Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Accelerate Diagnostics, Inc | tm203402d1_ex99-1.htm |

| 8-K - FORM 8-K - Accelerate Diagnostics, Inc | tm203402d1_8k.htm |

Exhibit 99.2

38TH ANNUAL J.P. Morgan Healthcare Conference Jack Phillips Incoming CEO January 2020

Cautionary Note On Forward-Looking Statements © Copyright 2020 Accelerate Diagnostics, Inc. All Rights Reserved. The “ACCELERATE DIAGNOSTICS” and “ACCELERATE PHENO” and “ACCELERATE PHENOTEST” and diamond shaped logos and marks are registered trademarks of Accelerate Diagnostics, Inc. All other trademarks are the property of their respective owners. Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements such as our preliminary, unaudited 2019 performance and financial results, our 2020 revenue and net cash burn expectations, becoming the standard of care, improving our commercial execution, the size of our total addressable market, long-term market penetration, gross margin and free cash flow estimates, go-live expectations, new product development plans, geographic expansion opportunities, and our runway for growth. Forward-looking statements may contain words such as “will,” “may,” “expect,” “believe,” “likely,” “anticipate,” similar expressions, and variations or negatives of these words. Forward-looking statements are made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made. Management is not under any obligation, and we expressly disclaim any obligation, to update, alter, or otherwise revise any forward-looking statements, whether as a result of new information, future events, or otherwise. You are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. Forward-looking statements include projections, statements about our future and those that are not historical facts. All forwardlooking statements that are made in this presentation are subject to risks, uncertainties and other factors that could cause our actual results to differ materially. These are discussed in greater detail in our Annual Report on Form 10-K for the year ended December 31, 2018 and other reports we file with the SEC.

OUR PURPOSE We deliver lifesaving answers for patients with serious infections 3 OUR MISSION Expand our market leadership in Rapid ID/AST by delivering innovation with clear clinical and financial value for health systems and patients

270,000 deaths in U.S. annually1 AIDS Breast Cancer Prostate Cancer Lung Cancer SEPSIS 1 in 3 patient deaths in U.S. hospitals 1. Centers for Disease Control and Prevention (cdc.gov/sepsis/datareports) 2. Agency for Healthcare Research and Quality Healthcare Cost and Utilization Project (HCUP): https://www.hcup-us.ahrq.gov/faststats/landing.jsp >$27B cost in U.S. annually2 4

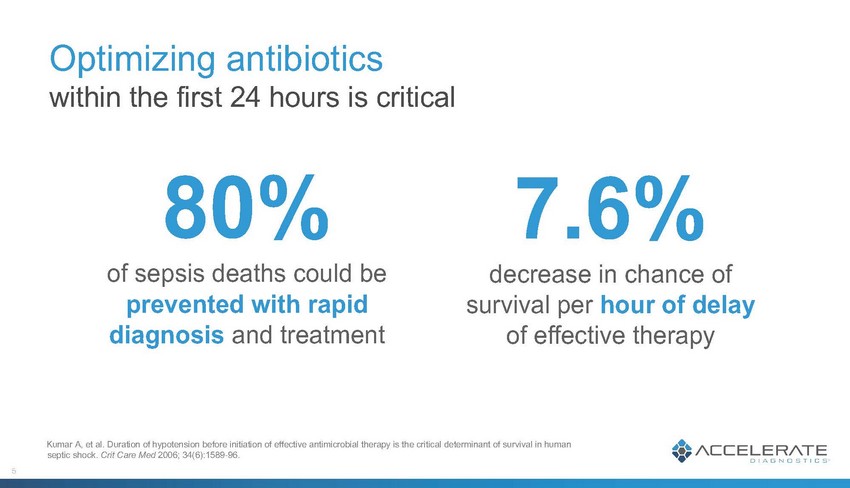

Optimizing antibiotics within the first 24 hours is critical 80% of sepsis deaths could be prevented with rapid diagnosis and treatment 7.6% decrease in chance of survival per hour of delay of effective therapy Kumar A, et al. Duration of hypotension before initiation of effective antimicrobial therapy is the critical determinant of survival in human septic shock. Crit Care Med 2006; 34(6):1589-96.

Can take up to 69 hours

The New Standard of Care Accelerate Pheno® system 7 1. Texas Health Huguley Hospital. Self-reported data (October 2019). 2. University of Iowa Health Care. Data presented at IDWeek™ (October 2019).

Patient & Economic Impact of rapid action based on Accelerate Pheno® results T–12 hrs Blood drawn, patient started on empiric therapy (cefepime) 8 hrs TTR: Accelerate Pheno® system results: multi-drug-resistant E. coli 12 hrs TTOT: Patient therapy changed to meropenem 9 CHILDREN’S HOSPITAL LOS ANGELES 7-year-old male, presented with infection 12 days after kidney transplant 60 hrs Conventional susceptibility test results available 0 hrs Blood culture pops positive 52hours earlier results than conventional method Day 1 Day 2 Day 3

The ID/AST Testing Market First mover advantage on substantial IVD market 10 ID/AST restated market value1 $3.7B ID/AST tests per annum2 All Other Micro Samples2 Blood Resp. 135M tests North America EMEA China Total Blood: 2.3 1.9 2.5 6.7 Respiratory: 0.9 0.9 0.7 2.5 All Other Micro Samples:2 34.7 28.7 37.8 101.2 Total: 41.8 34.6 41.0 117.4 (in MM) 1. Approximate figures shown based on management estimates and at various average unit prices 2. Based on management best estimates

The ID/AST Testing Market First mover advantage on substantial IVD market 10 ID/AST restated market value1 $3.7B ID/AST tests per annum2 All Other Micro Samples2 Blood Resp. 135M tests North America EMEA China Total Blood: 2.3 1.9 2.5 6.7 Respiratory: 0.9 0.9 0.7 2.5 All Other Micro Samples:2 34.7 28.7 37.8 101.2 Total: 41.8 34.6 41.0 117.4 (in MM) 1. Approximate figures shown based on management estimates and at various average unit prices 2. Based on management best estimates

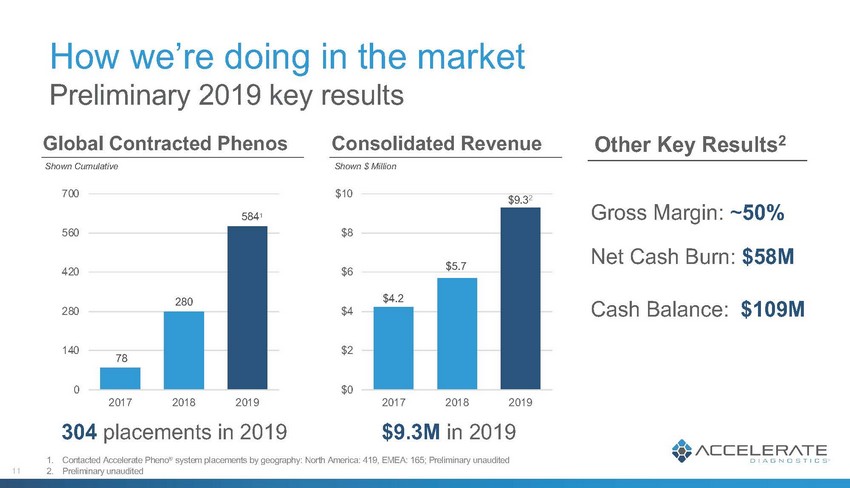

How we’re doing in the market Preliminary 2019 key results 0 140 280 420 560 700 2017 2018 2019 $0 $2 $4 $6 $8 $10 2017 2018 2019 Gross Margin: ~50% Net Cash Burn: $58M Cash Balance: $109M Global Contracted Phenos Consolidated Revenue Other Key Results2 304 placements in 2019 $9.3M in 2019 11 78 280 5841 Shown Cumulative Shown $ Million 1. Contacted Accelerate Pheno® system placements by geography: North America: 419, EMEA: 165; Preliminary unaudited 2. Preliminary unaudited $4.2 $5.7 $9.32

2020 Expectations Momentum continuing to build Revenue Net cash burn 2020 $16–18M $49M YOY% ~100% ~(15%)

U.S. Commercial Excellence Focused Geographic Expansion Targeted Investments in Innovation 1 2 3 13 2020 Priorities

1 U.S. Commercial Excellence 14 2020 Priorities

Powered by Evidence 15 Cost Savings $3,100/patient1 Length of Stay –6.1 days1 –4.7 days2 –2.4 days3 –5.9 days1,* –2.2 days4,* 1. Werner Forssmann Hospital. Data presented at DIVI Congress (December 2019). 2. Arnot Ogden Medical Center. Self-reported data (October 2019). 3. University of Arkansas for Medical Sciences. Data presented at IDWeek™ (October 2019) 4. Allegheny General Hospital. Data presented at SCACM WV (November 2019). 5. Texas Health Huguley Hospital. Self-reported data (October 2019). *ICU Length of Stay (LOS) reduction. All other LOS data are for inpatient reductions. Mortality Reduction –11.2%4 –17.2%1 Time to Optimal Therapy –53 hours5 –38 hours2 Days on Therapy (DOT) –4.6 days4 Sales Tools • Customer outcomes data integrated into ROI calculator Market Access 1. NTAP reimbursement decision expected 2H 2020 2. CPT reimbursement for outpatient in process 3. Expected Rapid ID/AST in 2021 CLSI guidelines OUTCOMES DATA FROM 4Q19 U.S. COMMERCIAL EXECUTION

Customer KOLs span key geographies/segments • Current customer base enables regional referral strategy • Customers across all segments • Leverage KOL base as advocates

Reengineering go-live process Improving time from contract to reliable annuity § Overhauled process in 4Q19 § Operational focus to improve multi-site delays § Long-term goal is 50% reduction to go-live $45k $102k Live Pheno Instruments + Not Yet Live US Annuity Current Average Per Instrument Annuity Largest Customer Per Instrument Annuity § Annuity proving durable/reliable § Averaging 3 Accelerate Pheno® systems per customer 164 255 U.S. Live Instruments at 12/31 U.S. Contracted Instruments Not Yet Live at 12/31 (Backlog)

2 Focused Geographic Expansion 18 2020 Priorities

Update on Non-US Markets EMEA China § An important long-term market § Focus on improving annuity § Leveraging mounting clinical evidence to expand utility from current ICU niche to all blood testing § Initiated NMPA registration/trial process § Building KOL network affiliated with China National Action Plan to Combat Antimicrobial Resistance § 1st KOL eval in process with strong performance to date

Targeted Investments 3 in Innovation 20 2020 Priorities

Targeted Investments in Innovation Accelerate Pheno® System Assay Expansion § Current blood test improvements: new drugs and AST features § Respiratory: analytical studies ongoing Next Generation Platform § Low-cost / high-throughput § Unlocks other clinical micro samples § Established multiplex capability; feasibility demonstrated on multiple sample types 2.0

Growth Strategy Platform innovation & geographic plan significantly expands available market1 $1.0B Current Addressable Market $3.7B 22 Adding Lower Respiratory Assay Expansion into China Blood Market Expanding Lab Footprint with Low Acuity Samples $1.3B $2.0B § Mature gross margins of ~70% § Strategic importance to ABX Pharma § Government interest in Rapid AST US & EMEA Blood Respiratory China Blood Next Generation Platform Other Value Drivers 1. Approximate figures shown based on management estimates and at various average unit prices

Summary WHO WE ARE A diagnostics company based in Arizona, founded in 2012, with a mission of reducing the impact of sepsis and antibiotic resistance through rapid diagnosis of serious infections. THE PROBLEM Due to the overuse of antibiotics, the human and hospital costs of treating conditions like sepsis are increasing. Each year sepsis causes hundreds of thousands of potentially avoidable deaths and adds an estimated $27 billion in costs to the U.S. healthcare system. OUR SOLUTION The Accelerate Pheno® system uses proprietary technology to identify pathogens and report antibiotic susceptibility testing results in about 7 hours, allowing antibiotic optimization up to 53 hours earlier than current standard of care. MARKET OPPORTUNITY / FUNDAMENTALS First-mover advantage with high barriers to entry in a $3.7B market. Razor/blade business model should support normalized 70% GM with significant FCF at scale, all while advancing our mission to save lives and reduce healthcare costs. RUNWAY FOR GROWTH Will exit 2019 with single-digit penetration after approximately doubling our contracted instrument based for the second year in a row. Reengineered go-live process will drive an improved annuity stream and support anticipated roughly doubling of revenue in 2020, with a strong commercial foundation in place to support powerful growth over the next several years.