other parts of this “Supervision and Regulation” section.

At this time, it is difficult to anticipate the continued impact this expansive legislation will have on our business, our clients, and the financial industry generally. Changes resulting from further implementation of, changes to or repeal of the Dodd-Frank Act may impact the profitability of our business activities, require changes to certain of our business practices, impose upon us more stringent capital, liquidity and leverage requirements, or otherwise adversely affect our business. These changes may also require us to invest significant management attention and resources to evaluate and make any changes necessary to comply with new statutory and regulatory requirements. Failure to comply with any new requirements may negatively impact our results of operations and financial condition.

Safety and Soundness Standards / Risk Management

The federal banking agencies have adopted guidelines establishing operational and managerial standards to promote the safety and soundness of federally insured depository institutions. The guidelines set forth standards for internal controls, information systems, internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth, compensation, fees and benefits, asset quality and earnings.

In general, the safety and soundness guidelines prescribe the goals to be achieved in each area, and each institution is responsible for establishing its own procedures to achieve those goals. If an institution fails to comply with any of the standards set forth in the guidelines, the financial institution’s primary federal regulator may require the institution to submit a plan for achieving and maintaining compliance. If a financial institution fails to submit an acceptable compliance plan or fails in any material respect to implement a compliance plan that has been accepted by its primary federal regulator, the regulator is required to issue an order directing the institution to cure the deficiency. Until the deficiency cited in the regulator’s order is cured, the regulator may restrict the financial institution’s rate of growth, require the financial institution to increase its capital, restrict the rates the institution pays on deposits or require the institution to take any action the regulator deems appropriate under the circumstances. Noncompliance with the standards established by the safety and soundness guidelines may also constitute grounds for other enforcement action by the federal bank regulatory agencies, including cease and desist orders and civil money penalty assessments.

During the past decade, the bank regulatory agencies have increasingly emphasized the importance of sound risk management processes and strong internal controls when evaluating the activities of the financial institutions they supervise. Properly managing risks has been identified as critical to the conduct of safe and sound banking activities and has become even more important as new technologies, product innovation and the size and speed of financial transactions have changed the nature of banking markets. The agencies have identified a spectrum of risks facing a banking institution including, but not limited to, credit, market, liquidity, operational, legal and reputational risk. In particular, recent regulatory pronouncements have focused on operational risk, which arises from the potential that inadequate information systems, operational problems, breaches in internal controls, fraud or unforeseen catastrophes will result in unexpected losses. New products and services, third party risk management and cybersecurity are critical sources of operational risk that financial institutions are expected to address in the current environment.

The Bank is expected to have active board and senior management oversight; adequate policies, procedures and limits; adequate risk measurement, monitoring and management information systems; and comprehensive internal controls.

Reserves

The Federal Reserve requires all depository institutions to maintain reserves against transaction accounts (noninterest-bearing and NOW checking accounts). The balances maintained to meet the reserve requirements imposed by the Federal Reserve may be used to satisfy liquidity requirements. An institution may borrow from the Federal

10

Reserve Bank “discount window” as a secondary source of funds, provided that the institution meets the Federal Reserve Bank’s credit standards.

Dividends

The Bank is subject to legal limitations on the frequency and amount of dividends that can be paid to the Company. The Federal Reserve may restrict the ability of the Bank to pay dividends if such payments would constitute an unsafe or unsound banking practice. Additionally, as of January 1, 2019, financial institutions are required to maintain a capital conservation buffer of at least 2.5% of risk-weighted assets in order to avoid restrictions on capital distributions and other payments. If a financial institution’s capital conservation buffer falls below the minimum requirement, its maximum payout amount for capital distributions and discretionary payments declines to a set percentage of eligible retained income based on the size of the buffer. See “Capital Regulations,” below for additional details on this new capital requirement.

In addition, Florida law and Federal regulation place restrictions on the declaration of dividends from state-chartered banks to their holding companies. Pursuant to the Florida Financial Institutions Code, the board of directors of a state-chartered bank, after charging off bad debts, depreciation and other worthless assets, if any, and making provisions for reasonably anticipated future losses on loans and other assets, may quarterly, semi-annually or annually declare a dividend of up to the aggregate net profits of that period combined with the bank’s retained net profits for the preceding two years and, with the approval of the Florida Office of Financial Regulation and Federal Reserve, declare a dividend from retained net profits which accrued prior to the preceding two years. Before declaring such dividends, 20% of the net profits for the preceding period as is covered by the dividend must be transferred to the surplus fund of the bank until this fund becomes equal to the amount of the bank’s common stock then issued and outstanding. A state-chartered bank may not declare any dividend if (i) its net income (loss) from the current year combined with the retained net income (loss) for the preceding two years aggregates a loss or (ii) the payment of such dividend would cause the capital account of the bank to fall below the minimum amount required by law, regulation, order or any written agreement with the Florida Office of Financial Regulation or a federal regulatory agency. Under Federal Reserve regulations, a state member bank may, without the prior approval of the Federal Reserve, pay a dividend in an amount that, when taken together with all dividends declared during the calendar year, does not exceed the sum of the bank’s net income during the current calendar year and the retained net income of the prior two calendar years. The Federal Reserve may approve greater amounts.

Insurance of Accounts and Other Assessments

Our deposit accounts are currently insured by the Deposit Insurance Fund generally up to a maximum of $250,000 per separately insured depositor. We pay deposit insurance assessments to the Deposit Insurance Fund, which are determined through a risk-based assessment system.

Under the current system, deposit insurance assessments are based on a bank’s assessment base, which is defined as average total assets minus average tangible equity. For established small institutions, such as the Bank, the FDIC sets deposit assessment rates based on the Financial Ratios Method, which takes into account several ratios that reflect leverage, asset quality, and earnings at each individual institution and then applies a pricing multiplier that is the same for all institutions. An institution’s rate must be within a certain minimum and a certain maximum, and the range varies based on the institution’s composite CAMELS rating. The deposit insurance assessment is calculated by multiplying the bank’s assessment base by the total base assessment rate.

All FDIC-insured institutions have been required to pay assessments to the FDIC at a current annual rate of approximately five tenths of a basis point of its assessment base to fund interest payments on bonds issued by the Financing Corporation, or FICO, an agency of the federal government established to recapitalize the predecessor to the Savings Association Insurance Fund. The last of the FICO bonds mature in 2019. The FDIC made its final collection of the assessment for these bonds in March 2019. FDIC-insured institutions accordingly are no longer required to pay the FICO bond assessment.

11

Under the FDIA, the FDIC may terminate deposit insurance upon a finding that the institution has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC.

Transactions with Affiliates and Insiders

Pursuant to Sections 23A and 23B of the Federal Reserve Act and Regulation W, the authority of the Bank to engage in transactions with related parties or “affiliates” or to make loans to insiders is limited. Loan transactions with an affiliate generally must be collateralized and certain transactions between the Bank and its affiliates, including the sale of assets, the payment of money or the provision of services, must be on terms and conditions that are substantially the same, or at least as favorable to the Bank, as those prevailing for comparable nonaffiliated transactions. In addition, the Bank generally may not purchase securities issued or underwritten by affiliates.

Loans to executive officers and directors of an insured depository institution or any of its affiliates or to any person who directly or indirectly, or acting through or in concert with one or more persons, owns, controls or has the power to vote more than 10% of any class of voting securities of a bank, which we refer to as 10% Shareholders, or to any political or campaign committee the funds or services of which will benefit those executive officers, directors, or 10% Shareholders or which is controlled by those executive officers, directors or 10% Shareholders, are subject to Sections 22(g) and 22(h) of the Federal Reserve Act and the corresponding regulations (Regulation O) and Section 13(k) of the Exchange Act relating to the prohibition on personal loans to executives (which exempts financial institutions in compliance with the insider lending restrictions of Section 22(h) of the Federal Reserve Act). Among other things, these loans must be made on terms substantially the same as those prevailing on transactions made to unaffiliated individuals and certain extensions of credit to those persons must first be approved in advance by a disinterested majority of the entire board. Section 22(h) of the Federal Reserve Act prohibits loans to any of those individuals where the aggregate amount exceeds an amount equal to 15% of an institution’s unimpaired capital and surplus plus an additional 10% of unimpaired capital and surplus in the case of loans that are fully secured by readily marketable collateral, or when the aggregate amount on all of the extensions of credit outstanding to all of these persons would exceed our unimpaired capital and unimpaired surplus. Section 22(g) identifies limited circumstances in which we are permitted to extend credit to executive officers of the Bank.

Community Reinvestment Act

The Community Reinvestment Act and its corresponding regulations are intended to encourage banks to help meet the credit needs of the communities they serve, including low and moderate income neighborhoods, consistent with safe and sound banking practices. These regulations provide for regulatory assessment of a bank’s record in meeting the credit needs of its market area. Federal banking agencies are required to publicly disclose each bank’s rating under the Community Reinvestment Act. The Federal Reserve considers a bank’s Community Reinvestment Act rating when the bank submits an application to establish bank branches, merge with another bank, or acquire the assets and assume the liabilities of another bank. In the case of a financial holding company, the Community Reinvestment Act performance record of all banks involved in a merger or acquisition are reviewed in connection with the application to acquire ownership or control of shares or assets of a bank or to merge with another bank or bank holding company. An unsatisfactory record can substantially delay or block the transaction. We received a satisfactory rating on our most recent Community Reinvestment Act assessment.

The federal banking regulators have adopted risk-based, capital adequacy guidelines for financial holding companies and their subsidiary banks based on the Basel III standards. Under these guidelines, assets and off-balance sheet items are assigned to specific risk categories each with designated risk weightings. The new risk-based capital guidelines are designed to make regulatory capital requirements more sensitive to differences in risk profiles among banks and bank holding companies, to account for off-balance sheet exposure, to minimize disincentives for holding liquid assets, and to achieve greater consistency in evaluating the capital adequacy of major banks throughout the world. The resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items. Final rules implementing the capital adequacy guidelines became effective, with various phase-in periods, on January 1,

12

2015 for community banks. All of the rules were fully phased in as of January 1, 2019. These final rules represent a significant change to the prior general risk-based capital rules and are designed to substantially conform to the Basel III international standards.

In computing total risk-weighted assets, bank and bank holding company assets are given risk-weights of 0%, 20%, 50%, 100% and 150%. In addition, certain off-balance sheet items are given similar credit conversion factors to convert them to asset equivalent amounts to which an appropriate risk-weight will apply. Most loans will be assigned to the 100% risk category, except for performing first mortgage loans fully secured by 1-to-4 family and certain multi-family residential property, which carry a 50% risk rating. Most investment securities (including, primarily, general obligation claims on states or other political subdivisions of the United States) will be assigned to the 20% category, except for municipal or state revenue bonds, which have a 50% risk-weight, and direct obligations of the U.S. Treasury or obligations backed by the full faith and credit of the U.S. Government, which have a 0% risk-weight. In covering off-balance sheet items, direct credit substitutes, including general guarantees and standby letters of credit backing financial obligations, are given a 100% conversion factor. Transaction-related contingencies such as bid bonds, standby letters of credit backing nonfinancial obligations, and undrawn commitments (including commercial credit lines with an initial maturity of more than one year) have a 50% conversion factor. Short-term commercial letters of credit are converted at 20% and certain short-term unconditionally cancelable commitments have a 0% factor.

Under the final rules, minimum requirements increased for both the quality and quantity of capital held by banking organizations. In this respect, the final rules implement strict eligibility criteria for regulatory capital instruments and improves the methodology for calculating risk-weighted assets to enhance risk sensitivity. Consistent with the international Basel III framework, the rules include a new minimum ratio of Common Equity Tier 1 Capital to Risk-Weighted Assets of 4.5%. The rules also create a Common Equity Tier 1 Capital conservation buffer of 2.5% of risk-weighted assets. This buffer is added to each of the three risk-based capital ratios to determine whether an institution has established the buffer. The rules raise the minimum ratio of Tier 1 Capital to Risk-Weighted Assets from 4% to 6% and include a minimum leverage ratio of 4% for all banking organizations. If a financial institution’s capital conservation buffer falls below 2.5% — e.g., if the institution’s Common Equity Tier 1 Capital to Risk-Weighted Assets is less than 7.0% — then capital distributions and discretionary payments will be limited or prohibited based on the size of the institution’s buffer. The types of payments subject to this limitation include dividends, share buybacks, discretionary payments on Tier 1 instruments, and discretionary bonus payments.

The new capital regulations may also impact the treatment of accumulated other comprehensive income, or AOCI, for regulatory capital purposes. Under the new rules, AOCI generally flows through to regulatory capital, however, community banks and their holding companies may make a one-time irrevocable opt-out election to continue to treat AOCI the same as under the old regulations for regulatory capital purposes. This election was required to be made on the first call report or bank holding company annual report (on form FR Y-9C) filed after January 1, 2015. We made the opt-out election. Additionally, the new rules also permit community banks with less than $15 billion in total assets to continue to count certain non-qualifying capital instruments issued prior to May 19, 2010 as Tier 1 capital, including trust preferred securities and cumulative perpetual preferred stock (subject to a limit of 25% of Tier 1 capital). However, non-qualifying capital instruments issued on or after May 19, 2010 do not qualify for Tier 1 capital treatment.

Additionally, effective August 30, 2018, under the Federal Reserve Board’s Small Bank Holding Company and Savings and Loan Holding Company Policy Act, bank holding companies with less than $3 billion in total consolidated assets are considered small bank holding companies. The small bank holding company policy statement eases the transfer of ownership of small community banks by allowing their holding companies to operate with higher levels of debt than would normally be permitted and excludes them from consolidated capital requirements. As such, we are excluded from consolidated capital requirements until such time that our total consolidated assets exceed $3 billion or the Federal Reserve Board decides that we are no longer to be considered a small bank holding company. However, if we were to be subject to the consolidated capital requirements, we would be in compliance.

On November 21, 2018, federal regulators released a proposed rulemaking that would, if enacted, provide certain banks and their holding companies with the option to elect out of complying with the Basel III capital rules. Under the proposal, a qualifying community banking organization would be eligible to elect the community bank leverage ratio framework if it has a community bank leverage ratio, or CBLR, greater than 9% at the time of election.

13

A qualifying community banking organization, or QCBO, is defined as a bank, a savings association, a bank holding company or a savings and loan holding company with:

|

· |

total consolidated assets of less than $10 billion; |

|

· |

total off-balance sheet exposures (excluding derivatives other than credit derivatives and unconditionally cancelable commitments) of 25% or less of total consolidated assets; |

|

· |

total trading assets and trading liabilities of 5% or less of total consolidated assets; |

|

· |

Mortgage servicing rights assets of 25% or less of CBLR tangible equity; and |

|

· |

temporary difference Deferred tax assets of 25% or less of CBLR tangible equity. |

A QCBO may elect out of complying with the Basel III capital rules if, at the time of the election, the QCBO has a CBLR above 9%. The numerator of the CBLR is referred to as “CBLR tangible equity” and is calculated as the QCBO’s total capital as reported in compliance with Call Report and FR Y-9C instructions, which are referred to as Reporting Instructions, prior to including non-controlling interests in consolidated subsidiaries, less:

|

· |

AOCI; |

|

· |

Intangible assets, calculated in accordance with Reporting Instructions, other than mortgage servicing assets; and |

|

· |

Deferred tax assets that arise from net operating loss and tax credit carry forwards net of any related valuations allowances. |

The denominator of the CBLR is the QCBO’s average assets, calculated in accordance with Reporting Instructions and less intangible assets and deferred tax assets deducted from CBLR tangible equity. We will continue to monitor this rulemaking. If and when the rulemaking goes into effect, we will consider whether it would be possible and advantageous at that time to elect to comply with the community bank leverage ratio framework.

Commercial Real Estate Concentration Guidelines

The federal banking regulators have implemented guidelines to address increased concentrations in commercial real estate loans. These guidelines describe the criteria regulatory agencies will use as indicators to identify institutions potentially exposed to commercial real estate concentration risk. An institution that has (i) experienced rapid growth in commercial real estate lending, (ii) notable exposure to a specific type of commercial real estate, (iii) total reported loans for construction, land development, and other land representing 100% or more of total capital, or (iv) total commercial real estate (including construction) loans representing 300% or more of total capital and the outstanding balance of the institutions commercial real estate portfolio has increased by 50% or more in the prior 36 months, may be identified for further supervisory analysis of a potential concentration risk.

As of December 31, 2019, the Bank’s ratio of construction and development loans to total capital was 43.3%, its ratio of total commercial real estate loans to total capital was 283.3% and, therefore, the Bank was under the 100% and 300% thresholds, respectively, set forth in clauses (iii) and (iv) above. As of December 31, 2019, Marquis Bank’s ratio of construction loans to total capital was 29.2%, below the 100% threshold in clause (iii) above. Its ratio of total commercial real estate loans to total capital was 339.9%, and this portfolio had increased by approximately 64.3% since December 31, 2016. Marquis Bank thus exceeded the 300% regulatory guideline threshold for commercial real estate, set forth in clause (iv) above. As a result, we are not deemed to have a concentration in commercial real estate lending under applicable regulatory guidelines, but Marquis Bank may be deemed to have such a concentration. However, we expect that the combined institution will fall below the regulatory guideline thresholds and would be deemed not to have a concentration in commercial real estate.

14

Prompt Corrective Action

Federal law and regulations establish a capital-based regulatory scheme designed to promote early intervention for troubled banks and require the FDIC to choose the least expensive resolution of bank failures. The capital-based regulatory framework contains five categories of compliance with regulatory capital requirements, including “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” and “critically undercapitalized.” To qualify as a “well-capitalized” institution under the new rules in effect as of January 1, 2015, a bank must have a leverage ratio of not less than 5%, a Tier 1 Common Equity ratio of not less than 6.5%, a Tier 1 Capital ratio of not less than 8%, and a total risk-based capital ratio of not less than 10%, and the bank must not be under any order or directive from the appropriate regulatory agency to meet and maintain a specific capital level.

Under the regulations, the applicable agency can treat an institution as if it were in the next lower category if the agency determines (after notice and an opportunity for hearing) that the institution is in an unsafe or unsound condition or is engaging in an unsafe or unsound practice. The degree of regulatory scrutiny of a financial institution will increase, and the permissible activities of the institution will decrease, as it moves downward through the capital categories.

Immediately upon becoming undercapitalized, a depository institution becomes subject to the provisions of Section 38 of the FDIA which: (i) restrict payment of capital distributions and management fees; (ii) require that the appropriate federal banking agency monitor the condition of the institution and its efforts to restore its capital; (iii) require submission of a capital restoration plan; (iv) restrict the growth of the institution’s assets; and (v) require prior approval of certain expansion proposals. The appropriate federal banking agency for an undercapitalized institution also may take any number of discretionary supervisory actions if the agency determines that any of these actions is necessary to resolve the problems of the institution at the least possible long-term cost to the deposit insurance fund, subject in certain cases to specified procedures. These discretionary supervisory actions include: (i) requiring the institution to raise additional capital; (ii) restricting transactions with affiliates; (iii) requiring divestiture of the institution or the sale of the institution to a willing purchaser; and (iv) any other supervisory action that the agency deems appropriate. These and additional mandatory and permissive supervisory actions may be taken with respect to significantly undercapitalized and critically undercapitalized institutions.

As of December 31, 2019, we exceeded the requirements contained in the applicable regulations, policies and directives pertaining to capital adequacy to be classified as “well capitalized” and are unaware of any material violation or alleged violation of these regulations, policies or directives (see table below). Rapid growth, poor loan portfolio performance, or poor earnings performance, or a combination of these factors, could change our capital position in a relatively short period of time, making additional capital infusions necessary.

Interstate Banking and Branching

The BHC Act, as amended by the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, or the Riegle-Neal Act, permits adequately capitalized and managed financial and bank holding companies to acquire banks in any state. State laws prohibiting interstate banking or discriminating against out-of-state banks are preempted. States are not permitted to enact laws opting out of this provision; however, states are allowed to adopt a minimum age restriction requiring that target banks located within the state be in existence for a period of time, up to a maximum of five years, before a bank may be subject to the Riegle-Neal Act. Also, the Dodd-Frank Act added deposit caps, which prohibit acquisitions that result in the acquiring company controlling 30% or more of the deposits of insured banks and thrift institutions held in the state in which the target maintains a branch or 10% or more of the deposits nationwide. States have the authority to waive the 30% deposit cap. State-level deposit caps are not preempted as long as they do not discriminate against out-of-state institutions, and the federal deposit caps apply only to initial entry acquisitions.

As a result of the Dodd-Frank Act, national banks and state banks are able to establish branches in any state if that state would permit the establishment of the branch by a state bank chartered in that state. Florida law permits a state bank to establish a branch of the bank anywhere in the state. Accordingly, a bank with its headquarters outside the State of Florida may establish branches anywhere within the state.

15

Anti-money Laundering

The USA PATRIOT Act provides the federal government with additional powers to address terrorist threats through enhanced domestic security measures, expanded surveillance powers, increased information sharing and broadened anti-money laundering requirements. By way of amendments to the Bank Secrecy Act, or BSA, the USA PATRIOT Act puts in place measures intended to encourage information sharing among bank regulatory and law enforcement agencies. In addition, certain provisions of the USA PATRIOT Act impose affirmative obligations on a broad range of financial institutions.

The USA PATRIOT Act and the related Federal Reserve regulations require banks to establish anti-money laundering programs that include, at a minimum:

|

· |

internal policies, procedures and controls designed to implement and maintain the savings association’s compliance with all of the requirements of the USA PATRIOT Act, the BSA and related laws and regulations; |

|

· |

systems and procedures for monitoring and reporting of suspicious transactions and activities; a designated compliance officer; |

|

· |

employee training; |

|

· |

an independent audit function to test the anti-money laundering program; |

|

· |

procedures to verify the identity of each client upon the opening of accounts; and |

|

· |

heightened due diligence policies, procedures and controls applicable to certain foreign accounts and relationships. |

Additionally, the USA PATRIOT Act requires each financial institution to develop a customer identification program, or CIP, as part of its anti-money laundering program. The key components of the CIP are identification, verification, government list comparison, notice and record retention. The purpose of the CIP is to enable the financial institution to determine the true identity and anticipated account activity of each customer. To make this determination, among other things, the financial institution must collect certain information from customers at the time they enter into the customer relationship with the financial institution. This information must be verified within a reasonable time. Furthermore, all customers must be screened against any CIP-related government lists of known or suspected terrorists. On May 11, 2018, the U.S. Treasury’s Financial Crimes Enforcement Network issued a final rule under the BSA requiring banks to identify and verify the identity of the natural persons behind their customers that are legal entities — the beneficial owners. We and our affiliates have adopted policies, procedures and controls designed to comply with the BSA and the USA PATRIOT Act.

Moreover, South Florida has been designated as a “High Intensity Financial Crime Area,” or HIFCA, by FinCEN and a “High Intensity Drug Trafficking Area,” or HIDTA, by the Office of National Drug Control Policy. The HIFCA program is intended to concentrate law enforcement efforts to combat money laundering efforts in higher-risk areas. The HIDTA designation makes it possible for local agencies to benefit from ongoing HIDTA-coordinated program initiatives that are working to reduce drug use. There is also increased scrutiny of compliance with the sanctions programs and rules administered and enforced by the Treasury Department’s Office of Foreign Assets Control.

Regulatory Enforcement Authority

Federal and state banking laws grant substantial regulatory authority and enforcement powers to federal and state banking regulators. This authority permits bank regulatory agencies to assess civil money penalties, to issue cease and desist or removal orders, and to initiate injunctive actions against banking organizations and institution-affiliated parties. In general, these enforcement actions may be initiated for either violations of laws or regulations or for unsafe or unsound practices. Other actions or inactions may provide the basis for enforcement action, including misleading or untimely reports filed with regulatory authorities.

16

Federal Home Loan Bank System

The Bank is a member of the Federal Home Loan Bank of Atlanta, which is one of 11 regional Federal Home Loan Banks. Each FHLB serves as a quasi-reserve bank for its members within its assigned region. It is funded primarily from funds deposited by member institutions and proceeds from the sale of consolidated obligations of the FHLB system. A FHLB makes loans to members (i.e., advances) in accordance with policies and procedures established by the Board of Trustees of the FHLB.

As a member of the FHLB of Atlanta, the bank is required to own capital stock in the FHLB in an amount at least equal to 0.09% (or 9 basis points), which is subject to annual adjustments, of the Bank’s total assets at the end of each calendar year (up to a maximum of $15 million), plus 4.25% of its outstanding advances (borrowings) from the FHLB of Atlanta under the activity-based stock ownership requirement. As of December 31, 2019, the Bank was in compliance with this requirement.

Privacy

Under the Gramm-Leach-Bliley Act, federal banking regulators adopted rules limiting the ability of banks and other financial institutions to disclose nonpublic information about consumers to nonaffiliated third parties. The rules require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to nonaffiliated third parties.

Overdraft Fee Regulation