Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Broadstone Net Lease, Inc. | ck0001424182-ex322_9.htm |

| EX-32.1 - EX-32.1 - Broadstone Net Lease, Inc. | ck0001424182-ex321_6.htm |

| EX-31.2 - EX-31.2 - Broadstone Net Lease, Inc. | ck0001424182-ex312_7.htm |

| EX-31.1 - EX-31.1 - Broadstone Net Lease, Inc. | ck0001424182-ex311_8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☒ |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2018, or

|

☐ |

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 000-55774

BROADSTONE NET LEASE, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

26-1516177 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

800 Clinton Square Rochester, New York |

14604 |

|

(Address of principal executive offices) |

(Zip Code) |

(585) 287-6500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 20,524,162.468 shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of August 10, 2018.

TABLE OF CONTENTS

|

|

Page |

|

|

1 |

||

|

Item 1. |

1 |

|

|

|

1 |

|

|

|

Condensed Consolidated Statements of Income and Comprehensive Income (Unaudited) |

2 |

|

|

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited) |

3 |

|

|

4 |

|

|

|

Notes to the Condensed Consolidated Financial Statements (Unaudited) |

5 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

|

26 |

|

|

|

26 |

|

|

|

36 |

|

|

|

40 |

|

|

|

40 |

|

|

|

40 |

|

|

|

41 |

|

|

|

45 |

|

|

|

48 |

|

|

|

48 |

|

|

Item 3. |

49 |

|

|

Item 4. |

50 |

|

|

51 |

||

|

Item 1. |

51 |

|

|

Item 1A. |

51 |

|

|

Item 2. |

51 |

|

|

Item 3. |

52 |

|

|

Item 4. |

52 |

|

|

Item 5. |

52 |

|

|

Item 6. |

53 |

|

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except per share amounts)

|

|

|

June 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Accounted for using the operating method, net of accumulated depreciation |

|

$ |

2,373,376 |

|

|

$ |

2,186,141 |

|

|

Accounted for using the direct financing method |

|

|

42,023 |

|

|

|

41,617 |

|

|

Investment in rental property, net |

|

|

2,415,399 |

|

|

|

2,227,758 |

|

|

Cash and cash equivalents |

|

|

13,765 |

|

|

|

9,355 |

|

|

Restricted cash |

|

|

7,057 |

|

|

|

744 |

|

|

Accrued rental income |

|

|

60,857 |

|

|

|

52,018 |

|

|

Tenant and other receivables, net |

|

|

95 |

|

|

|

897 |

|

|

Tenant and capital reserves |

|

|

1,041 |

|

|

|

943 |

|

|

Prepaid expenses and other assets |

|

|

1,837 |

|

|

|

267 |

|

|

Notes receivable |

|

|

— |

|

|

|

6,527 |

|

|

Investment in related party |

|

|

10,000 |

|

|

|

10,000 |

|

|

Interest rate swap, assets |

|

|

30,169 |

|

|

|

11,008 |

|

|

Intangible lease assets, net |

|

|

258,294 |

|

|

|

242,659 |

|

|

Debt issuance costs – unsecured revolver, net |

|

|

2,644 |

|

|

|

3,026 |

|

|

Leasing fees, net |

|

|

14,100 |

|

|

|

13,554 |

|

|

Total assets |

|

$ |

2,815,258 |

|

|

$ |

2,578,756 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

|

|

|

Unsecured revolver |

|

$ |

272,500 |

|

|

$ |

273,000 |

|

|

Mortgages and notes payable, net |

|

|

86,242 |

|

|

|

67,832 |

|

|

Unsecured term notes, net |

|

|

927,364 |

|

|

|

836,912 |

|

|

Interest rate swap, liabilities |

|

|

184 |

|

|

|

5,020 |

|

|

Accounts payable and other liabilities |

|

|

22,492 |

|

|

|

20,345 |

|

|

Due to related parties |

|

|

915 |

|

|

|

722 |

|

|

Tenant improvement allowances |

|

|

4,292 |

|

|

|

5,669 |

|

|

Accrued interest payable |

|

|

3,008 |

|

|

|

3,311 |

|

|

Intangible lease liabilities, net |

|

|

85,442 |

|

|

|

81,744 |

|

|

Total liabilities |

|

|

1,402,439 |

|

|

|

1,294,555 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (See Note 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

Broadstone Net Lease, Inc. stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 20,000 shares authorized, no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 80,000 shares authorized, 20,239 and 18,909 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively |

|

|

20 |

|

|

|

19 |

|

|

Additional paid-in capital |

|

|

1,409,541 |

|

|

|

1,301,979 |

|

|

Subscriptions receivable |

|

|

(500 |

) |

|

|

(15 |

) |

|

Cumulative distributions in excess of retained earnings |

|

|

(135,829 |

) |

|

|

(120,280 |

) |

|

Accumulated other comprehensive income |

|

|

27,310 |

|

|

|

5,122 |

|

|

Total Broadstone Net Lease, Inc. stockholders’ equity |

|

|

1,300,542 |

|

|

|

1,186,825 |

|

|

Non-controlling interests |

|

|

112,277 |

|

|

|

97,376 |

|

|

Total equity |

|

|

1,412,819 |

|

|

|

1,284,201 |

|

|

Total liabilities and equity |

|

$ |

2,815,258 |

|

|

$ |

2,578,756 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Income and Comprehensive Income

(Unaudited)

(in thousands, except per share amounts)

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income from operating leases |

|

$ |

53,590 |

|

|

$ |

41,256 |

|

|

$ |

105,422 |

|

|

$ |

80,657 |

|

|

Earned income from direct financing leases |

|

|

953 |

|

|

|

1,074 |

|

|

|

1,919 |

|

|

|

2,207 |

|

|

Operating expenses reimbursed from tenants |

|

|

2,486 |

|

|

|

1,296 |

|

|

|

5,235 |

|

|

|

2,913 |

|

|

Other income from real estate transactions |

|

|

3 |

|

|

|

45 |

|

|

|

45 |

|

|

|

78 |

|

|

Total revenues |

|

|

57,032 |

|

|

|

43,671 |

|

|

|

112,621 |

|

|

|

85,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

20,232 |

|

|

|

14,733 |

|

|

|

39,434 |

|

|

|

29,326 |

|

|

Asset management fees |

|

|

4,313 |

|

|

|

3,629 |

|

|

|

8,456 |

|

|

|

6,822 |

|

|

Property management fees |

|

|

1,595 |

|

|

|

1,218 |

|

|

|

3,112 |

|

|

|

2,386 |

|

|

Property and operating expense |

|

|

2,530 |

|

|

|

1,124 |

|

|

|

5,149 |

|

|

|

2,701 |

|

|

General and administrative |

|

|

1,456 |

|

|

|

1,162 |

|

|

|

2,787 |

|

|

|

2,125 |

|

|

State and franchise tax |

|

|

510 |

|

|

|

160 |

|

|

|

753 |

|

|

|

210 |

|

|

Total operating expenses |

|

|

30,636 |

|

|

|

22,026 |

|

|

|

59,691 |

|

|

|

43,570 |

|

|

Operating income |

|

|

26,396 |

|

|

|

21,645 |

|

|

|

52,930 |

|

|

|

42,285 |

|

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred distribution income |

|

|

187 |

|

|

|

182 |

|

|

|

375 |

|

|

|

363 |

|

|

Interest income |

|

|

52 |

|

|

|

115 |

|

|

|

162 |

|

|

|

227 |

|

|

Interest expense |

|

|

(12,454 |

) |

|

|

(7,860 |

) |

|

|

(23,631 |

) |

|

|

(15,802 |

) |

|

Cost of debt extinguishment |

|

|

(51 |

) |

|

|

(3,567 |

) |

|

|

(51 |

) |

|

|

(3,615 |

) |

|

Gain on sale of real estate |

|

|

4,256 |

|

|

|

5,477 |

|

|

|

7,595 |

|

|

|

6,280 |

|

|

Net income |

|

|

18,386 |

|

|

|

15,992 |

|

|

|

37,380 |

|

|

|

29,738 |

|

|

Net income attributable to non-controlling interests |

|

|

(1,412 |

) |

|

|

(1,265 |

) |

|

|

(2,834 |

) |

|

|

(2,418 |

) |

|

Net income attributable to Broadstone Net Lease, Inc. |

|

$ |

16,974 |

|

|

$ |

14,727 |

|

|

$ |

34,546 |

|

|

$ |

27,320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

19,829 |

|

|

|

16,623 |

|

|

|

19,498 |

|

|

|

16,102 |

|

|

Diluted |

|

|

21,478 |

|

|

|

18,051 |

|

|

|

21,098 |

|

|

|

17,530 |

|

|

Net earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.86 |

|

|

$ |

0.89 |

|

|

$ |

1.77 |

|

|

$ |

1.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

18,386 |

|

|

$ |

15,992 |

|

|

$ |

37,380 |

|

|

$ |

29,738 |

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of interest rate swaps |

|

|

7,042 |

|

|

|

(4,291 |

) |

|

|

23,997 |

|

|

|

(1,731 |

) |

|

Realized loss on interest rate swaps |

|

|

— |

|

|

|

(873 |

) |

|

|

— |

|

|

|

(873 |

) |

|

Comprehensive income |

|

|

25,428 |

|

|

|

10,828 |

|

|

|

61,377 |

|

|

|

27,134 |

|

|

Comprehensive income attributable to non-controlling interests |

|

|

(1,951 |

) |

|

|

(857 |

) |

|

|

(4,643 |

) |

|

|

(2,224 |

) |

|

Comprehensive income attributable to Broadstone Net Lease, Inc. |

|

$ |

23,477 |

|

|

$ |

9,971 |

|

|

$ |

56,734 |

|

|

$ |

24,910 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except per share amounts)

|

|

|

Common Stock |

|

|

Additional Paid-in Capital |

|

|

Subscriptions Receivable |

|

|

Cumulative Distributions in Excess of Retained Earnings |

|

|

Accumulated Other Comprehensive Income |

|

|

Non-controlling Interests |

|

|

Total |

|

|||||||

|

Balance, January 1, 2017 |

|

$ |

15 |

|

|

$ |

1,009,431 |

|

|

$ |

(9,790 |

) |

|

$ |

(89,960 |

) |

|

$ |

2,092 |

|

|

$ |

86,749 |

|

|

$ |

998,537 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

27,320 |

|

|

|

— |

|

|

|

2,418 |

|

|

|

29,738 |

|

|

Issuance of 2,169 shares of common stock, net |

|

|

2 |

|

|

|

170,679 |

|

|

|

9,790 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

180,471 |

|

|

Other offering costs |

|

|

— |

|

|

|

(802 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(802 |

) |

|

Issuance of 103 membership units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,278 |

|

|

|

8,278 |

|

|

Distributions declared ($0.410 per share January 2017, $0.415 per share February through June 2017) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(40,071 |

) |

|

|

— |

|

|

|

(3,733 |

) |

|

|

(43,804 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,606 |

) |

|

|

(125 |

) |

|

|

(1,731 |

) |

|

Realized loss on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(804 |

) |

|

|

(69 |

) |

|

|

(873 |

) |

|

Conversion of one membership unit to one share of common stock |

|

|

— |

|

|

|

27 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(27 |

) |

|

|

— |

|

|

Redemption of 39 shares of common stock |

|

|

— |

|

|

|

(3,016 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,016 |

) |

|

Balance, June 30, 2017 |

|

$ |

17 |

|

|

$ |

1,176,319 |

|

|

$ |

— |

|

|

$ |

(102,711 |

) |

|

$ |

(318 |

) |

|

$ |

93,491 |

|

|

$ |

1,166,798 |

|

|

|

|

Common Stock |

|

|

Additional Paid-in Capital |

|

|

Subscriptions Receivable |

|

|

Cumulative Distributions in Excess of Retained Earnings |

|

|

Accumulated Other Comprehensive Income |

|

|

Non-controlling Interests |

|

|

Total |

|

|||||||

|

Balance, January 1, 2018 |

|

$ |

19 |

|

|

$ |

1,301,979 |

|

|

$ |

(15 |

) |

|

$ |

(120,280 |

) |

|

$ |

5,122 |

|

|

$ |

97,376 |

|

|

$ |

1,284,201 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34,546 |

|

|

|

— |

|

|

|

2,834 |

|

|

|

37,380 |

|

|

Issuance of 1,405 shares of common stock, net |

|

|

1 |

|

|

|

114,040 |

|

|

|

(485 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

113,556 |

|

|

Other offering costs |

|

|

— |

|

|

|

(525 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(525 |

) |

|

Issuance of 194 membership units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,797 |

|

|

|

15,797 |

|

|

Distributions declared ($0.415 per share January 2018, $0.43 per share February through June 2018) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(50,095 |

) |

|

|

— |

|

|

|

(4,855 |

) |

|

|

(54,950 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

22,188 |

|

|

|

1,809 |

|

|

|

23,997 |

|

|

Conversion of eight membership units to eight shares of common stock |

|

|

— |

|

|

|

684 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(684 |

) |

|

|

— |

|

|

Redemption of 74 shares of common stock |

|

|

— |

|

|

|

(5,889 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,889 |

) |

|

Cancellation of nine shares of common stock |

|

|

— |

|

|

|

(748 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(748 |

) |

|

Balance, June 30, 2018 |

|

$ |

20 |

|

|

$ |

1,409,541 |

|

|

$ |

(500 |

) |

|

$ |

(135,829 |

) |

|

$ |

27,310 |

|

|

$ |

112,277 |

|

|

$ |

1,412,819 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

|

For the six months ended June 30, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

37,380 |

|

|

$ |

29,738 |

|

|

Adjustments to reconcile net income including non-controlling interest to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization including intangibles associated with investment in rental property |

|

|

39,901 |

|

|

|

29,714 |

|

|

Amortization of debt issuance costs charged to interest expense |

|

|

862 |

|

|

|

787 |

|

|

Straight-line rent and financing lease adjustments |

|

|

(10,303 |

) |

|

|

(8,068 |

) |

|

Cost of debt extinguishment |

|

|

51 |

|

|

|

3,615 |

|

|

Gain on sale of real estate |

|

|

(7,595 |

) |

|

|

(6,280 |

) |

|

Settlement of interest rate swap, liability |

|

|

— |

|

|

|

(1,965 |

) |

|

Leasing fees paid |

|

|

(1,177 |

) |

|

|

(1,796 |

) |

|

Non-cash interest |

|

|

— |

|

|

|

(1,349 |

) |

|

Other non-cash items |

|

|

329 |

|

|

|

237 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Tenant and other receivables |

|

|

54 |

|

|

|

(18 |

) |

|

Prepaid expenses and other assets |

|

|

(1,570 |

) |

|

|

(941 |

) |

|

Accounts payable and other liabilities |

|

|

1,046 |

|

|

|

797 |

|

|

Accrued interest payable |

|

|

(303 |

) |

|

|

837 |

|

|

Net cash provided by operating activities |

|

|

58,675 |

|

|

|

45,308 |

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

Acquisition of rental property accounted for using the operating method, net of mortgage assumed of $20,845 and $0 in 2018 and 2017, respectively |

|

|

(216,036 |

) |

|

|

(185,179 |

) |

|

Acquisition of rental property accounted for using the direct financing method |

|

|

(430 |

) |

|

|

(3,546 |

) |

|

Capital expenditures and improvements |

|

|

(1,445 |

) |

|

|

(3,871 |

) |

|

Proceeds from disposition of rental property, net |

|

|

30,289 |

|

|

|

28,929 |

|

|

Increase in tenant and capital reserves |

|

|

(98 |

) |

|

|

(81 |

) |

|

Net cash used in investing activities |

|

|

(187,720 |

) |

|

|

(163,748 |

) |

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

|

88,701 |

|

|

|

161,435 |

|

|

Redemptions of common stock |

|

|

(5,889 |

) |

|

|

(3,016 |

) |

|

Borrowings on mortgages, notes payable and unsecured term notes, net of mortgages assumed of $20,845 and $0 in 2018 and 2017, respectively |

|

|

90,000 |

|

|

|

400,000 |

|

|

Principal payments on mortgages and notes payable |

|

|

(2,442 |

) |

|

|

(374,023 |

) |

|

Borrowings on unsecured revolver |

|

|

115,000 |

|

|

|

175,000 |

|

|

Repayments on unsecured revolver |

|

|

(115,500 |

) |

|

|

(187,000 |

) |

|

Cash distributions paid to stockholders |

|

|

(25,245 |

) |

|

|

(21,091 |

) |

|

Cash distributions paid to non-controlling interests |

|

|

(4,785 |

) |

|

|

(3,727 |

) |

|

Debt issuance costs paid |

|

|

(72 |

) |

|

|

(8,470 |

) |

|

Net cash provided by financing activities |

|

|

139,768 |

|

|

|

139,108 |

|

|

Net increase in cash and cash equivalents and restricted cash |

|

|

10,723 |

|

|

|

20,668 |

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

|

10,099 |

|

|

|

23,103 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

20,822 |

|

|

$ |

43,771 |

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cash and cash equivalents and restricted cash |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

$ |

9,355 |

|

|

$ |

21,635 |

|

|

Restricted cash at beginning of period |

|

|

744 |

|

|

|

1,468 |

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

$ |

10,099 |

|

|

$ |

23,103 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

13,765 |

|

|

$ |

35,752 |

|

|

Restricted cash at end of period |

|

|

7,057 |

|

|

|

8,019 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

20,822 |

|

|

$ |

43,771 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Broadstone Net Lease, Inc. and Subsidiaries

Notes to the Condensed Consolidated Financial Statements (Unaudited)

(in thousands)

1. Business Description

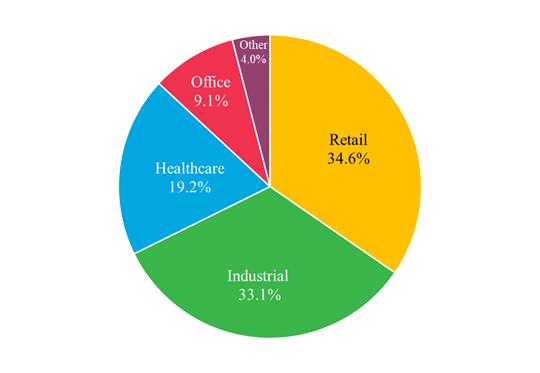

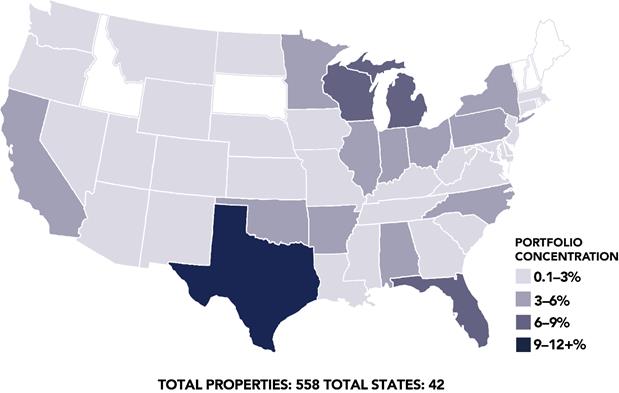

Broadstone Net Lease, Inc. (the “Corporation”) is a Maryland corporation formed on October 18, 2007, that elected to be taxed as a real estate investment trust (“REIT”) commencing with the taxable year ended December 31, 2008. The Corporation focuses on investing in income-producing, net leased commercial properties. The Corporation leases properties to retail, healthcare, industrial, office, and other commercial businesses under long-term lease agreements. Properties are generally leased on a triple-net basis such that tenants pay all operating expenses relating to the property, including, but not limited to, property taxes, insurance, maintenance, repairs, and capital costs, during the lease term. As of June 30, 2018, the Corporation owned a diversified portfolio of 558 individual net leased commercial properties located in 42 states throughout the continental United States.

Broadstone Net Lease, LLC (the “Operating Company”), is the entity through which the Corporation conducts its business and owns (either directly or through subsidiaries) all of the Corporation’s properties. The Corporation is the sole managing member and primary owner of the economic interest of the Operating Company. The remaining interests in the Operating Company, which are referred to as non-controlling interests, are held by members who acquired their interest by contributing property to the Operating Company in exchange for membership units of the Operating Company. As the Corporation conducts substantially all of its operations through the Operating Company, it is structured as what is referred to as an Umbrella Partnership Real Estate Investment Trust (“UPREIT”). The following table summarizes the economic ownership interest in the Operating Company as of June 30, 2018 and December 31, 2017:

|

Percentage of shares owned by |

|

June 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Corporation |

|

|

92.1 |

% |

|

|

92.4 |

% |

|

Non-controlling interests |

|

|

7.9 |

% |

|

|

7.6 |

% |

|

|

|

|

100.0 |

% |

|

|

100.0 |

% |

The Corporation operates under the direction of its board of directors (the “Board of Directors”), which is responsible for the management and control of the Company’s (as defined below) affairs. The Corporation is externally managed and its board of directors has retained the Corporation’s sponsor, Broadstone Real Estate, LLC (the “Manager”) and Broadstone Asset Management, LLC (the “Asset Manager”) to manage the Corporation’s day-to-day affairs, to implement the Corporation’s investment strategy, and to provide certain property management services for the Corporation’s properties, subject to the Board of Directors’ direction, oversight, and approval. The Asset Manager is a wholly-owned subsidiary of the Manager and all of the Corporation’s officers are employees of the Manager. Accordingly, both the Manager and the Asset Manager are related parties of the Company. Refer to Note 3 for further discussion over related parties and related party transactions.

2. Summary of Significant Accounting Policies

Interim Information

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information (Accounting Standards Codification (“ASC”) 270, Interim Reporting) and Article 10 of the Securities and Exchange Commission’s (“SEC”) Regulation S-X. Accordingly, the Corporation has omitted certain footnote disclosures which would substantially duplicate those contained within the audited consolidated financial statements for the year ended December 31, 2017, included in the Company’s 2017 Annual Report on Form 10-K, filed with the SEC on March 15, 2018. Therefore, the readers of this quarterly report should refer to those audited consolidated financial statements, specifically Note 2, Summary of Significant Accounting Policies, for further discussion of significant accounting policies and estimates. The Corporation believes all adjustments necessary for a fair presentation have been included in these interim Condensed Consolidated Financial Statements (which include only normal recurring adjustments).

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts and operations of the Corporation, the Operating Company and its consolidated subsidiaries, all of which are wholly owned by the Operating Company (collectively, the “Company”). All intercompany balances and transactions have been eliminated in consolidation.

5

To the extent the Corporation has a variable interest in entities that are not evaluated under the variable interest entity (“VIE”) model, the Corporation evaluates its interests using the voting interest entity model. The Corporation holds a 92.1% interest in the Operating Company at June 30, 2018, and is the sole managing member of the Operating Company, which gives the Corporation exclusive and complete responsibility for the day-to-day management, authority to make decisions, and control of the Operating Company. Based on consolidation guidance, the Corporation concluded that the Operating Company is a VIE as the members in the Operating Company do not possess kick-out rights or substantive participating rights. Accordingly, the Corporation consolidates its interest in the Operating Company. However, as the Corporation holds the majority voting interest in the Operating Company, it qualifies for the exemption from providing certain disclosure requirements associated with investments in VIEs.

The portion of the Operating Company not owned by the Corporation is presented as non-controlling interests as of and during the periods presented.

Basis of Accounting

The Condensed Consolidated Financial Statements have been prepared in accordance with GAAP.

Use of Estimates

The preparation of Condensed Consolidated Financial Statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting periods. Significant estimates include, but are not limited to, the allocation of purchase price between investment in rental property and intangible assets acquired and liabilities assumed, the value of long-lived assets, the provision for impairment, the depreciable lives of rental property, the amortizable lives of intangible assets and liabilities, the allowance for doubtful accounts, the fair value of assumed debt and notes payable, the fair value of the Company’s interest rate swap agreements, and the determination of any uncertain tax positions. Accordingly, actual results may differ from those estimates.

Restricted Cash

Restricted cash includes escrow funds the Company maintains pursuant to the terms of certain mortgage and notes payable and lease agreements, and undistributed proceeds from the sale of properties under Section 1031 of the Internal Revenue Code.

At the inception of a new lease arrangement, including new leases that arise from amendments, the Company assesses the terms and conditions to determine the proper lease classification. A lease arrangement is classified as an operating lease if none of the following criteria are met: (i) ownership transfers to the lessee prior to or shortly after the end of the lease term, (ii) lessee has a bargain purchase option during or at the end of the lease term, (iii) the lease term is greater than or equal to 75% of the underlying property’s estimated useful life, or (iv) the present value of the future minimum lease payments (excluding executory costs) is greater than or equal to 90% of the fair value of the leased property. If one or more of these criteria are met, and the minimum lease payments are determined to be reasonably predictable and collectible, the lease arrangement is generally accounted for as a direct financing lease. Consistent with Financial Accounting Standards Board (“FASB”) ASC 840, Leases, if the fair value of the land component is 25% or more of the total fair value of the leased property, the land is considered separately from the building for purposes of applying the lease term and minimum lease payments criterion in (iii) and (iv) above.

Revenue recognition methods for operating leases and direct financing leases are described below:

Rental property accounted for under operating leases – Revenue is recognized as rents are earned on a straight-line basis over the non-cancelable terms of the related leases. In most cases, revenue recognition under operating leases begins when the lessee takes possession of, or controls, the physical use of the leased asset. Generally, this occurs on the lease commencement date. For leases that have fixed and measurable rent escalations, the difference between such rental income earned and the cash rent due under the provisions of the lease is recorded as Accrued rental income on the Condensed Consolidated Balance Sheets.

Rental property accounted for under direct financing leases – The Company utilizes the direct finance method of accounting to record direct financing lease income. For a lease accounted for as a direct financing lease, the net investment in the direct financing lease represents receivables for the sum of future minimum lease payments and the estimated residual value of the leased property, less the unamortized unearned income. Unearned income is deferred and amortized into income over the lease terms so as to produce a constant periodic rate of return on the Company’s net investment in the leases.

6

Adoption of ASU 2014-09, described further in Recently Adopted Accounting Standards elsewhere in Note 2, did not have an impact on the nature, amount or timing of revenue recognized for operating leases and direct financing leases as revenue from these sources is derived from lease contracts and therefore falls outside the scope of this guidance.

Sales of Real Estate

As described further in Recently Adopted Accounting Standards elsewhere in Note 2, the Company adopted ASU 2017-05, effective January 1, 2018. Under ASU 2017-05, the Company’s sales of real estate are generally considered to be sales to non-customers, requiring the Company to identify each distinct non-financial asset promised to the buyer. The Company determines whether the buyer obtains control of the non-financial assets, achieved through the transfer of the risks and rewards of ownership of the non-financial assets. If control is transferred to the buyer, the Company derecognizes the asset.

If the Company determines that it did not transfer control of the non-financial assets to the buyer, the Company will analyze the contract for separate performance obligations and allocate a portion of the sales price to each performance obligation. As performance obligations are satisfied, the Company will recognize the respective income in the Condensed Consolidated Statements of Income and Comprehensive Income.

The Company accounts for discontinued operations if disposals of properties represent a strategic shift in operations. Those strategic shifts would need to have a major effect on the Company’s operations and financial results in order to meet the definition.

Rent Received in Advance

Rent received in advance represents tenant payments received prior to the contractual due date and are included in Accounts payable and other liabilities on the Condensed Consolidated Balance Sheets. Rents received in advance at June 30, 2018 and December 31, 2017 are as follows:

|

(in thousands) |

|

June 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Rents received in advance |

|

$ |

8,253 |

|

|

$ |

8,585 |

|

Allowance for Doubtful Accounts

Management periodically reviews the sufficiency of the allowance for doubtful accounts, taking into consideration its historical losses and existing economic conditions, and adjusts the allowance as it considers necessary. Uncollected tenant receivables are written off against the allowance when all possible means of collection have been exhausted.

The following table summarizes the changes in the allowance for doubtful accounts for the six months ended June 30, 2018 and the year ended December 31, 2017:

|

(in thousands) |

|

June 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Beginning balance |

|

$ |

742 |

|

|

$ |

323 |

|

|

Provision for doubtful accounts |

|

|

586 |

|

|

|

419 |

|

|

Write-offs |

|

|

(177 |

) |

|

|

— |

|

|

Ending balance |

|

$ |

1,151 |

|

|

$ |

742 |

|

Derivative Instruments

The Company uses interest rate swap agreements to manage risks related to interest rate movements. The interest rate swap agreements, designated and qualifying as cash flow hedges, are reported at fair value. The gain or loss on the qualifying hedges is initially included as a component of other comprehensive income or loss and is subsequently reclassified into earnings when interest payments on the related debt are incurred and as the swap net settlements occur. The Company documents its risk management strategy and hedge effectiveness at the inception of and during the term of each hedge. The Company’s interest rate risk management strategy is intended to stabilize cash flow requirements by maintaining interest rate swap agreements to convert certain variable-rate debt to a fixed rate.

7

Non-controlling interests represents the membership interests held in the Operating Company of 7.9% and 7.6% at June 30, 2018 and December 31, 2017, respectively, by third parties which are accounted for as a separate component of equity.

The Company periodically adjusts the carrying value of non-controlling interests to reflect their share of the book value of the Operating Company. Such adjustments are recorded to Additional paid-in capital as a reallocation of Non-controlling interests in the Condensed Consolidated Statements of Stockholders’ Equity.

Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value.

The balances of financial instruments measured at fair value on a recurring basis at June 30, 2018 and December 31, 2017 are as follows (see Note 10):

|

|

|

June 30, 2018 |

|

|||||||||||||

|

(in thousands) |

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Interest rate swap, assets |

|

$ |

30,169 |

|

|

$ |

— |

|

|

$ |

30,169 |

|

|

$ |

— |

|

|

Interest rate swap, liabilities |

|

|

(184 |

) |

|

|

— |

|

|

|

(184 |

) |

|

|

— |

|

|

|

|

$ |

29,985 |

|

|

$ |

— |

|

|

$ |

29,985 |

|

|

$ |

— |

|

|

|

|

December 31, 2017 |

|

|||||||||||||

|

|

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Interest rate swap, assets |

|

$ |

11,008 |

|

|

$ |

— |

|

|

$ |

11,008 |

|

|

$ |

— |

|

|

Interest rate swap, liabilities |

|

|

(5,020 |

) |

|

|

— |

|

|

|

(5,020 |

) |

|

|

— |

|

|

|

|

$ |

5,988 |

|

|

$ |

— |

|

|

$ |

5,988 |

|

|

$ |

— |

|

The Company has estimated that the carrying amount reported on the Condensed Consolidated Balance Sheets for Cash and cash equivalents, Restricted cash, Tenant and other receivables, net, Notes receivable, and Accounts payable and other liabilities approximates their fair values due to their short-term nature.

The following table summarizes the carrying amount reported on the Condensed Consolidated Balance Sheets and the Company’s estimate of the fair value of the Mortgage and notes payable, net, Unsecured term notes, net, and Unsecured revolver at June 30, 2018 and December 31, 2017:

|

(in thousands) |

|

June 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Carrying amount |

|

$ |

1,289,302 |

|

|

$ |

1,181,470 |

|

|

Fair value |

|

|

1,254,423 |

|

|

|

1,177,197 |

|

The fair value of the Company’s debt was estimated using Level 2 and Level 3 inputs based on recent financing transactions, estimates of the fair value of the property that serves as collateral for such debt, historical risk premiums for loans of comparable quality, current LIBOR, US treasury obligation interest rates, and on the discounted estimated future cash payments to be made on such debt. The discount rates estimated reflect the Company’s judgment as to the approximate current lending rates for loans or groups of loans with similar maturities and assumes that the debt is outstanding through maturity. Market information, as available, or present value techniques were utilized to estimate the amounts required to be disclosed. Since such amounts are estimates that are based on limited available market information for similar transactions and do not acknowledge transfer or other repayment restrictions that may exist on specific loans, it is unlikely that the estimated fair value of any such debt could be realized by immediate settlement of the obligation.

The Company did not have any assets measured at fair value on a nonrecurring basis at June 30, 2018.

8

Taxes Collected From Tenants and Remitted to Governmental Authorities

The Company’s properties are generally leased on a triple-net basis, which provides that the tenants are responsible for the payment of all property operating expenses, including, but not limited to, property taxes, maintenance, insurance, repairs, and capital costs, during the lease term. The Company records such expenses on a net basis.

The following table summarizes the approximate property tax payments made directly to the taxing authorities by the Company’s tenants, pursuant to their lease obligations, for the three and six months ended June 30, 2018 and 2017:

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

||||||||||

|

(in thousands) |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Property taxes paid by tenants directly to taxing authority |

|

$ |

2,786 |

|

|

$ |

3,498 |

|

|

$ |

11,968 |

|

|

$ |

10,957 |

|

In some situations, the Company may collect property taxes from its tenants and remit those taxes to governmental authorities. Taxes collected from tenants and remitted to governmental authorities are presented on a gross basis, where revenue is included in Operating expenses reimbursed from tenants and expense is included in Property and operating expense in the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

The following table summarizes taxes collected from tenants and remitted to governmental authorities for the three and six months ended June 30, 2018 and 2017:

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

||||||||||

|

(in thousands) |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Property taxes collected from tenants |

|

$ |

1,215 |

|

|

$ |

544 |

|

|

$ |

2,410 |

|

|

$ |

1,179 |

|

|

Property taxes remitted on behalf of tenants |

|

|

1,316 |

|

|

|

560 |

|

|

|

2,473 |

|

|

|

1,199 |

|

Recently Adopted Accounting Standards

In August 2017, the FASB issued Accounting Standards Update (“ASU”) 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. ASU 2017-12 amends the designation and measurement guidance for qualifying hedging transactions and the presentation of hedge results in an entity’s financial statements. The new guidance removes the concept of separately measuring and reporting hedge ineffectiveness and requires a company to present the earnings effect of the hedging instrument in the same income statement line item in which the earnings effect of the hedged item is reported. Disclosure requirements have been modified to include a tabular disclosure related to the effect of hedging instruments on the income statement and eliminate the requirement to disclose the ineffective portion of the change in fair value of such instruments. The new guidance is effective January 1, 2019, with early adoption permitted, and provides companies with a modified retrospective transition method for each cash flow and net investment hedge relationship existing on the date of adoption. This adoption method requires a company to recognize the cumulative effect of initially applying the ASU as an adjustment to accumulated other comprehensive income with a corresponding adjustment to the opening balance of retained earnings as of the beginning of the fiscal year that an entity adopts the update. The Company adopted the guidance effective January 1, 2018. The Company did not recognize a cumulative effect adjustment upon adoption as the Company had not recognized ineffectiveness on any of the hedging instruments existing as of the date of adoption.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows—Restricted Cash. ASU 2016-18 requires that the statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or cash equivalents. Therefore, amounts generally described as restricted cash and equivalents should be included with cash and cash equivalents when reconciling the beginning and end of period total amounts on the statement of cash flows. Previously, there had been no specific guidance to address how to classify or present these changes. ASU 2016-18 became effective, on a retrospective basis, for interim and annual periods beginning after December 15, 2017, with early adoption permitted. The Company adopted ASU 2016-18 as of January 1, 2018. In line with the retrospective adoption of this standard, the Company removed the change in restricted cash from cash flows used in investing activities of $(6,551) for the six months ended June 30, 2017. See Reclassifications elsewhere in Note 2.

9

In August 2016, the FASB issued ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 provides classification guidance for eight specific topics, including but not limited to, debt extinguishment costs, contingent consideration payments made after a business combination, and distributions received from equity method investees. ASU 2016-15 became effective, on a retrospective basis, for interim and annual periods beginning after December 15, 2017, with early adoption permitted. The Company adopted ASU 2016-15 as of January 1, 2018. The classification of debt extinguishment costs in the Condensed Consolidated Statements of Cash Flows addressed by ASU 2016-15 is applicable to the Company. However, adoption of this guidance did not have an impact on the Company’s Condensed Consolidated Statements of Cash Flows, as the Company historically classified these cash flows as required by the guidance.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09, including all updates, is a comprehensive new revenue recognition model requiring a company to recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration it expects to receive in exchange for those goods or services. In adopting ASU 2014-09, companies may use either a full retrospective or a modified retrospective approach. Additionally, this guidance requires improved disclosures regarding the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The Company adopted ASU 2014-09 as of January 1, 2018 on a modified retrospective basis. The adoption had no effect on the Company’s Condensed Consolidated Financial Statements as the Company’s revenues are lease related, which are not subject to the provisions of ASU 2014-09.

In February 2017, the FASB issued ASU 2017-05, Other Income – Gains and Losses from the Derecognition of Nonfinancial Assets. This new guidance was required to be adopted concurrently with the amendments in ASU 2014-09. The new pronouncement adds guidance for partial sales of nonfinancial assets, including real estate. In adopting ASU 2017-05, companies may use either a full retrospective or a modified retrospective approach. The Company previously recognized revenue on sales of real estate at the time the asset was transferred (i.e., at the time of closing). Upon adoption of ASU 2014-09, as discussed above, and therefore ASU 2017-05, the Company now evaluates any separate contract or performance obligation to determine proper timing of revenue recognition, as well as sales price allocation when a performance obligation is identified. Adoption of this pronouncement had no effect on the Company’s Condensed Consolidated Financial Statements during the three or six months ended June 30, 2018 or in any periods.

Other Recently Issued Accounting Standards

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes the existing guidance for lease accounting, Leases (Topic 840). ASU 2016-02 requires lessees to recognize a right-of-use asset and a corresponding lease liability, initially measured at the present value of lease payments, for both operating and financing leases. For leases with a term of 12 months or less, lessees will be permitted to make an accounting policy election by class of underlying asset to not recognize lease liabilities and lease assets. Under the new pronouncement, lessor accounting will be largely unchanged from existing GAAP, however disclosures will be expanded. The standard also eliminates current real estate-specific provisions and changes the guidance on sale-leaseback transactions, initial direct costs and lease executory costs for all entities. The provisions of ASU 2016-02 that are relevant to the Company’s accounting as lessor include those relating to 1) non-lease components of leases, 2) lease classification tests and 3) requirements to expense, on an as-incurred basis, certain initial direct costs that are not incremental in negotiating a lease. Under existing standards, certain of these costs are capitalizable and, therefore, adoption of this new standard may result in these costs being expensed as incurred. The Company is primarily a lessor and does not have any material leases where it is the lessee. Adoption of ASU 2016-02 is therefore not expected to have a material impact on the Company’s Condensed Financial Statements as it relates to leases where the Company is the lessee. Upon adoption, the Company will be required to record certain expenses paid directly by tenants that protect the Company’s interest as lessor in those properties, such as real estate taxes, on a gross basis, where revenue and the corresponding expense will be recorded and presented in the Consolidated Statements of Income and Comprehensive Income. The Company currently records and presents certain of these items on a net basis (see Taxes Collected From Tenants and Remitted to Governmental Authorities elsewhere in Note 2). Although there is not expected to be any impact to net income or cash flows as a result of a gross presentation of these payments, such presentation would have the impact of increasing both reported revenues and property expenses. The Company will evaluate additional guidance in this area as it becomes available. The new standard provides a number of practical expedients that companies may elect as part of transitional reporting. These include 1) an election not to reassess upon transition whether any expired or existing contracts are leases or contain leases, the lease classification for any expired or existing leases, and initial direct costs for existing leases, and 2) an election to use hindsight when evaluating the lease term of existing contracts, and impairment of right of use assets. The Company currently anticipates it will only elect the first of these practical expedients. In adopting the new guidance, companies are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The amendments are effective January 1, 2019, with early adoption permitted. The Company has completed its initial inventory of leases and is in the process of identifying changes needed to its processes and systems impacted by the new standard. The Company is continuing to evaluate the impact that adoption of this guidance will have on its Condensed Consolidated Financial Statements and footnote disclosures, including quantifying the impact of the requirement to report certain items on a gross basis, until the guidance becomes effective.

10

As described below, certain prior period amounts have been reclassified to conform with the current period’s presentation.

In connection with the adoption of ASU 2016-18, discussed in Recently Adopted Accounting Standards elsewhere in Note 2, certain reclassifications have been made to prior period balances to conform to current presentation in the Condensed Consolidated Statements of Cash Flows. Under ASU 2016-18, changes in restricted cash which were previously shown in cash flows used in investing activities in the Condensed Consolidated Statements of Cash Flows are now reflected as part of the total change in cash, cash equivalents and restricted cash in the Condensed Consolidated Statements of Cash Flows.

3. Related-Party Transactions

Property Management Agreement

The Corporation and the Operating Company are a party to a property management agreement (as amended, the “Property Management Agreement”) with the Manager, a related party in which certain directors of the Corporation have either a direct or indirect ownership interest. Under the terms of the Property Management Agreement, the Manager manages and coordinates certain aspects of the leasing of the Corporation’s rental property.

In exchange for services provided under the Property Management Agreement, the Manager receives certain fees and other compensation as follows:

|

|

(a) |

3% of gross rentals collected each month from the rental property for property management services (other than one property, which has a separate agreement for 5% of gross rentals); and |

|

|

(b) |

Re-leasing fees for existing rental property equal to one month’s rent for a new lease with an existing tenant and two months’ rent for a new lease with a new tenant. |

Effective January 1, 2018, the Property Management Agreement was amended to, among other things, extend the recurring term of the agreement from one year to three years, clarify termination provisions, include a Termination Event concept and a Key Person Event concept, each as defined in the Property Management Agreement, and remove fee provisions relating to short-term financing or guarantees provided by the Manager to the Operating Company.

The Property Management Agreement will automatically renew on January 1, 2019 for three years ending December 31, 2021, subject to earlier termination pursuant to the terms of the Property Management Agreement. The Property Management Agreement provides for termination (i) immediately by the Corporation’s Independent Directors Committee (“IDC”) for Cause, as defined in the Property Management Agreement, (ii) by the IDC, upon 30 days’ written notice to the Manager, in connection with a change of control of the Manager, as defined in the Property Management Agreement, (iii) by the IDC, by providing the Manager with written notice of termination not less than one year prior to the last calendar day of any renewal term, (iv) by the Manager upon written notice to the Company not less than one year prior to the last calendar day of any renewal period, (v) automatically in the event of a Termination Event, and (vi) by the IDC upon a Key Person Event.

If the Corporation terminates the agreement prior to any renewal term or in any manner described above, other than termination by the Corporation for Cause, the Corporation will be subject to a termination fee equal to three times the Management Fees, as defined in the Property Management Agreement, to which the Manager was entitled during the 12-month period immediately preceding the date of such termination. Although not terminable as of June 30, 2018, if the Property Management Agreement had been terminated at June 30, 2018, subject to the conditions noted above, the termination fee would have been $17,145.

Asset Management Agreement

The Corporation and the Operating Company are party to an asset management agreement (as amended, the “Asset Management Agreement”) with the Asset Manager, a single member limited liability company with the Manager as the single member, and therefore a related party in which certain directors of the Corporation have an indirect ownership interest. Under the terms of the Asset Management Agreement, the Asset Manager is responsible for, among other things, the Corporation’s acquisition, initial leasing, and disposition strategies, financing activities, and providing support to the Corporation’s IDC for its valuation functions and other duties. The Asset Manager also designates two individuals to serve on the Board of Directors of the Corporation.

11

Effective January 1, 2018, the Asset Management Agreement was amended to, among other things, extend the recurring term of the agreement from one year to three years, provide for additional disposition fee provisions, and include a Disposition Event concept and Key Person Event concept, each as defined in the amended Asset Management Agreement. The Asset Management Agreement defines a Disposition Event in the same manner as a Termination Event is defined in the Property Management Agreement discussed above.

Under the terms of the Asset Management Agreement, the Asset Manager is compensated as follows:

|

|

(a) |

a quarterly asset management fee equal to 0.25% of the aggregate value of common stock, based on the per share value as determined by the IDC each quarter, on a fully diluted basis as if all interests in the Operating Company had been converted into shares of the Corporation’s common stock; |

|

|

(b) |

0.5% of the proceeds from future equity closings as reimbursement for offering, marketing, and brokerage expenses; |

|

|

(c) |

1% of the gross purchase price paid for each rental property acquired (other than acquisitions described in (d) below), including any property contributed in exchange for membership interests in the Operating Company; |

|

|

(d) |

2% of the gross purchase price paid for each rental property acquired in the event that the acquisition of a rental property requires a new lease (as opposed to the assumption of an existing lease), such as a sale-leaseback transaction; |

|

|

(e) |

1% of the gross sale price received for each rental property disposition; and |

|

|

(f) |

1% of the Aggregate Consideration, as defined in the Asset Management Agreement, received in connection with a Disposition Event. |

The Asset Management Agreement will automatically renew on January 1, 2019 for three years ending December 31, 2021, subject to earlier termination pursuant to the terms of the Asset Management Agreement. The Asset Management Agreement provides for termination (i) immediately by the IDC for Cause, as defined in the Asset Management Agreement, (ii) by the IDC, upon 30 days’ written notice to the Asset Manager, in connection with a change in control of the Asset Manager, as defined in the Asset Management Agreement, (iii) by the IDC, by providing the Asset Manager with written notice of termination not less than one year prior to the last calendar of any renewal term, (iv) by the Asset Manager upon written notice to the Company not less than one year prior to the last calendar day of any renewal period, (v) automatically in the event of a Disposition Event, and (vi) by the IDC upon a Key Person Event.

If the Corporation terminates the agreement prior to any renewal term or in any manner described above, other than termination by the Corporation for Cause, the Corporation will be required to pay to the Asset Manager a termination fee equal to three times the Asset Management Fee to which the Asset Manager was entitled during the 12-month period immediately preceding the date of such termination. Although not terminable as of June 30, 2018, if the Asset Management Agreement had been terminated at June 30, 2018, subject to the conditions noted above, the termination fee would have been $49,167.

Total fees incurred under the Property Management Agreement and Asset Management Agreement for the three and six months ended June 30, 2018 and 2017, are as follows:

|

(in thousands) |

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

||||||||||

|

Type of Fee |

|

Financial Statement Presentation |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Asset management fee |

|

Asset management fees |

|

$ |

4,313 |

|

|

$ |

3,629 |

|

|

$ |

8,456 |

|

|

$ |

6,822 |

|

|

Property management fee |

|

Property management fees |

|

|

1,595 |

|

|

|

1,218 |

|

|

|

3,112 |

|

|

|

2,386 |

|

|

Total management fee expense |

|

|

|

|

5,908 |

|

|

|

4,847 |

|

|

|

11,568 |

|

|

|

9,208 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing fee (offering costs) |

|

Additional paid-in capital |

|

|

301 |

|

|

|

391 |

|

|

|

525 |

|

|

|

802 |

|

|

Acquisition fee |

|

Capitalized as a component of assets acquired |

|

|

1,380 |

|

|

|

1,032 |

|

|

|

2,386 |

|

|

|

1,929 |

|

|

Leasing fee |

|

Leasing fees, net |

|

|

392 |

|

|

|

899 |

|

|

|

1,177 |

|

|

|

1,796 |

|

|

Disposition fee |

|

Gain on sale of real estate |

|

|

155 |

|

|

|

240 |

|

|

|

323 |

|

|

|

303 |

|

|

Total management fees |

|

|

|

$ |

8,136 |

|

|

$ |

7,409 |

|

|

$ |

15,979 |

|

|

$ |

14,038 |

|

Included in management fees are $915 and $722 of unpaid fees recorded in Due to related parties on the Condensed Consolidated Balance Sheets at June 30, 2018 and December 31, 2017, respectively. All fees related to the Property Management Agreement and the Asset Management Agreement are paid for in cash within the Company’s normal payment cycle for vendors.

12

The Company closed on the following acquisitions during the six months ended June 30, 2018:

|

(in thousands, except number of properties) |

|

|

|

|

|

|

|

|

|

||

|

Date |

|

Property Type |

|

Number of Properties |

|

|

Real Estate Acquisition Price |

|

|

||

|

March 27, 2018 |

|

Industrial |

|

|

1 |

|

|

$ |

22,000 |

|

|

|

March 30, 2018 |

|

Retail/Industrial |

|

|

26 |

|

|

|

78,530 |

|

|

|

April 30, 2018 |

|

Other |

|

|

1 |

|

|

|

16,170 |

|

|

|

June 6, 2018 |

|

Industrial |

|

|

1 |

|

|

|

8,500 |

|

|

|

June 14, 2018 |

|

Industrial |

|

|

1 |

|

|

|

39,700 |

|

|

|

June 14, 2018 |

|

Retail |

|

|

6 |

|

|