Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vanguard Natural Resources, Inc. | form8-kforinvestorpresenta.htm |

247 / 247 / 247 176 / 176 / 181 36 / 31 / 85 0 / 155 / 199 Vanguard Natural Resources, Inc. 101 / 113 / 152 Investor Presentation—2Q 2018 0 / 85 / 140

Safe Harbor Language and Legal Disclosure Forward Looking Statements Statements made by representatives of Vanguard Natural Resources, Inc. (“Vanguard,” “VNRR,” or the “Company”) during the course of this presentation that are not historical facts are forward looking statements. Terminology such as “will,” “would,” “should,” “could,” “expect,” “anticipate,” “plan,” “project,” “intend,” “estimate,” “believe,” “target,” “continue,” “on track,” “potential,” the negative of such terms or other comparable terminology are intended to identify forward looking statements. These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate as of the date this presentation was prepared. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward looking statements. These include risks relating to financial performance and results, the ability to improve Vanguard’s results and profitability following its emergence from bankruptcy; our indebtedness under our revolving credit facility, term loan and second lien notes; availability of sufficient cash flow to make payments on our debt obligations and to execute our business plan; our prices and demand for oil, natural gas and natural gas liquids; our ability to replace reserves and efficiently develop our reserves; and our ability to make acquisitions and divestments on economically acceptable terms. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward looking 247 / 247 / 247 statements. Please read “Risk Factors” in our most recent annual report on Form 10-K and Item 1A. of Part II “Risk Factors” in our subsequent quarterly reports on Form 10-Q and any other public filings and press releases. Vanguard undertakes no obligation to publicly update any forward looking statements, whether as a result of new information or future events. This presentation has been prepared as of August 13, 2018. This presentation shall not constitute an offer to sell or the solicitation of any offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification of such securities under the securities law of any such jurisdiction. Securities may not be offered or sold in the United States absent registration with the Securities and Exchange Commission or an exemption from such registration. 176 / 176 / 181 Reserve Estimates The Securities and Exchange Commission (the “SEC”) permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. Vanguard may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as “estimated ultimate recovery” or “EUR,” “original oil in place” or “OOIP,” “resource potential,” “stacked pay potential” and similar terms to estimate oil and natural gas that may ultimately be recovered. These broader classifications do not constitute reserves as defined by the SEC. Estimates of such broader classification of volumes are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. You should not assume that such terms are comparable to proved, probable and possible reserves or represent estimates of future production from 36 / 31 / 85 properties or are indicative of expected future resource recovery. Original oil in place, for example, is merely an indication of the size of a hydrocarbon reservoir and is not an indication of reserves or the quantity of oil that is likely to be produced. Actual locations drilled and quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of Vanguard’s actual drilling program, availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, actual encountered geological conditions, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place, and other factors. These estimates may change significantly as the development of properties provides additional data. Reservoir engineering is a process of estimating underground accumulations of oil, natural gas and NGLs that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such 0 / 155 / 199 data and cost assumptions made by reservoir engineers. In addition the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. Please read Vanguard’s filings with the SEC, including “Risk Factors” in Vanguard’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other Current Reports on Form 8-K, which are available on Vanguard’s Investor Relations website at www.vnrenergy.com or on the SEC’s website at www.sec.gov, for a discussion of the risks and uncertainties involved in the process of estimating reserves. The estimates of reserves in this presentation were audited by Miller and Lents, an independent third party reserve engineering firm, and are based on various assumptions related to oil, natural gas and NGL prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Unless otherwise noted, the estimates of reserves in this presentation assume an effective date of December 31, 2017. 101 / 113 / 152 PV-10 PV-10 represents the present value, discounted at 10% per year, of estimated future net cash flows. Vanguard’s calculation of PV-10 herein differs from the standardized measure of discounted future net cash flows determined in accordance with the rules and regulations of the SEC in that it is calculated before income taxes, using $51.22 / Bbl and $2.99 / MMBtu as of December 31, 2017, rather than after income taxes, using the average price during the 12-month period, determined as an unweighted average of the first-day-of-the-month price for each month. Vanguard’s calculation of PV-10 should not be considered as an alternative to the standardized measure of discounted future net cash flows determined in accordance with the rules and regulations 0 / 85 / 140 of the SEC. Information related herein with respect to property ownership is based on the Company's estimates, and actual figures may vary from these estimates. As is customary in the oil and natural gas industry, the Company initially conducts only a cursory review of the title to its properties on which it does not have proved reserves. Prior to the commencement of drilling operations on those properties, however, the Company conducts a thorough title examination and performs curative work with respect to significant defects. The existence of a material title deficiency can render a lease worthless, and would adversely affect the figures reported herein. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures such as Adjusted EBITDA. Adjusted EBITDA is used as a quantitative standard by our management and by external users of our financial statements such as investors, research analysts and others to assess the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness; and our operating performance and return on capital as compared to those of other companies in our industry. Our Adjusted EBITDA should not be considered as an alternative to net income (loss), operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Our Adjusted EBITDA excludes some, but not all, items that affect net income and operating income and these measures may vary among other companies. Therefore, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies. For a reconciliation of Adjusted EBITDA to net income (loss) attributable to Vanguard stockholders/unitholders, please see our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. *** In preparing this presentation, the Company has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to the Company by third parties. 2

Vanguard Highlights 1 . Company restructured from an MLP to a C-Corp . New Company, No longer burdened by cash distributions . New, focused strategy—moving from 12 basins to 6 basins 247 / 247 / 247 New Management . Three core areas underpinned by high-graded stable PDP assets . Portfolio refocus underway 2 176 / 176 / 181 . Robust PDP asset base—363 mmcfe/d 2Q18 net production Strong, Predictable . (1) 36 / 31 / 85 Low cost producer with shallow decline assets (Proved R/P = ~14 years) Asset Base . Low-risk conventional well inventory offers predictable production profile 0 / 155 / 199 3 . Well-hedged, predictable operating cash flow . 101 / 113 / 152 Improved ability to enhance growth Significantly Improved . Sufficient inventory to support long-term plan Credit . Expects to be free cash flow positive across 2019 and 2020 0 / 85 / 140 . Enhancing liquidity through asset sales and strategic hedging . Goal of < 3.5x Net Debt/LTM Adj. EBITDA by 2021 4 . Improved credit metrics through de-leveraging Very Strong Asset . Borrowing base of ~$703 million Coverage . 2017YE Proved PV-10 of ~$1,195 million . 2017YE PD PV-10 of ~$1,055 million 3 (1) Latest production as of 2Q18 and proved reserves as of December 31, 2017.

New Company, 1 New Vanguard Management Team New Management Name Position Prior Experience Years in Industry Scott Sloan President & CEO 27+ 247 / 247 / 247 176 / 176 / 181 Ryan Midgett Chief Financial Officer 11+ 36 / 31 / 85 Keith Frobel VP, Operations Reveille Fina Oil & Chemical 37+ Resources, Inc. Company 0 / 155 / 199 101 / 113 / 152 James (JT) Albi(1) VP, Subsurface and Developments 27+ 0 / 85 / 140 Jonathan Curth VP, Land and General Counsel 11+ Patty Avila-Eady Chief Accounting Officer 19+ (1) September 4, 2018 start date. 4

New Company, 1 New Vanguard Natural Resources New Management Post-Emergence Vanguard has the Capability to Capture Substantial Upside in Core Growth Assets Key Highlights Asset Map & Highlights Williston Basin Increasingly focused portfolio Big Horn 247 / 247 / 247 Powder River Pinedale Diverse asset base in premier US oil and gas basins Wamsutter Wind 176 / 176 / 181 ─ 2017 year-end proved reserves of ~1,822 bcfe (75% gas, River DJ Basin 13% oil, 12% NGL) Arkoma-Woodford Piceance San Juan ─ 2017 year-end Proved PV-10 of ~$1,195 million Arkansas 36 / 31 / 85 Anadarko Basin ─ Q2 2018 net production of 363 mmcfe/d Permian Mississippi Growth Alabama 0 / 155 / 199 • 2018 guidance of 348–362 mmcfe/d Stable South Greater East Texas Haynesville Non-strategic LTM Adjusted EBITDA of $162 million as of June 30, 2018 101 / 113 / 152 Divested Properties Capital expenditures of $130–$140 million expected for full- Proved Reserves Q2 2018 Net Proved PV-10 year 2018 Asset Areas 0 / 85 / 140 (bcfe)(1) Production (mmcfe/d) ($mm)(1)(2) ─ Expects to be free cash flow positive across 2019 and 2020 Growth 1,280 221 $667 Post-emergence, the Company has completed nine Stable 218 71 $267 divestitures in multiple basins, shifting focus to its core Non-strategic 242 48 $183 Arkoma-Woodford, Piceance, and Pinedale areas Divested Properties(3) 82 23 $78 Total 1,822 363 $1,195 (1) Throughout the presentation, proved reserves and proved PV-10 have an effective date of December 31, 2017. 5 (2) Assumes SEC WTI oil price of $51.22 / bbl and Henry Hub gas price of $2.99 / mmbtu. (3) Divested properties since December 31, 2017.

New Company, 1 Vanguard Recent History New Management 2017 2018 Today In August, closed ~$28 million of divestments related to Potato Hills 247 / 247 / 247 In July, revised and other properties in borrowing base of Texas and Louisiana RCF to ~$730 million New Management Installed 176 / 176 / 181 and amended credit agreement In January, appointed Richard Scott Sloan as 36 / 31 / 85 New Board Instituted President & CEO and Ryan Midgett as CFO In August, completed successful 0 / 155 / 199 financial restructuring with amended $850 reserve-based RCF and Term Loan facility of $125 million 101 / 113 / 152 Borrowing base of ~$703 million 0 / 85 / 140 Closed transactions in Permian Basin, Green River Basin, and Mid- Continent for ~$62 million In December, closed ~$39 million divestiture of Williston properties In February, filed for Chapter 11 Protection 6

New Company, 1 Company Strategy New Management Streamline Assets to Lower Debt and Focus Growth 247 / 247 / 247 176 / 176 / 181 36 / 31 / 85 Streamlining Portfolio Strengthening Balance Sustainable, Focused Via Divestitures Sheet Growth 0 / 155 / 199 Sold assets for ~$90 million YTD Use divestiture proceeds to right- Focus growth in three basins 101 / 113 / 152 2018 size the balance sheet Two to three stable PDP areas to Robust PDP asset base Lowering total outstanding debt support controlled growth 0 / 85 / 140 Low cost producer with Proved to position the Company to Improved ability to enhance execute operational strategy R/P of ~14 years and shallow growth via proven inventory decline Position company to align Supported by current liquidity Core assets offer stable debt/asset strategy initiatives production platform with embedded growth potential 7

Strong, Predictable 2 Sustainable, Strong Operating Cash Margin Asset Base Low 10-year average PD base decline of ~9% offers a stable, predictable production profile Operating (1) 247 / 247 / 247 51% Margin Strong operating margins provide for strong operating Production & cash flow 7% Other Taxes 176 / 176 / 181 Significant free cash flow to strengthen the balance 9% Gathering & sheet or reinvest for future growth Transportation 36 / 31 / 85 33% LOE 0 / 155 / 199 PD Production Decline (%)(2) 101 / 113 / 152 13% 0 / 85 / 140 11% 10% 9% 9% 8% 8% 8% 8% 8% YE 2018 YE 2019 YE 2020 YE 2021 YE 2022 YE 2023 YE 2024 YE 2025 YE 2026 YE 2027 (1) Operating Margin is equal to 2Q18 Oil and Natural Gas Sales less Lease Operating Expense, Gathering and Transportation, and Production and Other Taxes. 8 (2) Based on December 31, 2017 reserve report. Refer to slide 5 for additional information regarding reserves estimates and PV-10 disclosure.

Strong, Predictable 2 Divestment Accomplishments Asset Base Sales proceeds continue to grow Future Planned Transactions Key Highlights Project Data Room Expected Close 247 / 247 / 247 Recently added new Business Development manager and land contractors to Arkansas July 4Q18 improve A&D best practices, ensuring maximum value from asset sales The Company is well-positioned to execute its de-leveraging plan DJ Basin (McKoy) Aug 4Q18 Focused on streamlining portfolio to quality, complimentary positions 176 / 176 / 181 Greater E. Haynesville Sept 4Q18 Stable production areas support growth in other areas Growth focus areas offer robust upside from proven new development Anadarko Nov 2Q19 36 / 31 / 85 Completed Transactions 0 / 155 / 199 Latest Proved Future Divestiture Candidates for 2018 PSA Gross Net Production Reserves Project Signing Close Proceeds (mmcfe/d) (bcfe) (1) 101 / 113 / 152 Williston Nov 2017 Dec 2017 $39 mm 7 20 Permian April 16th June 7th $27 mm 2 9 0 / 85 / 140 DJ Basin Mississippi May 3rd June 14th $12 mm 2 3 Wamsutter/Hay May 4th June 28th $23 mm 12 40 Anadarko Arkansas Potato Hills June 18th Aug 1st $23 mm 7 23 Basin Greater E. Other(2) N/A Various $6 mm, swap 2 7 Haynesville Total: $130 mm (1) 2017YE Proved Reserves of 20 bcfe. Transaction closed prior to December 31, 2017 and is therefore not included in 2017YE Proved Reserve figure. 9 (2) In May 2018, the Company completed the trade of its interests in certain properties in the Green River Basin in exchange for additional interests in other Vanguard properties. The non-cash exchange was accounted for at fair value and no gain or loss was recognized from the exchange.

Strong Base of Low Cost and Stable Strong, Predictable 2 Proved Reserves Asset Base Key Highlights Operating Expenses per Mcfe(1)(2) 247 / 247 / 247 Vanguard’s focus on efficiency $3.64 has resulted in a consistently low cost structure inline with that of its $2.79 peers 176 / 176 / 181 Peer Average of $1.94 $2.14 $2.07 $2.03 $2.01 $1.99 Low cost structure underpins cash $1.85 $1.74 $1.60 $1.50 flow and supports the future ($/mcfe) $1.06 36 / 31 / 85 development of core growth $0.91 assets Proved R/P ratio of 13.7x, above 0 / 155 / 199 the peer average Peer 1 Peer 8 Peer 6 Peer 3 Peer 2 Peer 7 Peer 4 Peer 5 Peer 11 Peer 10 Peer 9 Peer 12 PDP reserves generate significant 101 / 113 / 152 cash flow, enabling Vanguard to Comparable Companies Proved R/P (Years)(2) reinvest proceeds in core growth assets 26.2x 0 / 85 / 140 Peer Average of 12.8x 15.6x 13.7x 13.7x 13.9x 12.3x 12.5x 12.9x 10.4x 10.6x 11.1x 8.5x 6.0x Peer 11 Peer 2 Peer 6 Peer 9 Peer 3 Peer 8 Peer 4 Peer 5 Peer 7 Peer 12 Peer 1 Peer 10 (1) Includes lease operating expense, gathering and transportation, production taxes, and SG&A. 10 (2) Peer group includes: AMPY, CHK, HPR, ECR, JONE, NFX, SD, SN, UPL, CRK, WRD, and XCO. As of 2Q18 with the exception of EXCO which is as of 1Q18.

Strong, Predictable 2 Strong Base of Proved Reserves Asset Base Key Highlights Proved Reserves PV-10 of $1,195 million(1) As of Oil Gas NGLs Total PV-10(1) 247 / 247 / 247 In addition to Vanguard’s current 31-Dec-17 (mmbbl) (bcf) (mmbbl) (bcfe) ($mm) base of proved reserves, the Company holds significant PD(2) 34 831 31 1,225 $1,055 176 / 176 / 181 incremental resource potential PUD 5 526 7 596 $140 Total Proved 39 1,357 38 1,822 $1,195 36 / 31 / 85 0 / 155 / 199 YE 2017 Proved Reserves Summary 101 / 113 / 152 Proved Reserves Mix: 1,822 bcfe PV-10 by Category: $1,195 mm Proved Reserves by Area: 1,822 bcfe Oil Natural Gas NGLs PD PUD Growth Stable (3) 0 / 85 / 140 Non-strategic Divested Properties 12% 5% 12% 13% 13% 12% 70% 88% 75% 11 Note: Refer to slide 5 for additional information regarding reserves estimates and PV-10 disclosure. (1) Assuming $51.22 / bbl and $2.99 / mmbtu. (2) Includes PDP of 1,203 bcfe at a PV-10 of $1,027 mm and PDBP of 22 bcfe at PV-10 of $28 mm. (3) Divested properties since December 31, 2017.

Strong, Predictable 2 Growth Assets Asset Base I Arkoma-Woodford Pinedale Core of the Arkoma Basin, offset to 247 / 247 / 247 strong well results from BP, Newfield, and others Hughes Piceance 176 / 176 / 181 Oklahoma Net Acres ~60,000 Arkoma-Woodford Pittsburg 2017 PD Reserves 130 bcfe(1) Natural Gas 91% 36 / 31 / 85 Coal 2Q18 Net Production 31 mmcfe/d Pushmataha Atoka Gross Undev. Growth ~1,100 0 / 155 / 199 Locations 101 / 113 / 152 II Piceance III Pinedale Highly contiguous and operated position Highly delineated position with enabling efficient large-scale drilling substantial inventory of low cost and high 0 / 85 / 140 return well locations Colorado Horizontal wells and downspacing may Sublette offer additional upside Garfield Net Acres ~15,000 Net Acres ~14,000 Wyoming 2017 PD Reserves 276 bcfe(2) 2017 PD Reserves 314 bcfe(3) Natural Gas 66% Natural Gas 87% 117 2Q18 Net Production 73 mmcfe/d 2Q18 Net Production mmcfe/d Gross Undev. Gross Undev. Sweet Water ~550 Mesa ~1,500(4) Locations Locations Note: Refer to slide 5 for additional information regarding reserves estimates and PV-10 disclosure. 12 (1) Consists of a subset of properties for the Arkoma Basin with Proved Developed Reserves of 187 bcfe as reported in the 10-K. (2) As reported in the 10-K. (3) Consists of a subset of properties for the Green River Basin with Proved Developed Reserves of 356 bcfe as reported in the 10-K. (4) Assumes 10-acre spacing and no material horizontal development on flank acreage.

Substantial Opportunity for Low-Risk Upside in Strong, Predictable 2 Growth Assets Asset Base I Arkoma-Woodford II Piceance Step -Change in Performance Due to Larger Completions Material Upside through Utilization of Optimal Completion Techniques Wells utilizing modern fracs have demonstrated robust EURs and rates 247 / 247 / 247 of return at current commodity prices New larger volume completions have resulted in significant increases to EUR and single well economics across the basin Wells that have utilized high-fluid completions and generated strong results include BP’s Schmitt 1-1H, Resh #3, and Resh #5, which had Asset Poised for Development 176 / 176 / 181 30-day IP’s of 11.6, 7.2 and 10.4 mmcfe/d, respectively(1) 14-well pilot program with new completion designs began in Q4 2017 Further Delineation Expected from Multiple Operators Contiguous and operated acreage position enables efficient 36 / 31 / 85 Vanguard is participating in drilling programs led by BP and Newfield development supported by cost savings achieved through infrastructure investment Actively evaluating operated development plans in Atoka and Pittsburg Counties 0 / 155 / 199 III Pinedale 101 / 113 / 152 Significant Upside from Emerging Horizontal Development The six horizontal wells UPL drilled in the Lower Lance A1 zone had an 0 / 85 / 140 average 24-hour IP rate of 27.3 mmcfe/d(2) Horizontal wells have the potential to redefine the play by substantially increasing resource recovery and economics Extensive Remaining Undeveloped Inventory VNRR vertical inventory consists of ~1,500 wells assuming 10-acre spacing; downspacing to 5-acres increases total potential undeveloped inventory by >2x Ultra previously identified ~1,600 incremental horizontal locations located on the flank of the play(2) (1) Perforated lateral length of 4,901’, 4,539’, and 4,727’ for the Schmitt 1-1H, Resh #3, and Resh #5, respectively. 13 (2) Ultra Petroleum’s public filings and other publicly available information.

Strong, Predictable 2 Arkoma-Woodford Asset Overview Asset Base Key Highlights Hughes Pittsburg ~60,000 net acres in Hughes, Pittsburg, Coal, and Atoka Counties 247 / 247 / 247 2Q18 net production of 31 mmcfe/d from ~700 producing wells 1 176 / 176 / 181 Large identified undeveloped inventory consisting of ~1,100 gross 2 Operator: BP locations 1 Resh #3 Coal IP30: 7,215 mcfe/d Lat. Length: 4,539’ Participating in BP and Newfield Exploration drilling programs 36 / 31 / 85 Operator: BP Atoka Pushmataha Resh #5 Developing basin knowledge and evaluating operated development 2 IP30: 10,371 mcfe/d plans Oklahoma Lat. Length: 4,727’ 0 / 155 / 199 Vanguard Advantages Basin Highlights 101 / 113 / 152 Recent Arkoma-Woodford Well Highlights(1) Production within the Arkoma Basin is strongly gas-weighted; however, liquids content increases to the northwest along the 0 / 85 / 140 Resh #3 Resh #5 margin of the basin and the Cherokee Platform (where much of Vanguard’s acreage lies) 30-Day IP 7,215 mcf/d 10,371 mcf/d Recent operator type well economics of nearby operators showing 60-Day Cum. over 5,000 mmcfe EUR on a two stream basis 440,000 mcf 560,000 mcf Production Extensive SWD infrastructure across the basin providing low water disposal costs Lateral Length 4,539’ 4,727’ Nine rigs operating in the Arkoma Basin as of 8/13/2018 Recent M&A activity indicative of renewed interest in the play; Est. EUR 8 bcf 12 bcf Corterra Energy’s acquisition reinforces the potential for upside in the Arkoma Basin Est. EUR / 1,000’ LL 1.76 bcf 2.54 bcf 14 (1) Resh #3 and Resh #5 are the Company’s only two material investments in wells drilled in the Arkoma-Woodford in 2018 and are non-operated wells (working interest of ~27%).

Strong, Predictable 2 Piceance Asset Overview Asset Base Key Highlights Vanguard ~15,000 net acres Ursa Resources Caerus Oil & Gas 247 / 247 / 247 ~90% WI on ~80% of the acreage position Terra Energy Nearly 100% HBP and operated by Vanguard Laramie Energy 2Q18 net production of 73 mmcfe/d from ~950 gross wells Colorado 176 / 176 / 181 Large undeveloped inventory consisting of ~550 gross locations Garfield Largely completed a 14 well program in first half of 2018 Completion designs utilized varying fluid and proppant levels to test 36 / 31 / 85 formation ─ 5.0–7.5 million gallons of water Mesa ─ 1.0–1.5 million pounds of proppant 0 / 155 / 199 Vanguard Advantages Basin Highlights Pitkin 101 / 113 / 152 Significant undeveloped vertical well inventory assuming 10-acre Seven active rigs operating in Garfield County as of 8/13/2018 spacing 0 / 85 / 140 Substantial resource, with over 2,000’ of vertical pay distributed Mesaverde provides stacked pay potential in a high gas saturation throughout the Mesaverde shale play Potential for higher EURs by employing modern fracs Vanguard-owned compression facility and upgrade to gas lift and Recent Battlement Mesa results showing over 40% IRR at saltwater disposal system provide significant cost savings $3.00/mmbtu when utilizing 10 stage spacing Currently accumulating and evaluating well results to advance strategic understanding of the play Mancos/Niobrara zones provide additional upside opportunities, Key is to optimize the tradeoffs between higher volume fracs recent results continue to improve with higher proppant loading (higher EUR) and economic returns 15

Strong, Predictable 2 Pinedale Asset Overview Asset Base Key Highlights ~14,000 net acres in the Pinedale and Jonah fields with ~15% WI 247 / 247 / 247 Sublette Pinedale Field ~70% operated by Ultra Petroleum and ~30% operated by Pinedale Energy Partners; 5 rigs currently operating on Vanguard’s acreage 176 / 176 / 181 Jonah Wyoming Highly delineated and 100% HBP Field 2Q18 net production of 117 mmcfe/d from ~2,800 producing wells 36 / 31 / 85 Ultra Petroleum actively testing horizontal development through Sweet Water pilot program 0 / 155 / 199 Vanguard Advantages Basin Highlights 101 / 113 / 152 Conventional, Low-Risk Drilling Opportunities Productive depths in the prolific Lance and Mesaverde formations 0 / 85 / 140 ranging from 8,000’–14,000’ ~1,500 gross undeveloped locations at 10- Inventory acre spacing Over 8 productive targets across the Upper Lance, Lower Lance, Recent Well Highlights IP30 D&C EUR WI Inventory more than doubles at 5-acre Upside and Mesaverde Riverside 10A1-14D 8.4 mmcf/d $2.3 mm 4.0 bcf 11.25% spacing Riverside 10A2-14D 9.1 mmcf/d $2.9 mm 4.0 bcf 11.25% Warbonnet 15A1-25D 6.7 mmcf/d $2.7 mm 5.2 bcf 15.00% EUR 4 bcfe (type curve) Five discrete, high net-to-gross pay target intervals identified through well and 3D seismic control in the Pinedale Anticline Est. D&C Costs $3.0 million 16

Strong, Predictable 2 Other Stable Asset Area Overview Asset Base Other Stable Asset Area Map Big Horn Key Highlights Big Major fields in the Big Horn include the Elk Basin Field (Madison water Horn flood and Tensleep flue gas injection) and Gooseberry Field 247 / 247 / 247 2Q18 production from the Big Horn Field totals >2.5 mboe/d with a PD PV-10 of $118 million 176 / 176 / 181 - 10-year anticipated PD decline rate of <6% per year Permian Asset has historically outperformed anticipated production decline 36 / 31 / 85 Stable 0 / 155 / 199 Permian Asset Map Vanguard Permian Key Highlights 101 / 113 / 152 Vanguard retains substantial HBP acreage position in the Permian Operator: Vanguard Basin Williams B Fed #10 1 3 4 1 IP30: 50 bbl/d Evaluation underway to determine value maximizing alternatives 2 0 / 85 / 140 IRR: 100%+ Excess infrastructure available for third-party transactions Operator: Vanguard Multiple years of high return vertical drilling inventory and recompletes Williams B Fed #11 in Eddy County, NM (Red Lake) 2 IP30: 66 bbl/d IRR: 100%+ Operator: Vanguard General Permian Basin Highlights (1) 3 Staley State #3 Permian Basin currently has 482 operating rigs IP24: 90 bbl/d IRR: 100%+ Numerous pipeline project underway that should provide a long-term solution to wide differentials Operator: Vanguard Williams A Fed #14 Notable operators offset to Vanguard’s acreage: Shell, ExxonMobil, 4 IP24: 50 bbl/d Parsley, Concho, Anadarko, Diamondback, Centennial, and Energen IRR: 43% 17 (1) Rig count as of 8/2/2018.

Significantly 3 Credit Highlights Improved Credit . 10-year average PD decline rate of ~9% reduces capital required to maintain production Predictable, High Quality, . Low-risk conventional inventory offers proven returns Low-Risk Asset Portfolio . Material high-return upside potential from next-generation unconventional development . Offset operators further demonstrating Vanguard’s asset potential 247 / 247 / 247 . Proved reserves comprised of 67% PD, reflecting the mature nature of Vanguard’s assets PDP-Weighted Reserves . Proved R/P of ~14 years, provides a long production horizon . Minimal capital required to develop reserves 176 / 176 / 181 and High Asset Coverage . Strong asset coverage of 1.3x Proved PV-10/Total Debt(1) . 36 / 31 / 85 Contiguous and operated acreage enables efficient development . Cost savings achieved through infrastructure investment Low Cost Platform . Limited need to acquire new reserves given extensive inventory . Low base decline from mature asset base . 0 / 155 / 199 Highly attractive operating costs relative to peers Free Cash Flow Driven by . Unlocking value in extensive Arkoma, Piceance, and Pinedale positions through leading drilling and 101 / 113 / 152 Repeatable Drilling and completion techniques Attractive Growth . Expects to be free cash flow positive across 2019 and 2020 . Prospects Underpinned by stable, diverse PDP assets in the Big Horn, Powder River, and the Permian 0 / 85 / 140 . Divestments will lower commitments and improve leverage Strong Financial . Flexibility, Ample Liquidity, Sufficient liquidity to execute long-term development plan with optionality to generate liquidity via asset sales . Improved credit metrics with the goal of de-leveraging to <3.5x Net Debt/LTM Adj. EBITDA by 2021 and a Path to . Complementing NYMEX hedges with basis specific hedges to bolster downside protection Deleveraging . Significant unhedged, levered free cash flow through 2020 . Senior executive team has extensive experience at large energy companies Proven Leadership . New management team transforming business into a well-capitalized and growing company . Structuring organization to be operationally and development focused 18 (1) PV-10 as of December 31, 2017.

Significantly 3 Hedge Summary Improved Credit Go-Forward Hedging Strategy Hedge a minimum of 70% of PDP production for 2-3 year period utilizing a combination of swaps and collars Systematically add new hedges for the Company’s PDP production over an extended period of time to minimize “timing” the market and achieve acceptable levels of downside protection 247 / 247 / 247 Complement NYMEX hedges with basis specific hedges to bolster downside protection 176 / 176 / 181 Natural Gas NW Rockies 186,674 155,244 144,037 $2.60 - $3.00 105,000 36 / 31 / 85 $2.60 - $3.00 $2.89 60,000 $2.79 $2.75 ($0.621) mmbtu/d mmbtu/d 5,000 ($0.532) $2.60 - $3.07 Jul'18 - Dec'18 2019 2020 2021 Aug'18 - Oct'18 Nov'18 - Mar'19 0 / 155 / 199 Oil Mid-Cush 7,217 6,668 1,250 101 / 113 / 152 5,610 $43.81 - $54.04 $44.17 - $55.00 $46.60 ($5.780) bbls/d bbls/d $48.50 $49.53 307 0 / 85 / 140 $47.50 - $56.05 Jul'18 - Dec'18 2019 2020 2021 Jul'18 - Dec'18 2019 2020 2021 NGL 155,400 gal/d $25.36 44,421 $32.81 Jul'18 - Dec'18 2019 2020 2021 19 Swaps Collars Note: As of 8/8/2018

Current Vanguard Capital Structure Provides Very Strong Asset 4 Ample Flexibility Coverage Vanguard Current Capitalization ($mm) Management 2018 Guidance ($mm) Low High 30-Jun-18 Total Liquids Production (mboe/d) 16.5 - 17.5 Cash and Cash Equivalents $8 247 / 247 / 247 Total Gas Production (mmcf/d) 249.0 - 257.0 Revolving Credit Facility(2) $688 Total Production (mmcfe/d) 348.0 - 362.0 Term Loan due 2021 $124 Lease Operating Expenses $125.0 - $133.0 9.000% Senior Second Lien Notes due 2024 $81 176 / 176 / 181 Production Taxes (% of Revenue) 8.0% - 9.0% Lease Financing Obligations $13 G&A Expenses $40.0 - $43.5 Total Debt $906 Interest Expense $60.5 - $64.5 Net Debt $898 36 / 31 / 85 Capital Expenditures $130.0 - $140.0 Credit Statistics Net Debt / Statistic Metric (3) LTM Adj. EBITDA $162 / $201 5.5x / 4.5x Key Highlights (as of August 1, 2018) 0 / 155 / 199 2Q18 Production ($/mcfe/d) 363 $2,474 Vanguard had ~$50 million in liquidity(1) Proved Reserves ($/mcfe) 1,822 $0.49 % Gas 75% n.a. 101 / 113 / 152 First lien debt comprised of a Reserve Based Loan PD Reserves ($/mcfe)(4) 1,225 $0.73 (“RBL”), which has a current borrowing base of ~$703 Proved PV-10/First Lien Debt(4) $1,195 1.5x million, and term loan facility of $124 million Proved PV-10/Net Debt(4) $1,195 1.3x 0 / 85 / 140 PD PV-10/First Lien Debt(4)(5) $1,055 1.3x - Currently ~$662 million drawn on RBL facility PD PV-10/Net Debt(4)(5) $1,055 1.2x - Maturity date of RBL is February 2021 Liquidity 01-Aug-18 Borrowing Base $703 Less: Drawn Amount ($662) Less: Letters of Credit ($0.2) Plus: Cash and Cash Equivalents $9 Total Liquidity $50 (1) Pro forma for recently announced divestitures. (2) Per Company Q2 2018 Press Release. RCF as of August 1, 2018 is $662 million. 20 (3) “Including hedges / excluding hedges”. See page 26 for Adjusted EBITDA Reconciliation. (4) Includes PDP of 1,203 bcfe at a PV-10 of $1,027 mm and PDBP of 22 bcfe at PV-10 of $28 mm. (5) Does not exclude divestments since December 31, 2017. Assumes SEC WTI oil price of $51.22 / bbl and Henry Hub gas price of $2.99 / mmbtu.

Vanguard Highlights 1 New Company and New Management with Focused Basin Strategy 247 / 247 / 247 176 / 176 / 181 2 36 / 31 / 85 Strong, Predictable and Shallow-Decline Asset Base 0 / 155 / 199 3 101 / 113 / 152 Significantly Improved Credit Allows for Ability to Enhance Growth and Liquidity 0 / 85 / 140 4 Very Strong Asset Coverage That Will Continue to Improve Through De-Leveraging 21

247 / 247 / 247 176 / 176 / 181 36 / 31 / 85 0 / 155 / 199 101 / 113 / 152 Appendix 0 / 85 / 140 22

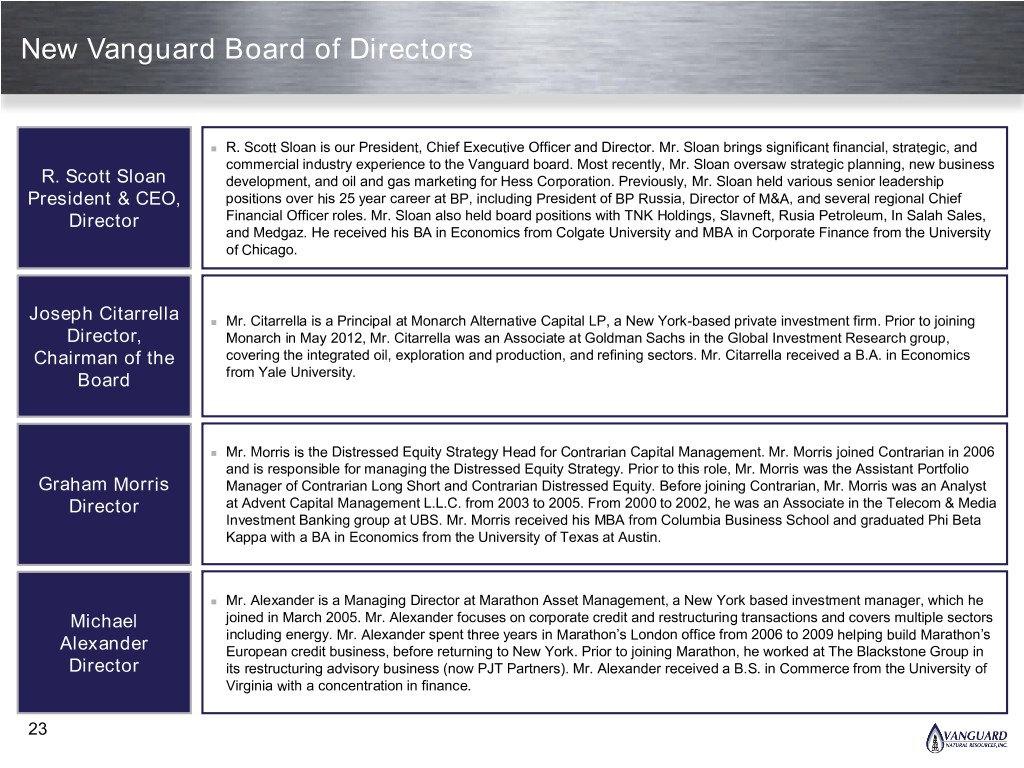

New Vanguard Board of Directors R. Scott Sloan is our President, Chief Executive Officer and Director. Mr. Sloan brings significant financial, strategic, and commercial industry experience to the Vanguard board. Most recently, Mr. Sloan oversaw strategic planning, new business R. Scott Sloan development, and oil and gas marketing for Hess Corporation. Previously, Mr. Sloan held various senior leadership positions over his 25 year career at BP, including President of BP Russia, Director of M&A, and several regional Chief 247 / 247 / 247 President & CEO, Director Financial Officer roles. Mr. Sloan also held board positions with TNK Holdings, Slavneft, Rusia Petroleum, In Salah Sales, and Medgaz. He received his BA in Economics from Colgate University and MBA in Corporate Finance from the University of Chicago. 176 / 176 / 181 Joseph Citarrella Mr. Citarrella is a Principal at Monarch Alternative Capital LP, a New York-based private investment firm. Prior to joining 36 / 31 / 85 Director, Monarch in May 2012, Mr. Citarrella was an Associate at Goldman Sachs in the Global Investment Research group, Chairman of the covering the integrated oil, exploration and production, and refining sectors. Mr. Citarrella received a B.A. in Economics Board from Yale University. 0 / 155 / 199 101 / 113 / 152 Mr. Morris is the Distressed Equity Strategy Head for Contrarian Capital Management. Mr. Morris joined Contrarian in 2006 and is responsible for managing the Distressed Equity Strategy. Prior to this role, Mr. Morris was the Assistant Portfolio Graham Morris Manager of Contrarian Long Short and Contrarian Distressed Equity. Before joining Contrarian, Mr. Morris was an Analyst at Advent Capital Management L.L.C. from 2003 to 2005. From 2000 to 2002, he was an Associate in the Telecom & Media 0 / 85 / 140 Director Investment Banking group at UBS. Mr. Morris received his MBA from Columbia Business School and graduated Phi Beta Kappa with a BA in Economics from the University of Texas at Austin. Mr. Alexander is a Managing Director at Marathon Asset Management, a New York based investment manager, which he Michael joined in March 2005. Mr. Alexander focuses on corporate credit and restructuring transactions and covers multiple sectors including energy. Mr. Alexander spent three years in Marathon’s London office from 2006 to 2009 helping build Marathon’s Alexander European credit business, before returning to New York. Prior to joining Marathon, he worked at The Blackstone Group in Director its restructuring advisory business (now PJT Partners). Mr. Alexander received a B.S. in Commerce from the University of Virginia with a concentration in finance. 23

New Vanguard Board of Directors (cont’d) Mr. Dunlevy is one of the Founding Partners of Kosmos Energy Ltd. Kosmos Energy is an international oil and gas exploration and production company with a primary focus in the deep waters of West Africa, South America and Europe. In 247 / 247 / 247 May 2011, Mr. Dunlevy led Kosmos’ initial public offering on the NYSE, valuing the company at $6 billion. Prior to going public, he was instrumental in securing $4 billion in combined debt and private equity commitments from a global consortium of banks and financial institutions that supported Kosmos’ exploration, appraisal and development program as a W. Greg Dunlevy private company operating offshore West Africa. Kosmos is best well known for its exploration success in Ghana where the 176 / 176 / 181 company made one of the largest oil discoveries of the decade in 2007. Mr. Dunlevy co-founded Kosmos in 2003 and was Director previously Senior Vice President and CFO of Triton Energy Ltd. (NYSE: OIL), where he worked closely with the CEO in setting strategic direction. Following the sale of Triton to Amerada Hess Corporation (now Hess Corporation), he led its transition from a publicly held company to a Hess business unit. Mr. Dunlevy began his career with ARCO, where he 36 / 31 / 85 worked for ARCO Petroleum Products Company, the ARCO Oil and Gas Company, and Lyondell Petrochemical Company subsidiaries. In 2011 he received Ernst & Young’s Entrepreneur of the Year Award (Southwest Area North) in the energy category. Mr. Dunlevy is a graduate of Harvard Business School and the College of William & Mary. 0 / 155 / 199 Mr. Albert is the owner and CEO of Shale Advisory Group, a consulting firm focused on the emerging shale plays. Mr. 101 / 113 / 152 Albert retired from CONSOL Energy in January 2014 after a 34 year career, serving the last several years as the Chief Randall M. Albert Operating Officer-Gas. Mr. Albert is a past Chairman of the Marcellus Shale Coalition, Member of the Board of Eclipse Resources Corporation and Wellsite Rentals and Fishing Tools, and serves on the Strategic Advisory Board of Black Bay 0 / 85 / 140 Director Energy Capital. He holds a BS in Mining Engineering from Virginia Tech, where he is a member of the Academy of Engineering Excellence, the highest honor conferred to College of Engineering graduates, and serves on the Mining and Minerals Engineering Distinguished Alumnus and serves on the Mining Engineering Department’s Advisory Board. Joseph Hurliman, Jr. was most recently President and CEO of Discovery Natural Resources, LLC. Previously, Mr. Hurliman Joseph Hurliman, lead a variety of roles within BP Exploration and its joint venture partnerships and affiliates, including more than thirty years in North America, South America, the UK and Russia. He held a number of senior positions in reservoir and asset Jr management on some of BP Exploration’s largest projects. Mr. Hurliman was previously on the board of directors of FIML Director Natural Resources, LLC. Mr. Hurliman holds a B.A. in Chemistry from Whitman College and a B.S. in Chemical Engineering from The California Institute of Technology. 24

Vanguard Natural Resources History In December, closed $329 million acquisition of assets from Bill Barrett Corp. In August, completed ~28 million of divestments related to Potato Hills and In December, In October, completed other properties in Texas purchased 100% $200 million add-on of and Louisiana interest in ENP’s GP senior unsecured notes and a 46.7% LP 247 / 247 / 247 In July, revised borrowing interest in ENP from In September, completed base of RCF to ~$730 Denbury for $380 ~$182 million equity In April, increased the million and amended million offering borrowing base on the credit agreement and RCF from $1.3 billion to further revised to ~$703 176 / 176 / 181 In June, purchased Arkoma $1.5 billion million in August In July, purchased In November, closed assets for $434 million South Texas assets $175 million Term Loan In March, completed In May, completed In 1Q18, executed four from Lewis Energy for as part of ENP In April, completed $350 ~$169 million perpetual ~$273 million sale of purchase and sales $53 million acquisition million senior unsecured preferred equity offering SCOOP/STACK assets agreements for more than notes offering 36 / 31 / 85 (Class B) $60 million In January, purchased In May, purchased In March, completed In February, issued ~$75.6 In January, appointed Permian assets from assets in MS, TX, and exchange of Appalachian In January, purchased million of Second Lien Richard Scott Sloan as Apache for $73 million NM for $115 million assets for 1.9 million VNR Pinedale/Jonah assets Notes to tender previously President & CEO and 0 / 155 / 199 units for $549 million outstanding Senior Notes Ryan Midgett as CFO 2006-2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 101 / 113 / 152 In November, closed Completed merger with Formed in October 2006 In July, purchased In February, completed In February, filed for additional South Texas amended $1.5 billion $246 million equity Eagle Rock Energy Chapter 11 Protection assets from Lewis Revolver and offering Partners for $414 million announced $100 million Energy for $52 million In August, completed 0 / 85 / 140 Scott Smith appointed Term Loan CEO In April, closed the $269 Completed Merger with successful financial million Permian restructuring with In December, LRR Energy Partners for acquisition from Range amended $850 million purchased Permian In December, $413 million Resources reserve-based RCF Richard Robert assets for $55 million completed merger with appointed CFO and Term Loan facility ENP (remaining 53.2%); of $125 million $814 million merger In June, completed ~$200 million equity In December, appointed Entered into RCF with a offering Jonathan C. Curth to borrowing base of $116 Completed $200 million General Counsel, million in other acquisitions In June, completed Corporate Secretary ~$61 million perpetual and VP of Land preferred equity offering (Class A) In December, finished ~$39 million divestiture of Williston properties 25

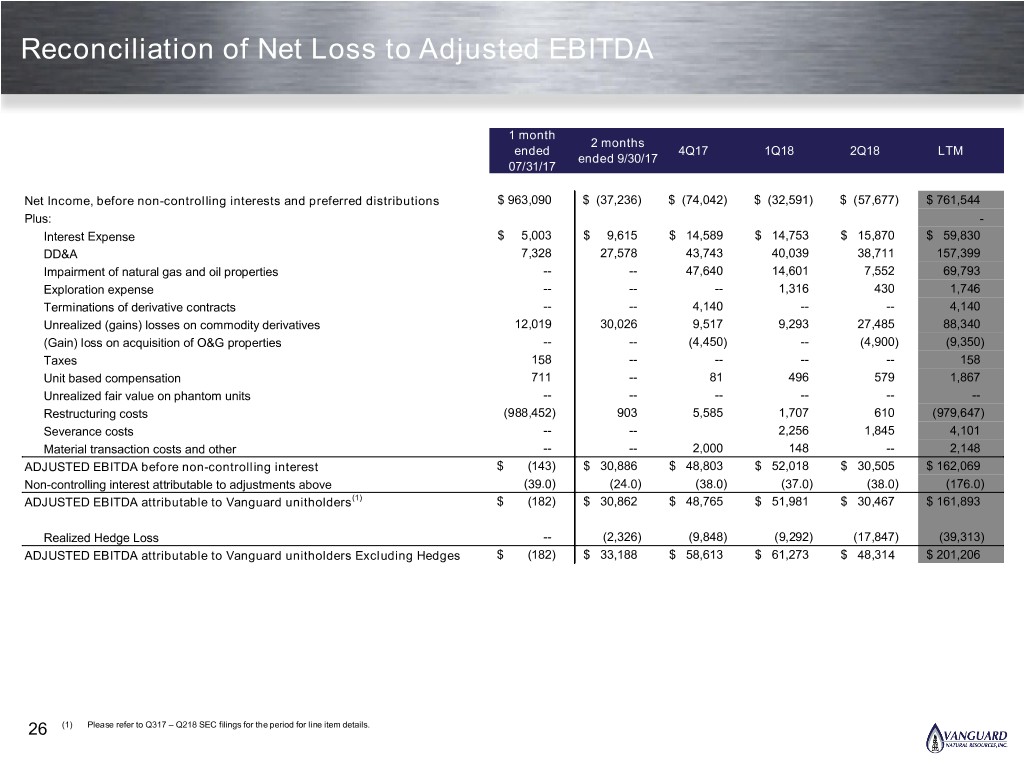

Reconciliation of Net Loss to Adjusted EBITDA 1 month 2 months ended 4Q17 1Q18 2Q18 LTM ended 9/30/17 07/31/17 Net Income, before non-controlling interests and preferred distributions $ 963,090 $ (37,236) $ (74,042) $ (32,591) $ (57,677) $ 761,544 247 / 247 / 247 Plus: - Interest Expense $ 5,003 $ 9,615 $ 14,589 $ 14,753 $ 15,870 $ 59,830 DD&A 7,328 27,578 43,743 40,039 38,711 157,399 176 / 176 / 181 Impairment of natural gas and oil properties -- -- 47,640 14,601 7,552 69,793 Exploration expense -- -- -- 1,316 430 1,746 Terminations of derivative contracts -- -- 4,140 -- -- 4,140 Unrealized (gains) losses on commodity derivatives 12,019 30,026 9,517 9,293 27,485 88,340 36 / 31 / 85 (Gain) loss on acquisition of O&G properties -- -- (4,450) -- (4,900) (9,350) Taxes 158 -- -- -- -- 158 Unit based compensation 711 -- 81 496 579 1,867 0 / 155 / 199 Unrealized fair value on phantom units -- -- -- -- -- -- Restructuring costs (988,452) 903 5,585 1,707 610 (979,647) Severance costs -- -- 2,256 1,845 4,101 101 / 113 / 152 Material transaction costs and other -- -- 2,000 148 -- 2,148 ADJUSTED EBITDA before non-controlling interest $ (143) $ 30,886 $ 48,803 $ 52,018 $ 30,505 $ 162,069 Non-controlling interest attributable to adjustments above (39.0) (24.0) (38.0) (37.0) (38.0) (176.0) ADJUSTED EBITDA attributable to Vanguard unitholders(1) $ (182) $ 30,862 $ 48,765 $ 51,981 $ 30,467 $ 161,893 0 / 85 / 140 Realized Hedge Loss -- (2,326) (9,848) (9,292) (17,847) (39,313) ADJUSTED EBITDA attributable to Vanguard unitholders Excluding Hedges $ (182) $ 33,188 $ 58,613 $ 61,273 $ 48,314 $ 201,206 26 (1) Please refer to Q317 – Q218 SEC filings for the period for line item details.