Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF REGISTERED PUBLIC ACCOUNTING FIRM - CONNECTICUT WATER SERVICE INC / CT | consent.htm |

| EX-21 - CTWS SUBSIDIARIES - CONNECTICUT WATER SERVICE INC / CT | subsidiaries.htm |

| EX-10.20 - AMENDED AND RESTATED DEFERRED COMP AGREEMENT - CONNECTICUT WATER SERVICE INC / CT | deferred_comp.htm |

| EX-31.1 - CEO RULE 13A-14 CERTIFICATION - CONNECTICUT WATER SERVICE INC / CT | ceo_certification.htm |

| EX-31.2 - CFO RULE 13A-14 CERTIFICATION - CONNECTICUT WATER SERVICE INC / CT | cfo_certification.htm |

| EX-32.2 - CFO SOX CERTIFICATION - CONNECTICUT WATER SERVICE INC / CT | cfo_sox-certification.htm |

| EX-32.1 - CEO SOX CERTIFICATION - CONNECTICUT WATER SERVICE INC / CT | ceo_sox-certification.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K

|

x

|

Annual Report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2010 or

|

|

o

|

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from

|

to

|

Commission File Number 0-8084

Connecticut Water Service, Inc.

(Exact name of registrant as specified in its charter)

|

Connecticut

(State or other jurisdiction of

incorporation or organization)

|

06-0739839

(I.R.S. Employer Identification No.)

|

|

93 West Main Street, Clinton, CT

(Address of principal executive office)

|

06413

(Zip Code)

|

Registrant's telephone number, including area code (860) 669-8636

Registrant’s website: www.ctwater.com

Securities registered pursuant to Section 12 (b) of the Act:

|

Title of each Class

Common Stock, without par value

|

Name of each exchange on which registered

The Nasdaq Stock Market, Inc.

|

Securities registered pursuant to Section 12 (g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K, (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer x

|

|

Non-Accelerated Filer o

|

Smaller Reporting Company o

|

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2010, the aggregate market value of the registrant's voting Common Stock held by non-affiliates of the registrant was $180,060,935 based on the closing sale price on such date as reported on the NASDAQ.

Number of shares of Common Stock, no par value, outstanding as of March 1, 2011 was 8,703,295, excluding 125,531 common stock equivalent shares.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

Part of Form 10-K Into Which Document is Incorporated

|

|

|

Definitive Proxy Statement, dated March 31, 2011, for Annual Meeting of Shareholders to be held on May 12, 2011.

|

Part III

|

|

For the Year Ended December 31, 2010

|

||||

|

Page Number

|

||||

|

4

|

||||

|

Part I

|

||||

|

5

|

||||

|

8

|

||||

|

11

|

||||

|

11

|

||||

|

12

|

||||

|

12

|

||||

|

Part II

|

||||

|

12

|

||||

|

14

|

||||

|

15

|

||||

|

23

|

||||

|

23

|

||||

|

23

|

||||

|

24

|

||||

|

24

|

||||

|

Part III

|

||||

|

24

|

||||

|

24

|

||||

|

24

|

||||

|

24

|

||||

|

24

|

||||

|

Part IV

|

||||

|

25

|

||||

|

26

|

Certain statements in this Annual Report on Form 10-K (“10-K”), or incorporated by reference into this 10-K, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (“Exchange Act”) that are made based upon, among other things, our current assumptions, expectations and beliefs concerning future developments and their potential effect on Connecticut Water Service, Inc. (referred to as “the Company”, “we”, “us”, or “our”). These forward-looking statements involve risks, uncertainties and other factors, many of which are outside our control, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. In some cases you can identify forward-looking statements where statements are preceded by, followed by or include the words “believes,” “expects,” “anticipates,” “plans,” “future,” “potential,” “probably,” “predictions,” “continue” or the negative of such terms or similar expressions. Forward-looking statements included in this 10-K, or incorporated by reference into this 10-K, include, but are not limited to, statements regarding:

|

·

|

projected capital expenditures and related funding requirements;

|

|

·

|

the availability and cost of capital;

|

|

·

|

developments, trends and consolidation in the water and wastewater utility industries;

|

|

·

|

dividend payment projections;

|

|

·

|

our ability to successfully acquire and integrate regulated water and wastewater systems, as well as unregulated businesses, that are complementary to our operations and the growth of our business;

|

|

·

|

the capacity of our water supplies, water facilities and wastewater facilities;

|

|

·

|

the impact of limited geographic diversity on our exposure to unusual weather;

|

|

·

|

the impact of conservation awareness of customers and more efficient plumbing fixtures and appliances on water usage per customer;

|

|

·

|

our capability to pursue timely rate increase requests;

|

|

·

|

our authority to carry on our business without unduly burdensome restrictions;

|

|

·

|

our ability to maintain our operating costs at the lowest possible level, while providing good quality water service;

|

|

·

|

our ability to obtain fair market value for condemned assets;

|

|

·

|

the impact of fines and penalties;

|

|

·

|

changes in laws, governmental regulations and policies, including environmental, health and water quality and public utility regulations and policies;

|

|

·

|

the decisions of governmental and regulatory bodies, including decisions to raise or lower rates;

|

|

·

|

our ability to successfully extend and expand our service contract work within our Service and Rentals Segment;

|

|

·

|

the development of new services and technologies by us or our competitors;

|

|

·

|

the availability of qualified personnel;

|

|

·

|

the condition of our assets;

|

|

·

|

the impact of legal proceedings;

|

|

·

|

general economic conditions;

|

|

·

|

the profitability of our Real Estate Segment, which is subject to the amount of land we have available for sale and/or donation, the demand for any available land, the continuation of the current state tax benefits relating to the donation of land for open space purposes and regulatory approval for land dispositions; and

|

|

·

|

acquisition-related costs and synergies.

|

Because forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including but not limited to:

|

·

|

changes in general economic, business, credit and financial market conditions;

|

|

·

|

changes in government regulations and policies, including environmental and public utility regulations and policies;

|

|

·

|

changes in environmental conditions, including those that result in water use restrictions;

|

|

·

|

abnormal weather conditions;

|

|

·

|

increases in energy and fuel costs;

|

|

·

|

unfavorable changes to the federal and/or state tax codes;

|

|

·

|

significant changes in, or unanticipated, capital requirements;

|

|

·

|

significant changes in our credit rating or the market price of our common stock;

|

|

·

|

our ability to integrate businesses, technologies or services which we may acquire;

|

|

·

|

our ability to manage the expansion of our business;

|

|

·

|

the extent to which we are able to develop and market new and improved services;

|

|

·

|

the continued demand by telecommunication companies for antenna site leases on our property;

|

|

·

|

the effect of the loss of major customers;

|

|

·

|

our ability to retain the services of key personnel and to hire qualified personnel as we expand;

|

|

·

|

labor disputes;

|

|

·

|

increasing difficulties in obtaining insurance and increased cost of insurance;

|

|

·

|

cost overruns relating to improvements or the expansion of our operations;

|

|

·

|

increases in the costs of goods and services;

|

|

·

|

civil disturbance or terroristic threats or acts; and

|

|

·

|

changes in accounting pronouncements.

|

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this 10-K and the documents that we incorporate by reference into this 10-K completely and with the understanding that our actual future results, performance and achievements may be materially different from what we expect. These forward-looking statements represent our assumptions, expectations and beliefs only as of the date of this 10-K. Except for our ongoing obligations to disclose certain information under the federal securities laws, we are not obligated, and assume no obligation, to update these forward-looking statements, even though our situation may change in the future. For further information or other factors which could affect our financial results and such forward-looking statements, see Part I, Item 1A “Risk Factors.” We qualify all of our forward-looking statements by these cautionary statements.

PART I

The Company

The Registrant, Connecticut Water Service, Inc. (referred to as “the Company”, “we”, “us”, or “our”) was incorporated in 1974, with The Connecticut Water Company (Connecticut Water) as its largest subsidiary which was organized in 1956. Connecticut Water Service, Inc. is a non-operating holding company, whose income is derived from the earnings of its four wholly-owned subsidiary companies. In 2010, approximately 88% of the Company’s net income was attributable to water activities carried out within its regulated water company, Connecticut Water. As of December 31, 2010, Connecticut Water supplied water to 89,402 customers, representing a population of over 300,000, in 55 towns throughout Connecticut. As a regulated water company, Connecticut Water is subject to state regulation regarding financial issues, rates, and operating issues, and to various other state and federal regulatory agencies concerning water quality and environmental standards.

In addition to its regulated utility, the Company owns two active unregulated companies as of December 31, 2010. In 2010, these unregulated companies, together with real estate transactions within Connecticut Water, contributed the remaining 12% of the Company’s net income through real estate transactions as well as services and rentals. The two active companies are Chester Realty, Inc., a real estate company in Connecticut; and New England Water Utility Services, Inc. (NEWUS), which provides contract water and sewer operations and other water related services.

Our mission is to provide high quality water service to our customers at a fair return to our shareholders while maintaining a work environment that attracts, retains and motivates our employees to achieve a high level of performance.

Our corporate headquarters are located at 93 West Main Street, Clinton, Connecticut 06413. Our telephone number is (860) 669-8636, and our internet address is www.ctwater.com.

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and all amendments to these documents will be made available free of charge through the “INVESTOR INFORMATION” menu of the Company’s internet website (http://www.ctwater.com) as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). The following documents are also available through the “CORPORATE GOVERNANCE” section of our website:

|

·

|

Employee Code of Conduct

|

|

·

|

Audit Committee Charter

|

|

·

|

Board of Directors Code of Conduct

|

|

·

|

Compensation Committee Charter

|

|

·

|

Corporate Governance Committee Charter

|

Additionally, information concerning the Company’s 2011 Annual Meeting Materials (2010 Annual Report and 2011 Proxy Statement) can be found under the “INVESTOR INFORMATION” menu, under the “Annual Report and Annual Meeting” tab. The Company’s amended bylaws are available under the “CUSTOMER INFORMATION” menu.

Copies of each of the Company’s SEC filings (without exhibits) and corporate governance documents mentioned above will also be mailed to investors, upon request, by contacting the Company’s Corporate Secretary, Kristen A. Johnson, at Connecticut Water, 93 West Main Street, Clinton, CT 06413.

Our Regulated Business

Our business is subject to seasonal fluctuations and weather variations. The demand for water is generally greater during the warmer months than the cooler months due to customers’ incremental water consumption related to cooling systems and various outdoor uses such as private and public swimming pools and lawn sprinklers. Demand will vary with rainfall and temperature levels from year to year and season to season, particularly during the warmer months.

In general, the profitability of the water utility industry is largely dependent on the timeliness and adequacy of rates allowed by utility regulatory commissions. In addition, profitability is affected by numerous factors over which we have little or no control, such as costs to comply with security, environmental, and water quality regulations. Inflation and other factors also impact costs for construction, materials and personnel related expenses.

Costs to comply with environmental and water quality regulations are substantial. Since the 1974 enactment of the Safe Drinking Water Act, we have spent approximately $59.7 million in constructing facilities and conducting aquifer mapping necessary to comply with the requirements of the Safe Drinking Water Act, and other federal and state regulations, of which $7.6 million was expended in the last five years. The Company expects to spend approximately $1.2 million in 2011 on Safe Water Drinking Act projects, primarily to bring newly acquired systems up to the Company’s standards. The Company believes that we are presently in compliance with current regulations, but the regulations are subject to change at any time. The costs to comply with future changes in state or federal regulations, which could require us to modify existing filtration facilities and/or construct new ones, or to replace any reduction of the safe yield from any of our current sources of supply, could be substantial.

Connecticut Water derives its rights and franchises to operate from special Connecticut acts that are subject to alteration, amendment or repeal and do not grant us exclusive rights to our service areas. Our franchises are free from burdensome restrictions, are unlimited as to time, and authorize us to sell potable water in all the towns we now serve. There is the possibility that the State of Connecticut could attempt to revoke our franchises and allow a governmental entity to take over some or all of our systems. While we would vigorously oppose any such attempts, from time to time such legislation is contemplated.

The rates we charge our water customers are established under the jurisdiction of and are approved by the Connecticut Department of Public Utility Control (DPUC). It is our policy to seek rate relief as necessary to enable us to achieve an adequate rate of return. Connecticut Water’s allowed return on equity and return on rate base, effective as of July 14, 2010 are 9.75% and 7.32%, respectively. Prior to July 14, 2010, Connecticut Water’s allowed return on equity and return on rate base were 10.125% and 8.07%, respectively.

On October 29, 2009, Connecticut Water filed its second Water Infrastructure Conservation Act (WICA) application with the DPUC, requesting a 2.15% surcharge to customers’ bills, inclusive of the 0.95% surcharge approved in July 2009. In response to that application on December 23, 2009, the DPUC approved a cumulative WICA surcharge of 2.1%. The 2.1% surcharge appeared on customers’ bills beginning January 1, 2010 and remained until July 14, 2010 when, upon the implementation of a general rate increase it was incorporated into base rates and was no longer a surcharge.

On January 6, 2010, Connecticut Water filed a rate application with the DPUC, requesting a multi-year increase totaling $19.1 million above pro forma test year revenues, including the aforementioned WICA surcharge, over a three-year period. The Company had proposed options for regulatory consideration, including a multi-year phase-in of rates that, if approved, would have been a first in Connecticut for water utilities. In addition to the phased-in rate increase, the Company also sought a Water Conservation Adjustment Mechanism (“WCAM”), to allow the Company to continue to promote water conservation in an effective manner while addressing the financial impact of increased conservation by its customers. The WCAM would have minimized the effects of conservation on the Company’s revenues through a recovery mechanism that would have been limited to a change in non-weather related residential sales, while at the same time allowing for the promotion of conservation to the benefit of customers and the environment, usually two opposing concerns. In addition to the conservation efforts that have impacted sales, the need for an increase in rates was, in part, based upon an investment of approximately $62 million in Net Utility Plant since 2006, the last time the Company filed for a general rate increase. In addition, increased operating costs for labor, employee benefits and other general operating needs, including chemicals, was requested.

On July 14, 2010, the DPUC issued its Final Decision in the case, granting an increase in revenues of $8.0 million, or approximately 13%, over pro forma test year revenues. The DPUC approved a return on equity of 9.75%, lower than the 11.3% requested. The new rates became effective for services rendered on or after July 14, 2010, at which point the previously approved WICA surcharges were folded into customers’ base charges. The DPUC did not approve Connecticut Water’s requested WCAM approach to align conservation incentives for both Connecticut Water and its customers. Of Connecticut Water’s three-year requested increase of $19.1 million, $16.3 million was associated with the initial year. The DPUC chose to not consider years 2 and 3 included in Connecticut Water’s application. Connecticut Water is not precluded from seeking increased rates for future years as part of a new general rate filing should it choose to do so.

On October 29, 2010, Connecticut Water filed a WICA application with the DPUC requesting a 1.58% surcharge to customer bills representing investments of approximately $9.4 million in WICA related projects. On December 28, 2010, the DPUC approved the 1.58% surcharge effective for all bills issued after January 1, 2011.

Our Water Systems

Our water infrastructure consists of 62 noncontiguous water systems in the State of Connecticut. Our system, in total, consists of approximately 1,500 miles of water main and reservoir storage capacity of 7.0 billion gallons. The safe, dependable yield from our 214 active wells and 18 reservoirs is approximately 54 million gallons per day. Water sources vary among the individual systems, but overall approximately 34% of the total dependable yield comes from reservoirs and 66% from wells.

For the year-ended December 31, 2010, Connecticut Water’s 89,402 customers consumed approximately 7.0 billion gallons of water generating $66,408,000 in revenue. We supply water, and in most cases, fire protection to all or portions of 55 towns in Connecticut.

The following table breaks down the above total figures by customer class as of December 31, 2010, 2009 and 2008:

|

2010

|

2009

|

2008

|

||||||||||

|

Customers:

|

||||||||||||

|

Residential

|

79,604 | 78,820 | 78,254 | |||||||||

|

Commercial

|

5,692 | 5,690 | 5,646 | |||||||||

|

Industrial

|

422 | 425 | 425 | |||||||||

|

Public Authority

|

609 | 608 | 606 | |||||||||

|

Fire Protection

|

1,724 | 1,705 | 1,648 | |||||||||

|

Other (including non-metered accounts)

|

1,351 | 1,286 | 782 | |||||||||

|

Total

|

89,402 | 88,534 | 87,361 | |||||||||

|

Water Revenues (in thousands):

|

||||||||||||

|

Residential

|

$ | 42,103 | $ | 36,471 | $ | 37,963 | ||||||

|

Commercial

|

7,725 | 6,729 | 7,150 | |||||||||

|

Industrial

|

1,755 | 1,459 | 1,822 | |||||||||

|

Public Authority

|

2,280 | 1,926 | 2,027 | |||||||||

|

Fire Protection

|

11,430 | 10,958 | 10,606 | |||||||||

|

Other (including non-metered accounts)

|

1,115 | 1,848 | 1,702 | |||||||||

|

Total

|

$ | 66,408 | $ | 59,391 | $ | 61,270 | ||||||

|

Customer Water Consumption (millions of gallons):

|

||||||||||||

|

Residential

|

5,124 | 4,737 | 4,954 | |||||||||

|

Commercial

|

1,151 | 1,078 | 1,180 | |||||||||

|

Industrial

|

335 | 306 | 396 | |||||||||

|

Public Authority

|

348 | 351 | 365 | |||||||||

|

Total

|

6,958 | 6,472 | 6,895 | |||||||||

Connecticut Water owns various small, discrete parcels of land that are no longer required for water supply purposes. At December 31, 2010, this land totaled approximately 490 acres. Over the past several years, we have been disposing of these land parcels. For more information, please refer to Segments of Our Business below.

Additional information on land dispositions can be found in Item 7 – Management’s Discussion and Analysis of Financial Conditions and Results of Operations – Commitments and Contingencies.

Competition

Connecticut Water faces competition from a few small privately-owned water systems operating within, or adjacent to, our franchise areas and from municipal and public authority systems whose service areas in some cases overlap portions of our franchise areas.

Employees

As of December 31, 2010, we employed a total of 204 persons. Our employees are not covered by collective bargaining agreements.

Organizational Review

As part of a broader organizational review, beginning in July 2010, the Company examined both its regulated and unregulated operations to ensure that it is maximizing the Company’s financial results while maintaining the high quality water and service our customers have come to expect. During the third quarter the Company determined that a targeted reduction in workforce was appropriate. The Company eliminated approximately 15 positions that centered on traditional managerial, officer and overhead positions. The Company did not eliminate positions in direct service of its customers. The Company recorded a one-time charge of approximately $786,000 related to this organizational review. This charge represents the aggregate severance benefit provided to the employees leaving the Company and other costs associated with the review. As of December 31, 2010, all payments related to the organizational review have been made. The Company expects that the Organizational Review undertaken during 2010 will provide savings in future periods related to labor and employee benefit expenses.

Executive Officers of the Registrant

The following is a list of the executive officers of the Company:

|

Name

|

Age in 2011*

|

Office

|

Period Held or Prior Position

|

Term of Office Expires

|

||||

|

E. W. Thornburg

|

50

|

Chairman, President, and Chief Executive Officer

|

Held position since March 2006

|

2011 Annual Meeting

|

||||

|

D. C. Benoit

|

54

|

Vice President – Finance, Chief Financial Officer and Treasurer

|

Held current position or other executive position with the Company since April 1996

|

2011 Annual Meeting

|

||||

|

T. P. O’Neill

|

56

|

Vice President – Service Delivery

|

Held current position or other engineering position with the Company since February 1980

|

2011 Annual Meeting

|

||||

|

M. P. Westbrook

|

52

|

Vice President – Customer and Regulatory Affairs

|

Held current position or other management position with the Company since September 1988

|

2011 Annual Meeting

|

||||

|

K. A. Johnson

|

44

|

Vice President – Human Resources and Corporate Secretary

|

Held current position or other human resources position with the Company since May 2007. Ms. Johnson previously served as the senior vice president, Human Resources and Organizational Development Officer for Rockville Bank.

|

2011 Annual Meeting

|

* - Age shown is as of filing date of March 11, 2011.

For further information regarding the executive officers see the Company’s Proxy Statement dated March 31, 2011.

Segments of Our Business

For management and financial reporting purposes we divide our business into three segments: Water Activities, Real Estate Transactions, and Services and Rentals.

Water Activities – The Water Activities segment is comprised of our core regulated water activities to supply public drinking water to our customers. This segment encompasses all transactions of our regulated water company with the exception of certain real estate transactions.

Real Estate Transactions – Our Real Estate Transactions segment involves the sale or donation for income tax benefits of our real estate holdings. These transactions can be effected by any of our subsidiary companies. Through land donations and sales in previous years, the Company earned tax credits to use in future years. The Company is limited by time and the amount of taxable income when using these credits. During 2009, the Company completed the sale of a conservation easement of approximately 200 acres to the Town of Windsor Locks, CT. Additionally, the Company made adjustments to tax valuation allowances associated with land donations made in previous years. Finally, Chester Realty sold a non-regulated rental property in Killingly, CT for a small profit. During 2008 and 2010, the Company did not make any land sales or donations; however, it did adjust its valuation allowances. The Company is currently in discussions to sell approximately 175 acres to the Town of Plymouth, CT for open space purposes. The Company expects the transaction, if approved by the Town’s residents and the DPUC, to be completed in late 2011 or early 2012.

A breakdown of the net income of this segment between our regulated and unregulated companies for the past three years is as follows:

|

Income (Loss) from Real Estate Transactions from Continuing Operations

|

||||||||||||

|

Regulated

|

Unregulated

|

Total

|

||||||||||

|

2010

|

$ | (7,000 | ) | $ | 237,000 | $ | 230,000 | |||||

|

2009

|

$ | 1,427,000 | $ | 22,000 | $ | 1,449,000 | ||||||

|

2008

|

$ | (160,000 | ) | -- | $ | (160,000 | ) | |||||

Services and Rentals – Our Services and Rentals segment provides contracted services to water and wastewater utilities and other clients and also leases certain of our properties to third parties through our unregulated companies. The types of services provided include contract operations of water and wastewater facilities; Linebacker®, our service line protection plan for public drinking water customers; and providing bulk deliveries of emergency drinking water to businesses and residences via tanker truck. Our lease and rental income comes primarily from the renting of residential and commercial property.

Linebacker® is an optional service line protection program offered by the Company to eligible residential customers through NEWUS covering the cost of repairs for leaking or broken water service lines which provide drinking water to a customer’s home. For customers who enroll in this program, the Company will repair or replace a leaking or broken water service line, curb box, curb box cover, meter pit, meter pit cover, meter pit valve plus in-home water main shut off valve before the meter. Beginning in January 2010 with the acquisition of certain assets from Home Service USA, NEWUS expanded its coverage offerings to Connecticut Water customers for failure of in-home plumbing and sewer and septic drainage lines. Depending on the coverage selected, the Linebacker® program costs between $70 and $170 per year for residential customers. As of December 31, 2010, the Company had 21,761 customers enrolled in its Linebacker® protection program. Of these, 3,079 customers were enrolled in one of the expanded plans.

Some of the services listed above, including the service line protection plan, have little or no competition. But there can be considerable competition for contract operations of large water and wastewater facilities and systems. However, we have sought to develop a niche market by seeking to serve smaller facilities and systems in our service areas where there is less competition. The Services and Rentals segment, while still a relatively small portion of our overall business, has grown over the past five years and has provided approximately 9%, 9% and 8% of our overall net income in 2010, 2009 and 2008, respectively. Net income generated by this segment of our business was $899,000, $929,000 and $790,000 for the years 2010, 2009 and 2008, respectively.

Our business, financial condition, operating results and cash flows can be impacted by a number of factors, including, but not limited to, those set forth below, any one of which could cause our actual results to vary materially from recent results or anticipated future results. For a discussion identifying additional risk factors and important factors that could cause actual results to differ materially from those anticipated, see the discussion in “Forward Looking Information” in Item 7 below – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Notes to Consolidated Financial Statements.”

Because we incur significant capital expenditures annually, we depend on the rates we charge our customers, which are subject to regulation.

The water utility business is capital intensive. On an annual basis, we spend significant sums for additions to or replacement of property, plant and equipment. Our ability to maintain and meet our financial objectives is dependent upon the rates we charge our customers. These rates are subject to approval by the DPUC. The Company is entitled to file rate increase requests, from time to time, to recover our investments in utility plant and expenses. Once a rate increase petition is filed with the DPUC, the ensuing administrative and hearing process may be lengthy and costly. We can provide no assurances that any future rate increase requests will be approved by the DPUC; and, if approved, we cannot guarantee that any such rate increase requests will be granted in a timely or sufficient manner to cover the investments and expenses for which we initially sought the rate increase. Additionally, the DPUC may rule that a company must reduce its rates.

Under a 2007 law, the DPUC may authorize regulated water companies to use a rate adjustment mechanism, known as a Water Infrastructure and Conservation Adjustment (WICA), for eligible projects completed and in service for the benefit of the customers. For more information related to WICA, please refer to the “Executive Overview” found in Item 7 of this Form 10-K.

If we are unable to pay the principal and interest on our indebtedness as it comes due, or we default under certain other provisions of our loan documents, our indebtedness could be accelerated and our results of operations and financial condition could be adversely affected.

As of December 31, 2010, we had $111.7 million in long-term debt outstanding and $26.3 million in bank loans payable. Our ability to pay the principal and interest on our indebtedness as it comes due will depend upon our current and future performance. Our performance is affected by many factors, some of which are beyond our control. We believe that our cash generated from operations, and, if necessary, borrowing under our existing and planned credit facilities, will be sufficient to enable us to make our debt payments as they become due. If, however, we do not generate sufficient cash, we may be required to refinance our obligations or sell additional equity, which may be on terms that are not favorable to the Company as current terms.

No assurance can be given that any refinancing or sale of equity will be possible when needed or that we will be able to negotiate acceptable terms. In addition, our failure to comply with certain provisions contained in our trust indentures and loan agreements relating to our outstanding indebtedness could lead to a default on these documents, which could result in an acceleration of our indebtedness.

Credit market volatility may affect our ability to refinance our existing debt, borrow funds under our existing lines of credit or incur additional debt.

During certain periods over the past several years, the volatility and disruption in the credit markets reached unprecedented levels. In many cases, the markets contained limited credit capacity for certain issuers, and lenders had requested shorter terms. The market for new debt financing was limited and in some cases not available at all. In addition, the markets had increased the uncertainty that lenders will be able to comply with their previous commitments. The Company noted improvements beginning during the second half of 2009 and throughout 2010. If market disruption and volatility return, the Company may not be able to refinance our existing debt when it comes due, draw upon our existing lines of credit or incur additional debt, which may require us to seek other funding sources to meet our liquidity needs or to fund our capital expenditures budget. We cannot assure you that we will be able to obtain debt or other financing on reasonable terms, or at all.

Failure to maintain our existing credit ratings could affect our cost of funds and related margins and liquidity position.

Since 2003, Standard & Poor's Ratings Services has rated our outstanding debt and has given credit ratings to us and our subsidiary The Connecticut Water Company. Their evaluations are based on a number of factors, which include financial strength as well as transparency with rating agencies and timeliness of financial reporting. On November 1, 2010, Standard & Poor's Ratings Services reaffirmed their ‘A’ credit rating on Connecticut Water Service, Inc. and The Connecticut Water Company, both with an outlook of "stable". There can be no assurance that we will be able to maintain our current strong credit ratings. Failure to do so could adversely affect our cost of funds and related margins and liquidity position.

Market disruptions caused by the worldwide financial crisis could affect our ability to meet our liquidity needs at reasonable cost and our ability to meet long-term commitments, which could adversely affect our financial condition and results of operations.

During 2009, the Company increased its lines of credit from $21 million to $40 million. During 2010, the Company renewed these lines of credit as they expired, with similar terms. We rely on our revolving credit facilities and the capital markets to satisfy our liquidity needs. A return to disruptions in the credit markets or further deterioration of the banking industry’s financial condition, may discourage or prevent lenders from meeting their existing lending commitments, extending the terms of such commitments or agreeing to new commitments. Market disruptions may also limit our ability to issue debt securities in the capital markets.

Our inability to comply with debt covenants under our credit facilities could result in prepayment obligations.

We are obligated to comply with debt covenants under our loan and debt agreements. Failure to comply with covenants under our credit facilities could result in an event of default, which if not timely cured or waived, could result in us being required to repay or finance these borrowings before their due date, could limit future borrowings, and result in cross default issues and increase borrowing costs. The covenants are normal and customary in bank and loan agreements. The Company was in compliance with all covenants at December 31, 2010.

Market conditions may unfavorably impact the value of our benefit plan assets and liabilities which then could require significant additional funding.

The performance of the capital markets affects the values of the assets that are held in trust to satisfy future obligations under the Company’s pension and postretirement benefit plans and could significantly impact our results of operations and financial position. As detailed in the Notes to Consolidated Financial Statements, the Company has significant obligations in these areas and the Company holds significant assets in these trusts. These assets are subject to market fluctuations, which may affect investment returns, which may fall below the Company’s projected return rates. A decline in the market value of the pension and postretirement benefit plan assets will increase the funding requirements under the Company’s pension and postretirement benefit plans if the actual asset returns do not recover these declines in value. Additionally, the Company’s pension and postretirement benefit plan liabilities are sensitive to changes in interest rates. As interest rates decrease, the liabilities increase, potentially increasing benefit expense and funding requirements. Further, changes in demographics, including increased numbers of retirements or changes in life expectancy assumptions may also increase the funding requirements of the obligations related to the pension and other postretirement benefit plans. Also, future increases in pension and other postretirement costs as a result of reduced plan assets may not be fully recoverable from our customers, and the results of operations and financial position of the Company could be negatively affected.

Our operating costs could be significantly increased because of state and federal environmental and health and safety laws and regulations.

Our water and wastewater operations are governed by extensive federal and state environmental protection and health and safety laws and regulations, including the federal Safe Drinking Water Act, the Clean Water Act and similar state laws, and federal and state regulations issued under these laws by the U.S. Environmental Protection Agency and state environmental regulatory agencies. These laws and regulations establish, among other things, criteria and standards for drinking water and for discharges into the waters of the United States and/or Connecticut. Pursuant to these laws, we are required to obtain various environmental permits from environmental regulatory agencies for our operations. We cannot assure that we have been or will be at all times in full compliance with these laws, regulations and permits. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators.

Environmental laws and regulations are complex and change frequently. These laws, and the enforcement thereof, have tended to become more stringent over time. While we have budgeted for future capital and operating expenditures to maintain compliance with these laws and our permits, it is possible that new or stricter standards could be imposed that will raise our operating costs. Although these costs may be recovered in the form of higher rates, there can be no assurance that the DPUC would approve rate increases to enable us to fully recover such costs. In summary, we cannot be assured that our costs of complying with, or discharging liabilities under, current and future environmental and health and safety laws will not adversely affect our business, results of operations or financial condition.

Climate change laws and regulations may be adopted that could require compliance with greenhouse gas emissions standards and other climate change initiatives. Additional capital expenditures could be required and our operating costs could be increased in order to comply with new regulatory standards imposed by federal and state environmental agencies.

Climate change is receiving ever increasing attention worldwide. Many scientists, legislators, and others attribute global warming to increased levels of greenhouse gases, including carbon dioxide, which has led to significant legislative and regulatory efforts to limit greenhouse gas emissions. Possible new climate change laws and regulations, if enacted, may require us to monitor and/or change our utility operations. It is possible that new standards could be imposed that will require additional capital expenditures or raise our operating costs. Because it is uncertain what laws will be enacted, we cannot predict the potential impact of such laws on our future consolidated financial condition, results of operations, or cash flows. Although these expenditures and costs may be recovered in the form of higher rates, there can be no assurance that the DPUC or other regulatory bodies that govern our business would permit us to recover such expenditures and costs. We cannot assure you that our costs of complying with new standards or laws will not adversely affect our business, results of operations or financial condition.

New Streamflow Regulations could potentially impact our ability to serve our customers.

In 2009, the Connecticut Department of Environmental Protection (DEP) formally proposed new regulations relative to the flow of water in the State’s rivers and streams. In October and again in December 2010, the State Legislature’s Regulations Review Committee rejected the proposed rules as written, and later as revised by the DEP. Since the regulations were rejected, the DEP is working to develop regulations that will be acceptable to a majority of stakeholders. Any new streamflow regulation has the potential to restrict our access to water, raise our capital and operating expenses and adversely affect our revenues and earnings. Although these costs may be recovered in the form of higher rates, there can be no assurance the DPUC would approve rate increases to enable us to recover such costs.

Our business is subject to seasonal fluctuations which could adversely affect demand for our water services and our revenues.

Demand for our water during the warmer months is generally greater than during cooler months due primarily to additional requirements for water in connection with irrigation systems, swimming pools, cooling systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand will vary with temperature and rainfall levels. In the event that temperatures during the typically warmer months are cooler than normal, or if there is more rainfall than normal, the demand for our water may decrease and adversely affect our revenues.

Declining per customer residential water usage may reduce our revenues, financial condition and results of operations in future years.

A trend of declining per customer residential water usage in Connecticut has been observed for the last several years, which we would attribute to increased water conservation, including the use of more efficient household fixtures and appliances among residential users. Our regulated business is heavily dependent on revenue generated from rates we charge to our residential customers for the volume of water they use. The rate we charge for our water is regulated by the DPUC and we may not unilaterally adjust our rates to reflect changes in demand. Declining volume of residential water usage may have a negative impact on our operating revenues in the future if regulators do not reflect any usage declines in the rate setting design process.

Potential regulatory changes or drought conditions may impact our ability to serve our current and future customers’ demand for water and our financial results.

We depend on an adequate water supply to meet the present and future demands of our customers. Changes in regulatory requirements could affect our ability to utilize existing supplies and/or secure new sources, as required. Insufficient supplies or an interruption in our water supply could have a material adverse effect on our financial condition and results of operations. Although not occurring in 2010, drought conditions could interfere with our sources of water supply and could adversely affect our ability to supply water in sufficient quantities to our existing and future customers. An interruption in our water supply could have a material adverse effect on our financial condition and results of operations. Moreover, governmental restrictions on water usage during drought conditions may result in a decreased demand for our water, even if our water reserves are sufficient to serve our customers during these drought conditions, which may adversely affect our revenues and earnings.

We are increasingly dependent on the continuous and reliable operation of our information technology systems.

We rely on our information technology systems in connection with the operation of our business, especially with respect to customer service and billing, accounting and, in some cases, the monitoring and operation of our treatment, storage and pumping facilities. A loss of these systems or major problems with the operation of these systems could affect our operations and have a significant material adverse effect on our results of operations.

With the implementation of the Company’s new Enterprise Resource Planning (ERP) system, the Company delayed customer billings in order to verify the integrity of the system and the accuracy of those bills prior to mailing. As a result, some billings and consequently, cash receipts were delayed. The Company has increased its utilization of its lines of credit during this period. Our operations, including plans to continue investment in new infrastructure, were not impacted.

The Company has returned to normal billing and collection processes and does not anticipate delays in billing or collection in subsequent periods. The delay in billing contributed to the increase in the Company’s bad debt expense for the year of approximately $198,000 due to the reserve policy based upon aging of the receivables. The Company fully anticipates that the reserve will return to more historical levels over the first quarter of 2011.

The failure of, or the requirement to repair, upgrade or dismantle, any of our dams may adversely affect our financial condition and results of operations.

We own and operate 32 dams throughout the state of Connecticut. While the Company maintains robust dam maintenance and inspection programs, a failure of any of those dams could result in injuries and damage to residential and/or commercial property downstream for which we may be responsible, in whole or in part. The failure of a dam could also adversely affect our ability to supply water in sufficient quantities to our customers and could adversely affect our financial condition and results of operations. Any losses or liabilities incurred due to the failure of one of our dams might not be covered by insurance policies or be recoverable in rates, and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

Any failure of our reservoirs, storage tanks, mains or distribution networks could result in losses and damages that may affect our financial condition and reputation.

Connecticut Water distributes water through an extensive network of mains and stores water in reservoirs and storage tanks located across Connecticut. A failure of major mains, reservoirs, or tanks could result in injuries and damage to residential and/or commercial property for which we may be responsible, in whole or in part. The failure of major mains, reservoirs or tanks may also result in the need to shut down some facilities or parts of our water distribution network in order to conduct repairs. Such failures and shutdowns may limit our ability to supply water in sufficient quantities to our customers and to meet the water delivery requirements prescribed by governmental regulators, including the DPUC, and adversely affect our financial condition, results of operations, cash flow, liquidity and reputation. Any business interruption or other losses might not be covered by insurance policies or be recoverable in rates, and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

Any future acquisitions we may undertake may involve risks and uncertainties.

An important element of our growth strategy is the acquisition and integration of water systems in order to move into new service areas and to broaden our current service areas. As of the date of this filing, the Connecticut Water Company now serves more than 89,000 customers, or a population of over 300,000 people, in 55 Connecticut towns. We will not be able to acquire other businesses if we cannot identify suitable acquisition opportunities or reach mutually agreeable terms with acquisition candidates. It is our intent, when practical, to integrate any businesses we acquire with our existing operations. The negotiation of potential acquisitions as well as the integration of acquired businesses could require us to incur significant costs and cause diversion of our management's time and resources. Future acquisitions by us could result in:

|

·

|

dilutive issuances of our equity securities;

|

|

·

|

incurrence of debt and contingent liabilities;

|

|

·

|

failure to have effective internal control over financial reporting;

|

|

·

|

fluctuations in quarterly results; and

|

|

·

|

other acquisition-related expenses.

|

Some or all of these items could have a material adverse effect on our business as well as our ability to finance our business and comply with regulatory requirements. The businesses we acquire in the future may not achieve sales and profitability that would justify our investment and any difficulties we encounter in the integration process, including the integration of controls necessary for internal control and financial reporting, could interfere with our operations, reduce our operating margins and adversely affect our internal controls. In addition, as consolidation becomes more prevalent in the water and wastewater industries, the prices for suitable acquisition candidates may increase to unacceptable levels and limit our ability to grow through acquisitions.

Water supply contamination may adversely affect our business.

Our water supplies are subject to contamination, including contamination from the development of naturally-occurring compounds, chemicals in groundwater systems, pollution resulting from man-made sources, such as Methyl Tertiary Butyl Ether (MTBE), and possible terrorist attacks. In the event that our water supply is contaminated, we may have to interrupt the use of that water supply until we are able to substitute the flow of water from an uncontaminated water source or provide additional treatment. We may incur significant costs in order to treat the contaminated source through expansion of our current treatment facilities, or development of new treatment methods. If we are unable to substitute water supply from an uncontaminated water source, or to adequately treat the contaminated water source in a cost-effective manner, there may be an adverse effect on our revenues, operating results and financial condition. The costs we incur to decontaminate a water source or an underground water system could be significant and could adversely affect our business, operating results and financial condition and may not be recoverable in rates. We could also be held liable for consequences arising out of human exposure to hazardous substances in our water supplies or other environmental damage. For example, private plaintiffs have the right to bring personal injury or other toxic tort claims arising from the presence of hazardous substances in our drinking water supplies. Our insurance policies may not be sufficient to cover the costs of these claims.

The need to increase security may continue to increase our operating costs.

In addition to the potential pollution of our water supply as described above, we have taken steps to increase security measures at our facilities and heighten employee awareness of threats to our water supply. We have also tightened our security measures regarding the delivery and handling of certain chemicals used in our business. We have and will continue to bear increased costs for security precautions to protect our facilities, operations and supplies. These costs may be significant. We are currently not aware of any specific threats to our facilities, operations or supplies; however, it is possible that we would not be in a position to control the outcome of terrorist events should they occur.

The accuracy of our judgments and estimates about financial and accounting matters will impact our operating results and financial condition.

We make certain estimates and judgments in preparing our financial statements regarding, among others:

|

·

|

the number of years to depreciate certain assets;

|

|

·

|

amounts to set aside for uncollectible accounts receivable and uninsured losses;

|

|

·

|

our legal exposure and the appropriate accrual for claims, including medical and workers’ compensation claims;

|

|

·

|

future costs for pensions and other post-retirement benefit obligations; and

|

|

·

|

possible tax allowances.

|

The quality and accuracy of those estimates and judgments will have an impact on our operating results and financial condition.

In addition, we must estimate unbilled revenues and costs at the end of each accounting period. If our estimates are not accurate, we will be required to make an adjustment in a future period.

Key employee turnover may adversely affect our operating results.

Our success depends significantly on the continued individual and collective contributions of our management team. The loss of the services of any member of our senior management team or the inability to hire and retain experienced management personnel could harm our operating results.

None

The properties of our regulated water company consist of land, easements, rights (including water rights), buildings, reservoirs, standpipes, dams, wells, supply lines, treatment plants, pumping plants, transmission and distribution mains and conduits, mains and other facilities and equipment used for the collection, purification, storage and distribution of water. In certain cases, our water company may be a party to limited contractual arrangements for the provision of water supply from neighboring utilities. We believe that our properties are in good operating condition. Water mains are located, for the most part, in public streets and, in a few instances, are located on land that we own in fee simple and/or land utilized pursuant to easement right, most of which are perpetual and adequate for the purpose for which they are held.

The net utility plant of the Company at December 31, 2010 was solely owned by Connecticut Water. Connecticut Water’s Net Utility Plant balance as of December 31, 2010 was $344,219,000, approximately $19 million more than the balance of net utility plant as of December 31, 2009, due primarily to normal plant additions and construction spending related to infrastructure improvements.

Sources of water supply owned, maintained, and operated by Connecticut Water include eighteen reservoirs and eighty-nine well fields. In addition, Connecticut Water has agreements with various neighboring water utilities to provide water, at negotiated rates, to our water systems. Collectively, these sources have the capacity to deliver approximately fifty-two million gallons of potable water daily to the thirteen major operating systems in the following table. In addition to the principal systems identified, Connecticut Water owns, maintains, and operates forty-nine small, non-interconnected satellite and consecutive water systems that, combined, have the ability to deliver about two million gallons of additional water per day to their respective systems. For some small consecutive water systems, purchased water may comprise substantially all of the total available supply of the system.

Connecticut Water owns and operates 22 water filtration facilities, having a combined treatment capacity of approximately 29.55 million gallons per day.

The Company’s estimated available water supply, including purchased water agreements, but excluding non-principal systems, is as follows:

|

System

|

Estimated Available Supply

(million gallons per day)

|

|||

|

Chester System

|

1.69 | |||

|

Collinsville System

|

1.65 | |||

|

Danielson System

|

3.76 | |||

|

Gallup System

|

0.60 | |||

|

Guilford System

|

10.10 | |||

|

Naugatuck System

|

7.07 | |||

|

Northern Western System

|

16.55 | |||

|

Plainfield System

|

1.01 | |||

|

Stafford System

|

1.00 | |||

|

Terryville System

|

0.91 | |||

|

Thomaston System

|

1.73 | |||

|

Thompson System

|

0.29 | |||

|

Unionville System

|

6.02 | |||

|

Total

|

52.38 | |||

As of December 31, 2010, the transmission and distribution systems of Connecticut Water consisted of approximately 1,500 miles of main. On that date, approximately 77 percent of our mains were eight-inch diameter or larger. Substantially all new main installations are cement-lined ductile iron pipe of eight-inch diameter or larger.

We believe that our properties are maintained in good condition and in accordance with current regulations and standards of good waterworks industry practice.

We are involved in various legal proceedings from time to time. Although the results of legal proceedings cannot be predicted with certainty, there are no pending legal proceedings to which we, or any of our subsidiaries are a party, or to which any of our properties is subject, that presents a reasonable likelihood of a material adverse impact on the Company’s financial condition, results of operations or cash flows.

PART II

Our Common Stock is traded on the NASDAQ Global Select Market under the symbol “CTWS”. Our quarterly high and low stock prices as reported by NASDAQ and the cash dividends we paid during 2010 and 2009 are listed as follows:

|

Price

|

Dividends

|

|||||||||||

|

Period

|

High

|

Low

|

Paid

|

|||||||||

|

2010

|

||||||||||||

|

First Quarter

|

$ | 25.12 | $ | 21.57 | $ | .2275 | ||||||

|

Second Quarter

|

24.28 | 20.00 | .2275 | |||||||||

|

Third Quarter

|

24.15 | 20.80 | .2325 | |||||||||

|

Fourth Quarter

|

27.90 | 23.60 | .2325 | |||||||||

|

2009

|

||||||||||||

|

First Quarter

|

$ | 24.76 | $ | 17.31 | $ | .2225 | ||||||

|

Second Quarter

|

22.63 | 19.31 | .2225 | |||||||||

|

Third Quarter

|

22.86 | 20.57 | .2275 | |||||||||

|

Fourth Quarter

|

26.45 | 21.68 | .2275 | |||||||||

As of March 1, 2011, there were approximately 3,700 holders of record of our common stock.

We presently intend to pay quarterly cash dividends in 2011 on March 15, June 15, September 15 and December 15, subject to our earnings and financial condition, regulatory requirements and other factors our Board of Directors may deem relevant.

The Company’s Annual Meeting of Shareholders is scheduled for May 12, 2011 in Westbrook, Connecticut.

Purchases of Equity Securities by the Company – In May 2005, the Company adopted a common stock repurchase program (Share Repurchase Program). The Share Repurchase Program allows the Company to repurchase up to 10% of its outstanding common stock, at a price or prices that are deemed appropriate. As of December 31, 2010, no shares have been repurchased. Currently, the Company has no plans to repurchase shares under the Share Repurchase Program.

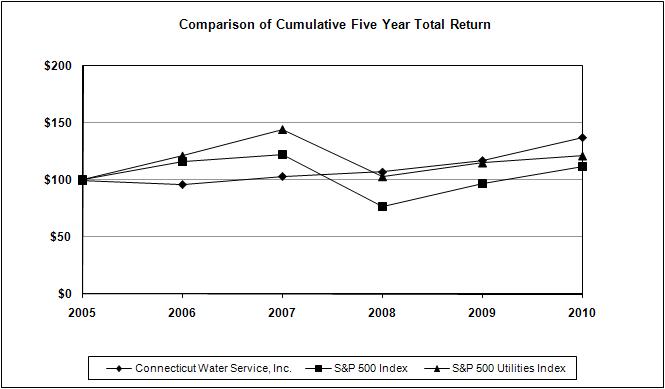

Performance Graph – Set forth below is a line graph comparing the cumulative total shareholder return for each of the years 2005 – 2010 on the Company’s Common Stock, based on the market price of the Common Stock and assuming reinvestment of dividends, with the cumulative total shareholder return of companies in the Standard & Poor’s 500 Index and the Standard and Poor’s 500 Utility Index.

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Connecticut Water Service, Inc.

|

100.00 | 96.31 | 103.44 | 107.31 | 117.36 | 137.52 | ||||||||||||||||||

|

Standard & Poor’s 500 Index

|

100.00 | 115.79 | 122.16 | 76.96 | 97.33 | 111.99 | ||||||||||||||||||

|

Standard & Poor’s 500 Utilities Index

|

100.00 | 120.99 | 144.43 | 102.58 | 114.79 | 121.06 | ||||||||||||||||||

|

SELECTED FINANCIAL DATA

|

||||||||||||||||||||

|

Years Ended December 31, (thousands of dollars except per share

|

||||||||||||||||||||

|

amounts and where otherwise indicated)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME

|

||||||||||||||||||||

|

Continuing Operations

|

||||||||||||||||||||

|

Operating Revenues

|

$ | 66,408 | $ | 59,391 | $ | 61,270 | $ | 59,026 | $ | 46,945 | ||||||||||

|

Operating Expenses

|

$ | 52,573 | $ | 47,003 | $ | 47,874 | $ | 46,324 | $ | 39,962 | ||||||||||

|

Other Utility Income, Net of Taxes

|

$ | 742 | $ | 704 | $ | 579 | $ | 552 | $ | 542 | ||||||||||

|

Total Utility Operating Income

|

$ | 14,577 | $ | 13,092 | $ | 13,975 | $ | 13,254 | $ | 7,525 | ||||||||||

|

Interest and Debt Expense

|

$ | 5,853 | $ | 4,744 | $ | 5,198 | $ | 4,411 | $ | 4,461 | ||||||||||

|

Net Income

|

$ | 9,798 | $ | 10,209 | $ | 9,424 | $ | 8,781 | $ | 6,708 | ||||||||||

|

Cash Common Stock Dividends Paid

|

$ | 7,942 | $ | 7,671 | $ | 7,373 | $ | 7,146 | $ | 7,014 | ||||||||||

|

Dividend Payout Ratio from Continuing Operations

|

81 | % | 75 | % | 78 | % | 81 | % | 105 | % | ||||||||||

|

Weighted Average Common Shares Outstanding

|

8,531,741 | 8,447,950 | 8,377,428 | 8,270,494 | 8,187,801 | |||||||||||||||

|

Basic Earnings Per Common Share from Continuing Operations

|

$ | 1.14 | $ | 1.20 | $ | 1.12 | $ | 1.06 | $ | 0.81 | ||||||||||

|

Number of Shares Outstanding at Year End

|

8,676,849 | 8,573,744 | 8,463,269 | 8,376,842 | 8,270,394 | |||||||||||||||

|

ROE on Year End Common Equity

|

8.7 | % | 9.4 | % | 9.1 | % | 8.8 | % | 7.0 | % | ||||||||||

|

Declared Common Dividends Per Share

|

$ | 0.920 | $ | 0.900 | $ | 0.880 | $ | 0.865 | $ | 0.855 | ||||||||||

|

CONSOLIDATED BALANCE SHEET

|

||||||||||||||||||||

|

Common Stockholders' Equity

|

$ | 113,191 | $ | 108,569 | $ | 103,476 | $ | 100,098 | $ | 95,938 | ||||||||||

|

Long-Term Debt (Consolidated, Excluding Current Maturities)

|

111,675 | 111,955 | 92,227 | 92,285 | 77,347 | |||||||||||||||

|

Preferred Stock

|

772 | 772 | 772 | 772 | 772 | |||||||||||||||

|

Total Capitalization

|

$ | 225,638 | $ | 221,296 | $ | 196,475 | $ | 193,155 | $ | 174,057 | ||||||||||

|

Stockholders' Equity (Includes Preferred Stock)

|

51 | % | 49 | % | 53 | % | 52 | % | 56 | % | ||||||||||

|

Long-Term Debt

|

49 | % | 51 | % | 47 | % | 48 | % | 44 | % | ||||||||||

|

Net Utility Plant

|

$ | 344,219 | $ | 325,202 | $ | 299,233 | $ | 277,662 | $ | 263,187 | ||||||||||

|

Total Assets

|

$ | 425,211 | $ | 415,276 | $ | 372,431 | $ | 360,813 | $ | 328,140 | ||||||||||

|

Book Value - Per Common Share

|

$ | 13.05 | $ | 12.66 | $ | 12.23 | $ | 11.95 | $ | 11.60 | ||||||||||

|

OPERATING REVENUES BY

|

||||||||||||||||||||

|

REVENUE CLASS

|

||||||||||||||||||||

|

Residential

|

$ | 42,103 | $ | 36,471 | $ | 37,963 | $ | 38,354 | $ | 29,067 | ||||||||||

|

Commercial

|

7,725 | 6,729 | 7,150 | 6,762 | 5,652 | |||||||||||||||

|

Industrial

|

1,755 | 1,459 | 1,822 | 1,764 | 1,589 | |||||||||||||||

|

Public Authority

|

2,280 | 1,926 | 2,027 | 1,924 | 1,507 | |||||||||||||||

|

Fire Protection

|

11,430 | 10,958 | 10,606 | 9,482 | 8,708 | |||||||||||||||

|

Other (Including Non-Metered Accounts)

|

1,115 | 1,848 | 1,702 | 740 | 422 | |||||||||||||||

|

Total Operating Revenues

|

$ | 66,408 | $ | 59,391 | $ | 61,270 | $ | 59,026 | $ | 46,945 | ||||||||||

|

Number of Customers (Average)

|

88,895 | 88,390 | 87,028 | 84,023 | 82,552 | |||||||||||||||

|

Billed Consumption (Millions of Gallons)

|

6,958 | 6,472 | 6,895 | 7,257 | 6,918 | |||||||||||||||

|

Number of Employees

|

204 | 225 | 226 | 206 | 200 | |||||||||||||||

FINANCIAL CONDITION

Executive Overview

The Company is a non-operating holding company, whose income is derived from the earnings of its three active wholly-owned subsidiary companies: The Connecticut Water Company (Connecticut Water), New England Water Utility Services, Inc. (NEWUS), and Chester Realty Company (Chester Realty).

In 2010, approximately 88% of the Company’s net income was attributable to the water activities of its largest subsidiary, Connecticut Water, a regulated water utility with 89,402 customers throughout 55 Connecticut towns, as of December 31, 2010. The rates charged for service by Connecticut Water are subject to review and approval by the Connecticut Department of Public Utility Control (DPUC).

In the mid 1990s, Connecticut Water made a conscious decision to minimize its reliance on rate increase requests to drive its financial performance. Instead, it relied upon unregulated operations and cost containment to grow the earnings of the Company without seeking higher rates. After a successful extended period of meeting these objectives, it became clear in 2006 that a rate increase was needed to continue to provide shareholder value through increased earnings. The Company decided to return to the more traditional model of recurring rate increase filings to efficiently collect its cost of both annual expenses and its investment in the infrastructure of the regulated business. In 2006, the Connecticut Water communicated to its customers, regulators and shareholders that it expected to seek rate relief on a more recurring basis.

On January 6, 2010, Connecticut Water filed a rate application with the DPUC, requesting a multi-year increase totaling $19.1 million above pro forma test year revenues, including the aforementioned WICA surcharge, over a three-year period. On July 14, 2010, the DPUC issued its Final Decision in the case, granting an increase in revenues of $8.0 million, or approximately 13%, over pro forma test year revenues. The DPUC approved a return on equity of 9.75%. The new rates became effective for services rendered on or after July 14, 2010, at which point all previously approved infrastructure surcharges were folded into customers’ base charges. The DPUC did not approve Connecticut Water’s multi-year requested increase of $19.1 million, $16.3 million was associated with the initial year. The DPUC chose to not consider years 2 and 3 included in Connecticut Water’s application. The Final Decision does not preclude Connecticut Water from seeking increased rates for future years as part of a new general rate filing should it choose to do so.

Recognizing the importance of timely infrastructure replacement and improvement, the Company, along with other investor-owned regulated water companies in the state, campaigned for the passage of the Water Infrastructure and Conservation Adjustment (WICA) Act in the Connecticut General Assembly, which was adopted in 2007. WICA allows the Company to add a surcharge to customers’ bills, subject to an expedited review and approval by the DPUC and no more than twice a year, to reflect the replacement of certain types of aging utility plant; principally water mains, meters, service lines and water conservation related investments.

On October 29, 2010, Connecticut Water filed a WICA application with the DPUC requesting a 1.58% surcharge to customer bills representing investments of approximately $9.4 million in WICA related projects that were placed into service after April 12, the date the DPUC recognized for rate base purposes during the 2010 rate case. On December 28, 2010, the DPUC approved the 1.58% surcharge effective for all bills issued after January 1, 2011.

The Company has and will continue to focus on minimizing operating costs that are passed along to its customers without sacrificing the quality service it values and the customers demand. At the same time, the Company will continue to employ its current strategy of timely collection of appropriate costs and a fair rate of return for its shareholders through appropriate rates for its regulated water service. As part of a broader organizational review, beginning in July 2010, the Company examined both its regulated and unregulated operations to ensure that it is maximizing the Company’s financial results while maintaining the high quality water and service our customers have come to expect. During the third quarter the Company determined that a targeted reduction in workforce was appropriate. The Company eliminated approximately 15 positions that centered on traditional managerial, officer and overhead positions. The Company did not eliminate positions in direct service of its customers. The Company recorded a one-time pre-tax charge of approximately $786,000 related to this organizational review. This charge represents the aggregate severance benefit provided to the employees leaving the Company, legal costs associated with the review and out placement services provided to the effected employees. The Company will continue to evaluate all segments of its business and will make additional changes if warranted.

The Company prides itself on being able to help water systems that do not have the resources to deliver the best water possible to their customers. On February 16, 2010, the Company announced the acquisition of the assets of water systems in Killingworth and Mansfield, Connecticut. These acquisitions added approximately 500 customers to the Company. The system acquired in Killingworth had water quality issues that the previous owners were unable to address. The Company designed, purchased, and installed a uranium treatment system that was brought on-line in October 2010. Since the treatment system went on-line, uranium has not been detected at the system.

In 2010, Connecticut Water added 70 private well owners in our existing service territories. In 2011 and beyond, the Company will continue its efforts to tie-in private well owners whose homes are in close proximity to our mains. Additionally, the Company will continue to work with developers to encourage public water use for new residential construction within Connecticut Water’s service areas.

While the Company plans to file timely rate cases, continue to make acquisitions and, in the future, utilize the WICA adjustment to allow for more timely recovery of investment in utility plant, it will also look to NEWUS to increase its earnings in the unregulated business. The Company will continue to seek out maintenance and service contracts with new customers and renew existing contracts that have proven to be beneficial to the Company, as well as to continue the expansion of the Linebacker® program. In January 2010, NEWUS acquired the assets of Home Service USA. Prior to the acquisition, Home Service USA offered Connecticut Water customers coverage for failure of home plumbing and septic drainage lines. NEWUS agreed to purchase the right to provide the service to Connecticut Water customers and began offering its own comparable coverage. As part of the agreement, Home Service USA will not offer its products to Connecticut Water customers for a period of ten years. The new products offered by NEWUS have been integrated into the Linebacker® program.