Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_070218.htm |

Exhibit 99.1

Synthesis Energy Systems, Inc. Corporate Presentation July 2018 Clean | Economic | Sustainable Global Energy Growth With Blue Skies

Forward - Looking Statements and Disclaimers This presentation includes "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Although we believe that in making such forward - looking statements, our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . Among those risks, trends and uncertainties are the ability of Batchfire Resources Pty Ltd (“BFR”) and Australian Future Energy Pty Ltd (“AFE”) management to successfully grow and develop their Australian assets and operations, including Callide and Pentland ; the ability of AFE and BFR to produce earnings and pay dividends ; the ability of SES EnCoal Energy sp . z o . o . management to successfully grow and develop projects, assets and operations in Poland ; our ability to raise additional capital ; our indebtedness and the amount of cash required to service our indebtedness ; our ability to develop and expand business of the Tianwo - SES Joint Venture in the joint venture territory ; our ability to develop our power business unit and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies ; our ability to successfully develop our licensing business ; the ability of our project with Yima to produce earnings and pay dividends ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to maintain our listing on the NASDAQ Stock Market ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular coal, natural gas, crude oil, methanol and power ; the availability and terms of financing ; our customers’ and/or our ability to obtain the necessary approvals and permits for future projects ; our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . We cannot assure you that the assumptions upon which these statements are based will prove to be correct . Please refer to our latest Form 10 - K available on our website at www . synthesisenergy . com . The financial projections presented in this presentation represent the subjective views of the management of the Company and management's current estimates of future performance based on various assumptions which management believes are reasonable, but which may or may not prove to be correct . There can be no assurance that management's views are accurate or that management's projections will be realized . Industry experts may disagree with these assumptions and with management's view of the market and the prospects for the Company . 2

Overview • SES is a clean energy company, founded in 2004 and publicly traded on NASDAQ since 2007 • We own proprietary technology for low cost, environmentally responsible generation of synthesis gas • Our synthesis gas is used for production of a wide variety of high - value clean energy and chemical products, such as synthetic natural gas, power, methanol, and fertilizer • We serve the global marketplace and our first 12 systems were built in China • SES is headquartered in Houston, Texas, with offices and operations in Shanghai, China and Brisbane, Australia 3 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved SES’s Second Operating Project, Commissioned in 2012, Henan Province, China

Business Model Value growth through generation of earnings from SES technology licensing and proprietary equipment sales combined with income from equity ownership in clean energy and chemical production facilities. Our target markets are regions of the world, such as Australia and Poland, with high energy prices due to limited access to affordable natural gas, combined with abundant low - quality, low - cost coal resources, renewable biomass and municipal solid wastes. Our core competencies include deployment of our unique synthesis gas generation technology, plus commercial development and financial structuring of regional business platforms and projects which utilize this proprietary technology. SES’s First Operating Project, Commissioned in 2007 , Shandong Province, China 4 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

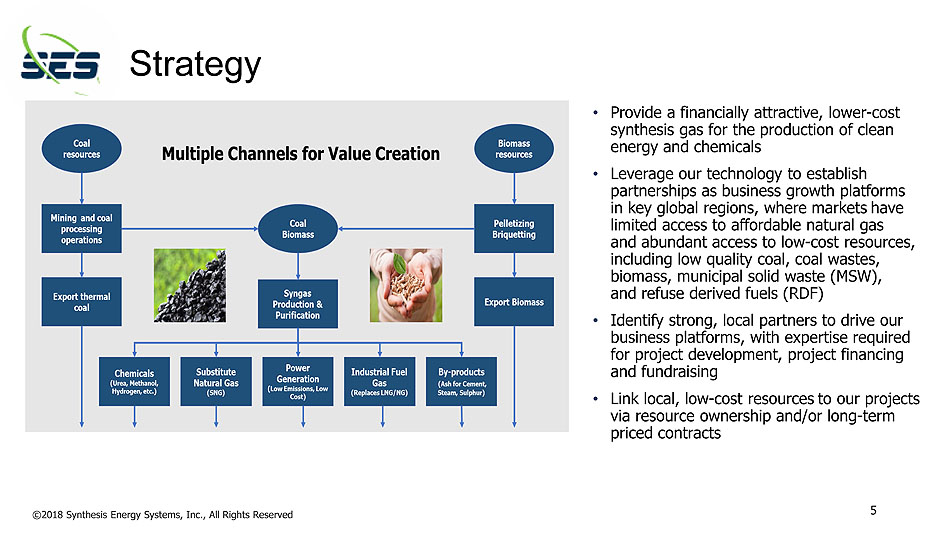

Strategy • Provide a financially attractive, lower - cost synthesis gas for the production of clean energy and chemicals • Leverage our technology to establish partnerships as business growth platforms in key global regions, where markets have limited access to affordable natural gas and abundant access to low - cost resources, including low quality coal, coal wastes, biomass, municipal solid waste (MSW), and refuse derived fuels (RDF) • Identify strong, local partners to drive our business platforms, with expertise required for project development, project financing and fundraising • Link local, low - cost resources to our projects via resource ownership and/or long - term priced contracts 5 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Key Accomplishments • Successfully commercialized technology from pilot - scale to current commercial scale • Completed 5 projects over 10 years utilizing 12 SES Gasification Technology (SGT) systems • Developed, owned and operated first commercial plant, proving robust commercial performance of SGT, start - up 2007 • 25% equity ownership in 330,000 TPY methanol operation in Henan Province, China, start - up 2012 • ~39% ownership in Australian Future Energy (AFE), our Australian business platform company, founded 2014 • Established China Joint Venture for SGT Technology and Equipment Sales, Tianwo - SES, 25 % ownership, established 2014 • 11.4% ownership in Batchfire Resources/Callide coal mine operation in Queensland, Australia, established 2016 • Secured Technology License Agreement with AFE for large - scale project in Australia, 2017 • 50% ownership in SES EnCoal Energy (SEE), our Poland business platform company, established 2017 • Expanded Intellectual Property rights with over 10 years of design and operations know - how and patents • Secured exclusive global partnership with Midrex Technologies, Inc., a subsidiary of Kobe Steel Limited, for Direct Reduced Iron (DRI) facilities for steel production which will combine SGT with MXCOL™ DRI technology • Today, SES is recognized as the global leader in flexible - fuel clean synthesis gas production with high efficiency and low cost Aluminum Corporation of China, 4 - SGT system industrial fuel gas facility, completed performance testing 2017 , Henan Province, China 6 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Batchfire R es o u r ces A us t r alian Future Energy Assets • SES ~39% and Ambre Investments ~45%, a privately held company • Acquired 270 MM ton Pentland coal resource (1) • Industrial fuel gas, power and fertilizer projects under review • Signed first SGT License Agreement with SES, May 2017 Notes: (1) Information provided by AFE, (2) Information provided by Batchfire Resources • Spin - off company from AFE, SES owns 11.4% • Acquired Callide Thermal Coal Mine operations in 2016 ~230MM tons reserves; ~850MM tons resource (2) • Robust plan to increase production and lower costs to near bottom of global cost curve • Batchfire’s plan is expected to generate compelling value for shareholders With Technology Leverage, SES Has Established a Valuable Foundation of Assets, Positioned for Future Growth SES EnCoal Energy • SES 50% and EnInvestments sp z.o.o 50%, a privately held company • Poland Platform Company • Three years’ market collaboration prior to JV formation • Industrial fuel gas, power and methanol projects under review 7 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Yima Joint Venture Tianwo - SES Clean Energy Technologies Assets • SES 25%, Suzhou THVOW Technology Company 50%, and Innovative Coal Chemical Design Institute 25%. Shanghai, China • Granted regional sub - licensing rights to SES technology • Completed 3 projects for Aluminum Corporation of China (CHALCO) – pictured below • SES 25% and Yima Coal Industry Group 75% • 3 SGT Systems with ~1200 TPD coal capacity each • 330,000 MTPY methanol production capability • Project is first of planned three phases, Henan Province, China With Technology Leverage, SES Has Established a Valuable Foundation of Assets, Positioned for Future Growth Chalco Shandong C ha lco S ha nxi C ha lco H en a n 8 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

0 2 4 6 8 10 12 14 16 18 SES Feedstock SES Low - Cost Syngas(3) NG from LNG(1) Crude Oil(2) Energy Cost ($/MMBTU) Energy Cost Comparison Value Proposition • Lowest cost syngas • Lowest cost feedstocks • Coal, coal wastes and solid renewable materials • Lower CO 2 footprint with renewable co - feeding Cost Advantage of SES Technology Notes and Assumptions: (1) NG from LNG range includes variation in landed LNG prices, and variation in post - landed costs, including regasification and pipeline delivery costs; (2) Crude Oil variation assumes a range of $50 to $100 per barrel; (3) Variation in syngas pricing includes variation in feedstock price and location based variation in construction costs SES Offers Compelling Cost Advantage Over Alternatives 9 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

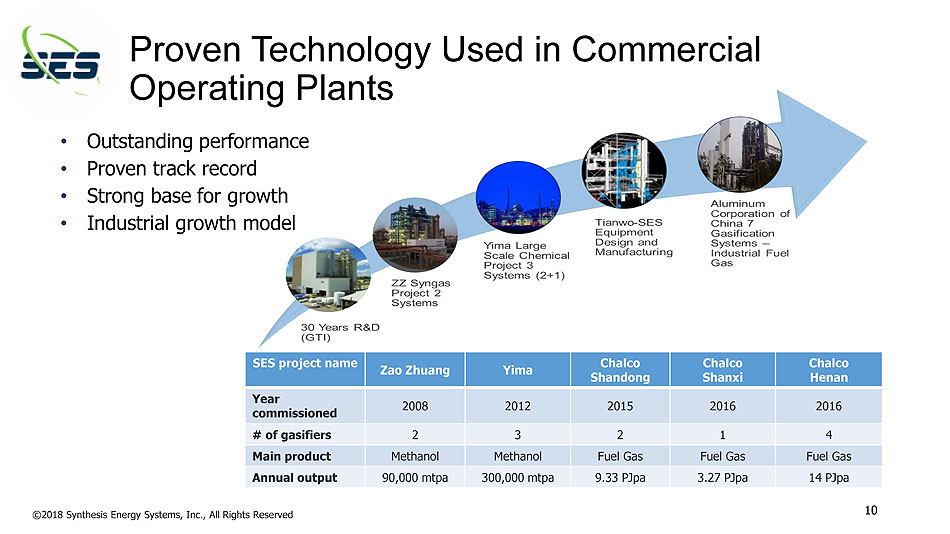

Proven Technology Used in Commercial Operating Plants • Outstanding performance • Proven track record • Strong base for growth • Industrial growth model SES project name Zao Zhuang Yima Chalco Shand o ng C halco Shanxi C halco Henan Year commissioned 2008 2012 2015 2016 2016 # of gasifiers 2 3 2 1 4 Main product Methanol Methanol Fuel Gas Fuel Gas Fuel Gas Annual output 90,000 mtpa 300,000 mtpa 9.33 PJpa 3.27 PJpa 14 PJpa 10 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

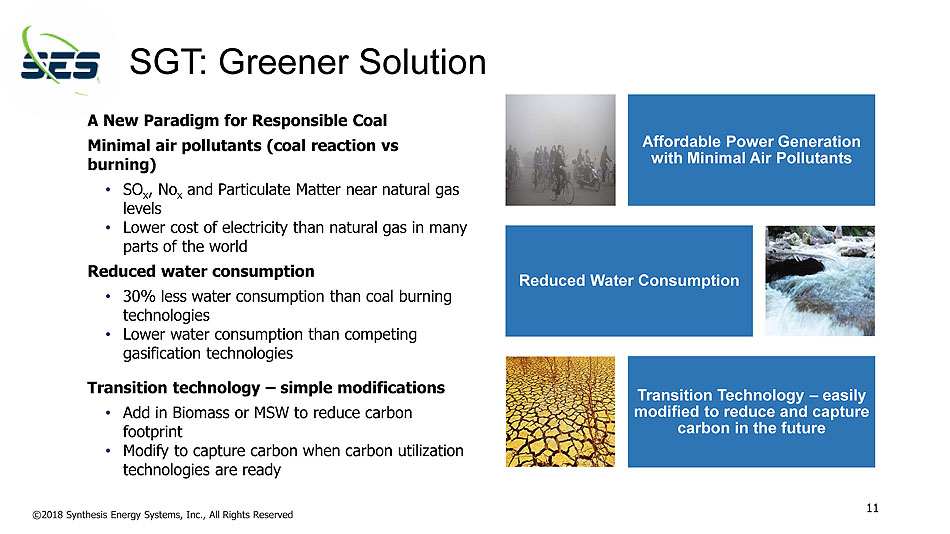

SGT: Greener Solution A New Paradigm for Responsible Coal Minimal air pollutants (coal reaction vs burning) • SO x , No x and Particulate Matter near natural gas levels • Lower cost of electricity than natural gas in many parts of the world Reduced water consumption • 30% less water consumption than coal burning technologies • Lower water consumption than competing gasification technologies Transition technology – simple modifications • Add in Biomass or MSW to reduce carbon footprint • Modify to capture carbon when carbon utilization technologies are ready Affordable Power Generation with Minimal Air Pollutants Reduced Water Consumption Transition Technology – easily modified to reduce and capture carbon in the future 11 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Positioned for Growth BATCHFIRE RESOURCES SES TECHNOLOGIES AUSTRALIAN FUTURE ENERGY CH I NA SES ENCOAL ENERGY - POLAND CURR E NT +2 YEARS OUT +5 YEARS OUT ~$320 Million ~$500 Million ~$70 Million (1) ( 1) ( 1) Notes: (1) Company asset valuation projections based on SES internal business modeling in June 2018, and forecast for existing SES assets using risk weighted discounted cash - flow methodology. SES corporate overhead cost ~$6 million annually not included, (2) Number of projects needed for success depends on the specific value of the successful projects Key Aspects of the Plan: Leverage our low - cost syngas capability in high - priced energy markets Secure long - term, low - price coal and biomass feedstock contracts Execute 4+ projects for Australia, Poland & Americas (2) Maintain focus on additional developing projects in parts of the world that meet our criteria, such as South America Generate financial results from existing operating assets 12 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Our Australian Platform Company In More Detail 13

Focus: The Australian Opportunity for SES Australia is at a tipping point with pressing domestic energy demand vs. export revenues • Increasing demand for reliable energy Australia wide and particularly on the east - coast grid • Increasing market prices for gas and base load power • Increased demand for base load power combined with predicted long - term supply issues due to the planned decommissioning of aging power stations and alternative source limitations • Shortages in domestic supply of gas and increasing prices • Real concern by industry for reliable supply and pricing – “will adversely affect 100 Australian cities and towns” – The Australian , 16 September 2017 • Demand for and acceptance of more environmentally friendly and cleaner energy solutions that are financially efficient (1) Large - scale gasification opportunities in Northern Queensland and across Australia • Shortages of base load power in Northern Queensland of approximately 2,000MW • Industrial users seeking long term, secure energy supply contracts Australian government is encouraging clean energy solutions • Environmentally focused country with abundant coal, as well as biomass resources • SGT delivers superior economics, and is an environmentally responsible and proven proprietary technology that can use blended coal - biomass feedstock, with low carbon dioxide syngas production July 11, 2017 Page One feature story on Australia’s rising gas exports and increased reliance on gas for power combining to create a local power shortage: “ The Energy Shortage No One Saw Coming ,” by Rachel Pannett Note: (1) Information provided by AFE 14 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

AFE is a vertically integrated energy generation company, using world - class gasification technology AFE’s core business model is based upon: • Providing baseload energy solutions to large industrial users and markets requiring a secure energy supply • Ownership or long - term commercial offtake contracts for coal supply • Unique ability to use non - market specification thermal coal (low rank) in conjunction with biomass, as feedstock • Offering long - term secure energy supply contracts to industrial market users, guaranteeing long - term reliable, efficient energy at a lower cost • Ability to export market quality thermal coal into international markets that are seeking new sources of long - term supply • Providing superior environmental performance with CO 2 mitigation capability AFE offers a clear solution utilizing SES’s efficient and low - cost clean syngas production technology • Australia’s lack of both domestic gas and a uniform energy policy has created a shortage of reliable energy supply at a world competitive price, creating unacceptable risk for the private sector Management is deeply experienced group of Australian energy, finance, project development and mining professionals AFE Business Model 15 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

AFE Focus and Accomplishments Large pipeline of projects under evaluation • Projects to be environmentally “class leading” with low carbon dioxide syngas production • Multiple locations, multiple energy and agrichemical end products • Low - cost production from low - cost coals from AFE resources and biomass Three focus project developments underway today: • Power generation • Coal ownership and waste coal utilization • Production of syngas as lower cost industrial fuel • First project license agreement signed with SES in 2017 • Securing funding now for next phase of development AFE Assets • Pentland, Queensland 270 million ton JORC (1) compliant coal resource • Project portfolio under development AFE Accomplishments • Successful acquisition of Callide Coal mine and spin out into Batchfire Resources company – detailed on next slide AFE Strategy & Development Goals: AFE is building a large - scale vertically integrated business in Australia based on developing, building and owning equity interests in financially attractive and environmentally responsible projects that produce agrichemicals and energy products from local coal and renewable resources and acquiring ownership positions in local coal and biomass resources for its projects and for direct local and Asian export market sales. Note: (1) The JORC Code is the Australasian Code, overseen by the global Committee for Mineral Reserves International Reporting Standards (CRIRSCO) 16 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Batchfire Resources: An AFE Success Story • Founded in 2016 as spinoff from AFE • AFE shareholders currently own approximately 52% of Batchfire • Acquired Callide Thermal Coal Mine, Central Queensland, operations October 2016 • ~230MM tons reserves; 1.7B metric ton estimated resource • Significant progress since acquisition : increased production, increased profitability, and lowered production costs to near bottom of global cost curve • Supplies CS Energy power stations for Australia’s national grid (c . 18 % of Qld’s electricity generation) ; domestic customers in Gladstone, and exports via Gladstone Port • Current production: ~10MM metric tons annually, with potential for further expansion – already increased production from 6.5mtpa to current 10.0mtpa • Positive cash flow from operations – within six months after acquisition – a true “turnaround” 17 Note: Information provided by Batchfire Resources ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Our Poland Platform Company In More Detail 18

Poland Market • Poland currently relies on its abundant coal reserves for over 80% of its electricity generation • Local economies are heavily coal - based, with broad government support for the development of cleaner coal technologies • Natural gas prices from Russia are volatile, and Poland seeks energy independence • The European Union has accepted coal gasification as a viable technology for energy and chemicals production • Coal wastes are being stockpiled, as they can no longer be sold by EU mandate; must have a solution for coal wastes • Poland is seeking advanced technology that allows the use of its indigenous resources in an environmentally responsible manner; plans to be 60% reliant on coal through 2050 Source: “Energy Policies of IEA Countries, Poland 2016 Review,” International Energy Agency (IEA), January 2017 19 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Business Model • Advancing the low - carbon coal conversion capability of SES technology via blended coal/biomass resource utilization, and facilitate the licensing of this capability to other parties in Poland • Providing a compelling clean energy alternative to Poland’s power and industrial markets, through the supply of competitively priced syngas for the replacement of expensive natural gas and LNG imports • Securing investment into financially attractive projects and delivering financial results through its equity ownership in the projects developed by SEE • Securing long - term coal and/or biomass supply agreements to provide low cost, secure feedstock supply for its projects SEE Strategy & Development Goals: The creation of value through becoming the leading company in Poland providing technology for conversion of Polish coal, coal wastes, renewable biomass and municipal wastes into clean energy and chemical products, establishing efficient clean energy centers in Poland by deploying SES’s Gasification Technology into its Projects, facilitating SGT licenses for Projects, and leveraging the combined expertise of partner ENI together with SES to transform Poland’s coal and renewable resources into much more valuable energy dense products. 20 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

SES EnCoal Energy Focus Grow the pipeline of projects • Prior to JV formation, three years of market collaboration have resulted in a pipeline of potential projects • Major state industrial companies seeking alternative for lower fuel costs » State power generators seeking cleaner coal solutions and ability to utilize coal wastes » Coal companies seeking long - term solution for wastes from mining • Project owners want lower CO 2 footprint through co - feeding with SES’s SGT • Working to secure first project technology agreements Multiple projects in early development in three markets: • Power Generation from coal wastes and renewables • Production of syngas as lower cost industrial fuel, from coal wastes and renewables • Production of syngas for chemicals, primarily from coal wastes • Tauron is a large Polish utility – 5.1GW capacity (1) • Leading innovation for clean coal • Project 1: ~200MW power boiler conversion (1) • Convert coal boilers to syngas • Utilization of waste coals and municipal waste • LOI signed February 2018 • Poland’s Institute of Coal Chemistry completed project feasibility study March 2018 • Large Polish EPC engaged as owner’s engineer for project • Potential for multiple follow - on projects • SES Technology Package supply Note: (1) Information provided by Tauron Wytwarzanie 21 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Growth Catalysts • Near - term • AFE funding completion • Permit filing for initial AFE project • Completion of SES Technology License for initial SEE project • Mid - term • Completion of SES Technology License for initial AFE project • Permit filing for second AFE project • Completion of SES Technology License for second SEE project • Long - term • Receive permits for first two AFE projects • Project debt and equity financing for initial AFE project • Construction start of initial SEE project Additional Development Opportunities in Brazil, China and India 22 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Why SES Now 23 Superior and proven clean energy technology » 5 projects built, with 12 SGT Systems; >$700MM total invested over 40 years (1) » Commercialized, economical & environmentally responsible clean energy solution Three - tier value growth business model » SGT licensing revenues » Proprietary equipment sales » Equity ownership in SGT projects Global markets with key energy needs » Local demand, economics & energy independence » High energy prices due to limited access to affordable natural gas » Abundant low - quality, low - cost local coal resources, renewable biomass and MSW Two regional platform companies – AFE and SEE » AFE, SES’s successful resource ownership and clean energy multi - project platform company is SES’s first regional success story » SEE repeats AFE’s successful model in Poland, with prior three - year market collaboration having created a ready pipeline of potential projects » SES’s business development strategy has opened up into additional commercially viable international markets including the Americas Guided by industry leaders » Fortune 100 engineering & business backgrounds – management and BOD Notes: (1) ~$200MM SES; ~$200MM GTI R&D; >$300MM Chinese partner and customer investments NASDAQ: SES As of May 31, 2018 Market Cap $35.8 MM Shares Ou t s t and i ng 11.0 MM Public Float 8.7 MM % Officers and Directors 4.3% % Held by I n st i t u t i o n s 23.7% ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Our Leadership Team 24

Leadership: Management DeLome Fair, President and Chief Executive Officer • Appointed SES’s chief executive in February 2016. Joined the SES executive team as SVP, Gasification Technology in December 2014. 25 years’ gasification and IGCC technology expertise in energy and petrochemical industries Francis Lau, Chief Technology Officer – Emeritus and Consultant • 10 - year tenure as SES’s SVP and CTO, following 36 - year tenure at the Gas Technology Institute, with six years serving as GTI’s Executive Director of Gasification and Gas Processing Center David Hiscocks, Corporate Controller • 23 - year accounting and finance experience, including extensive worldwide tenure with Transocean and its prior merged companies. Texas CPA Wade A. Taber, Vice President of Engineering • 19 - year gasification engineering career, with most recent 9 - year tenure as GE’s Senior Engineering Manager – Components/Technology Innovation Dr. John Winter, Chief Engineer • 30+ year career in petrochemical industry career includes 15+ gasification technology research, engineering design, technical services, and plant operations 25 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Leadership: Board of Directors Lorenzo Lamadrid, Chairman • Ten - year tenure as Chairman of SES. Since 2001, Managing Director of Globe Development Group Robert W. Rigdon, Vice Chairman • 35+ year career in chemicals manufacturing, project development and engineering management. Served as President and CEO from 2009 until February 2016 Harry Rubin, Director • Broad executive and financial management background, with a particular focus on acquisitions and divestitures Denis Slavich, Director • 35+ year career in large scale power generation development, with cross border transaction expertise Ziwang Xu, Director • Financial and investment banking executive, manages CXC China Sustainable Growth Fund Charles M. Brown, Director • Led 20 different operating businesses and more than two dozen factories around the world Robert F. Anderson, Director • 35+ year career in leading power generation sales for GE and Stewart & Stevenson DeLome Fair, Director • SES’s President and CEO. One of the world’s leading experts in clean energy gasification technology commercialization and IGCC power generation technology 26 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

AFE Directors Edek Choros, Executive Director • Geologist with over 25 years of professional experience in coal exploration, mine design, mine planning and management, with a focus on turnaround operations for numerous coal mines in Australia and the USA • Founder, CEO and MD of Millennium Coal Pty Ltd – company founded in 1999, and which developed a very successful hard coking coal mine in Bowen Basin in Queensland, which in 2004 was sold to Excel Coal Ltd • Founder, CEO and MD of Ambre Energy Ltd – company founded in 2005 and currently owns and operates two large coal mines in the U.S. and is developing the Millennium Bulk Terminal at Longview on the USA west coast to export coal to Asia • Co - founder of AFE – company formed in 2014 to develop large scale coal gasification projects converting waste coal to urea and SNG • Co - founder of Batchfire Resources Pty Ltd (spin - out of AFE) company formed in 2015 to acquire the Callide Mine from Anglo American Stephen Lonie, Chairman • Chartered Accountant having over 30 years with KPMG in Australia where he served as Queensland Managing Partner and was responsible for Queensland management consulting and corporate finance practices • Currently on several boards of public and private companies in Queensland, was the former chairman of an ASX listed company, former Chairman of CS Energy and formerly Deputy Chairman of Ambre Fuels (a CTL company) 27 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Our Technology In More Detail 29

CO 2 Low Grade Coal Bio mas s Syngas Pro cess i n g Synthesis Gas (Syngas) (CO+ H 2 ) SU L FUR As h iGAS Power Low Value Fee d s to c k SES Gasification Processing $3 - 6 per MMBTU Cost of Syngas (1) High Value End Products M SW Industrial Fuels S N G Chemicals & Fertilizers Diesel & Naphtha DRI for Steel Production 30 H2 for Cleaner Fuels SES Gasification Technology (SGT) Notes: (1) SES economics based on internal data • High efficiency conversion to syngas (CO + H 2 ) and methane (CH 4 ) • SES offers higher energy syngas with high CH 4 content • Synthesis gas can be converted to multiple useful products alternatively made from natural gas • Economic alternative to expensive natural gas • Clean use of coal – greener solution SES’s First Operating Project, Commissioned in 2007 , Shandong Province, C h i n a ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

• Proven commercial technology » ~$200MM R&D: Gas Technology Institute (GTI) » ~$200MM Commercialization & Investment: SES » >$300MM Investment and Debt: Chinese Partners & Customers • Twelve commercial - scale gasification systems built over the past 10 years • Technology license for first AFE project signed May 2017 • Over 50 coals, biomass, and wastes successfully converted to syngas, including feedstocks from US, Europe, China and Australia Tons/day Low Pressure Coal (<5 bar) Mid Pressure Coal (5 - 15 bar) High Pressure Coal (15 - 55 bar) Biomass SGT: The Road to Commercialization U - GAS® S G T • Technology performance validated at commercial scale 31 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved R & D Early Commercialization Final Commercialization 2015 - 16 SES - Tianwo C halco Seven SGT systems for fuel gas (C hina)

Best Performance Moderate Performance SGT is the Superior Gasification Technology Commercialized Gasification Technology Comparison 1 Fluid Bed Moving & Fixed Bed Entrained Flow SES Gasification Technology (SGT) Slag Non - slag Dry Feed Slurry Feed Cost Factors Capital Cost Low Capital Cost Operating Cost Lowest Operating Cost Performance Factors Carbon Conversion Best in class Cold Gas Efficiency Best in class Feedstock Properties Low Quality, Fine Coal & Lignite Unmatched range for coal and renewable feeds Biomass, MSW, Other Wastes 2 Environmental Factors Relative Environmental Impact Low water usage, no tars / oils Notes: 1) Analyses based on SES internal results and publicly available information for other technologies 2) For Biomass & Waste contents > 50% of total feed Worst Performance 32 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Project Year Gasifier Systems Product Syngas Capacity (n m 3 / hr) Syngas Energy per year Cost SES Role Zao Zhu a ng (ZZ) 2007 - 2014 2 Syngas 20,000 2.3 PJ $40MM (1) 100 % Equity, Technology & Equipment Yima 2012 - present 3 Methanol 90,000 10.6 PJ $250MM (1) 25% Equity, Technology & Equipment CHALCO Shandong 2015 - present 2 Fuel 80,000 9.3 PJ $30MM (2) Technology & Equipment (3) CHALCO Shanxi 2016 - present 1 Fuel 28,000 3.3 PJ $15MM (2) Technology & Equipment (3) CHALCO Henan 2016 - present 4 Fuel 120,000 14 PJ $60MM (2) Technology & Equipment (3) SES Project History (1) Total plant cost – including syngas processing (2) Estimated cost based on turnkey contract value – actual costs unknown (3) Technology and equipment provided through SES’s Tianwo - SES Joint Venture 33 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Append i x • Operating Structure • World Coal Reserves 34

Operating Structure • SGT Licensing & Equipment Sales • SGT Process Design • SGT Equipment Design • Packaging Design & Manufacturing • Facilities Operations • Acquisition Due Diligence • Project Development • Project Management • Acquisition Funding • Project Development & Equity Funding • Equity Management • Debt Financing Management Existing Eme r g i ng Future Capital - Lite, High Margin Business Royalties, Engineering Fees, Equipment & Product Sales Specialized Services Operating, & Management Fees Capital Intensive, High Cash Flow Potential Energy Project Income, IPO, MLP/ Distribution, Levered Equity, and project disposition 35 SES Technologies Licensing Proprietary Equip m ent Sales Technology Engineering & Services Pa ck aged Products SES Asset Management O&M for SES Projects Project De v elop m ent & EPCM SES Capital Development F i nan c ing & Capital Management Project In v e s t m ent Holdings ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

USA Total: 250.9 Bituminous & Anthracite: 220.8 Sub - bituminous & Lignite: 30.1 Africa Total: 13.2 Bit & Anthracite: 13.2 Sub - bituminous & Lignite: 0.07 India Total: 97.7 Bit & Anthracite (high ash): 92.8 Sub - bituminous & Lignite: 4.9 Australia Total: 144.8 Bit & Anthracite: 68.3 Sub - bituminous & Lignite: 76.5 Russ i a Total : 160 . 4 Bituminous & Anthracite : 69 . 6 Sub - bituminous & Lignite : 90 . 7 China Total: 138.8 Bit & Anthracite: 130.9 Sub - bit & Lignite: 8.0 Vietnam Total : 3 . 4 Bit & Anthracite : 3 . 1 Sub - bit & Lignite : 0 . 2 Pakistan Total : 3 . 1 Bit & Anthracite : 0 . 2 Sub - bit & Lignite : 2 . 9 Indonesia Total: 22.6 Bit & Anthracite: 15.1 Sub - bit & Lignite: 7.5 Brazil Total: 6.6 Bituminous & Anthracite: 1.5 Sub - bituminous & Lignite: 5.0 World Coal Reserves Total: 1035.0 Billion Tonnes Bituminous & Anthracite: 718.3 Sub - bituminous & Lignite: 316.7 World Coal Reserves Billion Tonnes • Nearly 30% of recoverable global coal resources are untapped sub - bituminous and close - to - surface lignite (brown) coal • Renewable biomass and municipal wastes are alternative SGT feedstocks Note: Total proved reserves at end 2017, Source: BP Statistical Review of World Energy June 2018 36 Poland Total : 25 . 8 Bit & Anthracite : 19 . 8 Sub - bit & Lignite : 6 . 0 Turkey Total: 11.4 Bit & Anthracite: 0.4 Sub - bit & Lignite: 11.0 ©2018 Synthesis Energy Systems, Inc., All Rights Reserved

Growth With Blue Skies Nasdaq: SES synthesisenergy.com Investor Relations: MDC GROUP Contact: David Castaneda, (414) 351 - 9758 IR@synthesisenergy.com