Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STONERIDGE INC | tv505597_ex99-1.htm |

| 8-K - FORM 8-K - STONERIDGE INC | tv505597_8k.htm |

Exhibit 99.2

Third - Quarter 2018 Results October 29, 2018

2 Forward - Looking Statements Statements in this presentation contain “forward - looking statements” under the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this report and may include statements regarding the intent, belief or current expectations o f t he Company, with respect to, among other things, our (i) future product and facility expansion, (ii) acquisition strategy, (iii) investments a nd new product development, (iv) growth opportunities related to awarded business and (v) operational expectations. Forward - looking statements may be ident ified by the words “will,” “may,” “should,” “designed to,” “believes,” “plans,” “projects,” “intends,” “expects,” “estimates,” “anticipates,” “c ont inue,” and similar words and expressions. The forward - looking statements are subject to risks and uncertainties that could cause actual events or results to differ materially from those expressed in or implied by the statements. Important factors that could cause actual results to differ materially fro m those in the forward - looking statements include, among other factors: • the reduced purchases, loss or bankruptcy of a major customer or supplier; • the costs and timing of business realignment, facility closures or similar actions; • a significant change in automotive, commercial, off - highway, motorcycle or agricultural vehicle production; • competitive market conditions and resulting effects on sales and pricing; • the impact on changes in foreign currency exchange rates on sales, costs and results, particularly the Argentinian peso, Braz ili an real, Chinese renminbi, euro, Mexican peso and Swedish krona; • our ability to achieve cost reductions that offset or exceed customer - mandated selling price reductions; • customer acceptance of new products; • our ability to successfully launch/produce products for awarded business; • adverse changes in laws, government regulations or market conditions, including tariffs, affecting our products or our custom ers ’ products; • our ability to protect our intellectual property and successfully defend against assertions made against us; • liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which w e a re or may become a party, or the impact of product recall or field actions on our customers; • labor disruptions at our facilities or at any of our significant customers or suppliers; • the ability of our suppliers to supply us with parts and components at competitive prices on a timely basis, including the im pac t of potential tariffs and trade considerations on their operations and output; • the amount of our indebtedness and the restrictive covenants contained in the agreements governing our indebtedness, includin g o ur revolving credit facility; • capital availability or costs, including changes in interest rates or market perceptions; • the failure to achieve the successful integration of any acquired company or business; • risks related to a failure of our information technology systems and networks, and risks associated with current and emerging te chnology threats and damage from computer viruses, unauthorized access, cyber attack and other similar disruptions; and • the items described in Part I, Item IA (“Risk Factors”) of our 10 - K filed with the SEC. In addition, the forward - looking statements contained herein represent our estimates only as of the date of this release and sho uld not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward - looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, chan ges in other factors affecting such forward - looking statements or otherwise. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared t o w hat is shown in this presentation. The differences are the a result of rounding due to the representation of values in millions rather than tho usands in public filings.

3 Overview of Achievements x Each segment contributed to our strong third quarter in which we drove year - over - year adjusted operating margin improvement of 130 basis points x Awarded new shift - by - wire program with Chinese OEM ($13 million peak annual revenue) x Showcased advanced technologies at IAA Commercial Vehicles show in Germany x Laurent Borne joined as Chief Technology Officer x Announcing share repurchase authorization to buy back up to approximately 8% of outstanding shares ($50 million) over 18 month period* Q 3 2018 Key Accomplishments Q 3 2018 Financial Performance Q 3 2018 Performance and Guidance 2018 Q3 (Actual) 2018 Full Year Guidance (Previous)** 2018 Full Year Guidance (Updated) Sales $208.9 Million $870 - $890 Million $855 - $870 Million Gross Margin 30.3% 31.0% - 32.0% 30.0% - 31.0% Adj. Operating Margin 9.0% 9.0% - 10.0% 8.75% - 9.25% Adj. EPS $0.47 $2.05 - $2.20 $2.00 - $2.10 Adj. EBITDA Margin 12.2% 12.5% - 13.5% 12.25% - 12.75% Reported Adjusted Sales $208.9 Million -- Gross Profit $63.3 Million -- Operating Income $18.3 Million $18.7 Million EPS $0.46 $0.47 EBITDA -- $25.4 Million *Based on stock price and market capitalization as of October 25, 2018 and authorization of $50 million share repurchase prog ram by the Board of Directors **Guided to low end of previously provided ranges on Q2 earnings call

4 Financial Summary We continue to deliver sustainable, profitable growth

5 Stoneridge - A Vehicle Technology Company Shift - by - Wire Award Awarded new Shift - by - Wire program with Chinese OEM for local market First major actuation award to be produced in China for the Company Establishes our actuation products in Chinese market to take advantage of growing Shift - by - Wire and Park - by - Wire market demand 3 Total platforms with both traditional & hybrid powertrains Customer prefers a standalone Shift - by - Wire mechanism external to the transmission $13 million peak annual revenue Expected start of production late - 2020 7 - year total life Image Source: www.ford.com Shift - by - Wire and Park - by - Wire remain a platform for growth

6 Stoneridge Leadership Announcement Newly created CTO position will drive product development aligned with industry mega trends and continued focus on Smart products Laurent Borne joined Stoneridge as Chief Technology Officer effective August 20 th Laurent brings extensive global leadership and transformation experience delivering results across a wide range of engineering disciplines He has a deep understanding of the importance of delivering system - based solutions as well as world - class product, process and program management disciplines Prior to joining Stoneridge, he was vice president of product development at Whirlpool Corporation. Previous roles at Whirlpool include vice president of product excellence, global connectivity leader, product marketing director and operations director. Prior to Whirlpool, he worked at McKinsey & Company and Delphi Powertrain Systems

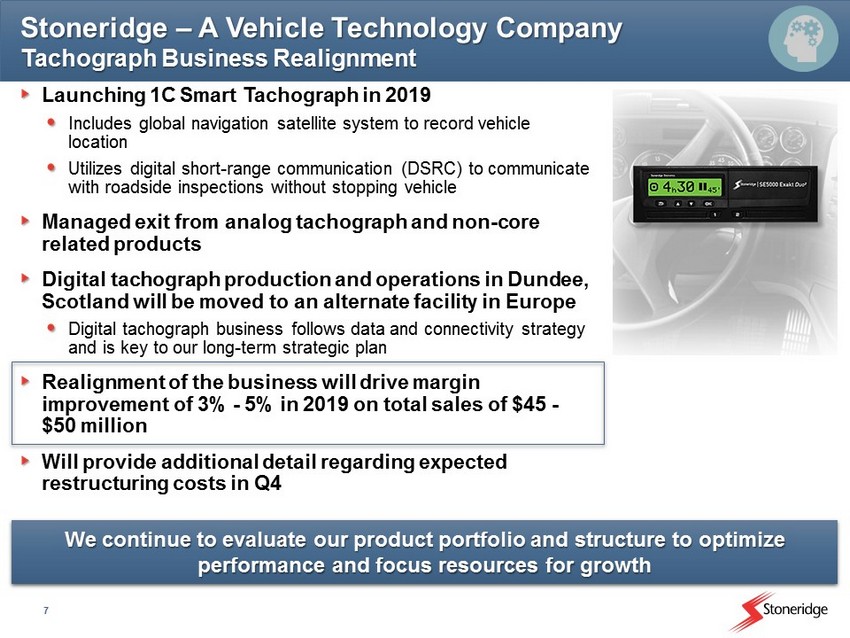

7 Stoneridge – A Vehicle Technology Company Tachograph Business Realignment Launching 1C Smart Tachograph in 2019 Includes global navigation satellite system to record vehicle location Utilizes digital short - range communication (DSRC) to communicate with roadside inspections without stopping vehicle Managed exit from analog tachograph and non - core related products Digital tachograph production and operations in Dundee, Scotland will be moved to an alternate facility in Europe Digital tachograph business follows data and connectivity strategy and is key to our long - term strategic plan Realignment of the business will drive margin improvement of 3% - 5% in 2019 on total sales of $45 - $50 million Will provide additional detail regarding expected restructuring costs in Q4 We continue to evaluate our product portfolio and structure to optimize performance and focus resources for growth

8 Each segment contributed to our strong 3 rd quarter Laurent Borne joined Stoneridge as Chief Technology Officer to drive product strategy and technology roadmap Significant Shift - by - Wire award with new customer in China $13 million peak annual revenue – 2020 Start - of - Production First major actuation award produced in China for the local market Realignment of tachograph business will drive margin improvement immediately and focus resources on high - growth products 3 rd Quarter 2018 Overview Driving shareholder value through strong financial performance and a well defined long - term strategy

Financial Update

10 3 rd Quarter 2018 Financial Summary 3 rd Quarter 2018 Financial Results 2018 Performance and Guidance Sales of $208.9 million, an increase of 3% over Q3 2017 Control Devices sales of $110.0 million, an increase of 2% over Q3 2017 Electronics sales of $90.7 million, an increase of 13% over Q3 2017 PST sales of $18.9 million, a decrease of 26% over Q3 2017 Adjusted operating income of $18.7 million, an increase of 20% over Q3 2017 (9.0% adjusted operating margin) Control Devices adjusted operating income of $16.7 million, an increase of 3% over Q3 2017 (15.2% adjusted operating margin) Electronics adjusted operating income of $9.3 million, an increase of 38% over Q3 2017 (10.3% adjusted operating margin) PST adjusted operating income of $1.2 million, a decrease of 18% over Q3 2017 (6.5% adjusted operating margin) Segment level financial information includes intercompany sales Due to centralizing certain procurement and operations functions we have allocated certain corporate costs to each segment th at were not previously allocated For purposes of our quarter over quarter comparisons we have adjusted these costs *Guided to low end of previously provided ranges on Q2 earnings call 2018 Q3 (Actual) 2018 Full Year Guidance (Previous)* 2018 Full Year Guidance (Updated) Sales $208.9 Million $870 - $890 Million $855 - $870 Million Gross Margin 30.3% 31.0% - 32.0% 30.0% - 31.0% Adj. Operating Margin 9.0% 9.0% - 10.0% 8.75% - 9.25% Adj. EPS $0.47 $2.05 - $2.20 $2.00 - $2.10 Adj. EBITDA Margin 12.2% 12.5% - 13.5% 12.25% - 12.75%

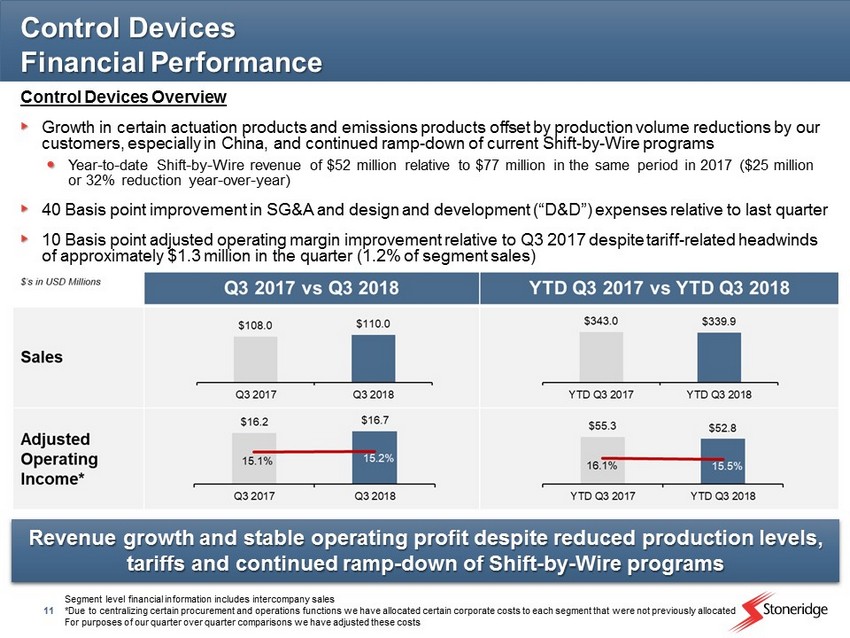

11 Control Devices Financial Performance Revenue growth and stable operating profit despite reduced production levels, tariffs and continued ramp - down of Shift - by - Wire programs Control Devices Overview Growth in certain actuation products and emissions products offset by production volume reductions by our customers, especially in China, and continued ramp - down of current Shift - by - Wire programs Year - to - date Shift - by - Wire revenue of $52 million relative to $77 million in the same period in 2017 ($25 million or 32% reduction year - over - year) 40 Basis point improvement in SG&A and design and development (“D&D”) expenses relative to last quarter 10 Basis point adjusted operating margin improvement relative to Q3 2017 despite tariff - related headwinds of approximately $1.3 million in the quarter (1.2% of segment sales) Segment level financial information includes intercompany sales *Due to centralizing certain procurement and operations functions we have allocated certain corporate costs to each segment t hat were not previously allocated For purposes of our quarter over quarter comparisons we have adjusted these costs

12 Electronics Financial Performance Continued strong revenue performance and margin expansion. Adjusted operating margin exceeds 10% for the quarter – first time in 5 years. Segment level financial information includes intercompany sales *Due to centralizing certain procurement and operations functions we have allocated certain corporate costs to each segment t hat were not previously allocated For purposes of our quarter over quarter comparisons we have adjusted these costs Electronics Overview Revenue increased by 13% quarter - over - quarter due to continued strong commercial vehicle production volumes and ramp - up of recently launched programs Revenue was negatively impacted by $3.1 million due to unfavorable currency translation Adjusted operating margin improved by 190 basis points relative to Q3 2017 and 130 basis points relative to last quarter.

13 PST Financial Performance Margin expansion continues despite challenging macroeconomic conditions Segment level financial information includes intercompany sales *Due to centralizing certain procurement and operations functions we have allocated certain corporate costs to each segment t hat were not previously allocated For purposes of our quarter over quarter comparisons we have adjusted these costs PST Overview Challenging macroeconomic conditions in Brazil. Reduced demand for aftermarket audio and alarm systems and currency headwinds leading to reduced revenue quarter - over - quarter. Track and trace growth contributing to margin expansion. Revenue was negatively impacted by approximately $5.1 million relative to Q3 2017 due to unfavorable currency movements. Despite reduced revenue, adjusted operating income improved by 70 basis points quarter - over - quarter primarily due to reduced SG&A expenses

14 Tariff / NAFTA Update Total announced tariffs expected to impact Q4 by $1.0 to $1.3 million as reflected in our updated guidance Expected tariff headwind in Q4: $1.0 - $1.3 million Expected tariff headwind 2018: $2.3 - $2.6 million On August 23, 2018 the United States imposed a 25% import tariff on certain Chinese goods and raw materials (not considered in previously provided guidance) On September 24, 2018 the United States implemented an additional 10% import tariff to increase to 25% on January 1, 2019 (not considered in previously provided guidance) Stoneridge is impacted by these tariffs, directly and indirectly through our suppliers, as we import and utilize certain components and raw materials from China On September 30, 2018 the United States - Mexico - Canada Agreement was reached to replace NAFTA Stoneridge does not expect to be impacted by this agreement in the short - term, but we will continue to monitor the situation We will continue to utilize our global manufacturing footprint and supply chain to reduce tariff exposure and work with our customers and suppliers to work to reduce the net impact

15 Capital Allocation Strategy Share Repurchase Authorization We will utilize our capital structure in order to maximize shareholder value Net Debt and Leverage Ratio Net Debt / Adjusted EBITDA We will utilize our capital to maximize shareholder return through investment in our existing business, inorganic growth and return of capital to shareholders Continue to target and prioritize inorganic growth through strategic technologies, geographic expansion and/or customer diversification Stoneridge’s Board of Directors have authorized the repurchase of up to approximately 8% of its common shares ($50 million) during the next 18 months* 1.6x 1.3x 0.5x 0.7 x 0.7 x 0.6 x 0.4x *Based on stock price and market capitalization as of October 25, 2018 and authorization of $50 million share repurchase prog ram by the Board of Directors

16 2018 Full - Year Adjusted EPS Guidance Continued customer volume reductions on certain platforms in China and North America Movements in currency are creating additional headwinds, specifically in Europe and Brazil Tariffs announced in Q2 and Q3 created $1.3 million headwind in Q3 and are expected to create $1.0 - $1.3 million headwind for Q4 (total tariff expenses in 2018 expected to be $2.3 - $2.6 million) Operating margin expansion expected to continue in Q4 Expecting tax rate below previously guided 20% – 25% range for Q4. Q4 tax rate expected to be 15% – 20%. Q2 Guidance Outlook Volume Reductions Q3 Guidance Outlook Low End of $2.05 - $2.20 Currency Midpoint $2.05 Tariffs Expected operating margin expansion and reduced tax rate partially offset challenging macroeconomic factors. Midpoint of full - year Adjusted EPS guidance ($2.05) reaffirms low - end of previously provided range. Tax rate Operating Margin Expansion Q2 Guidance Adjusted for Impact of External Factors < $2.05

17 All segments contributing to strong financial performance Control Devices – Marginal revenue growth despite reduced production volumes and shift - by - wire ramp down. Stable operating profit. Electronics – Strong quarter - over - quarter revenue growth despite currency headwinds. Continued margin expansion. PST – Significant macroeconomic challenges driving reduced revenue. Operating margin expansion continues. Announced share repurchase authorization of $50 million. Continue to pursue inorganic opportunities as we drive shareholder value through return of capital. Midpoint of full - year Adjusted EPS guidance ($2.05) reaffirms low - end of previously provided range 3 rd Quarter 2018 Financial Summary Driving shareholder value through strong financial performance and profitable long - term growth

Thank You

19 Appendix

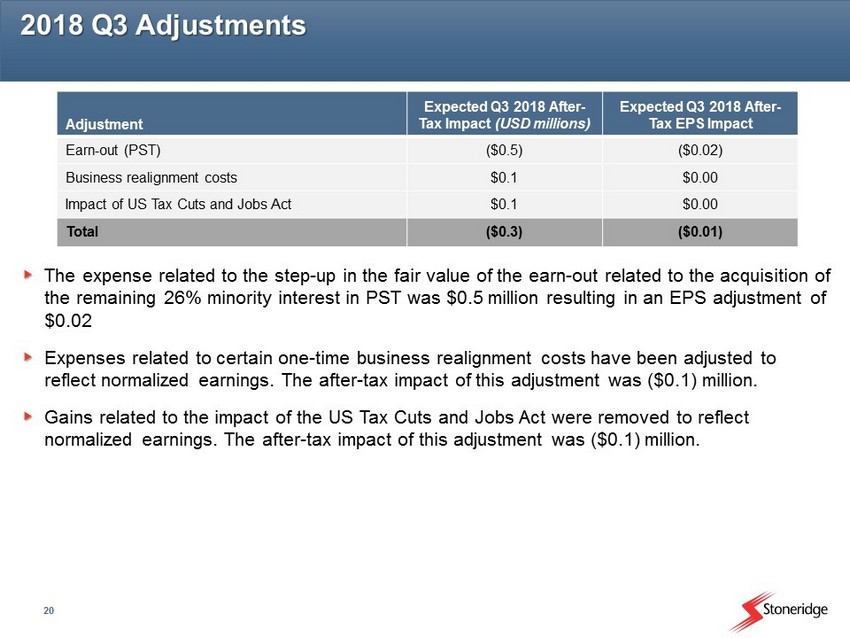

20 2018 Q3 Adjustments The expense related to the step - up in the fair value of the earn - out related to the acquisition of the remaining 26% minority interest in PST was $0.5 million resulting in an EPS adjustment of $0.02 Expenses related to certain one - time business realignment costs have been adjusted to reflect normalized earnings. The after - tax impact of this adjustment was ($0.1) million. Gains related to the impact of the US Tax Cuts and Jobs Act were removed to reflect normalized earnings. The after - tax impact of this adjustment was ($0.1) million. Adjustment Expected Q3 2018 After - Tax Impact (USD millions) Expected Q3 2018 After - Tax EPS Impact Earn - out (PST) ($0.5) ($0.02) Business realignment costs $0.1 $0.00 Impact of US Tax Cuts and Jobs Act $0.1 $0.00 Total ($0.3) ($0.01)

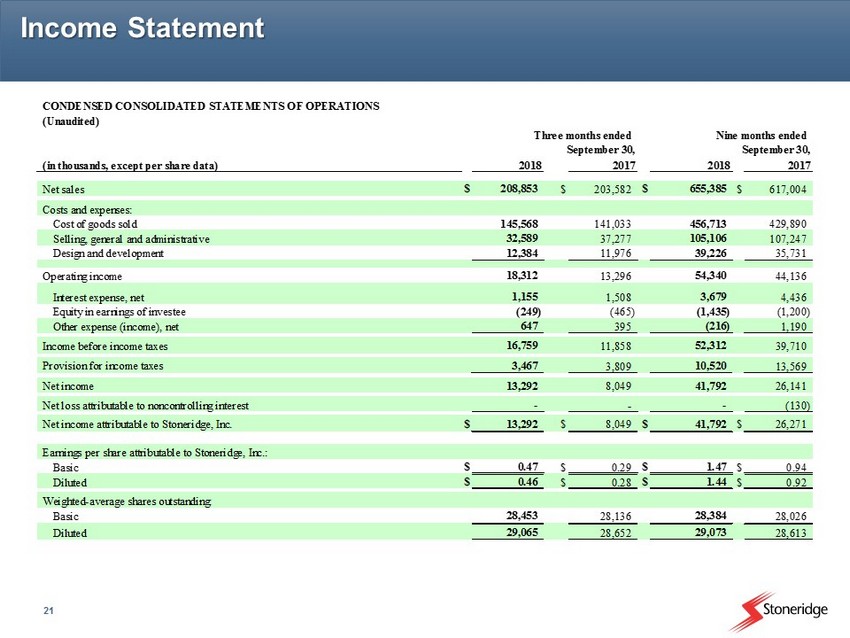

21 Income Statement (Unaudited) (in thousands, except per share data) 2018 2017 2018 2017 Net sales $ 208,853 $ 203,582 $ 655,385 $ 617,004 Costs and expenses: Cost of goods sold 145,568 141,033 456,713 429,890 Selling, general and administrative 32,589 37,277 105,106 107,247 Design and development 12,384 11,976 39,226 35,731 Operating income 18,312 13,296 54,340 44,136 Interest expense, net 1,155 1,508 3,679 4,436 Equity in earnings of investee (249) (465) (1,435) (1,200) Other expense (income), net 647 395 (216) 1,190 16,759 11,858 52,312 39,710 3,467 3,809 10,520 13,569 Net income 13,292 8,049 41,792 26,141 Net loss attributable to noncontrolling interest - - - (130) Net income attributable to Stoneridge, Inc. $ 13,292 $ 8,049 $ 41,792 $ 26,271 Earnings per share attributable to Stoneridge, Inc.: Basic $ 0.47 $ 0.29 $ 1.47 $ 0.94 Diluted $ 0.46 $ 0.28 $ 1.44 $ 0.92 Weighted-average shares outstanding: Basic 28,453 28,136 28,384 28,026 Diluted 29,065 28,652 29,073 28,613 CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS September 30, Income before income taxes Provision for income taxes Three months ended Nine months ended September 30,

22 Segment Financial Information 2018 2017 2018 2017 Net Sales: Control Devices $ 108,402 $ 106,842 $ 333,715 $ 339,716 Inter-segment sales 1,556 1,118 6,218 3,269 Control Devices net sales 109,958 107,960 339,933 342,985 Electronics 81,587 71,354 261,928 206,769 Inter-segment sales 9,067 8,959 29,310 30,538 Electronics net sales 90,654 80,313 291,238 237,307 PST 18,864 25,386 59,742 70,519 Inter-segment sales - 145 2 145 PST net sales 18,864 25,531 59,744 70,664 Eliminations (10,623) (10,222) (35,530) (33,952) Total net sales $ 208,853 $ 203,582 $ 655,385 $ 617,004 Operating Income (Loss): Control Devices $ 16,297 $ 16,249 $ 51,336 $ 55,257 Electronics 8,951 4,896 25,107 13,267 PST 668 1,018 1,553 2,720 Unallocated Corporate (7,604) (8,867) (23,656) (27,108) Total operating income $ 18,312 $ 13,296 $ 54,340 $ 44,136 Depreciation and Amortization: Control Devices $ 3,070 $ 2,664 $ 8,762 $ 8,050 Electronics 2,213 2,136 6,756 5,947 PST 1,583 2,115 5,828 6,299 Unallocated Corporate 200 181 596 376 Total depreciation and amortization $ 7,066 $ 7,096 $ 21,942 $ 20,672 Interest Expense, net: Control Devices $ 19 $ 19 $ 56 $ 84 Electronics 32 24 89 68 PST 230 378 762 1,482 Unallocated Corporate 874 1,087 2,772 2,802 Total interest expense, net $ 1,155 $ 1,508 $ 3,679 $ 4,436 Capital Expenditures: Control Devices $ 3,938 $ 5,523 $ 12,996 $ 13,318 Electronics 725 2,417 4,892 6,451 PST 522 974 2,477 2,899 Unallocated Corporate 786 811 2,451 2,224 Total capital expenditures $ 5,971 $ 9,725 $ 22,816 $ 24,892 Nine months endedThree months ended September 30,September 30,

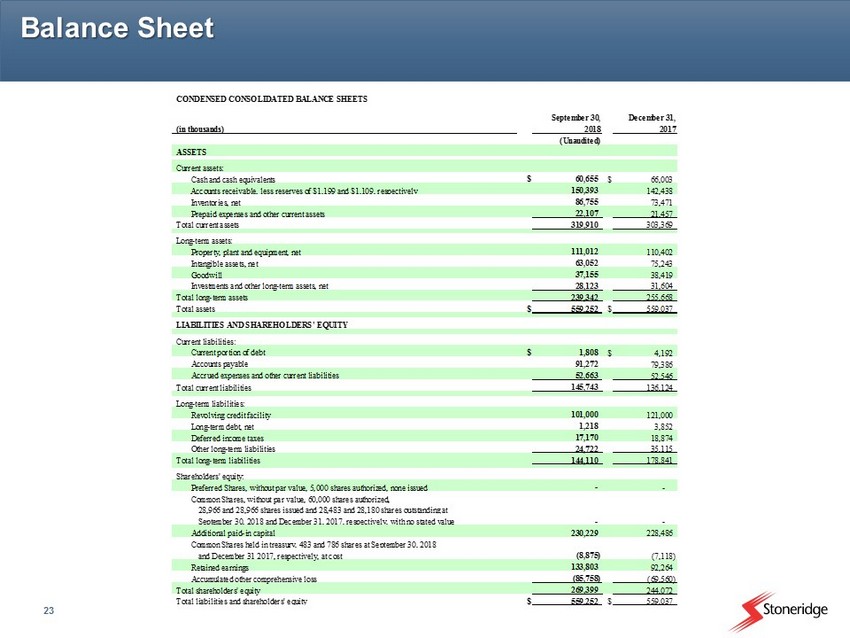

23 Balance Sheet CONDENSED CONSOLIDATED BALANCE SHEETS September 30, December 31, (in thousands) 2018 2017 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 60,655 $ 66,003 150,393 142,438 Inventories, net 86,755 73,471 Prepaid expenses and other current assets 22,107 21,457 Total current assets 319,910 303,369 Long-term assets: Property, plant and equipment, net 111,012 110,402 Intangible assets, net 63,052 75,243 Goodwill 37,155 38,419 Investments and other long-term assets, net 28,123 31,604 Total long-term assets 239,342 255,668 Total assets $ 559,252 $ 559,037 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of debt $ 1,808 $ 4,192 Accounts payable 91,272 79,386 Accrued expenses and other current liabilities 52,663 52,546 Total current liabilities 145,743 136,124 Long-term liabilities: Revolving credit facility 101,000 121,000 Long-term debt, net 1,218 3,852 Deferred income taxes 17,170 18,874 Other long-term liabilities 24,722 35,115 Total long-term liabilities 144,110 178,841 Shareholders' equity: Preferred Shares, without par value, 5,000 shares authorized, none issued - - Common Shares, without par value, 60,000 shares authorized, - - Additional paid-in capital 230,229 228,486 and December 31 2017, respectively, at cost (8,875) (7,118) Retained earnings 133,803 92,264 Accumulated other comprehensive loss (85,758) (69,560) Total shareholders' equity 269,399 244,072 Total liabilities and shareholders' equity $ 559,252 $ 559,037 September 30, 2018 and December 31, 2017, respectively, with no stated value 28,966 and 28,966 shares issued and 28,483 and 28,180 shares outstanding at Common Shares held in treasury, 483 and 786 shares at September 30, 2018 Accounts receivable, less reserves of $1,199 and $1,109, respectively

24 Statement of Cash Flows (Unaudited) Nine months ended September 30, (in thousands) 2018 2017 OPERATING ACTIVITIES: Net income $ 41,792 $ 26,141 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 17,073 15,922 Amortization, including accretion of deferred financing costs 5,112 4,993 Deferred income taxes 2,399 6,233 Earnings of equity method investee (1,435) (1,200) (Loss) gain on sale of fixed assets (21) 6 Share-based compensation expense 4,214 5,713 Tax benefit related to share-based compensation expense (879) (759) Change in fair value of earn-out contingent consideration 1,918 4,645 Accounts receivable, net (15,145) (18,232) Inventories, net (18,041) (6,564) Prepaid expenses and other assets (1,086) 1,530 Accounts payable 15,280 11,611 Accrued expenses and other liabilities (3,543) 1,079 Net cash provided by operating activities 47,638 51,118 INVESTING ACTIVITIES: Capital expenditures (22,816) (24,892) Proceeds from sale of fixed assets 44 66 Insurance proceeds for fixed assets 1,403 - Business acquisition, net of cash acquired - (77,258) Net cash used for investing activities (21,369) (102,084) Changes in operating assets and liabilities, net of effect of business combination: CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

25 Statement of Cash Flows (Cont.) (Unaudited) Nine months ended September 30, (in thousands) 2018 2017 FINANCING ACTIVITIES: Acquisition of noncontrolling interest, including transaction costs - (1,848) Revolving credit facility borrowings 27,500 91,000 Revolving credit facility payments (47,500) (32,000) Proceeds from issuance of debt 369 2,557 Repayments of debt (4,372) (10,307) Other financing costs - (61) Repurchase of Common Shares to satisfy employee tax withholding (4,206) (2,222) Net cash (used for) provided by financing activities (28,209) 47,119 Effect of exchange rate changes on cash and cash equivalents (3,408) 4,249 Net change in cash and cash equivalents (5,348) 402 Cash and cash equivalents at beginning of period 66,003 50,389 Cash and cash equivalents at end of period $ 60,655 $ 50,791 Supplemental disclosure of cash flow information: Cash paid for interest $ 3,899 $ 4,286 Cash paid for income taxes, net $ 14,899 $ 5,745 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

26 Reconciliations to US GAAP

27 Reconciliations to US GAAP This document contains information about Stoneridge's financial results which is not presented in accordance with accounting principles generally accepted in the United States ("GAAP"). Such non - GAAP financial measures are reconciled to their closest GAAP financial measures in the appendix of this document. The provision of these non - GAAP financial measures for 2017 and 2018 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non - GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this document and the adjustments that management can reasonably predict.

28 Reconciliations to US GAAP (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 Gross Profit 61.2$ 63.4$ 62.6$ 187.1$ 68.0$ 67.4$ 63.3$ 198.7$ Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco 1.0 0.7 1.6 Adjusted Gross Profit 62.1$ 64.1$ 62.6$ 188.8$ 68.0$ 67.4$ 63.3$ 198.7$ Reconciliation of Adjusted Gross Profit (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 Operating Income 15.2$ 15.7$ 13.3$ 44.1$ 16.8$ 19.2$ 18.3$ 54.3$ Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco 1.0 0.7 1.6 Add: Pre-Tax Transaction Costs Adjustment (Orlaco) 1.2 1.2 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 2.1 1.8 3.9 0.4 0.4 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.2 0.5 0.7 0.5 0.5 0.5 1.6 Add: Pre-Tax Business Realignment Costs 0.2 0.4 (0.1) 0.6 Adjusted Operating Income 17.4$ 18.7$ 15.6$ 51.6$ 18.0$ 20.1$ 18.7$ 56.8$ Reconciliation of Adjusted Operating Income (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 Income Before Tax 13.7$ 14.1$ 11.9$ 39.7$ 16.6$ 18.9$ 16.8$ 52.3$ Interest expense, net 1.4 1.5 1.5 4.4 1.4 1.2 1.2 3.7 Depreciation and amortization 6.5 7.1 7.1 20.7 7.8 7.1 7.1 21.9 EBITDA 21.6$ 22.7$ 20.5$ 64.8$ 25.8$ 27.2$ 25.0$ 77.9$ Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco 1.0 0.7 1.6 Add: Pre-Tax Transaction Costs Adjustment (Orlaco) 1.2 1.2 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 2.1 1.8 3.9 0.4 0.4 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.2 0.5 0.7 0.5 0.5 0.5 1.6 Add: Pre-Tax Business Realignment Costs 0.2 0.4 (0.1) 0.6 Adjusted EBITDA 23.8$ 25.7$ 22.8$ 72.3$ 26.9$ 28.1$ 25.4$ 80.4$ Reconciliation of Adjusted EBITDA

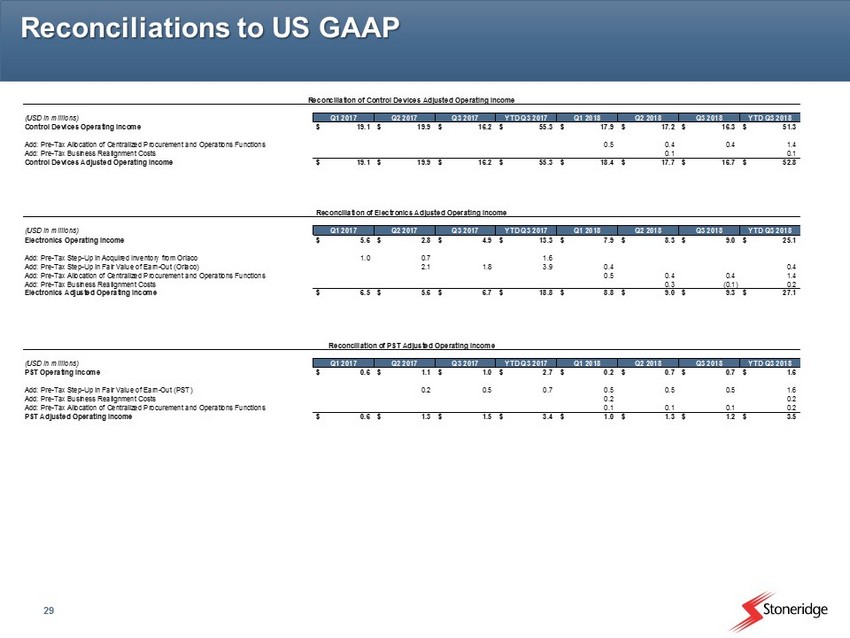

29 Reconciliations to US GAAP (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 Control Devices Operating Income 19.1$ 19.9$ 16.2$ 55.3$ 17.9$ 17.2$ 16.3$ 51.3$ Add: Pre-Tax Allocation of Centralized Procurement and Operations Functions 0.5 0.4 0.4 1.4 Add: Pre-Tax Business Realignment Costs 0.1 0.1 Control Devices Adjusted Operating Income 19.1$ 19.9$ 16.2$ 55.3$ 18.4$ 17.7$ 16.7$ 52.8$ Reconciliation of Control Devices Adjusted Operating Income (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 Electronics Operating Income 5.6$ 2.8$ 4.9$ 13.3$ 7.9$ 8.3$ 9.0$ 25.1$ Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco 1.0 0.7 1.6 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 2.1 1.8 3.9 0.4 0.4 Add: Pre-Tax Allocation of Centralized Procurement and Operations Functions 0.5 0.4 0.4 1.4 Add: Pre-Tax Business Realignment Costs 0.3 (0.1) 0.2 Electronics Adjusted Operating Income 6.5$ 5.6$ 6.7$ 18.8$ 8.8$ 9.0$ 9.3$ 27.1$ Reconciliation of Electronics Adjusted Operating Income (USD in millions) Q1 2017 Q2 2017 Q3 2017 YTD Q3 2017 Q1 2018 Q2 2018 Q3 2018 YTD Q3 2018 PST Operating Income 0.6$ 1.1$ 1.0$ 2.7$ 0.2$ 0.7$ 0.7$ 1.6$ Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 0.2 0.5 0.7 0.5 0.5 0.5 1.6 Add: Pre-Tax Business Realignment Costs 0.2 0.2 Add: Pre-Tax Allocation of Centralized Procurement and Operations Functions 0.1 0.1 0.1 0.2 PST Adjusted Operating Income 0.6$ 1.3$ 1.5$ 3.4$ 1.0$ 1.3$ 1.2$ 3.5$ Reconciliation of PST Adjusted Operating Income

30 Reconciliations to US GAAP (USD in millions) Q3 2018 Q3 2018 EPS Net Income Attributable to Stoneridge 13.3$ 0.46$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 0.5 $0.02 Less: After-Tax Impact of US Tax Cut and Jobs Act (0.1) ($0.00) Add: After-Tax Business Realignment Costs (0.1) ($0.00) Adjusted Net Income 13.6$ 0.47$ Reconciliation of Q3 2018 Adjusted EPS (USD in millions) Q3 2017 Q3 2017 EPS Net Income Attributable to Stoneridge 8.0$ 0.28$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 0.5 $0.02 Add: After-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 1.8 $0.06 Adjusted Net Income 10.3$ 0.36$ Reconciliation of Q3 2017 Adjusted EPS

31 Reconciliations to US GAAP (USD in millions) YTD Q3 2018 YTD Q3 2018 EPS Net Income Attributable to Stoneridge 41.8$ 1.44$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 1.6 $0.05 Add: After-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.4 $0.01 Less: After-Tax Impact of US Tax Cut and Jobs Act (0.1) ($0.00) Add: After-Tax Business Realignment Costs 0.4 $0.01 Adjusted Net Income 44.0$ 1.52$ Reconciliation of YTD Q3 2018 Adjusted EPS (USD in millions) YTD Q3 2017 YTD Q3 2017 EPS Net Income Attributable to Stoneridge 26.3$ 0.92$ Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 0.7 $0.02 Add: After-Tax Step-Up in Acquired Inventory from Orlaco 1.2 $0.04 Add: After-Tax Transaction Costs Adjustment (Orlaco) 0.8 $0.03 Add: After-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 3.9 $0.14 Adjusted Net Income 32.9$ 1.15$ Reconciliation of YTD Q3 2017 Adjusted EPS