Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CNB FINANCIAL CORP/PA | d851329dex991.htm |

| EX-2.1 - EX-2.1 - CNB FINANCIAL CORP/PA | d851329dex21.htm |

| 8-K - FORM 8-K - CNB FINANCIAL CORP/PA | d851329d8k.htm |

Acquisition of Bank of Akron December 2019 Exhibit 99.2

IMPORTANT INFORMATION FOR INVESTORS This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. The proposed transaction will be submitted to the shareholders of Bank of Akron for their consideration. In connection with the proposed merger with Bank of Akron, CNB Financial Corporation will file with the Securities and Exchange Commission (the "SEC") a Registration Statement on Form S-4 that will include a proxy statement of Bank of Akron and a prospectus of CNB Financial Corporation, as well as other documents concerning the proposed merger. Investors and security holders are urged to read the registration statement and the proxy statement/prospectus regarding the proposed merger when it becomes available, and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of Registration Statement and the proxy statement/prospectus, as well as other documents filed with the SEC that will contain important information, when they become available, may be obtained at the SEC's website at www.sec.gov. Copies of the Registration Statement and proxy statement/prospectus (when they become available) and the filings that will be incorporated by reference therein may be obtained, free of charge, from CNB Financial Corporation’s website at www.CNBBank.bank, or by directing a request to CNB Financial Corporation, 1 South Second Street, P.O. Box 42, Clearfield, PA 16830, or to Bank of Akron, 46 Main Street, P.O. Box 420, Akron, NY 14001. PARTICIPANTS IN THE TRANSACTION CNB Financial Corporation, Bank of Akron and their respective directors, executive officers and certain other members of management and employees may be deemed to be "participants" in the solicitation of proxies from the shareholders of Bank of Akron. in connection with the merger. Information about the directors and executive officers of Bank of Akron and their ownership of Bank of Akron common stock, and the interests of such participants, may be obtained by reading the proxy statement/prospectus when it becomes available. Information about the directors and executive officers of CNB Financial Corporation may be found in CNB Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 7, 2019, and in its definitive proxy statement filed with the SEC on March 13, 2019. You may obtain free copies of these documents from CNB Financial Corporation using the contact information above. FORWARD-LOOKING STATEMENTS This presentation contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and this statement is included for purposes of complying with these safe harbor provisions. Readers should not place undue reliance on such forward-looking statements, which speak only as of the date made. These forward-looking statements are based on current plans and expectations, which are subject to a number of risk factors and uncertainties that could cause future results to differ materially from historical performance or future expectations. These differences may be the result of various factors, including, among others: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of Bank of Akron to approve the merger agreement; (3) failure to obtain governmental approvals for the merger; (4) disruptions to the parties' businesses as a result of the announcement and pendency of the merger; (5) costs or difficulties related to the integration of the business following the proposed merger; (6) the risk that the anticipated benefits, cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize; (7) changes in general business, industry or economic conditions or competition; (8) changes in any applicable law, rule, regulation, policy, guideline or practice governing or affecting financial holding companies and their subsidiaries with respect to tax or accounting principles or otherwise; (9) adverse changes or conditions in the capital and financial markets; (10) changes in interest rates; (11) the inability to realize expected cost savings or achieve other anticipated benefits in connection with the proposed merger; (12) changes in the quality or composition of our loan and investment portfolios; (13) adequacy of loan loss; (14) increased competition; (15) loss of certain key officers; (16) deposit attrition; (17) rapidly changing technology; (18) unanticipated regulatory or judicial proceedings and liabilities and other costs; (19) changes in the cost of funds, demand for loan products or demand for financial services; and (20) other economic, competitive, governmental or technological factors affecting operations, markets, products, services and prices. The foregoing list should not be construed as exhaustive, and CNB Financial Corporation and Bank of Akron undertake no obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements, or to reflect the occurrence of anticipated or unanticipated events or circumstances. For additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements, please see filings by CNB Financial Corporation with the SEC, including CNB Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018.

Strategically Compelling Transaction Transaction rationale In market expansion for high growth BankOnBuffalo division of CNB Nearly doubles division assets to over $1 billion Consolidation of larger competitors in Western New York has left a void in serving smaller commercial banking clientele; BankOnBuffalo has taken advantage of that opportunity and this transaction will further escalate the combined bank’s ability to serve this market One of the largest community banks with local decision making in Buffalo MSA Strategic impact on Buffalo market Bank of Akron is a highly regarded, high performing community bank Branches, footprints and target markets contiguous but not overlapping Similar commercial banking focus to CNB Provides critical personnel depth to rapidly growing Buffalo franchise Culture and community banking model perfect fit 1 inclusive of previously announced at-the-market common equity offering Organizational structure Bank of Akron to merge with and into CNB Bank To operate as part of locally managed and uniquely branded BankOnBuffalo division Bank of Akron CEO, Tony Delmonte, expected to join BankOnBuffalo as Market Executive Growth and scale at BankOnBuffalo has created a need for retaining a large percentage of the support personnel at Bank of Akron All existing Bank of Akron locations expected to remain open

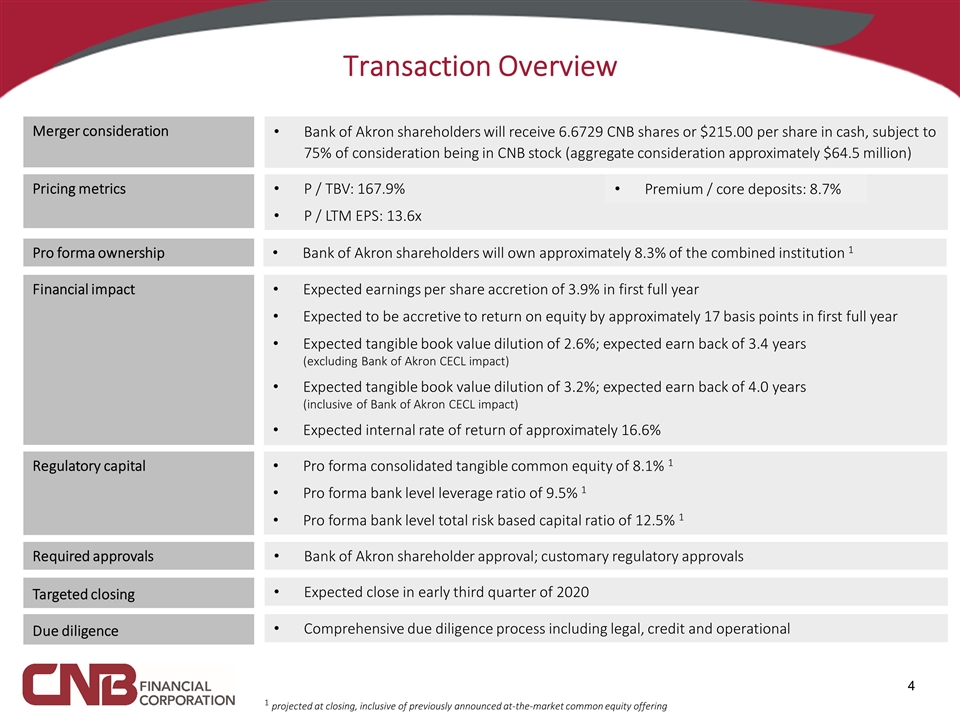

Transaction Overview Merger consideration Bank of Akron shareholders will receive 6.6729 CNB shares or $215.00 per share in cash, subject to 75% of consideration being in CNB stock (aggregate consideration approximately $64.5 million) Pro forma ownership Bank of Akron shareholders will own approximately 8.3% of the combined institution 1 Required approvals Bank of Akron shareholder approval; customary regulatory approvals Targeted closing Expected close in early third quarter of 2020 Due diligence Comprehensive due diligence process including legal, credit and operational Pricing metrics P / TBV: 167.9% P / LTM EPS: 13.6x 1 projected at closing, inclusive of previously announced at-the-market common equity offering Regulatory capital Pro forma consolidated tangible common equity of 8.1% 1 Pro forma bank level leverage ratio of 9.5% 1 Pro forma bank level total risk based capital ratio of 12.5% 1 Financial impact Expected earnings per share accretion of 3.9% in first full year Expected to be accretive to return on equity by approximately 17 basis points in first full year Expected tangible book value dilution of 2.6%; expected earn back of 3.4 years (excluding Bank of Akron CECL impact) Expected tangible book value dilution of 3.2%; expected earn back of 4.0 years (inclusive of Bank of Akron CECL impact) Expected internal rate of return of approximately 16.6% Premium / core deposits: 8.7%

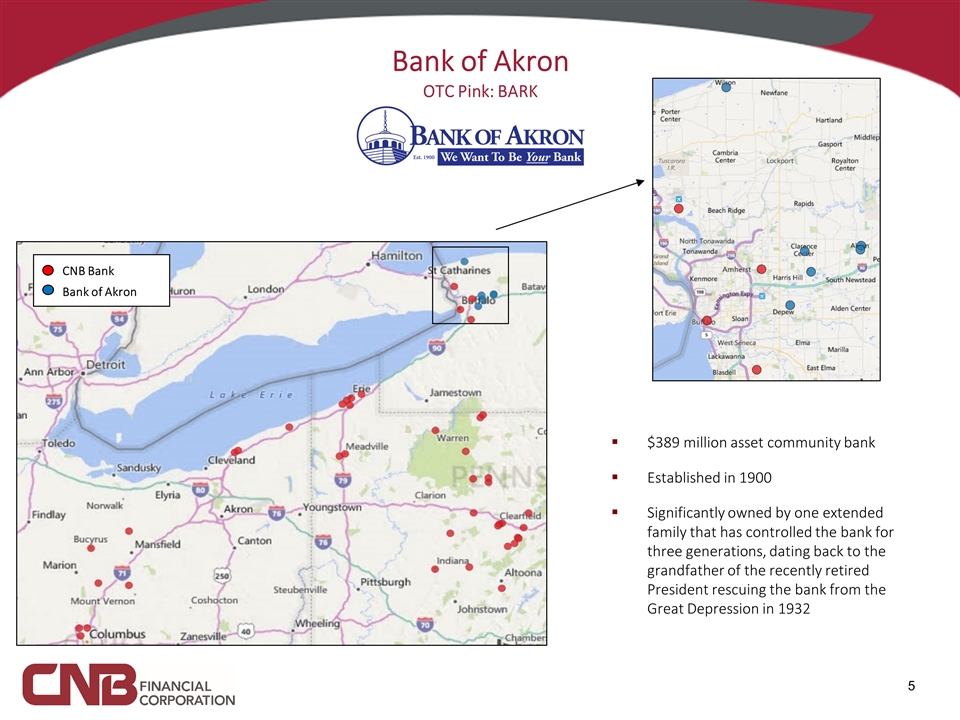

Bank of Akron OTC Pink: BARK CNB Bank Bank of Akron $389 million asset community bank Established in 1900 Significantly owned by one extended family that has controlled the bank for three generations, dating back to the grandfather of the recently retired President rescuing the bank from the Great Depression in 1932

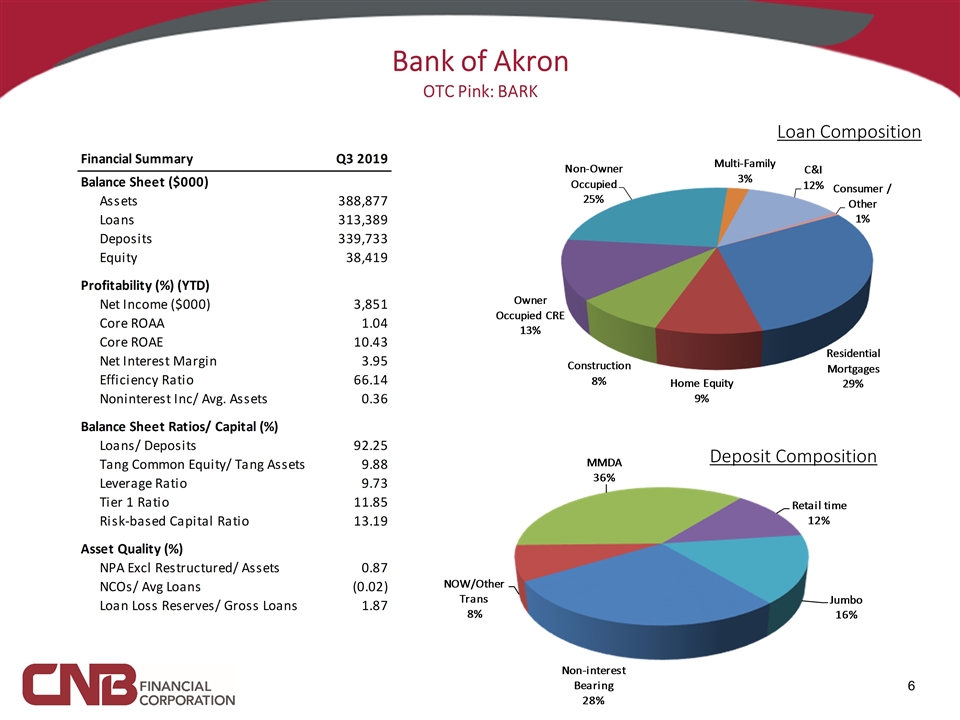

Bank of Akron OTC Pink: BARK Loan Composition Deposit Composition

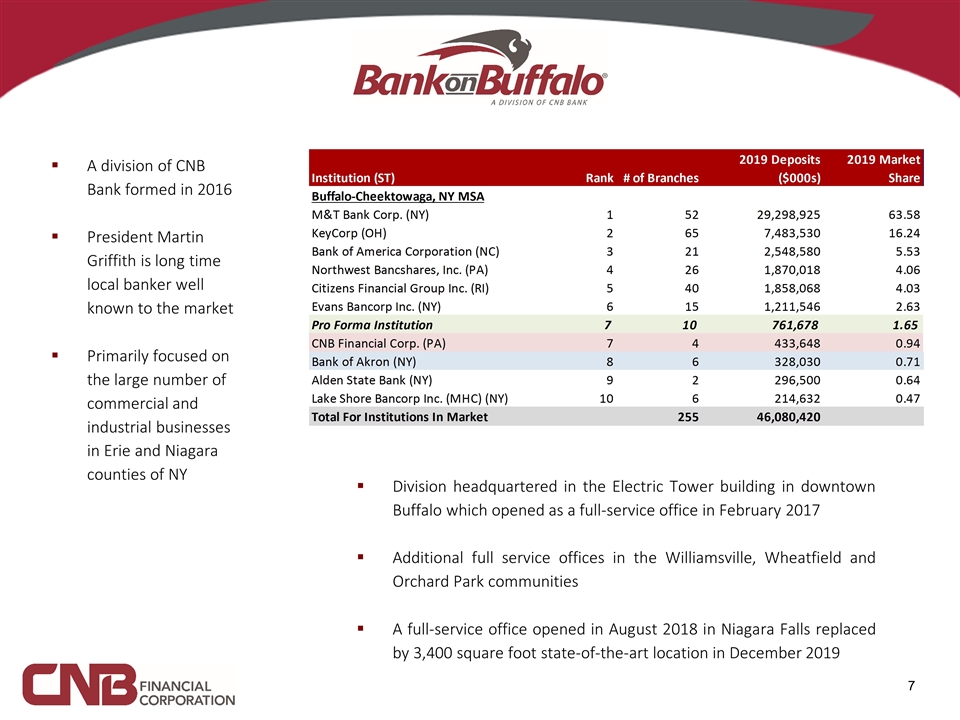

A division of CNB Bank formed in 2016 President Martin Griffith is long time local banker well known to the market Primarily focused on the large number of commercial and industrial businesses in Erie and Niagara counties of NY Division headquartered in the Electric Tower building in downtown Buffalo which opened as a full-service office in February 2017 Additional full service offices in the Williamsville, Wheatfield and Orchard Park communities A full-service office opened in August 2018 in Niagara Falls replaced by 3,400 square foot state-of-the-art location in December 2019

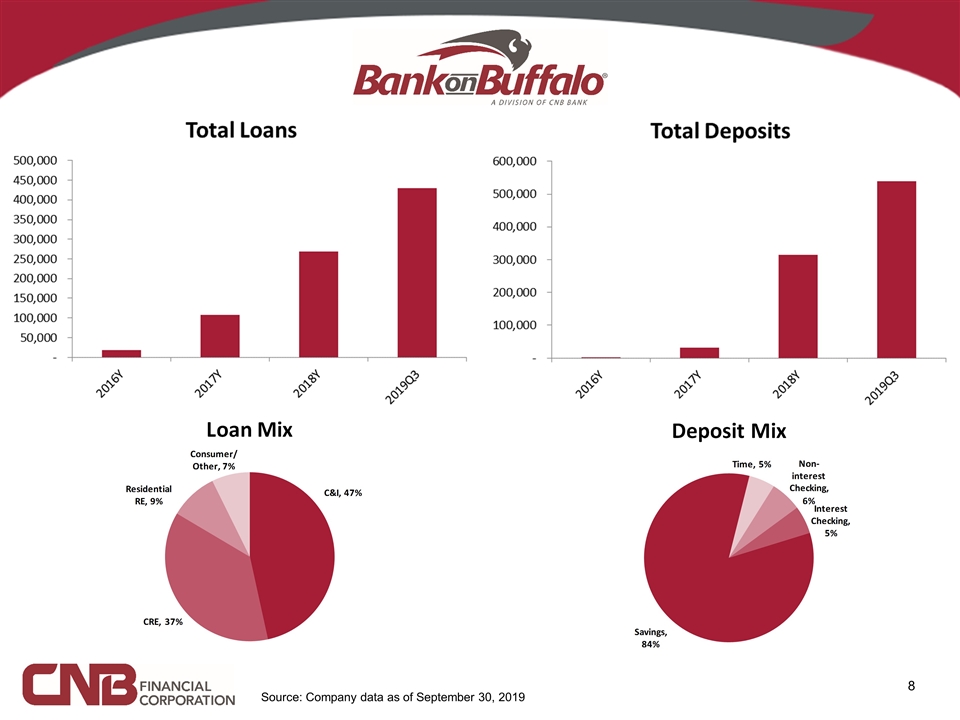

Source: Company data as of September 30, 2019

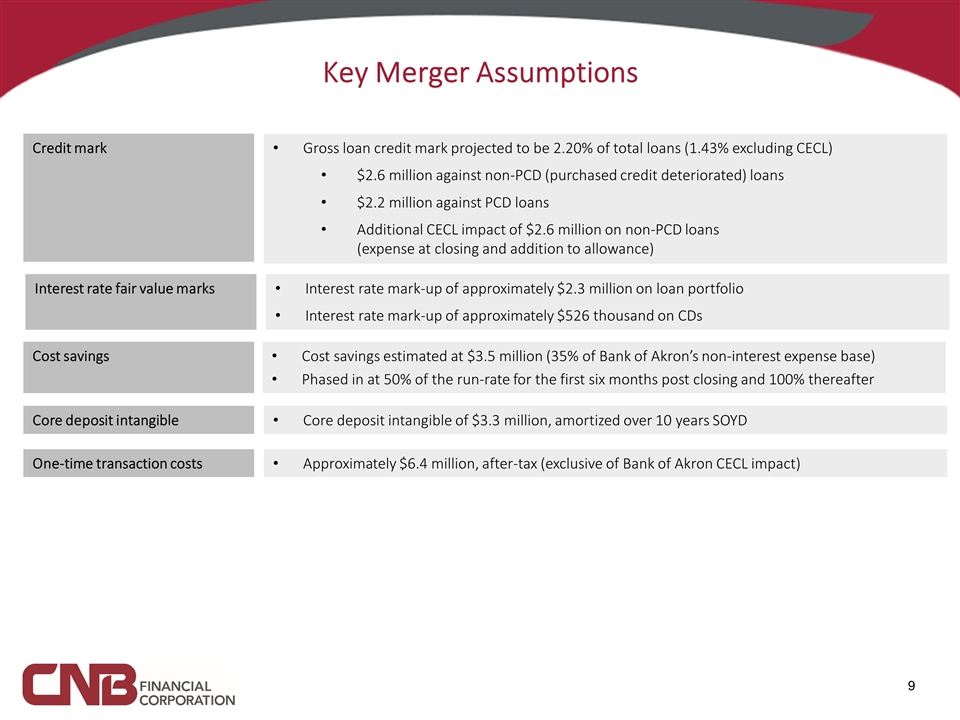

Key Merger Assumptions Credit mark Gross loan credit mark projected to be 2.20% of total loans (1.43% excluding CECL) $2.6 million against non-PCD (purchased credit deteriorated) loans $2.2 million against PCD loans Additional CECL impact of $2.6 million on non-PCD loans (expense at closing and addition to allowance) Cost savings Cost savings estimated at $3.5 million (35% of Bank of Akron’s non-interest expense base) Phased in at 50% of the run-rate for the first six months post closing and 100% thereafter One-time transaction costs Approximately $6.4 million, after-tax (exclusive of Bank of Akron CECL impact) Core deposit intangible Core deposit intangible of $3.3 million, amortized over 10 years SOYD Interest rate fair value marks Interest rate mark-up of approximately $2.3 million on loan portfolio Interest rate mark-up of approximately $526 thousand on CDs