Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EARTHSTONE ENERGY INC | a8-ksabaloproformasandhist.htm |

| EX-99.5 - EXHIBIT 99.5 - EARTHSTONE ENERGY INC | ex995shadreservereport.htm |

| EX-99.3 - EXHIBIT 99.3 - EARTHSTONE ENERGY INC | ex993-sabaloproformas.htm |

| EX-99.2 - EXHIBIT 99.2 - EARTHSTONE ENERGY INC | ex992auditedshadfs.htm |

| EX-99.1 - EXHIBIT 99.1 - EARTHSTONE ENERGY INC | ex991auditedsabalofs.htm |

| EX-23.2 - EXHIBIT 23.2 - EARTHSTONE ENERGY INC | ex232consentofwdvongontenco.htm |

| EX-23.1 - EXHIBIT 23.1 - EARTHSTONE ENERGY INC | ex231consentoffisherherbst.htm |

October 16, 2018

Mr. Barry Clark

Sabalo Energy, LLC

800 North Shoreline Blvd.

Suite 900N

Corpus Christi, Texas 78401

Re: Sabalo Energy, LLC

Estimate of Reserves & Revenues

Year End 2017 SEC Pricing

“As of” January 1, 2018

Dear Mr. Clark:

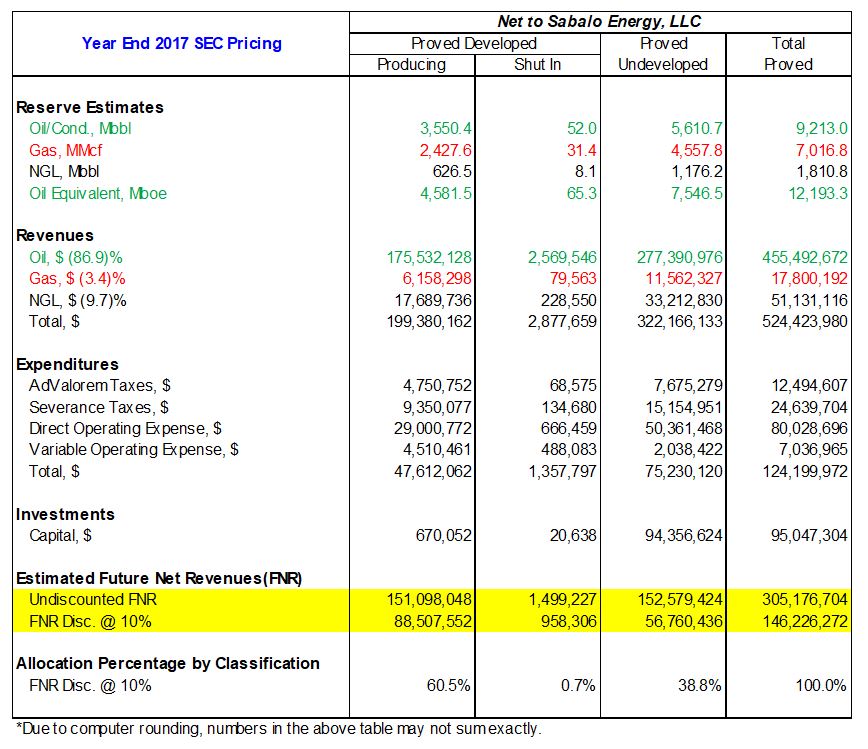

At your request, W.D. Von Gonten & Co. has estimated reserves and future net revenues attributable to all of the oil and gas interests currently owned by Sabalo Energy, LLC (Sabalo). In all, the properties represented herein are located in Howard County, Texas. This report utilized an effective date of January 1, 2018, was prepared using constant prices and costs, and conforms to Item 1202(a)(8) of Regulation S-K and other rules of the Securities and Exchange Commission (SEC). This report was prepared for the inclusion as an exhibit in a filing to be made with the SEC. A summary of the discounted future net revenue attributable to Sabalo’s Proved oil and gas reserves, “As of” January 1, 2018, is as follows:

Sabalo Energy, LLC – Year End 2017 Reserves Report – October 16, 2018 - Page 1

Purpose of Report - The purpose of this report is to provide Sabalo with an estimation of the reserves and future net revenues attributable to 100% of the Proved oil and gas interests presently owned. All of the reserves are in Howard County, Texas.

Reporting Requirements - SEC Regulation S-X, Rule 4-10 and Regulation S-K, Item 1200, and Financial Accounting Standards Board (FASB) Statement No. 69 require oil and gas reserve information to be reported by publicly held companies as supplemental financial data. These regulations and standards provide for estimates of Proved reserves and revenues discounted at 10% and based on unescalated prices and costs. Revenues based on alternate product price scenarios may be reported in addition to the current pricing case.

The Society of Petroleum Engineers (SPE) requires Proved reserves to be economically recoverable with prices and costs in effect on the “as of” date of the report. In conjunction with the World Petroleum Council (WPC), American Association of Petroleum Geologists (AAPG), and the Society of Petroleum Evaluation Engineers (SPEE), the SPE has issued Petroleum Resources Management System (2007 ed.), which sets forth the definitions and requirements associated with the classification of both reserves and resources. In addition, the SPE has issued Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserve Information, which sets requirements for the qualifications and independence of reserve estimators and auditors.

The estimated Proved reserves herein have been prepared in conformance with all SEC, SPE, WPC, AAPG, and SPEE definitions and requirements.

Property Discussion

W.D. Von Gonten & Co. reviewed 100% of Sabalo’s reserves as of January 1, 2018. Sabalo is presently involved in both operated and non-operated activities surrounding the horizontal development of previously established reservoirs such as the Spraberry and Wolfcamp. Surrounding the Sabalo position, the activity level in Howard County continues to increase with numerous operators drilling similar offset wells.

Due to a robust drilling program, a few of the producing wells are currently shut in for offset fracking. Those wells have been moved to the Proved Developed Shut In (PSI) category.

In addition to Sabalo’s horizontal assets, this report also includes vertical assets purchased from Finley Resources Inc. in August 2016. These assets are associated with the Cisco, Canyon, and Pennsylvanian reservoirs.

Sabalo Energy, LLC – Year End 2017 Reserves Report – October 16, 2018 - Page 2

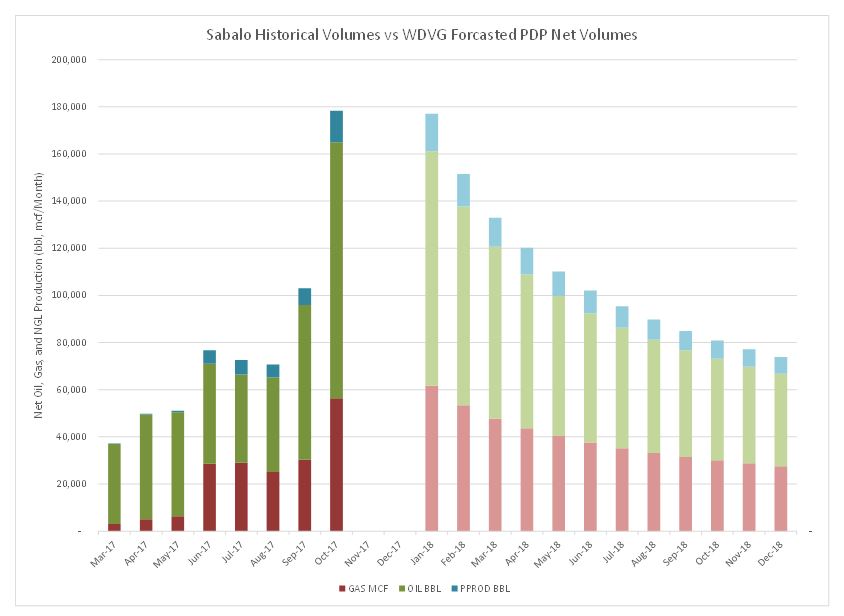

Figure 1 displays the comparison of Sabalo’s historical monthly net production and W.D. Von Gonten & Co.’s forecasted net monthly production beginning January 1, 2018.

Figure 1: Historical Net Production and PDP Reserves Forecast as of January 1, 2018

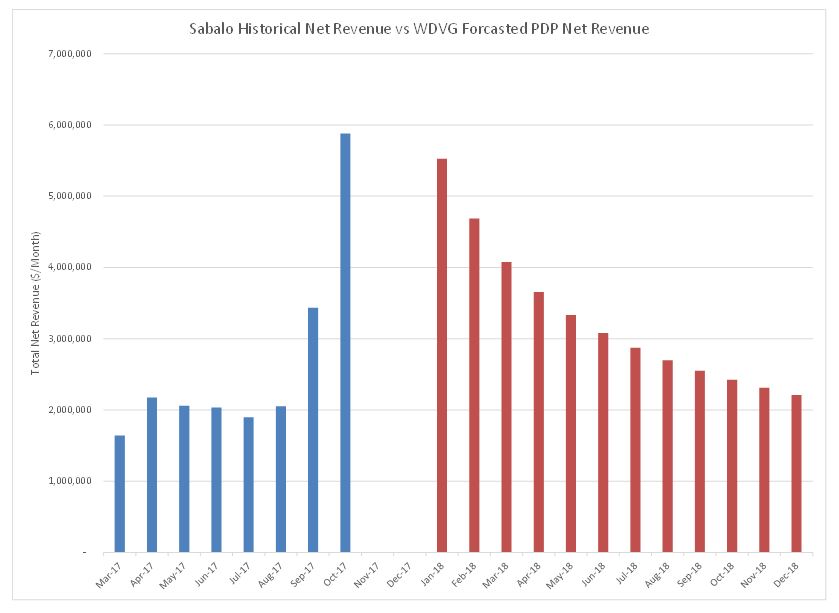

Figure 2 below is a graphical comparison of Sabalo’s March through October 2017 historical net revenue and W.D. Von Gonten & Co.’s forecasted net revenue beginning January 2018.

Figure 2: Historical Net Revenue and Forecasted Net Revenue as of January 1, 2018

Sabalo Energy, LLC – Year End 2017 Reserves Report – October 16, 2018 - Page 3

Reserves Discussion

Reserves estimates represented herein were generally determined through the implementation of various methods including but not limited to performance decline, volumetric calculation, material balance calculation/projection, type curve analysis, and analogy. Based on the amount of available data and/or the type of specific reservoir in question, one or more of the above methods was utilized as deemed appropriate by us.

Specifically, reserves associated with the Producing category were primarily based on performance decline where applicable. For completions associated with newer wells with no established trend, or in cases that we felt performance alone was inappropriate, some combination of the methods mentioned above was utilized. Reserves estimates associated with the Nonproducing and Undeveloped categories were primarily based on a combination of type curve analysis, volumetric analysis, material balance calculation/projection, and analogy.

Estimates of gas stream loss, also known as shrinkage, were provided by Sabalo and were confirmed on a summary basis by W.D. Von Gonten & Co. through historical lease operating data that was provided.

Reserves and schedules of production included in this report are only estimates. The amount of available data, reservoir and geological complexity, reservoir drive mechanism, and mechanical aspects can have a material effect on the accuracy of these reserve estimates. Due to inherent uncertainties in future production rates, well costs, commodity prices, and geologic conditions, it should be recognized that the reserve estimates, the reserves actually recovered, the revenue derived therefrom, and the actual cost incurred could be more or less than the estimated amounts. We consider the assumptions, data, methods, and procedures used in this report appropriate, and we have used all such methods and procedures that we consider necessary and appropriate to prepare the estimates of reserves and future net revenues herein.

Product Prices Discussion

SEC pricing is determined by averaging the first day of each month’s closing price for the previous calendar year using published benchmark oil and gas prices. This method, as applied for the purposes of this report, results in a price of $51.34 per barrel of oil and $3.02 per MMBtu of gas. These prices were held constant throughout the life of the properties as required by SEC guidelines.

W.D. Von Gonten & Co. included a basis differential for each property to account for the difference between prices actually received and the NYMEX price. These differentials account for transportation costs, geographical differentials, quality adjustments, marketing bonuses or deductions, and any other factors that may affect the price actually received at the wellhead.

Based on Sabalo’s LPC Crude Oil Marketing contracts, W.D. Von Gonten & Co. applied an oil differential of -$1.90/bbl to each well. The differential was supported by revenue data provided by Sabalo and represents the time period June 2017 through January 2018. The gas and NGL differentials were determined from plant statements representing the time period February 2017 through January 2018. Additionally, the same statements were used to calculate shrinkage and NGL yield.

Operating Expenses and Capital Costs Discussion

Sabalo provided a lease operating statement (LOS) covering the time period February through October 2017. Based on the supplied data, W.D. Von Gonten & Co. determined and applied a direct and variable cost to each vertical well. Sabalo owns the salt water disposal (SWD) system in Howard County, therefore a SWD cost of $0.17/bbl was applied to each well in this area, as provided by Sabalo.

For the Spraberry and Wolfcamp wells, historical data is limited. Therefore, Sabalo and W.D. Von Gonten & Co. agreed to use the following fixed costs based on knowledge derived from similar work in the area. The fixed gross cost per well, for the first 18 months, is approximately $30,000 before dropping to

Sabalo Energy, LLC – Year End 2017 Reserves Report – October 16, 2018 - Page 4

approximately $7,000 for the remaining life of each property. SWD costs, as provided by Sabalo, are modeled at $2.50/bbl for the first month assuming trucking to third party disposal facilities. Afterwards, Sabalo operated wells utilize Sabalo’s own system which is modeled at $0.17/bbl. The non-operated wells demonstrate an average SWD cost of $1.00/bbl.

All capital costs associated with drilling activities were provided by Sabalo. W.D. Von Gonten & Co. only reviewed such estimates for reasonableness.

All utilized operating expenses and capital costs were held constant throughout the life of the properties.

Other Considerations

Abandonment Costs - Cost estimates regarding future plugging and abandonment procedures associated with these properties were not supplied by Sabalo for the purposes of this report. Based on our prior experience, W.D. Von Gonten & Co. has applied plugging and abandonment costs to each property. As we have not inspected the properties personally, W.D. Von Gonten & Co. expresses no warranties regarding the accuracy or validity of our assumptions. A third party study would be necessary in order to accurately estimate all future abandonment liabilities.

Data Sources - Historical performance data was either provided by Sabalo or extracted from public data sources for all properties represented in this report. Sabalo provided all other information, including but not limited to, flow back data, ownership, drilling locations, capital cost estimates, drilling schedules, lease maps, geologic interpretations, well logs, stimulation data, and test information. While every attempt was made by W.D. Von Gonten & Co. to check such data for reasonableness, we make no warranties as to the accuracy or completeness of such data.

While oil and gas industry may be subject to regulatory changes from time to time that could affect an industry participant’s ability to recover its oil and gas reserves, we are not aware of any such governmental actions which would restrict the recovery of the January 1, 2018 estimated oil and gas volumes. The reserves in this report can be produced under current regulatory guidelines. Actual future commodity prices may differ substantially from the utilized pricing scenario which may or may not extend or limit the estimated reserve and revenue quantities presented in this report.

We have not inspected the properties included in this report, nor have we conducted independent well tests. W.D. Von Gonten & Co. and our employees have no direct ownership in any of the properties included in this report. Our fees are based on hourly expenses, and are not related to the reserve and revenue estimates produced in this report.

Thank you for the opportunity to assist Sabalo Energy, LLC with this project.

Sabalo Energy, LLC – Year End 2017 Reserves Report – October 16, 2018 - Page 5