Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - ESSENDANT INC | a2196670zex-23.htm |

| EX-21 - EXHIBIT 21 - ESSENDANT INC | a2196670zex-21.htm |

| EX-32.1 - EXHIBIT 32.1 - ESSENDANT INC | a2196670zex-32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ESSENDANT INC | a2196670zex-31_2.htm |

| EX-10.45 - EXHIBIT 10.45 - ESSENDANT INC | a2196670zex-10_45.htm |

| EX-10.26 - EX-10.26 - ESSENDANT INC | a2196670zex-10_26.htm |

| EX-10.43 - EXHIBIT 10.43 - ESSENDANT INC | a2196670zex-10_43.htm |

| EX-10.44 - EXHIBIT 10.44 - ESSENDANT INC | a2196670zex-10_44.htm |

| EX-10.42 - EXHIBIT 10.42 - ESSENDANT INC | a2196670zex-10_42.htm |

| EX-31.1 - EXHIBIT 31.1 - ESSENDANT INC | a2196670zex-31_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

United States Securities and Exchange Commission

Washington, DC 20549

FORM 10-K

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2009 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 0-10653

UNITED STATIONERS INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 36-3141189 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

One Parkway North Boulevard

Suite 100

Deerfield, Illinois 60015-2559

(847) 627-7000

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant's

Principal Executive Offices)

| Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.10 par value per share |

Name of Exchange on which registered: NASDAQ Global Select Market |

|

| (Title of Class) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No ý

The aggregate market value of the common stock of United Stationers Inc. held by non-affiliates as of June 30, 2009 was approximately $827.2 million.

On February 23, 2010, United Stationers Inc. had 24,007,363 shares of common stock outstanding.

Documents Incorporated by Reference:

Certain portions of United Stationers Inc.'s definitive Proxy Statement relating to its 2010 Annual Meeting of Stockholders, to be filed within 120 days after the end of United Stationers Inc.'s fiscal year, are incorporated by reference into Part III.

UNITED STATIONERS INC.

FORM 10-K

For The Year Ended December 31, 2009

TABLE OF CONTENTS

| |

|

Page No.

|

||||

|---|---|---|---|---|---|---|

| Part I | ||||||

Item 1. |

Business |

1 |

||||

| Item 1A. | Risk Factors | 6 | ||||

| Item 1B. | Unresolved Comment Letters | 9 | ||||

| Item 2. | Properties | 9 | ||||

| Item 3. | Legal Proceedings | 10 | ||||

| Item 4. | Submission of Matters to a Vote of Security Holders | 10 | ||||

| Executive Officers of the Registrant | 10 | |||||

Part II |

||||||

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

13 |

||||

| Item 6. | Selected Financial Data | 16 | ||||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 18 | ||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 40 | ||||

| Item 8. | Financial Statements and Supplementary Data | 41 | ||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 90 | ||||

| Item 9A. | Controls and Procedures | 90 | ||||

Part III |

||||||

Item 10. |

Directors, Executive Officers and Corporate Governance |

91 |

||||

| Item 11. | Executive Compensation | 91 | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 91 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 92 | ||||

| Item 14. | Principal Accounting Fees and Services | 92 | ||||

Part IV |

||||||

Item 15. |

Exhibits and Financial Statement Schedules |

93 |

||||

Signatures |

98 |

|||||

| Schedule II—Valuation and Qualifying Accounts | 99 | |||||

General

United Stationers Inc. is a leading wholesale distributor of business products, with consolidated net sales of approximately $4.7 billion. United stocks a broad and deep line of approximately 100,000 products, including technology products, traditional office products, office furniture, janitorial and breakroom supplies, and industrial supplies. The Company's network of 64 distribution centers allows it to ship these items to over 25,000 reseller customers, reaching more than 90% of the population of the U.S. and major cities in Mexico on an overnight basis.

Except where otherwise noted, the terms "United" and "the Company" refer to United Stationers Inc. and its consolidated subsidiaries. The parent holding company, United Stationers Inc. (USI), was incorporated in 1981 in Delaware. USI's only direct wholly owned subsidiary—and its principal operating company—is United Stationers Supply Co. (USSC), incorporated in 1922 in Illinois.

Products

United stocks approximately 100,000 stockkeeping units ("SKUs") in these categories:

Technology Products. The Company is a leading wholesale distributor of computer supplies and peripherals in North America. It stocks approximately 10,000 items, including imaging supplies, data storage, digital cameras, computer accessories and computer hardware items such as printers and other peripherals. United provides these products to value-added computer resellers, office products dealers, drug stores, grocery chains and e-commerce merchants. Technology products generated about 35% of the Company's 2009 consolidated net sales.

Traditional Office Products. The Company is one of the largest national wholesale distributors of a broad range of office supplies. It carries about 20,000 brand-name and private label products, such as filing and record storage products, business machines, presentation products, writing instruments, paper products, shipping and mailing supplies, calendars and general office accessories. These products contributed approximately 27% of net sales during the year.

Janitorial and Breakroom Supplies. United is a leading wholesaler of janitorial and breakroom supplies throughout the U.S. The Company holds over 8,000 items in these lines: janitorial and breakroom supplies (cleaners and cleaning accessories), foodservice consumables (such as disposable cups, plates and utensils), safety and security items, and paper and packaging supplies. This product category provided about 24% of the latest year's net sales primarily from Lagasse, Inc. (Lagasse), a wholly owned subsidiary of USSC, and is the fastest growing category of the business.

Office Furniture. United is one of the largest office furniture wholesaler distributors in North America. It stocks approximately 4,500 products from more than 40 of the industry's leading manufacturers including, desks, filing and storage solutions, seating and systems furniture, along with a variety of products for niche markets such as education, government, healthcare and professional services. Innovative marketing programs and related services help drive this business across multiple customer channels. This product category represented approximately 8% of net sales for the year.

Industrial Supplies. USSC acquired ORS Nasco Holding, Inc. (ORS Nasco) in December 2007, and as a result, now stocks over 55,000 items including hand and power tools, safety and security supplies, janitorial equipment and supplies, other various industrial MRO (maintenance, repair and operations) items and oil field and welding supplies. In 2009, this product category accounted for roughly 5% of the Company's net sales.

The remaining 1% of the Company's consolidated net sales came from freight and advertising revenue.

1

United offers private brand products within each of its product categories to help resellers provide quality value-priced items to their customers. These include Innovera® technology products, Universal® office products, Windsoft® paper products, UniSan® janitorial and sanitation products, Alera® office furniture and Anchor Brand® in the welding, industrial, safety and oil field pipeline categories.

During 2009, private brand products accounted for about 14% of United's net sales.

Customers

United serves a diverse group of over 25,000 customers. They include independent office products dealers; contract stationers; office products superstores; computer products resellers; office furniture dealers; mass merchandisers; mail order companies; sanitary supply, paper and foodservice distributors; drug and grocery store chains; healthcare distributors; e-commerce merchants; oil field, welding supply and industrial/MRO distributors; and other independent distributors. The Company had one customer, Staples, that constituted 10.7% of its 2009 consolidated net sales. No other single customer accounted for more than 10% of 2009 consolidated net sales.

Sales to independent resellers—which include our United Stationers Supply, Lagasse and ORS Nasco resellers, as well as new channel customers—contributed approximately 84% of consolidated net sales. The Company provides these customers with value-added services designed to help them market their products and services while improving operating efficiencies and reducing costs. National accounts comprise about 16% of the Company's 2009 consolidated net sales.

Marketing and Customer Support

United's customers can purchase most of the products the Company distributes at similar prices from many other sources. Many reseller customers purchase their products from more than one source, frequently using "first call" and "second call" distributors. A "first call" distributor typically is a reseller's primary wholesaler and has the first opportunity to fill an order. If the "first call" distributor cannot meet the demand, or do so on a timely basis, the reseller will contact its "second call" distributor.

United's marketing and logistic capabilities differentiate the Company from its competitors by providing an unmatched level of value-added services to resellers:

- •

- A broad line of products for one-stop shopping;

- •

- Comprehensive printed product catalogs for easy shopping and reference guides;

- •

- A digital catalog and search capabilities to power e-commerce Web sites;

- •

- Extensive promotional materials and marketing programs to increase sales;

- •

- High levels of products in stock, with an average line fill rate better than 97% in 2009;

- •

- Efficient order processing, resulting in a 99.6% order accuracy rate for the year;

- •

- High-quality customer service from several state-of-the-art customer care

centers;

- •

- National distribution capabilities that enable next- to second-day delivery to the contiguous U.S.

and major cities in Mexico, providing a 98% on-time delivery rate in 2009;

- •

- Training programs designed to help resellers improve their operations;

- •

- End-consumer research to help resellers better understand their markets.

United's marketing programs emphasize two other major strategies. First, the Company produces product content that is used to populate an extensive array of print and electronic catalogs for commercial dealers, contract stationers and retail dealers. The printed catalogs usually are customized with each reseller's name, then sold to the resellers who, in turn, distribute them to their customers. The

2

Company markets its broad product offering primarily through General Line catalogs. These are available in both print and electronic versions and can include various selling prices (rather than the manufacturer's suggested retail price). In addition, the Company typically produces a number of promotional catalogs each quarter. United also develops separate monthly, quarterly and semi-annual flyers covering most of its product categories, including its private brand lines that offer a large selection of popular commodity products. Since catalogs and electronic content provide product exposure to end consumers and generate demand, United tries to maximize their distribution on behalf of its suppliers and customers.

Second, United provides its resellers with a variety of dealer support and marketing services. These programs are designed to help resellers differentiate themselves by making it easier for customers to buy from them, and often allow resellers to reach customers they had not traditionally served.

Resellers can place orders with the Company by phone, fax and e-mail and through a variety of electronic order entry systems. Electronic order entry systems allow resellers to forward their customers' orders directly to United, resulting in the delivery of pre-sold products to the reseller. In 2009, United received approximately 90% of its orders electronically.

Distribution

The Company uses a network of 64 distribution centers to provide about 100,000 items to over 25,000 reseller customers. This network, combined with the Company's depth and breadth of inventory in technology products, traditional office products, office furniture, janitorial and breakroom supplies, and industrial supplies, enables the Company to ship products on an overnight basis to more than 90% of the population of the U.S. and major cities in Mexico. United's domestic operations generated approximately $4.6 billion of its approximately $4.7 billion in 2009 consolidated net sales, with its international operations contributing another $0.1 billion to 2009 net sales.

Regional distribution centers are supplemented with 30 local distribution points across the U.S., which serve as re-distribution points for orders filled at the regional centers. United has a dedicated fleet of approximately 550 trucks, most of which are under contract to the Company. This enables United to make direct deliveries to resellers from regional distribution centers and local distribution points.

United's inventory locator system allows it to provide resellers with timely delivery of the products they order. If a reseller asks for an item that is out of stock at the nearest distribution center, the system has the capability to automatically search for the product at other facilities within the shuttle network. When the item is found, the alternate location coordinates shipping with the primary facility. For most resellers, the result is a single on-time delivery of all items. This system gives United added inventory support while minimizing working capital requirements. As a result, the Company can provide higher service levels to its reseller customers, reduce back orders, and minimize time spent searching for substitute merchandise. These factors contribute to a high order fill rate and efficient levels of inventory. To meet its delivery commitments and to maintain high order fill rates, United carries a significant amount of inventory, which contributes to its overall working capital requirements.

The "Wrap and Label" program is another important service for resellers. It gives resellers the option to receive individually packaged orders ready to be delivered to their end consumers. For example, when a reseller places orders for several individual consumers, United can pick and pack the items separately, placing a label on each package with the consumer's name, ready for delivery to the end consumer by the reseller. Resellers appreciate the "Wrap and Label" program because it eliminates the need to break down bulk shipments and repackage orders before delivering them to consumers.

In addition to providing value-adding programs for resellers, United also remains committed to reducing its operating costs. Its "War on Waste" (WOW2) program, which began in 2007, is meeting the goal of removing $100 million in costs over five years through a combination of new and continuing activities. In

3

addition, WOW2 includes process improvement and work simplification activities that will help increase efficiency throughout the business and improve customer satisfaction.

Purchasing and Merchandising

As a leading wholesale distributor of business products, United leverages its broad product selection as a key merchandising strategy. The Company orders products from over 1,000 manufacturers. This purchasing volume means United receives substantial supplier allowances and can realize significant economies of scale in its logistics and distribution activities. In 2009, United's largest supplier was Hewlett-Packard Company, which represented approximately 20% of its total purchases.

The Company's Merchandising Department is responsible for selecting merchandise and for managing the entire supplier relationship. Product selection is based on three factors: end-consumer acceptance; anticipated demand for the product; and the manufacturer's total service, price and product quality. As part of its effort to create an integrated supplier approach, United introduced the "Preferred Supplier Program." In exchange for working closely with United to reduce overall supply chain costs, participating suppliers' products are treated as preferred brands in the Company's marketing efforts.

Competition

There is only one other nationwide broad line office products wholesale distributor in North America. United and this firm compete on the basis of breadth of product lines, availability of products, speed of delivery to resellers, order fill rates, net pricing to resellers, and the quality of marketing and other value-added services.

The Company also competes with specialty distributors of office products, office furniture, technology products, janitorial and breakroom supplies and industrial supplies. These distributors typically offer more limited product lines and compete nationally, regionally or locally. In most cases, competition is based primarily upon net pricing, minimum order quantity, speed of delivery, and value-added marketing and logistics services.

The Company also competes with manufacturers who often sell their products directly to resellers and may offer lower prices. United believes that it provides an attractive alternative to manufacturer direct purchases by offering a combination of value-added services, including 1) Wrap and Label capabilities, 2) marketing and catalog programs, 3) same- to second-day delivery, 4) a broad line of business products from multiple manufacturers on a "one-stop shop" basis, and 5) lower minimum order quantities.

Seasonality

United's sales generally are relatively steady throughout the year. However, sales also reflect seasonal buying patterns for consumers of office products. In particular, the Company's sales of office products usually are higher than average during January, when many businesses begin operating under new annual budgets and release previously deferred purchase orders. Janitorial and breakroom supplies sales are somewhat higher in the summer months. Industrial supplies sales are somewhat higher in summer months as well.

Employees

As of February 23, 2010, United employed approximately 5,700 people.

Management believes it has good relations with its associates. Approximately 570 of the shipping, warehouse and maintenance associates at certain of the Company's Baltimore, Los Angeles and New Jersey distribution centers are covered by collective bargaining agreements. In 2009, United successfully renegotiated the collective bargaining agreement with associates in the Baltimore

4

distribution center. The bargaining agreements in the Los Angeles and New Jersey distribution centers are scheduled to expire in 2011. The Company has not experienced any work stoppages during the past five years.

Availability of the Company's Reports

The Company's principal Web site address is www.unitedstationers.com. This site provides United's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K—as well as amendments and exhibits to those reports filed or furnished under Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") for free as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, copies of these filings (excluding exhibits) may be requested at no cost by contacting the Investor Relations Department:

United

Stationers Inc.

Attn: Investor Relations Department

One Parkway North Boulevard

Suite 100

Deerfield, IL 60015-2559

Telephone: (847) 627-7000

E-mail: IR@ussco.com

5

Any of the risks described below could have a material adverse effect on the Company's business, financial condition or results of operations. These risks are not the only risks facing United; the Company's business operations could also be materially adversely affected by risks and uncertainties that are not presently known to United or that United currently deems immaterial.

United's operating results depend on the strength of the general economy.

The customers that United serves are affected by changes in economic conditions outside the Company's control, including national, regional and local slowdowns in general economic activity and job markets. Demand for the products and services the Company offers, particularly in office products, technology and furniture, is affected by the number of white collar and other workers employed by the businesses United's customers serve. An interruption of growth in these markets or a general economic downturn, together with the negative effect this has on the number of workers employed, may adversely affect United's business, financial condition and results of operations.

United may not achieve its cost-reduction and margin enhancement goals.

United has set goals to improve its profitability over time by reducing expenses and growing sales to existing and new customers. There can be no assurance that United will achieve its enhanced profitability goals. Factors that could have a significant effect on the Company's efforts to achieve these goals include the following:

- •

- Inability to achieve the Company's annual "War on Waste" (WOW2) initiatives to reduce expenses and improve

productivity and quality;

- •

- Impact on gross margin from competitive pricing pressures;

- •

- Failure to maintain or improve the Company's sales mix between lower margin and higher margin products;

- •

- Inability to pass along cost increases from United's suppliers to its customers;

- •

- Failure to increase sales of United's private brand products; and

- •

- Failure of customers to adopt the Company's product pricing and marketing programs.

The loss of a significant customer could significantly reduce United's revenues and profitability.

United's top five customers accounted for approximately 25% of the Company's 2009 net sales. The loss of one or more key customers, changes in the sales mix or sales volume to key customers, a significant downturn in the business or financial condition of any of them or the failure of any of them to timely pay all amounts due United could significantly reduce United's sales and profitability.

United's financial condition and results of operation depend on the availability of financing sources to meet its business needs.

The Company depends on various external financing sources to fund its operating, investing, and financing activities. The Company's financing agreements include covenants by the Company to maintain certain financial ratios and comply with other obligations. If the Company violates a covenant or otherwise defaults on its obligations under a financing agreement, the Company's lenders may refuse to extend additional credit, demand repayment of outstanding indebtedness and terminate the financing agreements. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—General" included below under Item 7.

6

One of the Company's external financing sources is a receivables securitization program that is dependent on back-up liquidity facilities that must be renewed annually. The Company's other primary external financing sources terminate or mature in two to four years. If the Company defaults on its obligations under a financing agreement or is unable to obtain or renew financing sources on commercially reasonable terms, its business and financial condition could be materially adversely affected.

United's reliance on supplier allowances and promotional incentives could impact profitability.

Supplier allowances and promotional incentives that are often based on volume contribute significantly to United's profitability. If United does not comply with suppliers' terms and conditions, or does not make requisite purchases to achieve certain volume hurdles, United may not earn certain allowances and promotional incentives. In addition, if United's suppliers reduce or otherwise alter their allowances or promotional incentives, United's profit margin for the sale of the products it purchases from those suppliers may be harmed. The loss or diminution of supplier allowances and promotional support could have an adverse effect on the Company's results of operation.

United relies on independent dealers for a significant percentage of its net sales.

Sales to independent office product dealers and janitorial and sanitation distributors account for a significant portion of United's net sales. Independent dealers and distributors compete with national retailers that have substantially greater financial resources and technical and marketing capabilities. Over the years, several of the Company's independent dealer and distributor customers have been acquired by national retailers. If United's customer base of independent dealers and distributors declines, the Company's business and results of operations may be adversely affected.

United operates in a competitive environment.

The Company operates in a competitive environment. Competition is based largely upon service capabilities and price, as the Company's competitors are wholesalers that offer products that are the same as or similar to the products the Company offers to the same customers or potential customers. United also faces competition from some of its own suppliers, which sell their products directly to United's customers. The Company's financial condition and results of operations depend on its ability to compete effectively on price, product selection and availability, marketing support, logistics and other ancillary services.

The loss of key suppliers or supply chain disruptions could decrease United's revenues and profitability.

United believes its ability to offer a combination of well-known brand name products, competitively-priced private brand products, and support services is an important factor in attracting and retaining customers. The Company's ability to offer a wide range of products and services is dependent on obtaining adequate product supply and services from manufacturers or other suppliers. United's agreements with its suppliers are generally terminable by either party on limited notice. The loss of, or a substantial decrease in the availability of products or services from key suppliers at competitive prices could cause the Company's revenues and profitability to decrease. In addition, supply interruptions could arise due to transportation disruptions, labor disputes or other factors beyond United's control. Disruptions in United's supply chain could result in a decrease in revenues and profitability.

7

United must manage inventory effectively in order to maximize supplier allowances while minimizing excess and obsolete inventory.

To maximize supplier allowances and minimize excess and obsolete inventory, United must project end-consumer demand for over 100,000 SKUs in stock. If United underestimates demand for a particular manufacturer's products, the Company will lose sales, reduce customer satisfaction, and earn a lower level of allowances from that manufacturer. If United overestimates demand, it may have to liquidate excess or obsolete inventory at a loss.

United is focusing on increasing its sales of private brand products. These products can present unique inventory challenges. United sources many of its private brand products overseas, resulting in longer order-lead times than for comparable products sourced domestically. These longer lead-times make it more difficult to forecast demand accurately and require larger inventory investments to support high service levels. In addition, United generally does not have the right to return excess inventory of private brand products to the manufacturers.

A significant disruption or failure of the Company's existing information technology systems or in its implementation of new information technology systems could disrupt United's business and result in increased costs and decreased revenues.

The Company relies on information technology in all aspects of its business, including managing and replenishing inventory, filling and shipping customer orders, and coordinating sales and marketing activities. Many of the Company's software applications are legacy systems, including order entry, order processing, pricing, billing, returns and credits, and inventory receiving and control. The Company is building and implementing new applications to replace some of the legacy systems and to provide new services to customers. Interruptions in the proper functioning of the Company's information systems or delays in implementing new systems could disrupt United's business and result in increased costs and decreased revenue. A significant disruption or failure of the Company's existing information technology systems or in the Company's development and implementation of new systems could put it at a competitive disadvantage and could adversely affect its results of operations.

United may not be successful in identifying, consummating and integrating future acquisitions.

Historically, part of United's growth and expansion into new product categories or markets has come from targeted acquisitions. Going forward, United may not be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms and conditions. Furthermore, competition for attractive acquisition candidates may limit the number of acquisition candidates or increase the overall costs of making acquisitions. Acquisitions involve significant risks and uncertainties, including difficulties integrating acquired business systems and personnel with United's business; the potential loss of key employees, customers or suppliers; the assumption of liabilities and exposure to unforeseen liabilities of acquired companies; the difficulties in achieving target synergies; and the diversion of management attention and resources from existing operations. Difficulties in identifying, completing or integrating acquisitions could impede United's revenues, profitability and net worth.

The Company relies heavily on its key executives and the loss of one or more of these individuals could harm the Company's ability to carry out its business strategy.

United's ability to implement its business strategy depends largely on the efforts, skills, abilities and judgment of the Company's executive management team. United's success also depends to a significant degree on its ability to recruit and retain sales and marketing, operations and other senior managers. The Company may not be successful in attracting and retaining these employees, which may in turn have an adverse effect on the Company's results of operations and financial condition.

8

Unexpected events could disrupt normal business operations, which might result in increased costs and decreased revenues.

Unexpected events, such as hurricanes, fire, war, terrorism, and other natural or man-made disruptions, may increase the cost of doing business or otherwise impact United's financial performance. In addition, damage to or loss of use of significant aspects of the Company's infrastructure due to such events could have an adverse affect on the Company's operating results and financial condition.

ITEM 1B. UNRESOLVED COMMENT LETTERS.

None.

The Company considers its properties to be suitable with adequate capacity for their intended uses. The Company evaluates its properties on an ongoing basis to improve efficiency and customer service and leverage potential economies of scale. Substantially all owned facilities are subject to liens under USSC's debt agreements (see the information under the caption "Liquidity and Capital Resources" included below under Item 7). As of December 31, 2009, these properties consisted of the following:

Offices. The Company leases approximately 205,000 square feet for its corporate headquarters in Deerfield, Illinois. Additionally the Company owns 49,000 square feet of office space in Orchard Park, New York and leases 13,000 square feet of office space in Tulsa, Oklahoma and 20,000 square feet in Muskogee, Oklahoma.

Distribution Centers. The Company utilizes 64 distribution centers totaling approximately 12.4 million square feet of warehouse space. Of the 12.4 million square feet of distribution center space, 2.1 million square feet is owned and 10.3 million square feet is leased.

9

The Company is involved in legal proceedings arising in connection with its business. The Company is not involved in any legal proceedings that it believes will result, individually or in the aggregate, in a material adverse effect upon its financial condition or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of security holders during the fourth quarter of 2009.

EXECUTIVE OFFICERS OF THE REGISTRANT (as of February 23, 2010)

The executive officers of the Company are as follows:

Name, Age and Position with the Company |

Business Experience | |

|---|---|---|

Richard W. Gochnauer |

Richard W. Gochnauer became the Company's President and Chief Executive Officer in December 2002, after joining the Company as its Chief Operating Officer and as a Director in July 2002. From 1994 until he joined the Company, Mr. Gochnauer held the positions of Vice Chairman and President, International, and President and Chief Operating Officer of Golden State Foods, a privately-held food company that manufactures and distributes food and paper products. Prior to that, he served as Executive Vice President of the Dial Corporation, with responsibility for its household and laundry consumer products businesses. | |

S. David Bent |

S. David Bent was named as the Company's Senior Vice President, e Business Services and Corporate Chief Information officer in July 2009. He joined the Company as its Senior Vice President and Chief Information Officer in May 2003. From August 2000 until such time, Mr. Bent served as the Corporate Vice President and Chief Information Officer of Acterna Corporation, a multi-national telecommunications test equipment and services company, and also served as General Manager of its Software Division from October 2002. Previously, he spent 18 years with the Ford Motor Company. During his Ford tenure, Mr. Bent most recently served during 1999 and 2000 as the Chief Information Officer of Visteon Automotive Systems, a tier one automotive supplier, and from 1998 through 1999 as its Director, Enterprise Processes and Systems. |

|

Eric A. Blanchard |

Eric A. Blanchard has served as the Company's Senior Vice President, General Counsel and Secretary since January 2006. From November 2002 until December 2006 he served as the Vice President, General Counsel and Secretary at Tennant Company. Previously Mr. Blanchard was with Dean Foods Company where he held the positions of Chief Operating Officer, Dairy Division from January 2002 to October 2002, Vice President and President, Dairy Division from 1999 to 2002 and General Counsel and Secretary from 1988 to 1999. |

10

Name, Age and Position with the Company |

Business Experience | |

|---|---|---|

Barbara J. Kennedy |

Barbara J. Kennedy has been United Stationers' Senior Vice President, Human Resources since August 2008. Before she joined the Company, Ms. Kennedy held various human resources management positions, serving most recently as Executive Vice President, Human Resources, Safety, Recruiting and Driver Services for Swift Transportation. Prior to joining Swift, she served as Vice President, Human Resources at Barr-Nunn Transportation. |

|

Kenneth M. Nickel |

Kenneth M. Nickel has been the Company's Vice President, Controller and Chief Accounting Officer since February 2007. Prior to that, Mr. Nickel served as the Company's Vice President and Controller from November 2002 to February 2007, as its Vice President and Field Support Center Controller from November 2001 to October 2002 and as its Vice President and Assistant Controller from April 2001 to October 2001. Mr. Nickel has been with the Company since November 1989 and has held progressively more responsible accounting positions within the Company's Finance department. |

|

P. Cody Phipps |

P. Cody Phipps has served as the Company's President, United Stationers Supply since October 2006. He joined the Company in August 2003 as its Senior Vice President, Operations. Prior to joining the Company, Mr. Phipps was a partner at McKinsey & Company, Inc., a global management consulting firm. During his tenure at McKinsey from and after 1990, he became a leader in the firm's North American Operations Effectiveness Practice and co-founded and led its Service Strategy and Operations Initiative, which focused on driving significant operational improvements in complex service and logistics environments. Prior to joining McKinsey, Mr. Phipps worked as a consultant with The Information Consulting Group, a systems consulting firm, and as an IBM account marketing representative. |

|

Victoria J. Reich |

Victoria J. Reich joined the Company in June 2007 as its Senior Vice President and Chief Financial Officer. Prior to joining the Company, Ms. Reich spent ten years with Brunswick Corporation where she most recently was President of Brunswick European Group from August 2003 until June 2006. She served as Brunswick's Senior Vice President and Chief Financial Officer from 2000 to 2003 and as Vice President and Controller from 1996 until 2000. Before joining Brunswick, Ms. Reich spent 17 years at General Electric Company where she held various financial management positions. |

11

Name, Age and Position with the Company |

Business Experience | |

|---|---|---|

Stephen A. Schultz |

Stephen A. Schultz was appointed to the position of Group President, Lagasse and ORS Nasco in September 2008. Prior to this appointment, he held the position of President, Lagasse, Inc., a wholly owned subsidiary of USSC, from August 2001. In October 2003, he assumed the additional position of Senior Vice President, Category Management-Janitorial/Sanitation, of the Company. Mr. Schultz joined Lagasse in early 1999 as Vice President, Marketing and Business Development, and became a Senior Vice President of Lagasse in late 2000. Before joining Lagasse, he served for nearly 10 years in various executive sales and marketing roles for Hospital Specialty Company, a manufacturer and distributor of hygiene products for the institutional janitorial and sanitation industry. |

Executive officers are elected by the Board of Directors. Except as required by individual employment agreements between executive officers and the Company, there exists no arrangement or understanding between any executive officer and any other person pursuant to which such executive officer was elected. Each executive officer serves until his or her successor is appointed and qualified or until his or her earlier removal or resignation.

12

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Common Stock Information

USI's common stock is quoted through the NASDAQ Global Select Market ("NASDAQ") under the symbol USTR. The following table shows the high and low closing sale prices per share for USI's common stock as reported by NASDAQ:

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

2009 |

|||||||

First Quarter |

$ | 34.26 | $ | 18.49 | |||

Second Quarter |

39.00 | 28.44 | |||||

Third Quarter |

49.25 | 34.57 | |||||

Fourth Quarter |

58.03 | 45.04 | |||||

2008 |

|||||||

First Quarter |

$ | 57.14 | $ | 43.01 | |||

Second Quarter |

49.91 | 36.56 | |||||

Third Quarter |

52.01 | 34.20 | |||||

Fourth Quarter |

47.42 | 28.39 | |||||

On February 23, 2010, the closing sale price of Company's common stock as reported by NASDAQ was $56.38 per share. On February 23, 2010, there were approximately 737 holders of record of common stock. A greater number of holders of USI common stock are "street name" or beneficial holders, whose shares are held of record by banks, brokers and other financial institutions.

13

Stock Performance Graph

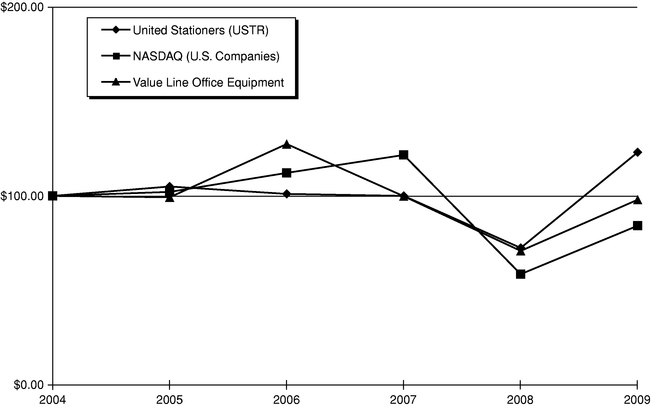

The following graph compares the performance of the Company's common stock over a five-year period with the cumulative total returns of (1) The NASDAQ Stock Market Index (U.S. companies), and (2) a group of companies included within Value Line's Office Equipment Industry Index. The graph assumes $100 was invested on December 31, 2004 in the Company's common stock and in each of the indices and assumes reinvestment of all dividends (if any) at the date of payment. The following stock price performance graph is presented pursuant to SEC rules and is not meant to be an indication of future performance.

| |

2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

United Stationers (USTR) |

$ | 100.00 | $ | 104.98 | $ | 101.06 | $ | 100.02 | $ | 72.49 | $ | 123.12 | |||||||

NASDAQ (U.S. Companies) |

$ | 100.00 | $ | 102.13 | $ | 112.19 | $ | 121.66 | $ | 58.61 | $ | 84.24 | |||||||

Value Line Office Equipment |

$ | 100.00 | $ | 99.28 | $ | 127.47 | $ | 99.84 | $ | 70.92 | $ | 98.00 | |||||||

Common Stock Repurchases

As of December 31, 2009, the Company had $100.9 million under share repurchase authorizations from its Board of Directors. The Company did not repurchase any common stock during 2009.

Purchases may be made from time to time in the open market or in privately negotiated transactions. Depending on market and business conditions and other factors, the Company may continue or suspend purchasing its common stock at any time without notice.

Acquired shares are included in the issued shares of the Company and treasury stock, but are not included in average shares outstanding when calculating earnings per share data.

Dividends

The Company's policy has been to reinvest earnings to enhance its financial flexibility and to fund future growth. Accordingly, USI has not paid cash dividends and has no plans to declare cash dividends on its common stock at this time. Furthermore, as a holding company, USI's ability to pay cash dividends in the

14

future depends upon the receipt of dividends or other payments from its operating subsidiary, USSC. The Company's debt agreements impose limited restrictions on the payment of dividends. For further information on the Company's debt agreements, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" in Item 7, and Note 9 to the Consolidated Financial Statements included in Item 8 of this Annual Report.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by Item 201(d) of Regulation S-K (Securities Authorized for Issuance under Equity Compensation Plans) is included in Item 12 of this Annual Report.

15

ITEM 6. SELECTED FINANCIAL DATA.

The selected consolidated financial data of the Company for the years ended December 31, 2005 through 2009 have been derived from the Consolidated Financial Statements of the Company, which have been audited by Ernst & Young LLP, an independent registered public accounting firm. The adoption of new accounting pronouncements, changes in certain accounting policies, reclassifications of discontinued operations and certain other reclassifications are reflected in the financial information presented below. The selected consolidated financial data below should be read in conjunction with, and is qualified in its entirety by, Management's Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements of the Company included in Items 7 and 8, respectively, of this Annual Report. Except for per share data, all amounts presented are in thousands:

| |

Years Ended December 31,(1) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2006(2) | 2005 | ||||||||||||

Income Statement Data: |

|||||||||||||||||

Net sales |

$ | 4,710,291 | $ | 4,986,878 | $ | 4,646,399 | $ | 4,546,914 | $ | 4,279,089 | |||||||

Cost of goods sold |

4,019,650 | 4,246,199 | 3,939,684 | 3,792,833 | 3,637,065 | ||||||||||||

Gross profit |

690,641 | 740,679 | 706,715 | 754,081 | 642,024 | ||||||||||||

Operating expenses: |

|||||||||||||||||

Warehousing, marketing and administrative expenses |

499,659 | 548,222 | 502,810 | 516,234 | 471,193 | ||||||||||||

Restructuring, severance and other charges (reversals), net(3) |

3,354 | — | 1,378 | 1,941 | (1,331 | ) | |||||||||||

Total operating expenses |

503,013 | 548,222 | 504,188 | 518,175 | 469,862 | ||||||||||||

Operating Income |

187,628 | 192,457 | 202,527 | 235,906 | 172,162 | ||||||||||||

Interest expense |

(27,797 | ) | (28,563 | ) | (13,109 | ) | (8,276 | ) | (3,050 | ) | |||||||

Interest income |

474 | 1,048 | 1,197 | 970 | 342 | ||||||||||||

Other expense, net(4) |

(204 | ) | (8,079 | ) | (14,595 | ) | (12,786 | ) | (7,035 | ) | |||||||

Income from continuing operations before income taxes |

160,101 | 156,863 | 176,020 | 215,814 | 162,419 | ||||||||||||

Income tax expense |

59,116 | 58,449 | 68,825 | 80,510 | 60,949 | ||||||||||||

Income from continuing operations |

100,985 | 98,414 | 107,195 | 135,304 | 101,470 | ||||||||||||

Loss from discontinued operations, net of tax |

— | — | — | (3,091 | ) | (3,969 | ) | ||||||||||

Net income |

$ | 100,985 | $ | 98,414 | $ | 107,195 | $ | 132,213 | $ | 97,501 | |||||||

Net income per share—basic: |

|||||||||||||||||

Income from continuing operations |

$ | 4.32 | $ | 4.17 | $ | 3.92 | $ | 4.37 | $ | 3.08 | |||||||

Loss from discontinued operations, net of tax |

— | — | — | (0.10 | ) | (0.12 | ) | ||||||||||

Net income per common share—basic |

$ | 4.32 | $ | 4.17 | $ | 3.92 | $ | 4.27 | $ | 2.96 | |||||||

Net income per share—diluted: |

|||||||||||||||||

Income from continuing operations |

$ | 4.19 | $ | 4.13 | $ | 3.83 | $ | 4.31 | $ | 3.02 | |||||||

Loss from discontinued operations, net of tax |

— | — | — | (0.10 | ) | (0.12 | ) | ||||||||||

Net income per common share—diluted |

$ | 4.19 | $ | 4.13 | $ | 3.83 | $ | 4.21 | $ | 2.90 | |||||||

Cash dividends declared per share |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||

Balance Sheet Data: |

|||||||||||||||||

Working capital(5) |

$ | 721,503 | $ | 807,631 | $ | 543,258 | $ | 551,556 | $ | 421,005 | |||||||

Total assets(5) |

1,808,516 | 1,881,516 | 1,765,555 | 1,560,355 | 1,550,545 | ||||||||||||

Total debt(6) |

441,800 | 663,100 | 451,000 | 117,300 | 21,000 | ||||||||||||

Total stockholders' equity |

706,713 | 565,638 | 574,254 | 800,940 | 768,512 | ||||||||||||

Statement of Cash Flows Data: |

|||||||||||||||||

Net cash provided by (used in) operating activities |

$ | 239,395 | $ | (129,305 | ) | $ | 218,054 | $ | 13,994 | $ | 236,067 | ||||||

Net cash used in investing activities |

(14,829 | ) | (28,366 | ) | (197,898 | ) | (18,624 | ) | (171,748 | ) | |||||||

Net cash (used in) provided by financing activities |

(216,667 | ) | 146,430 | (13,188 | ) | 2,198 | (62,680 | ) | |||||||||

- (1)

- Certain prior period amounts have been reclassified to conform to the current presentation. Such reclassifications were limited to Balance Sheet and Cash Flow Statement presentation and did not impact the Statements of Income. Specifically, the Company reclassified capitalized software costs from "Other Assets" to "Property, Plant and Equipment" beginning in the first quarter of 2006, with prior periods updated to conform to this presentation. For the year ended December 31, 2005,

16

$17.0 million in operating cash outflows were reclassified as cash outflows from investing activities. The reclassification of capitalized software also resulted in a reclassification from "Other Assets" to "Property, Plant and Equipment" for 2005 of $17.0 million. Additionally, the Company reclassified certain offsets to "Accrued Liabilities" related to merchandise return reserves to "Inventory". This reclassification began in the fourth quarter of 2007, with prior periods updated to conform to this presentation. For the years ended December 31, 2006 and 2005, $7.0 million and $8.3 million, respectively, were reclassified to "Inventory" out of "Accrued Liabilities" with corresponding changes made to the Statement of Cash Flows within "Cash Flows From Operating Activities".

- (2)

- In

2006, the Company recorded $60.6 million, or $1.21 per diluted share in favorable benefits from the Company's product content syndication program

and certain marketing program changes.

- (3)

- Reflects

severance and restructuring charges in the following years: 2009—$3.4 million

severance charge. 2007—$1.4 million charge for the 2006 Workforce Reduction Program.

2006—$6.0 million charge for the 2006 Workforce Reduction Program, partially offset by a $4.1 million reversal of previously established restructuring

reserves. 2005—$1.3 million reversal of previously established restructuring reserves.

- (4)

- Primarily

represents the loss on the sale of certain trade accounts receivable through the Company's Prior Receivables Securitization Program. For further

information on the Company's Prior Receivables Securitization Program, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Off-Balance

Sheet Arrangements—Prior Receivables Securitization Program" under Item 7 of this Annual Report.

- (5)

- In

accordance with Generally Accepted Accounting Principles ("GAAP"), total assets exclude $23.0 million in 2008, $248.0 million in 2007, and

$225.0 million in 2006 and 2005 of certain trade accounts receivable sold through the Company's Prior Receivables Securitization Program. For further information on the Company's Prior

Receivables Securitization Program, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Off-Balance Sheet Arrangements—Prior

Receivables Securitization Program" under Item 7 of this Annual Report.

- (6)

- Total debt includes current maturities.

FORWARD LOOKING INFORMATION

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. Forward-looking statements often contain words such as "expects", "anticipates", "estimates", "intends", "plans", "believes", "seeks", "will", "is likely", "scheduled", "positioned to", "continue", "forecast", "predicting", "projection", "potential" or similar expressions. Forward-looking statements include references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These forward-looking statements are based on management's current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, without limitation, those set forth above under the heading "Risk Factors."

Readers should not place undue reliance on forward-looking statements contained in this Annual Report on Form 10-K. The forward-looking information herein is given as of this date only, and the Company undertakes no obligation to revise or update it.

17

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with both the information at the end of Item 6 of this Annual Report on Form 10-K appearing under the caption, "Forward Looking Information", and the Company's Consolidated Financial Statements and related notes contained in Item 8 of this Annual Report.

Overview and Recent Results

The Company is a leading wholesale distributor of business products, with 2009 net sales of approximately $4.7 billion. The Company sells its products through a national distribution network of 64 distribution centers to over 25,000 resellers, who in turn sell directly to end consumers.

Key Company and Industry Trends

The following is a summary of selected trends, events or uncertainties that the Company believes may have a significant impact on its future performance.

- •

- Despite modestly improved market conditions which led to a slight increase in sales during the fourth quarter of 2009,

business conditions remain mixed and uncertain as evidenced by continued high unemployment, recovering industrial production trends and an improving gross domestic product. However, it appears that

job growth and industrial production may still be slow to recover. As a result, the Company remains cautious entering 2010.

- •

- Total Company sales for 2009 declined by a workday adjusted 5.2%, reflecting one less selling day in 2009, to just over

$4.7 billion. Janitorial and breakroom supplies experienced 6.5% growth, buoyed by sales of products used in response to the H1N1 flu. This improvement was more than offset by a 29% decline in

furniture and a 23% drop in industrial supplies. The pace of the sales decline in these categories eased within the latter part of the year. Technology product sales and office product sales declined

2% and 4%, respectively on a workday adjusted basis with sequential improvements seen in the latter part of the year as well.

- •

- Gross margin as a percent of sales for 2009 was 14.7% versus 14.9% in 2008. The gross margin rate in 2009 was negatively

impacted by declines of 20 basis points (bps) due to reduced pricing margin resulting from a less favorable sales product mix, 15 bps from the effects of lower product cost inflation throughout

2009 versus 2008, and 15 bps in lower supplier allowances due to reduced purchasing activity. These declines were partially offset by 30 bps in freight-related components as lower fuel

costs and cost containment initiatives drove favorability in this margin component.

- •

- The Company has set margin management as a primary focus for 2010 as margin pressures are expected in several areas. In

particular, low product cost inflation, especially when compared to high inflation in the first quarter of 2009, is expected to negatively affect margins versus the prior year. In addition, margin

pressure may result from a product mix that continues to be skewed towards value-oriented consumables. Offsetting these margin pressures will be leverage from expected sales growth, WOW2

cost reductions, price management, and marketing programs to earn additional supplier allowances.

- •

- Operating expenses in 2009 were $503.0 million or 10.7% as a percent of sales for the year compared to $548.2 million or 11.0% in 2008. Included in 2009 operating expenses are a $14 million gain related to a negotiated settlement with a service supplier and a $3.4 million severance charge. Operating expenses in 2008 include a $9.8 million gain on the sale of three buildings and a $6.7 million asset impairment charge. Excluding these items operating expenses declined 7% and were 10.9% of sales versus 11.1% in the prior year. The decline is due to reduced

18

- •

- Cost containment and operating leverage will be another key area of focus in 2010 in order to help offset the reversal of

approximately $20 million in compensation and other short-term cost reduction actions taken in 2009. The Company will carefully manage the restoration of these costs dependent on

the Company's performance in 2010. This will occur while the Company continues to invest in key growth strategies and innovative services including e-business capabilities. As a result,

the WOW2 savings plan will be aggressive again in 2010 as the Company strives to gain optimal expense leverage from expected sales growth.

- •

- Operating cash flows for 2009 were $239.4 million versus a use of $129.3 million in 2008. Adjusted to

exclude the effects of accounts receivable sold under the Receivables Securitization Program, the Company's operating cash flows increased to a source of $262.4 million in 2009 from

$95.7 million in 2008. This increase reflects the impacts of lower inventory requirements to support lower sales and effective working capital management particularly in inventories and

payables.

- •

- During 2009, the Company did not repurchase any shares of common stock under its publicly announced share repurchase programs. As of February 23, 2010, the Company had approximately $100.9 million remaining of its existing share repurchase authorizations from the Board of Directors.

salaries and wages as a percent of sales of 5 bps, lower bad debt costs of 7 bps, and reduced discretionary expenses of 25 bps, partially offset by increased healthcare costs of 10 bps and 5 bps of expenses related to the Company's continued execution of its plan to expand ORS Nasco's presence to 18 key markets by leveraging existing company distribution centers.

Critical Accounting Policies, Judgments and Estimates

The Company's significant accounting policies are more fully described in Note 2 of the Consolidated Financial Statements. As described in Note 2, the preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes. Future events and their effects cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results may differ from those estimates. The Company believes that such differences would have to vary significantly from historical trends to have a material impact on the Company's financial results.

The Company's critical accounting policies are most significant to the Company's financial condition and results of operations and require especially difficult, subjective or complex judgments or estimates by management. In most cases, critical accounting policies require management to make estimates on matters that are uncertain at the time the estimate is made. The basis for the estimates is historical experience, terms of existing contracts, observance of industry trends, information provided by customers or vendors, and information available from other outside sources, as appropriate. These critical accounting policies include the following:

Supplier Allowances

Supplier allowances (fixed and variable) are common practice in the business products industry and have a significant impact on the Company's overall gross margin. Gross margin is determined by, among other items, file margin (determined by reference to invoiced price), as reduced by estimated customer discounts and rebates as discussed below, and increased by estimated supplier allowances and promotional incentives. These allowances and incentives are estimated on an ongoing basis and the potential variation between the actual amount of these margin contribution elements and the Company's estimates of them could be material to its financial results. Reported results include management's current estimate of such allowances and incentives.

19

In 2009, approximately 17% of the Company's estimated annual supplier allowances and incentives were fixed, based on supplier participation in various Company advertising and marketing publications. Fixed allowances and incentives are taken to income through lower cost of goods sold as inventory is sold.

The remaining 83% of the Company's estimated supplier allowances and incentives in 2009 were variable, based on the volume and mix of the Company's product purchases from suppliers. These variable allowances are recorded based on the Company's annual inventory purchase volumes and product mix and are included in the Company's Consolidated Financial Statements as a reduction to cost of goods sold, thereby reflecting the net inventory purchase cost. Supplier allowances and incentives attributable to unsold inventory are carried as a component of net inventory cost. The potential amount of variable supplier allowances often differs based on purchase volumes by supplier and product category. As a result, lower Company sales volume (which reduce inventory purchase requirements) and product sales mix changes (primarily because higher-margin products often benefit from higher supplier allowance rates) can make it difficult to reach supplier allowance goals.

Customer Rebates

Customer rebates and discounts are common in the business products industry and have a significant impact on the Company's overall sales and gross margin. Such rebates are reported in the Consolidated Financial Statements as a reduction of sales.

Customer rebates include volume rebates, sales growth incentives, advertising allowances, participation in promotions and other miscellaneous discount programs. These rebates are paid to customers monthly, quarterly and/or annually. Volume rebates and growth incentives are based on the Company's annual sales volumes to its customers. The aggregate amount of customer rebates depends on product sales mix and customer mix changes.

Revenue Recognition

Revenue is recognized when a service is rendered or when title to the product has transferred to the customer. Management establishes a reserve and records an estimate for future product returns related to revenue recognized in the current period. This estimate requires management to make certain estimates and judgments, including estimating the amount of future returns of products sold in the current period. This estimate is based on historical product-return trends and the loss of gross margin associated with those returns. This methodology involves some risk and uncertainty due to its dependence on historical information for product returns and gross margins to record an estimate of future product returns. If actual product returns on current period sales differ from historical trends, the amounts estimated for product returns (which reduce net sales) for the period may be overstated or understated, causing actual results of operations or financial condition to differ from those expected.

Valuation of Accounts Receivable

To determine an estimate for an allowance for doubtful accounts, the Company makes judgments as to the collectability of accounts receivable based on historical trends and future expectations. This allowance adjusts gross trade accounts receivable downward to its estimated collectible or net realizable value. To determine the appropriate allowance for doubtful accounts, management undertakes a two-step process. First, management reviews specific customer accounts receivable balances and specific customer circumstances to determine whether a further allowance is necessary. As part of this specific-customer analysis, management considers items such as account agings, bankruptcy filings, litigation, government investigations, historical charge-off patterns, accounts receivable concentrations and the current level of receivables compared with historical customer account balances. Second, a set of general allowance percentages are applied to accounts receivable

20

generated as a result of sales. These percentages are based on historical trends for non-specific customer write-offs. Periodically, management reviews these allowance percentages, adjusting for current information and trends.

The primary risks in the methodology used to estimate the allowance for doubtful accounts are its dependence on historical information to predict the collectability of accounts receivable and timeliness of current financial information from customers. To the extent actual collections of accounts receivable differ from historical trends, the allowance for doubtful accounts and related expense for the current period may be overstated or understated.

Goodwill and Intangible Assets

Goodwill is initially recorded based on the premium paid for acquisitions and is subsequently tested for impairment. The Company tests goodwill for impairment annually and whenever events or circumstances indicate that an impairment may have occurred, such as a significant adverse change in the business climate, loss of key personnel or a decision to sell or dispose of a reporting unit. Determining whether an impairment has occurred requires valuation of the respective reporting unit, which the Company estimates using a discounted cash flow method. When available and as appropriate, comparative market multiples are used to corroborate discounted cash flow results. If this analysis indicates goodwill is impaired, an impairment charge would be taken based on the amount of goodwill recorded versus the implied fair value of goodwill computed by independent appraisals. ORS Nasco contains a material amount of goodwill, $86.4 million as of December 31, 2009. The goodwill impairment analysis on this reporting unit resulted in a fair value that exceeded the carrying value of the entity by 5% as of the last goodwill impairment testing date of December 31, 2009. This valuation performed for goodwill impairment testing as of December 31, 2009 was based on both a discounted cash flow method and comparative market multiples. The key assumptions driving the fair value of ORS Nasco for purposes of this goodwill impairment test include forecasted revenues and margins. The discounted cash flow method also relied on a terminal value growth rate and the weighted average cost of capital of a market participant. Continued economic uncertainty, particularly in the industrial services sector, could have a negative effect on the fair value of the reporting unit. The Company's United Stationers Supply and Lagasse reporting units are not at risk of failing the first step of the goodwill impairment test prescribed by related accounting guidance.

Intangible assets are initially recorded at their fair market values determined on quoted market prices in active markets, if available, or recognized valuation models. Intangible assets that have finite useful lives are amortized on a straight-line basis over their useful lives. Intangible assets that have indefinite useful lives are not amortized but are tested at least annually for impairment or whenever events or circumstances indicate an impairment may have occurred. See Note 4 to the Consolidated Financial Statements.

Insured Loss Liability Estimates

The Company is primarily responsible for retained liabilities related to workers' compensation, vehicle, property and general liability and certain employee health benefits. The Company records expense for paid and open claims and an expense for claims incurred but not reported based upon historical trends and certain assumptions about future events. The Company has an annual per-person maximum cap, provided by a third-party insurance company, on certain employee medical benefits. In addition, the Company has both a per-occurrence maximum loss and an annual aggregate maximum cap on workers' compensation claims.

21

Inventories

Inventory constituting approximately 79% and 81% of total inventory as of December 31, 2009 and December 31, 2008, respectively, has been valued under the last-in, first-out ("LIFO") accounting method. LIFO results in a better matching of costs and revenues. The remaining inventory is valued under the first-in, first-out ("FIFO") accounting method. Inventory valued under the FIFO and LIFO accounting methods is recorded at the lower of cost or market. If the Company had valued its entire inventory under the lower of FIFO cost or market, inventory would have been $80.9 million and $84.7 million higher than reported as of December 31, 2009 and December 31, 2008, respectively. The decrease in the LIFO reserve, which reduced cost of sales by $3.8 million, was driven by decrements in certain LIFO pools. These decrements resulted in liquidations of LIFO inventory quantities carried at lower costs in prior years as compared with the cost of current year purchases. These liquidations resulted in LIFO income of $18.6 million, partially offset by LIFO expense of $14.8 million related to current inflation or a net reduction in cost of sales of $3.8 million referenced above.

The Company records adjustments for shrinkage. Inventory that is obsolete, damaged, defective or slow moving is recorded to the lower of cost or market. These adjustments are determined using historical trends and are adjusted, if necessary, as new information becomes available.

Derivative Financial Instruments

The Company's risk management policies allow for the use of derivative financial instruments to prudently manage foreign currency exchange rate and interest rate exposure. The policies do not allow such derivative financial instruments to be used for speculative purposes. At this time, the Company primarily uses interest rate swaps which are subject to the management, direction and control of our financial officers. Risk management practices, including the use of all derivative financial instruments, are presented to the Board of Directors for approval.

All derivatives are recognized on the balance sheet date at their fair value. All derivatives in a net receivable position are included in "Other assets", and those in a net liability position are included in "Other long-term liabilities". The interest rate swaps that the Company has entered into are classified as cash flow hedges in accordance with accounting guidance on derivative instruments and hedging activities as they are hedging a forecasted transaction or the variability of cash flow to be paid by the Company. Changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge are recorded in other comprehensive income, net of tax, until earnings are affected by the forecasted transaction or the variability of cash flow, and then are reported in current earnings.

The Company formally documents all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives designated as cash flow hedges to specific forecasted transactions or variability of cash flow.

The Company formally assesses, at both the hedge's inception and on an ongoing basis, whether the derivatives used in hedging transactions are highly effective in offsetting changes in cash flow of hedged items. When it is determined that a derivative is not highly effective as a hedge then hedge accounting is discontinued prospectively in accordance with accounting guidance on derivative instruments and hedging activities. At this time, this has not occurred as all cash flow hedges contain no ineffectiveness. See Note 20, "Derivative Financial Instruments", for further detail.

Income Taxes

The Company accounts for income taxes in accordance with accounting guidance on income taxes. The Company estimates actual current tax expense and assesses temporary differences that exist due to

22

differing treatments of items for tax and financial statement purposes. These temporary differences result in the recognition of deferred tax assets and liabilities.

The current and deferred tax balances and income tax expense recognized by the Company are based on management's interpretation of the tax laws of multiple jurisdictions. Income tax expense also reflects the Company's best estimates and assumptions regarding, among other things, the level of future taxable income, interpretation of tax laws, and tax planning. Future changes in tax laws, changes in projected levels of taxable income, and tax planning could impact the effective tax rate and current and deferred tax balances recorded by the Company. Management's estimates as of the date of the Consolidated Financial Statements reflect its best judgment giving consideration to all currently available facts and circumstances. As such, these estimates may require adjustment in the future, as additional facts become known or as circumstances change. Further, in accordance with accounting guidance on uncertain tax positions, the tax effects from uncertain tax positions are recognized in the Consolidated Financial Statements, only if it is more likely than not that the position will be sustained upon examination, based on the technical merits of the position. The Company also accounts for interest and penalties related to uncertain tax positions as a component of income tax expense.

Pension and Postretirement Health Benefits

Calculating the Company's obligations and expenses related to its pension and postretirement health benefits requires using certain actuarial assumptions. As more fully discussed in Notes 12 and 13 to the Consolidated Financial Statements included in Item 8 of this Annual Report, these actuarial assumptions include discount rates, expected long-term rates of return on plan assets, and rates of increase in compensation and healthcare costs. To select the appropriate actuarial assumptions, management relies on current market trends and historical information. The expected long-term rate of return on plan assets assumption is based on historical returns and the future expectation of returns for each asset category, as well as the target asset allocation of the asset portfolio. Pension expense for 2009 was $6.3 million, compared to $5.6 million in 2008 and $7.4 million in 2007. A one percentage point decrease in the assumed discount rate would have resulted in an increase in pension expense for 2009 of approximately $3.2 million and increased the year-end projected benefit obligation by $20.3 million.