Attached files

| file | filename |

|---|---|

| EX-3.1 - EX-3.1 - Santander Consumer USA Holdings Inc. | d684259dex31.htm |

| EX-3.2 - EX-3.2 - Santander Consumer USA Holdings Inc. | d684259dex32.htm |

| EX-32.2 - EX-32.2 - Santander Consumer USA Holdings Inc. | d684259dex322.htm |

| EX-32.1 - EX-32.1 - Santander Consumer USA Holdings Inc. | d684259dex321.htm |

| EX-31.1 - EX-31.1 - Santander Consumer USA Holdings Inc. | d684259dex311.htm |

| EX-31.2 - EX-31.2 - Santander Consumer USA Holdings Inc. | d684259dex312.htm |

| EX-23.1 - EX-23.1 - Santander Consumer USA Holdings Inc. | d684259dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2013

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-36270

SANTANDER CONSUMER USA HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 32-0414408 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

8585 North Stemmons Freeway Suite 1100-N

Dallas, Texas 75247

(214) 634-1110

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Name of Exchange on Which Registered | |

| Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation ST (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

As of June 30, 2013, the last business day of the Registrant’s most recently completed second fiscal quarter, there was no established public market for the Registrant’s Common Stock and, therefore, the Registrant cannot calculate the aggregate market value of its Common Stock held by non-affiliates as of such date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding at February 28, 2014 | |

| Common Stock ($0.01 par value) | 348,710,767 shares |

Table of Contents

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 20 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| Item 7A - Quantitative and Qualitative Disclosures About Market Risk |

78 | |||

| 79 | ||||

| Item 9 - Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

122 | |||

| 122 | ||||

| 123 | ||||

| Item 10 - Directors, Executive Officers and Corporate Governance |

123 | |||

| 130 | ||||

| 159 | ||||

| 161 | ||||

| 165 | ||||

| 167 | ||||

| 167 | ||||

| 168 | ||||

2

Table of Contents

Cautionary Note Regarding Forward-Looking Information

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are:

| • | adverse economic conditions in the United States and worldwide may negatively impact our results; |

| • | our business could suffer if our access to funding is reduced; |

| • | we face significant risks implementing our growth strategy, some of which are outside our control; |

| • | our agreement with Chrysler Group LLC (“Chrysler”) may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; |

| • | our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; |

| • | our financial condition, liquidity, and results of operations depend on the credit performance of our loans; |

| • | loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; |

| • | future changes in our relationship with Banco Santander, S.A. (“Santander”) could adversely affect our operations; and |

| • | we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business. |

If one or more of the factors affecting our forward-looking information and statements proves incorrect, its actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

3

Table of Contents

| ITEM 1. | BUSINESS |

General

Santander Consumer USA Holdings Inc., a Delaware corporation (“SCUSA Delaware” or, together with its subsidiaries, “SCUSA” or “the Company”), is the holding company for Santander Consumer USA Inc., an Illinois corporation (“SCUSA Illinois”), and its subsidiaries, a technology-driven specialized consumer finance company focused on vehicle finance and unsecured consumer lending products. The Company’s primary business is the indirect origination of retail installment contracts principally through manufacturer-franchised dealers in connection with their sale of used and new automobiles and light-duty trucks to retail consumers. In conjunction with a ten-year private label financing agreement with Chrysler Group (the “Chrysler Agreement”) that became effective May 1, 2013, the Company offers a full spectrum of auto financing products and services to Chrysler customers and dealers under the Chrysler Capital brand. These products and services include consumer retail installment contracts and leases, as well as dealer loans for inventory, construction, real estate, working capital and revolving lines of credit.

The Company also originates vehicle loans through a web-based direct lending program, purchases vehicle retail installment contracts from other lenders, and services automobile and recreational and marine vehicle portfolios for other lenders. Additionally, in 2013 the Company began originating and acquiring unsecured consumer loans.

The Company is currently owned approximately 60.5% by Santander Holdings USA, Inc. (“SHUSA”), a subsidiary of Banco Santander, S.A. (“Santander”), approximately 4.1% by Sponsor Auto Finance Holdings Series LP (“Auto Finance Holdings”), approximately 9.9% by DDFS LLC, an entity affiliated with the Company’s Chief Executive Officer (“CEO”), approximately 25.3% by public shareholders, and approximately 0.2% by other holders, primarily members of senior management.

Reorganization

In July 2013, SCUSA Illinois formed SCUSA Delaware and SCUSA Merger Sub Inc., an Illinois corporation and a wholly owned subsidiary of SCUSA Delaware (“SCUSA Merger Sub”). On January 16, 2014, pursuant to an Agreement and Plan of Merger by and among SCUSA Illinois, SCUSA Delaware and SCUSA Merger Sub, SCUSA Merger Sub merged with and into SCUSA Illinois, with SCUSA Illinois surviving the merger as a wholly owned subsidiary of SCUSA Delaware, the registrant. In the merger, all of the outstanding shares of common stock of SCUSA Illinois were exchanged for shares of SCUSA Delaware common stock on a 2.6665 for 1.00 basis. We refer to these transactions as the “Reorganization.” The Reorganization has not resulted in any change of the business, management, jobs, fiscal year, assets, liabilities, or location of the principal facilities of SCUSA Illinois.

4

Table of Contents

Our Markets

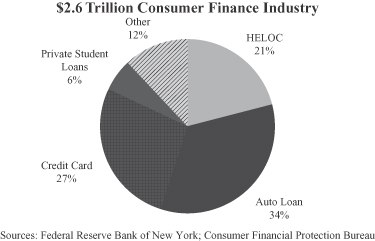

The consumer finance industry in the United States has approximately $2.6 trillion of outstanding borrowings and includes vehicle loans and leases, credit cards, home equity lines of credit, private student loans, and personal loans. As economic conditions have recovered from the 2008 and 2009 downturn, there has been a significant demand for consumer financing, particularly finance vehicle sales.

Our primary focus is the vehicle finance segment of the U.S. consumer finance industry. Vehicle finance includes loans and leases taken out by consumers to fund the purchase of new and used automobiles, as well as motorcycles, RVs, and watercraft. Within the vehicle finance segment, we maintain a strong presence in the auto finance market. The auto finance market features a fungible product resulting in an efficient pricing market, but it is highly fragmented, with no individual lender accounting for more than 10% of market share. As of December 31, 2013, there were approximately $863 billion of auto loans outstanding.

5

Table of Contents

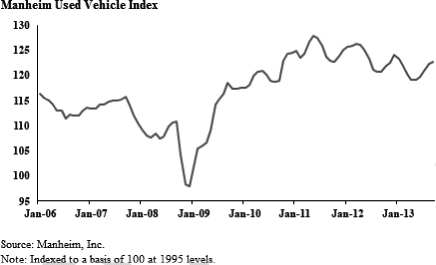

Through the recent economic downturn, auto loans generally were not as adversely impacted as most other consumer lending products. This performance was largely attributable to several factors, including: (i) the importance that automobiles serve in consumers’ everyday lives; (ii) the ability to locate, repossess and sell a vehicle to mitigate losses on defaulted loans; and (iii) the robustness of the used car market and residual values. This latter factor is subject to fluctuations in the supply and demand of automobiles. The primary metric used by the market to monitor the strength of the used car market is the Manheim Used Vehicle Index, a measure of wholesale used car prices adjusted by their mileage or vintage. As of December 31, 2013, used car financing represented 72% of our outstanding retail installment contracts of which 88% consisted of nonprime auto loans. The Manheim Used Vehicle Index has recently been well above historical norms and during the recent economic downturn rebounded in nine months while the broader economy took several years to rebound. This strength in the used car market reflects the importance of cars to U.S. consumers.

6

Table of Contents

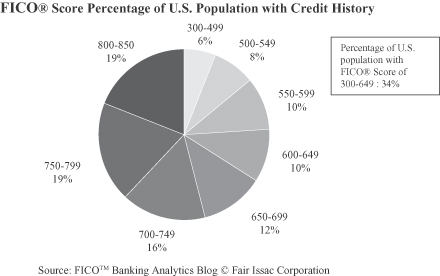

Historically, used car financing has made up a majority of our business. Used automobiles accounted for 74% of total automobiles sold in the United States in 2012. In 2013, through the third quarter, approximately 53% of used car purchases were financed. Most loans in the used auto finance space are extended to nonprime consumers, who comprise a significant portion of the U.S. population. Of the approximately 200 million Americans with a credit history, 34% have FICO® scores below 650. Although nonprime auto loans typically produce higher losses than prime loans, our data-driven approach, extensive experience, and adaptive platform have enabled us to accurately project cash flows and effectively price loans for their inherent risk.

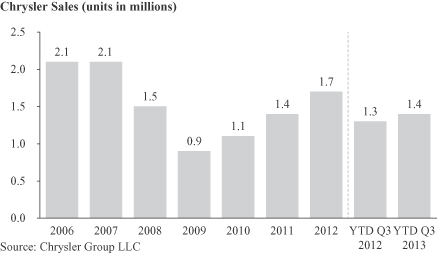

Through our Chrysler Capital brand, we are increasing our focus on the new auto finance space by providing financing for the acquisition of new Chrysler cars. The new auto market continues to recover from the recent economic downturn. There were 15.5 million new cars sold in 2013, which was an increase of 49% over the number of new cars sold in 2009. In 2013, through the third quarter, approximately 84% of total new auto sales were financed. Future growth of new auto sales in the United States, and the parallel growth of consumer loans and leases to finance those sales, are driven by improving economic conditions, new automobile product offerings, and the need to replace aging automobiles. During 2013, the average age of U.S. autos reached an all-time high of 11.4 years. Chrysler Capital loan and lease growth will be driven by the volume of new Chrysler cars sold in the United States.

7

Table of Contents

We are a leading originator of nonprime auto loans. National and regional banks have historically been the largest originators of used and nonprime vehicle loans and leases due to their broad geographic footprint and wide array of vehicle finance products. We primarily compete against national and regional banks, as well as automobile manufacturers’ captive finance businesses, to originate loans and leases to finance consumers’ purchases of new and used cars.

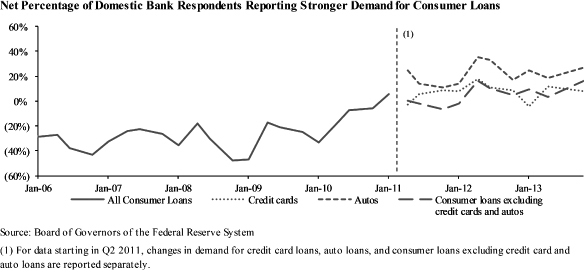

The unsecured consumer lending market, including credit cards, private student loans, point-of-sale financing, and personal loans, represents a significant expansion opportunity for us within the U.S. consumer finance industry. From a recent high in 2008, the U.S. consumer has steadily faced declining access to traditional sources of consumer credit. This decline is evidenced by the reduction of outstanding consumer credit card limits by approximately $795 billion and of home equity lines of credit by approximately $379 billion since 2008. During the recent economic downturn, traditional lenders were forced to tighten credit and, in some cases, exit the market altogether, leaving a large market opportunity with significant growth potential. Additionally, consumer loan demand is recovering and, on average, most domestic bank lenders have reported stronger demand for consumer loans since April 2011. Imbalances in supply and demand have created a significant opportunity for companies like us who have national scale, financial strength, stability of management, strong credit and underwriting processes, and an appetite for identifying incremental lending opportunities.

8

Table of Contents

In both the vehicle finance and unsecured consumer lending markets, we generate originations indirectly and directly. The indirect model requires relationships with third parties who are generally active in the market, are looking for an additional source of financing for their customers, and agree to direct certain customers to SCUSA. The direct model requires an internally-managed platform through which consumers are able to make requests for credit directly to SCUSA. While we have historically focused on the indirect model, we are growing our direct presence in the vehicle finance market through our RoadLoans.com platform and we are currently building out our unsecured consumer lending platform. Additionally, we continue to develop new relationships with third parties to further broaden our origination channels within these markets.

Our Business Strategy

Our primary goal is to create stockholder value by leveraging our systems, data, liquidity, and management. Our growth strategy is to increase market penetration in the consumer finance industry while deploying our capital and funding efficiently.

Expand Our Vehicle Finance Franchise

Organic Growth in Indirect Auto Finance. We have a deep knowledge of consumer behavior across the full credit spectrum and are a key player in the U.S. vehicle finance market. We have the ability to continue to increase our market penetration in the vehicle finance market, subject to attractive market conditions, via the number and depth of our relationships. We plan to achieve this in part through rolling out alliance programs with national vehicle dealer groups and financial institutions, including banks, credit unions, and other lenders, in both the prime and nonprime vehicle finance markets. Our technology-based platform enables us to integrate seamlessly with other originators and thereby benefit from their channels and brands. Additionally, we are evaluating new indirect auto finance opportunities across both North and South America.

Strategic Alliances with original equipment manufacturers(“OEMs”). We plan to expand our existing OEM relationships and develop future relationships with other OEMs to drive incremental origination volume. The loans and leases originated through Chrysler Capital should provide us with the majority of our near-term expected growth. In addition, the experience gained in lease and dealer financing can be applied to improve origination volume through the rest of our dealer base. Our relationship with Chrysler has accelerated our transformation into a full-service vehicle finance company that provides financial products and services to consumers and automotive dealers. In addition to the Chrysler Agreement, we have a pilot program with another OEM, pursuant to which we serve as a preferred finance provider for dealers in certain geographic markets, and have executed a letter of intent to serve as preferred finance provider for a third OEM.

Growth in Direct-to-Consumer Exposure. We are working to further diversify our vehicle finance product offerings by expanding our web-based, direct-to-consumer offerings. We are seeking to engage the consumer at the early stages of the car buying experience. Our RoadLoans.com program is a preferred finance resource for many major vehicle shopping websites, including Cars.com, AutoTrader.com, Kelley Blue Book, and eBay Motors, each of which have links on their websites promoting our RoadLoans.com website for financing. We will continue to focus on securing relationships with additional vehicle-related websites. We anticipate that the next generation of our web-based direct-to-consumer offerings will include additional strategic relationships, an enhanced online experience, and additional products and services to assist with all stages of the vehicle ownership life cycle, including research, financing, buying, servicing, selling, and refinancing.

Expansion of Fee-Based Income Opportunities. We seek out opportunities to leverage our technologically sophisticated and highly adaptable servicing platform for both prime and nonprime loans, as well as other vehicle finance (including RV and marine) and unsecured consumer lending products. We collect fees to service loan portfolios for third parties, and we handle both secured and unsecured loan products across the full credit spectrum. Loans and leases sold to or sourced to banks through flow agreements (including our flow agreements with Bank of America and Santander Bank N.A. (“SBNA,” formerly Sovereign Bank)) and off-balance sheet securitizations also provide additional opportunities to service large vehicle loan and lease pools. Additionally,

9

Table of Contents

we are exploring the possibility of expanding our loan servicing activities in North and South America by leveraging our existing relationships with Chrysler, as well as Santander and other banks in these regions. We believe our loan servicing business is scalable and provides an attractive return on equity, and we intend to continue to develop new third-party relationships to increase its size. In 2013, we added over $3.0 billion of assets to our portfolio of assets serviced for others.

Continue to Grow Our Unsecured Consumer Lending Platform

We are further diversifying our business through our strategic relationships in the unsecured consumer lending space, which includes point-of-sale financing, personal loans, and private label credit cards. Unsecured consumer lending is a rapidly growing segment of the consumer finance market in the United States, and we expect that financing in the unsecured consumer loan space will significantly contribute to our growth. We originated our first unsecured consumer loans in March 2013 and by December 31, 2013 had originated over $1.1 billion in these loans. Our ability to offer these products is derived from our deep knowledge of consumer behavior across the full credit spectrum, our scalable technology platform and Santander’s expertise in the unsecured consumer lending industry. One of our principal strategic consumer finance relationships is with Bluestem, which owns the Fingerhut®, Gettington.com™ and PayCheck Direct® brands. Bluestem’s customers rely on Bluestem proprietary credit products at the point of sale to make purchases. Through our agreement with Bluestem, we have the option to purchase certain loans through April 2020. Additionally, we have a strategic relationship with LendingClub, pursuant to which we invest in or purchase personal loans and have the right to purchase nonprime loans as well, and have recently begun originating private label revolving lines of credit through our relationship with another point-of-sale lending technology company. We also have a pipeline of private label credit card initiatives we expect to pursue. We believe these relationships and initiatives provide us with a strong entry point into the unsecured consumer lending space.

Our Products and Services

We offer vehicle-related financing products and services and, beginning in the first quarter of 2013, unsecured consumer financing.

Vehicle Finance

Our vehicle finance products and services include loans and leases to consumers and dealer loans.

Consumer Vehicle Loans

Our primary business is to indirectly originate vehicle loans through automotive dealerships throughout the United States. We currently do business with over 14,000 dealers, over 95% of whom are manufacturer-affiliated and the remainder of whom are selected large and reputable independent dealers. We use our risk-adjusted methodology to determine the price we pay the automotive dealer for the loan, which may be above or below the principal amount of the loan depending on characteristics such as the contractual APR, the borrower’s credit profile and the tenor of the loan. The consumer is obligated to make payments in an amount equal to the principal amount of the loan plus interest at the APR negotiated with the dealer. In addition, the consumer is also responsible for charges related to past-due payments. Dealers typically retain some portion of the finance charge as income. Our agreements with dealers place a limit on the amount of the finance charges they are entitled to retain. Although we do not own the vehicles we finance through loans, we hold a perfected security interest in those vehicles. Loans with below-market APRs are frequently offered through manufacturer incentive programs. The manufacturer will compensate the originator of these loans for the amount of the financing rate that is below market. These payments are called rate subvention. We are entitled to receive rate subvention payments as Chrysler’s preferred provider through the Chrysler Agreement.

10

Table of Contents

Since 2008, we also have directly originated loans through our branded online RoadLoans.com platform, and we also periodically acquire large portfolios of loans. The loans acquired in bulk acquisitions have primarily been collateralized by automobiles. However, a small amount of such loans have been collateralized by marine and RVs. We generate revenue on these loans through finance charges.

Vehicle Leases

We acquire leases primarily from Chrysler-affiliated automotive dealers and, as a result, become the titleholder for the leased car. The acquisition cost for these leases is based on the underlying value of the vehicle, the contractual lease payments and the residual value, which is the expected value of the vehicle at the time of the lease termination. We use projected residual values that are estimated by third parties, such as ALG. The residual value we use to determine lease payments, or the contractual residual value, may be upwardly adjusted as part of marketing incentives provided by the manufacturer of the vehicle. When a contractual residual value is written up, the lease payments we offer may become more attractive to consumers. The marketing incentive payment that manufacturers pay is equal to the expected difference between the projected ALG residual value and the contractual residual value. This residual support payment is a form of subvention. We are a preferred provider of subvented leases through Chrysler Capital. The consumer, or lessee, is responsible for the contractual lease payments and any excessive mileage or wear and tear on the car that results in a lower residual value of the car at the time of the lease’s termination. In addition, the consumer is also generally responsible for charges related to past due payments. Our leases are primarily closed-ended, meaning the consumer does not bear the residual risk.

We generate revenue on leases through monthly lease payments and fees, and, depending on the market value of the off-lease vehicle, we may recognize a gain or loss upon remarketing. Our agreement with Chrysler permits us to share any residual losses over a threshold, determined on an individual lease basis, with Chrysler.

Dealer Loans

We provide dealer floorplan loans to certain automotive dealers, primarily Chrysler-franchised dealerships, so that they can acquire new and used vehicles for their inventory. We provide these loans in our sole discretion and in accordance with our credit policies, generally advancing up to 100% of the vehicle’s wholesale invoice price for a new vehicle, up to 100% of the price of a used vehicle purchased at an authorized auction, and up to 90% for any other used vehicle. Each dealer loan is secured by all of the dealer’s existing vehicle inventory and is generally secured by dealership assets and/or personal guarantees by the dealership’s owner. Repayment of the advance related to each vehicle in inventory is required within seven days of the date the vehicle is sold or leased. A full or partial repayment also may be required if the vehicle in inventory remains unsold. The interest charged on such loans is based on our internal risk rating for the dealer and is payable monthly.

In addition, we may periodically provide certain automotive dealers, primarily Chrysler-franchised dealerships, with real estate loans and working capital revolving lines of credit. Generally a dealer must have a floorplan loan with us in order to be eligible for real estate loans and working capital revolving lines of credit from us.

As of December 31, 2013, substantially all of the dealer loans originated under Chrysler Capital were held by our affiliate, SBNA, under terms of a flow agreement entered into in June 2013 or sale agreements entered into in August and November 2013.

Servicing for Others

We service a portfolio of vehicle loans originated or otherwise independently acquired by SBNA, as well as the dealer loans SBNA purchased from us and originated under a flow agreement. We also service loans sold through our flow agreement with Bank of America and through our Chrysler Capital off-balance sheet

11

Table of Contents

securitizations, as well as several smaller loan portfolios for various third-party institutions. Beginning in 2014, we also service vehicle leases originated by SBNA under terms of a flow agreement with us.

Unsecured Consumer Lending

In March 2013, we began indirectly originating unsecured consumer loans. Most of these loans are currently serviced by the third-party originators, who handle daily cash remittances and customer service. We are continually evaluating new unsecured consumer lending opportunities, such as credit cards, so that we may further diversify and expand our business.

Origination and Servicing

Vehicle Finance

Our origination platform delivers automated 24/7 underwriting decision-making through a proprietary credit-scoring system designed to ensure consistency and efficiency, with dealers receiving a decision in under ten seconds for 95% of all requests. Every loan application we receive is processed by our risk scoring and pricing models. Our credit scorecard development process is supported by an extensive market database that includes nearly 20 years of historical data on the loans we have acquired as well as extensive consumer finance third-party data. We continuously evaluate loan performance and consumer behavior to improve our underwriting decisions. As a result of our readily adaptable and scalable systems, we are able to quickly implement changes in pricing and scoring credit policy rules and we seek to modify our underwriting standards to match the economic environment. Our scorecard methodology supports underwriting decisions for consumers across the full credit spectrum and has been designed to allow us to maximize modeled risk-adjusted yield for a given consumer’s credit profile. As a result of the Chrysler Agreement, we have adjusted underwriting standards in the prime space to compete with the major lenders in the area.

We have built our servicing approach based on years of experience as a nonprime lender. Our servicing activities consist largely of processing customer payments, responding to customer inquiries (such as requests for payoff quotes), processing customer requests for account revisions (such as payment deferrals), maintaining a perfected security interest in the financed vehicle, monitoring vehicle insurance coverage, pursuing collection of delinquent accounts, and remarketing repossessed or off-lease vehicles. We have made significant technology investments in our servicing systems to ensure that our servicing activities are in compliance with federal and local consumer lending rules in all 50 states.

Through our servicing platform, we seek to maximize collections while providing the best possible customer service. Our servicing practices are closely integrated with our origination platform, resulting in an efficient exchange of customer data, market information and understanding of the latest trends in consumer behavior. Our customer account management process is model-driven and utilizes automated customer service and collection strategies, including the use of automated dialers rather than physical phones. Each of the models we use is validated by back-testing with data and can be adjusted to reflect new information that we receive throughout our entire business such as new vehicle loan and lease applications, refreshed consumer credit data, and consumer behavior that we observe through our servicing operations. Our robust processes and sophisticated technology support our servicing platform to maximize efficiency, consistent loan treatment, and cost control.

In order to provide the best possible customer service, we provide multiple convenience options to our customers and have implemented many strategies to monitor and improve the customer experience. In addition to live agent assistance, our customers are offered a wide range of self-service options via our interactive voice response system and through our customer website. Self-service options include demographic management (such as updating a customer’s address, phone number, and other identifying information), payment and payoff capability, and payment history reporting, as well as online chat and communication requests. Quality assurance teams perform account reviews and are responsible for grading our phone calls to ensure adherence to our policies and procedures as well as compliance with regulatory rules. Our analytics software converts speech from

12

Table of Contents

every call into text so that each of our conversations with a customer can be analyzed and subsequently data-mined. This is used to identify harmful words or phrases in real-time for potential intervention from a manager, and to search for the omission of words or phrases that are required for specific conversations. A quality control team provides an independent, objective assessment of the servicing department’s internal control systems and underlying business processes. This helps us identify organizational improvements while protecting our franchise reputation and brand. Lastly, complaint tracking processes ensure customer complaints are addressed appropriately and that the customers receive status updates. These systems assign the account to a specialized team (Office of the President) until the complaint is deemed to be closed. This team tracks and resolves customer complaints and is subject to a robust quality assurance program.

The servicing process is divided into stages based on delinquency status and the collectors for each stage receive specialized training. In the event that a retail installment contract becomes delinquent, we follow an established set of procedures that we believe maximize our ultimate recovery on the loan or lease. Late stage account managers employ skip tracing, utilize specialized negotiation skills, and are trained to tailor their collection attempts based on the proprietary borrower behavioral score we assign to each of our customers. Collection efforts include calling within one business day when an obligor has broken a promise to make a payment on a certain date and using alternative methods of contact such as location gathering via references, employers, landlords, credit bureaus, and cross-directories. If the borrower is qualified, the account manager may offer an extension of the maturity date, a temporary reduction in payment, or a modification permanently lowering the interest rate or principal. If attempts to work with the customer to cure the delinquency are unsuccessful, the customer is sent a “right to cure” letter in accordance with state laws and the loan is assigned a risk score based on our historical days-to-repossess data. This score is used to prioritize repossessions, and each repossession is systematically assigned to third-party repossession agents according to their recent performance with us. Once the vehicle has been secured, any repairs required are performed and the vehicle is remarketed as quickly as possible, typically through an auction process.

Most of our servicing processes and quality-control measures also serve a dual purpose in that they both ensure compliance with the appropriate regulatory laws and ensure that we deliver the best possible customer service. Additionally, our servicing platform and all of the features we offer to our customers are scalable and can be tailored through statistical modeling and automation.

Unsecured Consumer Lending

We offer point-of-sale financing and personal loans through our partnerships with retailers and other lenders that offer several unsecured consumer lending products. Our ability to offer these products is derived from our expertise in originating nonprime vehicle retail loans and Santander’s expertise in the unsecured consumer lending industry. Our existing relationships with Bluestem, LendingClub, and others are partner-managed programs. In these arrangements, our partner decides whether to extend credit on any application using their own credit policies. If the applicant is declined, the application is sent to us to decide whether or not to extend a loan based on our own credit policy. For each unsecured consumer loan that we purchase, our partner retains the servicing rights unless the loan becomes delinquent, at which point we can elect to become the servicer. Additionally, our partners are required to share data files with us for accounting and portfolio review throughout the life of the unsecured consumer loan. We intend to leverage this data to further strengthen our origination and servicing systems with respect to unsecured consumer lending.

Our Relationship with Chrysler

On February 6, 2013, we entered into the Chrysler Agreement pursuant to which we are the preferred provider for Chrysler’s consumer loans and leases and dealer loans effective May 1, 2013. Business generated under terms of the Chrysler Agreement is branded as Chrysler Capital. During the period from the May 1, 2013 launch of the Chrysler Capital business through December 31, 2013, we acquired over $7.5 billion of Chrysler Capital retail installment contracts and over $2.4 billion of Chrysler Capital vehicle leases, and facilitated the origination of over $500 million of Chrysler Capital dealer loans. We expect these volumes to continue.

13

Table of Contents

The Chrysler Agreement requires, among other things, that we bear the risk of loss on loans originated pursuant to the agreement, but that Chrysler share in any residual gains and losses in respect of consumer leases. The agreement also requires that we maintain at least $5.0 billion in funding available for dealer inventory financing and $4.5 billion of financing dedicated to Chrysler retail financing. In turn, Chrysler must provide designated minimum threshold percentages of its subvention (Chrysler subsidized below-market loan and lease rates) business to us.

Under the Chrysler Agreement, we have agreed to specific transition milestones, including market penetration rates, approval rates, staffing, and service milestones, for the initial year following launch on May 1, 2013. If the transition milestones are not met in the first year, the agreement may terminate and we may lose the ability to operate as Chrysler Capital. If the transition milestones are met, the Chrysler Agreement will have a ten-year term, subject to early termination in certain circumstances, including the failure by either party to comply with certain of their ongoing obligations. In addition, Chrysler may also terminate the agreement, among other circumstances, if (i) we fail to meet certain performance metrics, including certain penetration and approval rate targets, during the term of the agreement, (ii) a person other than Santander and its affiliates or our other stockholders owns 20% or more of our common stock and Santander and its affiliates own fewer shares of common stock than such person, (iii) we become, control, or become controlled by, an OEM that competes with Chrysler or (iv) if certain of our credit facilities become impaired. Based on projections and our initial performance under the agreement, management believes that we will meet all of our performance targets.

In connection with entering into the Chrysler Agreement, we paid Chrysler a $150 million upfront, nonrefundable fee on May 1, 2013. This fee is considered payment for future profits generated from the Chrysler Agreement and, accordingly, we are amortizing it over the expected ten-year term of the agreement as a component of net finance and other interest income. We have also executed an Equity Option Agreement with Chrysler, whereby Chrysler may elect to purchase, at any time during the term of the Chrysler Agreement, at fair market value, an equity participation of any percentage in the Chrysler Capital portion of our business.

For a period of 20 business days after Chrysler’s delivery to us of a notice of intent to exercise its option, we are to discuss with Chrysler in good faith the structure and valuation of the proposed equity participation. If the parties are unable to agree on a structure and Chrysler still intends to exercise its option, we will be required to create a new company into which the Chrysler Capital assets will be transferred and which will own and operate the Chrysler Capital business. If Chrysler and we cannot agree on a fair market value during the 20-day negotiation period, each party will engage an investment bank and the appointed banks will mutually appoint a third independent investment bank to determine the value, with the cost of the valuation divided evenly between Chrysler and us. Each party has the right to a one-time deferral of the independent valuation process for up to nine months. Chrysler will have a period of 90 days after a valuation has been determined, either by negotiation between the parties or by an investment bank, to deliver a binding notice of exercise. Following this notice, Chrysler’s purchase is to be paid and settled within 10 business days, subject to a delay of up to 180 days if necessary to obtain any required consents from governmental authorities.

Any new company formed to effect Chrysler’s exercise of its equity option will be a Delaware limited liability company unless otherwise agreed to by the parties. As long as each party owns at least 20% of the business, Chrysler and we will have equal voting and governance rights without regard to ownership percentage. If either party has an ownership interest in the business of less than 20%, the party with less than 20% ownership will have the right to designate a number of directors proportionate to its ownership and will have other customary minority voting rights.

As the equity option is exercisable at fair market value, we could recognize a gain or loss upon exercise if the fair market value is determined to be different from book value. We believe that the fair market value of our Chrysler Capital financing business currently exceeds book value and therefore have not recorded a contingent liability for potential loss upon Chrysler’s exercise.

14

Table of Contents

Subsequent to the exercise of the equity option, SCUSA’s rights under the Chrysler Agreement will be assigned to the jointly owned business. Exercise of the equity option would be considered a triggering event requiring re-evaluation of whether or not the remaining unamortized balance of the upfront fee we paid to Chrysler on May 1, 2013 should be impaired.

On June 13, 2013, we entered into a committed forward flow agreement that, as amended on September 26, 2013, commits us to sell up to $300 million per month of prime loans to Bank of America through May 31, 2018. For those loans, we will retain the servicing rights at contractually agreed upon rates. This servicing arrangement will provide us with an additional fee income stream. We also will receive or pay a servicer performance payment if net credit losses on the sold loans are lower or higher, respectively, than expected net credit losses at the time of sale.

On June 28, 2013, we entered into a flow agreement with SBNA whereby we provide SBNA with the first right to review and assess Chrysler dealer lending opportunities and, if SBNA elects, to provide the proposed financing. On August 16, 2013, we sold most of our existing Chrysler floorplan loans to SBNA. On November 1, 2013, we sold certain existing Chrysler non-floorplan loans to SBNA. We provide servicing on all loans sold or originated under these agreements. We also will receive or pay a servicer performance payment if yields, net of credit losses, on the loans originated under the flow agreement are higher or lower, respectively, than expected at origination.

On February 4, 2014, we entered into a flow agreement with SBNA whereby we will provide SBNA with the first right to review and approve consumer vehicle lease applications. We may review any applications declined by SBNA for our own portfolio. We will provide servicing and receive an origination fee for all leases originated under this agreement.

In addition, we may periodically provide certain automotive dealers, primarily Chrysler-franchised dealerships, with real estate loans and working capital revolving lines of credit. Generally, a dealer must have a floorplan loan with us in order to be eligible for real estate loans and working capital revolving lines of credit from us.

Segments

The Company has one reportable segment: Consumer Finance which includes our vehicle financial products and services, including retail installment contracts, vehicle leases, and dealer loans, as well as financial products and services related to motorcycles, RVs, and watercraft. It also includes our unsecured personal loan and point-of-sale financing operations.

Subsidiaries

SCUSA Delaware has one principal consolidated majority-owned subsidiary: SCUSA Illinois.

Employees

At December 31, 2013, SCUSA had approximately 4,100 employees. None of the Company’s employees are represented by a collective bargaining agreement.

Seasonality

Our origination volume is generally highest in March and April each year due to consumers receiving tax refunds. Our delinquencies are generally highest in the period from November through January due to consumers’ holiday spending. Although we are profitable throughout the year, these trends drive a seasonal fluctuation whereby our profits generally are highest in the first quarter of each year and decline each quarter thereafter.

15

Table of Contents

Intellectual Property

Our right to use the Santander name is on the basis of a non-exclusive, royalty-free and non-transferable license from Santander, and only extends to uses in connection with our current and future operations within the United States. Santander may terminate such license at any time Santander ceases to own, directly or indirectly, 50% or more of our common stock.

In connection with our agreement with Chrysler, Chrysler has granted us a limited, non-exclusive, non-transferable, royalty-free license to use certain Chrysler trademarks, including the term “Chrysler Capital,” for as long as the Chrysler Agreement is in effect. We are required to adhere to specified guidelines, specifications, and other usage instructions related to these trademarks, as well as to obtain prior written approval of any materials, including financing documents and promotional materials, using the trademarks. This license does not grant us any ownership rights in Chrysler’s trademarks.

Competition

The automotive finance industry is highly competitive. We compete on the pricing we offer on our loans and leases as well as the customer service we provide to our automotive dealer customers. Pricing for these loans and leases is very transparent. We, along with our competitors, post our pricing for loans and leases on web-based credit application aggregation platforms. When dealers submit applications for consumers acquiring vehicles, they can compare our pricing against our competitors’ pricing. Dealer relationships are important in the automotive finance industry. Vehicle finance providers need to tailor product offerings to meet each individual dealer’s needs.

We believe that we can effectively compete because our proprietary scorecards and industry experience enable us to price risk appropriately. In addition, we benefit from Chrysler subvention programs through the Chrysler Agreement. We have developed strong dealer relationships through our nationwide sales force and long history in the automotive finance space. Further, we expect that we will be able to deepen dealer relationships through our Chrysler Capital product offerings.

Our primary competitors in the vehicle finance space are:

| • | national and regional banks; |

| • | credit unions; |

| • | independent financial institutions; and |

| • | the affiliated finance companies of automotive manufacturers. |

While the used car market is fragmented with no single lender accounting for more than 10% of the market, in both the new and used car markets there are a number of competitors that have substantial positions nationally or in the markets in which they operate. Some of our competitors have lower cost structures, lower funding costs, and are less reliant on securitizations. We believe we can compete effectively by continuing to expand and deepen our relationships with dealers. In addition, through our Chrysler Capital brand we will benefit from the manufacturer’s subvention programs and Chrysler’s relationship with its dealers.

Our primary competitors in the unsecured consumer lending space are banks that have traditionally offered revolving credit products such as credit cards, home equity lines of credit, and personal loans. In recent years, new, smaller competitors have emerged to fulfill consumers’ demand for credit products by offering point-of-sale financing and personal loans through technologically sophisticated and often web-based applications. We compete with banks by identifying borrowers with attractive credit profiles who do not rely on traditional bank-offered consumer finance products like credit cards and home equity lines of credit. We also compete with other financial institutions who seek to identify potential partners that offer point-of-sale and web-based credit

16

Table of Contents

applications. We believe we can compete successfully due to our ability to identify unsecured consumer loan applications with attractive risk-adjusted returns, as well as the speed at which we can adapt to our potential partners’ operations.

Supervision and Regulation

The U.S. lending industry is highly regulated under various U.S. Federal laws, including the Truth-in-Lending, Truth-in-Savings, Equal Credit Opportunity, Fair Credit Reporting, Fair Debt Collection Practices Service Members Civil Relief, and Unfair and Deceptive Practices Acts, as well as various state laws. We are subject to inspections, examinations, supervision, and regulation by each state in which we are licensed, the Consumer Financial Protection Bureau (“CFPB”), and the Federal Trade Commission. In addition, because our largest shareholder is a bank holding company, we are subject to certain bank regulations, including oversight by the Federal Reserve, the Office of the Comptroller of the Currency, and the Bank of Spain. Additional legal and regulatory matters affecting the Company’s activities are further discussed in the Item 1A—Risk Factors section of this annual report on Form 10-K.

Dodd-Frank Wall Street Reform and Consumer Protection Act

At the federal level, Congress enacted comprehensive financial regulatory reform legislation on July 21, 2010. A significant focus of the new law (the Dodd-Frank Act) is heightened consumer protection. The Dodd-Frank Act established a new body, the CFPB, which has regulatory, supervisory, and enforcement powers over providers of consumer financial products and services, including us, including explicit supervisory authority to examine and require registration of non-depository lenders and promulgate rules that can affect the practices and activities of lenders.

Although the Dodd-Frank Act expressly provides that the CFPB has no authority to establish usury limits, some consumer advocacy groups have suggested that various forms of alternative financial services or specific features of consumer loan products should be a regulatory priority, and it is possible that at some time in the future the CFPB could propose and adopt rules making such lending services materially less profitable or impractical, which may impact finance loans or other products that we offer.

In March 2013, the CFPB issued a bulletin recommending that indirect vehicle lenders, a class that includes us, take steps to monitor and impose controls over dealer markup policies whereby dealers charge consumers higher interest rates, with the markup shared between the dealer and the lender.

The CFPB is also conducting supervisory audits of large vehicle lenders and has indicated it intends to study and take action with respect to possible Equal Credit Opportunity Act (“ECOA”) “disparate impact” credit discrimination in indirect vehicle finance. If the CFPB enters into a consent decree with one or more lenders on disparate impact claims, it could negatively impact the business of the affected lenders, and potentially the business of dealers and other lenders in the vehicle finance market. This impact on dealers and lenders could increase our regulatory compliance requirements and associated costs.

In addition to the grant of certain regulatory powers to the CFPB, the Dodd-Frank Act gives the CFPB authority to pursue administrative proceedings or litigation for violations of federal consumer financial laws. In these proceedings, the CFPB can obtain cease and desist orders (which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief) and monetary penalties.

Disclosure Pursuant to Section 219 of the Iran Threat Reduction and Syria Human Rights Act

Pursuant to Section 219 of the Iran Threat Reduction and Syria Human Rights Act of 2012, which added Section 13(r) to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), an issuer is required to disclose in its annual or quarterly reports, as applicable, whether it or any of its affiliates knowingly engaged in

17

Table of Contents

certain activities, transactions or dealings relating to Iran or with individuals or entities designated pursuant to certain Executive Orders. Disclosure is generally required even where the activities, transactions or dealings were conducted in compliance with applicable law.

The following activities are disclosed in response to Section 13(r) with respect to affiliates of the Company through its relationship with Santander. During the period covered by this annual report:

| • | A Santander UK plc (Santander UK) customer, being an Iranian national resident in the UK, was designated in September 2013 as acting for or on behalf of the Government of Iran. This account holder’s current account and credit card with Santander UK were closed in December 2013. No revenue was generated by Santander UK on these products. |

| • | In early October 2013, Santander UK opened an account for a Tunisian national, resident in the UK, who is currently designated by the US for terrorism. After becoming aware of this customer’s designation, Santander UK exited the relationship later in October 2013. No revenue was generated by Santander UK on these accounts. |

| • | Santander UK holds frozen savings and current accounts for three customers resident in the UK who are currently designated by the US for terrorism. The accounts held by each customer were blocked after the customer’s designation and have remained blocked and dormant throughout 2013. No revenue was generated by Santander UK on these accounts. |

| • | A U.K. company maintained two commercial accounts at Santander UK that were used to provide payroll processing services for a UK entity that is currently designated by the US under the Iran sanctions regime. The accounts may have been used to provide payroll services to other Iranian clients. Santander UK became aware of this account activity in September 2013 and exited the relationship in January 2014. No revenue was generated by Santander UK on these accounts. |

| • | An Iranian national, resident in the UK, who is currently designated by the US and the UK under the Iran Sanctions regime held a mortgage with Santander UK that was issued prior to any such designation. No further draw-down has been made (or would be allowed) under this mortgage although we continue to receive repayment installments. In 2013, total revenue in connection with the mortgage was £10,421 while net profits were negligible relative to the overall profits of Santander UK. Santander UK does not intend to enter into any new relationships with this customer, and any disbursements will only be made in accordance with applicable sanctions. The same Iranian national also holds two investment accounts with Santander Asset Management UK Limited. The accounts remained frozen throughout 2013. The investment returns are being automatically reinvested, and no disbursements have been made to the customer. Total revenue for Santander in connection with the investment accounts was £247 while net profits in 2013 were negligible relative to the overall profits of Santander. |

In addition, Santander has certain legacy export credits and performance guarantees with Bank Mellat, which are included in the U.S. Department of the Treasury’s Office of Foreign Assets Control’s Specially Designated Nationals and Blocked Persons List. The Bank entered into two bilateral credit facilities in February 2000 in an aggregate principal amount of €25.9 million. Both credit facilities matured in 2012. In addition, in 2005 Santander participated in a syndicated credit facility for Bank Mellat of €15.5 million, which matures on July 6, 2015. As of December 31, 2013, Santander was owed €4.3 million under this credit facility.

Bank Mellat has been in default under all of these agreements in recent years and Santander has been and expects to continue to be repaid any amounts due by official export credit agencies, which insure between 95% and 99% of the outstanding amounts under these credit facilities. No funds have been extended by Santander under these facilities since they were granted.

Santander also has certain legacy performance guarantees for the benefit of Bank Sepah and Bank Mellat (stand-by letters of credit to guarantee the obligations - either under tender documents or under contracting

18

Table of Contents

agreements - of contractors who participated in public bids in Iran) that were in place prior to April 27, 2007. However, should any of the contractors default in their obligations under the public bids, Santander would not be able to pay any amounts due to Bank Sepah or Bank Mellat because any such payments would be frozen pursuant to Council Regulation (EU) No. 961/2010.

In the aggregate, all of the transactions described above resulted in approximately €72,000 gross revenues and approximately €123,000 net loss to Santander in 2013, all of which resulted from the performance of export credit agencies rather than any Iranian entity. Santander has undertaken significant steps to withdraw from the Iranian market such as closing its representative office in Iran and ceasing all banking activities therein, including correspondent relationships, deposit taking from Iranian entities and issuing export letters of credit, except for the legacy transactions described above. Santander is not contractually permitted to cancel these arrangements without either (i) paying the guaranteed amount - which payment would be frozen as explained above (in the case of the performance guarantees), or (ii) forfeiting the outstanding amounts due to it (in the case of the export credits). As such, Santander intends to continue to provide the guarantees and hold these assets in accordance with company policy and applicable laws.

Available Information

All reports filed electronically by the Company with the SEC, including the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as any amendments to those reports, are accessible on the SEC’s Web site at www.sec.gov. These forms are also accessible at no cost on the Company’s website at www.santanderconsumerusa.com. The information contained on our website is not being incorporated herein.

19

Table of Contents

| ITEM 1A. | RISK FACTORS |

The Company is subject to a number of risks potentially impacting its business, financial condition, results of operations and cash flows. The following are the most significant risk factors that affect the Company. Any one or more of these risk factors could have a material adverse impact on the business, financial condition, results of operations or cash flows, in addition to presenting other possible adverse consequences, which are described below.

Business Risks

Adverse economic conditions in the United States and worldwide may negatively impact our results.

We are subject to changes in general economic conditions that are beyond our control. During periods of economic slowdown such as the recent economic downturn, delinquencies, defaults, repossessions, and losses generally increase while proceeds from auction sales decrease. These periods may also be accompanied by increased unemployment rates, decreased consumer demand for automobiles and other consumer products, and declining values of automobiles and other consumer products securing outstanding accounts, which weaken collateral coverage and increase the amount of a loss in the event of default. Additionally, higher gasoline prices, unstable real estate values, reset of adjustable rate mortgages to higher interest rates, general availability of consumer credit, or other factors that impact consumer confidence or disposable income could increase loss frequency and decrease consumer demand for automobiles and other consumer products as well as weaken collateral values on certain types of automobiles and other consumer products. Because our historical focus has been predominantly on nonprime consumers, the actual rates of delinquencies, defaults, repossessions, and losses on these loans could be more dramatically affected by a general economic downturn. In addition, during an economic slowdown or recession, our servicing costs may increase without a corresponding increase in our finance charge income. Furthermore, our business is significantly affected by monetary and regulatory policies of the U.S. federal government and its agencies. Changes in any of these policies are influenced by macroeconomic conditions and other factors that are beyond our control and could have a material adverse effect on us through interest rate changes, costs of compliance with increased regulation, and other factors.

Although market conditions have improved, unemployment in the United States remains at elevated levels, and conditions remain challenging for financial institutions. Furthermore, certain Eurozone member countries have fiscal outlays that exceed their fiscal revenue, which has raised concerns about such countries’ abilities to continue to service their debt and foster economic growth. A weakened European economy could undermine investor confidence in European financial institutions and the stability of European member economies. Notwithstanding its geographic diversification, this could adversely impact Santander, with whom we have a significant relationship. Such events could also negatively affect U.S.-based financial institutions, counterparties with which we do business, and the stability of the global financial markets. Disruptions in the global financial markets have also adversely affected the corporate bond markets, debt and equity underwriting, and other elements of the financial markets. In recent years, downgrades of the sovereign debt of some European countries have resulted in increased volatility in capital markets and have caused some lenders and institutional investors to reduce and, in some cases, cease to provide funding to certain borrowers, including other financial institutions. The impact on available credit, increased volatility in the financial markets, and reduced business activity has adversely affected, and may continue to adversely affect, our businesses, capital, liquidity, or other financial conditions and results of operations, and access to credit.

The process we use to estimate losses inherent in our credit exposure requires complex judgments, including forecasts of economic conditions and how those economic conditions might impair the ability of our borrowers to repay their loans. The degree of uncertainty concerning economic conditions may adversely affect the accuracy of our estimates, which may, in turn, impact the reliability of the process and the quality of our assets.

20

Table of Contents

Our business could be negatively impacted if our access to funding is reduced.

We rely upon our ability to sell securities in the ABS market and upon our ability to access various credit facilities to fund our operations. The ABS market, along with credit markets in general, experienced unprecedented disruptions during the recent economic downturn. Although market conditions have improved since 2009, for a number of years following the economic downturn, certain issuers experienced increased risk premiums while there was a relatively lower level of investor demand for certain ABS (particularly those securities backed by nonprime collateral). In addition, the risk of volatility surrounding the global economic system and uncertainty surrounding regulatory reforms such as the Dodd-Frank Act continue to create uncertainty around access to the capital markets. As a result, there can be no assurance that we will continue to be successful in selling securities in the ABS market. Adverse changes in our ABS program or in the ABS market generally could materially adversely affect our ability to securitize loans on a timely basis or upon terms acceptable to us. This could increase our cost of funding, reduce our margins or cause us to hold assets until investor demand improves.

We also depend on various credit facilities and flow agreements to fund our future liquidity needs. We cannot guarantee that these financing sources will continue to be available beyond the current maturity dates, on reasonable terms, or at all. As our volume of loan acquisitions and originations increases, especially due to our recent relationship with Chrysler, we will require the expansion of our borrowing capacity on our existing credit facilities and flow agreements or the addition of new credit facilities and flow agreements. The availability of these financing sources depends, in part, on factors outside of our control, including regulatory capital treatment for unfunded bank lines of credit, the financial strength and strategic objectives of Santander and the other banks that participate in our credit facilities and flow agreements, and the availability of bank liquidity in general. We may also experience the occurrence of events of default or breach of financial covenants, which could reduce our access to bank funding. In the event of a sudden or unexpected shortage of funds in the banking system, we cannot be sure that we will be able to maintain necessary levels of funding without incurring high funding costs, a reduction in the term of funding instruments, or the liquidation of certain assets.

We have not experienced a significant increase in risk premiums or cost of funding to date, but we are not isolated from general market conditions that may affect issuers of ABS and other borrowers and we could experience increased risk premiums or funding costs in the future. In addition, if the sources of funding described above are not available to us on a regular basis for any reason, we may have to curtail or suspend our loan acquisition and origination activities. Downsizing the scale of our business would have a material adverse effect on our financial position, liquidity, and results of operations.

We face significant risks in implementing our growth strategy, some of which are outside our control.

We intend to continue our growth strategy to (i) expand our vehicle finance franchise by increasing market penetration via the number and depth of our relationships in the vehicle finance market, pursuing additional relationships with OEMs, and expanding our direct-to-consumer footprint and (ii) grow our unsecured consumer lending platform. Our ability to execute this growth strategy is subject to significant risks, some of which are beyond our control, including:

| • | the inherent uncertainty regarding general economic conditions; |

| • | our ability to obtain adequate financing for our expansion plans; |

| • | the prevailing laws and regulatory environment of each state in which we operate or seek to operate, and, to the extent applicable, federal laws and regulations, which are subject to change at any time; |

| • | the degree of competition in new markets and its effect on our ability to attract new customers; |

| • | our ability to recruit qualified personnel, in particular in areas where we face a great deal of competition; and |

| • | our ability to obtain and maintain any regulatory approvals, government permits, or licenses that may be required on a timely basis. |

21

Table of Contents

Our recent agreement with Chrysler may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement.

In February 2013, we entered into a ten-year Master Private Label Financing Agreement (the “Chrysler Agreement”) with Chrysler whereby we launched the Chrysler Capital brand, which originates private-label loans and leases to facilitate the purchase of Chrysler vehicles by consumers and Chrysler-franchised automotive dealers. The financing services that we provide under the Chrysler Agreement, which launched May 1, 2013, include credit lines to finance Chrysler-franchised dealers’ acquisitions of vehicles and other products that Chrysler sells or distributes, automotive loans and leases to finance consumer acquisitions of new and used vehicles at Chrysler-franchised dealerships, financing for commercial and fleet customers, and ancillary services. In addition, we will offer dealers dealer loan financing, construction loans, real estate loans, working capital loans, and revolving lines of credit. In accordance with the terms of the Chrysler Agreement, in May 2013 we paid Chrysler a $150 million upfront, nonrefundable payment, which will be amortized over ten years but would be recognized as expense immediately if the Chrysler Agreement is terminated in accordance with its terms.

As part of the Chrysler Agreement, we received limited exclusivity rights to participate in specified minimum percentages of certain of Chrysler’s financing incentive programs, which include loan rate subvention and automotive lease residual support subvention. We have committed to certain revenue sharing arrangements, as well as to considering future revenue sharing opportunities. We will bear the risk of loss on loans originated pursuant to the Chrysler Agreement, but Chrysler will share in any residual gains and losses in respect of automotive leases, subject to specific provisions in the Chrysler Agreement, including limitations on our participation in gains and losses. In addition, under the Chrysler Agreement, Chrysler has the option to acquire, for fair market value, an equity participation in an operating entity through which the financial services contemplated by the Chrysler Agreement are offered and provided, through either an equity interest in the new entity or participation in a joint venture or other similar business relationship or structure. There is no maximum limit on the size of Chrysler’s potential equity participation. Although the Chrysler Agreement contains provisions that are designed to address a situation in which the parties disagree on the fair market value of the equity participation interest, there is a risk that we ultimately receive less than what we believe to be the fair market value for such interest.

Under the Chrysler Agreement, we have agreed to specific transition milestones, including market penetration rates, approval rates, and staffing and service milestones for the initial year following launch. If the transition milestones are not met in the first year, the agreement will terminate and we will lose the ability to operate as Chrysler Capital. If the transition milestones are met, the Chrysler Agreement will have a ten-year term, subject to early termination in certain circumstances, including the failure by either party to comply with certain of their ongoing obligations under the Chrysler Agreement. In addition, Chrysler may also terminate the agreement, among other circumstances, if (i) we fail to meet certain performance metrics, including certain penetration and approval rate targets, during the term of the agreement, (ii) a person other than Santander and its affiliates or our other stockholders owns 20% or more of our common stock and Santander and its affiliates own fewer shares of common stock than such person, (iii) we become, control, or become controlled by, an OEM that competes with Chrysler or (iv) if certain of our credit facilities become impaired.

The loans and leases originated through Chrysler Capital are expected to provide us with the majority of our projected growth over the next several years. Our ability to realize the full strategic and financial benefits of our relationship with Chrysler depends in part on the successful development of our Chrysler Capital business, which will require a significant amount of management’s time and effort. If we are unable to realize the expected benefits of our relationship with Chrysler, or if the Chrysler Agreement were to terminate, our ability to generate or grow revenues could be reduced, and we may not be able to implement our business strategy, which would negatively impact our future growth.

22

Table of Contents

Our business could be negatively impacted if we are unsuccessful in developing and maintaining relationships with automobile dealerships.

Our ability to acquire loans and automotive leases is reliant on our relationships with automotive dealers. In particular, our automotive finance operations depend in large part upon our ability to establish and maintain relationships with reputable automotive dealers that direct customers to our offices or originate loans at the point-of-sale, which we subsequently purchase. Although we have relationships with certain automotive dealers, none of our relationships are exclusive and some of them are newly established and they may be terminated at any time. As a result of the recent economic downturn and contraction of credit to both dealers and their customers, there was an increase in dealership closures and our existing dealer base experienced decreased sales and loan volume in the past and may experience decreased sales and loan volume in the future, which may have an adverse effect on our business, results of operations, and financial condition.

A reduction in demand for our products and failure by us to adapt to such reduction could adversely affect our business, results of operations, and financial condition.

The demand for the products we offer may be reduced due to a variety of factors, such as demographic patterns, changes in customer preferences or financial conditions, regulatory restrictions that decrease customer access to particular products, or the availability of competing products. Should we fail to adapt to significant changes in our customers’ demand for, or access to, our products, our revenues could decrease significantly and our operations could be harmed. Even if we do make changes to existing products or introduce new products to fulfill customer demand, customers may resist such changes or may reject such products. Moreover, the effect of any product change on the results of our business may not be fully ascertainable until the change has been in effect for some time, and, by that time, it may be too late to make further modifications to such product without causing further harm to our business, results of operations, and financial condition.

Our financial condition, liquidity, and results of operations depend on the credit performance of our loans.