Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AXON ENTERPRISE, INC. | aaxnq42019-ex991shareh.htm |

| 8-K - 8-K - AXON ENTERPRISE, INC. | aaxnq42019-8ksharehold.htm |

Q4 2019 // LETTER TO SHAREHOLDERS 2020 / TO OUR SHAREHOLDERS CONTACT Axon 2019 Revenue Grows 26% to $531 Million, Investor Relations SaaS ARR up 49%, Axon Enterprise, Inc. Foundation Set for Continued Growth, Momentum IR@axon.com PAGE 1

Q4 2019 // LETTER TO SHAREHOLDERS DEAR SHAREHOLDERS We are pleased to report a strong finish to 2019. Revenue grew 26% to $531 million for the year, driven by demand for our latest generation camera, Axon Body 3, the cloud-connected TASER 7, and our cloud software. Bottom line performance reflects our ability to scale manufacturing of TASER 7, continued growth of higher margin Axon Cloud revenue (up 41% for the full year), and cost control discipline. While net income was affected by catch-up stock compensation expense, we delivered a record $88 million in adjusted EBITDA for the full year, up 43%, and Q4 2019 adjusted EBITDA more than tripled to $38 million, reflecting a 22% margin. The successful launch of Axon Body 3 drove record Q4 2019 sales of $172 million, up 50%, and holds tremendous strategic value. Customers are enthusiastic about better core performance and situational awareness features such as live-video streaming and real-time alerts. With LTE connectivity, GPS and a more powerful CPU for edge-AI processing, Axon Body 3 is designed to improve officer performance and drive adoption of SaaS features. Importantly, this is expected to fuel continued growth in annual recurring SaaS revenue. Axon Body 3’s communications capabilities also pave the way for adoption of the emergency dispatch solution we are bringing to market this year. PAGE 2

Q4 2019 // LETTER TO SHAREHOLDERS Our strategic focus on driving recurring cash Our strategic priorities in 2020 include continuing to flow and building a self-reinforcing SaaS-centric execute in our core market, while accelerating our path-to- business is working. market in new product categories such as de-escalation For example, in 2019: and communications, and expanding to new customer categories. This will position us to achieve a higher level of annual recurring SaaS revenue over the long term. + WE ACHIEVED $161 MILLION IN Specifically: ANNUAL RECURRING SAAS REVENUE, UP 49% OVER 2018 01 + 71% OF OUR FULL-YEAR REVENUE WAS IN RECURRING CONTRACTS, UP FROM 55% IN 2018 AND 46% IN 2017 We are accelerating our R&D investments in developing real-time command-and-control software for public + MORE THAN 100 AGENCIES ADOPTED safety, which represents a $2 billion rapidly growing OFFICER SAFETY PLAN 7, WHICH market. Axon’s cloud-based software will be designed to empower everyone involved in incident response: CARRIES PER-OFFICER-PER-MONTH dispatchers, call takers, command staff, patrol officers, PRICING OF $149 TO $229 AND firefighters and medical personnel. We intend to CREATED A PIPELINE OF CUSTOMERS fundamentally improve the workflow that the industry THAT HAVE GAINED ACCESS TO AXON refers to as Computer Aided Dispatch, or CAD — RECORDS; enabling entire agencies to respond as one team to get the right people with the right information to the right + MORE THAN 70% OF OFFICER SAFETY place at the right time. We expect to be live by mid-year PLAN 7 USERS ARE ON THE TOP-TIER with our first paying customer. 7+ PLAN; AND + MORE THAN 550 AGENCIES ADOPTED 02 THE CLOUD-CONNECTED TASER 7, WITH 80% OF THOSE SELECTING OUR HIGHEST VALUE PLANS We see a major opportunity in the corrections and federal law enforcement channels. In Q4 2019, Axon won a Department of Justice contract to equip Bureau We continue to see customer enthusiasm of Alcohol, Tobacco, Firearms and Explosives officers for Axon Records, which underscores the with body cameras. This contract vehicle will also effectiveness of our go-to-market strategy. allow other federal law enforcement agencies to join We’ve made it attractive for agencies to start the Axon network. We are now proud to support both using Records by including it as a built-in benefit the US Forest Service’s adoption of body cameras to our highest tier Officer Safety Plan — and and TASER devices, and the DOJ’s new body camera some agencies will be able to fund the majority pilot effort, both representing significant milestones of their upgrade to that tier with savings from in Axon’s federal expansion efforts. We estimate these transitioning their legacy records management two markets add $1.5 billion to our core municipal public system to Axon Records. safety market. PAGE 3

Q4 2019 // LETTER TO SHAREHOLDERS UNLOCKING NEW OPPORTUNITIES Axon’s strategic growth areas have evolved and expanded into: 1 DE-ESCALATION 3 PRODUCTIVITY Developing tools that support public safety Our productivity suite of tools reduce time spent officers in avoiding or minimizing use of force is a on paperwork. Axon Records takes a disruptive key component of Axon’s mission to protect life. modern approach to displace legacy on-premises These tools include the cloud-connected TASER Records Management Systems (RMS) by putting conducted energy device as well as a suite of body camera video at the heart of incident records. Augmented Reality and Virtual Reality (AR/VR) Axon Records includes Axon Standards, a radically training services for law enforcement, delivered simpler approach to use-of-force reporting. Another through our Axon Academy training platform. software solution in this suite, Axon Performance, To obsolete the bullet, we intend to not only helps agencies ensure that officers are adhering develop more effective TASER devices over time to agency policies, and provides analytics on the but also drive training and adoption of the best effectiveness of body-worn camera programs. And practices in modern policing. Redaction Assistant enables agencies to redact videos in a fraction of the time through the use of 2 SENSORS artificial intelligence (AI). Our digital evidence management software, Axon Evidence, supports our network of cloud- 4 COMMUNICATIONS connected cameras and sensors. Axon Evidence We are developing communication tools that is the world’s largest cloud-hosted data support real-time situational awareness through repository of law enforcement video data and the sharing of information across various channels, other types of electronic evidence. In September including voice, messaging, location mapping, and 2019, we began shipping Axon Body 3, a camera intelligence and evidence sharing. Products include with an LTE antenna and GPS chip, which Axon Aware, which allows agencies to know the GPS supports real-time awareness. location of their officers and what those officers are experiencing through live video streaming and more; and Axon Dispatch, the emergency dispatch solution we are bringing to market this year. BY 2030, WE BELIEVE TASER devices AI-enabled Cloud-enabled Axon will be a house- will be the body cameras devices will be hold name by virtue of primary means will eliminate the primary means the transformative value to stop a threat the majority of to dispatch officers we’ll create for society manual report in the field and all of our stakeholders writing PAGE 4

Q4 2019 // LETTER TO SHAREHOLDERS GROSS MARGIN RESULTS SUMMARY Total company gross margin of 53.9% reflected a higher-than-usual mix of Q4 2019 body camera hardware and TASER 7 cartridges, as expected. For more details, please see gross margin commentary by segment, below. $172M QUARTERLY REVENUE ($0.21) $0.41 Record quarterly revenue of $172 million, GAAP EPS NON-GAAP EPS up 50% year over year, included $26 million of Axon Body 3 hardware shipments, and GAAP EPS was ($0.21); Non-GAAP EPS reflected a successful product launch. of $0.41 excludes non-cash stock-based compensation expense. / GAAP EPS includes the “catch-up” stock-based compensation expense referred to above. OPERATING EXPENSES / For more details about Axon’s innovative stock- Operating expenses of $107 million based compensation plans, which were approved included $47.5 million in stock-based by shareholders and align the interests of compensation expenses, including $33 management and employees with shareholders, please see our online FAQ . million of incremental “catch up” expense. Operating expenses excluding stock- based compensation declined sequentially, reflecting rigorous cost controls. $38M / SG&A of $78 million included $40.2 ADJ. EBITDA million in stock-based compensation Quarterly Adjusted EBITDA was a record $38 expenses, including $29.9 million in million, representing 22% margin on revenue, “catch up” expenses. R&D of $29 million and 48% incremental contribution margin. For included $7.3 million in stock-based the full year, adjusted EBITDA grew 43% to compensation expenses, including $2.9 $88 million. million in “catch up” expenses. / These “catch up” expenses are tied to Axon’s CEO Performance Award $396M and eXponential Stock Performance CASH & INVESTMENTS Plan (“XSPP”), for which six additional Cash and investments grew $43 million performance goals became probable of sequentially to approximately $396 million. attainment during Q4 2019 due to our Axon’s strong balance sheet, with zero debt, strengthened outlook, bringing the total provides us with the latitude to continue number of performance goals that are growing our subscription contracts as a statistically probable to nine. percentage of revenue. PAGE 5

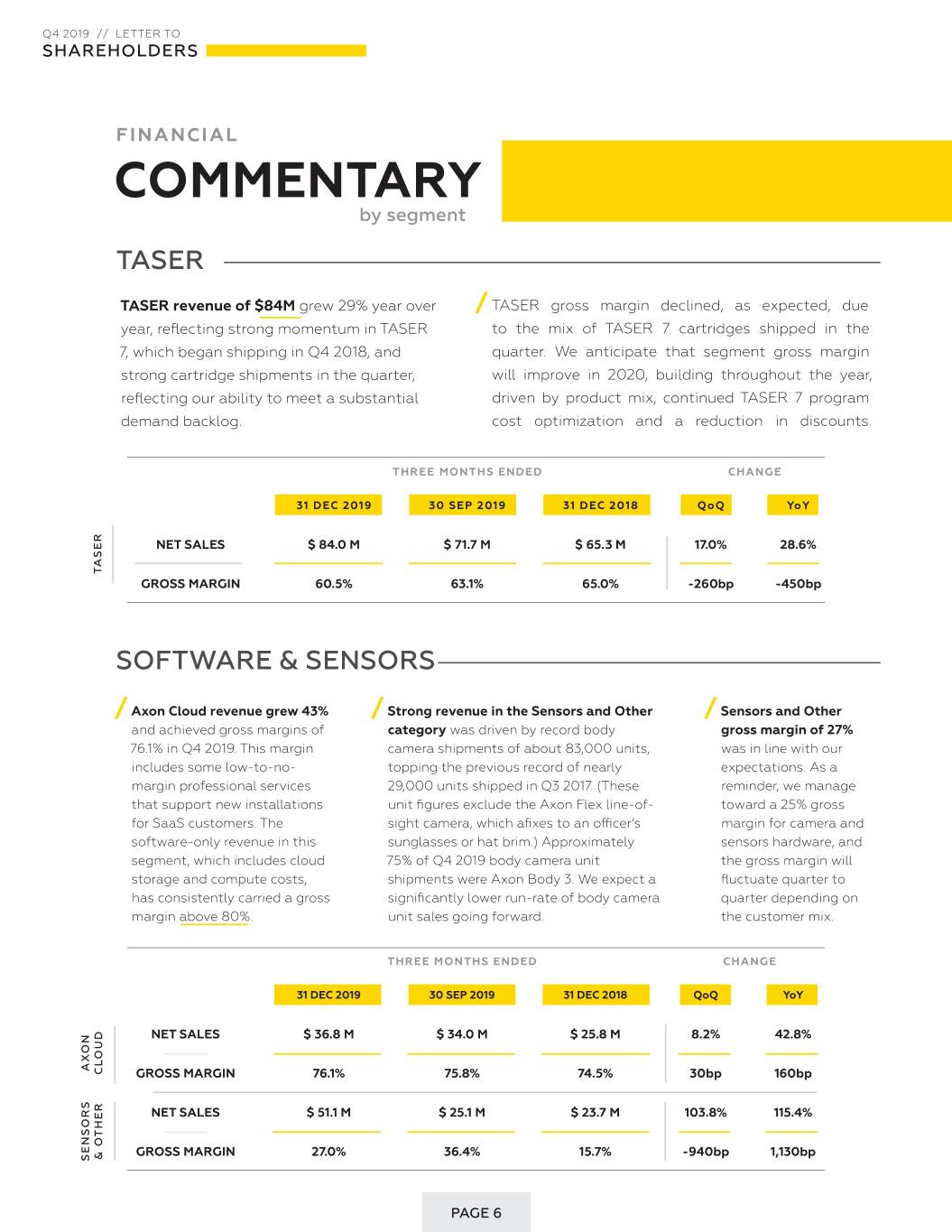

Q4 2019 // LETTER TO SHAREHOLDERS FINANCIAL COMMENTARY by segment TASER TASER revenue of $84M grew 29% year over / TASER gross margin declined, as expected, due year, reflecting strong momentum in TASER to the mix of TASER 7 cartridges shipped in the 7, which began shipping in Q4 2018, and quarter. We anticipate that segment gross margin strong cartridge shipments in the quarter, will improve in 2020, building throughout the year, reflecting our ability to meet a substantial driven by product mix, continued TASER 7 program demand backlog. cost optimization and a reduction in discounts. THREE MONTHS ENDED CHANGE 31 DEC 2019 30 SEP 2019 31 DEC 2018 QoQ YoY NET SALES $ 84.0 M $ 71.7 M $ 65.3 M 17.0% 28.6% TASER GROSS MARGIN 60.5% 63.1% 65.0% -260bp -450bp SOFTWARE & SENSORS / Axon Cloud revenue grew 43% / Strong revenue in the Sensors and Other / Sensors and Other and achieved gross margins of category was driven by record body gross margin of 27% 76.1% in Q4 2019. This margin camera shipments of about 83,000 units, was in line with our includes some low-to-no- topping the previous record of nearly expectations. As a margin professional services 29,000 units shipped in Q3 2017. (These reminder, we manage that support new installations unit figures exclude the Axon Flex line-of- toward a 25% gross for SaaS customers. The sight camera, which afixes to an officer’s margin for camera and software-only revenue in this sunglasses or hat brim.) Approximately sensors hardware, and segment, which includes cloud 75% of Q4 2019 body camera unit the gross margin will storage and compute costs, shipments were Axon Body 3. We expect a fluctuate quarter to has consistently carried a gross significantly lower run-rate of body camera quarter depending on margin above 80%. unit sales going forward. the customer mix. THREE MONTHS ENDED CHANGE 31 DEC 2019 30 SEP 2019 31 DEC 2018 QoQ YoY NET SALES $ 36.8 M $ 34.0 M $ 25.8 M 8.2% 42.8% AXON AXON CLOUD GROSS MARGIN 76.1% 75.8% 74.5% 30bp 160bp NET SALES $ 51.1 M $ 25.1 M $ 23.7 M 103.8% 115.4% GROSS MARGIN 27.0% 36.4% 15.7% -940bp 1,130bp & OTHER SENSORS SENSORS PAGE 6

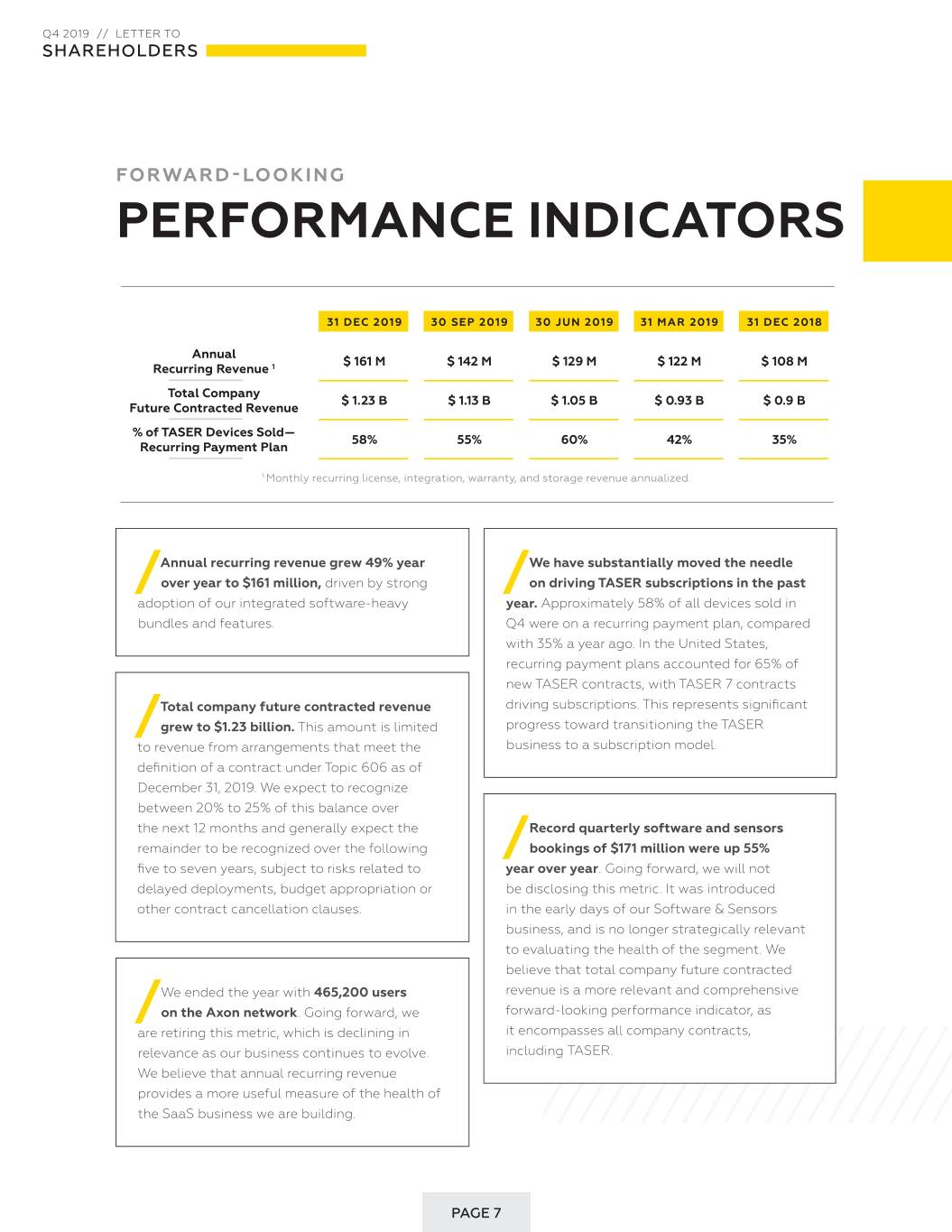

Q4 2019 // LETTER TO SHAREHOLDERS FORWARD-LOOKING PERFORMANCE INDICATORS 31 DEC 2019 30 SEP 2019 30 JUN 2019 31 MAR 2019 31 DEC 2018 Annual $ 161 M $ 142 M $ 129 M $ 122 M $ 108 M Recurring Revenue 1 Total Company $ 1.23 B $ 1.13 B $ 1.05 B $ 0.93 B $ 0.9 B Future Contracted Revenue % of TASER Devices Sold— 58% 55% 60% 42% 35% Recurring Payment Plan 1 Monthly recurring license, integration, warranty, and storage revenue annualized. Annual recurring revenue grew 49% year We have substantially moved the needle / over year to $161 million, driven by strong / on driving TASER subscriptions in the past adoption of our integrated software-heavy year. Approximately 58% of all devices sold in bundles and features. Q4 were on a recurring payment plan, compared with 35% a year ago. In the United States, recurring payment plans accounted for 65% of new TASER contracts, with TASER 7 contracts Total company future contracted revenue driving subscriptions. This represents significant / grew to $1.23 billion. This amount is limited progress toward transitioning the TASER to revenue from arrangements that meet the business to a subscription model. definition of a contract under Topic 606 as of December 31, 2019. We expect to recognize between 20% to 25% of this balance over the next 12 months and generally expect the Record quarterly software and sensors remainder to be recognized over the following / bookings of $171 million were up 55% five to seven years, subject to risks related to year over year. Going forward, we will not delayed deployments, budget appropriation or be disclosing this metric. It was introduced other contract cancellation clauses. in the early days of our Software & Sensors business, and is no longer strategically relevant to evaluating the health of the segment. We believe that total company future contracted We ended the year with 465,200 users revenue is a more relevant and comprehensive / on the Axon network. Going forward, we forward-looking performance indicator, as are retiring this metric, which is declining in it encompasses all company contracts, relevance as our business continues to evolve. including TASER. We believe that annual recurring revenue provides a more useful measure of the health of the SaaS business we are building. PAGE 7

Q4 2019 // LETTER TO SHAREHOLDERS OUTLOOK FOR THE FULL YEAR 2020, WE EXPECT TO ACHIEVE: This is an exciting time for Axon and its customers—the products we are + Revenue in the range of $615 million to $625 million; bringing to market / At the midpoint, this represents 17% year-over-year growth, and more than 20% year-over-year growth excluding the surge of Axon Body 3 hardware are fundamentally shipments in Q4 2019; improving public / We anticipate that Q1 2020 revenue will increase approximately 13% year- safety, creating over-year; massive societal value, / We anticipate that 2020 revenue will accelerate in the second half of the year, and saving lives. with a back-half weighting similar to 2019; Thank you for joining + Adjusted EBITDA in the range of $100 million to $105 million; us on this journey. / Adjusted EBITDA guidance reflects modest gross margin improvement over 2019, which will be partially offset by camera hardware shipments to major city customers; / Adjusted EBITDA guidance reflects accelerated investments to take advantage of total addressable market expansion opportunities in new product categories, such as communications, and new customer categories, such as federal and corrections, as described above, and in building out systems for scale; / Adjusted EBITDA guidance excludes expected legal costs of up to $15 million RICK SMITH associated with litigation (https://www.axon.com/ftc) involving the FTC, which // CEO we intend to treat as an add-back to Adjusted EBITDA; / We expect Adjusted EBITDA margin of approximately 10% to 12% in Q1 2020; + We expect a normalized tax rate of 20% to 25%, which can fluctuate depending on geography of income and the effects of discrete items, LUKE LARSON including changes in our stock price; // PRESIDENT + We expect stock-based compensation expenses to be approximately $85 million for the full year, which is subject to change depending on our assessment of the probability of attaining operational metrics for the CEO Performance Award and XSPP awards, and the expected timing of such JAWAD AHSAN attainment; and // CFO + We are closely monitoring our supply chain and operations in the context of the coronavirus crisis. Though the situation is dynamic, at this time, we believe the potential impact to Axon is reflected in our full-year guidance. PAGE 8

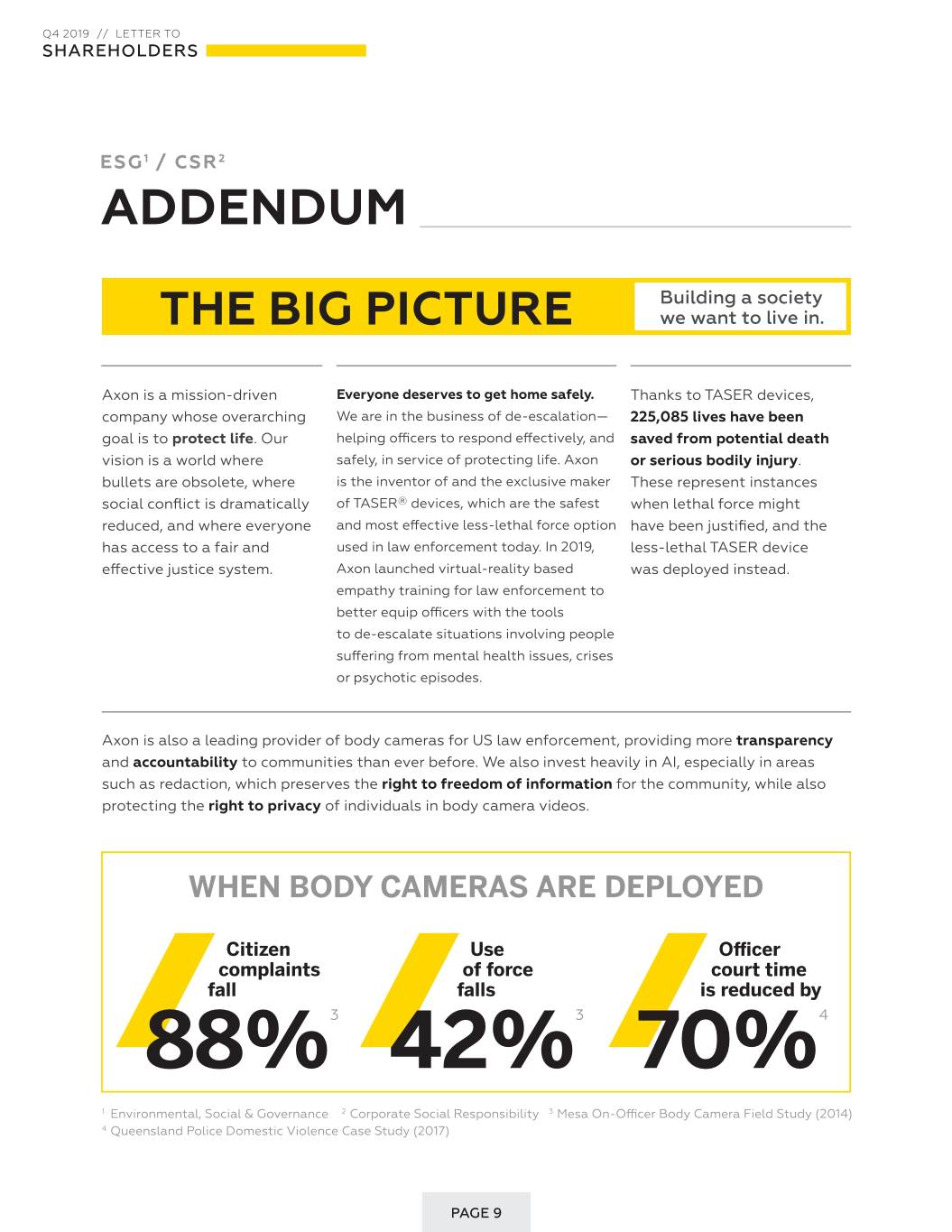

Q4 2019 // LETTER TO SHAREHOLDERS ESG1 / CSR2 ADDENDUM Building a society THE BIG PICTURE we want to live in. Axon is a mission-driven Everyone deserves to get home safely. Thanks to TASER devices, company whose overarching We are in the business of de-escalation— 225,085 lives have been goal is to protect life. Our helping officers to respond effectively, and saved from potential death vision is a world where safely, in service of protecting life. Axon or serious bodily injury. bullets are obsolete, where is the inventor of and the exclusive maker These represent instances social conflict is dramatically of TASER® devices, which are the safest when lethal force might reduced, and where everyone and most effective less-lethal force option have been justified, and the has access to a fair and used in law enforcement today. In 2019, less-lethal TASER device effective justice system. Axon launched virtual-reality based was deployed instead. empathy training for law enforcement to better equip officers with the tools to de-escalate situations involving people suffering from mental health issues, crises or psychotic episodes. Axon is also a leading provider of body cameras for US law enforcement, providing more transparency and accountability to communities than ever before. We also invest heavily in AI, especially in areas such as redaction, which preserves the right to freedom of information for the community, while also protecting the right to privacy of individuals in body camera videos. WHEN BODY CAMERAS ARE DEPLOYED Citizen Use Officer complaints of force court time fall falls is reduced by 88%3 42%3 70%4 1 Environmental, Social & Governance 2 Corporate Social Responsibility 3 Mesa On-Officer Body Camera Field Study (2014) 4 Queensland Police Domestic Violence Case Study (2017) PAGE 9

Q4 2019 // LETTER TO SHAREHOLDERS Axon is proud to be developing products that In June 2019, Axon made national news when address some of society’s most entrenched we said we would not put facial recognition problems. As a leading technology company on our body cameras at this time because the for law enforcement, we believe we have technology is not reliable enough for widespread the obligation to do so in a responsible way use. — one that promotes transparency, with And in October 2019, Axon again made headlines built in mechanisms for accountability. when we announced we would launch the Thus, we have assembled an Axon AI and industry’s first AI-powered Automated License Policing Technology Ethics Board that Plate Recognition (ALPR) system built from the provides expert guidance to Axon on the ground up using an ethical design and privacy- development of its AI products and services, centric framework. paying particular attention to its impact on communities. This diverse board includes leaders in the industry as well as some of the We have not, and will not nation’s most well-known thought leaders and legal scholars regarding policing, police ever sell public safety reform, technology, racial equity and civil data. We believe the data liberties. Read about them, here: is owned by public safety www.axon.com/axon-ai-and-policing- technology-ethics agencies and the communities they serve, and should not be resold to // private entities whose interests may not be aligned with the public good.” _ Axon CEO and founder Rick Smith Also in 2019, Smith published The End of Killing, a book meant to provide thought leadership on how to build a safer society. Smith’s critical and creative thinking about solving challenges represents Axon’s mission and raison d’être. PAGE 10

Q4 2019 // LETTER TO SHAREHOLDERS Continued Robust Shareholder ENGAGEMENT Maintaining strong relationships with shareholders, as well as exhibiting good corporate governance, is a priority for Axon’s management and Board of Directors. Axon strives to be as helpful as possible to its shareholders—regularly discussing our financial and operating performance, helping investors to understand the products we are developing and our customer segment, discussing the competitive landscape, and seeking feedback on executive compensation matters. We value shareholder feedback tremendously and strive to align employee interests with that of shareholders, and all stakeholders. // // // In 2019, Axon published four Axon actively maintains In 2019, Axon hosted several in-depth shareholder letters to investor.axon.com with investor events including the outline management’s strategy a calendar of events and Axon Accelerate user conference and augment our quarterly easy access to all relevant in April, the Annual Meeting of filings with the SEC, and hosted documentation, and maintains Shareholders in May, and the four investor earnings conference special FAQ pages for topics International Association of calls and made the transcripts about which investors might Chiefs of Police Conference in available on investor.axon.com, have questions. October. Axon also participated so all shareholders can access in several investor conferences the content without paying a and, over the course of the year, fee, no matter how large or small hosted more than 300 one-on- their assets under management. one meetings or phone calls with shareholders. In designing its 2019 executive and employee stock-based compensation plan, Axon engaged in dialogue with the analysts, portfolio managers, and corporate governance stewards at its largest shareholders, who each provided feedback that informed the ultimate design of the plan. For the employee version of the plan, the Board’s compensation committee gathered feedback from Axon’s largest shareholders and also applied careful consideration and judgment around issues shareholders cared about, ultimately adopting several shareholder friendly provisions in the plan, including an anti-dilution provision. PAGE 11

Q4 2019 // LETTER TO SHAREHOLDERS Efforts Continued DIVERSITY & INCLUSION & Expanded In 2019, Axon welcomed Caitlin Kalinowski, the Axon recognizes mental health and well-being as head of hardware at Oculus VR, to the Axon Board a diversity issue, and promotes these concepts of Directors, bringing total board leadership to two through a series of events, programs and classes women and six men. throughout the year that are attended by Axon employees together. Axon management also values open communication and transparency with employees—and holds four / Axon employees have created at least four formal company-wide updates per year, as well as affinity groups allowing employees to connect engages in a series of meetings known as Axon with other individuals sharing similar identities Connects, and AMAs (ask me anythings), which and interests, including Axon LGBT & Allies, highlight a specific leader or area of the business and Women at Axon, Veterans at Axon, and an allow all employees to ask open-ended questions. Accessibility Group for differently-abled design considerations. / Axon is tracking to its goal of hosting two D&I employee training sessions, leveraging an external D&I specialist, plus kicked off bi-monthly teaching events leveraging D&I training materials. / Axon strives to be a fun place to work, and hosts a series of engaging events throughout the year designed to value the whole self of individual Axon recently expanded its adoption of inclusive employees, foster a sense of well-being at building design principles, employing a firm to construct work, and enhance employee leadership coverings on the open stair risers at the building development. Many cross-functional Axon headquarters. Axon’s Seattle leadership also opened employees participate in an immersive team- an additional private mother’s room at the company’s building and leadership development program global software hub. hiking the Grand Canyon. Axon once again 2019 AWARDS & ACHIEVEMENTS hosted Axon Kids Day in 2019, allowing parents to bring their children to work and engage in / Most Admired Companies Arizona Business Magazine activities including cookies with a cop, playing in Axon Fleet cars, and other fun events. The / Best Workplaces in Washington Puget Sound Business Journal Seattle office was treated to a formal “snow day,” which was a company-sponsored ski, / Best Company Outlook Comparably.com snowboard and snow-shoeing trip. Axon’s family-friendly leave policies are industry-leading — including up to 20 weeks of maternity leave, and 10 weeks of paternity leave. Axon also offers unlimited paid time off, allowing employees to better manage their lives as well as their jobs. For more info, visit global.axon.com/parental-leave-policy PAGE 12

Q4 2019 // LETTER TO SHAREHOLDERS Programs Continued ENHANCED REWARDS & Expanded Our Aspire Awards recognize Employees who recruit new for employees performing talent receive monetary outstanding work company wide awards through our enhanced referral program The President’s Club provides recognition for Axon’s sales Axon developed and is providing force for hitting & exceeding robust manager training sales goals company-wide Programs Continued SUSTAINABILITY & Expanded + We have introduced a wire/spool recycling program for our TASER devices + Axon has set a goal to reduce employee air travel and has deployed Zoom video conferencing company-wide + In 2019, Axon provided re-usable water bottles to Scottsdale employees to reduce plastic use, following the Seattle offices’s efforts to reduce plastic PAGE 13

Q4 2019 // LETTER TO SHAREHOLDERS QUARTERLY CONFERENCE CALL We will host our Q4 2019 earnings conference call on February 27 at 2 p.m. PT / 5 p.m. ET. The call will be available via live audio webcast and archived replay on Axon’s investor relations website at investor.axon.com STATISTICAL DEFINITIONS Software and Sensors bookings are an indication of the activity the Company is seeing relative to Software and Sensors hardware, software and Axon Evidence. We consider bookings to be a statistical measure defined as the sales price of orders (not invoiced sales), including contractual optional periods we expect to be exercised, net of cancellations, inclusive of renewals, placed in the relevant fiscal period, regardless of when the products or services ultimately will be provided. Most bookings will be invoiced in subsequent periods. Due to municipal government funding rules, in some cases certain of the future period amounts included in bookings are subject to budget appropriation or other contract cancellation clauses. Although Axon has entered into contracts for the delivery of products and services in the future and anticipates the contracts will be fulfilled, if agencies do not exercise contractual options, do not appropriate money in future year budgets or do enact a cancellation clause, revenue associated with these bookings may not ultimately be recognized, resulting in a future reduction to bookings. NON-GAAP MEASURES For more information relative to our revenue recognition policies, please reference our SEC filings. To supplement the Company’s financial results presented in accordance with GAAP, we present the non-GAAP financial measures of EBITDA, Adjusted EBITDA, Non-GAAP Net Income, Non-GAAP Diluted Earnings Per Share and Free Cash Flow. The Company’s management uses these non-GAAP financial measures in evaluating the Company’s performance in comparison to prior periods. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing its performance, and when planning and forecasting our future periods. A reconciliation of GAAP to the non-GAAP financial measures is presented herein. / EBITDA (Most comparable GAAP Measure: Net income) - Earnings before interest expense, investment interest income, income taxes, depreciation and amortization. / Adjusted EBITDA (Most comparable GAAP Measure: Net income) - Earnings before interest expense, investment interest income, income taxes, depreciation, amortization, non-cash stock-based compensation expense and pre-tax certain other items (described below). / Non-GAAP Net Income (Most comparable GAAP Measure: Net income) - Net income excluding the costs of non-cash stock-based compensation and excluding pre-tax certain other items, including, but not limited to, net gain/loss/write- down/disposal/abandonment of property, equipment and intangible assets; loss on impairment; and costs related to business acquisitions. The Company tax-effects non-GAAP adjustments using the blended statutory federal and state tax rates for each period presented. / Non-GAAP Diluted Earnings Per Share (Most comparable GAAP Measure: Earnings Per share) - Measure of Company’s Non-GAAP Net Income divided by the weighted average number of diluted common shares outstanding during the period presented. / Free Cash Flow (Most comparable GAAP Measure: Cash flow from operating activities) - cash flows provided by operating activities minus purchases of property and equipment, intangible assets and cash flows related to business acquisitions. PAGE 14

Q4 2019 // LETTER TO SHAREHOLDERS CAUTION ON USE OF NON-GAAP MEASURES Although these non-GAAP financial measures are not consistent with GAAP, management believes investors will benefit by referring to these non-GAAP financial measures when assessing the Company’s operating results, as well as when forecasting and analyzing future periods. However, management recognizes that: / these non-GAAP financial measures are limited in their usefulness and should be considered only as a supplement to the Company’s GAAP financial measures; / these non-GAAP financial measures should not be considered in isolation from, or as a substitute for, the Company’s GAAP financial measures; / these non-GAAP financial measures should not be considered to be superior to the Company’s GAAP financial measures; and / these non-GAAP financial measures erew not prepared in accordance with GAAP or under a comprehensive set of rules or principles. Further, these non-GAAP financial measures may be unique to the Company, as they may be different from similarly titled non-GAAP financial measures used by other companies. As such, this presentation of non-GAAP financial measures may not enhance the comparability of the Company’s results to the results of other companies. ABOUT AXON Axon is a network of devices, apps and people that helps public safety personnel become smarter and safer. With a mission of protecting life, our technologies give customers the confidence, focus and time they need to keep their communities safe. Our products impact every aspect of a public safety officer’s day-to-day experience. We work hard for those who put themselves in harm’s way for all of us. More than 225,000 lives and countless dollars have been saved with the Axon network of devices, apps and people. Learn more at www.axon.com or by calling (800) 978-2737. Facebook is a trademark of Facebook, Inc.; Oculus Pro and Oculus Rift are trademarks of Facebook Technologies, LLC; LTE is a trademark of the European Telecommunications Standards Institute; and Twitter is a trademark of Twitter, Inc. Axon, Axon Records, Evidence.com, Fleet, TASER, TASER 7 and the Delta Logo are trademarks of Axon Enterprise, Inc., some of which are registered in the US and other countries. For more information, visit www.axon.com/legal. All rights reserved. PAGE 15

Q4 2019 // LETTER TO SHAREHOLDERS FORWARD LOOKING // STATEMENTS These forward-looking statements include, without limitation, statements regarding: proposed products and services and related development efforts and activities; expectations about the market for our current and future products and services; expectations about customer behavior; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s strategies, goals and objectives and other similar expressions; as well as the ultimate resolution of financial statement items requiring critical accounting estimates, including those set forth in our Form 10-K for the year ended December 31, 2019. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. Words such as “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate,” and similar expressions, as well as statements in future tense, identify forward-looking statements. However, not all forward-looking statements contain these identifying words. We cannot guarantee that any forward-looking statement will be realized, although we believe we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions. The following important factors could cause actual results to differ materially from those in the forward-looking statements: customer purchase behavior, including adoption of our software as a service delivery model; the impact of product mix on projected gross margins; our ability to manage our supply chain and avoid production delays, shortages, and impacts to expected gross margins; changes in the costs of product components and labor; defects in our products; delayed cash collections and possible credit losses due to our subscription model; exposure to international operational risks; our ability to design, introduce and sell new products or features; our ability to defend against litigation and protect our intellectual property, and the resulting costs of this activity; our exposure to cancellations of government contracts due to appropriation clauses, exercise of a cancellation clause, or non-exercise of contractually optional periods; loss of customer data, a breach of security or an extended outage, including our reliance on third party cloud-based storage providers; negative media publicity regarding our products; changes in government regulations in the U.S. and in foreign markets, especially related to the classification of our product by the United States Bureau of Alcohol, Tobacco, Firearms and Explosives and to evolving regulations surrounding privacy and data protection; our ability to integrate acquired businesses; our ability to attract and retain key personnel; and counter-party risks relating to cash balances held in excess of FDIC insurance limits. Many events beyond our control may determine whether results we anticipate will be achieved. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements. Our Annual Report on Form 10-K lists various important factors that could cause actual results to differ materially from expected and historical results. These factors are intended as cautionary statements for investors within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act. Readers can find them under the heading “Risk Factors” in the Annual Report on Form 10-K and in the Quarterly Report on Form 10-Q, and investors should refer to them. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Form 10-Q, 8-K and 10-K reports to the SEC. PAGE 16

Q4 2019 // LETTER TO SHAREHOLDERS CONTACT IR@axon.com Andrea James Investor Relations /Axon.ProtectLife Axon Enterprise, Inc. /axon_us Please visit investor.axon.com // axon.com/press // /Axon.ProtectLife // /axon_us where Axon discloses information about the company, its financial information, and its business. PAGE 17

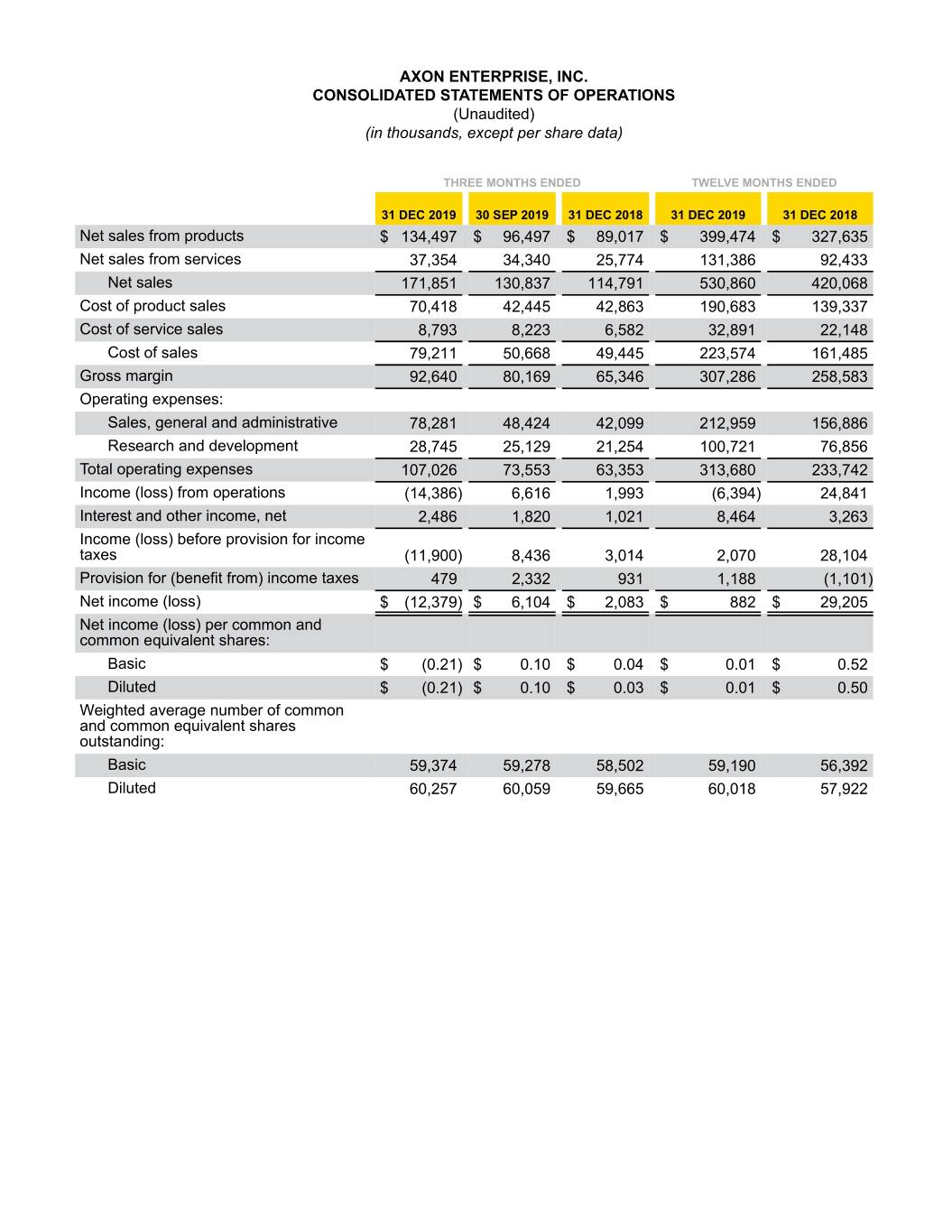

AXON ENTERPRISE, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in thousands, except per share data) THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 Net sales from products $ 134,497 $ 96,497 $ 89,017 $ 399,474 $ 327,635 Net sales from services 37,354 34,340 25,774 131,386 92,433 Net sales 171,851 130,837 114,791 530,860 420,068 Cost of product sales 70,418 42,445 42,863 190,683 139,337 Cost of service sales 8,793 8,223 6,582 32,891 22,148 Cost of sales 79,211 50,668 49,445 223,574 161,485 Gross margin 92,640 80,169 65,346 307,286 258,583 Operating expenses: Sales, general and administrative 78,281 48,424 42,099 212,959 156,886 Research and development 28,745 25,129 21,254 100,721 76,856 Total operating expenses 107,026 73,553 63,353 313,680 233,742 Income (loss) from operations (14,386) 6,616 1,993 (6,394) 24,841 Interest and other income, net 2,486 1,820 1,021 8,464 3,263 Income (loss) before provision for income taxes (11,900) 8,436 3,014 2,070 28,104 Provision for (benefit from) income taxes 479 2,332 931 1,188 (1,101) Net income (loss) $ (12,379) $ 6,104 $ 2,083 $ 882 $ 29,205 Net income (loss) per common and common equivalent shares: Basic $ (0.21) $ 0.10 $ 0.04 $ 0.01 $ 0.52 Diluted $ (0.21) $ 0.10 $ 0.03 $ 0.01 $ 0.50 Weighted average number of common and common equivalent shares outstanding: Basic 59,374 59,278 58,502 59,190 56,392 Diluted 60,257 60,059 59,665 60,018 57,922

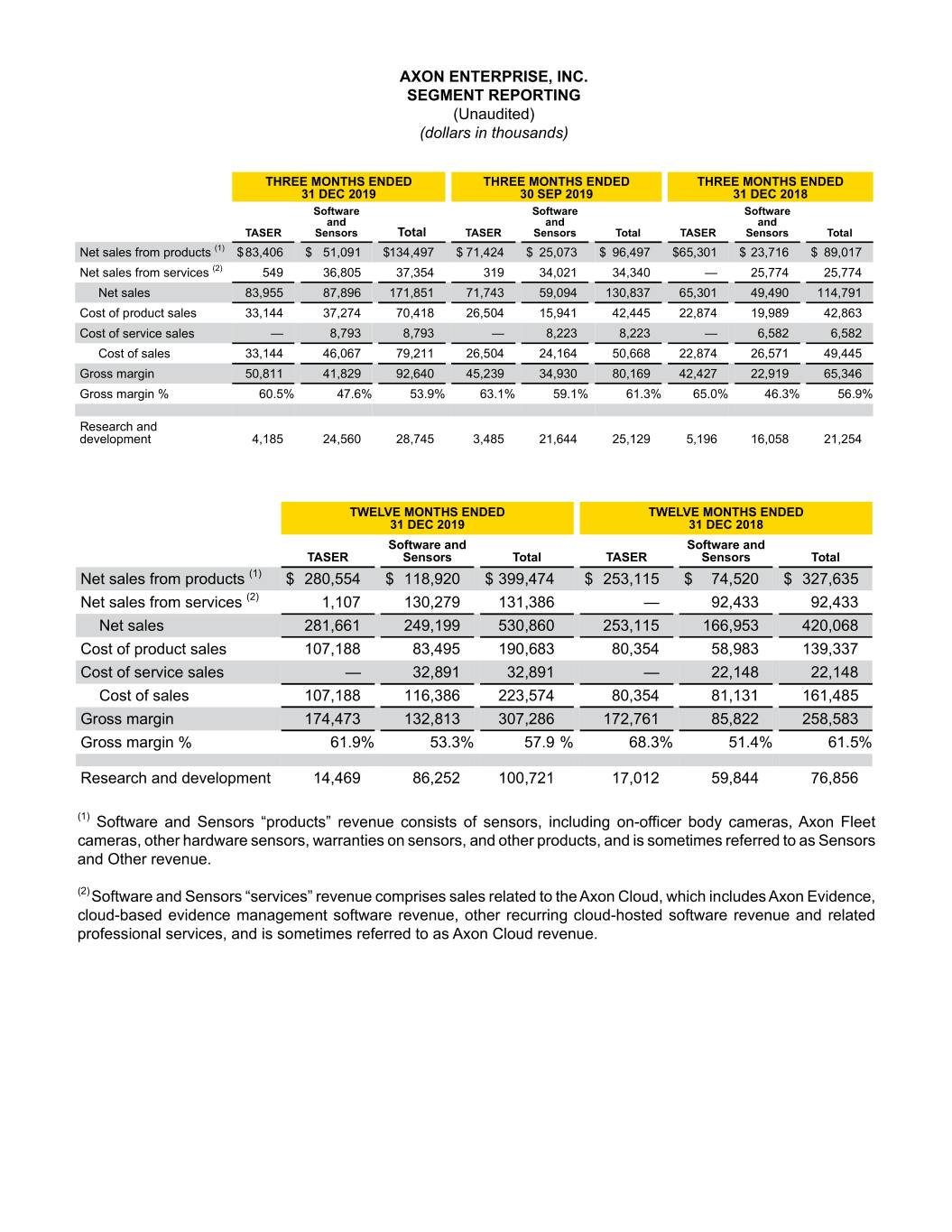

AXON ENTERPRISE, INC. SEGMENT REPORTING (Unaudited) (dollars in thousands) THREE MONTHS ENDED THREE MONTHS ENDED THREE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 Software Software Software and and and TASER Sensors Total TASER Sensors Total TASER Sensors Total Net sales from products (1) $83,406 $ 51,091 $134,497 $ 71,424 $ 25,073 $ 96,497 $65,301 $ 23,716 $ 89,017 Net sales from services (2) 549 36,805 37,354 319 34,021 34,340 — 25,774 25,774 Net sales 83,955 87,896 171,851 71,743 59,094 130,837 65,301 49,490 114,791 Cost of product sales 33,144 37,274 70,418 26,504 15,941 42,445 22,874 19,989 42,863 Cost of service sales — 8,793 8,793 — 8,223 8,223 — 6,582 6,582 Cost of sales 33,144 46,067 79,211 26,504 24,164 50,668 22,874 26,571 49,445 Gross margin 50,811 41,829 92,640 45,239 34,930 80,169 42,427 22,919 65,346 Gross margin % 60.5% 47.6% 53.9% 63.1% 59.1% 61.3% 65.0% 46.3% 56.9% Research and development 4,185 24,560 28,745 3,485 21,644 25,129 5,196 16,058 21,254 TWELVE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 31 DEC 2018 Software and Software and TASER Sensors Total TASER Sensors Total Net sales from products (1) $ 280,554 $ 118,920 $ 399,474 $ 253,115 $ 74,520 $ 327,635 Net sales from services (2) 1,107 130,279 131,386 — 92,433 92,433 Net sales 281,661 249,199 530,860 253,115 166,953 420,068 Cost of product sales 107,188 83,495 190,683 80,354 58,983 139,337 Cost of service sales — 32,891 32,891 — 22,148 22,148 Cost of sales 107,188 116,386 223,574 80,354 81,131 161,485 Gross margin 174,473 132,813 307,286 172,761 85,822 258,583 Gross margin % 61.9% 53.3% 57.9 % 68.3% 51.4% 61.5% Research and development 14,469 86,252 100,721 17,012 59,844 76,856 (1) Software and Sensors “products” revenue consists of sensors, including on-officer body cameras, Axon Fleet cameras, other hardware sensors, warranties on sensors, and other products, and is sometimes referred to as Sensors and Other revenue. (2) Software and Sensors “services” revenue comprises sales related to the Axon Cloud, which includes Axon Evidence, cloud-based evidence management software revenue, other recurring cloud-hosted software revenue and related professional services, and is sometimes referred to as Axon Cloud revenue.

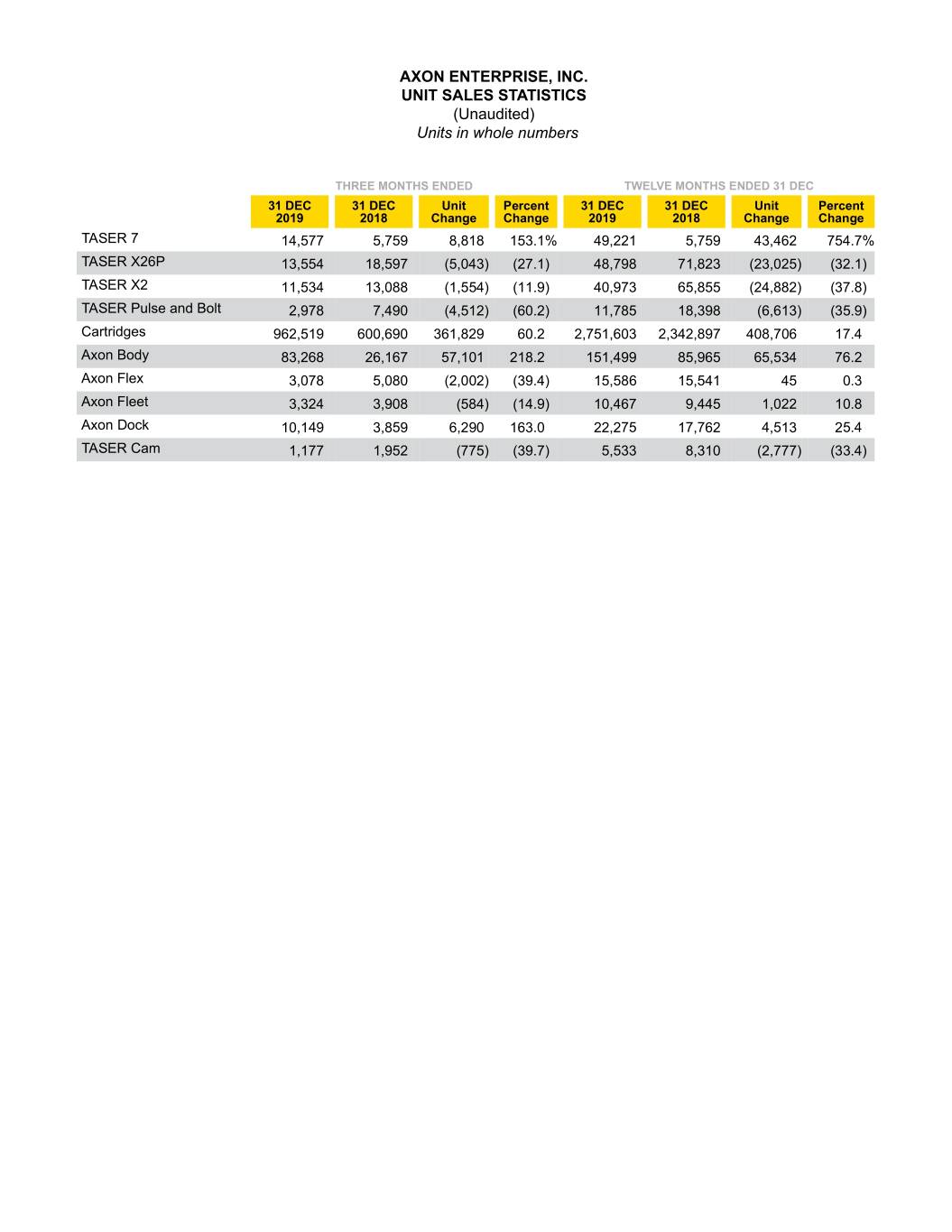

AXON ENTERPRISE, INC. UNIT SALES STATISTICS (Unaudited) Units in whole numbers THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 31 DEC 31 DEC Unit Percent 31 DEC 31 DEC Unit Percent 2019 2018 Change Change 2019 2018 Change Change TASER 7 14,577 5,759 8,818 153.1% 49,221 5,759 43,462 754.7% TASER X26P 13,554 18,597 (5,043) (27.1) 48,798 71,823 (23,025) (32.1) TASER X2 11,534 13,088 (1,554) (11.9) 40,973 65,855 (24,882) (37.8) TASER Pulse and Bolt 2,978 7,490 (4,512) (60.2) 11,785 18,398 (6,613) (35.9) Cartridges 962,519 600,690 361,829 60.2 2,751,603 2,342,897 408,706 17.4 Axon Body 83,268 26,167 57,101 218.2 151,499 85,965 65,534 76.2 Axon Flex 3,078 5,080 (2,002) (39.4) 15,586 15,541 45 0.3 Axon Fleet 3,324 3,908 (584) (14.9) 10,467 9,445 1,022 10.8 Axon Dock 10,149 3,859 6,290 163.0 22,275 17,762 4,513 25.4 TASER Cam 1,177 1,952 (775) (39.7) 5,533 8,310 (2,777) (33.4)

AXON ENTERPRISE, INC. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) Dollars in thousands THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 EBITDA and Adjusted EBITDA: Net income (loss) $ (12,379) $ 6,104 $ 2,083 $ 882 $ 29,205 Depreciation and amortization 3,165 2,709 2,389 11,361 10,615 Interest expense 19 4 33 46 86 Investment interest income (1,760) (1,647) (1,076) (7,040) (3,002) Provision for (benefit from) income taxes 479 2,332 931 1,188 (1,101) EBITDA $ (10,476) $ 9,502 $ 4,360 $ 6,437 $ 35,803 Adjustments: Stock-based compensation expense $ 48,300 $ 13,663 $ 6,577 $ 78,495 $ 21,879 Transaction costs and adjustments related to business acquisition — — — — 1,382 Loss on disposal and abandonment of intangible assets 16 33 14 67 2,117 Loss on disposal and impairment of property and equipment, net 134 845 13 2,542 303 Costs related to FTC litigation 240 — — 240 — Adjusted EBITDA $ 38,214 $ 24,043 $ 10,964 $ 87,781 $ 61,484 Net income (loss) as a percentage of net sales (7.2)% 4.7% 1.8% 0.2% 7.0% Adjusted EBITDA as a percentage of net sales 22.2 % 18.4% 9.6% 16.5% 14.6% Stock-based compensation expense: Cost of product and service sales $ 790 $ 312 $ 152 $ 1,565 $ 511 Sales, general and administrative 40,212 9,508 3,927 59,342 12,710 Research and development 7,298 3,843 2,498 17,588 8,658 Total $ 48,300 $ 13,663 $ 6,577 $ 78,495 $ 21,879

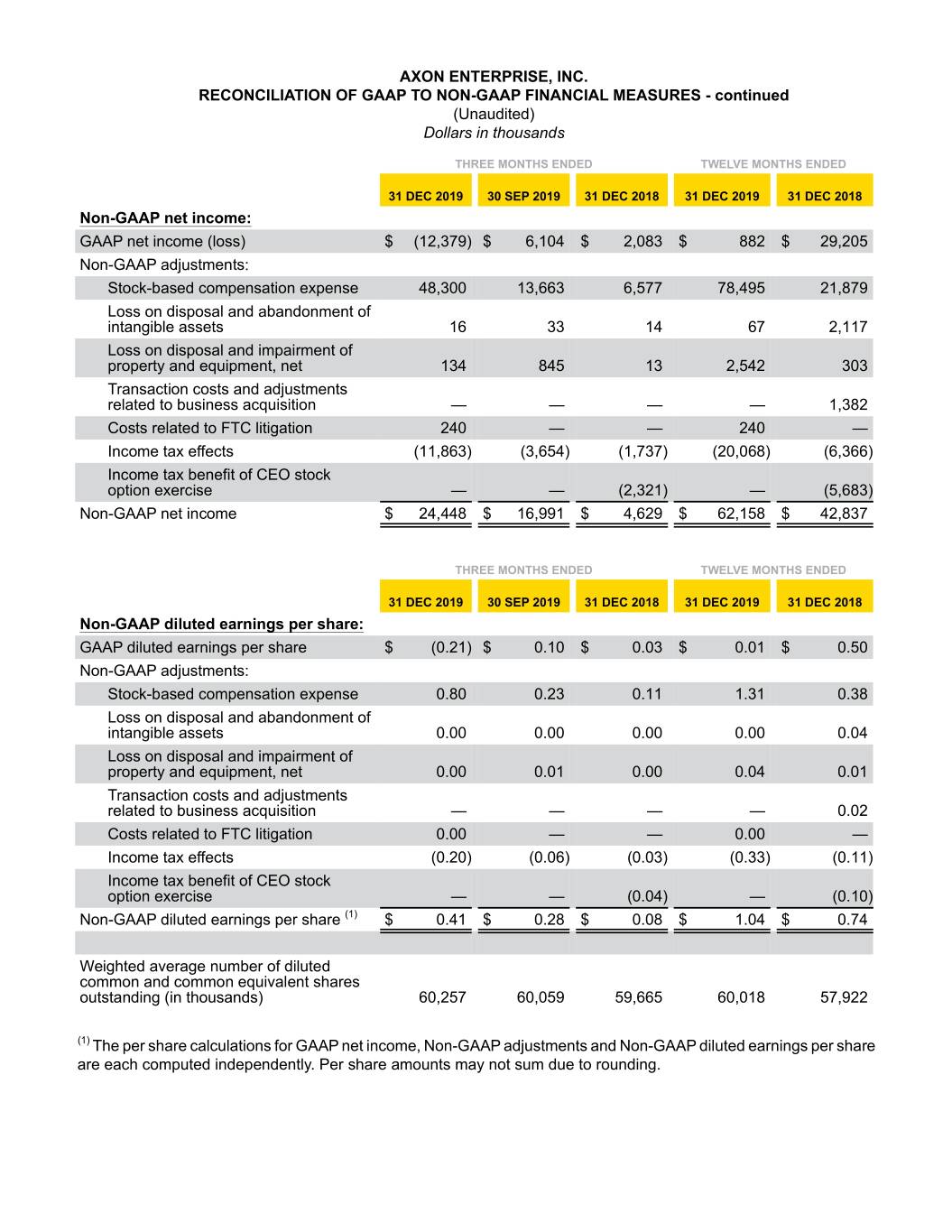

AXON ENTERPRISE, INC. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES - continued (Unaudited) Dollars in thousands THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 Non-GAAP net income: GAAP net income (loss) $ (12,379) $ 6,104 $ 2,083 $ 882 $ 29,205 Non-GAAP adjustments: Stock-based compensation expense 48,300 13,663 6,577 78,495 21,879 Loss on disposal and abandonment of intangible assets 16 33 14 67 2,117 Loss on disposal and impairment of property and equipment, net 134 845 13 2,542 303 Transaction costs and adjustments related to business acquisition — — — — 1,382 Costs related to FTC litigation 240 — — 240 — Income tax effects (11,863) (3,654) (1,737) (20,068) (6,366) Income tax benefit of CEO stock option exercise — — (2,321) — (5,683) Non-GAAP net income $ 24,448 $ 16,991 $ 4,629 $ 62,158 $ 42,837 THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 Non-GAAP diluted earnings per share: GAAP diluted earnings per share $ (0.21) $ 0.10 $ 0.03 $ 0.01 $ 0.50 Non-GAAP adjustments: Stock-based compensation expense 0.80 0.23 0.11 1.31 0.38 Loss on disposal and abandonment of intangible assets 0.00 0.00 0.00 0.00 0.04 Loss on disposal and impairment of property and equipment, net 0.00 0.01 0.00 0.04 0.01 Transaction costs and adjustments related to business acquisition — — — — 0.02 Costs related to FTC litigation 0.00 — — 0.00 — Income tax effects (0.20) (0.06) (0.03) (0.33) (0.11) Income tax benefit of CEO stock option exercise — — (0.04) — (0.10) Non-GAAP diluted earnings per share (1) $ 0.41 $ 0.28 $ 0.08 $ 1.04 $ 0.74 Weighted average number of diluted common and common equivalent shares outstanding (in thousands) 60,257 60,059 59,665 60,018 57,922 (1) The per share calculations for GAAP net income, Non-GAAP adjustments and Non-GAAP diluted earnings per share are each computed independently. Per share amounts may not sum due to rounding.

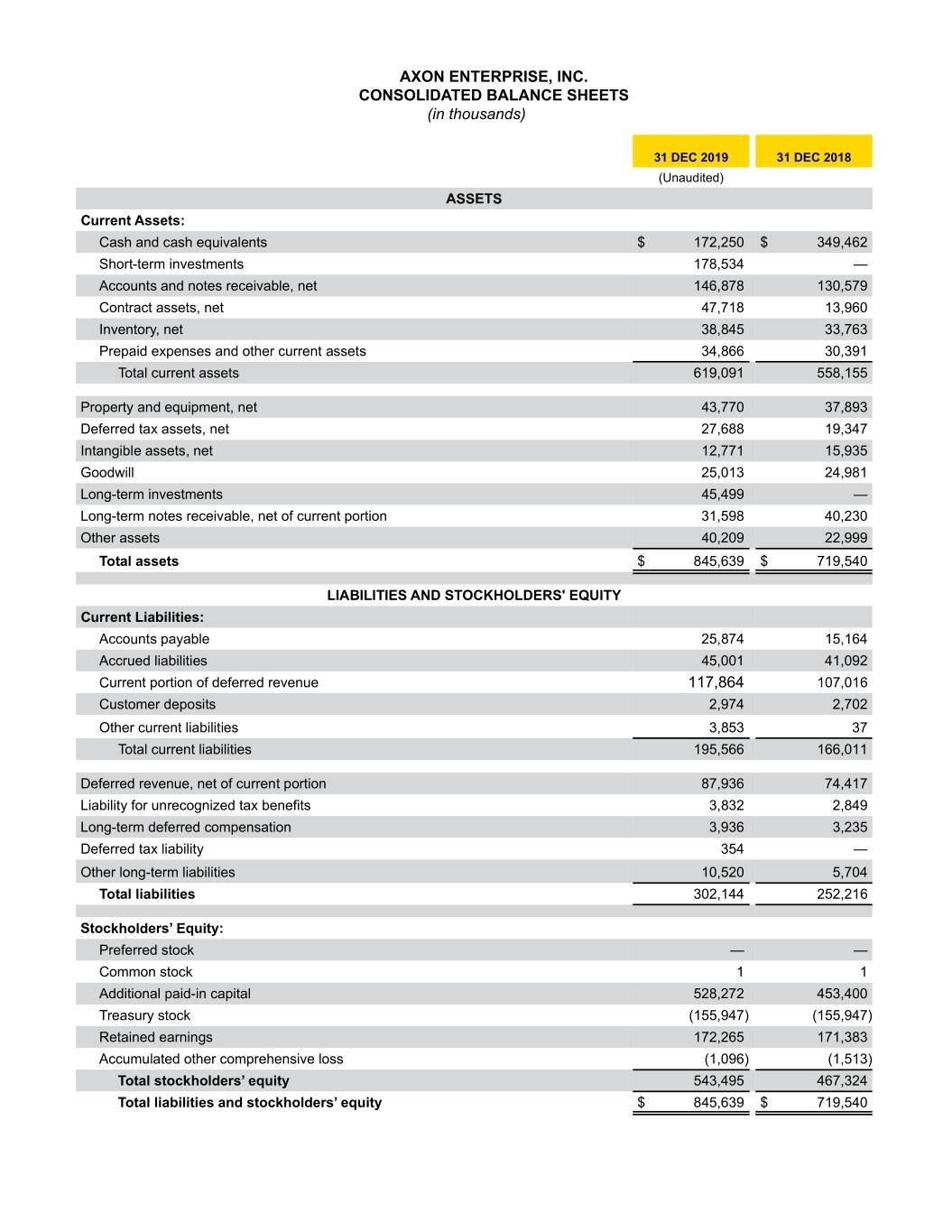

AXON ENTERPRISE, INC. CONSOLIDATED BALANCE SHEETS (in thousands) 31 DEC 2019 31 DEC 2018 (Unaudited) ASSETS Current Assets: Cash and cash equivalents $ 172,250 $ 349,462 Short-term investments 178,534 — Accounts and notes receivable, net 146,878 130,579 Contract assets, net 47,718 13,960 Inventory, net 38,845 33,763 Prepaid expenses and other current assets 34,866 30,391 Total current assets 619,091 558,155 Property and equipment, net 43,770 37,893 Deferred tax assets, net 27,688 19,347 Intangible assets, net 12,771 15,935 Goodwill 25,013 24,981 Long-term investments 45,499 — Long-term notes receivable, net of current portion 31,598 40,230 Other assets 40,209 22,999 Total assets $ 845,639 $ 719,540 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable 25,874 15,164 Accrued liabilities 45,001 41,092 Current portion of deferred revenue 117,864 107,016 Customer deposits 2,974 2,702 Other current liabilities 3,853 37 Total current liabilities 195,566 166,011 Deferred revenue, net of current portion 87,936 74,417 Liability for unrecognized tax benefits 3,832 2,849 Long-term deferred compensation 3,936 3,235 Deferred tax liability 354 — Other long-term liabilities 10,520 5,704 Total liabilities 302,144 252,216 Stockholders’ Equity: Preferred stock — — Common stock 1 1 Additional paid-in capital 528,272 453,400 Treasury stock (155,947) (155,947) Retained earnings 172,265 171,383 Accumulated other comprehensive loss (1,096) (1,513) Total stockholders’ equity 543,495 467,324 Total liabilities and stockholders’ equity $ 845,639 $ 719,540

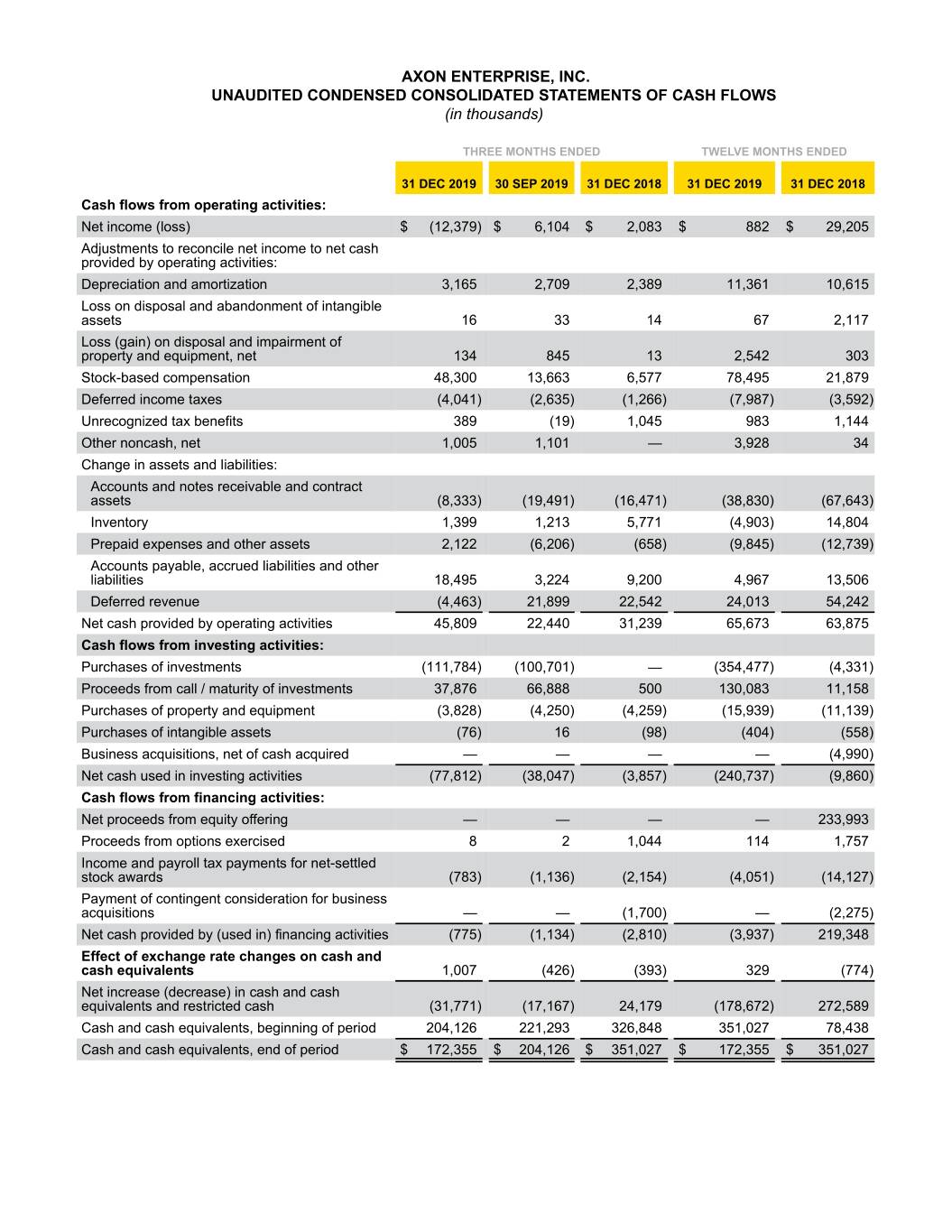

AXON ENTERPRISE, INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 Cash flows from operating activities: Net income (loss) $ (12,379) $ 6,104 $ 2,083 $ 882 $ 29,205 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 3,165 2,709 2,389 11,361 10,615 Loss on disposal and abandonment of intangible assets 16 33 14 67 2,117 Loss (gain) on disposal and impairment of property and equipment, net 134 845 13 2,542 303 Stock-based compensation 48,300 13,663 6,577 78,495 21,879 Deferred income taxes (4,041) (2,635) (1,266) (7,987) (3,592) Unrecognized tax benefits 389 (19) 1,045 983 1,144 Other noncash, net 1,005 1,101 — 3,928 34 Change in assets and liabilities: Accounts and notes receivable and contract assets (8,333) (19,491) (16,471) (38,830) (67,643) Inventory 1,399 1,213 5,771 (4,903) 14,804 Prepaid expenses and other assets 2,122 (6,206) (658) (9,845) (12,739) Accounts payable, accrued liabilities and other liabilities 18,495 3,224 9,200 4,967 13,506 Deferred revenue (4,463) 21,899 22,542 24,013 54,242 Net cash provided by operating activities 45,809 22,440 31,239 65,673 63,875 Cash flows from investing activities: Purchases of investments (111,784) (100,701) — (354,477) (4,331) Proceeds from call / maturity of investments 37,876 66,888 500 130,083 11,158 Purchases of property and equipment (3,828) (4,250) (4,259) (15,939) (11,139) Purchases of intangible assets (76) 16 (98) (404) (558) Business acquisitions, net of cash acquired — — — — (4,990) Net cash used in investing activities (77,812) (38,047) (3,857) (240,737) (9,860) Cash flows from financing activities: Net proceeds from equity offering — — — — 233,993 Proceeds from options exercised 8 2 1,044 114 1,757 Income and payroll tax payments for net-settled stock awards (783) (1,136) (2,154) (4,051) (14,127) Payment of contingent consideration for business acquisitions — — (1,700) — (2,275) Net cash provided by (used in) financing activities (775) (1,134) (2,810) (3,937) 219,348 Effect of exchange rate changes on cash and cash equivalents 1,007 (426) (393) 329 (774) Net increase (decrease) in cash and cash equivalents and restricted cash (31,771) (17,167) 24,179 (178,672) 272,589 Cash and cash equivalents, beginning of period 204,126 221,293 326,848 351,027 78,438 Cash and cash equivalents, end of period $ 172,355 $ 204,126 $ 351,027 $ 172,355 $ 351,027

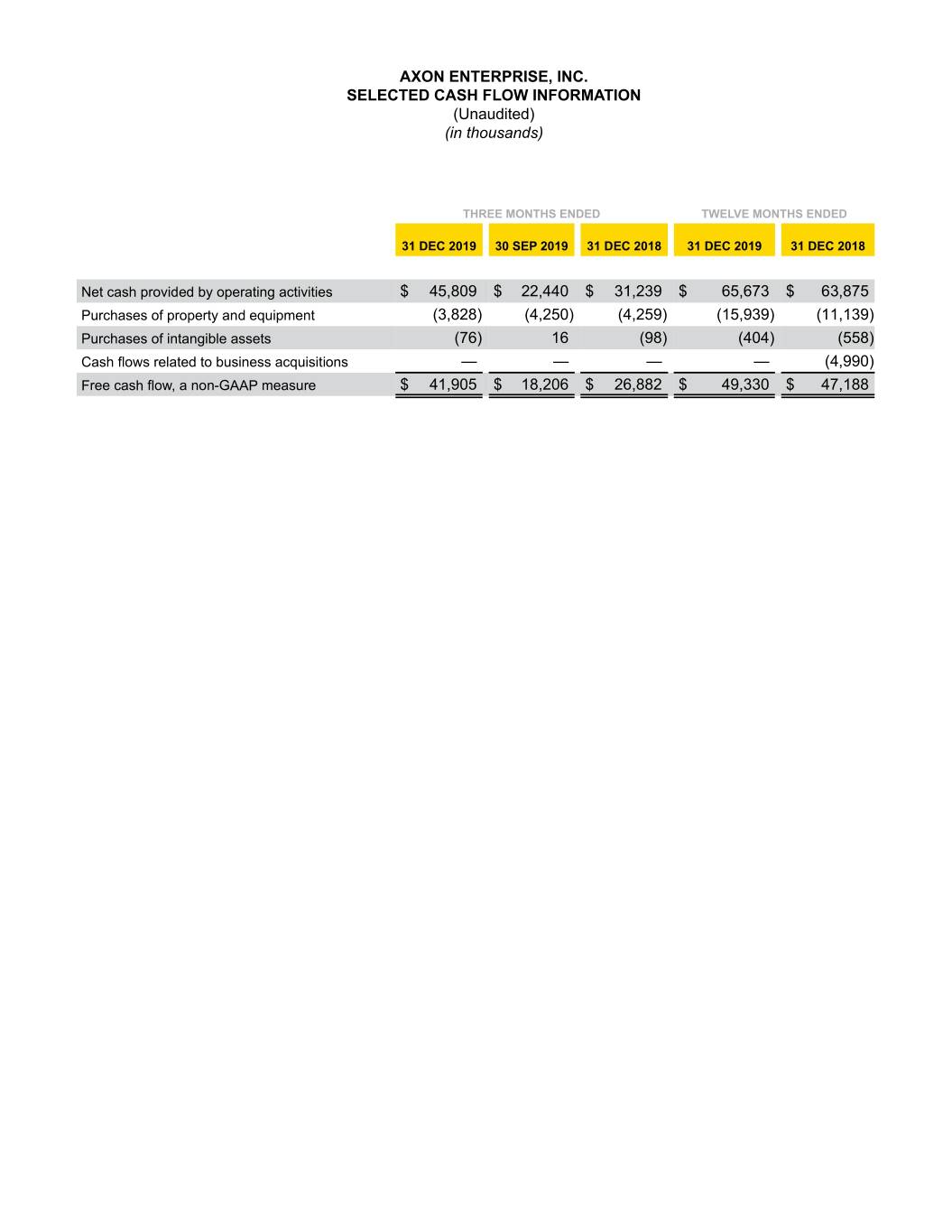

AXON ENTERPRISE, INC. SELECTED CASH FLOW INFORMATION (Unaudited) (in thousands) THREE MONTHS ENDED TWELVE MONTHS ENDED 31 DEC 2019 30 SEP 2019 31 DEC 2018 31 DEC 2019 31 DEC 2018 Net cash provided by operating activities $ 45,809 $ 22,440 $ 31,239 $ 65,673 $ 63,875 Purchases of property and equipment (3,828) (4,250) (4,259) (15,939) (11,139) Purchases of intangible assets (76) 16 (98) (404) (558) Cash flows related to business acquisitions — — — — (4,990) Free cash flow, a non-GAAP measure $ 41,905 $ 18,206 $ 26,882 $ 49,330 $ 47,188

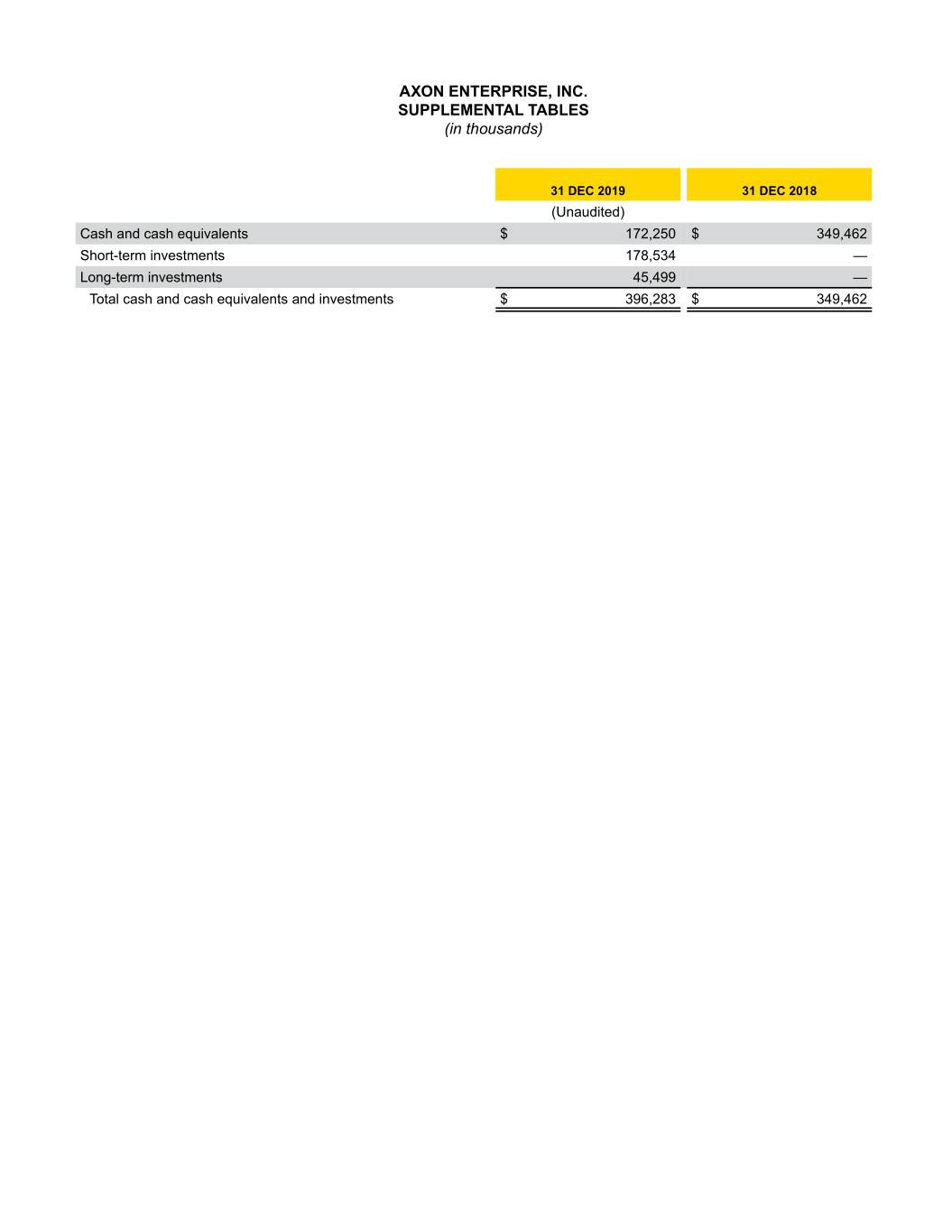

AXON ENTERPRISE, INC. SUPPLEMENTAL TABLES (in thousands) 31 DEC 2019 31 DEC 2018 (Unaudited) Cash and cash equivalents $ 172,250 $ 349,462 Short-term investments 178,534 — Long-term investments 45,499 — Total cash and cash equivalents and investments $ 396,283 $ 349,462