Attached files

| file | filename |

|---|---|

| EX-10.2 - EX-10.2 - PETROQUEST ENERGY INC | d680232dex102.htm |

| EX-10.1 - EX-10.1 - PETROQUEST ENERGY INC | d680232dex101.htm |

| 8-K - 8-K - PETROQUEST ENERGY INC | d680232d8k.htm |

Exhibit 10.3

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

|

In re:

PETROQUEST ENERGY, INC., et al.,

Debtors.1 |

§ § § § § § § |

Chapter 11

Case No. 18-36322 (DRJ)

(Jointly Administered) |

SECOND AMENDED DISCLOSURE STATEMENT FOR THE

DEBTORS’ FIRST AMENDED CHAPTER 11 PLAN OF REORGANIZATION

| PORTER HEDGES LLP

John F. Higgins (TX 09597500) Joshua W. Wolfshohl (TX 24038592) M. Shane Johnson (TX 24083263) 1000 Main Street, 36th Floor Houston, Texas 77002

|

| PROPOSED ATTORNEYS FOR THE DEBTORS

Dated: December 20, 2018 |

| THIS IS NOT A SOLICITATION OF AN ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL THIS DISCLOSURE STATEMENT HAS BEEN CONDITIONALLY APPROVED BY THE COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN CONDITIONALLY APPROVED BY THE COURT FOR PURPOSES OF SOLICITATION. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY SECURITIES. |

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are as follows: PetroQuest Energy, Inc. (0714), PetroQuest Energy, L.L.C. (2439), TDC Energy LLC (8877), PetroQuest Oil & Gas, L.L.C. (1170), PQ Holdings LLC (7576), Pittrans Inc. (1747), and Sea Harvester Energy Development, L.L.C. (5903). The address of the Debtors’ headquarters is: 400 E. Kaliste Saloom Road, Suite 6000, Lafayette, Louisiana 70508. |

THE DEBTORS ARE PROVIDING THE INFORMATION IN THIS DISCLOSURE STATEMENT TO HOLDERS OF CLAIMS FOR PURPOSES OF SOLICITING VOTES TO ACCEPT OR REJECT THE DEBTORS’ CHAPTER 11 PLAN OF REORGANIZATION ATTACHED HERETO AS EXHIBIT A. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY ENTITY FOR ANY OTHER PURPOSE. PRIOR TO DECIDING WHETHER AND HOW TO VOTE ON THE PLAN, EACH HOLDER ENTITLED TO VOTE SHOULD CAREFULLY CONSIDER ALL OF THE INFORMATION IN THIS DISCLOSURE STATEMENT, INCLUDING THE RISK FACTORS DESCRIBED IN ARTICLE VIII HEREIN.

THE PLAN IS SUPPORTED BY THE DEBTORS, PREPETITION TERM LOAN LENDERS, AND COMBINED CONSENTING SECOND LIEN NOTEHOLDERS PURSUANT TO THE RESTRUCTURING SUPPORT AGREEMENT, AND ALL SUCH PARTIES URGE HOLDERS OF CLAIMS WHOSE VOTES ARE BEING SOLICITED TO ACCEPT THE PLAN.

HOLDERS OF CLAIMS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, SECURITIES, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE VOTING ON THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS, AMONG OTHER THINGS, SUMMARIES OF THE PLAN, CERTAIN STATUTORY PROVISIONS, AND CERTAIN ANTICIPATED EVENTS IN THE DEBTORS’ CHAPTER 11 CASES. ALTHOUGH THE DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE, THESE SUMMARIES ARE QUALIFIED IN THEIR ENTIRETY TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF SUCH DOCUMENTS OR STATUTORY PROVISIONS OR EVERY DETAIL OF SUCH ANTICIPATED EVENTS. IN THE EVENT OF ANY INCONSISTENCY OR DISCREPANCY BETWEEN A DESCRIPTION IN THIS DISCLOSURE STATEMENT AND THE TERMS AND PROVISIONS OF THE PLAN OR ANY OTHER DOCUMENTS INCORPORATED HEREIN BY REFERENCE, THE PLAN OR SUCH OTHER DOCUMENTS WILL GOVERN FOR ALL PURPOSES. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY THE DEBTORS’ MANAGEMENT EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS DO NOT REPRESENT OR WARRANT THAT THE INFORMATION CONTAINED HEREIN OR ATTACHED HERETO IS WITHOUT ANY MATERIAL INACCURACY OR OMISSION.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(B) AND IS NOT NECESSARILY PREPARED IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER SIMILAR LAWS.

THIS DISCLOSURE STATEMENT WAS NOT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE AUTHORITY AND NEITHER THE

SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE DEBTORS WILL RELY ON SECTION 1145(a) OF THE BANKRUPTCY CODE TO EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND BLUE SKY LAWS THE OFFER, ISSUANCE, AND DISTRIBUTION OF NEW EQUITY AND NEW SECOND LIEN PIK NOTES UNDER THE PLAN. NEITHER THE SOLICITATION NOR THIS DISCLOSURE STATEMENT CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION, AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. THIS DISCLOSURE STATEMENT CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND THESE STATEMENTS, INCLUDING THOSE RELATING TO THE INTENT, BELIEFS, PLANS OR EXPECTATIONS OF THE DEBTORS ARE BASED UPON CURRENT EXPECTATIONS AND ARE SUBJECT TO A NUMBER OF RISKS, UNCERTAINTIES AND ASSUMPTIONS DESCRIBED HEREIN.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS (THE “COURT”).

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN. THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN OR THIS DISCLOSURE STATEMENT.

THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE, AND MAY NOT BE CONSTRUED AS, AN ADMISSION OF FACT, LIABILITY, STIPULATION, OR

WAIVER. THE DEBTORS MAY SEEK TO INVESTIGATE, FILE, AND PROSECUTE CLAIMS AND MAY OBJECT TO CLAIMS AFTER THE CONFIRMATION OR EFFECTIVE DATE OF THE PLAN IRRESPECTIVE OF WHETHER THIS DISCLOSURE STATEMENT IDENTIFIES ANY SUCH CLAIMS OR OBJECTIONS TO CLAIMS.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE. ALL EXHIBITS TO THE DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

IF THE PLAN IS CONFIRMED BY THE COURT AND THE EFFECTIVE DATE OCCURS, ALL HOLDERS OF CLAIMS AND INTERESTS (INCLUDING THOSE HOLDERS OF CLAIMS WHO DO NOT SUBMIT BALLOTS (AS DEFINED BELOW) TO ACCEPT OR REJECT THE PLAN, OR WHO ARE NOT ENTITLED TO VOTE ON THE PLAN) WILL BE BOUND BY THE TERMS OF THE PLAN AND THE RESTRUCTURING TRANSACTION CONTEMPLATED THEREBY.

TABLE OF CONTENTS

| Page | ||||||||

| I. |

INTRODUCTION | 1 | ||||||

| II. |

OVERVIEW OF THE DEBTORS’ OPERATIONS | 6 | ||||||

| A. | The Debtors’ Business | 6 | ||||||

| B. | The Debtors’ History | 6 | ||||||

| C. | The Debtors’ Corporate Structure | 10 | ||||||

| D. | Directors and Officers | 10 | ||||||

| E. | The Debtors’ Capital Structure | 11 | ||||||

| III. |

KEY EVENTS LEADING TO CHAPTER 11 CASES | 15 | ||||||

| A. | Restructuring Negotiations | 16 | ||||||

| B. | The Restructuring Support Agreement | 16 | ||||||

| IV. |

DEVELOPMENTS AND ANTICIPATED EVENTS DURING THE CHAPTER 11 CASES | 19 | ||||||

| A. | First Day Pleadings | 19 | ||||||

| B. | Other Administrative Motions and Retention Applications | 20 | ||||||

| C. | Claims Bar Date | 21 | ||||||

| D. | Assumption and Rejection of Executory Contracts and Unexpired Leases | 21 | ||||||

| E. | Litigation Matters | 21 | ||||||

| V. |

SUMMARY OF THE PLAN | 21 | ||||||

| A. | Administrative Claims, Professional Fee Claims, and Priority Claims | 21 | ||||||

| B. | Classification of Claims and Interests | 23 | ||||||

| C. | Treatment of Claims and Interests | 24 | ||||||

| D. | Means for Implementation of the Plan | 31 | ||||||

| E. | Treatment of Executory Contracts and Unexpired Leases | 41 | ||||||

| F. | Provisions Governing Distributions | 44 | ||||||

| G. | Procedures for Resolving Contingent, Unliquidated, and Disputed Claims | 50 | ||||||

| H. | Settlement, Release, Injunction, and Related Provisions | 53 | ||||||

| I. | Conditions Precedent to Confirmation and Consummation of the Plan | 60 | ||||||

| A. | Modification, Revocation, or Withdrawal of the Plan | 62 | ||||||

| B. | Retention of Jurisdiction | 63 | ||||||

| C. | Miscellaneous Provisions | 65 | ||||||

| D. | United States Reservation of Rights | 69 | ||||||

| VI. |

TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES LAWS | 70 | ||||||

| VII. |

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 72 | ||||||

| A. | Introduction | 72 | ||||||

| B. | Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors | 73 | ||||||

| C. | Certain U.S. Federal Income Tax Consequences to Certain U.S. Holders of Claims | 76 | ||||||

| D. | Certain U.S. Federal Income Tax Consequences to Certain Non-U.S. Holders of Claims | 84 | ||||||

| E. | Information Reporting and Backup Withholding | 90 | ||||||

| VIII. |

CERTAIN RISK FACTORS TO BE CONSIDERED | 91 | ||||||

| A. | Certain Bankruptcy Law Considerations | 91 | ||||||

| B. | Additional Factors Affecting the Value of the Reorganized Debtors and Recoveries Under the Plan | 94 | ||||||

| C. | Risks Relating to the Debtors’ Business and Financial Condition | 96 | ||||||

| D. | Factors Relating to Securities to Be Issued Under the Plan | 98 | ||||||

| E. | Additional Factors | 99 | ||||||

| IX. |

VOTING PROCEDURES AND REQUIREMENTS | 100 | ||||||

| A. | Parties Entitled to Vote | 100 | ||||||

| B. | Voting Procedures | 101 | ||||||

| C. | Voting Deadline | 102 | ||||||

| D. | Waivers of Defects and Irregularities | 103 | ||||||

| X. |

CONFIRMATION OF THE PLAN | 104 | ||||||

| A. | Confirmation Hearing | 104 | ||||||

| B. | Objections to Confirmation | 104 | ||||||

| C. | Requirements for Confirmation of the Plan | 105 | ||||||

| D. | Best Interests Test/Liquidation Analysis | 107 | ||||||

| E. | Feasibility | 108 | ||||||

| F. | Acceptance by Impaired Classes | 108 | ||||||

| G. | Additional Requirements for Nonconsensual Confirmation | 109 | ||||||

| H. | Valuation of the Debtors | 110 | ||||||

| XI. |

ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 110 | ||||||

| A. | Alternative Plan of Reorganization | 110 | ||||||

| B. | Sale Under Section 363 of the Bankruptcy Code | 110 | ||||||

| C. | Liquidation Under Chapter 7 or Applicable Non-Bankruptcy Law | 110 | ||||||

| XII. |

CONCLUSION AND RECOMMENDATION | 111 | ||||||

ii

EXHIBITS

| EXHIBIT A | Plan of Reorganization | |

| EXHIBIT B | Restructuring Support Agreement | |

| EXHIBIT C | Liquidation Analysis | |

| EXHIBIT D | Financial Projections | |

| EXHIBIT E | Valuation Analysis | |

| EXHIBIT F | Summary of Litigation | |

| EXHIBIT G | Exit Facility Subscription Form | |

iii

| I. | INTRODUCTION |

PetroQuest Energy, Inc. (“PetroQuest”) and its debtor affiliates, as debtors and debtors in possession (collectively, the “Debtors”) submit this disclosure statement (the “Disclosure Statement”) pursuant to section 1125 of the Bankruptcy Code in connection with the solicitation of votes on the Debtors’ First Amended Chapter 11 Plan of Reorganization, dated December 20, 2018 (the “Plan,” attached hereto as Exhibit A).2 The Plan constitutes a separate chapter 11 plan for PetroQuest and each of the other Debtors. To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan governs.

The Debtors are commencing this solicitation after extensive discussions over the past several months among the Debtors and certain of their key creditor constituencies, including the holders of the fulcrum security, the Combined Prepetition Second Lien Noteholders. As a result of these negotiations, certain creditors holding 100% of the Debtors’ First Lien Claims and approximately 85% of the Debtors’ Second Lien Notes Claims entered into a restructuring support agreement (as amended on December 18, 2018, the “Restructuring Support Agreement”) with the Debtors, a copy of which is attached hereto as Exhibit B. Under the terms of the Restructuring Support Agreement, the Prepetition Term Loan Lenders and the Combined Prepetition Second Lien Noteholders who are, or later become, signatories to the Restructuring Support Agreement have agreed to a deleveraging transaction that would restructure the existing debt obligations of the Debtors in chapter 11 through the Plan (the “Restructuring”).

WHO IS ENTITLED TO VOTE: Under the Bankruptcy Code, only Holders of Claims or Interests in “impaired” Classes are entitled to vote on the Plan (unless, for reasons discussed in more detail below, such Holders are deemed to accept the Plan pursuant to section 1126(f) of the Bankruptcy Code or are deemed to reject the Plan pursuant to section 1126(g) of the Bankruptcy Code). Under section 1124 of the Bankruptcy Code, a Class of Claims or Interests is deemed to be “impaired” under the Plan unless (i) the Plan leaves unaltered the legal, equitable, and contractual rights to which such Claim or Interest entitles the Holder thereof or (ii) notwithstanding any legal right to an accelerated payment of such Claim or Interest, the Plan, among other things, cures all existing defaults (other than defaults resulting from the initiation of these Chapter 11 Cases) and reinstates the maturity of such Claim or Interest as it existed before the default.

The following table summarizes: (i) the treatment of Claims and Interests under the Plan, (ii) which Classes are Impaired by the Plan, (iii) which Classes are entitled to vote on the Plan, and (iv) the estimated recoveries for Holders of Claims and Interests. The table is qualified in its entirety by reference to the full text of the Plan. For a more detailed summary of the terms and provisions of the Plan, see Section V—Summary of the Plan below.

| 2 | Capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such terms in the Plan. |

| Class |

Claim or |

Treatment |

Impaired or |

Entitled to |

Approx. % Recovery |

|||||||||

| 1 | Other Priority Claims |

In full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Other Priority Claim, each Holder thereof shall receive (i) payment in full, in Cash, of the unpaid portion of its Allowed Other Priority Claim or (ii) such other treatment as may otherwise be agreed to by such Holder, the Debtors, and the Requisite Creditors. | Unimpaired | No (Deemed to Accept) |

100 | % | ||||||||

| 2 | Other Secured Claims |

Except to the extent that a Holder of an Allowed Other Secured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Other Secured Claim, each such Holder shall receive, at the Debtors’ election, either (i) Cash equal to the full Allowed amount of its Claim, (ii) Reinstatement of such Holder’s Allowed Other Secured Claim, (iii) the return or abandonment of the collateral securing such Allowed Other Secured Claim to such Holder, or (iv) such other treatment as may otherwise be agreed to by such Holder, the Debtors, and the Requisite Creditors. | Unimpaired | No (Deemed to Accept) |

100 | % | ||||||||

| 3 | Secured Tax Claims |

Except to the extent that a Holder of an Allowed Secured Tax Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Secured Tax Claim, each such Holder shall receive, at the Debtors’ election, either (i) Cash equal to the full Allowed amount of its Claim, (ii) Reinstatement of such Holder’s Allowed Secured Tax Claim, (iii) the return or abandonment of the collateral securing such Allowed Secured Tax Claim to such Holder, or (iv) such other treatment as may otherwise be agreed to by such Holder, the Debtors, and the Requisite Creditors. | Unimpaired | No (Deemed to Accept) |

100 | % | ||||||||

| 4 | First Lien Claims |

On or before the Effective Date, each Holder of a First Lien Claim will receive Cash equal to the amount of its Allowed Claim from funds available pursuant to the Exit Facility. | Unimpaired | No (Deemed to Accept) | 100 | % | ||||||||

2

| Class |

Claim or |

Treatment |

Impaired or |

Entitled to |

Approx. % Recovery |

|||||||||

| 5 | Prepetition Second Lien Notes Secured Claims | Except to the extent that a Holder of an Allowed Prepetition Second Lien Notes Claim agrees to less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Prepetition Second Lien Notes Secured Claim, each such Holder shall receive (i) its Pro Rata share of 100% of the New Equity under the Plan, subject to (x) dilution by the awards related to New Equity issued under the Management Incentive Plan and (y) the Put Option Premium, and (ii) its Pro Rata share of $80 million in New Second Lien PIK Notes; such Pro Rata share of the New Equity and New Second Lien PIK Notes calculated by including the $275,045,768 (plus any accrued and unpaid interest thereon payable through the Petition Date) of Prepetition Second Lien PIK Notes Claims as Claims that will share Pro Rata in 100% of New Equity, subject to (x) dilution by the awards related to New Equity issued under the Management Incentive Plan and (y) the Put Option Premium and $80 million in New Second Lien PIK Notes. | Impaired | Yes | 21-49 | %3 | ||||||||

| 6 | Prepetition Second Lien PIK Notes Secured Claims | Except to the extent that a Holder of an Allowed Prepetition Second Lien PIK Notes Claim agrees to less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Prepetition Second Lien PIK Notes Secured Claim, each such Holder shall receive (i) its Pro Rata share of 100% of the New Equity under the Plan, subject to (x) dilution by the awards related to New Equity issued under the Management Incentive Plan and (y) the Put Option Premium, and (ii) its Pro Rata share of $80 million in New Second Lien PIK Notes; such Pro Rata share of the New Equity and New Second Lien PIK Notes calculated by including the $9,427,000 (plus any accrued and unpaid interest thereon payable through the Petition Date) of Prepetition Second Lien Notes Claims as Claims that will share Pro Rata in 100% of New Equity, subject to (x) dilution by the awards related to New Equity issued under the Management Incentive Plan and (y) the Put Option Premium, and $80 million in New Second Lien PIK Notes. | Impaired | Yes | 21-49 | %4 | ||||||||

| 3 | The estimated range of recoveries for Class 5 is based on the Reorganized Debtors’ Value in the Valuation Analysis attached hereto as Exhibit E. The Valuation Analysis reflects work performed by Seaport based on information available as of November 6, 2018. The value of assets of an operating business is subject to numerous uncertainties and contingencies that are difficult to predict and will fluctuate over time. |

| 4 | The estimated range of recoveries for Class 6 is based on the Reorganized Debtors’ Value in the Valuation Analysis attached hereto as Exhibit E. The Valuation Analysis reflects work performed by Seaport based on information available as of November 6, 2018. The value of assets of an operating business is subject to numerous uncertainties and contingencies that are difficult to predict and will fluctuate over time. |

3

| Class |

Claim or |

Treatment |

Impaired or |

Entitled to |

Approx. % Recovery | |||||||

| 7 | General Unsecured Claims | Except to the extent that a Holder of an Allowed General Unsecured Claim agrees to less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of each Allowed General Unsecured Claim and of and in exchange for each Allowed General Unsecured Claim, each such Holder shall receive its Pro Rata share of the General Unsecured Claims Distribution on the Effective Date. | Impaired | Yes | 0.1-0.2%5 | |||||||

| 8 | Section 510(b) Claims |

Section 510(b) Claims, if any, shall be discharged, canceled, released, and extinguished as of the Effective Date, and shall be of no further force or effect, and Holders of Section 510(b) Claims shall not receive any distribution on account of such Section 510(b) Claims. | Impaired | No (Deemed to Reject) | 0% | |||||||

| 9 | Intercompany Claims |

Intercompany Claims shall be Reinstated as of the Effective Date or, at the Reorganized Debtors’ option, shall be cancelled. No distribution shall be made on account of any Intercompany Claims other than in the ordinary course of business of the Reorganized Debtors, as applicable. For the avoidance of doubt, Intercompany Claims that are Reinstated as of the Effective Date, if any, shall be subordinated in all respects to the Exit Facility and the New Second Lien PIK Notes. | Unimpaired / Impaired | No (Deemed to Either Accept or Reject) | N/A | |||||||

| 10 | Intercompany Interests |

Intercompany Interests shall be Reinstated as of the Effective Date or, at the Reorganized Debtors’ option, shall be cancelled. No distribution shall be made on account of any Intercompany Interests. | Unimpaired / Impaired | No (Deemed to Either Accept or Reject) | N/A | |||||||

| 11 | PetroQuest Interests | On the Effective Date, or as soon thereafter as reasonably practicable, all PetroQuest Interests will be extinguished and the Holders of PetroQuest Interests shall not receive or retain any distribution, property, or other value on account of their PetroQuest Interests. | Impaired | No (Deemed to Reject) | 0% | |||||||

WHERE TO FIND ADDITIONAL INFORMATION: PetroQuest currently files annual, quarterly and current reports, proxy statements, and other information with the SEC. Copies of any document filed with the SEC may be obtained by visiting the SEC website at http://www.sec.gov and performing a search under the “Company Filings” link. Information including, but not limited to, that in the following filings incorporated by reference is deemed to be part of this Disclosure Statement, except for any information superseded or modified by information contained expressly in this Disclosure Statement. You should not assume that the

| 5 | Includes a range of the Allowed amount of the Second Lien Deficiency Claims from $156,577,000-$239,877,000. |

4

information in this Disclosure Statement is current as of any date other than the date on the first page of the Disclosure Statement. Any information PetroQuest files under Section 13(a), 13(c), 14 or 15(d) of the Securities Act that updates information in the filings incorporated by reference will update and supersede that information:

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed on March 8, 2018 and amended on March 29, 2018 and April 27, 2018, including portions of the definitive Proxy Statement on Schedule 14A filed on April 7, 2018 incorporated by reference therein; |

| • | Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2018, filed on November 13, 2018; |

| • | Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2018, filed on August 7, 2018; |

| • | Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2018, filed on May 8, 2018; and |

| • | Current Reports on Form 8-K filed on November 7, 2018, October 31, 2018, October 19, 2018, October 5, 2018, September 28, 2018, September 17, 2018, August 31, 2018, August 15, 2018, July 31, 2018, July 10, 2018, June 22, 2018, May 18, 2018, May 7, 2018, April 17, 2018, February 20, 2018, and February 1, 2018. |

DECIDING HOW TO VOTE ON THE PLAN: All Holders of Claims are encouraged to read this Disclosure Statement, its exhibits, and the Plan carefully and in their entirety before, if applicable, deciding to vote either to accept or to reject the Plan. This Disclosure Statement contains important information about the Plan, considerations pertinent to acceptance or rejection of the Plan and developments concerning the Chapter 11 Cases.

IN ORDER FOR YOUR VOTE TO BE COUNTED, YOUR VOTE MUST BE RECEIVED BY THE VOTING AGENT AT THE ADDRESS SET FORTH BELOW ON OR BEFORE THE VOTING DEADLINE ON JANUARY 23, 2019, UNLESS EXTENDED BY THE DEBTORS AND THE REQUISITE CREDITORS. IF YOU HOLD YOUR CLAIMS THROUGH A NOMINEE, PLEASE FOLLOW THE INSTRUCTIONS PROVIDED BY YOUR NOMINEE FOR RETURNING YOUR VOTING INSTRUCTIONS. UNLESS OTHERWISE INSTRUCTED, PLEASE RETURN YOUR BENEFICIAL HOLDER BALLOT TO YOUR NOMINEE OR YOUR VOTE WILL NOT BE COUNTED.

EACH BALLOT ADVISES THAT CREDITORS WHO (A) VOTE TO ACCEPT THE PLAN OR (B) DO NOT VOTE OR VOTE TO REJECT THE PLAN AND DO NOT ELECT TO OPT OUT OF THE RELEASE PROVISIONS CONTAINED IN ARTICLE VIII OF THE PLAN SHALL BE DEEMED TO HAVE CONSENTED TO THE RELEASE, INJUNCTION, AND EXCULPATION PROVISIONS SET FORTH IN ARTICLE VIII OF THE PLAN AND UNCONDITIONALLY, IRREVOCABLY, AND FOREVER RELEASED AND DISCHARGED THE RELEASED PARTIES FROM ANY

5

AND ALL CAUSES OF ACTION. CREDITORS WHO DO NOT GRANT THE RELEASES CONTAINED IN ARTICLE VIII OF THE PLAN WILL NOT RECEIVE THE BENEFIT OF THE RELEASES SET FORTH IN ARTICLE VIII OF THE PLAN.

ARTICLE IX OF THIS DISCLOSURE STATEMENT PROVIDES ADDITIONAL DETAILS AND IMPORTANT INFORMATION REGARDING VOTING PROCEDURES AND REQUIREMENTS. PLEASE READ ARTICLE IX OF THIS DISCLOSURE STATEMENT CAREFULLY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

THE DEBTORS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE

PLAN. THE DEBTORS AND THE CONSENTING CREDITORS BELIEVE THAT THE PLAN MAXIMIZES THE VALUE OF THE DEBTORS’ ESTATES AND REPRESENTS THE BEST AVAILABLE ALTERNATIVE FOR COMPLETING THE CHAPTER 11 CASES.

| II. | OVERVIEW OF THE DEBTORS’ OPERATIONS |

| A. | The Debtors’ Business |

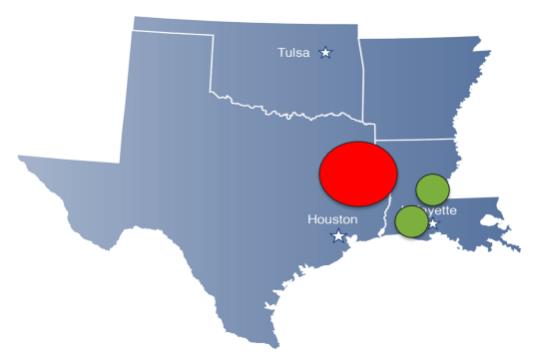

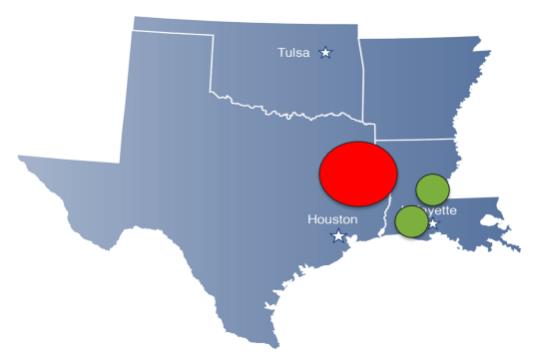

The Debtors are an independent oil and gas company created in 1998 through a reverse merger involving Optima Petroleum Corp. and American Explorer, L.L.C., and are engaged in the exploration, development, acquisition and operation of oil and gas properties in Texas and Louisiana, primarily in the Cotton Valley, Gulf Coast Basin, and Austin Chalk plays. The Debtors maintain offices in Lafayette, Louisiana and The Woodlands, Texas. PetroQuest and the other Debtors, all of which are direct or indirect wholly-owned domestic subsidiaries of PetroQuest, currently employ 62 employees and utilize the services of an additional eight specialized and trained field workers and engineers through third-party service providers.

As of September 30, 2018, the Debtors reported total assets of approximately $130 million on their unaudited consolidated balance sheet, of which approximately $52 million were current assets. The remaining $78 million in reported assets related primarily to oil and gas properties, other property and equipment, and other assets. The Debtors reported consolidated net losses of approximately $1.8 million for the year ended December 31, 2017.

| B. | The Debtors’ History |

Until 2002, the Debtors were focused exclusively in the Gulf Coast Basin with onshore properties principally in southern Louisiana and offshore properties in the shallow waters of the Gulf of Mexico shelf. During 2003, the Debtors began the implementation of their strategic goal of diversifying their reserves and production into longer life and lower risk onshore properties with the acquisition of the Carthage Field in East Texas. From 2005 through 2015, the Debtors further implemented this strategy by focusing their efforts in the Woodford Shale play in Oklahoma, along with various other resource projects wherein the Debtors have drilled, operated and or participated in the drilling and completion of approximately 650 horizontal wells. Through these projects, the Debtors have gained valuable experience and will now focus in their two primary project areas: the Cotton Valley Formation in East Texas targeting economic natural gas and natural gas liquids and the Austin Chalk formation in Central Louisiana (see below) targeting primarily oil, striving to achieve a balanced product mix over time.

6

The Debtors’ most recent material acquisitions and divestitures are highlighted below.

| 1. | Woodford Shale and Mississippian Lime Sale |

On June 4, 2015, the Debtors completed the sale of a majority of their interests in the Woodford Shale and Mississippian Lime for $280 million, subject to customary post-closing purchase price adjustments, effective January 1, 2015. At closing, the Debtors received $257.7 million in cash and recognized a receivable of $13.9 million, which was received in full during the third quarter of 2015.

On April 20, 2016, the Debtors completed the sale of a majority of their remaining Woodford Shale assets in the Oklahoma field for approximately $18 million, subject to customary post-closing purchase price adjustments, effective April 1, 2016.

| 2. | East Texas Assets |

In March 2016, the Debtors sold certain non-producing assets in East Texas for $7 million to a potential joint venture partner. After determining they would not pursue a joint venture with this party, the Debtors repurchased the non-producing assets for $5 million in December 2016. The Debtors subsequently entered into a new drilling joint venture in East Texas with another group of partners.

On December 15, 2017, the Debtors completed the sale of their saltwater disposal assets in East Texas for approximately $8.5 million.

7

| 3. | Austin Chalk Formation |

On December 20, 2017, the Debtors entered into an oil focused play in central Louisiana targeting the Austin Chalk formation through the execution of agreements to acquire interests in approximately 24,600 gross acres for a purchase price of approximately $9.3 million and the issuance of 2.0 million shares of PetroQuest common stock.

| 4. | Gulf of Mexico Properties |

On January 31, 2018, the Debtors sold their properties in the Gulf of Mexico to Northstar Offshore Ventures LLC. The Debtors received no consideration from the sale of these properties and are required to contribute approximately $3.8 million towards the future abandonment costs for the properties. As a result of the sale, the Debtors extinguished approximately $28.4 million of their discounted asset retirement obligation subsequent to December 31, 2017. In connection with the sale, the Debtors expect to receive a cash refund of approximately $12.7 million related to a depositary account that served to collateralize a portion of the Debtors’ offshore bonds related to these properties. The Debtors received approximately $8.3 million of this cash refund in October 2018.

| 5. | The Debtors’ Current Operations |

As a result of the sale of their Gulf of Mexico assets in January 2018, the Debtors’ asset base is now exclusively comprised of onshore assets in Texas and Louisiana. The Debtors have substantially reduced their operational footprint, which allows them to concentrate their efforts in fewer areas. Operating in concentrated areas helps to better control overhead by managing a greater amount of acreage with fewer employees and minimizing incremental costs of increased drilling and production. The Debtors have substantial geological and reservoir data, operating experience and partner relationships in these regions.

For the nine months ended September 30, 2018, approximately 94% of the Debtors’ estimated proved reserves were located in East Texas and 6% were located in the Gulf Coast Basin. In terms of production diversification, during the first nine months of 2018, 55% of the Debtors’ production was derived from East Texas and production was comprised of 75% natural gas, 9% oil and 16% natural gas liquids.

During the first nine months of 2018, the Debtors invested $3.3 million in their East Texas properties, where the Debtors completed two gross wells. Net production from the East Texas assets averaged 33.9 MMcfe per day during the first nine months of 2018, a 39% increase from the first nine months of 2017. As a result of producing 9.3 Bcfe in the first nine months of 2018, reserves attributable to the East Texas assets decreased 11% at September 30, 2018 from 2017.

The Debtors invested $2.7 million in the Gulf Coast during the first nine months of 2018, primarily related to Austin Chalk leasing activity. Production from this area decreased 9% from the first nine months of 2017 related to normal production declines. The estimated proved reserves in this area at September 30, 2018 decreased 56% from 2017, primarily because of the 7 Bcfe of production in the first nine months of 2018.

8

The following table sets forth estimated proved reserves and annual production from each of the Debtors’ core areas (in Bcfe) as of and for the nine months ended September 30, 2018 and for the years ended December 31, 2017 and 2016:

| As of September 30, 2018 | 2017 | 2016 | ||||||||||||||||||||||

| Reserves As 30, 2018 |

Production 30, 2018 |

Reserves As of December 31, 2017 |

Production During 2017 |

Reserves As of December 31, 2016 |

Production During 2016 |

|||||||||||||||||||

| Gulf Coast |

7.7 | 7.1 | 13.8 | 10.6 | 16.3 | 6.9 | ||||||||||||||||||

| Gulf of Mexico (1) |

— | 0.4 | 10.5 | 6.9 | 16.6 | 5.9 | ||||||||||||||||||

| East Texas |

117.3 | 9.2 | 131.6 | 10.1 | 82.6 | 9.0 | ||||||||||||||||||

| Oklahoma Woodford (2) |

— | — | — | — | — | 1.7 | ||||||||||||||||||

| 125.1 | 16.8 | 155.9 | 27.6 | 115.5 | 23.5 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | In January 2018, the Debtors sold all of their Gulf of Mexico producing assets. |

| (2) | In 2016 the Debtors sold the remainder of their Oklahoma assets. |

9

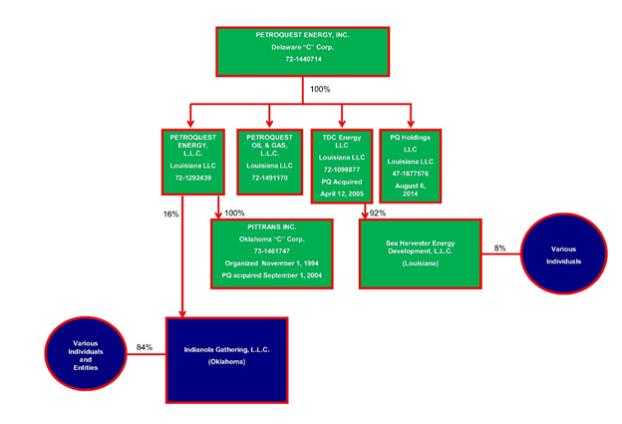

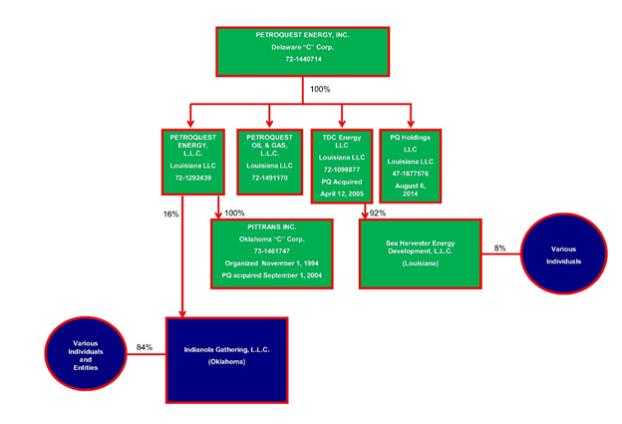

| C. | The Debtors’ Corporate Structure |

All of the Debtors other than PetroQuest are direct or indirect subsidiaries of PetroQuest. The following depicts the Debtors’ full corporate organization structure (the Debtors are highlighted in green):

The Debtors other than PetroQuest and PQE currently have limited assets and operations. POG and PQ Holdings serve as nominees that hold legal title to certain oil and gas interests for third parties in which PetroQuest and its subsidiaries claim no equitable interest. TDC, Sea Harvester and Pittrans are inactive companies with no operations or assets. Indianola Gathering, L.L.C., which is a non-Debtor, has a minority interest in a minor gathering system in Oklahoma. The aggregate assets and revenues as of and for the nine months ended September 30, 2018, attributable to all subsidiaries of PetroQuest other than PQE constituted less than 1% of the Debtors’ consolidated assets and revenues.

| D. | Directors and Officers |

PetroQuest’s current Board is composed of Charles T. Goodson, William W. Rucks, IV, E. Wayne Nordberg, W.J. Gordon, III, Dr. Charles F. Mitchell, and J. Gerard Jolly. With the exception of Mr. Goodson, each member of the Board is an independent director.

PetroQuest’s current executive management team is composed of Charles T. Goodson—President and CEO; J. Bond Clement—Executive Vice President, CFO, and Treasurer; Art M. Mixon—Executive Vice President Operations and Production; Stephen H. Green—Senior Vice President Exploration; and Edgar A. Anderson—Vice President of the ArkLaTex Region.

The composition of the board of directors and identity of the officers of each Reorganized Debtor, as well as the nature of any compensation to be paid to any director or officer who is an Insider, will be disclosed prior to the entry of the order confirming the Plan in accordance with section 1129(a)(5) of the Bankruptcy Code.

10

| E. | The Debtors’ Capital Structure |

| 1. | Prepetition Secured Indebtedness |

| (a) | Prior Prepetition Term Loan |

PQE was the borrower under that certain Multidraw Term Loan Agreement, dated as of October 17, 2016 (as amended or otherwise modified from time to time, the “Prior Prepetition Term Loan Agreement”), between PetroQuest, PQE, the lenders party thereto, and Wells Fargo Bank, National Association, as administrative agent.

As of August 31, 2018, PQE had drawn $32.5 million of the $50 million available under the Prior Prepetition Term Loan Agreement, which was scheduled to mature on October 17, 2020. The Debtors were subject to a restrictive financial covenant under the Prior Prepetition Term Loan Agreement, consisting of maintaining a ratio of the present value, discounted at 10% per annum, of the estimated future net revenues in respect of PetroQuest’s and its subsidiaries’ oil and gas properties, before any state, federal, foreign or other income taxes, attributable to proved developed reserves, using three-year strip prices in effect at the end of each calendar quarter, including swap agreements in place at the end of each quarter, to the sum of the outstanding term loans and the then-outstanding commitments to provide term loans, of not less than 2.0 to 1.0 as measured on the last day of each calendar quarter (the “Coverage Ratio”). The Coverage Ratio limited the amount PQE was able to borrow under the Prior Prepetition Term Loan Agreement.

PQE’s obligations under the Prior Prepetition Term Loan Agreement were guaranteed by PetroQuest and TDC. The facility was secured by a first priority lien on substantially all of the assets of PetroQuest and certain of its subsidiaries, including a lien on all equipment and at least 90% of the aggregate total value of the oil and gas properties of PetroQuest and its subsidiaries and a pledge of the equity interests of PQE and certain of PetroQuest’s other subsidiaries.

| (b) | Prepetition Term Loan |

On August 31, 2018, PQE entered into a $50 million Multidraw Term Loan Agreement (as amended or otherwise modified from time to time, the “Prepetition Term Loan Agreement”), substantially similar to the Prior Prepetition Term Loan Agreement, with the lenders party thereto (the “Prepetition Term Loan Lenders”) and Wells Fargo Bank, N.A., as administrative agent (the “Prepetition Term Loan Agent”), guaranteed by PetroQuest and TDC and secured by a first-priority lien on substantially all of the assets of PetroQuest and certain of its subsidiaries, including a lien on all equipment and at least 90% of the aggregate total value of the oil and gas properties of PetroQuest and its subsidiaries, a lien on certain undeveloped acreage, and a pledge of the equity interests of PQE and certain of PetroQuest’s other subsidiaries. Pursuant to the terms of the Prepetition Term Loan Agreement, the Debtors were able to immediately draw upon the balance of the $50 million of availability on the closing date of the Prepetition Term Loan Agreement. The Debtors drew down $50 million to pay the outstanding borrowings of $32.5 million, plus accrued interest, under the Prior Prepetition Term Loan Agreement and retained the balance (less fees) for general corporate purposes.

11

On September 14, 2018, PetroQuest, PQE, and TDC entered into a Forbearance Agreement with the Prepetition Term Loan Agent and the Prepetition Term Loan Lenders whereby the Prepetition Term Loan Agent and the Prepetition Term Loan Lenders agreed to forbear from taking any action with respect to certain anticipated events of default under the Prepetition Term Loan Agreement as a result of the non-payment by PetroQuest of interest on the Combined Prepetition Second Lien Notes. The Forbearance Agreement was originally effective from September 14, 2018 until the earlier to occur of (i) 11:59 p.m. Eastern Time on September 28, 2018 and (ii) the occurrence of any specified forbearance default, but was subsequently extended pursuant to various amendments to the Forbearance Agreement until the earlier to occur of (i) 11:59 p.m. Eastern Time on November 6, 2018 and (ii) the occurrence of any specified forbearance default.

| (c) | Prepetition Second Lien Notes |

On February 17, 2016, PetroQuest issued $144,674,000 in aggregate principal amount of 10% second lien senior secured notes due February 15, 2021 (the “Prepetition Second Lien Notes”). The Prepetition Second Lien Notes were issued under that certain Indenture dated as of February 17, 2016 (as amended, supplemented or otherwise modified from time to time, including by the First Supplemental Indenture dated as of September 13, 2016, collectively the “Prepetition Second Lien Indenture”), among PetroQuest, as issuer, PQE and TDC as guarantors, and Wilmington Trust, National Association, as Trustee and Collateral Trustee thereunder (in such capacity, the “Prepetition Second Lien Trustee”). Interest under the Prepetition Second Lien Indenture is payable semi-annually on February 15 and August 15, subject to a 30-day grace period. As a result of a September 2016 exchange offer and a December 2017 exchange, the Debtors reduced the outstanding amount of the Prepetition Second Lien Notes and as of the Petition Date, $9,427,000 of the Prepetition Second Lien Notes, plus any accrued and unpaid interest, remains outstanding. The Debtors did not make the interest payment due on August 15, 2018 and the 30-day grace period expired on September 14, 2018. On September 14, 2018, PetroQuest, PQE, and TDC entered into a Forbearance Agreement with certain Holders of approximately $7,343,000 in aggregate principal amount (representing approximately 77.9% of the outstanding principal amount) of the Prepetition Second Lien Notes whereby the Holders agreed to forbear from exercising their rights and remedies under the Prepetition Second Lien Indenture or related security documents with respect to certain anticipated events of default. The Forbearance Agreement was originally effective from September 14, 2018 until the earlier to occur of (i) 11:59 p.m. Eastern Time on September 28, 2018 and (ii) the date the Forbearance Agreement otherwise terminated in accordance with its terms, but was subsequently extended pursuant to various amendments to the Forbearance Agreement until the earlier to occur of (i) 11:59 p.m. Eastern Time on November 6, 2018 and (ii) the occurrence of any specified forbearance default.

The Prepetition Second Lien Notes are secured equally and ratably with the Prepetition Second Lien PIK Notes by second-priority liens on substantially all of PetroQuest’s and the subsidiary guarantors’ oil and gas properties and substantially all of their other assets to the extent such properties and assets secure the Prepetition Term Loan Agreement.

12

| (d) | Prepetition Second Lien PIK Notes |

On September 27, 2016, PetroQuest issued $243,468,000 in aggregate principal amount of 10% second lien senior secured PIK notes due February 15, 2021 (the “Prepetition Second Lien PIK Notes,” and collectively with the Prepetition Second Lien Notes, the “Combined Prepetition Second Lien Notes”). The Prepetition Second Lien PIK Notes were issued under that certain Indenture dated as of September 27, 2016 (as amended or supplemented from time to time, the “Prepetition Second Lien PIK Indenture”), among PetroQuest, as issuer, PQE and TDC as guarantors, and Wilmington Trust, National Association, as Trustee and Collateral Trustee thereunder (in such capacity, the “Prepetition Second Lien PIK Trustee,” and collectively in its capacity as the Prepetition Second Lien Trustee, the “Indenture Trustee”).

The Debtors were permitted, at their option, for the first three interest payment dates on the Prepetition Second Lien PIK Notes ending with the February 2018 interest payment, to instead pay interest at (i) the annual rate of 1% per annum in cash plus (ii) the annual rate of 9% PIK payable by increasing the principal amount outstanding of the Prepetition Second Lien PIK Notes. The Debtors exercised this option in connection with the interest payments due on February 15, 2017, August 15, 2017, and February 15, 2018. Interest under the Prepetition Second Lien PIK Indenture is payable semi-annually on February 15 and August 15, subject to a 30-day grace period. As of the Petition Date, $275,045,768 of the Prepetition Second Lien PIK Notes, plus any accrued and unpaid interest, remains outstanding.

The Debtors did not make the interest payment due on August 15, 2018 and the 30-day grace period expired on September 14, 2018. On September 14, 2018, PetroQuest, PQE, and TDC entered into a Forbearance Agreement with certain Holders of approximately $194,559,842 in aggregate principal amount (representing approximately 70.7% of the outstanding principal amount) of the Prepetition Second Lien PIK Notes whereby the Holders agreed to forbear from exercising their rights and remedies under the Prepetition Second Lien PIK Indenture or related security documents with respect to certain anticipated events of default. The Forbearance Agreement was originally effective from September 28, 2018 until the earlier to occur of (i) 11:59 p.m. Eastern Time on September 28, 2018 and (ii) the date the Forbearance Agreement otherwise terminated in accordance with its terms, but was subsequently extended pursuant to various amendments to the Forbearance Agreement until the earlier to occur of (i) 11:59 p.m. Eastern Time on November 6, 2018 and (ii) the occurrence of any specified forbearance default.

The Prepetition Second Lien PIK Notes are secured equally and ratably with the Prepetition Second Lien Notes by second-priority liens on substantially all of PetroQuest’s and the subsidiary guarantors’ oil and gas properties and substantially all of their other assets to the extent such properties and assets secure the Prepetition Term Loan Agreement.

| 2. | Equity Ownership |

| (a) | Convertible Preferred Stock |

As of September 30, 2018, PetroQuest had issued and outstanding 1,495,000 shares of 6.875% Series B Cumulative Convertible Perpetual Preferred Stock (the “Preferred Stock”). The Preferred Stock accumulates dividends at an annual rate of 6.875% for each share of Preferred Stock. Dividends are cumulative from the date of first issuance.

13

In connection with an amendment to the Debtors’ prior bank credit facility (which was terminated and replaced by the Prior Prepetition Term Loan Agreement in October 2016 and the Prepetition Tem Loan Agreement in August 2018) prohibiting PetroQuest from declaring or paying dividends on the Preferred Stock, PetroQuest suspended the quarterly cash dividend on its Preferred Stock beginning with the dividend payment due on April 15, 2016. The Prior Prepetition Term Loan Agreement also prohibited, and the Prepetition Term Loan Agreement prohibits, PetroQuest from declaring and paying cash dividends on the Preferred Stock.

As of September 30, 2018, PetroQuest had deferred ten dividend payments and had accrued a $14.1 million payable related to the ten deferred payments and the quarterly dividend that was payable on October 15, 2018 (collectively with any accrued interest as of the Petition Date, the “Preferred Dividend Claims”). Because of the restrictions under the Prior Prepetition Term Loan Agreement, PetroQuest did not pay the dividend that was payable on July 15, 2017, which represented the sixth deferred dividend payment. As a result, the Holders of the Preferred Stock, voting as a single class, had the right prior to the Petition Date to elect two additional directors to PetroQuest’s Board of Directors (the “Board”) unless all accumulated and unpaid dividends on the Preferred Stock were paid in full. On April 12, 2018, June 18, 2018, and September 7, 2018, PetroQuest received written notices from separate Holders of the Preferred Stock exercising this right by requesting that the Board call a special meeting of the Holders of the Preferred Stock for the purposes of electing the additional directors, as set forth in Section 4(ii) of the Certificate of Designations establishing the Preferred Stock, dated September 24, 2007. The April 12, 2018 and June 18, 2018 requests were subsequently withdrawn, but the September 7, 2018 request remains outstanding.

Each share of Preferred Stock may be converted at any time, at the option of the Holder, into 0.8608 shares of PetroQuest’s common stock (which is based on a conversion price of approximately $58.08 per share of common stock, subject to further adjustment) plus cash in lieu of fractional shares, subject to PetroQuest’s right to settle all or a portion of any such conversion in cash or shares of its common stock. If PetroQuest elects to settle all or any portion of its conversion obligation in cash, the conversion value and the number of shares of PetroQuest’s common stock it will deliver upon conversion (if any) will be based upon a 20 trading day averaging period. Upon any conversion, the Holder will not receive any cash payment representing accumulated and unpaid dividends on the Preferred Stock, whether or not in arrears, except in limited circumstances.

| (b) | Common Stock |

As of the Petition Date, the Debtors have 25,587,441 outstanding shares of common stock, par value $0.001 per share. Since 2005, the common stock of PetroQuest had been traded on the New York Stock Exchange (the “NYSE”) under the symbol “PQ.” On May 4, 2018, the NYSE Regulation Staff determined that PetroQuest’s common stock would be delisted from the NYSE. The decision was reached by the Staff under Section 802.01B of the NYSE’s Listed Company Manual because PetroQuest had fallen below the NYSE’s continued listing standard requiring listed companies to maintain an average global market capitalization over a consecutive 30 trading day period of at least $15,000,000. PetroQuest’s common stock began trading on the OTCQX market (“OTC Pink”) on May 7, 2018 under the symbol “PQUE.”

14

| III. | KEY EVENTS LEADING TO CHAPTER 11 CASES |

From 2015 to 2018, the Debtors took the following actions, among others, to increase liquidity, reduce debt levels, and extend debt maturities:

| • | Sold all of the Debtors’ Oklahoma assets in three transactions that closed in June 2015, April 2016 and October 2016 for total consideration of $292.6 million; |

| • | Reduced capital expenditures in 2016 by 75% when compared to capital expenditures in 2015; |

| • | Completed two debt exchanges in 2016 to extend maturities on a significant portion of debt and to reduce cash interest expense until August 2018; |

| • | Reduced total debt 25% from $425 million as of December 31, 2014 to $334 million as of September 30, 2018; |

| • | Suspended the quarterly dividend on the Preferred Stock, saving $5.1 million annually; |

| • | Entered into the $50 million Prior Prepetition Term Loan Agreement, which was subsequently replaced by the Prepetition Term Loan Agreement; |

| • | Secured and executed the drilling joint venture in East Texas; |

| • | Sold the Debtors’ Gulf of Mexico assets resulting in the extinguishment of $28.2 million of discounted asset retirement obligations from the Debtors’ balance sheet and the expected refund of up to $12.4 million of cash collateral ($8.3 million of which was received in October 2018) used to secure the Debtors’ offshore bonding (subject to the Debtors’ obligation to pay approximately $3.8 million to the purchaser of these assets, which was paid in October 2018); and |

| • | Reduced full-time employees by 53% since year-end 2015. |

However, because of the continued downturn in natural gas prices, the Debtors’ overall liquidity position and cash available for capital expenditures was negatively impacted. Due to the sale of the Debtors’ Gulf of Mexico properties in January 2018 and normal production declines, production decreased by 41% in the three months ended September 30, 2018 when compared to the same period in 2017 and cash flow from operations for the nine months ended September 30, 2018 was $1.9 million. As of September 30, 2018, the Debtors had approximately $25.5 million of cash on hand and approximately $334 million aggregate principal amount of outstanding indebtedness.

As discussed above, beginning with the August 15, 2018 interest payment on the Prepetition Second Lien PIK Notes, the Debtors were required to pay interest on their Prepetition Second Lien PIK Notes at 10% in cash (instead of 1% in cash and 9% in payment in kind). The

15

cash interest payment due on August 15, 2018 on the Combined Prepetition Second Lien Notes totaled approximately $14.2 million. Available borrowings under the Prior Prepetition Term Loan were subject to reductions on a calendar quarter basis and the Debtors’ ability to utilize such available borrowings was subject to the Coverage Ratio. Accordingly, the Debtors elected not to make the August 15, 2018 interest payment on the Combined Prepetition Second Lien Notes to fund continuing operations.

Because of the limited cash available for the August 15, 2018 interest payment on the Combined Prepetition Second Lien Notes, which were subject to a 30-day grace period, the Debtors engaged with certain Holders of the Combined Prepetition Second Lien Notes (the “Combined Consenting Second Lien Noteholders”) to restructure their debt.

Pursuant to the Plan negotiated with the Consenting Creditors, the Holders of the Combined Prepetition Second Lien Notes will exchange their debt for 100% of the New Equity in New Parent, subject to (i) dilution by the awards related to New Equity issued under the Management Incentive Plan and (ii) the Put Option Premium, and $80 million of New Second Lien PIK Notes. If approved by this Court, the Debtors’ restructuring will significantly reduce the Debtors’ debt load and associated cash interest expense, and provide them with additional liquidity to fund the Debtors’ continued development of their Cotton Valley assets in East Texas as well as investment in the Austin Chalk, a recently acquired oil focused play in Central Louisiana.

| A. | Restructuring Negotiations |

Given the uncertainty regarding future commodity prices, continued price declines, and the Debtors’ unsustainable capital structure, the Board determined to hire Seaport Global (“Seaport”) in March 2016 to explore additional strategic alternatives. At this time, the Debtors and their advisors (including Porter Hedges LLP) also began discussions with certain Combined Prepetition Second Lien Noteholders.

| B. | The Restructuring Support Agreement |

After extensive arm’s-length negotiations, the Debtors, the Prepetition Term Loan Lenders and certain of the Combined Prepetition Second Lien Noteholders were able to agree on the terms of a comprehensive restructuring transaction. The key terms of this transaction are embodied in the Restructuring Support Agreement attached hereto as Exhibit B, which was signed on November 6, 2018 and later amended on December 18, 2018 by the Debtors, the Prepetition Term Loan Lenders, and a group of Combined Prepetition Second Lien Noteholders holding approximately 85% of the face value of the Prepetition Second Lien Notes.

The Debtors entered into the Restructuring Support Agreement only after a robust review process by the members of the Board. Based upon regular updates to the Board regarding the status of negotiations between the parties in the period leading up to the commencement of the Chapter 11 Cases, and upon rigorous review and negotiation of the Restructuring Support Agreement and the Plan by the Board, the Debtors determined that the terms of the Restructuring Support Agreement and the Plan represent the best transaction available and will maximize value to all stakeholders.

16

Among other agreements and term sheets, the Restructuring Support Agreement contains forms of employment agreements, which the Reorganized Debtors will enter into with certain of their employees upon the Effective Date, including with Charles Goodson, the Chairman of the Board, Chief Executive Officer and President of PetroQuest, J. Bond Clement, the Executive Vice President, Chief Financial Officer and Treasurer of PetroQuest, and Arthur M. Mixon III, the Executive Vice President – Operations and Production of PetroQuest. A copy of the form of executive employment agreement to be entered into with Messrs. Goodson, Clement and Mixon is attached as Exhibit J to the Restructuring Support Agreement.

Prior to entering into the Restructuring Support Agreement, the Board determined that it was in the best interest of PetroQuest that entry into the Restructuring Support Agreement, commencement of the Chapter 11 Cases, and consummation of the transactions contemplated by the Plan should not be considered events constituting or reasonably leading to a “Change of Control” under the PetroQuest Energy, Inc. Change of Control Severance Benefit Plan effective May 21, 2013 (the “Change of Control Severance Plan”). Based on such determination by the Board and as permitted under the Change of Control Severance Plan, the Board concluded that the entry into the Restructuring Support Agreement, the Chapter 11 Cases, and the consummation of the transactions contemplated by the Plan will not be deemed a Change of Control under the Change of Control Severance Plan.

The Board, in consultation with its independent compensation advisor, also adopted the PetroQuest Energy, Inc. 2018 Annual Cash Bonus Plan (the “Cash Bonus Plan”) to reward certain of the Debtors’ key employees for their performance, based on a review of certain criteria determined by the Compensation Committee of the Board (the “Committee”). The Cash Bonus Plan consists of a total cash pool of $1,500,000 (the “Cash Pool”) to be awarded to employees in amounts determined by management, as delegated by the Committee, based on the criteria set forth in the Cash Bonus Plan. On November 5, 2018, the Debtors awarded one fourth of the Cash Pool as bonuses to certain employees of the Debtors, including $130,000, $57,500 and $57,500 to Messrs. Goodson, Clement and Mixon, respectively. The remaining portion of the Cash Pool will be awarded to the Reorganized Debtors’ employees, subject to the approval of the Board, on a quarterly basis in the first three quarters of 2019. If awarded the full amounts allocated to them under the Cash Bonus Plan, Messrs. Goodson, Clement and Mixon would receive $390,000, $172,500 and $172,500, respectively.

A copy of the Cash Bonus Plan is attached as Exhibit 10.2 to the Form 8-K filed on November 7, 2018, and is incorporated by reference herein. The foregoing description of the Cash Bonus Plan is only a summary, does not purport to be complete, and is qualified in its entirety by reference to the Cash Bonus Plan.

The Restructuring Support Agreement also contemplates that certain restructuring transactions will be implemented in accordance with terms consistent with the Plan. The key elements of the Plan include:

| • | Combined Prepetition Second Lien Noteholders receive the New Equity and New Second Lien PIK Notes. The Combined Prepetition Second Lien Noteholders will receive 100% of the New Equity, subject to (i) dilution by the awards related to New Equity issued under the Management Incentive Plan and (ii) the Put Option Premium, and $80 million of New Second Lien PIK Notes. |

17

| • | Restructuring takes place on an agreed schedule. The restructuring transactions will be conducted under a timeline set forth in the Restructuring Support Agreement, which requires the Debtors to initially File the Plan by November 6, 2018 and the Effective Date to occur no later than February 8, 2019. |

| • | Releases and Exculpation. The Plan includes mutual releases in favor of (a) the Debtors and their related persons, professionals, and entities, and (b) the Consenting Creditors and their related persons, professionals, and entities. The Plan will also provide for the exculpation of the Debtors and their related persons, professionals, and entities. |

The Restructuring Support Agreement includes the following key milestones:6

| (a) | No later than 11:59 p.m. prevailing Central Time on December 31, 2018, an amended Final Cash Collateral Order must have been entered by the Court; |

| (b) | No later than 11:59 p.m. prevailing Central Time on January 3, 2019, the Debtors shall have filed this Disclosure Statement and the Plan; |

| (c) | No later than 11:59 p.m. prevailing Central Time on January 7, 2019, the Court shall have entered an order finally approving the Disclosure Statement; |

| (d) | No later than 11:59 p.m. prevailing Central Time on January 31, 2019, the Confirmation Order must have been entered by the Court; and |

| (e) | No later than 11:59 p.m. prevailing Central Time on February 8, 2019, the Effective Date shall have occurred. |

It is important to note that the Debtors maintain a broad “fiduciary out” under the Restructuring Support Agreement. Specifically, Section 5(c)(ii) of the Restructuring Support Agreement provides that each Debtor may terminate its obligations thereunder if its board of directors (or board of managers, as applicable) determines that proceeding with the contemplated restructuring transactions “would be inconsistent with the exercise of its fiduciary duties.”

| 6 | The Restructuring Support Agreement contains additional milestones that have already been satisfied. |

18

| IV. | DEVELOPMENTS AND ANTICIPATED EVENTS DURING THE CHAPTER 11 CASES |

Under the Restructuring Support Agreement, the Debtors agreed to commence the Chapter 11 Cases no later than November 6, 2018 (the “Petition Date”). The Debtors expect the Chapter 11 Cases to proceed quickly. Should the Debtors’ projected timelines prove accurate, the Debtors could emerge from chapter 11 by February 8, 2019. No assurances can be made, however, that the Court will enter various orders on the timetable anticipated by the Debtors.

| A. | First Day Pleadings |

On the Petition Date, along with their voluntary petitions for relief under chapter 11 of the Bankruptcy Code, the Debtors Filed several motions (the “First Day Pleadings”) designed to facilitate the administration of the Chapter 11 Cases and minimize disruption to the Debtors’ operations, by, among other things, easing the strain on the Debtors’ relationships with employees, vendors, insurers, and taxing authorities, among others, following the commencement of the Chapter 11 Cases. On the Petition Date, the Debtors Filed the following First Day Pleadings, which the Court granted on an interim basis on November 7, 2018 and later entered on a final basis on November 27, December 3, and December 13, 2018:

| • | Debtors’ Emergency Motion for Joint Administration of These Chapter 11 Cases; |

| • | Debtors’ Emergency Motion to (I) Authorize the Debtors to File a Consolidated List of Their 30 Largest Unsecured Creditors and (II) Waive the Requirement that Each Debtor File a List of Creditors; |

| • | Debtors’ Emergency Motion for Interim and Final Orders Authorizing the Debtors to (I) Continue Operating Their Cash Management System, (II) Honor Certain Prepetition Obligations, (III) Maintain Existing Bank Accounts and Business Forms, and (IV) Granting Related Relief; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing Debtors to (A) Maintain Existing Insurance Policies and Pay All Insurance Obligations Thereunder and (B) Renew, Revise, Extend, Supplement, Change, or Enter into New Insurance Policies and (II) Directing Financial Institutions to Honor All Related Payment Requests; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection to the Prepetition Secured Parties, and (III) Modifying the Automatic Stay; |

| • | Debtors’ Emergency Motion for Entry of Interim and Final Orders (I) Authorizing the Payment of the Prepetition Claims of Certain Lien Claimants and Section 503(B)(9) Claims and (II) Confirming Administrative Expense Priority of Outstanding Orders; |

19

| • | Debtors’ Emergency Motion for Interim and Final Orders Authorizing (I) the Debtors to Pay Certain Prepetition Taxes and Related Obligations, and (II) Authorizing Financial Institutions to Receive, Process, Honor, and Pay All Checks Presented for Payment and to Honor all Funds Transfer Requests Related to Such Obligations; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing, but not Directing, the Debtors to Pay Prepetition Workforce Obligations; (II) Authorizing, but not Directing, the Debtors to Continue Certain Workforce Benefit Programs; and (III) Authorizing, but not Directing, Applicable Banks and Financial Institutions to Honor Prepetition Checks for Payment of the Prepetition Workforce Obligations; |

| • | Debtors’ Emergency Motion to (I) Approve Adequate Assurance of Payment to Utility Companies, (II) Establish Procedures to Resolve Objections by Utility Companies, and (III) Prohibit Utility Companies from Altering, Refusing, or Discontinuing Service; |

| • | Debtors’ Emergency Motion for Interim and Final Orders Authorizing (I) Payment of Joint Interest Billings, Interest Owner Payments, and GTP Costs and Adjustments and (II) Financial Institutions to Receive, Process, Honor, and Pay All Checks Presented for Payment and to Honor All Funds Transfer Requests Related to Such Obligations; and |

| • | Debtors’ Emergency Motion for Entry of Interim and Final Orders Establishing Certain Notice and Hearing Procedures for Transfers of, and Declarations of Worthlessness with Respect to Certain Equity Interests of PetroQuest Energy, Inc. Nunc Pro Tunc to the Petition Date. |

| B. | Other Administrative Motions and Retention Applications |

The Debtors intend to File several other motions that are common to chapter 11 proceedings of similar size and complexity as the Chapter 11 Cases. The Debtors have or will File applications (the “Retention Applications”) to retain the following professionals to assist them in the Chapter 11 Cases, including:

| • | Porter Hedges LLP; |

| • | Seaport Global; |

| • | FTI Consulting, Inc.; |

| • | Ernst & Young, LLP; |

| • | Epiq Corporate Restructuring, LLC; |

| • | LSH Partners Securities, LLC; and |

| • | Ryan, LLC. |

20

| C. | Claims Bar Date |

On December 13, 2018, the Court entered the Order (I) Setting Bar Dates for Filing Proofs of Claim, Including Requests for Payment Under Section 503(b)(9), (II) Establishing Amended Schedules Bar Date and Rejection Damages Bar Date, (III) Approving the Form of and Manner for Filing Proofs of Claim, Including Section 503(b)(9) Requests, and (IV) Approving Notice of Bar Dates [Docket No. 272], which, among other things, set January 15, 2019 as the Claims Bar Date.

| D. | Assumption and Rejection of Executory Contracts and Unexpired Leases |

Prior to the Petition Date and in the ordinary course of business, the Debtors entered into hundreds of Executory Contracts and Unexpired Leases. The Debtors, with the assistance of their advisors, have reviewed and will continue to review the Executory Contracts and Unexpired Leases to identify contracts and leases to either assume or reject pursuant to sections 365 or 1123 of the Bankruptcy Code.

The Debtors intend to include information in the Plan Supplement regarding the assumption or rejection of their Executory Contracts and Unexpired Leases to be carried out as of the Effective Date, but may also elect to File additional discrete motions seeking to assume or reject various of the Debtors’ Executory Contracts and Unexpired Leases before such time.

| E. | Litigation Matters |

The Debtors’ material litigation is summarized in Exhibit F annexed hereto.

| V. | SUMMARY OF THE PLAN |

This section of the Disclosure Statement summarizes the Plan, a copy of which is annexed hereto as Exhibit A. This summary is qualified in its entirety by reference to the Plan.

| A. | Administrative Claims, Professional Fee Claims, and Priority Claims |

| 1. | Administrative Claims |

Except with respect to Administrative Claims that are Professional Fee Claims, and except to the extent that an Administrative Claim has already been paid during the Chapter 11 Cases or a Holder of an Allowed Administrative Claim and the applicable Debtor(s) agree to less favorable treatment, each Holder of an Allowed Administrative Claim shall be paid in full in Cash on the latest of: (a) on or as soon as reasonably practicable after the Effective Date if such Administrative Claim is Allowed as of the Effective Date; (b) on or as soon as reasonably practicable after the date such Administrative Claim is Allowed, if not Allowed as of the Effective Date; and (c) the date such Allowed Administrative Claim becomes due and payable, or as soon thereafter as is reasonably practicable; provided that Allowed Administrative Claims that arise in the ordinary course of the Debtors’ businesses shall be paid in the ordinary course of business in accordance with the terms and subject to the conditions of any agreements governing, instruments evidencing, or other documents relating to such transactions.

21

Except as otherwise provided in Article II.A of the Plan and except with respect to Administrative Claims that are Professional Fee Claims, requests for payment of Administrative Claims arising between the Petition Date and the Effective Date must be Filed and served on the Reorganized Debtors pursuant to the procedures specified in the Confirmation Order and the notice of entry of the Confirmation Order no later than the Administrative Claims Bar Date. Holders of Administrative Claims that are required to, but do not, File and serve a request for payment of such Administrative Claims by such dates shall be forever barred, estopped, and enjoined from asserting such Administrative Claims against the Debtors or their property and such Administrative Claims shall be deemed discharged as of the Effective Date. Objections to such requests, if any, must be Filed and served on the Reorganized Debtors and the requesting party no later than 60 days after the Effective Date or such other date fixed by the Court. Notwithstanding the foregoing, no request for payment of an Administrative Claim need be Filed with respect to an Administrative Claim previously Allowed.

For the avoidance of doubt, Claims for fees and expenses of advisors to the Debtors and the Creditors’ Committee shall constitute Professional Fee Claims.

| 2. | Professional Compensation |

| (a) | Final Fee Applications |

All final requests for payment of Professional Fee Claims, including the Professional Fee Claims incurred during the period from the Petition Date through the Effective Date, must be Filed and served on the Reorganized Debtors no later than 45 days after the Effective Date. All such final requests will be subject to approval by the Court after notice and a hearing in accordance with the procedures established by the Bankruptcy Code and prior orders of the Court in the Chapter 11 Cases, including the Interim Compensation Order, and once approved by the Court, will be promptly paid from the Professional Fee Escrow Account in the full Allowed amount of each such Professional Fee Claim. If the Professional Fee Escrow Account is insufficient to fund the full Allowed amounts of Professional Fee Claims, remaining unpaid Allowed Professional Fee Claims will be promptly paid by the Reorganized Debtors without any further action or order of the Court.

| (b) | Professional Fee Escrow Account |

On the Effective Date, the Reorganized Debtors shall establish and fund the Professional Fee Escrow Account with Cash equal to the Professional Fee Reserve Amount. The Professional Fee Escrow Account shall not be subject to any Lien and shall be maintained in trust solely for the benefit of the Professionals. The funds in the Professional Fee Escrow Account shall not be considered property of the Estates or of the Reorganized Debtors. When all Allowed amounts owing to Professionals have been paid in full, any remaining amount in the Professional Fee Escrow Account shall promptly be turned over to the Reorganized Debtors without any further action or order of the Court.

22

| (c) | Professional Fee Reserve Amount |

Professionals shall reasonably estimate their unpaid Professional Fee Claims before and as of the Effective Date, and shall deliver such estimate to the Debtors no later than five (5) Business Days before the Effective Date, provided, however, that such estimate shall not be deemed to limit the amount of the fees and expenses that are the subject of the Professional’s final request for payment of Professional Fee Claims. If a Professional does not provide an estimate, the Debtors or Reorganized Debtors may estimate the unpaid and unbilled fees and expenses of such Professional.

| (d) | Post-Effective Date Fees and Expenses |

Except as otherwise specifically provided in the Plan, from and after the Effective Date, the Debtors or Reorganized Debtors shall, in the ordinary course of business and without any further notice or application to or action, order, or approval of the Court, pay in Cash the reasonable, actual, and documented legal, professional, or other fees and expenses related to implementation of the Plan and Consummation incurred on or after the Effective Date by the Professionals. Upon the Effective Date, any requirement that Professionals comply with sections 327 through 331, 363, and 1103 of the Bankruptcy Code in seeking retention or compensation for services rendered after such date shall terminate, and the Debtors or Reorganized Debtors may employ and pay any Professional for fees and expenses incurred after the Effective Date in the ordinary course of business without any further notice to or action, order, or approval of the Court.

| 3. | Priority Tax Claims |

Except to the extent that a Holder of an Allowed Priority Tax Claim agrees to a less favorable treatment, in full and final satisfaction, settlement, release, and discharge of and in exchange for each Allowed Priority Tax Claim, each Holder of such Allowed Priority Tax Claim shall be treated in accordance with the terms set forth in section 1129(a)(9)(C) of the Bankruptcy Code. In the event an Allowed Priority Tax Claim is also a Secured Tax Claim, such Claim shall, to the extent it is Allowed, be treated as an Other Secured Claim if such Claim is not otherwise paid in full.

| 4. | Statutory Fees |

All fees payable pursuant to 28 U.S.C. § 1930(a) shall be paid by the Debtors or Reorganized Debtors, as applicable, for each quarter (including any fraction thereof) until the Chapter 11 Cases are converted, dismissed or closed, whichever occurs first. The Reorganized Debtors shall continue to File quarterly-post confirmation operating reports in accordance with the U.S. Trustee’s Region 7 Guidelines for Debtors-in-Possession.

| B. | Classification of Claims and Interests |

| 1. | Summary of Classification |

Claims and Interests, except for Administrative Claims, Professional Fee Claims, Cure Claims, and Priority Tax Claims, are classified in the Classes set forth in Article III of the Plan.

23

A Claim or Interest is classified in a particular Class only to the extent that the Claim or Interest qualifies within the description of that Class and is classified in other Classes to the extent that any portion of the Claim or Interest qualifies within the description of such other Classes. A Claim or Interest also is classified in a particular Class for the purpose of receiving distributions pursuant to the Plan only to the extent that such Claim is an Allowed Claim in that Class and has not been paid, released, or otherwise satisfied prior to the Effective Date. The Plan constitutes a separate chapter 11 plan of reorganization for each Debtor and the classifications set forth in Classes 1 through 11 shall be deemed to apply to each Debtor. For all purposes under the Plan, each Class will contain sub-Classes for each of the Debtors (i.e., there will be 11 Classes for each Debtor); provided that any Class that is vacant as to a particular Debtor will be treated in accordance with Article III.E of the Plan.

Class Identification

The classification of Claims and Interests against each Debtor (as applicable) pursuant to the Plan is as follows:

| Class |

Claim or Interest |

Status |

Entitled to Vote | |||

| 1 | Other Priority Claims | Unimpaired | No (Deemed to Accept) | |||

| 2 | Other Secured Claims | Unimpaired | No (Deemed to Accept) | |||

| 3 | Secured Tax Claims | Unimpaired | No (Deemed to Accept) | |||

| 4 | First Lien Claims | Unimpaired | No (Deemed to Accept) | |||

| 5 | Prepetition Second Lien Notes Secured Claims | Impaired | Yes | |||

| 6 | Prepetition Second Lien PIK Notes Secured Claims | Impaired | Yes | |||