Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended February 28, 2018

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___________ to _____________

Commission File Number: 333-175483

China Xuefeng Environmental Engineering Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

99-0364975

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

229 Tongda Avenue

Economic and Technological Development Zone,

Suqian, Jiangsu Province, P.R. China

|

223800

|

|

(Address of principal executive offices)

|

(Zip Code)

|

+86 (527) 8437-0508

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☒

|

|

|

|

|

|

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 9, 2018, there were 66,520,871 outstanding shares of common stock of the registrant, par value $0.001 per share.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC.

FORM 10-Q

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

|

|

|

|

Page

|

|

|

|

|

Item 1. Financial Statements.

|

1

|

|

|

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

32

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

|

44

|

|

|

|

|

Item 4. Controls and Procedures.

|

44

|

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

Item 1. Legal Proceedings.

|

45

|

|

|

|

|

Item 1A. Risk Factors.

|

45

|

|

|

|

|

Item 2 Unregistered Sales of Equity Securities and Use of Proceeds.

|

45

|

|

|

|

|

Item 3 Defaults Upon Senior Securities.

|

45

|

|

|

|

|

Item 4. Mine Safety Disclosures.

|

45

|

|

|

|

|

Item 5. Other Information.

|

45

|

|

|

|

|

Item 6. Exhibits.

|

45

|

|

|

|

|

Signatures

|

46

|

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S. $)

|

February 28,

|

May 31,

|

|||||||

|

ASSETS

|

2018

|

2017

|

||||||

|

(Unaudited)

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

13,789,487

|

$

|

10,343,963

|

||||

|

Accounts receivable

|

3,191,936

|

4,365,854

|

||||||

|

Inventory

|

44,195

|

-

|

||||||

|

Prepaid Expenses

|

319,576

|

7,009,322

|

||||||

|

Prepaid VAT

|

5,087,818

|

4,649,599

|

||||||

|

Deferred registration cost

|

141,975

|

-

|

||||||

|

Total current assets

|

22,574,987

|

26,368,738

|

||||||

|

Noncurrent assets:

|

||||||||

|

Fixed assets, net

|

34,814,143

|

23,860,312

|

||||||

|

Lease equipment, net

|

28,037,439

|

23,774,359

|

||||||

|

Prepaid lease

|

5,923,136

|

5,592,757

|

||||||

|

Accounts receivable-non-current

|

-

|

1,463,078

|

||||||

|

Deferred income tax assets

|

779,620

|

211,653

|

||||||

|

Total noncurrent assets

|

69,554,338

|

54,902,159

|

||||||

|

TOTAL ASSETS

|

$

|

92,129,325

|

$

|

81,270,897

|

||||

See accompanying notes to the consolidated financial statements.

1

CONSOLIDATED BALANCE SHEETS

(UNAUDITED, IN U.S. $)

|

February 28,

|

May 31,

|

|||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

2018

|

2017

|

||||||

|

(Unaudited)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

1,105,230

|

$

|

498,959

|

||||

|

Deferred revenues

|

3,786,350

|

3,695,730

|

||||||

|

Taxes payable

|

492,446

|

596,765

|

||||||

|

Loan from stockholder

|

10,930,221

|

17,468,486

|

||||||

|

Accrued liabilities

|

200,610

|

99,299

|

||||||

|

Total current liabilities

|

16,514,857

|

22,359,239

|

||||||

|

Security deposits payable

|

3,404,670

|

|||||||

|

TOTAL LIABILITIES

|

21,570,345

|

25,763,909

|

||||||

|

Stockholders' equity:

|

||||||||

|

Common stock, $0.001 par value per share, 75,000,000 shares authorized; 64,572,153 and 63,020,871 shares issued and outstanding as of February 28, 2018 and May 31, 2017

|

66,521

|

63,021

|

||||||

|

Additional paid-in capital

|

41,581,497

|

34,584,997

|

||||||

|

Statutory reserve fund

|

2,593,995

|

2,437,684

|

||||||

|

Retained earnings

|

25,163,252

|

22,022,689

|

||||||

|

Other comprehensive income (loss)

|

1,153,715

|

(3,601,403

|

)

|

|||||

|

Total stockholders' equity

|

70,558,980

|

55,506,988

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

92,129,325

|

$

|

81,270,897

|

||||

See accompanying notes to the consolidated financial statements.

2

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(CONTINUED)

(UNAUDITED, IN U.S. $)

|

Three Months Ended,

February 28,

|

Nine Months Ended,

February 28,

|

|||||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Revenue:

|

||||||||||||||||

|

Sales

|

$

|

1,832,415

|

$

|

1,955,155

|

$

|

4,977,147

|

$

|

5,443,844

|

||||||||

|

Lease income

|

1,058,016

|

671,135

|

2,892,551

|

1,845,971

|

||||||||||||

|

Total revenue

|

2,890,431

|

2,626,290

|

7,869,698

|

7,289,815

|

||||||||||||

|

Cost of goods sold:

|

||||||||||||||||

|

Cost of sales

|

436,180

|

154,534

|

703,615

|

410,863

|

||||||||||||

|

Depreciation expense - leased equipment

|

511,698

|

349,084

|

1,399,358

|

922,285

|

||||||||||||

|

Total cost of goods sold

|

947,878

|

503,618

|

2,102,973

|

1,333,148

|

||||||||||||

|

Gross profit

|

1,942,553

|

2,122,672

|

5,766,725

|

5,956,667

|

||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Selling and marketing

|

313,282

|

181,591

|

742,850

|

510,234

|

||||||||||||

|

General and administrative

|

304,507

|

153,086

|

826,793

|

696,399

|

||||||||||||

|

R&D Expense

|

374,841

|

-

|

999,276

|

-

|

||||||||||||

|

Total operating expenses

|

992,630

|

334,677

|

2,568,919

|

1,206,633

|

||||||||||||

See accompanying notes to the consolidated financial statements.

3

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(CONTINUED)

(UNAUDITED, IN U.S. $)

|

Three Months Ended,

February 28,

|

Nine Months Ended,

February 28,

|

|||||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Income from operations

|

949,923

|

1,787,995

|

3,197,806

|

4,750,034

|

||||||||||||

|

Interest income

|

59,292

|

103,903

|

211,538

|

361,197

|

||||||||||||

|

Government subsidy

|

232,660

|

217,462

|

681,908

|

665,688

|

||||||||||||

|

Income before provision for income taxes

|

1,241,875

|

2,109,360

|

4,091,252

|

5,776,919

|

||||||||||||

|

Provision for income taxes

|

179,532

|

480,143

|

794,379

|

1,297,023

|

||||||||||||

|

Net income

|

1,629,217

|

3,296,873

|

4,479,896

|

|||||||||||||

|

Earnings per common share, basic and diluted

|

$

|

0.02

|

$

|

0.03

|

$

|

0.05

|

$

|

0.07

|

||||||||

|

Weighted average shares outstanding, basic and diluted

|

64,572,153

|

63,020,871

|

64,572,153

|

63,020,871

|

||||||||||||

|

Comprehensive Income:

|

||||||||||||||||

|

Net Income

|

$

|

1,062,343

|

$

|

1,629,217

|

$

|

3,296,873

|

$

|

4,479,896

|

||||||||

|

Foreign currency translation adjustment

|

3,006,557

|

87,049

|

4,755,118

|

(2,231,954

|

)

|

|||||||||||

|

Comprehensive income

|

$

|

4,068,900

|

$

|

1,716,266

|

$

|

8,051,991

|

$

|

2,247,942

|

||||||||

See accompanying notes to the consolidated financial statements.

4

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE NINE MONTHS ENDED FEBRUARY 28, 2018

(UNAUDITED, IN U.S. $)

|

Common

Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Statutory

Reserve Fund

|

Other

Comprehensive

Income

|

Total

|

|||||||||||||||||||

|

Balance, May 31, 2017

|

$

|

63,021

|

$

|

34,584,997

|

$

|

22,022,689

|

$

|

2,437,684

|

$

|

(3,601,403

|

)

|

$

|

55,506,988

|

|||||||||||

|

Ordinary shares issue

|

3,500

|

6,996,500

|

-

|

-

|

-

|

7,000,000

|

||||||||||||||||||

|

Net income

|

-

|

-

|

3,296,873

|

-

|

-

|

3,296,873

|

||||||||||||||||||

|

Appropriation to statutory reserve

|

-

|

-

|

(156,311

|

)

|

156,311

|

-

|

-

|

|||||||||||||||||

|

Foreign currency translation adjustment

|

-

|

-

|

-

|

-

|

4,755,118

|

4,755,118

|

||||||||||||||||||

|

Balance, February 28, 2018 (Unaudited)

|

$

|

66,521

|

$

|

41,581,497

|

$

|

$25,163,251

|

$

|

2,593,995

|

$

|

1,153,715

|

$

|

70,558,979

|

||||||||||||

See accompanying notes to the consolidated financial statements.

5

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

|

For Nine Months Ended

February 28,

|

||||||||

|

2018

|

2017

|

|||||||

|

(Unaudited)

|

||||||||

| Cash flows from operating activities: | ||||||||

|

Net income

|

$

|

3,296,873

|

$

|

4,479,896

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation

|

1,880,514

|

992,137

|

||||||

|

Amortization for the land

|

93,649

|

91,421

|

||||||

|

(Increase) in deferred income tax assets

|

(529,246

|

)

|

(71,382

|

)

|

||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Decrease in accounts receivable

|

2,840,839

|

3,025,754

|

||||||

|

(Increase) in inventory

|

(42,391

|

)

|

(90,848

|

)

|

||||

|

(Increase) in prepaid VAT

|

(79,023

|

)

|

(1,218,759

|

)

|

||||

|

(Increase) in prepaid expenses

|

(4,413,591

|

)

|

(213,020

|

)

|

||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

4,086,527

|

(8,196

|

)

|

|||||

|

Decrease (increase) in deferred revenue

|

(184,368

|

)

|

547,343

|

|||||

|

(Decrease) in taxes payable

|

(143,976

|

)

|

(44,115

|

)

|

||||

|

Net cash provided by operating activities

|

6,805,807

|

7,490,231

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of fixed assets

|

(6,001

|

)

|

(661,940

|

)

|

||||

|

Cash paid for stock issuance costs

|

(141,975

|

)

|

-

|

|||||

|

Purchase of items of leasing equipment

|

(3,743,237

|

)

|

(6,797,044

|

)

|

||||

|

Net cash (used in) investing activities

|

(3,891,213

|

)

|

(7,458,984

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Cash received from stock issuance

|

7,000,000

|

-

|

||||||

|

Increase in security deposit payable

|

727,369

|

710,067

|

||||||

|

Payment on shareholder loans

|

(7,544,217

|

) |

-

|

|||||

|

Net cash provided by financing activities

|

183,152

|

710,067

|

||||||

|

Effect of exchange rate changes on cash

|

347,778

|

|

(400,150

|

)

|

||||

6

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

|

For Nine Months Ended

February 28,

|

||||||||

|

2018

|

2017

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Net increase in cash

|

3,445,524

|

341,164

|

||||||

|

Cash, beginning

|

10,343,963

|

5,912,106

|

||||||

|

Cash, end

|

$

|

13,789,487

|

$

|

6,253,270

|

||||

|

Supplemental disclosure of cash flow information

|

||||||||

|

Income taxes paid

|

$

|

1,467,848

|

$

|

1,412,520

|

||||

|

Land appreciation tax paid

|

$

|

4,546

|

$

|

4,438

|

||||

|

Supplemental disclosure of non-cash activities

|

||||||||

|

Property, equipment, equipment construction in process transferred from prepayment

|

$

|

9,229,770

|

$

|

-

|

||||

|

Property, equipment, equipment construction in process accrued

|

$

|

-

|

$

|

1,934,476

|

||||

|

Payment of accrued liabilities by shareholder

|

$

|

62,365

|

$

|

89,000

|

||||

See accompanying notes to the consolidated financial statements

7

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 1. ORGANIZATION

China Xuefeng Environmental Engineering Inc. (the "Company"), formerly known as NYC Moda Inc., was incorporated under the laws of the State of Nevada on March 30, 2011. Since its inception until the closing of the Exchange Agreement, the Company was a development-stage company.

On November 27, 2012, the Company completed a reverse acquisition transaction through a share exchange with the stockholders of Inclusion Business Limited ("Inclusion"), whereby the Company acquired 100% of the outstanding shares of Inclusion in exchange for 7,895,000 shares of its common stock, representing 76.65% of the issued and outstanding shares of common stock. As a result of the reverse acquisition, Inclusion became the Company's wholly-owned subsidiary and the former Inclusion Stockholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Inclusion as the acquirer and the Company as the acquired party for accounting purposes.

In November, 2012, the Company filed a certificate of amendment to its articles of incorporation to change its name from "NYC Moda, Inc." to "China Xuefeng Environmental Engineering Inc." (the "Name Change") and to initiate a 4-for-1 forward stock split (the "Forward Split") of its outstanding shares of common stock. The Name Change and the Forward Split were effective in December, 2012. Upon the effectiveness of the Forward Split, the number of outstanding shares of the Company's common stock increased from 10,300,000 to 41,200,000 shares. In March, 2013, the Company sold 14,000,000 shares of common stock to 12 unrelated individuals in a private offering, generating $7,000,000 in net proceeds.

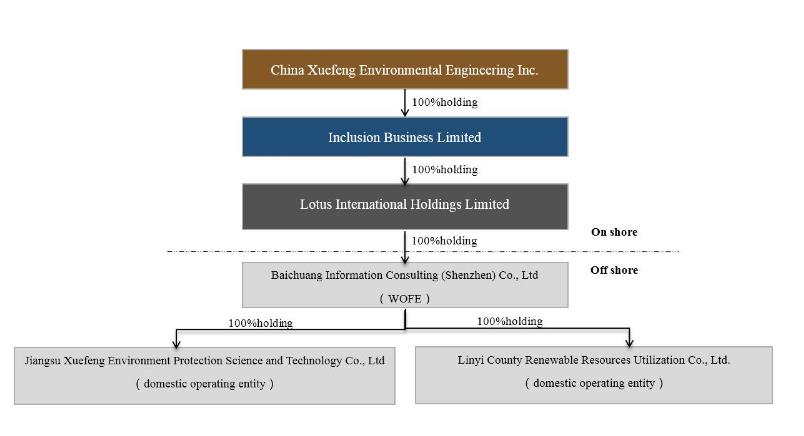

As a result of the transaction with Inclusion, the Company owns all of the issued and outstanding common stock of Lotus International Holdings Limited ("Lotus"), a wholly-owned subsidiary of Inclusion, which in turn owns all of the issued and outstanding capital stock of Baichuang Information Consulting (Shenzhen) Co. Ltd ("Baichuang Consulting"). In addition, the Company effectively and substantially controls Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd. ("Jiangsu Xuefeng") through a series of captive agreements with Baichuang Consulting.

The Company conducts its operations through its controlled consolidated variable interest entity ("VIE"), Jiangsu Xuefeng. Jiangsu Xuefeng, incorporated under the laws of the People's Republic of China ("PRC") in December, 2007, is primarily engaged in the sale, lease and installation of garbage recycling equipment and provides improvement and upgrading services of garbage recycling processing technology and equipment.

In October 2012, Baichuang Consulting (the "WFOE"), a wholly-owned subsidiary of Lotus, entered into a series of contractual arrangements (the "VIE Agreements"). The VIE Agreements include (i) an Exclusive Technical Service and Business Consulting Agreement; (ii) a Proxy Agreement, (iii) Share Pledge Agreement and, (iv) Call Option Agreement with the stockholders of Jiangsu Xuefeng.

8

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 1. ORGANIZATION (CONTINUED)

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, the WFOE provides technical support, consulting, training, marketing and operational consulting services to Jiangsu Xuefeng. In consideration for such services, Jiangsu Xuefeng has agreed to pay an annual service fee to the WFOE of 95% of Jiangsu Xuefeng's annual net income and an additional payment of approximately US$15,910 (RMB100,000) each month. The Agreement has an unlimited term and only can be terminated upon written notice agreed to by both parties.

Proxy Agreement: Pursuant to the Proxy Agreement, the stockholders of Jiangsu Xuefeng agreed to irrevocably entrust the WFOE to designate a qualified person acceptable under PRC law and foreign investment policies, all of the equity interests in Jiangsu Xuefeng held by the stockholders of Jiangsu Xuefeng. The Agreement has an unlimited term and only can be terminated upon written notice agreed to by both parties.

Call Option Agreement: Pursuant to the Call Option agreement, the WFOE has an exclusive option to purchase, or to designate a purchaser, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Jiangsu Xuefeng held by each of the stockholders. To the extent permitted by PRC laws, the purchase price for the entire equity interest is approximately US$0.16 (RMB1.00) or the minimum amount required by PRC law or government practice. This Agreement remains effective until all the call options under the Agreement have been exercised by Baichuang Consulting or its designated entities or natural persons.

Share Pledge Agreement: Pursuant to the Share Pledge agreement, each of the stockholders pledged their shares in Jiangsu Xuefeng to the WFOE, to secure their obligations under the Exclusive Technical Service and Business Consulting Agreement. In addition, the stockholders of Jiangsu Xuefeng agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their interests in Jiangsu Xuefeng that would affect the WFOE's interests. This Agreement remains effective until the obligations under the Exclusive Technical Service and Business Consulting Agreement, Call Option Agreement and Proxy Agreement have been fulfilled or terminated.

On January 19, 2016, the VIE structure was terminated upon Baichuang Consulting exercising its option to purchase all of the registered equity of Jiangsu Xuefeng. Baichuang Consulting became the sole owner of Jiangsu Xuefeng.

On August 4, 2016, Baichuang Information Consulting Co., Ltd ("Baichuang Information") entered into an agreement with Mr. Li Yuan, the sole shareholder of Linyi County Xuefeng Renewable Resources Utilization Technology Co., Ltd ("Linyi Xuefeng"), to purchase his 100% ownership of Linyi Xuefeng. Mr. Li Yuan is the Chief Executive Officer and main shareholder of the Company. The purchase price was determined by the audited net assets of the Company as of May 31, 2016, initially with a payment of RMB10,000,000 ($1,500,000 US) in cash and the balance to be paid in common shares of China Xuefeng at 75% of the closing price on August 4, 2016. On October 7, 2016, a supplementary agreement was entered between both parties to finalize the purchase based upon the audited net asset value of $ 23,462,612 on May 31, 2016. The supplementary agreement eliminated the cash payment making the entire purchase with stock of the Company. The price utilized was $3 per share and 7,820,871 shares were issued to Mr. Li Yuan.

9

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 1. ORGANIZATION (CONTINUED)

Linyi Xuefeng also signed a series of agreements with Jiangsu Liding Machinery Manufacturing Co., Ltd ("Jiangsu Liding") for the construction of the garbage recycling processing plant and production facilities purchase. The shareholder of the Company, Mr. Li Yuan, is also the shareholder of Jiangsu Liding (see note 6). In 2016, the total purchase amount $7,714,280 from Jiangsu Liding was fully delivered in December 2015 and included in the fixed assets of the accompanying consolidated balance sheet as of February 28, 2018 and May 31, 2017. In 2017, and the total purchase amount $8,599,726 from Jiangsu Liding, and paid in advanced with $6,879,781 was included in prepaid expenses with of the accompanying consolidated balance sheet as of May 31, 2017. The total purchase in 2017 was fully delivered in July, 2017 and included in the fixed assets of the accompanying consolidated balance sheet as of February 28, 2018.

Linyi Xuefeng was officially approved and incorporated under the laws of the People's Republic of China ("PRC") in June 2013. Mr. Yuan Li was the sole owner since inception. Linyi Xuefeng is constructing a garbage processing plant which has commenced operations and drive revenue in February 2018. The non-operating revenue was a subsidy received from the government for the city pollution garbage processing plant construction.

On October 30, 2017, China Xuefeng Environmental Engineering, Inc. (the "Company") completed a closing of private placement offering (the "Offering") of shares of the Company's common stock, par value $0.001 per share (the "Shares"), at a purchase price of RMB 13.275, or US$2.00 per share, based on the currency exchange rate of 6.6375 on October 27, 2017, for an aggregate purchase price of RMB 46,462,500, or approximately $7,000,000. Upon the closing, the Company issued a total of 3,500,000 shares of its common stock to the subscribers in the Offering.

As a result of the entry into the foregoing agreements, the Company has a corporate structure which is set forth as follows:

10

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF ACCOUNTING AND PRESENTATION

The unaudited interim consolidated financial statements of the Company as of February 28, 2018 and for the three and nine months ended February 28, 2018 and 2017, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company's Form 10-K filed with the SEC. The results of operations for the three and nine months ended February 28, 2018 are not necessarily indicative of the results to be expected for future three months or for the year ending May 31, 2018.

The acquisition of Linyi Xuefeng was treated as a combination of entities under common control as Mr. Li Yuan was the chief executive officer, a major shareholder and had voting control of both companies. An acquisition of an entity under common control is treated similar to a "pooling of interest." Accordingly, the financial statements of the Company have been restated and include the historical balances of Linyi Xuefeng as if the acquisition occurred on the first day of the earliest period presented.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars ("US Dollar" or "US$" or "$").

VARIABLE INTEREST ENTITY

Until January 19, 2016, the consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries and its VIE for which it is deemed the primary beneficiary. On January 19, 2016, the VIE structure was terminated upon Baichuang Consulting exercising its option to purchase all of the registered equity of Jiangsu Xuefeng. Baichuang Consulting became the sole owner of Jiangsu Xuefeng. All significant inter-company accounts and transactions have been eliminated in consolidation.

11

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

ACQUISITION OF LINYI XUEFENG

The following financial statement amounts and balances of Linyi Xuefeng have been included in the accompanying consolidated financial statements.

|

February 28,

|

May 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

(Unaudited)

|

||||||||

|

TOTAL ASSETS

|

$

|

44,196,781

|

$

|

40,133,685

|

||||

|

TOTAL LIABILITIES

|

$

|

19,613,463

|

$

|

16,877,408

|

||||

|

For Three Months Ended

February 28,

|

For Nine Months Ended

February 28,

|

|||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||||||

|

TOTAL OPERATING EXPENSES

|

$

|

904,210

|

$

|

93,833

|

$

|

1,591,218

|

$

|

286,880

|

||||||||

|

TOTAL OTHER INCOME

|

$

|

233,891

|

$

|

217,978

|

$

|

686,550

|

$

|

667,040

|

||||||||

|

NET (LOSS) INCOME

|

$

|

(370,827

|

)

|

$

|

147,056

|

$

|

(434,277

|

)

|

$

|

451,542

|

||||||

USE OF ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

12

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

FOREIGN CURRENCY TRANSLATION

Almost all Company assets are located in the PRC. The functional currency for the majority of the Company's operations is the Renminbi ("RMB"). The Company uses the United States dollar ("US Dollar" or "US$" or "$") for financial reporting purposes. The financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, "Foreign Currency Matters."

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of income amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company's financial statements are recorded as other comprehensive income (loss).

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the financial statements are as follows:

|

February 28,

2018

|

May 31,

2017

|

February 28,

2017

|

|

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|

|

Balance sheet items, except for stockholders' equity, as of periods end

|

0.1580

|

0.1468

|

N/A

|

|

Amounts included in the statements of income, statements of changes in stockholders' equity and statements of cash flows for three months

|

0.1551

|

N/A

|

0.1450

|

|

Amounts included in the statements of income, statements of changes in stockholders' equity and statements of cash flows for nine months

|

0.1515

|

N/A

|

0.1479

|

For the three months ended February 28, 2018 and 2017, foreign currency translation adjustments of $3,006,558 and $87,049, respectively, for the nine months ended February 28, 2018 and 2017, foreign currency translation adjustments of $4,755,118 and $(2,231,954), respectively, have been reported as other comprehensive income (loss). Other comprehensive income (loss) of the Company consists entirely of foreign currency translation adjustments. Pursuant to ASC 740-30-25-17, "Exceptions to Comprehensive Recognition of Deferred Income Taxes," the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

13

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC's political and economic conditions. Any significant revaluation of the RMB may materially affect the Company's financial condition in terms of US dollar reporting.

Revenues are primarily derived from selling and leasing garbage processing equipment, providing garbage recycling processing system technology support, renovation and upgrade services and patent licensing to customers. The Company's revenue recognition policies comply with FASB ASC 605 "Revenue Recognition." In general, the Company recognizes revenue when there is persuasive evidence of an arrangement, the fee is fixed or determinable, the products or services have been delivered or performed and collectability of the resulting receivable is reasonably assured.

Improvement and upgrading service is a one-time service provided to upgrade customer's existing equipment before they opt to license and use our patented technology. The fee for the service would be paid within thirty (30) days upon execution of the contract.

Inspection would be conducted by the customers according to industry standards within three days upon completion of the improvement and upgrading service. Performance testing would then be conducted on the upgraded equipment, which typically can be done within a month. A final inspection assessment report would be provided to the customers within five days upon completion of the testing and Customers would provide the Company with a signed acceptance form if they are satisfied. The Company will recognize the revenue for the improvement and upgrading service once the performance testing is passed and the final evaluation report is provided by the customer.

Patent licensing is limited to five (5) years with payments due annually in advance and recognized as revenue monthly. We are responsible to provide repairing service when necessary, but customers would bear any out of pocket expense relating to the repairing service.

We believe that lease receivables have four potential risks: operation risk, credit risk, accident risk and natural disasters risk.

First, there is no guarantee that the licensee of our patent will have sufficient capital resources to perform the licensing agreement and pay the licensing fee on time or at all. The length of the agreement is up to five (5) years and therefore the Company may not able to collect fees for the entire agreement. Second, there is a potential credit risk for which the licensee may unilaterally terminate the agreement and thus affect the payout of the licensing agreement. Third, an accident involving the equipment caused by employees of the licensee may have material adverse effect on the operation of the licensee. This unforeseeable risk could impact the licensee's ability to perform throughout the length of the agreement. Lastly, unforeseeable natural disasters could have a material adverse effect on the production and operation of the Company's licensees. If their operation is impacted by events such as fire, flood or earthquakes, they may need to cease their operation and therefore may be unable to perform their obligations under the agreement.

Linyi Xuefeng's income relates solely to government for city pollution garbage processing system constructions. Government subsidies are recognized as earned when grant expenses are incurred up to the maximum amount allowed for each grant award.

14

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Sales-Type Leases

The Company entered into three sales-type lease arrangements during the three months ended August 31, 2015, with two customers for financing of their purchase of garbage processing equipment. The arrangements with the customers have a fixed term of three years. Revenue from the sale of the equipment is recognized at the inception of the lease. The payments have been present valued with an annual interest rate of 5.25%. In connection with these arrangements, the Company recognized no revenue for the three and nine months ended February 28, 2018 and 2017. Future minimum collections for the year ending May 31 are as follows:

|

Year Ending

|

||||

|

May 31,

|

Amount

|

|||

|

2018

|

$

|

1,164,719

|

||

|

2019

|

1,575,047

|

|||

|

$

|

2,739,766

|

|||

Operating Leases

The Company entered into seven operating lease arrangements with six customers for garbage processing equipment on October 20, 2017, March 31, 2017, December 28, 2016, April 25, 2016, December 28, 2015 and November 6, 2015, respectively. The arrangement with the customer has a fixed term of five years with quarterly payments of $151,535 (RMB1,000,000), $181,842 (RMB1,200,000), $181,842 (RMB1,200,000), $181,842 (RMB1,200,000), $363,684 (RMB2,400,000), and $151,535 (RMB1,000,000) respectively. Revenue from the leasing of the equipment is recognized monthly. In addition, the lease required a security deposit on $631,936 (RMB4,000,000), $758,323 (RMB4,800,000), $758,323 (RMB4,800,000), $758,323 (RMB4,800,000), $1,516,646 (RMB9,600,000) and $631,936 (RMB4,000,000), respectively. At the end of the five years lease term, it will be determined whether the lease will be extended, leased to a new customer or returned to the Company. Future minimum payments for the years ending May 31 are as follows:

15

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements

In October 2009, the FASB issued Accounting Standards Update ("ASU") No. 2009-13, "Multiple Deliverable Revenue Arrangements." ASU No. 2009-13 amended the guidance on arrangements with multiple deliverables under ASC 605-25, "Revenue Recognition—Multiple-Element Arrangements." To qualify as a separate unit of accounting under ASC 605-25, the delivered item must have value to the customer on a standalone basis. The significant deliverables under the Company's multiple-element arrangements are improvement and upgrade services and patent licensing.

Improvement and Upgrade Service

The improvement and upgrade service is a one-time service. By the end of improvement and upgrading services, there is persuasive evidence of an arrangement exists since company has a signed contract with a customer; delivery has occurred and a customer has completed inspection and accepted the improvement and upgrading services then delivered; the fee is fixed and become due within 30 days upon the signing of the contract; and collectability is probable. An inspection is conducted by the customer according to industry standards within three days of the completion of the improvement and upgrade. An acceptance form is provided by the customer if the inspection is satisfactory. Performance testing is conducted on the upgraded equipment within one month. A final evaluation report is provided within five days of the completion of the performance testing. The fee for improvement and upgrade services is fixed and becomes due within 30 days, upon the signing of the contract. The fees for the improvement and upgrading services are not subject to refund, forfeiture or any other concession if patent licensing is not completed.

The Company has met the agreed upon specifications and has not been required to make any refunds for its services. No warranty is provided by the Company.

The customer is responsible for repair services when necessary. The out of pocket expenses for the repair services will be charged separately to the customer by the Company.

16

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements (Continued)

Patent Licensing

Patent licensing is limited to 5 years with payments due annually in advance. The patent technology of "harmless and comprehensive garbage processing equipment" provided by the Company to its customers has high garbage processing capacity and stable operation capacity. It is the first modern system equipment in China to use DCS (Distributed Control System) centralized control, by which mechanical automation will be realized for the comprehensive treatment of life garbage. Its core technology is to organically integrate the anaerobic digestion and aerobic fermentation garbage process, degrade and transform the organic matter of domestic waste, effectively sort out the garbage and recycle all kinds of materials, to eventually realize the true waste resource utilization and harmless utilization, with a utilization rate approaching 100%. The resource recovery products, biogas, not only can be used for meeting the needs of the plant itself, but also can be sold as a separate product, which greatly improves the efficiency of garbage processing of the customer's equipment, decreases production cost, and increases the recovery return of garbage processing.

The Company's customer who pays for an upgrade and improvement fee is not required to enter into a licensing agreement to continue to use the patented technology. If the customer does not require the garbage processing equipment to reach the level of the patented technology which can process 500 tons to 1,000 tons of garbage per day, then the customer does not need to enter into the patent licensing agreement.

Multiple Elements

The Company determined that its improvement and upgrade services are individually a separate unit of accounting. In determining whether the improvement and upgrade services has standalone value, the Company considered factors including the availability of similar services from other vendors, its fee structure based on inclusion and exclusion of the service, and its marketing and delivery of the services. The Company uses the vendor-specific objective evidence to determine the selling price for its improvement and upgrade services when sold in multiple-element arrangements. Although not yet being sold separately, the price established by the management has the relevant authority.

The Company also determined that the patent licensing has standalone value because the patent can be licensed separately. The Company uses the vendor-specific objective evidence to determine the price for patent licensing when sold in multiple-element arrangements. Although not yet being licensed separately, the price established by the management has the relevant authority. The Company establishes the price of upgrading and improvement service and the price of patent licensing is determined based on the following method:

17

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements (Continued)

Multiple Elements (Continued)

Since equipment improvement and upgrade service and patent leasing service are derived from the Company's patented technology, which the Company has the exclusive right to while others must obtain licensing rights to use the technology, the Company has a strong bargaining power in the market to undertake the promotion of its brand and corporate image. Furthermore, the Company uses a profit cost pricing method to determine the price of its product. The Company calculates the price by adding its target profit, or a 90% gross profit margin, to the base product cost to derive the final sale price of its services.

The Company allocates the arrangement consideration based on their relative selling prices. Revenues for the improvement and upgrade services are recognized when completed, the performance testing is passed and the final evaluation report is provided by the customer, which generally is within 30 days, assuming all other revenue recognition criteria are met. Revenues for patent licensing are recognized monthly over the licensing period.

The Company believes the effect of changes in the selling price for improvement and upgrade services and patent licensing will not have significant effect on the allocation of the arrangement.

FAIR VALUE OF FINANCIAL INSTRUMENTS

FASB ASC 820, "Fair Value Measurement," defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity.

|

Level 1 Inputs –

|

Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

|

|

Level 2 Inputs –

|

Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

|

|

Level 3 Inputs –

|

Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements

|

.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

FAIR VALUE OF FINANCIAL INSTRUMENTS (CONTINUED)

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of February 28, 2018 and May 31, 2017, none of the Company's assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable, prepaid VAT, accounts payable and accrued expenses, and deferred revenue approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

CASH AND CASH EQUIVALENTS

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents

FIXED ASSETS AND LEASE EQUIPMENT

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditures that substantially increase the asset's value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend the original useful life or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred. The estimated useful lives for fixed asset categories are as follows:

|

Computers and equipment

|

3 years

|

|

Motor vehicles

|

4 years

|

|

Furniture and fixtures

|

5 years

|

|

Lease equipment

|

15 years

|

|

Machinery

|

10 years

|

|

Building and improvement

|

20 years

|

IMPAIRMENT OF LONG-LIVED ASSETS

The Company applies FASB ASC 360, "Property, Plant and Equipment," which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

19

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

DEFERRED REVENUE

Deferred revenue is advance payments received for patent licensing fees and received from government for city pollution garbage processing system constructions. These payments received, but not yet earned, are recognized as deferred revenue in the consolidated balance sheets.

INCOME TAXES

The Company accounts for income taxes in accordance with FASB ASC 740, "Income Taxes" ("ASC 740"), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. During the year ended May 31, 2015, as permitted by the PRC tax law, the Company began recognizing revenue from patent licensing fees for income tax purposes, based on when it is earned rather than when it is collected, consistent with the financial statement recognition. As a result, there are no differences between the basis of assets and liabilities for financial statements and income tax purposes for deferred revenue and, as a result, deferred income taxes are no longer required to be recognized. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized.

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of February 28, 2018 and May 31, 2017, the Company does not have a liability for any unrecognized tax benefits.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 34%. No provision for income taxes in the United States has been made as the Company had no U.S. taxable income for the three and nine months ended February 28, 2018 and 2017.

PRC

Jiangsu Xuefeng and Baichuang Consulting are subject to an Enterprise Income Tax at 25% and file their own tax returns. Consolidated tax returns are not permitted in China.

20

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

INCOME TAXES (CONTINUED)

BVI

Inclusion is incorporated in the BVI and is governed by their income tax laws. According to current BVI income tax law, the applicable income tax rate for the Company is 0%.

Hong Kong

Lotus is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

ADVERTISING COSTS

Advertising costs are charged to operations when incurred. For the three months ended February 28, 2018 and 2017, advertising expense was $139,596 and $130,933 respectively. For the nine months ended February 28, 2018 and 2017, advertising expense was $409,145 and $355,033, respectively .

STATUTORY RESERVE FUND

Pursuant to corporate law in the PRC, the Company is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of the Company's registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund previous years' losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such use is not less than 25% of the registered capital. For the nine months ended February 28, 2018 and 2017, a statutory reserve of $156,311 and $401,191, respectively, was required to be allocated to the Company.

VALUE ADDED TAX ("VAT")

All China-based enterprises are subject to a VAT imposed by the PRC government on their domestic product sales. The output VAT is charged to customers who purchase goods from the Company and the input VAT is paid when the Company purchases goods from its vendors. Input VAT rates are 17% for the purchasing activities conducted by the Company. Output VAT rate is 17% for all products. The input VAT can be offset against the output VAT. The VAT payable will be presented on the balance sheets when input VAT is less than the output VAT. Recoverable balance will be presented on the balance sheets when input VAT is larger than the output VAT.

21

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS

In November 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2016-18, "Statement of Cash Flows: Restricted Cash". The amendments address diversity in practice that exists in the classification and presentation of changes in restricted cash on the statement of cash flows. The amendment is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The Company does not anticipate that this adoption will have a significant impact on its financial position, results of operations, or cash flows.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. This ASU addresses the classification of certain specific cash flow issues including debt prepayment or extinguishment costs, settlement of certain debt instruments, contingent consideration payments made after a business combination, proceeds from the settlement of certain insurance claims and distributions received from equity method investees. This ASU is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted. An entity that elects early adoption must adopt all of the amendments in the same period. The Company is currently evaluating the effect this ASU will have on its consolidated statement of cash flows.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The new standard requires financial assets measured at amortized cost be presented at the net amount expected to be collected, through an allowance for credit losses that is deducted from the amortized cost basis. The standard will be effective for the Company beginning January 1, 2020, with early application permitted. The Company is evaluating the impact of adopting this new accounting guidance on its consolidated financial statements.

In May, 2016, the FASB issued ASU No. 2016-10, Revenue with Contracts with Customers: Narrow-scope Improvements and Practical Expedients, which is an amendment to ASU No. 2014-09 that clarifies the objective of the collectability criterion, to allow entities to exclude amounts collected from customers from all sales taxes from the transaction price, to specify the measurement date for noncash consideration is contract inception, variable consideration guidance applies only tovariability resulting from reasons other than the form of the consideration, and clarification on contract modifications at transition. The implementation guidelines follow ASU No. 2014-09.

In April 2016, the FASB issued ASU No. 2016-12, Revenue from Contracts with Customers. In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606).'' This guidance supersedes current guidance on revenue recognition in Topic 605, "Revenue Recognition.'' In addition, there are disclosure requirements related to the nature, amount, timing, and uncertainty of revenue recognition. In August 2015, the FASB issued ASU No.2015-14 to defer the effective date of ASU No. 2014-09 for all entities by one year. For public business entities that follow U.S. GAAP, the deferral results in the new revenue standard are being effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, with early adoption permitted for interim and annual periods beginning after December 15, 2016. The Company is currently evaluating the impact of adopting this standardon its consolidated financial statements.

22

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 4. FIXED ASSETS

Fixed assets are summarized as follows:

|

February 28,

2018

|

May 31,

2017

|

|||||||

|

(Unaudited)

|

||||||||

|

Computers and equipment

|

$

|

91,949

|

$

|

79,601

|

||||

|

Vehicles

|

91,511

|

85,007

|

||||||

|

Production facilities

|

18,567,117

|

8,308,691

|

||||||

|

Furniture and fixtures

|

121,779

|

112,548

|

||||||

|

Building and improvement

|

16,667,312

|

15,482,441

|

||||||

|

35,539,668

|

24,068,288

|

|||||||

|

Less: accumulated depreciation

|

(725,525

|

)

|

(207,976

|

|||||

|

$

|

34,814,143

|

$

|

23,860,312

|

|||||

For the three months ended February 28, 2018 and 2017, depreciation expense was $427,445 and $24,514 respectively. For the nine months ended February 28, 2018 and 2017, depreciation expense was $481,157 and $74,884 respectively.

Building and improvements and production facilities include approximately $34 million relating to construction of the garbage recycling processing plant and production facilities purchase.

NOTE 5. LEASE EQUIPMENT

|

February 28,

2018

|

May 31,

2017

|

|||||||

|

(Unaudited)

|

||||||||

|

Leasing equipment

|

$

|

31,346,275

|

$

|

25,492,775

|

||||

|

Less: accumulated depreciation

|

(3,308,836

|

)

|

(1,718,416

|

)

|

||||

|

$

|

28,037,439

|

$

|

23,774,359

|

|||||

For the three months ended February 28, 2018 and 2017, depreciation expense was $511,698 and $349,134 respectively. For the nine months ended February 28, 2018 and 2017, depreciation expense was $1,399,357 and $917,253 respectively.

Before leasing the equipment to their client, the Company will upgrade the equipment to meet the client's requirement. The Company recorded the equipment as equipment construction in process before it finishes the upgrading process. As of February 28, 2018, no equipment construction in process was included in lease equipment.

23

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 6. INCOME TAXES

The Company is required to file income tax returns in both the United States and the PRC. Its operations in the United States have been insignificant and income taxes have not been accrued. In the PRC, the Company files tax returns for Jiangsu Xuefeng.

The provision for (benefit from) income taxes consists of the following for the three and nine months ended February 28, 2018 and 2017:

|

For the Three Months

Ended February 28,

|

For the nine months

ended February 28,

|

|||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||||||

|

Current

|

$

|

380,695

|

$

|

503,057

|

$

|

1,166,441

|

$

|

1,368,405

|

||||||||

|

Deferred

|

(201,163

|

)

|

(22,914

|

)

|

(372,062

|

)

|

(71,382

|

)

|

||||||||

|

Total

|

$

|

179,532

|

$

|

480,143

|

$

|

794,379

|

$

|

1,297,023

|

||||||||

As of February 28, 2018, the Company had unused operating loss carry-forwards of approximately $3,118,480 expiring in various years through 2022.

The expected tax rate for income in the PRC is 25%. The following table reconciles the effective income tax rates with the statutory rates for the nine months ended February 28:

|

2018

|

2017

|

|||||||

|

Statutory rate

|

25

|

%

|

25

|

%

|

||||

|

Permanent difference

|

(1

|

%)

|

-

|

|||||

|

Government subsidy

|

(5

|

%)

|

(3

|

%)

|

||||

|

Effective income tax rate

|

19

|

%

|

22

|

%

|

||||

The recognized government subsidy by Linyi Xuefeng was tax exempt per notice form the PRC tax authorities and accordingly there is no tax provision to be recognized.

The Company is required to file income tax returns in both the PRC and the United States. PRC tax filings for the tax year ended December 31, 2017 was examined by the PRC tax authorities in May 2018. PRC tax filings for the tax year ended December 31, 2016 were examined by PRC tax authorities in May 2017. The tax filings were accepted and no adjustments were proposed by the PRC tax authorities.

24

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 6. INCOME TAXES (CONTINUED)

During the year ended May 31, 2017, the Company filed its U.S. federal income tax returns, including, without limitation, information returns on Internal Revenue Service ("IRS") Form 5471, "Information Return of U.S. Persons with Respect to Certain Foreign Corporations" for the fiscal years ended May 31, 2017, May 31, 2016, and May 31, 2015, which is a short year income tax return required to be filed as a result of the change in fiscal year. and the information reports for the years ended December 31, 2016, 2015 and 2014 concerning its interest in foreign bank accounts on form TDF 90-22.1, "Report of Foreign Bank and Financial Accounts" ("FBAR"). Currently, the 2015, 2016 and 2017 tax years are open and subject to examination by the taxing authorities. Management is of the opinion that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

In addition, because the Company did not generate any income in the United States or otherwise have any U.S. taxable income, the Company does not believe that it has any U.S. Federal income tax liabilities with respect to any transactions that the Company or any of its subsidiaries may have engaged in through May 31, 2017. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. Federal income taxes, interest and penalties. The tax years ended May 31, 2017, 2016 and 2015 remain open to examination by the IRS.

NOTE 7. RELATED PARTY TRANSACTIONS

On August 5, 2012, the Company entered into an agreement to lease the patent rights on garbage recycling processing technology from Li Yuan, one of the Company's stockholders. Under the current terms, the Company is required to pay a fee of $12,123 (RMB80,000) each month for five years from September 2012 to August 2017. The Company has renewed the agreement to pay the same fee each month for five years from September 2017 to August 2022. The related prepaid patent leasing fees of $126,387 and $82,182 are included in prepaid expenses on the consolidated balance sheets as of February 28, 2018 and May 31, 2017, respectively.

The remaining payments for the patent rights are as follows:

|

Year Ending

|

||||

|

May 31,

|

Amount

|

|||

|

2018

|

37,916

|

|||

|

2019

|

151,665

|

|||

|

2020

|

151,665

|

|||

|

2021

|

151,665

|

|||

|

2022

|

151,665

|

|||

|

Thereafter

|

37,916

|

|||

|

Total

|

$

|

682,492

|

||

25

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 7. RELATED PARTY TRANSACTIONS (CONTINUED)

The Company obtained a demand loan from Li Yuan, a stockholder which is non-interest bearing. The total loan of approximately $645,964 represents $566,964 of expenses paid by the stockholder and payments of approximately $79,000 representing the registered capital and operating expenses of Baichuang Information Consulting (Shenzhen) Co., Ltd. The balance is reflected as loan from stockholder As of February 28, 2018 and May 31, 2017.

On June 25, 2013, Linyi Xuefeng and the shareholder, Mr. Li Yuan, entered into a loan agreement pursuant to which Mr. Li Yuan provides a loan facility to the Linyi Xuefeng, which are non-interest bearing and expiring on June 30, 2017. The maximum amount of the loan is RMB200,000,000 ($29,350,600). Any borrowings in excess of this amount may be negotiated between the parties. As of February 28, 2018, the loans outstanding was RMB115,096,000 (approximately $17,403,000). On December 17, 2015, a resolution of the board was signed by Mr. Li Yuan, who is the sole shareholder of Linyi Xuefeng, surrendered another loan to the Linyi Xuefeng of RMB140,000,000 (approximately $20,545,00) and treated as a capital contribution to the Linyi Xuefeng.

Linyi Xuefeng also signed a series of agreements with Jiangsu Liding Machinery Manufacturing Co., Ltd ("Jiangsu Liding") for the construction of the garbage recycling processing plant and production facilities purchase. The shareholder of the Company, Mr. Li Yuan, is also the shareholder of Jiangsu Liding. Total purchase amount $7,714,280 from Jiangsu Liding was fully delivered in December 2015, and included in the fixed assets of the accompanying consolidated balance sheet as of May 31, 2017 and 2016. In 2017, and the total purchase amount $8,599,726 from Jiangsu Liding, and advanced payment of $6,879,781 was included in prepaid expenses with of the accompanying consolidated balance sheet as of May 31, 2017. In 2018, and the total purchase in 2017 was fully delivered in July, 2017 and included in the fixed assets of the accompanying consolidated balance sheet as of February 28, 2018.

NOTE 8. LAND USE RIGHT

On September 6, 2013, the Company signed with Linyi Yanjiazhuang Beizhi Village government to obtain a land use right 66,667 square meters of land at total $5,870,120 (RMB40,000,000). In addition, the Company was required to subject a deed tax of $176,104 (RMB1,200,000 ). The purchase of the land was approved by local government on September 9, 2013. The Company fully paid the deed tax of $176,104 when the purchase agreement was signed. The Company paid $3,668,825 (RMB25,000,000) on September 25, 2013 and $2,201,295 (RMB15,000,000) on November 12, 2013 to local government for the land purchase. The land use right started on September 9, 2013 and ends on September 8, 2063.

The amortization for the land use right for the three months ended February 28, 2018 and 2017 was $31,952 and $29,865 respectively. The amortization for the land use right for the nine months ended February 28, 2018 and 2017 was $93,649 and $91,421 respectively.

NOTE 9. SECURITY DEPOSIT PAYABLE

The company leased out highly efficient waste disposal equipment to customers and received one year leasing fee as deposit. The security deposit payable was $5,055,488 and $3,404,670, as of February 28, 2018 and May 31, 2017, respectively.

26

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND 2017

(UNAUDITED, IN U.S. $)

NOTE 10. LEASES

The Company entered into a new lease agreement with an unrelated third party for new office space, which commenced on April 1, 2016 and expires on March 31, 2019. The lease requires the Company to prepay the semi-annual rental of $3,637 (RMB24,000). The lease provides for renewal options.