Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - SYNTHESIS ENERGY SYSTEMS INC | exh_321.htm |

| EX-31.1 - EXHIBIT 31.1 - SYNTHESIS ENERGY SYSTEMS INC | exh_311.htm |

| EX-23.1 - EXHIBIT 23.1 - SYNTHESIS ENERGY SYSTEMS INC | exh_231.htm |

| EX-21.1 - EXHIBIT 21.1 - SYNTHESIS ENERGY SYSTEMS INC | exh_211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2017 | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission file number: 01-33522

SYNTHESIS ENERGY SYSTEMS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-2110031 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| Three Riverway, Suite 300, Houston, Texas | 77056 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (713) 579-0600

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Common Stock, $.01 par value | NASDAQ Stock Market |

| (Title of Class) | (Name of Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of 15(d) of the Exchange Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☒ |

Emerging growth company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $68.7 million on December 31, 2016. The registrant had 87,542,390 shares of common stock outstanding on October 12, 2017.

| 1 |

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be disclosed in Part III of this report is incorporated by reference from the registrant’s definitive Proxy Statement for the 2017 Annual Meeting of Stockholders, which will be filed not later than 120 days after the end of the fiscal year covered by this report.

| 2 |

TABLE OF CONTENTS

| 3 |

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. All statements other than statements of historical fact are forward-looking statements and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Among those risks, trends and uncertainties are the ability of Batchfire Resources Pty Ltd (“BFR”) and Australian Future Energy Pty Ltd (“AFE”) management to successfully grow and develop their Australian assets and operations, including Callide and Pentland; the ability of BFR to produce earnings and pay dividends; our ability to raise additional capital; our indebtedness and the amount of cash required to service our indebtedness; our ability to develop and expand business of the TSEC joint venture in the joint venture territory; our ability to develop our power business unit and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies, and renewables; our ability to successfully develop the SES licensing business; the ability of our project with Yima to produce earnings and pay dividends; the economic conditions of countries where we are operating; events or circumstances which result in an impairment of our assets; our ability to reduce operating costs; our ability to make distributions and repatriate earnings from our Chinese operations; our ability to maintain our listing on the NASDAQ Stock Market; our ability to successfully commercialize our technology at a larger scale and higher pressures; commodity prices, including in particular natural gas, crude oil, methanol and power, the availability and terms of financing; our customers’ and/or our ability to obtain the necessary approvals and permits for future projects; our ability to estimate the sufficiency of existing capital resources; the sufficiency of internal controls and procedures; and our results of operations in countries outside of the U.S., where we are continuing to pursue and develop projects. Although SES believes that in making such forward-looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us. SES cannot assure you that the assumptions upon which these statements are based will prove to be correct.

When used in this Form 10-K, the words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Because these forward-looking statements involve risks and uncertainties, actual results could differ materially from those expressed or implied by these forward-looking statements for a number of important reasons, including those discussed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Form 10-K.

You should read these statements carefully because they discuss our expectations about our future performance, contain projections of our future operating results or our future financial condition, or state other “forward-looking” information. You should be aware that the occurrence of certain of the events described in this Form 10-K could substantially harm our business, results of operations and financial condition and that upon the occurrence of any of these events, the trading price of our common stock could decline, and you could lose all or part of your investment.

We cannot guarantee any future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to update any of the forward-looking statements in this Form 10-K after the date hereof.

| 4 |

PART I

Item 1. Description of Business

General

We are a global clean energy company that owns proprietary technology for the low-cost and environmentally responsible production of synthesis gas (“syngas”). Syngas produced from our technology is a mixture of primarily hydrogen, carbon monoxide and methane, is used for the production of a wide variety of high-value clean energy and chemical products, such as substitute natural gas, power, methanol and fertilizer. Since 2007, we have built five projects in China which utilize twelve of our proprietary gasification systems. These projects have demonstrated the unique capabilities of our technology to provide low-cost syngas with lower-cost to build, efficient operations and environmentally responsible attributes. Over the past 10 years, we have focused primarily on the successful demonstration and commercialization of our technology. Our current focus is on leveraging our unique proven technology capabilities to form value accretive regional business platforms in stable and dependable regions of the world, creating the necessary commercial structures and financing approaches which we believe will deliver attractive financial results. Our business model is to create value growth via these regional platforms, through the generation of earnings, from the licensing of our proprietary technology and the sale of proprietary equipment, and through income from equity ownership in clean energy and chemical production facilities that utilize our technology. It is also our strategy to further the commercial success of these regional business platforms by working simultaneously to link low-cost local coal or renewable resources to the projects that are being developed through ownership in resources, and through contractual relationships.

We believe our business proposition is compelling due to our ability to generate lower cost syngas in a clean and responsible manner utilizing coal, coal wastes, renewable biomass and municipal wastes for the production of clean energy and chemicals. For example, our target regions of Australia, Eastern Europe, the Americas and China/Asia are heavily exposed to elevated natural gas pricing today due primarily to inadequate gas supplies or, in the case of Australia, due to the significant number of operating LNG projects with long-term LNG supply commitments into Asia. Australia is also uniquely challenged with an increasingly unsustainable decline in the ratio of conventional base-load power to intermittently available solar and wind power due to shutdowns of older coal power stations.

It is our goal to partner with established local expertise to form regionally focused growth platforms. We cooperate with partners who can bring strong local knowledge of the markets and government influences and who have the expertise required for project development, project financing, and fundraising to deliver financial results for the platforms. At present, we have completed the formation of our first regional platform in Australia, Australian Future Energy (“AFE”), and are in detailed negotiations on the development of a second similarly structured platform in Eastern Europe.

We operate our business from our headquarters located in Houston, Texas and our offices in Shanghai, China. Additionally, our investments in Australia have independent operations in Brisbane, Australia.

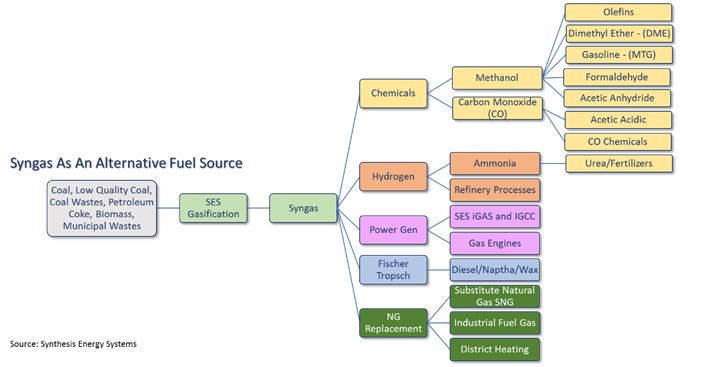

Syngas as an Alternative to Conventional Energy Sources

Our syngas can provide a competitive alternative to other forms of energy such as natural gas, LNG, crude oil and conventional utilization of coal in boilers for power generation. Such competing technologies include reforming of natural gas for chemicals and hydrogen production, oil refining for fuels production, petroleum byproducts for plastics, precursors such as olefins and conventional natural gas, fuel oil and coal combustion in power generation equipment and other industrial applications.

| 5 |

The competitive advantage of our syngas is primarily driven by the price and lack of availability of natural gas, LNG and crude oil. As such, our syngas can provide a lower cost energy source in markets where coal, low quality coal, coal wastes, biomass and municipal wastes are available and where natural gas, LNG and crude oil are expensive or constrained due to lack of infrastructure such as distribution pipelines and power transmission lines, such as Asia, Eastern Europe, and parts of South America, while conversely in markets with relatively inexpensive natural gas, LNG and crude oil, we do not anticipate new syngas capacity additions.

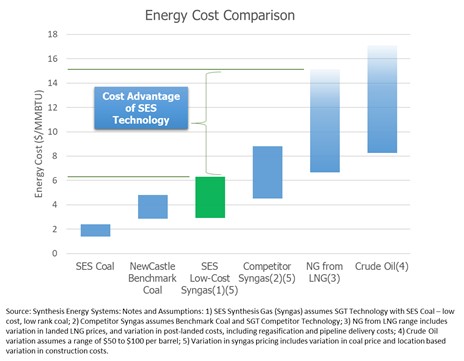

The figure below shows a comparison of the cost of energy from our syngas, our competitor’s syngas, and traditional energy resources. Because our technology can utilize the lowest cost feedstocks, notated on the figure as SES Coal, and has the benefit of lower capital costs, we believe that our cost of syngas is lower than our competitor’s cost of syngas, and significantly lower than natural gas prices in many parts of the world. Since our syngas is made from coal, coal wastes, renewable biomass or municipal wastes, we provide lower exposure to risks from price volatility versus more traditional sources of energy and chemical feedstock (oil and natural gas).

| 6 |

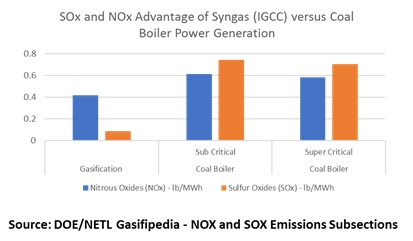

In addition to economic advantages, we believe our syngas also provides an environmentally responsible option for manufacturing chemicals, hydrogen, industrial fuel gas and can provide a cleaner option for the generation of power from coal as it minimizes both air and solid environmental emissions, in addition to utilizing less water.

Production of chemicals and hydrogen require exceptionally pure syngas with low parts per million levels of constituents such as sulfur to meet the ultimate chemical and hydrogen product specifications. The syngas produced by our technology is easily processed through a variety of commercially available technologies to remove these contaminants and in the case of sulfur this syngas cleaning process produces a saleable sulphur by-product.

The processes for producing exceptionally pure syngas required for chemicals and hydrogen production can significantly benefit syngas as a clean fuel source for industrial fuel gas and power production. Because our syngas can be processed to remove pollutants such as sulfur and mercury from the syngas prior to the combustion of the syngas to generate power, our syngas can generate power with similar levels of criteria pollutants as power derived from natural gas and much lower than power derived from traditional coal burning technologies.

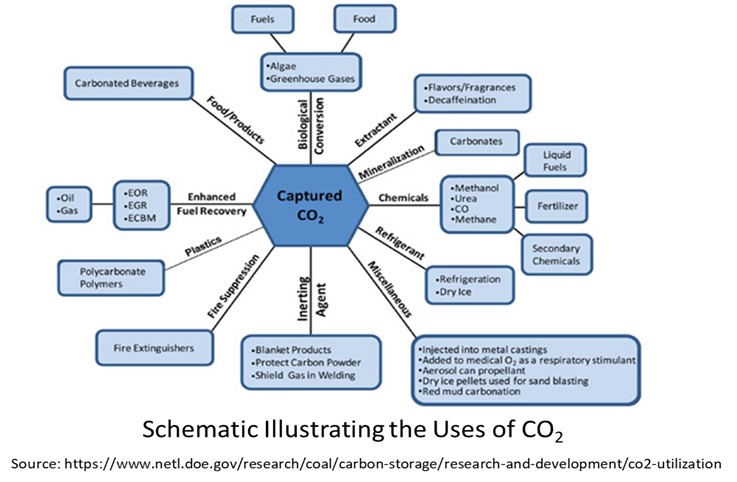

The commercial technologies that are used for sulfur and carbon dioxide (“CO2”) removal from syngas work much more effectively than removing these constituents from traditional coal boiler exhaust gas. Therefore, the cost to remove sulfur and CO2 for our syngas is significantly lower than cleaning these contaminants from coal boiler flue gas. In addition, when using pre-combustion syngas processing, the syngas processing technologies can achieve a deeper level of contaminant reduction resulting in lower emissions. When the CO2 is removed at elevated pressures and pre-combustion, the CO2 is much better suited for economically viable utilization, such as enhanced oil recovery and the production of urea fertilizer.

As for other pollutants such as nitrous oxide (“NOx”) and particulate matter (“PM”) emissions, with power derived from our syngas, the syngas stream is typically being combusted in a gas turbine to generate power, this type of power production produces significantly lower amounts of NOx and PM than that of coal combustion technology and can be similar to levels achieved with natural gas combustion. Because coal boiler technology burns coal directly there are larger amounts of NOx and particulate matter being generated. This requires expensive post combustion removal technologies on the high-volume boiler exhaust “flue” gas stream to lower the NOx and PM emissions. Even when using these post combustion technologies, coal boiler technologies are highly challenged (and potentially incapable, depending upon the coal qualities) of achieving the low emissions of sulfur oxides (“SOx”), NOx, mercury, and PM that are easily achievable with coal gasification derived power. If legislation restricting the emissions SOx, NOx, or other PM emissions become more stringent, as is occurring in certain developing nations, coal gasification derived power will become cost competitive with traditional coal fired boilers.

Today, much focus has been placed on emissions of CO2 as a global warming gas and coal burning technologies such as traditional coal to power and coal usage as an industrial energy source have come under much closer scrutiny. Although legislation and consistent regulations regarding CO2 emissions is largely absent in the global market place, there are wide spread incentives in many countries to adopt technologies that do not burn coal. Our gasification technology chemically converts coal and other solid carbonaceous materials to syngas without combustion and our syngas can contain much lower levels of traditional pollutants such as SOx, NOx and PM.

| 7 |

We believe the growing energy demands of the world, which are largely based on GDP growth, combined with the rate that many countries are lifting their populations out of poverty, will require responsible use of coal for many decades to come. Our gasification technology inherently separates CO2 from our syngas and this CO2 is readily available for capturing. However, we believe capturing CO2 will not occur in the global market place without robust legislation to put regulations in place that control CO2 emissions. Should such regulations be implemented then we believe future coal gasification derived power generation will be significantly advantaged over coal combustion technologies. Furthermore, it will be less costly to retrofit a gasification derived power facility to comply with increased regulation in the future. However, the absence of regulation on conventional coal based technology may delay adoption of coal gasification technologies, especially in the power generation market.

In terms of water consumption, it has been shown in multiple studies sponsored by the U.S. Department of Energy, Electric Power Research Institute, and others that a plant designed to convert coal to power using gasification technology will use about 30% less water than a similar sized plant that burns coal directly.

Target Markets

World population is expected to increase by 1.5 billion reaching 8.8 billion by 2035 and global GDP is predicted to almost double over the next 20 years as more than 2 billion people emerge from poverty. This places a large demand on energy which, despite improvements in energy efficiency, is predicted to increase on the order of 30% over this time period, according to the BP Energy Outlook 2017 edition. While assessing target markets in relation to the deployment of our gasification technology into global projects, we believe our ability to produce a competitively priced and environmentally responsible syngas as an alternative to natural gas and LNG positions us as a syngas energy alternative that bridges between coal markets based on traditional coal burning and the growing natural gas and LNG markets. Thus, while coal is expected to decline as part of global energy consumption, natural gas and LNG are expected to dramatically rise over the same time period. We believe this shift from coal burning offers a compelling opportunity for our technology to utilize the lowest cost coals to produce a clean syngas which can be economically advantaged over LNG in markets where LNG imports are expected to rise such as Asia/ China and Europe. The shift in the global fuel mix is expected to continue over the next 20 years with renewables, nuclear, and hydroelectric expected to account for half this growth. Nevertheless, oil, gas and coal will remain the primary sources of energy making up 85% of all energy supply in 2035, according to the BP Energy Outlook 2017 edition.

| 8 |

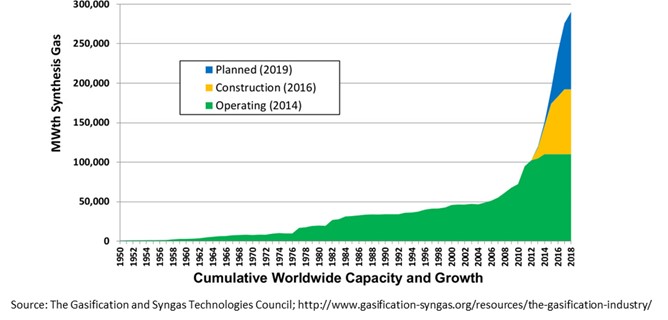

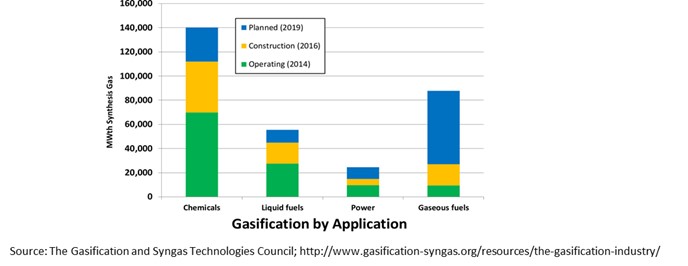

Against this market backdrop, we believe there will be increasing demand for new global syngas capacity from coal conversion technologies such as ours. We can see the acceleration of interest in syngas as an energy source by examining the number of global projects either under construction or planned through 2019.

While traditional uses of gasification technology have predominantly been driven by the chemicals industry, we believe new growth will be within the chemicals industry but will also come from utilization of syngas as a source of industrial fuel gas, SNG and power generation. For example, the global share of energy for power generation is expected to rise to 47% by 2035, according to the BP Energy Outlook 2017 edition, as consumer preference shift towards electricity. Our technological ability to utilize coal in a clean manner to produce syngas for either power generation or a replacement alternative for natural gas and LNG affords us the opportunity to be part of meeting these global energy needs.

We believe that our technology is well positioned to be an important solution that addresses the market needs of the changing global energy landscape. Our gasification technology is unique in its ability to provide an economic, efficient and environmentally responsible alternative to many energy and chemical products normally derived from natural gas, LNG, crude oil, and oil derivatives.

| 9 |

Our target markets focus primarily on lower quality coals, biomass and municipal waste where our gasification technology allows energy in the widest range of feedstocks to be unlocked and converted into flexible and valuable syngas. We offer a compelling advantage because of our ability to use such a wide range of solid fuel natural resources. Without our technology, regions where lignite coal, high moisture coal, high ash coal and/or high fines coals exist may face technology barriers which will prevent those resources from being used in energy production. Our technology can transform most of these natural resources into a valuable and flexible syngas product. This clean syngas product can then be used in place of natural gas and oil for making most energy and chemical products.

Because of these market dynamics, we believe our gasification technology has broad strategic importance to:

| 1) | Countries and regions with developing economies which have their own low cost domestic coal resources or easy access to imported low cost coal. Such countries and regions need access to low cost clean energy and chemical products to grow and in some cases to provide basic necessities that improve the health and well-being of their populations. These regions have limited access to affordable alternate energy sources like natural gas and oil, and can benefit from economic growth by using the lowest cost energy resources such as low cost domestic or imported coal for the production of vital products. Many Asian countries expect to see a surge in expensive imported LNG and a need to utilize their domestic coal to meet their energy product demand increase. |

| 2) | Countries which possess significant low-cost coal resources such as Australia and those in South America and Eastern Europe which also have a strategic need and desire to produce clean and affordable energy and chemicals from their own domestic resources. |

| 3) | Existing operating companies which deploy their own technologies for energy and/or chemicals production or who rely upon oil and natural gas for their industrial applications. These technologies have been well established for use with oil and natural gas resources but are constrained from growing in parts of the world where the oil and natural gas feedstocks are either not readily available due to missing infrastructure and/or very expensive such as LNG in much of Asia. Integrating those establish technologies with our technology opens these technologies to a new low cost natural resource in low quality coals thereby transforming the economic opportunity. Such is the case for example in producing power, methanol, DRI steel product, ammonia and urea for fertilizers and many transportation fuels such as gasoline, diesel and jet fuel. |

| 4) | Developed countries such as the United States and Western Europe who are searching for a viable solution for growing biomass and municipal solid waste disposal issues and could also benefit from additional renewable resources. |

While we are actively pursuing a global strategy, our historical geographical operational focus has been on the China market. The development of the modern coal chemical industry in China depended mainly on the country’s resource possession status: coal-rich, oil-lean and gas-lacking, and has also been driven by the vast and increasing demand for clean energy and chemical products. Coal has been and is predicted to continue to be the most widely used natural resource for energy production in China.

Today, our business plan is intended to build on our past technical successes in China and our value opportunity is based primarily on leveraging the unique aspects of our technology. We intend to do this by bringing our alternative clean and lower cost energy and chemicals solution to markets with expensive natural gas and LNG with adequate demand growth and suitable energy product prices to allow for attractive investment returns. Over the past 10 years we have focused primarily on the successful demonstration and commercialization of our technology. Our current focus is on leveraging our unique proven technology capabilities to form value accretive regional business platforms in stable and dependable regions of the world and creating the necessary commercial structures and financing approaches which we believe will deliver attractive financial results.

We are expanding our targeted global markets to include a focus on Australia and Eastern Europe where each have unique market dynamics where we believe we can deploy our technology into projects. While Australia is rich in LNG it has a significant number of operating LNG projects with long-term LNG supply commitments into Asia and needs to continue the responsible development of its own rich coal resources. We believe Australia is also challenged with an increasingly unsustainable decline in the ratio of conventional based load power to intermittently available solar and wind power due to shutdowns of older coal-power stations. This imbalance is creating high power prices and the resultant market demand for cleaner coal and natural gas power for base load. Eastern Europe is growing its dependence on LNG and has large quantities of coal. Countries such as Poland are seeking clean, responsible coal based alternatives to higher priced LNG and Russian natural gas imports. Poland also has vast quantities of waste coal which have been increasing over time as it mined coal for traditional power generation. We believe this waste coal opportunity in Poland provides a unique opportunity for our technology to utilize these low-cost waste coal stockpiles in projects.

| 10 |

In addition to these markets we are evaluating and bidding new opportunities in the Americas such as in southern Brazil where natural gas prices are high and there are meaningful quantities of low quality coal and in the Caribbean where industrial power prices are high ranging from $100 per MW-HR to $350 per MW-HR due to heavy reliance on diesel fired generation and the long term expensive outlook for LNG based power.

Relationships with Strategic Partners and Business Verticals

As part of our overall strategy, we intend to (i) continue to form new strategic regional and market-based partnerships or business verticals; (ii) grow our existing partner relationships where our technology offers advantages; and (iii) through cooperation with these partners, grow an installed base of projects. Through collaborative partnering arrangements, we believe we will gain industry acceptance and market share much faster than entering these markets alone. In addition to regional growth platforms, we are continuing to evaluate and develop our business in markets such as power, steel, fuels, substitute natural gas, chemicals and renewables which can benefit from deploying our technology offering to create these products from low cost coal and renewable feedstocks. We are developing these market-based business vertical opportunities together with strategic partners which have established businesses or interests in these markets with the goal of growing and expanding these businesses by partnering with us and deployment of our technology offering. We understand the need to partner in certain markets, and plan to do so with companies that we believe can help us accelerate our business. Our partnering approach in some cases is country specific and in other cases is industry or market segment specific. Additionally, where strategic relationships and capital and/or financing is available, we may acquire operating assets with potential to generate near term earnings and provide us with advantages in deploying our technology.

In February 2014, we formed the Tianwo-SES Joint Venture. The purpose of this strategic partnership is to establish our gasification technology as the leading gasification technology in the Tianwo-SES Joint Venture territory (which is China, Indonesia, the Philippines, Vietnam, Mongolia, and Malaysia) by becoming a leading provider of proprietary equipment and engineering services for the technology. The scope of the Tianwo-SES Joint Venture is to market and license our gasification technology via project sublicenses; procurement and sale of proprietary equipment and services; coal testing; and engineering, procurement and research and development related to the technology.

In 2014, we established Australian Future Energy Pty Ltd together with an Australian company, Ambre Investments PTY Limited (“Ambre”). AFE is an independently managed Australian business platform established for the purpose of building a large-scale, vertically integrated business in Australia based on developing, building and owning equity interests in financially attractive and environmentally responsible projects that produce low cost syngas as a competitive alternative to expensive local natural gas and LNG. The project undertakings by AFE are expected to produce syngas for the markets of industrial fuel gas such as aluminum manufacturing, cement making and ore processing as well as power generation, chemicals and fertilizers. The syngas is expected to be produced from local coal and renewable resources where AFE is acquiring ownership positions in the resources or creating long-term priced contracts for secure sources of low-cost feedstock for its projects, and for direct local and seaborne export markets. In 2016, AFE completed the creation and spin-off of Batchfire Resources Pty Ltd, which now owns the operating Callide coal mine in Queensland. AFE is currently evaluating multiple project opportunities that would use SGT and plans to down select to two projects to move forward with full project development activities.

In July 2015, we entered into a Project Alliance Agreement that expands our exclusive relationship with Midrex Technologies for integration and optimization of DRI technology using coal gasification. Midrex has taken the lead in marketing, sales, proposal development, and project execution for coal gasification DRI projects as part of the new project alliance. Midrex may also lead the construction of the fully integrated solution for customers who desire such an execution strategy. We will provide the DRI gasification technology for each project including engineering, key equipment, and technical services. The agreement includes finalization of an engineering package for the optimized coal gasification DRI solution. Prior to the Project Alliance Agreement, we also entered into an exclusive agreement with Tianwo-SES and Midrex for the joint marketing of coal gasification-based DRI facilities in China. These facilities will combine our gasification technology with the Direct Reduction Process of Midrex to create syngas from low quality coals in order to convert iron ore into high-purity DRI. Tianwo-SES will aid in the marketing of these DRI facilities in China and will supply the gasification equipment and licensing of the technology.

| 11 |

We believe the distributed power segment offers opportunity over time to provide meaningful sales for our gasification technology and equipment systems, and we intend to continue to develop this opportunity. We have developed our iGAS power generation plant concept design which pairs our technology with leading gas turbine technology at distributed power plant sizes. As such, we anticipate collaboration with original equipment manufacturers related to the supply of aero-derivative gas turbines, small scale multi-use industrial gas turbines and gas engines.

In November 2015, we announced the signing of a Global Business and Market Development Alliance with China Coal Research Institute (“CCRI”), a subsidiary of China Coal Technology & Engineering Group Corporation (“CCTEG”). The agreement is intended to deliver global clean energy technology projects that dovetail with the Chinese government's One Belt, One Road (“OBOR”) "Going Out" strategy and use our gasification technology. Today CCRI’s parent company CCTEG is not placing its business priorities on the deployment of gasification into OBOR projects and has been more focused on the development of international and domestic coal mines and the supply of coal mining equipment. While CCTEG and the OBOR long-term objectives may return to including large scale gasification projects, we do not believe this cooperation will result in the development of new projects for us in the near term. However, we intend to maintain our relationship with CCTEG and CCRI as CCRI’s current plans may prove mutually beneficial over time.

| 12 |

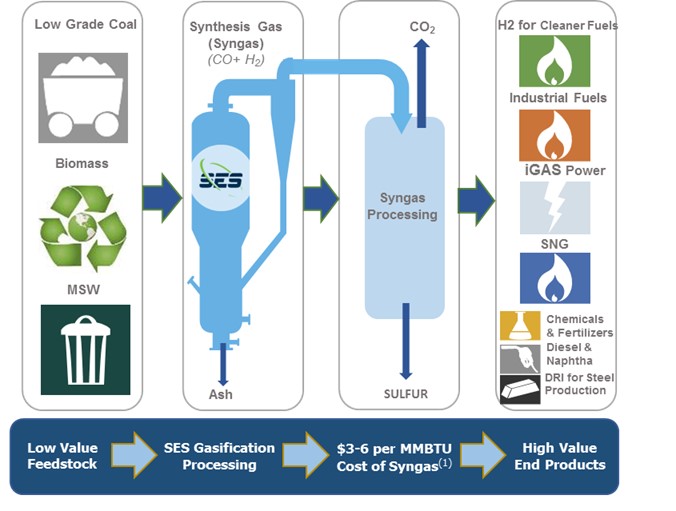

Overview of Our Gasification Process

Our gasification technology uses oxygen, steam and heat to extract carbon and hydrogen from a wide variety of feedstocks. The gasifier utilizes a partial oxidation process where the carbon and hydrogen atoms are converted to a gaseous form that includes compounds such as hydrogen (“H2”), carbon monoxide (“CO”) and methane (“CH4”). Other components of syngas include water vapor (“H2O”), CO2, inert compounds such as nitrogen, and trace compounds derived from other materials in the feedstock.

Syngas is a valuable and extremely versatile intermediary product which can provide production costs that are lower than using traditional crude oil or natural gas, especially in areas where these resources are costly or not readily available. Syngas can be readily converted into a wide range of fundamental energy and chemical products. These products include but are not limited to electricity, substitute natural gas (“SNG”), transportation fuels such as gasoline, diesel and jet fuel, chemicals such as methanol, olefins, glycols, ammonia and urea for agricultural fertilizers and feedstocks for steel making.

SES Gasification Technology

Generates Syngas Used for the Production of a Variety of Energy and Chemical Products

The origination of our technology is the U-GAS® gasification technology, developed in the mid-1970’s. In 1975, the Gas Technology Institute (“GTI”), a leading non-profit energy technology research and development organization serving the gas industry headquartered in Chicago, Illinois, developed a fluidized bed gasification technology trademarked as U-GAS®. In 2004, we obtained our first license for the U-GAS® gasification technology from GTI. That license has evolved and expanded over the years. Our current U-GAS® license grants us the exclusive worldwide right to manufacture, make, use and sell both U-GAS® coal gasification systems and coal and biomass mixture (with coal content exceeding 60% by weight) gasification systems, and a non-exclusive right to manufacture 100% biomass gasification systems and coal and biomass mixtures (with biomass content exceeding 40% by weight) gasification systems. We also have rights to sublicense U-GAS® systems to third parties for coal, coal and biomass mixtures, and 100% biomass projects (subject to the approval of GTI, which approval shall not be unreasonably withheld), with GTI and us to share the revenue from such third-party licensing fees based on an agreed percentage split. Our license had an initial term which expired in August 2016, with two additional 10-year extensions exercisable at our option. In May 2016, we exercised the first of our 10-year extensions and are the exclusive licensee for the above processes through August 2026. For more information, see “GTI Agreement” below.

| 13 |

Since we first obtained the U-GAS® license, we have created new intellectual property and know-how of our own based on our developments and experience from our initial ZZ Joint Venture plant and later through our work in the development of Yima Joint Venture’s plant and the CHALCO projects. Our current SGT is based on the basic technology developed by GTI which we have improved and advanced through our own know how and experiences. Today, we commercially offer our SGT and proprietary equipment based on our technology improvements and through our numerous innovations developed over nine years of plant operating experience. We continue to refine, improve and expand our gasification process to further differentiate it from other processes in its ability to reliably, cleanly and efficiently produce valuable products from feedstocks that are of low cost and quality.

We believe we have several advantages that differentiate our technology from other commercially available gasification technologies, such as entrained flow, fixed bed, and moving bed gasification technologies. These advantages include:

| · | our ability to economically utilize a wide range of feedstocks to make clean syngas. Our feedstock advantage opens up global opportunities for gasification projects in areas where the coal quality would not be suitable for other gasification technologies; |

| · | our technology’s advanced fluidized bed design is extremely tolerant to a wide variation in feedstock during operation, which allows for flexible fuel purchasing for our customers over the life of their projects and |

| · | our technology uses less water and has a simpler design that yields more favorable fabrication costs, lower operating costs and lower capital cost than other gasification technologies. |

We believe that the critical factors of lower feedstock cost, feedstock flexibility and lower water consumption position our technology for future worldwide deployment because our technology enables projects to become lower cost and environmentally friendly alternative energy sources.

In our gasification process, the feedstock is prepared as needed and conveyed into the gasifier reactor. Inside the fluidized bed region of the gasifier, the feedstock has a reaction with air or oxygen plus steam at relatively high temperatures. The gasifier temperature is monitored and controlled to maintain high conversion of the carbon and non-slagging conditions for the ash. Our gasification process accomplishes four important functions in a single-stage, fluidized-bed gasifier: it decakes, devolatilizes and gasifies the feedstock, and, if necessary, agglomerates and separates ash from the reacting coal. The optimal gasifier operating pressure depends on the end use for the syngas and can be designed to range from 0 to 55 barg pressure (14.7 psia to 880 psia) or higher. After the gasification reaction, the syngas is cleaned of impurities and then can be converted into higher value end products or energy forms such as electricity, SNG, chemicals such as methanol, DME and glycol, ammonia for fertilizer production, hydrogen, fuels for industrial processes, reducing gas for DRI processing, and transportation fuels, such as gasoline and diesels.

During gasifier operation, the feedstock is gasified rapidly within the fluidized bed and produces syngas. Reactant gases, including steam and either air, enriched air or oxygen are introduced into the gasifier to both facilitate the chemical reactions and fluidize the feedstock inside the reactor. Ash is removed by gravity from the gasifier through a proprietary system for cooling, metering and depressurization. Typically, the ash is sold as a raw material for construction and concrete products. The gasifier maintains a low level of carbon in the bottom ash discharge stream. A small amount of fine ash is carried overhead in the syngas. This fine ash is removed, and through our Fines Management System ("FMS"), can be returned to the gasifier. Our FMS which, along with other gasifier improvements, increases conversion of the feedstock which lowers feedstock costs and increases efficiency. Gasifier efficiency is evaluated using a factor called cold gas efficiency (“CGE”). CGE is a measure of the amount of energy in the feed coal that is converted to energy in the syngas and is an important driver of gasification economics. CGEs of up to 83% on high ash coals and carbon conversions of over 99% have been repeatedly demonstrated in our 12 commercial gasification systems using the improved SES design.

| 14 |

With FMS, we believe that we can maximize the utilization of low rank coal in our gasifiers, and as a result, improve the cost advantages derived from using our technology. Our Ash Management System ("AMS"), recovers thermal energy from the hot ash generated during gasification and converts it to steam used in the gasification process for export or for generating power. Both our FMS and AMS increase overall efficiency. Syngas generated from coal is free of tars and oils due to the SGT temperature profile and residence time of the gases in the fluidized bed, which simplifies the downstream design of heat recovery systems and gas cleaning operations.

We believe that our gasification process has certain environmental advantages over our competitors as it minimizes environmental wastewater and solid discharge as compared to other gasification technologies. The combination of dry processes for feeding coal into the gasifier, separation of fine solids from syngas, novel proprietary methods for ash cooling, and high cold gas efficiencies all reduce the water ultimately discharged as wastewater. Process water generated from our gasification units is readily treatable to enable recovery and recycling, such that ultimate wastewater discharge is minimized. We also have an advantage from a solid discharge prospective. Because SGT does not run in a slagging mode (melting and re-solidifying the solids), SGT does not require contact with water to remove the solids, and has an extremely high carbon conversion ratio. The combination of dry solid processing and high carbon conversion produces a solid byproduct that can be sold rather than landfilled. The most common use of this material is as an aggregate in cement products.

Competition

Our technology offers an economical and cleaner approach for conversion of coal into energy and chemicals through our ability to economically gasify a wide range of solid-form natural resources including biomass, low quality coals, high quality coals, and coal wastes. We are not aware of commercially available gasifiers with such a wide range of feedstock flexibility. Our gasification technology operates efficiently with high ash and high moisture coals without coal rejection due to particle size and without the formation of tars and oils present in the technology of our competitors.

While our technology has been proven to be commercially viable, we are continually seeking to advance and improve our gasification technology, such as through our new XL3000 gasification system. We are continuing to work with our prospective customers to determine the suitability of their low rank coals for our technology through proprietary coal characterization testing and bench scale gasification tests. We are growing our technology base through: (i) continued development of know-how with our engineering and technical staff, (ii) growing and protecting our trade secrets as a result of patenting improvements tested at our ZZ and Yima Joint Venture plants, (iii) developing improvements resulting from integration of our technology with downstream processes, and (iv) developing improvements resulting from scaling up the design of our technology in pressure and capacity. Examples of our technology development include our high-pressure gasifier, FMS and AMS which increase overall efficiency. During the current year we received an additional patent for processes which were a result of our continued development of SGT. We have several additional patent applications pending relating to these technology improvements in addition to a number of other improvements to increase the gasifier availability and to lower the costs of the gasifier installation and subsequent operations.

The most predominant commercially deployed gasification technology providers are: GE, Shell, Siemens, CB&I and Lurgi. With the exception of Lurgi, these competitors utilized entrained flow slagging gasification technologies. The entrained flow technologies operate on more expensive high grade bituminous and some sub-bituminous coals as feedstocks, but lack capability with the more difficult low heating value, high ash and high moisture coals and with biomass or other renewable waste materials. We have seen what we believe are significant changes in the competitive landscape for gasification over the past few years. Primarily this has been reflected in the inability of these long standing traditional entrained flow technologies to meet the needs of the many of the new projects now in development because many of these projects owners are faced with the need to use much lower quality coals or renewable feedstocks. We believe this change in the competitive landscape is pushing SGT and other fluidized bed and moving/fixed bed technologies into the forefront for consideration for future projects.

The Lurgi gasification technology, a moving bed gasification technology, is capable of gasifying the lower grade coals, but has more restrictive requirements on feedstock particle size. The Lurgi gasification technology also generates tars and oils in the syngas that have to be removed prior to downstream processing.

| 15 |

Several types of simple fluid bed technologies are available. ThyssenKrupp (Uhde division) offers the High Temperature Winkler (“HTW”) technology and there are several versions of very simple, low pressure fluid bed gasifiers offered in Asia. While a number of HTW plants were built and operated, we are not aware of any in current commercial operation. All of these simple fluid bed technologies have more operating temperature limits than SGT, and none have managed to achieve the high conversions which SGT has demonstrated in commercial plants.

The following chart details our view of the current competitive landscape and details the current technologies available on the marketplace, along with their competitive advantages and disadvantages.

SES Gasification Technology Competitive Comparison

| Biomass & Peat | Lignite | Sub Bituminous | Bituminous & Anthracite | Comments | |

| SES Advanced Fluidized Bed |

Good Economics Good Efficiency Low Capex Low water use |

Good Economics Good Efficiency Low Capex Low water use Good for high ash Good for high moisture Includes fine coal

|

Good Economics Good Efficiency Low Capex Low water use Good for high ash Good for high moisture Includes fine coal

|

Best Economics Good Efficiency Low Capex Low water use Good for high ash Good for high moisture Includes fine coal

|

SES Advanced Fluidized gasification maintains its efficiency across all feedstock qualities, and has lower water usage and low Capex and Opex. This leads to attractive economics on most of the world’s solid-form natural resources. |

| Simple Fluid Beds |

Low Conversion/high feed cost Good Efficiency Low Capex Low water use

|

Low Conversion/high feed cost Good Efficiency Low Capex Low water use

|

Low Conversion/high feed cost Good Efficiency Low Capex Low water use |

Very Low Conversion/high feed cost Good Efficiency Low Capex Low water use |

Simple fluid beds cannot achieve high conversion and are more limited in range of acceptable ash fusion temperatures. |

|

Entrained Flow

|

Excluded due to technology capability or to poor economics |

Reduced Economics Some are Efficient Low to High Capex Med to high water use Not suitable for high ash Not suitable for high moisture Includes fine coal |

Reduced Economics Some are Efficient Low to High Capex Med to high water use Some have moisture or ash limits Includes fine coal

|

Good Economics Efficient Low to High Capex Med to high water use Not suitable for high ash Not suitable for high moisture Includes fine coal |

Entrained flow technologies have been the most widely deployed over the past 4 decades. These technologies tend to perform well and are best suited for highest quality coal resources. They can be large water consumers depending on coal feed type and syngas cooling systems used. Low to high Capex due mainly to variations in gasification heat recovery and integration designs. |

|

Moving Bed

|

Excluded due to technology capability or to poor economics |

Acceptable Economics due to lower coal pricing Good Efficiency High Capex High water use Environmental issues due to tars and oils Lump coal only Excludes fine coal |

Reduced Economics Good Efficiency High Capex High water use Environmental issues due to tars and oils Lump coal only Excludes fine coal |

Reduced Economics Good Efficiency High Capex High water use Environmental issues due to tars and oils Lump coal only Excludes fine coal |

Large installed base in South Africa and China. Prior to SES technology, this was the High Capex alternative for low quality coal where entrained flow technologies were uneconomic. |

|

Emerging

Transport Reactor & Other |

Non- Commercial | Non- Commercial | Non- Commercial | Non- Commercial | Emerging technologies have very limited commercial plants in operation such as the transport reactor which is best suited for low ash lignite coals. Many other emerging technologies attempting to gasify biomass and municipal wastes. |

Barriers to New Competition

Historically gasification technologies have required many years and development costs on the order of hundreds of millions of dollars to reach credible commercial deployment. Because of the costs surrounding such development, gasification technology developed has been historically funded by users with strategic interests and significant economic resources such as major international oil companies or governmental entities looking at alternative clean energy solutions.

| 16 |

Most, if not all, gasification technologies have received significant government subsidies in the early research and development stages. Our technology has been highly developed by both GTI and us over the past 40+ years where the technology has been enhanced and commercially deployed. More than $700 million dollars have been spent in the development and commercialization of our SGT technology, including ~$200 million for the research and development required to develop the U-GAS® technology at GTI, ~$200 million of additional funding by us to further technology development and early commercialization, and over $300 million dollars from our Chinese partners and customers providing equity and debt guarantees for the commercial systems now up and running in China. We believe that the current range of available technologies leaves little incentive for development of new technologies, and emerging competition for everyone in the industry will focus on imitation and adaptation.

GTI Agreement

In November 2009, we entered into an Amended and Restated License Agreement, or the GTI Agreement, with GTI, replacing the Amended and Restated License Agreement between us and GTI dated August 31, 2006, as amended. Under the GTI Agreement, we maintain our exclusive worldwide right to license the U-GAS® technology for all types of coals and coal/biomass mixtures with coal content exceeding 60%, as well as the non-exclusive right to license the U-GAS® technology for 100% biomass and coal/biomass blends exceeding 40% biomass.

In order to sublicense any U-GAS® system, we are required to comply with certain requirements set forth in the GTI Agreement. In the preliminary stage of developing a potential sublicense, we are required to provide notice and certain information regarding the potential sublicense to GTI and GTI is required to provide notice of approval or non-approval within ten business days of the date of the notice from us, provided that GTI is required to not unreasonably withhold their approval. If GTI does not respond within the ten-business day period, they are deemed to have approved of the sublicense. We are required to provide updates on any potential sublicenses once every three months during the term of the GTI Agreement. We are also restricted from offering a competing gasification technology during the term of the GTI Agreement.

For each U-GAS® unit which we license, design, build or operate for ourselves or for a party other than a sub-licensee and which uses coal or a coal and biomass mixture or biomass as the feedstock, we must pay a royalty based upon a calculation using the MMBtu per hour of dry syngas production of a rated design capacity, payable in installments at the beginning and at the completion of the construction of a project, or the Standard Royalty. If we invest, or have the option to invest, in a specified percentage of the equity of a third party, and the royalty payable by such third party for their sublicense exceeds the Standard Royalty, we are required to pay to GTI an agreed percentage split of third party licensing fees, or the Agreed Percentage, of such royalty payable by such third party. However, if the royalty payable by such third party for their sublicense is less than the Standard Royalty, we are required to pay to GTI, in addition to the Agreed Percentage of such royalty payable by such third party, the Agreed Percentage of our dividends and liquidation proceeds from our equity investment in the third party. In addition, if we receive a carried interest in a third party, and the carried interest is less than a specified percentage of the equity of such third party, we are required to pay to GTI, in our sole discretion, either (i) the Standard Royalty or (ii) the Agreed Percentage of the royalty payable to such third party for their sublicense, as well as the Agreed Percentage of the carried interest. We will be required to pay the Standard Royalty to GTI if the percentage of the equity of a third party that we (a) invest in, (b) have an option to invest in, or (c) receive a carried interest in, exceeds the percentage of the third party specified in the preceding sentence.

We are required to make an annual payment to GTI for each year of the term, with such annual payment due by the last day of January of the following year; provided, however, that we are entitled to deduct all royalties paid to GTI in a given year under the GTI Agreement from this amount, and if such royalties exceed the annual payment amount in a given year, we are not required to make the annual payment. We must also provide GTI with a copy of each contract that we enter into relating to a U-GAS® system and report to GTI with our progress on development of the technology every six months.

For a period of ten years, beginning in May 2016, we and GTI are restricted from disclosing any confidential information (as defined in the GTI Agreement) to any person other than employees of affiliates or contractors who are required to deal with such information, and such persons will be bound by the confidentiality provisions of the GTI Agreement. We have further indemnified GTI and its affiliates from any liability or loss resulting from unauthorized disclosure or use of any confidential information that we receive.

| 17 |

While the core of our technology is the U-GAS® system, we have continued to innovate and modify the process to a point where we maintain certain intellectual property rights over SGT. Since the original licensing in 2004, we have maintained a strong relationship with GTI and continue to benefit from the resources and collaborative work environment that GTI provides us. It is in part for that reason, in May 2016, we exercised the first of our 10-year extensions and now maintain the exclusive license described above through 2026.

Current Operations and Projects

Australian Future Energy Pty Ltd ("AFE”)

In 2014, we established Australian Future Energy Pty Ltd together with an Australian company, Ambre Investments PTY Limited (“Ambre”). AFE is an independently managed Australian business platform established for the purpose of building a large-scale, vertically integrated business in Australia based on developing, building and owning equity interests in financially attractive and environmentally responsible projects that produce low cost syngas as a competitive alternative to expensive local natural gas and LNG. The project undertakings by AFE are expected to produce syngas for the markets of industrial fuel gas such as aluminum manufacturing, cement making and ore processing as well as power generation, chemicals and fertilizers. The syngas is expected to be produced from local coal and renewable resources where AFE is acquiring ownership positions in the resources or creating long-term priced contracts for secure sources of low-cost feedstock for its projects, and for direct local and seaborne export markets. In 2016, AFE completed the creation and spin-off of Batchfire Resources Pty Ltd (as discussed below), which now owns the operating Callide coal mine in Queensland. Also, in August 2017, AFE completed the acquisition of the mine development lease related to the 270 million ton resource near Pentland, Queensland, through AFE’s wholly owned subsidiary, Great Northern Energy Pty Ltd.

For our ownership interest in AFE, we have been contributing cash and engineering support for AFE’s business development while Ambre contributed cash. Additional ownership has been granted to individuals providing services to AFE. In January 2017, we elected to increase our ownership interest in AFE by contributing approximately $0.4 million of cash. At June 30, 2017, we owned approximately 39% of AFE. Subsequent to June 30, 2017, we elected to make additional cash contributions of $0.47 million to maintain our 39% ownership interest in AFE. We account for our investment in AFE under the equity method.

On May 10, 2017, we entered into a Master Technology Agreement (the “MTA”) with AFE. Pursuant to the MTA, we have conveyed certain access rights to our gasification technology in Australia focusing on promotion and use of our technology in projects. AFE is the exclusive operational entity for business relating to our technology in Australia. AFE will work with us on project license agreements for use of our technology as projects are developed in Australia. In return for its work, AFE will receive a share of any license fee we receive for a project license in Australia.

On May 10, 2017, we entered into a technology license agreement with AFE in connection with a project being developed by AFE in Queensland Australia. Upon the formation of the project company, AFE will novate the license to that company and that company will assume all of the obligations of AFE thereunder. Pursuant to the license, we will grant a non-exclusive, non-transferrable license to use our technology at the project to manufacture syngas and to use the technology in the design of the facility. In consideration, we will receive a license fee of $25.0 million based on the plant capacity and a separate fee of $2.0 million for the delivery of a process design package. License fees are typically paid as milestones are reached throughout the planning, construction and first five years of plant operations. The success and timing of the project being developed by AFE will impact if and/or when we will be able to receive all of the payments from license and service fees relating to this technology license agreement. However, there can be no assurance that AFE will be successful in developing a project or the timing of when we may be entitled to receive any fees related to any project that may ultimately be developed. If AFE makes, whether patentable or not, improvements relating to our technology, they grant to us and our affiliates, an irrevocable royalty free right to use or license such improvements and agrees to make such improvements available free of charge.

AFE provides indemnity to us for damages resulting from the use of the technology in a manner other than as contemplated by the license, while we indemnify AFE to the extent that the intellectual property associated with the technology is found to infringe on the rights of a third party. Either party may terminate the license in connection with a material breach by the other party or the other party’s bankruptcy. AFE may also terminate if we fail to diligently commence the process design package as contemplated by the license. We also provide a guarantee of all obligations under the license.

| 18 |

AFE is currently evaluating multiple project opportunities that would use SGT, and plans to down select to two projects to move forward with full project development activities.

Batchfire Resources Pty Ltd (“BFR”)

As a result of AFE’s early stage business development efforts associated with the Callide coal mine in Central Queensland, Australia, AFE created Batchfire Resources Pty Ltd. BFR was a spin-off company for which ownership interest was distributed to the existing shareholders of AFE and to the new BFR management team in December 2015. BFR is registered in Australia and was formed for the purpose of purchasing the Callide thermal coal mine from Anglo-American plc (“Anglo-American”). The acquisition of the Callide thermal coal mine from Anglo-American was completed in October 2016. The Callide mine is one of the largest thermal coal mines in Australia, and has been in operation for more than 20 years. As reported by BFR at the time of the acquisition, Callide has approximately 230 million metric tons of recoverable reserves and an additional 850 million metric tons of proven resources.

The exact terms of the acquisition are confidential, but BFR stated that it had received investment support for the acquisition from Singapore-based Lindenfels Pte, Ltd, a subsidiary of commodity traders Avra Commodities. As a result of the completed transaction, our ownership position in BFR is approximately 11% as of June 30, 2017. Because of the nature of our contributions in AFE, the carrying value of our investment in BFR was zero as of June 30, 2017 and June 30, 2016. The mine has historically delivered approximately 9 to 10 million tons per annum of coal, with 5.5 metric tons per annum of coal delivered to the adjacent Callide Power Station, which generates up to 18% of Queensland’s electricity, and the remainder delivered primarily to the export seaborne coal market, with 5% to 10% going to local domestic customers.

BFR is implementing its mining plan at Callide intended to lower the per unit mining costs and deliver profitable financial results.

Yima Joint Venture

In August 2009, we entered into amended joint venture contracts with Yima Coal Industry Group Company (“Yima”), replacing the prior joint venture contracts entered into in October 2008 and April 2009. The joint ventures were formed for each of the gasification, methanol/methanol protein production, and utility island components of the plant (collectively, the “Yima Joint Venture”). The amended joint venture contracts provide that:

| · | we and Yima contribute equity of 25% and 75%, respectively, to the Yima Joint Venture; |

| · | Yima is obligated to provide debt financing via shareholder loans to the project until the project is able to secure third-party debt financing; and |

| · | Yima will supply coal to the project at a preferential price. |

As discussed below, in November 2016, as part of an overall corporate restructuring plan, these joint ventures were combined into a single joint venture.

We continue to own a 25% interest in the Yima Joint Venture and Yima owns a 75% interest. Notwithstanding this, in connection with an expansion of the project, we have the option to contribute a greater percentage of capital for the expansion, such that as a result, we could expand through contributions, at our election, up to a 49% ownership interest in the Yima Joint Venture. Since 2014, we have accounted for this joint venture under the cost method of accounting. Our conclusion to account for this joint venture under this methodology is based upon our historical lack of significant influence in the Yima Joint Venture. The lack of significant influence was determined based upon our interactions with the Yima Joint Venture related to our limited participation in operating and financial policymaking processes coupled with our limited ability to influence decisions which contribute to the financial success of the Yima Joint Venture. We continue to evaluate our level of influence over the Yima Joint Venture.

| 19 |

The remaining capital for the project construction has been funded with project debt obtained by the Yima Joint Venture. Yima agreed to guarantee the project debt in order to secure debt financing from domestic Chinese banking sources. We have agreed to pledge to Yima our ownership interests in the joint venture as security for our obligations under any project guarantee. In the event that the necessary additional debt financing is not obtained, Yima has agreed to provide a loan to the joint venture to satisfy the remaining capital needs of the project with terms comparable to current market rates at the time of the loan.

Under the terms of the joint venture agreement, the Yima Joint Venture is to be governed by a board of directors consisting of eight directors, two of whom were appointed by us and six of whom were appointed by Yima. The term of the joint venture shall commence upon each joint venture company obtaining its business operating license and shall end 30 years after the business license issue date.

We believe there has been a consistent pattern of the Yima Joint Venture management not demonstrating an understanding of the methanol facility operations and not sourcing available expertise in China to improve the overall operations. We have witnessed operation of the gasifier systems at Yima with design and operating parameter deviations from our existing technology recommendations. However, we are recently seeing signs of this improving.

Yima’s parent company, Henan Energy Chemistry Group Company (“Henan Energy”) restructured the management of the Yima Joint Venture under the direction of the Henan Coal Gasification Company (“Henan Gasification”), which is an affiliated company reporting directly to Henan Energy. Henan Gasification currently has full authority of day to day operational and personnel decisions at the Yima Joint Venture. The ownership of the Yima Joint Venture is unchanged.

Despite initiating methanol production in December 2012, the Yima Joint Venture’s plant continued its construction through the beginning of 2016. In March 2016, the Yima Joint Venture completed the required performance testing of the SGT systems and successfully issued its Performance Test Certificate, which is the point that we considered the plant to be completed. In 2016, the plant faced increasing regulatory scrutiny from the environmental and safety bureaus as the plant was not built in full compliance with its original submitted designs.

In June 2016, the local environmental bureau requested that the plant temporarily halt operations to address certain issues identified by the environmental bureau. After the plant shut down operations, the Yima plant experienced an accident during maintenance activities that was unrelated to the gasification units. The Yima Joint Venture returned to operations in late November 2016.

The approval for the original joint ventures was for the production of methanol protein, and methanol by-product. This has impacted the ability of the plant to sell pure methanol on the open market and has been an impediment for the facility to receive its permanent safety operating permit.

To resolve these issues, during the quarter ended June 30, 2016, the Yima Joint Venture commenced an organizational restructuring to better streamline the operations. This restructuring effort was a multi-step process which included combining the three joint ventures into a single operating entity and obtaining a business operating license. After completing these steps, the new joint venture would obtain the permanent safety and environmental permits. The Yima Joint Venture received the business license for the production of methanol protein and methanol by-product in July 2016 and merged the three joint ventures into one joint venture in November 2016. They continue to make progress on completing the remaining items required to complete the environmental and safety permitting activities. When this is complete, the Yima Joint Venture will be able to obtain its business license to produce and sell pure methanol.

Since the plant became operational in November 2016, it has had periods of running at full design capacity, and periods of operation at lower levels of production. For the period November 2016 through June 2017, the plant generated 132,250 tons of pure methanol. The primary operational issues were related to poor equipment supply quality issues that have plagued this facility throughout its operational history. We continue to see signs of overall improvement in operations, resulting in longer periods of production at design capacity. In August 2017, the plant completed a 90-day period of operating at full capacity. In addition, since May 2017, the Yima Joint Venture team is now working closely with our technical team to address specific items that are necessary to continue to improve the operations in the coming years.

| 20 |

The Yima Joint Venture experienced certain liquidity concerns with a series of third party bank loans due during calendar year 2016. Yima, the 75% shareholder of the Yima Joint Venture, has been routinely providing liquidity to the Yima Joint Venture in the form of shareholder loans and in October 2016, Yima successfully refinanced amounts which were due in October 2016. In addition to this refinancing, Yima has completed an internal restructuring of its debts in 2017 and has converted the majority of outstanding third-party loans into shareholder loans from Yima and its related affiliate companies. As of June 30, 2017, the Yima Joint Venture had approximately $9.3 million of third party debt, of which $7.4 million was due starting in September 2017. This $7.4 million was successfully refinanced in September 2017, with $6.66 million now due in April 2018.

The Company evaluated the conditions of the Yima Joint Venture to determine whether an other-than-temporary decrease in value had occurred as of June 30, 2017 and 2016. In the Current Year, Management determined that there were triggering events related to the value of its investment and these were the lower than expected production levels and the increased debt levels as compared to the previous year, which indicated a continued liquidity concern for the joint venture. In the Prior Year, the triggering events included the extended plant shutdown and a significant liquidity concern involving multiple bank loans that were coming due in the near future. Management determined these events in both years were other-than-temporary in nature and therefore conducted an impairment analysis utilizing a discounted cash flow fair market valuation with the assistance of a third-party valuation expert. In this valuation, significant unobservable inputs were used to calculate the fair value of the investment. The valuation led to the conclusion that the investment in the Yima Joint Venture was impaired as of June 30, 2017, and accordingly, we recorded a $17.7 million impairment for the fiscal year ended June 30, 2017 and an $8.6 million impairment for the fiscal year ended June 30, 2016. The carrying value of our Yima investment was approximately $8.5 million as of June 30, 2017 as compared to $26.2 million as of June 30, 2016. We continue to monitor the Yima Joint Venture and could record an additional impairment in the future if operating conditions do not improve to meet our expectations, or if the liquidity situation worsens.

Tianwo-SES Clean Energy Technologies Limited (the “Tianwo-SES Joint Venture”)

Joint Venture Contract

In February 2014, SES Asia Technologies Limited, one of our wholly owned subsidiaries, entered into a Joint Venture Contract (the “JV Contract”) with Zhangjiagang Chemical Machinery Co., Ltd., which subsequently changed its legal name to Suzhou Thvow Technology Co. Ltd. (“STT”), to form the Tianwo-SES Joint Venture. The purpose of the Tianwo-SES Joint Venture is to establish the Company’s gasification technology as the leading gasification technology in the Tianwo-SES Joint Venture territory (which is China, Indonesia, the Philippines, Vietnam, Mongolia and Malaysia) by becoming a leading provider of proprietary equipment and engineering services for the technology. The scope of the Tianwo-SES Joint Venture is to market and license our gasification technology via project sublicenses; procurement and sale of proprietary equipment and services; coal testing; and engineering, procurement and research and development related to the technology. STT contributed 53.8 million RMB in April 2014 and was required to contribute an additional 46.2 million RMB within two years of such date for a total contribution of 100 million RMB (approximately $14.8 million) in cash to the Tianwo-SES Joint Venture, and owns 65% of the Tianwo-SES Joint Venture.

We have contributed certain exclusive technology sub-licensing rights into the Tianwo-SES Joint Venture for the territory pursuant to the terms of a Technology Usage and Contribution Agreement (the “TUCA”) entered into among the Tianwo-SES Joint Venture, STT and us on the same date and further described in more detail below. This resulting in an ownership of 35% of the Tianwo-SES Joint Venture by SES. Under the JV Contract, neither party may transfer their interests in the Tianwo-SES Joint Venture without first offering such interests to the other party.

| 21 |

In August 2017, a restructuring of the Tianwo-SES Joint Venture was completed (“Restructuring Agreement”). In this restructuring, an additional party will be added to the JV Contract, upon receipt of final governmental approvals, The Innovative Coal Chemical Design Institute (“ICCDI”) will become a 25% owner of Tianwo-SES, we will decrease our ownership to 25% and STT will decrease its ownership to 50%. We received 11.15 million RMB (approximately $1.7 million) from ICCDI as a result of this restructuring. ICCDI, which was previously owned by STT, engineered and constructed all three projects for the Aluminum Corporation of China. The inclusion of ICCDI as an owner, will enhance the joint venture’s bidding ability, and we believe the joint venture will now focus on securing larger coal to chemical projects as well as continue to pursue projects in the industrial fuels segment. The agreed change in share ownership is expected to be completed over the next two to three months and involves a reduction in the registered capital of the joint venture to be completed with the local governmental authorities and the final transfer of shares. In addition to the ownership changes described above, Tianwo-SES will now be managed by a board of directors (the “Board”) consisting of eight directors, four appointed by STT, two appointed by ICCDI and two appointed by us. Certain acts as described in the JV Contract require the unanimous approval of the Board. If the Board becomes deadlocked on any issue, it will be resolved through binding arbitration in Shanghai. We, ICCDI and STT have the right to appoint a supervisor, which will supervise the management of Tianwo-SES, including through (i) inspecting accounting records, vouchers, books and statements of Tianwo-SES; (ii) supervising the actions of directors and management; and (iii) attending meetings of the Board to raise questions or suggestions regarding matters to be resolved by the Board. The general manager, which will serve as the principal executive of Tianwo-SES, will now be appointed by ICCDI. Certain other members of management will now be appointed by both us and STT. In conjunction with the joint venture restructuring, we received 1.2 million RMB (approximately $180,000) related to outstanding invoices for services we had provided to the Tianwo-SES Joint Venture.

The JV Contract also includes a non-competition provision which requires that the Tianwo-SES Joint Venture be the exclusive legal entity within the Tianwo-SES Joint Venture territory for the marketing and sale of any gasification technology or related equipment that utilizes low quality coal feedstock. Notwithstanding this, STT retained the right to manufacture and sell gasification equipment outside the scope of the Tianwo-SES Joint Venture within the Tianwo-SES Joint Venture territory. In addition, we retained the right to develop and invest equity in projects outside of the Tianwo-SES Joint Venture within the Tianwo-SES Joint Venture territory. As a result of the Restructuring Agreement, we have further retained the right to provide gasification technology licenses and to sell proprietary equipment directly into projects in the joint venture territory provided we have an equity interest in the project. After the termination of the Tianwo-SES Joint Venture, STT and ICCDI must obtain written consent from us to market development of any gasification technology that utilizes low quality coal feedstock in the Tianwo-SES Joint Venture territory.