Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Taylor Morrison Home Corp | d642655dex991.htm |

| 8-K - 8-K - Taylor Morrison Home Corp | d642655d8k.htm |

Q3 2018 EARNINGS CALL October 31, 2018 Exhibit 99.2

Disclaimer The statements made by representatives of the Company during the course of this presentation that are not historical facts are forward-looking statements. Although the Company believes that the assumptions underlying these statements are reasonable, individuals considering such statements for any purpose are cautioned that such forward-looking statements are inherently uncertain and necessarily involve risks that may affect the Company’s business prospects and performance, causing actual results to differ from those discussed during the presentation. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements included in the Company’s reports filed with the Securities and Exchange Commission (SEC). Any forward-looking statements made are subject to risks and uncertainties, many of which are beyond management’s control. These risks include the risks described in the Company’s reports filed with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are made only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. The information in this presentation should be considered together with all information included in the Company’s reports filed with the SEC, including the “Risk Factors” described therein. For additional information, as well as explanations and reconciliations of certain non-GAAP financial measures and the reasons why we use these supplemental measures of performance and believe they provide useful information to investors, please refer to the Company’s earnings release dated October 31, 2018.

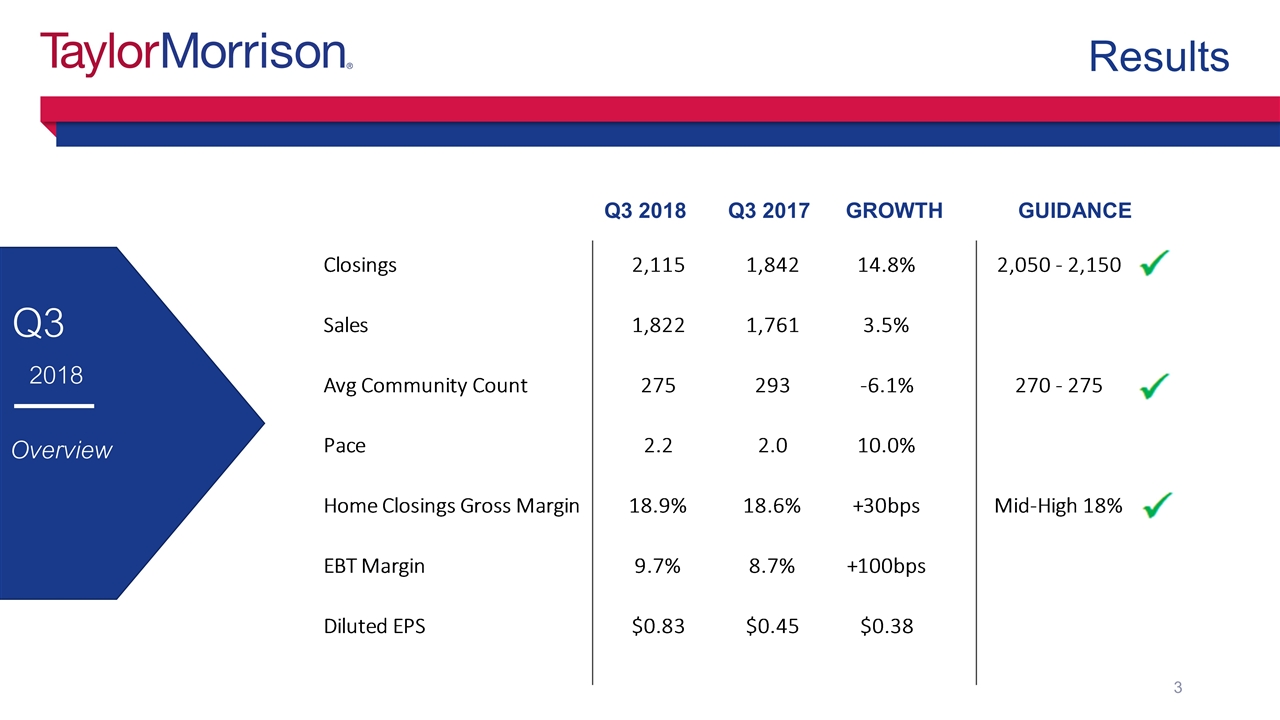

Results 2018 Q3 Overview Q3 2018 Q3 2017 GROWTH GUIDANCE

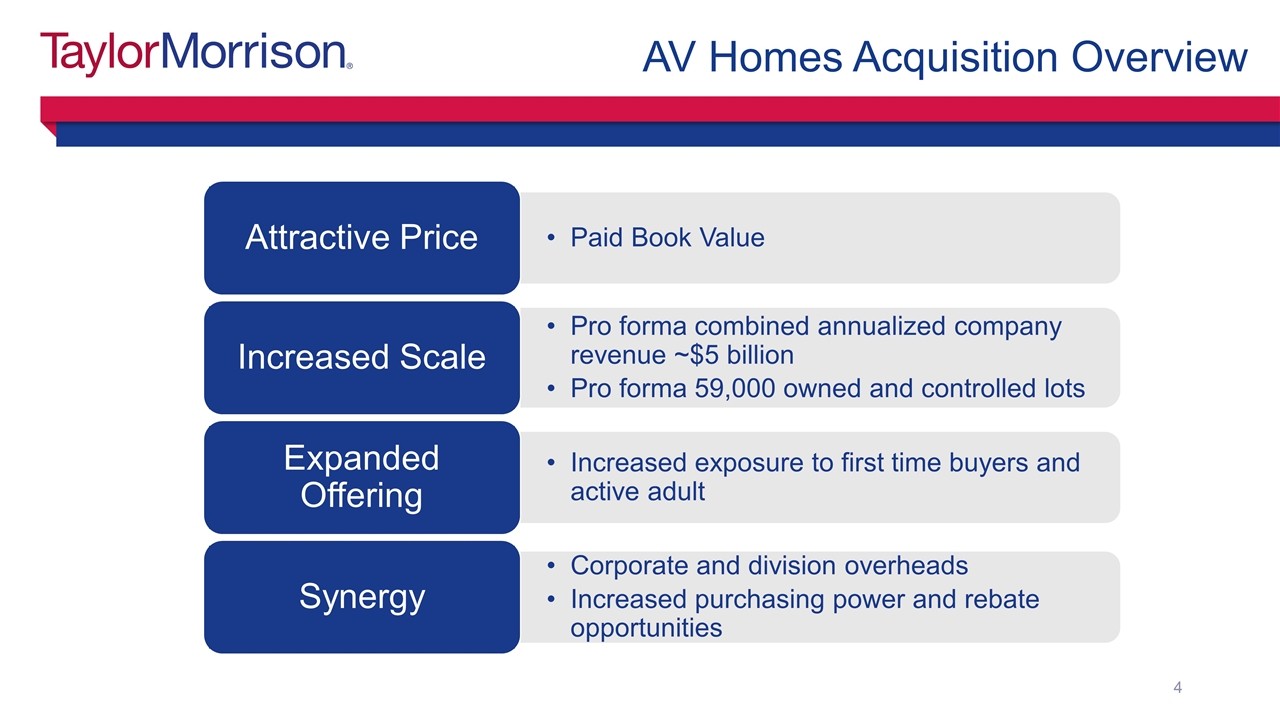

Paid Book Value Attractive Price Pro forma combined annualized company revenue ~$5 billion Pro forma 59,000 owned and controlled lots Increased Scale Increased exposure to first time buyers and active adult Expanded Offering Corporate and division overheads Increased purchasing power and rebate opportunities Synergy AV Homes Acquisition Overview

Detailed Results 2018 Q3 Details Q3 2018 Q3 2017 GROWTH Q3 2018 Q3 2017 GROWTH Note: $$ in millions except EPS

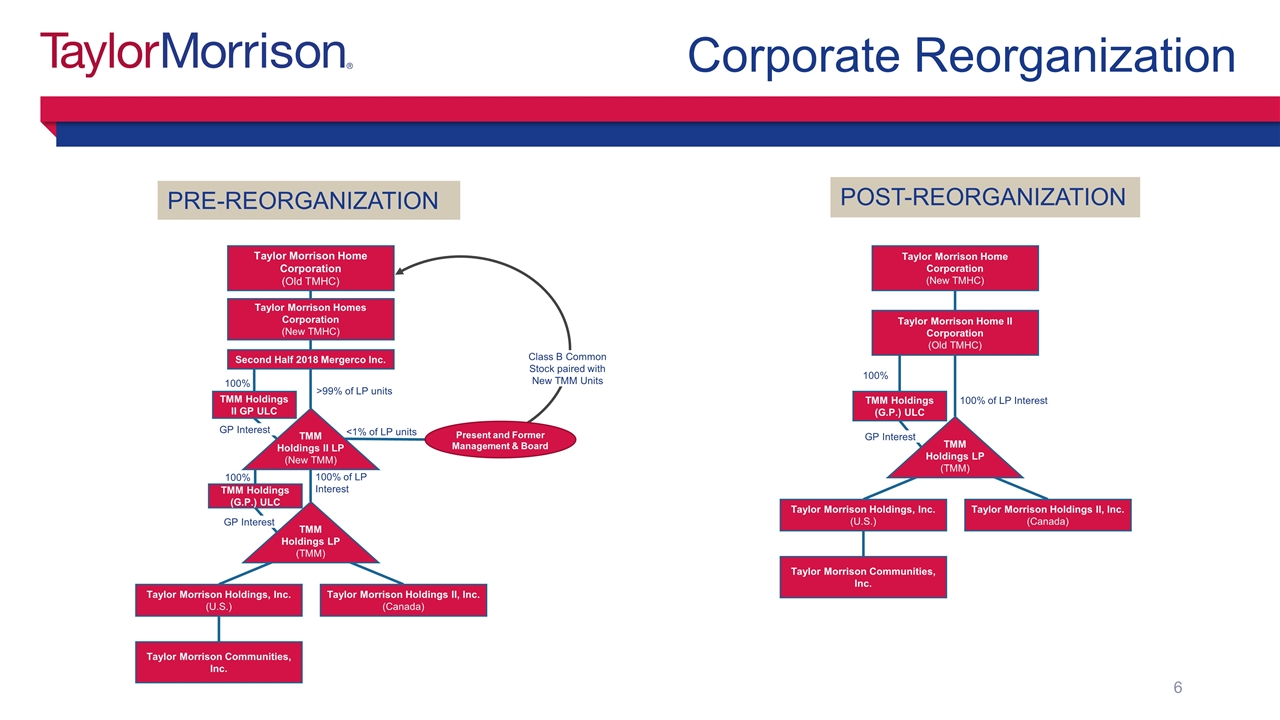

Corporate Reorganization PRE-REORGANIZATION POST-REORGANIZATION Taylor Morrison Communities, Inc. TMM Holdings II LP (New TMM) Taylor Morrison Holdings, Inc. (U.S.) Taylor Morrison Holdings II, Inc. (Canada) Second Half 2018 Mergerco Inc. <1% of LP units >99% of LP units Class B Common Stock paired with New TMM Units TMM Holdings LP (TMM) TMM Holdings II GP ULC TMM Holdings (G.P.) ULC 100% of LP Interest 100% GP Interest GP Interest 100% Present and Former Management & Board Taylor Morrison Communities, Inc. Taylor Morrison Holdings, Inc. (U.S.) Taylor Morrison Holdings II, Inc. (Canada) Taylor Morrison Home Corporation (New TMHC) TMM Holdings LP (TMM) TMM Holdings (G.P.) ULC 100% of LP Interest 100% GP Interest Taylor Morrison Home II Corporation (Old TMHC) Taylor Morrison Homes Corporation (New TMHC) Taylor Morrison Home Corporation (Old TMHC)

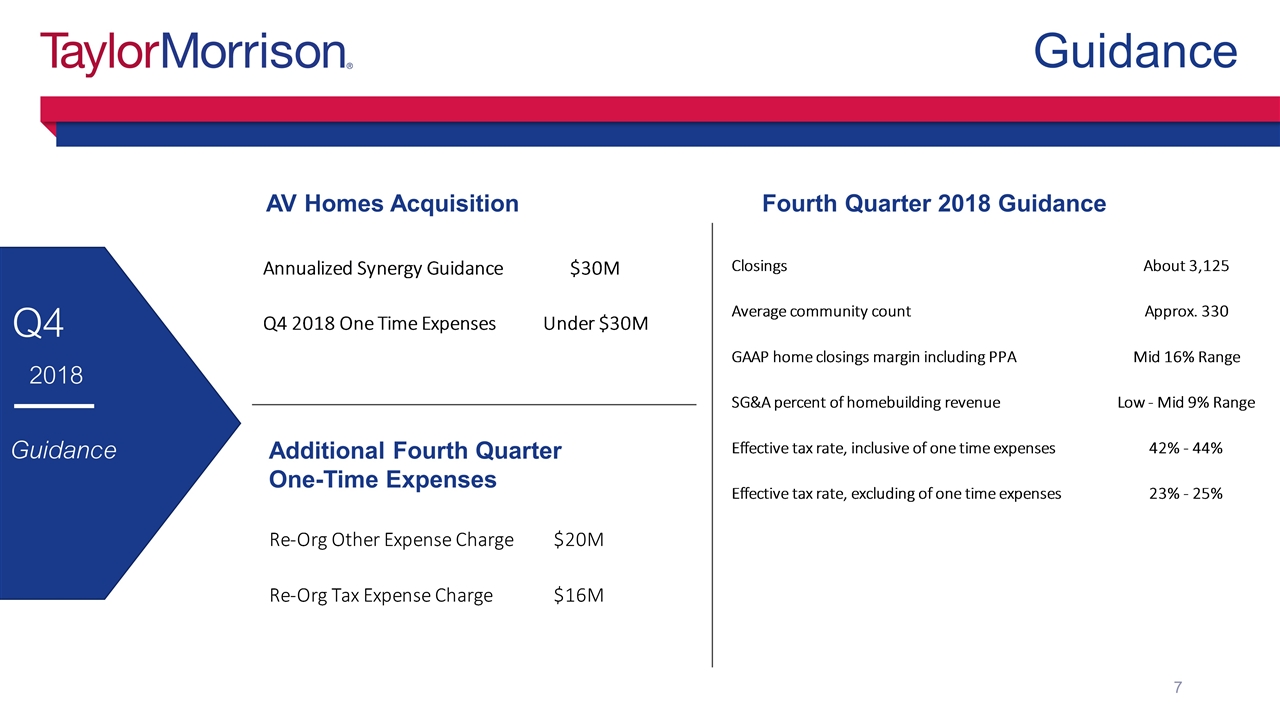

Guidance Fourth Quarter 2018 Guidance AV Homes Acquisition Additional Fourth Quarter One-Time Expenses 2018 Q4 Guidance