Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

☒ ANNUAL REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For The

Year Ended: December 31, 2019

———————

ISSUER DIRECT CORPORATION

(Name of small business issuer in its charter)

———————

|

Delaware

|

|

1-10185

|

|

26-1331503

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

One Glenwood Avenue, Suite 1001, Raleigh, NC 27603

(Address of Principal Executive Office) (Zip Code)

(919) 481-4000

(Registrant’s telephone number, including area

code)

———————

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common

Stock, par value $0.001 per share

|

|

NYSE

American.

|

Securities registered pursuant to Section 12(g) of the

Act:

None

(Title of Class)

———————

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item

405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definition of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐ (Do not check if a smaller reporting

company)

|

Smaller

reporting company

|

☒

|

|

|

|

Emerging

growth company

|

☐

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Act). Yes ☐ No

☒

The

aggregate market value of the voting stock held by non-affiliates

of the registrant as of June 30, 2019, the last business day of the

registrant's second fiscal quarter, was approximately $43,260,762

based on the closing price reported on the NYSE American as of such

date.

As of

February 27, 2020, the number of outstanding shares of the

registrant's common stock was 3,786,398.

DOCUMENTS INCORPORATED BY REFERENCE

Portions

of the registrant’s definitive proxy statement relating to

its 2020 annual meeting of stockholders (the “2020 Proxy

Statement”) are incorporated by reference into Part III of

this Annual Report on Form 10-K where indicated. The 2020 Proxy

Statement will be filed with the U.S. Securities and Exchange

Commission within 120 days after the end of the year to which this

report relates.

Table of Contents

|

|

|

|

|

|

Description of Business

|

|

4

|

|

|

|

|

|

|

|

Risk Factors

|

|

11

|

|

|

|

|

|

|

|

Unresolved Staff Comments

|

|

19

|

|

|

|

|

|

|

|

Property

|

|

19

|

|

|

|

|

|

|

|

Legal Proceedings

|

|

19

|

|

|

|

|

|

|

|

Mine Safety Disclosures

|

|

19

|

|

|

|

|

|

|

|

|

|

|

|

|

Market for Common Equity and Related Stockholder

Matters

|

|

20

|

|

|

|

|

|

|

|

Select Financial Data

|

|

22

|

|

|

|

|

|

|

|

Management’s Discussion and Analysis and Results of

Operations

|

|

23

|

|

|

|

|

|

|

|

Quantitative and Qualitative Disclosures About Market

Risk

|

|

30

|

|

|

|

|

|

|

|

Financial Statements and Supplementary Data

|

|

30

|

|

|

|

|

|

|

|

Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure

|

|

30

|

|

|

|

|

|

|

|

Controls and Procedures

|

|

30

|

|

|

|

|

|

|

|

Other Information

|

|

31

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers, and Corporate

Governance

|

|

32

|

|

|

|

|

|

|

|

Executive Compensation

|

|

32

|

|

|

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

|

32

|

|

|

|

|

|

|

|

Certain Relationships and Related Transactions, and Director

Independence

|

|

32

|

|

|

|

|

|

|

|

Principal Accountant Fees and Services

|

|

32

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibits

|

|

33

|

|

|

|

|

|

|

|

|

Signature

|

|

33

|

|

|

|

|

|

|

EX-21.1

|

Subsidiaries of the Registrant

|

|

|

|

|

|

|

|

|

EX-23.1

|

Consent of Independent Registered Public Accounting

Firm

|

|

|

|

|

|

|

|

|

EX-31.1

|

Chief Financial Officer Certification Pursuant to Section

302

|

|

|

|

|

|

|

|

|

EX-31.2

|

Chief Financial Officer Certification Pursuant to Section

302

|

|

|

|

|

|

|

|

|

EX-32.1

|

Chief Executive Officer Certification Pursuant to Section

906

|

|

|

|

|

|

|

|

|

EX-32.2

|

Chief Financial Officer Certification Pursuant to Section

906

|

|

|

|

|

|

|

|

|

EX-101.INS

|

XBRL INSTANCE DOCUMENT

|

|

|

|

EX-101.SCH

|

XBRL TAXONOMY EXTENSION SCHEMA

|

|

|

|

EX-101.CAL

|

XBRL TAXONOMY EXTENSION CALCULATION LINKBASE

|

|

|

|

EX-101.DEF

|

XBRL TAXONOMY EXTENSION DEFINITION LINKBASE

|

|

|

|

EX-101.LAB

|

XBRL TAXONOMY EXTENSION LABEL LINKBASE

|

|

|

|

EX-101.PRE

|

XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE

|

|

|

CAUTIONARY STATEMENT

All

statements, other than statements of historical fact, included in

this Form 10-K, including without limitation the statements under

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Description

of Business,” are, or may be deemed to be, forward-looking

statements. Such forward-looking statements involve assumptions,

known and unknown risks, uncertainties and other factors, which may

cause the actual results, performance or achievements of Issuer

Direct Corporation, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements contained in this Form

10-K.

In our

capacity as Company management, we may from time to time make

written or oral forward-looking statements with respect to our

long-term objectives or expectations which may be included in our

filings with the Securities and Exchange Commission (the

“SEC”), reports to stockholders and information

provided in our web site.

The

words or phrases “will likely,” “are expected

to,” “is anticipated,” “is

predicted,” “forecast,” “estimate,”

“project,” “plans to continue,”

“believes,” or similar expressions identify

“forward-looking statements.” Such forward-looking

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from historical

earnings and those presently anticipated or projected. We wish to

caution you not to place undue reliance on any such forward-looking

statements, which speak only as of the date made. We are calling to

your attention important factors that could affect our financial

performance and could cause actual results for future periods to

differ materially from any opinions or statements expressed with

respect to future periods in any current statements.

The

following list of important risk factors is not all-inclusive, and

we specifically decline to undertake an obligation to publicly

revise any forward-looking statements that have been made to

reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated

events. Among the factors that could have an impact on our ability

to achieve expected operating results and growth plan goals and/or

affect the market price of our stock are:

●

Dependence on key

personnel.

●

Fluctuation in

quarterly operating results related to transaction-based

revenue.

●

Our ability to

successfully integrate and operate acquired or newly formed

entities, ventures and or subsidiaries.

●

Changes in laws and

regulations that affect our operations and demand for our products

and services.

Available Information

Our

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q,

Financial Data in XBRL, Current Reports on Form 8-K, proxy

statements and amendments to those reports filed or furnished

pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act

of 1934, as amended, are available, free of charge, in the investor

relations section of our website at

www.issuerdirect.com.

The SEC

maintains an Internet site that contains reports, proxy and

information statements and other information regarding issuers that

file electronically with the SEC at www.sec.gov. The public may

read and copy any materials we file with the SEC at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.

The public may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330.

PART I

ITEM 1. DESCRIPTION OF

BUSINESS.

Company Overview

Issuer

Direct Corporation and its subsidiaries are hereinafter

collectively referred to as “Issuer Direct”, the

“Company”, “We” or “Our” unless

otherwise noted). Our corporate offices are located at One Glenwood

Ave., Suite 1001, Raleigh, North Carolina, 27603.

We

announce material financial information to our investors using our

investor relations website, SEC filings, investor events, news and

earnings releases, public conference calls, webcasts and social

media. We use these channels to communicate with our investors and

the public about our company, our products and services and other

related matters. It is possible that information we post on some of

these channels could be deemed to be material information.

Therefore, we encourage investors, the media and others interested

in our company to review the information we post to all of our

channels, including our social media accounts.

Issuer Direct® is a premier provider of

communications and compliance technology solutions that are

designed to help organizations tell their stories globally. Issuer

Direct's principal platform, Platform id.™, empowers users by thoughtfully

integrating the most relevant tools, technologies and products,

thus eliminating the complexity associated with producing and

distributing their business communications and financial

information.

We work with a diverse customer base, which

includes not only corporate issuers and private companies, but also

investment banks, professional firms, such as investor relations

and public relations firms, as well as the accounting and legal

communities. We also sell products and services to others in the

financial services industry, including brokerage firms and mutual

funds. Our customers and their service providers utilize

Platform id.

and related solutions from document

creation all the way to dissemination to regulatory bodies, news

outlets, financial platforms and their shareholders. Private

companies primarily use our news distribution and webcasting

products and services to disseminate their message globally.

Platform id.’s intelligent subscription platform guides

thousands of customers through the process of communicating their

message to a large audience.

We also work with several select stock exchanges

by making available certain parts of our platform

under agreements to integrate our

offerings within their products. We believe such partnerships will

yield increased exposure to a targeted customer base that could

impact our revenue and overall brand in the

market.

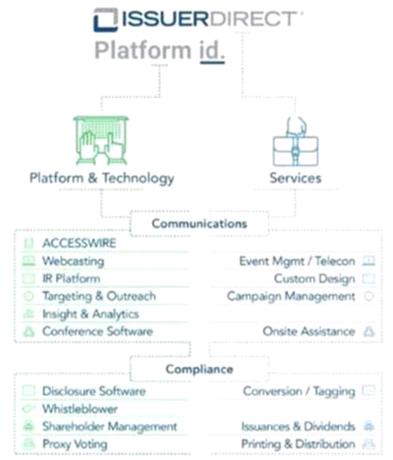

In order to provide a good representation of our

business and reflect our platform first

engagement strategy, we report revenue

in two revenue streams: (i) Platform and Technology and (ii)

Services. Set forth below is an infographic depicting the modules

included in Platform id.

and the services we

provide:

4

Platform and Technology

As our cloud-based subscription business continues

to mature, we expect the Platform and Technology portion of our

business to continue to increase over the next several years, both

in terms of overall revenue and as compared to the Services portion

of our business. Platform and Technology revenue grew to 66% of

total revenue during 2019, compared to 60%, 56% and approximately

44% of our revenue for the years ending December 31, 2018, 2017 and

2016, respectively. In 2019, growth in our Platform &

Technology revenue stream was led by the acquisition of the

VisualWebcaster Platform (“VWP”) in our webcasting

business as well as increased subscriptions of Platform

id.

as a result of our focus on a

platform

first engagement strategy and

converting customers which historically relied on us for services

work to utilizing Platform id. While our ACCESSWIRE® news distribution offering

showed some overall growth in 2019, it had represented a majority

of the year over year growth in our Platform and Technology revenue

for fiscal years 2017 and 2018.

We plan to continue to invest in both our current

Platform id.

offerings as well as additional

offerings that we intend to incorporate into our Platform and

Technology offerings. These new offerings will further help

establish Platform id.

and our strategy of bringing the

issuer and investor closer together. One offering is helping public

issuers better understand the shareholder composition of their

company, which we believe is an area that is underserved by the

market today.

Platform id.

Platform id.

is our cloud-based subscription

platform that efficiently and effectively helps our customers

manage their events when seeking to distribute their messaging to

key constituents, investors, markets and regulatory systems around

the globe. Platform id.

consists of several related but

distinct shareholder communications and compliance modules that

public companies utilize every quarter when they have requirements

to meet reporting obligations as well as fair disclosure to the

markets.

5

Within most of our target markets, customers

require several individual services and/or software providers to

meet their investor relations, communications and compliance needs.

We believe Platform id.

can address all of these needs in a

single, secure, cloud-based platform - one that offers a customer

control, increases efficiencies, demonstrates clear value and, most

importantly, delivers consistent and compliant messaging from one

centralized platform.

Communications Modules

ACCESSWIRE

Our press release offering, which is marketed

under the brand ACCESSWIRE, is a cost-effective, Regulation Fair Disclosure

(“FD”) news dissemination and media outreach service.

The ACCESSWIRE product offering focuses on press release

distribution for both private and public companies globally. We

believe ACCESSWIRE is becoming a competitive alternative to the

traditional newswires because we have been able to integrate

customer editing features and improve the targeting and growing

analytics reporting systems as well as increase its dissemination

distribution footprint. We believe this strategy will enable us to

add new customers for 2020 and beyond. We have also been able to

maintain flexible pricing by offering our customers the option to

pay per release or enter into longer-term, flat-fee subscriptions.

Currently, ACCESSWIRE is available within Platform

id.

as part of a subscription, or as a

stand-alone module.

On July 3, 2018, we completed the acquisition of

Filing Services Canada Inc. (“FSCwire”), which not only

increased our customer base, but more importantly increased the

global footprint, distribution capabilities and editorial team of

our press release business. During the latter part of 2018, we

completed the integration of FSCwire and rebranded it as ACCESSWIRE

Canada, and are now focused on offering those customers the full

suite of products included in Platform id.

ACCESSWIRE

is dependent upon several key partners for news distribution, some

of which are also partners that we rely on for other investor

outreach offerings. During the second quarter of 2019, one of our

key partners made an industry-wide decision to no longer accept

investor commentary content. A significant portion of our

historical ACCESSWIRE revenue was generated from this type of

content, as further discussed in the Results of Operations below.

As part of our efforts to expand our customer base during the

second half of 2018, we began to market ACCESSWIRE more heavily

towards public and private company news issuers, which we believe

will mitigate the impact of the loss of the investment commentary

content long-term. Absent of the investment commentary business,

our ACCESSWIRE news business grew 44% during 2019 compared to the

prior year. Further disruption in any of our partnerships could

have a materially adverse impact on our ACCESSWIRE and overall

business.

Professional Conference Organizer (PCO) Module

At the end of 2018, we released a new module to

Platform id., centered around the professional conference

organizer (“PCO”). This subscription is being

licensed to investor conference organizers, which in the aggregate

we believe hold an estimated 1,000 plus events a year. This

cloud-based product is integrated within Platform id. and enhances our

communications module subscription offerings of newswire,

newsrooms, webcasting and shareholder targeting.

This

cloud-based platform, which is now available as a mobile app,

offers organizers, issuers and investors the ability to register,

request and approve one-on-one meetings, manage schedules, perform

event promotion and sponsorship, print attendee badges and manage

lodging. By combining this module with the other components of

Platform id.

(particularly webcasting and newswire modules), we believe it gives

us a unique offering for PCOs that is not available elsewhere in

the market.

We

believe entering this business expands our current Platform and

Technology revenue base, and as an adjacency, should assist in

making Platform id.

an platform of choice for investment banks, issuers and

investors.

Investor Network

Over the past few years, we have been focused on

refining the model of digital distribution of our customers’

message to the investment community and beyond. This is being

accomplished by integrating our shareholder outreach module,

Investor Network, into and with Platform id.

Most of the customers subscribing to

this module today are historical PrecisionIR (“PIR”)

– Annual Report Service (“ARS”) users, as well as

new customers purchasing the entire Platform id.

subscription. We have migrated some of

the customers from the traditional ARS business into this new

digital subscription business. However, there can be no assurances

these customers will continue using this digital platform in the

long term if market conditions or shareholder interest is not

present.

6

Webcasting

The earnings event industry is a highly

competitive space with the majority of the business being driven

from practitioners in investor relations and communications firms.

We estimate there are over 5,000 companies in North America

conducting earnings events each quarter that include a

teleconference, webcast or both as part of their events.

Platform id. also

incorporates other elements of the

earnings event, including earnings date/call announcement, earnings

press release and SEC Form 8-K filings. There are a handful of our

competitors that can offer this integrated full service solution

today. However, we believe our real-time event setup and integrated

approach offers a more effective way to manage the process as well

as attract an audience of investors.

We have also attempted to differentiate our

offering by investing time and financial resources developing and

integrating systems and processes within Platform

id.

and creating an application

programming interface (“API”). This API allows

customers, such as financial content sites and investment banks, to

query an industry or a single company’s current and past

earnings calls and present those webcasts on their

platforms. Initially, this has

been broadly distributed via our Investor Network platform, with

expectations that customers will license this dataset for their

platforms in the future. We believe this offering will further

increase our brand awareness.

Additionally,

as a commitment to broadening the reach of our webcast platform,

all events are broadcast live within our shareholder outreach

module, which helps drive new audiences and give companies the

ability to view their analytics and engagement of each event. We

believe these analytics, which will be a component of our Insight

and Analytics module, will increase the demand for our webcasting

platform among the corporate issuer community.

On

January 3, 2019, we acquired VWP from Onstream Media Corporation.

VWP is a leading cloud-based webcast, webinar and training platform

that delivers live and on-demand streaming of events to audiences

of all sizes. VWP allows customers to create, produce and deliver

events, which we feel integrates well into Platform id. We believe by acquiring VWP

we have significantly strengthened our webcasting product and

Platform id.

offering as well as acquired over 120 customers, ranging from small

private companies to Fortune 500 companies. The VWP technology

enables us the ability to host thousands of additional webcasts

each year, expanding and diversifying our webcast business from our

historical earnings based events to include corporate meetings,

training sessions and town hall type events. As we expand our

platform, it is vital for us to have solutions that service both

our core public companies but also a growing segment of private

customers.

Investor Relations Content

Our investor relations content network is another

component of Platform id., which is used to create the investor

relations’ tab of a company’s website. This investor

relations content network is a robust series of data feeds

including news feeds, stock feeds, fundamentals, regulatory

filings, corporate governance and many other components which are

aggregated from a majority of the major exchanges and news

distribution outlets around the world. Customers can subscribe to

one or more of these data feeds or as a component of a fully

designed and hosted website for pre-IPO companies, SEC reporting

companies and partners seeking to display our content on their

corporate sites. The clear benefit to our investor relations module

is its integration into Platform id.

As such, companies can produce content

for public distribution and it is automatically linked to their

corporate website, distributed to targeted groups and placed into

our data feed partners.

Compliance Modules

Platform id.’s disclosure reporting module is a document

conversion, editing and filing offering which is designed for

reporting companies and professionals seeking to insource the

document drafting, editing and filing processes to the SEC’s

EDGAR system. This module is available in both a secure public

cloud within our Platform id.

subscription as well as in a private

cloud option for corporations, mutual funds and the legal community

looking to further enhance their internal document process. As this

module has begun to be adopted by our customers, we have seen a

negative impact on our legacy disclosure conversion services

business. However, the margins associated with our Platform and

Technology business compared to our Services business are higher

and align with our long-term strategy, and as such, we believe this

module will have a positive impact on our compliance business going

forward.

Toward the end of 2017, we completed upgrades to

our disclosure reporting product to include tagging functionality

that meets newly mandated SEC requirements. On June 28, 2018, the

SEC voted to adopt rules mandating the use of Inline XBRL (Inline

Extensible Business Reporting Language or “iXBRL”) for

the submission of financial statement information to the SEC. The

new requirements for iXBRL have a three-year phase in which began

for large accelerated filers that use U.S. GAAP on June 15, 2019,

and will begin for all other accelerated filers to begin reporting

for fiscal periods ending on or after June 15, 2020 and for all

other filers to begin reporting for fiscal periods ending on or

after June 15, 2021. These upgrades also include meeting new SEC

mandates for foreign filers that compile financial statements using

International Financial Reporting Standards (“IFRS”) to

be able to utilize our cloud-based platform. Beginning in 2018,

foreign filers with fiscal year’s ending on or after December

15, 2017, are now required to report their financial statements in

XBRL with the SEC. Platform id.

has adopted the new IFRS taxonomy into

and with its new disclosure upgrade for iXBRL to ensure our

customers are able to meet these new mandates.

7

Our whistleblower module is an add-on product

within Platform id.

This system delivers secure

notifications and basic incident workflow management processes that

align with a company’s corporate governance whistleblower

policy. As a supported and subsidized bundle product of the New

York Stock Exchange (“NYSE”) offerings, we are able to

gain relationships with new IPO customers and other larger cap

customers listed on the NYSE.

A valued subscription add-on in our

Platform id.

offering is the ability for our

customers to gain access to real-time information about their

shareholders, stock ledgers and reports and to issue new shares

from our cloud-based stock transfer module. Managing the

capitalization table of a public company or pre-IPO company is a

cornerstone of corporate governance and transparency, and as such

companies and community banks have chosen us to assist with their

stock transfer needs, including bond offerings and dividend

management. This is an industry which has experienced declining

overall revenues as it was affected by the replacement of paper

certificates with digital certificates. However, we have been

focused on selling subscriptions of the stock transfer component of

our platform, allowing customers to gain access to our cloud-based

system in order to move shares or query shareholders, which we

believe has resulted in a more efficient process for both our

customers and us.

Our

proxy module is marketed as a fully integrated, real-time voting

platform for our customers and their shareholders of record. This

module is utilized for every annual meeting or special meeting we

manage for our customers and offers both full-set mailing and

notice of internet availability options.

Services

As we focus on expanding our cloud-based

subscription business, we expect to see decreases in the overall

revenues associated with our Services business, absent additional

acquisitions which may occur in the future. Typically, Services

revenues relate to activities where substantial resources are

required to perform the work for our customers and/or hard goods

are utilized as part of the engagement. To date, most of our

Services have been related to converting and editing SEC documents

and XBRL tagging, which has been our core disclosure business over

the last 13 years, and completing SEDAR (the Canadian equivalent of

EDGAR) filings. Services also include telecommunications services

and print, fulfillment and delivery of stock certificates, proxy

materials or annual reports depending on each customer’s

engagement. Services are not required, but are optional for

customers that utilize our Platform id.

and are invoiced as

used.

Our investor outreach and engagement offering,

formerly known as ARS, was acquired from PIR in 2013. The ARS

business has existed for over 20 years primarily as a physical hard

copy delivery service of annual reports and prospectuses. We

continue to operate a portion of this legacy system for customers

who opt to take advantage of physical delivery of material.

Additionally, we continue to attempt to migrate the install base

over to subscriptions of our digital outreach engagement module

within Platform id.

We believe we will continue to see

further attrition of both customers and revenues in this category

as we focus our efforts on our Platform and Technology

business.

Our overall strategy includes:

Expansion of Current Customers

We

expect to continue to see demand for our products within our

customer base. As we continue to transition from a services

oriented business, our focus is to migrate customer contracts over

to subscription-based contracts for our entire Platform

id. offering. We

believe this will help us move from a transaction based revenue

model to a recurring subscription-based revenue model, which may

give us more consistent, predictable revenue patterns and hopefully

creates longer lasting customer relationships. Additionally, as

part of our customer expansion efforts, we are committed to working

beyond the single point of contact and into the entire C suite

(CEO, CFO, IRO, Corporate Secretary, etc.) of an organization which

we believe will help drive

subscription revenues.

Focus on Organic Growth

Our

primary growth strategy continues to be selling our cloud-based

offerings via Platform

id.

to new customers under a subscription arrangement, whereas in the

past we were inclined to sell a single point solution. Selling a

subscription of Platform id. allows us to provide our

customers with a competitively priced, complete solution for their

communications and compliance needs. Our strategy of selling our

cloud-based offerings via Platform id. to all customers under a

subscription agreement should benefit us by moving away from

selling individual solutions within highly commoditized markets

that are experiencing pricing pressures.

8

New Offerings

During

2020 and going forward, we will continue to innovate, improve and

build new applications into and with our platform, with the

ultimate objective of developing applications in combination, that

are not offered by our competitors. As a company focused on

technology offerings, we understand the importance of advancements

and fully appreciate the risks and consequences of losing our

market position - a very common mistake many technology companies

have made. The pursuit of technological innovation is and has been

a part of our overall strategy as an organization over the last

several years.

Each

year we bring to market certain platform upgrades, add-ons, and new

offerings that we believe will round out our overall platform

solutions. We believe our innovation and technological efficiencies

continue to be a competitive advantage and focus for

us.

Part of

our continued strategy from 2019 is to bring to market our insight

and analytics engine for our Platform id. product offering, which we

began testing with a close group of professionals and customers in

late 2018. The insights and analytics component of Platform

id. will give our

customers the ability to see shareholder and investor engagement

from the source, (i.e. at a conference, road show, earnings event,

corporate website, Investor Network, affiliate networks and

thousands of distribution points from our already robust news

distribution network.), which we believe will enable them to better

assess the effectiveness of investor outreach programs and target

potential investors more effectively. This module’s success

relies on access to raw historical data, from both our customers

and investors in order to tie together patterns and insights. Being

in the conference business, adding improved IR tools and selling

subscriptions are all the right steps in order to gather this data

to run through our engines and analytics systems. We believe we

have gathered enough data for the analysis to be meaningful and

plan to make this module available in 2020.

Acquisition Strategy

We will

continue to evaluate complimentary verticals and systems that we

can integrate well into our current platforms. These opportunities

typically need to be accretive and consistent with what we have

done in the past. We will continue to maintain our product and

technology focus, so it is likely we will look for acquisitions in

areas we currently generate revenues and/or see clear opportunities

to leverage our strengths to disrupt existing markets. In these

potential transactions, we will look for recurring long-term

revenues, customers, and leading technologies that will further

enhance our overall market position.

Sales and Marketing

During

2020, we will continue to strengthen our brands in the market by

working aggressively to expand our new customer footprint and

continue to cross sell to increase average revenue per user. Since

our platform, systems and operations are built to handle growth, we

can leverage them to produce consistently high margins and

increased cash flows without a proportional increase in our capital

or operating expenses.

Our

sales organization is responsible for generating new customer

opportunities and expanding our current customers. We ended 2019

with a multi-tier organization of sales personnel, made up of

Strategic Account Managers and Business Development Managers. We

believe this structured approach is the most efficient and

effective way to reach new customers and also grow our current

install base. The total compensation packages for these teams are

heavily weighted with commission compensation to incent sales. All

members of the team have sales quotas. As of December 31, 2019, we

employed 20 full-time equivalent sales personnel compared to 16 as

of December 31, 2018. During the first quarter of 2020, we have

also created a new inbound digital sales and marketing group to

manage all inbound leads, e-commerce and digital marketing focused

on the portions of our platform we believe can be purchased

online.

Our

marketing organization has been focused on both new customer

acquisition as well as campaigns to educate current customers on

the advantages of our entire Platform id. Additionally, our marketing

team has expanded their focus on investor conferences, strategic

exchange partnerships and private company marketing activities in

order to continue to scale our business long term.

Additionally, our

management team plays a critical role in our sales process,

assisting the organization and customers with new offerings, cross

selling opportunities and channel development; because our overall

organization is small, we benefit from this approach and believe

this is key to our future success.

9

Technology and Security

We will

continue to make investments in our technology as we transition our

business from a historically service-oriented business to a

cloud-based subscription organization. In all of our offerings,

quality, support, and scalability as well as the need to preserve

the confidential content of our customers are of utmost importance

and part of our core values.

Since

2018, we continue to maintain agreements with security consulting

firms to identify, address and create policies and plans which

enable us to mitigate our cybersecurity and information

vulnerabilities on both a short-term and long-term basis. We

believe having a strong cyber and information security policy is

not only necessary to maintain our current business model but also

important to attract new customers. We plan to continue to work

closely with these firms and others to ensure our security policies

meet our customers’ needs and requirements.

Industry Overview

Our

industry benefits from increased regulatory requirements and the

need for platforms and systems to manage these new regulations.

Additionally, the industry, along with cloud-based technologies,

have matured considerably over the past several years, whereby

corporate issuers and communication professionals are seeking

platforms and systems to do some, if not all the work themselves.

We believe we are well positioned in this new environment to

benefit from software licensing and further advancements of

Platform id.

The

business services industry as it relates to compliance and

communications is highly fragmented, with hundreds of independent

service companies that provide a range of financial reporting,

document management services and with a wide range of printing and

technology software providers. The demands for many of our services

historically have been cyclical and reliant on capital market

activity. Over the past few years, we have invested in several new

product offerings beyond our traditional compliance reporting and

transaction services business. We believe these new offerings will

afford us the ability to reduce our revenue seasonality and provide

a new baseline of recurring annualized contracts under our new

subscription-based business.

According to a 2018

Burton-Taylor Media Intelligence report, the global communications

technology market is $4.1+ billion in annual spend. This total

consists of spending on press releases, earnings events, engagement

and targeting and investor relations platforms globally. The key

drivers of growth in our industry relate to changing regulatory

requirements, new innovated platform technologies and typical

industry consolidations. We believe we have a significant

competitive advantage as a result of our technology and workflow

automation solutions.

Competition

Despite

some significant consolidation in recent years, our industry

remains both highly fragmented and extremely competitive. The

success of our products and services are generally based on price,

quality and the ability to service customer demands. Management has

been focused on offsetting these risks relating to competition as

well as the seasonality by introducing our cloud-based subscription

platforms, with higher margins, clear competitive advantages and

scalability to withstand market and pricing pressures.

We also

review our operations on a regular basis to balance growth with

opportunities to maximize efficiencies and support our long-term

strategic goals. We believe by blending our workflow technologies

with our legacy service offerings we are able to offer a

comprehensive set of products and solutions to each of our

customers within one platform that most competitors cannot offer

today.

We

believe we are positioned to be the public company platform of

choice as a cost-effective alternative to both small regional

providers and global providers. We also believe we benefit from our

location in Raleigh, North Carolina, as we do not experience

significant competition for sales, customer service, or production

personnel.

Customers

Our

customers include a wide variety of public and private companies,

mutual funds, law firms, brokerage firms, investment banks,

individuals, and other institutions. For the year ended December

31, 2019, we worked with 2,169 publicly traded customers and 2,691

private customers, compared to 2,103 publicly traded customers and

2,265 private customers for the year ended December 31, 2018. We

did not have any customers during the year ended December 31, 2019

that accounted for more than 10% of our revenue or more than 10% of

our year end accounts receivable balance as of December 31,

2019.

10

Employees

As of

December 31, 2019, we employed seventy-nine employees and engaged

six independent contractors, none of which are represented by a

union. Our employees work in our corporate offices in North

Carolina and in other offices throughout North

America.

Facilities

Our

headquarters are located in Raleigh, North Carolina. In October

2019, we began a new lease for 9,766 square feet of office space,

which expires December 31, 2027. As part of our acquisition of VWP,

we assumed a three-year lease for an office in Ft. Lauderdale,

Florida and a short term lease for an office in New York City, New

York. Additionally, we have an office in Salt Lake City, Utah which

is also on a short term lease.

Insurance

We

maintain both a general business liability policy and an errors and

omissions policy specific to our industry and operations. We

believe that our insurance policies provide adequate coverage for

all reasonable risks associated with operating our business.

Additionally, we maintain a Directors and Officers insurance

policy, which is standard for our industry and size. We also

maintain key person life insurance on our C level executives, and

other key individuals.

Regulations

The

securities and financial services industries generally are subject

to regulation in the United States and elsewhere. Regulatory

policies in the United States and the rest of the world are tasked

with safeguarding the integrity of the securities and financial

markets with protecting the interests of both issuers and

shareholders.

In the

United States, corporate issuers are subject to regulation under

both federal and state laws, which often require public disclosure

and regulatory filings. At the federal level, the SEC regulates the

securities industry, along with the Financial Industry Regulatory

Authority, or FINRA, formally known as NASD, and NYSE market

regulations, various stock exchanges, and other self-regulatory

organizations (“SRO”).

In the

European Union (EU), the securities and reporting authorities tend

to be based on exchanges as well as individual country disclosure

requirements. We currently work with our stock exchange partners to

deliver our solutions. We believe this is the best approach as this

market is highly complex and divided in comparison to our North

American markets.

We

operate our filing agent business and transfer agent business under

the supervision and regulations of the SEC.

Our

transfer agency business, Direct Transfer, LLC, is subject to

certain regulations, which are governed, without limitation by the

SEC, with respect to registration with the SEC, annual reporting,

examination, internal controls, tax reporting and escheatment

services. Our transfer agency is currently approved to handle the

securities of NYSE, NASDAQ and OTC securities.

Our

mission is to assist corporate issuers with these regulations,

communication and compliance of rules imposed by regulatory bodies.

The majority of our business involves the distribution of content,

either electronically or on paper, to governing bodies and

shareholders alike. We are licensed under these regulations to

disseminate, communicate and or solicit on behalf of our customers,

the issuers.

ITEM 1A. RISK FACTORS.

Forward-Looking and Cautionary Statements

Investing in our

common stock involves a high degree of risk. Prospective investors

should carefully consider the following risks and uncertainties and

all other information contained or referred to in this Annual

Report on Form 10-K before investing in our common stock. The risks

and uncertainties described below are not the only ones facing us.

Additional risks and uncertainties that we are unaware of, or that

we currently deem immaterial, also may become important factors

that affect us. If any of the following risks occur, our business,

financial condition or results of operations could be materially

and adversely affected. In that case, the trading price of our

common stock could decline, and you could lose some or all of your

investment.

11

Risks related to our business

Legislative and regulatory changes can influence demand for our

solutions and could adversely affect our business.

The

market for our solutions depends in part on the requirements of the

SEC and other regulatory bodies. Any legislation or rulemaking

substantially affecting the content or method of delivery of

documents to be filed with these regulatory bodies could have an

adverse effect on our business. In addition, evolving market

practices in light of regulatory developments could adversely

affect the demand for our solutions. Uncertainty caused by

political change in the United States and European Union

(particularly Brexit) heightens regulatory uncertainty in these

areas. For example, the White House and Congressional leadership

have publicly announced a goal of repealing or amending parts of

the Dodd Frank Act, as well as certain regulations affecting the

financial services industry. New legislation, or a significant

change in rules, regulations, directives or standards could reduce

demand for our products and services. Regulatory changes could also

increase expenses as we modify our products and services to comply

with new requirements and retain relevancy, impose limitations on

our operations, and increase compliance or litigation expense, each

of which could have a material adverse effect on our business,

financial condition and results of operations.

The environment in which we compete is highly competitive, which

creates adverse pricing pressures and may harm our business and

operating results if we cannot compete effectively.

Competition across

all of our businesses is intense. The speed and accuracy with which

we can meet customers’ needs, the price of our services and

the quality of our products and supporting services are factors in

this competition.

Some

of our competitors have longer operating histories, greater name

recognition, more established customer bases and significantly

greater financial, technical, marketing and other resources than we

do. As a result, they may be able to respond more quickly and

effectively than we can to new or changing market demands and

requirements. We could also be negatively impacted if our

competitors reduce prices, add new features, form strategic

alliances with other companies, or are acquired by other companies

with greater available resources.

These

competitive pressures to any aspect of our business could reduce

our revenue and earnings.

Our revenue growth rate in the recent period relating to our

Platform and Technology business may not be indicative of this

business segment’s future performance.

We

experienced a revenue growth rate of 24% from 2018 to 2019, 21%

from 2017 to 2018 and 49% from 2016 to 2017 with respect to our

Platform and Technology revenue stream. In 2019, much of the growth

came from the acquisition of VWP in January 2019 and FSCwire in

July 2018, while the previous years’ growth was due to the

success of our ACCESSWIRE business. Our historical revenue growth

rate of the Platform and Technology revenue stream is not

indicative of future growth, and we may not achieve similar revenue

growth rates in future periods. You should not rely on our revenue

or revenue growth for any prior quarterly or annual periods as any

indication of our future revenue or revenue growth. If we are

unable to maintain consistent revenue or revenue growth, our stock

price could be volatile, and it may be difficult to achieve and

maintain profitability.

The success of our cloud-based software largely depends on our

ability to provide reliable solutions to our customers. If a

customer were to experience a product defect, a disruption in its

ability to use our solutions or a security flaw, demand for our

solutions could be diminished, we could be subject to substantial

liability and our business could suffer.

Our

Platform and Technology solutions are complex and we often release

new features. As such, our solutions could have errors, defects,

viruses or security flaws that could result in unanticipated

downtime for our customers and harm our reputation and our

business. Internet-based software may contain undetected errors or

security flaws when first introduced or when new versions or

enhancements are released. We might from time to time find such

defects in our solutions, the detection and correction of which

could be time consuming and costly. Since our customers use our

solutions for important aspects of their business, any errors,

defects, disruptions in access, security flaws, viruses, data

corruption or other performance problems with our solutions could

hurt our reputation and may damage our customers’ businesses.

If that occurs, customers could elect not to renew, could delay or

withhold payment to us or may make warranty or other claims against

us, which could result in an increase in our provision for doubtful

accounts, an increase in collection cycles for accounts receivable

or the expense and risk of litigation. We could also lose future

sales. In addition, a security breach of our solutions could result

in our future business prospects being materially adversely

impacted.

12

A substantial portion of our business is derived from our

ACCESSWIRE brand, which is dependent on technology and key

partners.

As

noted, our ACCESSWIRE brand has been vital to the increase in

revenue associated with our Platform and Technology revenue stream.

ACCESSWIRE is dependent upon several key partners for news

distribution, some of which are also partners that we rely on for

other shareholder communications services. During the second quarter of 2019, one of our key

partners made an industry-wide decision to no longer accept

investor commentary content. A significant portion of our

historical ACCESSWIRE revenue was generated from this type of

content, which has significantly affected revenue going

forward. Further disruption in any of these partnership

relationships could have a material adverse impact on our business

and financial results and the inability to procure new key partners

could impact the growth of the ACCESSWIRE brand, particularly with

respect to public company news distribution. Additionally,

ACCESSWIRE is highly dependent on technology and any performance

issues with this technology could have a material impact on our

ability to serve our customers and thus our ability to generate

revenue.

Failure to manage our growth may adversely affect our business or

operations.

Since

2013, we have experienced overall growth in our business, customer

base, employee headcount and operations, and we expect to continue

to grow our business over the next several years. This growth

places a significant strain on our executive management team and

employees and on our operating and financial systems. To manage our

future growth, we must continue to scale our business functions,

improve our financial and management controls and our reporting

systems and procedures and expand and train our work force. In

particular, we grew from twenty-four employees and contractors as

of December 31, 2012 to eighty-five as of December 31, 2019. We

anticipate that additional investments in sales personnel,

infrastructure and research and development spending will be

required to:

●

scale our

operations and increase productivity;

●

address the needs

of our customers;

●

further develop and

enhance our existing solutions and offerings; and

●

develop new

technology.

We

cannot assure you that our controls, systems and procedures will be

adequate to support our future operations or that we will be able

to manage our growth effectively. We also cannot assure you that we

will be able to continue to expand our market presence in the

United States and other current markets or successfully establish

our presence in other markets. Failure to effectively manage growth

could result in difficulty or delays in deploying customers,

declines in quality or customer satisfaction, increases in costs,

difficulties in introducing new features or other operational

difficulties, and any of these difficulties could adversely impact

our business performance and results of operations.

If we are unable to retain our key employees and attract and retain

other qualified personnel, our business could suffer.

Our

ability to grow and our future success will depend to a significant

extent on the continued contributions of our key executives,

managers and employees. In addition, many of our individual

technical and sales personnel have extensive experience in our

business operations and/or have valuable customer relationships

that would be difficult to replace. Their departure, if unexpected

and unplanned, could cause a disruption to our business. Our

competition for these individuals is intense in certain areas of

our business. We may not succeed in identifying and retaining the

appropriate personnel in key positions. Further, competitors and

other entities have in the past recruited and may in the future

attempt to recruit our employees, particularly our sales personnel.

The loss of the services of our key personnel, the inability to

identify, attract and retain qualified personnel in the future or

delays in hiring qualified personnel, particularly technical and

sales personnel, could make it difficult for us to manage our

business and meet key objectives, such as the timely introduction

of new technology-based products and services, which could harm our

business, financial condition and operating results.

13

If we fail to keep our customers’ information confidential or

if we handle their information improperly, our business and

reputation could be significantly and adversely

affected.

If we

fail to keep customers’ proprietary information and

documentation confidential, we may lose existing customers and

potential new customers and may expose them to significant loss of

revenue based on the premature release of confidential information.

While we have security measures in place to protect customer

information and prevent data loss and other security breaches,

these measures may be breached as a result of third-party action,

employee error, malfeasance or otherwise. Because the techniques

used to obtain unauthorized access or sabotage systems change

frequently and generally are not identified until they are launched

against a target, we may be unable to anticipate these techniques

or to implement adequate preventative measures.

In

addition, our service providers (including, without limitation,

hosting facilities, disaster recovery providers and software

providers) may have access to our customers’ data and could

suffer security breaches or data losses that affect our

customers’ information.

If an

actual or perceived security breach or premature release occurs,

our reputation could be damaged and we may lose future sales and

customers. We may also become subject to civil claims, including

indemnity or damage claims in certain customer contracts, or

criminal investigations by appropriate authorities, any of which

could harm our business and operating results. Furthermore, while

our errors and omissions insurance policies include liability

coverage for these matters, if we experienced a widespread security

breach that impacted a significant number of our customers for whom

we have these indemnity obligations, we could be subject to

indemnity claims that exceed such coverage.

We must adapt to rapid changes in technology and customer

requirements to remain competitive.

The

market and demand for our products and services, to a varying

extent, have been characterized by:

●

Technological

change;

●

Frequent product

and service introductions; and

●

Evolving customer

requirements.

We

believe that these trends will continue into the foreseeable

future. Our success will depend, in part, upon our ability

to:

●

Enhance our

existing products and services;

●

Gain market

acceptance.

●

Successfully

develop new products and services that meet increasing customer

requirements; and

To

achieve these goals, we will need to continue to make substantial

investments in sales and marketing. We may not:

●

Have sufficient

resources to make these investments;

●

Be successful in

developing product and service enhancements or new products and

services on a timely basis, if at all; or

●

Be able to market

successfully these enhancements and new products once

developed.

Further, our

products and services may be rendered obsolete or uncompetitive by

new industry standards or changing technology.

14

Our business could be harmed if we do not successfully manage the

integration of any business that we have acquired or may acquire in

the future. These risks include:

●

the difficulty of

integrating the operations and personnel of the acquired businesses

into our ongoing operations;

●

the potential

disruption of our ongoing business and distraction of

management;

●

the difficulty in

incorporating acquired technology and rights into our products and

technology;

●

unanticipated

expenses and delays relating to completing acquired development

projects and technology integration;

●

a potential

increase in our indebtedness and contingent liabilities, which

could restrict our ability to access additional capital when needed

or to pursue other important elements of our business

strategy;

●

the management of

geographically remote units;

●

the establishment

and maintenance of uniform standards, controls, procedures and

policies;

●

the impairment of

relationships with employees and customers as a result of any

integration of new management personnel;

●

risks of entering

markets or types of businesses in which we have either limited or

no direct experience;

●

the potential loss

of key employees or customers of the acquired businesses;

and

●

potential unknown

liabilities, such as liability for hazardous substances, or other

difficulties associated with acquired businesses.

Revenue from Platform id. subscriptions and many of

our service contracts is recognized ratably over the term of the

contract or subscription period. As a result, downturns or upturns

in sales may not be immediately reflected in our operating

results.

We

generally recognize subscription and support revenue from customers

ratably over the terms of their subscription agreements, which are

typically on a quarterly or annual cycle and automatically renew

for additional periods. As a result, a substantial portion of the

revenue we report in each quarter will be derived from the

recognition of deferred revenue relating to subscription agreements

entered into during previous quarters. Consequently, a decline in

new or renewed subscriptions in any one quarter may not be

immediately reflected in our revenue results for that quarter. This

decline, however, will negatively affect our revenue in future

quarters. Accordingly, the effect of significant downturns in sales

and market acceptance of our solutions and potential changes in our

rate of renewals may not be fully reflected in our results of

operations until future periods. Our subscription model also makes

it difficult for us to rapidly increase our subscription revenue

through additional sales in any period, as revenue from new

customers must be recognized over the applicable subscription term.

In addition, we may be unable to adjust our cost structure to

reflect the changes in revenue, which could adversely affect our

operating results.

We cannot accurately predict subscription renewal or upgrade rates

and the impact these rates may have on our future revenue and

operating results.

Our

business depends substantially on customers renewing their

subscriptions with us, specifically Platform id., and expanding their use of

our products. Our customers have no obligation to renew their

subscriptions for our products after the expiration of their

initial subscription period. Given our limited operating history

with respect to our Platform and Technology revenue stream, we may

be unable to accurately predict our revenue retention rate. In

addition, our customers may renew for shorter contract lengths,

lower prices or fewer users. We cannot accurately predict new

subscription or expansion rates and the impact these rates may have

on our future revenue and operating results. Our renewal rates may

decline or fluctuate as a result of a number of factors, including

customer dissatisfaction with our service, customers’ ability

to continue their operations and spending levels and deteriorating

general economic conditions. If our customers do not renew their

subscriptions for our products, purchase fewer solutions at the

time of renewal, or negotiate a lower price upon renewal, our

revenue will decline and our business will suffer. Our future

success also depends in part on our ability to sell additional

solutions and products, more subscriptions or enhanced editions of

our products to our current customers. If our efforts to sell

additional solutions and products to our customers are not

successful, our growth and operations may be impeded. In addition,

any decline in our customer renewals or failure to convince our

customers to broaden their use of our products would harm our

future operating results.

15

Although we have generated positive cash flows for the past 12

years, we have incurred operating losses in the past and may do so

again in the future.

The

Company has incurred operating losses in the past and may do so

again in the future. At December 31, 2019, the Company had

$3,837,000 of retained earnings. Although we have generated

positive cash flows from operations for the past twelve years,

there can be no assurances that we will be able to do so in the

future. As we continue to invest in our cloud-based technologies

and sales and marketing teams, we could experience fluctuations in

our cash flows from operations and retained earnings and there are

no guarantees that our business can continue to generate the

current revenue levels.

We continue to transition our business from a services company to a

software as a service company, which makes it difficult to predict

our future operating results.

In

2015, we began our transition from a services company to a software

as a service company. As a result of this transition, our ability

to forecast our future operating results is limited and subject to

a number of uncertainties, including our ability to plan for and

model future growth. We have encountered and will encounter risks

and uncertainties frequently experienced by growing companies in

rapidly changing industries, such as the risks and uncertainties

described herein. If our assumptions regarding these risks and

uncertainties (which we use to plan our business) are incorrect or

change due to changes in our markets, or if we do not address these

risks successfully, our operating and financial results could

differ materially from our expectations and our business could

suffer.

We are subject to general litigation and regulatory requirements

that may materially adversely affect us.

From

time to time, we may be involved in disputes or regulatory

inquiries that arise in the ordinary course of business. We expect

that the number and significance of these potential disputes may

increase as our business expands and we grow larger. While most of

our agreements with customers limit our liability for damages

arising from our solutions, we cannot assure you that these

contractual provisions will protect us from liability for damages

in the event we are sued. Although we carry general liability

insurance coverage, our insurance may not cover all potential

claims to which we are exposed or may not be adequate to indemnify

us for all liability that may be imposed. Any claims against us,

whether meritorious or not, could be time consuming, result in

costly litigation, require significant amounts of management time,

and result in the diversion of significant operational resources.

Because litigation is inherently unpredictable, we cannot assure

you that the results of any of these actions will not have a

material adverse effect on our business, financial condition,

results of operations and prospects.

New and existing laws make determining our income tax rate complex

and subject to uncertainty.

The

computation of our provision for income tax is complex, as it is

based on the laws of multiple taxing jurisdictions and requires

significant judgment on the application of complicated rules

governing accounting for tax provisions under U.S. generally

accepted accounting principles. Additionally, provisions for income

tax for interim quarters are based on forecasts of our U.S. and

non-U.S. effective tax rates for the year and contain numerous

assumptions. Various items cannot be accurately forecasted and

future events may be treated as discrete to the period in which

they occur. Our provision for income tax can be materially impacted

by things such as changes in our business, internal restructuring

and acquisitions, changes in tax laws and accounting guidance and

other regulatory, legislative developments, tax audit

determinations, changes in uncertain tax positions, tax deductions

attributed to equity compensation and changes in our determination

for a valuation allowance for deferred tax assets. For all of these

reasons, our actual income taxes may be materially different than

our provision for income tax.

We are subject to U.S. and foreign data privacy and protection laws

and regulations as well as contractual privacy obligations, and our

failure to comply could subject us to fines and damages and would

harm our reputation and business.

We

manage private and confidential information and documentation

related to our customers’ finances and transactions, often

prior to public dissemination. The use of insider information is

highly regulated in the United States and abroad, and violations of

securities laws and regulations may result in civil and criminal

penalties. In addition, we are subject to the data privacy and

protection laws and regulations adopted by federal, state and

foreign legislatures and governmental agencies. Data privacy and

protection is highly regulated and may become the subject of

additional regulation in the future. Privacy laws restrict our

storage, use, processing, disclosure, transfer and protection of

non-public personal information by our customers or collected from

visitors of our website. We strive to comply with all applicable

laws, regulations, policies and legal obligations relating to

privacy and data protection. However, it is possible that these

requirements may be interpreted and applied in a manner that is

inconsistent from one jurisdiction to another and may conflict with

other rules or our practices. Any failure, or perceived failure, by

us to comply with federal, state or international laws, including

laws and regulations regulating privacy, payment card information,

personal health information, data or consumer protection, could

result in proceedings or actions against us by governmental

entities or others.

16

The

regulatory framework for privacy and data protection issues

worldwide is evolving, and various government and consumer agencies

and public advocacy groups have called for new regulation and

changes in industry practices, including some directed at providers

of mobile and online resources in particular. Our obligations with

respect to privacy and data protection may become broader or more

stringent. If we are required to change our business activities or

revise or eliminate services, or to implement costly compliance

measures, our business and results of operations could be

harmed.

Our business may be affected by factors outside of our

control.

Our

ability to increase sales and deliver and sell our service

offerings profitably is subject to a number of risks, including

changes to corporate disclosure requirements, regulatory filings

and distribution of proxy materials, competitive risks such as the

entrance of additional competitors into our market, pricing and

competition and risks associated with the marketing of new services

in order to remain competitive.

If potential customers take a long time to evaluate the use of our

products, we could incur additional selling expenses and require

additional working capital.

The

acceptance of our services depends on a number of factors,

including the nature and size of the potential customer base, the

effectiveness of our system, and the extent of the commitment being

made by the potential customer, and is difficult to predict.

Currently, our sales and marketing expenses per customer are fairly