Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONNECTICUT WATER SERVICE INC / CT | d587795d8k.htm |

Exhibit 99.1

Connecticut Water SJW Group Investor Presentation May 21, 2018

Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of the Company or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of SJW Group or the Company; (8) the ability of SJW Group and the Company to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 filed by SJW Group with the SEC on April 25, 2018 in connection with the proposed transaction and the Company’s quarterly report on Form 10-Q for the period ended March 31, 2018 filed with the SEC on May 9, 2018. In addition, actual results are subject to other risks and uncertainties that relate more broadly to the Company’s overall business and financial condition, including those more fully described in the Company’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017 and SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017. Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither the Company or its management nor SJW Group or its management undertakes any obligation to update or revise any forward-looking statements. 2

Agenda The Merger with SJW Group (“SJW”) delivers significant value to Connecticut Water shareholders, both at close and over the long-term, and creates a new company that reflects the investment criteria that our shareholders have said they desire ? The SJW Merger is the result of an independent process and robust arm’s length negotiations designed to serve the best interests of Connecticut Water shareholders, while also recognizing the stakeholder responsibilities we have as a regulated public utility ? Eversource’s unsolicited acquisition proposal is not a Superior Proposal and would not serve the interests of Connecticut Water shareholders or stakeholders 3

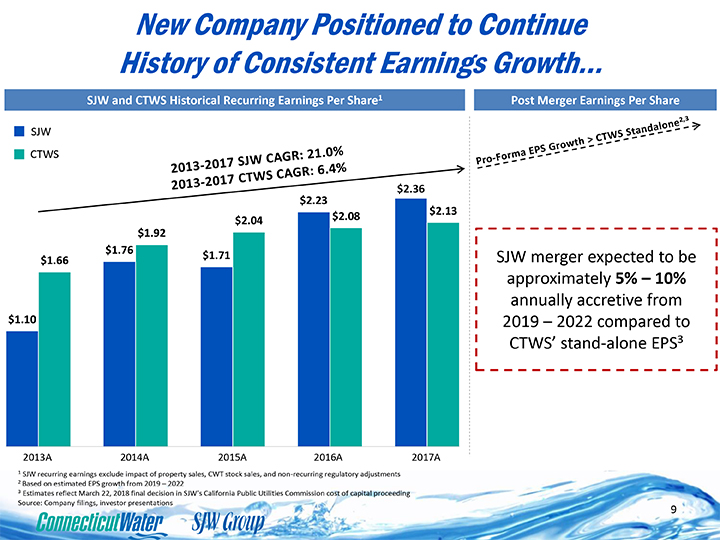

The SJW Merger Delivers Significant Value to CTWS Shareholders – At Close and Over the Long-Term ? Tax free, stock-for-stock merger provides value at close and opportunity to participate in future growth ? Pro forma ownership: 40% CTWS / 60% SJW ? Immediate value at close ? 18% premium to unaffected CTWS share price1 ? Premium well in excess of 5% average2 premium for merger of equals (“MOE”) transactions ? Immediately accretive to CTWS’ standalone EPS – without need for job cuts or significant cost savings ? SJW merger expected to be approximately 5% – 10% annually accretive from 2019 – 2022 compared to CTWS’ stand-alone EPS3 ? Immediate uplift to CTWS dividend with path for continued, sustainable dividend increases ? Dividend at close expected to be at least equivalent to SJW’s announced 2018 annual dividend of $1.12 per share (equivalent to $1.27 per CTWS share) ? SJW and its predecessor have paid a common stock dividend for 74 consecutive years, and its annual dividend amount has increased in each of the last 50 years ? Leading national platform with significant future growth opportunities ? Planned organic investments across combined operations expected to drive significant EPS growth over the next five years compared to standalone CTWS ? Increased financial strength of new company to support acquisition-driven growth across a diverse set of geographies 1 Based on 1.1375x exchange-ratio and SJW and CTWS unaffected share prices as of March 14, 2018 of $54.38 and $52.57, respectively 2 Includes the four utility MOE transactions completed or currently pending since 2005, excluding the SJW Merger 3 Estimates reflect March 22, 2018 final decision in SJW’s California Public Utilities Commission cost of capital proceeding Note the value per share of the SJW Merger is not fixed and fluctuates based on SJW Group’s stock price 4

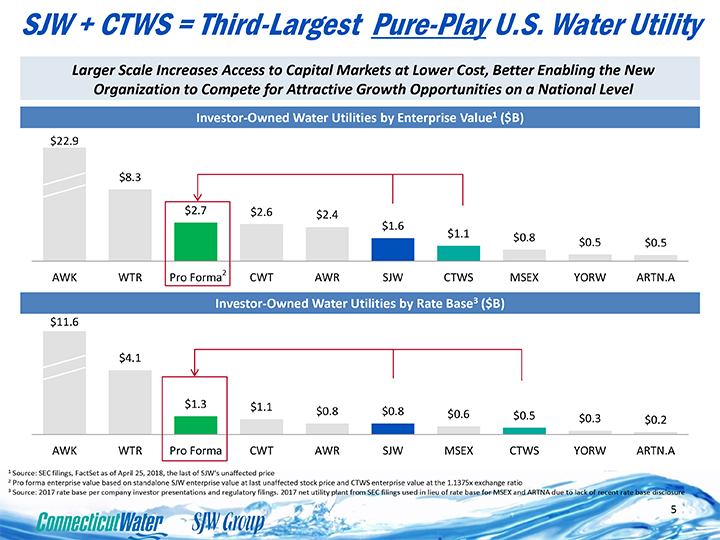

SJW + CTWS = Third-Largest Pure-Play U.S. Water Utility Larger Scale Increases Access to Capital Markets at Lower Cost, Better Enabling the New Organization to Compete for Attractive Growth Opportunities on a National Level Investor-Owned Water Utilities by Enterprise Value1 ($B) $22.9 $8.3 $2.7 $2.6 $2.4 $1.6 $1.1 $0.8 $0.5 $0.5 AWK WTR Pro Forma2 CWT AWR SJW CTWS MSEX YORW ARTN.A Investor-Owned Water Utilities by Rate Base3 ($B) $11.6 $4.1 $1.3 $1.1 $0.8 $0.8 $0.6 $0.5 $0.3 $0.2 AWK WTR Pro Forma CWT AWR SJW MSEX CTWS YORW ARTN.A 1 Source: SEC filings, FactSet as of April 25, 2018, the last of SJW’s unaffected price 2 Pro forma enterprise value based on standalone SJW enterprise value at last unaffected stock price and CTWS enterprise value at the 1.1375x exchange ratio 3 Source: 2017 rate base per company investor presentations and regulatory filings. 2017 net utility plant from SEC filings used in lieu of rate base for MSEX and ARTNA due to lack of recent rate base disclosure 5

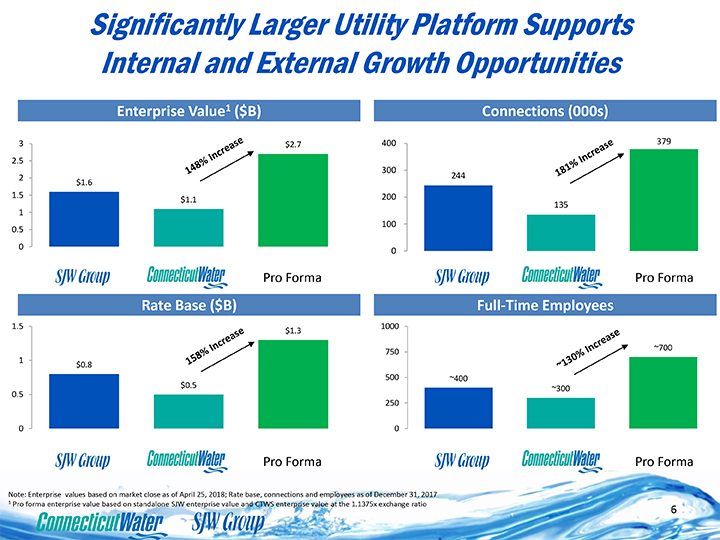

Significantly Larger Utility Platform Supports Internal and External Growth Opportunities Enterprise Value1 ($B) Connections (000s) 3 $2.7 400 379 2.5 300 2 $1.6 244 1.5 200 $1.1 135 1 100 0.5 0 0 Pro Forma Pro Forma Rate Base ($B) Full-Time Employees 1.5 1000 $1.3 ~700 750 1 $0.8 500 ~400 $0.5 ~300 0.5 250 0 0 Pro Forma Pro Forma Note: Enterprise values based on market close as of April 25, 2018; Rate base, connections and employees as of December 31, 2017 1 Pro forma enterprise value based on standalone SJW enterprise value and CTWS enterprise value at the 1.1375x exchange ratio

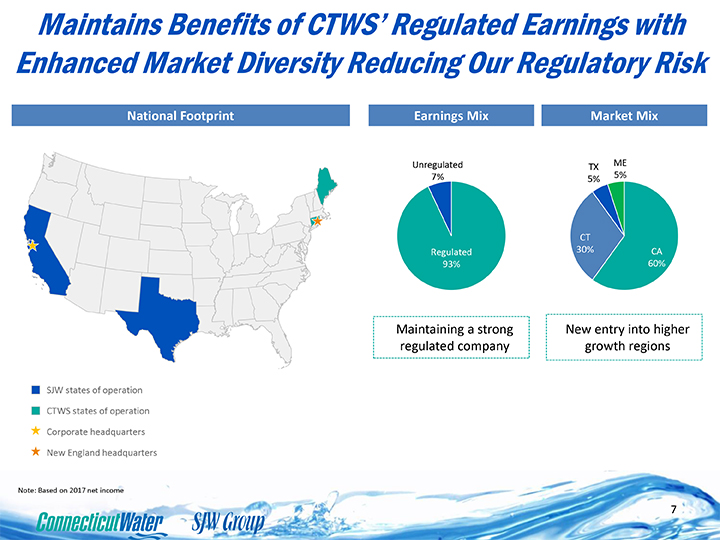

Maintains Benefits of CTWS’ Regulated Earnings with Enhanced Market Diversity Reducing Our Regulatory Risk National Footprint Earnings Mix Market Mix Unregulated ME TX 7% 5% 5% CT Regulated 30% CA 93% 60% Maintaining a strong New entry into higher regulated company growth regions SJW states of operation CTWS states of operation Corporate headquarters New England headquarters Note: Based on 2017 net income

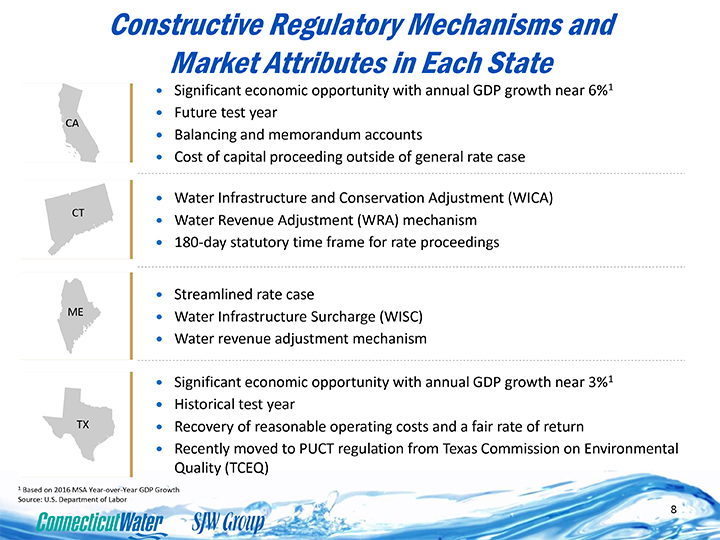

Constructive Regulatory Mechanisms and Market Attributes in Each State Significant economic opportunity with annual GDP growth near 6%1 Future test year Balancing and memorandum accounts Cost of capital proceeding outside of general rate case Water Infrastructure and Conservation Adjustment (WICA) Water Revenue Adjustment (WRA) mechanism 180-day statutory time frame for rate proceedings Streamlined rate case Water Infrastructure Surcharge (WISC) Water revenue adjustment mechanism Significant economic opportunity with annual GDP growth near 3%1 Historical test year Recovery of reasonable operating costs and a fair rate of return Recently moved to PUCT regulation from Texas Commission on Environmental Quality (TCEQ) 1 Based on 2016 MSA Year-over-Year GDP Growth Source: U.S. Department of Labor

New Company Positioned to Continue History of Consistent Earnings Growth… SJW and CTWS Historical Recurring Earnings Per Share1 Post Merger Earnings Per Share SJW CTWS $2.36 $2.23 $2.13 $2.04 $2.08 $1.92 $1.76 $1.71 SJW merger expected to be $1.66 approximately 5% – 10% annually accretive from $1.10 2019 – 2022 compared to CTWS’ stand-alone EPS3 2013A 2014A 2015A 2016A 2017A 1 SJW recurring earnings exclude impact of property sales, CWT stock sales, and non-recurring regulatory adjustments 2 Based on estimated EPS growth from 2019 – 2022 3 Estimates reflect March 22, 2018 final decision in SJW’s California Public Utilities Commission cost of capital proceeding Source: Company filings, investor presentations

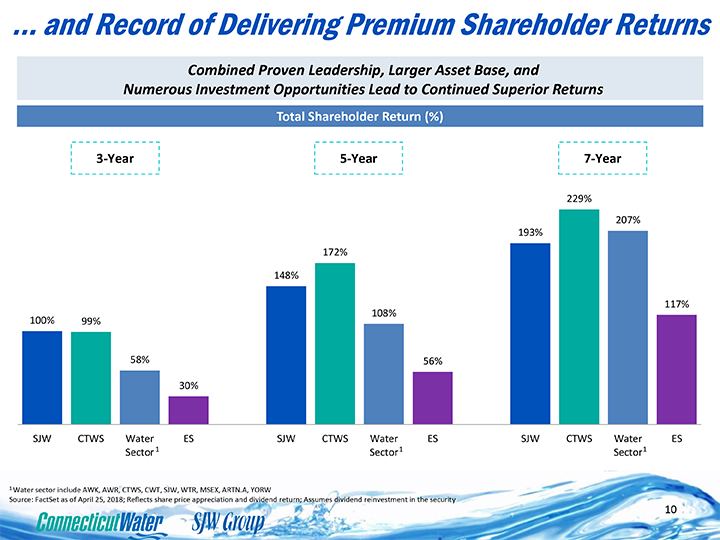

… and Record of Delivering Premium Shareholder Returns Combined Proven Leadership, Larger Asset Base, and Numerous Investment Opportunities Lead to Continued Superior Returns Total Shareholder Return (%) 3-Year 5-Year 7-Year 229% 207% 193% 172% 148% 117% 108% 100% 99% 58% 56% 30% SJW CTWS Water ES SJW CTWS Water ES SJW CTWS Water ES Sector1 Sector1 Sector1 1 Water sector include AWK, AWR, CTWS, CWT, SJW, WTR, MSEX, ARTN.A, YORW Source: FactSet as of April 25, 2018; Reflects share price appreciation and dividend return; Assumes dividend reinvestment in the security

How We Arrived Here: Summary Background to the SJW Merger The SJW Merger Is the Result of Rigorous, Independent Process Designed to Serve the Best Interests of CTWS Shareholders Initial SJW Approach June 2016: SJW approached CTWS about a potential MOE transaction with no premium August 2016 – January 2017: CTWS and SJW conducted mutual due diligence and held preliminary discussions regarding a potential transaction ? At the time, SJW verbally proposed a no-premium transaction January 2017: Following a thorough review and evaluation, the CTWS and SJW Boards discontinued discussions ? At this time, the CTWS Board elected to continue to pursue growth opportunities independently and build upon CTWS’ strong track record of outperformance and robust shareholder returns Review of Strategic Opportunities and SJW Re-Approach November 2016 – May 2017: CTWS explored another transaction involving the possible acquisition of a large water utility, which did not occur ? Notwithstanding the unsuccessful acquisition process, the Board recognized it should consider other opportunities to increase scale and geographic diversity as a potential path for expanding its investor base, increasing capital markets access and enhancing shareholder value February – July 2017: Consistent with its independent growth strategy, CTWS completed the acquisitions of HVWC and AWC to add nearly 10,000 new water customers across Connecticut September 2017: SJW hired former CTWS CEO, Eric Thornburg, as CEO and President November – December 2017: SJW re-approached CTWS with a non-binding indication of interest offering an all-stock MOE at an exchange ratio of 1.000x ? Recognizing a combination with SJW continued to offer potential value creation opportunities and maintained strong industrial logic, the Board elected to re-engage with SJW

How We Arrived Here: Summary Background Continued The SJW Merger Is the Result of Rigorous, Independent Process Designed to Serve the Best Interests of CTWS Shareholders Thorough Review of SJW Merger and Other Alternatives Resulted in Enhanced Offer November – March 2018: The Board held eight meetings and the CF&I Committee held four meetings, directing management on negotiations, which resulted in a substantial improvement of the proposed terms and CTWS valuation ? The Board worked closely with Wells Fargo Securities, Sullivan & Cromwell and management to evaluate the SJW offer, conduct due diligence and negotiate potential terms ? The Board negotiations resulted in CTWS achieving two significant price increases and meaningful benefits for all CTWS stakeholders During its review of the SJW offer, the Board also discussed, reviewed, and evaluated the potential for other alternatives, including maintaining status quo or a sale to a third party ? The Board further determined it would be in the best interests of CTWS shareholders to pursue an MOE enabling continued ownership and participation in CTWS’ strong asset base and future growth Board’s Consideration of Eversource’s Initial Advances October 2017: A representative of Eversource contacted our chairman, Carol Wallace, to discuss Eversource’s interest in acquiring CTWS ? During this discussion, Ms. Wallace indicated the Board was pleased with the company’s performance and future growth strategy and was not interested in an outright sale of CTWS In February 2018, Ms. Wallace and the Eversource representative discussed, in response to Eversource’s request for a meeting, the Board’s position to not pursue an outright sale of CTWS Nonetheless, the Board, working closely with Wells Fargo Securities, carefully considered and evaluated Eversource’s financial wherewithal, credit capacity and earnings expectations to estimate its ability to acquire CTWS at a premium valuation Based on that evaluation, the Board saw no evidence that Eversource could deliver a proposal superior to the SJW Merger, which was validated by Eversource’s subsequent inferior proposal (submitted in April 2018)

How We Arrived Here: Summary Background Continued The SJW Merger Is the Result of Rigorous, Independent Process Designed to Serve the Best Interests of CTWS Shareholders Board’s Decision to Proceed with SJW Merger The Board determined the SJW Merger was the most attractive option for numerous reasons, including the following: ? Immediate and ongoing value creation for CTWS shareholders ? Increased scale/diversity to position CTWS to continue to provide shareholders with top tier returns ? Determination that other parties would likely not be able to provide materially better terms than SJW, given relative valuations and capital constraints ? Desire to ensure CTWS shareholders’ ability to remain invested in a pure-play water utility, on a tax-free basis Unsolicited Approach by Eversource April 2018: Following the SJW Merger announcement, Eversource made an unsolicited inferior proposal The undermarket value proposed by Eversource reinforced the Board’s prior analysis and decision not to engage with Eversource ? Eversource’s proposal is below the value of CTWS’ shares on the day it made its proposal public Review and Rejection of Eversource’s Inferior Proposal April 2018: The independent members of the Board thoroughly evaluated and rejected Eversource’s proposal and reaffirmed its commitment to the SJW Merger The merger agreement with SJW clearly states that CTWS is bound to continue to use its reasonable best efforts to close the SJW Merger and limits its ability to engage with Eversource, or any potential interloper, in the absence of a Superior Proposal Further, the Board firmly believes in the growth prospects, industrial logic, and substantial long-term value creating opportunities presented by the SJW Merger

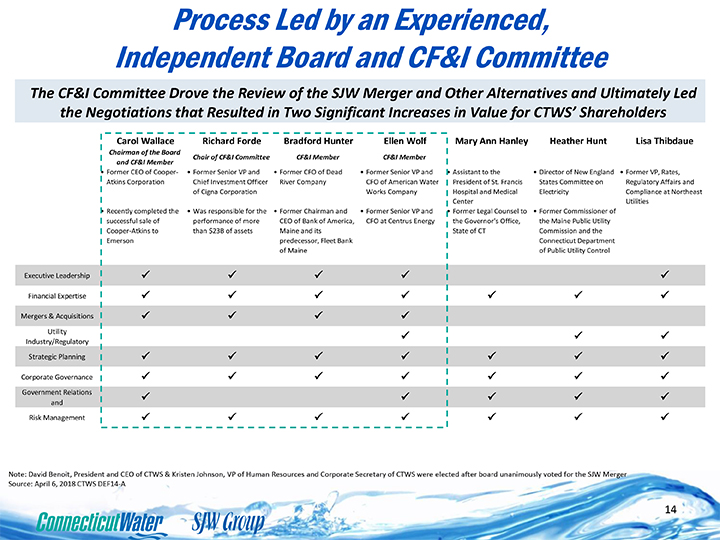

Process Led by an Experienced, Independent Board and CF&I Committee The CF&I Committee Drove the Review of the SJW Merger and Other Alternatives and Ultimately Led the Negotiations that Resulted in Two Significant Increases in Value for CTWS’ Shareholders Carol Wallace Richard Forde Bradford Hunter Ellen Wolf Mary Ann Hanley Heather Hunt Lisa Thibdaue Chairman of the Board Chair of CF&I Committee CF&I Member CF&I Member and CF&I Member • Former CEO of Cooper- • Former Senior VP and • Former CFO of Dead • Former Senior VP and • Assistant to the • Director of New England • Former VP, Rates, Atkins Corporation Chief Investment Officer River Company CFO of American Water President of St. Francis States Committee on Regulatory Affairs and of Cigna Corporation Works Company Hospital and Medical Electricity Compliance at Northeast Center Utilities • Recently completed the • Was responsible for the • Former Chairman and • Former Senior VP and • Former Legal Counsel to • Former Commissioner of successful sale of performance of more CEO of Bank of America, CFO at Centrus Energy the Governor’s Office, the Maine Public Utility Cooper-Atkins to than $23B of assets Maine and its State of CT Commission and the Emerson predecessor, Fleet Bank Connecticut Department of Maine of Public Utility Control Executive Leadership????? Financial Expertise??????? Mergers & Acquisitions???? Utility ??? Industry/Regulatory Strategic Planning??????? Corporate Governance??????? Government Relations ????? and Risk Management??????? Note: David Benoit, President and CEO of CTWS & Kristen Johnson, VP of Human Resources and Corporate Secretary of CTWS were elected after board unanimously voted for the SJW Merger Source: April 6, 2018 CTWS DEF14-A

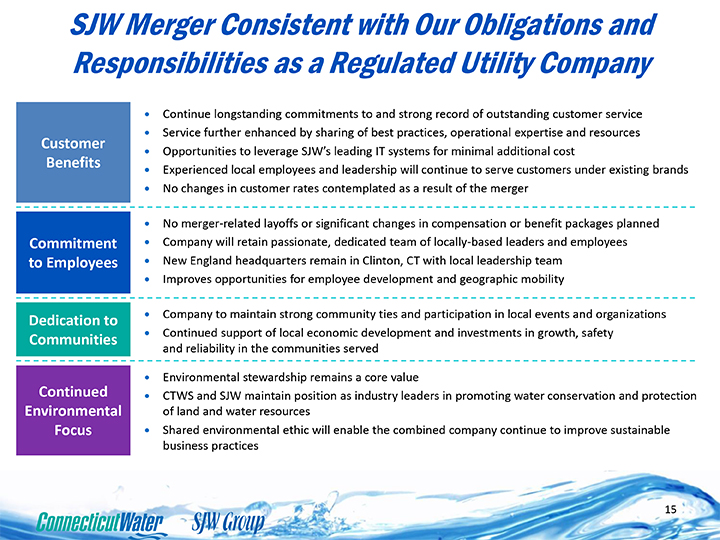

SJW Merger Consistent with Our Obligations and Responsibilities as a Regulated Utility Company Customer Benefits Continue longstanding commitments to and strong record of outstanding customer service Service further enhanced by sharing of best practices, operational expertise and resources Opportunities to leverage SJW’s leading IT systems for minimal additional cost Experienced local employees and leadership will continue to serve customers under existing brands No changes in customer rates contemplated as a result of the merger Commitment to Employees No merger-related layoffs or significant changes in compensation or benefit packages planned Company will retain passionate, dedicated team of locally-based leaders and employees New England headquarters remain in Clinton, CT with local leadership team Improves opportunities for employee development and geographic mobility Dedication to Communities Company to maintain strong community ties and participation in local events and organizations Continued support of local economic development and investments in growth, safety and reliability in the communities served Continued Environmental Focus Environmental stewardship remains a core value CTWS and SJW maintain position as industry leaders in promoting water conservation and protection of land and water resources Shared environmental ethic will enable the combined company continue to improve sustainable business practices

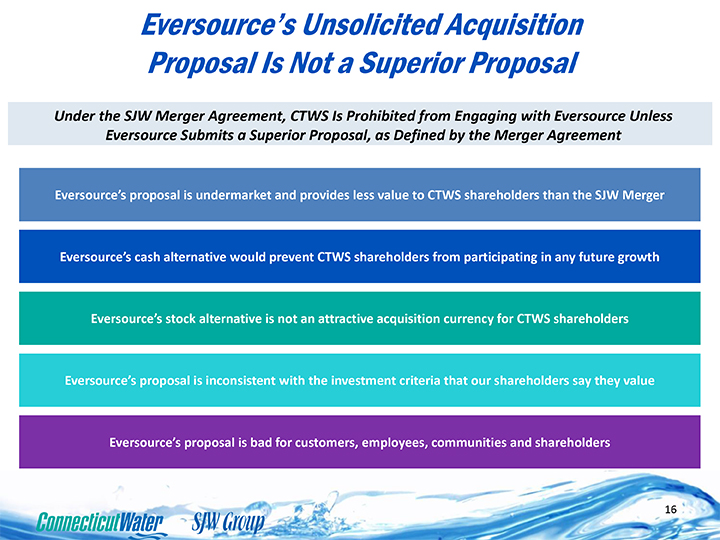

Eversource’s Unsolicited Acquisition Proposal Is Not a Superior Proposal Under the SJW Merger Agreement, CTWS Is Prohibited from Engaging with Eversource Unless Eversource Submits a Superior Proposal, as Defined by the Merger Agreement Eversource’s proposal is undermarket and provides less value to CTWS shareholders than the SJW Merger Eversource’s cash alternative would prevent CTWS shareholders from participating in any future growth Eversource’s stock alternative is not an attractive acquisition currency for CTWS shareholders Eversource’s proposal is inconsistent with the investment criteria that our shareholders say they value Eversource’s proposal is bad for customers, employees, communities and shareholders

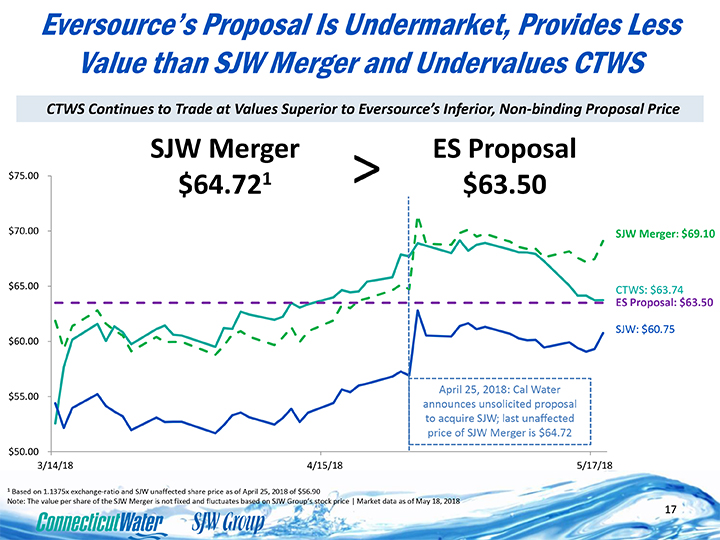

Eversource’s Proposal Is Undermarket, Provides Less Value than SJW Merger and Undervalues CTWS CTWS Continues to Trade at Values Superior to Eversource’s Inferior, Non-binding Proposal Price SJW Merger ES Proposal $75.00 $64.721 > $63.50 $70.00 SJW Merger: $69.10 $65.00 CTWS: $63.74 ES Proposal: $63.50 SJW: $60.75 $60.00 April 25, 2018: Cal Water $55.00 announces unsolicited proposal to acquire SJW; last unaffected price of SJW Merger is $64.72 $50.00 3/14/18 4/15/18 5/17/18 1 Based on 1.1375x exchange-ratio and SJW unaffected share price as of April 25, 2018 of $56.90 Note: The value per share of the SJW Merger is not fixed and fluctuates based on SJW Group’s stock price | Market data as of May 18, 2018

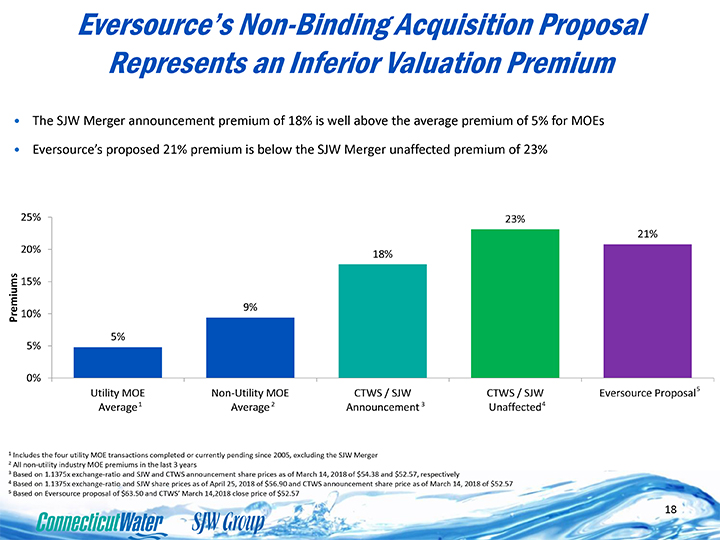

Eversource’s Non-Binding Acquisition Proposal Represents an Inferior Valuation Premium ? The SJW Merger announcement premium of 18% is well above the average premium of 5% for MOEs ? Eversource’s proposed 21% premium is below the SJW Merger unaffected premium of 23% 25% 23% 21% 20% 18% 15% emiums 9% Pr 10% 5% 5% 0% Utility MOE Non-Utility MOE CTWS / SJW CTWS / SJW Eversource Proposal5 Average1 Average2 Announcement 3 Unaffected4 1 Includes the four utility MOE transactions completed or currently pending since 2005, excluding the SJW Merger 2 All non-utility industry MOE premiums in the last 3 years 3 Based on 1.1375x exchange-ratio and SJW and CTWS announcement share prices as of March 14, 2018 of $54.38 and $52.57, respectively 4 Based on 1.1375x exchange-ratio and SJW share prices as of April 25, 2018 of $56.90 and CTWS announcement share price as of March 14, 2018 of $52.57 5 Based on Eversource proposal of $63.50 and CTWS’ March 14,2018 close price of $52.57

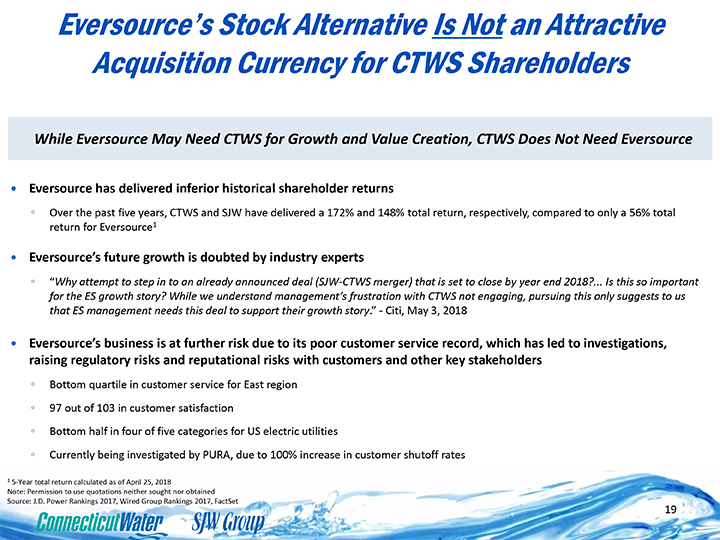

Eversource’s Stock Alternative Is Not an Attractive Acquisition Currency for CTWS Shareholders While Eversource May Need CTWS for Growth and Value Creation, CTWS Does Not Need Eversource Eversource has delivered inferior historical shareholder returns ? Over the past five years, CTWS and SJW have delivered a 172% and 148% total return, respectively, compared to only a 56% total return for Eversource1 Eversource’s future growth is doubted by industry experts ? “Why attempt to step in to an already announced deal (SJW-CTWS merger) that is set to close by year end 2018?. Is this so important for the ES growth story? While we understand management’s frustration with CTWS not engaging, pursuing this only suggests to us that ES management needs this deal to support their growth story.”—Citi, May 3, 2018 Eversource’s business is at further risk due to its poor customer service record, which has led to investigations, raising regulatory risks and reputational risks with customers and other key stakeholders ? Bottom quartile in customer service for East region ? 97 out of 103 in customer satisfaction ? Bottom half in four of five categories for US electric utilities ? Currently being investigated by PURA, due to 100% increase in customer shutoff rates 1 5-Year total return calculated as of April 25, 2018 Note: Permission to use quotations neither sought nor obtained Source: J.D. Power Rankings 2017, Wired Group Rankings 2017, FactSet

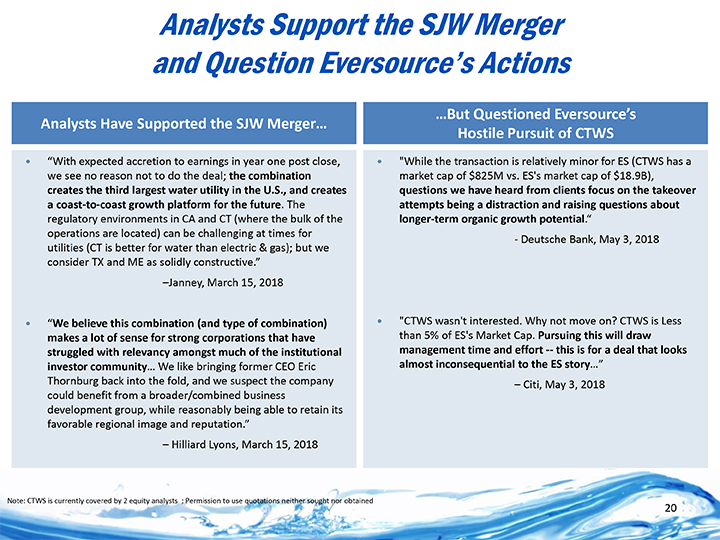

Analysts Support the SJW Merger and Question Eversource’s Actions Analysts Have Supported the SJW Merger… “With expected accretion to earnings in year one post close, we see no reason not to do the deal; the combination creates the third largest water utility in the U.S., and creates a coast-to-coast growth platform for the future. The regulatory environments in CA and CT (where the bulk of the operations are located) can be challenging at times for utilities (CT is better for water than electric & gas); but we consider TX and ME as solidly constructive.” –Janney, March 15, 2018 “We believe this combination (and type of combination) makes a lot of sense for strong corporations that have struggled with relevancy amongst much of the institutional investor community… We like bringing former CEO Eric Thornburg back into the fold, and we suspect the company could benefit from a broader/combined business development group, while reasonably being able to retain its favorable regional image and reputation.” – Hilliard Lyons, March 15, 2018 …But Questioned Eversource’s Hostile Pursuit of CTWS “While the transaction is relatively minor for ES (CTWS has a market cap of $825M vs. ES’s market cap of $18.9B), questions we have heard from clients focus on the takeover attempts being a distraction and raising questions about longer-term organic growth potential.” —Deutsche Bank, May 3, 2018 “CTWS wasn’t interested. Why not move on? CTWS is Less than 5% of ES’s Market Cap. Pursuing this will draw management time and effort — this is for a deal that looks almost inconsequential to the ES story…” – Citi, May 3, 2018 Note: CTWS is currently covered by 2 equity analysts ; Permission to use quotations neither sought nor obtained

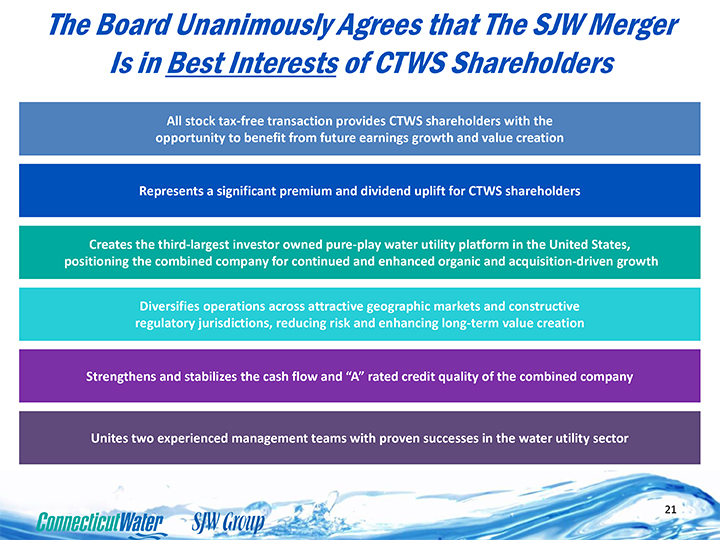

The Board Unanimously Agrees that The SJW Merger Is in Best Interests of CTWS Shareholders All stock tax-free transaction provides CTWS shareholders with the opportunity to benefit from future earnings growth and value creation Represents a significant premium and dividend uplift for CTWS shareholders Creates the third-largest investor owned pure-play water utility platform in the United States, positioning the combined company for continued and enhanced organic and acquisition-driven growth Diversifies operations across attractive geographic markets and constructive regulatory jurisdictions, reducing risk and enhancing long-term value creation Strengthens and stabilizes the cash flow and “A” rated credit quality of the combined company Unites two experienced management teams with proven successes in the water utility sector

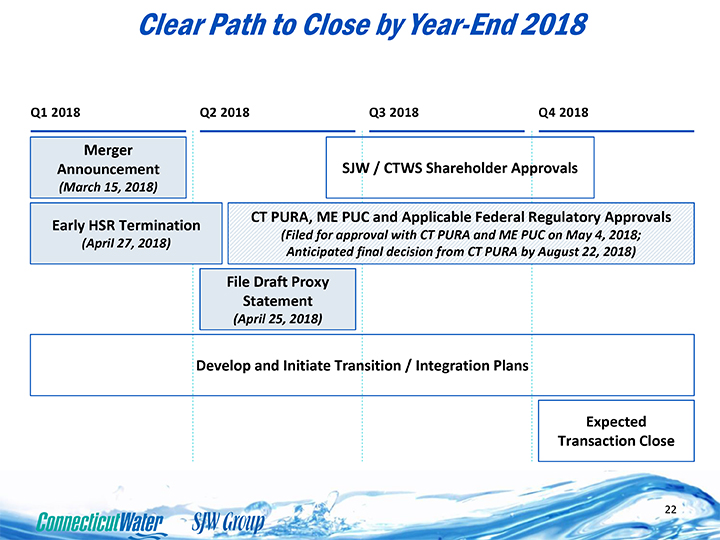

Clear Path to Close by Year-End 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Merger Announcement SJW / CTWS Shareholder Approvals (March 15, 2018) CT PURA, ME PUC and Applicable Federal Regulatory Approvals Early HSR Termination (Filed for approval with CT PURA and ME PUC on May 4, 2018; (April 27, 2018) Anticipated final decision from CT PURA by August 22, 2018) File Draft Proxy Statement (April 25, 2018) Develop and Initiate Transition / Integration Plans Expected Transaction Close

Additional Information About the Merger and Where to Find It Additional Information and Where to Find It In connection with the proposed transaction between the Company and SJW Group, SJW Group filed with the SEC a Registration Statement on Form S-4 that includes a joint proxy statement of the Company and SJW Group that also constitutes a prospectus of SJW Group. The Company will also file a GREEN proxy card with the SEC, and the Company and SJW Group may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, Form S-4 or any other document which the Company or SJW Group has filed or may file with the SEC. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND SJW GROUP ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Form S-4 and joint proxy statement/prospectus and any other documents filed with the SEC by the Company or SJW Group through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by the Company will be made available free of charge on the Company’s investor relations website at https://ir.ctwater.com. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in the Solicitation The Company, SJW Group and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of the Company and SJW Group securities in respect of the proposed transaction between the Company and SJW Group. Information regarding the Company’s directors and officers is available in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated April 6, 2018, which are filed with the SEC. Information regarding the SJW Group’s directors and officers is available in SJW Group’s annual report on Form 10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the Form S-4 and the joint proxy statement/prospectus and other documents filed with the SEC by the Company and SJW Group. These documents will be available free of charge from the sources indicated above. 23