Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Professional Holding Corp. | pfhd-20210331ex322c1369e.htm |

| EX-32.1 - EX-32.1 - Professional Holding Corp. | pfhd-20210331ex3211ea5df.htm |

| EX-31.2 - EX-31.2 - Professional Holding Corp. | pfhd-20210331ex31253ab83.htm |

| EX-31.1 - EX-31.1 - Professional Holding Corp. | pfhd-20210331ex3115b312b.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

Quarterly report pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

For the quarterly period ended |

| Commission file |

March 31, 2021 | | number 001‑39215 |

Professional Holding Corp.

(Exact name of Registrant as specified in its charter)

Florida |

| |

| 46-5144312 |

|---|---|---|---|---|

(State or other jurisdiction of | | | | (I.R.S. Employer |

incorporation or organization) | | | | Identification Number) |

396 Alhambra Circle, Suite 255

Coral Gables, FL 33134 (786) 483-1757

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

Class A Common Stock |

| PFHD |

| NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | |

| | Emerging growth company | ☒ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Number of shares of common stock outstanding as of May 10, 2021: 13,657,108

| 3 | ||

| | | |

| 3 | ||

| | | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 30 | |

| | | |

| 60 | ||

| | | |

| 60 | ||

| | | |

| 60 | ||

| | | |

| 60 | ||

| | | |

| 61 | ||

| | | |

| 61 | ||

| | | |

| 61 | ||

| | | |

| 62 | ||

| | | |

| 62 | ||

| | | |

| 62 | ||

| | | |

2

Item 1. Condensed Consolidated Financial Statements (unaudited).

PROFESSIONAL HOLDING CORP.

CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollar amounts in thousands, except share data)

|

| March 31, |

| December 31, | ||

| | 2021 | | 2020 | ||

ASSETS |

| |

|

| |

|

Cash and due from banks | | $ | 29,140 | | $ | 62,305 |

Interest-bearing deposits | |

| 250,670 | |

| 129,291 |

Federal funds sold | |

| 43,919 | |

| 25,376 |

Cash and cash equivalents | |

| 323,729 | |

| 216,972 |

Securities available for sale, at fair value - taxable | |

| 57,067 | |

| 65,110 |

Securities available for sale, at fair value - tax exempt | | | 22,341 | | | 22,398 |

Securities held to maturity (fair value March 31, 2021 – $1,528, December 31, 2020 – $1,561) | |

| 1,515 | |

| 1,547 |

Equity securities | |

| 5,914 | |

| 6,005 |

Loans, net of allowance of $9,656 and $16,259 as of March 31, 2021, and December 31, 2020, respectively | |

| 1,717,671 | |

| 1,643,373 |

Loans held for sale | | | 3,608 | | | 1,270 |

Federal Home Loan Bank stock, at cost | |

| 2,529 | |

| 3,229 |

Federal Reserve Bank stock, at cost | |

| 4,944 | |

| 4,762 |

Accrued interest receivable | |

| 6,511 | |

| 6,666 |

Premises and equipment, net | |

| 4,033 | |

| 4,370 |

Bank owned life insurance | |

| 37,642 | |

| 37,360 |

Deferred tax asset | | | 8,923 | | | 10,525 |

Goodwill | | | 24,621 | | | 24,621 |

Core deposit intangibles | | | 1,347 | | | 1,422 |

Other assets | |

| 11,163 | |

| 7,640 |

Total assets | | $ | 2,233,558 | | $ | 2,057,270 |

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

| |

Deposits | |

| | |

| |

Demand – non-interest bearing | | $ | 589,415 | | $ | 475,598 |

Demand – interest bearing | |

| 1,067,530 | |

| 947,370 |

Time deposits | |

| 248,759 | |

| 236,575 |

Total deposits | |

| 1,905,704 | |

| 1,659,543 |

Official checks | |

| 4,238 | |

| 4,447 |

Federal Home Loan Bank advances | |

| 40,000 | |

| 40,000 |

Other borrowings | | | 40,678 | | | 114,573 |

Subordinated debt | | | 10,108 | | | 10,153 |

Accrued interest and other liabilities | |

| 12,799 | |

| 12,989 |

Total liabilities | |

| 2,013,527 | |

| 1,841,705 |

Stockholders’ equity | |

| | |

| |

Preferred stock, 10,000,000 shares authorized, none issued | |

| — | |

| — |

Class A Voting Common stock, $0.01 par value; authorized 50,000,000 shares, issued 14,281,977 and outstanding 13,661,567 shares as of March 31, 2021, and authorized 50,000,000 shares, issued 14,100,760 and outstanding 13,534,829 shares at December 31, 2020 | |

| 143 | |

| 141 |

Class B Non-Voting Common stock, $0.01 par value; 10,000,000 shares authorized, none issued and outstanding at March 31, 2021, and none issued and outstanding at December 31, 2020 | |

| — | |

| — |

Treasury stock, at cost | |

| (10,087) | |

| (9,209) |

Additional paid-in capital | |

| 209,770 | |

| 208,995 |

Retained earnings | |

| 19,541 | |

| 14,756 |

Accumulated other comprehensive income (loss) | |

| 664 | |

| 882 |

Total stockholders’ equity | |

| 220,031 | |

| 215,565 |

Total liabilities and stockholders' equity | | $ | 2,233,558 | | $ | 2,057,270 |

3

PROFESSIONAL HOLDING CORP.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Unaudited)

(Dollar amounts in thousands, except share data)

| | Three Months Ended March 31, | ||||

|

| 2021 |

| 2020 | ||

Interest income | | | | | | |

Loans, including fees | | $ | 19,233 | | $ | 10,015 |

Investment securities - taxable | |

| 179 | |

| 213 |

Investment securities - tax exempt | | | 203 | | | 9 |

Dividend income on restricted stock | |

| 95 | |

| 79 |

Other | |

| 62 | |

| 704 |

Total interest income | |

| 19,772 | |

| 11,020 |

| | | | | | |

Interest expense | |

| | |

|

|

Deposits | |

| 1,317 | |

| 2,626 |

Federal Home Loan Bank advances | |

| 196 | |

| 278 |

Subordinated debt | | | 130 | | | — |

Other borrowings | | | 250 | | | 55 |

Total interest expense | |

| 1,893 | |

| 2,959 |

| | | | | | |

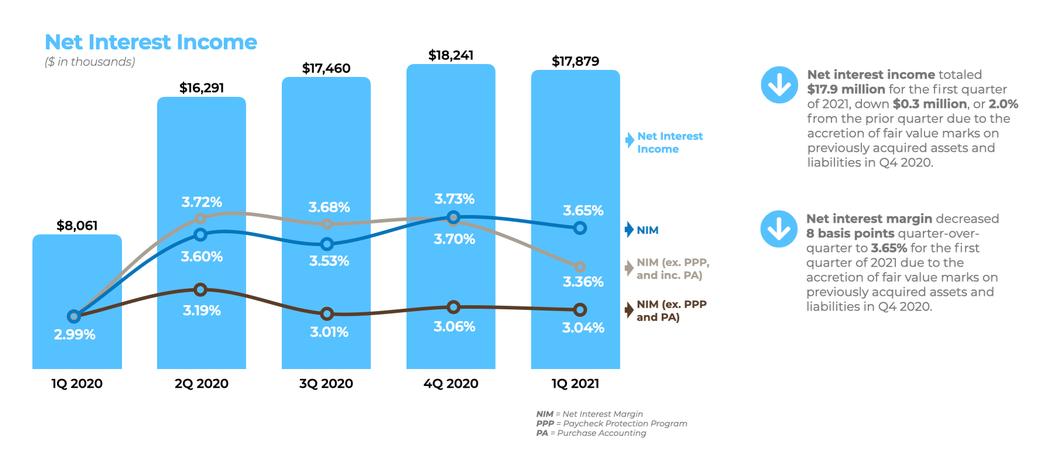

Net interest income | |

| 17,879 | |

| 8,061 |

Provision for loan losses | |

| 1,038 | |

| 845 |

Net interest income after provision for loan losses | |

| 16,841 | |

| 7,216 |

| | | | | | |

Non-interest income | |

| | |

|

|

Service charges on deposit accounts | |

| 395 | |

| 222 |

Income from Bank owned life insurance | |

| 282 | |

| 129 |

SBA origination fees | | | 145 | | | 30 |

SWAP fees | | | 209 | | | 263 |

Third party loan sales | | | 75 | | | 110 |

Gain on sale and call of securities | | | 1 | | | 4 |

Other | |

| 12 | |

| 98 |

Total non-interest income | |

| 1,119 | |

| 856 |

| | | | | | |

Non-interest expense | |

| | |

| |

Salaries and employee benefits | |

| 6,784 | |

| 5,263 |

Occupancy and equipment | |

| 1,102 | |

| 774 |

Data processing | |

| 290 | |

| 176 |

Marketing | |

| 153 | |

| 137 |

Professional fees | |

| 628 | |

| 355 |

Acquisition expenses | | | 684 | | | 1,663 |

Regulatory assessments | |

| 349 | |

| 214 |

Other | |

| 1,798 | |

| 904 |

Total non-interest expense | |

| 11,788 | |

| 9,486 |

| | | | | | |

Income (loss) before income taxes | |

| 6,172 | |

| (1,414) |

Income tax provision (benefit) | |

| 1,387 | |

| (97) |

Net income (loss) | |

| 4,785 | |

| (1,317) |

| | | | | | |

Earnings per share: | |

| | |

|

|

Basic | | $ | 0.36 | | $ | (0.14) |

Diluted | | $ | 0.34 | | $ | (0.14) |

| | | | | | |

Other comprehensive income: | |

| | |

|

|

Unrealized holding gain (loss) on securities available for sale | |

| (289) | |

| 324 |

Tax effect | |

| 71 | |

| (82) |

Other comprehensive gain (loss), net of tax | |

| (218) | |

| 242 |

Comprehensive income (loss) | | $ | 4,567 | | $ | (1,075) |

4

PROFESSIONAL HOLDING CORP.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (Unaudited)

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | | Additional | | | | | Other | | | | ||

| | Common Stock | | Treasury | | Paid-in | | Retained | | Comprehensive | | | | |||||||

| | Shares | | Amount | | Stock | | Capital | | Earnings |

| Income (Loss) | | Total | ||||||

Balance at January 1, 2020 | | 5,867,446 | | $ | 60 | | $ | (4,155) | | $ | 77,019 | | $ | 6,451 | | $ | (73) | | $ | 79,302 |

Issuance of common stock, net of issuance cost |

| 3,575,500 | |

| 36 |

| | — |

| | 59,771 |

| | — |

| | — |

| | 59,807 |

Marquis Bancorp (MBI) acquisition | | 4,227,816 | | | 42 | | | — | | | 64,657 | | | — | | | — | | | 64,699 |

Employee stock purchase plan |

| — | |

| — |

| | — |

| | 31 |

| | — |

| | — |

| | 31 |

Stock based compensation |

| — | |

| — |

| | — |

| | 196 |

| | — |

| | — |

| | 196 |

Treasury stock |

| (133,197) | |

| — |

| | (2,102) |

| | (4) |

| | — |

| | — |

| | (2,106) |

Net loss |

| — | |

| — |

| | — |

| | — |

| | (1,317) |

| | — |

| | (1,317) |

Other comprehensive income |

| — | |

| — |

| | — |

| | — |

| | — |

| | 242 |

| | 242 |

Balance at March 31, 2020 |

| 13,537,565 | | $ | 138 | | $ | (6,257) | | $ | 201,670 | | $ | 5,134 | | $ | 169 | | $ | 200,854 |

| | | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2021 |

| 13,534,829 | | $ | 141 | | $ | (9,209) | | $ | 208,995 | | $ | 14,756 | | $ | 882 | | $ | 215,565 |

Issuance of common stock, net of issuance cost |

| 52,845 | |

| 1 |

| | — |

| | 436 |

| | — |

| | — |

| | 437 |

Employee stock purchase plan |

| 873 | |

| — |

| | — |

| | 16 |

| | — |

| | — |

| | 16 |

Stock based compensation |

| 127,499 | |

| 1 |

| | — |

| | 324 |

| | — |

| | — |

| | 325 |

Treasury stock |

| (54,479) | |

| — |

| | (878) |

| | (1) |

| | — |

| | — |

| | (879) |

Net income |

| — | |

| — |

| | — |

| | — |

| | 4,785 |

| | — |

| | 4,785 |

Other comprehensive income |

| — | |

| — |

| | — |

| | — |

| | — |

| | (218) |

| | (218) |

Balance at March 31, 2021 |

| 13,661,567 | | $ | 143 |

| $ | (10,087) |

| $ | 209,770 |

| $ | 19,541 |

| $ | 664 |

| $ | 220,031 |

5

PROFESSIONAL HOLDING CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Dollar amounts in thousands, except share data)

| | Three Months Ended March 31, | ||||

|

| 2021 |

| 2020 | ||

Cash flows from operating activities |

| |

|

| |

|

Net income (loss) | | $ | 4,785 | | $ | (1,317) |

Adjustments to reconcile net income to net cash from operating activities | |

|

| |

|

|

Provision for loan losses | |

| 1,038 | |

| 845 |

Deferred income tax benefit (expense) | |

| 1,387 | |

| (209) |

Depreciation and amortization | |

| 384 | |

| 245 |

Gain on sale of securities | | | — | | | (4) |

Gain on call of securities | | | (1) | | | — |

Equity unrealized change in market value | | | 91 | | | (21) |

Net amortization of securities | |

| 568 | |

| (1,049) |

Net amortization of deferred loan fees | |

| (2,802) | |

| 251 |

Loans held for sale | | | (2,338) | | | (673) |

Income from bank owned life insurance | |

| (282) | |

| (129) |

Loss on disposal of premises and equipment | | | 137 | | | — |

Employee stock purchase plan | | | 16 | | | 31 |

Stock compensation | |

| 325 | |

| 196 |

Changes in operating assets and liabilities: | |

|

| |

|

|

Accrued interest receivable | |

| 155 | |

| (385) |

Other assets | |

| (3,523) | |

| 4,820 |

Official checks, accrued interest, interest payable and other liabilities | |

| (113) | |

| (12,982) |

Net cash provided by operating activities | |

| (173) | |

| (10,381) |

| | | | | | |

Cash flows from investing activities | |

|

| |

|

|

Proceeds from maturities and paydowns of securities available for sale | |

| 5,733 | |

| 2,768 |

Proceeds from calls of securities available for sale | | | 1,514 | | | 1,000 |

Proceeds from paydowns of securities held to maturity | |

| 29 | |

| 32 |

Purchase of securities available for sale | |

| — | |

| (46,615) |

Proceeds from sale of securities available for sale | | | — | | | 1,759 |

Loans originations, net of principal repayments | |

| (71,802) | |

| (37,716) |

Purchase of Federal Reserve Bank stock | |

| (182) | |

| (301) |

Proceeds from maturities of Federal Home Loan Bank Stock | | | 700 | | | — |

Purchase of Federal Home Loan Bank Stock | |

| — | |

| (1,510) |

Purchases of premises and equipment | |

| (154) | |

| (692) |

Proceeds from acquisition | | | — | | | 26,860 |

Net cash used in investing activities | |

| (64,162) | |

| (54,415) |

| | | | | | |

Cash flows from financing activities | |

|

| |

|

|

Net increase (decrease) in deposits | |

| 246,161 | |

| (17,698) |

Proceeds from issuance of stock, net of issuance costs | |

| 437 | |

| 59,807 |

Purchase of treasury stock | | | (879) | | | (2,106) |

Proceeds from Federal Home Loan Bank advances | |

| — | |

| 10,000 |

Repayments of Federal Home Loan advances | |

| — | |

| (20,000) |

Repayment of line of credit | | | — | | | (9,999) |

Repayments of PPPLF advances | | | (74,627) | | | — |

Net cash provided by financing activities | |

| 171,092 | |

| 20,004 |

| | | | | | |

Increase in cash and cash equivalents | |

| 106,757 | |

| (44,792) |

| | | | | | |

Cash and cash equivalents at beginning of period | |

| 216,972 | |

| 198,950 |

| | | | | | |

Cash and cash equivalents at end of period | | $ | 323,729 | | $ | 154,158 |

| | | | | | |

Supplemental cash flow information: | |

|

| |

|

|

Cash paid during the period for interest | | $ | 2,203 | | $ | 2,712 |

Cash paid during the period for taxes | |

| — | |

| — |

| | | | | | |

Supplemental noncash disclosures: | |

|

| |

|

|

Recognition of participation loans as secured borrowings | | $ | 732 | | $ | — |

Lease liabilities arising from obtaining right of use assets | | | — | | | 1,620 |

Total assets acquired | | | — | | | 589,205 |

Total liabilities assumed | | | — | | | 539,403 |

6

PROFESSIONAL HOLDING CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Tables in thousands, except share data)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation:

The accompanying unaudited condensed consolidated financial statements of Professional Holding Corp. and its subsidiary, Professional Bank (the “Bank” and collectively with Professional Holding Corp., the “Company”) have been prepared in accordance with U.S. generally accepted accounting principles for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Certain prior period amounts have been reclassified to conform to the current period presentation.

Operating results for the three months ended March 31, 2021, are not necessarily indicative of the results that may be expected for the year ending December 31, 2021, or any other period. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

Use of Estimates:

The preparation of these financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Adoption of new accounting standards:

ASU 2019-12, Income Taxes (Topic 740)

In December 2019, FASB issued guidance which simplifies the accounting for income taxes by removing multiple exceptions to the general principals in Topic 740. The standard is effective for public business entities for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2020. The new guidance did not materially impact the Company’s Consolidated Financial Statements or disclosures.

ASU 2020-04, Reference Rate Reform (Topic 848)

In March 2020, FASB issued guidance which provides optional guidance to ease the accounting burden in accounting for, or recognizing the effects from, reference rate reform on financial reporting. The new standard is a result of the London Interbank Offered Rate ("LIBOR") likely being discontinued as an available benchmark rate. The standard is elective and provides optional expedients and exceptions for applying U.S. Generally Accepted Accounting Principles (“GAAP”) to contracts, hedging relationships, or other transactions that reference LIBOR, or another reference rate expected to be discontinued. The amendments in the update are effective for all entities between March 12, 2020, and December 31, 2022. The Company has established a cross-functional working group to guide the Company’s transition from LIBOR and has begun efforts to transition to alternative rates consistent with industry timelines. The Company has identified its products that utilize LIBOR and has implemented enhanced fallback language to facilitate the transition to alternative reference rates. The Company is evaluating existing platforms and systems and preparing to offer new rates. The new guidance did not materially impact the Company’s Consolidated Financial Statements or disclosures.

7

New accounting standards that have not yet been adopted:

The following provides a brief description of accounting standards that have been issued but are not yet adopted that could have a material effect on the Company’s financial statements:

ASU 2016-13, Financial Instruments – Credit Losses (Topic 326) | |

Description | In June 2016, FASB issued guidance to replace the incurred loss model with an expected loss model, which is referred to as the current expected credit loss (CECL) model. The CECL model is applicable to the measurement of credit losses on financial assets measured at amortized cost, including loan receivables and held to maturity debt securities. It also applies to off-balance sheet credit exposures not accounted for as insurance (i.e. loan commitments, standby letters of credit, financial guarantees and other similar instruments). |

Date of Adoption | For PBEs that are non-SEC filers and for SEC filers that are considered small reporting companies, it is effective for January 1, 2023. Early adoption is still permitted. |

Effect on the Consolidated Financial Statements | The Company's management is in the process of evaluating credit loss estimation models. Updates to business processes and the documentation of accounting policy decisions are ongoing. The company may recognize an increase in the allowance for credit losses upon adoption, recorded as a one-time cumulative adjustment to retained earnings. However, the magnitude of the impact on the Company's consolidated financial statements has not yet been determined. The Company will adopt this accounting standard effective January 1, 2023. |

NOTE 2 — EARNINGS PER SHARE

Basic earnings per common share is computed by dividing net income available to common stockholders by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per common share is computed by dividing net income available to common stockholders by the weighted average number of shares of common stock outstanding plus the effect of employee stock options during the year.

| | Three Months Ended March 31, | ||||

|

| 2021 |

| 2020 | ||

Basic earnings per share: |

| |

|

| |

|

Net income (loss) | | $ | 4,785 | | $ | (1,317) |

Total weighted average common stock outstanding | |

| 13,442,359 | |

| 9,617,986 |

Net income (loss) per share | | $ | 0.36 | | $ | (0.14) |

Diluted earnings per share: | |

| | |

| |

Net income (loss) | | $ | 4,785 | | $ | (1,317) |

Total weighted average common stock outstanding | |

| 13,442,359 | |

| 9,617,986 |

Add: Dilutive effect of employee stock options | | | 478,915 | | | - |

Total weighted average diluted stock outstanding | | | 13,921,274 | | | 9,617,986 |

Net income (loss) per share | | $ | 0.34 | | $ | (0.14) |

For the three months ended March 31, 2021, there were 403 thousand stock options that were anti-dilutive and for the three months ended March 31, 2020, there were 560 thousand stock options that were anti-dilutive.

8

NOTE 3 — SECURITIES

The following table summarizes the amortized cost and fair value of securities available-for-sale and securities held-to-maturity at March 31, 2021, and December 31, 2020, and the corresponding amounts of gross unrealized gains and losses recognized in accumulated other comprehensive loss and gross unrecognized gains and losses:

|

| | |

| Gross |

| Gross |

| | | ||

| | Amortized | | Unrealized | | Unrealized | | | | |||

March 31, 2021 | | Cost | | Gains | | Losses | | Fair Value | ||||

Available-for-sale - taxable | | | | | | | | | | | | |

Small Business Administration loan pools | | $ | 29,008 | | $ | 46 | | $ | (172) | | $ | 28,882 |

Mortgage-backed securities | |

| 23,880 | |

| 291 | |

| (97) | |

| 24,074 |

United States agency obligations | | | 2,000 | | | 100 | | | - | | | 2,100 |

Corporate bonds | |

| 2,000 | |

| 11 | |

| - | |

| 2,011 |

Total available-for-sale - taxable | | $ | 56,888 | | $ | 448 | | $ | (269) | | $ | 57,067 |

Available-for-sale - tax exempt | | | | | | | | | | | | |

Community Development District bonds | | $ | 20,579 | | $ | 674 | | $ | - | | $ | 21,253 |

Municipals | | | 1,060 | | | 28 | | | - | | | 1,088 |

Total available-for-sale - tax exempt | | $ | 21,639 | | $ | 702 | | $ | - | | $ | 22,341 |

| | | | | | | | | | | | |

|

| | |

| Gross |

| Gross |

|

| | ||

| | Amortized | | Unrecognized | | Unrecognized | | | | |||

| | Cost | | Gains | | Losses | | Fair Value | ||||

Held-to-Maturity | |

|

| |

|

| |

|

| |

|

|

Mortgage-backed securities | | $ | 314 | | $ | 13 | | $ | — | | $ | 327 |

United States Treasury | | | 201 | | | — | | | — | | | 201 |

Foreign Bonds | | | 1,000 | | | — | | | — | | | 1,000 |

Total Held-to-Maturity | | $ | 1,515 | | $ | 13 | | $ | — | | $ | 1,528 |

|

| | |

| Gross |

| Gross |

| | | ||

| | Amortized | | Unrealized | | Unrealized | | Fair | ||||

December 31, 2020 | | Cost | | Gains | | Losses | | Value | ||||

Available-for-sale - taxable |

| |

|

| |

|

| |

|

| |

|

Small Business Administration loan pools | | $ | 30,678 | | $ | 77 | | $ | (199) | | $ | 30,556 |

Mortgage-backed securities | |

| 28,514 | |

| 438 | |

| (30) | |

| 28,922 |

United States agency obligations | | | 3,000 | | | 122 | | | - | | | 3,122 |

Corporate bonds | |

| 2,501 | |

| 9 | |

| - | |

| 2,510 |

Total available-for-sale - taxable | | $ | 64,693 | | $ | 646 | | $ | (229) | | $ | 65,110 |

Available-for-sale - tax exempt | | | | | | | | | | | | |

Community Development District bonds | | $ | 20,582 | | $ | 717 | | $ | - | | $ | 21,299 |

Municipals | | | 1,064 | | | 35 | | | - | | | 1,099 |

Total available-for-sale - tax exempt | | $ | 21,646 | | $ | 752 | | $ | - | | $ | 22,398 |

| | | | | | | | | | | | |

|

| | |

| Gross |

| Gross | | | | ||

| | Amortized | | Unrecognized | | Unrecognized | | Fair | ||||

| | Cost | | Gains | | Losses |

| Value | ||||

Held-to-Maturity |

| |

|

| |

|

| |

|

| |

|

Mortgage-backed securities | | $ | 345 | | $ | 14 | | $ | — | | $ | 359 |

United States Treasury | | | 202 | | | — | | | — | | | 202 |

Foreign Bonds | | | 1,000 | | | — | | | — | | | 1,000 |

Total Held-to-Maturity | | $ | 1,547 | | $ | 14 | | $ | — | | $ | 1,561 |

As of March 31, 2021, and December 31, 2020, Corporate bonds are comprised of investments in the financial services industry. During the three months ended March 31, 2021, the net investment portfolio decreased by $8.3 million as a result of paydowns, maturities and redemptions. Proceeds from the maturity and redemption of securities during the three months ended March 31, 2021, were $1.5 million, with gross realized gains of $1 thousand. Proceeds from the sales and redemption of securities during the three months ended March 31, 2020, were $7.6 million, with gross realized gains of $4 thousand. Proceeds from the sales of securities during the year ended

9

December 31, 2020, were $1.7 million, with gross realized gains of $4 thousand. Proceeds from redemption of securities for the year ended December 31, 2020, were $9.1 million, with gross realized gains of $33 thousand. Securities pledged for public funds as of March 31, 2021, and December 31, 2020, were $12.5 million and $12.5 million, respectively.

The amortized cost and fair value of debt securities are shown by contractual maturity. Expected maturities may differ from contractual maturities if borrowers have the right to call or prepay obligations with or without call or prepayment penalties. Securities not due at a single maturity date are shown separately. The scheduled maturities of securities as of March 31, 2021, are as follows:

| | March 31, 2021 | ||||

|

| Amortized |

| Fair | ||

| | Cost | | Value | ||

Available-for-sale | | | | | | |

Due in one year or less | | $ | 1,497 | | $ | 1,520 |

Due after one year through five years | |

| 22,898 | |

| 23,646 |

Due after five years through ten years | | | 929 | | | 963 |

Due after ten years | | | 315 | | | 323 |

Subtotal | | $ | 25,639 | | $ | 26,452 |

| | | | | | |

Small Business Administration loan pools | | $ | 29,008 | | $ | 28,882 |

Mortgage-backed securities | | | 23,880 | | | 24,074 |

Total available-for-sale | | $ | 78,527 | | $ | 79,408 |

| | | | | | |

Held-to-maturity | | | | | | |

Due in one year or less | | $ | 1,201 | | $ | 1,201 |

Due after one year through five years | | | — | | | — |

Subtotal | | $ | 1,201 | | $ | 1,201 |

| | | | | | |

Mortgage-backed securities | | $ | 314 | | $ | 327 |

Total held-to-maturity | | $ | 1,515 | | $ | 1,528 |

At March 31, 2021, and December 31, 2020, there were no holdings of securities of any one issuer, other than the U.S. Government and its agencies, in an amount greater than 10% of stockholders’ equity.

At March 31, 2021, and December 31, 2020, the number of investment positions that are in an unrealized loss position were 35 and 36, respectively. The tables below indicate the fair value of debt securities with unrealized losses and for the period of time of which these

10

losses were outstanding at March 31, 2021, and December 31, 2020, respectively, aggregated by major security type and length of time in a continuous unrealized loss position:

| | Less Than 12 Months | | 12 Months or Longer | | Total | ||||||||||||

|

| Fair |

| Unrealized |

| Fair |

| Unrealized |

| Fair |

| Unrealized | ||||||

| | Value | | Losses | | Value | | Losses | | Value | | Losses | ||||||

March 31, 2021 | | | | | | | | | | | | | | | | | | |

Available-for-sale - taxable | | | | | | | | | | | | | | | | | | |

Small Business Administration loan pools | | $ | 2,159 | | $ | (42) | | $ | 17,493 | | $ | (130) | | $ | 19,652 | | $ | (172) |

Mortgage-backed securities | |

| 5,099 | |

| (97) | |

| — | |

| — | |

| 5,099 | |

| (97) |

United States agency obligations | | | — | | | — | | | — | | | — | | | — | | | — |

Corporate bonds | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — |

Total available-for-sale - taxable | | $ | 7,258 | | $ | (139) | | $ | 17,493 | | $ | (130) | | $ | 24,751 | | $ | (269) |

Available-for-sale - tax exempt | | | | | | | | | | | | | | | | | | |

Community Development District bonds | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

Municipals | | | — | | | — | | | — | | | — | | | — | | | — |

Total available-for-sale - tax exempt | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

| | | | | | | | | | | | | | | | | | |

December 31, 2020 | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Available-for-sale - taxable | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Small Business Administration loan pools | | $ | 18,849 | | $ | (133) | | $ | 8,945 | | $ | (66) | | $ | 27,794 | | $ | (199) |

Mortgage-backed securities | |

| 5,839 | |

| — | |

| 2,510 | |

| (30) | |

| 8,349 | |

| (30) |

United States agency obligations | | | 227 | | | — | | | — | | | — | | | 227 | | | — |

Corporate bonds | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — |

Total available-for-sale - taxable | | $ | 24,915 | | $ | (133) | | $ | 11,455 | | $ | (96) | | $ | 36,370 | | $ | (229) |

Available-for-sale - tax exempt | | | | | | | | | | | | | | | | | | |

Community Development District bonds | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

Municipals | | | — | | | — | | | — | | | — | | | — | | | — |

Total available-for-sale - tax exempt | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

The unrealized holding losses within the investment portfolio are considered to be temporary and are mainly due to changes in the interest rate cycle. The unrealized loss positions may fluctuate positively or negatively with changes in interest rates or spreads. Since SBA loan pools and mortgage-backed securities are government sponsored entities that are highly rated, the decline in fair value is attributable to changes in interest rates and not credit quality. The Company does not have any securities in an Other Than Temporary Impairment (“OTTI”) position. The Company does not intend to sell these securities and it is likely that it will not be required to sell the securities before their anticipated recovery. The Company does not consider these securities to be other-than-temporarily impaired at March 31, 2021. No credit losses were recognized in operations during the three months ended March 31, 2021, or during 2020.

11

NOTE 4 — LOANS

Loans at March 31, 2021 and December 31, 2020 were as follows:

| | | | | | |

|

| March 31, 2021 |

| December 31, 2020 | ||

Commercial real estate | | $ | 820,465 | | $ | 777,776 |

Residential real estate | |

| 369,234 | |

| 380,491 |

Commercial | |

| 443,032 | |

| 396,642 |

Construction and land development | |

| 93,302 | |

| 99,883 |

Consumer and other | |

| 12,563 | |

| 11,688 |

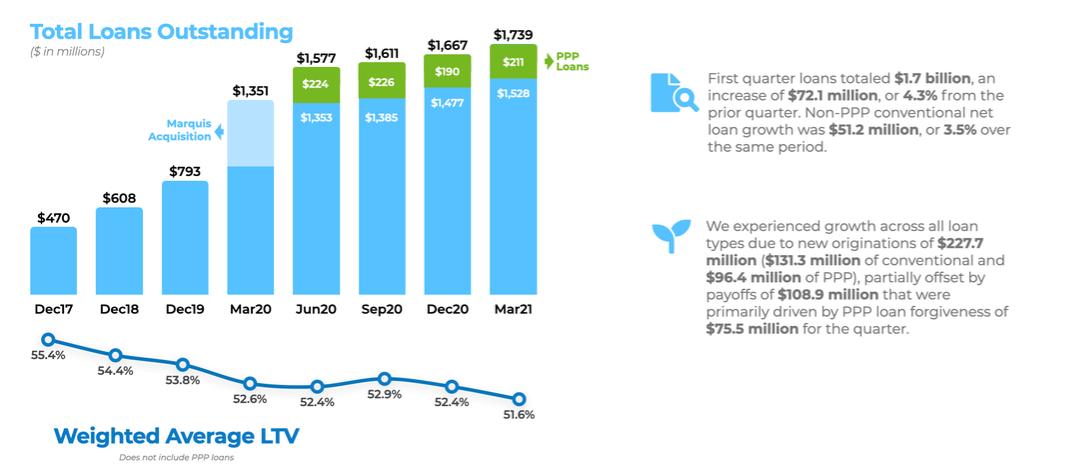

Total loans | |

| 1,738,596 | |

| 1,666,480 |

Unearned loan origination (fees) costs, net | |

| (1,489) | |

| (1,323) |

Unearned PPP loan origination (fees) costs, net | | | (5,708) | | | (4,255) |

Allowance for loan loss | |

| (9,656) | |

| (16,259) |

Loans, net(1) | | $ | 1,721,743 | | $ | 1,644,643 |

| (1) | Does not include loan control, loan participation control or loans in process. |

The recorded investment in loans excludes accrued interest receivable due to immateriality.

At March 31, 2021, and December 31, 2020, there were $242.2 million and $227.8 million, respectively in total loans pledged to the Federal Home Loan Bank (“FHLB”) for liquidity.

Loan premiums for loans purchased are amortized over the life of the loan with acceleration upon the increase in principal paydowns or payoffs. At March 31, 2021, and December 31, 2020, loan premiums for purchased loans were $0.5 million and $0.6 million, respectively.

There are no loans over 90 days past due and accruing as of March 31, 2021, or December 31, 2020. The following table presents the aging of the recorded investment in past due loans as of March 31, 2021, and December 31, 2020, by class of loans:

| | | | | | | | | | | | | | | | | | | | | |

| | 30 – 59 | | 60 – 89 | | Greater than | | | | | | | | | | | | | |||

| | Days | | Days | | 89 Days | | | | | Total | | Loans Not | | | | |||||

|

| Past Due |

| Past Due |

| Past Due |

| Nonaccrual |

| Past Due |

| Past Due |

| Total | |||||||

March 31, 2021 |

| |

|

| |

|

| |

| | |

| | |

|

| |

|

| |

|

Commercial real estate | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 820,465 | | $ | 820,465 |

Residential real estate | |

| 611 | |

| — | |

| — | |

| — | |

| 611 | |

| 368,623 | |

| 369,234 |

Commercial | |

| — | |

| — | |

| — | |

| 1,468 | |

| 1,468 | |

| 441,564 | |

| 443,032 |

Construction and land development | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 93,302 | |

| 93,302 |

Consumer and other | |

| 97 | |

| — | |

| — | | | 1,307 | | | 1,404 | |

| 11,159 | |

| 12,563 |

Total | | $ | 708 | | $ | — | | $ | — | | $ | 2,775 | | $ | 3,483 | | $ | 1,735,113 | | $ | 1,738,596 |

| | | | | | | | | | | | | | | | | | | | | |

| | 30 – 59 | | 60 – 89 | | Greater than | | | | | | | | | | | | | |||

| | Days | | Days | | 89 Days | | | | | Total | | Loans Not | | | | |||||

|

| Past Due |

| Past Due |

| Past Due |

| Nonaccrual |

| Past Due |

| Past Due |

| Total | |||||||

December 31, 2020 | | | | | | | | | | | | | | | | | | | | | |

Commercial real estate | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 777,776 | | $ | 777,776 |

Residential real estate | |

| 1,303 | |

| — | |

| — | |

| — | |

| 1,303 | |

| 379,188 | |

| 380,491 |

Commercial | |

| 278 | |

| — | |

| — | |

| 9,127 | |

| 9,405 | |

| 387,237 | |

| 396,642 |

Construction and land development | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 99,883 | |

| 99,883 |

Consumer and other | |

| — | |

| — | |

| — | | | 1,307 | | | 1,307 | |

| 10,381 | |

| 11,688 |

Total | | $ | 1,581 | | $ | — | | $ | — | | $ | 10,434 | | $ | 12,015 | | $ | 1,654,465 | | $ | 1,666,480 |

12

At March 31, 2021, there were six impaired loans (consisting of nonaccrual loans, troubled debt restructured loans, loans past due 90 days or more and still accruing interest and other loans based on management’s judgment) with both unpaid principal balance and recorded investments totaling $5.4 million. Three of these were impaired loans with a recorded investment of $2.8 million with an allowance of $0.7 million and one substandard accruing loan with a recorded investment of $2.3 million with no allowance. The average net investment on the impaired residential real estate and commercial loans during the three months ended March 31, 2021 were $0.9 million. Residential real estate loans had $2.6 thousand and $3.7 thousand interest income recognized for the three months ended March 31, 2021, and 2020, respectively, which was equal to the cash basis interest income. At December 31, 2020, there were six impaired loans with recorded investments totaling $13.1 million, of which there were three impaired loans with a recorded investment of $10.4 million on nonaccrual with an allowance of $8.3 million and one substandard accruing loan with a recorded investment of $2.4 million with no allowance. The average net investment on the impaired residential real estate and commercial loans during the year ended December 31, 2020, was $2.2 million. The residential real estate loans had $12.7 thousand of interest income recognized during the year ended December 31, 2020, which was equal to the cash basis interest income.

Troubled Debt Restructurings:

The principal carrying balances of loans that met the criteria for consideration as troubled debt restructurings (“TDR”) were $272 thousand and $298 thousand as of March 31, 2021, and December 31, 2020, respectively. The Company has allocated no specific reserves to customers whose loan terms have been modified in troubled debt restructurings as of March 31, 2021, and December 31, 2020. The Company has not committed any additional amounts to customers whose loans are classified as a troubled debt restructuring.

Credit Quality Indicators:

The Company categorizes loans into risk categories based on relevant information about the ability of borrowers to service their debt including: current financial information, historical payment experience, credit documentation, public information, and current economic trends, among other factors. Generally, all credits greater than $1.0 million are reviewed at least annually to monitor and adjust, if necessary, the credit risk profile. Loans classified as substandard or special mention are reviewed quarterly by the Company for further evaluation to determine if they are appropriately classified and whether there is any impairment. Beyond the annual review, all loans are graded upon initial issuance. In addition, during the renewal process of any loan, as well as if a loan becomes past due, the Company will determine the appropriate loan grade.

Loans excluded from the review process above are generally classified as pass credits until: (a) they become past due; (b) management becomes aware of deterioration in the creditworthiness of the borrower; or (c) the customer contacts the Company for a modification. In these circumstances, the loan is specifically evaluated for potential classification as to special mention, substandard, doubtful, or even charged-off. The Company uses the following definitions for risk ratings:

Pass: A Pass loan’s primary source of loan repayment is satisfactory, with secondary sources very likely to be realized if necessary. The pass category includes the following:

Riskless: Loans that are fully secured by liquid, properly margined collateral (listed stock, bonds, or other securities; savings accounts; certificates of deposit; loans or that portion thereof which are guaranteed by the U.S. Government or agencies backed by the “full faith and credit” thereof; loans secured by properly executed letters of credit from prime financial institutions).

High Quality Risk: Loans to recognized national companies and well-seasoned companies that enjoy ready access to major capital markets or to a range of financing alternatives. Borrower’s public debt offerings are accorded highest ratings by recognized rating agencies, e.g., Moody’s or Standard & Poor’s. Companies display sound financial conditions and consistent superior income performance. The borrower’s trends and those of the industry to which it belongs are positive.

Satisfactory Risk: Loans to borrowers, reasonably well established, that display satisfactory financial conditions, operating results and excellent future potential. Capacity to service debt is amply demonstrated. Current financial strength, while financially adequate, may be deficient in a number of respects. Normal comfort levels are achieved through a closely monitored collateral position and/or the strength of outside guarantors.

Moderate Risk: Loans to borrowers who are in non-compliance with periodic reporting requirements of the loan agreement, and any other credit file documentation deficiencies, which do not otherwise affect the borrower’s credit risk profile. This may include borrowers who fail to supply updated financial information that supports the adequacy of the primary source of repayment to service the Bank’s debt and prevents bank management to evaluate the borrower’s current debt service capacity. Existing loans will include those with consistent

13

track record of timely loan payments, no material adverse changes to underlying collateral, and no material adverse change to guarantor(s) financial capacity, evidenced by public record searches.

Special mention: A Special Mention loan has potential weaknesses that deserve management’s close attention. If left uncorrected, these potential weaknesses may result in the deterioration of the repayment prospects for the asset or the Company’s credit position at some future date. Special Mention loans are not adversely classified and do not expose an institution to sufficient risk to warrant adverse classification.

Substandard: A Substandard loan is inadequately protected by the current sound worth and paying capacity of the obligor or of the collateral pledged, if any. Loans so classified must have a well-defined weakness or weaknesses that jeopardize the liquidation of the debt. They are characterized by the distinct possibility that the Company will sustain some loss if the deficiencies are not corrected.

Doubtful: A loan classified Doubtful has all the weaknesses inherent in one classified Substandard with the added characteristics that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable.

Loss: A loan classified Loss is considered uncollectible and of such little value that continuance as a bankable asset is not warranted. This classification does not mean that the asset has absolutely no recovery or salvage value, but rather it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future.

Based on the most recent analysis performed, the risk category of loans by class of loans is as follows:

| | | | | | | | | | | | | | | |

| | | | | Special | | | | | | | | | | |

(Dollars in thousands) |

| Pass |

| Mention |

| Substandard |

| Doubtful |

| Total | |||||

March 31, 2021 | | | |

| | |

| | |

| | |

| | |

Commercial real estate | | $ | 818,139 | | $ | — | | $ | 2,326 | | $ | — | | $ | 820,465 |

Residential real estate | |

| 369,234 |

|

| — |

|

| — |

|

| — |

|

| 369,234 |

Commercial | |

| 441,111 |

|

| 453 |

|

| 1,468 |

|

| — |

|

| 443,032 |

Construction and land development | |

| 93,302 |

|

| — |

|

| — |

|

| — |

|

| 93,302 |

Consumer | |

| 11,256 |

|

| — |

|

| 1,307 |

|

| — |

|

| 12,563 |

Total | | $ | 1,733,042 |

| $ | 453 |

| $ | 5,101 |

| $ | — |

| $ | 1,738,596 |

| | | |

| | |

| | |

| | |

| | |

December 31, 2020 | | | | | | | | | | | | | | | |

Commercial real estate | | $ | 775,420 | | $ | — | | $ | 2,356 | | $ | — | | $ | 777,776 |

Residential real estate | |

| 380,062 |

|

| 429 |

|

| — |

|

| — |

|

| 380,491 |

Commercial | |

| 387,403 |

|

| 112 |

|

| 9,127 |

|

| — |

|

| 396,642 |

Construction and land development | |

| 99,883 |

|

| — |

|

| — |

|

| — |

|

| 99,883 |

Consumer | |

| 10,381 |

|

| — |

|

| 1,307 |

|

| — |

|

| 11,688 |

Total | | $ | 1,653,149 |

| $ | 541 |

| $ | 12,790 |

| $ | — |

| $ | 1,666,480 |

Purchased Credit Impaired Loans:

The Company has purchased loans, for which there was, at acquisition, evidence of deterioration of credit quality since origination and it was probable, at acquisition, that all contractually required payments would not be collected. The carrying amount of those loans is as follows:

| | | | | | |

(Dollars in thousands) | | March 31, 2021 |

| December 31, 2020 | ||

Residential real estate | | $ | 405 | | $ | 405 |

Commercial | |

| 678 | |

| 746 |

Construction and development | |

| 5,555 | |

| 3,732 |

Carrying amount, net of total discounts | | $ | 6,638 | | $ | 4,883 |

14

Changes in the carrying amount of the accretable yield for all purchased credit impaired loans were as follows for the three months ended March 31, 2021:

(Dollars in thousands) |

| 2021 | |

Balance at beginning of period | | $ | (630) |

Adjustment of income | |

| — |

Accretion | |

| 89 |

Reclassifications from nonaccretable difference | |

| — |

Disposals | |

| — |

Balance at end of period | | $ | (541) |

For those purchased credit impaired loans disclosed above, no allowances for loan losses were recorded or reversed during the three months ended March 31, 2021.

The credit fair value adjustment on purchased credit impairment (“PCI”) loans represents the portion of the loan balances that have been deemed uncollectible based on the Company’s expectations of future cash flows for each respective loan. PCI loans purchased on March 26, 2020, for which it was probable at acquisition that all contractually required payments would not be collected are as follows:

(Dollars in thousands) |

| March 26, 2020 | |

Contractually required principal and interest by loan type | | | |

Commercial real estate | | $ | 427 |

Residential real estate | |

| 604 |

Commercial | |

| 2,176 |

Construction and development | |

| 5,614 |

Consumer and other loans | |

| - |

Total | | $ | 8,821 |

Contractual cash flows not expected to be collected (nonaccretable discount) | | | |

Commercial real estate | | $ | 80 |

Residential real estate | |

| 138 |

Commercial | |

| 1,123 |

Construction and development | |

| 2,297 |

Consumer and other loans | |

| - |

Total | | $ | 3,638 |

| | | |

Expected cash flows | | $ | 5,183 |

Interest component of expected cash flows (accretable discount) | | | (545) |

Fair value of PCI loans accounted for under ASC 310-30 | | $ | 4,638 |

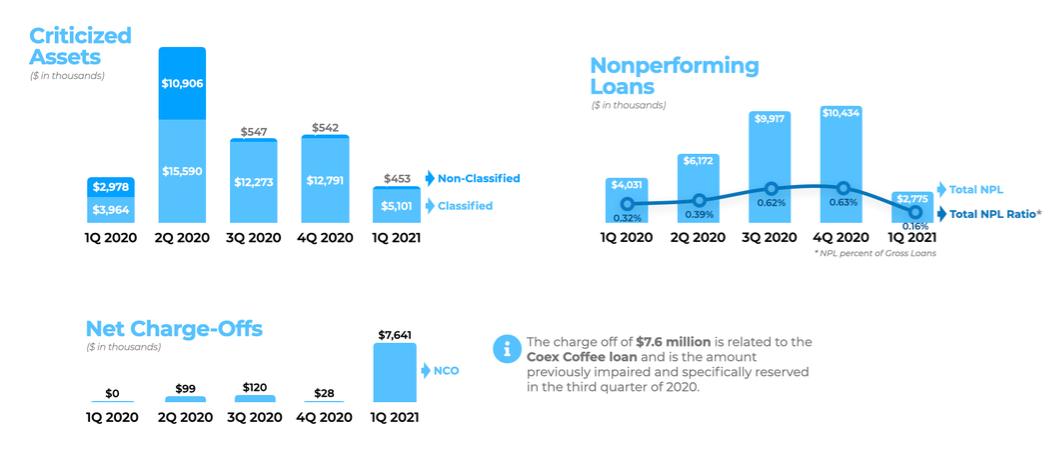

Non-Performing Assets

As of March 31, 2021, the Company had nonperforming assets of $2.8 million, or 0.12% of total assets, compared to nonperforming assets of $10.4 million, or 0.51% of total assets, at December 31, 2020. In March 2021, the Company charged off $7.6 million of the Coex Coffee International Inc. (“Coex”) loan, which amount was previously reserved during the third quarter of 2020. Based on a review of the estimated receivables collected by the assignee, the remaining book balance of $0.6 million for the Coex loan appears to be collectable by the Company, subject to final accounting by the assignee.

Paycheck Protection Program

The Company participated in the Paycheck Protection Program (“PPP”) and funded 2,113 small business loans representing $322.5 million in relief proceeds under all three Rounds of the PPP. During the first quarter of 2021, the Company funded 608 loans representing $96.4 million under Round Three of the PPP. Through the Company’s online PPP application and loan closing documentation process, there have been 1,062 loans submitted for forgiveness for a total of $160.4 million, or 70.9% of total PPP loan volume from Rounds One and Two as of March 31, 2021. From the total loans submitted for forgiveness, 913 loans representing $110.8 million were forgiven and removed from the balance sheet. Most of the PPP loans were initially pledged to the Federal Reserve as part of the Payroll Protection Program Liquidity Facility ("PPPLF"). The PPPLF pledged loans are non-recourse to the Company. In addition, the Company paid off approximately

15

$74.6 million in PPPLF advances during the three months ended March 31, 2021. PPP loan fees recognized during the three months ended March 31, 2021, were $2.5 million. Net unearned PPP loan fees outstanding at March 31, 2021, and December 31, 2020, were $5.7 million and $4.3 million, respectively.

Debt Service Relief Requests Related to COVID-19

As a result of the COVID-19 pandemic the Company has reviewed and processed numerous debt service relief requests in accordance with Section 4013 of the CARES Act and interagency guidelines published by federal banking regulators on March 13, 2020. As currently interpreted by the agencies, the guidelines assert that short-term modifications made on good faith for reasons related to the COVID-19 pandemic to borrowers who were current prior to such relief are not considered TDRs. These modifications include deferrals of principal and interest, modification to interest only, and deferrals to escrow requirements. The modifications have varying terms up to six months. As of March 31, 2021, the Company has approved $199.8 million in payment relief modifications that were granted under the CARES Act guidance associated with the treatment of TDRs. Since the inception of the CARES Act, one loan was downgraded to non-performing in the amount of $1.3 million, and one loan remains on payment relief with an outstanding balance of $0.4 million. These loans remain under the exemption from TDR classification as provided for in the CARES Act. All other loans that were provided payment relief have either been reinstated to their original payment terms or paid off. To manage credit risk, the Company increased oversight and analysis of loans to borrowers in vulnerable industries, such as hotels and hospitality. As of March 31, 2021, these hotels and hospitality loans have a balance of $59.2 million. As of March 31, 2021, $32.2 million of these hotels and hospitality loans were provided payment relief consistent with Section 4013 of the CARES Act and the interagency guidelines published on March 13, 2020. As of March 31, 2021, all loans in this segment have been reinstated and returned to normal payment schedules.

NOTE 5 — ALLOWANCE FOR LOAN LOSSES

The following table presents the balance in the allowance for loan losses and the recorded investment in loans by portfolio segment and based on the impairment method for the three months ended March 31, 2021, and year ended December 31, 2020:

| | | | | | | | | | | Construction | | | | | | ||

| | Commercial | | Residential | | | | | and land | | Consumer | | | | ||||

|

| Real Estate |

| Real Estate |

| Commercial |

| Development |

| and Other |

| Total | ||||||

March 31, 2021 |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Allowance for loan losses: |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Beginning balance | | $ | 3,159 | | $ | 2,177 | | $ | 10,462 | | $ | 388 | | $ | 73 | | $ | 16,259 |

Provision for loan losses | |

| 323 | |

| 11 | |

| 700 | |

| 16 | |

| (12) | |

| 1,038 |

Loans charged-off | |

| - | |

| - | |

| (7,641) | |

| - | |

| - | |

| (7,641) |

Recoveries | |

| - | |

| - | |

| - | |

| - | |

| - | |

| - |

Total ending allowance balance | | $ | 3,482 | | $ | 2,188 | | $ | 3,521 | | $ | 404 | | $ | 61 | | $ | 9,656 |

| | | | | | | | | | | Construction | | | | | | | |

| | Commercial | | Residential | | | | | and land | | Consumer | | | | ||||

|

| Real Estate |

| Real Estate |

| Commercial |

| Development |

| and Other |

| Total | ||||||

December 31, 2020 |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Allowance for loan losses: |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Beginning balance | | $ | 1,845 | | $ | 3,115 | | $ | 1,235 | | $ | 272 | | $ | 81 | | $ | 6,548 |

Provision for loan losses | |

| 1,314 | |

| (731) | |

| 9,326 | |

| 116 | |

| (8) | |

| 10,017 |

Loans charged-off | |

| — | |

| (207) | |

| (99) | |

| — | |

| — | |

| (306) |

Recoveries | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — |

Total ending allowance balance | | $ | 3,159 | | $ | 2,177 | | $ | 10,462 | | $ | 388 | | $ | 73 | | $ | 16,259 |

16

| | | | | | | | | | | Construction | | | | | | ||

| | Commercial | | Residential | | | | | and Land | | Consumer | | | | ||||

|

| Real Estate |

| Real Estate |

| Commercial |

| Development |

| and Other |

| Total | ||||||

March 31, 2021 | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for loan losses: | | | | | | | | | | | | | | | | | | |

Ending allowance balance attributable to loans | | | | | | | | | | | | | | | | | | |

Individually evaluated for impairment | | $ | — | | $ | — | | $ | 685 | | $ | — | | $ | — | | $ | 685 |

Purchased Credit Impaired (PCI) loans | | | — | | | — | | | — | | | — | | | — | | | — |

Collectively evaluated for impairment | | | 3,482 | | | 2,188 | | | 2,836 | | | 404 | | | 61 | | | 8,971 |

Total ending allowance balance | | $ | 3,482 | | $ | 2,188 | | $ | 3,521 | | $ | 404 | | $ | 61 | | $ | 9,656 |

| | | | | | | | | | | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | | | |

Loans individually evaluated for impairment | | $ | 2,326 | | $ | 272 | | $ | 1,468 | | $ | — | | $ | 1,307 | | $ | 5,373 |

Loans collectively evaluated for impairment | | | 818,139 | | | 368,962 | | | 441,564 | | | 93,302 | | | 11,256 | | | 1,733,223 |

Total ending loans balance | | $ | 820,465 | | $ | 369,234 | | $ | 443,032 | | $ | 93,302 | | $ | 12,563 | | $ | 1,738,596 |

| | | | | | | | | | | | | | | | | | |

December 31, 2020 | | | | | | | | | | | | | | | | | | |

Allowance for loan losses: | | | | | | | | | | | | | | | | | | |

Ending allowance balance attributable to loans | | | | | | | | | | | | | | | | | | |

Individually evaluated for impairment | | $ | — | | $ | — | | $ | 8,309 | | $ | — | | $ | — | | $ | 8,309 |

Purchased Credit Impaired (PCI) loans | | | — | | | — | | | — | | | — | | | — | | | |

Collectively evaluated for impairment | | | 3,159 | | | 2,177 | | | 2,153 | | | 388 | | | 73 | | | 7,950 |

Total ending allowance balance | | $ | 3,159 | | $ | 2,177 | | $ | 10,462 | | $ | 388 | | $ | 73 | | $ | 16,259 |

| | | | | | | | | | | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | | | |

Loans individually evaluated for impairment | | $ | 2,356 | | $ | 298 | | $ | 9,127 | | $ | — | | $ | 1,307 | | $ | 13,088 |

Loans collectively evaluated for impairment | | | 775,420 | | | 380,193 | | | 387,515 | | | 99,883 | | | 10,381 | | | 1,653,392 |

Total ending loans balance | | $ | 777,776 | | $ | 380,491 | | $ | 396,642 | | $ | 99,883 | | $ | 11,688 | | $ | 1,666,480 |

NOTE 6 — DEPOSITS

The Company’s total deposits are comprised of the following at the dates indicated:

| | | | | | | | | | | |

| | For the Three Months Ended | | For the Year Ended | | ||||||

| | March 31, 2021 | | December 31, 2020 | | ||||||

| | Ending | | | | Ending | | | | ||

(Dollars in thousands) |

| Balance |

| % of Total |

| Balance |

| % of Total |

| ||

NOW accounts | | $ | 64,317 | | 3.4 | % | $ | 60,995 | | 3.7 | % |

Money market accounts | |

| 979,742 |

| 51.4 | % |

| 865,625 |

| 52.2 | % |

Savings accounts | |

| 23,471 |

| 1.2 | % |

| 20,750 |

| 1.3 | % |

Certificates of deposit | |

| 248,759 |

| 13.1 | % |

| 236,575 |

| 14.3 | % |

Total interest-bearing deposits | |

| 1,316,289 |

| 69.1 | % |

| 1,183,945 |

| 71.3 | % |

Noninterest-bearing deposits | |

| 589,415 |

| 30.9 | % |

| 475,598 |

| 28.7 | % |

Total deposits | | $ | 1,905,704 | | 100.0 | % | $ | 1,659,543 | | 100.0 | % |

The following table presents the maturities of our insured time deposits that meet or exceed the $250,000 FDIC insurance limit as of March 31, 2021.

| | | | | | | | | | | | | | | |

|

| | |

| Over |

| Over Six |

| | |

| | | ||

| | Three | | Three | | Months | | | | | | | |||

| | Months or | | Through | | Through | | Over | | | | ||||

(Dollars in thousands) | | Less | | Six Months | | 12 Months | | 12 Months | | Total | |||||

Time deposits under $250,000 | | $ | 13,944 | | $ | 15,481 | | $ | 24,613 | | $ | 29,207 | | $ | 83,245 |

Time deposits over $250,000 | | | 36,553 | | | 22,484 | | | 51,806 | | | 54,671 | | | 165,514 |

Total | | $ | 50,497 | | $ | 37,965 | | $ | 76,419 | | $ | 83,878 | | $ | 248,759 |

17

The following tables present the maturities of our insured time deposits that meet or exceed the $250,000 FDIC insurance limit as of December 31, 2020.

| | | | | | | | | | | | | | | |

|

| | |

| Over |

| Over Six |

| | |

| | | ||

| | Three | | Three | | Months | | | | | | | |||

| | Months or | | Through | | Through | | Over | | | | ||||

(Dollars in thousands) | | Less | | Six Months | | 12 Months | | 12 Months | | Total | |||||

Time deposits under $250,000 | | $ | 20,767 | | $ | 13,258 | | $ | 24,805 | | $ | 19,240 | | $ | 78,070 |

Time deposits over $250,000 | | | 40,189 | | | 35,314 | | | 42,844 | | | 40,158 | | | 158,505 |

Total | | $ | 60,956 | | $ | 48,572 | | $ | 67,649 | | $ | 59,398 | | $ | 236,575 |

As of March 31, 2021, and December 31, 2020, the Company had time deposits that meet or exceed the $250,000 FDIC insurance limit of $165.5 million and $158.5 million, respectively. Securities, mortgage loans or other financial instruments pledged as collateral for certain deposits was $53.7 million, and $54.7 million at March 31, 2021, and December 31, 2020, respectively. The aggregate amount of demand deposits that have been re-classified as loan balances at March 31, 2021, and December 31, 2020, were $0.4 million, and $0.1 million, respectively. Deposits from principal officers, directors and their affiliates at March 31, 2021, and December 31, 2020, were $12.9 million, and $12.1 million, respectively.

For time deposits having a remaining term of more than one year, the aggregate amount of maturities for each of the five years at the dates indicated.

| | | | | | |

| | March 31, 2021 | | December 31, 2020 | ||

Less than 1 year | | $ | 164,882 | | $ | 177,178 |

Over 1 through 2 years | | | 82,460 | | | 57,034 |

Over 2 through 3 years | | | 1,293 | | | 1,658 |

Over 3 through 4 years | | | 124 | | | 705 |

Over 4 through 5 years | | | - | | | - |

Over 5 years | | | - | | | - |

Total | | $ | 248,759 | | $ | 236,575 |

Banks are required to maintain cash reserves in the form of vault cash or in an account with the Federal Reserve Bank or in noninterest-earning accounts with other qualified banks. This requirement is based on the Bank’s amount of transaction deposit accounts. Due to the amount of transaction deposit accounts, the Bank was not required to have cash reserve requirements at March 31, 2021, and December 31, 2020. Additionally, the Company had $98.8 million and $98.9 million, in Qualified Public Deposits (“QPD”) that require collateral pledged as of March 31, 2021, and December 31, 2020.

NOTE 7 — DEBT

Subordinated Debt. On March 26, 2020, pursuant to terms of the acquisition, the Company assumed the subordinated notes payable of Marquis Bancorp, Inc. (“MBI”) at its fair value of $10.3 million. According to the terms of the subordinated note, the principal amount due is $10.0 million with a 7% fixed rate until October 30, 2021, and a variable rate thereafter at LIBOR plus 576 basis points. The note matures on October 30, 2026, and can be redeemed by the Company anytime on or after October 30, 2021. The subordinated debt was fair valued at a discount of $0.5 million and is being amortized over the expected life.

Valley National Line of Credit. On December 19, 2019, the Company entered into a new $10.0 million secured revolving line of credit with Valley National Bank, N.A. Amounts drawn under this line of credit bears interest at the Prime Rate, as announced by The Wall Street Journal from time to time as its prime rate, and its obligations under this line of credit are secured by shares of the capital stock of the Bank, which we have pledged as security. On January 7, 2021, (the “Closing Date”) the Company and Valley National Bank entered an amendment, which among other things, extended the maturity date of the note to March 19, 2021. No other material terms of the note changed. The principal balance outstanding pursuant to the note on the Closing Date was $0. As further described in Note 17 - Subsequent Events, after the quarter ended March 31, 2021, the Company and Valley National Bank entered into an extension agreement, which among other things, extended the maturity date of the note to March 1, 2022.

18

NOTE 8 — BORROWINGS

The Company uses short-term and long-term borrowings to supplement deposits to fund lending and investment activities.

FHLB Advances. The FHLB allows the Company to borrow up to 25% of its assets on a blanket floating lien status collateralized by certain securities and loans. As of March 31, 2021, approximately $285.1 million in loans were pledged as collateral for our FHLB borrowings. We utilize these borrowings to meet liquidity needs and to fund certain fixed rate loans in our portfolio. As of March 31, 2021, we had $40.0 million in outstanding advances and $120.6 million in additional available borrowing capacity from the FHLB based on the collateral that we have currently pledged. The following table sets forth certain information on our FHLB borrowings during the periods presented.

| | Three Months Ended | | Year Ended | | ||

(Dollars in thousands) |

| March 31, 2021 |

| December 31, 2020 | | ||

Amount outstanding at period-end | | $ | 40,000 | | $ | 40,000 | |

Weighted average interest rate at period-end | |

| 1.96 | % |

| 1.96 | % |

Maximum month-end balance during period | | $ | 40,000 | | $ | 70,000 | |

Average balance outstanding during period | |

| 40,000 | |

| 58,210 | |

Weighted average interest rate during period | |

| 1.96 | % |

| 1.63 | % |

Federal Reserve Bank of Atlanta. The Federal Reserve Bank of Atlanta has an available borrower in custody arrangement which allows us to borrow on a collateralized basis. No advances were outstanding under this facility as of March 31, 2021.

PPPLF Advances. The Company initially funded PPP loans with the PPPLF. Most of the PPP loans were initially pledged to the Federal Reserve as part of the PPPLF. The PPPLF pledged loans are non-recourse to the Company. In addition, we paid off approximately $74.6 million in PPPLF advances during the three months ended March 31, 2021.

NOTE 9 — COMMON STOCK AND PREFERRED STOCK

Class A Voting Common Stock

The Company has Class A voting common stock with a par value of $0.01 per share. As of March 31, 2021, there are 50,000,000 shares authorized as Class A voting common stock of which 13,661,567 are outstanding. During the three months ended March 31, 2021, the Company issued 184,427 shares of Class A voting common stock, inclusive of 127,499 shares of restricted stock grants, 56,055 shares of options exercised, and 873 shares pursuant to the employee stock purchase program.

19

During the three months ended March 31, 2021, the Company repurchased 54,479 shares of Class A common stock. Further, during the same three month period, upon the vesting of a portion of restricted stock, employees of the Company elected to have 3,210 shares of Class A common voting stock withheld for tax purposes.

Class B Non-voting Common Stock

The Company has Class B non-voting common stock with a par value of $0.01 per share. As of March 31, 2021, there are 10,000,000 shares authorized as Class B non-voting common stock, none of which are outstanding.

Preferred Stock

The Company has 10,000,000 shares of undesignated and unissued preferred stock.

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. There are three levels of inputs that may be used to measure fair values:

Level 1 — Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

Level 2 — Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 — Significant unobservable inputs that reflect a Company’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

The Company used the following methods and significant assumptions to estimate fair value:

Cash and cash equivalents: The carrying amounts of cash and cash equivalents approximate their fair value.

Securities available for sale: Where quoted prices are available in an active market, securities are classified within Level 1 of the valuation hierarchy. Level 1 securities include highly liquid government bonds, certain mortgage products and exchange-traded equities. If quoted market prices are not available, then fair values are estimated by using pricing models, quoted prices of securities with similar characteristics, or discounted cash flows. Examples of such instruments, which would generally be classified within Level 2 of the valuation hierarchy, include certain collateralized mortgage and debt obligations, corporate bonds, municipal bonds and U.S. agency notes. In certain cases where there is limited activity or less transparency around inputs to the valuation, securities are classified within Level 3 of the valuation hierarchy. Securities classified within Level 3 might include certain residual interests in securitizations and other less liquid securities. As of March 31, 2021 and December 31, 2020, all securities available for sale were Level 2.

Securities held-to-maturity: Reported at fair value utilizing level 2 inputs. The estimated fair value is determined based on market quotes when available. If not available, quoted market prices of similar securities, discounted cash flow analysis, pricing models and observable market data are used in determining fair market value.

Equity securities: The Company values equity securities at readily determinable market values based on the closing price at the end of each period. Changes in fair value are recognized through net income.

Loans: Fair values are estimated for portfolios of loans with similar characteristics. Loans are segregated by type, such as commercial or residential mortgage. Each loan category is further segmented into fixed and adjustable rate interest terms as well as performing and non-performing categories. The fair value of loans is calculated by discounting scheduled cash flows through the estimated life including prepayment considerations and estimated market discount rates that reflect the risks inherent to the loan. The calculation of the fair value considers market driven variables including credit related factors and reflects an exit price as defined in ASC Topic 820.

Federal Home Loan Bank stock: It is not practical to determine fair value due to restrictions placed on transferability.

20

Federal Reserve Bank stock: It is not practical to determine fair value due to restrictions placed on transferability.

Accrued interest receivable: The carrying amounts of accrued interest approximate their fair values.

Deposits: The fair values disclosed for demand, NOW, money-market and savings deposits are, by definition, equal to the amount payable on demand at the reporting date (that is, their carrying amounts). Fair values for fixed-rate time deposits are estimated using a current market rates offered for remaining or similar maturities.

Federal Home Loan Bank advances: Fair values are estimated using discounted cash flow analysis based on the Bank’s current incremental borrowing rates for similar types of borrowing arrangements.

Off-balance-sheet instruments: Fair values for off-balance-sheet lending commitments are based on fees currently charged to enter into similar agreements, taking into account the remaining terms of the agreements and the counterparties’ credit standing.

Assets and Liabilities Measured on a Recurring Basis

Assets and liabilities measured at fair value on a recurring basis, are summarized below:

| | | | | Fair Value Measurements | |||||||

| | | | | at March 31, 2021 Using: | |||||||

| | | | | | | | Significant | | | | |

| | | | | Quoted Prices in | | Other | | Significant | |||

| | | | | Active Markets for | | Observable | | Unobservable | |||

| | Fair | | Identical Assets | | Inputs | | Inputs | ||||

March 31, 2021 |

| Value |

| (Level 1) |

| (Level 2) |

| (Level 3) | ||||

Available-for-sale - taxable |

| |

|

| |

|

| |

|

| |

|

Small Business Administration loan pools | | $ | 28,882 | | $ | — | | $ | 28,882 | | $ | — |

Mortgage-backed securities | |

| 24,074 | |

| — | |

| 24,074 | |

| — |

United States agency obligations | | | 2,100 | | | — | | | 2,100 | | | — |

Corporate bonds | |

| 2,011 | |

| — | |

| 2,011 | |

| — |

Total | | $ | 57,067 | | $ | — | | $ | 57,067 | | $ | — |

Available-for-sale - tax exempt | | | | | | | | | | | | |

Community Development District bonds | | $ | 21,253 | | $ | — | | $ | 21,253 | | $ | — |

Municipals | | | 1,088 | | | — | | | 1,088 | | | — |

Total | | $ | 22,341 | | $ | — | | $ | 22,341 | | $ | — |

Equity |

| |

|

| |

|

| |

|

| |

|

Mutual funds | | $ | 5,914 | | $ | 5,914 | | $ | — | | $ | — |

Total | | $ | 5,914 | | $ | 5,914 | | $ | — | | $ | — |

21

| | | | | Fair Value Measurements | |||||||

| | | | | at December 31, 2020 Using: | |||||||

| | | | | | | | Significant | | | | |

| | | | | Quoted Prices in | | Other | | Significant | |||

| | | | | Active Markets for | | Observable | | Unobservable | |||

| | Fair | | Identical Assets | | Inputs | | Inputs | ||||

December 31, 2020 |

| Value |

| (Level 1) |

| (Level 2) |

| (Level 3) | ||||

Available-for-sale - taxable |

| |

|

| |

|

| |

|

| |

|

Small Business Administration loan pools | | $ | 28,882 | | $ | — | | $ | 28,882 | | $ | — |

Mortgage-backed securities | |

| 24,074 | |

| — | |

| 24,074 | |

| — |

United States agency obligations | |

| 2,100 | |

| — | |

| 2,100 | |

| — |

Corporate bonds | |

| 2,011 | |

| — | |

| 2,011 | |

| — |

Total | | $ | 57,067 | | $ | — | | $ | 57,067 | | $ | — |

Available-for-sale - tax exempt | | | | | | | | | | | | |

Community Development District bonds | | $ | 21,253 | | $ | — | | $ | 21,253 | | $ | — |

Municipals | | | 1,088 | | | — | | | 1,088 | | | — |

Total | | $ | 22,341 | | $ | — | | $ | 22,341 | | $ | — |

Equity |

| |

|

| |

|

| |

|

| |

|

Mutual funds | | $ | 6,005 | | $ | 6,005 | | $ | — | | $ | — |

Total | | $ | 6,005 | | $ | 6,005 | | $ | — | | $ | — |

There were no securities reclassified into or out of Level 3 during the three months ended March 31, 2021, or for the year ended December 31, 2020.