Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Crank Media Inc | ex32.htm |

| EX-31 - EXHIBIT 31 - Crank Media Inc | ex31.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 000-55824

TEAM

360 SPORTS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 33-1227600 |

| (State or other jurisdiction | (IRS Employer Identification No.) |

| of Incorporation or organization) |

163 Killian Rd.

Maple, Ontario, Canada LGA 1A8

(Address of principal executive offices and zip code)

(775) 882-4641

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

[X] Yes [ ] No

1

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| [ ] Large accelerated filer | [ ] Accelerated filer | [ ] Non-accelerated filer |

[X] Smaller Reporting company |

|

[X] Emerging Growth company |

|||

| (Do not check if smaller reporting company) | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at April 2, 2018 | |

| Common stock, $0.001 par value | 5,131,612 |

DOCUMENTS INCORPORATED BY REFERENCE: None.

2

TEAM 360 SPORTS, INC.

Form 10-K

INDEX

| Page | ||

| Part I | ||

| Item 1 | Business | 5 |

| Item 1A | Risk Factors | 5 |

| Item 1B | Unresolved Staff Comments | 11 |

| Item 2 | Properties | 11 |

| Item 3 | Legal Proceedings | 11 |

| Item 4 | Mine Safety Disclosures | 11 |

| Part II | ||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

| Item 6 | Selected Financial Data | 14 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 14 |

| Item 7A | Quantitative and Qualitative Disclosures about Market Risk | 16 |

| Item 8 | Financial Statements and Supplementary Data | 17 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 17 |

| Item 9A | Controls and Procedures | 17 |

| Item 9B | Other Information | 18 |

| Part III | ||

| Item 10 | Directors and Executive Officers and Corporate Governance | 18 |

| Item 11 | Executive Compensation | 19 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 20 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 21 |

| Item 14 | Principal Accounting Fees and Services | 22 |

| Part IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 23 |

| Signatures | 24 |

PART I

FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

3

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

As used in this Form 10-K, “we,” “us,” and “our” refer to Team 360 Sports, Inc., which is also sometimes referred to as the “Company.”

YOU SHOULD NOT PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS

The forward-looking statements made in this report on Form 10-K relate only to events or information as of the date on which the statements are made in this report on Form 10-K. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this report and the documents that we reference in this report, including documents referenced by incorporation, completely and with the understanding that our actual future results may be materially different from what we expect or hope.

4

ITEM 1. BUSINESS.

Corporate History

Team 360 Sports, Inc. formerly, TSI Sports Inc., was incorporated in the State of Nevada on February 26, 2013, and amended its name to TEAM 360 SPORTS INC., (“Team 360 Sports”) on April 4, 2016 with the State of Nevada. TSI Sports Inc was formed for the purpose of developing software to facilitate sports team management.

The Company has its Nevada registered office at 711 S. Carson Street, Suite 4, Carson City, Nevada 89701. The Company’s main phone number is 775-882-4641. Its principal operations are conducted from its office at 163 Killian Rd., Maple, Ontario L6A 1A8. We are located on the Internet at www.team360apps.com.

Business

The Amateur sports market is a multi-billion dollar industry. We plan to address the need to make life easier and save time of amateur sports administrators and coaches by providing easy to use app for them to manage their team mobile web app service to coaches and sports.

Team 360 Sports is planning to fulfill the need for time saving team management app for today’s busy sports volunteer to help them better organize, coach and administer a team.

| 1. | Developing easy to use web and mobile applications with powerful time saving tools. In amateur sports, volunteers are coaches and administrators who make up the backbone of the organization. The biggest challenge facing them is the time commitment required to do their job effectively while maintaining regular jobs, family and kids. Our goal is to help coaches and managers effectively administer their teams and save time doing it by providing easy to use tools. |

| 2. | Leverage off managements' experience. The Team 360 Sports management has been involved in the past with sports administrative services and were the founders of a company that sold its primary asset in 2016, which was software somewhat similar to the software being produced by the Company in 2016. Its customers were some of the largest leagues and clubs in North America representing over 300,000 players. See the biography of Mr. Miklos on pages 33-34. |

| 3. | Maximizing profits by selling services online. The Company plans to make the entire sales funnel automated and online therefore maximizing profit margins. |

| 4. | Maintaining low overhead costs. The Company plans to outsource certain front end design, and coding/programming services overseen by the company CTO. An offshore call center will be used for customer service. |

| 5. | Effective Marketing. We have an outstanding product and to "tell" the amateur sports world about it we will utilize, print, media, content, and online marketing. |

| 6. | E web and mobile applications with powerful time saving tools. In amateur sports, volunteers are coaches and administrators who make up the backbone of the organization. The biggest challenge facing them is the time commitments required to do their job effectively while maintaining regular jobs, family and kids. Our goal is to help coaches and managers effectively administer their teams and save time doing it by providing easy to use tools. |

Team 360 Sports offers several proven solutions for the Sports Industry:

Team360Apps

The Company’s app is located at www.team260apps.com.

5

The Company has a customized mobile website to manage teams. (Web, Native IOS and Android app). Available as "freemium" with limited functions or as a pay account. The full features include: drag and drop templates for customized team mobile website; Blog section for team specific content; Communications function to custom or auto notify participants by email or text of events, practice and game schedules and track who will or will not be attending; Schedule practices, games and events; Collect dues and fees and track who paid and who did not.

The software features include an auto prompt that is delivered by email or text to those who have not paid. The customer (typically a team) is charged a monthly recurring fee of $4.99. Another feature is Team mobile website builder which is designed to provide an easy and quick means to create and maintain a mobile team website and integrate with a league, club or federation (if the league using Team360Clubs software). A team coach, administrator or manager signs up by quickly and easily by providing an email address or an existing social media account. The software allows the team to use a team logo and photos upload (the freemium version limits the number of photos); and provides space for a description and history of the team and using 40 different drag and drop templates to create a Team mobile website (the freemium version allows only one set template. Players may provide additional information. (Contact details, photos, videos) and may provide their own unique content and blog.

Activities are easily scheduled, players auto notified via text or email. Confirmation of attendance is sent back to administrator who then sets a roster for practice or a game.

The team site may be integrated with each member’s social media to allow for a wider audience and fan base.

A fundraising campaign option is available for teams to make use of the company's crowdfunding platform. A fundraising campaign is initiated and managed by the administrator. The platform leverages the team's social media to help them achieve their goal.

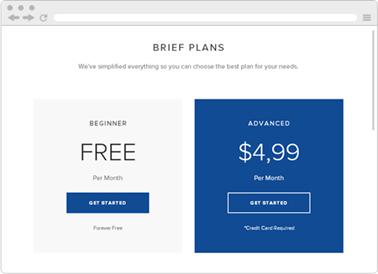

The cost of the packages is:

Freemium Version. No cost

Full Coaching Package $4.99 per month.

Crowdfunding Add On $9.99 per month and 5% of funds raised.

The primary app for Team 360 Sports Inc. is Team 360 apps.

6

Team360Funding

The Team 360 Funding part of the app may be used in web format, Native IOS and Android app format. Social media is integrated into the Team crowdfunding platform. A registered user of any of the Company's products automatically gets a Team crowdfunding profile. The account may be activated at any time to launch a donation or reward based crowdfunding campaign and leverage social media contacts of the team. The platform will keep track of funds raised, from whom, what and when the reward was shipped, keep the whole process compliant with regulations. For use of the Team360Funding feature, the Company charges a recurring monthly fee of $9.99 and 5 % of the funds raised. This software is in development and is not operational at this time.

Team360Clubs. The Team360Clubs software provides an online suite of professional tools for managers of sports leagues and clubs to effectively administer their organizations consisting of hundreds of teams and thousands of players. The App features include: Coaches, Certification maintenance, training, scheduling and pay; Players. Signup, team roster referees, schedules, tournaments. It functions in web format, Native IOS and Android app. This software is in development and is not operational at this time.

Overview

Amateur sports teams are typically coached, administered, and managed by volunteers with day jobs, families, and busy lives. As such they lack time and resources to effectively manage their teams. The Company provides an easy to use time saving web and native apps to help coach or administrator effectively manage the team. A coach or administrator can easily create a mobile team website, upload team logo, photos, and videos to customize it using drag and drop templates, collect fees, schedule games and events, auto notify all participants, keep track of who is attending and communicate with team members.

Another big challenge for amateur sports organizations is fundraising. The Company provides a donation and rewards based "crowdfunding" portal help to raise money for trips, equipment and uniforms by leveraging and utilizing participants’ social media connections.

The founders of the Company have over 35 years experience with team coaching and sports management software administration and development.

7

See Mr. Miklos' biography for more details at pages 18.

Team 360 Sports Inc is Nevada Corporation. Sandor Miklos is the Chief Executive Officer and he and Mario Discepola own majority of the Company. We are located on the Internet at www.team360apps.com

Customers, Distribution and Marketing

The world of amateur athletics goes far beyond the confines of high school and collegiate sports and is changing rapidly in size and demographics. Amateur athletics and their corresponding leagues create industries which not only continue to increase membership, but generate billions of dollars in revenues in the U.S. and Canada. While the amateur segment is fragmented at the commercial level, youth athletics alone (including all sports) represents an industry that generates an estimated $5 billion (in the U.S.) in annual revenues and provides services to an estimated 44 million youth between the ages of 6 and 17 annually.[1]

Adults in the U.S. spend more than $100 billion on recreational sports and sports-related sectors each year, with a large part going to league/association memberships as dues and subscriptions. There is strong potential for companies that can capitalize on under represented market niches including sports team management and data collection services.

Youth Sports

| Sport | US Participants (in millions) |

| Basketball | 24.4 |

| Baseball/Softball | 23.3 |

| Soccer | 13.6 |

| Volleyball | 10.7 |

| Football | 8.9 |

| Disc Ultimate | 4.9 |

| Ice Hockey | 3.1 |

| Lacrosse | 0.7 |

Source: Humphreys Ruesky Sports Industry Study

Adult Participation in Youth Sports (in millions)

| Coaches | 2.4 |

| Officials | 0.9 |

| Administrative | 0.8 |

| Other | 3.2 |

| Total | 7.3 |

Source: National Council on Youth Sports

___________________________

[1] As reported in a report by the North American Association of Sports Economists, IASE/NAASE Working Paper Series, No. 08-11. The abstract of the report states: "We estimate the economic scope of the sports industry in the United States. Drawing on a variety of data sources, we investigate the economic size of sport participation, sports viewing, and the supply and demand side of the sports market in the United States. Estimates of the size of the sports industry based on aggregate demand and aggregate supply range from $44 to $73 billion in 2005. In addition, participation in sports and the opportunity time cost of attending sporting events are important, but hard to value, components of the industry."

8

| Golf | 5.0 |

| Basketball | 3.4 |

| Soccer | 0.9 |

| Bowling | 0.6 |

| Volleyball | 0.4 |

| Touch Football | 0.2 |

| Softball | 0.1 |

Estimated Adult Team Sport Participants (in millions)

Source: BRFS Survey

| Baseball | 9 |

| Basketball | 5 |

| Field Hockey | 11 |

| Football | 11 |

| Hockey | 6 |

| Lacrosse | 10 |

| Soccer | 11 |

| Softball (Fast Pitch) | 9 |

| Softball (Slow Pitch) | 10 |

| Ultimate Frisbee | 7 |

| Volleyball | 6 |

Numbers of Players on a Team

The Humphreys and Ruesky Sports Industry Report (2008) estimates that 50% of the US population participates in some sport regularly and a more significant number participates in a sport irregularly.

The Company's target market is US/Canadian amateur sports team market (with players of any age).

The Company plans to develop the market through social media, email, pay per click marketing and through developing a strong presence at industry tradeshows.

Marketing

Our target markets are U.S. amateur sports teams and more specifically the team coach or assistant coach. Volunteers coach most amateur sports teams. In youth sports specifically parents typically take on the coaching roles while their children play on the team. On average these volunteers come with no previous coaching experience and not a lot of excess time to devote to learning difficult to use software. They may volunteer to coach or assist the coach because they want to help out; there is no one else who will take on the role; (not necessarily for the love of the game). In adult team sports, coaches are also players.

- Amateur coaches need a time saving solution as they have jobs, families, and lives.

- Amateur coaches need an easy to learn and use product as they are not interested in taking on a huge learning curve.

- Amateur coaches need to efficiently schedule games, venues and tournaments rather than using spreadsheets and paper based notes.

- Amateur coaches need an automated and efficient way to collect dues and fees from players. Collecting money from participants consumes much time and is a major hassle.

- Amateur coaches need help to fundraise for team trips and equipment. Lack of funding and difficulty in achieving fundraising goals is one of the major obstacles facing sports organizations.

9

The Company services the needs of the market with a robust solution that is:

- Easy to learn and use

- Robust and customizable

- Web based or native (IOS and Android) application

- Provides a crowdfunding optional package unique to the industry

Competition

The Company is engaged in the amateur sports administration market in which there are many competitors. Some competitors focus on the top of the pyramid, for example; sports federations, leagues and clubs providing data storage and manipulation for the league and club management. Other competitors focus on providing more specific services at the lower end of the pyramid to amateur sports teams. These services typically include player sign up, scheduling and communications, data collection, storage and data manipulation. The services are typically provided using downloadable native applications. There are some companies that address both markets the leagues and providing federations, leagues and clubs and teams.

The most significant competitors are Teamsnap and Sportsngn. They are both well funded organizations competing in the same marketplace. Their products are well designed and popular in the market place. However, from a user’s prospective, their services are not as easy to identify. We intend to compete by making our products easy to use and understand. Our prices and services are clearly listed on the website. They do not have to search and go through a series of hoops to find out the actual cost of our services. Our main competitors have large marketing budgets and will be difficult to compete with. Some competitors to a lesser extent are Eteamz and Sportslogic. Their product is equally concentrated on larger sports organizations leagues and clubs versus teams. These companies also provide a mix of applications that are similar to ours. They are also well capitalized with large marketing budgets and will be difficult to compete with.

Other competitors: There is a myriad of small companies that provide some or all or more of the services we provide.

Overall there is a barrier to entry to this market due to the amount of time and effort required to develop a robust software platform and design and create native applications.

Employees

As of the date of this filing, Team 360 Sports employed a total of 2 people. Team 360 Sports considers its relationship with its employees to be stable.

Facilities and Logistics

Team 360 Sports Inc is headquartered with its executive offices located in the residence of Sandor Miklos at 163 Killian Road, Maple, Ontario, Canada L6A 1A8. The Company does not have a formal lease, but expects that as it grows, it will lease offices as needed.

Involvement in Certain Legal Proceedings

The Company and none of our officer nor directors, promoters or control persons have been involved in the past ten years in any of the following:

10

| (1) | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| (2) | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| (3) | Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| (4) | Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Patents

The Company has no current patents or trademarks.

Seasonality

We generally do not have a strong seasonality trend to our business.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

None.

ITEM 3. LEGAL PROCEEDINGS.

None.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

11

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained. A stockholder in all likelihood, therefore, will not be able to resell his or her securities should he or he desire to do so when eligible for public resale. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops. We have no plans, proposals, arrangements, or understandings with any person with regard to the development of a trading market in any of our securities.

Penny Stock Considerations

Our shares likely will be “penny stocks” as that term is generally defined in the Exchange Act and the rules and regulations promulgated thereunder to mean equity securities with a price of less than $5.00. Our shares thus will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale. Generally, an individual with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with his or her spouse is considered an accredited investor. In addition, under the penny stock regulations the broker-dealer is required to:

· Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt;

· Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities;

· Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value and information regarding the limited market in penny stocks; and

· Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account.

12

Because of these regulations,

broker-dealers may encounter difficulties in their attempt to sell shares of our Common Stock, which may affect the ability of

Selling Stockholders or other holders to sell their shares in the secondary market and have the effect of reducing the level of

trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of

our securities, if our securities become publicly traded. In addition, the liquidity for our securities may be decreased, with

a corresponding decrease in the price of our securities. Our shares in all probability will be subject to such penny stock rules

and our stockholders will, in all likelihood, find it difficult to sell their securities.

OTC Bulletin Board Qualification for Quotation

To have our shares of Common Stock on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our Common Stock. We have not had conversations with nor engaged any market maker to file our application on Form 211 with FINRA. No Assurances can be made that we will be able to obtain a sponsor to file our application.

Stockholders

As of the date of this Annual Report, we had 50 holders of record of our Common Stock.

Dividends

We have not declared any cash dividends on our Common Stock since our inception and do not anticipate paying such dividends in the foreseeable future. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

13

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company for the fiscal years ended December 31, 2017 and 2016. The discussion and analysis that follows should be read together with our financial statements and the notes to the financial statements included elsewhere in this Annual Report on Form 10-K. Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report.

Overview

We were incorporated in Nevada on February 26, 2013, and on April 4, 2016, amended the Articles of Incorporation to change the name of the company to Team 360 Sports Inc. The Company provides amateur sports clubs, leagues and teams with easy to use robust digital administration management systems.

The Company has had minimal revenues from two customers in three transactions as the Company was developing its technology and platform. One transaction on September 1, 2016 for $1,250 was for a "white label" administration scheduler software. Another transaction on November 5, 2016 was a payment of $10,000 as a non-refundable up-front payment for a non-exclusive license for use of the Company's software. Another transaction on the same date was a training fee of $3,000 in conjunction with a non-exclusive license. The license agreement calls for a five percent (5%) royalty on further sales by licensees, but no fees have been received to date. There are no assurances that the previous customers will continue using our services as there are no existing contracts due to the nature of our business. The trend in the market place is to provide services to teams versus large organizations such as leagues and clubs. The Company is planning to move into that market place, however there can be no assurances that it will succeed.

Results of Operations

Comparison of twelve-month periods ended December 31, 2017 and 2016

Revenue

We have generated $2,557 and $1,676 in revenues for the year ended December 31, 2017 and 2016, respectively.

Expenses

General and administration expenses for the year ended December 31, 2017, amounted to $759,313, compared to $10,947 during the year ended December 31, 2016. The increase is primarily attributable to issuing stock for services valued at $700,000 and also incurring significant accounting and legal expense associated with registering the company with the Securities and Exchange Commission.

Compensation expenses for the year ended December 31, 2017, amounted to $25,000 compared to $0 during the year ended December 31, 2016.

14

Other expense for the year ended December 31, 2017 amounted to $910, compared to $0 during the year ended December 31, 2016. The increase is primarily due to an increase in interest expense associated with the company’s increase in its loan payable.

Net Loss

For the year ended December 31, 2017, we incurred a net loss of $757,666, compared to a net loss of $9,271 for the year ended December 31, 2016. The increase is due to increased costs associated with registering the company with the Securities and Exchange Commission.

Liquidity and Capital Resources

As of December 31, 2017, we have $18,163 in current assets and $49,664 in current liabilities. Our total assets were $18,163 and our total liabilities were $49,664. We had $18,163 in cash and our working capital deficit was $31,501.

Cash Flows:

| For the years ended | ||||||||

| December 31, | ||||||||

| 2017 | 2016 | |||||||

| Cash Flows from Operating Activities | $ | (56,491 | ) | $ | 804 | |||

| Cash Flows from Investing Activities | — | — | ||||||

| Cash Flows from Financing Activities | 73,638 | — | ||||||

| Effects of Currency Translations | — | — | ||||||

| Net increase in cash | $ | 17,147 | $ | 804 | ||||

15

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with generally accepted accounting principles of the United States (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the year. The more significant areas requiring the use of estimates include asset impairment, stock-based compensation, and future income tax amounts. Management bases its estimates on historical experience and on other assumptions considered to be reasonable under the circumstances. However, actual results may differ from the estimates.

We believe the following is among the most critical accounting policies that impact or consolidated financial statement. We suggest that our significant accounting policies, as described in our financial statements in the Summary of Significant Accounting Policies, be read in conjunction with this Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Revenue Recognition

The Company recognizes revenue only when all of the following criteria have been met:

| • | Persuasive evidence of an arrangement exists; |

| • | Delivery has occurred or services have been rendered; |

| • | The fee for the arrangement is fixed or determinable; and |

| • | Collectibility is reasonably assured. |

Persuasive Evidence of an Arrangement - The Company documents all terms of an arrangement in a written contract signed by the customer prior to recognizing revenue.

Delivery Has Occurred or Services Have Been Performed - The Company performs all services or delivers all products prior to recognizing revenue. Monthly services are considered to be performed ratably over the term of the arrangement. Professional consulting services are considered to be performed when the services are complete. Equipment is considered delivered upon delivery to a customer’s designated location.

The Fee for the Arrangement Is Fixed or Determinable - Prior to recognizing revenue, a customer’s fee is either fixed or determinable under the terms of the written contract. Fees for most monthly services, professional consulting services, and equipment sales and rentals are fixed under the terms of the written contract. Fees for certain monthly services, including certain portions of networking, storage, and content distribution and caching services, are variable based on an objectively determinable factor such as usage. Those factors are included in the written contract such that the customer’s fee is determinable. The customer’s fee is negotiated at the outset of the arrangement and is not subject to refund or adjustment during the initial term of the arrangement.

Collectability Is Reasonably Assured - The Company determines that collectability is reasonably assured prior to recognizing revenue. Collectability is assessed on a customer by customer basis based on criteria outlined by management. New customers are subject to a credit review process, which evaluates the customer’s financial position and ultimately its ability to pay. The Company does not enter into arrangements unless collectability is reasonably assured at the outset. Existing customers are subject to ongoing credit evaluations based on payment history and other factors. If it is determined during the arrangement that collectability is not reasonably assured, revenue is recognized on a cash basis.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

16

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The financial statements annexed to this Form 10-K for the year ended December 31, 2017 begin on page F-1 and have been audited by our independent accountants, Pinnacle Accountancy Group of Utah.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, Sandor Miklos, who is our Chief executive officer and Chief financial officer, as of December 31, 2017, we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended. Based on this evaluation, our Chief Executive Officer has concluded that, based on the material weaknesses discussed below, our disclosure controls and procedures were not effective as of such date to ensure that information required to be disclosed by us in reports filed or submitted under the Securities Exchange Act were recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Act Commission's rules and forms and that our disclosure controls are not effectively designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act is accumulated and communicated to management, including our Chief Executive Officer, as appropriate to allow timely decisions regarding required disclosure.

Management's Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Rules 13a-15(f) under the Securities Exchange Act of 1934, internal control over financial reporting is a process designed by, or under the supervision of, Sandor Miklos, the Company's Chief Executive Officer, and effected by the Company's board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP.

The Company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records, that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company's assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of the Company's management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management, including our principal executive officer and principal financial officer, assessed the effectiveness of our internal control over financial reporting at December 31, 2017. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework (2013). Based on that assessment under those criteria, management has determined that, as of December 31, 2017, our internal control over financial reporting was not effective.

Our internal controls are not effective for the following reasons: (i) there is an inadequate segregation of duties consistent with control objectives as management is comprised of only two persons, one of which is the Company's principal executive officer and principal financial officer and, (ii) the Company does not have an audit committee with a financial expert, and thus the Company lacks the board oversight role within the financial reporting process.

In order to mitigate the foregoing material weakness, we have engaged an outside accounting consultant with significant experience in the preparation of financial statements in conformity with GAAP to assist us in the preparation of our financial statements to ensure that these financial statements are prepared in conformity with GAAP. We will continue to monitor the effectiveness of this action and make any changes that our management deems appropriate.

We would need to hire additional staff to provide greater segregation of duties. Currently, it is not feasible to hire additional staff to obtain optimal segregation of duties. Management will continue to reassess this matter to determine whether improvement in segregation of duty is feasible. In addition, we would need to expand our board to include independent members.

Going forward, we intend to evaluate our processes and procedures and, where practicable and resources permit, implement changes in order to have more effective controls over financial reporting.

This Annual Report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to the exemption provided to issuers that are not "large accelerated filers" nor "accelerated filers" under the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting that occurred during our fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION.

None

17

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Neither the Company, its property, nor any of its directors or officers is a party to any pending legal proceeding, nor have they been subject to a bankruptcy petition filed against them. None of its officers or directors have been convicted in, nor is subject to, any criminal proceeding.

The names and ages of the directors and executive officers of the Company and their positions with the Company are as follows:

| Name | Age | Position |

| Sandor (Alex) Miklos | 60 | President, Chief Executive Officer, Chief Financial Officer (Principal Accounting Officer), Chairman of the Board |

| Simon Smith | 46 | Vice President and Chief Technical Officer |

Sandor (Alex) Miklos -- President, Chief Executive Officer, Chief Financial Officer (Principal Accounting Officer), Chairman of the Board of Directors

Mr. Miklos started his post high school education Seneca College in Toronto and graduated with a science diploma. His financial career began in 1987 with a bank owned investment firm managing currency and interest rate risk for large institutions utilizing, futures, options, and other derivatives. Later in his career he was selected as the manager of Ontario Secondary School Teachers Federation’s funds. His ongoing education include business at Laurier University in Waterloo; Wharton School of Business in conjunction with the Investment Management Consultants Association (IMCA where he earned the Certified Investment Management Consultant (CIMA) designation and utilized it until 2004 when he left the professional advisory investment business. Since 2004 he has been an angel investor and business consultant specializing in sales and marketing. In the past, he has held real estate, securities, futures, options and derivatives, partners and officers’ licenses and a CIMA designation. He is a part owner and an employee of a Florida Company named Casavue, LLC, also a technology and software development company that is based in Florida. Mr. Miklos intends to devote between 10 and 20 hours per week or more if needed to manage and direct the operations of the Company. Mr. Miklos has a compensation agreement with the Company.

Simon Smith, Vice President and Chief Technical Officer

Simon is a Science graduate with a M.Sc. in Physics from Queens University in Canada and a B.Sc. from Warwick University in the U.K. After graduation Simon worked as a researcher for Oil and Gas companies in the fields of electromagnetics and ultrasound. 1996-2002 Simon worked in Europe and the Middle East managing ERP implementations for Chemical, Utility and Mining companies. In 2002 Simon became the CTO of Detectent, a US based company providing software and analytics for the utility industry, Simon was one of the founders of this company which grew to over 50 employees until it was sold to Silver Springs Networks in 2014. Simon also started his own IT company based in Vietnam and Thailand in 2005 which provides IT programming and Quality Assurance services as well as global sourcing software to the Oil and Gas industry. He is a part owner and an employee of a Florida Company named Casavue, LLC, also a technology and software development company that is based in Florida. Mr. Smith intends to devote between 10 and 20 hours per week or more if needed to manage and direct the operations of the Company. Mr. Smith has a compensation agreement with the Company.

18

ITEM 11. EXECUTIVE COMPENSATION.

Summary Compensation. The following table summarizes, for each of 2015 and 2016 the compensation awarded, paid to or earned by our President, CEO and Chairman of the Board of Directors, Sandor Miklos and our Vice President and Chief Technical Officer Simon Smith who are compensated for their services to the Company; no other officer receives compensation from the Company. Until the Company acquires additional capital, it is not anticipated that any other officer other than these two individuals will receive compensation from the Company other than reimbursement for out-of-pocket expenses incurred on behalf of the Company.

|

Summary Compensation Table | |||||||||||||||||||||||||

| Name and Principal Position | Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

||||||||||||||||

| Sandor Miklos (1), | 2017 | 0 | - | 200,000 | - | - | - | - | 200,000 | ||||||||||||||||

| President CEO,CFO, (Principal Accounting Officer) Chairman | 2016 | - | - | 100 | - | - | - | - | 100 | ||||||||||||||||

| 2015 | - | 100 | 100 | ||||||||||||||||||||||

| Simon Smith (2)- | 2017 | - | - | 200,000 | - | - | - | - | 200,000 | ||||||||||||||||

| Chief Technical Officer | 2016 | - | - | 100 | - | - | - | - | 100 | ||||||||||||||||

| 2015 | - | - | - | - | - | - | - | - | |||||||||||||||||

(1) The Company has entered into an employment agreement with Mr. Miklos dated January 1, 2015 which provides for compensation for Mr. Miklos in the form of 100,000 shares of the Company's common stock for each year of his service to the Company and any other financial compensation, however, no monetary compensation has been paid to date. The Agreement was amended as of January 1, 2017 to provide the annual compensation at the annual rate of 200,000 shares of Company common stock for services rendered after January 1, 2017, together with a cash payment of $75,000 for each year after January 1, 2017. During the year ended December 31, 2017, no compensation has been paid or accrued to Mr. Miklos in addition to the 200,000 shares of common stock issued at a value of $1 per share.

(2) The Company has entered into an employment agreement with Mr. Smith dated January 1, 2016 which provides for compensation for Mr. Smith in the form of 100,000 shares of the Company's common stock for each year of his service to the Company and any other financial compensation, however, no monetary compensation has been paid to date. The Agreement was amended as of January 1, 2017 to provide the annual compensation at the annual rate of 200,000 shares of Company common stock for services rendered after January 1, 2017. A payment was made to Mr. Smith in 2015 for the complete development of the software by payment to software developers from Vietnam and Thailand, some of which is compensation to him in conjunction with such development. During the year ended December 31, 2017, the Company issued Mr. Smith 200,000 shares of common stock issued at a value of $1 per share.

19

(3) Based upon FASB ASC Topic 718 in reference to Item 402(n)(2)(v) of Regulation S-K, the shares were valued at $200,000 ($1.00 per share) for the year end 12/31/17 as the Company sold shares for $1/share during the year and at 12/31/16, it being $100 each for Miklos and Smith and $100 solely for Miklos at 12/31/15 as the shares were valued at par value.

The Company has no stock option, retirement, pension, or profit sharing programs for the benefit of directors, officers or other employees, but our officers and directors may recommend adoption of one or more such programs in the future.

The Company does not have a standing compensation committee, audit committee, nomination committee, or committees performing similar functions. We anticipate that we will form such committees of the Board of Directors once we have a full Board of Directors.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The following table sets forth certain information as of April 2, 2018, with respect to the beneficial ownership of our common stock for (i) each director and officer, (ii) all of our directors and officers as a group, and (iii) each person known to us to own beneficially five percent (5%) or more of the outstanding shares of our common stock. As of April 2, 2018 there were 5,131,612 shares of common stock outstanding.

|

Name and Address of Beneficial Owner (1) |

Class of Securities |

Shares Beneficially Owned |

Percentage Owned (2) |

| Directors and Executive Officers | |||

| Sandor Alex Miklos, Chief Executive Officer, Chief Financial Officer, President and Director | Common Stock | 1,800,000 | 33.12% |

| Simon Smith, Vice President and Chief Technical Officer | Common Stock | 500,000 | 6.21% |

|

All Officers and Directors |

Common Stock |

2,300,000 |

39.33% |

| 5% Stockholders | |||

| Mario Discepola | Common Stock | 1,500,000 | 31.05% |

| Brookside Investments Ltd. | Common Stock | 375,000 | 7.76% |

| 0815423 BC Ltd | Common Stock | 375,000 | 7.76% |

| Hartswood Limited | Common Stock | 375,000 | 7.76% |

20

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Pursuant to the rules of the SEC, shares of common stock which an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be beneficially owned and outstanding for the purpose of computing the percentage ownership of any other person shown in the table. |

| (2) | Based on 5,131,612 shares of our Common Stock issued and outstanding as of April 2, 2018. |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Family relationships between any of the selling shareholders and Sandor Miklos, our President, CEO and Chairman of the Board of Directors:

The following table shows the relationship of stockholders of the Company's common stock and their relationship to officers, directors and principal stockholders of the Company:

| Name | Shares | Relationship to |

| Stephanie Miklos | 1,063 | Daughter of Sandor Miklos* |

| Lee Miklos | 2,000 | Former wife of Sandor Miklos* |

| Vanessa Discepola | 241 | Daughter of Mario Discepola* |

| Angelo Discepola | 965 | Son of Mario Discepola* |

| Concetta Sonia Discepola | 483 | Daughter of Mario Discepola* |

| Antoinette Mignaca | 100,241 | Wife of Mario Discepola* |

*shares are held by family and former family members who are not residing in the same household as the parent or former spouse and such shares are not deemed to be beneficially owned by the parent or former spouse.

There is an agreement between the Company and Casavue LLC. Both Mr. Miklos and Mr. Smith have positions and ownership with Casavue LLC, similar to what they have with the Company, but they have agreed to devote between 10 and 20 hours per week or more if needed by the Company. Casavue LLC, is a company that develops websites and platforms in the same programming language, design language and uses the same environment as Team 360 Sports Inc. The Company entered into a contract with Casavue LLC to develop and market the Company’s software. The payment was a one-time contract for $45,000, with $35,000 going towards the development of the software and website and native app, and $10,000 for social media content creation, management and marketing the Company’s services. The Company reviews all contracts and as such it received an alternative quote provided by another software development company which was much higher in cost. Upon review, the Company’s management decided to enter into a contract with Casavue LLC instead since its quote was lower. The Company’s majority shareholder ratified this decision on a board resolution.

Related Party Transactions

On January 1, 2016, pursuant to the terms of an Executive Management Agreement, the Company granted 100,000 shares of common stock to Mr. Sandor Miklos, President and member of the Board of Directors, for services to be rendered. Shares are deemed to be earned proportionally over twelve months. The shares were issued at par of $0.001 for a total non-cash expense of $100.

21

On January 1, 2016, pursuant to the terms of an Executive and Consulting Agreement, the Company granted 100,000 shares of common stock to Mr. Simon Smith, Chief Technology Officer, for services to be rendered. Shares are deemed to be earned proportionally over twelve months. The shares were issued at par of $0.001 for a total non-cash expense of $100.

On January 1, 2017, pursuant to the terms of an Executive Management Agreement, the Company granted 200,000 shares of common stock to Mr. Sandor Miklos, President and member of the Board of Directors, for services to be rendered. Shares are deemed to be earned proportionally over twelve months. The shares were issued at a value of $1.00 per share for a total non-cash expense of $200,000.

On January 1, 2017, pursuant to the terms of an Executive and Consulting Agreement, the Company granted 200,000 shares of common stock to Mr. Simon Smith, Chief Technology Officer, for services to be rendered. Shares are deemed to be earned proportionally over twelve months. The shares were issued at a value of $1.00 per share for a total non-cash expense of $200,000.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

The following table shows the fees paid or accrued by us for the audit and other services provided by Pinnacle Accountancy Group of Utah and Michael Gillespie & Associates, PLLC, the predecessor auditor, for the fiscal periods shown.

| December 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Audit Fees | $ | 9,665 | $ | 8,700 | ||||

| Audit Related Fees | — | — | ||||||

| Tax Fees | — | — | ||||||

| All Other Fees | — | — | ||||||

| Total | $ | 9,665 | $ | 8,700 | ||||

Audit fees consist of fees billed for professional services rendered for the audit of our financial statements and review of the interim financial statements included in quarterly reports and services that are normally provided by the above auditors in connection with statutory and regulatory fillings or engagements.

Audit-Related Fees" are fees for assurance and related services by the principal accountant that are traditionally performed by the principal accountant and which are "reasonably related to the performance of the audit or review of the registrant's financial statements.

In the absence of a formal audit committee, the full Board of Directors pre-approves all audit and non-audit services to be performed by the independent registered public accounting firm in accordance with the rules and regulations promulgated under the Securities Exchange Act of 1934, as amended. The Board of Directors pre-approved 100% of the audit, audit-related and tax services performed by the independent registered public accounting firm for the fiscal years ended December 31, 2017 and 2016. The percentage of hours expended on the principal accountant’s engagement to audit the Company’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

22

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

The following documents are filed as part of this Annual Report:

(a) Financial Statements:

| Page | |

| Reports of Independent Registered Accounting Firm | F-1 |

| Balance Sheets as of December 31, 2017 and 2016 | F-3 |

| Statement of Operations and Comprehensive Loss for the years ended December 31, 2017 and 2016 | F-4 |

| Statement of Changes in Shareholders’ Deficit for the years ended December 31, 2017 and 2016 | F-5 |

| Statement of Cash Flows for the years ended December 31, 2017 and 2016 | F-6 |

| Notes to Consolidated Financial Statements | F-7 |

(b) Exhibits:

| Incorporated by reference | ||||||

| Exhibit | Exhibit Description | Filed herewith | Form | Period ending | Exhibit | Filing date |

| 3.1 | Certificate of Incorporation | S-1 | 3.1 | 3/17/2017 | ||

| 3.1.1 | Articles of Amendment to the Articles of Incorporation dated April 4, 2016 | S-1 | 3.1.1 | 3/17/2017 | ||

| 3.2 | By-Laws | S-1/A | 3.2 | 5/22/2017 | ||

| 4.1 | Specimen Stock Certificate | S-1 | 4.1 | 3/17/2017 | ||

| 10.1 | Sandor Miklos Amended Agreement | S-1/A | 10.1 | 5/22/2017 | ||

| 10.2 | Simon Smith Amended Agreement | S-1/A | 10.3 | 5/22/2017 | ||

| 10.3 | Sandor Miklos Employment Agreement | S-1/A | 10.3 | 5/22/2017 | ||

| 10.4 | Sandor Miklos Second Amended Agreement | S-1/A | 10.4 | 5/22/2017 | ||

| 10.5 | Simon Smith Employment Agreement | S-1/A | 10.5 | 6/30/2017 | ||

| 31 | Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | X | ||||

| 32 | Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | X | ||||

| 101 | Interactive Data Files | X | ||||

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

Team 360 Sports Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheet of Team 360 Sports Inc. (the Company) as of December 31, 2017, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the year ended December 31, 2017 and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2017, and the results of its operations and its cash flows for the year ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provide a reasonable basis for our opinion.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has negative working capital and has not generated revenues to cover operating expenses. These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Pinnacle Accountancy Group of Utah

We have served as the Company’s auditor since 2017

Farmington, Utah

April 2, 2018

F-1

MICHAEL GILLESPIE & ASSOCIATES, PLLC

CERTIFIED PUBLIC ACCOUNTANTS

10544 ALTON AVE NE

SEATTLE, WA 98125

206.353.5736

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Team 360 Sports, Inc.

We have audited the accompanying balances sheet of Team 360 Sports, Inc. as of December 31, 2016 (restated) and 2015 and the related restated statements of operations, stockholders’ deficit and cash flows for the periods then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion the financial statements referred to above present fairly, in all material respects, the financial position of Team 360 Sports, Inc. for the years ended December 31, 2016 (restated) and 2015 and the restated results of its operations and cash flows for the years then ended in conformity with generally accepted accounting principles in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note #3 to the financial statements, although the Company has limited operations it has yet to attain profitability. This raises substantial doubt about its ability to continue as a going concern. Management’s plan in regard to these matters is also described in Note #3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

As discussed in Note 7 to the financial statements, the December 31, 2016 financial statements have been restated to correct a misstatement.

/S/ MICHAEL GILLESPIE & ASSOCIATES, PLLC

Seattle, Washington

February 25, 2017, except for Note 7, as to which the date is June 27, 2017

F-2

Team 360 Sports Inc.

Balance Sheets

| December 31, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | 18,163 | $ | 1,016 | ||||

| Prepaid Expenses and other Current Assets | — | 5,000 | ||||||

| Total Current Assets | 18,163 | 6,016 | ||||||

| TOTAL ASSETS | $ | 18,163 | $ | 6,016 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts Payable and Accrued Liabilities | $ | 99 | $ | 2,277 | ||||

| Deferred revenue | 10,017 | 12,574 | ||||||

| Loan payable | 39,548 | — | ||||||

| Total liabilities | 49,664 | 14,851 | ||||||

| Commitments and Contingencies | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Common stock, par value $0.001 per share; 100,000,000 shares authorized; 5,131,612 and 4,421,612 shares issued and outstanding, as of December 31, 2017 and December 31, 2016, respectively | 5,132 | 4,422 | ||||||

| Additional paid in capital | 783,100 | 48,810 | ||||||

| Accumulated deficit | (819,733 | ) | (62,067 | ) | ||||

| Total stockholders' deficit | (31,501 | ) | (8,835 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 18,163 | $ | 6,016 | ||||

The accompanying notes are an integral part of these financial statements.

F-3

Team 360 Sports Inc.

Statement of Operations

| For the Year Ended December 31 | ||||||||

| 2017 | 2016 | |||||||

| REVENUES | $ | 2,557 | 1,676 | |||||

| OPERATING EXPENSES: | ||||||||

| Compensation Expense | 25,000 | — | ||||||

| General and Administrative | 734,313 | 10,947 | ||||||

| Total operating expenses | 759,313 | 10,947 | ||||||

| LOSS FROM OPERATIONS | (756,756 | ) | (9,271 | ) | ||||

| OTHER EXPENSE: | ||||||||

| Interest expense | (910 | ) | — | |||||

| TOTAL OTHER INCOME (EXPENSE) | (910 | ) | — | |||||

| Income before income taxes | (757,666 | ) | (9,271 | ) | ||||

| Income tax | — | — | ||||||

| NET LOSS | $ | (757,666 | ) | $ | (9,271 | ) | ||

| Weighted average common shares outstanding – basic and diluted | 4,935,996 | 4,421,612 | ||||||

| Basic earnings per share | $ | (0.15 | ) | $ | — | |||

The accompanying notes are an integral part of these financial statements.

F-4

Team 360 Sport Inc.

Statement of Stockholders’ Deficit

Years ended December 31, 2017 and 2016

| Common Stock: Shares | Common Stock: Amount | Additional Paid in Capital | Accumulated Deficit | Totals | ||||||||||||||||

| Balance – December 31, 2015 | 4,197,612 | $ | 4,198 | $ | 48,810 | $ | (52,796 | ) | $ | 212 | ||||||||||

| Common stock issued for services | 224,000 | 224 | — | 224 | ||||||||||||||||

| Net loss for the period | — | — | — | (9,271 | ) | (9,271 | ) | |||||||||||||

| Balance - December 31, 2016 | 4,421,612 | 4,422 | 48,810 | (62,067 | ) | (8,835 | ) | |||||||||||||

| Common stock for cash | 10,000 | 10 | 9,990 | — | 10,000 | |||||||||||||||

| Common stock to be issued for services | 700,000 | 700 | 699,300 | — | 700,000 | |||||||||||||||

| Discharge of related party debt | 25,000 | 25,000 | ||||||||||||||||||

| Net loss for the period | — | — | — | (757,666 | ) | (757,666 | ) | |||||||||||||

| Balance December 31, 2017 | 5,131,612 | $ | 5,132 | $ | 783,100 | $ | (819,733 | ) | $ | (31,501 | ) | |||||||||

The accompanying notes are an integral part of these financial statements.

F-5

Team 360 Sports Inc.

Statement of Cash Flows

| For the Years ended December 31, | ||||||||

| 2017 | 2016 | |||||||

| OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (757,666 | ) | $ | (9,271 | ) | ||

| Adjustments to reconcile net loss to net cash (used in) operating activities: | ||||||||

| Stock issued for services | 700,000 | 224 | ||||||

| Changes in net assets and liabilities - | ||||||||

| Accounts payable and accrued expenses | (2,178 | ) | 2,277 | |||||

| Accrued Compensation | 25,000 | — | ||||||

| Prepaid expense | 5,000 | (5,000 | ) | |||||

| Accrued Interest – R/P | 910 | — | ||||||

| Deferred revenue | (2,557 | ) | 12,574 | |||||

| NET CASH USED IN OPERATING ACTIVITIES | (31,491 | ) | 804 | |||||

| INVESTING ACTIVITIES: | ||||||||

| — | — | |||||||

| NET CASH USED IN INVESTING ACTIVITIES | — | — | ||||||

| FINANCING ACTIVITIES: | ||||||||

| Proceeds from the sale of common stock | 10,000 | — | ||||||

| Proceeds from loans | 42,638 | — | ||||||

| Repayment of loans | (4,000 | ) | — | |||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 48,638 | — | ||||||

| NET INCREASE (DECREASE) IN CASH | 17,147 | 804 | ||||||

| CASH – BEGINNING OF PERIOD | 1,016 | 212 | ||||||

| CASH – END OF PERIOD | $ | 18,163 | $ | 1,016 | ||||

| SUPPLEMENTAL CASHFLOW INFORMATION: | ||||||||

| Cash paid for: | ||||||||

| Income tax | $ | — | $ | — | ||||

| Interest | — | — | ||||||

| NONCASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| Discharge of related party debt | $ | 25,000 | $ | — | ||||

The accompanying notes are an integral part of these financial statements.

F-6

Team 360 Sports Inc.

Notes to the Financial Statements

December 31, 2017

Note 1 – Organization and basis of accounting

Basis of Presentation and Organization

The Company incorporated in the State of Nevada on February 26, 2013. Effective April 4, 2016, the Company changed its name from TSI Sports, Inc. to Team 360 Sports Inc. The Company will provide amateur sports clubs, leagues and teams with easy to use robust digital administration management systems.

The Company’s audited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates. The accompanying audited financial statements reflect all adjustments, consisting of only normal recurring items, which, in the opinion of management, are necessary for a fair statement of the results of operations for the periods shown and are not necessarily indicative of the results to be expected for the full year ending December 31, 2017.

Note 2 – Summary of significant accounting policies

Cash and Cash Equivalents

For purposes of reporting within the statements of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

Software Development Costs

Costs incurred to develop computer software products to be sold or otherwise marketed are charged to expense until technological feasibility of the product has been established. Once technological feasibility has been established, computer software development costs (consisting primarily of internal labor costs) are capitalized and reported at the lower of amortized cost or estimated realizable value. Purchased software development cost is capitalized and recorded at its estimated fair market value. When a product is ready for general release, its capitalized costs are amortized on a product-by-product basis. The annual amortization is the greater of the amounts of: the ratio that current gross revenues for a product bear to the total of current and anticipated future gross revenues for that product and, the straight-line method over the remaining estimated economic life (a period of three to ten years) of the product including the period being reported on.

Revenue Recognition

Software license revenue is recognized when persuasive evidence of an arrangement exists, delivery of the product component has occurred, the fee is fixed and determinable, and collectability is reasonably assured. If any of these criteria are not met, revenue recognition is deferred until such time as all of the criteria are met.

F-7

The Company accounts for delivered elements in accordance with the selling price when arrangements include multiple product components or other elements and vendor-specific objective evidence exists for the value of all undelivered elements. Revenues on undelivered elements are recognized once delivery is complete.

In those instances, in which arrangements include significant customization, contractual milestones, acceptance criteria or other contingencies, the Company accounts for the arrangements using contract accounting, as follows:

| · | when customer acceptance can be estimated, but reliable estimated costs to complete cannot be determined, expenditures are capitalized as work-in process and deferred until completion of the contract at which time the costs and revenues are recognized. |

| · | when customer acceptance cannot be estimated based on historical evidence, costs are expensed as incurred and revenue is recognized at the completion of the contract when customer acceptance is obtained. |

The Company records amounts collected from customers in excess of recognizable revenue as deferred revenue in the accompanying consolidated balance sheets. Revenues for maintenance agreements, software support, online services and information products are recognized ratably over the term of the service agreement.

The Company recognizes revenue on a net basis, which excludes sales tax collected from customers and remitted to governmental authorities.