Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991q12018.htm |

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-kq12018earningsfinal.htm |

04.24.2018

First Quarter 2018

Exhibit 99.2

2IMPORTANT INFORMATION

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our

expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking.

These statements are often, but not always, made through the use of words or phrases such as anticipates, believes, can, could, may, predicts, potential, should,

will, estimates, plans, projects, continuing, ongoing, expects, intends, and similar words or phrases. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties that are subject to

change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled Risk Factors

and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the U.S. Securities and Exchange Commission (SEC).

Among the factors that could cause the forward-looking statements in this presentation and/or our financial performance to differ materially from that suggested

by the forward-looking statements are: (a) the inherent limitations in internal controls over financial reporting; (b) our ability to remediate any material

weaknesses in internal controls over financial reporting completely and in a timely manner; (c) continually changing federal, state, and local laws and regulations

could materially adversely affect our business; (d) adverse economic conditions in the United States and worldwide may negatively impact our results; (e) our

business could suffer if our access to funding is reduced; (f) significant risks we face implementing our growth strategy, some of which are outside our control; (g)

unexpected costs and delays in connection with exiting our personal lending business; (h) our agreement with Fiat Chrysler Automobiles US LLC may not result in

currently anticipated levels of growth, and is subject to certain conditions that could result in termination of the agreement; (i) our business could suffer if we are

unsuccessful in developing and maintaining relationships with automobile dealerships; (j) our financial condition, liquidity, and results of operations depend on the

credit performance of our loans; (k) loss of our key management or other personnel, or an inability to attract such management and personnel; (l) certain

regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the European

Central Bank, and the Federal Reserve, whose oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other

limitations on our business; and (m) future changes in our relationship with Banco Santander which could adversely affect our operations. If one or more of the

factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from

those expressed in, or implied by, forward-looking information and statements. Therefore, we caution the reader not to place undue reliance on any forward-

looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader

should not consider these factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements only speak as of the date of this

document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as

required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

3

» Total auto originations of $6.3 billion, up 18% YoY

» Core retail auto loan originations of $2.3 billion, up 4% YoY

» Chrysler Capital1 loan originations of $1.9 billion, up 24% YoY

» Chrysler average quarterly penetration rate of 28%, up from 23% during the same quarter last year

» Net finance and other interest income of $1.0 billion, decreased 8% YoY

» Net leased vehicle income of $146 million, increased 14% YoY

» RIC net charge-off ratio of 8.3%, down 50 basis points YoY

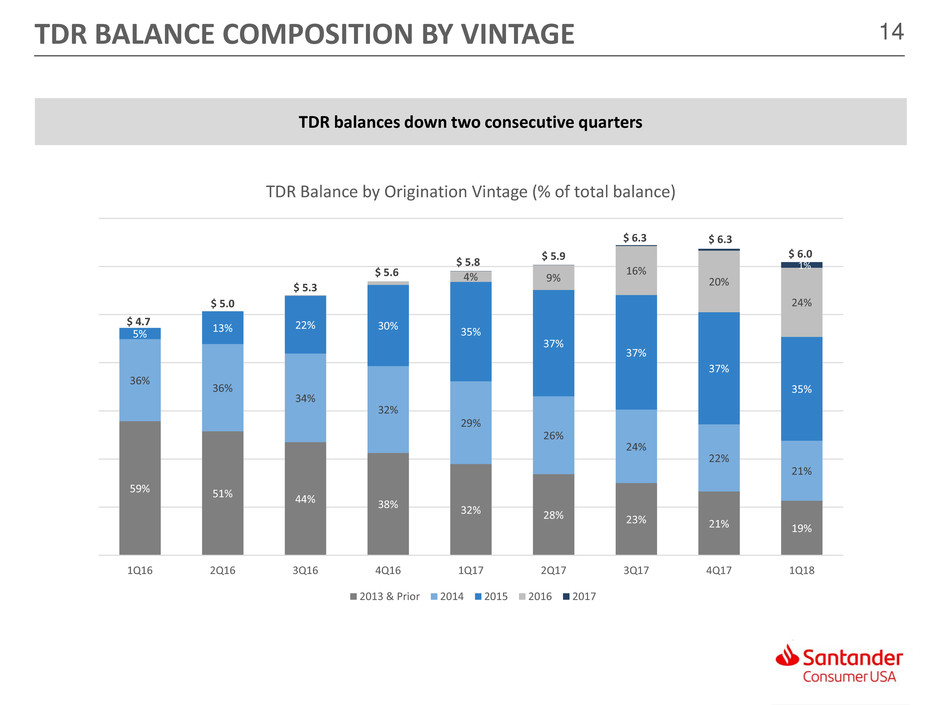

» Troubled Debt Restructuring (“TDR”) balance of $6.0 billion, down from $6.3 billion QoQ

» Auction-plus recovery rate of 55.1%, up 400 basis points YoY

» Return on average assets of 2.4%, up from 1.5% YoY

» Asset sales of $1.5 billion executed through the Santander flow agreement

» $3.3 billion in asset-backed securities “ABS” offered and sold

» Launched pilot program with SBNA2 to facilitate the origination and servicing of primarily Chrysler loans

» Reached agreements with AutoFi and AutoGravity expanding SC's digital partnerships

» April 2018 - Completed prime auto loan portfolio conversion of $1.0 billion with a new third party

» April 2018 - $1.0 billion in ABS offered and sold via the SDART platform

Q1 2018 HIGHLIGHTS AND SUBSEQUENT EVENTS

1 Chrysler Capital is a dba of Santander Consumer USA

2Santander Bank N.A.

4

17.0

Max 18.5

Min 9.0

Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18

ECONOMIC INDICATORS

U.S. Auto Sales1

Units in Millions

1 Bloomberg

2 University of Michigan

3 U.S. Bureau of Economic Analysis

Consumer Confidence2

Index Q1 1966=100

U.S. GDP3

%

U.S. Unemployment Rate1

%

OR

IGIN

A

TI

O

N

S

CRE

D

IT

Max 102.0

Min 55.3

Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18

2.9

Max 3.2

Min -4.0

Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

Max 10.0

Min 4.1

Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18

5

44.9%

46.8%

51.1%

55.1%

35%

40%

45%

50%

55%

60%

65%

70%

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18

SC Auction Only Recovery Rate SC Auction Plus Recovery Rate (Quarterly)

100

105

110

115

120

125

130

135

110

115

120

125

130

135

140

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18

Manheim (Left Axis) JDP Used-Vehicle Price Index (Right Axis)

AUTO INDUSTRY ANALYSIS

Used Vehicle Indices1

Manheim: Seasonally Adjusted JD Power: Not Seasonally Adjusted

SC Recovery Rates2

Industry Net Loss Rates3

SE

V

ER

IT

Y

CRE

D

IT

Industry 60+ Day Delinquency Rates3

1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; JD Power Used-Vehicle Price Index (not seasonally adjusted)

2 Auction Only - includes all auto-related recoveries including inorganic/purchased receivables from auction lanes only

2 Auction Plus – Per the financial statements includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts

3 Standard & Poor’s Rating Services (ABS Auto Trust Data – two-month lag on data, as of January 31, 2018)

10.0%

Max 13.6%

Min 3.3%

Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18

Subprime

Max 5.9%

5.9%

Min 1.6%

Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18

Subprime

6DIVERSIFIED UNDERWRITING ACROSS THE CREDIT SPECTRUM

YoY auto originations increase across all channels

1 Approximate FICOs

2 Includes nominal capital lease originations

($ in Millions) Q1 2018 Q4 2017 Q1 2017 QoQ YoY

Total Core Retail Auto 2,291$ 1,469$ 2,198$ 56% 4%

Chrysler Capital Loans (<640)

1

1,083 741 833 46% 30%

Chrysler Capital Loans (≥640)1 879 804 755 9% 16%

Total Chrysler Capital Retail 1,962$ 1,545$ 1,588$ 27% 24%

Total Leases2 2,096 1,299 1,602 61% 31%

Total Auto Originations 6,349$ 4,313$ 5,388$ 47% 18%

Total Per onal Lending 273 529 288 (48%) (5%)

Total SC Originations 6,623$ 4,842$ 5,676$ 37% 17%

SBNA Originations 24 - - N/A N/A

Total SC & SBNA Originations 6,647$ 4,842$ 5,676$ 37% 17%

Asset Sales 1,475$ -$ 931$ N/A 58%

Average Managed Assets 48,421$ 48,972$ 51,230$ (1%) (5%)

% VarianceThree Months Ended Originations

7

0.49 0.51 0.56 0.51 0.51

2.11

2.26 2.25

2.07

2014 2015 2016 2017 2018

YTD Full Year

Chrysler Capital average quarterly penetration rate of 28% as of Q1 2018

Through SBNA, SC has increased dealer receivables outstanding (“floorplan”) 9% QoQ

FCA US LLC (FCA) RELATIONSHIP

SC continues to optimize the Chrysler Capital program

FCA Sales1

(units in millions)

1 FCA filings; sales as reported on 4/3/2018

2Dealer receivables originated through SBNA

Dealer Floorplan2 Outstanding

($ in millions)

$1,742 $1,723 $1,777

$1,963

$2,133

1Q17 2Q17 3Q17 4Q17 1Q18

8

$11,015

$9,881 $9,957

$8,639 $8,723

1Q17 2Q17 3Q17 4Q17 1Q18

$ in Millions

Santander Flow Sales 931 566 1,347 1,480

SBNA Originations 24

RV/Marine Sale 135

Santander Flow Sales totaling $1.5 billion

in Q1 2018

Launched pilot program with SBNA to

facilitate origination and servicing of

primarily Chrysler loans

Recent trend in total balance related to

lower prime originations and timing of

asset sales to Santander

SERVICED FOR OTHERS (SFO) PLATFORM

Composition at

03/31/2018

RIC 92%

Leases 1%

RV/Marine 7%

Total 100%

Serviced for Others Balances (End of Period)

*Sales with retained servicing during period, also include non-Santander sales.

9

March 31, 2018 December 31, 2017 March 31, 2017 QoQ YoY

Interest on finance receivables and loans 1,114,137$ 1,129,181$ 1,209,186$ (1%) (8%)

Net leased vehicle income 145,595 112,491 128,062 29% 14%

Other finance and interest income 7,137 4,470 3,825 60% 87%

Interest expense 241,028 236,600 227,089 2% 6%

Net finance and other interest income 1,025,841$ 1,009,542$ 1,113,984$ 2% (8%)

Provision for credit losses 458,995 562,346 635,013 (18%) (28%)

Profit sharing 4,377 7,235 7,945 (40%) (45%)

Total other income 25,053 (37,716) 55,480 (166%) (55%)

Total operating expenses 287,912 426,040 305,078 (32%) (6%)

Income before tax 299,610$ (23,795)$ 221,428$ NM 35%

Income tax expense 57,311 (603,911) 78,001 (109%) (27%)

Net income 242,299$ 580,116$ 143,427$ (58%) 69%

Diluted EPS ($) 0.67$ 1.61$ 0.40$ (58%) 68%

Average total assets 39,694,041$ 38,992,937$ 38,910,193$ 2% 2%

Average managed assets 48,421,303$ 48,971,677$ 51,229,729$ (1%) (5%)

% Variance

Three Months Ended

(Unaudited, Dollars in Thousands, except per share)

Q1 2018 FINANCIAL RESULTS

1

1 Q4 2017 was impacted by significant items. Please refer to the 8-K filed January 31, 2018 for further details.

10

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Cum

u

la

ti

ve

N

et

L

o

ss

Ra

te

Months on Book

Total Annual Vintage Cumulative Net Loss Rate

2014 2015 2016

CREDIT QUALITY: VINTAGE LOSS PERFORMANCE

2016 vintage continues to outperform the 2015 vintage on a gross and net loss basis

*Retained originations only

0%

5%

10%

15%

20%

25%

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Cum

u

la

ti

ve

G

ro

ss

L

o

ss

Ra

te

Months on Book

Total Annual Vintage Cumulative Gross Loss Rate

2014 2015 2016

11DELINQUENCY AND LOSS

YoY delinquency ratios flat

18.1%

16.4%

18.0%

19.2%

18.5%

8.8%

7.5%

9.1%

10.3%

8.3%

51.1%

53.9%

49.3%

46.4%

55.1%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

100.0%

110.0%

120.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

Credit: Individually Acquired Retail Installment Contracts,

Held for Investment

Gross Charge-

off Ratio

Net Charge-

off Ratio

Recovery

Rate (as % of

recorded

investment)

YoY gross charge-off ratio increased 40 basis points

YoY net charge-off ratio decreased 50 basis points

7.3%

9.4% 9.2%

10.3%

7.3%

3.9%

4.7% 5.1%

5.4%

3.8%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

Delinquency: Individually Acquired Retail Installment Contracts,

Held for Investment

31-60

>60

12CREDIT QUALITY: LOSS DETAIL

$599

$538

$24

$42

$27

$16

Q1 2017 Performance Recoveries Balance Other Q1 2018

Q1 2017 to Q1 2018 Net Charge-Off Walk

($ in millions)

Gross Loss

Performance

13

$635

$521 $536

$562

$459

12.7% 12.6%

12.8%

12.6%

12.3%

12.0%

12.5%

13.0%

13.5%

14.0%

$0

$100

$200

$300

$400

$500

$600

$700

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

Provision Expense and Allowance Ratio

($ in millions)

Provision for credit losses Allowance Ratio

PROVISION AND RESERVES

1 TDR migration – the allowance for assets classified as TDRs or “troubled debt restructuring” takes into consideration expected lifetime losses, typically requiring additional coverage

2 Explanation of quarter over quarter variance are estimates

QoQ allowance decreased $80 million

New volume and TDR migration1 were offset

by performance adjustment and liquidations

and other

Allowance to loans ratio decreased 30 bps to 12.3% QoQ

Provision for credit losses decreased $176 million YoY

$3,270

$3,190

$140

$59 ($70)

($209)

$3,100

$3,150

$3,200

$3,250

$3,300

$3,350

$3,400

$3,450

$3,500

Q4 2017 New

Volume

TDR

Migration

Performance

Adjustment

Liquidations

& Other

Q1 2018

Q4 2017 to Q1 2018 ALLL Reserve Walk

($ in millions)

14

TDR balances down two consecutive quarters

TDR BALANCE COMPOSITION BY VINTAGE

59% 51% 44% 38% 32% 28% 23% 21% 19%

36%

36%

34%

32%

29%

26%

24%

22%

21%

5% 13%

22% 30%

35%

37%

37%

37%

35%

4% 9%

16%

20%

24%

$ 4.7

$ 5.0

$ 5.3

$ 5.6

$ 5.8

$ 5.9

$ 6.3 $ 6.3

$ 6.0

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

TDR Balance by Origination Vintage (% of total balance)

2013 & Prior 2014 2015 2016 2017

1%

15EXPENSE MANAGEMENT

Operating expenses totaled $288 million, a decrease of 6% versus the same quarter last year

1 Q4 2017 was impacted by significant items. Please refer to the 8-K filed January 31, 2018 for further details.

1

$51,230 $50,436 $49,998 $48,972 $48,421

$305

$282

$298

$426

$288

2.4% 2.2% 2.4%

3.5%

2.4%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

$2

$10,002

$20,002

$30,002

$40,002

$50,002

$60,002

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

Average

Managed

Assets

($ millions)

Total Expenses

($ millions)

Expense Ratio

16

3.0 3.0

1.8 1.8

3.0 3.0

Q4 2017 Q1 2018

Term

Revolving

Contingent

4.1 4.6

5.8 5.4

Q4 2017 Q1 2018

Unused Used

$16.9 billion in commitments from 12 lenders1

54% unused capacity on revolving lines at Q1 2018

FUNDING AND LIQUIDITY

Total funding of $42.2 billion at the end Q1 2018, up 5% from $40.3 billion at the end of Q4 2017

Asset-Backed Securities

($ Billions)

Financings

($ Billions)

Banco Santander & Subsidiaries

($ Billions)

Asset Sales

($ Billions)

$3.3 billion in asset-backed securities (ABS) offered and sold

Executed second lease ABS securitization

$7.8 billion in total commitments

52% unused revolving capacity at Q1 2018

Fourth Santander flow sale of $1.5 billion

Amortizing Revolving

9.9 10.0

Santander

7.87.8

1 Does not include repo facilities

1.5

Q4 2017 Q1 2018

7.6 6.9

Q4 2017 Q1 2018

15.0 16.0

Q4 2017 Q1 2018

17

13.8% 14.3%

15.0%

16.3%

16.9%

13.6% 14.1%

14.9%

16.2% 16.6%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

CET1 TCE/TA

CONSISTENT CAPITAL GENERATION

1 Common Equity Tier 1 (CET1) Capital Ratio is a non-GAAP financial measure that begins with stockholders’ equity and then adjusts for AOCI, goodwill/intangibles, DTAs, cash flow hedges and

other regulatory exclusions over risk-weighted assets. See appendix for further details.

2 Tangible common equity to tangible assets is a non-GAAP financial measure defined as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets, excluding Goodwill

and intangible assets

1 2

SC has exhibited a strong ability to generate earnings and capital, while growing assets

Tangible Assets $38,956 $39,401 $38,657 $39,319 $39,940

Tangible Common Equity $5,313 $5,572 $5,780 $6,377 $6,621

$ in millions

The Company has declared a cash dividend of $0.05 per share, to be paid on May 14, 2018, to shareholders of record as of the close of

business on May 4, 2018

APPENDIX

19COMPANY ORGANIZATION

Other Subsidiaries

100% Ownership

Santander Holdings USA, Inc.

(“SHUSA’)

~68% Ownership

Santander Bank, N.A. Other Subsidiaries

Banco Santander, S.A. Spain

*Ownership percentages are approximates as of March 31, 2018

~32% Ownership

Santander Consumer USA Holdings Inc.

(“SC”)

Public Shareholders

20

2% 2% 2% 2% 2%

12% 12% 10% 10% 12%

18% 17% 14% 14% 14%

25% 24%

23% 24% 26%

13%

13%

13% 13%

15%

30% 33% 38% 36%

31%

1Q17 2Q17 3Q17 4Q17 1Q18

Originations by Credit (RIC1 only)

($ in millions)

>640

600-640

540-599

<540

No FICO

Commercial

$3,787 $4,055 $4,278$3,328 $3,014

DIVERSIFIED UNDERWRITING ACROSS FULL CREDIT SPECTRUM

Average loan balance in dollars $20,193 $20,816 $21,825 $22,013 $21,699

$2,664

1 RIC; Retail Installment Contract

2 Loans to commercial borrowers; no FICO score obtained

$2,940

2

47% 48%

55% 53% 50%

53% 52%

45% 47% 50%

1Q17 2Q17 3Q17 4Q17 1Q18

New/Used Originations

($ in millions)

Used

New

$3,787 $4,055 $4,278$3,328 $3,014

21HELD FOR INVESTMENT CREDIT TRENDS

Retail Installment Contracts1

1Held for investment; excludes assets held for sale

2

.8

% 1

2

.0

%

2

2

.3

%

3

1

.7

%

1

7

.4

%

1

3

.8

%

2

.5

% 1

1

.9

%

2

2

.4

%

3

1

.9

%

1

7

.3

%

1

4

.0

%

2

.4

% 1

1

.6

%

2

2

.4

%

3

2

.4

%

1

7

.5

%

1

3

.7

%

2

.5

% 1

1

.2

%

2

1

.8

%

3

2

.0

%

1

7

.4

%

1

5

.1

%

2

.2

% 1

1

.2

%

2

1

.6

%

3

2

.4

%

1

7

.6

%

1

5

.0

%

Commercial Unknown <540 540-599 600-639 >=640

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

22EXCLUDING PERSONAL LENDING DETAIL

1The $59 million of investment losses related to personal lending in Q1 2018, comprised of $106 million in customer default activity, partially offset by a $47 million decrease in

market discount, consistent with typical seasonal patterns.

1

Personal lending earned $68 million before operating expenses and taxes

Total

Personal

Lending

Excluding

Personal

Lending

Total

Personal

Lending

Excluding

Personal

Lending

Total

Personal

Lending

Excluding

Personal

Lending

Interest on finance receivables and loans $ 1,114,137 $ 89,260 $ 1,024,877 $ 1,129,181 $ 83,080 $ 1,046,101 $ 1,209,186 $ 92,449 $ 1,116,737

Net leased vehicle income 145,595 - 145,595 112,491 - 112,491 128,062 - 128,062

Other finance and interest income 7,137 - 7,137 4,470 - 4,470 3,825 - 3,825

Interest expense 241,028 10,992 230,036 236,600 13,998 222,602 227,089 12,013 215,076

Net finance and other interest income $ 1,025,841 $ 78,268 $ 947,573 $ 1,009,542 $ 69,082 $ 940,460 $ 1,113,984 $ 80,436 $ 1,033,548

Provision for credit losses 458,995 102 458,892 562,346 415 561,931 635,013 - 635,013

Profit sharing 4,377 207 4,170 7,235 877 6,358 7,945 (242) 8,187

Investment Gains (losses), net (86,520) (58,963) (27,557) (137,926) (136,393) (1,533) (76,399) (64,639) (11,760)

Servicing fee income 26,182 - 26,182 26,031 - 26,031 31,684 - 31,684

Fees, commissions and other 85,391 49,487 35,903 74,179 45,830 28,349 100,195 50,740 49,455

Total other income $ 25,053 $ (9,476) $ 34,529 $ (37,716) $ (90,563) $ 52,847 $ 55,480 $ (13,899) $ 69,379

Average gross individually acquired retail

installment contracts

$ 26,820,166 - $ 27,098,976 - $ 28,200,907 -

Average gross personal loans - $ 1,459,308 - $ 1,392,529 - $ 1,488,665

Average gross operating leases $ 11,441,789 - $ 11,088,361 - $ 9,849,077 -

March 31, 2018 December 31, 2017 March 31, 2017

23CONSOLIDATED BALANCE SHEETS

(Unaudited, dollars in thousands) March 31, 2018 December 31, 2017

Assets

Cash and cash equivalents $ 618,809 $ 527,805

Finance receivables held for sale, net 1,611,535 2,210,421

Finance receivables held for investment, net 22,587,358 22,427,769

Restricted cash 2,895,615 2,553,902

Accrued interest receivable 269,258 326,640

Leased vehicles, net 10,612,824 10,160,327

Furniture and equipment, net 65,961 69,609

Federal, state and other income taxes receivable 99,099 95,060

Related party taxes receivable 634 467

Goodwill 74,056 74,056

Intangible assets 31,088 29,734

Due from affiliates 53,408 33,270

Other assets 1,125,544 913,244

Total assets $ 40,045,189 $ 39,422,304

Liabilities and Equity

Liabilities:

Notes payable — credit facilities $ 5,294,358 $ 4,848,316

Notes payable — secured structured financings 22,862,607 22,557,895

Notes payable — related party 3,148,194 3,754,223

Accrued interest payable 38,375 38,529

Accounts payable and accrued expenses 430,361 429,531

Deferred tax liabilities, net 966,444 897,121

Due to affiliates 103,012 82,382

Other liabilities 475,822 333,806

Total liabilities $ 33,319,174 $ 32,941,803

Equity:

Common stock, $0.01 par value $ 3,610 $ 3,605

Additional paid-in capital 1,689,996 1,681,558

Accumulated other comprehensive income (loss), net 63,211 44,262

Retained earnings 4,969,198 4,751,076

Total stockholders’ equity $ 6,726,015 $ 6,480,501

Total liabilities and equity $ 40,045,189 $ 39,422,304

For the Three Months Ended

24CONSOLIDATED INCOME STATEMENT

(Unaudited, dollars in thousands, except per share amounts) March 31, 2018 March 31, 2017

Interest on finance receivables and loans $ 1,114,137 $ 1,209,186

Leased vehicle income 504,278 418,233

Other finance and interest income 7,137 3,825

Total finance and other interest income $ 1,625,552 $ 1,631,244

Interest expense 241,028 227,089

Leased vehicle expense 358,683 290,171

Net finance and other interest income $ 1,025,841 $ 1,113,984

Provision for credit losses 458,995 635,013

Net finance and other interest income after provision for credit losses $ 566,846 $ 478,971

Profit sharing 4,377 7,945

Net finance and other interest income after provision for credit losses and profit sharing $ 562,469 $ 471,026

Investment (losses), net (86,520) (76,399)

Servicing fee income 26,182 31,684

Fees, commissions, and other 85,391 100,195

Total other income $ 25,053 $ 55,480

Compensation expense 122,005 136,262

Repossession expense 72,081 71,299

Other operating costs 93,826 97,517

Total operating expenses $ 287,912 $ 305,078

Income before income taxes 299,610 221,428

Income tax expense 57,311 78,001

Net income $ 242,299 $ 143,427

Net income per common share (basic) $ 0.67 $ 0.40

Net income per common share (diluted) $ 0.67 $ 0.40

Dividends paid per common share $0.05 -

Weighted average common shares (basic) 360,703,234 359,105,050

Weighted average common shares (diluted) 361,616,732 360,616,032

For the Three Months Ended

25RECONCILIATION OF NON-GAAP MEASURES

(a) Under the banking agencies' risk-based capital guidelines, assets and credit equivalent amounts of derivatives and off-balance sheet exposures are assigned to broad risk categories. The

aggregate dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together with the measure for market risk,

resulting in the Company's and the Bank's total Risk weighted assets

(b) CET1 is calculated under Basel III regulations required as of January 1, 2015.

March 31, December 31, September 30, June 30, March 31,

2018 2017 2017 2017 2017

Total equity $ 6,726,015 $ 6,480,501 $ 5,885,234 $ 5,678,733 $ 5,418,998

Deduct: Goodwill and intangibles 105,144 103,790 105,590 106,298 106,331

Tangible common equity $ 6,620,871 $ 6,376,711 $ 5,779,644 $ 5,572,435 $ 5,312,667

Total assets $ 40,045,188 $ 39,422,304 $ 38,765,557 $ 39,507,482 $ 39,061,940

Deduct: Goodwill and intangibles 105,144 103,790 105,590 106,298 106,331

Tangible assets $ 39,940,044 $ 39,318,514 $ 38,659,967 $ 39,401,184 $ 38,955,609

Equity to assets ratio 16.8% 16.4% 15.2% 14.4% 13.9%

Tangible common equity to tangible assets 16.6% 16.2% 14.9% 14.1% 13.6%

Total equity 6,726,015$ 6,480,501$ 5,885,234$ 5,678,733$ 5,418,998$

Deduct: Goodwill and other intangible assets, net of deferred tax liabilities 169,870 172,664 172,502 177,619 182,156

Deduct: Accumulated other comprehensive income, net 63,211 44,262 27,481 27,860 35,504

Tier 1 common capital 6,492,934$ 6,263,575$ 5,685,251$ 5,473,254$ 5,201,338$

Risk weighted assets (a) 38,517,988$ 38,473,339$ 37,828,130$ 38,368,928$ 37,799,513$

Common Equity Tier 1 capital ratio (b) 16.9% 16.3% 15.0% 14.3% 13.8%

(Unaudited, dollars in thousands)