Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - StoneX Group Inc. | pressreleasegainacquisitio.htm |

| 8-K - 8-K - StoneX Group Inc. | a8-kgainacquisitonprinvdeck.htm |

INVESTOR PRESENTATION Acquisition of GAIN Capital Holdings, Inc. NASDAQ: INTL

Disclaimer Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are identified by words such as “may,” “should,” “expects,” “anticipates,” “assumes,” “can,” “will,” “could,” “likely,” “intends,” “might,” “predicts,” “seeks,” “would,” “believes,” “estimates” or “plans.” These forward-looking statements include, among other things, statements relating to the expected results of the merger with GAIN, including any anticipated cost or capital synergies associated therewith, operating efficiencies and results, growth, client and stockholder benefits, accretion, financial benefits or returns, key assumptions, the expected timing of the closing of the merger, integration costs and transaction costs, expected timing or use of proceeds of any financing, our future financial performance, our business prospects and strategy, anticipated financial position, liquidity and capital needs and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond our control, that may cause actual results to be materially different from any anticipated results expressed or implied by these forward-looking statements, including, among others, (i) the occurrence of any event, change, or other circumstance that could give rise to the termination of the merger agreement, (ii) the transaction closing conditions may not be satisfied in a timely manner or at all, including due to the failure to obtain GAIN stockholder approval and regulatory approvals, (iii) the announcement and pendency of the merger may disrupt our or GAIN’s business operations, (iv) anticipated benefits of the merger, including the realization of revenue, accretion, financial benefits or returns and other cost and capital synergies may not be fully realized or may take longer to realize than expected, (v) adverse changes in economic, political and market conditions, such as price levels and volatility in the commodities, securities and foreign exchange markets in which we and GAIN operate, (vi) losses from our market-making and trading activities arising from counter-party failures and changes in market conditions, (vii) the possible loss of key personnel or GAIN key personnel, (viii) the impact of increasing competition, (ix) the impact of changes in government regulation, (x) the possibility of liabilities arising from violations of federal and state securities laws, (xi) the impact of changes in technology in the securities and commodities trading industries and (xii) other risks and uncertainties. You should read cautionary statements made as being applicable to all related forward-looking statements wherever they appear in this presentation. We cannot assure you that the forward-looking statements in this presentation will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, if at all. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they were made. Except as expressly required under federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we do not have any obligation, and do not undertake, to update any forward-looking statements to reflect events or circumstances arising after the date of this presentation, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us are expressly qualified by these cautionary statements. Additional Information and Where to Find It This presentation may be deemed solicitation material in respect of the proposed acquisition of GAIN by INTL FCStone. In connection with the proposed merger, GAIN will file with the SEC and furnish to GAIN’s stockholders a proxy statement and other relevant documents. This filing does not constitute a solicitation of any vote or approval. Stockholders of GAIN are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement because they will contain important information about the proposed merger. Investors will be able to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, the proxy statement will be available free of charge through GAIN’s website at www.ir.gaincapital.com as soon as reasonably practicable after it is electronically filed with the SEC. The directors, executive officers and certain other members of management and employees of each of GAIN and INTL FCStone may be deemed “participants” in the solicitation of proxies from stockholders of GAIN in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of GAIN in connection with the proposed merger will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. You can find information about GAIN’s executive officers and directors in the definitive proxy statement on Schedule 14A in connection with GAIN’s 2019 Annual Meeting of Shareholders, filed with the SEC on April 30, 2019. Non-GAAP Measures This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are not measures of financial performance in accordance with generally accepted accounting principles and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under generally accepted accounting principles. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. A reconciliation of these financial measures to the most comparable measures presented in accordance with generally accepted accounting principles has been included at the end of this presentation. The INTL FCStone Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of INTL FCStone Markets, LLC (IFM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. IFM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of IFM. INTL FCStone Financial Inc. (IFCF) is a member of FINRA/NFA/SIPC and registered with the MSRB. IFCF is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading are made on behalf of the BD Division of IFCF and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of IFCF. INTL FCStone Ltd is registered in England and Wales, Company No. 5616586, authorized and regulated by the Financial Conduct Authority. Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the INTL FCStone group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of INTL FCStone Inc. © 2019 INTL FCStone Inc. All Rights Reserved. NASDAQ: INTL 2

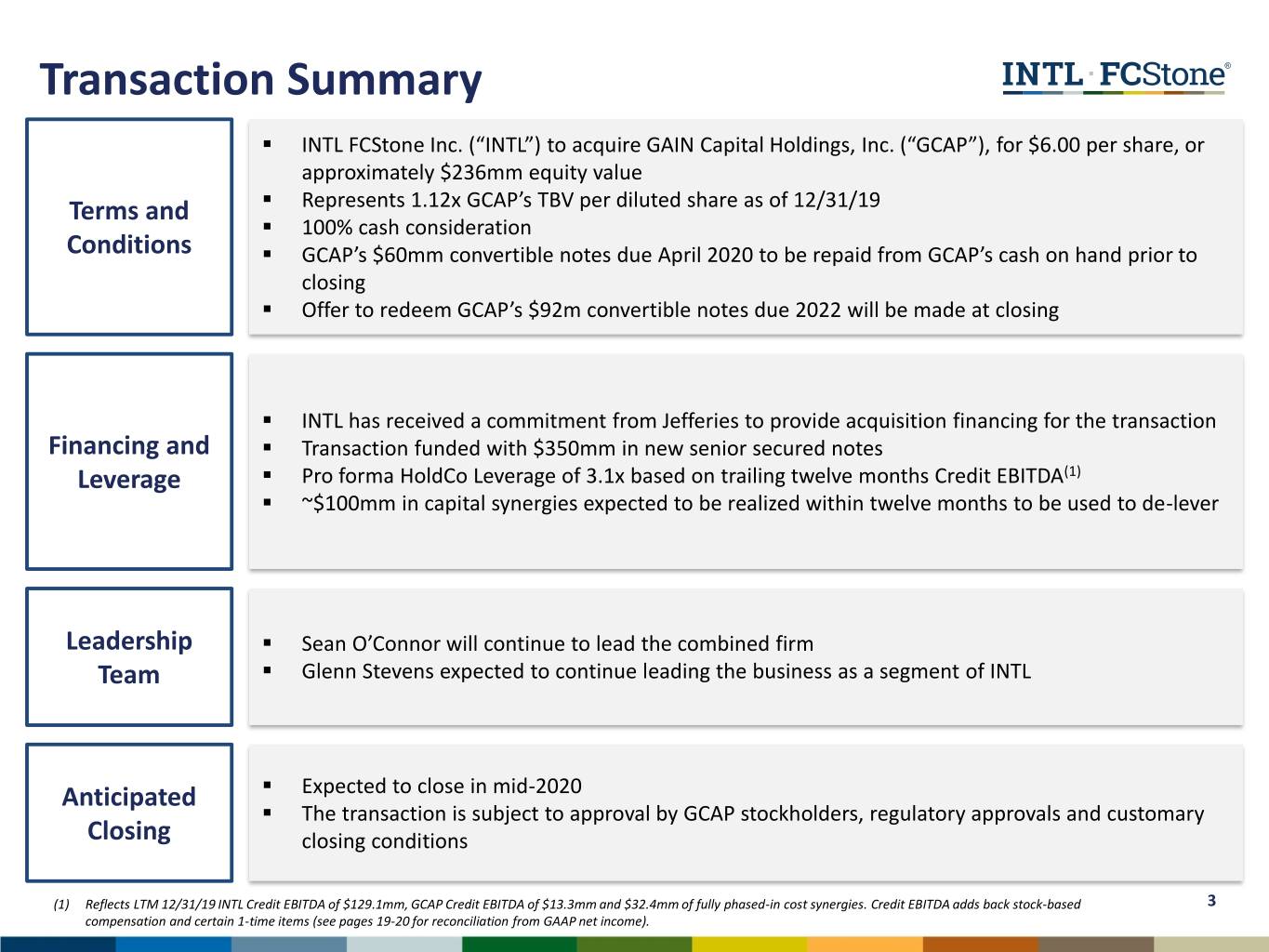

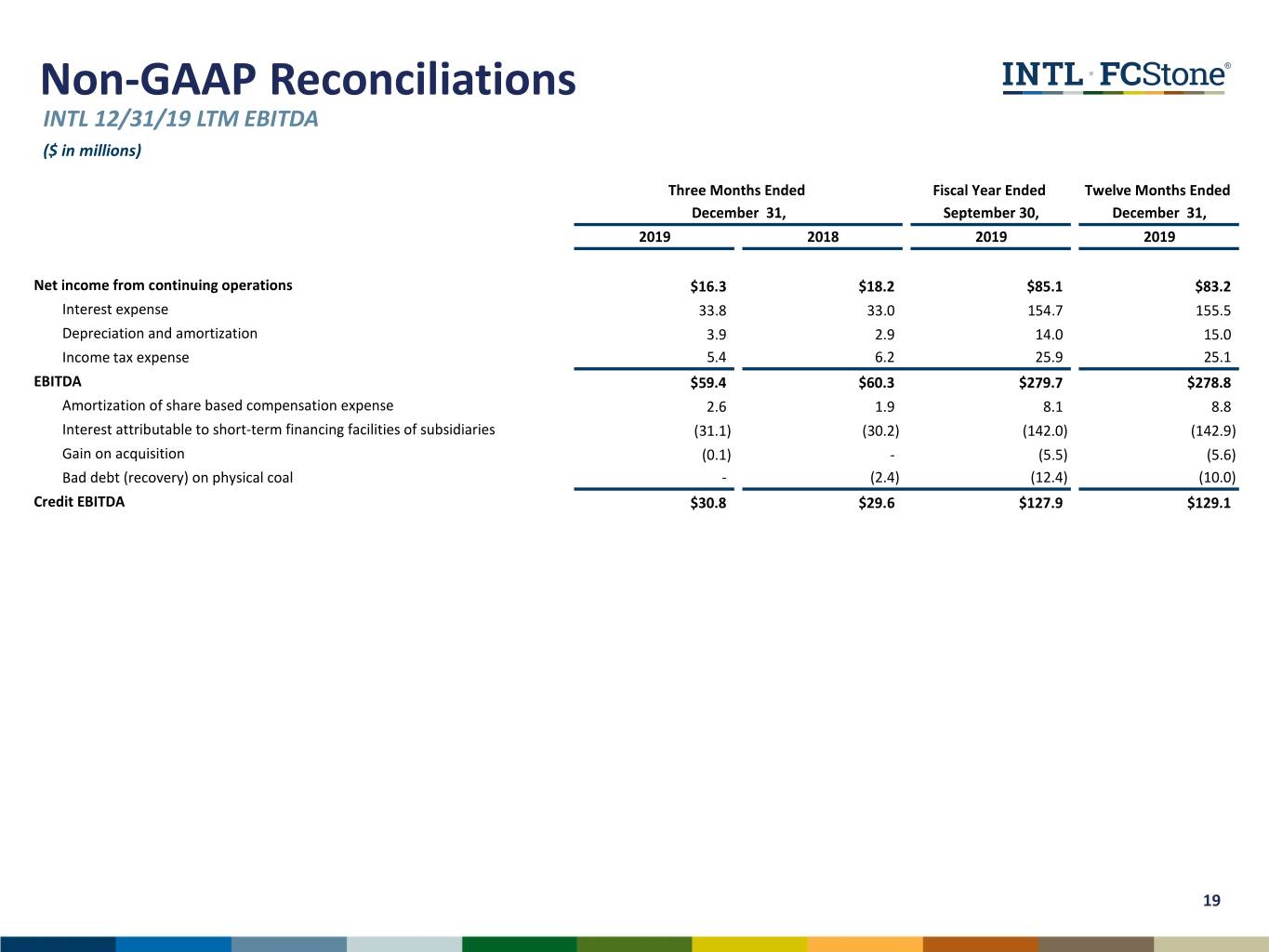

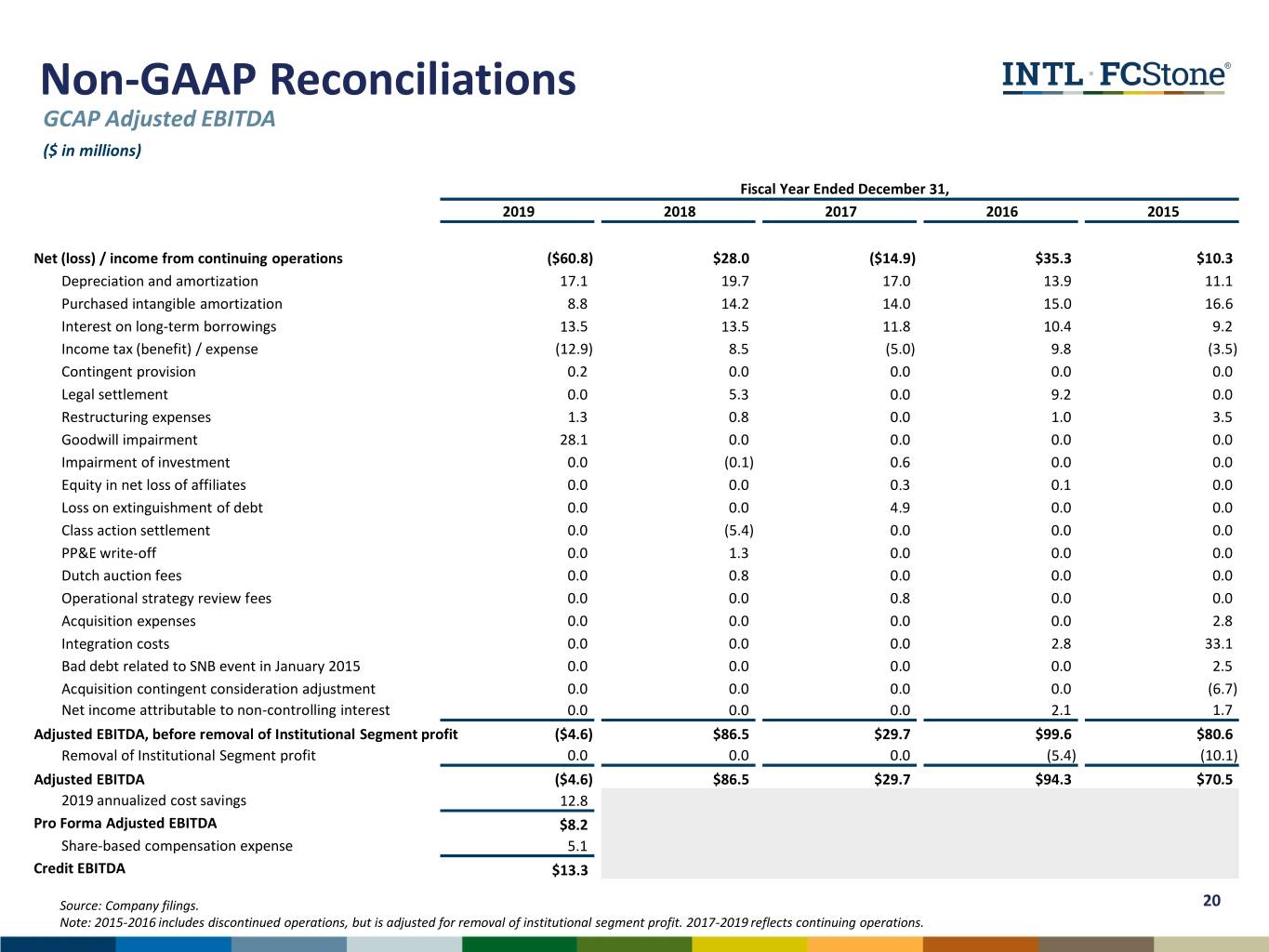

Transaction Summary ▪ INTL FCStone Inc. (“INTL”) to acquire GAIN Capital Holdings, Inc. (“GCAP”), for $6.00 per share, or approximately $236mm equity value Terms and ▪ Represents 1.12x GCAP’s TBV per diluted share as of 12/31/19 ▪ 100% cash consideration Conditions ▪ GCAP’s $60mm convertible notes due April 2020 to be repaid from GCAP’s cash on hand prior to closing ▪ Offer to redeem GCAP’s $92m convertible notes due 2022 will be made at closing ▪ INTL has received a commitment from Jefferies to provide acquisition financing for the transaction Financing and ▪ Transaction funded with $350mm in new senior secured notes Leverage ▪ Pro forma HoldCo Leverage of 3.1x based on trailing twelve months Credit EBITDA(1) ▪ ~$100mm in capital synergies expected to be realized within twelve months to be used to de-lever Leadership ▪ Sean O’Connor will continue to lead the combined firm Team ▪ Glenn Stevens expected to continue leading the business as a segment of INTL Anticipated ▪ Expected to close in mid-2020 ▪ The transaction is subject to approval by GCAP stockholders, regulatory approvals and customary Closing closing conditions (1) Reflects LTM 12/31/19 INTL Credit EBITDA of $129.1mm, GCAP Credit EBITDA of $13.3mm and $32.4mm of fully phased-in cost synergies. Credit EBITDA adds back stock-based 3 compensation and certain 1-time items (see pages 19-20 for reconciliation from GAAP net income).

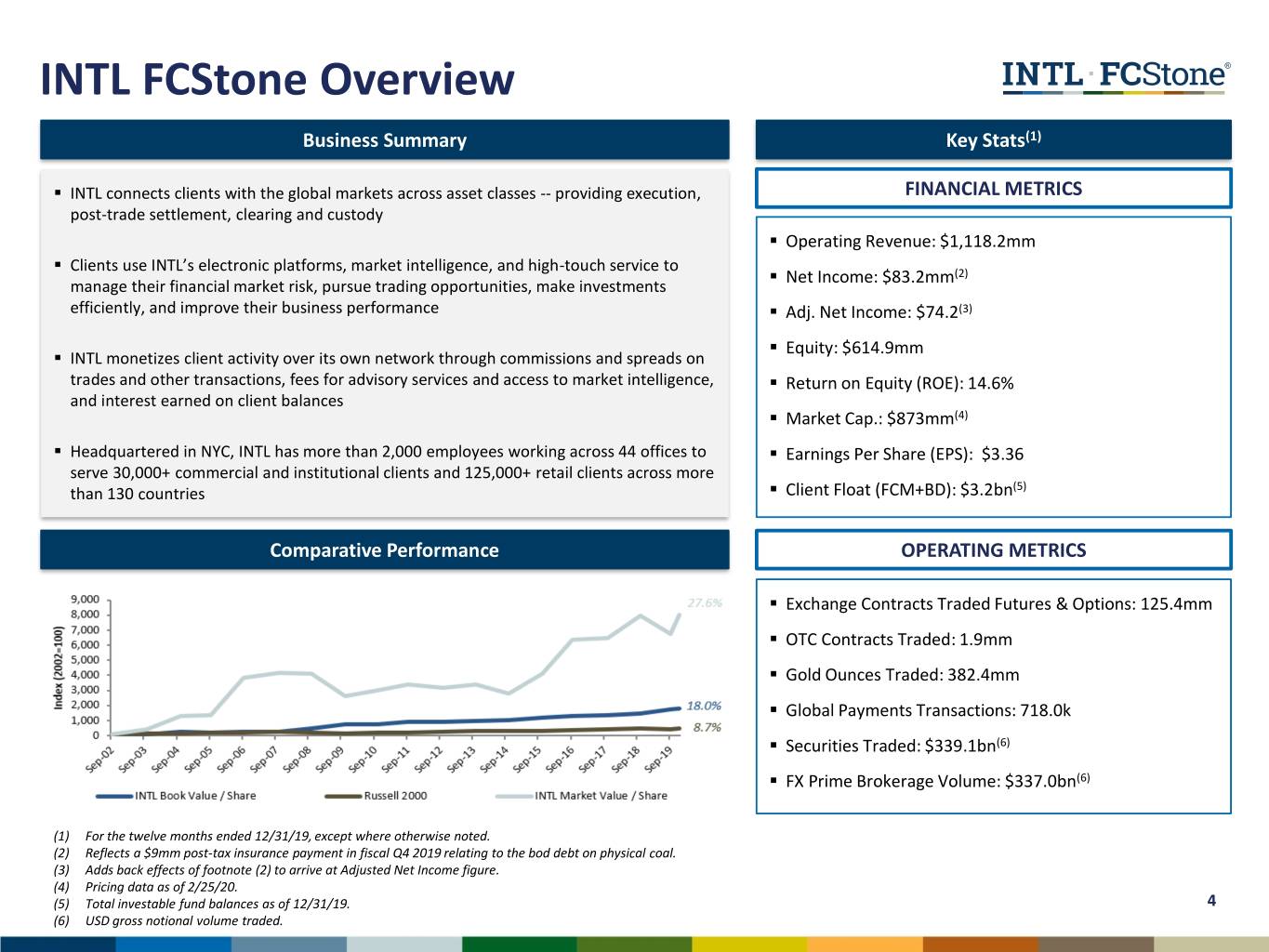

INTL FCStone Overview Business Summary Key Stats(1) ▪ INTL connects clients with the global markets across asset classes -- providing execution, FINANCIAL METRICS post-trade settlement, clearing and custody ▪ Operating Revenue: $1,118.2mm ▪ Clients use INTL’s electronic platforms, market intelligence, and high-touch service to ▪ Net Income: $83.2mm(2) manage their financial market risk, pursue trading opportunities, make investments efficiently, and improve their business performance ▪ Adj. Net Income: $74.2(3) ▪ Equity: $614.9mm ▪ INTL monetizes client activity over its own network through commissions and spreads on trades and other transactions, fees for advisory services and access to market intelligence, ▪ Return on Equity (ROE): 14.6% and interest earned on client balances ▪ Market Cap.: $873mm(4) ▪ Headquartered in NYC, INTL has more than 2,000 employees working across 44 offices to ▪ Earnings Per Share (EPS): $3.36 serve 30,000+ commercial and institutional clients and 125,000+ retail clients across more than 130 countries ▪ Client Float (FCM+BD): $3.2bn(5) Comparative Performance OPERATING METRICS ▪ Exchange Contracts Traded Futures & Options: 125.4mm ▪ OTC Contracts Traded: 1.9mm ▪ Gold Ounces Traded: 382.4mm ▪ Global Payments Transactions: 718.0k ▪ Securities Traded: $339.1bn(6) ▪ FX Prime Brokerage Volume: $337.0bn(6) (1) For the twelve months ended 12/31/19, except where otherwise noted. (2) Reflects a $9mm post-tax insurance payment in fiscal Q4 2019 relating to the bod debt on physical coal. (3) Adds back effects of footnote (2) to arrive at Adjusted Net Income figure. (4) Pricing data as of 2/25/20. (5) Total investable fund balances as of 12/31/19. 4 (6) USD gross notional volume traded.

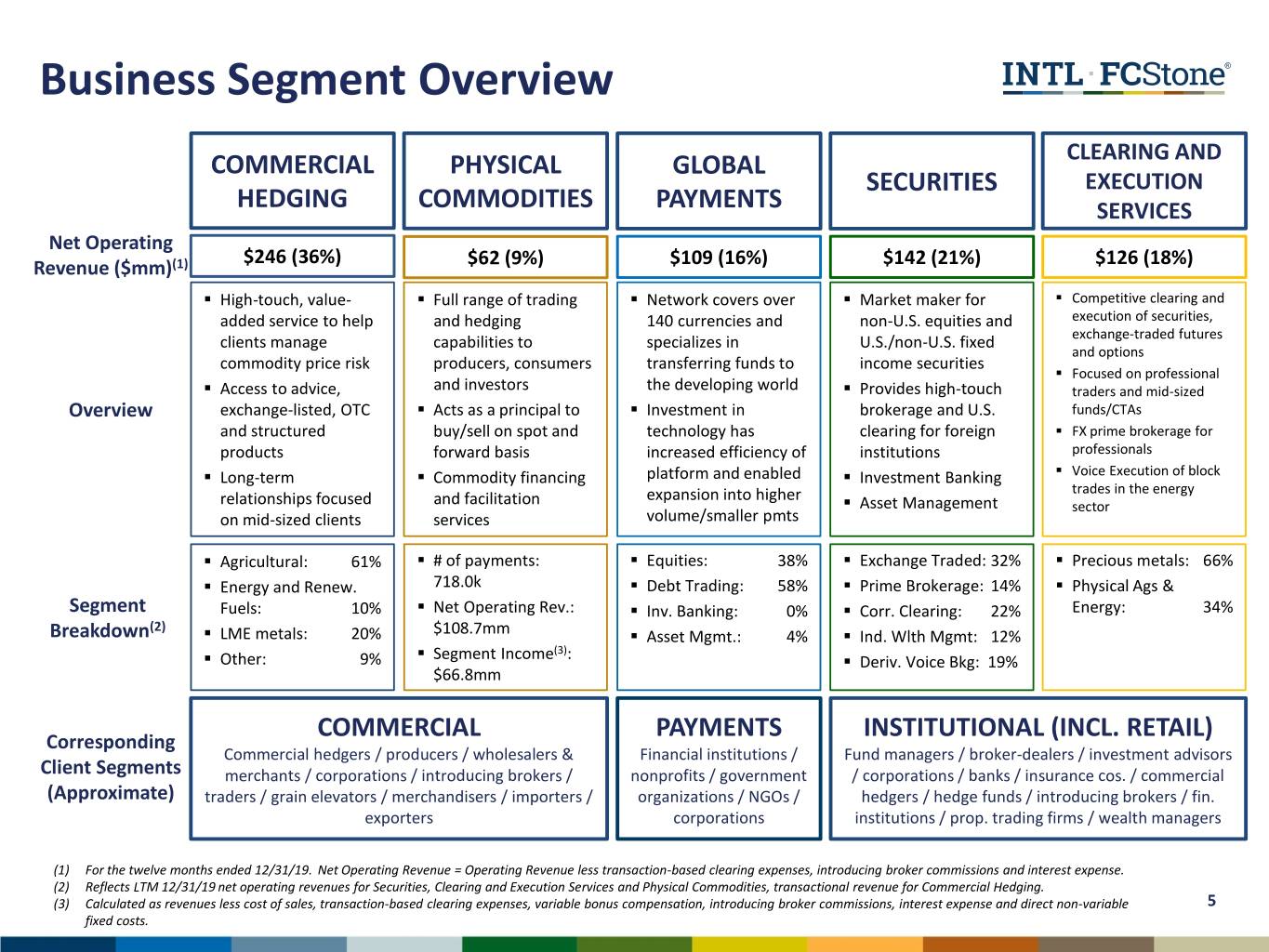

Business Segment Overview COMMERCIAL PHYSICAL GLOBAL CLEARING AND SECURITIES EXECUTION HEDGING COMMODITIES PAYMENTS SERVICES Net Operating $246 (36%) Revenue ($mm)(1) $62 (9%) $109 (16%) $142 (21%) $126 (18%) ▪ High-touch, value- ▪ Full range of trading ▪ Network covers over ▪ Market maker for ▪ Competitive clearing and added service to help and hedging 140 currencies and non-U.S. equities and execution of securities, clients manage capabilities to specializes in U.S./non-U.S. fixed exchange-traded futures and options commodity price risk producers, consumers transferring funds to income securities ▪ Focused on professional ▪ Access to advice, and investors the developing world ▪ Provides high-touch traders and mid-sized Overview exchange-listed, OTC ▪ Acts as a principal to ▪ Investment in brokerage and U.S. funds/CTAs and structured buy/sell on spot and technology has clearing for foreign ▪ FX prime brokerage for products forward basis increased efficiency of institutions professionals ▪ Long-term ▪ Commodity financing platform and enabled ▪ Investment Banking ▪ Voice Execution of block expansion into higher trades in the energy relationships focused and facilitation ▪ Asset Management sector on mid-sized clients services volume/smaller pmts ▪ Agricultural: 61% ▪ # of payments: ▪ Equities: 38% ▪ Exchange Traded: 32% ▪ Precious metals: 66% ▪ Energy and Renew. 718.0k ▪ Debt Trading: 58% ▪ Prime Brokerage: 14% ▪ Physical Ags & Segment Fuels: 10% ▪ Net Operating Rev.: ▪ Inv. Banking: 0% ▪ Corr. Clearing: 22% Energy: 34% (2) Breakdown ▪ LME metals: 20% $108.7mm ▪ Asset Mgmt.: 4% ▪ Ind. Wlth Mgmt: 12% ▪ (3) ▪ Other: 9% Segment Income : ▪ Deriv. Voice Bkg: 19% $66.8mm COMMERCIAL PAYMENTS INSTITUTIONAL (INCL. RETAIL) Corresponding Commercial hedgers / producers / wholesalers & Financial institutions / Fund managers / broker-dealers / investment advisors Client Segments merchants / corporations / introducing brokers / nonprofits / government / corporations / banks / insurance cos. / commercial (Approximate) traders / grain elevators / merchandisers / importers / organizations / NGOs / hedgers / hedge funds / introducing brokers / fin. exporters corporations institutions / prop. trading firms / wealth managers (1) For the twelve months ended 12/31/19. Net Operating Revenue = Operating Revenue less transaction-based clearing expenses, introducing broker commissions and interest expense. (2) Reflects LTM 12/31/19 net operating revenues for Securities, Clearing and Execution Services and Physical Commodities, transactional revenue for Commercial Hedging. (3) Calculated as revenues less cost of sales, transaction-based clearing expenses, variable bonus compensation, introducing broker commissions, interest expense and direct non-variable 5 fixed costs.

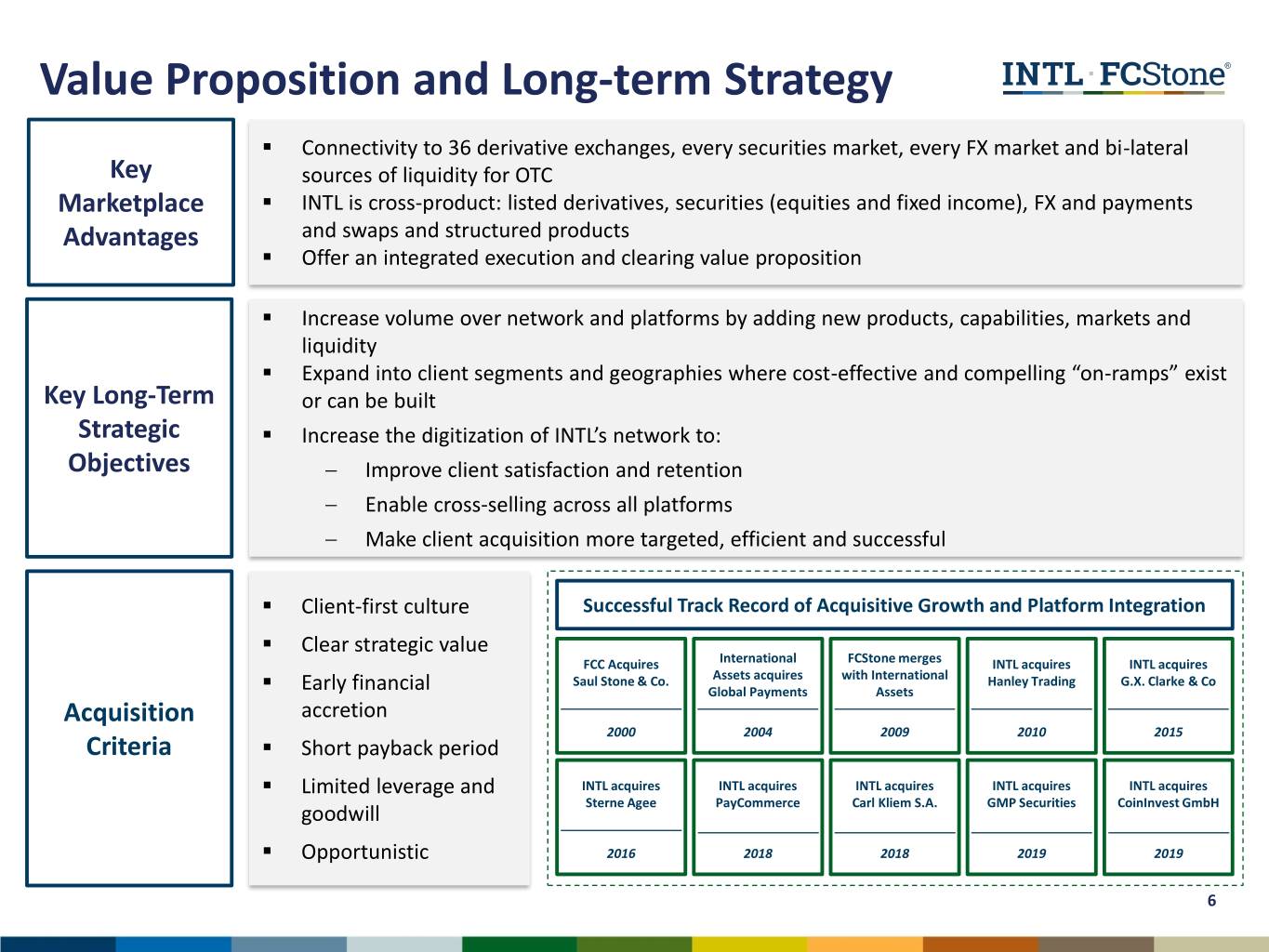

Value Proposition and Long-term Strategy ▪ Connectivity to 36 derivative exchanges, every securities market, every FX market and bi-lateral Key sources of liquidity for OTC Marketplace ▪ INTL is cross-product: listed derivatives, securities (equities and fixed income), FX and payments Advantages and swaps and structured products ▪ Offer an integrated execution and clearing value proposition ▪ Increase volume over network and platforms by adding new products, capabilities, markets and liquidity ▪ Expand into client segments and geographies where cost-effective and compelling “on-ramps” exist Key Long-Term or can be built Strategic ▪ Increase the digitization of INTL’s network to: Objectives – Improve client satisfaction and retention – Enable cross-selling across all platforms – Make client acquisition more targeted, efficient and successful ▪ Client-first culture Successful Track Record of Acquisitive Growth and Platform Integration ▪ Clear strategic value FCC Acquires International FCStone merges INTL acquires INTL acquires Saul Stone & Co. Assets acquires with International Hanley Trading G.X. Clarke & Co ▪ Early financial Global Payments Assets Acquisition accretion 2000 2004 2009 2010 2015 Criteria ▪ Short payback period ▪ Limited leverage and INTL acquires INTL acquires INTL acquires INTL acquires INTL acquires goodwill Sterne Agee PayCommerce Carl Kliem S.A. GMP Securities CoinInvest GmbH ▪ Opportunistic 2016 2018 2018 2019 2019 6

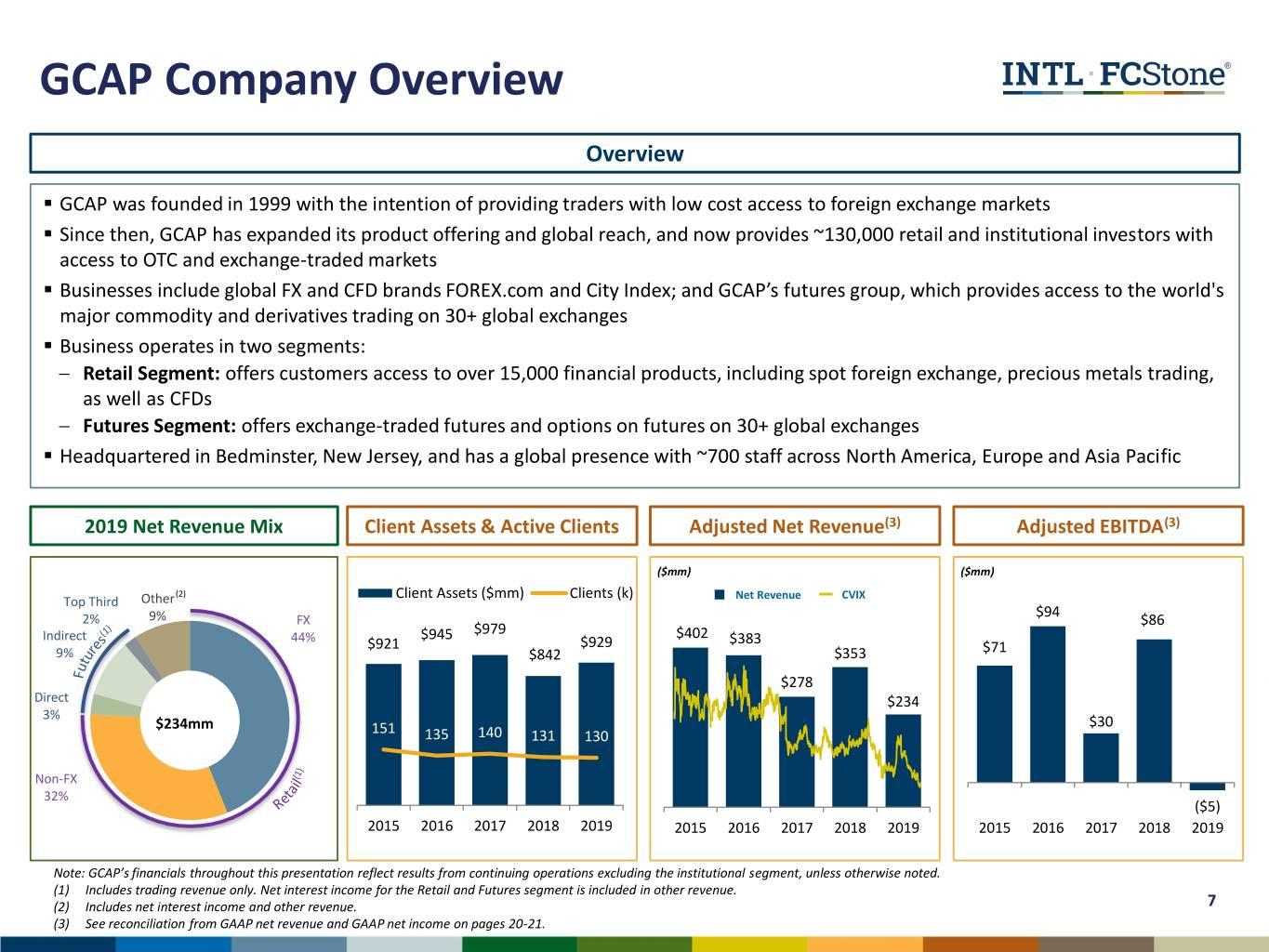

GCAP Company Overview Overview ▪ GCAP was founded in 1999 with the intention of providing traders with low cost access to foreign exchange markets ▪ Since then, GCAP has expanded its product offering and global reach, and now provides ~130,000 retail and institutional investors with access to OTC and exchange-traded markets ▪ Businesses include global FX and CFD brands FOREX.com and City Index; and GCAP’s futures group, which provides access to the world's major commodity and derivatives trading on 30+ global exchanges ▪ Business operates in two segments: – Retail Segment: offers customers access to over 15,000 financial products, including spot foreign exchange, precious metals trading, as well as CFDs – Futures Segment: offers exchange-traded futures and options on futures on 30+ global exchanges ▪ Headquartered in Bedminster, New Jersey, and has a global presence with ~700 staff across North America, Europe and Asia Pacific 2019 Net Revenue Mix Client Assets & Active Clients Adjusted Net Revenue(3) Adjusted EBITDA(3) ($mm) ($mm) (2) Client Assets ($mm) Clients (k) CVIX Top Third Other Net Revenue $94 2% 9% FX $86 Indirect $945 $979 $402 44% $921 $929 $383 9% $842 $353 $71 $278 Direct $234 3% $234mm 151 $30 135 140 131 130 Non-FX 32% ($5) 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Note: GCAP’s financials throughout this presentation reflect results from continuing operations excluding the institutional segment, unless otherwise noted. (1) Includes trading revenue only. Net interest income for the Retail and Futures segment is included in other revenue. (2) Includes net interest income and other revenue. 7 (3) See reconciliation from GAAP net revenue and GAAP net income on pages 20-21.

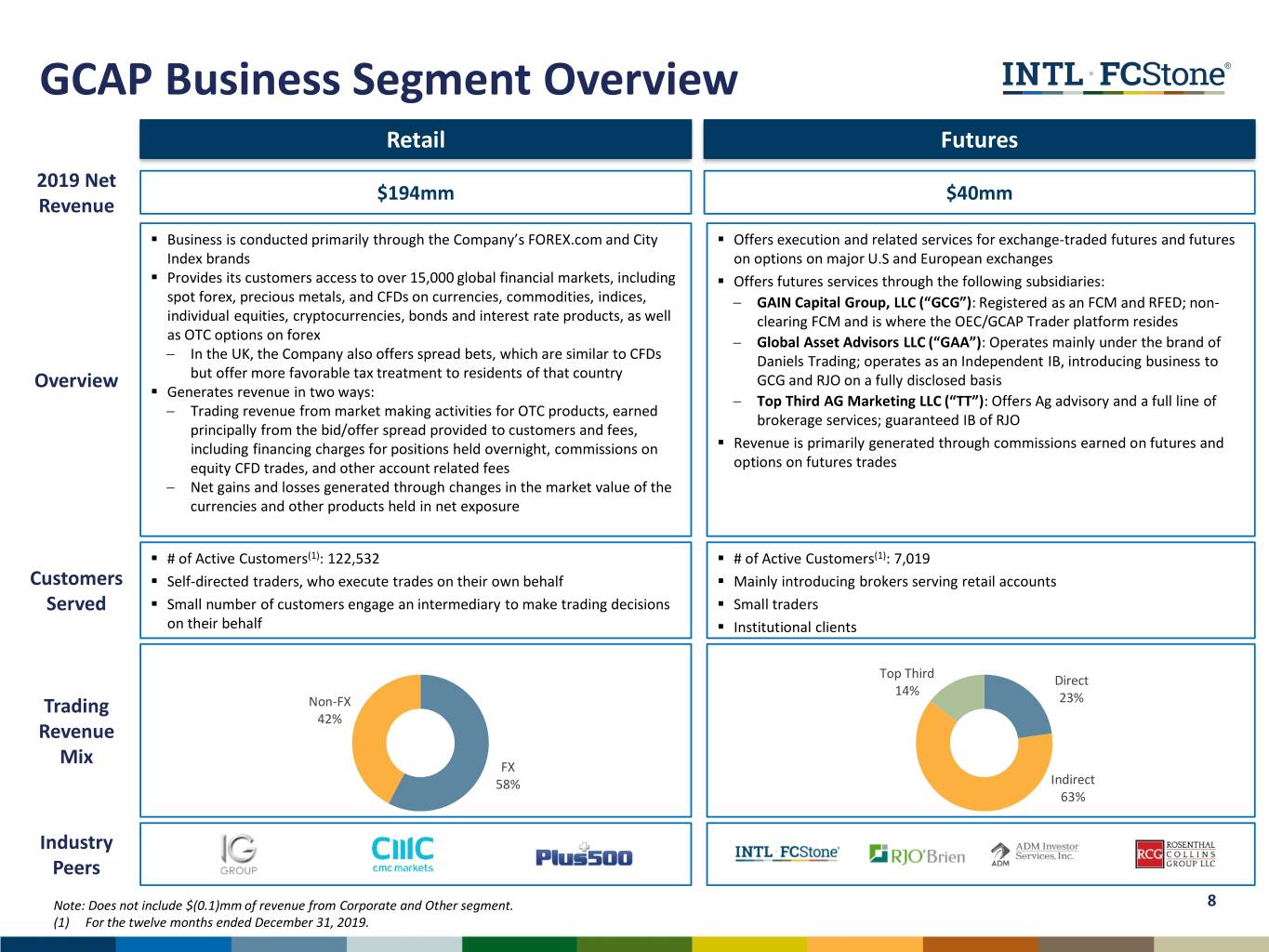

GCAP Business Segment Overview Retail Futures 2019 Net $194mm $40mm Revenue ▪ Business is conducted primarily through the Company’s FOREX.com and City ▪ Offers execution and related services for exchange-traded futures and futures Index brands on options on major U.S and European exchanges ▪ Provides its customers access to over 15,000 global financial markets, including ▪ Offers futures services through the following subsidiaries: spot forex, precious metals, and CFDs on currencies, commodities, indices, – GAIN Capital Group, LLC (“GCG”): Registered as an FCM and RFED; non- individual equities, cryptocurrencies, bonds and interest rate products, as well clearing FCM and is where the OEC/GCAP Trader platform resides as OTC options on forex – Global Asset Advisors LLC (“GAA”): Operates mainly under the brand of – In the UK, the Company also offers spread bets, which are similar to CFDs Daniels Trading; operates as an Independent IB, introducing business to Overview but offer more favorable tax treatment to residents of that country GCG and RJO on a fully disclosed basis ▪ Generates revenue in two ways: – Top Third AG Marketing LLC (“TT”): Offers Ag advisory and a full line of – Trading revenue from market making activities for OTC products, earned brokerage services; guaranteed IB of RJO principally from the bid/offer spread provided to customers and fees, including financing charges for positions held overnight, commissions on ▪ Revenue is primarily generated through commissions earned on futures and equity CFD trades, and other account related fees options on futures trades – Net gains and losses generated through changes in the market value of the currencies and other products held in net exposure ▪ # of Active Customers(1): 122,532 ▪ # of Active Customers(1): 7,019 Customers ▪ Self-directed traders, who execute trades on their own behalf ▪ Mainly introducing brokers serving retail accounts Served ▪ Small number of customers engage an intermediary to make trading decisions ▪ Small traders on their behalf ▪ Institutional clients Top Third Direct 14% Trading Non-FX 23% 42% Revenue Mix FX 58% Indirect 63% Industry Peers Note: Does not include $(0.1)mm of revenue from Corporate and Other segment. 8 (1) For the twelve months ended December 31, 2019.

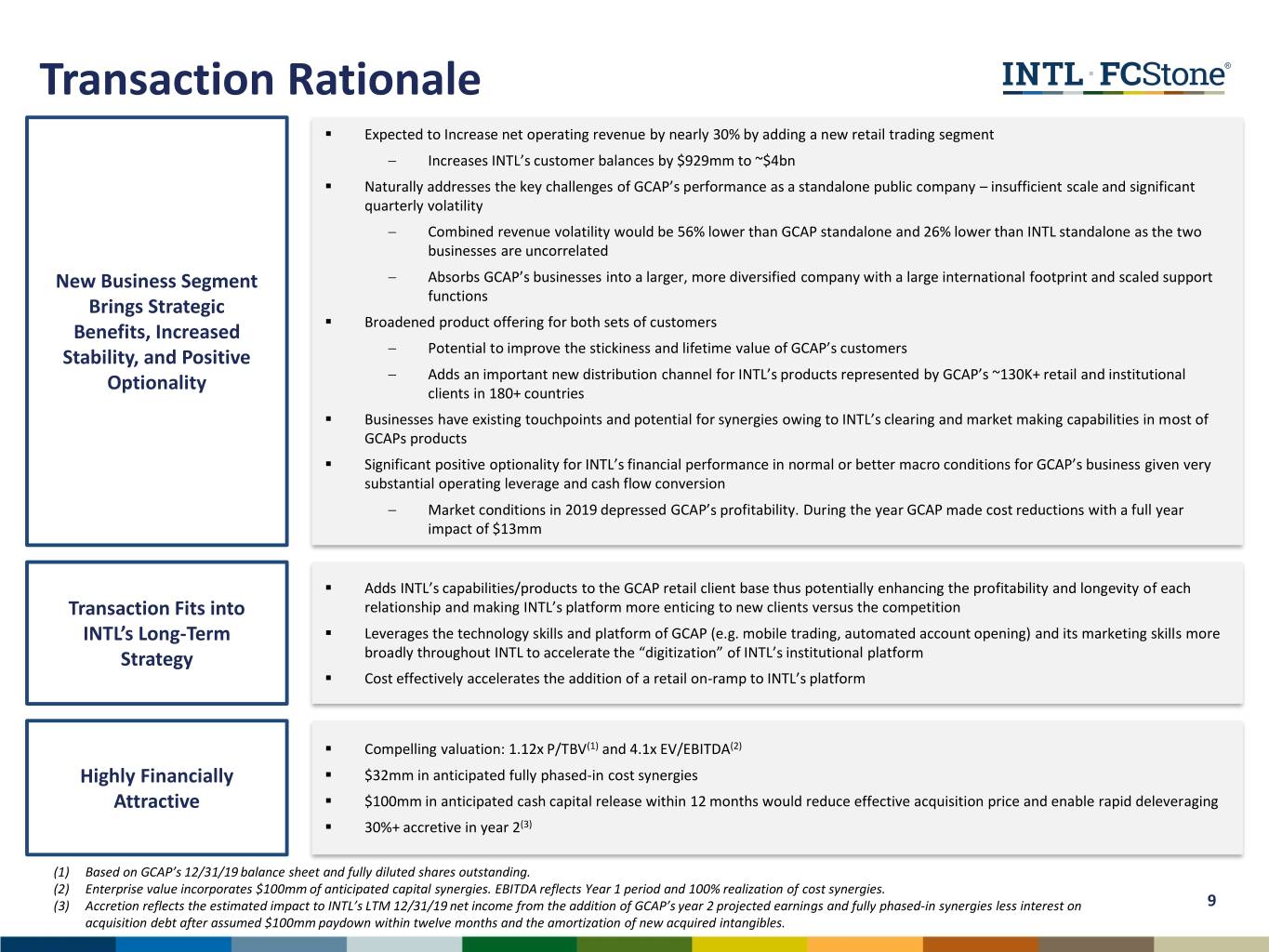

Transaction Rationale ▪ Expected to Increase net operating revenue by nearly 30% by adding a new retail trading segment – Increases INTL’s customer balances by $929mm to ~$4bn ▪ Naturally addresses the key challenges of GCAP’s performance as a standalone public company – insufficient scale and significant quarterly volatility – Combined revenue volatility would be 56% lower than GCAP standalone and 26% lower than INTL standalone as the two businesses are uncorrelated New Business Segment – Absorbs GCAP’s businesses into a larger, more diversified company with a large international footprint and scaled support functions Brings Strategic ▪ Benefits, Increased Broadened product offering for both sets of customers Stability, and Positive – Potential to improve the stickiness and lifetime value of GCAP’s customers – Adds an important new distribution channel for INTL’s products represented by GCAP’s ~130K+ retail and institutional Optionality clients in 180+ countries ▪ Businesses have existing touchpoints and potential for synergies owing to INTL’s clearing and market making capabilities in most of GCAPs products ▪ Significant positive optionality for INTL’s financial performance in normal or better macro conditions for GCAP’s business given very substantial operating leverage and cash flow conversion – Market conditions in 2019 depressed GCAP’s profitability. During the year GCAP made cost reductions with a full year impact of $13mm ▪ Adds INTL’s capabilities/products to the GCAP retail client base thus potentially enhancing the profitability and longevity of each Transaction Fits into relationship and making INTL’s platform more enticing to new clients versus the competition INTL’s Long-Term ▪ Leverages the technology skills and platform of GCAP (e.g. mobile trading, automated account opening) and its marketing skills more Strategy broadly throughout INTL to accelerate the “digitization” of INTL’s institutional platform ▪ Cost effectively accelerates the addition of a retail on-ramp to INTL’s platform ▪ Compelling valuation: 1.12x P/TBV(1) and 4.1x EV/EBITDA(2) Highly Financially ▪ $32mm in anticipated fully phased-in cost synergies Attractive ▪ $100mm in anticipated cash capital release within 12 months would reduce effective acquisition price and enable rapid deleveraging ▪ 30%+ accretive in year 2(3) (1) Based on GCAP’s 12/31/19 balance sheet and fully diluted shares outstanding. (2) Enterprise value incorporates $100mm of anticipated capital synergies. EBITDA reflects Year 1 period and 100% realization of cost synergies. (3) Accretion reflects the estimated impact to INTL’s LTM 12/31/19 net income from the addition of GCAP’s year 2 projected earnings and fully phased-in synergies less interest on 9 acquisition debt after assumed $100mm paydown within twelve months and the amortization of new acquired intangibles.

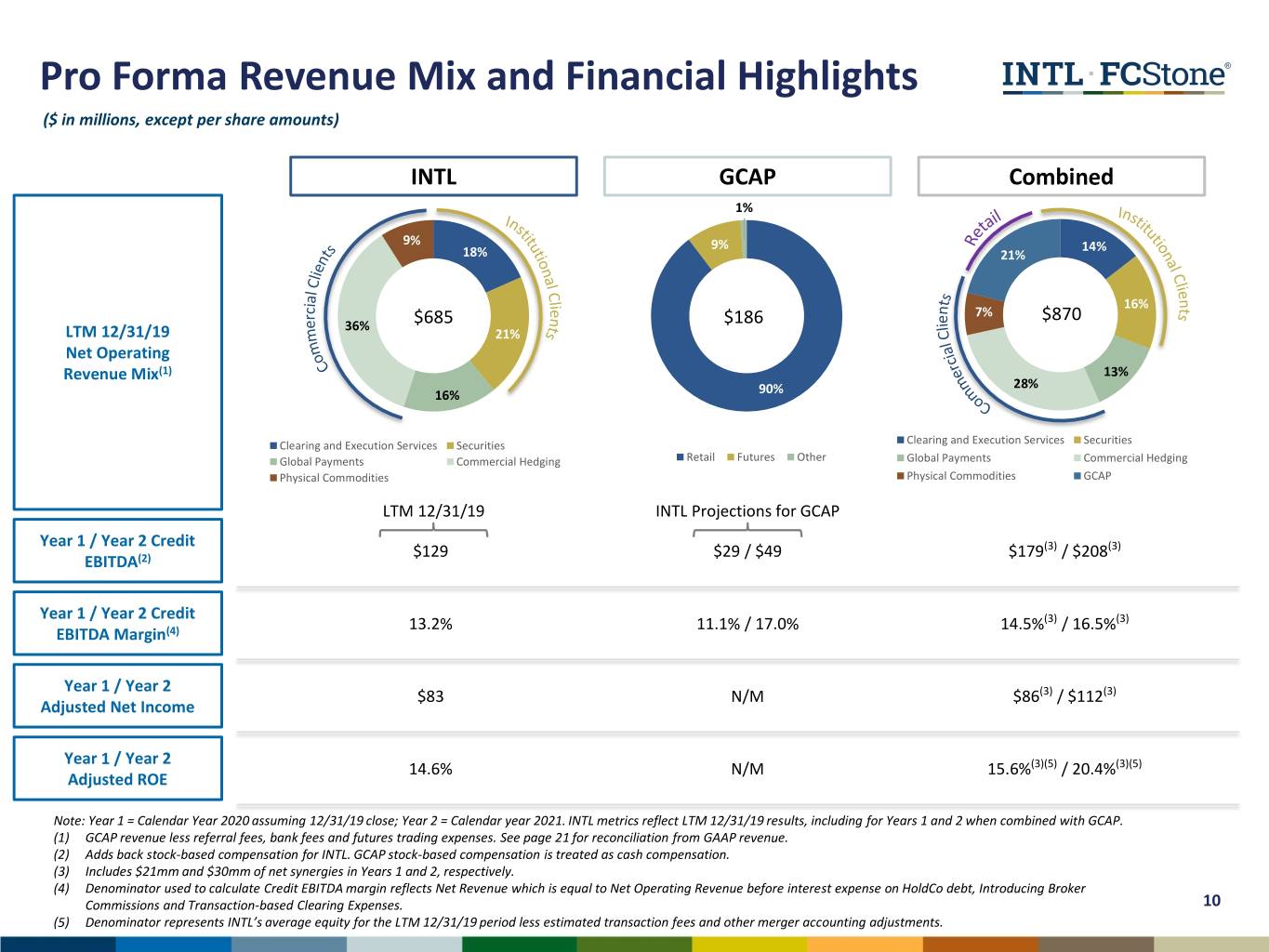

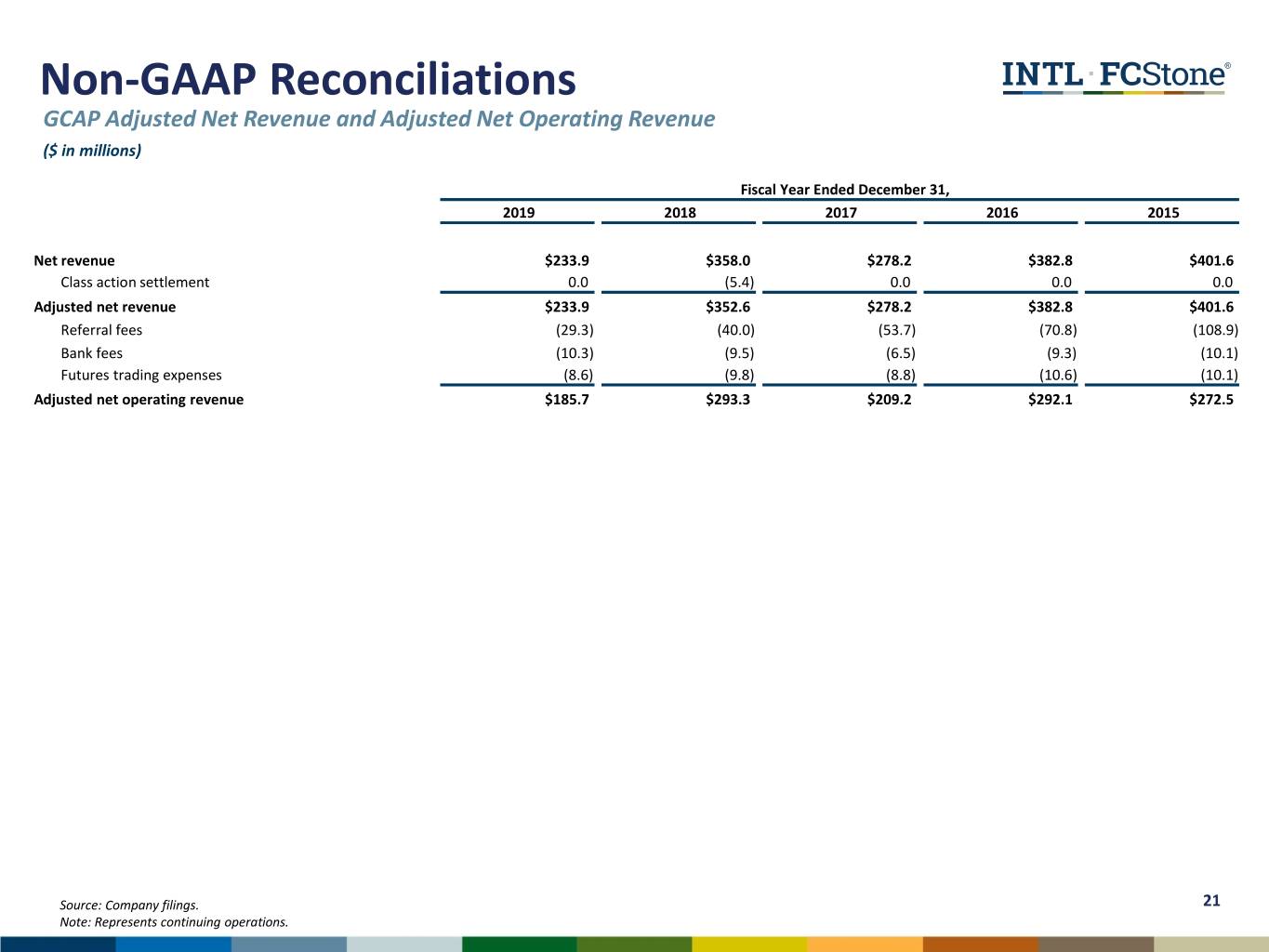

Pro Forma Revenue Mix and Financial Highlights ($ in millions, except per share amounts) INTL GCAP Combined 1% 9% 9% 14% 18% 21% 16% 7% $870 36% $685 $186 LTM 12/31/19 21% Net Operating Revenue Mix(1) 13% 28% 16% 90% Clearing and Execution Services Securities Clearing and Execution Services Securities Global Payments Commercial Hedging Retail Futures Other Global Payments Commercial Hedging Physical Commodities GCAP Physical Commodities GCAP LTM 12/31/19 INTL Projections for GCAP Year 1 / Year 2 Credit $129 $29 / $49 $179(3) / $208(3) EBITDA(2) Year 1 / Year 2 Credit 13.2% 11.1% / 17.0% 14.5%(3) / 16.5%(3) EBITDA Margin(4) Year 1 / Year 2 $83 N/M $86(3) / $112(3) Adjusted Net Income Year 1 / Year 2 14.6% N/M 15.6%(3)(5) / 20.4%(3)(5) Adjusted ROE Note: Year 1 = Calendar Year 2020 assuming 12/31/19 close; Year 2 = Calendar year 2021. INTL metrics reflect LTM 12/31/19 results, including for Years 1 and 2 when combined with GCAP. (1) GCAP revenue less referral fees, bank fees and futures trading expenses. See page 21 for reconciliation from GAAP revenue. (2) Adds back stock-based compensation for INTL. GCAP stock-based compensation is treated as cash compensation. (3) Includes $21mm and $30mm of net synergies in Years 1 and 2, respectively. (4) Denominator used to calculate Credit EBITDA margin reflects Net Revenue which is equal to Net Operating Revenue before interest expense on HoldCo debt, Introducing Broker Commissions and Transaction-based Clearing Expenses. 10 (5) Denominator represents INTL’s average equity for the LTM 12/31/19 period less estimated transaction fees and other merger accounting adjustments.

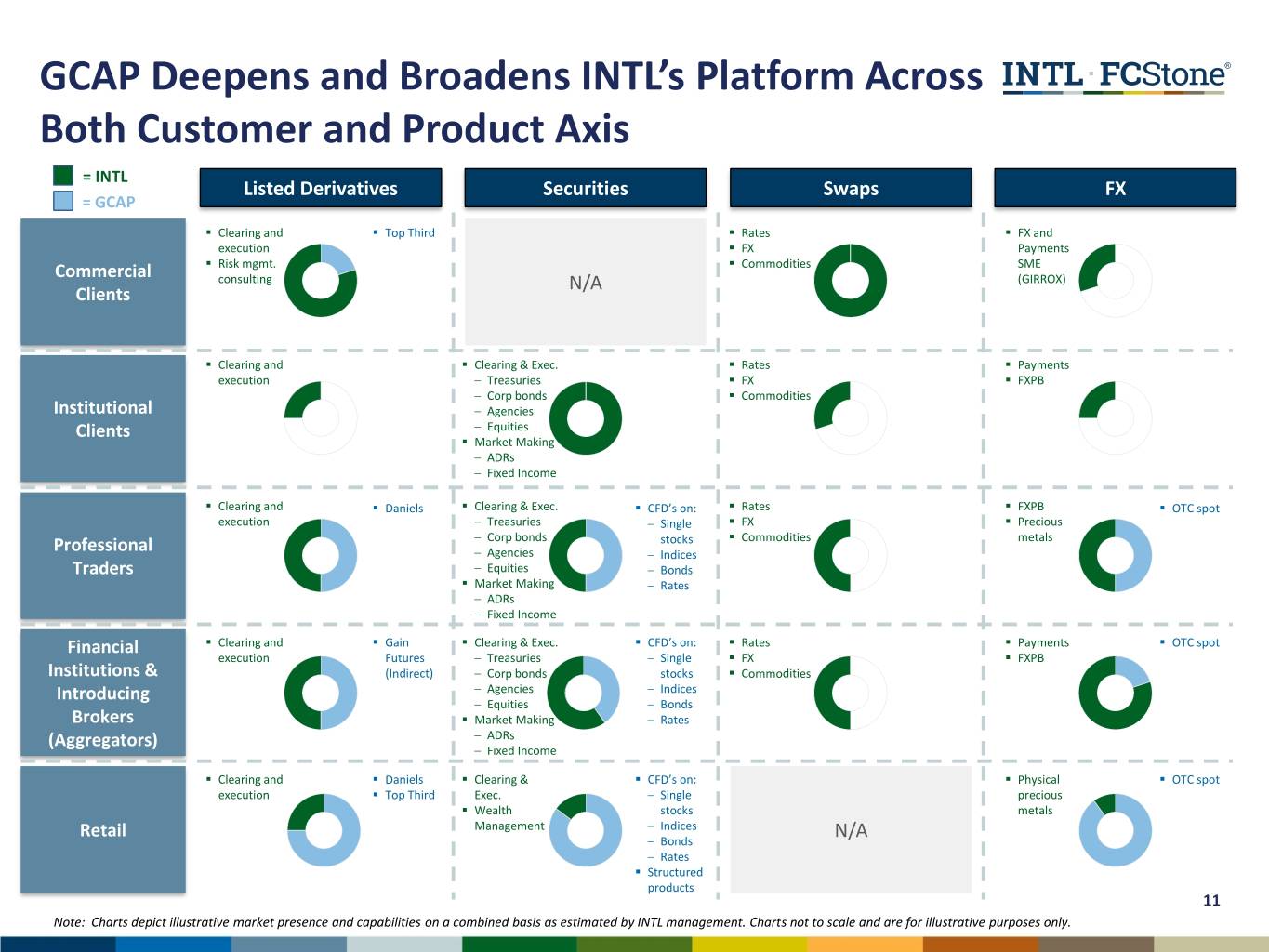

GCAP Deepens and Broadens INTL’s Platform Across Both Customer and Product Axis = INTL Listed Derivatives Securities Swaps FX = GCAP ▪ Clearing and ▪ Top Third ▪ Rates ▪ FX and execution ▪ FX Payments Commercial ▪ Risk mgmt. ▪ Commodities SME consulting N/A (GIRROX) Clients ▪ Clearing and ▪ Clearing & Exec. ▪ Rates ▪ Payments execution – Treasuries ▪ FX ▪ FXPB – Corp bonds ▪ Commodities Institutional – Agencies Clients – Equities ▪ Market Making – ADRs – Fixed Income ▪ Clearing and ▪ Daniels ▪ Clearing & Exec. ▪ CFD’s on: ▪ Rates ▪ FXPB ▪ OTC spot execution – Treasuries – Single ▪ FX ▪ Precious – Corp bonds stocks ▪ Commodities metals Professional – Agencies – Indices Traders – Equities – Bonds ▪ Market Making – Rates – ADRs – Fixed Income Financial ▪ Clearing and ▪ Gain ▪ Clearing & Exec. ▪ CFD’s on: ▪ Rates ▪ Payments ▪ OTC spot execution Futures – Treasuries – Single ▪ FX ▪ FXPB Institutions & (Indirect) – Corp bonds stocks ▪ Commodities Introducing – Agencies – Indices – Equities – Bonds Brokers ▪ Market Making – Rates (Aggregators) – ADRs – Fixed Income ▪ Clearing and ▪ Daniels ▪ Clearing & ▪ CFD’s on: ▪ Physical ▪ OTC spot execution ▪ Top Third Exec. – Single precious ▪ Wealth stocks metals Retail Management – Indices – Bonds N/A – Rates ▪ Structured products 11 Note: Charts depict illustrative market presence and capabilities on a combined basis as estimated by INTL management. Charts not to scale and are for illustrative purposes only.

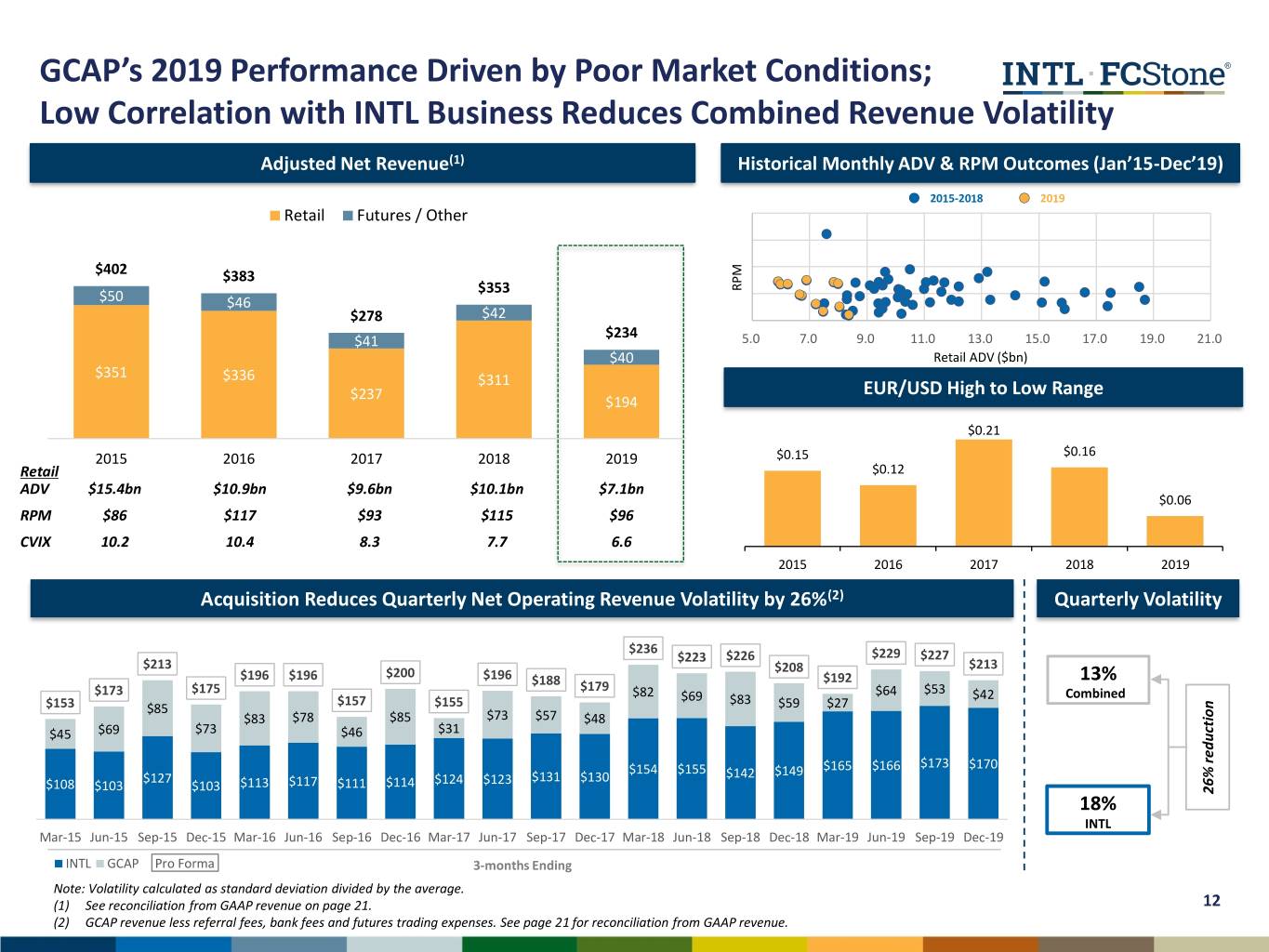

GCAP’s 2019 Performance Driven by Poor Market Conditions; Low Correlation with INTL Business Reduces Combined Revenue Volatility Adjusted Net Revenue(1) Historical Monthly ADV & RPM Outcomes (Jan’15-Dec’19) 2015-2018 2019 Retail Futures / Other $402 $383 $353 RPM $50 $46 $278 $42 $234 $41 5.0 7.0 9.0 11.0 13.0 15.0 17.0 19.0 21.0 $40 Retail ADV ($bn) $351 $336 $311 $237 EUR/USD High to Low Range $194 $0.21 2015 2016 2017 2018 2019 $0.15 $0.16 Retail $0.12 ADV $15.4bn $10.9bn $9.6bn $10.1bn $7.1bn $0.06 RPM $86 $117 $93 $115 $96 CVIX 10.2 10.4 8.3 7.7 6.6 2015 2016 2017 2018 2019 Acquisition Reduces Quarterly Net Operating Revenue Volatility by 26%(2) Quarterly Volatility $236 $226 $229 $227 $213 $223 $213 $200 $208 $196 $196 $196 $188 $192 13% $173 $175 $179 $82 $64 $53 Combined $157 $69 $83 $42 $153 $85 $155 $59 $27 $83 $78 $85 $73 $57 $48 $45 $69 $73 $46 $31 $173 $154 $155 $149 $165 $166 $170 $127 $131 $130 $142 $108 $103 $103 $113 $117 $111 $114 $124 $123 18% reduction 26% INTL Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 INTL GCAP Pro Forma 3-months Ending Note: Volatility calculated as standard deviation divided by the average. (1) See reconciliation from GAAP revenue on page 21. 12 (2) GCAP revenue less referral fees, bank fees and futures trading expenses. See page 21 for reconciliation from GAAP revenue.

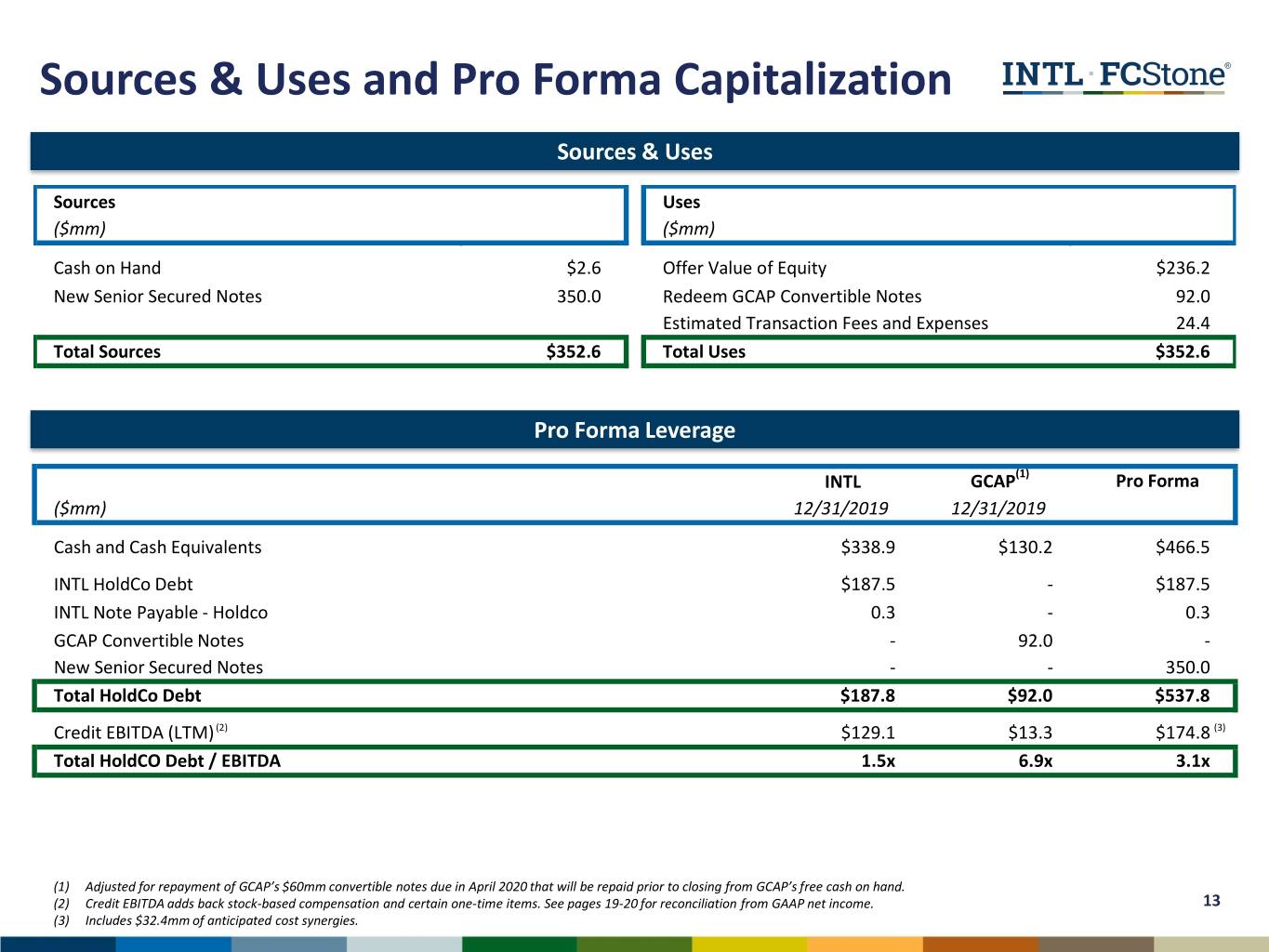

Sources & Uses and Pro Forma Capitalization Sources & Uses Sources Uses ($mm) ($mm) 0 0 Cash on Hand $2.6 Offer Value of Equity $236.2 New Senior Secured Notes 350.0 Redeem GCAP Convertible Notes 92.0 Estimated Transaction Fees and Expenses 24.4 Total Sources $352.6 Total Uses $352.6 Pro Forma Leverage INTL GCAP(1) Pro Forma ($mm) 12/31/2019 12/31/2019 Cash and Cash Equivalents $338.9 $130.2 $466.5 INTL HoldCo Debt $187.5 - $187.5 INTL Note Payable - Holdco 0.3 - 0.3 GCAP Convertible Notes - 92.0 - New Senior Secured Notes - - 350.0 Total HoldCo Debt $187.8 $92.0 $537.8 Credit EBITDA (LTM) (2) $129.1 $13.3 $174.8 (3) Total HoldCO Debt / EBITDA 1.5x 6.9x 3.1x (1) Adjusted for repayment of GCAP’s $60mm convertible notes due in April 2020 that will be repaid prior to closing from GCAP’s free cash on hand. (2) Credit EBITDA adds back stock-based compensation and certain one-time items. See pages 19-20 for reconciliation from GAAP net income. 13 (3) Includes $32.4mm of anticipated cost synergies.

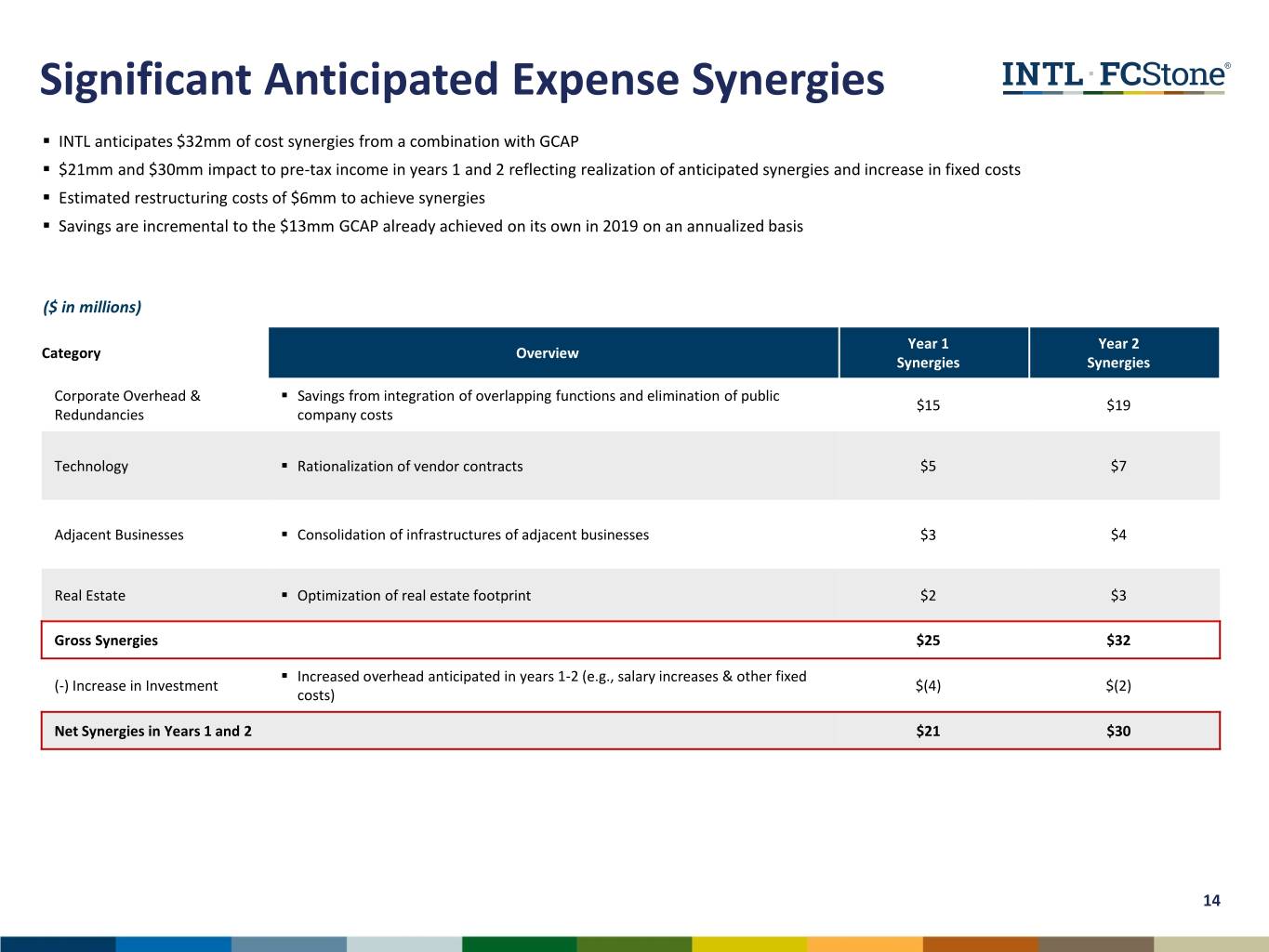

Significant Anticipated Expense Synergies ▪ INTL anticipates $32mm of cost synergies from a combination with GCAP ▪ $21mm and $30mm impact to pre-tax income in years 1 and 2 reflecting realization of anticipated synergies and increase in fixed costs ▪ Estimated restructuring costs of $6mm to achieve synergies ▪ Savings are incremental to the $13mm GCAP already achieved on its own in 2019 on an annualized basis ($ in millions) Year 1 Year 2 Category Overview Synergies Synergies Corporate Overhead & ▪ Savings from integration of overlapping functions and elimination of public $15 $19 Redundancies company costs Technology ▪ Rationalization of vendor contracts $5 $7 Adjacent Businesses ▪ Consolidation of infrastructures of adjacent businesses $3 $4 Real Estate ▪ Optimization of real estate footprint $2 $3 Gross Synergies $25 $32 ▪ Increased overhead anticipated in years 1-2 (e.g., salary increases & other fixed (-) Increase in Investment $(4) $(2) costs) Net Synergies in Years 1 and 2 $21 $30 14

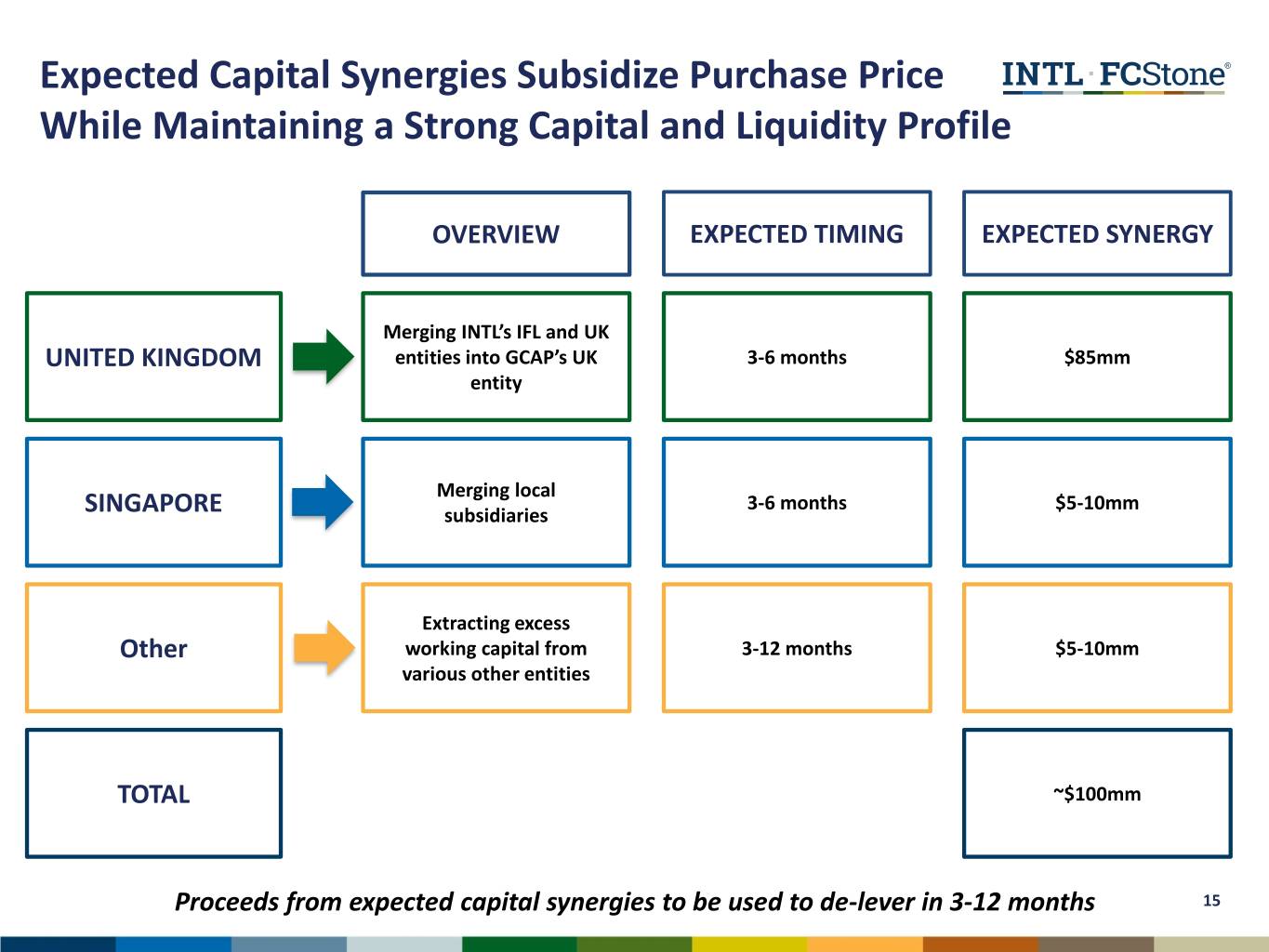

Expected Capital Synergies Subsidize Purchase Price While Maintaining a Strong Capital and Liquidity Profile OVERVIEW EXPECTED TIMING EXPECTED SYNERGY Merging INTL’s IFL and UK UNITED KINGDOM entities into GCAP’s UK 3-6 months $85mm entity Merging local 3-6 months $5-10mm SINGAPORE subsidiaries Extracting excess Other working capital from 3-12 months $5-10mm various other entities TOTAL ~$100mm Proceeds from expected capital synergies to be used to de-lever in 3-12 months 15

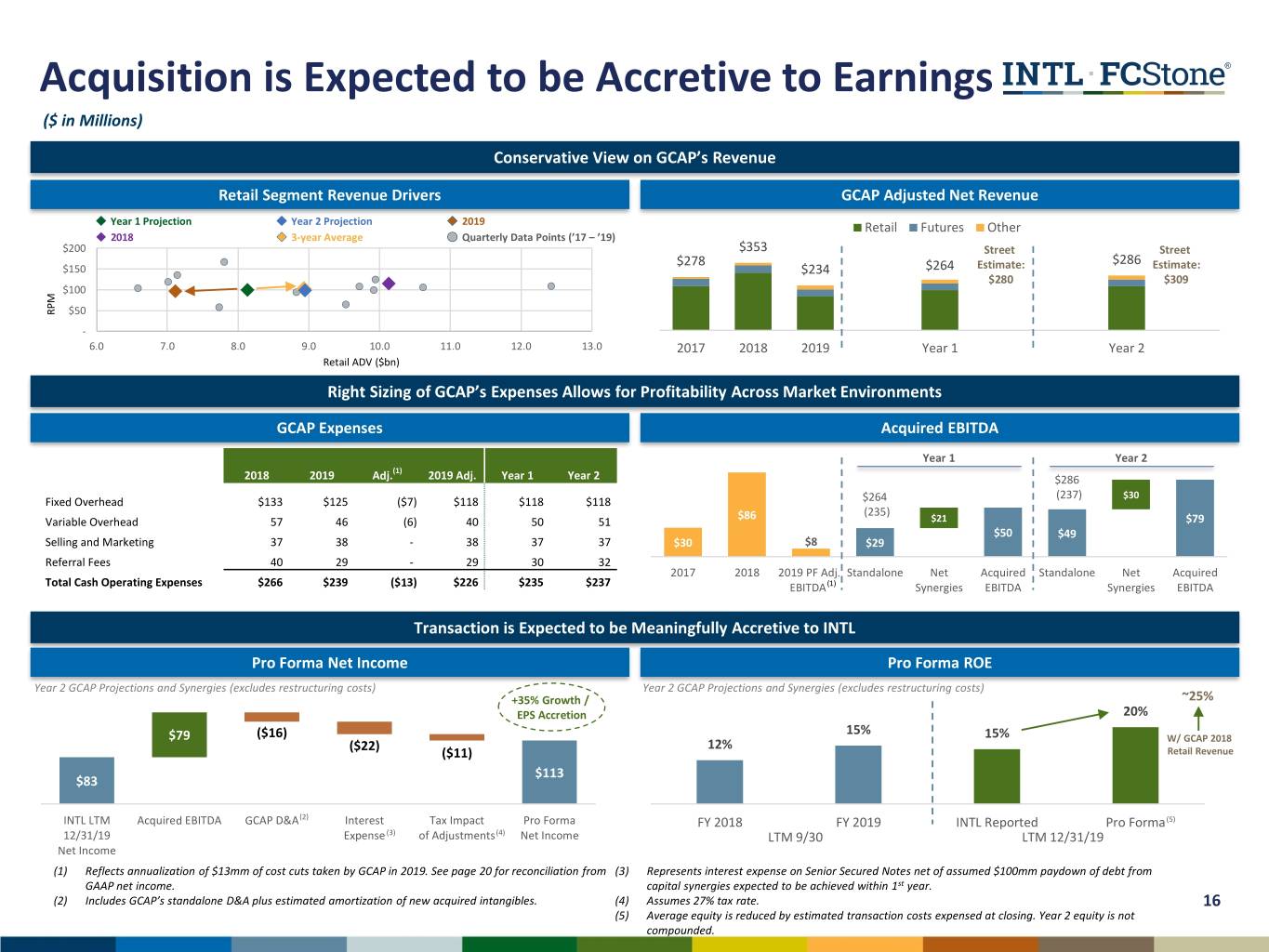

Acquisition is Expected to be Accretive to Earnings ($ in Millions) Conservative View on GCAP’s Revenue Retail Segment Revenue Drivers GCAP Adjusted Net Revenue Year 1 Projection Year 2 Projection 2019 Retail Futures Other 2018 3-year Average Quarterly Data Points (’17 – ’19) $200 $353 Street Street $278 $286 $150 $234 $264 Estimate: Estimate: $280 $309 $100 RPM $50 - 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 2017 2018 2019 Year 1 Year 2 Retail ADV ($bn) Right Sizing of GCAP’s Expenses Allows for Profitability Across Market Environments GCAP Expenses Acquired EBITDA Year 1 Year 2 (1) 2018 2019 Adj. 2019 Adj. Year 1 Year 2 $286 (237) $30 Fixed Overhead $133 $125 ($7) $118 $118 $118 $264 $86 (235) Variable Overhead 57 46 (6) 40 50 51 $21 $79 $50 $49 Selling and Marketing 37 38 - 38 37 37 $30 $8 $29 Referral Fees 40 29 - 29 30 32 2017 2018 2019 PF Adj. Standalone Net Acquired Standalone Net Acquired Total Cash Operating Expenses $266 $239 ($13) $226 $235 $237 EBITDA(1) Synergies EBITDA Synergies EBITDA Transaction is Expected to be Meaningfully Accretive to INTL Pro Forma Net Income Pro Forma ROE Year 2 GCAP Projections and Synergies (excludes restructuring costs) Year 2 GCAP Projections and Synergies (excludes restructuring costs) +35% Growth / ~25% EPS Accretion 20% 15% $79 ($16) 15% W/ GCAP 2018 ($22) 12% ($11) Retail Revenue $113 $83 INTL LTM Acquired EBITDA GCAP D&A(2) Interest Tax Impact Pro Forma FY 2018 FY 2019 INTL Reported Pro Forma(5) 12/31/19 Expense (3) of Adjustments(4) Net Income LTM 9/30 LTM 12/31/19 Net Income (1) Reflects annualization of $13mm of cost cuts taken by GCAP in 2019. See page 20 for reconciliation from (3) Represents interest expense on Senior Secured Notes net of assumed $100mm paydown of debt from GAAP net income. capital synergies expected to be achieved within 1st year. (2) Includes GCAP’s standalone D&A plus estimated amortization of new acquired intangibles. (4) Assumes 27% tax rate. 16 (5) Average equity is reduced by estimated transaction costs expensed at closing. Year 2 equity is not compounded.

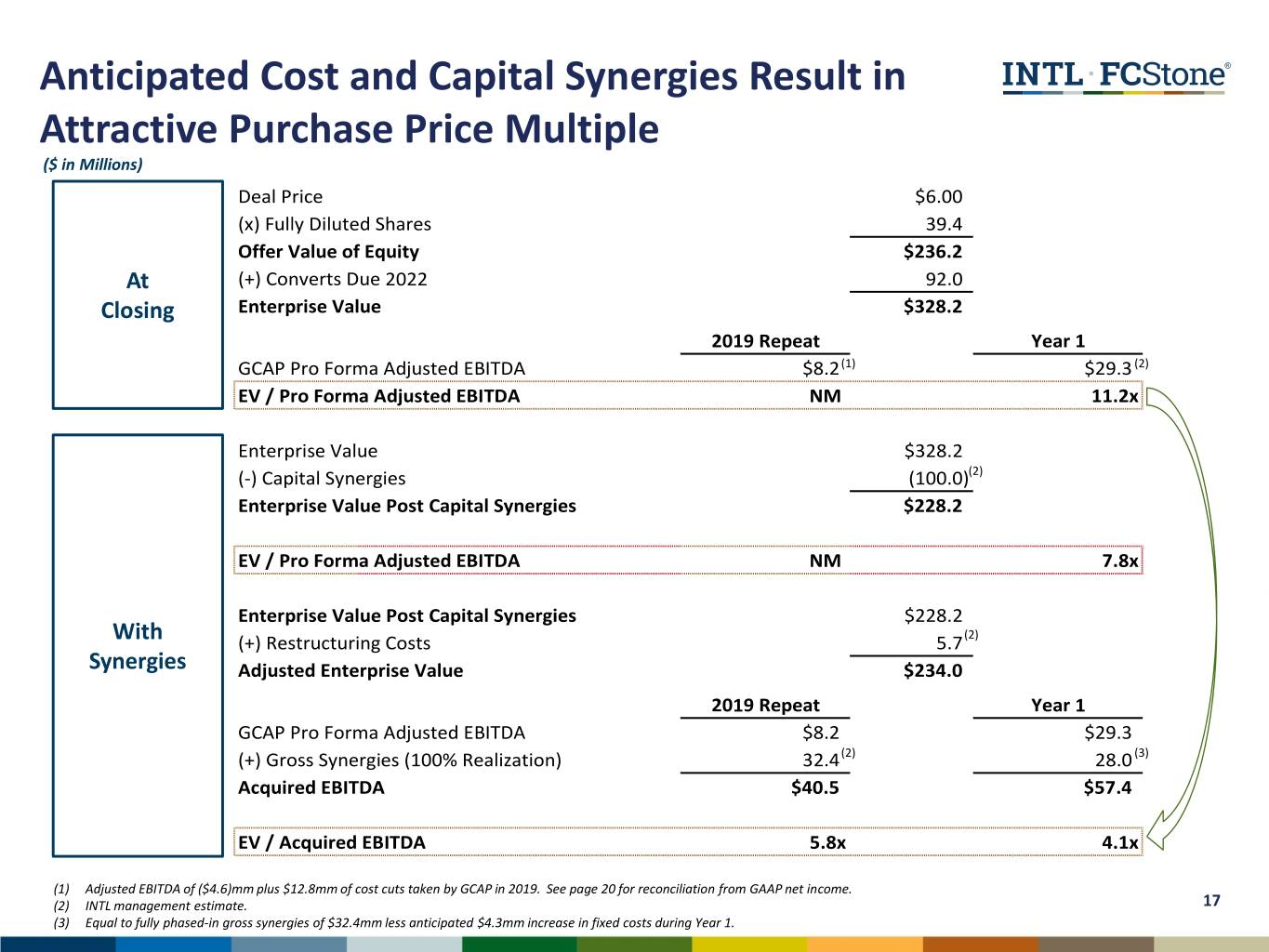

Anticipated Cost and Capital Synergies Result in Attractive Purchase Price Multiple ($ in Millions) Deal Price $6.00 (x) Fully Diluted Shares 39.4 Offer Value of Equity $236.2 At (+) Converts Due 2022 92.0 Closing Enterprise Value $328.2 2019 Repeat Year 1 GCAP Pro Forma Adjusted EBITDA $8.2(1) $29.3 (2) EV / Pro Forma Adjusted EBITDA NM 11.2x Enterprise Value $328.2 (-) Capital Synergies (100.0)(2) Enterprise Value Post Capital Synergies $228.2 EV / Pro Forma Adjusted EBITDA NM 7.8x Enterprise Value Post Capital Synergies $228.2 With (+) Restructuring Costs 5.7(2) Synergies Adjusted Enterprise Value $234.0 2019 Repeat Year 1 GCAP Pro Forma Adjusted EBITDA $8.2 $29.3 (+) Gross Synergies (100% Realization) 32.4(2) 28.0 (3) Acquired EBITDA $40.5 $57.4 EV / Acquired EBITDA 5.8x 4.1x (1) Adjusted EBITDA of ($4.6)mm plus $12.8mm of cost cuts taken by GCAP in 2019. See page 20 for reconciliation from GAAP net income. (2) INTL management estimate. 17 (3) Equal to fully phased-in gross synergies of $32.4mm less anticipated $4.3mm increase in fixed costs during Year 1.

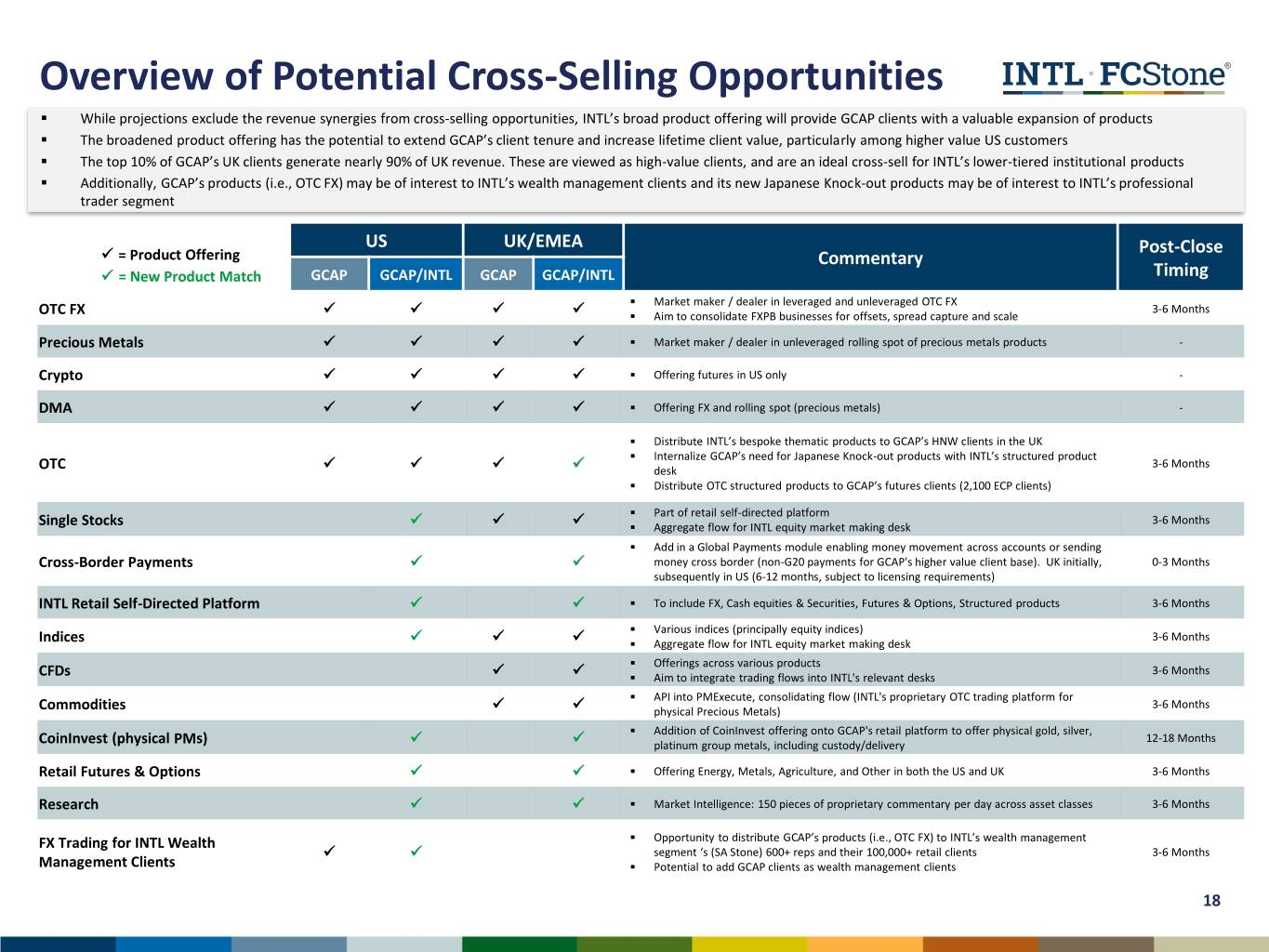

Overview of Potential Cross-Selling Opportunities ▪ While projections exclude the revenue synergies from cross-selling opportunities, INTL’s broad product offering will provide GCAP clients with a valuable expansion of products ▪ The broadened product offering has the potential to extend GCAP’s client tenure and increase lifetime client value, particularly among higher value US customers ▪ The top 10% of GCAP’s UK clients generate nearly 90% of UK revenue. These are viewed as high-value clients, and are an ideal cross-sell for INTL’s lower-tiered institutional products ▪ Additionally, GCAP’s products (i.e., OTC FX) may be of interest to INTL’s wealth management clients and its new Japanese Knock-out products may be of interest to INTL’s professional trader segment US UK/EMEA Post-Close ✓ = Product Offering Commentary ✓ = New Product Match GCAP GCAP/INTL GCAP GCAP/INTL Timing ▪ Market maker / dealer in leveraged and unleveraged OTC FX 3-6 Months OTC FX ✓ ✓ ✓ ✓ ▪ Aim to consolidate FXPB businesses for offsets, spread capture and scale Precious Metals ✓ ✓ ✓ ✓ ▪ Market maker / dealer in unleveraged rolling spot of precious metals products - Crypto ✓ ✓ ✓ ✓ ▪ Offering futures in US only - DMA ✓ ✓ ✓ ✓ ▪ Offering FX and rolling spot (precious metals) - ▪ Distribute INTL’s bespoke thematic products to GCAP’s HNW clients in the UK ▪ Internalize GCAP’s need for Japanese Knock-out products with INTL’s structured product 3-6 Months OTC ✓ ✓ ✓ ✓ desk ▪ Distribute OTC structured products to GCAP’s futures clients (2,100 ECP clients) ▪ Part of retail self-directed platform 3-6 Months Single Stocks ✓ ✓ ✓ ▪ Aggregate flow for INTL equity market making desk ▪ Add in a Global Payments module enabling money movement across accounts or sending Cross-Border Payments ✓ ✓ money cross border (non-G20 payments for GCAP's higher value client base). UK initially, 0-3 Months subsequently in US (6-12 months, subject to licensing requirements) INTL Retail Self-Directed Platform ✓ ✓ ▪ To include FX, Cash equities & Securities, Futures & Options, Structured products 3-6 Months ▪ Various indices (principally equity indices) 3-6 Months Indices ✓ ✓ ✓ ▪ Aggregate flow for INTL equity market making desk ▪ Offerings across various products 3-6 Months CFDs ✓ ✓ ▪ Aim to integrate trading flows into INTL's relevant desks ▪ API into PMExecute, consolidating flow (INTL's proprietary OTC trading platform for 3-6 Months Commodities ✓ ✓ physical Precious Metals) ▪ Addition of CoinInvest offering onto GCAP's retail platform to offer physical gold, silver, 12-18 Months CoinInvest (physical PMs) ✓ ✓ platinum group metals, including custody/delivery Retail Futures & Options ✓ ✓ ▪ Offering Energy, Metals, Agriculture, and Other in both the US and UK 3-6 Months Research ✓ ✓ ▪ Market Intelligence: 150 pieces of proprietary commentary per day across asset classes 3-6 Months FX Trading for INTL Wealth ▪ Opportunity to distribute GCAP’s products (i.e., OTC FX) to INTL’s wealth management ✓ ✓ segment ‘s (SA Stone) 600+ reps and their 100,000+ retail clients 3-6 Months Management Clients ▪ Potential to add GCAP clients as wealth management clients 18

Non-GAAP Reconciliations INTL 12/31/19 LTM EBITDA ($ in millions) Three Months Ended Fiscal Year Ended Twelve Months Ended December 31, September 30, December 31, 2019 2018 2019 2019 Net income from continuing operations $16.3 $18.2 $85.1 $83.2 Interest expense 33.8 33.0 154.7 155.5 Depreciation and amortization 3.9 2.9 14.0 15.0 Income tax expense 5.4 6.2 25.9 25.1 EBITDA $59.4 $60.3 $279.7 $278.8 Amortization of share based compensation expense 2.6 1.9 8.1 8.8 Interest attributable to short-term financing facilities of subsidiaries (31.1) (30.2) (142.0) (142.9) Gain on acquisition (0.1) - (5.5) (5.6) Bad debt (recovery) on physical coal - (2.4) (12.4) (10.0) Credit EBITDA $30.8 $29.6 $127.9 $129.1 19

Non-GAAP Reconciliations GCAP Adjusted EBITDA ($ in millions) Fiscal Year Ended December 31, 2019 2018 2017 2016 2015 Net (loss) / income from continuing operations ($60.8) $28.0 ($14.9) $35.3 $10.3 Depreciation and amortization 17.1 19.7 17.0 13.9 11.1 Purchased intangible amortization 8.8 14.2 14.0 15.0 16.6 Interest on long-term borrowings 13.5 13.5 11.8 10.4 9.2 Income tax (benefit) / expense (12.9) 8.5 (5.0) 9.8 (3.5) Contingent provision 0.2 0.0 0.0 0.0 0.0 Legal settlement 0.0 5.3 0.0 9.2 0.0 Restructuring expenses 1.3 0.8 0.0 1.0 3.5 Goodwill impairment 28.1 0.0 0.0 0.0 0.0 Impairment of investment 0.0 (0.1) 0.6 0.0 0.0 Equity in net loss of affiliates 0.0 0.0 0.3 0.1 0.0 Loss on extinguishment of debt 0.0 0.0 4.9 0.0 0.0 Class action settlement 0.0 (5.4) 0.0 0.0 0.0 PP&E write-off 0.0 1.3 0.0 0.0 0.0 Dutch auction fees 0.0 0.8 0.0 0.0 0.0 Operational strategy review fees 0.0 0.0 0.8 0.0 0.0 Acquisition expenses 0.0 0.0 0.0 0.0 2.8 Integration costs 0.0 0.0 0.0 2.8 33.1 Bad debt related to SNB event in January 2015 0.0 0.0 0.0 0.0 2.5 Acquisition contingent consideration adjustment 0.0 0.0 0.0 0.0 (6.7) Net income attributable to non-controlling interest 0.0 0.0 0.0 2.1 1.7 Adjusted EBITDA, before removal of Institutional Segment profit ($4.6) $86.5 $29.7 $99.6 $80.6 Removal of Institutional Segment profit 0.0 0.0 0.0 (5.4) (10.1) Adjusted EBITDA ($4.6) $86.5 $29.7 $94.3 $70.5 2019 annualized cost savings 12.8 Pro Forma Adjusted EBITDA $8.2 Share-based compensation expense 5.1 Credit EBITDA $13.3 Source: Company filings. 20 Note: 2015-2016 includes discontinued operations, but is adjusted for removal of institutional segment profit. 2017-2019 reflects continuing operations.

Non-GAAP Reconciliations GCAP Adjusted Net Revenue and Adjusted Net Operating Revenue ($ in millions) Fiscal Year Ended December 31, 2019 2018 2017 2016 2015 Net revenue $233.9 $358.0 $278.2 $382.8 $401.6 Class action settlement 0.0 (5.4) 0.0 0.0 0.0 Adjusted net revenue $233.9 $352.6 $278.2 $382.8 $401.6 Referral fees (29.3) (40.0) (53.7) (70.8) (108.9) Bank fees (10.3) (9.5) (6.5) (9.3) (10.1) Futures trading expenses (8.6) (9.8) (8.8) (10.6) (10.1) Adjusted net operating revenue $185.7 $293.3 $209.2 $292.1 $272.5 Source: Company filings. 21 Note: Represents continuing operations.