Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SELECT MEDICAL HOLDINGS CORP | tm2011551-1_8k.htm |

Exhibit 99.1

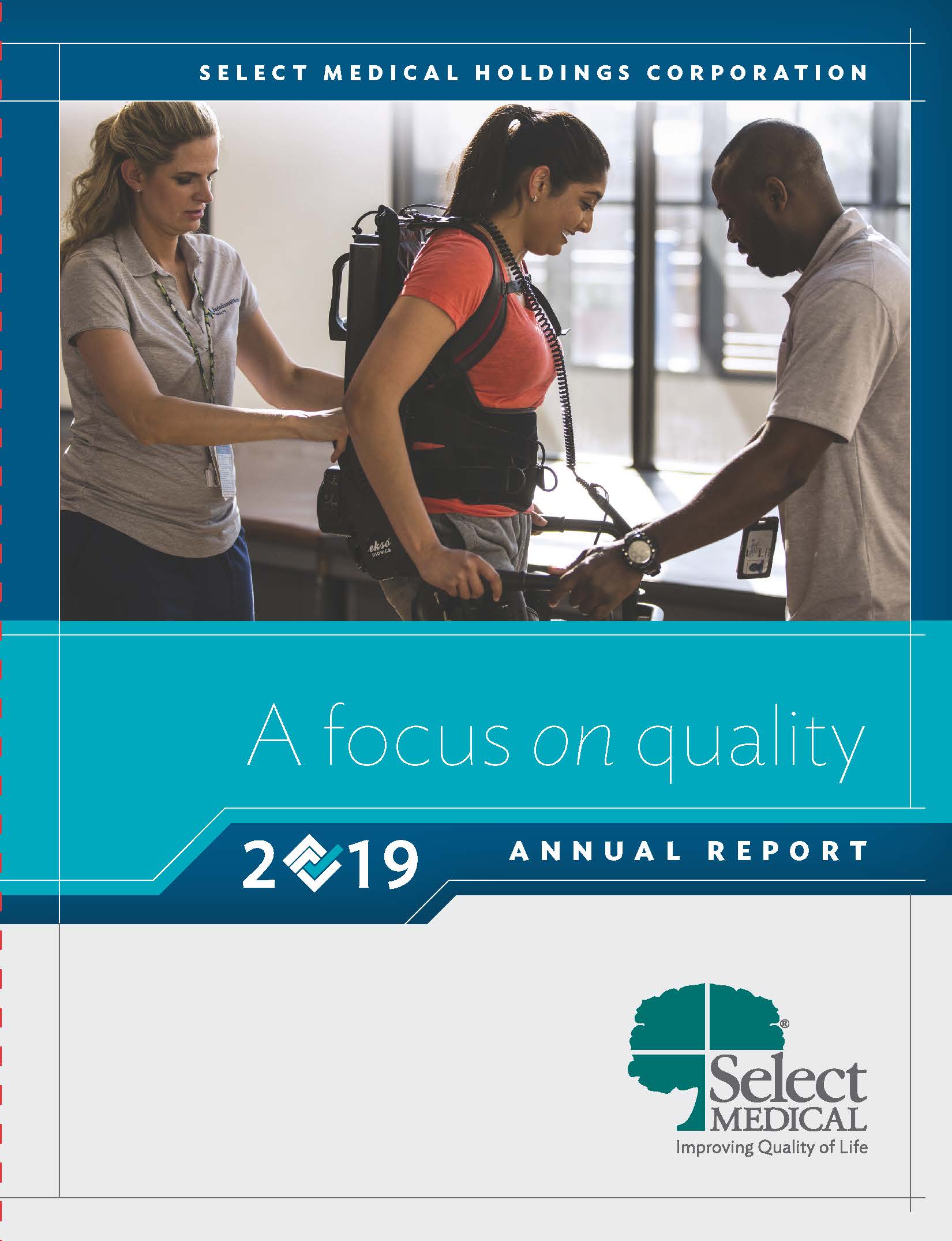

S E L E C TM E D I C A LH O L D I N G SC O R P O R A T I O N A focus on quality A N N U A LR E P O R T

S E L E C TM E D I C A LH O L D I N G SC O R P O R A T I O N A focus on quality A N N U A LR E P O R T

OURC OMMIT MENTT OQU ALITYCARE Quality in the healthcare setting is often defined by measures that keep patients safe as well as mark their intended targets of recovery. Our metrics for success are respectively defined by each division and based on both internal and industry standard benchmarks, the latter set by the regulatory bodies such as Centers for Medicare & Medicaid Services (CMS), Centers for Disease Control & Prevention (CDC) and National Healthcare Safety Network (NHSN). Though we consistently attain and exceed these benchmarks, it is also each successful patient encounter that fuels our clinical teams to deliver a high quality, exceptional care experience to the more than 80,000 patients we treat across our post-acute continuum every day. The Company’s commitment to quality emanates from the highest level, the Committee on Quality of Care and Patient Safety, reporting to the Select Medical Board of Directors.

OURC OMMIT MENTT OQU ALITYCARE Quality in the healthcare setting is often defined by measures that keep patients safe as well as mark their intended targets of recovery. Our metrics for success are respectively defined by each division and based on both internal and industry standard benchmarks, the latter set by the regulatory bodies such as Centers for Medicare & Medicaid Services (CMS), Centers for Disease Control & Prevention (CDC) and National Healthcare Safety Network (NHSN). Though we consistently attain and exceed these benchmarks, it is also each successful patient encounter that fuels our clinical teams to deliver a high quality, exceptional care experience to the more than 80,000 patients we treat across our post-acute continuum every day. The Company’s commitment to quality emanates from the highest level, the Committee on Quality of Care and Patient Safety, reporting to the Select Medical Board of Directors.

Confirming a commitment to place quality at the core of its mission to deliver an exceptional patient experience, Select Medical formed the Select Medical Patient Safety and Quality Institute (SMPSQI), a federally-listed Patient Safety Organization (PSO) under the U.S. Department of Health & Human Services’ Agency for Healthcare Research and Quality. The Quality of Care and Patient Safety Committee of Select Medical’s Board of Directors fully supports and empowers the SMPSQI to make patient safety its top priority by reviewing data from our nearly 130 specialty hospitals to identify trends, opportunities for improvement and best practices. Committee, led by Board Members Sen. William H. Frist and Marilyn Tavenner, reviews quality and patient safety metrics from across the company on a quarterly basis. Detailed analysis of the quality and outcomes data results in the development of our care models and performance improvement. Select Medical has not only been able to reach these defined benchmarks, but has demonstrated sustainability. Persistence, passion and perseverance has facilitated consistent models of practice at hospital, center and clinic levels, even in the face of a more complex and ill patient population. Our commitment to quality each and every day, one patient at a time has never been stronger. 2 0 1 9 A N N U A L R E P O R T 2

Confirming a commitment to place quality at the core of its mission to deliver an exceptional patient experience, Select Medical formed the Select Medical Patient Safety and Quality Institute (SMPSQI), a federally-listed Patient Safety Organization (PSO) under the U.S. Department of Health & Human Services’ Agency for Healthcare Research and Quality. The Quality of Care and Patient Safety Committee of Select Medical’s Board of Directors fully supports and empowers the SMPSQI to make patient safety its top priority by reviewing data from our nearly 130 specialty hospitals to identify trends, opportunities for improvement and best practices. Committee, led by Board Members Sen. William H. Frist and Marilyn Tavenner, reviews quality and patient safety metrics from across the company on a quarterly basis. Detailed analysis of the quality and outcomes data results in the development of our care models and performance improvement. Select Medical has not only been able to reach these defined benchmarks, but has demonstrated sustainability. Persistence, passion and perseverance has facilitated consistent models of practice at hospital, center and clinic levels, even in the face of a more complex and ill patient population. Our commitment to quality each and every day, one patient at a time has never been stronger. 2 0 1 9 A N N U A L R E P O R T 2

D E A RS H A R E H O L D E R We are pleased to report that 2019 was a standout year for Select Medical. We continued to expand the Company’s national footprint, fortified joint venture partnerships and remained highly focused on delivering quality care. These achievements were underscored by strong financial performance. Net operating revenues grew 7.3% year-over-year to more than $5.45 billion, and operating income grew 13.1% year-over-year to $471.9 million. During the latter half of 2019, we accessed the debt capital markets and, through several refinancings, Preeminent Provider of Post-Acute Care in U.S. Today, Select Medical is the nation’s largest operator of each of three business lines: critical illness recovery hospitals, outpatient rehabilitation clinics and occupational medicine centers. Our inpatient rehabilitation network of hospitals is the second largest in the country and continues to grow. Collectively, more than 80,000 patients are treated each day across our continuum of care. Quality Driving Reputation and Growth The Critical Illness Recovery Hospital Division solidified its market position as the largest provider of special-division achieved its best quality and safety scores against national benchmark standards in the history of the Company. This reputation for clinical excellence continues to propel growth, particularly as we forge relation-ships with large health care systems seeking to address high volume intensive care unit (ICU) challenges and provide patients with a high quality care path to continued recovery. This performance, combined with the acquisition of four hospitals, contributed to an Adjusted EBITDA increase of 4.9% or $11.9 million for the year. The Inpatient Rehabilitation Hospital Division continued to thrive with 29 hospitals, five wholly-owned and 24 operated through 17 joint venture partnerships. The division provided Adjusted EBITDA of $135.9 million, a 24.7% increase over the prior year. In 2019, we opened a new hospital, Northshore Rehabilitation underway for two new Banner Rehabilitation hospitals in Arizona, due to open in 2020. Kessler Institute for Rehabilitation was again ranked one of the top rehabilitation hospitals in the country by U.S. News & World Report, achieving the No. 2 spot on the prestigious “Best Hospitals” list. This marked the 27th consecutive year that Kessler has been listed among the nation’s leading rehabilitation hospitals. Additionally, Baylor Scott and White Institute for Rehabilitation-Dallas was recognized as “high performing” Overall, 2019 was an important year for Concentra with the completion of its 18-month integration of more than 210 acquired U.S. HealthWorks centers. Today, its national footprint includes 521 occupational medicine centers, 131 onsite centers and 32 community-based outpatient clinics. This, combined with ongoing technology advancements designed to improve the patient experience, positioned Concentra to improve to $276.5 million. In the first quarter of 2020, Select Medical purchased an additional interest in the joint venture and now holds 66.6% of Concentra. l f i i i r owered our overall average borrowing rate. Additionally, we were able to push out significant debt maturities or several years, and paved the way for combining the capital structures of Select Medical and Concentra. zed post-acute care for the nation’s growing chronic, critically ill patient population. Equally impressive, the n Louisiana, and moved Virginia-based Riverside Rehabilitation to a new facility. Construction also got n medical rehabilitation, one of just seven hospitals nationwide to achieve this recognition. esults clinically and financially, posting an Adjusted EBITDA with an increase of 9.7% from the prior year 3 S E L E C T M E D I C A LI M P R O V I N G Q U A L I T Y O F L I F E

D E A RS H A R E H O L D E R We are pleased to report that 2019 was a standout year for Select Medical. We continued to expand the Company’s national footprint, fortified joint venture partnerships and remained highly focused on delivering quality care. These achievements were underscored by strong financial performance. Net operating revenues grew 7.3% year-over-year to more than $5.45 billion, and operating income grew 13.1% year-over-year to $471.9 million. During the latter half of 2019, we accessed the debt capital markets and, through several refinancings, Preeminent Provider of Post-Acute Care in U.S. Today, Select Medical is the nation’s largest operator of each of three business lines: critical illness recovery hospitals, outpatient rehabilitation clinics and occupational medicine centers. Our inpatient rehabilitation network of hospitals is the second largest in the country and continues to grow. Collectively, more than 80,000 patients are treated each day across our continuum of care. Quality Driving Reputation and Growth The Critical Illness Recovery Hospital Division solidified its market position as the largest provider of special-division achieved its best quality and safety scores against national benchmark standards in the history of the Company. This reputation for clinical excellence continues to propel growth, particularly as we forge relation-ships with large health care systems seeking to address high volume intensive care unit (ICU) challenges and provide patients with a high quality care path to continued recovery. This performance, combined with the acquisition of four hospitals, contributed to an Adjusted EBITDA increase of 4.9% or $11.9 million for the year. The Inpatient Rehabilitation Hospital Division continued to thrive with 29 hospitals, five wholly-owned and 24 operated through 17 joint venture partnerships. The division provided Adjusted EBITDA of $135.9 million, a 24.7% increase over the prior year. In 2019, we opened a new hospital, Northshore Rehabilitation underway for two new Banner Rehabilitation hospitals in Arizona, due to open in 2020. Kessler Institute for Rehabilitation was again ranked one of the top rehabilitation hospitals in the country by U.S. News & World Report, achieving the No. 2 spot on the prestigious “Best Hospitals” list. This marked the 27th consecutive year that Kessler has been listed among the nation’s leading rehabilitation hospitals. Additionally, Baylor Scott and White Institute for Rehabilitation-Dallas was recognized as “high performing” Overall, 2019 was an important year for Concentra with the completion of its 18-month integration of more than 210 acquired U.S. HealthWorks centers. Today, its national footprint includes 521 occupational medicine centers, 131 onsite centers and 32 community-based outpatient clinics. This, combined with ongoing technology advancements designed to improve the patient experience, positioned Concentra to improve to $276.5 million. In the first quarter of 2020, Select Medical purchased an additional interest in the joint venture and now holds 66.6% of Concentra. l f i i i r owered our overall average borrowing rate. Additionally, we were able to push out significant debt maturities or several years, and paved the way for combining the capital structures of Select Medical and Concentra. zed post-acute care for the nation’s growing chronic, critically ill patient population. Equally impressive, the n Louisiana, and moved Virginia-based Riverside Rehabilitation to a new facility. Construction also got n medical rehabilitation, one of just seven hospitals nationwide to achieve this recognition. esults clinically and financially, posting an Adjusted EBITDA with an increase of 9.7% from the prior year 3 S E L E C T M E D I C A LI M P R O V I N G Q U A L I T Y O F L I F E

The year also proved to be strong for the Outpatient Rehabilitation Division with an Adjusted EBITDA of $151.8 million, a 6.9% increase over the prior year. Further cementing its No. 1 position as the largest outpatient physical therapy network in the country, the Company added 88 new clinics through start-ups and acquisitions, expanding the footprint to 1,740 centers across 37 states and the District of Columbia. Its sports partnerships also continued to grow reaching more than 500 contracts with high school, collegiate and professional sports organizations. ReVital, Select Medical’s innovative oncology rehabilitation program, also continued to expand the outpatient rehabilitation business in 2019. To date, more than 600 specially-trained therapists now offer ReVital services at over 300 clinic locations in 14 markets. As we enter 2020, we are confident that our clinical excellence, strategic partnerships and patient-centered mission will continue to serve as catalysts for growth, market leadership and enhanced shareholder value. We thank you for your support in our ongoing commitment to improve the quality of life for millions of patients and their families in the communities we serve. Sincerely, David S. Chernow Rocco Ortenzio Robert Ortenzio President & Chief Executive OfficerVice Chairman & Co-FounderExecutive Chairman & Co-Founder 2 0 1 9 A N N U A L R E P O R T 4

The year also proved to be strong for the Outpatient Rehabilitation Division with an Adjusted EBITDA of $151.8 million, a 6.9% increase over the prior year. Further cementing its No. 1 position as the largest outpatient physical therapy network in the country, the Company added 88 new clinics through start-ups and acquisitions, expanding the footprint to 1,740 centers across 37 states and the District of Columbia. Its sports partnerships also continued to grow reaching more than 500 contracts with high school, collegiate and professional sports organizations. ReVital, Select Medical’s innovative oncology rehabilitation program, also continued to expand the outpatient rehabilitation business in 2019. To date, more than 600 specially-trained therapists now offer ReVital services at over 300 clinic locations in 14 markets. As we enter 2020, we are confident that our clinical excellence, strategic partnerships and patient-centered mission will continue to serve as catalysts for growth, market leadership and enhanced shareholder value. We thank you for your support in our ongoing commitment to improve the quality of life for millions of patients and their families in the communities we serve. Sincerely, David S. Chernow Rocco Ortenzio Robert Ortenzio President & Chief Executive OfficerVice Chairman & Co-FounderExecutive Chairman & Co-Founder 2 0 1 9 A N N U A L R E P O R T 4

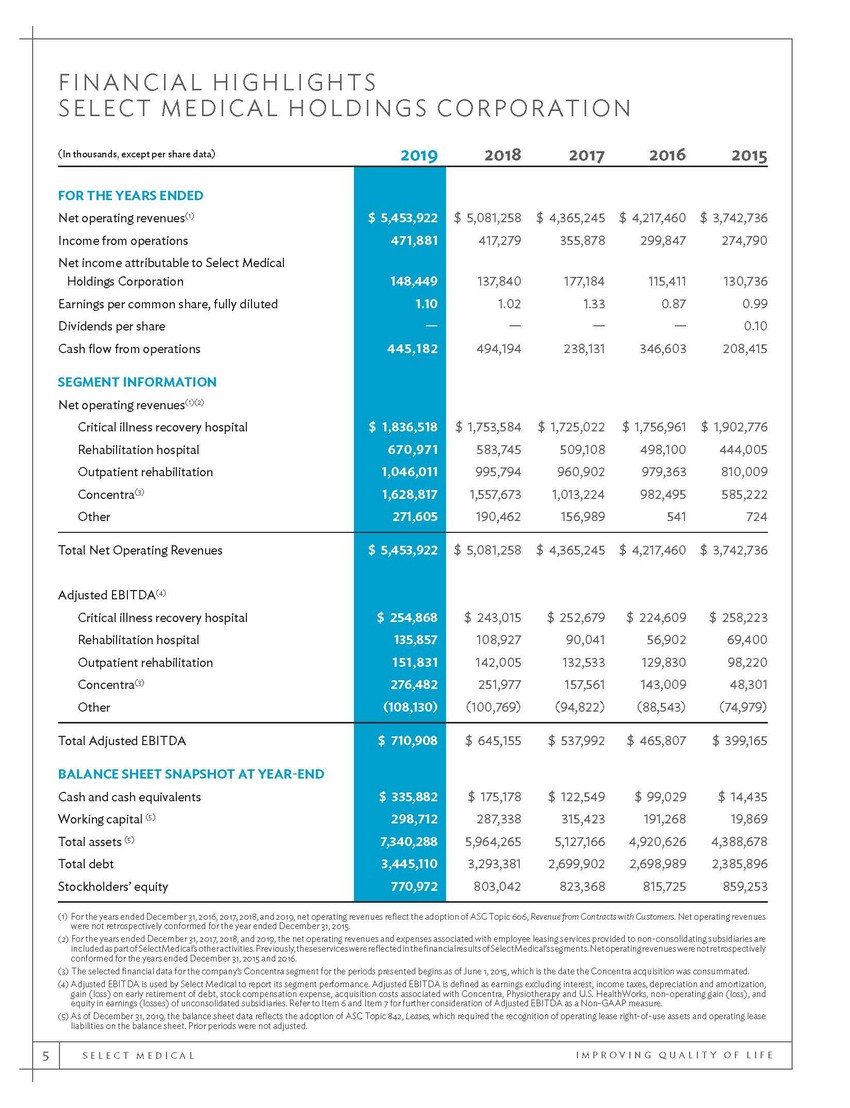

FINANCIAL HIGHLIGHT S SELE CT MEDICAL HOLDINGS C ORP OR ATION (In thousands, except per share data) 20192018201720162015 (1) For the years ended December 31, 2016, 2017, 2018, and 2019, net operating revenues reflect the adoption of ASC Topic 606, Revenue from Contracts with Customers. Net operating revenues were not retrospectively conformed for the year ended December 31, 2015. (2) For the years ended December 31, 2017, 2018, and 2019, the net operating revenues and expenses associated with employee leasing services provided to non-consolidating subsidiaries are includedaspartofSelectMedical’sotheractivities.Previously,theseserviceswerereflectedinthefinancialresultsofSelectMedical’ssegments.Netoperatingrevenueswerenotretrospectively conformed for the years ended December 31, 2015 and 2016. (3) The selected financial data for the company’s Concentra segment for the periods presented begins as of June 1, 2015, which is the date the Concentra acquisition was consummated. (4) Adjusted EBITDA is used by Select Medical to report its segment performance. Adjusted EBITDA is defined as earnings excluding interest, income taxes, depreciation and amortization, gain (loss) on early retirement of debt, stock compensation expense, acquisition costs associated with Concentra, Physiotherapy and U.S. HealthWorks, non-operating gain (loss), and equity in earnings (losses) of unconsolidated subsidiaries. Refer to Item 6 and Item 7 for further consideration of Adjusted EBITDA as a Non-GAAP measure. (5) As of December 31, 2019, the balance sheet data reflects the adoption of ASC Topic 842, Leases, which required the recognition of operating lease right-of-use assets and operating lease liabilities on the balance sheet. Prior periods were not adjusted. 5 S E L E C T M E D I C A LI M P R O V I N G Q U A L I T Y O F L I F E FOR THE YEARS ENDED Net operating revenues(1) Income from operations Net income attributable to Select Medical Holdings Corporation Earnings per common share, fully diluted Dividends per share Cash flow from operations SEGMENT INFORMATION Net operating revenues(1)(2) Critical illness recovery hospital Rehabilitation hospital Outpatient rehabilitation Concentra(3) Other $ 5,453,922 471,881 148,449 1.10 — 445,182 $ 1,836,518 670,971 1,046,011 1,628,817 271,605 $ 5,081,258$ 4,365,245 $ 4,217,460 $ 3,742,736 417,279355,878299,847274,790 137,840177,184115,411130,736 1.021.330.87 0.99 — — — 0.10 494,194238,131 346,603 208,415 $ 1,753,584$ 1,725,022$ 1,756,961$ 1,902,776 583,745509,108 498,100444,005 995,794960,902 979,363810,009 1,557,6731,013,224982,495585,222 190,462156,989541724 Total Net Operating Revenues Adjusted EBITDA(4) Critical illness recovery hospital Rehabilitation hospital Outpatient rehabilitation Concentra(3) Other $ 5,453,922 $ 254,868 135,857 151,831 276,482 (108,130) $ 5,081,258$ 4,365,245 $ 4,217,460 $ 3,742,736 $ 243,015$ 252,679$ 224,609 $ 258,223 108,92790,04156,902 69,400 142,005132,533129,83098,220 251,977157,561 143,009 48,301 (100,769) (94,822) (88,543) (74,979) Total Adjusted EBITDA BALANCE SHEET SNAPSHOT AT YEAR-END Cash and cash equivalents Working capital (5) Total assets (5) Total debt Stockholders’ equity $ 710,908 $ 335,882 298,712 7,340,288 3,445,110 770,972 $ 645,155$ 537,992$ 465,807 $ 399,165 $ 175,178$ 122,549$ 99,029$ 14,435 287,338 315,423191,268 19,869 5,964,2655,127,166 4,920,626 4,388,678 3,293,3812,699,9022,698,9892,385,896 803,042 823,368815,725859,253

FINANCIAL HIGHLIGHT S SELE CT MEDICAL HOLDINGS C ORP OR ATION (In thousands, except per share data) 20192018201720162015 (1) For the years ended December 31, 2016, 2017, 2018, and 2019, net operating revenues reflect the adoption of ASC Topic 606, Revenue from Contracts with Customers. Net operating revenues were not retrospectively conformed for the year ended December 31, 2015. (2) For the years ended December 31, 2017, 2018, and 2019, the net operating revenues and expenses associated with employee leasing services provided to non-consolidating subsidiaries are includedaspartofSelectMedical’sotheractivities.Previously,theseserviceswerereflectedinthefinancialresultsofSelectMedical’ssegments.Netoperatingrevenueswerenotretrospectively conformed for the years ended December 31, 2015 and 2016. (3) The selected financial data for the company’s Concentra segment for the periods presented begins as of June 1, 2015, which is the date the Concentra acquisition was consummated. (4) Adjusted EBITDA is used by Select Medical to report its segment performance. Adjusted EBITDA is defined as earnings excluding interest, income taxes, depreciation and amortization, gain (loss) on early retirement of debt, stock compensation expense, acquisition costs associated with Concentra, Physiotherapy and U.S. HealthWorks, non-operating gain (loss), and equity in earnings (losses) of unconsolidated subsidiaries. Refer to Item 6 and Item 7 for further consideration of Adjusted EBITDA as a Non-GAAP measure. (5) As of December 31, 2019, the balance sheet data reflects the adoption of ASC Topic 842, Leases, which required the recognition of operating lease right-of-use assets and operating lease liabilities on the balance sheet. Prior periods were not adjusted. 5 S E L E C T M E D I C A LI M P R O V I N G Q U A L I T Y O F L I F E FOR THE YEARS ENDED Net operating revenues(1) Income from operations Net income attributable to Select Medical Holdings Corporation Earnings per common share, fully diluted Dividends per share Cash flow from operations SEGMENT INFORMATION Net operating revenues(1)(2) Critical illness recovery hospital Rehabilitation hospital Outpatient rehabilitation Concentra(3) Other $ 5,453,922 471,881 148,449 1.10 — 445,182 $ 1,836,518 670,971 1,046,011 1,628,817 271,605 $ 5,081,258$ 4,365,245 $ 4,217,460 $ 3,742,736 417,279355,878299,847274,790 137,840177,184115,411130,736 1.021.330.87 0.99 — — — 0.10 494,194238,131 346,603 208,415 $ 1,753,584$ 1,725,022$ 1,756,961$ 1,902,776 583,745509,108 498,100444,005 995,794960,902 979,363810,009 1,557,6731,013,224982,495585,222 190,462156,989541724 Total Net Operating Revenues Adjusted EBITDA(4) Critical illness recovery hospital Rehabilitation hospital Outpatient rehabilitation Concentra(3) Other $ 5,453,922 $ 254,868 135,857 151,831 276,482 (108,130) $ 5,081,258$ 4,365,245 $ 4,217,460 $ 3,742,736 $ 243,015$ 252,679$ 224,609 $ 258,223 108,92790,04156,902 69,400 142,005132,533129,83098,220 251,977157,561 143,009 48,301 (100,769) (94,822) (88,543) (74,979) Total Adjusted EBITDA BALANCE SHEET SNAPSHOT AT YEAR-END Cash and cash equivalents Working capital (5) Total assets (5) Total debt Stockholders’ equity $ 710,908 $ 335,882 298,712 7,340,288 3,445,110 770,972 $ 645,155$ 537,992$ 465,807 $ 399,165 $ 175,178$ 122,549$ 99,029$ 14,435 287,338 315,423191,268 19,869 5,964,2655,127,166 4,920,626 4,388,678 3,293,3812,699,9022,698,9892,385,896 803,042 823,368815,725859,253

[LOGO]

[LOGO]

Our Mission SE L E C T ME D ICA L WI LL P R O VI D E AN E X CE PT IO N A L P A T IEN T CARE E X PERIENCE T H A T P R OM O T E S HEA L IN G A ND R E C O VE R Y I N A C O M P ASSI O N A TE E N VI R O NME N T . L EAR N M O RE A T

Our Mission SE L E C T ME D ICA L WI LL P R O VI D E AN E X CE PT IO N A L P A T IEN T CARE E X PERIENCE T H A T P R OM O T E S HEA L IN G A ND R E C O VE R Y I N A C O M P ASSI O N A TE E N VI R O NME N T . L EAR N M O RE A T