Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Intrepid Potash, Inc. | ipi12312019exhibit312.htm |

| EX-95.1 - EXHIBIT 95.1 - Intrepid Potash, Inc. | ipi12312019exhibit951.htm |

| EX-32.2 - EXHIBIT 32.2 - Intrepid Potash, Inc. | ipi12312019exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Intrepid Potash, Inc. | ipi12312019exhibit321.htm |

| EX-31.1 - EXHIBIT 31.1 - Intrepid Potash, Inc. | ipi12312019exhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - Intrepid Potash, Inc. | ipi12312019exhibit232.htm |

| EX-23.1 - EXHIBIT 23.1 - Intrepid Potash, Inc. | ipi12312019exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Intrepid Potash, Inc. | ipi12312019exhibit211.htm |

| EX-4.1 - EXHIBIT 4.1 - Intrepid Potash, Inc. | ipi12312019exhibit41.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K | ||

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2019 | |

or | |

¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 001-34025

INTREPID POTASH, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 26-1501877 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1001 17th Street, Suite 1050, Denver, Colorado | 80202 |

(Address of principal executive offices) | (Zip Code) |

(303) 296-3006

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | IPI | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ |

Smaller reporting company ¨ | Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant, based upon the closing sale price of the common stock on June 28, 2019, the last trading day of the registrant's most recently completed second fiscal quarter, of $3.36 per share as reported on the New York Stock Exchange was $390 million. Shares of common stock held by each director and executive officer and by each person who owns 10% or more of the registrant's outstanding common stock and is believed by the registrant to be in a control position were excluded. The determination of affiliate status for this purpose is not a conclusive determination of affiliate status for any other purposes.

As of February 26, 2020, the registrant had 131,688,835 shares of common stock, par value $0.001, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Items 10, 11, 12, 13 and 14 of Part III is incorporated by reference from portions of the registrant's definitive proxy statement relating to its 2020 annual meeting of stockholders to be filed within 120 days after December 31, 2019.

INTREPID POTASH, INC.

TABLE OF CONTENTS

Page | ||

PART I

Unless the context otherwise requires, the following definitions apply throughout this Annual Report on Form 10-K:

• | "Intrepid," "our," "we," or "us" means Intrepid Potash, Inc. and its consolidated subsidiaries. |

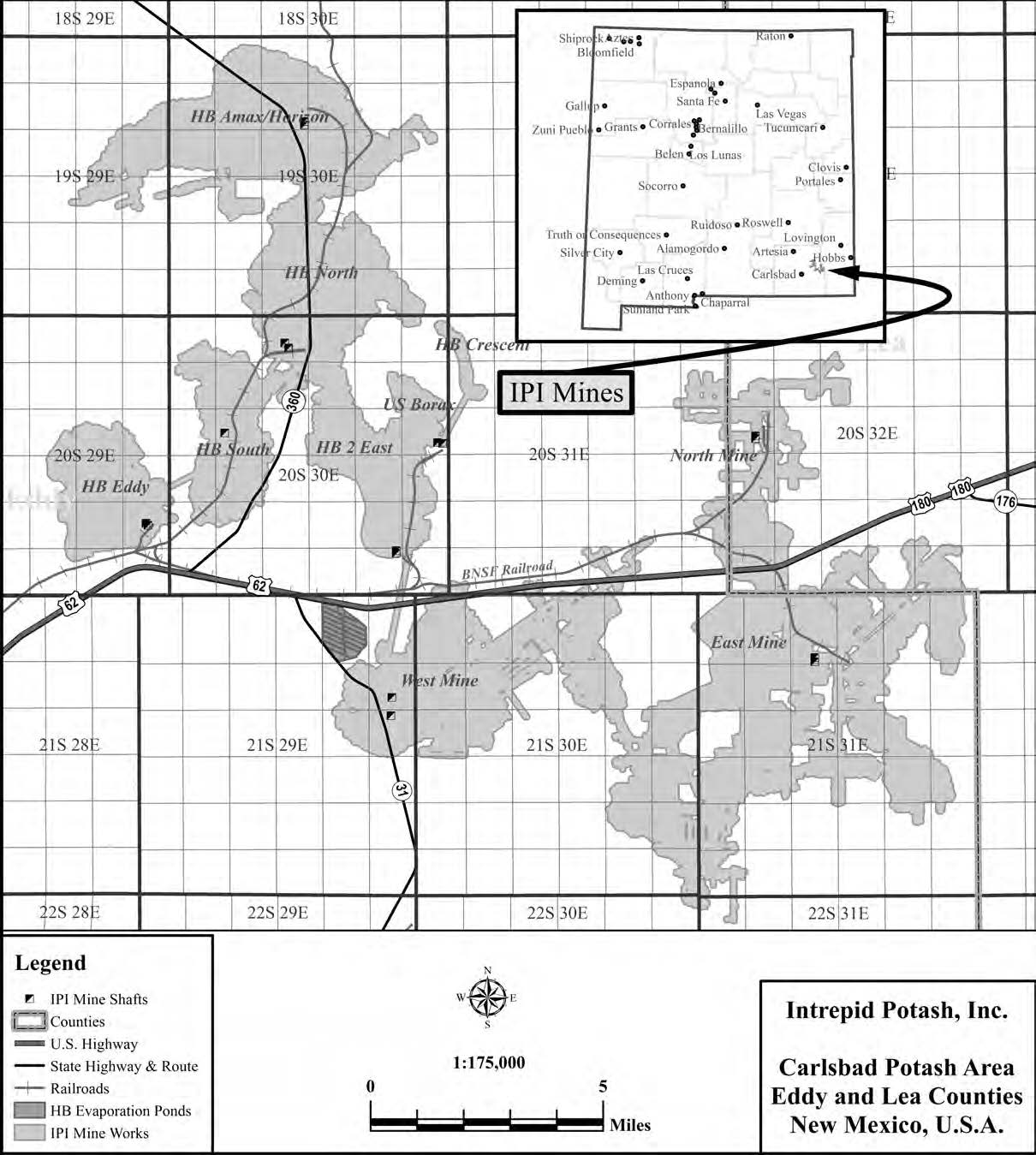

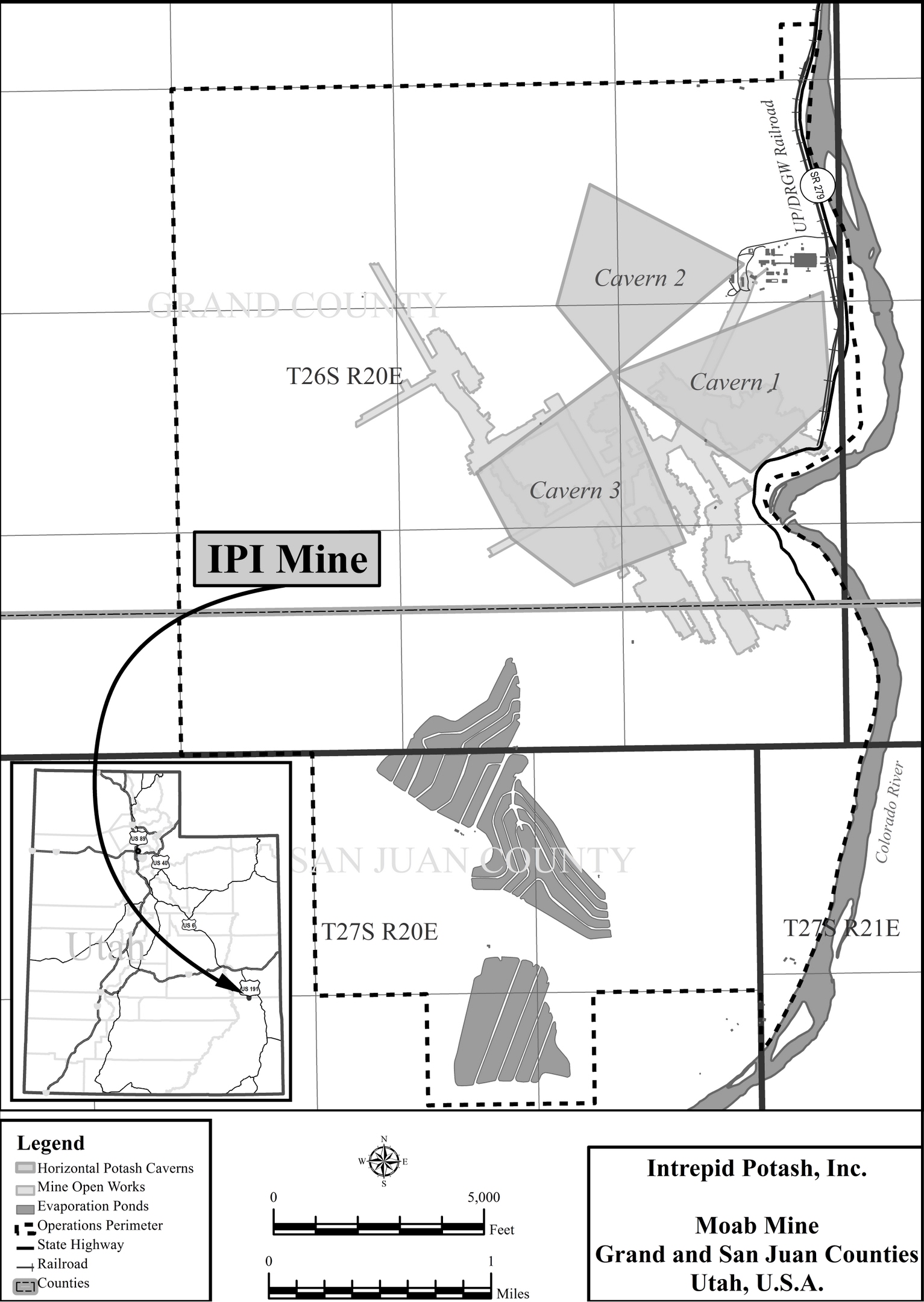

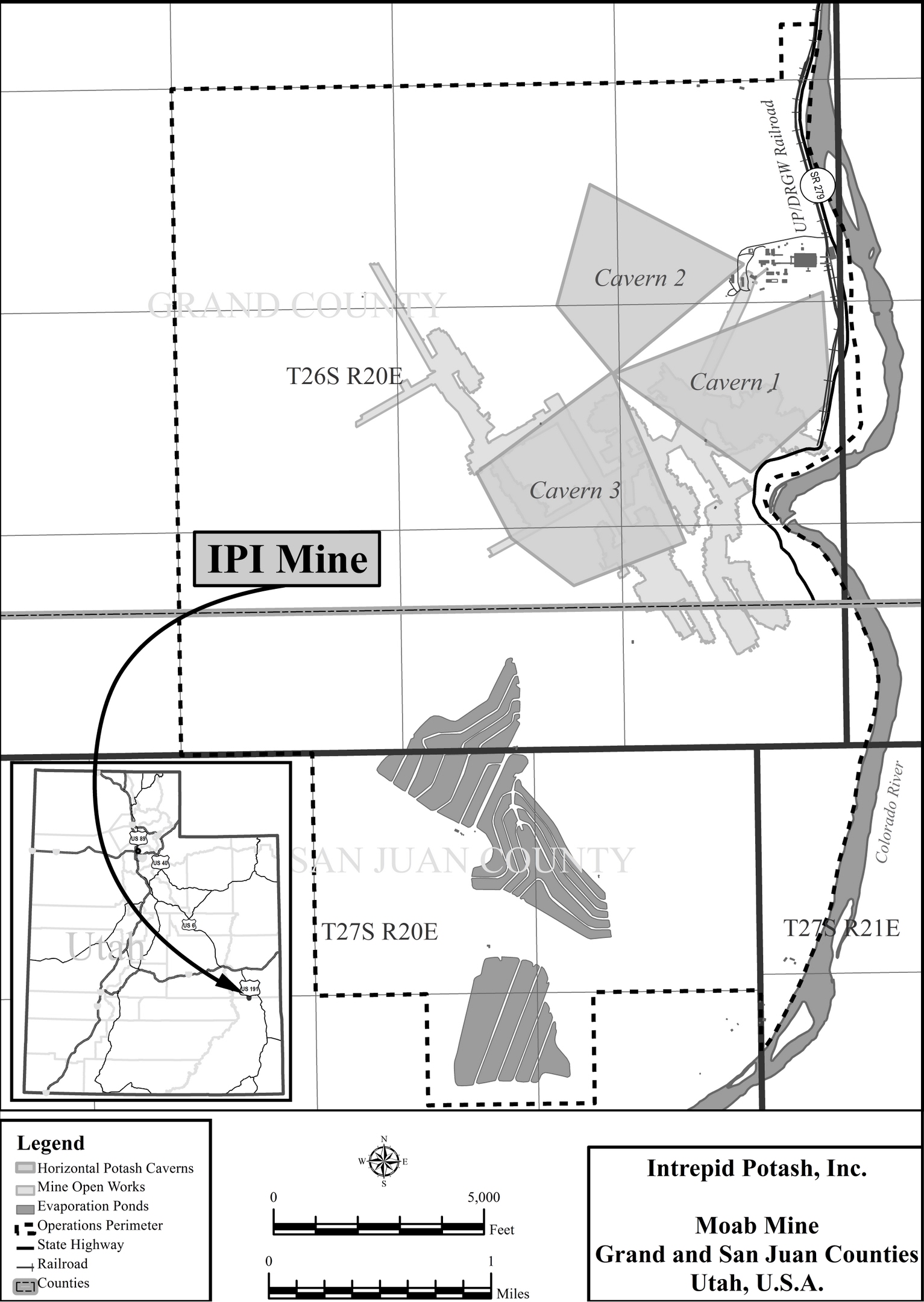

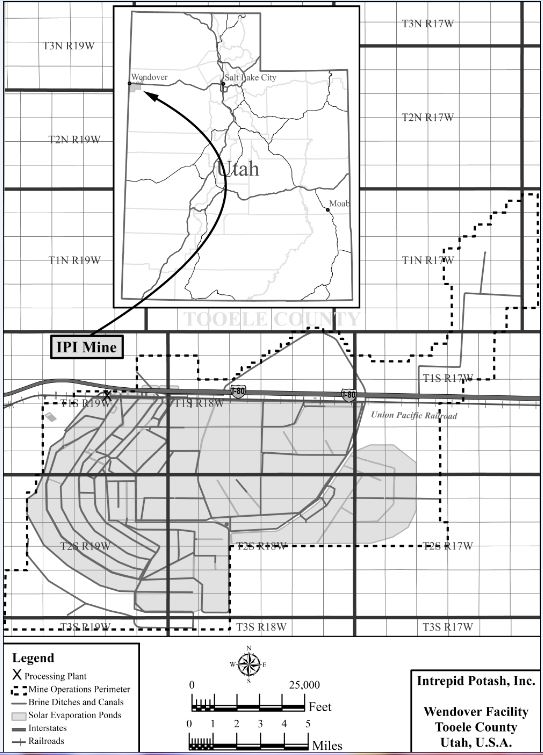

• | "East," "North," and "HB" mean our three operating facilities in Carlsbad, New Mexico. "Moab" means our operating facility in Moab, Utah. "Wendover" means our operating facility in Wendover, Utah. "West" means our previous operating facility in Carlsbad, New Mexico, which was placed in care-and-maintenance mode in mid‑2016. "Intrepid South" refers to certain land, water rights, and other related assets in southeast New Mexico we acquired from Dinwiddie Cattle Company in May 2019. You can find more information about our facilities in Item 2 of this Annual Report on Form 10-K. |

• | "Ton" means a short ton, or a measurement of mass equal to 2,000 pounds. |

To supplement our consolidated financial statements, which are presented in this Annual Report on Form 10-K and which are prepared and presented in accordance with generally accepted accounting principles ("GAAP"), we use "average net realized sales price per ton," which is a non‑GAAP financial measure to monitor and evaluate our performance. You can find more information about average net realized sales price per ton, including a reconciliation of this measure to the most comparable GAAP measure, in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations under the heading "Non-GAAP Financial Measure."

CAUTIONARY NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward‑looking statements within the meaning of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Securities Act of 1933, as amended. These forward‑looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements in this Annual Report on Form 10-K other than statements of historical fact are forward‑looking statements. Forward-looking statements include statements about our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, among other things. In some cases, you can identify these statements by forward‑looking words, such as "estimate," "expect," "anticipate," "project," "plan," "intend," "believe," "forecast," "foresee," "likely," "may," "should," "goal," "target," "might," "will," "could," "predict," and "continue." Forward‑looking statements are only predictions based on our current knowledge, expectations, and projections about future events.

These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, which are described in Item 1A. Risk Factors in this Annual Report on Form 10-K.

In addition, new risks emerge from time to time. It is not possible for our management to predict all risks that may cause actual results to differ materially from those contained in any forward-looking statements we may make.

In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in these forward-looking statements. As a result, you should not place undue reliance on these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, except as required by law.

1

ITEM 1. | BUSINESS |

General

We are a diversified mineral company that delivers potassium, magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed and the oil and gas industry. We are the only U.S. producer of muriate of potash (sometimes referred to as potassium chloride or potash), which is applied as an essential nutrient for healthy crop development, utilized in several industrial applications, and used as an ingredient in animal feed. In addition, we produce a specialty fertilizer, Trio®, which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. We also provide water, magnesium chloride, brine and various oilfield products and services.

Our extraction and production operations are conducted entirely in the continental United States. We produce potash from three solution mining facilities: our HB solution mine in Carlsbad, New Mexico, our solution mine in Moab, Utah and our brine recovery mine in Wendover, Utah. We also operate our North compaction facility in Carlsbad, New Mexico, which compacts and granulates product from the HB mine. We produce Trio® from our conventional underground East mine in Carlsbad, New Mexico. Until mid-2016, we also produced potash from our East and West mines in Carlsbad, New Mexico. In April 2016, we converted our East facility from a mixed-ore facility that produced both potash and Trio® to a Trio®‑only facility. In addition, in early July 2016, we idled mining operations at our West facility and transitioned the facility into care and maintenance. These changes were designed to increase our production of Trio®, a product that had traditionally shown more resilience to pricing pressure than potash, and to lower costs in a time of declining potash prices.

We have water rights in New Mexico under which we sell water primarily to support oil and gas development in the Permian Basin near our Carlsbad facilities. We continue to work to expand our sales of water. In May 2019, we acquired certain land, water rights, other related assets in Lea County, New Mexico, from Dinwiddie Cattle Company. We refer to these assets and operations as "Intrepid South." The purchase price was $53 million. A reduction of $12 million from the original $65 million purchase price was agreed upon by the parties prior to closing subject to issues identified in the diligence process. Dinwiddie Cattle Company also reserved a 20-year, 10% royalty, proportionally reduced as to our interest, on certain produced water disposal revenue related to Intrepid South and certain other properties located near Intrepid South. We capitalized $3.2 million of acquisition fees related to the purchase of the Intrepid South Assets.

Our principal offices are located at 1001 17th Street, Suite 1050, Denver, Colorado 80202, and our telephone number is (303) 296-3006. Intrepid was incorporated in Delaware in 2007.

Our Products and Services

Our three primary products are potash, Trio®, and water. We also sell salt, magnesium chloride, metal recovery salts, brines, and water that are derived as part of our mining processes. Product sales as a percentage of total sales for the last three years were as follows:

Year Ended December 31, | |||||||||

2019 | 2018 | 2017 | |||||||

Potash | 47 | % | 52 | % | 54 | % | |||

Trio® | 29 | % | 31 | % | 36 | % | |||

Water | 12 | % | 10 | % | 4 | % | |||

Salt | 6 | % | 2 | % | 3 | % | |||

Magnesium Chloride | 2 | % | 3 | % | 3 | % | |||

Brines | 1 | % | 1 | % | — | % | |||

Other | 3 | % | 1 | % | — | % | |||

Total | 100 | % | 100 | % | 100 | % | |||

We have three segments: potash, Trio®, and oilfield solutions. Prior to the adoption of Accounting Standards Codification ("ASC") Topic 606 Revenue from Contract with Customers ("ASC 606"), on January 1, 2018, we accounted for the sale of byproducts as a credit to cost of goods sold.

Potash

We sell potash into three primary markets: the agricultural market as a fertilizer input, the industrial market as a component in drilling and fracturing fluids for oil and gas wells and an input to other industrial processes, and the animal feed market as a nutrient supplement. Potash is sold in different product sizes, such as granular, standard, and fine standard. The agricultural market predominately uses granular-sized potash, while the industrial and animal feed markets mostly use standard-

2

and fine standard-sized product. We have the flexibility to produce all of our product in a granular form, which decreases our dependence on sales of any one particular size of potash and any particular market.

We manage sales and marketing operations centrally. This allows us to evaluate the product needs of our customers and then centrally determine which of our production facilities is best suited, typically based on geographic location, to use to fill customer orders in a manner designed to realize the highest average net realized sales price per ton. Average net realized sales price per ton is a non-GAAP measure that we calculate as sales less byproduct sales and freight costs and then divided by product sales tons. We also monitor product inventory levels and overall production costs centrally.

During 2019, we supplied 0.5% of annual world potassium consumption and 3.9% of annual U.S. potassium consumption.

Substantially all of our potash is sold in the United States, and many of our potash sales are geographically concentrated in the central and western United States. Fertilizer sales are affected by weather and planting conditions in these regions, as well as farmer economics. For more information, please see "Seasonality." A significant portion of our industrial sales are derived from oil and gas customers and vary based on the price of potash, the availability and price of substitute products, and changes in industry preferences.

Trio®

Trio® is our specialty fertilizer that delivers potassium, sulfate, and magnesium in a single particle and has the added benefit of being low in chloride. This unique combination of nutrients makes Trio® an attractive fertilizer across diverse crops and geographies. We produce Trio® in premium, granular, standard, and fine standard sizes for sale both domestically and internationally.

Oilfield Solutions

We have water rights in New Mexico under which we sell water primarily for industrial uses in the oil and gas services industry. We also offer potassium chloride ("KCl") real-time mixing services on location for hydraulic fracturing operations and trucking services. In May 2019 we acquired Intrepid South as part of our strategy to expand our sales of water and other related products and services that support oil and gas development in the Permian Basin in southeast New Mexico. Our other oilfield related products and service offerings include, but are not limited to, caliche, right-of-way agreements, surface damages and easements, and a produced water royalty. We sell water on Intrepid South under a joint marketing agreement with NGL Energy Partners, a land and water rights owner adjacent to our South property. Under this agreement, we are responsible for the marketing, sale, and delivery of water to various customers across our combined acreage. Demand for water and other oilfield related products and services is due to the significant oil and gas activity and development in southeast New Mexico. We continue to work to expand our agreements with operators in the area.

Byproducts

We also sell salt, magnesium chloride, metal recovery salts, brines, and water that are derived as part of our mining processes. Our salt is used in a variety of markets including animal feed, industrial applications, pool salt, and the treatment of roads and walkways for ice melting or to manage road conditions. Magnesium chloride is typically used as a road treatment agent for both deicing and dedusting. Our brines contain salt and potassium and are used primarily by the oil and gas industry to support well workover and completion activities. When the water that we sell was previously used in the production process for potash or Trio®, it is considered a byproduct of the underlying product. We continue to work to expand sales of byproducts, particularly to serve the oil and gas markets near our operating facilities. Sales of byproducts are accounted for within the segment that produced the byproduct. In each of the last three years, the majority of our byproduct sales were accounted for in the potash segment.

Production Facilities

We produce potash from three solar evaporation solution mining facilities: our HB solution mine in Carlsbad, New Mexico, a solution mine in Moab, Utah, and a brine recovery mine in Wendover, Utah. We also operate our North compaction facility in Carlsbad, New Mexico, which compacts and granulates product from the HB mine. Solution mining is a process by which potash is extracted from mineralized beds by injecting a salt-saturated brine into a potash ore body and recovering a brine that contains potash and other minerals. The brine is brought to the surface for mineral recovery through solar evaporation. For solar evaporation, the brine is placed in ponds and solar energy is used to evaporate water thus crystallizing out the potash and minerals contained in the brine. The resulting mineral evaporates are then processed to separate the minerals for sale. Solution mining does not require employees or machines to be underground.

We produce Trio® from our conventional underground East mine in Carlsbad, New Mexico. A conventional underground mine uses a mechanical method of extracting minerals from underground. Underground mining consists of

3

multiple shafts or entry points and a network of tunnels to provide access to minerals and conveyance systems to transport materials to the surface. Underground mining machines are used to remove the ore and a series of pillars are left behind to provide the appropriate level of ground support to ensure safe access and mining.

We have a current estimated annual designed productive capacity of approximately 390,000 tons of potash from our solar evaporation solution mines. We also have an estimated annual designed productive capacity of 400,000 tons of Trio®.

Our annual production rates for potash and Trio® are less than our estimated productive capacity. Actual production is affected by operating rates, the grade of ore mined, recoveries, mining rates, evaporation rates, product pricing, product demand, and the amount of development work that we perform. Therefore, as with other producers in our industry, our production results tend to be lower than reported productive capacity.

We also have pipelines and ponds that we use to deliver water to customers. As mentioned above, we acquired Intrepid South in May 2019 which increased our water rights and water delivery infrastructure.

Industry Overview

Fertilizer serves a fundamental role in global agriculture by providing essential crop nutrients that help sustain both the yield and the quality of crops. The three primary nutrients required for plant growth are nitrogen, phosphate, and potassium. There are no known substitutes for these nutrients. A proper balance of each of the three nutrients is necessary to maximize their effectiveness. Potassium helps regulate plants' physiological functions and improves plant durability, providing crops with protection from drought, disease, parasites, and cold weather. Unlike nitrogen and phosphate, the potassium contained in naturally occurring potash does not require additional chemical conversion to be used as a plant nutrient.

In addition to the primary nutrients, which are required in the greatest quantities in crop nutrition, important secondary nutrients such as sulfur and magnesium are also essential in crop nutrition. Intrepid's Trio® product contains the primary nutrient potassium and two secondary nutrients in its sulfur and magnesium content.

Long-term global fertilizer demand has historically been driven primarily by population growth and global economic conditions with annual demand variations based on planted acreage, agricultural commodity yields and prices, inventories of grains and oilseeds, application rates of fertilizer, weather patterns, and farm sector income. We expect these key variables to continue to have an impact on global fertilizer demand for the foreseeable future. Sustained per capita income growth and agricultural policies in the developing world also affect global demand for fertilizer. Fertilizer demand is affected by other geopolitical factors such as temporary disruptions in fertilizer trade related to government intervention and changes in the buying patterns of key consuming countries. Volatility in agricultural commodity prices also may impact farmer fertilizer buying decisions.

The world potash market has long been characterized by nameplate production capacities that exceed demand. A significant portion of this capacity is controlled by a few companies and this concentration increased in early 2018 with the merger of two Canadian producers. Historically, these larger producers have managed production levels to approximate world demand. Several international brownfield and greenfield expansions have also begun production, with increases in production rates expected over the next few years. Due to the increased production, near-term potash pricing will likely depend on the larger producers' ability to continue to manage this supply and demand balance through decreased utilization rates, a practice we saw in effect in the second half of 2019 as producers removed approximately four million tons of expected production through extended outages at certain facilities. Increases in world fertilizer demand, due mainly to population growth and limitations on arable land, are expected to eventually lessen the burden on producers, although recent increases in productive capacities and the continued progress of key expansion projects across the globe make this unlikely for at least the next few years.

The United States potash market is also impacted by the volume of imports. A change in the volume of imports could result in a material change to potash prices in the United States.

4

Virtually all of the world's potash is currently extracted from 19 commercial deposits. According to the International Fertilizer Industry Association and data published by potash mining companies, six countries accounted for approximately 89% of the world's aggregate potash production during 2018. During this time period, the top nine potash producers supplied approximately 97% of world production. Two major Canadian producers participate in the Canpotex marketing group that supplied approximately 31% of the global potash production in 2018, one producer in Russia supplied approximately 17% of global potash production in 2018 and one producer in Belarus supplied approximately 17% of the global potash production in 2018.

Hydraulically fractured horizontal wells account for the majority of oil and gas wells drilled in the United States today and are responsible for the record amount of fossil fuels produced in the United States in recent years. The use of horizontal drilling in oil and gas production allows a well to remain in contact with the targeted formation, increasing production compared to a vertically drilled well. This process has resulted in longer wells, with some horizontal drilling sections reaching several miles long. The increase in horizontal drilling has also increased the use of fresh water, with a single frac potentially using millions of gallons. In the frac process, water and sand are used to move proppant and other frac additives into the targeted rock formation. Fresh water is important in the fracking process, as impurities in the water can impact the overall effectiveness of the frac. The majority of water used in fracking is transported by pipeline to the frac site, where it is stored in ponds or storage tanks.

The most productive region in the United States for oil production is the Permian Basin, which spans from west Texas to southeastern New Mexico. As of January 2020, the Permian Basin produced approximately 4.8 million barrels of oil per day. For comparison, the next most productive region in the United States produced approximately 1.5 million barrels of oil per day. In addition to producing wells, the Permian Basin also had approximately 3,600 drilled but uncompleted wells as of December 2019.

Competition and Competitive Strategy

We sell into commodity markets and compete based on delivered price, our ability to deliver product in a timely manner, and product quality. We also compete based on the durability, particle size, and potassium oxide content of our potash and Trio® products. For potash, we compete primarily with much larger potash producers, principally Canadian producers and, to a lesser extent, producers located in Russia, Belarus, Chile, Germany, and Israel. For Trio®, we compete with one other producer of langbeinite as well as producers of other specialty nutrients and blended products. For water, we compete primarily with water-specialty companies, farmers, and ranchers operating in or near the Permian Basin in New Mexico. Some of our competitors and potential competitors may have significant advantages over us, including greater name recognition, longer operating histories, pre-existing relationships with current or potential customers, significantly greater financial, marketing and other resources, ownership of more diverse assets and products, geographically and/or access to less expensive mining assets, any of which could allow them to respond more quickly to new or changing opportunities.

Our competitive strategy is focused on the following:

• | Maximize potash gross margin and optimize potash production. All of our potash production comes from solar solution mines, which carry fewer fixed costs than our conventional potash mines. Our per-ton costs are lower for solution mining than conventional mining as solar solution mining requires less labor, energy, and equipment. In addition, we have the advantage of being located close to the markets we serve, and the North American market is significantly larger than our production capacity. As a result, we are able to selectively participate in the markets that we believe will provide the highest average net realized sales price per ton. We also attempt to maximize our gross margin by leveraging our freight advantage to key geographies, our diverse customer and market base, and our flexible marketing approach. Long-term, we have optimization and expansion opportunities at our solution mining facilities, that, over time, could further reduce our per-ton costs and increase our potash production. For example, we have potential expansion opportunities at our HB mine. |

• | Expand Trio® sales and maximize gross margin. We plan to continue to expand our sales and marketing efforts for Trio®. These efforts include continued education in international markets and an increased marketing effort in domestic organic markets. In order to maximize gross margin, we are working to optimize our production process to recover more of the langbeinite we mine and to produce more granular-sized product, which is preferred by most markets. Given the current pricing and demand environment, we intend to continue to operate our Trio® facility at reduced production levels and expect to continue to do so for the foreseeable future. |

• | Expand offerings of oilfield solutions. We intend to continue working to expand sales of water, particularly to service the oil and gas markets near our operating plants in New Mexico. We have a meaningful amount of water |

5

rights under which we sell water primarily for industrial uses such as in the oil and gas services industry. As a result of these efforts, our water sales increased significantly over the past three years. In addition, as described above, in May 2019, we purchased land, water rights, and other assets in the Permian Basin which we operate as Intrepid South. These additional water rights contributed to the growth in water sales in 2019 and we expect to increase the amount of water available for sale on the Intrepid South property over the next few years through additional infrastructure investment and permitting. The Intrepid South property also generates revenue from the sale of caliche, a produced water royalty, and right-of-way and surface use agreements with oil and gas operators.

• | Continue diversification of products and services. We recover magnesium chloride, salt, brines, and water during the production of potash and Trio®. These byproducts offer additional diversity to our portfolio of product and service offerings. As we continue to look for opportunities to diversify our revenue sources, we may enter into new or complementary businesses that expand our product and service offerings. For example, we are adding a brine station on the Intrepid South property and we are in the process of developing a produced water facility with a partner near our Intrepid South property which we expect will begin operating in mid-2020. We may also expand into oil and natural gas exploration and production, or into new products or services in our current industry or other industries. |

Competitive Strengths

• | U.S.-based producer. We are the only producer of potash in the United States. We are located in a market that consumes significantly more potash than we can currently produce on an annual basis. Our geographic location provides us with a transportation advantage over our competitors for shipping our product to our customers. In general, this allows us to obtain a higher average net realized sales price per ton than our competitors, who must ship their products across longer distances to consuming markets, which increases their costs and reduces their gross margin. Our location allows us to target sales to the markets in which we have the greatest transportation advantage, maximizing our average net realized sales price per ton. Our access to strategic rail destination points and our location along major agricultural trucking routes also support this advantage. |

As a U.S. producer, we enjoy a significantly lower total production tax and royalty burden than our principal competitors, which operate primarily in Saskatchewan, Canada. The Saskatchewan tax system for potash producers includes a capital tax and several potash mineral taxes, none of which are imposed on us as a U.S. producer. We currently pay an average royalty rate of approximately 5.0% of our potash and Trio® sales less their related freight costs, which compares favorably to that of our competitors in Canada. The relative tax and royalty advantage for U.S. producers becomes more pronounced when profits per ton increase due primarily to the profit tax component of the Saskatchewan potash mineral tax.

• | Solar evaporation operations. All of our potash production comes from solar solution mines. Solar evaporation is a cost-efficient production method because it significantly reduces labor and energy consumption, which are two of the largest costs of production. Our understanding and application of low-cost solution mining, combined with our reserves being located where a favorable climate for evaporation exists, make solar solution mining difficult for other producers to replicate. We also have significant reserves for future expansion of our solution mining operations. |

• | Participation in specialty markets. Given the greater scarcity of langbeinite relative to potash and its agronomic suitability for certain soils and crops, we believe there is a market for Trio® outside of our core potash markets. We also believe that there is a market for Trio® beyond the United States, and we continue to attempt to capture and grow this market. Through our existing operations and assets, we also have the potential to grow our offerings of salt, water, and brine with low capital investments. |

• | Water rights. We have water rights in New Mexico under which we sell water primarily for industrial uses such as in the oil and gas services industry. We continue to work to expand sales of water, especially to support oil and gas development in the Permian Basin near our Carlsbad facilities. The Intrepid South property increased our total water rights available for sale and our footprint in and around the Delaware Basin. This has expanded our relationships with oil and gas producers, which we may be able to use to expand sales of our industrial potash products, byproducts, and services. |

• | Diversity of potash markets. We sell potash into three different markets—the agricultural, industrial, and feed markets. During 2019, these markets represented approximately 74%, 12%, and 14% of our potash sales, respectively. The agricultural market supplies farmers producing a wide range of crops in different geographies. Because of our geographic proximity to areas that have seen recent increases in oil and gas drilling activity, we |

6

believe that we have an opportunity promote the benefits of potash in drilling activities and to increase our industrial sales volumes.

• | Marketing flexibility. We have the ability to convert all of our standard-sized potash product into granular-sized product as market conditions warrant. We also produce Trio® in premium, granular, standard and fine standard sizes. This provides us with increased marketing flexibility as well as decreased dependence on any one particular market. |

• | Significant reserve life. Our potash and langbeinite reserves each have substantial years of reserve life, with remaining reserve lives for our actively mined areas ranging from 30 years to greater than 100 years, based on proven and probable reserve estimates. In addition to our reserves, we have water rights and access to additional mineralized areas of potash for potential future exploitation. |

• | Existing facilities and infrastructure. Constructing a new potash production facility requires substantial time and extensive capital investment in mining, milling, and infrastructure to extract, process, store, and ship product. Our operations already have significant facilities and infrastructure in place. We also have the ability to expand our business using existing installed infrastructure, in less time and with lower expenditures than would be required to construct entirely new mines. |

Seasonality

The sales pattern for potash sold into the agricultural market is seasonal. Over the last three years, our monthly potash sales volume has been highest in March through May and September through November when purchasers are looking to have product on hand in advance of the spring and fall application seasons in the United States. In turn, our monthly potash sales volume has been the lowest in July and December. The specific timing of when farmers apply potash remains highly weather dependent and varies across the numerous growing regions within the U.S. The timing of potash sales is significantly influenced by the marketing programs of potash producers, as well as storage volumes closer to the farm gate.

The sales pattern for Trio® sold into the domestic agricultural market is also seasonal. Over the last three years, our domestic Trio® sales volume has been highest in March and April, as Trio® products are typically applied to crops in the United States during the spring planting season. Demand for the spring planting season generally runs from December to May, during which we have sold approximately 60% of our domestic Trio® volumes over the past three years. As we expand our Trio® sales efforts outside of the United States, we expect the overall seasonality of our Trio® sales to be impacted by the timing of deliveries to warehouses as we generally ship in larger volumes to minimize per ton transportation costs.

The month-to-month seasonality of our agricultural sales is somewhat moderated due to the variety of crops, industries, distribution strategies and geographies that we serve. Because all of our potash production comes from our solar solution mines, our potash production is also seasonal. Our solar solution mines suspend potash production activities from early spring through late summer, the peak solar evaporation period. Accordingly, we manage our inventories during the low demand periods of the year in order to ensure timely product availability during the peak sales seasons, as well as during the summer evaporation period when we have no potash being produced. The seasonality of fertilizer demand results in our sales volumes and revenue being the highest during the spring and our working capital requirements being the highest just before the start of the spring season. We have observed fertilizer dealers in North America instituting practices that are designed to reduce their risk of changes in the price of fertilizer products through consignment-type programs. These programs tend to make the timing of the spring and fall seasonal demand profile less predictable within the season. Further, through technological advances, the farmers in the United States have gained efficiencies in planting and harvesting their crops, which has compressed the application seasons.

Our quarterly financial results can also vary from one year to the next due to weather‑related shifts in planting schedules and purchasing patterns.

Demand for our oilfield products and services is highly correlated to oil and gas exploration activities and can vary from quarter to quarter.

Major Customers

Within the agricultural market, we supply a diversified customer base of distributors, cooperatives, retailers, and dealers, which in turn supply farmers producing a wide range of crops in different geographies. We sell into the industrial and feed markets through sales to distributors and directly to end users. For water, we have entered into multiple long-term supply agreements with a diverse set of customers aimed at generating a long-term recurring revenue stream from water sales.

In each of 2019, 2018 and 2017, no customer accounted for more than 10% of our total sales.

7

Environmental, Safety, and Health Matters

We are subject to an evolving set of federal, state, and local environmental, safety, and health laws that regulate, among other things; (1) soil, air, and water quality standards for our facilities; (2) disposal, storage, and management of hazardous and solid wastes; (3) post-mining land reclamation and closure; (4) conditions of mining and production operations; (5) employee and contractor safety and occupational health; and (6) product content and labeling. We employ and consult with professionals who assist in monitoring our compliance with these laws and who work with management to ensure that appropriate strategies and processes are in place to promote a culture that prioritizes safety and environmental responsibility.

In 2019, we had approximately $4.0 million of capital investments, and $0.5 million in other expenses, relating to environmental compliance, environmental studies, and remediation efforts. We expect to spend $1.0 million to $3.0 million for environmental related capital projects in both 2020 and 2021. Future capital expenditures are subject to a number of uncertainties, including changes to environmental regulations and interpretations, and enforcement initiatives. If potential negative effects to the environment are discovered, or if the potential negative effects are of a greater magnitude than currently estimated, material expenditures could be required in the future to remediate the identified effects. We expect that continued emphasis on environmental issues will result in increased future investments for environmental controls at our operations. See Item 1A. Risk Factors “Risks Related to Our Business - Environmental laws and regulations could subject us to significant liability and require us to incur additional costs.”

Product Registration Requirements

We are required to register fertilizer products with each U.S. state and foreign country where products are sold. Each brand and grade of commercial fertilizer must be registered with the appropriate state agency before being offered for sale, sold, or distributed in that jurisdiction. In most cases, these product registrations impose specific requirements relating to guaranteed analysis, product labeling, and regular reporting of sales.

Some states require similar registration and reporting for feed grade products. Industrial-grade products typically do not require registration or reporting.

Operating Requirements and Government Regulations

Permits

We are subject to numerous environmental laws and regulations, including laws and regulations regarding land use and reclamation; release of emissions to the atmosphere or water; plant and animal life; and the generation, treatment, storage, disposal, and handling of hazardous substances and wastes. These laws include the Clean Air Act; the Clean Water Act; the Resource Conservation and Recovery Act; the Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA"); the Toxic Substances Control Act; and various other federal, state, and local laws and regulations. Violations can result in substantial penalties, court orders to install pollution‑control equipment, civil and criminal sanctions, permit revocations, and facility shutdowns. In addition, environmental laws and regulations may impose joint and several liability, without regard to fault, for cleanup costs on potentially responsible parties who have released, disposed of, or arranged for release or disposal of hazardous substances in the environment.

We hold numerous environmental, mining, and other permits or approvals authorizing operations at each of our facilities. Our operations are subject to permits for, among other things, extraction of salt and brine, discharges of process materials and waste to air and surface water, and injection of brine. Some of our proposed activities may require waste storage permits. A decision by a government agency to deny or delay issuing a new or renewed permit or approval, or to revoke or substantially modify an existing permit or approval, could limit or prevent us from mining at these properties. In addition, changes to environmental and mining regulations or permit requirements could limit our ability to continue operations at the affected facility. In many cases, environmental permits and approvals are also required for an expansion of, or changes to, our operations. As a condition to procuring the necessary permits and approvals, we may be required to comply with financial assurance regulatory requirements. The purpose of these requirements is to assure the government that sufficient company funds will be available for the ultimate reclamation, closure, and post-closure care at our facilities. We obtain bonds as financial assurance for these obligations. These bonds require annual payment and renewal.

We believe we are in compliance with existing regulatory programs, permits, and approvals where non-compliance could have a material adverse effect on our operating results or financial condition. In 2016, the New Mexico Office of State Engineer ("OSE") determined that our East tailing impoundment embankments are considered jurisdictional dams. We continue to work with the OSE to determine required dam modifications associated with this determination. We may be required to spend a significant amount of capital to bring the impoundments into compliance with requirements for jurisdictional dams or modify our operations to no longer use impoundments that may qualify as jurisdictional dams.

8

From time to time, we have received notices from governmental agencies that we are not in compliance with certain environmental laws, regulations, permits, or approvals. For example, although designated as zero discharge facilities under the applicable water quality laws and regulations, our East, North, and Moab facilities at times may experience some water and brine discharges during periods of significant rainfall or due to other circumstances. We have implemented several initiatives to address discharge issues, including the reconstruction or modification of certain impoundments, increasing evaporation, and reducing process water usage and discharges and improved management systems. State and federal officials are aware of these issues and have visited the sites to review our corrective efforts and action plans.

Air and Drinking Water

In the ordinary course of our business, from time to time, we receive notices from the New Mexico Environment Department of alleged air or drinking water quality control violations. Upon receipt of these notices, we evaluate the matter and take any required corrective actions. In some cases, we may be required to pay civil penalties for these notices of violation.

Safety and Health Regulation and Programs

Certain of our facilities are subject to the Federal Mine Safety and Health Act of 1977, the Occupational Safety and Health Act, related state statutes and regulations, or a combination of these laws.

The Mine Safety and Health Administration ("MSHA") is the governing agency for our conventional underground mines and related surface facilities in New Mexico. As required by MSHA, these operations are regularly inspected by MSHA personnel. Item 4 and Exhibit 95.1 to this Annual Report on Form 10-K provide information concerning certain mine safety violations.

Our New Mexico facilities participate in MSHA's Region 8 "Partnership Program." There is a formally signed document and plan, pursuant to which each party commits to specific actions and behaviors. Examples of principles include working for an open, cooperative environment; agreeing to citation and conflict processes; and improving training. Our New Mexico facilities are serviced by a trained mine rescue team, which is ready to respond to on-site incidents or assist in local incidents, if needed. The team practices and participates at state and federal events and competitions. In addition, our New Mexico facilities participate in a basin agreement with other natural resource and hazardous waste facilities to provide mine rescue support.

The Occupational Safety and Health Administration ("OSHA") is the governing agency relating to the safety standards at our Utah facilities, as well as our HB mine and plant. Training and other certifications are provided to employees as needed based upon their work duties.

Remediation at Intrepid Facilities

Many of our current facilities have been in operation for a number of years. Operations by us and our predecessors have involved the historical use and handling of potash, salt, related potash and salt byproducts, process tailings, hydrocarbons and other regulated substances. Some of these operations resulted, or may have resulted, in soil, surface water, or groundwater contamination. At some locations, there are areas where process waste, building materials (including asbestos‑containing transite), and ordinary trash may have been disposed or buried, and have since been closed and covered with soil and other materials.

At many of these facilities, spills or other releases of regulated substances may have occurred previously and potentially could occur at any of our facilities in the future, possibly requiring us to undertake or fund cleanup efforts under CERCLA or state laws governing cleanup or disposal of hazardous and solid waste substances.

We work closely with governmental authorities to obtain the appropriate permits to address identified site conditions. For example, buildings located at our facilities in both Utah and New Mexico have a type of siding that contains asbestos. We have adopted programs to encapsulate and stabilize portions of the siding through use of an adhesive spray and to remove the siding, replacing it with an asbestos-free material. Also, we have trained asbestos abatement crews that handle and dispose of the asbestos‑containing siding and related materials. We have a permitted asbestos landfill in Utah and have worked closely with Utah officials to address asbestos‑related issues at our Moab mine.

9

Reclamation Obligations

Mining and processing of potash generates residual materials that must be managed both during the operation of the facility and upon facility reclamation and closure. Potash tailings, consisting primarily of salt and fine sediments that remain after potash is removed from ore during processing, are stored in surface disposal sites. Some of these tailing materials may also include other contaminants, such as lead, that were introduced as reagents during historic processing methods that may require additional management and could cause additional disposal and reclamation requirements to be imposed. For example, at least one of our New Mexico mining facilities may have legacy issues regarding lead in the tailings pile resulting from production methods utilized prior to our acquisition of these assets. During the life of the tailings management areas, we have incurred, and will continue to incur, significant costs to manage potash residual materials in accordance with environmental laws and regulations and with permit requirements. Additional legal and permit requirements will take effect when these facilities are closed.

Our surface permits require us to reclaim property disturbed by operations at our facilities. Our operations in Utah and New Mexico have specific obligations related to reclamation of the land after mining and processing operations are concluded. The discounted present value of our estimated reclamation costs for our facilities as of December 31, 2019, is approximately $22.3 million, which is reflected in our audited financial statements found elsewhere in this Annual Report on Form 10-K. Various permits and authorization documents negotiated with or issued by the appropriate governmental authorities include these estimated reclamation costs on an undiscounted basis.

It is difficult to estimate and predict the potential actual costs and liabilities associated with remediation and reclamation, and there is no guarantee that we will not be identified in the future as potentially responsible for additional remediation and reclamation costs, either as a result of changes in existing laws and regulations or as a result of the identification of additional matters subject to remediation and/or reclamation obligations or liabilities.

Royalties

The potash, langbeinite, water, and byproducts we produce and sell from leased land may be subject to royalty payments. We produce and sell from leased land owned by the U.S. government, the States of New Mexico and Utah, and private landowners. The terms of the royalty payments are determined at the time of the issuance or renewal of the leases. Some royalties are determined as a fixed percentage of revenue and others vary based upon ore grade. Additionally, some of our leases are subject to overriding royalty interest payments paid to various owners. In 2019, we paid $7.9 million in royalties and other taxes. The royalty rates on our state and federal leases in New Mexico are currently set at various rates from 2.0% to 5.0%. The royalty rates on our state and federal leases in Utah are currently set at rates from 3.0% to 5.0%. The royalty rates for the private leaseholds are between 5.0% and 8.0%. For certain water sales we pay an $0.11 per barrel sold royalty to the State of New Mexico.

Employees

As of January 31, 2020, we had 445 employees, the majority of which were full-time employees.

We have a collective bargaining agreement with a labor organization representing our hourly employees in Wendover, Utah, which expires on May 31, 2020. This is the seventh agreement negotiated between us and the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, Local 867. We consider our relationships with our employees to be good.

Available Information

We file or furnish with the U.S. Securities and Exchange Commission (the "SEC") reports, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, and any amendments to these reports filed or furnished pursuant to Section 13(a) or Section 15(d) of the Exchange Act. These reports are available free of charge on our website at intrepidpotash.com as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. These reports also can be obtained at sec.gov.

We routinely post important information about us and our business, including information about upcoming investor presentations, on our website under the Investor Relations tab. We encourage investors and other interested parties to enroll on our website to receive automatic email alerts or Really Simple Syndication (RSS) feeds regarding new postings. The information found on, or that can be accessed through, our website is not part of this or any other report we file with, or furnish to, the SEC.

10

Executive Officers

The following section includes biographical information for our executive officers:

Name | Age | Position | ||

Robert P. Jornayvaz III | 61 | Executive Chairman of the Board, President, and Chief Executive Officer | ||

Robert E. Baldridge | 58 | Senior Vice President - New Mexico | ||

Mark A. McDonald | 55 | Vice President of Sales and Marketing | ||

Matthew D. Preston | 35 | Vice President, Finance | ||

Kyle R. Smith | 46 | Vice President, General Counsel and Secretary | ||

E. Brian Stone | 57 | Chief Operating Officer | ||

Erica K. Wyatt | 47 | Chief Human Resources Officer | ||

Robert P. Jornayvaz III has served as our Executive Chairman of the Board since 2010 and as our President and Chief Executive Officer since August 2014. Mr. Jornayvaz served as our Chairman of the Board and Chief Executive Officer from our formation in 2007 until 2010. Mr. Jornayvaz served, directly or indirectly, as a manager of our predecessor, Intrepid Mining LLC, from 2000 until its dissolution at the time of our initial public offering in 2008. Mr. Jornayvaz is the sole owner of Intrepid Production Corporation. Mr. Jornayvaz and Intrepid Production Corporation together beneficially own 14.9% of our common stock.

Robert E. Baldridge has served as our Senior Vice President - New Mexico since December 2019. Mr. Baldridge served as General Manager of our New Mexico operations from July 2010 to December 2019 and Manager of Mines since our formation in 2007. Previously Mr. Baldridge served as Mine Manager of Intrepid Mining from 2003 until its dissolution at the time of our IPO in 2008. Prior to joining Intrepid, Mr. Baldridge held various positions with Mississippi Potash, Inc. from 1988 to 2003. Mr. Baldridge has over 30 years experience in the potash mining industry.

Mark A. McDonald has served as our Vice President of Sales and Marketing since November 2017. Mr. McDonald previously served as our Director of U.S. Agricultural and Feed Sales from March 2017 to November 2017, Director of Industrial, Feed, and Midwest Agricultural Sales from July 2016 to March 2017, and National Accounts Manager from December 2013 to July 2016. Before joining Intrepid, Mr. McDonald worked at Agrium U.S. Inc. and Agrium Inc., a manufacturer, wholesaler, and retail supplier of agricultural products and services, for 17 years in various positions culminating with Director, Eastern Sales Region. Before joining Agrium, Mr. McDonald held positions at Cargill Limited and Monsanto Company.

Matthew D. Preston has served as our Vice President of Finance since November 2019. Mr. Preston also serves as our principal financial officer and principal accounting officer. Mr. Preston served as our Director of Budget and Forecast from April 2016 to November 2019. Previously, Mr. Preston served in successively more senior finance roles since joining Intrepid in 2008, including Senior Manager of Budget and Forecast, Manager of Budget and Forecast, and Financial Analyst.

Kyle R. Smith has served as our Vice President, General Counsel and Secretary since December 2019. Before joining Intrepid, Mr. Smith served as General Counsel for an Alaska Native Claims Settlement Act Regional Corporation. Prior to that, Mr. Smith was in private practice from July 2017 to January 2019, served as Executive Vice President and General Counsel for Echo Energy, a start-up pure-play oil and gas operator from December 2016 to June 2017, and as Assistant General Counsel for Operations for Continental Resources, a large independent upstream producer, from June 2014 to June 2016.

E. Brian Stone has served as our Chief Operating Officer since December 2019. Prior to joining Intrepid, Mr. Stone was the Chief Operating Officer for Hupecol Operating Co. LLC, an international oil and gas company focused on South America and Europe, from 2005 to 2019.

Erica K. Wyatt has served as our Chief Human Resources Officer since December 2018. Ms. Wyatt previously served as Vice President of Human Resources from June 2015 to December 2018, Senior Director of Human Resources from 2013 to June 2015, and Director of Human Resources from 2007 to 2013. Prior to joining Intrepid, Ms. Wyatt held various positions at DISH Network Corporation, a pay-TV provider, from 1999 to 2007, including most recently Director of Human Resources supporting the field services division.

11

ITEM 1A. | RISK FACTORS |

You should carefully consider the following risk factors. Our future performance is subject to a variety of risks and uncertainties that could materially and adversely affect our business, financial condition, and results of operations, and the trading price of our common stock. We may be subject to other risks and uncertainties not presently known to us. See "Cautionary Note Regarding Forward-Looking Statements."

Risks Related to Our Business

Our potash sales are subject to price and demand volatility resulting from periodic imbalances of supply and demand, which could negatively affect our results of operations.

The market for potash is cyclical, and the prices and demand for potash can fluctuate significantly. Periods of high demand, increasing profits, and high-capacity utilization lead to new plant investment and increased production. This growth continues until the market is over-saturated, leading to decreased prices and lower-capacity utilization until the cycle repeats. We are currently experiencing an oversupplied potash market and expect these conditions to continue for several years. Also, individual potash producers have, at times, independently suspended production in response to market outlook. As a result of these factors, the prices and demand for potash can be volatile. This volatility can reduce profit margins and negatively affect our results of operations. We sell most of our potash into the spot market in the U.S. In addition, there is no active hedge market for potash as there is for many other commodities. As a result, we do not have protection from this price and demand volatility.

We are working to expand our sales of Trio®, and our sales and results of operations could be negatively impacted if we are unsuccessful in our plans.

One of our strategies is to continue to expand our sales of Trio® both domestically and internationally. Our expansion efforts may not be successful, which would temper any Trio® sales growth. With respect to international sales, it is difficult to determine if or how international demand and pricing for Trio® may develop. Our international sales often result in lower gross margins than domestic sales due to higher costs. These costs could include higher transportation costs, importation costs, and costs associated with duties, trade requirements, or other import or export control laws and regulations. We also face price pressure and competition in some international markets where substitutes are more prevalent. Any of these items could negatively impact our results of operations. In addition, international sales may occur on an irregular basis, which could cause volatility in our inventories and our results of operations. See also "International sales could present risks to our business."

We may not be successful in our efforts to sustain or expand water sales due to challenges to our water rights, changes in the demand for water in the areas around our facilities, or other events, which could adversely impact our financial condition and results of operations.

We have water rights in New Mexico under which we sell water primarily for industrial uses such as in the oil and gas services industry. We continue to work to expand sales of water, especially to support oil and gas development in the Permian Basin near our New Mexico facilities. In May 2019, we acquired certain land, water rights, and other related assets from Dinwiddie Cattle Company. The land is comprised of fee, federal, and state acreage. If there are changes in state or federal regulations regarding oil and gas production or water usage, this could materially impact our ability to monetize our water rights. Third parties regularly challenge our applications for permits to sell water under our water rights. We may not be successful in these efforts. In many cases, sales of water require governmental permits or approvals. A decision to deny, delay, revoke, or modify a permit or approval could prevent us from selling water, increase the cost to provide water, or result in our having to refund prepayments that we have received for future water sales. If oil or gas prices decline, if oil and gas development in the Permian Basin decreases, or if demand for fresh water in the Permian Basin declines for other reasons, the demand for water under our water rights could be adversely affected. In addition, we could be required to expend capital to meet customer needs. Any of these events could adversely impact our financial condition and results of operations.

Water rights in New Mexico are subject to a stated purpose and place of use, and our water rights were originally issued for uses relating to our mining operations. To sell water under these rights for oil and gas development, we must apply for a permit from the OSE to change the purpose and/or place of use of the underlying water rights. The OSE reviews and makes a determination as to the validity of the right and if it determines the requested change will not negatively impact other valid interests, the OSE can issue a preliminary authorization for the change. The preliminary authorization allows for water sales to begin immediately, subject to repayment if the underlying water rights were ultimately found to be invalid. Third parties may protest the preliminary authorization at minimal cost and frequently do so. Once protested, the OSE is required to hold a hearing to determine if the preliminary authorization was appropriate. A significant portion our water sales are being made under preliminary authorizations issued by the OSE.

In February 2019, certain protestants filed an expedited inter se proceeding in New Mexico District Court as the adjudication court for the Pecos Stream System challenging the validity of our water rights relating to the Pecos River. In

12

August 2019, the parties stipulated to the jurisdiction of the adjudication court. To promote settlement, the adjudication court established a settlement schedule and ordered a trial date in August 2020 if the parties have not reached a settlement by that time. In the adjudication proceeding, the court is expected to make a determination as to the size of our Pecos River water rights. In addition, the Protestants are asking for unspecified monetary and injunctive relief, as well as attorneys' fees and costs, relating to our sale of water under these water rights and breach of contract claims. The OSE has temporarily stayed the hearing process until the adjudication process is complete. We continue to operate under the preliminary authorizations until the adjudication and hearing processes are complete.

We may face political and regulatory issues relating to the potential use of the maximum amount of our rights. However, we believe that our legal position with respect to the validity of our water rights is solid and that we will be able to meet our water commitments.

A decline in oil and gas drilling or a reduction in the use of potash in drilling fluids could increase our operating costs and decrease our revenue.

A portion of our revenue comes from the sale of water and potassium chloride for use in oil and gas development. A decline in oil and gas drilling, especially in the Permian Basin, could reduce our sales of water and potassium chloride. In addition, oil and gas developers are regularly looking for ways to use more produced, or recycled, water instead of fresh water in oil and gas development. Also, there are other products available that have some of the same clay-inhibiting properties as our potassium chloride. These alternative products could temporarily or permanently replace some of our sales of water or potassium chloride. We also have other oilfield product and service offerings, such as trucking services and brine products, the sales of which could be negatively impacted if oil and gas development declined.

We may alter or expand our operations or continue to pursue acquisitions, which could adversely affect our business if we are unable to manage any expansion or acquisition effectively.

We continue to look for opportunities designed to maximize the value of our existing assets, such as through increased production and sales of water, salt, and brine. For example, in 2019 we purchased water and real property assets in southeastern New Mexico, which we refer to as Intrepid South, in an effort to expand our water sales and other revenue from the oil and gas industry. We are also exploring ways to potentially monetize the known but small lithium resource in our Wendover ponds. In addition, we may enter into new or complementary businesses that expand our product offerings beyond our existing assets. For example, we may expand into oil and natural gas exploration and production or into new products or services in our current industry or other industries. We may not be able to successfully implement any alteration or expansion initiatives. Further, we may not be able to fully realize any anticipated benefits of these initiatives. Any expansion initiatives may require significant capital investments and those investments may not produce the expected benefits.

As part of this growth strategy, we may consider the acquisition of other companies or assets that complement or expand our business. We may not be able to successfully identify suitable acquisition opportunities, prevail against competing potential acquirers, negotiate appropriate acquisition terms, obtain necessary financing, complete proposed acquisitions, successfully integrate acquired businesses or assets into our existing operations, or expand into new markets. An acquisition may require us to use a significant portion of available cash or may result in significant dilution to our stockholders. We may be required to assume unanticipated liabilities or contingencies as part of an acquisition, or we may face substantial costs, delays, or other problems as part of the integration process. In addition, acquired businesses or assets may not achieve the desired effects or otherwise perform as we expect. We may not realize the synergies that we expect to achieve. Additionally, while we execute these acquisitions and related integration activities, our attention may be diverted from our ongoing operations, which could have a negative impact on our business.

Any of these items could negatively impact our financial condition and results of operations. See “-Our acquisition of Intrepid South may not achieve the intended results or anticipated cost and operational synergies, which could negatively impact us.”

Our acquisition of Intrepid South may not achieve the intended results or anticipated cost and operational synergies, which could negatively impact us.

In 2019, we purchased water and real property assets from Dinwiddie Cattle Company in southeastern New Mexico in an effort to expand our water sales and other revenue from the oil and gas industry. The success of the acquisition of Intrepid South will depend, in part, on our ability to realize anticipated cost and operational synergies. However, the acquisition may not produce the expected benefits, or we may not realize the synergies that we expect to achieve. Our success in realizing these cost synergies, and the timing of this realization, depends on our ability to expand our water sales and other revenue from the oil and gas industry. Even if we are able to integrate the acquired assets and operations successfully, this integration may not result in the realization of the full benefits of the cost and operational synergies that we currently expect within the anticipated time frame, or at all.

13

Current and future indebtedness could adversely affect our financial condition and impair our ability to operate our business.

As of December 31, 2019, we had outstanding $50 million aggregate principal amount of senior notes. We also have $19.8 million outstanding under a revolving credit facility that allows us to borrow up to $75 million, as of December 31, 2019. We may incur additional indebtedness in the future. The agreements governing the senior notes and credit facility restrict, but do not prohibit, us from incurring additional indebtedness.

Current and future indebtedness could have important consequences, including the following:

• | it could limit our ability to borrow additional money or sell additional shares of common stock to fund our working capital, capital expenditures, and debt service requirements |

• | it could limit our flexibility in planning for, or reacting to, changes in our business |

• | we could be more highly leveraged than some of our competitors, which could place us at a competitive disadvantage |

• | it could make us more vulnerable to a downturn in our business or the economy |

• | it could require us to dedicate a substantial portion of our cash flows from operations to the repayment of our indebtedness, thereby reducing the availability of our cash flows for other purposes |

• | it could adversely affect our business and financial condition if we default on or are unable to service our indebtedness, are unable to refinance such indebtedness on favorable terms or are unable to obtain additional financing, as needed |

Our debt agreements contain financial and other restrictive covenants. For example, the agreements include financial covenants that require us to maintain a minimum fixed charge coverage ratio and a maximum leverage ratio (as these ratios are defined under the agreements). Also, the interest rates under the notes may be adjusted quarterly subject to our financial performance and certain financial covenant levels and we may be subject to higher interest rates. For more information about these financial covenants, see Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources."

These covenants could limit our ability to engage in activities that are in our long-term best interests. Our failure to comply with these covenants would result in an event of default that, if not waived, could result in the acceleration of all outstanding indebtedness. The senior notes and credit facility are variously secured by substantially all of our assets. As such, an event of default could also result in our lenders foreclosing on some or all of our assets.

The credit facility expires in 2024 and the senior notes are due in 2020, 2023, and 2025. In the future, we may be unable to obtain new financing or refinancing on acceptable terms.

Despite our current level of indebtedness, we may incur more debt and undertake additional obligations. Incurring such debt or undertaking such additional obligations could further exacerbate the risks to our financial condition.

Although the agreements governing our indebtedness contain restrictions on our incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions and the indebtedness incurred in compliance with these restrictions could increase. To the extent new debt is added to our current debt levels, the risks to our financial condition would increase.

While the agreements governing our indebtedness also contains restrictions on our ability to make loans and investments, these restrictions are subject to a number of qualifications and exceptions, and the investments incurred in compliance with these restrictions could be substantial.

The proposed phase out of the London Interbank Offered Rate ("LIBOR") could adversely affect our financial results.

Borrowings under our revolving credit facility bear interest at LIBOR plus an applicable margin. In July 2017, the United Kingdom's Financial Conduct Authority (the authority that regulates LIBOR) announced that it intends to phase out LIBOR by the end of 2021. The Alternative Reference Rates Committee (“ARRC”) has proposed that the Secured Overnight Financing Rate (“SOFR”) is the rate that represents best practice as the alternative to USD-LIBOR for use in derivatives and other financial contracts that are currently indexed to USD-LIBOR. ARRC has proposed a paced market transition plan to SOFR from USD-LIBOR and organizations are currently working on industry wide and company specific transition plans as it relates to derivatives and cash markets exposed to USD-LIBOR. The agreement governing our revolving credit facility is indexed to USD-LIBOR and we are monitoring this activity and evaluating the related risks. In September 2019, the FASB proposed guidance that would help facilitate the market transition from existing reference rates to alternative rates. However, at this time, it is not possible to predict the effect of any such changes, any establishment of alternative reference rates or any other reforms to LIBOR that may be enacted in the United Kingdom or elsewhere. Uncertainty as to the nature of such potential changes, alternative reference rates or other reforms may adversely affect the trading market for LIBOR-based

14

securities, including certain of our debt that is indexed to USD-LIBOR. Furthermore, we may need to renegotiate any debt agreements extending beyond 2021 that utilize LIBOR as a factor in determining the interest rate to replace LIBOR with the new standard that is established. There is currently no definitive information regarding the future utilization of LIBOR or of any particular replacement rate. As such, potential effect of any such event on our business, financial condition and results of operations cannot yet be determined.

Aggressive pricing or operating strategies by our competitors could adversely affect our sales and results of operations.

The potassium-fertilizer industry is concentrated, with a small number of producers accounting for the majority of global production. Many of these producers have significantly larger operations and more resources than we do. These larger producers may have greater leverage in pricing negotiations with customers and transportation providers. They also have a broader product portfolio, which may allow them to offer rebates or bundle products to offer discounts or incentives to gain a competitive advantage. They may also be able to mine their potash or langbeinite at a lower cost due to economies of scale or other competitive advantages. In addition, they may decide to pursue aggressive pricing or operating strategies that disrupt the global and U.S. markets. These disruptions could cause lower prices or demand for our product, which would adversely affect our sales and results of operations.

Changes in the agricultural industry could exacerbate the cyclical nature of the prices and demand for our products or adversely affect the markets for our products.

Farmers attempt to apply the optimum amounts of fertilizer to maximize their economic returns. A farmer's decision about the application rate for each fertilizer, or the decision to forgo the application of a fertilizer, particularly potash and Trio®, varies from year to year depending on a number of factors. These factors include crop types, crop prices, weather patterns, fertilizer and other crop input costs, and the level of crop nutrients remaining in the soil following the previous harvest. Farmers are more likely to increase application rates of fertilizers when crop prices are relatively high, fertilizer and other crop input costs are relatively low, or the level of crop nutrients remaining in the soil is relatively low. Conversely, farmers are likely to reduce application of fertilizers when farm economics are weak or declining or the level of crop nutrients remaining in the soil is relatively high. This variability in application rates can impact the cyclical nature of the prices and demand for our products. In addition, farmers may buy and apply potash or Trio® in excess of current crop needs, which results in a build-up of potassium in the soil that can be used by crops in subsequent crop years. If this occurs, demand for our products could be delayed to future periods.

State and federal governmental policies, including farm and ethanol subsidies and commodity support programs, may also influence the number of acres planted, the mix of crops planted, and the use of fertilizers. In addition, there are various city, county, and state initiatives to regulate the use and application of fertilizers due to various environmental concerns. If U.S. agricultural production or fertilizer use decreased significantly due to one or more of these factors, our results of operations could be adversely affected.