Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ESSENDANT INC | esnd-ex991_6.htm |

| 8-K - 8-K - ESSENDANT INC | esnd-8k_20180726.htm |

Earnings Presentation Second Quarter 2018 July 27, 2018 Exhibit 99.2

Forward-Looking Statements 2 This presentation contains forward-looking statements, including statements regarding the proposed business combination transaction between the Company and Genuine Parts Company (“GPC”) in which GPC will separate its Business Products Group and combine this business with Essendant. From time to time, oral or written forward-looking statements may also be included in other information released to the public. These forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements often contain words such as “expects,” “anticipates,” “estimates,” “intends,” “plans,” “believes,” “seeks,” “will,” “is likely to,” “scheduled,” “positioned to,” “continue,” “forecast,” “predicting,” “projection,” “potential” or similar expressions. Forward-looking statements may include references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results, events or transactions of the Company or the combined company following the proposed transaction with GPC, the anticipated benefits of the proposed transaction, including estimated synergies, the expected timing of completion of the transaction, and other statements that are not strictly historical in nature. These forward-looking statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here, including but not limited to: market dynamics that create sales risks, including the Company’s reliance on key customers, including key customers in the independent reseller channel, the risks inherent in continuing or increased customer concentration and consolidations, efforts by suppliers and customers to bypass the Company and transact directly with each other, and competition from e-commerce businesses and other resellers increasing their presence at the wholesale level; the impact of price transparency, customer consolidation and product sales mix changes on the Company’s sales and margins; the Company’s reliance on supplier allowances and promotional incentives; the Company’s exposure to the credit risk of its customers; potential disruptions to the Company’s relationships with customers and suppliers due to the Company’s significant cost reduction initiatives; continuing or increasing competitive activity and pricing pressures within existing or expanded product categories, including competition from e-commerce businesses and the online branches of brick-and-mortar businesses; the impact of supply chain disruptions or changes in key suppliers’ distribution strategies; continued declines in end-user demand for products in the office, technology and furniture product categories; financial cycles due to secular consumer demand, recession or other events, most notably in the Company’s Industrial and Automotive businesses; the impact of the Company’s strategic objectives and possible disruption of business operations and relationships with customers and suppliers; the Company’s ability to manage inventory in order to maximize sales and supplier allowances while minimizing excess and obsolete inventory; the Company’s success in effectively identifying, consummating and integrating acquisitions; the Company’s ability to attract and retain key management personnel; the costs and risks related to compliance with laws, regulations and industry standards affecting the Company’s business; the Company’s ability to maintain its existing information technology systems and to successfully procure, develop and implement new systems and services without business disruption or other unanticipated difficulties or costs; the impact on the Company’s reputation and relationships of a breach of the Company’s information technology systems or a failure to maintain the security of private information; the availability of financing sources to meet the Company’s business needs; unexpected events that could disrupt business operations, increasing costs and decreasing revenues; the ability of the Company and GPC to receive the required regulatory approvals for the proposed transaction and approval of the Company’s stockholders and to satisfy the other conditions to the closing of the transaction on a timely basis or at all; the occurrence of events that may give rise to a right of one or both of the Company and GPC to terminate the merger agreement; negative effects of the announcement or the consummation of the transaction with GPC on the market price of the Company’s common stock and/or on its business, financial condition, results of operations and financial performance; risks relating to the value of the shares of the Company to be issued in the transaction with GPC, significant transaction costs and/or unknown liabilities; the possibility that the anticipated benefits from the proposed transaction with GPC cannot be realized in full or at all or may take longer to realize than expected; risks associated with contracts containing consent and/or other provisions that may be triggered by the proposed transaction with GPC; risks associated with litigation related to the transaction with GPC; the possibility that costs or difficulties related to the integration of the Company and GPC’s SP Richards business will be greater than expected; and the ability of the combined company to retain and hire key personnel. There can be no assurance that the proposed transaction with GPC or any other transaction will in fact be consummated in the manner described or at all. Stockholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, please see the Company’s and GPC’s statements and reports on Forms S-4, 10-K, 10-Q and 8-K filed with or furnished to the U.S. Securities and Exchange Commission and other written statements made by the Company and/or GPC from time to time. The forward-looking information herein is given as of this date only, and neither the Company nor GPC undertakes any obligation to revise or update it.

Q2 2018 Headlines 3 Net sales declined 0.5%, to $1.3 billion Driven by declines in national reseller channel offset by growth in key channels Adjusted income per share(1) of $0.16 Restructuring program on track and on time On track to deliver an annualized run rate of cost savings over $50 million in 2020, with more than half realized in this year. (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

Strategic Drivers Improve efficiency across the distribution network and reduce the cost base Redesign inbound freight logistics through inbound consolidation centers Optimize distribution network footprint Reduce operating expenses Accelerate sales performance in key channels Align resources around channels and independent resellers that provide growth opportunities, including JanSan distributors, vertical markets, industrial, e-commerce, and automotive Partner with independent resellers who are well positioned to grow Advance supplier partnerships that leverage Essendant’s network and capabilities Continued evolution of Preferred Supplier Program Collaborate to develop successful market strategies Deepen insights through advanced digital analytics

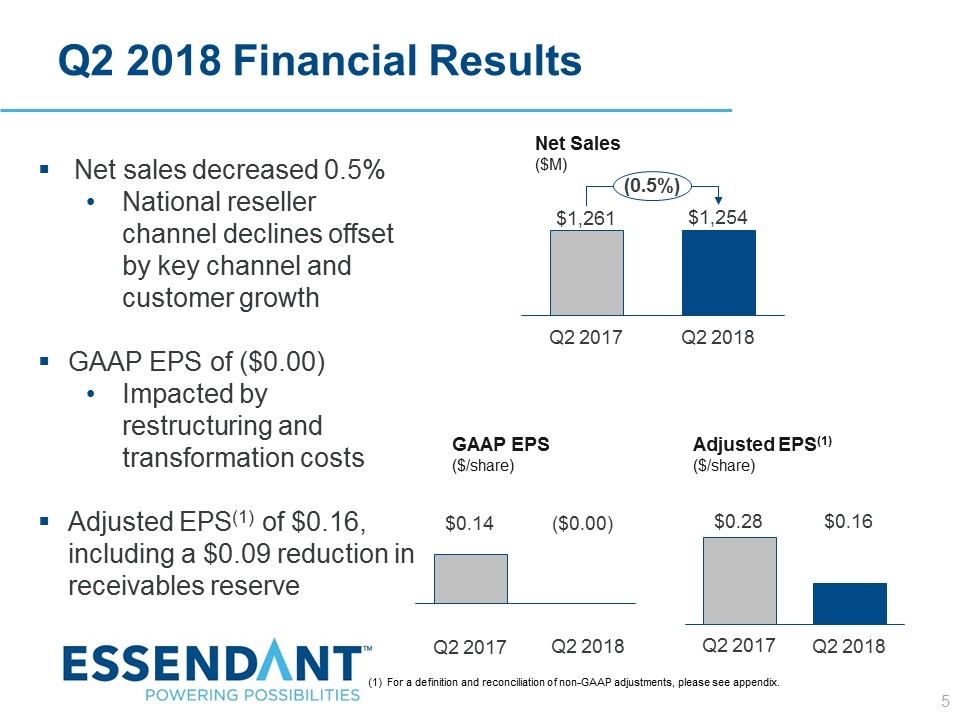

Q2 2018 Financial Results 5 Net sales decreased 0.5% National reseller channel declines offset by key channel and customer growth GAAP EPS of ($0.00) Impacted by restructuring and transformation costs Adjusted EPS(1) of $0.16, including a $0.09 reduction in receivables reserve GAAP EPS ($/share) Adjusted EPS(1) ($/share) $0.28 Q2 2017 $0.16 Q2 2018 (0.5%) Q2 2017 Q2 2018 $1,254 $1,261 Net Sales ($M) Q2 2018 Q2 2017 ($0.00) $0.14 (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

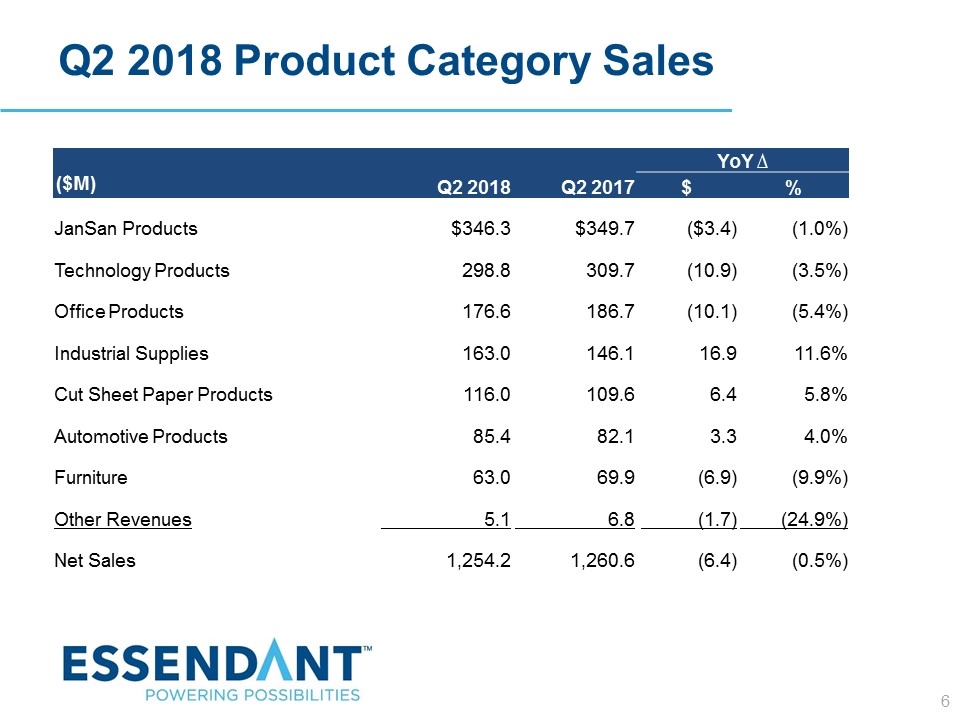

6 Q2 2018 Product Category Sales YoY ∆ Q2 2018 Q2 2017 $ % JanSan Products $346.3 $349.7 ($3.4) (1.0%) Technology Products 298.8 309.7 (10.9) (3.5%) Office Products 176.6 186.7 (10.1) (5.4%) Industrial Supplies 163.0 146.1 16.9 11.6% Cut Sheet Paper Products 116.0 109.6 6.4 5.8% Automotive Products 85.4 82.1 3.3 4.0% Furniture 63.0 69.9 (6.9) (9.9%) Other Revenues 5.1 6.8 (1.7) (24.9%) Net Sales 1,254.2 1,260.6 (6.4) (0.5%) ($M)

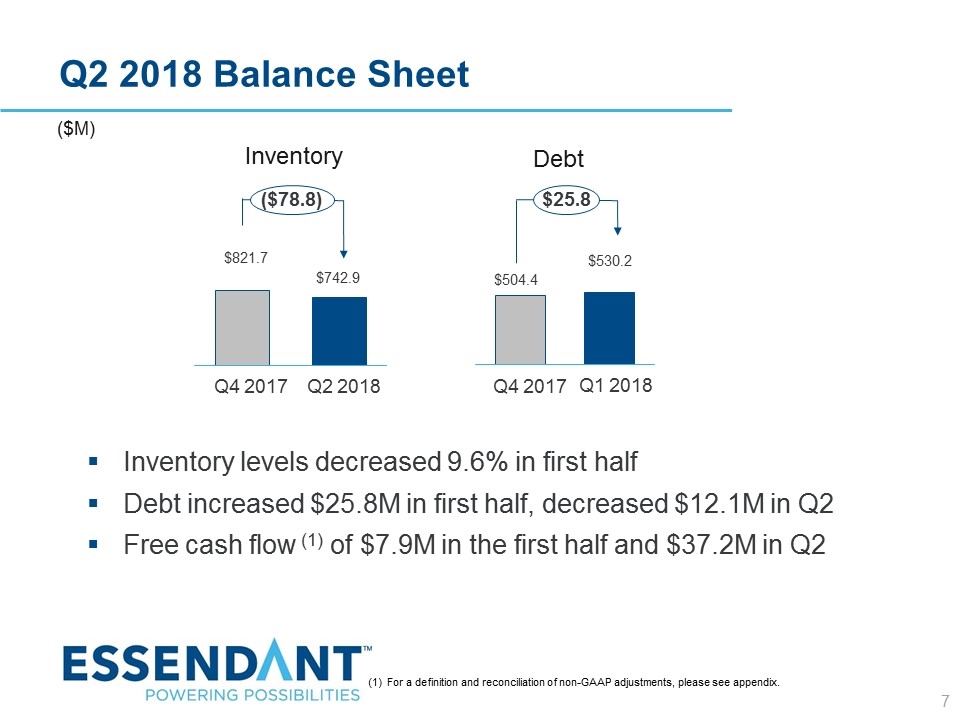

7 Q2 2018 Balance Sheet Inventory levels decreased 9.6% in first half Debt increased $25.8M in first half, decreased $12.1M in Q2 Free cash flow (1) of $7.9M in the first half and $37.2M in Q2 Inventory Debt $821.7 $742.9 $504.4 $530.2 ($M) Q4 2017 Q4 2017 Q2 2018 Q1 2018 ($78.8) $25.8 (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

8 Full Year 2018 Outlook Net sales for full year 2018 are expected to be down 1% to down 3% from the prior year. Adjusted diluted earnings per share (1) in the second half of 2018 are expected to be better than the first half of 2018 and better than the second half of 2017, as cost improvement efforts will continue to scale through the year. Free cash flow (1) for 2018, including the costs and benefits of the Company's previously announced restructuring program, but excluding transaction costs related to the S.P. Richards merger, is expected to be in excess of $40 million for the full year. Total transaction costs related to the S.P. Richards merger are expected to be approximately $40 million with an estimated $25 million payable upon closing. (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

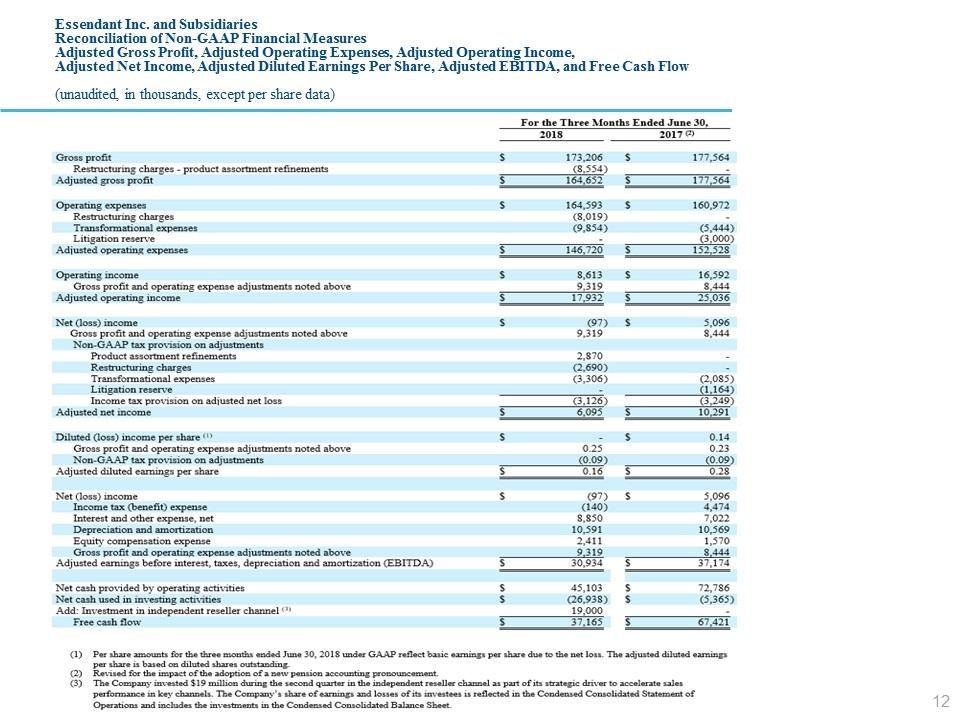

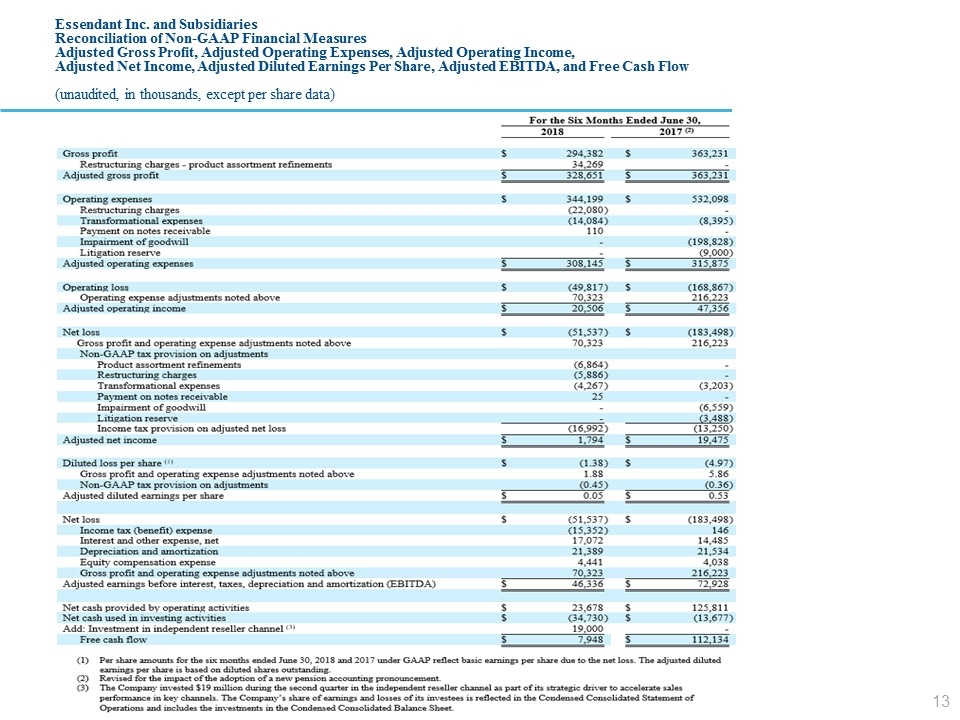

Appendix

10 The Non-GAAP table below presents Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings per Share, Adjusted EBITDA and Free Cash Flow for the three and six months ended June 30, 2018 and 2017 (in thousands, except per share data). These non-GAAP measures exclude certain non-recurring items and exclude other items that do not reflect the Company’s ongoing operations and are included to provide investors with useful information about the financial performance of our business. The presented non-GAAP financial measures should not be considered in isolation or as substitutes for the comparable GAAP financial measures. The non-GAAP financial measures do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. In order to calculate the non-GAAP measures, management excludes the following items to the extent they occur in the reporting period, to facilitate the comparison of current and prior year results and ongoing operations, as management believes these items do not reflect the underlying cost structure of our business. These items can vary significantly in amount and frequency. Restructuring charges. Workforce reduction and facility closure charges such as employee termination costs, facility closure and consolidation costs, and other costs directly associated with shifting business strategies or business conditions that are part of a restructuring program. Restructuring actions were taken in the three and six months ended June 30, 2018 and included product assortment refinements and workforce reductions and facility consolidation. Gain or loss on sale of assets or businesses. Sales of assets, such as buildings or equipment, and businesses can cause gains or losses. These transactions occur as the Company is repositioning its business and reviewing its cost structure. Severance costs for operating leadership. Employee termination costs related to members of the Company’s operating leadership team are excluded as they are based upon individual agreements. Asset impairments. Changes in strategy or macroeconomic events may cause asset impairments. In the six months ended June 30, 2017, the Company recorded goodwill impairment which resulted from declines in sales, earnings and market capitalization. Other actions. Actions, which may be non-recurring events, that result from the changing strategies and needs of the Company and do not reflect the underlying expense of the on-going business. In the three and six months ended June 30, 2018, these were charges related to transformational expenses, including potential merger, acquisition and equity investment transactions, and a gain reflecting receipt of payment on notes receivable reserved in 2015. In the three and six months ended June 30, 2017, other actions included litigation and transformational expenses. Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow

11 Adjusted Gross Profit, adjusted operating expenses and adjusted operating income. Adjusted gross profit, adjusted operating expenses and adjusted operating income provide management and our investors with an understanding of the results from the primary operations of our business by excluding the effects of items described above that do not reflect the ordinary expenses and earnings of our operations. Adjusted gross profit, adjusted operating expenses and adjusted operating income are used to evaluate our period-over-period operating performance as they are more comparable measures of our continuing business. These measures may be useful to an investor in evaluating the underlying operating performance of our business. Adjusted net income and adjusted diluted earnings per share. Adjusted net income and adjusted diluted earnings per share provide a more comparable view of our Company’s underlying performance and trends than the comparable GAAP measures. Net (loss) income and diluted (loss) earnings per share are adjusted for the effect of items described above that do not reflect the ordinary earnings of our operations. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). Adjusted EBITDA is helpful in evaluating our operating performance and is used by management for various purposes, including as a measure of performance and as a basis for strategic planning and forecasting. Net (loss) income is adjusted for the effect of interest and other expenses, net, taxes, depreciation and amortization and stock-based compensation expense. Management believes that adjusted EBITDA is also commonly used by investors to evaluate operating performance between competitors because it helps reduce variability caused by differences in capital structures, income taxes, stock-based compensation accounting policies, and depreciation and amortization policies. Free cash flow. Free cash flow is useful to management and our investors as it is a measure of the Company’s liquidity. It provides a more complete understanding of factors and trends affecting our cash flows than the comparable GAAP measure. Net cash provided by operating activities and net cash used in investing activities are aggregated and adjusted to exclude acquisitions and equity investments, net of cash acquired and divestitures. Outlook. Adjusted diluted earnings per share and free cash flow are non-GAAP measures. A quantitative reconciliation of non-GAAP guidance to the corresponding GAAP information is not available because the non-GAAP guidance excludes certain GAAP information that is uncertain and difficult to predict. The adjusted diluted earnings per share guidance excludes impacts in the three and six months ended June 30, 2018 of $0.25 and $1.88 per share, respectively, related to restructuring charges, transformational expenses and a payment on notes receivable reserved in 2015. Actual amounts appear in the non-GAAP table included later in this section. For the remainder of the year, the factors that will be excluded are currently unknown due to the level of unpredictability and uncertainty associated with these items, but may include actions such as future restructuring charges, transformational expenses and cash flow impacts of equity investments. Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow

12 Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow (unaudited, in thousands, except per share data)

13 Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow (unaudited, in thousands, except per share data)