Attached files

| file | filename |

|---|---|

| 8-K - THOR INDUSTRIES, INC. 8-K - THOR INDUSTRIES INC | a51868176.htm |

| EX-99.3 - EXHIBIT 99.3 - THOR INDUSTRIES INC | a51868176ex99_3.htm |

| EX-99.1 - EXHIBIT 99.1 - THOR INDUSTRIES INC | a51868176ex99_1.htm |

Exhibit 99.2

Thor’s Acquisition of Erwin Hymer Group Creates The Premier Global RV Manufacturer

Forward Looking Statements This presentation contains forward-looking information related to Thor Industries, Inc., and the acquisition of the Erwin Hymer Group (EHG), that is based on current expectations and involves substantial risks and uncertainties that could cause actual results, performance, events, or transactions to differ materially from those expressed or implied by such statements. Forward-looking statements include, among other things, statements about Thor’s plans, objectives, expectations and intentions; the anticipated timing of the closing of the acquisition; the potential benefits of the proposed acquisition, and the anticipated operating synergies; the satisfaction of the conditions to closing the acquisition (including obtaining necessary regulatory approvals) in the anticipated timeframe or at all; the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and Erwin Hymer Group’s business. Other business risks include raw material and commodity price fluctuations; raw material, commodity or chassis supply restrictions; the level of warranty claims incurred; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation, legal and compliance issues including those that may arise in conjunction with recent transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers; restrictive lending practices; management changes; the success of new and existing products and services; consumer preferences; the ability to efficiently utilize production facilities; the pace of acquisitions and the successful closing, integration and financial impact thereof; the potential loss of existing customers of acquisitions; our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; asset impairment charges; cost structure changes; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand; general economic, market and political conditions; and changes to investment and capital allocation strategies or other facets of our strategic plan. In addition, actual results, performance, events and transactions, are subject to other risks and uncertainties that relate more broadly to Thor’s overall business, including those more fully described in Thor’s filings with the U.S. Securities and Exchange Commission (“SEC”) (including, but not limited to, the factors discussed in Item 1A. Risk Factors of Thor’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q). In light of these risks, uncertainties, and other factors, you are cautioned not to place undue reliance on the forward-looking information. Thor, except as required by law, undertakes no obligation to update or revise the forward-looking statements, whether as a result of new developments or otherwise. 2

3 Thor has agreed to acquire Erwin Hymer Group (“EHG”) for an enterprise value of approximately €2.1 billion, with the purchase price to be funded with cash and equity. Equity consideration will consist of approximately 2.3 million shares of Thor. Thor is the #1 manufacturer in North America with over $8.3 billion¹ in revenueErwin Hymer Group is the #1 manufacturer in Europe (based on revenue) with forecasted FY18 sales of €2.5 billion² ($2.9 billion³ at current exchange rate) Combining the premier North American and European RV companies Notes: 1 Trailing twelve months ended 4/30/2018; ² EHG’s forecast for FYE 8/31/2018; 3 Exchange rate of USD / EUR:1.16

4 Strategic rationale Creates the #1 Global RV Manufacturer with a Leading Portfolio of Brands, Dealer Network and Global ReachEstablishes a Leading Position in Growing European RV Market with a Complementary and Geographically Diverse Product PortfolioSignificant Mutual Benefits Derived from Sharing Design, R&D, Technology, Engineering and Manufacturing Excellence Numerous Areas of Near-Term and Long-Term Synergies between the Two Companies Aligned with Thor’s Strategic Plan to Enhance Shareholder Value – Transaction to be Accretive to Earnings in First Year* *Before anticipated synergies, purchase accounting adjustments and transaction related expenses

5 Erwin Hymer Group key statistics 1957HYMER FAMILY BEGAN Recreational vehicle production ~62Kunits sold in FYE 2018 24Renowned brands €2.5BForecasted fy18 sales ~7,300Dedicated team members in 2018 9RV Production facilities in Germany, UK, Italy and Canada ~1,200Dealers across 35 countries ~29%European market share by revenue

6 Erwin Hymer Group overview Motor Caravans68% Campervans17% Caravans15% By type3 €2.0bn 1 EHG’s FYE 08/31/17; 2 Total revenues; 3 Vehicle revenues only, excludes revenues from accessories, services, rental, and others; 4 Exchange rate of USD / EUR:1.16 Vehicles 90% Owndealerships 4% By segment2 Accessoriesand services 3% Rental 3% €2.2bn Other<1% Germany 51% UK 11% France 7% North America 6% RoW 1% By region2 €2.2bn RoE 24% 2017 Revenue breakdown1 EHG is the leading manufacturer of recreational vehicles in Europe, with ~29% market share, and is the only European manufacturer with a North American presence $2.6bn4 $2.6bn4 $2.3bn4 U.S. Europe RV categories Travel Trailer Class BClass A / C CaravanCampervanMotor Caravan ===

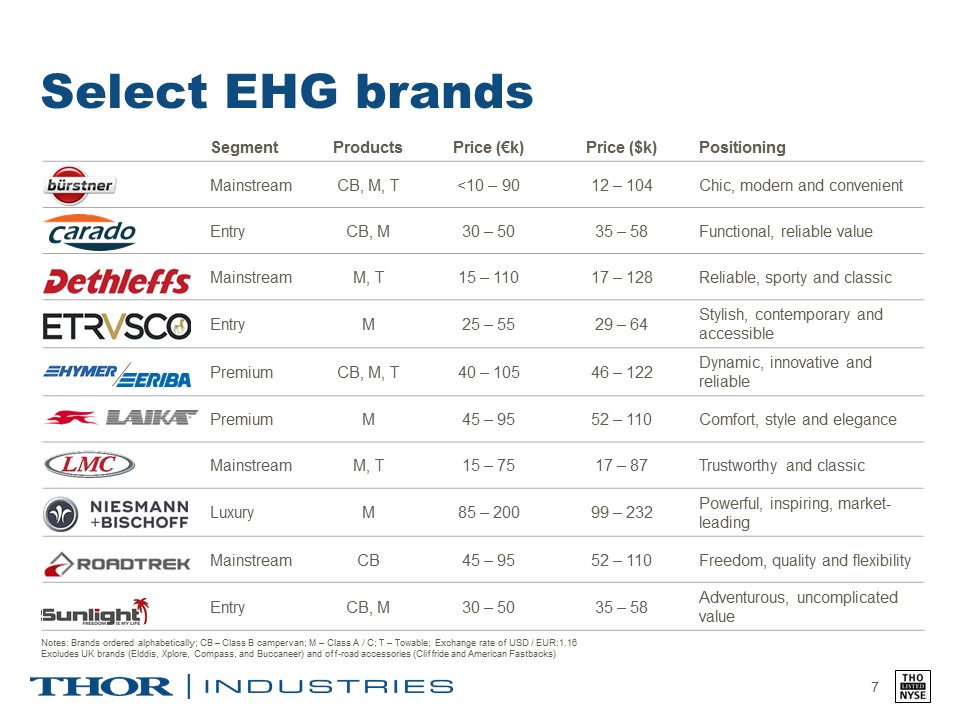

7 Select EHG brands Notes: Brands ordered alphabetically; CB – Class B campervan; M – Class A / C; T – Towable; Exchange rate of USD / EUR:1.16Excludes UK brands (Elddis, Xplore, Compass, and Buccaneer) and off-road accessories (Cliffride and American Fastbacks) Segment Products Price (€k) Price ($k) Positioning Mainstream CB, M, T <10 – 90 12 – 104 Chic, modern and convenient Entry CB, M 30 – 50 35 – 58 Functional, reliable value Mainstream M, T 15 – 110 17 – 128 Reliable, sporty and classic Entry M 25 – 55 29 – 64 Stylish, contemporary and accessible Premium CB, M, T 40 – 105 46 – 122 Dynamic, innovative and reliable Premium M 45 – 95 52 – 110 Comfort, style and elegance Mainstream M, T 15 – 75 17 – 87 Trustworthy and classic Luxury M 85 – 200 99 – 232 Powerful, inspiring, market-leading Mainstream CB 45 – 95 52 – 110 Freedom, quality and flexibility Entry CB, M 30 – 50 35 – 58 Adventurous, uncomplicated value

8 Product line-up spans across multiple price points and categories Motorized recreational vehiclesPrice range1:€32,000–€180,000$37,100–$208,800 Towable recreational vehiclesPrice range1:€8,700–€45,000$10,100–$52,200 Motorized recreational vehicle on van chassisPrice range1:€32,000–€90,000$37,100–$104,400 Caravanning equipment, camping accessories and tent trailersChassis and suspension technology Global rental of recreational vehiclesConsulting and financing services for dealersOnline travel portal ~27,300 vehicles sold2 (107,225 total market) ~16,700 vehicles sold2 (78,530 total market) ~9,300 vehicles sold2 ~2,6003 vehicles in rental fleet2 Notes: Exchange rate of USD / EUR:1.161 Manufacturer selling price; 2 FYE 2017A, Hymer unit sales; 3 Excluding franchises 25.5% by volume 21.3% by volume Motorcaravans Caravans Campervans Accessories and services Other

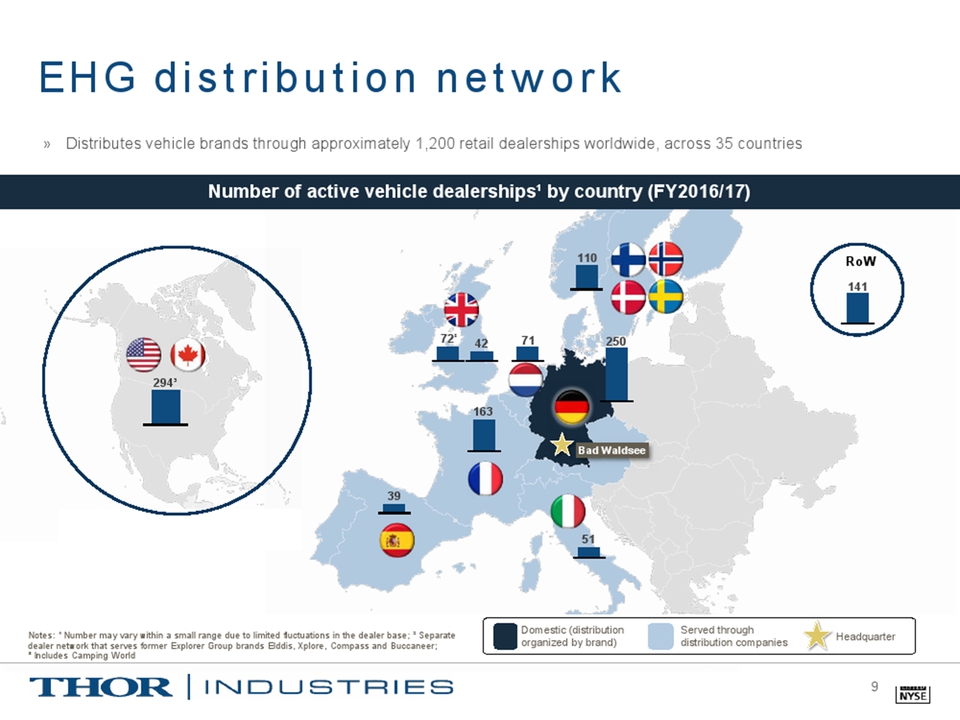

Number of active vehicle dealerships¹ by country (FY2016/17) ² RoW Bad Waldsee 9 EHG distribution network Distributes vehicle brands through approximately 1,200 retail dealerships worldwide, across 35 countries Notes: ¹ Number may vary within a small range due to limited fluctuations in the dealer base; ² Separate dealer network that serves former Explorer Group brands Elddis, Xplore, Compass and Buccaneer; ³ Includes Camping World Domestic (distribution organized by brand) Served throughdistribution companies Headquarter

10 Snapshot of combined company Adds scale Diversifies exposure across geographies Enhances end market product mix Notes: Exchange rate of USD / EUR:1.16; Revenue based on FYE 7/31/2017 for Thor and FYE 8/31/2017 for EHG Revenue ($mm) Revenue (%) Revenue (%) Based on 2017 Actual Results

11 European RV industry 2017 European RV market share (by sales) 2017 Europe RV market overview (€bn) €6.1bn 65% 21% 14% Motorcaravan Caravan Campervan Source: Company information, leading consulting firm 7% CAGR 9% CAGR 4% CAGR 4% CAGR 33% CAGR 12% CAGR

12 Strong growing European RV market Source: CIVD; European Commission; World Bank; Leading consulting firm Motorhomes New vehicle registrations by type (’000) 3.7 3.0 1.4 1.1 (0.1) 2.8 2.7 2.0 2.9 3.0 3.0 3.9 2.2 1.4 1.3 2.6 2.1 3.3 3.1 0.5 (4.4) 2.1 1.7 (0.4) 0.3 1.7 2.3 1.9 2.2 % GDP Growth +8.2%

EHG has a long track record of industry-leading product innovation 13 1960’s 1970’s 1980’s 1990’s 2000’s 2010’s 1968Wheel housing refrigerator 1966Crank handle skylights 1976Pull-down double bed for motorcaravans 1975 - 76Pop-top roof for campervans 1986First OEM to guarantee 6 years waterproofness 1978PUAL1 technology based walls 1996Introduction of central locking to EHG models 1993 - 94Development of Hymer bonding technology 2012 - 15Lightweighttechnology leads to first integrated MC on Mercedes Benz basis2 2000Introduction of heated double floors 1 Polyurethane foam is filled into the walls to enhance insulation and stability2 Below 3.5t (Hymermobil ML-I) Marketing / PR campaignSunlight factory team SafetyNiesmann+Bischoff Flair Exterior DesignDethleffs Coco Bloggers FavoriteConcept Car e.home TechnologyHymer B-SL SLC Chassis Overall campervan conceptHymer DuoCar Floor planBürstner Lyseo TD 745 Recent award-winning innovations Industry standard setting innovations Major innovations in Hymer products

EHG management team 14 CEO since August 2015Prior experience with Zumtobel, Assa Abloy and Baumgartner & Partner CFO since September 2017Prior experience with Bizerba, Spheros, Sennheiser and Kosta CSO since December 2017Held EHG management positions since 2008Prior experience with MAN and Neoplan CTO since December 2017Held EHG management positions since 2011Prior experience in Schuler Pressen, Coperion and Müller Weingarten Martin Brandt – CEO Stefan Junker – CFO Jan de Haas – CSO Jörg Reithmeier – CTO Experienced, proven CEO and management team with a track record of creating value and growing share at EHG

15 TransactionHighlights Transaction overview Enterprise value of approximately €2.1 billion, with the purchase price to be funded with cash and equity. Equity consideration will consist of approximately 2.3 million shares of Thor. EHG’s EBITDA: Estimated FY18 EBITDA, as adjusted of €235 million¹; FY 2019 plan EBITDA of approximately €300 million² Accretive to earnings per share (before synergies, purchase accounting adjustments and transaction related expenses) Notes: 1 EHG’s forecast for FYE 08/31/2018 (based on International Reporting Standards (IFRS)), excludes ~€9 million of primarily transaction related expenses; ² EHG’s plan for FYE 8/31/2019 (based on International Reporting Standards (IFRS)), before synergies, purchase accounting adjustments and transaction related expenses Closing of transaction Financing Cash consideration financed through fully committed credit facilities led by J.P. Morgan and BarclaysTerm loan B, 7-year, $2.3 billionSenior secured assets based loan (ABL), 5-year, $750 millionSubsequent to closing, Thor intends to repurchase shares both opportunistically and systematically in order to offset the issuance of shares to the Hymer family Customary closing conditions, including regulatory approvalsExpected to close near the end of calendar year 2018

16 Synergies expected to create meaningful additional value Engineering & DesignR&D and Technology MarketingHuman Resources Strategies Thor has a Proven Track Record of Generating Significant Acquisition Related Synergies Thor and EHG to Mutually Benefit from Sharing of Best Practices Leveraging Manufacturing and Financial Management Expertise Overall Spending LeverageProcurement Strategies Production MethodologiesWorking Capital Management

17 Thor Industries capital strategy Invest in Organic Growth InitiativesReduce Outstanding DebtOpportunistically Fund Acquisitions in Global RV Industry – both Core and Adjacencies Return Capital to Shareholders with Predictable Dividend Growth and Share Repurchase Strong cash flow supports a balanced approach to debt reduction, growth investments and returns to shareholders

18 Key investment highlights Leading European RV manufacturer Strong management team with proven ability to grow the business and deliver innovative products Diversified geographic exposure to fast-growing European RV market Well-recognized brands with a highly complementary product portfolio Global assembly footprint and unrivalled European distribution network – only European OEM with North American production and distribution

19

20 APPENDIX

EHG history 21 0 1957 1990 1991 1996 1998 2000 2004 2005/6 2011 2018 1 CMC Founded by Erwin Hymer in 1980; 2 Manufacturer of recreational vehicles for Carado and Sunlight brands 2013 Successful delisting of Hymer AG and return to 100% Hymer family ownership as a prerequisite to merge CMC Caravan and Hymer Start of Erwin Hymer as recreational vehicle manufacturer Merger of CMC Caravan into Erwin Hymer Group (EHG) 2015 2016 2017 Initial public offering as Hymer AG EHG Acquired EHG Acquired EHG Acquired EHG Acquired Beginning of repurchasing program for outstanding shares of Hymer AG Establishment of Erwin Hymer Group AG & Co CMC1 Acquired Hymer AG Acquired Founding of Movera as Hymer AG and CMC joint venture Hymer Ag Acquired Hymer Ag Acquired Founding of Capron JV, Carado and Sunlight2