Attached files

| file | filename |

|---|---|

| 8-K - THOR INDUSTRIES, INC. 8-K - THOR INDUSTRIES INC | a51868176.htm |

| EX-99.2 - EXHIBIT 99.2 - THOR INDUSTRIES INC | a51868176ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - THOR INDUSTRIES INC | a51868176ex99_1.htm |

Exhibit 99.3

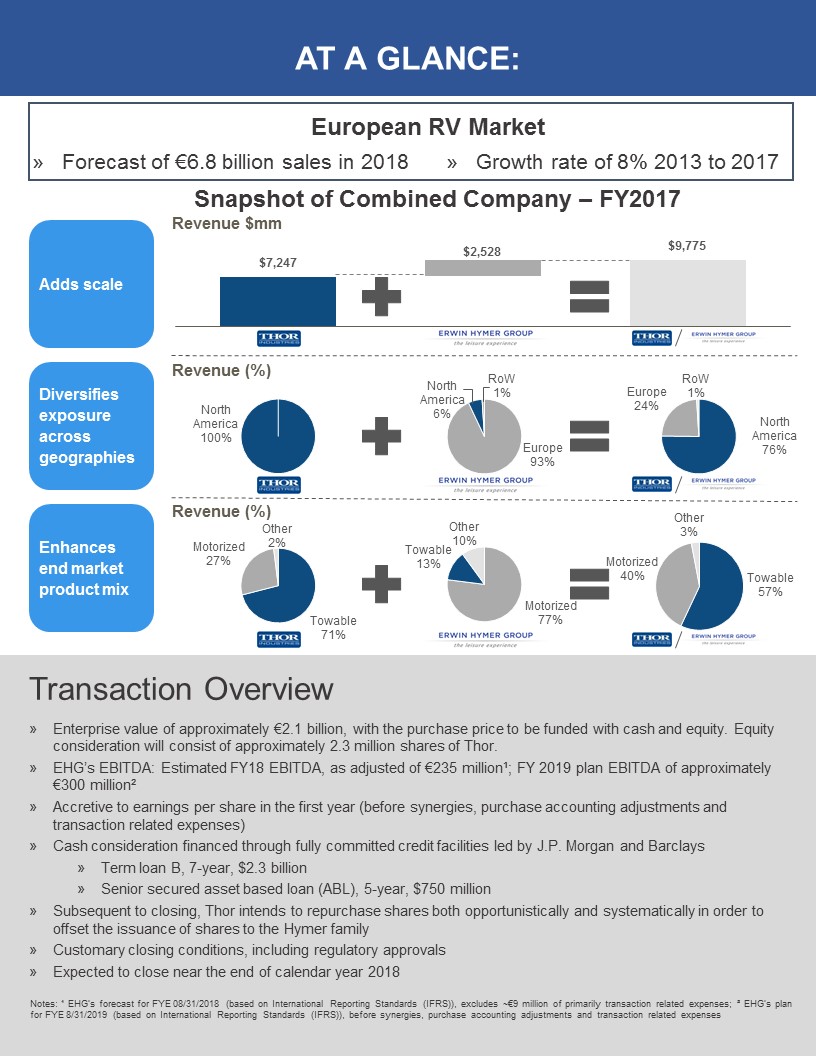

FactsheetThor Industries’ Acquisition of Erwin Hymer Group Creates the #1 Global RV Manufacturer with a Leading Portfolio of Brands, Dealer Network and Global Reach Combining the premier North American and European RV companies Establishes a Leading Position in Growing European RV Market Significant Mutual Benefits to be Derived from Sharing Design, R&D, Technology, Engineering and Manufacturing Excellence Numerous Areas of Near-Term and Long-Term Synergies between the Two Companies Aligned with Thor’s Strategic Plan to Enhance Shareholder Value

Snapshot of Combined Company – FY2017 AT A GLANCE: Transaction OverviewEnterprise value of approximately €2.1 billion, with the purchase price to be funded with cash and equity. Equity consideration will consist of approximately 2.3 million shares of Thor.EHG’s EBITDA: Estimated FY18 EBITDA, as adjusted of €235 million¹; FY 2019 plan EBITDA of approximately €300 million²Accretive to earnings per share in the first year (before synergies, purchase accounting adjustments and transaction related expenses)Cash consideration financed through fully committed credit facilities led by J.P. Morgan and BarclaysTerm loan B, 7-year, $2.3 billion Senior secured asset based loan (ABL), 5-year, $750 millionSubsequent to closing, Thor intends to repurchase shares both opportunistically and systematically in order to offset the issuance of shares to the Hymer familyCustomary closing conditions, including regulatory approvalsExpected to close near the end of calendar year 2018 Adds scale Diversifies exposure across geographies Enhances end market product mix Notes: ¹ EHG’s forecast for FYE 08/31/2018 (based on International Reporting Standards (IFRS)), excludes ~€9 million of primarily transaction related expenses; ² EHG’s plan for FYE 8/31/2019 (based on International Reporting Standards (IFRS)), before synergies, purchase accounting adjustments and transaction related expenses Revenue $mm Revenue (%) Revenue (%) European RV Market Growth rate of 8% 2013 to 2017 Forecast of €6.8 billion sales in 2018

FORWARD LOOKING STATEMENTS This fact sheet contains forward-looking information related to Thor Industries, Inc., and the acquisition of the Erwin Hymer Group (EHG), that is based on current expectations and involves substantial risks and uncertainties that could cause actual results, performance, events, or transactions to differ materially from those expressed or implied by such statements. Forward-looking statements include, among other things, statements about Thor’s plans, objectives, expectations and intentions; the anticipated timing of the closing of the acquisition; the potential benefits of the proposed acquisition, and the anticipated operating synergies; the satisfaction of the conditions to closing the acquisition (including obtaining necessary regulatory approvals) in the anticipated timeframe or at all; the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and Erwin Hymer Group’s business. Other business risks include raw material and commodity price fluctuations; raw material, commodity or chassis supply restrictions; the level of warranty claims incurred; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation, legal and compliance issues including those that may arise in conjunction with recent transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers; restrictive lending practices; management changes; the success of new and existing products and services; consumer preferences; the ability to efficiently utilize production facilities; the pace of acquisitions and the successful closing, integration and financial impact thereof; the potential loss of existing customers of acquisitions; our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; asset impairment charges; cost structure changes; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand; general economic, market and political conditions; and changes to investment and capital allocation strategies or other facets of our strategic plan. In addition, actual results, performance, events and transactions, are subject to other risks and uncertainties that relate more broadly to Thor’s overall business, including those more fully described in Thor’s filings with the U.S. Securities and Exchange Commission (“SEC”) (including, but not limited to, the factors discussed in Item 1A. Risk Factors of Thor’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q). In light of these risks, uncertainties, and other factors, you are cautioned not to place undue reliance on the forward-looking information. Thor, except as required by law, undertakes no obligation to update or revise the forward-looking statements, whether as a result of new developments or otherwise.