Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CAPITAL SENIOR LIVING CORP | d577746dex991.htm |

| 8-K - FORM 8-K - CAPITAL SENIOR LIVING CORP | d577746d8k.htm |

Capital Senior Living A Leading Pure-Play Senior Housing Owner-Operator Exhibit 99.2

Forward-Looking Statements The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause results to differ materially, including, but not without limitation to, the Company’s ability to complete the refinancing of certain of our wholly owned communities, realize the anticipated savings related to such financing, find suitable acquisition properties at favorable terms, financing, licensing, business conditions, risks of downturns in economic conditions generally, satisfaction of closing conditions such as those pertaining to licensures, availability of insurance at commercially reasonable rates and changes in accounting principles and interpretations among others, and other risks and factors identified from time to time in our reports filed with the Securities and Exchange Commission The Company assumes no obligation to update or supplement forward-looking statements in this presentation that become untrue because of new information, subsequent events or otherwise.

Non-GAAP Financial Measures Adjusted EBITDAR is a financial valuation measure and Adjusted Net Income/(Loss) and Adjusted CFFO are financial performance measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures may have material limitations in that they do not reflect all of the costs associated with our results of operations as determined in accordance with GAAP. As a result, these non-GAAP financial measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. Adjusted EBITDAR is a valuation measure commonly used by our management, research analysts and investors to value companies in the senior living industry. Because Adjusted EBITDAR excludes interest expense and rent expense, it allows our management, research analysts and investors to compare the enterprise values of different companies without regard to differences in capital structures and leasing arrangements. The Company believes that Adjusted Net Income/(Loss) and Adjusted CFFO are useful as performance measures in identifying trends in day-to-day operations because they exclude the costs associated with acquisitions and conversions and other items that do not ordinarily reflect the ongoing operating results of our primary business. Adjusted Net Income/(Loss) and Adjusted CFFO provide indicators to management of progress in achieving both consolidated and individual business unit operating performance and are used by research analysts and investors to evaluate the performance of companies in the senior living industry. The Company strongly urges you to review the reconciliation of net loss to Adjusted EBITDAR and the reconciliation of net (loss) income to Adjusted Net Income/(Loss) and Adjusted CFFO, on the last page of the Company’s first quarter 2018 earnings release dated May 1, 2018, along with the Company’s consolidated balance sheets, statements of operations, and statements of cash flows, which can be found on the Company’s website at www.capitalsenior.com/investor-relations/press-releases/

Capital Senior Living Investment Rationale Attractively Positioned in the Highly Fragmented Senior Housing Market Executing a Long-Term, Sustainable Growth Strategy with a Focus on Real Estate Ownership Track Record of Strong Growth and Uniquely Positioned for Continued Success Capital Plan Supports Long-Term Growth Initiatives CSU has a clear and differentiated real-estate strategy and competitive advantages to drive industry-leading growth and superior shareholder value. 1 4 2 3

Attractively Positioned in the Highly Fragmented Senior Housing Market 1

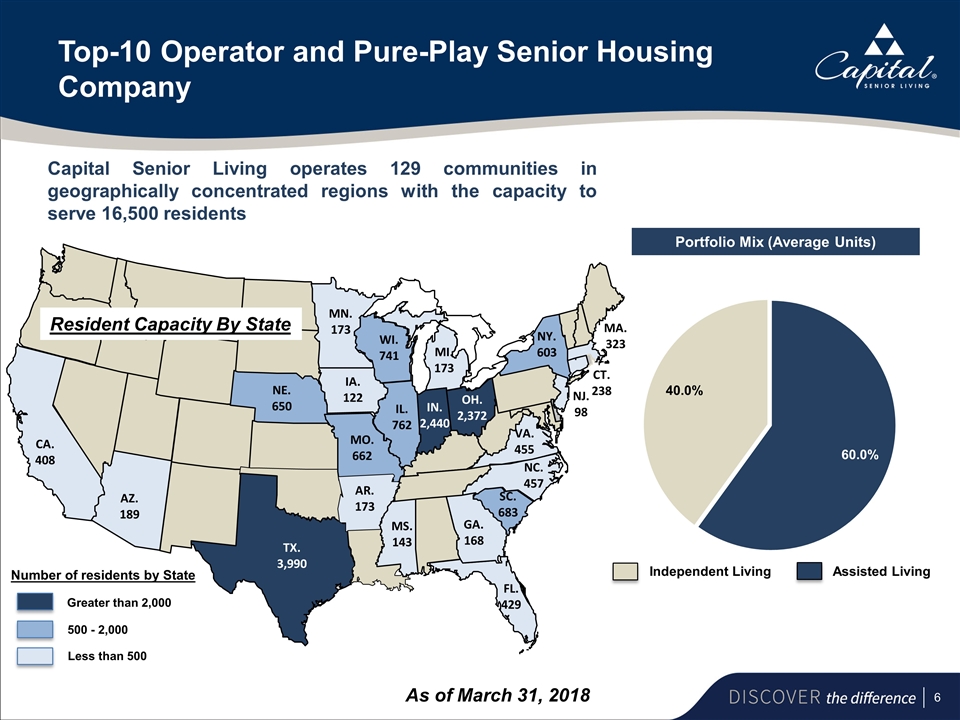

Top-10 Operator and Pure-Play Senior Housing Company Portfolio Mix (Average Units) As of March 31, 2018 AR. 173 AZ. 189 CT. 238 FL. 429 IA. 122 IL. 762 IN. 2,440 MI. 173 MN. 173 MO. 662 MS. 143 NC. 457 SC. 683 NE. 650 NJ. 98 NY. 603 OH. 2,372 TX. 3,990 VA. 455 CA. 408 CA. 408 AZ. 189 Resident Capacity By State Capital Senior Living operates 129 communities in geographically concentrated regions with the capacity to serve 16,500 residents WI. 741 GA. 168 MA. 323 Number of residents by State Greater than 2,000 500 - 2,000 Less than 500 Assisted Living

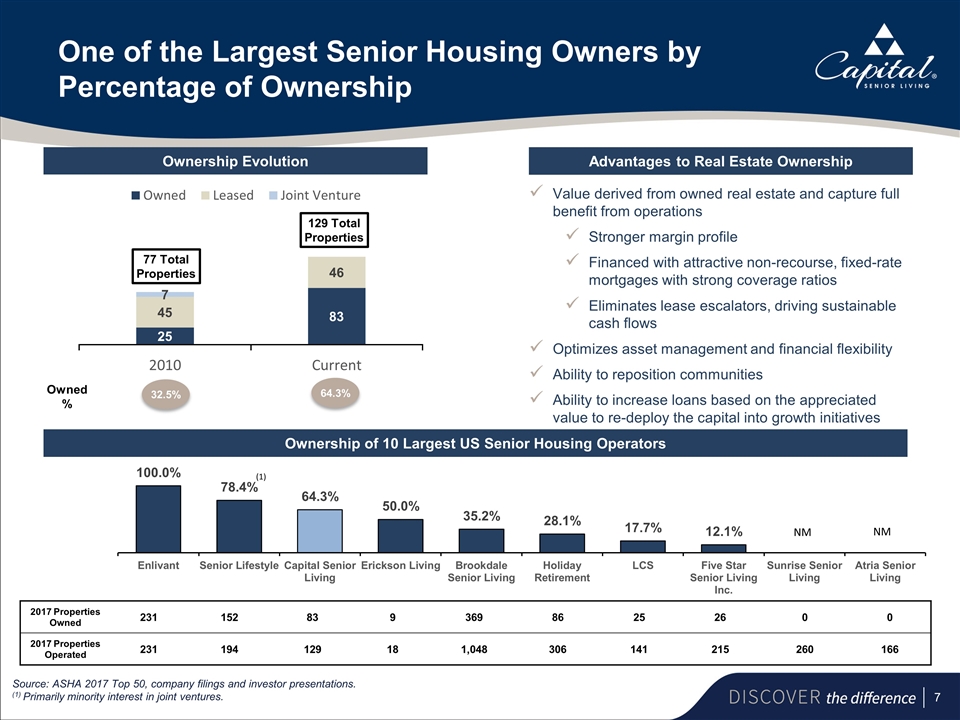

One of the Largest Senior Housing Owners by Percentage of Ownership Ownership Evolution Advantages to Real Estate Ownership Ownership of 10 Largest US Senior Housing Operators Value derived from owned real estate and capture full benefit from operations Stronger margin profile Financed with attractive non-recourse, fixed-rate mortgages with strong coverage ratios Eliminates lease escalators, driving sustainable cash flows Optimizes asset management and financial flexibility Ability to reposition communities Ability to increase loans based on the appreciated value to re-deploy the capital into growth initiatives Owned % 129 Total Properties 77 Total Properties 32.5% 64.3% 2017 Properties Owned 231 152 83 9 369 86 25 26 0 0 2017 Properties Operated 231 194 129 18 1,048 306 141 215 260 166 Source: ASHA 2017 Top 50, company filings and investor presentations. (1) Primarily minority interest in joint ventures. (1) NM NM

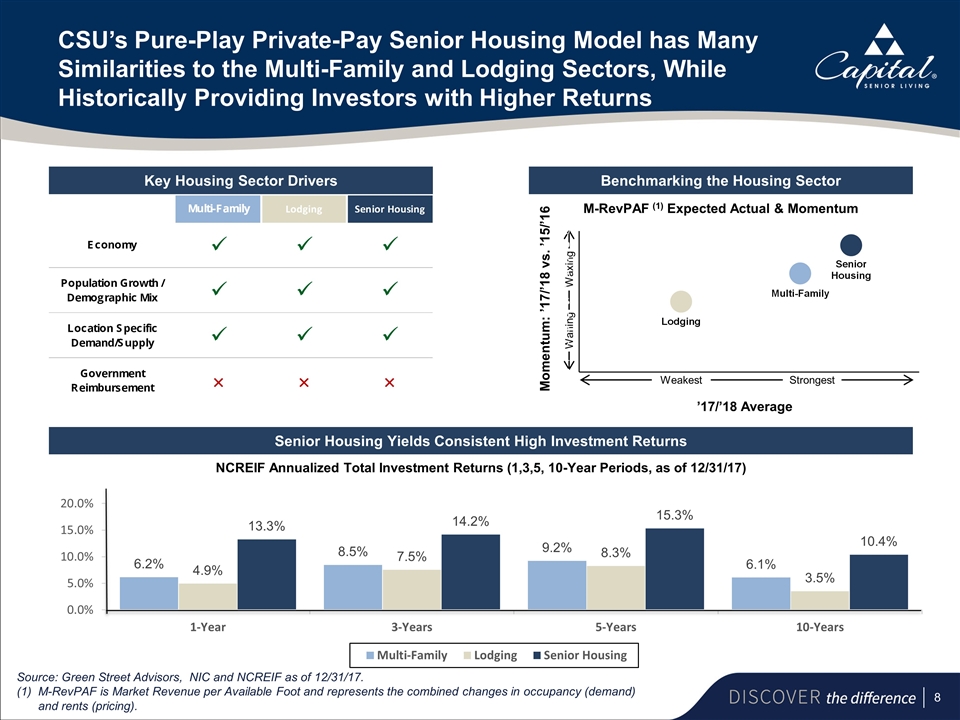

CSU’s Pure-Play Private-Pay Senior Housing Model has Many Similarities to the Multi-Family and Lodging Sectors, While Historically Providing Investors with Higher Returns Key Housing Sector Drivers Benchmarking the Housing Sector Senior Housing Yields Consistent High Investment Returns NCREIF Annualized Total Investment Returns (1,3,5, 10-Year Periods, as of 12/31/17) Momentum: ’17/’18 vs. ’15/’16 ’17/’18 Average M-RevPAF (1) Expected Actual & Momentum Source: Green Street Advisors, NIC and NCREIF as of 12/31/17. (1)M-RevPAF is Market Revenue per Available Foot and represents the combined changes in occupancy (demand) and rents (pricing). Strongest Weakest Waning Waxing

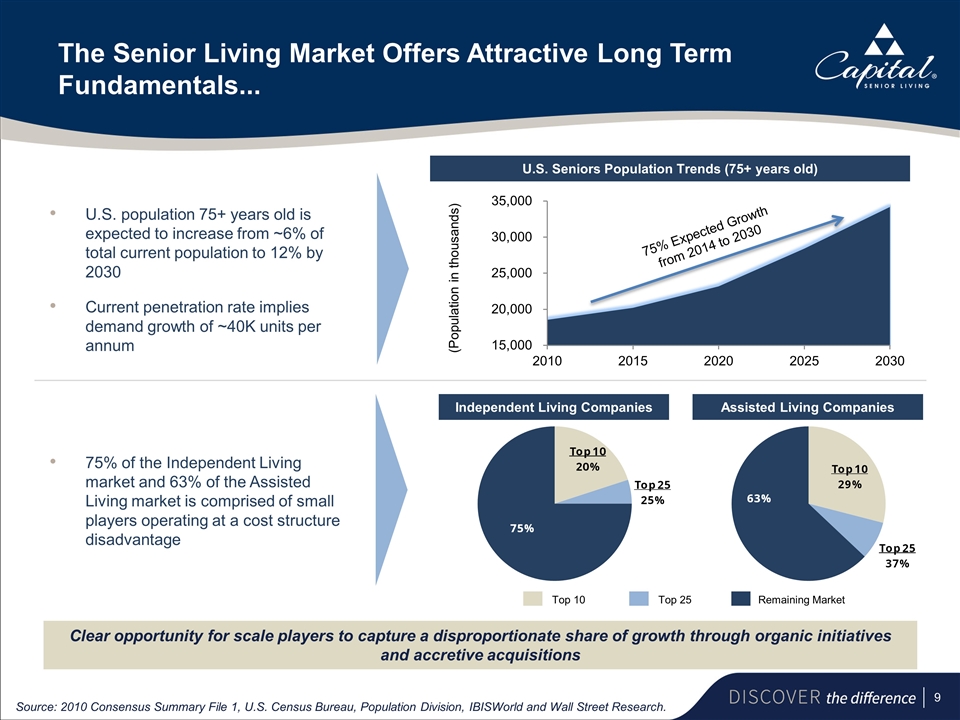

The Senior Living Market Offers Attractive Long Term Fundamentals... U.S. population 75+ years old is expected to increase from ~6% of total current population to 12% by 2030 Current penetration rate implies demand growth of ~40K units per annum 75% of the Independent Living market and 63% of the Assisted Living market is comprised of small players operating at a cost structure disadvantage (Population in thousands) 75% Expected Growth from 2014 to 2030 Top 10 Remaining Market Top 25 Clear opportunity for scale players to capture a disproportionate share of growth through organic initiatives and accretive acquisitions Source: 2010 Consensus Summary File 1, U.S. Census Bureau, Population Division, IBISWorld and Wall Street Research. U.S. Seniors Population Trends (75+ years old) Independent Living Companies Assisted Living Companies

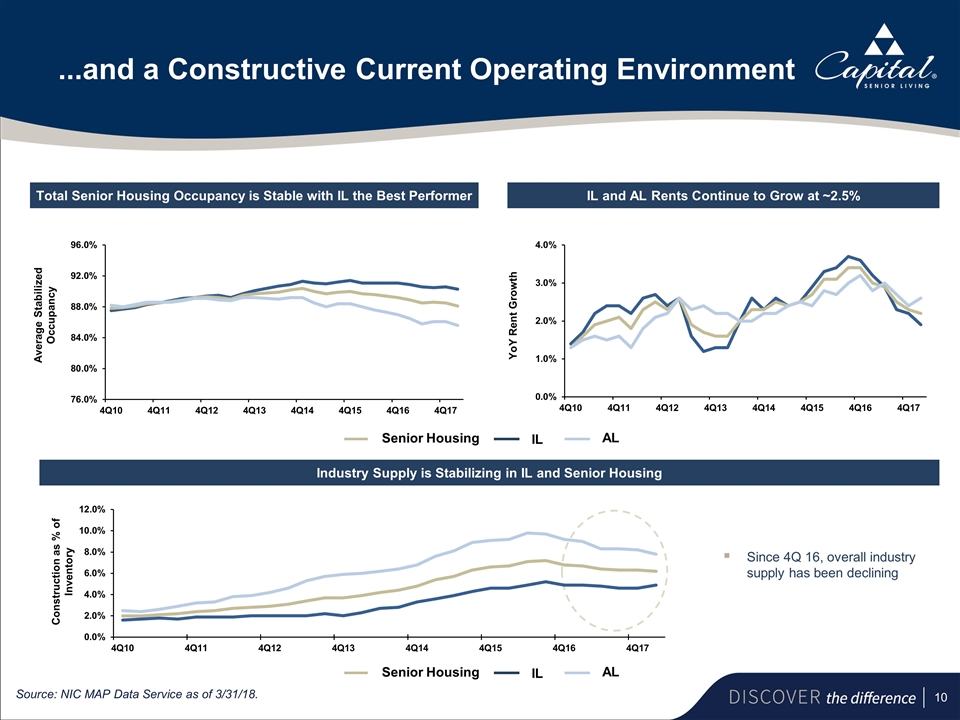

...and a Constructive Current Operating Environment Source: NIC MAP Data Service as of 3/31/18. Total Senior Housing Occupancy is Stable with IL the Best Performer IL and AL Rents Continue to Grow at ~2.5% Average Stabilized Occupancy YoY Rent Growth Industry Supply is Stabilizing in IL and Senior Housing Construction as % of Inventory Since 4Q 16, overall industry supply has been declining Senior Housing IL AL Senior Housing IL AL

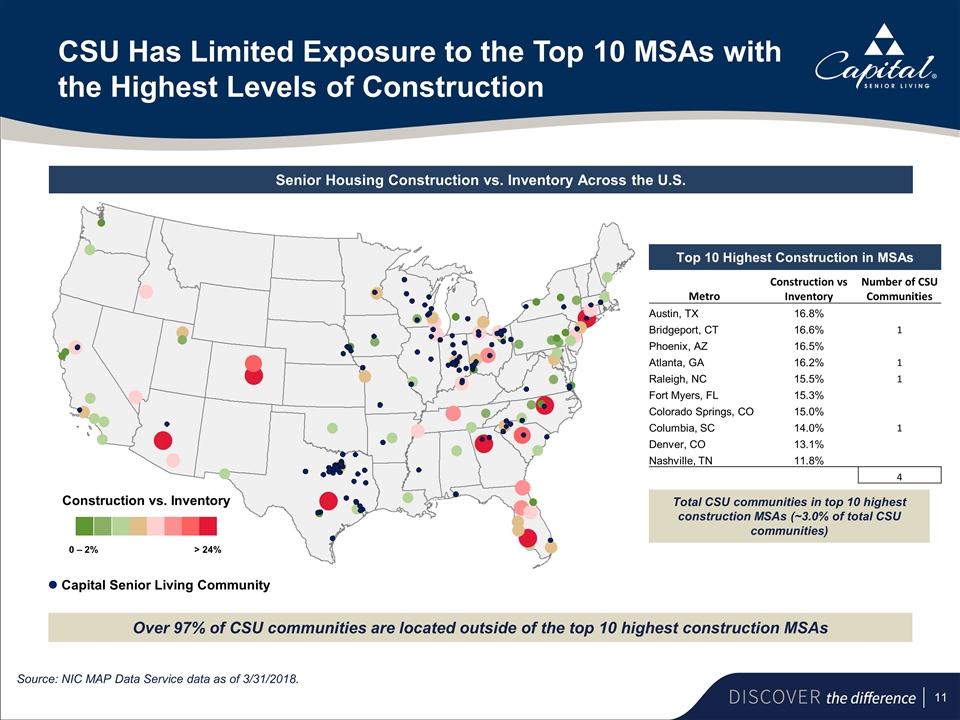

CSU Has Limited Exposure to the Top 10 MSAs with the Highest Levels of Construction Source: NIC MAP Data Service data as of 3/31/2018. Senior Housing Construction vs. Inventory Across the U.S. Top 10 Highest Construction in MSAs Total CSU communities in top 10 highest construction MSAs (~3.0% of total CSU communities) Over 97% of CSU communities are located outside of the top 10 highest construction MSAs Capital Senior Living Community 0 – 2% Construction vs. Inventory > 24% Metro Construction vs Inventory Number of CSU Communities Austin, TX 16.8% Bridgeport, CT 16.6% 1 Phoenix, AZ 16.5% Atlanta, GA 16.2% 1 Raleigh, NC 15.5% 1 Fort Myers, FL 15.3% Colorado Springs, CO 15.0% Columbia, SC 14.0% 1 Denver, CO 13.1% Nashville, TN 11.8% 4

Executing a Long-Term, Sustainable Growth Strategy with a Focus on Real Estate Ownership 2

Executing a Long-Term, Sustainable Growth Strategy with a Focus on Real Estate Ownership Conversions Accretive Acquisitions Core Organic Growth Increasing Real Estate Ownership

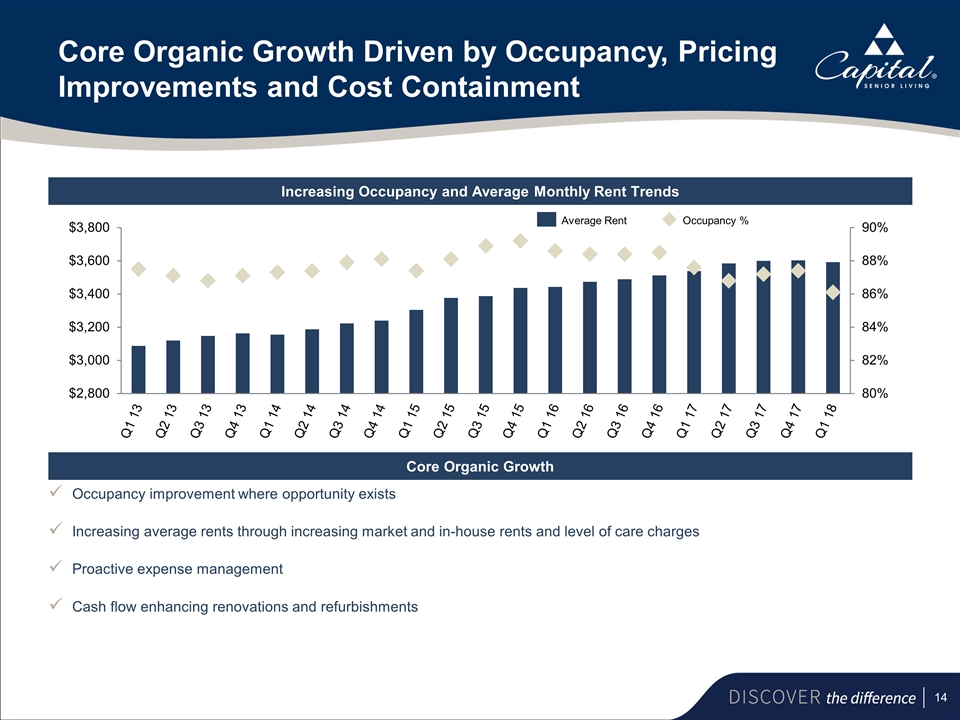

Core Organic Growth Driven by Occupancy, Pricing Improvements and Cost Containment Occupancy improvement where opportunity exists Increasing average rents through increasing market and in-house rents and level of care charges Proactive expense management Cash flow enhancing renovations and refurbishments Core Organic Growth Increasing Occupancy and Average Monthly Rent Trends Average Rent Occupancy %

Action Plans to Drive Sustainable Profitable Growth and Enhance Shareholder Value Executing comprehensive strategy to drive higher revenues, enhance cash flow and maximize value of real estate portfolio Instituting new operating model and realigning sales team to instill greater accountability and drive operational excellence Strengthened team with the recent appointment of Brett Lee as COO Strong record of operational success within healthcare services sector Experience leading operations within highly complex care delivery environments Building more centralized, robust operating platform to improve all facets of community operations to better serve residents Quality Service People Growth Cost

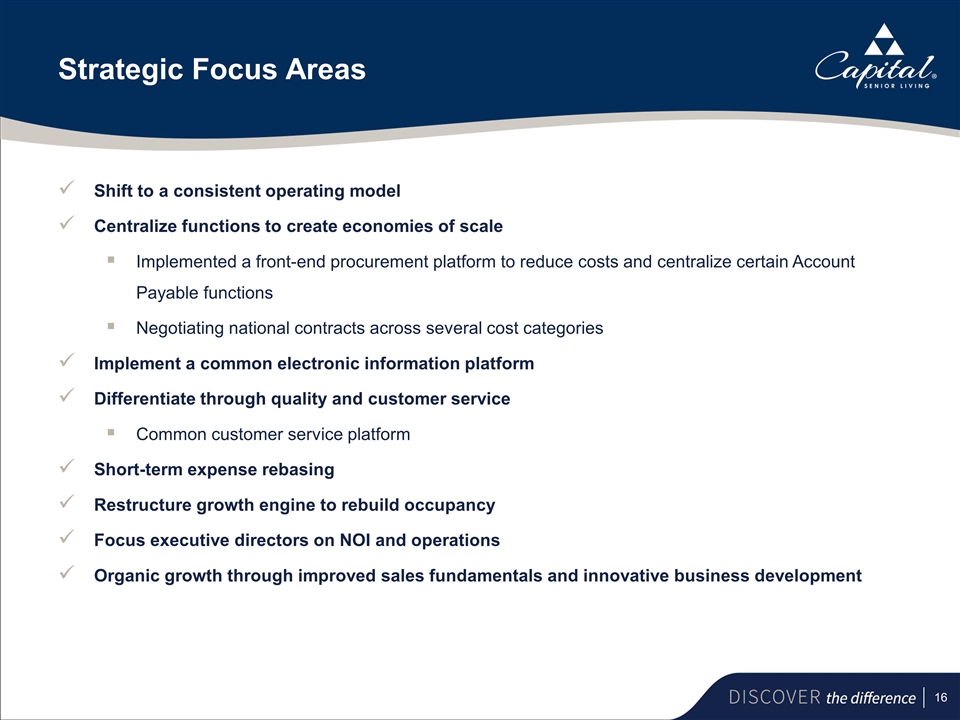

Strategic Focus Areas Shift to a consistent operating model Centralize functions to create economies of scale Implemented a front-end procurement platform to reduce costs and centralize certain Account Payable functions Negotiating national contracts across several cost categories Implement a common electronic information platform Differentiate through quality and customer service Common customer service platform Short-term expense rebasing Restructure growth engine to rebuild occupancy Focus executive directors on NOI and operations Organic growth through improved sales fundamentals and innovative business development

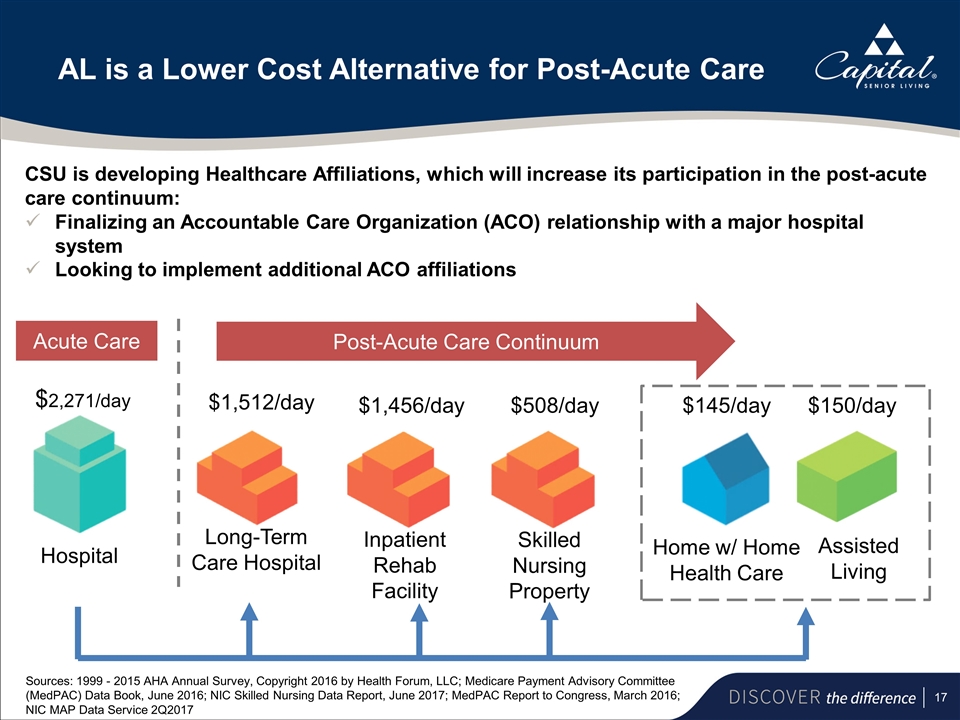

AL is a Lower Cost Alternative for Post-Acute Care Acute Care Post-Acute Care Continuum Hospital $2,271/day Long-Term Care Hospital $1,512/day Inpatient Rehab Facility $1,456/day Skilled Nursing Property $508/day Home w/ Home Health Care $145/day Assisted Living $150/day Sources: 1999 - 2015 AHA Annual Survey, Copyright 2016 by Health Forum, LLC; Medicare Payment Advisory Committee (MedPAC) Data Book, June 2016; NIC Skilled Nursing Data Report, June 2017; MedPAC Report to Congress, March 2016; NIC MAP Data Service 2Q2017 CSU is developing Healthcare Affiliations, which will increase its participation in the post-acute care continuum: Finalizing an Accountable Care Organization (ACO) relationship with a major hospital system Looking to implement additional ACO affiliations

Quality Uphold Highest Quality Standards Reduce Variation/Enhance Safety Service Maintain a Family-Centered Culture Implement Best Practices in Family Experience People Engage Colleagues Cultivate Talent Growth Serve New Residents Cost Move to Centralization/Standardization The Capital Operating System drives all facets of our community operations Upholding Highest Standards of Core Pillars to Improve Resident Experience

J.D. Power, a global marketing information company, recognized Capital Senior Living as one of the top senior living providers in the nation in their 2018 Senior Living Satisfaction Study The most important factors of satisfaction included: Community staff Convenient location Food and beverage Room, building and grounds Senior service Activities Capital Senior Living scored well above the industry average and ranked third overall among senior living operators nationally The Company’s annual resident satisfaction survey, conducted by an independent third party, resulted in 94.6% satisfaction among all residents across its 129 communities CSU Received Top Scores in Resident Satisfaction

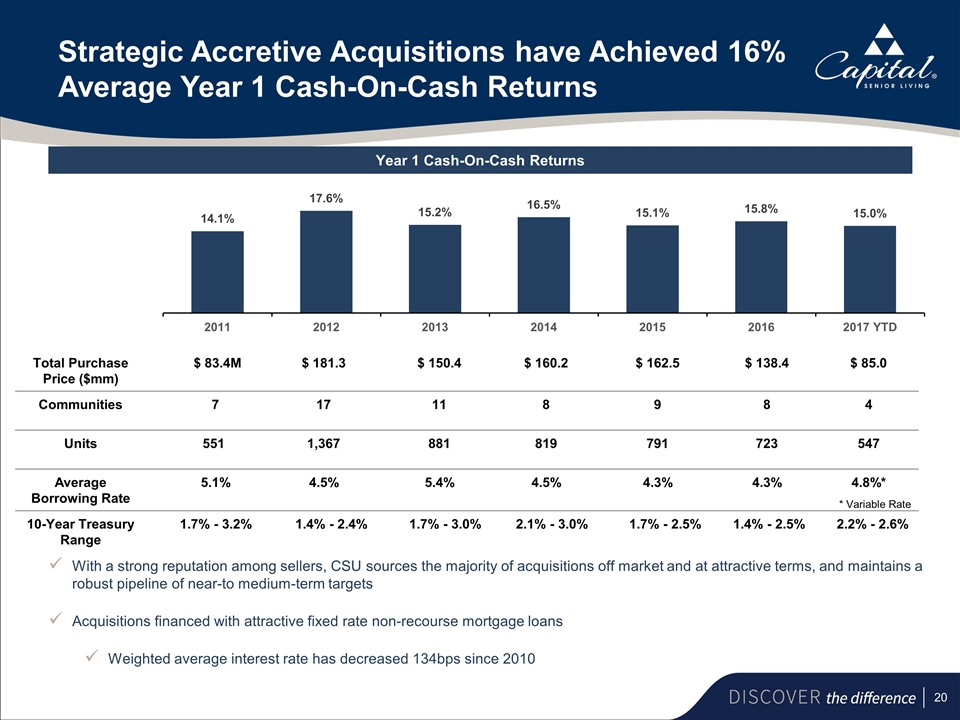

Strategic Accretive Acquisitions have Achieved 16% Average Year 1 Cash-On-Cash Returns Year 1 Cash-On-Cash Returns With a strong reputation among sellers, CSU sources the majority of acquisitions off market and at attractive terms, and maintains a robust pipeline of near-to medium-term targets Acquisitions financed with attractive fixed rate non-recourse mortgage loans Weighted average interest rate has decreased 134bps since 2010 Total Purchase Price ($mm) $ 83.4M $ 181.3 $ 150.4 $ 160.2 $ 162.5 $ 138.4 $ 85.0 Communities 7 17 11 8 9 8 4 Units 551 1,367 881 819 791 723 547 Average Borrowing Rate 5.1% 4.5% 5.4% 4.5% 4.3% 4.3% 4.8%* 10-Year Treasury Range 1.7% - 3.2% 1.4% - 2.4% 1.7% - 3.0% 2.1% - 3.0% 1.7% - 2.5% 1.4% - 2.5% 2.2% - 2.6% * Variable Rate

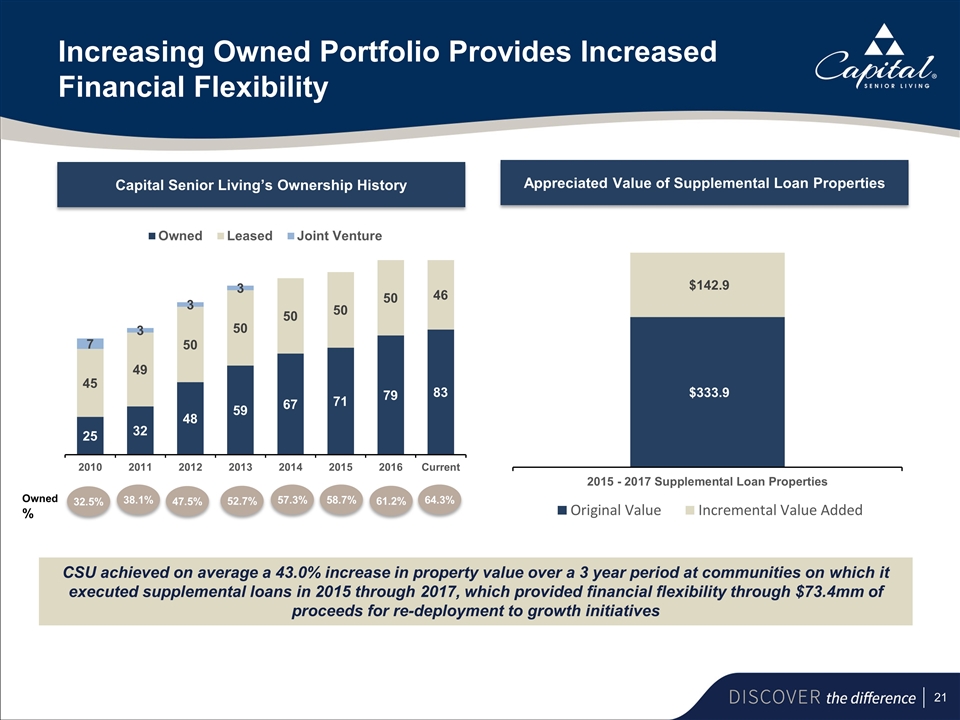

Increasing Owned Portfolio Provides Increased Financial Flexibility CSU achieved on average a 43.0% increase in property value over a 3 year period at communities on which it executed supplemental loans in 2015 through 2017, which provided financial flexibility through $73.4mm of proceeds for re-deployment to growth initiatives Appreciated Value of Supplemental Loan Properties 32.5% 38.1% 47.5% 52.7% 58.7% 57.3% Capital Senior Living’s Ownership History Owned % 61.2% 64.3%

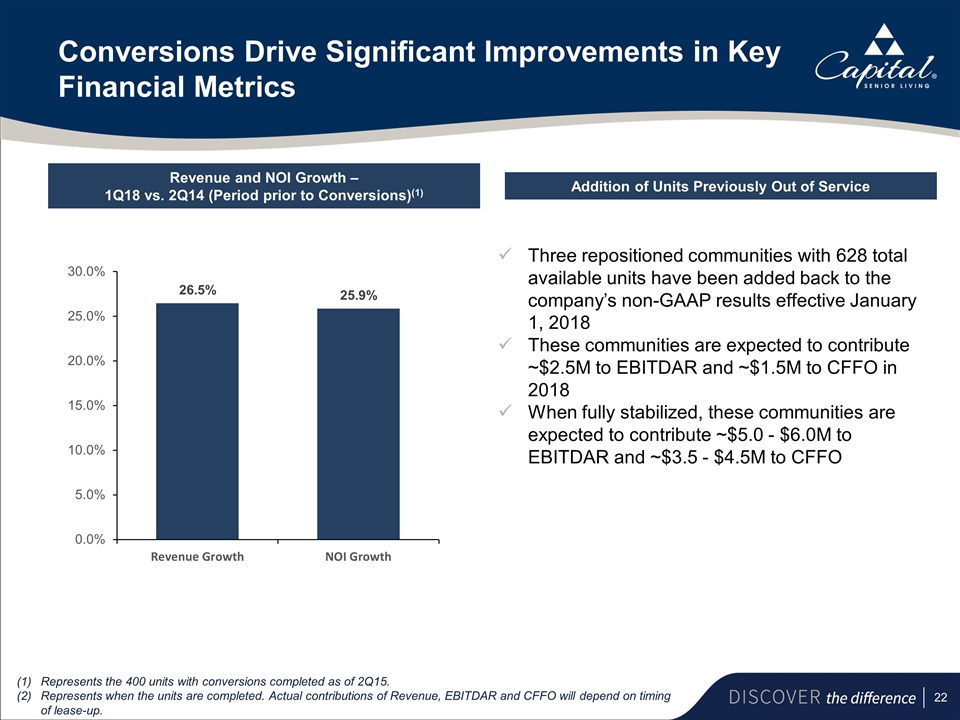

Conversions Drive Significant Improvements in Key Financial Metrics Revenue and NOI Growth – 1Q18 vs. 2Q14 (Period prior to Conversions)(1) Represents the 400 units with conversions completed as of 2Q15. Represents when the units are completed. Actual contributions of Revenue, EBITDAR and CFFO will depend on timing of lease-up. 2 Three repositioned communities with 628 total available units have been added back to the company’s non-GAAP results effective January 1, 2018 These communities are expected to contribute ~$2.5M to EBITDAR and ~$1.5M to CFFO in 2018 When fully stabilized, these communities are expected to contribute ~$5.0 - $6.0M to EBITDAR and ~$3.5 - $4.5M to CFFO Addition of Units Previously Out of Service

Track Record of Strong Growth and Uniquely Positioned for Continued Success 3

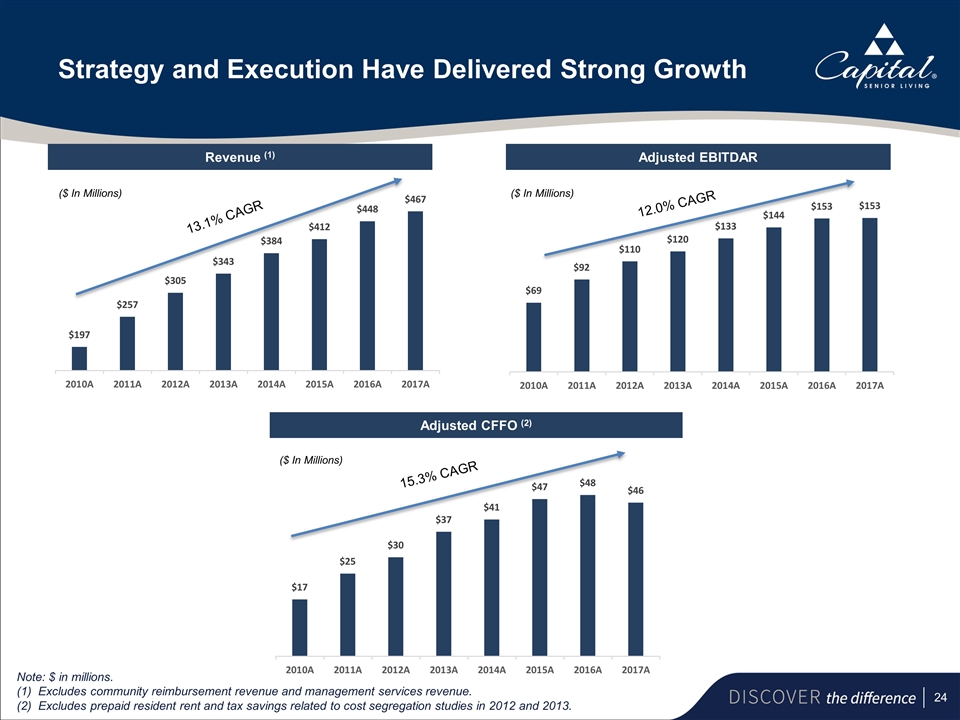

Strategy and Execution Have Delivered Strong Growth Revenue (1) Adjusted EBITDAR Adjusted CFFO (2) Note: $ in millions. Excludes community reimbursement revenue and management services revenue. (2)Excludes prepaid resident rent and tax savings related to cost segregation studies in 2012 and 2013. ($ In Millions) ($ In Millions) 15.3% CAGR 13.1% CAGR 12.0% CAGR ($ In Millions)

Capital Plan Supports Long-Term Growth Initiatives 4

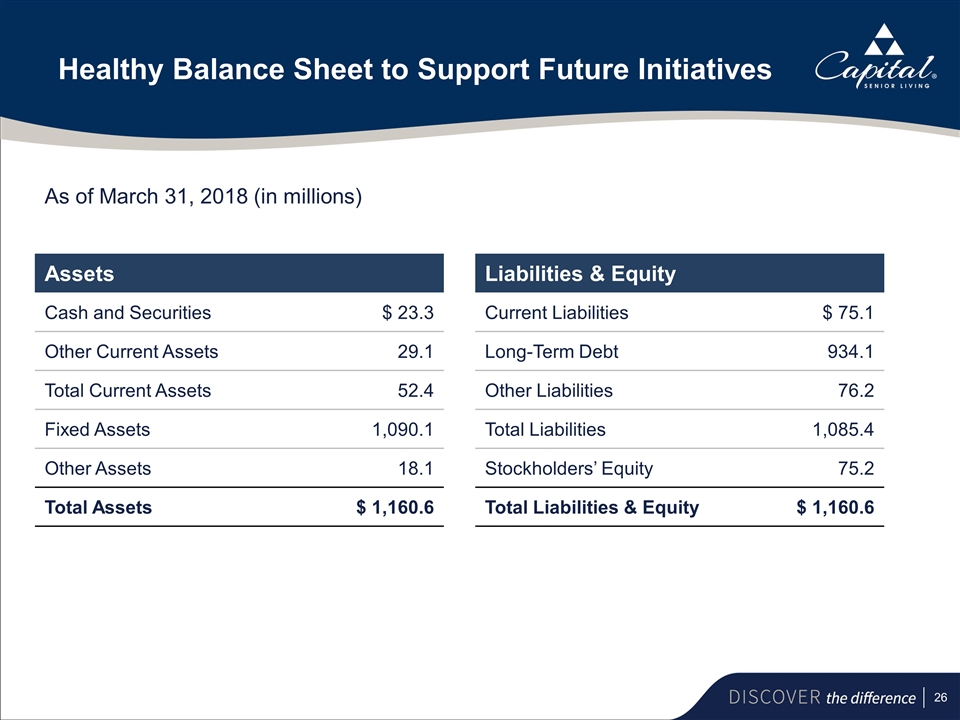

Healthy Balance Sheet to Support Future Initiatives Assets Cash and Securities $ 23.3 Other Current Assets 29.1 Total Current Assets 52.4 Fixed Assets 1,090.1 Other Assets 18.1 Total Assets $ 1,160.6 Liabilities & Equity Current Liabilities $ 75.1 Long-Term Debt 934.1 Other Liabilities 76.2 Total Liabilities 1,085.4 Stockholders’ Equity 75.2 Total Liabilities & Equity $ 1,160.6 As of March 31, 2018 (in millions)

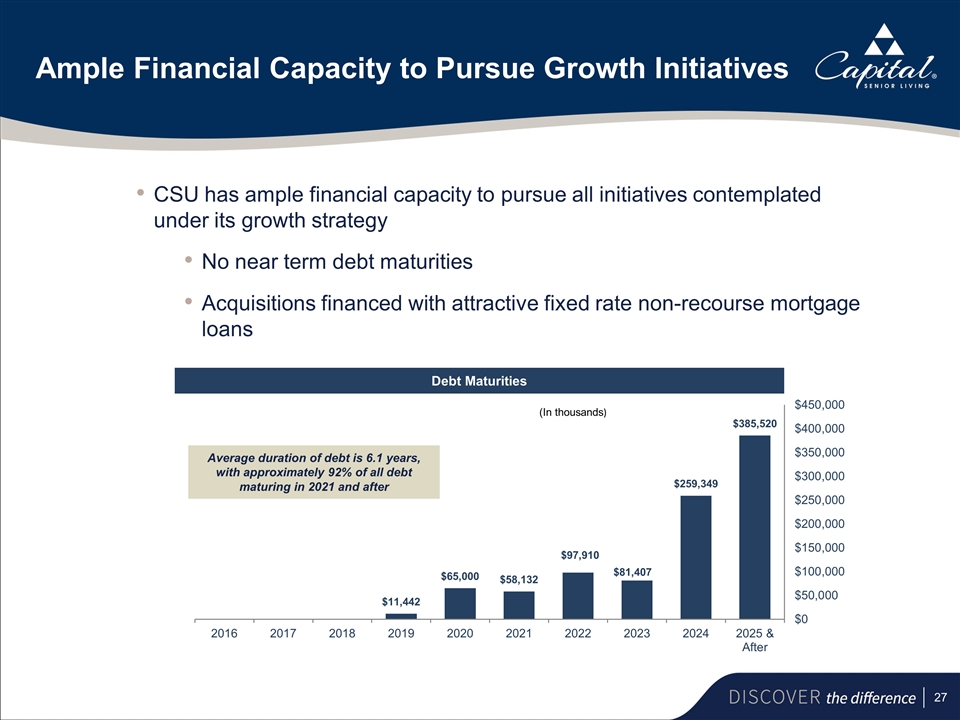

Debt Maturities CSU has ample financial capacity to pursue all initiatives contemplated under its growth strategy No near term debt maturities Acquisitions financed with attractive fixed rate non-recourse mortgage loans Average duration of debt is 6.1 years, with approximately 92% of all debt maturing in 2021 and after (In thousands) Ample Financial Capacity to Pursue Growth Initiatives

Capital Senior Living Investment Rationale Attractively Positioned in the Highly Fragmented Senior Housing Market Executing a Long-Term, Sustainable Growth Strategy with a Focus on Real Estate Ownership Track Record of Strong Growth and Uniquely Positioned for Continued Success Capital Plan Supports Long-Term Growth Initiatives CSU has a clear and differentiated real-estate strategy to drive industry-leading growth and superior shareholder value 1 4 2 3 Conversions Accretive Acquisitions Core Organic Growth Increasing Real Estate Ownership