Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PETROQUEST ENERGY INC | july20188k.htm |

July 2018

Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this presentation are forward-looking statements. Although PetroQuest believes that the expectations reflected in these forward-looking statements are reasonable, these statements are based upon assumptions and anticipated results that are subject to numerous uncertainties and risks. Actual results may vary significantly from those anticipated due to many factors, including the volatility of oil and natural gas prices; our indebtedness and the significant amount of cash required to service our indebtedness; our estimate of the sufficiency of our existing capital sources to fund our exploration and development activities and service our indebtedness, including the August 15, 2018 cash interest payment on our 2021 second lien senior secured notes; including availability under our multi-draw term loan facility; our ability to raise additional capital to fund cash requirements for future operations; limits on our growth and our ability to finance our operations and service our indebtedness; our ability to fund and execute our Cotton Valley and Austin Chalk development programs as planned; our ability to increase recoveries in the Austin Chalk formation and to increase our overall oil production as planned; our estimates with respect to fracked Austin Chalk wells in Louisiana, including production, EURs and costs; our estimates with respect to production, reserve replacement ratio and finding and development costs; our receipt of a cash refund with respect to our offshore bonds and the timing and amount of the same; our responsibility for offshore decommissioning liabilities for offshore interests we no longer own; our ability to hedge future production to reduce our exposure to price volatility in the current commodity pricing market; our ability to find, develop and produce oil and natural gas reserves that are economically recoverable and to replace reserves and sustain and/or increase production; ceiling test write-downs resulting, and that could result in the future, from lower oil and natural gas prices; fund our capital needs and respond to changing conditions imposed by our multi-draw term loan facility and restrictive debt covenants; approximately 46% of our production being exposed to the additional risk of severe weather, including hurricanes, tropical storms and flooding, and natural disasters; losses and liabilities from uninsured or underinsured drilling and operating activities; changes in laws and governmental regulations as they relate to our operations; the operating hazards attendant to the oil and gas business; the volatility of our common stock price; and the limited trading market for our common stock. In particular, careful consideration should be given to cautionary statements made in the various reports the Company has filed with the SEC. The Company undertakes no duty to update or revise these forward-looking statements. In particular, careful consideration should be given to cautionary statements made in the various reports PetroQuest has filed with the Securities and Exchange Commission. PetroQuest undertakes no duty to update or revise these forward-looking statements. Prior to 2010, the Securities and Exchange Commission generally permitted oil and gas companies, in their filings, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Beginning with year-end reserves for 2009, the SEC permits the optional disclosure of probable and possible reserves. We have elected not to disclose our probable and possible reserves in our filings with the SEC. We use the terms “reserve inventory,” “gross unrisked reserves,” “EUR,” “inventory”, “unrisked resource potential”, 3P reserves or other descriptions of volumes of hydrocarbons to describe volumes of resources potentially recoverable through additional drilling or recovery techniques that the SEC’s guidelines prohibit us from including in filings with the SEC. Estimates of reserve inventory, gross unrisked reserves EUR, inventory, unrisked 3P reserves do not reflect volumes that are demonstrated as being commercially or technically recoverable. Even if commercially or technically recoverable, a significant recovery factor would be applied to these volumes to determine estimates of volumes of proved reserves. Accordingly, these estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being actually realized by the Company. The methodology for estimating unrisked inventory, gross unrisked reserves, EUR, or unrisked resource potential or 3P reserves may also be different than the methodology and guidelines used by the Society of Petroleum Engineers and is different from the SEC’s guidelines for estimating probable and possible reserves. 2

2018 Overview ▪ Acquired low-cost position in the Louisiana Austin Chalk providing opportunity for oil growth and acreage value appreciation ▪ Sold GOM assets in early 2018 to remove regulatory risk and substantial P&A burden ▪ Production growth takes a step back with divestiture ▪ Cash interest on 2021 Second Lien Senior Secured PIK Notes returns in August 2018 ▪ Cotton Valley drilling program on hold while assessing options 3

Production Profile Production (MMcfe/d) 100 94 90 81 GOM Sale 1/31/18: 80 4.7 MMcfe/d 69 70 68 60 58 57 50 50 40 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18* * Based on the mid-point of production guidance 4

Our Properties 2017 Reserves (1) 1Q18 Production Gulf Coast 10% 75% Gas Gulf Coast 15% NGL 46% East Texas 10% Oil 54% East Texas 90% 145 Bcfe 68 Mmcfe/d (1) Proforma for reserves sold with divestiture of GOM assets in January 2018 5

Louisiana Austin Chalk Entry Rationale for PQUE ▪ Familiar development story: access existing fields that had variable production success using conventional development techniques and apply the latest horizontal/completion technologies to significantly enhance recoveries ▪ Examples: Permian, Eagle Ford, Scoop/Stack, Cotton Valley, etc ▪ Hundreds of control points in the area from vintage unfracked Austin Chalk/Tuscaloosa wells ▪ Increase oil production/reserves in portfolio: Louisiana Austin Chalk production mix is approximately 80% oil ▪ Attractive leasehold position: early mover action resulted in acreage position nearby the initial EOG test well – first 90 days of production have totaled approximately 80,000 bbls of oil ▪ Strong economics: base case estimate of 600,000 Bbl/well is projected to generate 60% IRR at $50 oil 6

Austin Chalk Trend Regional Overview = EOG Eagles Ranch 14H Brookeland North Bayou Jack Giddings Master’s Pearsall Creek Karnes ▪ Austin Chalk trend has produced over 1.3 billion barrels of oil ▪ Several large cap companies with Austin Chalk experience in Texas have established leasehold positions in the Louisiana Austin Chalk ▪ Goal is to replicate the recent Texas Austin Chalk results in Louisiana ▪ Over 500,000 acres have been leased by EOG and COP with an additional 100,000 – 200,000 acres leased by others ▪ 8 Louisiana parishes have ongoing leasing activity ▪ Latest horizontal fracked Austin Chalk wells in Karnes County, Texas have EURs on average (22 wells) over 600,000 BOE – 500% uplift over unfracked wells (119,000 BOE) 7

CHALK COMPARISON: TEXAS – LOUISIANA Karnes County, TX Avoyelles Parish, LA = EOG Eagles Ranch 14H = Austin Chalk Wells MBOE = Austin Chalk Wells MBOE Avg. pre-fracked Horizontal Oil 104 Avg. pre-fracked Horizontal Oil CUM 119 CUM (Pre-2013) Estimated Fracked Horizontal Oil EUR 732 EOG: Avg. Fracked Horizontal Oil 632 (based on % increase in 22 sample EUR (2016–Current) EOG wells in Karnes County) Percent increase 508% Estimated Percent Increase 508% 8

LOUISIANA ACREAGE MAP (>600,000 acres) 9

EAGLES RANCH 14H: Directional survey N EOG Eagles Ranch 14H APC Dominique 27#1 S Pilot Hole Pilot Hole KB = 106’ KB = 66’ Anadarko Dominique 27#1 APC Dominique 27#1 Pilot Hole 5” Bulk Density Log Upper Perf: 16,477’ Lower perf: 20,411’ 108 MBO 105 MMCF 9/11/2017 – 4/30/2018 Upper Perf: 15,805' Lower perf: 22,293' 14 MBO 1.7 MMCF 17 MBW 9/2011 - 5/2015 10

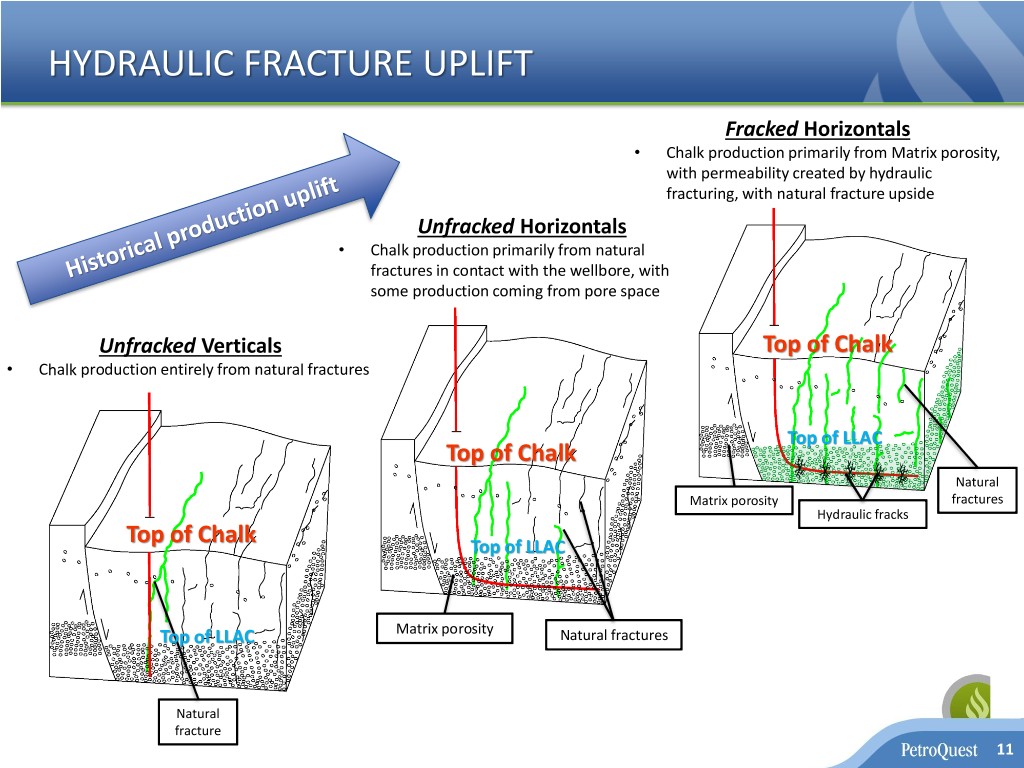

HYDRAULIC FRACTURE UPLIFT Fracked Horizontals • Chalk production primarily from Matrix porosity, with permeability created by hydraulic fracturing, with natural fracture upside Unfracked Horizontals • Chalk production primarily from natural fractures in contact with the wellbore, with some production coming from pore space Unfracked Verticals Top of Chalk • Chalk production entirely from natural fractures Top of LLAC Top of Chalk Natural Matrix porosity fractures Hydraulic fracks Top of Chalk Top of LLAC Top of LLAC Matrix porosity Natural fractures Natural fracture 11

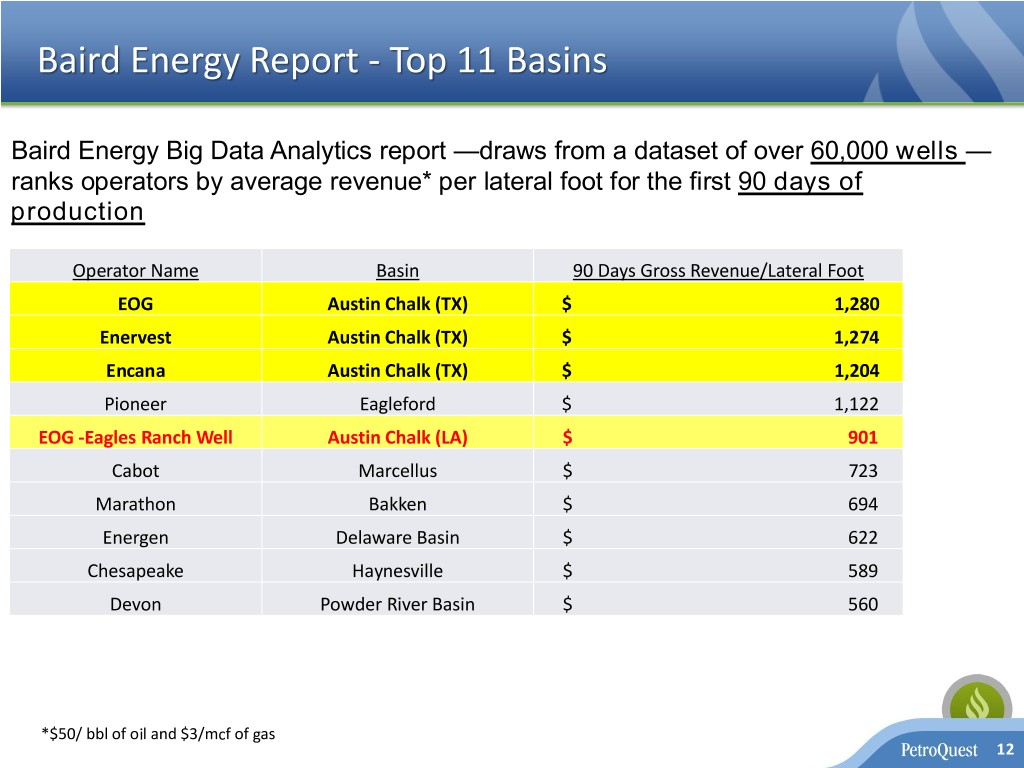

Baird Energy Report - Top 11 Basins Baird Energy Big Data Analytics report —draws from a dataset of over 60,000 wells — ranks operators by average revenue* per lateral foot for the first 90 days of production Operator Name Basin 90 Days Gross Revenue/Lateral Foot EOG Austin Chalk (TX) $ 1,280 Enervest Austin Chalk (TX) $ 1,274 Encana Austin Chalk (TX) $ 1,204 Pioneer Eagleford $ 1,122 EOG -Eagles Ranch Well Austin Chalk (LA) $ 901 Cabot Marcellus $ 723 Marathon Bakken $ 694 Energen Delaware Basin $ 622 Chesapeake Haynesville $ 589 Devon Powder River Basin $ 560 *$50/ bbl of oil and $3/mcf of gas 12

Louisiana Austin Chalk - Economic Sensitivities Estimates IRR ROI PV(10) High Side Case 800 MBO/Well 97% 2.98 $12.5 MM Expected Case 600 MBO/Well 60% 2.08 $6.4 MM Low Side Case 400 MBO/Well 16% 1.23 $0.4 MM Assumptions: Well Cost = $9.0 MM Facility and SWD Cost of $375 M/well Product Pricing: $50/BO, $3.00/Mcf, $25.50/Bbl NGL 13

Industry Activity - Cotton Valley Trend (16 Rigs) Relative Rock Quality Comparison Haynesville PQ Cotton Valley Porosity (3-14%) (10%) Haynesville PQ Cotton Valley Permeability (<0.001) (~0.1) County Company Rig Count BHP Billiton Petro Caddo 1 (TXLA) De Soto Covey Park Gas LLC 2 Indigo Minerals LLC 2 Lincoln Wildhorse Res Mgmt 1 Range LA Oper 3 Harrison RHE Operating, LLC 1 Panola Tanos Exploration II, LLC 1 Robertson O'Benco Inc. 1 Rusk Sabine Oil & Gas Corp 1 Sojitz Energy Venture, 1 Inc. Tanos Exploration II, LLC 1 KJ Energy LLC 1 14

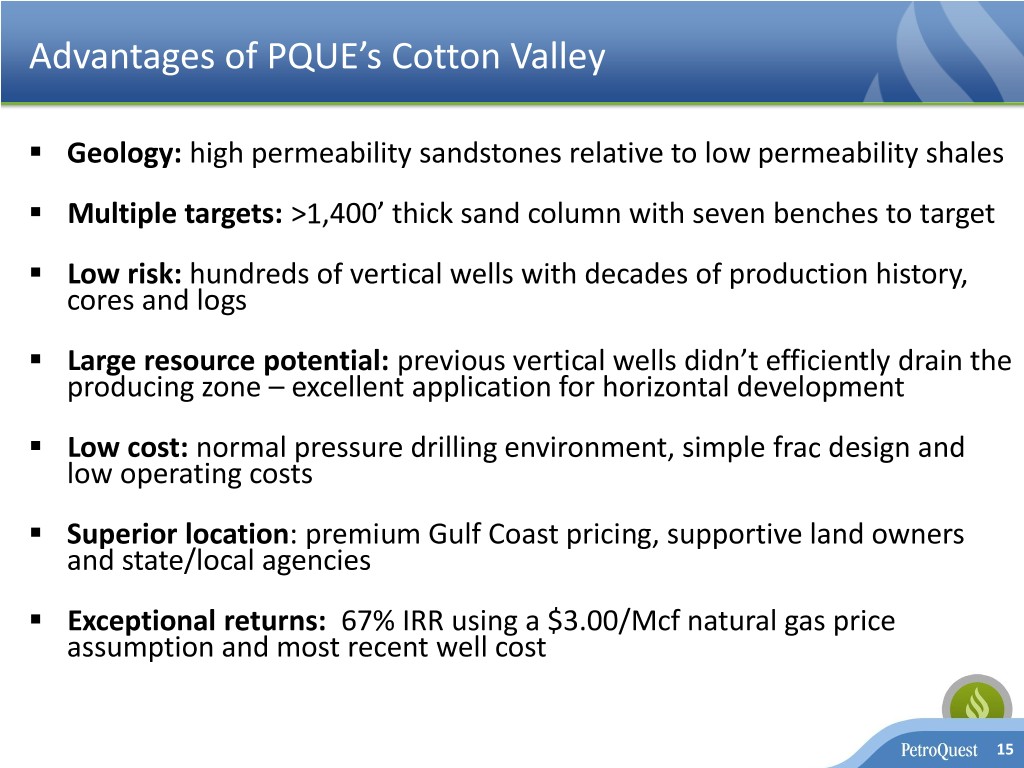

Advantages of PQUE’s Cotton Valley ▪ Geology: high permeability sandstones relative to low permeability shales ▪ Multiple targets: >1,400’ thick sand column with seven benches to target ▪ Low risk: hundreds of vertical wells with decades of production history, cores and logs ▪ Large resource potential: previous vertical wells didn’t efficiently drain the producing zone – excellent application for horizontal development ▪ Low cost: normal pressure drilling environment, simple frac design and low operating costs ▪ Superior location: premium Gulf Coast pricing, supportive land owners and state/local agencies ▪ Exceptional returns: 67% IRR using a $3.00/Mcf natural gas price assumption and most recent well cost 15

Cotton Valley Horizontal – Production Up with Costs Down Improving Well Performance 3,000 5,747 6,000 14 13.3 12 5,500 $2,200 10 2,000 5,000 8 6.3 4,500 6 LateralFeet $/LateralFoot 1,000 $916 4,000 4 3,654 24HR IP Rate (MMCFE/D) 24HRRate IP 2 3,500 0 0 3,000 Avg. 2011 Last 10 wells* PQ #1 Last 10 wells* Gas Liquids Cost/Lateral FT Lateral Length Goal to Consistently Execute Drilling @ Less than $1,000/lateral foot * Excludes PQ #24 due to mechanical issues 16

Cotton Valley Horizontal Economics Sensitivity to Gas Prices Horizontal CV Well Economics 98% 100% $4.0 MM D&C 80% 67% 60% 42% 40% 20% 0% $2.50 $3.00 $3.50 Economic Assumptions Assumptions Gross Well Cost ($MM) 4.0 (~$900/lateral foot) EUR (Bcfe) (1) 8.0 IP Rate (Mmcfe/d) (1) 11 % Gas / Liquids 70% / 30% IRR (%) 67% (1) 2015 Avg. well performance with laterals in excess of 4,500 feet - $3.00/Mcf gas, $18 NGL/Bbl and $50 oil/Bbl 17

SE CARTHAGE 8200 8250 8250 8250 8300 8300 8300 8350 Multi 8350 Bench Cotton Valley Opportunities8350 8400 8400 8400 8450 8450 8450 8500 PetroQuest 8500 -- McFadden Bagley #1 8500 8550 8550 8550 8600 8600 8600 8650 8650 8650Cotton Valley 8700 8700 Cotton Valley Drilling8700 Locations 8750 8750 8750 8800 8800 Benches 8800 8850 8,500’ 8850 8850 8900 8900 Bench 8900 Gross Drilling Locations* 8950 8950 8950 9000 9000 “C&D” Sands C&D 9000 124 9050 9050 9050 Vaughn 124 9100 9100 9100 9150 9150 Davis 9150 229 9200 9200 9200 9250 9250 E4 9250 63 9300 9300 9300 E 116 9,000’ 9350 9350 Vaughn Sand 9350 9400 9400 Eberry/Roseberry9400 154 9450 9450 9450 9500 9500 Sexton/Taylor9500 28 9550 Davis Sand 9550 9550 Total Gross Drilling Locations 838 9600 9600 9600 9650 9650 E4 Sands * Locations9650 based on 1,200’ spacing within area 9700 9700 of estimated9700 economic net feet of pay 9750 9750 9750 9800 9,500’ 9800 E Sands determined9800 by offsetting vertical well logs 9850 9850 9850 9900 9900 9900 9950 9950 Roseberry/Eberry Sand 9950 10000 10000 10000 10050 10050 10050 10100 10100 NOTE: All of the above benches10100 are productive on 10150 10150 Taylor/Sexton PQ acreage through >140 10150vertical wells and all 10200 10,000’ 10200 10200 10250 10250 benches have been tested10250 horizontally in close 10300 10300 proximity to PQ acreage 10300 10350 10350 10350 MCFADDEN-BAGLEY UNI 10400 1 10400 GR 42365359740000 Resistivity Den. Porosity 10450 CUMGAS : 153,052 MCF 10450 CUMOIL : 835 BBLS 10500 CUMWTR : 22,183 BBLS 10500 2/15/2006 18 10550 10550 PETRA 6/17/2013 10:36:53 AM

PQ Cotton Valley - 838 Future Locations 19

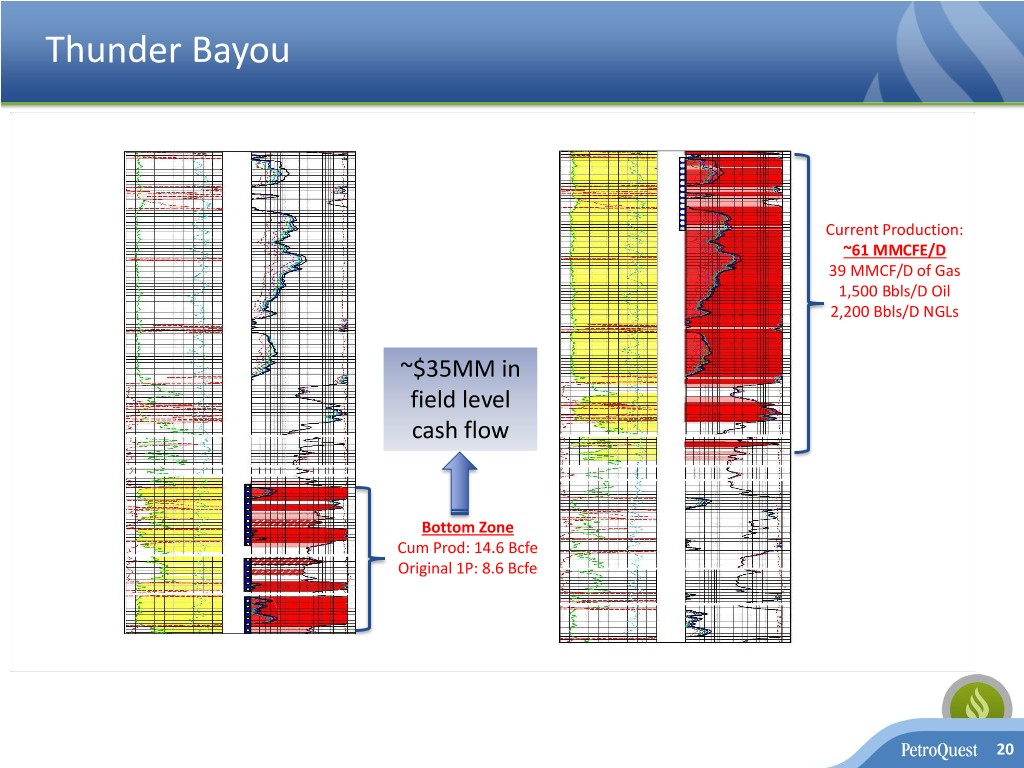

Thunder Bayou Current Production: ~61 MMCFE/D 39 MMCF/D of Gas 1,500 Bbls/D Oil 2,200 Bbls/D NGLs ~$35MM in field level cash flow Bottom Zone Cum Prod: 14.6 Bcfe Original 1P: 8.6 Bcfe 20

Debt Maturity Profile ($000s) 12/31/15 3/31/18 400 400 350 350 350 300 300 275 250 250 200 200 150 150 100 100 50 50 30 9 0 0 2017 2020 2021 2021 Unsecured 2017 Notes First Lien Term Loan 2021 2L Notes 2021 2L PIK Notes 21

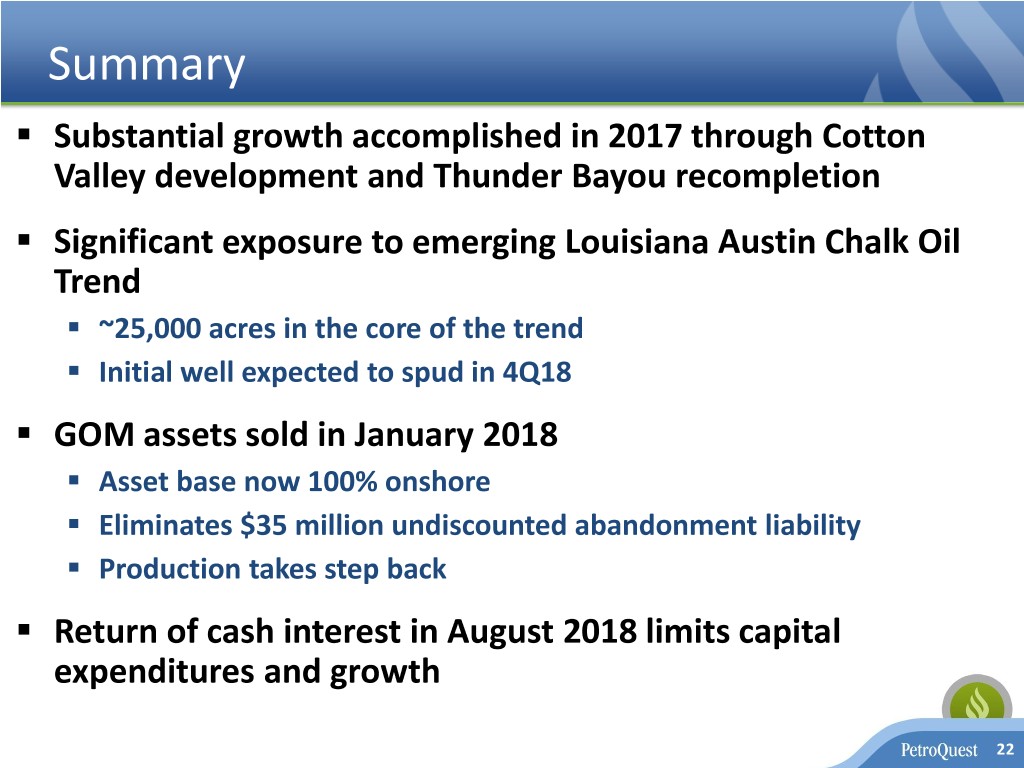

Summary ▪ Substantial growth accomplished in 2017 through Cotton Valley development and Thunder Bayou recompletion ▪ Significant exposure to emerging Louisiana Austin Chalk Oil Trend ▪ ~25,000 acres in the core of the trend ▪ Initial well expected to spud in 4Q18 ▪ GOM assets sold in January 2018 ▪ Asset base now 100% onshore ▪ Eliminates $35 million undiscounted abandonment liability ▪ Production takes step back ▪ Return of cash interest in August 2018 limits capital expenditures and growth 22

Appendix 23

Appendix 1 – Adjusted EBITDA Reconciliation ($ in thousands) 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17 2Q17 3Q17 4Q17 2017 1Q18 Net Income (Loss) available to common $26,051 ($299,977) ($39,137) ($24,143) ($23,306) ($4,310) ($90,896) ($4,918) ($3,385) ($3,085) ($389) ($11,777) (2,212) stockholders Income tax expense (2,941) 2,673 86 475 (18) - 543 - (189) (84) (675) (948) 106 (benefit) Interest expense & 34,420 38,905 9,751 7,788 9,022 8,807 35,368 8,543 8,432 8,655 8,345 33,975 5,772 preferred dividends Depreciation, 87,818 63,497 10,138 7,193 6,030 5,359 28,720 6,117 6,841 8,795 10,300 32,053 6,505 depletion, and amortization Share based 5,248 4,617 442 483 436 83 1,444 425 401 312 265 1,403 340 compensation expense Gain on Asset Sale - (21,937) - - - - - - - - - - - 2,958 3,259 608 618 670 619 2,515 547 553 571 581 2,252 198 Accretion of asset retirement obligation Derivative (income) - - - - - - - - - - - - - expense Ceiling test - 266,562 18,857 12,782 8,665 - 40,304 - - - - - - writedown $153,554 $57,599 $745 $5,196 $1,499 $10,558 $17,998 $10,714 $12,653 $15,164 $18,427 $56,958 $10,709 Adjusted EBITDA ▪ Adjusted EBITDA represents net income (loss) available to common stockholders before income tax expense (benefit), interest expense (net), preferred stock dividends, depreciation, depletion, amortization, share based compensation expense, gain on asset sale, accretion of asset retirement obligation, derivative (income ) expense and ceiling test writedowns. We have reported Adjusted EBITDA because we believe Adjusted EBITDA is a measure commonly reported and widely used by investors as an indicator of a company’s operating performance. We believe Adjusted EBITDA assists such investors in comparing a company’s performance on a consistent basis without regard to depreciation, depletion and amortization, which can vary significantly depending upon accounting methods or nonoperating factors such as historical cost. Adjusted EBITDA is not a calculation based on generally accepted accounting principles, or GAAP, and should not be considered an alternative to net income in measuring our performance or used as an exclusive measure of cash flow because it does not consider the impact of working capital growth, capital expenditures, debt principal reductions and other sources and uses of cash which are disclosed in our consolidated statements of cash flows. Investors should carefully consider the specific items included in our computation of Adjusted EBITDA. While Adjusted EBITDA has been disclosed herein to permit a more complete comparative analysis of our operating performance relative to other companies, investors should be cautioned that Adjusted EBITDA as reported by us may not be comparable in all instances to Adjusted EBITDA as reported by other companies. Adjusted EBITDA amounts may not be fully available for management’s discretionary use, due to certain requirements to conserve funds for capital expenditures, debt service and other commitments, and therefore management relies primarily on our GAAP results. ▪ Adjusted EBITDA is not intended to represent net income as defined by GAAP and such information should not be considered as an alternative to net income, cash flow from operations or any other measure of 24 performance prescribed by GAAP in the United States. The above table reconciles net income (loss) available to common stockholders to Adjusted EBITDA for the periods presented.

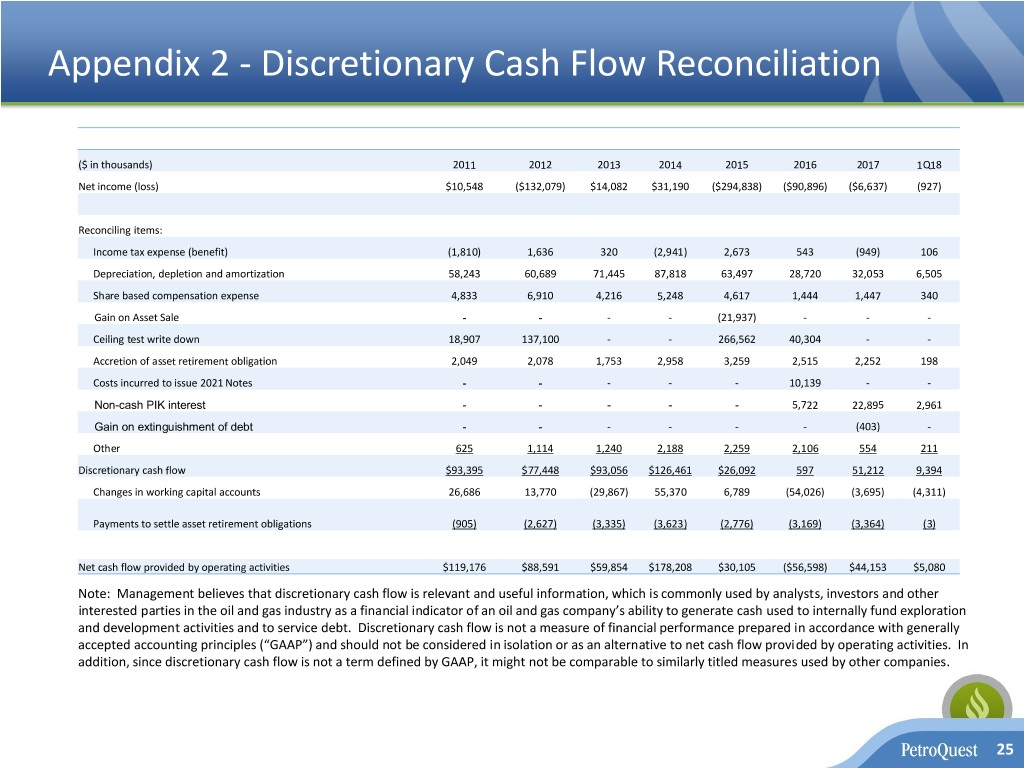

Appendix 2 - Discretionary Cash Flow Reconciliation ($ in thousands) 2011 2012 2013 2014 2015 2016 2017 1Q18 Net income (loss) $10,548 ($132,079) $14,082 $31,190 ($294,838) ($90,896) ($6,637) (927) Reconciling items: Income tax expense (benefit) (1,810) 1,636 320 (2,941) 2,673 543 (949) 106 Depreciation, depletion and amortization 58,243 60,689 71,445 87,818 63,497 28,720 32,053 6,505 Share based compensation expense 4,833 6,910 4,216 5,248 4,617 1,444 1,447 340 Gain on Asset Sale - - - - (21,937) - - - Ceiling test write down 18,907 137,100 - - 266,562 40,304 - - Accretion of asset retirement obligation 2,049 2,078 1,753 2,958 3,259 2,515 2,252 198 Costs incurred to issue 2021 Notes - - - - - 10,139 - - Non-cash PIK interest - - - - - 5,722 22,895 2,961 Gain on extinguishment of debt - - - - - - (403) - Other 625 1,114 1,240 2,188 2,259 2,106 554 211 Discretionary cash flow $93,395 $77,448 $93,056 $126,461 $26,092 597 51,212 9,394 Changes in working capital accounts 26,686 13,770 (29,867) 55,370 6,789 (54,026) (3,695) (4,311) Payments to settle asset retirement obligations (905) (2,627) (3,335) (3,623) (2,776) (3,169) (3,364) (3) Net cash flow provided by operating activities $119,176 $88,591 $59,854 $178,208 $30,105 ($56,598) $44,153 $5,080 Note: Management believes that discretionary cash flow is relevant and useful information, which is commonly used by analysts, investors and other interested parties in the oil and gas industry as a financial indicator of an oil and gas company’s ability to generate cash used to internally fund exploration and development activities and to service debt. Discretionary cash flow is not a measure of financial performance prepared in accordance with generally accepted accounting principles (“GAAP”) and should not be considered in isolation or as an alternative to net cash flow provided by operating activities. In addition, since discretionary cash flow is not a term defined by GAAP, it might not be comparable to similarly titled measures used by other companies. 25

Appendix 3 - Panola County Cotton Valley – Room to Run Legend Cotton Valley Wells PQ CV Vertical Wells PQ CV Horizontal Wells PQ Area Carthage Field Area of Mutual – 4.4 TCF of Interest Unrisked Resource Potential 2.2 Tcfe of CV/TP/Bossier Unrisked Resource Potential 26

Appendix 4 – Cotton Valley Production Profile Recent Horizontal Cotton Valley Results PQ #19 PQ #20 PQ #21 PQ #22 PQ #23 PQ #24* PQ #25 PQ #26 PQ #27 PQ #28 PQ #29 PQ #30 Avg.** IP Rate (Mmcfe/d) 12.5 14.8 7.1 10.6 14.5 5.4 18.3 12.7 13.3 15.4 11.5 15.4 13.3 30 Day Avg. Rate (Mmcfe/d) 11.4 11.5 6.0 7.6 12.3 3.9 14.7 12.6 10.8 11.9 N/A N/A 11.0 60 Day Avg. Rate (Mmcfe/d) 10.6 10.4 5.2 7.7 11.2 3.2 12.3 11.9 9.8 11.1 N/A N/A 10.0 90 Day Avg. Rate (Mmcfe/d) 9.8 9.9 4.6 7.4 10.3 N/A 11.1 11.0 9.7 10.2 N/A N/A 9.3 • PQ #24 experienced mechanical issues (directional equipment failure) during the drilling process resulting in 50% of the well being drilled out of section ** Average excludes PQ #24 due to mechanical issues 27

Appendix 5 - Cotton Valley Acreage Position 55,000 Gross Acres (100% HBP) ~800 Gross Future Locations (420 Net) 28

Company Information 400 East Kaliste Saloom Road, Suite 6000 Lafayette, Louisiana 70508 Phone: (337) 232-7028 Fax: (337) 232-0044 www.petroquest.com V1 29