Attached files

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

Commission File Number: 000-53676

| LODE-STAR MINING INC. |

| (Exact name of registrant as specified in its charter) |

| NEVADA | 47-4347638 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| 1 East Liberty Street, Suite 600 |

| Reno, NV 89501 |

| (Address of principal executive offices, including zip code.) |

| (775) 234-5443 |

| (Registrant’s telephone number, including area code) |

| Securities registered pursuant to Section 12(b) of the Act: | Securities registered pursuant to section 12(g) of the Act: |

| NONE | Common Stock, $0.001 par value |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES o NO

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act:

YES o NO

þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO

o

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES þ NO

o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Accelerated Filer | o | |

| Non-accelerated Filer | o | Smaller Reporting Company | þ | |

| Emerging Growth Company | o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO þ

The aggregate market value of the registrant’s common stock held by non-affiliates at June 30, 2019, its most recently completed second fiscal quarter, was $509,088. The stock price used in this calculation was the closing price of the registrant’s stock reported on the OTCQB marketplace on June 27, 2019, the date of trading activity closest to last business day of the registrant’s most recently completed second fiscal quarter. For purposes of calculating this amount only, all executive officers, directors and beneficial owners of 5% or more of the outstanding shares of common stock have been treated as affiliates. At March 23, 2020 50,605,965 shares of the registrant’s common stock were outstanding.

1

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements.

This current report on Form 10-K (this “Report”) contains forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks and the risks set out below, any of which may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| ● | the uncertainty of future revenue and profitability based upon our current financial condition and history of losses; |

| ● | our lack of operating history; |

| ● | we have no proven and/or probable reserves at the present time; |

| ● | risks relating to our liquidity; |

| ● | risks related to the market for our common stock and our ability to dilute our current shareholders’ interest; |

| ● | risks related to our ability to locate and proceed with a new project or business for which we can obtain funding; |

| ● | risks related to our ability to obtain adequate financing on a timely basis and on acceptable terms; and |

| ● | other risks and uncertainties related to our business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are issued, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Unless the context otherwise requires, references in this Report to “LSM,” the “Company”, “we”, “us”, “our”, or “ours” refer to Lode-Star Mining Inc.

2

| ITEM 1. | BUSINESS |

Lode-Star Mining Inc. was incorporated in the State of Nevada on December 9, 2004 for the purpose of acquiring and exploring mineral properties. Our principal executive offices are in Reno, Nevada. We also maintain a business office in Vancouver, British Columbia, Canada.

We have no revenues, have losses since inception, and have been issued a going concern opinion by our auditor. We are relying upon loans and/or the sale of securities to fund our operations. We have no employees and expect to use outside consultants, advisors, attorneys and accountants as necessary for the next twelve months.

Mineral Property Interest

Further to a Mineral Option Agreement (the “Option Agreement”) dated October 4, 2014, on December 5, 2014, we entered into a subscription agreement (the “Subscription Agreement”) with Lode-Star Gold INC., a private Nevada corporation (“LSG”) in which we agreed to issue 35,000,000 shares of our common stock, valued at $230,180, to LSG in exchange for an initial 20% undivided beneficial interest in and to LSG’s Goldfield property, which made LSG our largest and controlling shareholder.

LSG was incorporated in the State of Nevada on March 13, 1998 for the purpose of acquiring exploration stage mineral properties. It currently has one shareholder, Lonnie Humphries, who is the spouse of Mark Walmesley, our President and Chief Financial Officer. Mr. Walmesley is also the Director of Operations and a director of LSG.

LSG’s Goldfield Bonanza property is comprised of 31 patented mineral claims owned 100% by LSG, located on approximately 460 acres in the district of Goldfield in the state of Nevada (the “Property”). The Property is clear titled, with a 1% Net Smelter Royalty (“NSR”) existing in the favor of the original property owner. LSG has rehabbed approximately 1/2 mile of drift at the 300ft level and completed 22 surface core drill holes for a total of 10,400 ft and 152 underground core drill holes for a total of 23,000ft.

LSG acquired the leases to the Property in 1997 and became the registered and beneficial owner of the Property on September 19, 2009. Since the earlier of those dates, it has conducted contract exploration work on the Property but has not determined whether it contains mineral reserves that are economically recoverable. LSG is an exploration stage company and has not generated any revenues since its inception. The Property represents its only material asset.

The Property is located in west-central Nevada, in the Goldfield Mining District at Latitude 37° 42’, and Longitude 117° 14’. The claims comprising the Property are located in surveyed sections 35 and 36, Township 2 South, Range 42 East, and in sections 1, 2, 11, and 12, Township 3 South, Range 42 East, in Esmeralda County, Nevada. The Property is accessible by traveling approximately one-half mile northeast of the community of Goldfield, along a county-maintained road that originates at U.S. Highway 95, which runs through “downtown” Goldfield. The town of Goldfield, which is the Esmeralda county seat (population 300), is approximately 200 air miles south of Reno and 180 air miles north of Las Vegas. Surface access on the Property is excellent and the relief is low, at an elevation of approximately 6,000 feet. Vegetation is sparse, consisting largely of sagebrush, rabbitbrush, Joshua trees and grasses. Water, electricity and other sundry needs such as restaurants, lodging, minor medical needs, fire station, and police are within 1 mile of the property.

All properties, claims, buildings, equipment, and supplies are owned by LSG and we have free access to utilize and manage all those items. Operations are managed from a 6,000 sq. ft. office and warehouse facility complete with showers and laundry amenities. Two residential trailer sites are immediately adjacent to this building for crew needs.

The Property has one working shaft, the February Premier, which has access to the 300 ft level, with approximately 1/2 mile of ventilated drift. Underground work has identified 2 high-grade gold-bearing zones which the company plans to further explore. The program that we envision undertaking includes the mining of approximately 10,000 tons of non-NI 43-101 compliant gold mineralization at an approximate grade of 0.9 ounces per ton. The estimated grade is based on historic drilling work done by LSG, for which the 1.5-inch core samples were consumed by assay requirements. In order to provide adequate sample weights to the assaying lab, the entire core was processed for individual samples. While we have encountered several additional high-grade drill anomalies throughout the property, it is important to note that we have no proven and/or probable reserves at the present time and therefore the program is exploratory in nature.

The Property has two operating water monitoring wells that were mandatory for us to receive a water pollution control permit. Part of the permitting application is for the allowance of the company to store its waste rock underground. The property has no milling onsite and we must rely on a third party to receive our mineralized material and tombstone our tailings.

3

| ITEM 1. | BUSINESS |

The execution of the Subscription Agreement was one of the closing conditions of the Option Agreement, pursuant to which we acquired the sole and exclusive option to earn up to an 80% undivided interest in and to the Property. To earn the additional 60% interest in the Property, we were required to fund all expenditures on the Property and pay LSG an aggregate of $5 million in cash from the Property’s mineral production proceeds in the form of an NSR. Until we have earned the additional 60% interest, the NSR will be split 79.2% to LSG, 19.8% to us and 1% to the former Property owner.

The Option Agreement can be found as Exhibit 10.1 to our report filed on Form 8-K on October 9, 2014 and is incorporated by reference, shown as Exhibit 10.5 to this report. The Subscription Agreement can be found as Exhibit 10.7 to our report filed on Form 10-K/A on January 11, 2017 and is incorporated by reference, shown as Exhibit 10.7 to this report.

If we fail to make any cash payments to LSG within one year of October 4, 2014, we are required to pay LSG an additional $100,000, and in any subsequent years in which we fail to complete the payment of the entire $5 million described above, we must make quarterly cash payments to LSG of $25,000 until we have earned the additional 60% interest in the Property.

LSG granted us a series of deferrals of the payments, with the most recent being granted on January 11, 2017. LSG agreed on that date to defer payment of all amounts due in accordance with the Option Agreement until further notice. On January 17, 2017, the Company and LSG agreed that as of January 1, 2017, all outstanding balances shall carry a compound interest rate of 5% per annum. It was further agreed that the ongoing payment deferral shall apply to interest and principal.

Amendment to Option Agreement

On October 31, 2019, we entered into an amendment (the “Amendment”) to the Option Agreement with LSG.

Under the Amendment, the exercise of the 60% option was restructured into two separate 30% options, such that we may now earn a 30% interest in the Property (for a total of 50%) (the “Second Option”) by completing the following actions:

| ● | paying LSG $5 million in cash from the Property’s mineral production proceeds in the form of an NSR royalty (the “Initial Payment”); |

| ● | paying LSG all accrued and unpaid penalty payments under the Option Agreement; |

| ● | repaying to LSG (i) all loans, advances or other payments made by LSG to the Company and (ii) all expenditures on the Property funded by or on behalf of LSG until the date on which the Initial Payment has been completed; and |

| ● | funding all expenditures on the Property until the date on which the Initial Payment has been completed. |

Following the exercise of the Second Option, we may earn an additional 30% interest in the Property (for a total of 80%) (the “Third Option”) by completing the following actions:

| ● | paying LSG a further $5 million in cash from the Property’s mineral production proceeds in the form of a NSR royalty (the “Final Payment”); and |

| ● | funding all expenditures on the Property from the date on which the Second Option is exercised until the date on which the Final Payment has been completed. |

The primary effect of the Amendment is therefore to increase to the purchase price for the additional 60% interest in the Property from $5 million to $10 million, while at the same time separating it into tranches.

The Amendment also corrects a number of inconsistences in the Option Agreement, updates the defined terms to accommodate the creation of the Second Option and Third Option, and includes our acknowledgements regarding accrued and unpaid penalty payments and amounts owing by us to LSG as of September 30, 2019.

The foregoing description of the Amendment includes a summary of all the material provisions but is qualified in its entirety by reference to the complete text of the Amendment included as Exhibit 10.8 to this report and incorporated herein by reference.

We agreed with LSG that upon the successful completion of a toll milling agreement after permitting is achieved, there will be a basis to form a joint management committee to outline work programs and budgets, as contemplated in the Option Agreement and for us to act as the operator of the Property. To the date of this report LSG has borne all costs in connection with operations on the Property. We expect the first work program, entailing Property-related costs for which we will be responsible, to be approved in 2020.

4

| ITEM 1A. | RISK FACTORS |

You should carefully consider the risks described below before purchasing our common stock. The following risk factors could have a material adverse effect on our business, financial condition and results of operations.

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.

We have a history of operating losses and may not achieve or sustain profitability. We cannot guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so would adversely affect our business, including our ability to raise additional funds.

Because our auditors have issued a going concern opinion, there is substantial uncertainty that we will be able to continue our operations.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue to operate over the next 12 months. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence. As such, if we are unable to obtain new financing to execute our business plan we may be required to cease our operations.

The Property may not contain mineral reserves that are economically recoverable and we cannot accurately predict the effect of certain factors affecting such a determination.

LSG has not determined if the Property contains mineral reserves that are economically recoverable. Exploration for mineral reserves involves a high degree of risk, which even a combination of careful evaluation, experience and knowledge, may not eliminate. Few properties which are explored are ultimately developed into producing properties. Estimates of mineral reserves and any potential determination as to whether a mineral deposit will be commercially viable can be affected by such factors as deposit size; grade; unusual or unexpected geological formations and metallurgy; proximity to infrastructure; metal prices which are highly cyclical; environmental factors; unforeseen technical difficulties; work interruptions; and government regulations, including regulations relating to permitting, prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted. The long term profitability of our operations will be, in part, directly related to the cost and success of our exploration and development program. Substantial expenditures are required to establish reserves through drilling, to develop processes to extract the ore and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. Although substantial benefits may be derived from the discovery of a major deposit, we cannot provide any assurance that any such deposit will be commercially viable or that we will be able to obtain the funds required for development on a timely basis.

If the Property is ultimately placed into production, we will encounter hazards and risks that could result in significant legal liability.

In the event that we are ultimately able to commence commercial production on the Property, our operations will be subject to all of the hazards and risks normally encountered in the exploration, development and production of gold, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, the mine and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take appropriate precautions to mitigate these hazards and risks by, among other things, obtaining liability insurance in an amount considered to be adequate by management, their nature is such that the liabilities might exceed policy limits, they might not be insurable, or we may not elect to insure against them due to high premium costs or other reasons, which could have a material adverse effect upon our financial condition and results of operations.

We face significant competition in the mineral resource industry that presents an ongoing threat to the success of our business.

The mining industry is intensely competitive in all of its phases, and we will be forced to compete with many companies that possess greater financial resources and technical facilities than we do. Significant competition exists for the limited number of mineral acquisition opportunities available in our sphere of operations. As a result of this competition, our ability to acquire additional attractive mining properties on terms we consider acceptable may be adversely affected.

5

| ITEM 1A. | RISK FACTORS (continued) |

Fluctuating mineral prices may negatively affect our ability to secure financing or our results of operations.

Our future revenues, if any, will likely be derived from the extraction and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond our control including economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of our business, could negatively affect our ability to secure financing or our results of operations.

We are subject to government laws and regulations particular to our operations with which we may be unable to comply.

We may not be able to comply with all current and future government environmental laws and regulations which are applicable to our business. Our operations are subject to all government regulations normally incident to conducting business: occupational safety and health acts, workmen’s compensation statutes, unemployment insurance legislation, income tax and social security laws and regulations, and most importantly, environmental laws and regulations. In addition, we are subject to laws and regulations regarding the development of mineral properties in the State of Nevada. We are also subject to governmental laws and regulations applicable to small public companies and their capital formation efforts.

We are engaged in mineral exploration and are accordingly exposed to environmental risks associated with mineral exploration and mining activity. LSG is currently in the exploration stage and has not determined whether significant site reclamation costs will be required on the Property in the future, which we will likely be responsible for as well. Although we will make every effort to comply with all applicable laws and regulations, we cannot provide any assurance that we will be able to deal with evolving environmental attitudes and regulations, nor can we predict the effect of any future changes to environmental regulations on our proposed business activities. We only plan to record liabilities for site reclamation when reasonably determinable and when such costs can be reliably quantified. Other costs of compliance with environmental regulations may also be burdensome. Our failure to comply with material regulatory requirements could have an adverse effect on our ability to conduct our business. The expenditure of substantial sums on environmental matters would have a materially negative effect on our ability to implement our business plan and could require us to cease operations.

Our business depends substantially on the continuing efforts of our officers, and our business may be severely disrupted if we lose their services.

Our future success heavily depends on the continued service of our officers. Although we plan to increase the size of our Board of Directors, appoint additional officers and engage various consultants as our business grows, if they are unable or unwilling to continue to work for us in their present capacities, we may have to spend a considerable amount of time and resources searching, recruiting and integrating one or more replacements into our operations, which would severely disrupt our business. This may also adversely affect our ability to execute our business strategy.

We may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation of our business plan.

Our success depends to a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating such personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee, including members of our management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

We may indemnify our officers and directors against liability to us and our security holders, and such indemnification could increase our operating costs.

Our Amended and Restated Articles of Incorporation allow us to indemnify our officers and directors against claims associated with carrying out the duties of their offices. Our Bylaws also allow us to reimburse them for the costs of certain legal defenses. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our officers, directors or control persons, we have been advised by the SEC that such indemnification is against public policy and is therefore unenforceable.

Since our officers and directors are aware that they may be indemnified for carrying out the duties of their offices, they may be less motivated to meet the standards required by law to properly carry out such duties, which could increase our operating costs. Further, if any of our officers or directors files a claim against us for indemnification, the associated expenses could also increase our operating costs.

6

| ITEM 1A. | RISK FACTORS (continued) |

Failure to comply with the Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As a Nevada corporation, we are subject to the Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Some foreign companies, including some that may compete with us, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the countries in which we conduct our business. However, our employees or other agents may engage in conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Current global financial and economic conditions could adversely impact our operations and financial condition.

Current global financial and economic conditions remain volatile. Many industries, including the mineral resource industry, are impacted by these market conditions. Some of the key impacts of financial market turmoil include contraction in credit markets resulting in a widening of credit risk; devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets; and a lack of market liquidity. Such factors may impact our ability to obtain financing on favorable terms or at all. Additionally, global economic conditions may cause a long term decrease in asset values. If such global volatility and market turmoil were to continue, our operations and financial condition could be adversely impacted.

Risks Related to Ownership of Our Common Stock

Because there is a limited public trading market for our common stock, investors may not be able to resell their shares.

There is currently a limited public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell any shares of our common stock. If investors wish to resell their shares, they will have to locate a buyer and negotiate their own sale. As a result, they may be unable to sell their shares or may be forced to sell them at a loss.

We cannot assure investors that there will be a market in the future for our common stock. The trading of securities on the OTCQB is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. Investors may not be able to sell shares at their purchase price or at any price at all.

LSG has voting control over matters submitted to a vote of the stockholders, and it may take actions that conflict with the interests of our other stockholders and holders of our debt securities.

We issued 35,000,000 shares of our common stock to LSG in the acquisition of our mineral property interest. LSG and its owner control approximately 72 % of the votes eligible to be cast by stockholders in the election of directors and generally. As a result, LSG has the power to control all matters requiring the approval of our stockholders, including the election of directors and the approval of mergers and other significant corporate transactions.

The sale of securities by us in any equity or debt financing could result in dilution to our existing stockholders and have a material adverse effect on our earnings.

Any sale of common stock by us in a future private placement offering could result in dilution to the existing stockholders as a direct result of our issuance of additional shares of our capital stock. In addition, our business strategy may include expansion through the acquisition of additional property interests or through business combinations with entities operating in our industry. In order to do so, or to finance the cost of our operations, we may issue additional equity securities that could dilute our stockholders’ stock ownership. We may also pursue debt financing, if and when available, and this could negatively impact our earnings and results of operations. If the board of directors issues an additional class of voting for less than fair value, the value of your interest in the company will be diluted. We have no present intention to issue any additional class of voting securities.

We are subject to penny stock regulations and restrictions and investors may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the “penny stock rules”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

7

| ITEM 1A. | RISK FACTORS (continued) |

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 (excluding the value of such person’s primary residence) or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such security and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for the penny stocks held in an account and information to the limited market in penny stocks.

Consequently, these rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares of common stock.

There can be no assurance that our common stock will qualify for exemption from the penny stock rules. In any event, even if our common stock was exempt from the penny stock rules, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

We do not expect to pay dividends for the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, our stockholders will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all.

Investors may face significant restrictions on the resale of their shares due to state “blue sky” laws.

Each state has its own securities laws, commonly known as “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. Investors should therefore consider the resale market for our common stock to be limited, as they may be unable to resell their shares without the significant expense of state registration or qualification.

| ITEM 1 B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

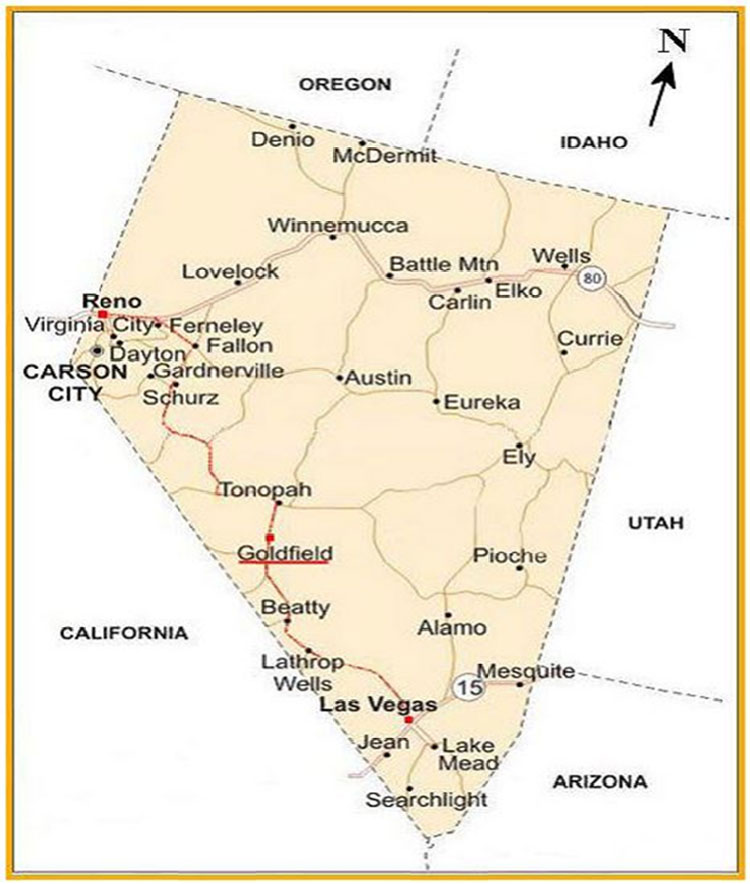

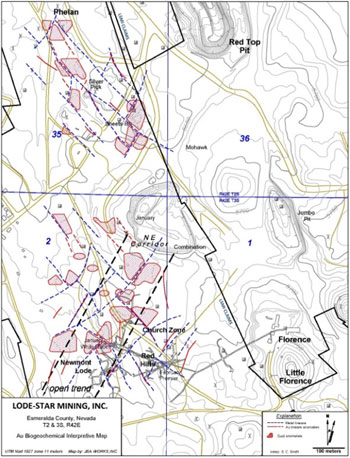

Our Property is located in west-central Nevada (Figure 1), in the Goldfield Mining District at Latitude 37° 42’, and Longitude 117° 14’. The claims comprising the Property are located in surveyed sections 35 and 36, Township 2 South, Range 42 East, and in sections 1, 2, 11, and 12, Township 3 South, Range 42 East, in Esmeralda County, Nevada. The Property is accessible by traveling approximately one-half mile northeast of the community of Goldfield, along a county-maintained road that originates at U.S. Highway 95, which runs through “downtown” Goldfield. The town of Goldfield, which is the Esmeralda county seat (population 300), is approximately 200 air miles south of Reno and 180 air miles north of Las Vegas. Surface access on the Property is excellent and the relief is low, at an elevation of approximately 6,000 feet. Vegetation is sparse, consisting largely of sagebrush, rabbitbrush, Joshua trees and grasses.

8

| ITEM 2. | PROPERTIES (continued) |

Figure 1: Property Location Map

The Property is wholly owned by LSG, the company’s largest shareholder and is clear titled. The 31 patented claims cover an area of approximately 460 acres, or 186 hectares. The claims are owned as private land by LSG, and only annual property taxes must be paid.

9

| ITEM 2. | PROPERTIES (continued) |

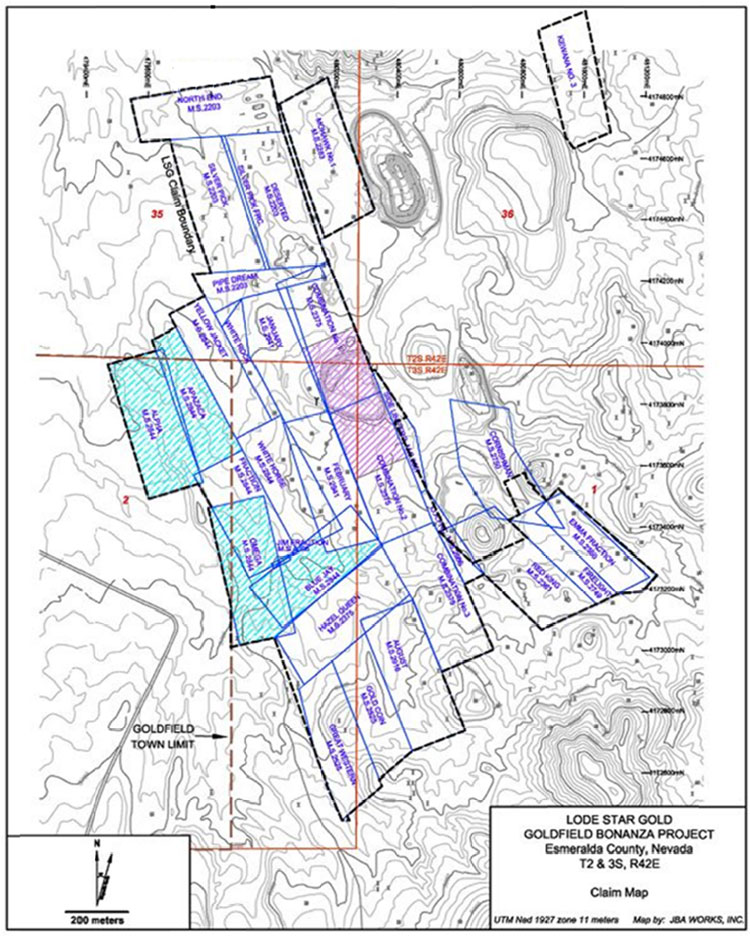

We have mineral rights to all the claims listed below. We have surface rights on all claims except for a portion of five claims that exist within the town boundary of Goldfield. The claims include any and all contracts, easements, leases and rights-of-way affecting or appurtenant thereto. The fees and maintenance of the claims are currently being paid by the LSG. The annual fee for maintaining all the claims is under $1,500. A map of the claims is shown below in Figure 2.

Patented Claims

| Claim Name | U.S. Survey No. |

| Combination No. 3 | 2375 |

| August | 2916 |

| Great Western | 2525 |

| Gold Coin | 2525 |

| February | 2941 |

| Mohawk No. 1 | 2283 |

| Side Line Fraction | 2567 |

| January | 2941 |

| Silver Pick | 2203 |

| Silver Pick Fraction | 2203 |

| Deserted (1) | 2203 |

| Pipe Dream | 2203 |

| North End (2) | 2203 |

| Hazel Queen | 2375 |

| Fraction | 2844 |

| White Horse | 2844 |

| White Rock | 2844 |

| Yellow Jacket | 2844 |

| Firelight | 2749 |

| Emma Fraction | 2360 |

| S.E. 2/3 Red King (more or less) | 2361 |

| S.E. 1/2 (Cornishman) | 2750 |

| Kewana #3 | 2565 |

| Blue Jay | 2375 |

| Combination No. 1 Claim (3) | 2375 |

| Combination No 2 Claim (4) | 2844 (19/24th interest) |

| Omega | 2844 (19/24th interest) |

| Apazaca | 2844 (19/24th interest) |

| Alpha | 2844 (19/24th interest) |

| Jim Fraction | 4096 (19/24th interest) |

| O.K. Fraction | 2560 (¾ of ½ interest) |

Notes:

| (1) | Excluding the upper 200 feet from surface of the north ½ of such claim (the “Deserted Excluded Zone”). We may, in our sole and unfettered discretion, by written notice to LSG at any time during the term of the Option Agreement, opt to include the Deserted Excluded Zone in the Property. |

| (2) | Excluding the upper 200 feet from surface of the east ½ of such claim (the “North End Excluded Zone”). We may, in our sole and unfettered discretion, by written notice to LSG at any time during the term of the Agreement, opt to include the North End Excluded Zone in the Property. |

| (3) | Includes all depths of the north ½ of such claim along with depths beneath 380 feet on the south ½ of such claim. |

| (4) | Includes all depths of the south ½ of such claim along with depths beneath 380 feet on the south ½ of such claim. |

10

| ITEM 2. | PROPERTIES (continued) |

Figure 2: Claim Map

11

| ITEM 2. | PROPERTIES (continued) |

Current Infrastructure and recent developments:

All properties, claims, buildings, equipment, and supplies are owned by our largest shareholder, LSG. We have free access to utilize and manage all the above noted items.

The property is immediately adjacent to the historic gold producing town of Goldfield, NV, which is the county seat for Esmeralda County. Water, electricity and other sundry needs such as restaurants, lodging, minor medical needs, fire station, and police are within 1 mile of the property.

Operations are managed from a 6,000 sq. ft. office and warehouse facility complete with showers and laundry amenities. Two residential trailer sites are immediately adjacent to this building for crew needs.

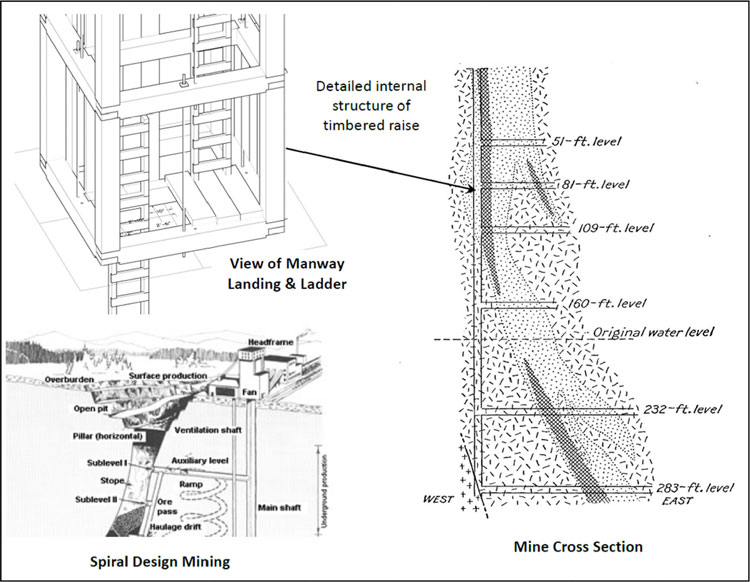

The property has one working shaft, the February Premier, which has access to the 300 ft level, with approximately 1/2 mile of ventilated drift. Underground work has identified 2 high-grade gold-bearing zones which the company plans to further explore. The program that we envision undertaking includes the mining of approximately 10,000 tons of non-NI 43-101 compliant gold mineralization at an approximate grade of 0.9 ounces per ton. The estimated grade is based on historic drilling work done by LSG, for which the 1.5-inch core samples were consumed by assay requirements. In order to provide adequate sample weights to the assaying lab, the entire core was processed for individual samples. While we have encountered several additional high-grade drill anomalies throughout the property, it is important to note that we have no proven and/or probable reserves at the present time and therefore the program is exploratory in nature.

The property has two operating water monitoring wells that were mandatory for us to receive a water pollution control permit. Part of the permitting application is for the allowance of the company to store its waste rock underground. The property has no milling on site and we must rely on a third party to receive our mineralized material and tombstone our tailings.

The Company has been issued Water Pollution Control Permit NEV2017109 from the Nevada Department of Environmental Protection (NDEP) regarding production at the property, as at November 20, 2018. This Permit authorizes the construction, operation, and closure of approved mining facilities in Esmeralda County, Nevada. The Permit is effective for 5 years until November 20, 2023 and authorizes the processing of 10,000 tons of ore per year from Lode-Star’s underground operations. In accordance with MSHA guidelines, we are in the process of re-occupying the Property’s underground workings.

On February 17, 2017, we executed an agreement with Scorpio Gold Corporation (Scorpio) for a pilot toll milling test. We completed the first test in May 2017 and both companies have determined that further testing needs to be completed to determine a definitive cost analysis and other operational details. The sample processed was historic material stockpiled on the property surface and therefore of limited metallurgical value, but indicative of material that will be run through the mill. Milling throughput did identify specific equipment configuration details that need to be considered for future runs. Both parties agree that additional milling circuitry is needed for the most optimum gold yield. We expect to provide material from our targeted underground zone for more comprehensive milling results.

On January 22, 2020 we executed a toll milling agreement (the “Agreement”) with Scorpio’s affiliate, Goldwedge LLC. The Agreement will allow for the processing of ore delivered from our Property to the 400 ton per day Goldwedge milling facility located in Manhattan, Nevada.

Based on previous metallurgical testing, our ore requires gravity combined with flotation for optimal recoveries of contained precious metals. The Goldwedge milling circuit is currently configured with a gravity recovery circuit. Under the terms of the Agreement, we will advance funds required for the design, engineering, permitting and modifications to the Goldwedge facility to include the addition of a flotation circuit, supporting reagent tanks/silos, secondary lining of process containment ponds, leak detection and monitoring wells associated with fluid containments.

The Agreement provides for us to recoup the advanced funds through a reduction in toll milling rates until all advanced funds have been repaid. Following repayment, the toll charges will revert to standard rates.

| ITEM 3. | LEGAL PROCEEDINGS |

We are not a party to any pending legal proceeding which management believes is likely to result in a material liability and no such action has been threatened against us, or, to the best of our knowledge, is contemplated.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

12

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our stock is quoted under the symbol “LSMG” on the OTCQB marketplace of the OTC Markets Group. OTCQB companies must verify via an annual OTCQB Certification, signed by the company CEO or CFO, that their company information is current, including information about a company’s reporting status, company profile, information on management and boards, major shareholders, law firms, transfer agents, and IR / PR firms.

The high and low bid quotations of our common stock for the 2019 and 2018 quarters are as follows:

| 2019 | 2018 | |||||||||||||||

| Quarter Ended | High | Low | High | Low | ||||||||||||

| March 31 | $ | 0.06 | $ | 0.022 | $ | 0.038 | $ | 0.022 | ||||||||

| June 30 | $ | 0.15 | $ | 0.045 | $ | 0.035 | $ | 0.0249 | ||||||||

| September 30 | $ | 0.056 | $ | 0.0425 | $ | 0.033 | $ | 0.025 | ||||||||

| December 31 | $ | 0.07402 | $ | 0.0325 | $ | 0.05 | $ | 0.022 | ||||||||

These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not represent actual transactions.

The market for our common stock has been sporadic and there have been significant periods during which there were few, if any, transactions in the common stock and no reported quotations. Accordingly, reliance should not be placed on the quotes listed above, as the trades and depth of the market may be limited, and therefore, such quotes may not be a true indication of the current market value of the Company’s common stock.

On December 31, 2019, we had 69 shareholders of record of our common stock.

We competed our NI 43-101 report as of January 15, 2020.

Capitalization

Shares

Our authorized capital is 500,000,000 shares of capital stock, divided into 480,000,000 shares of common stock with a par value of $0.001 per share, and 20,000,000 shares of preferred stock with a par value of $0.001 par value per share.

At December 31, 2019 and to date 50,605,965 (2018: 50,605,965) shares of common stock have been issued. No shares of preferred stock have been issued to date.

Stock Options

On November 20, 2018, we granted 500,000 non-qualified stock options pursuant to the Equity Incentive Plan, to key outside consultants, with 50% vesting after one year and 50% vesting after two years. Each option is exercisable into one share of our common stock at a price of $0.06 per share, for a term of five years. None of the options have been exercised to date.

On February 14, 2017, we granted 9,500,000 non-qualified stock options to key corporate officers and outside consultants, with 25% vesting immediately and a further 25% vesting every six months thereafter for eighteen months. Each option is exercisable into one share of our common stock at a price of US$0.06 per share, equal to the closing price of the common stock on the grant date, for a term of five years. None of the options have been exercised to date.

Warrants

In connection with a 2015 consulting agreement, there are warrants outstanding to November 10, 2020 to purchase 3,336,060 shares of common stock at a price of $0.02 per share, including a cashless exercise option.

13

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES (continued) |

Securities Authorized for Issuance under Equity Compensation Plans

We reserved 10,000,000 shares of common stock for issuance under our 2015 Omnibus Equity Incentive Plan. The purpose of the Plan is to maintain our ability to attract and retain highly qualified and experienced directors, officers and consultants and to give such directors, officers and consultants a continued proprietary interest in our success. The Plan is available to any stockholder on request.

Dividends

We have not declared any cash dividends, nor do we have any plans to do so. Management anticipates that, for the foreseeable future, all available cash will be needed to fund our operations.

Penny Stock

Our common stock is subject to the provisions of Section 15(g) of the Exchange Act and Rule 15g-9 thereunder, commonly referred to as the “penny stock rule”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of securities and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document prepared by the SEC relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares.

Recent Sales of Unregistered Securities

During the years ended December 31, 2019 and 2018, we had no subscriptions for shares of our common stock.

On December 3, 2018, the Company issued 1,478,140 common shares in exchange for debt totaling $48,778 owed to a related party, comprised of $40,205 in loans and $8,573 in accrued interest.

Other than as disclosed above, we have not issued any equity securities that were not registered under the Securities Act within the past three years.

| ITEM 6. | SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our audited financial statements and related notes appearing elsewhere in this report. In addition to historical financial information, the following discussion includes a number of forward-looking statements that reflect our plans, estimates and our current views with respect to future events and financial performance. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report. It is important to note, while we have encountered several high-grade drill anomalies throughout the property, we have no proven and/or probable reserves at the present time.

14

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Property - Previous Exploration Work, Mineralization and State of Exploration

The Property is wholly owned by LSG, our largest shareholder, and is clear titled. A 1% net smelter royalty exists in the favor of the original property owner. The property consists of 31 patented claims on approximately 460 acres. LSG, over the past 15 years and continuing, has spent over $7 million on underground rehab of approximately 1/4 mile of drift at the 300ft sub-surface level. LSG also executed 22 surface core drill holes for a total of 10,400ft and 152 underground core drill holes for a total of 23,000ft.

It is important to note the following sample preparation and quality controls used by LSG and by ICN, a previous operator of the Property:

Lode-Star Gold drill hole core sampling and analytical protocol

All drill core samples were prepared and delivered to ALS Minerals in Reno by Tom Temkin, our COO. Individual sampled intervals varied from one to five-foot lengths, based on geologic parameters, and included 100% of core intervals. No core splitting was conducted. No duplicate samples or standards were introduced other than those inserted and utilized by ALS for their internal quality control. Lab preparation of individual samples included crushing and grinding to minus 200 mesh, followed by a 1-ton assay for gold. All samples that initially assayed over 1.0 opt Au were systematically re-assayed.

ICN drill hole core and Rotary RC sampling and analytical protocol

All drill core samples were prepared by ICN personnel and either delivered to the assay lab or were picked up on-site by lab personnel. Rotary RC chip drilling samples were collected on-site and transported to Reno by the respective labs. The labs used included ALS Minerals and American Assay Lab. Core was sawn by ALS Minerals and/or ICN personnel. Individual core sampled intervals varied from one to five-foot lengths, based on geologic parameters, and included one-half of the original core material. Rotary RC samples were taken at five-foot intervals entirely. Quality control for all samples included a protocol of inserting duplicate samples, blanks, and known standards, at repeating intervals to maintain .08% check sampling. Lab preparation of Individual samples included crushing and grinding to minus 200 mesh, followed by a 1-ton assay for gold. All samples that initially assayed over 1.0 opt Au were systematically re-assayed.

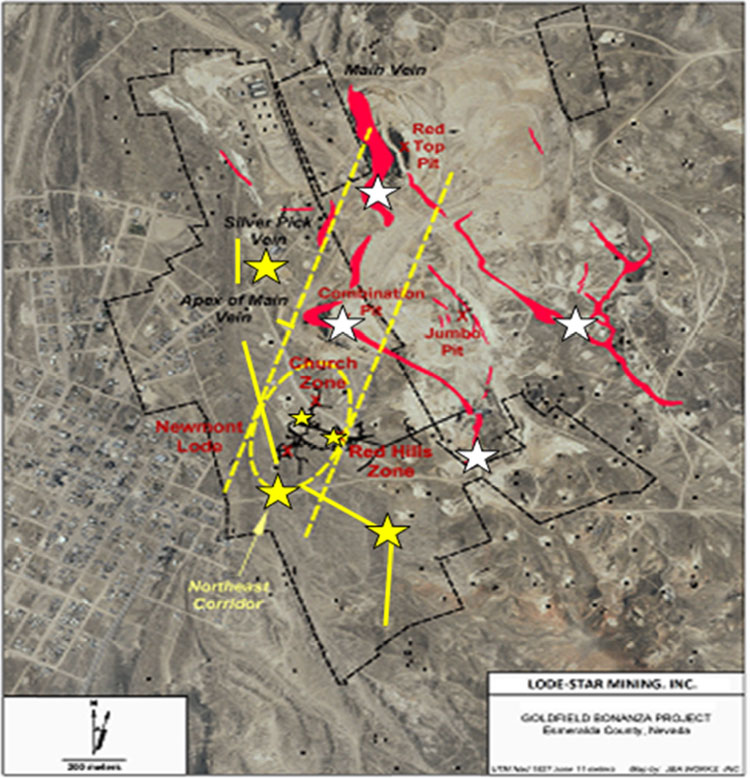

Underground work has identified 2 high-grade gold-bearing zones (see the small yellow stars in Fig. 1. and see Fig. 2.) that can support mine development utilizing our current infrastructure. The property is now permitted for production and should be mine ready by the end of Q2, 2020. It is our intention to then start mining the property. Much of the property remains under-explored and it is our belief that the district’s high-grade, million-ounce ore zones repeat themselves. Further surface and underground exploration work need to be executed. We plan to explore through production and chase our known, high-grade vein zones.

Third Party Assay Data Audit

Mine Development Associates (MDA Reno), a highly regarded, third party NI 43-101 service provider, has audited our drill hole database and performed a comparative QA/QC check assay analysis on selected drilling and determined no inconsistencies to exist and assays were repeatable within both the Red Hills and Church Zones.

NI 43-101 Update Status

We filed an independent Technical Report written in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) on our property located in Goldfield, Nevada. Although not required for OTC listing, we had this report prepared under NI 43-101 guidelines to provide a summary of the Goldfield Bonanza Project. This NI 43-101 is required documentation for future possible business transactions and listings on Canadian exchanges. The Technical Report titled “Technical Report on the Goldfield Bonanza Project Esmeralda County Nevada U.S.A.” dated January 15, 2020 has been prepared by Mr. Robert M. Hatch, SME Registered Geologist.

The report is available for review on EDGAR (https://www.sec.gov/edgar/searchedgar/companysearch.html) and SEDAR (https://www.sedar.com/) under Lode-Star Mining’s issuer profile.

15

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

The white stars below show the historic zones where roughly 1 million ounces per star were produced during the period 1904-1918 (See Figure 1a. below): Last year of production by Goldfield Consolidated, (Source: Albers and Stewart, 1972). The large yellow stars indicate areas we need to explore to possibly repeat the past high-grade production intercepts. The yellow lines are known geophysical interpreted structures. The small yellow stars are the immediate production zones targeted by us for development.

Fig. 1. - The red vein zones contained in the aerial photo below depict the historic mined veins

16

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

HISTORIC PRODUCTION

Figure 1a. - Production from Goldfield Mining District

| Year | Ore (tons) | Gold (ounces) | ● Silver (ounces) |

| 1903 | 3,419 | 287 | |

| 1904 | 8,000 | 113,293 | 19,954 |

| 1905 | 11,700 | 91,088 | 8,589 |

| 1906 | 59,628 | 339,890 | 15,648 |

| 1907 | 101,136 | 406,756 | 71,710 |

| 1908 | 88,152 | 236,082 | 30,823 |

| 1909 | 297,199 | 453,915 | 33,164 |

| 1910 | 339,219 | 538,760 | 117,598 |

| 1911 | 390,431 | 497,637 | 126,406 |

| 1912 | 362,777 | 301,848 | 125,736 |

| 1913 | 364,785 | 242,815 | 153,984 |

| 1914 | 367,166 | 227,612 | 129,830 |

| 1915 | 418,935 | 212,337 | 165,305 |

| 1916 | 383,456 | 128,250 | 129,781 |

| 1917 | 339,488 | 91,917 | 78,184 |

| 1918* | 264,237 | 58,685 | 90,560 |

| 1919 | 16,435 | 35,810 | 39,912 |

| 1920 | 6,571 | 7,536 | 6,081 |

| 1921 | 1,903 | 7,101 | 1,761 |

| 1922 | 5,619 | 12,773 | 5,755 |

| 1923 | 3,137 | 4,471 | 3,613 |

| 1924 | 7,352 | 4,336 | 3,982 |

| 1925 | 2,773 | 5,053 | 2,369 |

| 1925-1960 | 129,705 | 168,616 | 88,967 |

| Total | 3,958,104 | 4,190,000 | 1,450,000 |

| * | Last year of production by Goldfield Consolidated |

SOURCE: Albers and Stewart, 1972

17

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Geologic Structure

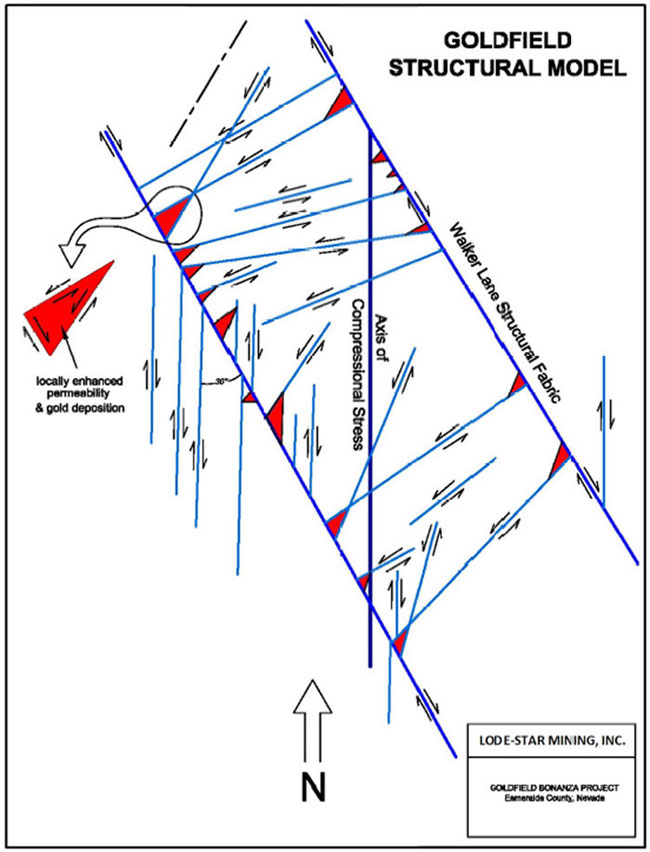

The geologic model that made Goldfield successful still exists today. Fig. 1b. shows the formation of the Goldfield high-grade gold zones which leads to our conclusion that more multi-million-ounce intercepts are possible.

Fig. 1b. Geologic Structural Model

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

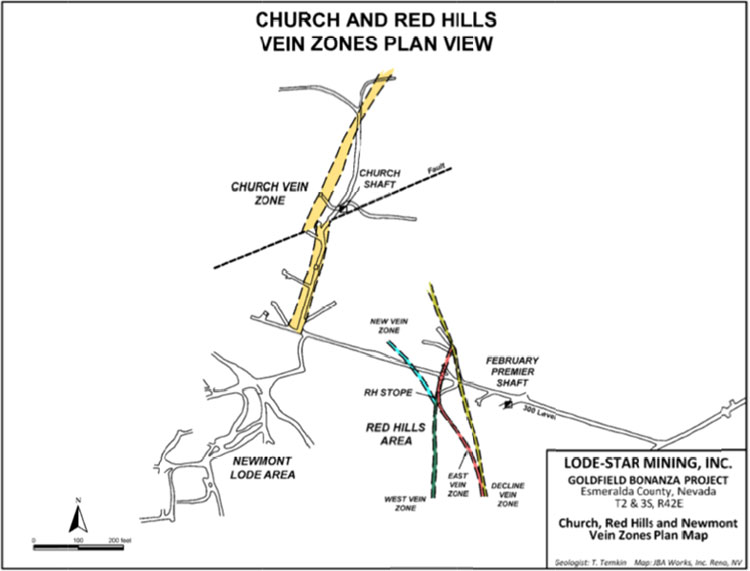

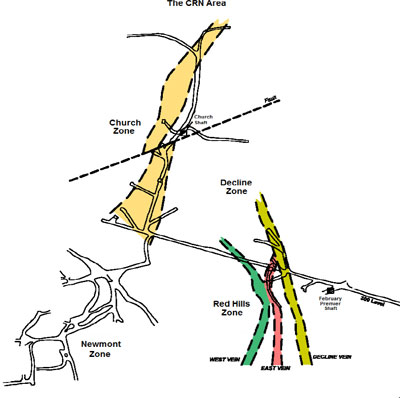

Fig.

2. - Church and Red Hills Vein Zones are the two high-grade gold-bearing

zones that we expect to yield high-grade gold concentrations.

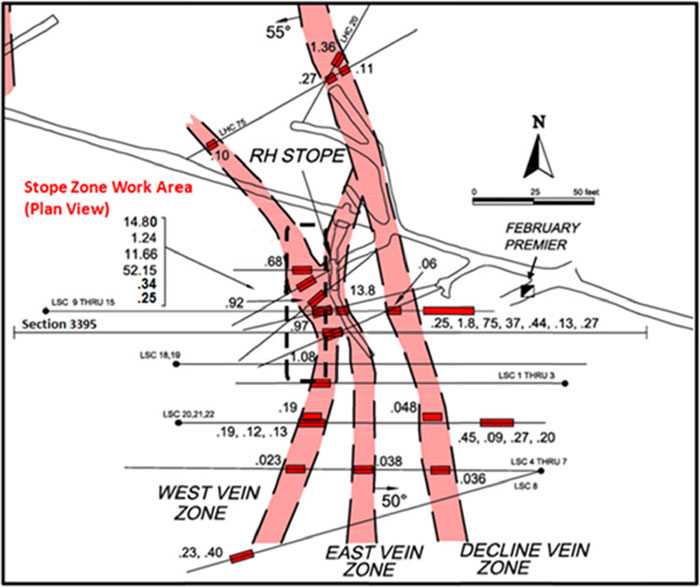

Red Hills Vein System - Priority 1.

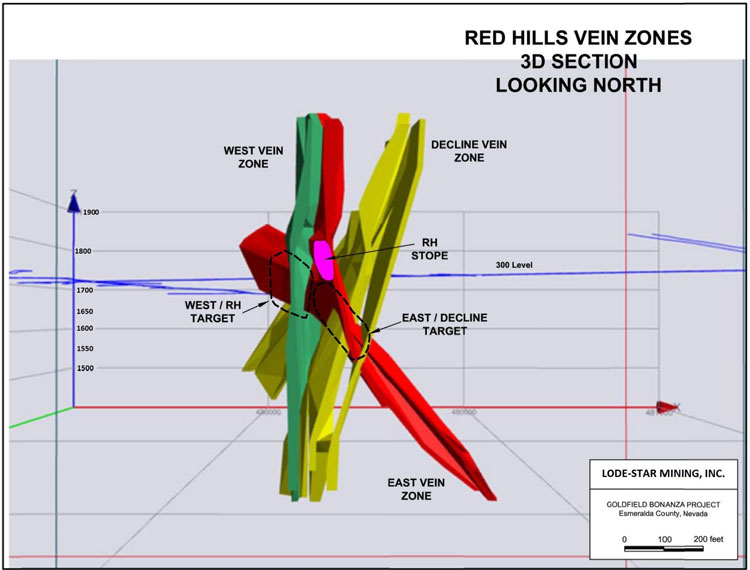

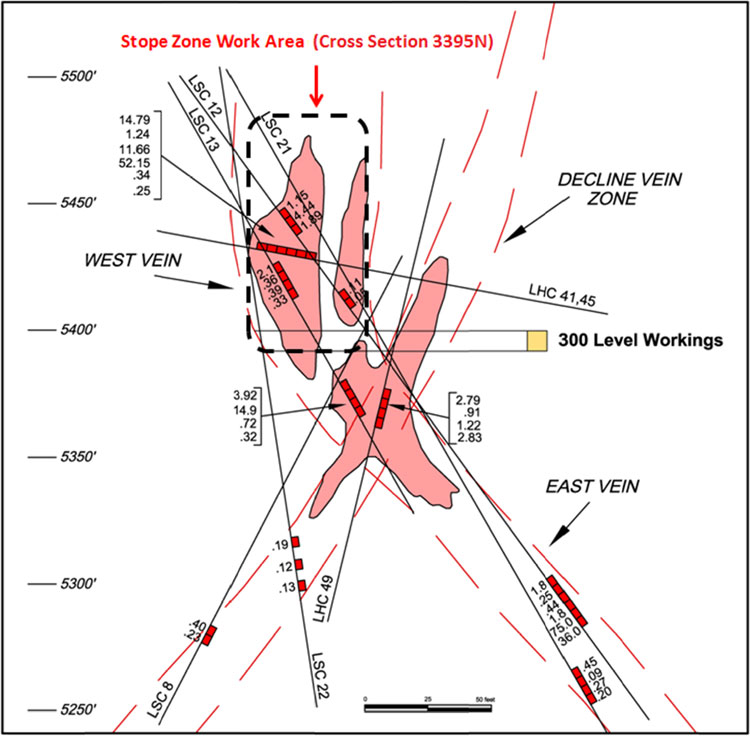

Two major vein zones exist in the Red Hills area, including the Stope veins and the Decline vein (see Fig. 4 on the following page). The respective names refer to the nature of brief mining conducted previously in these areas. As further defined through LSG’s drilling to date, the area referred to as the Stope Veins is comprised of two intersecting vein-filled faults, including the West vein zone and the East vein zone (Fig. 3 below). The average width of each of these vein zones is approximately three feet. Drilling to date suggests the West vein zone to be essentially vertical and near parallel to the East vein zone. The Decline vein zone is also shown on Fig. 3, as a north-northwest trending zone. Drilling on the Decline vein zone indicates a generally westerly dipping feature with an average width of several feet. To date, drilling has yielded very encouraging gold values within each of the vein zones described above. As shown on Figures 4 and 5 on the following page, several high-grade intercepts have been encountered with values up to 75.0 oz/ton gold (East vein zone). Drilling indicates each of these vein zones to be open along strike and at depth.

A 3-D depiction, (Fig. 3 below), of the three identified vein zones within the Red Hills shows the complex nature of their intersecting relationship. This complex intersection of the three vein components provides several locations where high-grade gold concentrations are identified. Two readily obvious targets where high-grade gold in excess of 1.0 ounce of gold per ton has been intersected is shown on Figure 3 with dashed outlines. The drill holes and actual values have been omitted for sake of clarity. Additionally, each of these vein zones appear to be open to the north, to the south, and to depth.

19

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Fig. 3. - 3D Section of the Red Hills Vein Zones

20

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Fig. 4. - Red Hills Vein Zones Composite Cross Section

21

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Fig. 5 - Red Hills Vein Zones Plan View

Red Hills Zone Summary

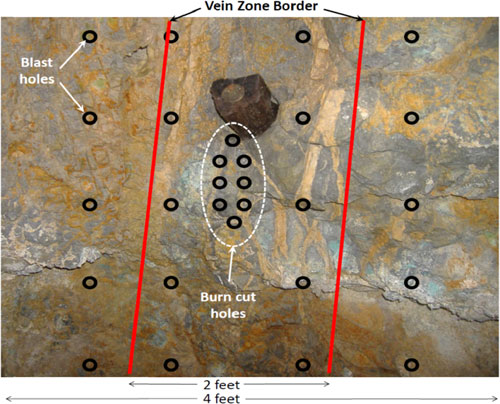

The drilling of this resource area was performed by LSG from 2000 to 2006 and assaying was performed by ALS Chemex. All activity was performed prior to the company’s need to have the drilling be resource NI 43-101 compliant. We assume the zone contains 10,000 ounces of AU (This assumption is non-NI 43-101 compliant). Historic underground mining was executed by chasing veins that yielded pockets of high-grade gold production. It is LSM’s intention to follow the same method and chase its known high-grade gold-bearing veins. LSM’S initial mining stage in the Red Hills area will extract mineralized material from the currently exposed Stope Vein Zone, and the Decline Vein Zone on the 300-foot mine level. Mining dimensions in the Stope Zone are expected to be an average of 4 to 10 feet wide, approximately 80 feet upwards and 100 feet along strike. The mining in the Decline will achieve mineralized material extraction while developing access to lower levels. Eventually the gold mineralization below the 300-foot level in both the Stope and Decline Vein Zones will be removed through the development of a downward spiral ramping approach, ultimately accessing mining depths to approximately the 450-foot mine level. Mine Development Associates has audited LSG’s drilling data base and concluded analyses of drill-sample pulps compared well with the original database gold analyses at grades relevant to the potential underground mining scenario at Red Hills.

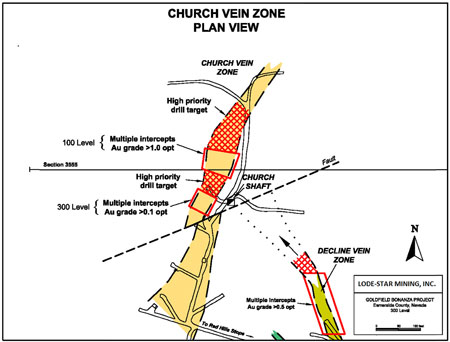

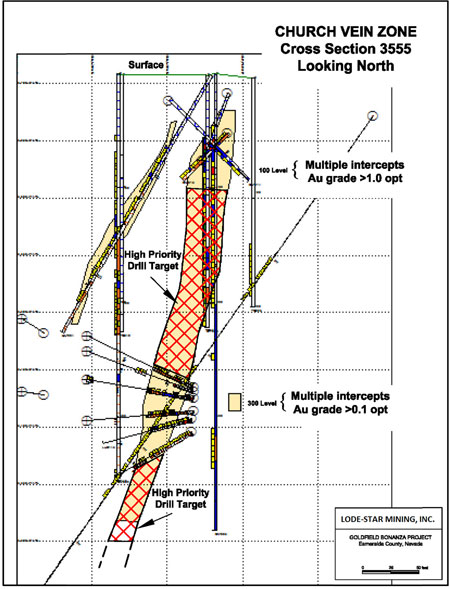

Church Vein Zone - Priority 2.

Based on the success and encouragement realized through drilling conducted by Trafalgar in 1982 and Westley in 1985, and further success through follow-up drilling by LSG and ICN to date, a vein zone measuring up to 40 feet in width and trending at least 600 feet north-northeasterly, exists immediately west of the Church shaft (fig. 6 below).

As shown on fig. 6, our interpretation of drilling to date indicates this vein zone, which is comprised of numerous individual veins up to several inches in width each, to be a steeply westerly-dipping feature, with several intercepts of high-grade gold exceeding 1.0 ounce of gold per ton. Areas highlighted in red on figures 6 and 7 display interpreted orientation of repeated vein sets based on drill intercepts. Figure 6 also shows the high priority drill targets that we expect to yield additional high-grade gold concentrations in the Church Vein zone. The nearly 200-foot vertical interval between the 100-level gold mineralization and the 300-level gold mineralization is a high priority target, as are the extensions to the north and south, and down-dip from the 300-level workings.

22

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Fig. 6 - Church Vein Zones and Decline Vein Zone

Figure 7 - Cross Section of Church Vein Zone at Section 3555

23

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

ICN Resources Drilling

ICN Resources acquired control of the property in March 2011. During that year ICN drilled 26 core holes for a total of 5,795 ft (1,767 m) and an additional 63 RC holes for a total of 27,470 ft (8,375 m). The core holes (hole ID prefixed with “ICN-” ) were drilled largely in the Church Zone and the RC holes (hole ID prefixed with “ICR-”) were utilized to test other exploration targets throughout the property.

The third core hole, ICN-003, returned a weighted-average intercept of 9.5 ft (2.90 m) that assayed 40.8 oz/ton (1.4 kg/t) gold. Eleven holes were then drilled around the ICN-003 discovery hole within a 100 meter by 150-meter area. Additional extraordinary high-grade intercepts included 4.5 ft (1.37 m) in ICN-013 that assayed 51.46 oz/ton (1.76 kg) gold, and a weighted average of 9.5 ft (2.9 m) in ICN-014 that averaged 26.8 oz/ton (918.0 g/t) gold. The next highest-grade intervals are 4 ft (1.22 m) in ICN-023 that averaged 1.46 oz/ton (50 g/t) and 3 ft (.91 m) in ICN-024 that assayed .802 oz/ton (27.5 g/t). All of these high-grade intercepts lie along the same north-northeast structural trend, which also falls in the broader NE corridor of mineralization. See the table below for drill hole intercepts greater or equal to 0.5 oz/ton (17.14 g/t).

ICN’s core drilling showed that the Church Zone is covered by as little as 55 ft (16.9 m) of post-mineral cover. The zone remains open along strike and down-dip and falls within the NE Corridor as defined by mineralization and geophysics.

The RC drilling program was designed to test four areas. Most of the work was focused on the 600-foot (183 m) strike length of the NE Corridor between the Church Zone and the Combination Pit. Six holes were drilled to test the January area, immediately west of the Combination Pit. An additional 19 holes were drilled to test mineralized zones noted by prior exploration programs in the northeastern portion of the claim block, including the Sheets-Ish Silver Pick and Phelan Shaft areas. Five holes were located in the Newmont Lode area to test extensions of known mineralization.

Drilling in the NE Corridor (away from the Church Zone) showed that the structure and alteration persist throughout, and that attractive gold mineralization is present. Numerous lower grade intercepts were encountered, which contained shorter high-grade intervals. The degree of silicification, quartz veining and fracturing in these intercepts indicates that the lower grade intercepts may represent halos to higher grade mineralization. Additional drilling will be required to better delineate these mineralized zones.

ICN

Resources Drill Intercepts Greater or Equal To 0.5 oz/ton (17.14 g/t)

Intervals greater than 1.0 oz/ton (34.29 g/t) are in bold.

| Hole ID | From m | To m | From ft | To ft | Length ft | Au g/t | Au oz/ton |

| ICN-001 | 59.7 | 60.7 | 196.0 | 199.0 | 3.0 | 23.2 | 0.677 |

| ICN-001 | 60.7 | 61.6 | 199.0 | 202.0 | 3.0 | 215.7 | 6.290 |

| ICN-003 | 16.9 | 19.8 | 55.5 | 65.0 | 9.5 | 1398.6 | 40.793 |

| Incl. | 16.9 | 18.6 | 55.5 | 61.0 | 5.5 | 547.3 | 15.963 |

| Incl. | 18.6 | 19.8 | 61.0 | 65.0 | 4.0 | 2569.2 | 74.935 |

| ICN-003 | 24.8 | 26.8 | 81.5 | 88.0 | 6.5 | 57.1 | 1.665 |

| ICN-008 | 94.5 |

95.3 |

310.0 | 312.5 | 2.5 | 183.6 | 5.355 |

| ICN-013 | 28.0 | 29.4 | 92.0 | 96.5 | 4.5 | 1,764.2 | 51.455 |

| ICN-014 | 25.1 | 26.1 | 82.5 | 85.5 | 3.0 | 181.9 | 5.306 |

| ICN-014 | 27.0 | 28.0 | 88.5 | 92.0 | 3.5 | 2,332.0 | 68.018 |

| ICN-015 | 66.4 | 67.2 | 218.0 | 220.5 | 2.5 | 24.5 | 0.714 |

| ICN-018 | 57.9 | 59.4 | 190.0 | 195.0 | 5.0 | 23.5 | 0.684 |

| ICN-023 | 64.3 | 64.9 | 211.0 | 213.0 | 2.0 | 61.6 | 1.798 |

| ICN-023 | 64.9 | 65.5 | 213.0 | 215.0 | 2.0 | 37.1 | 1.081 |

| ICN-024 | 24.1 | 25.0 | 79.0 | 82.0 | 3.0 | 27.6 | 0.805 |

24

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

ICN Resources Drill Intercepts Greater or Equal To 0.5 oz/ton (17.14 g/t) (Continued)

Intervals greater than 1.0 oz/ton (34.29 g/t) are in bold.

| ICN Resources rotary-reverse circulation | |||||||

| ICR-003 | 18.3 | 19.8 | 60.0 | 65.0 | 5.0 | 39.0 | 1.138 |

| ICR-003 | 19.8 | 21.3 | 65.0 | 70.0 | 5.0 | 21.7 | 0.633 |

| ICR-003 | 39.6 | 41.1 | 130.0 | 135.0 | 5.0 | 17.2 | 0.502 |

| ICR-003 | 59.4 | 61.0 | 195.0 | 200.0 | 5.0 | 19.0 | 0.554 |

| ICR-031 | 105.2 | 106.7 | 345.0 | 350.0 | 5.0 | 17.3 | 0.505 |

| ICR-032 | 64.0 | 65.5 | 210.0 | 215.0 | 5.0 | 18.2 | 0.530 |

| ICR-044 | 12.2 | 13.7 | 40.0 | 45.0 | 5.0 | 28.3 | 0.826 |

GOLD MINERALIZATION and ALTERATION

Goldfield is one of the most prominent North American examples of the epithermal subclass classification known as high-sulfidation (or alunite-gold) deposits. This type of deposit is characterized by intense pyritization and low-pH, acid-sulfate hydrothermal alteration of the volcanic host rocks. Gold mineralization occurs in brecciated, quartz-alunite vein-filled faults and fractures. Individual veined zones are typically one to three feet in total width and are characterized by a clustering of several smaller veins up to three inches in width each. Gold deposition has been dated (using isotopes) as occurring 22 to 18 million years ago (Silberman, 1985). Fluid inclusion and oxygen isotope data from several locations within the district indicate an ore deposition temperature ranging from 200 to 2900 degrees C.

Host rocks surrounding the brecciated quartz-alunite-filled faults and fractures typically display a near-symmetrical pattern of three successive hydrothermal alteration zones. The gold-bearing veined zones containing predominantly quartz, alunite and pyrite, invariably are surrounded by strongly developed silicification (silica replacement of host rock). An advanced argillic zone enveloping the silicification is characterized by the presence of alunite, kaolinite, pyrite, quartz and montmorillonite, which further grades into a more regional propylitic alteration zone containing calcite, chlorite, and pyrite. Widespread intense hydrothermal alteration often makes it difficult to trace individual volcanic units.

HIGH-GRADE GOLD OCCURRENCES

The Goldfield mining district has recorded production of more than 4.2 million ounces of gold and 1.5 million ounces of silver. Production in the district generally has been limited to an area about one mile (east-west) by about one and one-half mile (north-south).

High-grade gold ores (>1.0 oz/ton) typically occur as breccia-matrix and open-space vug fillings within a series of banded quartz-alunite veins, surrounded by pervasively silicified zones that often contain lower-grade gold (>0.05 oz/ton). From 1903 to 1925, about fifteen individual high-grade ore bodies averaging 100,000 tons and yielding 100,000 to 500,000 ounces of gold each were mined from the veins in the immediate vicinity of the Apex of the Main Vein at the Combination pit. Typical dimensions of these ore bodies are approximately 200 feet along strike, 300 feet on dip, and up to 20 feet in width. Of the total tonnage, high-grade ores accounted for 51% mined. The average grade of total gold produced during this period was 1.13 ounces per ton; 96% of total gold produced had an average grade greater than 1 ounce per ton, while 39% of total gold produced had an average grade of 2.9 ounces per ton. The cutoff grade in the district was 0.25 ounces of gold per ton. The majority (75% to 80%) of the district’s gold production occurred from depths of 600 feet or less. The deepest ores mined at Goldfield were 1,900 feet below the surface and approximately 2,500 feet downdip from the apex of the lode.

Unoxidized ore, formed as cavity fillings in brecciated veins, consists of varying proportions of native gold and gold tellurides including calaverite and goldfieldite, as well as sulfosalt minerals including bismuthinite and famatinite, each of which are associated with high-grade gold.

25

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

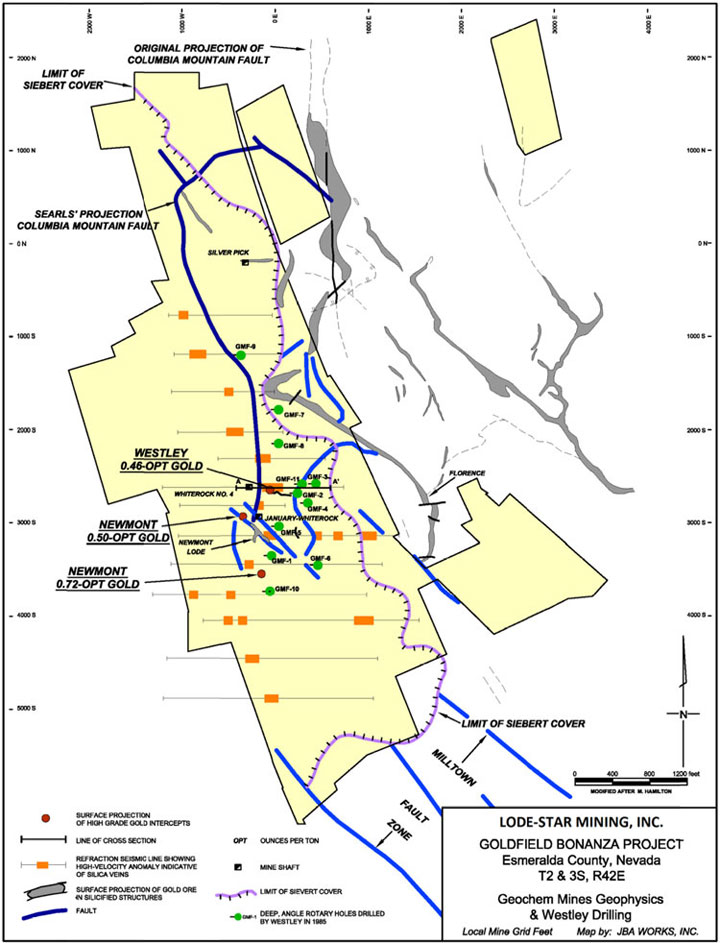

Geophysics

CSAMT

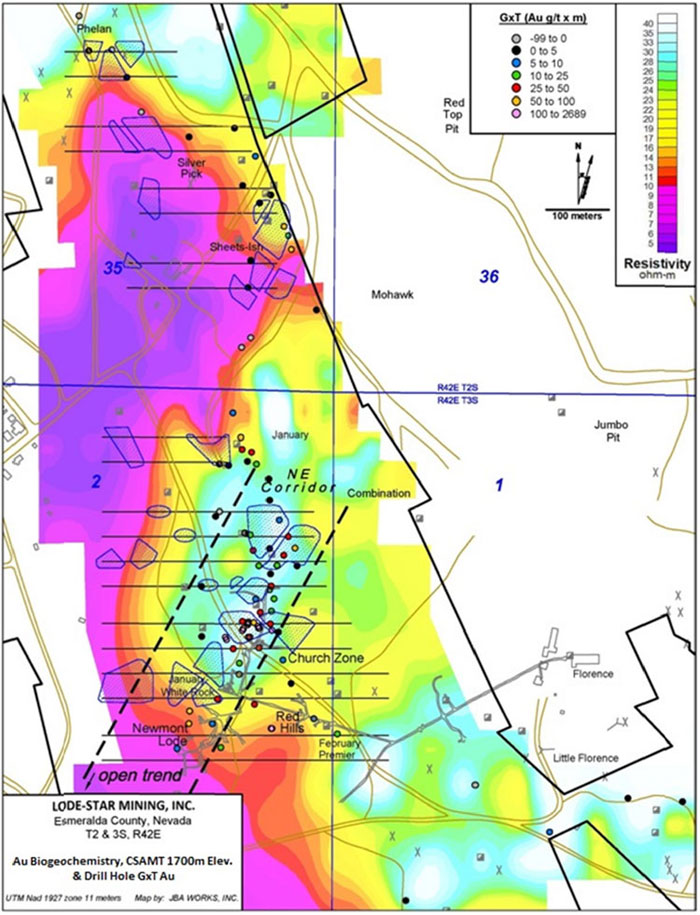

In 2008, Lode-Star Gold contracted Zonge Geophysics to carry out an orientation CSAMT (controlled source, audio-frequency magneto-telluric) survey. The objective was to determine the effectiveness of this technique in detecting resistivity variations that correlate with known gold-bearing quartz vein zones. Five east-west lines were run across the Church-Red Hills-Newmont Zone area for a total of 1.7 line miles (2.7km) of coverage. The results clearly defined several pronounced resistivity gradients with patterns associated with aforementioned areas of known gold mineralization.

In February 2012, ICN contracted Zonge Geophysics to carry out a similar CSAMT survey which covered nearly all of the Goldfield Bonanza property. It included 32 lines for a total of 10.6 line-miles (17 line-kilometers). The survey data was acquired using 30-meter (100 ft) receiver dipoles in spreads of six down-line electric field dipoles with two magnetic field measurements taken per spread in the broadside mode of operation. The signal source was a Zonge GGT-30 constant current transmitter. Survey control was maintained using a Trimble PRO-XRS GPS receiver.

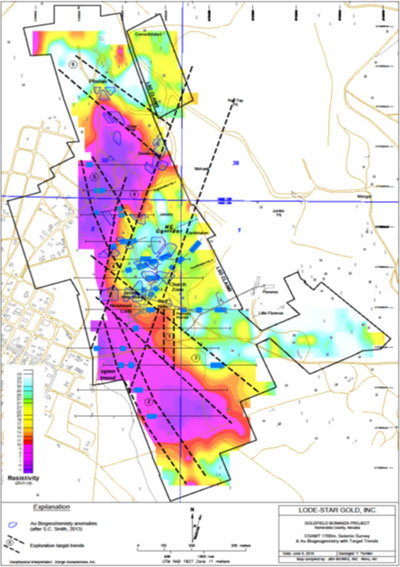

Figure 8 below displays the results of the property-wide survey. Overlain on the CSAMT is drilling in the Northeast Corridor with drill hole assays presented as calculated grade X thickness (GxT) values. There is a clear association of CSAMT resistivity highs with high gold assays from these drill holes, occurring in highly silicified areas. Also shown on figure 8, the biogeochemical survey anomalies are overlain on the CSAMT results, indicating close correlation with high resistivity values. The biogeochemistry patterns are discussed further in the Biogeochemistry section below.

The main NE Corridor is defined by a major break in the CSAMT data. This break is directly indicative of significant northwest and northeast oriented structures at depth, some of which have been observed in underground exposures and interpreted through drilling. The potential significance of the CSAMT break is demonstrated by the drill holes in and around the Newmont Lode in the southern portion of the grid.

Holes in this area are weakly to strongly gold mineralized, suggesting that further drill testing southwest along this break is warranted.

In addition, the mineralization trending northwesterly in the Sheets-Ish, Silver Pick, Phelan area is shown to hug the sharp Northwest break in the CSAMT response. Thus, the better gold grades seem to follow the margins of the CSAMT highs. The principal conclusion was that the general exploration model was verified – “Main District style” high-grade gold mineralization is, in fact, localized beneath the post-mineral cover below the Lode-Star Gold claim block.

26

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Figure 8 - Geophysics & Biochemistry Anomalies w/ GxT Drill Assays

27

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

Biogeochemistry

Conventional surface sampling of outcrops and soils on the Lode-Star claims is not useful due to poor exposures and contamination by waste dumps and tailings. However, biogeochemical sampling has been shown to be effective in indicating areas of anomalous gold and other gold-related trace metal values below the Seibert gravels.

In August 2011, ICN personnel sampled rabbit brush in an area measuring approximately 4000 feet (1200 m) by 2000 feet (600 m) in the northern and central portions of the property, including in the Silver Pick shaft area and in the NE Corridor target area. The program was designed, and the data interpreted by Shea Clark Smith of Minerals Exploration & Environmental Geochemistry (Smith, 2012). Large areas that are defined by gold concentrations from 2 – 60 ppb are significant and attest to the volume (and possibly grade) of mineralized rock in contact with groundwater in these areas. Smith states that metal uptake in rabbit brush is not overwhelmed by mineralized dust that might have masked the metal concentrations in plant tissues of less well endowed (by gold) areas.

The Figure to the right displays the gold-mineralized areas indicated by the biogeochemical data. The anomalies cluster in areas of historically mined mineralization near the Phelan, Sheets-Ish and Silver Pick shafts. Most importantly multiple clusters occur in the Northeast Corridor area, which includes the Newmont Lode and especially the Church Zone. Of particular note is the cluster of anomalies that exist to the northwest of the NE Corridor, correlating closely with interpreted northwest-trending structures. Thus, the biogeochemical data confirms the conclusions from drilling and underground geologic work as shown on Figure 8 above. Overall the biogeochemical anomalies were found in four areas of the property that have had no drilling, as follows: | Figure 9 Biogeochemical Interpretive Map  |

| 1. | the area immediately east of the Church Zone coinciding with a CSAMT anomaly; |

| 2. | several grouped anomalies immediately northwest of the Newmont Lode and the January-Whiterock shaft; |

| 3. | a northwest trending series of anomalies extending 400 meters to the northwest of the Church discovery zone; and, |

| 4. | three separate anomalies located to the west of the Silver Pick shaft and to the east of the Phelan shaft in the northern portion of the claim group. In general, all of the drill holes with anomalous gold values fall within biogeochemical anomalies and all those holes with no significant gold intercepts are outside the biogeochemical anomalies. |