Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STONERIDGE INC | tm2011038d1_ex99-1.htm |

| 8-K - FORM 8-K - STONERIDGE INC | tm2011038d1_8k.htm |

Full - Year and Q4 2019 Results February 27, 2020 Exhibit 99.2

2 Forward - Looking Statements Statements in this presentation that are not historical facts are forward - looking statements, which involve risks and uncertaint ies that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that ma y cause actual results to differ materially from those in the forward - looking statements include, among other factors, the loss or bankruptcy o f a major customer; the costs and timing of facility closures, business realignment or similar actions; a significant change in automot ive , commercial, off - highway, motorcycle and agricultural vehicle production; our ability to achieve cost reductions that offset or exceed custom er - mandated selling price reductions; a significant change in general economic conditions in any of the various countries in which Stoner idg e operates; labor disruptions at Stoneridge’s facilities or at any of Stoneridge’s significant customers or suppliers; the ability of sup pli ers to supply Stoneridge with parts and components at competitive prices on a timely basis; the amount of Stoneridge’s indebtedness and the re strictive covenants contained in the agreements governing its indebtedness, including its revolving credit facility; customer acceptanc e o f new products; capital availability or costs, including changes in interest rates or market perceptions; the failure to achieve su cce ssful integration of any acquired company or business; the occurrence or non - occurrence of circumstances beyond Stoneridge’s control; and the items described in “Risk Factors” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed wit h t he Securities and Exchange Commission. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially fro m t hose in the forward - looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and global markets, (2) changes in economic conditions, housing prices, foreign currency exchange rates, commodity prices, includ ing shortages of and increases or volatility in the price of oil, (3) changes in laws and regulations, (4) the state of the credit markets, (5 ) political stability, (6) international conflicts and (7) the occurrence of force majeure events. These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stonerid ge’ s filings with the Securities and Exchange Commission. Forward - looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condit ion and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or sug gested by the forward - looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial co ndition and liquidity, and the development of the industry in which Stoneridge operates are consistent with the forward - looking statements c ontained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. This presentation contains time - sensitive information that reflects management’s best analysis only as of the date of this prese ntation. Any forward - looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obl igation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future tren ds or indications of future performance, unless expressed as such, and should only be viewed as historical data. Stoneridge does not undertake any obligation to publicly update or revise any forward - looking statement as a result of new infor mation, future events or otherwise, except as otherwise required by law. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared t o w hat is shown in this presentation. The differences are the result of rounding due to the representation of values in millions rathe r t han thousands in public filings.

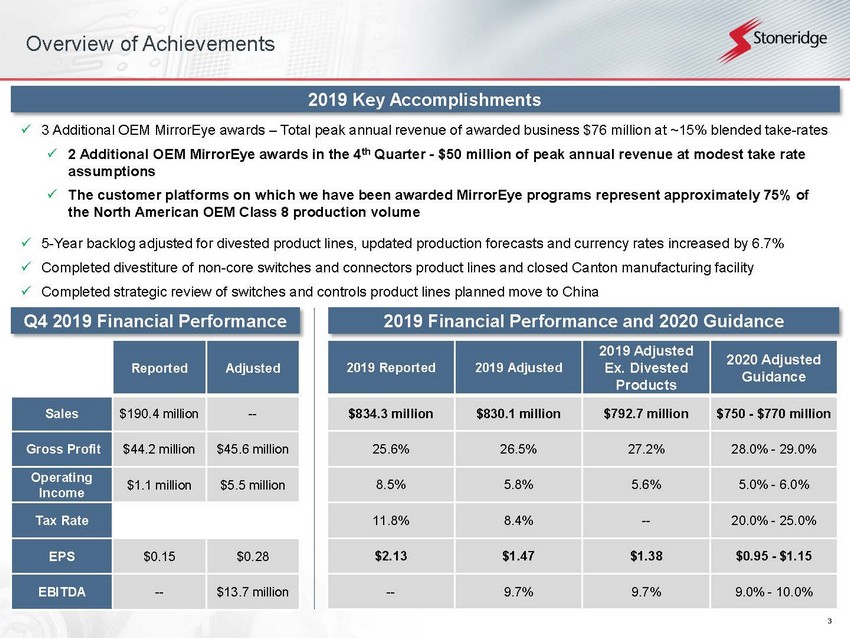

3 Overview of Achievements x 3 Additional OEM MirrorEye awards – Total peak annual revenue of awarded business $76 million at ~15% blended take - rates x 2 Additional OEM MirrorEye awards in the 4 th Quarter - $50 million of peak annual revenue at modest take rate assumptions x The customer platforms on which we have been awarded MirrorEye programs represent approximately 75% of the North American OEM Class 8 production volume x 5 - Year backlog adjusted for divested product lines, updated production forecasts and currency rates increased by 6.7% x Completed divestiture of non - core switches and connectors product lines and closed Canton manufacturing facility x Completed strategic review of switches and controls product lines planned move to China 2019 Key Accomplishments Q 4 2019 Financial Performance 2019 Financial Performance and 2020 Guidance 2019 Reported 2019 Adjusted 2019 Adjusted Ex. Divested Products 2020 Adjusted Guidance $834.3 million $830.1 million $792.7 million $750 - $770 million 25.6% 26.5% 27.2% 28.0% - 29.0% 8.5% 5.8% 5.6% 5.0% - 6.0% 11.8% 8.4% -- 20.0% - 25.0% $2.13 $1.47 $1.38 $0.95 - $1.15 -- 9.7% 9.7% 9.0% - 10.0% Reported Adjusted Sales $190.4 million -- Gross Profit $44.2 million $45.6 million Operating Income $1.1 million $5.5 million Tax Rate EPS $0.15 $0.28 EBITDA -- $13.7 million

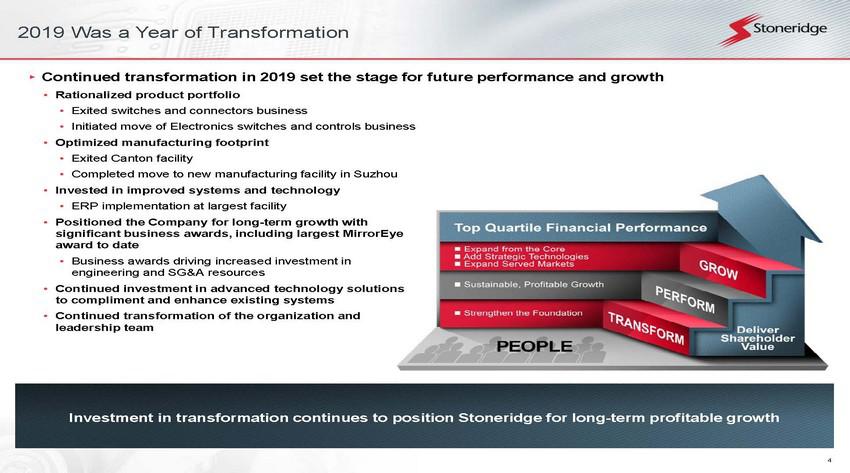

4 2019 Was a Year of Transformation Investment in transformation continues to position Stoneridge for long - term profitable growth ▸ Continued transformation in 2019 set the stage for future performance and growth • Rationalized product portfolio • Exited switches and connectors business • Initiated move of Electronics switches and controls business • Optimized manufacturing footprint • Exited Canton facility • Completed move to new manufacturing facility in Suzhou • Invested in improved systems and technology • ERP implementation at largest facility • Positioned the Company for long - term growth with significant business awards, including largest MirrorEye award to date • Business awards driving increased investment in engineering and SG&A resources • Continued investment in advanced technology solutions to compliment and enhance existing systems • Continued transformation of the organization and leadership team

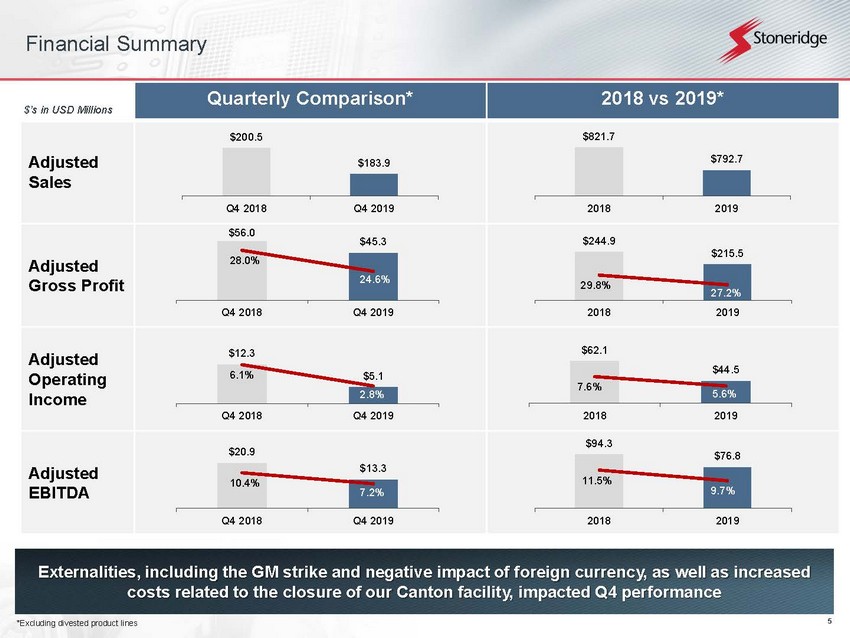

5 Quarterly Comparison* 2018 vs 2019* Adjusted Sales Adjusted Gross Profit Adjusted Operating Income Adjusted EBITDA Financial Summary Externalities, including the GM strike and negative impact of foreign currency, as well as increased costs related to the closure of our Canton facility, impacted Q4 performance $’s in USD Millions *Excluding divested product lines $200.5 $183.9 $170.0 $180.0 $190.0 $200.0 $210.0 Q4 2018 Q4 2019 $56.0 $45.3 28.0% 24.6% $0.0 $20.0 $40.0 $60.0 Q4 2018 Q4 2019 20.0% 25.0% 30.0% $12.3 $5.1 6.1% 2.8% $0.0 $5.0 $10.0 $15.0 $20.0 Q4 2018 Q4 2019 0.0% 5.0% 10.0% $20.9 $13.3 10.4% 7.2% $0.0 $10.0 $20.0 $30.0 Q4 2018 Q4 2019 0.0% 5.0% 10.0% 15.0% $821.7 $792.7 $760.0 $780.0 $800.0 $820.0 $840.0 2018 2019 $244.9 $215.5 29.8% 27.2% $130.0 $180.0 $230.0 $280.0 2018 2019 23.0% 28.0% 33.0% 38.0% $62.1 $44.5 7.6% 5.6% $25.0 $45.0 $65.0 2018 2019 2.0% 7.0% 12.0% $94.3 $76.8 11.5% 9.7% $20.0 $70.0 2018 2019 5.0% 10.0% 15.0%

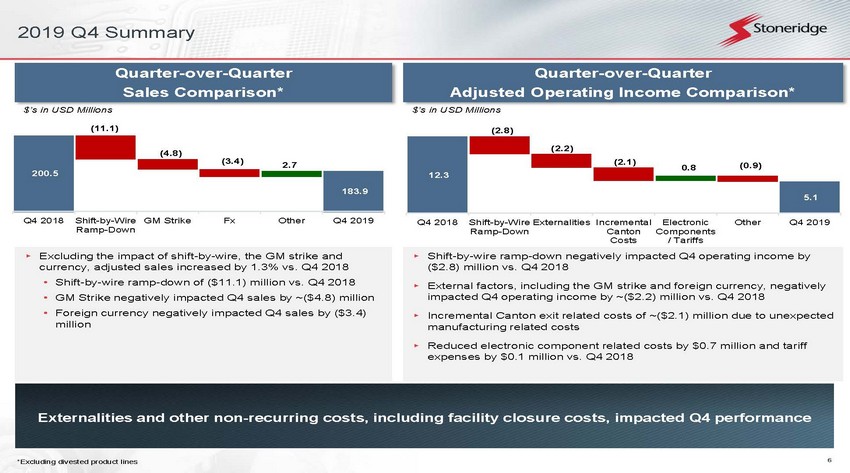

6 2019 Q4 Summary Externalities and other non - recurring costs, including facility closure costs, impacted Q4 performance Quarter - over - Quarter Sales Comparison* Quarter - over - Quarter Adjusted Operating Income Comparison* ▸ Excluding the impact of shift - by - wire, the GM strike and currency, adjusted sales increased by 1.3% vs. Q4 2018 • Shift - by - wire ramp - down of ($11.1) million vs. Q4 2018 • GM Strike negatively impacted Q4 sales by ~($4.8) million • Foreign currency negatively impacted Q4 sales by ($3.4) million ▸ Shift - by - wire ramp - down negatively impacted Q4 operating income by ($2.8) million vs. Q4 2018 ▸ External factors, including the GM strike and foreign currency, negatively impacted Q4 operating income by ~($2.2) million vs. Q4 2018 ▸ Incremental Canton exit related costs of ~($2.1) million due to unexpected manufacturing related costs ▸ Reduced electronic component related costs by $0.7 million and tariff expenses by $0.1 million vs. Q4 2018 200.5 (3.4) 2.7 183.9 (11.1) (4.8) Q4 2018 Shift-by-Wire Ramp-Down GM Strike Fx Other Q4 2019 *Excluding divested product lines 12.3 (2.8) (2.1) 0.8 (0.9) 5.1 (2.2) Q4 2018 Shift-by-Wire Ramp-Down Externalities Incremental Canton Costs Electronic Components / Tariffs Other Q4 2019 $’s in USD Millions $’s in USD Millions

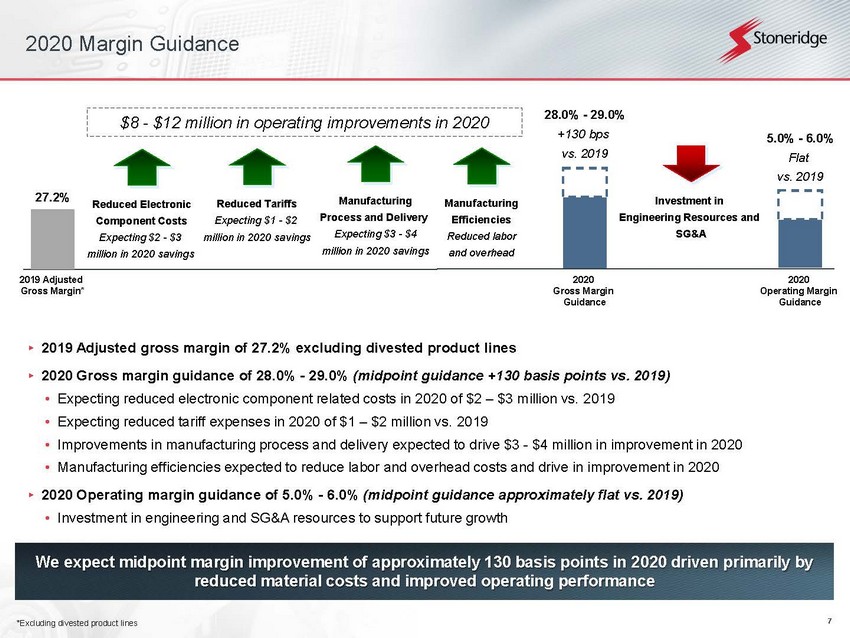

7 2020 Margin Guidance 2019 Adjusted Gross Margin* Reduced Electronic Component Costs Expecting $2 - $3 million in 2020 savings 27.2% Investment in Engineering Resources and SG&A 28.0% - 29.0% +130 bps vs. 2019 2020 Gross Margin Guidance We expect midpoint margin improvement of approximately 130 basis points in 2020 driven primarily by reduced material costs and improved operating performance ▸ 2019 Adjusted gross margin of 27.2% excluding divested product lines ▸ 2020 Gross margin guidance of 28.0% - 29.0% (midpoint guidance +130 basis points vs. 2019) • Expecting reduced electronic component related costs in 2020 of $2 – $3 million vs. 2019 • Expecting reduced tariff expenses in 2020 of $1 – $2 million vs. 2019 • Improvements in manufacturing process and delivery expected to drive $3 - $4 million in improvement in 2020 • Manufacturing efficiencies expected to reduce labor and overhead costs and drive in improvement in 2020 ▸ 2020 Operating margin guidance of 5.0% - 6.0% (midpoint guidance approximately flat vs. 2019) • Investment in engineering and SG&A resources to support future growth 5.0% - 6.0% Flat vs. 2019 2020 Operating Margin Guidance Reduced Tariffs Expecting $1 - $2 million in 2020 savings Manufacturing Efficiencies Reduced labor and overhead Manufacturing Process and Delivery Expecting $3 - $4 million in 2020 savings $8 - $12 million in operating improvements in 2020 *Excluding divested product lines

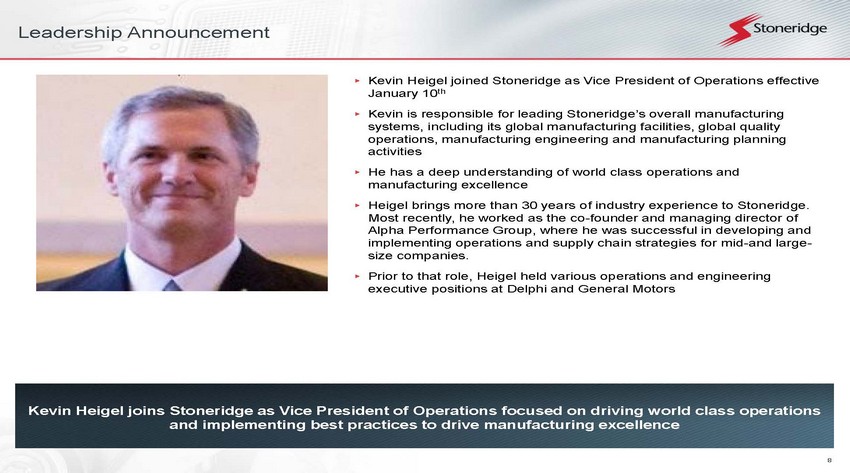

8 Leadership Announcement Kevin Heigel joins Stoneridge as Vice President of Operations focused on driving world class operations and implementing best practices to drive manufacturing excellence ▸ Kevin Heigel joined Stoneridge as Vice President of Operations effective January 10 th ▸ Kevin is responsible for leading Stoneridge’s overall manufacturing systems, including its global manufacturing facilities, global quality operations, manufacturing engineering and manufacturing planning activities ▸ He has a deep understanding of world class operations and manufacturing excellence ▸ Heigel brings more than 30 years of industry experience to Stoneridge. Most recently, he worked as the co - founder and managing director of Alpha Performance Group, where he was successful in developing and implementing operations and supply chain strategies for mid - and large - size companies. ▸ Prior to that role, Heigel held various operations and engineering executive positions at Delphi and General Motors

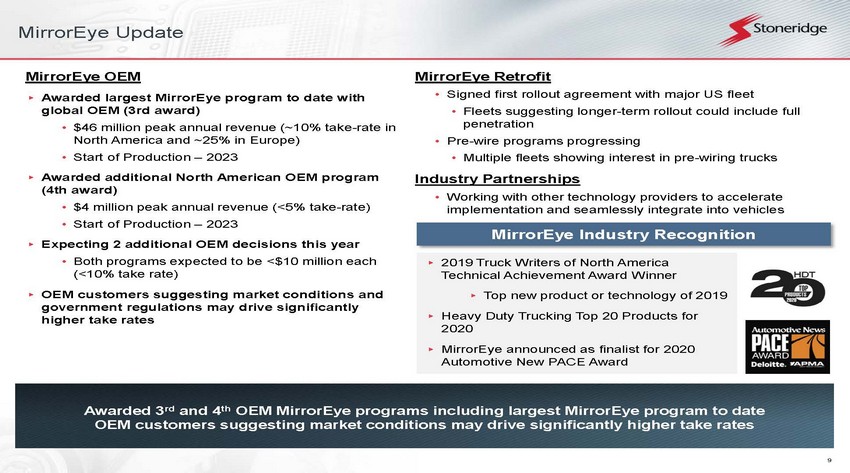

9 MirrorEye Update MirrorEye OEM ▸ Awarded largest MirrorEye program to date with global OEM (3rd award) • $46 million peak annual revenue (~10% take - rate in North America and ~25% in Europe) • Start of Production – 2023 ▸ Awarded additional North American OEM program (4th award) • $4 million peak annual revenue (<5% take - rate) • Start of Production – 2023 ▸ Expecting 2 additional OEM decisions this year • Both programs expected to be <$10 million each (<10% take rate) ▸ OEM customers suggesting market conditions and government regulations may drive significantly higher take rates Awarded 3 rd and 4 th OEM MirrorEye programs including largest MirrorEye program to date OEM customers suggesting market conditions may drive significantly higher take rates MirrorEye Industry Recognition ▸ 2019 Truck Writers of North America Technical Achievement Award Winner ▸ Top new product or technology of 2019 ▸ Heavy Duty Trucking Top 20 Products for 2020 ▸ MirrorEye announced as finalist for 2020 Automotive New PACE Award MirrorEye Retrofit • Signed first rollout agreement with major US fleet • Fleets suggesting longer - term rollout could include full penetration • Pre - wire programs progressing • Multiple fleets showing interest in pre - wiring trucks Industry Partnerships • Working with other technology providers to accelerate implementation and seamlessly integrate into vehicles

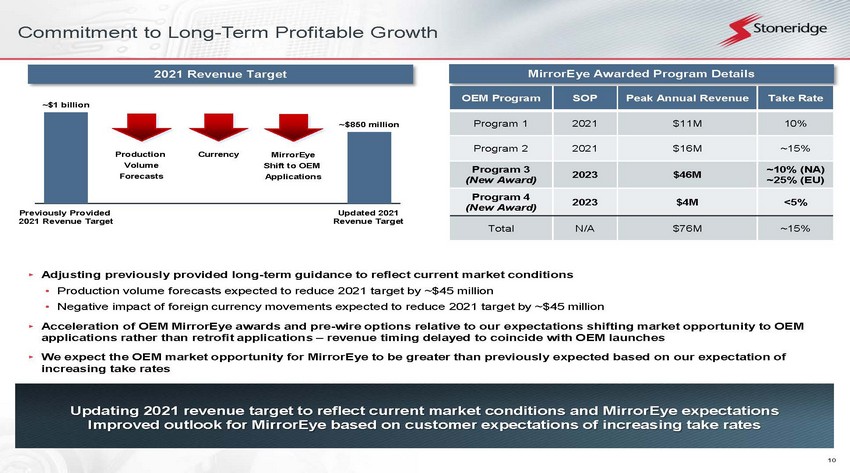

10 Commitment to Long - Term Profitable Growth Updating 2021 revenue target to reflect current market conditions and MirrorEye expectations Improved outlook for MirrorEye based on customer expectations of increasing take rates Previously Provided 2021 Revenue Target Production Volume Forecasts ~$1 billion Currency MirrorEye Shift to OEM Applications ~$850 million Updated 2021 Revenue Target OEM Program SOP Peak Annual Revenue Take Rate Program 1 2021 $11M 10% Program 2 2021 $16M ~15% Program 3 (New Award) 2023 $46M ~10% (NA) ~25% (EU) Program 4 (New Award) 2023 $4M <5% Total N/A $76M ~15% MirrorEye Awarded Program Details 2021 Revenue Target ▸ Adjusting previously provided long - term guidance to reflect current market conditions • Production volume forecasts expected to reduce 2021 target by ~$45 million • Negative impact of foreign currency movements expected to reduce 2021 target by ~$45 million ▸ Acceleration of OEM MirrorEye awards and pre - wire options relative to our expectations shifting market opportunity to OEM applications rather than retrofit applications – revenue timing delayed to coincide with OEM launches ▸ We expect the OEM market opportunity for MirrorEye to be greater than previously expected based on our expectation of increasing take rates

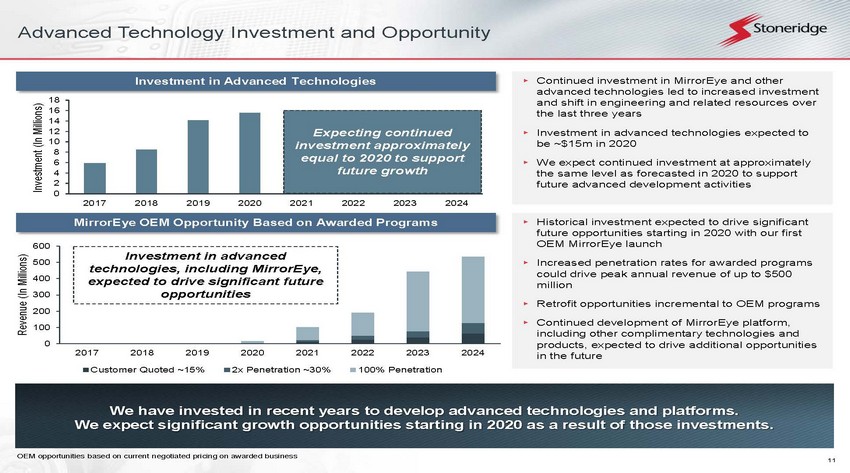

11 0 2 4 6 8 10 12 14 16 18 2017 2018 2019 2020 2021 2022 2023 2024 Investment (In Millions) Advanced Technology Investment and Opportunity We have invested in recent years to develop advanced technologies and platforms. We expect significant growth opportunities starting in 2020 as a result of those investments. Investment in Advanced Technologies MirrorEye OEM Opportunity Based on Awarded Programs 0 100 200 300 400 500 600 2017 2018 2019 2020 2021 2022 2023 2024 Revenue (In Millions) Customer Quoted ~15% 2x Penetration ~30% 100% Penetration Expecting continued investment approximately equal to 2020 to support future growth Investment in advanced technologies, including MirrorEye, expected to drive significant future opportunities ▸ Continued investment in MirrorEye and other advanced technologies led to increased investment and shift in engineering and related resources over the last three years ▸ Investment in advanced technologies expected to be ~$15m in 2020 ▸ We expect continued investment at approximately the same level as forecasted in 2020 to support future advanced development activities ▸ Historical investment expected to drive significant future opportunities starting in 2020 with our first OEM MirrorEye launch ▸ Increased penetration rates for awarded programs could drive peak annual revenue of up to $500 million ▸ Retrofit opportunities incremental to OEM programs ▸ Continued development of MirrorEye platform, including other complimentary technologies and products, expected to drive additional opportunities in the future OEM opportunities based on current negotiated pricing on awarded business

12 Leveraging Our Existing Technology Portfolio for What’s Next Commercial vehicles have increased needs for advanced safety and efficiency tools which align with our current capabilities and future product roadmap V2X ▸ V2V cooperative warnings ▸ Extended range sensing Video Recording and Transmission ▸ Data collection for fleet safety management, AI and machine learning Situational Awareness ▸ Advanced HMI ▸ Vulnerable Road User (VRU) detection ▸ Birds Eye View ▸ Driver monitoring

13 Summary 2019 Summary ▸ Optimized product portfolio ▸ Optimized manufacturing footprint ▸ Investment in improved systems and technology ▸ Significant business awards, including largest MirrorEye award to date, positioned the Company for long - term growth ▸ Continued investment in advanced technology solutions to compliment and advance existing systems ▸ Continued transformation of the organization and leadership team 2020 Outlook and Beyond ▸ Continued focus on operational improvement expected to drive $8 - $12 million of improved performance in 2020 ▸ Continued investment in advanced technologies and engineering capabilities to support product development and future program launches ▸ We expect the OEM market opportunity for MirrorEye to be greater than previously expected based on our expectation of increasing take rates – market opportunity shifting from retrofit to OEM applications Driving shareholder value through strong financial performance and a well - defined long - term strategy

14 Financial Update

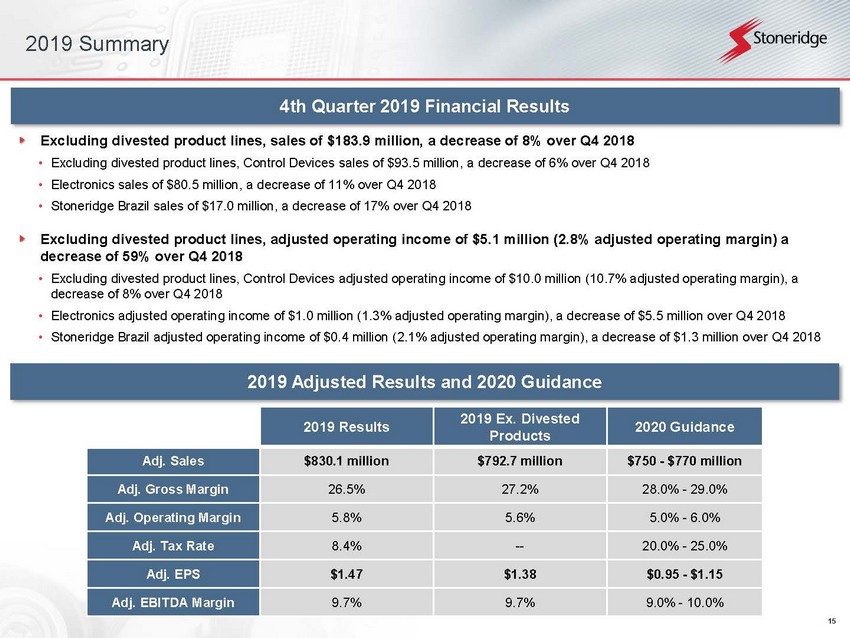

15 2019 Summary 4 th Quarter 2019 Financial Results Excluding divested product lines, sales of $183.9 million, a decrease of 8% over Q4 2018 • Excluding divested product lines, Control Devices sales of $93.5 million, a decrease of 6% over Q4 2018 • Electronics sales of $80.5 million, a decrease of 11% over Q4 2018 • Stoneridge Brazil sales of $17.0 million, a decrease of 17% over Q4 2018 Excluding divested product lines, adjusted operating income of $5.1 million (2.8% adjusted operating margin) a decrease of 59% over Q4 2018 • Excluding divested product lines, Control Devices adjusted operating income of $10.0 million (10.7% adjusted operating margin ), a decrease of 8% over Q4 2018 • Electronics adjusted operating income of $1.0 million (1.3% adjusted operating margin), a decrease of $5.5 million over Q4 20 18 • Stoneridge Brazil adjusted operating income of $0.4 million (2.1% adjusted operating margin), a decrease of $1.3 million over Q4 2018 2019 Adjusted Results and 2020 Guidance 2019 Results 2019 Ex. Divested Products 2020 Guidance Adj. Sales $830.1 million $792.7 million $750 - $770 million Adj. Gross Margin 26.5% 27.2% 28.0% - 29.0% Adj. Operating Margin 5.8% 5.6% 5.0% - 6.0% Adj. Tax Rate 8.4% -- 20.0% - 25.0% Adj. EPS $1.47 $1.38 $0.95 - $1.15 Adj. EBITDA Margin 9.7% 9.7% 9.0% - 10.0%

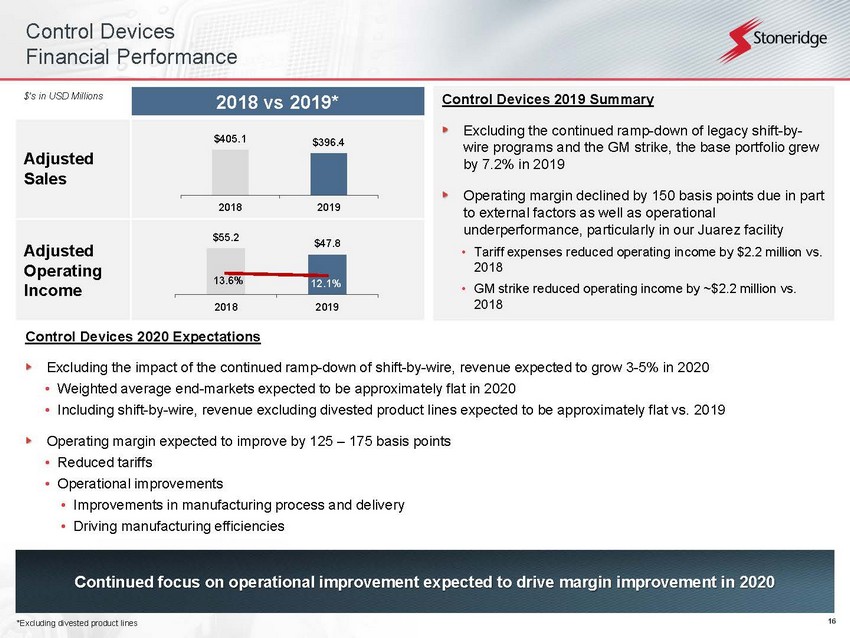

16 Control Devices Financial Performance Continued focus on operational improvement expected to drive margin improvement in 2020 Control Devices 2020 Expectations Excluding the impact of the continued ramp - down of shift - by - wire, revenue expected to grow 3 - 5% in 2020 • Weighted average end - markets expected to be approximately flat in 2020 • Including shift - by - wire, revenue excluding divested product lines expected to be approximately flat vs. 2019 Operating margin expected to improve by 125 – 175 basis points • Reduced tariffs • Operational improvements • Improvements in manufacturing process and delivery • Driving manufacturing efficiencies 2018 vs 2019* Adjusted Sales Adjusted Operating Income $’s in USD Millions Control Devices 2019 Summary Excluding the continued ramp - down of legacy shift - by - wire programs and the GM strike, the base portfolio grew by 7.2% in 2019 Operating margin declined by 150 basis points due in part to external factors as well as operational underperformance, particularly in our Juarez facility • Tariff expenses reduced operating income by $2.2 million vs. 2018 • GM strike reduced operating income by ~$2.2 million vs. 2018 $405.1 $396.4 $300.0 $350.0 $400.0 $450.0 2018 2019 $55.2 $47.8 13.6% 12.1% $0.0 $20.0 $40.0 $60.0 2018 2019 0.0% 10.0% 20.0% 30.0% 40.0% *Excluding divested product lines

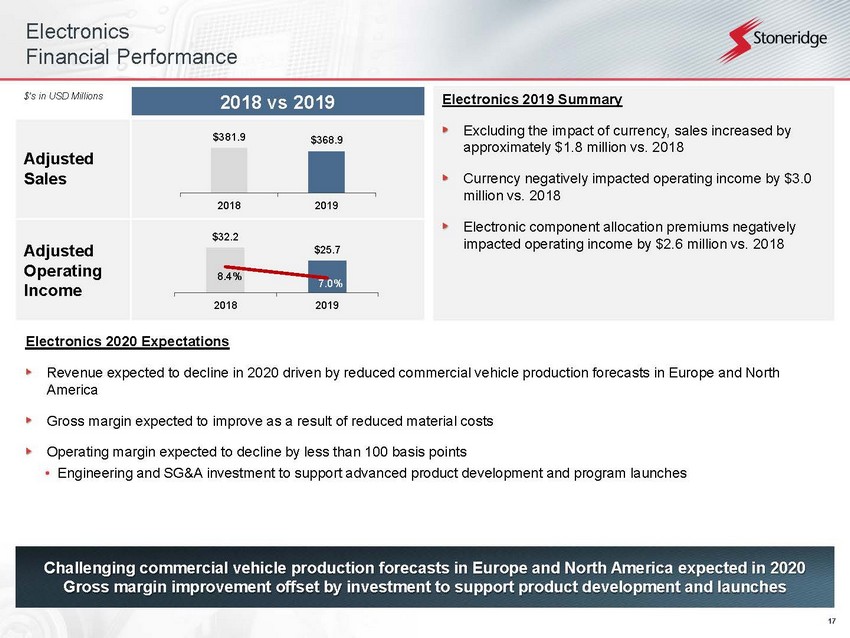

17 Electronics Financial Performance Challenging commercial vehicle production forecasts in Europe and North America expected in 2020 Gross margin improvement offset by investment to support product development and launches Electronics 2020 Expectations Revenue expected to decline in 2020 driven by reduced commercial vehicle production forecasts in Europe and North America Gross margin expected to improve as a result of reduced material costs Operating margin expected to decline by less than 100 basis points • Engineering and SG&A investment to support advanced product development and program launches 2018 vs 2019 Adjusted Sales Adjusted Operating Income $’s in USD Millions Electronics 2019 Summary Excluding the impact of currency, sales increased by approximately $1.8 million vs. 2018 Currency negatively impacted operating income by $3.0 million vs. 2018 Electronic component allocation premiums negatively impacted operating income by $2.6 million vs. 2018 $381.9 $368.9 $200.0 $300.0 $400.0 2018 2019 $32.2 $25.7 8.4% 7.0% $10.0 $20.0 $30.0 $40.0 2018 2019 5.0% 7.0% 9.0% 11.0% 13.0%

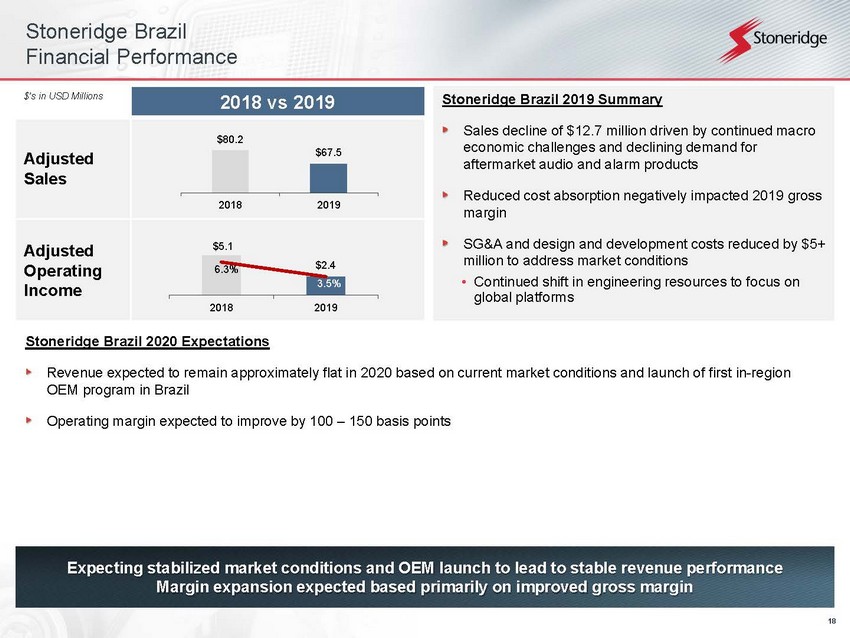

18 Stoneridge Brazil Financial Performance Expecting stabilized market conditions and OEM launch to lead to stable revenue performance Margin expansion expected based primarily on improved gross margin Stoneridge Brazil 2020 Expectations Revenue expected to remain approximately flat in 2020 based on current market conditions and launch of first in - region OEM program in Brazil Operating margin expected to improve by 100 – 150 basis points Stoneridge Brazil 2019 Summary Sales decline of $12.7 million driven by continued macro economic challenges and declining demand for aftermarket audio and alarm products Reduced cost absorption negatively impacted 2019 gross margin SG&A and design and development costs reduced by $5+ million to address market conditions • Continued shift in engineering resources to focus on global platforms 2018 vs 2019 Adjusted Sales Adjusted Operating Income $’s in USD Millions $80.2 $67.5 $40.0 $60.0 $80.0 $100.0 2018 2019 $5.1 $2.4 6.3% 3.5% $0.0 $2.0 $4.0 $6.0 $8.0 2018 2019 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0%

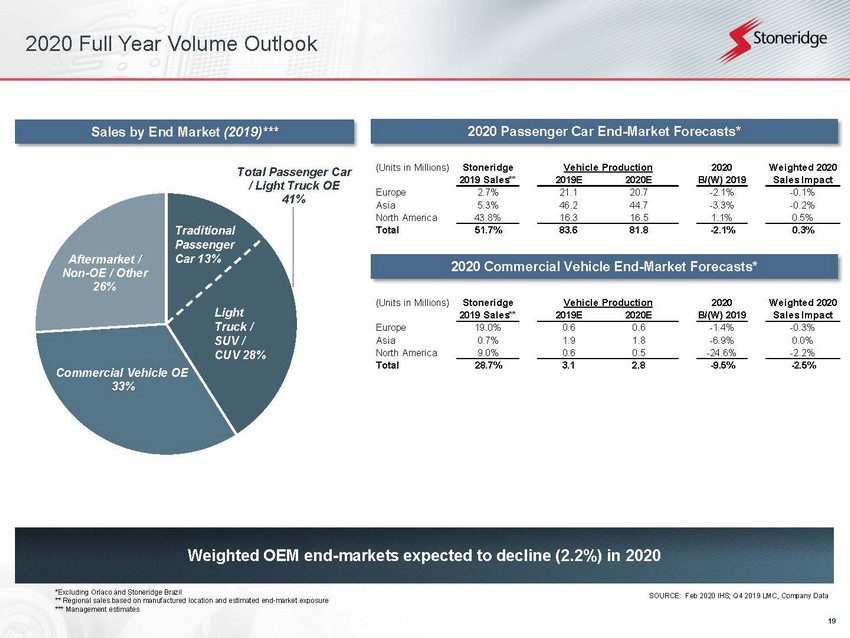

19 Weighted OEM end - markets expected to decline (2.2%) in 2020 *Excluding Orlaco and Stoneridge Brazil ** Regional sales based on manufactured location and estimated end - market exposure *** Management estimates Total Passenger Car / Light Truck OE 41% Commercial Vehicle OE 33% Aftermarket / Non - OE / Other 26% Traditional Passenger Car 13% Sales by End Market ( 2019 )*** 2020 Passenger Car End - Market Forecasts* Light Truck / SUV / CUV 28% SOURCE: Feb 2020 IHS; Q4 2019 LMC, Company Data 2020 Full Year Volume Outlook 2020 Commercial Vehicle End - Market Forecasts* (Units in Millions) Stoneridge 2020 Weighted 2020 2019 Sales** 2019E 2020E B/(W) 2019 Sales Impact Europe 2.7% 21.1 20.7 -2.1% -0.1% Asia 5.3% 46.2 44.7 -3.3% -0.2% North America 43.8% 16.3 16.5 1.1% 0.5% Total 51.7% 83.6 81.8 -2.1% 0.3% Vehicle Production (Units in Millions) Stoneridge 2020 Weighted 2020 2019 Sales** 2019E 2020E B/(W) 2019 Sales Impact Europe 19.0% 0.6 0.6 -1.4% -0.3% Asia 0.7% 1.9 1.8 -6.9% 0.0% North America 9.0% 0.6 0.5 -24.6% -2.2% Total 28.7% 3.1 2.8 -9.5% -2.5% Vehicle Production

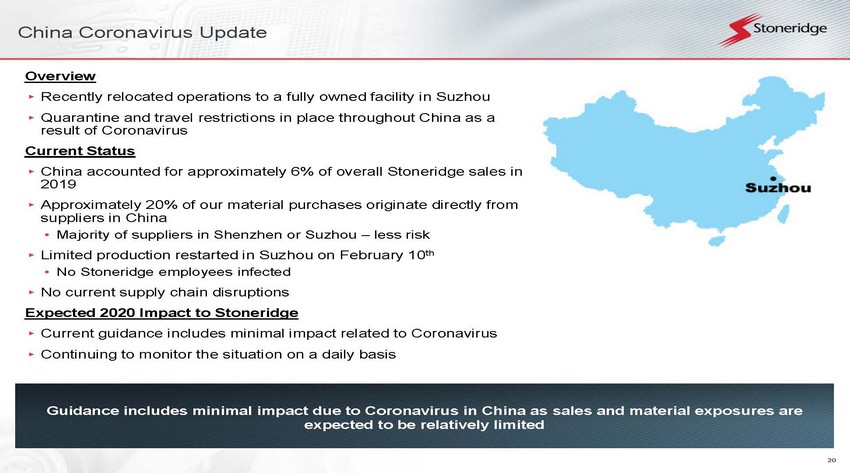

20 China Coronavirus Update Guidance includes minimal impact due to Coronavirus in China as sales and material exposures are expected to be relatively limited Overview ▸ Recently relocated operations to a fully owned facility in Suzhou ▸ Quarantine and travel restrictions in place throughout China as a result of Coronavirus Current Status ▸ China accounted for approximately 6% of overall Stoneridge sales in 2019 ▸ Approximately 20% of our material purchases originate directly from suppliers in China • Majority of suppliers in Shenzhen or Suzhou – less risk ▸ Limited production restarted in Suzhou on February 10 th • No Stoneridge employees infected ▸ No current supply chain disruptions Expected 2020 Impact to Stoneridge ▸ Current guidance includes minimal impact related to Coronavirus ▸ Continuing to monitor the situation on a daily basis

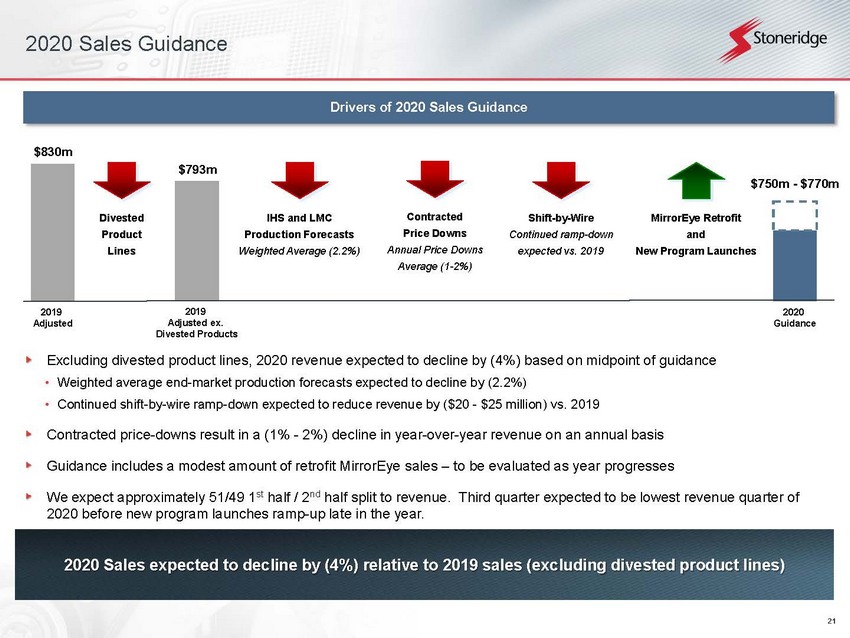

21 2020 Sales Guidance 2019 Adjusted Drivers of 2020 Sales Guidance MirrorEye Retrofit and New Program Launches Divested Product Lines $830m IHS and LMC Production Forecasts Weighted Average (2.2%) $750m - $770m 2020 Guidance 2020 Sales expected to decline by (4%) relative to 2019 sales (excluding divested product lines) Excluding divested product lines, 2020 revenue expected to decline by (4%) based on midpoint of guidance • Weighted average end - market production forecasts expected to decline by (2.2%) • Continued shift - by - wire ramp - down expected to reduce revenue by ($20 - $25 million) vs. 2019 Contracted price - downs result in a (1% - 2%) decline in year - over - year revenue on an annual basis Guidance includes a modest amount of retrofit MirrorEye sales – to be evaluated as year progresses We expect approximately 51/49 1 st half / 2 nd half split to revenue. Third quarter expected to be lowest revenue quarter of 2020 before new program launches ramp - up late in the year. 2019 Adjusted ex. Divested Products $793m Contracted Price Downs Annual Price Downs Average (1 - 2%) Shift - by - Wire Continued ramp - down expected vs. 2019

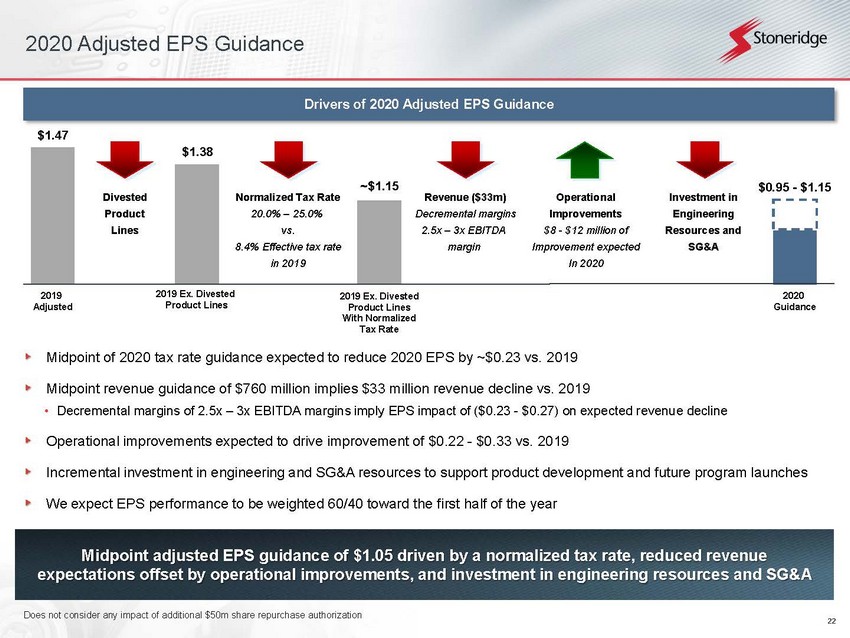

22 Investment in Engineering Resources and SG&A 2020 Adjusted EPS Guidance 2019 Adjusted Drivers of 2020 Adjusted EPS Guidance $1.47 $0.95 - $1.15 2020 Guidance Midpoint adjusted EPS guidance of $1.05 driven by a normalized tax rate, reduced revenue expectations offset by operational improvements, and investment in engineering resources and SG&A Midpoint of 2020 tax rate guidance expected to reduce 2020 EPS by ~$0.23 vs. 2019 Midpoint revenue guidance of $760 million implies $33 million revenue decline vs. 2019 • Decremental margins of 2.5x – 3x EBITDA margins imply EPS impact of ($0.23 - $0.27) on expected revenue decline Operational improvements expected to drive improvement of $0.22 - $0.33 vs. 2019 Incremental investment in engineering and SG&A resources to support product development and future program launches We expect EPS performance to be weighted 60/40 toward the first half of the year 2019 Ex. Divested Product Lines $1.38 Divested Product Lines Operational Improvements $8 - $12 million of Improvement expected In 2020 Normalized Tax Rate 20.0% – 25.0% vs. 8.4% Effective tax rate in 2019 ~$1.15 2019 Ex. Divested Product Lines With Normalized Tax Rate Revenue ($33m) Decremental margins 2.5x – 3x EBITDA margin Does not consider any impact of additional $50m share repurchase authorization

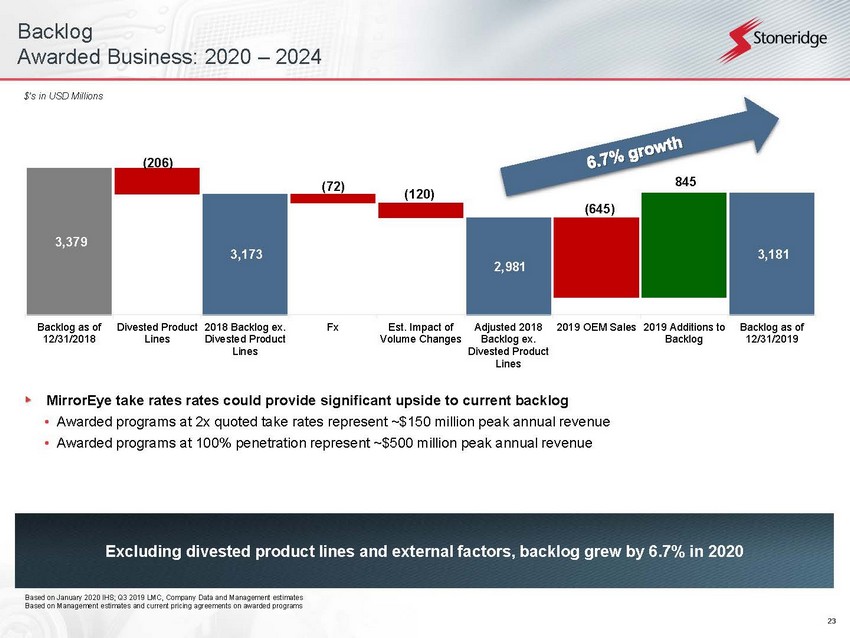

23 Backlog Awarded Business: 2020 – 2024 Excluding divested product lines and external factors, backlog grew by 6.7% in 2020 Based on January 2020 IHS; Q3 2019 LMC, Company Data and Management estimates Based on Management estimates and current pricing agreements on awarded programs MirrorEye take rates rates could provide significant upside to current backlog • Awarded programs at 2x quoted take rates represent ~$150 million peak annual revenue • Awarded programs at 100% penetration represent ~$500 million peak annual revenue $’s in USD Millions 3,379 (206) 3,173 (120) 2,981 3,181 (72) (645) 845 Backlog as of 12/31/2018 Divested Product Lines 2018 Backlog ex. Divested Product Lines Fx Est. Impact of Volume Changes Adjusted 2018 Backlog ex. Divested Product Lines 2019 OEM Sales 2019 Additions to Backlog Backlog as of 12/31/2019

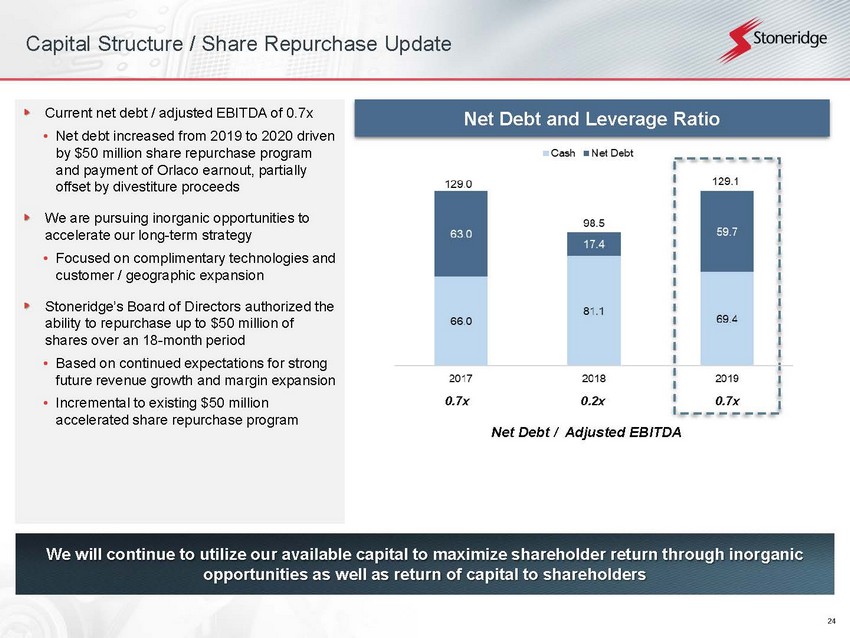

24 Capital Structure / Share Repurchase Update We will continue to utilize our available capital to maximize shareholder return through inorganic opportunities as well as return of capital to shareholders Net Debt / Adjusted EBITDA 0.7x 0.2x 0.7x Net Debt and Leverage Ratio Current net debt / adjusted EBITDA of 0.7x • Net debt increased from 2019 to 2020 driven by $50 million share repurchase program and payment of Orlaco earnout, partially offset by divestiture proceeds We are pursuing inorganic opportunities to accelerate our long - term strategy • Focused on complimentary technologies and customer / geographic expansion Stoneridge’s Board of Directors authorized the ability to repurchase up to $50 million of shares over an 18 - month period • Based on continued expectations for strong future revenue growth and margin expansion • Incremental to existing $50 million accelerated share repurchase program

25 Summary 2019 Summary ▸ Control Devices – Excluding the continued ramp - down of legacy shift - by - wire programs and the GM strike, the base portfolio grew by 7.2% in 2019. Operating performance, especially in the 4 th quarter, resulted in margin contraction of 150 basis points vs. 2018. ▸ Electronics – Excluding the impact of currency, revenue increased despite end - market contraction, especially in the 2 nd half of the year. Macroeconomic factors, including electronic component premiums, contributed to margin contraction of 140 basis points vs. 2018. ▸ Stoneridge Brazil – Cost reductions resulted in profitability despite challenging macroeconomic conditions 2020 Outlook and Guidance ▸ Midpoint revenue guidance of $760 million • Driven primarily by reduced end - market production forecasts • Guidance includes modest MirrorEye retrofit revenue – to be evaluated as year progresses ▸ Midpoint adjusted gross margin guidance of 28.5% vs. 27.2% in 2019 ▸ Midpoint adjusted operating margin guidance of 5.5% • Expected gross margin improvement in 2020 offset by incremental investment in engineering resources and SG&A ▸ Midpoint adjusted EPS guidance of $1.05 per share • Normalized tax rate expected to reduce adjusted EPS by ~$0.23 vs. 2019 Driving shareholder value through strong financial performance and a well - defined long - term strategy

26 Appendix

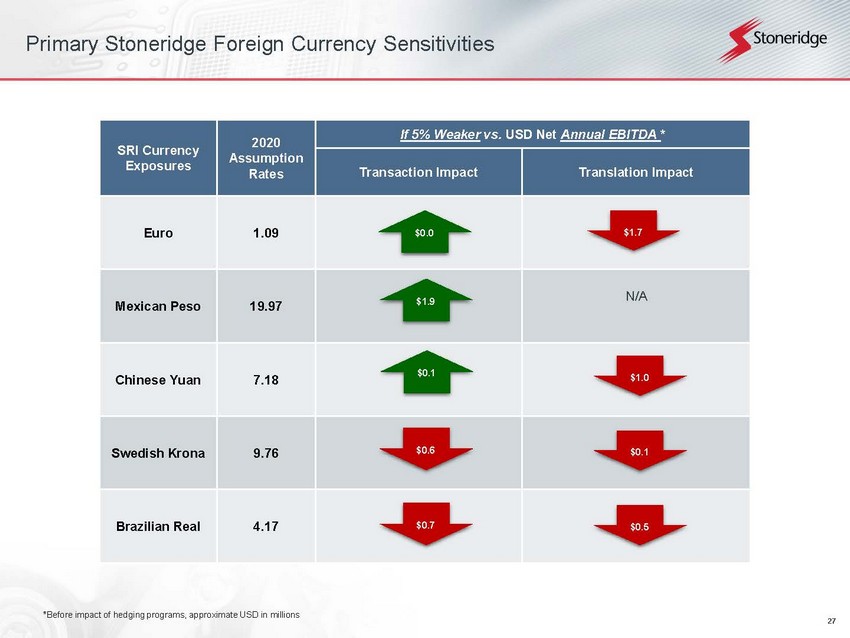

27 Primary Stoneridge Foreign Currency Sensitivities SRI Currency Exposures 2020 Assumption Rates If 5% Weaker vs. USD N et Annual EBITDA * Transaction Impact Translation Impact Euro 1.09 Mexican Peso 19.97 N/A Chinese Yuan 7.18 Swedish Krona 9.76 Brazilia n Real 4.17 *Before impact of hedging programs, approximate USD in millions $0.6 $1.9 $1.7 $1.0 $0.1 $0.7 $0.5 $0.0 $0.1

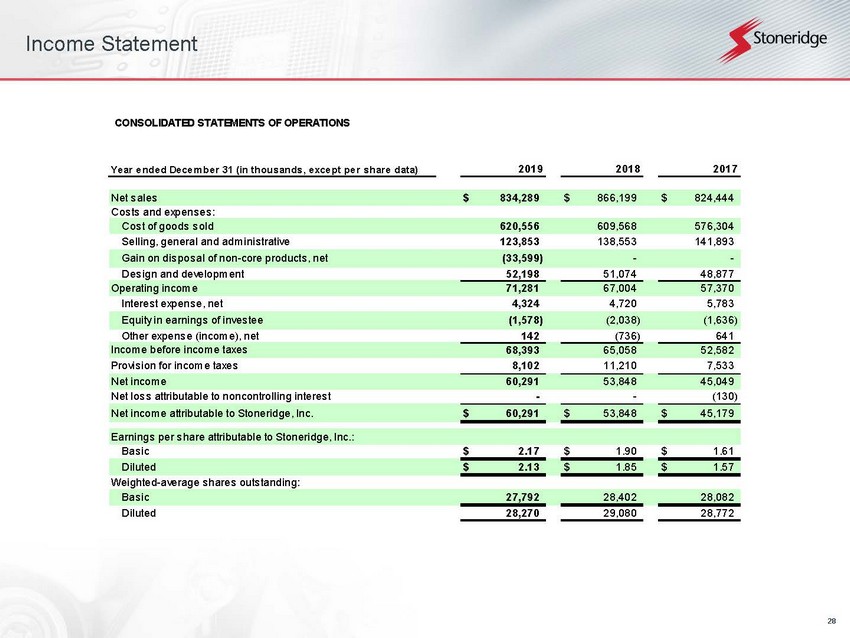

28 Income Statement Year ended December 31 (in thousands, except per share data) Net sales $ 834,289 $ 866,199 $ 824,444 Costs and expenses: Cost of goods sold 620,556 609,568 576,304 Selling, general and administrative 123,853 138,553 141,893 Gain on disposal of non-core products, net (33,599) - - Design and development 52,198 51,074 48,877 Operating income 71,281 67,004 57,370 Interest expense, net 4,324 4,720 5,783 Equity in earnings of investee (1,578) (2,038) (1,636) Other expense (income), net 142 (736) 641 68,393 65,058 52,582 8,102 11,210 7,533 Net income 60,291 53,848 45,049 Net loss attributable to noncontrolling interest - - (130) Net income attributable to Stoneridge, Inc. $ 60,291 $ 53,848 $ 45,179 Earnings per share attributable to Stoneridge, Inc.: Basic $ 2.17 $ 1.90 $ 1.61 Diluted $ 2.13 $ 1.85 $ 1.57 Weighted-average shares outstanding: Basic 27,792 28,402 28,082 Diluted 28,270 29,080 28,772 2019 2018 2017 Income before income taxes Provision for income taxes CONSOLIDATED STATEMENTS OF OPERATIONS

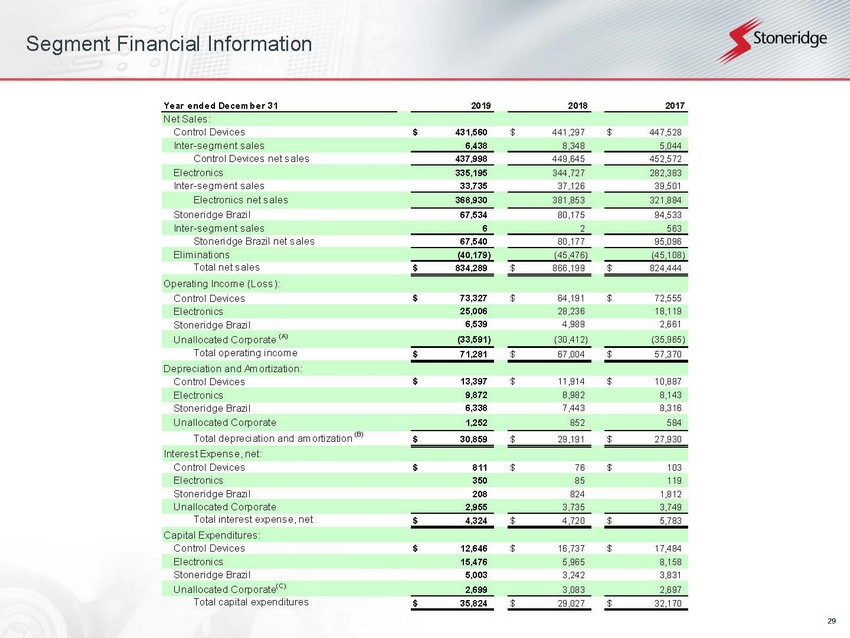

29 Segment Financial Information Year ended December 31 Net Sales: Control Devices $ 431,560 $ 441,297 $ 447,528 Inter-segment sales 6,438 8,348 5,044 Control Devices net sales 437,998 449,645 452,572 Electronics 335,195 344,727 282,383 Inter-segment sales 33,735 37,126 39,501 Electronics net sales 368,930 381,853 321,884 Stoneridge Brazil 67,534 80,175 94,533 Inter-segment sales 6 2 563 Stoneridge Brazil net sales 67,540 80,177 95,096 Eliminations (40,179) (45,476) (45,108) Total net sales $ 834,289 $ 866,199 $ 824,444 Operating Income (Loss): Control Devices $ 73,327 $ 64,191 $ 72,555 Electronics 25,006 28,236 18,119 Stoneridge Brazil 6,539 4,989 2,661 Unallocated Corporate (A) (33,591) (30,412) (35,965) Total operating income $ 71,281 $ 67,004 $ 57,370 Depreciation and Amortization: Control Devices $ 13,397 $ 11,914 $ 10,887 Electronics 9,872 8,982 8,143 Stoneridge Brazil 6,338 7,443 8,316 Unallocated Corporate 1,252 852 584 Total depreciation and amortization (B) $ 30,859 $ 29,191 $ 27,930 Interest Expense, net: Control Devices $ 811 $ 76 $ 103 Electronics 350 85 119 Stoneridge Brazil 208 824 1,812 Unallocated Corporate 2,955 3,735 3,749 Total interest expense, net $ 4,324 $ 4,720 $ 5,783 Capital Expenditures: Control Devices $ 12,646 $ 16,737 $ 17,484 Electronics 15,476 5,965 8,158 Stoneridge Brazil 5,003 3,242 3,831 Unallocated Corporate (C) 2,699 3,083 2,697 Total capital expenditures $ 35,824 $ 29,027 $ 32,170 2019 2018 2017

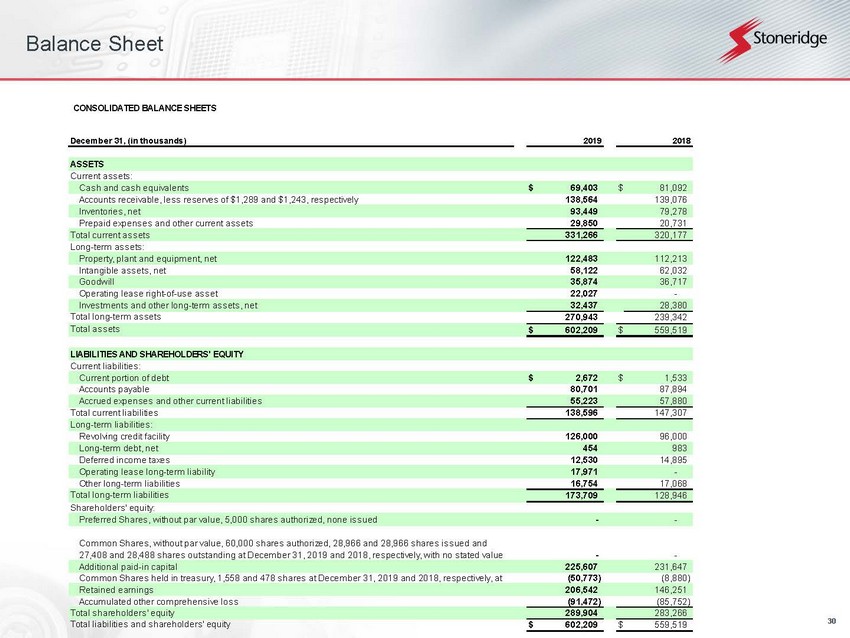

30 Balance Sheet CONSOLIDATED BALANCE SHEETS December 31, (in thousands) ASSETS Current assets: Cash and cash equivalents $ 69,403 $ 81,092 Accounts receivable, less reserves of $1,289 and $1,243, respectively 138,564 139,076 Inventories, net 93,449 79,278 Prepaid expenses and other current assets 29,850 20,731 Total current assets 331,266 320,177 Long-term assets: Property, plant and equipment, net 122,483 112,213 Intangible assets, net 58,122 62,032 Goodwill 35,874 36,717 Operating lease right-of-use asset 22,027 - Investments and other long-term assets, net 32,437 28,380 Total long-term assets 270,943 239,342 Total assets $ 602,209 $ 559,519 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of debt $ 2,672 $ 1,533 Accounts payable 80,701 87,894 Accrued expenses and other current liabilities 55,223 57,880 Total current liabilities 138,596 147,307 Long-term liabilities: Revolving credit facility 126,000 96,000 Long-term debt, net 454 983 Deferred income taxes 12,530 14,895 Operating lease long-term liability 17,971 - Other long-term liabilities 16,754 17,068 Total long-term liabilities 173,709 128,946 Shareholders' equity: Preferred Shares, without par value, 5,000 shares authorized, none issued - - Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 27,408 and 28,488 shares outstanding at December 31, 2019 and 2018, respectively, with no stated value - - Additional paid-in capital 225,607 231,647 Common Shares held in treasury, 1,558 and 478 shares at December 31, 2019 and 2018, respectively, at (50,773) (8,880) Retained earnings 206,542 146,251 Accumulated other comprehensive loss (91,472) (85,752) Total shareholders' equity 289,904 283,266 Total liabilities and shareholders' equity $ 602,209 $ 559,519 2019 2018

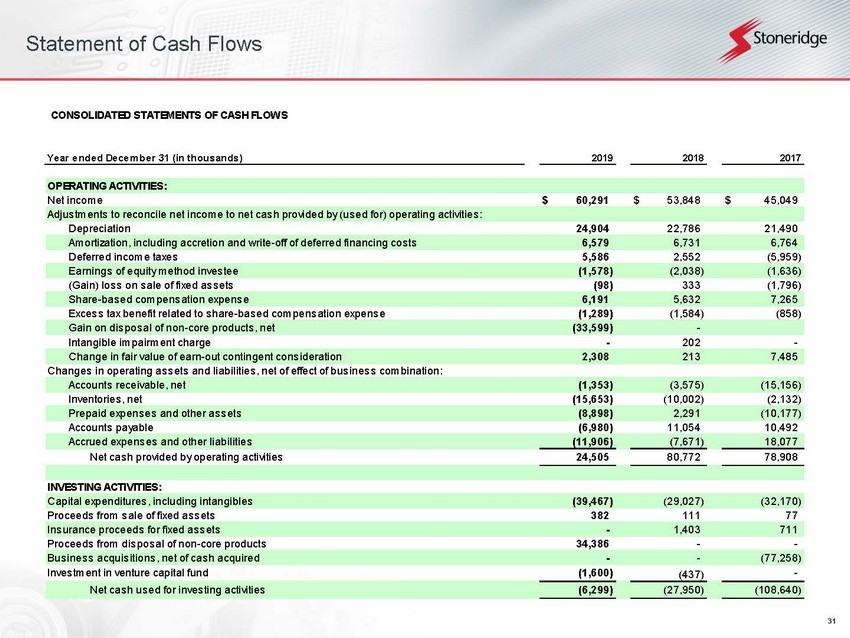

31 Statement of Cash Flows CONSOLIDATED STATEMENTS OF CASH FLOWS Year ended December 31 (in thousands) OPERATING ACTIVITIES: Net income $ 60,291 $ 53,848 $ 45,049 Adjustments to reconcile net income to net cash provided by (used for) operating activities: Depreciation 24,904 22,786 21,490 Amortization, including accretion and write-off of deferred financing costs 6,579 6,731 6,764 Deferred income taxes 5,586 2,552 (5,959) Earnings of equity method investee (1,578) (2,038) (1,636) (Gain) loss on sale of fixed assets (98) 333 (1,796) Share-based compensation expense 6,191 5,632 7,265 Excess tax benefit related to share-based compensation expense (1,289) (1,584) (858) Gain on disposal of non-core products, net (33,599) - Intangible impairment charge - 202 - Change in fair value of earn-out contingent consideration 2,308 213 7,485 Changes in operating assets and liabilities, net of effect of business combination: Accounts receivable, net (1,353) (3,575) (15,156) Inventories, net (15,653) (10,002) (2,132) Prepaid expenses and other assets (8,898) 2,291 (10,177) Accounts payable (6,980) 11,054 10,492 Accrued expenses and other liabilities (11,906) (7,671) 18,077 Net cash provided by operating activities 24,505 80,772 78,908 INVESTING ACTIVITIES: Capital expenditures, including intangibles (39,467) (29,027) (32,170) Proceeds from sale of fixed assets 382 111 77 Insurance proceeds for fixed assets - 1,403 711 Proceeds from disposal of non-core products 34,386 - - Business acquisitions, net of cash acquired - - (77,258) Investment in venture capital fund (1,600) (437) - Net cash used for investing activities (6,299) (27,950) (108,640) 2019 2018 2017

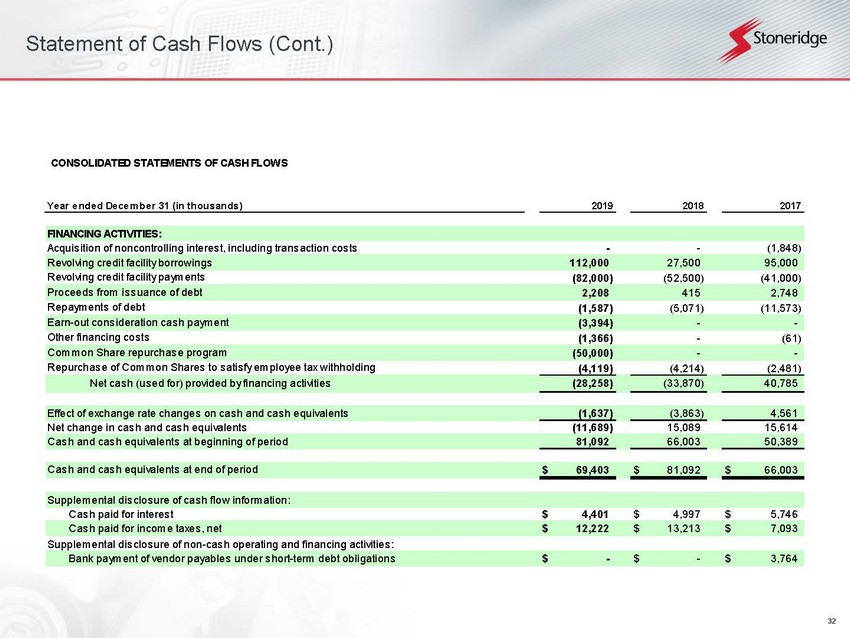

32 Statement of Cash Flows (Cont.) CONSOLIDATED STATEMENTS OF CASH FLOWS Year ended December 31 (in thousands) FINANCING ACTIVITIES: Acquisition of noncontrolling interest, including transaction costs - - (1,848) Revolving credit facility borrowings 112,000 27,500 95,000 Revolving credit facility payments (82,000) (52,500) (41,000) Proceeds from issuance of debt 2,208 415 2,748 Repayments of debt (1,587) (5,071) (11,573) Earn-out consideration cash payment (3,394) - - Other financing costs (1,366) - (61) Common Share repurchase program (50,000) - - Repurchase of Common Shares to satisfy employee tax withholding (4,119) (4,214) (2,481) Net cash (used for) provided by financing activities (28,258) (33,870) 40,785 Effect of exchange rate changes on cash and cash equivalents (1,637) (3,863) 4,561 Net change in cash and cash equivalents (11,689) 15,089 15,614 Cash and cash equivalents at beginning of period 81,092 66,003 50,389 Cash and cash equivalents at end of period $ 69,403 $ 81,092 $ 66,003 Supplemental disclosure of cash flow information: Cash paid for interest $ 4,401 $ 4,997 $ 5,746 Cash paid for income taxes, net $ 12,222 $ 13,213 $ 7,093 Supplemental disclosure of non-cash operating and financing activities: Bank payment of vendor payables under short-term debt obligations $ - $ - $ 3,764 2019 2018 2017

33 Reconciliations to US GAAP

34 Reconciliations to US GAAP This document contains information about Stoneridge's financial results which is not presented in accordance with accounting principles generally accepted in the United States ("GAAP"). Such non - GAAP financial measures are reconciled to their closest GAAP financial measures in the appendix of this document. The provision of these non - GAAP financial measures is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non - GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this document and the adjustments that management can reasonably predict.

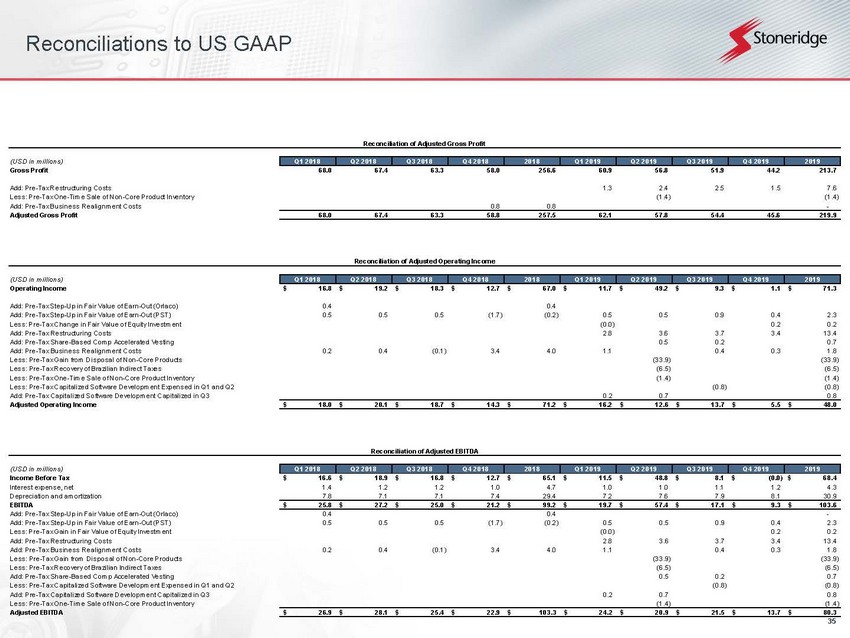

35 Reconciliations to US GAAP (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Gross Profit 68.0 67.4 63.3 58.0 256.6 60.9 56.8 51.9 44.2 213.7 Add: Pre-Tax Restructuring Costs 1.3 2.4 2.5 1.5 7.6 Less: Pre-Tax One-Time Sale of Non-Core Product Inventory (1.4) (1.4) Add: Pre-Tax Business Realignment Costs 0.8 0.8 - Adjusted Gross Profit 68.0 67.4 63.3 58.8 257.5 62.1 57.8 54.4 45.6 219.9 Reconciliation of Adjusted Gross Profit (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Operating Income 16.8$ 19.2$ 18.3$ 12.7$ 67.0$ 11.7$ 49.2$ 9.3$ 1.1$ 71.3$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.4 0.4 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.5 0.5 0.5 (1.7) (0.2) 0.5 0.5 0.9 0.4 2.3 Less: Pre-Tax Change in Fair Value of Equity Investment (0.0) 0.2 0.2 Add: Pre-Tax Restructuring Costs 2.8 3.6 3.7 3.4 13.4 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.5 0.2 0.7 Add: Pre-Tax Business Realignment Costs 0.2 0.4 (0.1) 3.4 4.0 1.1 0.4 0.3 1.8 Less: Pre-Tax Gain from Disposal of Non-Core Products (33.9) (33.9) Less: Pre-Tax Recovery of Brazilian Indirect Taxes (6.5) (6.5) Less: Pre-Tax One-Time Sale of Non-Core Product Inventory (1.4) (1.4) Less: Pre-Tax Capitalized Software Development Expensed in Q1 and Q2 (0.8) (0.8) Add: Pre-Tax Capitalized Software Development Capitalized in Q3 0.2 0.7 0.8 Adjusted Operating Income 18.0$ 20.1$ 18.7$ 14.3$ 71.2$ 16.2$ 12.6$ 13.7$ 5.5$ 48.0$ Reconciliation of Adjusted Operating Income (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Income Before Tax 16.6$ 18.9$ 16.8$ 12.7$ 65.1$ 11.5$ 48.8$ 8.1$ (0.0)$ 68.4$ Interest expense, net 1.4 1.2 1.2 1.0 4.7 1.0 1.0 1.1 1.2 4.3 Depreciation and amortization 7.8 7.1 7.1 7.4 29.4 7.2 7.6 7.9 8.1 30.9 EBITDA 25.8$ 27.2$ 25.0$ 21.2$ 99.2$ 19.7$ 57.4$ 17.1$ 9.3$ 103.6$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.4 0.4 - Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.5 0.5 0.5 (1.7) (0.2) 0.5 0.5 0.9 0.4 2.3 Less: Pre-Tax Gain in Fair Value of Equity Investment (0.0) 0.2 0.2 Add: Pre-Tax Restructuring Costs 2.8 3.6 3.7 3.4 13.4 Add: Pre-Tax Business Realignment Costs 0.2 0.4 (0.1) 3.4 4.0 1.1 0.4 0.3 1.8 Less: Pre-Tax Gain from Disposal of Non-Core Products (33.9) (33.9) Less: Pre-Tax Recovery of Brazilian Indirect Taxes (6.5) (6.5) Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.5 0.2 0.7 Less: Pre-Tax Capitalized Software Development Expensed in Q1 and Q2 (0.8) (0.8) Add: Pre-Tax Capitalized Software Development Capitalized in Q3 0.2 0.7 0.8 Less: Pre-Tax One-Time Sale of Non-Core Product Inventory (1.4) (1.4) Adjusted EBITDA 26.9$ 28.1$ 25.4$ 22.9$ 103.3$ 24.2$ 20.9$ 21.5$ 13.7$ 80.3$ Reconciliation of Adjusted EBITDA

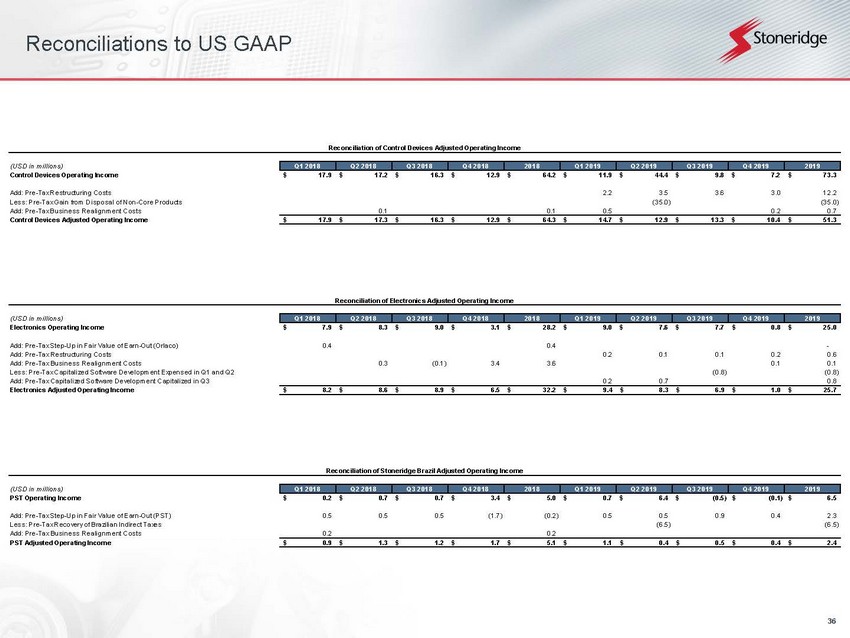

36 Reconciliations to US GAAP (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Control Devices Operating Income 17.9$ 17.2$ 16.3$ 12.9$ 64.2$ 11.9$ 44.4$ 9.8$ 7.2$ 73.3$ Add: Pre-Tax Restructuring Costs 2.2 3.5 3.6 3.0 12.2 Less: Pre-Tax Gain from Disposal of Non-Core Products (35.0) (35.0) Add: Pre-Tax Business Realignment Costs 0.1 0.1 0.5 0.2 0.7 Control Devices Adjusted Operating Income 17.9$ 17.3$ 16.3$ 12.9$ 64.3$ 14.7$ 12.9$ 13.3$ 10.4$ 51.3$ Reconciliation of Control Devices Adjusted Operating Income (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Electronics Operating Income 7.9$ 8.3$ 9.0$ 3.1$ 28.2$ 9.0$ 7.6$ 7.7$ 0.8$ 25.0$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.4 0.4 - Add: Pre-Tax Restructuring Costs 0.2 0.1 0.1 0.2 0.6 Add: Pre-Tax Business Realignment Costs 0.3 (0.1) 3.4 3.6 0.1 0.1 Less: Pre-Tax Capitalized Software Development Expensed in Q1 and Q2 (0.8) (0.8) Add: Pre-Tax Capitalized Software Development Capitalized in Q3 0.2 0.7 0.8 Electronics Adjusted Operating Income 8.2$ 8.6$ 8.9$ 6.5$ 32.2$ 9.4$ 8.3$ 6.9$ 1.0$ 25.7$ Reconciliation of Electronics Adjusted Operating Income (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 PST Operating Income 0.2$ 0.7$ 0.7$ 3.4$ 5.0$ 0.7$ 6.4$ (0.5)$ (0.1)$ 6.5$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.5 0.5 0.5 (1.7) (0.2) 0.5 0.5 0.9 0.4 2.3 Less: Pre-Tax Recovery of Brazilian Indirect Taxes (6.5) (6.5) Add: Pre-Tax Business Realignment Costs 0.2 0.2 PST Adjusted Operating Income 0.9$ 1.3$ 1.2$ 1.7$ 5.1$ 1.1$ 0.4$ 0.5$ 0.4$ 2.4$ Reconciliation of Stoneridge Brazil Adjusted Operating Income

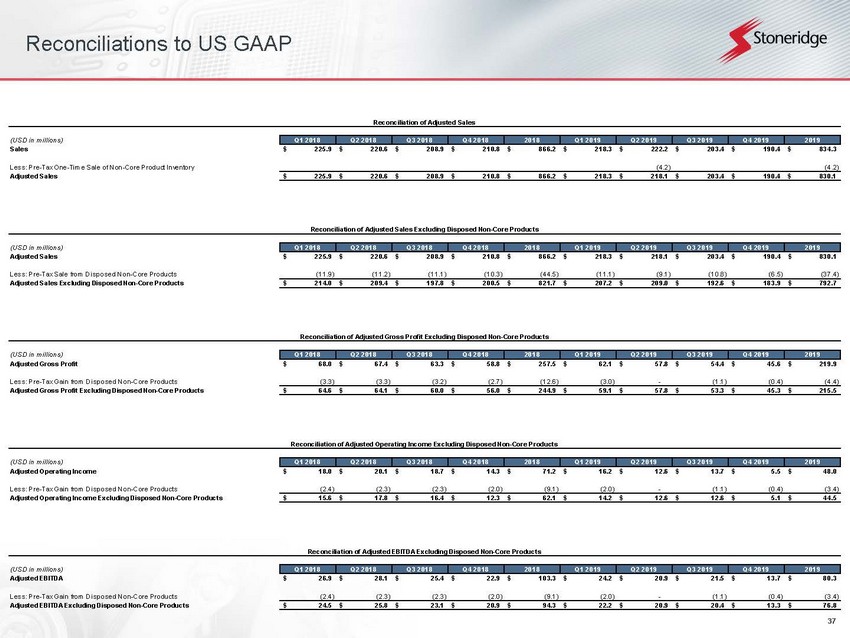

37 Reconciliations to US GAAP (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Sales 225.9$ 220.6$ 208.9$ 210.8$ 866.2$ 218.3$ 222.2$ 203.4$ 190.4$ 834.3$ Less: Pre-Tax One-Time Sale of Non-Core Product Inventory (4.2) (4.2) Adjusted Sales 225.9$ 220.6$ 208.9$ 210.8$ 866.2$ 218.3$ 218.1$ 203.4$ 190.4$ 830.1$ Reconciliation of Adjusted Sales (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted Sales 225.9$ 220.6$ 208.9$ 210.8$ 866.2$ 218.3$ 218.1$ 203.4$ 190.4$ 830.1$ Less: Pre-Tax Sale from Disposed Non-Core Products (11.9) (11.2) (11.1) (10.3) (44.5) (11.1) (9.1) (10.8) (6.5) (37.4) Adjusted Sales Excluding Disposed Non-Core Products 214.0$ 209.4$ 197.8$ 200.5$ 821.7$ 207.2$ 209.0$ 192.6$ 183.9$ 792.7$ Reconciliation of Adjusted Sales Excluding Disposed Non-Core Products (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted Gross Profit 68.0$ 67.4$ 63.3$ 58.8$ 257.5$ 62.1$ 57.8$ 54.4$ 45.6$ 219.9$ Less: Pre-Tax Gain from Disposed Non-Core Products (3.3) (3.3) (3.2) (2.7) (12.6) (3.0) - (1.1) (0.4) (4.4) Adjusted Gross Profit Excluding Disposed Non-Core Products 64.6$ 64.1$ 60.0$ 56.0$ 244.9$ 59.1$ 57.8$ 53.3$ 45.3$ 215.5$ Reconciliation of Adjusted Gross Profit Excluding Disposed Non-Core Products (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted Operating Income 18.0$ 20.1$ 18.7$ 14.3$ 71.2$ 16.2$ 12.6$ 13.7$ 5.5$ 48.0$ Less: Pre-Tax Gain from Disposed Non-Core Products (2.4) (2.3) (2.3) (2.0) (9.1) (2.0) - (1.1) (0.4) (3.4) Adjusted Operating Income Excluding Disposed Non-Core Products 15.6$ 17.8$ 16.4$ 12.3$ 62.1$ 14.2$ 12.6$ 12.6$ 5.1$ 44.5$ Reconciliation of Adjusted Operating Income Excluding Disposed Non-Core Products (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted EBITDA 26.9$ 28.1$ 25.4$ 22.9$ 103.3$ 24.2$ 20.9$ 21.5$ 13.7$ 80.3$ Less: Pre-Tax Gain from Disposed Non-Core Products (2.4) (2.3) (2.3) (2.0) (9.1) (2.0) - (1.1) (0.4) (3.4) Adjusted EBITDA Excluding Disposed Non-Core Products 24.5$ 25.8$ 23.1$ 20.9$ 94.3$ 22.2$ 20.9$ 20.4$ 13.3$ 76.8$ Reconciliation of Adjusted EBITDA Excluding Disposed Non-Core Products

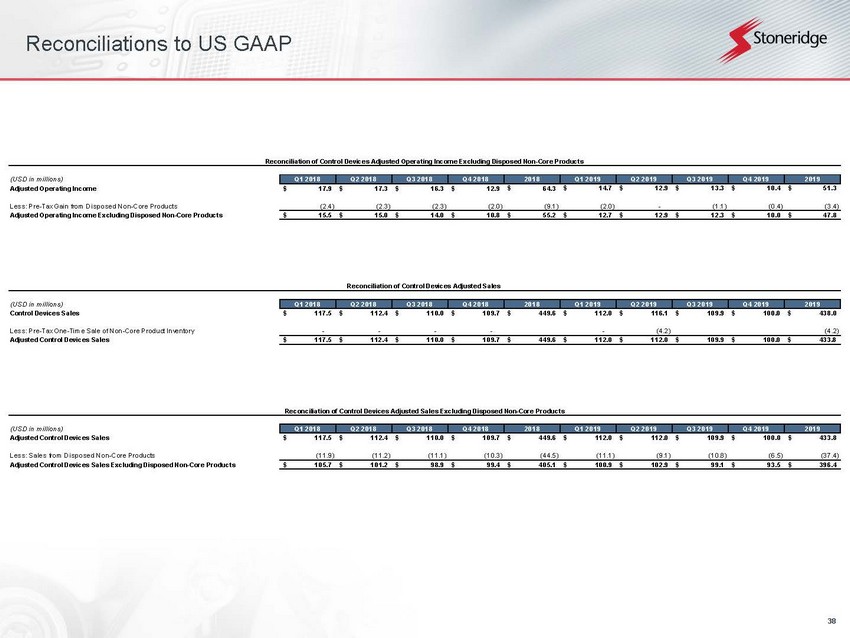

38 Reconciliations to US GAAP (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted Operating Income 17.9$ 17.3$ 16.3$ 12.9$ 64.3$ 14.7$ 12.9$ 13.3$ 10.4$ 51.3$ Less: Pre-Tax Gain from Disposed Non-Core Products (2.4) (2.3) (2.3) (2.0) (9.1) (2.0) - (1.1) (0.4) (3.4) Adjusted Operating Income Excluding Disposed Non-Core Products 15.5$ 15.0$ 14.0$ 10.8$ 55.2$ 12.7$ 12.9$ 12.3$ 10.0$ 47.8$ Reconciliation of Control Devices Adjusted Operating Income Excluding Disposed Non-Core Products (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Control Devices Sales 117.5$ 112.4$ 110.0$ 109.7$ 449.6$ 112.0$ 116.1$ 109.9$ 100.0$ 438.0$ Less: Pre-Tax One-Time Sale of Non-Core Product Inventory - - - - - (4.2) (4.2) Adjusted Control Devices Sales 117.5$ 112.4$ 110.0$ 109.7$ 449.6$ 112.0$ 112.0$ 109.9$ 100.0$ 433.8$ Reconciliation of Control Devices Adjusted Sales (USD in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 Adjusted Control Devices Sales 117.5$ 112.4$ 110.0$ 109.7$ 449.6$ 112.0$ 112.0$ 109.9$ 100.0$ 433.8$ Less: Sales from Disposed Non-Core Products (11.9) (11.2) (11.1) (10.3) (44.5) (11.1) (9.1) (10.8) (6.5) (37.4) Adjusted Control Devices Sales Excluding Disposed Non-Core Products 105.7$ 101.2$ 98.9$ 99.4$ 405.1$ 100.9$ 102.9$ 99.1$ 93.5$ 396.4$ Reconciliation of Control Devices Adjusted Sales Excluding Disposed Non-Core Products

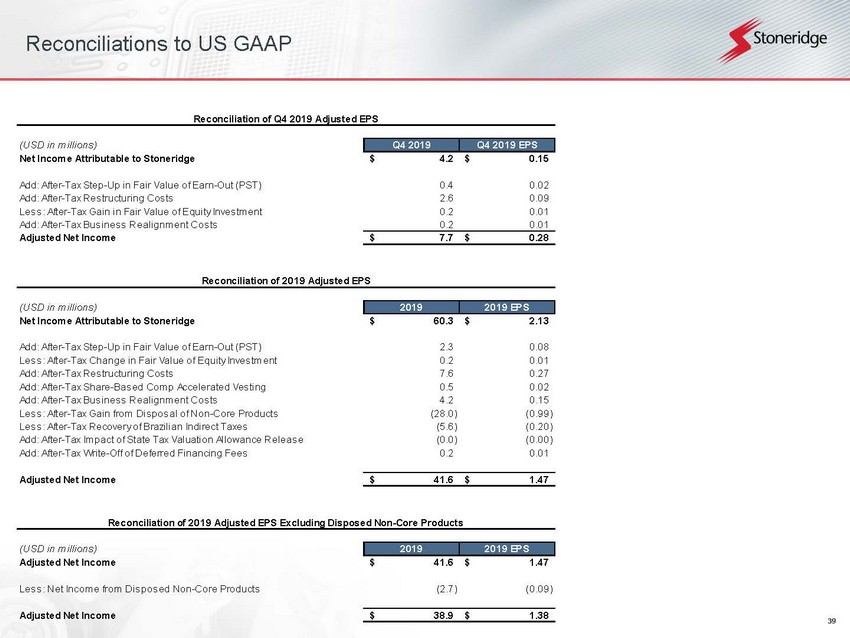

39 Reconciliations to US GAAP (USD in millions) Q4 2019 Q4 2019 EPS Net Income Attributable to Stoneridge 4.2$ 0.15$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 0.4 0.02 Add: After-Tax Restructuring Costs 2.6 0.09 Less: After-Tax Gain in Fair Value of Equity Investment 0.2 0.01 Add: After-Tax Business Realignment Costs 0.2 0.01 Adjusted Net Income 7.7$ 0.28$ Reconciliation of Q4 2019 Adjusted EPS (USD in millions) 2019 2019 EPS Net Income Attributable to Stoneridge 60.3$ 2.13$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 2.3 0.08 Less: After-Tax Change in Fair Value of Equity Investment 0.2 0.01 Add: After-Tax Restructuring Costs 7.6 0.27 Add: After-Tax Share-Based Comp Accelerated Vesting 0.5 0.02 Add: After-Tax Business Realignment Costs 4.2 0.15 Less: After-Tax Gain from Disposal of Non-Core Products (28.0) (0.99) Less: After-Tax Recovery of Brazilian Indirect Taxes (5.6) (0.20) Add: After-Tax Impact of State Tax Valuation Allowance Release (0.0) (0.00) Add: After-Tax Write-Off of Deferred Financing Fees 0.2 0.01 Adjusted Net Income 41.6$ 1.47$ Reconciliation of 2019 Adjusted EPS (USD in millions) 2019 2019 EPS Adjusted Net Income 41.6$ 1.47$ Less: Net Income from Disposed Non-Core Products (2.7) (0.09) Adjusted Net Income 38.9$ 1.38$ Reconciliation of 2019 Adjusted EPS Excluding Disposed Non-Core Products

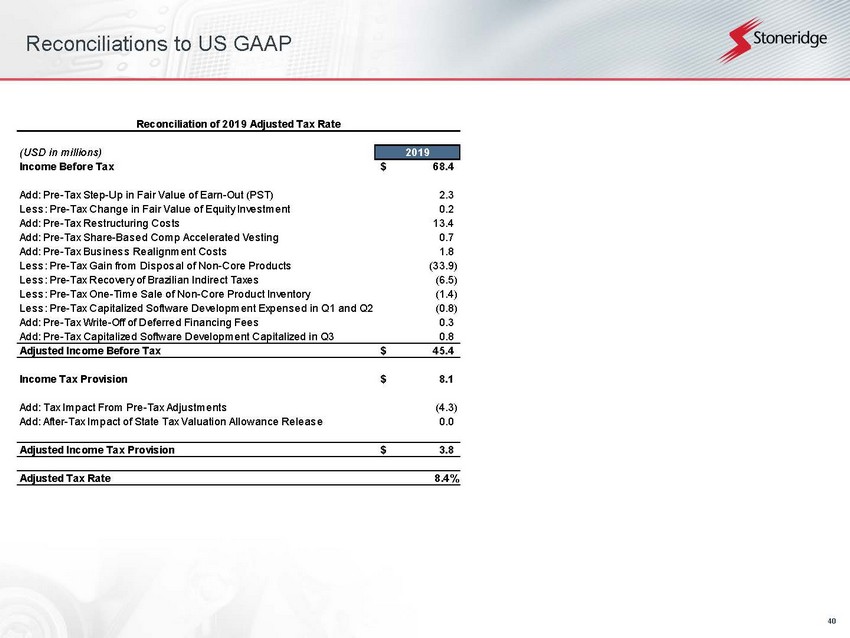

40 Reconciliations to US GAAP (USD in millions) 2019 Income Before Tax 68.4$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 2.3 Less: Pre-Tax Change in Fair Value of Equity Investment 0.2 Add: Pre-Tax Restructuring Costs 13.4 Add: Pre-Tax Share-Based Comp Accelerated Vesting 0.7 Add: Pre-Tax Business Realignment Costs 1.8 Less: Pre-Tax Gain from Disposal of Non-Core Products (33.9) Less: Pre-Tax Recovery of Brazilian Indirect Taxes (6.5) Less: Pre-Tax One-Time Sale of Non-Core Product Inventory (1.4) Less: Pre-Tax Capitalized Software Development Expensed in Q1 and Q2 (0.8) Add: Pre-Tax Write-Off of Deferred Financing Fees 0.3 Add: Pre-Tax Capitalized Software Development Capitalized in Q3 0.8 Adjusted Income Before Tax 45.4$ Income Tax Provision 8.1$ Add: Tax Impact From Pre-Tax Adjustments (4.3) Add: After-Tax Impact of State Tax Valuation Allowance Release 0.0 Adjusted Income Tax Provision 3.8$ Adjusted Tax Rate 8.4% Reconciliation of 2019 Adjusted Tax Rate