Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Till Capital Ltd. | exh_321.htm |

| EX-31.2 - EXHIBIT 31.2 - Till Capital Ltd. | exh_312.htm |

| EX-31.1 - EXHIBIT 31.1 - Till Capital Ltd. | exh_311.htm |

| EX-23.1 - EXHIBIT 23.1 - Till Capital Ltd. | exh_231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number 001-37402

Till Capital Ltd.

(Exact name of registrant as specified in its Charter)

|

Bermuda (State or Other Jurisdiction of Incorporation or Organization)

|

Not Applicable (I.R.S. Employer Identification Number)

|

Crawford House

50 Cedar Avenue

Hamilton, HM11, Bermuda

(Address of Principal Executive Offices, Including Zip Code)

(208) 635-5415

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

______________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Restricted voting shares, par value $0.001 | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: Restricted voting shares, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [x] |

| Emerging growth company [x] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [x]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [x]

The aggregate market value of the registrant’s restricted voting shares held by stockholders who were not affiliates (as defined by regulations of the Securities and Exchange Commission) of the registrant was $13,133,113 at June 30, 2017 based on the closing price reported for such date on the NASDAQ Capital Market.

As of March 29, 2018, the registrant had 3,290,884 restricted voting shares outstanding.

TILL CAPITAL LTD.

ANNUAL REPORT ON FORM 10-K

Year Ended December 31, 2017

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K (this “Report”) of Till Capital Ltd. (“Till,” “we,” “us,” or “our”), including statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, of this Report, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those forward-looking statements include, but are not limited to, statements and information concerning (i) the potential benefit of the acquisition of Americas Bullion Royalty Corp. (“AMB”) on April 17, 2014 (the “Arrangement”), and the potential benefits of the Arrangement, (ii) statements relating to the business and future activities of, and developments related to, Till after the date of this Report, and (iii) Till’s market position and future financial or operating performance, goals, business and investment strategies, future growth, sufficiency of sources of liquidity and funding, stock repurchases, and other events or conditions that may occur in the future.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events, or performance (often, but not always, using phrases such as “expects” or “does not expect,” “is expected,” “anticipates,” or “does not anticipate,” “plans,” “scheduled,” “forecasts,” “estimates,” “believes,” “intends,” or variations of such words and phrases or stating that certain actions, events, or results “may,” “could,” “would,” “might,” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Those forward-looking statements are based on the beliefs of our management, as well as on assumptions that such management believes to be reasonable, based on information currently available at the time such statements were made. Forward-looking statements speak only as of the date they are made, and Till assumes no duty to undertake or to update forward-looking statements.

By their nature, forward-looking statements are based on assumptions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed, or implied, by the forward-looking statements. Forward-looking statements are subject to a variety of risks, uncertainties, and other factors that could cause actual events or results to differ from those expressed, or implied, by the forward-looking statements.

In addition to the factors discussed under Part 1, Item 1A, “Risk Factors,” and elsewhere in this Report, the reader should also consider the following list of general factors that, among others, could cause Till’s actual results and financial condition to differ materially from estimated results and financial condition.

Factors related to the regulatory and legal environment in which Till and its subsidiaries operate:

| • | Governmental actions, including, but not limited to, implementation of new U.S. federal and state, Bermuda, and Canada laws and regulations, and court decisions interpreting existing laws and regulations or policy provisions; |

| • | Uncertainties related to regulatory approval of insurance rates, policy forms, insurance products, license applications, dividends from insurance subsidiaries, acquisitions or divestitures of businesses, and other matters within the purview of insurance regulators; |

| • | Till is subject to the risk of possibly becoming an investment company under U.S. federal securities law; |

| • | Insurance regulations to which Till’s subsidiaries are, or may become, subject, and potential changes thereto, could have a significant and negative effect on Till’s business; |

| • | Till is an “emerging growth company” and there is no certainty that Till will be able to maintain such status or if the reduced disclosure requirements applicable to emerging growth companies will make Till’s restricted voting shares less attractive to investors; and |

| • | Adverse outcomes in litigation or other legal or regulatory proceedings involving Till, its subsidiaries, or affiliates. |

Factors related to insurance claims and related reserves in Till’s insurance businesses:

| • | The number and severity of insurance claims; |

| • | Changes in facts and circumstances affecting assumptions used in determining loss and loss adjustment expense (“LAE”) reserves, including, but not limited to, the number and severity of insurance claims, changes in claim handling procedures, and closure and development patterns; |

| 1 |

| • | The impact of inflation on insurance claims, including, but not limited to, the effects on personal injury claims and property claims; |

| • | Developments related to insurance policy claims and coverage issues, including, but not limited to, interpretations or decisions by courts or regulators that may govern or influence losses incurred; |

| • | Orders, interpretations, or other actions by regulators that impact the reporting, adjustment, and payment of claims; and |

| • | Changes in the pricing or availability of reinsurance, or in the financial condition of reinsurers, and amounts recoverable therefrom. |

Factors related to Till’s ability to compete:

| • | Changes in ratings by rating agencies of Till and/or its insurance company subsidiaries with regard to credit, financial strength, claims-paying ability, and other areas on which those entities are or may be rated; |

| • | The level of success and costs incurred in realizing or maintaining economies of scale, implementing significant business initiatives, including those related to, but not limited to, expenses, claims, consolidations, reorganizations, technology, integration of acquired businesses, and divestitures of businesses; |

| • | Absolute and relative performance of Till’s products and services, including, but not limited to, the level of success achieved in designing and introducing new products; |

| • | The ability of Till to maintain availability of critical systems and manage technology initiatives cost-effectively to address insurance industry developments and regulatory requirements; and |

| • | Heightened competition, including, with respect to pricing, entry of new competitors, and alternative distribution channels, introduction of new technologies, refinements of existing products, and development of new products by current or future competitors. |

Factors related to the business environment in which Till and its subsidiaries operate:

| • | Changes in general economic conditions, including, but not limited to, performance of financial markets, interest rates, inflation, unemployment rates, and fluctuating values of certain investments held by Till that may be thinly traded or that are subject to other market considerations; |

| • | Till’s outstanding common shares (“Till Shares”) are not widely held, and, accordingly, the market for Till Shares may be more volatile and less liquid than the securities of other publicly traded companies. |

| • | Absolute and relative performance of investments held by Till; |

| • | Investments in junior and intermediate resource companies that may have a significantly higher degree of volatility risk than other types of investments; |

| • | Changes in insurance industry trends and significant industry developments; |

| • | Changes in consumer trends and significant consumer or product developments; |

| • | Changes in capital requirements, including the calculations thereof, used by regulators and rating agencies; |

| • | Regulatory, accounting, or tax changes that may affect the cost of, or demand for, Till’s products, services, or after-tax returns from Till’s investments; |

| • | Changes in distribution channels, methods, or costs resulting from changes in laws or regulations, lawsuits, or market forces; |

| 2 |

| • | Increased costs and risks related to cybersecurity and information technology, including, but not limited to, identity theft, data breaches, and system disruptions affecting services and actions taken to minimize the risks thereof; and |

| • | Failure to maintain the security of personal data that may result in lost business, reputational harm, legal costs, and regulatory penalties. |

Other risks and uncertainties described from time to time in Till’s filings with the U.S. Securities and Exchange Commission (“SEC”):

Till cannot provide any assurances that the results contemplated in any forward-looking statements will be achieved, or will be achieved in any particular timetable, or that future events or developments will not cause such statements to be inaccurate. Till assumes no obligation to correct or update any forward-looking statements publicly for any changes in events or developments or in Till’s expectations or results subsequent to the date of this Report. Till advises the reader to consult any further disclosures Till makes on related subjects, if any, in its filings with the SEC.

| 3 |

PART I

In this Report, unless otherwise specified, all dollar amounts are expressed in United States dollars (“US$” or “$”) and any references to “Cdn$” and “Canadian dollars” are to the lawful currency of Canada. All references to “Till Shares” refer to Till’s restricted voting shares, par value $0.001.

Our Corporate History

Till Capital Ltd. was incorporated under the laws of Bermuda on August 20, 2012 under the name Resource Holdings Ltd. On March 19, 2014, we changed our name to Till Capital Ltd. in accordance with our bye-laws and Section 10 of the Bermuda Companies Act 1981, as amended (the “Companies Act”). Till Capital Ltd. is an exempted holding company with its principal place of business and registered office at Crawford House, 50 Cedar Avenue, Hamilton HM 11, Bermuda, U.S. telephone number (208) 635-5415. Our registered agent is Compass Administration Services, Ltd.

On April 17, 2014, we acquired Americas Bullion Royalty Corp. (“AMB”) in a reverse takeover by way of a plan of arrangement (the “Arrangement”) under the British Columbia Business Corporations Act. Prior to the Arrangement, AMB was an exploration and development junior natural resource and mining company with royalty and exploration property holdings, and Till was an exempted holding company with no operations. Following completion of the Arrangement, we began to transition our business to primarily conduct reinsurance business through Resource Re Ltd. (“RRL”), our wholly-owned Bermuda-based subsidiary (a Class 3A insurance company in Bermuda). In support of that transition, through the Arrangement, we acquired an investment portfolio of cash, marketable securities, and illiquid securities from Kudu Partners L.P. (“Kudu”).

On May 15, 2015, Till acquired all of the issued and outstanding shares of Omega Insurance Holdings Inc. (“Holdings”), a privately held company based in Toronto, Canada, including its subsidiaries, Omega General Insurance Company (a fully licensed insurance company) (“Omega”) and Focus Group Inc. (“Focus”).

In the third quarter of 2017, Till initiated a plan to sell Holdings, including its subsidiaries, Omega and Focus. As a result of that decision, pursuant to U.S. Generally Accepted Accounting Principles ("U.S. GAAP"), Holdings is required to be classified as held for sale and is also required to be considered a discontinued operation. However, during the potential sale process, Holdings, Omega, and Focus each continues to operate as a normal operation of Till.

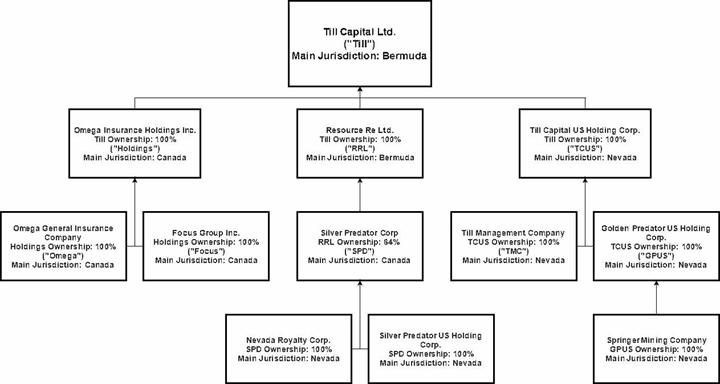

Our Corporate Organization Chart

The following chart sets forth Till’s corporate structure as of March 29, 2018.

| 4 |

Our Business

Following completion of the Arrangement, we transitioned our business to primarily conduct reinsurance business through RRL, a wholly-owned subsidiary. In 2015, Till began the transition out of various investments in the natural resource sector. We also expanded into the insurance business through the acquisition of Holdings.

In the third quarter 2017, Till initiated a plan to sell Holdings. Till's management and Board of Directors believe the sale of Holdings will better position Till's operations for the benefit of its shareholders through other investments that include the possible financing of reinsurance contracts at RRL and other investments. Till has engaged an investment adviser to facilitate the sale of Holdings. There can be no assurance that the process will result in any transaction.

Overview of Insurance and Reinsurance Business

Insurance

Insurance is a business arrangement in which an insurance company agrees to indemnify another company or individual against the expenses associated with events that are unpredictable in advance with respect to their realization and/or their time of occurrence. The insurer charges a “premium” to the insured to cover its expected costs of the indemnity, including all expenses associated with the processing of covered claims, plus a margin for the insurer’s overhead costs, general and administrative (“G&A”) expenses, and profit. The premiums are determined by multiple factors, including actuarial estimates of the expected claims, the insurer’s overhead costs and G&A expenses, market conditions, and an assumed profit margin. Since there is generally some passage of time between when premiums are received and claim expenses are incurred, the premiums are typically invested in risk-appropriate securities to provide an investment return on insurance-related capital. The insurer profits when the composite premiums charged, combined with the insurer’s investment gains, exceed the insurer’s composite expenses. In the case that the latter composite expenses are larger than the composite premiums and investment income and gains, the insurer sustains a loss.

There are many different risk categories of insurance, having variable degrees of risk. In general, the spectrum of risks ranges from those having to do with events of higher frequency but lower severity, where claim expenses tend to be rather predictable, as compared to those having to do with infrequent and less predictable events that may have extreme claim costs when losses occur. The latter class of insurance is often denoted as “catastrophic” coverage. In general, the more predictable the claim costs and expenses are, the more stable the expected required reserve and related allocation of capital.

| 5 |

The insurance industry is highly-regulated, with specific licensing required for each class of insurance written. Insurance regulators monitor the fiscal performance of insurance companies under their charge and, in the U.S., Canada, and Bermuda, require those insurers to maintain certain levels of statutory capital and surplus. In addition, various regulators require company-specific calculated risk-based capital levels. Insurance regulators also establish limitations on the types of investments allowed in an insurer’s investment portfolio to minimize exposure to potential market losses. In combination with competitive pressures, those regulations and requirements result in the insurance industry being driven by the type of insurance being written, with the volatility in the expected returns generally being the lowest for higher-frequency, lower-severity classes of insurance, and the highest for catastrophic coverage.

Reinsurance

Reinsurance is an arrangement whereby one insurance company, the “reinsurer,” agrees to indemnify another insurance company, the “cedent,” for all or a portion of the insurance risks underwritten by the cedent. Reinsurance can benefit a cedent in a number of ways, including reducing exposure on individual or multiple risks, providing catastrophe protections from large or multiple losses, and providing surplus relief to assist the cedent in maintaining or managing its capital and surplus risk exposure. Reinsurance can also be used to help provide a cedent additional underwriting capacity by assuming all or a portion of the cedent’s contract risk through fronting and quota-share reinsurance arrangements that may permit the cedent to accept larger risks and/or to underwrite a greater number of risks without a corresponding increase in its capital.

Reinsurance is generally written on a treaty or facultative basis. Treaty reinsurance is an agreement whereby the reinsurer assumes a specified portion or category of risk under all qualifying policies issued by the cedent during the term of the agreement, usually one year. When a reinsurer writes reinsurance on a treaty basis, the reinsurer does not re-underwrite each individual risk and generally accepts the original underwriting decisions made by the cedent. Treaty reinsurance is typically written on either a proportional or excess of loss basis. A proportional reinsurance treaty is an arrangement whereby a reinsurer assumes a predetermined proportional share of the premiums and losses attributable to a specific book of business. An excess of loss treaty is an arrangement whereby a reinsurer assumes losses that exceed a specific retention of loss by the cedent. Facultative reinsurance, on the other hand, is underwritten on a risk-by-risk basis that allows the reinsurer to determine the pricing for each exposure.

A period of time, sometimes significant, normally elapses between the receipt of reinsurance premiums and the payment of reinsurance claims. While premiums are generally payable to the reinsurer at inception of the underlying coverage, claim payments typically occur later. The related claim process, generally, begins with the occurrence of an event causing an insured loss followed by (i) the reporting of the loss by the insured to its broker or agent; (ii) the reporting by the broker or agent to the insurer; (iii) the reporting by the insurer/cedent to its reinsurance intermediary or agent; (iv) the reporting by the reinsurance intermediary or agent to the reinsurer; (v) the cedent’s adjustment and payment of the loss; and (vi) the payment to the cedent by the reinsurer. During that elapsed time period, reinsurers generally are able to invest premiums pursuant to their investment management strategy to earn investment income along with net realized and unrealized investment gains and losses on investments.

Summary of Our Reinsurance and Insurance Business

RRL

RRL’s business strategy is to offer reinsurance coverage to a select group of insurance companies, e.g., captive insurers, privately-held insurers, and other global insurers and reinsurers. In addition to more traditional investments, RRL has an investment approach, ancillary to the reinsurance business, that includes alternative asset strategies.

Till may conduct certain reinsurance business through its wholly-owned subsidiary, RRL. RRL was incorporated in Bermuda in August 2012 and licensed as a Class 3A insurance company by the Bermuda Monetary Authority (“BMA”) in August 2013. Certain of the conditions of that license are summarized as follows:

| • | RRL is to, at all times, meet and maintain the relevant solvency margin(s), liquidity, and other ratios applicable under Bermuda law; |

| • | Without obtaining the prior written approval of the BMA, RRL is not to: |

| • | Write any “long- term” business, as such expression is understood in Bermuda’s Insurance Act of 1978, as amended and its related regulations (the “Insurance Act”); |

| • | Enter into any contracts of retrocession other than with Multi-Strat Re Ltd., a Class 3A Bermuda insurance company; and |

| 6 |

| • | Declare and/or pay any dividends and/or make any capital contributions to RRL’s parent, shareholders, or affiliates. |

RRL entered into its initial reinsurance contracts effective December 31, 2014 through Multi-Strat Re Ltd. (“Multi-Strat Re”). Those initial reinsurance contracts were novated in September 2015 and RRL currently has no reinsurance contracts in force. In the future, RRL may participate in reinsurance contracts using the Multi-Strat Re platform to underwrite medium- to long-term property and casualty business, as acceptable opportunities are identified.

RRL Reinsurance Business

RRL’s may offer property and casualty insurers the opportunity to cede a proportionate amount of their insurance risk with the objectives of achieving an underwriting profit and retaining most of the investment returns on the related premium- and reserve-related liability investment float. RRL may also underwrite loss portfolio transfers of prior business written by an insurer to provide adverse development protection. However, the downside risks on loss portfolio transfers are to be contractually capped relative to the premium collected.

Reinsurance Strategy

RRL has been a party to a quota-share retrocession agreement (the “Retrocession Agreement”) and a master services agreement (the “MSA”), collectively, the “Multi-Strat Agreements”, with Multi-Strat Re in respect of the reinsurance arrangements. Under the terms of the Multi-Strat Agreements, Multi-Strat Re is expected to assume risks from insurers, reinsurers, and captive insurers. Multi-Strat Re will, in turn, retrocede all of its premiums and risks to its pool of subscribing reinsurers, including RRL and reinsurers similar to RRL, based on the individual subscribing company’s acceptance of its subject risks and relative level of equity capital and appetite for reinsurance risks.

As part of its participation in the Multi-Strat Re program, RRL incurs two types of expenses in connection with its reinsurance underwriting, namely, (i) initial payments for sourcing premiums, including, but not limited to, brokerage, commissions, expert opinions, taxes, and pre-underwriting audits, and (ii) ongoing payments for claims handling and risk monitoring of business underwritten, including, but not limited to, audits, technical accounting and reporting, collateral administration, and underwriting renewals. Multi-Strat Re charges each reinsurer a retrocession commission on any premium at the time of binding and an annual administration fee for servicing the business underwritten. Multi-Strat Re also charges a performance fee based on the difference between the targeted underwriting profitability and the actual underwriting profitability, payable when the reinsurer is no longer at risk.

Annually, RRL may opt to maintain or increase the portion of its capital committed to the Multi-Strat Re program or withdraw from the program. If RRL elects to withdraw from the program, Multi-Strat Re is to consider, but is not obligated to, reallocate RRL’s portion of the reinsured book to the other Class 3A reinsurers, including other Multi-Strat Re participating reinsurers, provided that those other Class 3A reinsurers have the capacity and willingness to accept any such reallocation.

Under the MSA, Multi-Strat Re remains obligated to service the business underwritten and RRL remains obligated to pay the administrative servicing fee to Multi-Strat Re. Once RRL has hired senior staff, RRL may elect to continue to do business with Multi-Strat Re in conjunction with initiating its own insurance or reinsurance underwriting or RRL may ultimately withdraw from new business under the Multi-Strat Re program consistent with the Retrocession Agreement.

Underwriting

For all insurance business that is accepted by RRL from Multi-Strat Re, RRL relies on Multi-Strat Re to fulfill the role of underwriter for that business by adhering, at a minimum, to the underwriting guidelines set forth in the MSA.

The types of non-acceptable risks and exposures that RRL will not underwrite include, but are not limited to, (i) war and civil risks, (ii) nuclear risks, (iii) windstorms, earthquake, flood, and terrorism risks, (iv) cybersecurity exposures, (v) asbestos and environmental risks, and (vi) master policies issued to a risk group, association, or an organization that solicits its members under a mass marketing program. However, excluded risk exposures of an incidental nature may be included in business to be underwritten. RRL does not intend to underwrite life or health insurance.

Premium Payments

Premiums on business assumed by RRL are paid directly to an account in the name of Multi-Strat Re, to its agents in a fiduciary capacity, or into collateral accounts. Multi-Strat Re may not use those premiums except for certain purposes as specified in the MSA.

| 7 |

Claims Handling

All claim billings are reviewed to ensure that the billings are covered by the terms and conditions of the reinsurance agreements (period of coverage, limits, etc.). As a reinsurer, RRL does not intend to handle claims directly, but will retain the right to audit the cedent’s handling of claims.

Security and Funding

Every insurance obligation placed through the Multi-Strat platform by RRL is required to be collateralized to the aggregate limit reinsured by RRL using either Reinsurance Trust Agreements (“RTAs”) or Letters of Credit (“LOCs”) from banks rated “A-” or better.

Regulatory Considerations - Solvency II

Bermuda has been awarded full equivalence for commercial insurers (which criteria includes Class 3A insurers) under Europe’s Solvency II regime applicable to insurance companies, which regime came into effect on January 1, 2016. As a Class 3A insurance company, RRL is required to comply with Solvency II.

Solvency II is a European-based regulatory frame-work for regulation of the insurance industry, the key objectives of which are to (i) improve consumer protection by ensuring a uniform and enhanced level of policyholder protection across the European Union, (ii) modernize the insurance regulatory focus from compliance monitoring and capital to evaluating insurers’ risk profiles and the quality of their risk management and governance systems, (iii) increase harmonization of the various country regulatory regimes, and (iv) establish a regulatory framework that includes not just capital concerns, but a more comprehensive program of regulatory requirements for insurers, including licensing/authorizations, corporate governance, supervisory reporting, public disclosure, risk assessment and management, as well as the establishment of solvency and reserving criteria. In summary, the Solvency II focus is comprised of three “pillars” that include financial requirements, governance and supervision, and reporting and disclosure.

Ratings

RRL may in the future apply for a rating from an insurance industry rating company, e.g., A.M. Best Company (“A.M. Best”), a company that provides credit ratings services for the insurance industry. If such a rating is obtained, RRL will strive to maintain capital levels consistent with an “A-” or better rating. There is no guarantee that such a rating will be obtained by RRL. Debt may be used as deemed prudent, consistent with maintaining such rating, though, in general, RRL expects to utilize a less leveraged asset mix than that used by many of its peers.

Holdings

Holdings Background

On May 15, 2015, Till completed the acquisition of Holdings, a privately-held insurance holding company domiciled in Toronto, Canada and its wholly-owned subsidiaries, Omega and Focus. In the second quarter of 2015, Till reported the purchase price of $14,062,970, an amount that represented 1.2 times Holdings’ book value as of the closing date, and included $751,880 for pending insurance transactions in process at the time. All payments were subject to a 5% hold-back to be paid to Holdings' shareholders based on Omega’s 2015 operating results, and adjusted to give effect to any adverse development above 10% in loss reserves as calculated from the closing date until December 31, 2015. One of the two pending insurance transactions was closed in the third quarter of 2015 and the other one was closed in October 2015. The final amount for the two pending insurance transactions was $730,994. Accordingly, the final purchase price for Holdings was approximately $14,042,000.

Holdings was incorporated in January 2004 under the Ontario Business Corporations Act. In September 2004, Holdings began operations by incorporating a wholly-owned subsidiary insurance company, Omega, under the Insurance Companies Act (Canada). In September 2004, Holdings acquired all of the assets and liabilities of Focus, an Ontario corporation, through the purchase of all of its outstanding shares. Focus was formed in 1985 and has been providing management and consulting services to the insurance industry for over 30 years. Focus also has significant experience and expertise in managing the operations of foreign insurance companies that want to operate in Canada without establishing a fully-staffed Canadian operation. Omega and Focus have two main target markets:

| • | Managing “run-off” business of insurance companies that have decided to exit the Canadian market, in whole or in part. Omega and Focus provide operational services to facilitate the exit of those companies and the management of the financial and legal obligations of that business on a continuing basis, while being able to repatriate their surplus capital in a more-timely manner. |

| 8 |

| • | Providing those insurers that want to access the Canadian market an ability to do so in an efficient manner, through customized fronting arrangements and other means. |

In October 2004, Omega received its order to commence insurance business from the Office of the Superintendent of Financial Institutions (“OSFI”), an independent agency of the Government of Canada. Omega is authorized to write all classes of insurance, other than life insurance, subject to the limitation that, in the case of policies that fall within classes other than property and liability, insurance approval has to be obtained from OSFI. At December 31, 2017, Omega was licensed in all provinces and territories in Canada. Omega’s insurance business focuses on property and casualty insurance. Omega earns income from underwriting insurance and reinsurance risks and fees from managing insurers in run-off.

Focus provides management services to Omega. Focus also has chief agency contracts with three foreign insurers and management contracts with two foreign insurers. Focus also provides ongoing and one-time consulting services in the areas of taxation, risk management, mergers and acquisitions, expert witness testimony, and claim reviews.

As a participant in the Canadian insurance industry, Omega is subject to significant regulations enacted by the Canadian federal and provincial governments, including capital and solvency standards, restrictions on certain types of investments, and periodic market conduct and financial examinations by regulators. Omega is a property and casualty insurance company that is regulated by OSFI. Omega has established procedures and controls to gain reasonable assurance that it is in compliance with all relevant laws, rules, and regulations.

Omega

Omega’s revenue is from three sources, namely, (i) premiums on portfolio transfer transactions and fees related to managing Canadian branch offices in “run off,” (ii) assumption reinsurance, including servicing fees in certain transactions, and (iii) premiums on direct insurance business. To manage its risk exposures, Omega purchases reinsurance for both its portfolio transfer and direct insurance businesses.

As a reinsurer, Omega provides assumption reinsurance to insurance companies that want to exit the Canadian market, and to insurance companies that want to transfer of all their remaining claim liabilities on particular books of business. Those arrangements are commonly referred to as “run-off” or “loss portfolio transfer” assumption business. Omega also provides support services on assumed risks.

Omega’s business also includes acting as the primary insurer, direct writer, for insurance companies seeking Canadian business, but lacking the appropriate Canadian insurance licenses. In that capacity, Omega acts as the direct writer, or fronting company, for a specific insurance company, and Omega typically will cede most or all of that direct, fronted, business to that insurer. Omega remains contingently liable for the payment of losses on such fronted business. Omega’s principal income on fronting business is a fee for the management of the business in Canada. If Omega retains any of that fronting business, Omega also retains a portion of the premium and retains the insurance risk on the portion retained by Omega. That business generally requires customized contractual arrangements to address the unique aspects of those markets and to define the specifics of the coverage. Omega tends to write Canadian insurance business that is non-traditional, also known as “boutique” insurance, where there are fewer competitors. Those classes of insurance typically require more extensive research regarding the insurance risks, as there may be less generally-available loss-related data on those non-traditional types of business.

Relationship between RRL and Omega

RRL and Omega are wholly-owned insurance subsidiary companies of Till, but operate independently of each other and maintain their distinct legal and governance structures.

Our Competitive Strengths

Till believes it is well positioned to take advantage and leverage potential opportunities in its businesses due to Till’s insurance and investment capabilities, and its ability to leverage the resources of its business partners. Those strengths include:

Industry Expertise

Till has internal resources that are strong in investment management and insurance operations, including, among others, product development, underwriting, claims management, reinsurance, and financial management. In addition, through the leveraging of our outside service providers, including actuarial, claims management, the Multi-Strat platform, and select investment advisors, Till is well positioned to actively monitor and manage our assets and liabilities as a whole, matching cash flows to produce a resilient business portfolio to optimize our long-term performance.

| 9 |

Development of Tailored Solutions for Clients

Our focus is on developing tailored solutions to best address our clients’ insurance and reinsurance needs. By delivering individualized solutions to cedents and insureds, we expect to attract new business and to structure arrangements that may be more advantageous to both our clients and us.

Investment Strategy

Till Management Company (“TMC”), a wholly-owned subsidiary of Till, oversees Till’s investment strategy and serves as an investment advisor to Till, RRL, Holdings, and Omega.

Till’s primary investments are its 100% ownership of RRL and Holdings, and ownership of mineral properties and mining royalties. Till may pursue acquisitions of other companies in the insurance industry or other sectors, but does not have any plans to do so at this time. Till’s investment strategy is designed to not only meet the regulatory requirements of RRL’s and Omega’s insurance business, but to also research investments that provide opportunity to leverage those investments with higher risks to benefit Till’s overall business and shareholder returns.

RRL’s Investment Guidelines

RRL’s investment policy is intended to achieve the highest portfolio yields consistent with its overall objectives, strategy, and parameters, including the maintenance of adequate liquidity to reasonably meet its obligations and liabilities. Those objectives take into account the “prudent person” objective of balancing a reasonably high and stable growth rate while avoiding undue risk of loss.

It is the responsibility of RRL’s investment advisor(s) to provide guidance and/or instructions for the purchase or sale of securities for RRL with accredited, reputable, and reliable brokers/traders/custodians in the investment community. All transactions are to be promptly and accurately recorded as they occur and appropriate reports are to be submitted to RRL by the advisors for review.

All investment transactions, along with the investment performance and adherence to RRL’s investment policy, are reviewed by the Board of Directors of RRL, or its designee, on a regular basis to ensure compliance with that investment policy and Bermudian laws and regulations.

At least annually, all RRL officers, advisors, and any others associated with the investment function confirm to the Board of Directors of RRL that they have no conflict of interest and undertake not to engage in any activity pursuant to the investment function that could produce a potential conflict of interest.

RRL reviews its investment portfolio together with its reinsurance operations on a periodic basis with its advisors to ensure that RRL has sufficient capital to withstand modeled losses on either or both of its investment and reinsurance portfolios.

RRL’s Investment Portfolio

The following table summarizes RRL’s investment portfolio at December 31, 2017:

| Cash | $5.3 million |

| Marketable securities | $0.4 million |

| Control position: | |

| Silver Predator Corp. | 18.3 million shares (approx. 64% ownership) |

| IG Copper, LLC | 243,910 units (approx. 3.5% ownership) |

| Other holdings - Royalty rights |

| 10 |

RRL’s Investment in Silver Predator Corp.

Following the Arrangement, RRL owned approximately 55% of the issued and outstanding shares of Silver Predator Corp. (“SPD”) and had a $4.5 million collateralized note receivable from SPD (the “SPD Collateralized Note”). On July 31, 2014, SPD completed a non-brokered private placement of 19,000,000 common shares at Cdn$0.07 per share for proceeds of Cdn$1,330,000. In April 2015, SPD issued 29,028,000 of its common shares to RRL at a value of Cdn$0.05 per share as the first payment on the SPD Collateralized Note. At December 31, 2017, RRL owned approximately 64% of SPD’s issued and outstanding common shares.

SPD has historically been engaged in exploring for and developing economically viable silver, gold, and tungsten deposits in Canada and the United States, with a focus on Nevada and Idaho. SPD’s two core properties were the Springer tungsten mine and mill in Pershing County, Nevada (the “Springer Property”) and the Taylor mine and mill near Ely, Nevada (the “Taylor Property”). SPD also owns the Copper King property near Coeur d’Alene, Idaho, the Cornucopia property in Elko County, Nevada, and several additional properties in Nevada. SPD is not currently engaged in any mining or exploration activities; however, a drill program for its Copper King property is being considered for 2018.

In January 2017, SPD transferred 100% of its ownership of the Springer Property to RRL in exchange for the full release and satisfaction of the SPD Collateralized Note. The balance of that SPD Collateralized Note, at the date of transfer to RRL, amounted to $3.97 million. Following that transfer, RRL distributed 100% of its ownership of the Springer Property to its parent company Till Capital. The Springer Property is currently owned by Till's wholly-owned subsidiary Golden Predator US Holding Corp. ("GPUS").

Taylor Property

SPD owns a 100% interest in the Taylor Property, a gold and silver mining and mill project site located in White Pine County, Nevada, 17 miles south of Ely, Nevada. The property consists of 130 unpatented and patented lode claims and five unpatented mill site claims totaling approximately 2,166 acres, subject to a 2% net smelter royalty and a 1% net profits royalty. The Taylor Property was a high-grade underground silver producer during the late 1880s, and again in the 1960s. The most significant production history occurred from 1981 to 1984, when its then owner produced over five million ounces of silver from several open pits. The mine closed due to low silver prices, leaving significant current resources pre-stripped in close proximity to the existing mill. The mill opened again in 1989 to process ore from a nearby gold mine and continued in operation until 1991 when the nearby mine closed. To restart mining and production at the mine and mill, SPD will need to either modernize and expand the existing mill or build a new mill and design and build a new tailings facility. SPD will also need to conduct further exploration of the property to identify mineral reserves. SPD did not conduct any significant exploration on the Taylor Property in 2015, 2016, or 2017.

In April 2017, SPD entered into an option agreement (the “Taylor Agreement”) with Montego Resource Inc. (“Montego”) pursuant to which Montego has the right to acquire the Taylor Property from SPD.

Under the terms of the Taylor Agreement, Montego can acquire the Taylor Property in consideration for the completion of a series of cash payments totaling $1,200,000, issuing 2,500,000 common shares of Montego to SPD, and incurring expenditures of at least $700,000 on the Taylor Property. Upon completion of the payments, share issuances, and expenditures, Montego will hold a 100% interest in the Taylor Property, subject to a 2% net smelter returns royalty ("NSR") and a 1% net profit royalty that will be retained by SPD.

The payments, share issuances, and expenditures must be completed in accordance with the following schedule:

| • | At Closing: $200,000 cash and 500,000 common shares |

| • | 6 months from Closing: $100,000 cash and 300,000 common shares |

| • | 12 months from Closing: $200,000 cash and 400,000 common shares and expenditures of $100,000 |

| • | 24 months from Closing: $300,000 cash and 500,000 common shares and expenditures of $250,000 |

| • | 36 months from Closing: $400,000 cash and 800,000 common shares and expenditures of $350,000 |

The closing occurred on April 20, 2017 on which date SPD had received $200,000 cash and 500,000 common shares of Montego initially valued at $156,309. On October 19, 2017 SPD received $100,000 cash and 300,000 common shares of Montego initially valued at $45,655 for the second installment from Montego on the Taylor Agreement.

Omega’s Investment Guidelines

Omega’s investment policy is intended to achieve the highest portfolio yields consistent with its overall objectives, strategy, and operational parameters, including the maintenance of adequate liquidity to reasonably meet its obligations and liabilities and regulatory guidelines. Those objectives take into account the “prudent person” objective of balancing a reasonable and stable income stream while avoiding undue risk of loss.

| 11 |

It is the responsibility of Omega’s Chief Executive Officer, or other persons so designated, to provide guidance and/or instructions for the purchase or sale of securities for Omega with accredited, reputable, and reliable investment advisors and brokers/traders in the Canadian and U.S. investment community, and to use a reputable Canadian custodial firm designated by Omega. All transactions are to be promptly and accurately recorded as they occur and appropriate reports are to be submitted to Omega for review.

All investment transactions are reviewed by Omega on a regular basis to ensure compliance with Omega’s investment policy and Canadian laws and regulations.

At least annually, all Omega officers, advisors, and any others associated with the investment function confirm to the Board of Directors of Omega that they have no conflict of interest and undertake not to engage in any activity pursuant to the investment function that could produce a potential conflict of interest.

Omega reviews its investment portfolio together with its insurance operations on a periodic basis with its advisors to ensure that Omega has sufficient capital to withstand modeled losses on either or both of its investment and insurance portfolios.

The following table summarizes Omega’s investment portfolio at December 31, 2017:

| Cash and cash equivalents | $3.6 million |

| Canadian government term deposits and debt | $6.9 million |

| Exchange traded bond funds | $3.8 million |

Springer Property

Until January 2017, SPD owned a 100% interest in the Springer Property, a non-operating former tungsten production facility located on the east flank of the Eugene Mountains, approximately 25 miles southwest of Winnemucca, Nevada. In addition to the former tungsten production facility, the project consists of 209 lode mineral claims, 25 placer claims, and fee lands for a total area of approximately 6,400 acres, including all mineral claims and fee lands, subject to a 2% net smelter royalty. The Springer production facility consists of a 1,360-foot vertical shaft and underground workings, a 1,200 ton per day mill with automated rod/ball mill grinding and flotation circuits, plus all water rights, and most permits necessary for operation of the facility. SPD has not conducted any significant exploration on the Springer Property for several years. As described previously, in January 2017, SPD transferred 100% of its ownership of the Springer Property to RRL. Following that transfer, RRL distributed the Springer Property to Till. Till, in turn, contributed, as capital, the Springer Property to Till's wholly-owned subsidiary GPUS.

In the second quarter of 2015, SPD announced its intention to realize value from assets by initiating a process to sell all, or part, of the tangible and intangible assets at some of its properties in Nevada. At that time, SPD disclosed that mining and production at the facility could be restarted with additional capital expenditures required for exploration to determine the existence of mineral reserves, modernization, and refurbishment. In 2017, Till engaged an investment adviser to facilitate the sale of the Springer Property. There can be no assurance that the process will result in any transaction.

Neither GPUS, nor Till, currently intend to allocate additional capital to restart mining, exploration, and production at the Springer Property.

Regulatory Matters

Bermuda Insurance Regulations

Bermuda Exchange Control Regulation

The BMA must give permission for all issuances and transfers of securities of Bermuda exempted companies like Till and RRL, unless the proposed transaction is exempted by the BMA’s written general permissions. In its policy statement, dated June 1, 2005, the BMA provides that, where any equity securities, including Till Shares, of a Bermuda company are listed on an appointed stock exchange, general permission is given for the issuance and subsequent transfer of any securities of such a company from and/or to a non-resident, for as long as any such equity securities of such company remain so listed. Till Shares are listed on the Toronto Stock Exchange-Venture (“TSX-V”) and on the NASDAQ Stock Market (“NASDAQ”); both the TSX-V and NASDAQ are deemed to be appointed stock exchanges under Bermuda law. Therefore, following the listing the Till Shares on the TSX-V, in April 2014, the general permission issued by the BMA resulted in Till Shares being freely transferable among persons who are residents and non-residents of Bermuda.

| 12 |

Although Till is incorporated in Bermuda, Till is classified as a non-resident of Bermuda for exchange control purposes by the BMA. Other than transferring Bermuda dollars out of Bermuda, there are no restrictions on our ability to transfer funds into and out of Bermuda or to pay dividends in currency other than Bermuda dollars to nonresidents of Bermuda who are holders of Till Shares.

The Insurance Act of 1978.

The Insurance Act and related regulations of Bermuda that regulate the insurance business of RRL provide that no person is to carry on any insurance business in or from within Bermuda unless registered as an insurer under the Insurance Act by the BMA. Under the Insurance Act, insurance business includes reinsurance business. The BMA is required by the Insurance Act to determine whether the applicant is a fit and proper body to be engaged in the insurance business and, in particular, whether it has, or has available to it, adequate knowledge and expertise. The registration of an applicant as an insurer is subject to its compliance with the terms of its registration and such other conditions as the BMA may impose from time to time.

The Insurance Act also imposes, on Bermuda insurance companies, various solvency and liquidity standards, auditing and reporting requirements, and grants to the BMA powers to supervise, investigate, and intervene in the affairs of those insurance companies. Certain significant aspects of the Bermuda insurance regulatory framework are set forth below.

RRL, like all Bermuda domiciled insurers, is required to maintain a principal office in Bermuda and to appoint and maintain a principal representative in Bermuda. Further, any registered insurer that is a Class 3A insurer or above is required to maintain a head office in Bermuda and direct and manage its insurance business from Bermuda.

Every registered Bermuda insurer must appoint an independent auditor who will annually audit and report on the statutory financial statements and the statutory financial return of the insurer, both of which, in the case of RRL, are required to be filed annually with the BMA. The independent auditor of RRL must be approved by the BMA and may be the same person or firm that audits RRL’s financial statements and reports for presentation to its shareholders. RRL’s independent auditor is Arthur Morris & Company Limited and has been approved by the BMA.

Generally, a Class 3A insurer must appoint an individual approved by the BMA to be its loss reserve specialist and annually submit an opinion of its approved loss reserve specialist with its statutory financial statements and return in respect of its loss and loss expense provisions. Ordinance Holdings Limited serves as the actuary for RRL and has been approved by the BMA.

A Bermuda insurer, such as RRL, has to prepare annual statutory financial statements and file a statutory financial return. The Insurance Act prescribes rules for the preparation and substance of such statutory financial statements (that include, in statutory form, a balance sheet, an income statement, a statement of capital and surplus, and notes related thereto). The insurer is required to give detailed information and analyses as regards premiums, claims, reinsurance, and investments. The statutory financial statements are not prepared in accordance with U.S. GAAP and are distinct from the financial statements prepared for presentation to the insurer’s shareholders under the Companies Act, which financial statements are to be prepared in accordance with U.S. GAAP. An insurer is required to submit the annual statutory financial statements as part of its annual statutory financial return. The statutory financial statements and the statutory financial return do not form part of the public records maintained by the BMA or the Bermuda Registrar of Companies.

Canada Insurance Regulation

Omega’s business is regulated through various federal and provincial regulators in Canada and in the provinces in which it operates. Omega’s insurance business is subject to regulation and supervision by OSFI under the Insurance Companies Act (Canada) and by insurance regulatory authorities of the provinces in which it is licensed to conduct business. That regulation and supervision is designed to protect policyholders and creditors rather than investors. Provincial insurance regulations pertain primarily to market conduct, and the authorities have latitude to effect change in the commercial operating environment.

OSFI has established, and monitors compliance with, required minimum capital levels and targeted capital levels for insurance companies such as Omega. OSFI also requires insurance companies, such as Omega, to establish, and adhere to, prudent investment and lending policies, standards, and procedures that are subject to certain limits. Further, there are various regulatory requirements, guidelines, and/or restrictions on dividends, capital, reinsurance, acquisitions, and divestitures that govern Omega’s business. In certain circumstances, prior regulatory approvals for certain transactions and products are required.

| 13 |

United States Insurance Regulation

Neither RRL nor Omega currently intend to do business in any jurisdiction in the United States. The insurance laws of each state of the United States and of many foreign countries regulate the sale of insurance and reinsurance within their jurisdictions by alien insurers and reinsurers, such as RRL and Omega that are organized under the laws of non-U.S. jurisdictions. RRL and Omega intend to conduct their respective business so as not to be subject to the licensing requirements of insurance regulators in the United States or elsewhere, other than their respective domicile countries, namely, Bermuda and Canada, respectively.

Competition

The insurance and reinsurance market is well established and very competitive with both mature and new companies participating in the marketplace. The market exhibits periodic cycles of soft and hard pricing that our insurance subsidiaries, RRL and Omega, consider in the underwriting of their insurance and reinsurance business.

Employees

At December 31, 2017, Till and its subsidiaries had a total of 18 full-time employees, ten employees are located in Canada and eight employees are located in the United States. There are also three part-time employees in Bermuda and one part-time employee in Canada.

The following risks related to Till are in addition to the general risk factors set forth on pages 1-3 of this Report.

Insurance and Reinsurance Risks

| • | The insurance and reinsurance markets are cyclical and we are subject to those cycles. |

The insurance and reinsurance markets are cyclical and subject to unforeseen developments that may affect our operating results. Those developments could include trends of legal and regulatory decisions that could result in increasingly larger awards for certain types of losses, natural disasters, fluctuations in interest rates, changes in laws, changes in the investment environment that affect market prices of investments, inflationary pressures, and other events that affect the size of premiums or losses that companies and insurers experience. Prevailing market and economic conditions can affect the demand for insurance and reinsurance.

| • | We may not be able to purchase reinsurance on favorable terms when required. |

We may purchase reinsurance for our own account to mitigate the volatility of losses impacting our financial condition. From time to time, market conditions have limited, and in some cases have prevented, insurers and reinsurers from obtaining the types and amounts of reinsurance that they consider adequate for their business needs. If we are unable to purchase reinsurance on the terms we desire, we may be exposed to additional costs and/or insurance-related risks that could adversely affect our results of operations.

| • | There are ever-changing legal and regulatory developments in the insurance and reinsurance industries that could adversely affect our business. |

The insurance industry has experienced substantial volatility as a result of litigation, investigations, and regulatory activity by various insurance, government, and enforcement authorities concerning certain practices within the insurance industry. Those events have resulted in changes in the insurance and reinsurance markets and industry business practices. We cannot predict the potential effects, if any, that future litigation, investigations, and regulatory activity may have on the insurance and reinsurance industries that could materially affect our results of operation.

| • | The effect of emerging claim and coverage issues on our business is uncertain. |

As industry practices and legal, judicial, and regulatory conditions change, unexpected issues related to claims and coverage may emerge. Various provisions of our contracts, such as limitations or exclusions from coverage or choice of forum, may be difficult to enforce in the manner we intend, due to, among other things, disputes relating to coverage and choice of legal forum. Those issues may adversely affect our business by either extending coverage beyond the period that we intended or by increasing the number or size of claims. In some instances, those changes may not manifest themselves until many years after we have issued insurance or reinsurance contracts that are, or could be, affected by those changes.

| 14 |

| • | We could face unanticipated losses from acts of terror and the continued threat of terrorism, as well as increased political instability that could have a material adverse effect on our financial condition and results of operations. |

We could be exposed to unexpected losses on our reinsurance contracts resulting from terrorist activity, the continued threat of terrorism, and acts of civil or international hostility, both within the United States and abroad, political instability, and other politically-driven events, locally or globally. Those risks are inherently unpredictable and such events may indicate, or may result in, an increased frequency and severity of losses. It is difficult to predict the likelihood or timing of those types of events or to estimate the amount of loss that any given occurrence could cause.

| • | Any suspension or revocation of RRL’s or Omega’s reinsurance/insurance license could materially affect our ability to do insurance and reinsurance business and to implement our business strategy. |

RRL is licensed as a reinsurer only in Bermuda and Omega is licensed as an insurance provider only in Canada. The suspension or revocation of RRL’s or Omega’s licenses to do business as a reinsurance or insurance company in either of their respective jurisdictions, for any reason, would mean that RRL or Omega would not be able to enter into any new reinsurance or insurance contracts until the license revocation or suspension ended or until RRL or Omega became licensed in other jurisdictions.

| • | RRL is unrated and may not be able to generate sufficient premiums to be profitable. |

The reinsurance markets rely heavily on ratings whereby third-party rating agencies assess and rate the claims-paying ability of insurers and reinsurers based on criteria established by such rating agencies. The claims-paying ability ratings assigned by rating agencies to insurance and reinsurance companies represent independent opinions of financial strength and ability to meet policyholder obligations, and are not directed toward the protection of investors. Insured parties and brokers/intermediaries use those ratings as one measure by which to assess the financial strength and quality of insurers and reinsurers. Those ratings are often a key factor in the decision by an insured or a broker/intermediary as to whether to place business with a particular insurance or reinsurance provider. RRL may in the future apply for such a rating from A.M. Best. However, there is no guarantee that such a rating, or a rating from any rating agency, will be obtained, or that, if any such rating is obtained, it will be maintained.

| • | Interest rates could increase significantly or we could be unable to generate sufficient investment income. |

If interest rates move upward significantly, competitors may become more aggressive in their insurance product pricing to make up for any increase in underwriting losses with higher investment income and/or gains. Cedents could also insist on higher claims limits to compensate for the opportunity cost of investing the funds that they are using to pay premiums on products issued by RRL and Omega. RRL’s and Omega’s operating results may be adversely affected if significant changes in interest rates occur and competitive factors occur that result from such changes, e.g., product-pricing changes or reinsurance-related changes.

Operational Risks

| • | Our operational structure is continually being developed and implemented. |

We continue to develop and implement our operational structure and enterprise risk management framework, including risk exposure management, financial reporting, information technology, and internal controls, with which we conduct our business activities. There can be no assurance that the development of our operational structure or the implementation of our enterprise risk management framework will proceed smoothly or on our projected timetable.

| • | We may not be able to recruit the quality or quantity of full-time management necessary to make us successful. |

While outsourcing makes sense at our current size, an expansion of our business may require us to recruit additional full-time management and employees. If we are unable to do so, we could fail to grow, and our results of operations could be adversely affected.

| • | We are reliant on key employees. |

Various aspects of our business will depend on the services and skills of key personnel, including our Chief Executive Officer, Chief Investment Officer, and other key management personnel of Holdings. There can be no assurance that we will be able to attract and retain key personnel.

| 15 |

| • | There are limitations in using predictive models. |

We utilize predictive models to underwrite our insurance and reinsurance business and to calculate our reserves. Any substantial or repeated failures in the accuracy or reliability of such models could have a material adverse effect on our business, financial condition, and results of operation.

| • | Till may require additional capital that may be unavailable when we need it. |

Our future capital requirements depend on many factors, including our ability to establish reserves at levels sufficient to cover losses. We may need to raise additional funds through financings or curtail our growth and reduce our assets. Any equity or debt financing, if available at all, may be on terms that are not favorable to us. In the case of equity financings, dilution to our shareholders could result.

| • | We are subject to the jurisdiction of Bermuda work eligibility laws that may limit our ability to employ key employees. |

We may be affected by Bermuda laws that require work permits for certain employees. Under Bermuda law, non-Bermudians (other than spouses of Bermudians) may not engage in any gainful occupation in Bermuda without an appropriate governmental work permit. Our success may depend in part on the continued services of key employees and contractors in Bermuda. A work permit may be granted or renewed after a showing that, after proper public advertisement, no Bermudian (or spouse of a Bermudian or a holder of a permanent resident’s certificate or holder of a working resident’s certificate) is available who meets the minimum standards reasonably required by the employer. If work permits are not obtained, or are not renewed, for our principal employees and contractors, we would lose their services, which event could materially affect our business.

| • | There could be changes in the Bermuda or Canada laws and regulations that could adversely affect us. |

Because we are organized in Bermuda, and also operate in Canada, we are subject to changes of law or regulation in those jurisdictions that may have an adverse impact on our operations, including imposition of tax liability or increased regulatory supervision. We are also exposed to changes in the political environment in Bermuda and Canada that could have an adverse impact on our operations.

| • | Because Till currently qualifies as a “smaller reporting company,” our disclosure obligations are different than what is required for non-smaller reporting companies. |

In addition to qualifying as an “emerging growth company,” Till currently qualifies as a “smaller reporting company”. The “smaller reporting company” category includes companies that (i) have a common equity public float of less than $75 million or (ii) are unable to calculate their public float and have annual revenue of $50 million or less when entering the system. A smaller reporting company prepares and files reports and registration statements with the Securities and Exchange Commission (“SEC”) using the same forms as are required for other SEC reporting companies; however, the information required to be disclosed may differ and may be less comprehensive than that required for other registrants.

| • | As a result of the loss of our foreign private issuer status, Till currently is required to comply with the Exchange Act’s domestic reporting regime. |

As of June 30, 2016, Till determined that it no longer qualified as a “foreign private issuer” as such term is defined in Rule 405 under the Securities Act. As a result, as of January 1, 2017, Till is required to comply with the provisions of U.S. securities laws applicable to U.S. domestic issuers, including without limitation, periodic disclosure and current reporting requirements of the Exchange Act that are applicable to U.S. domestic issuers, such as the filing of Forms 10-K, 10-Q, and 8-K that, in some cases, are more detailed and extensive than the forms Till has filed with the SEC in the past as a foreign private issuer. As a U.S. domestic issuer, Till is required to comply with the U.S. proxy rules and Regulation FD, and Till’s officers, directors, and principal shareholders are subject to the Section 16 beneficial ownership reporting and short-swing profit rules. In addition, Till is required to prepare its financial statements filed with the SEC in accordance with U.S. GAAP. As a result of such compliance with those additional securities laws, we could incur additional costs and could lose certain exemptions available to foreign private issuers.

| • | We are exposed to foreign currency risk. |

We are a multi-national company and have operations in Canada, Bermuda, and the United States. As a result, Till is exposed to foreign currency risk to the extent that exchange rates of foreign currencies are subject to adverse change over time. In particular, the U.S. dollar value of our foreign currency transaction settlements and the periodic conversion of the foreign-denominated earnings to U.S. dollars are each subject to foreign exchange rate movements. Consequently, the resulting impact of a movement in foreign currency exchange rates could materially and adversely affect our results of operations and/or financial condition.

| 16 |

Taxation Risks

| • | U.S. holders who hold Till Shares may be subject to adverse U.S. tax consequences if Till is considered to be a passive foreign investment company (“PFIC”) for U.S. federal income tax purposes as contemplated in Section 1291 of the U.S. Internal Revenue Code (“IRC”). |

Under Section 1291 of the IRC, a “U.S. holder” means a beneficial owner of shares of Till Shares who is, or that is, (i) a U.S. citizen or resident, (ii) a U.S. corporation, (iii) an estate, the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust that it is subject to the primary supervision of a U.S. court and the control of one or more U.S. persons, or has a valid election in effect under applicable U.S. Treasury Regulations to be treated as a U.S. person.

If Till is considered to be a PFIC, a U.S. holder who owns any Till Shares may be subject to adverse U.S. federal income tax consequences, including (i) a greater tax liability than might otherwise apply, (ii) an interest charge on certain taxes that are otherwise deferred by virtue of our non-U.S. status, (iii) recognizing gain from the sale of Till Shares as ordinary income (and potentially subject to an interest charge), and (iv) dividends received from us not constituting qualified dividend income (and therefore not eligible for the preferential rate of tax otherwise available to qualified dividend income). In such a case, U.S. holders that own an interest in Till will be required to file additional annual U.S. federal tax information returns.

For tax years through December 31, 2017, in general, Till would be a PFIC for a tax year if either (i) 75% or more of its income constitutes “passive income” or (ii) 50% or more of its assets (by value) produce or were held to produce “passive income,” based on the quarterly average of the fair market value of such assets. Passive income generally includes interest, dividends, and other investment income but does not include income derived in the active conduct of an insurance business by a corporation predominantly engaged in an insurance business (the “Active Insurance Company Exception”).

We do not believe that Till was classified as a PFIC for the tax years ended December 31, 2014, 2015, 2016, and 2017. No opinion of legal counsel or ruling from the U.S. Internal Revenue Service (“IRS”) concerning our status as a PFIC has been requested or obtained. Whether Till will be classified as a PFIC for the year ended December 31, 2017, or any prior tax years, will depend, in part, on whether Till was actively engaged in insurance activities that involved sufficient transfer of risk and whether our financial reserves were consistent with industry and regulatory standards. As such, Till can provide no assurance that it will not be deemed a PFIC for federal income tax purposes as contemplated in Section 1291 of the IRC.

Should Till be classified as a PFIC, a U.S. resident holder of Till Shares may be required to file an annual report with the IRS containing such information as the Treasury Regulations and/or other IRS guidance may require (e.g., IRS Form 8621). In addition to penalties, a failure to satisfy such reporting requirements may result in an extension of the time period during which the IRS can assess a tax.

If Till is classified as a PFIC, a U.S. holder may be able to mitigate certain of the adverse, or negative, tax consequences by making an election to treat Till as a “Qualified Electing Fund” or by making a mark-to-market election with respect to such U.S. holder’s ownership of Till Shares.

On December 22, 2017, the President of the United States signed the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act, among other things, replaces the PFIC test based on whether a corporation is predominately engaged in an insurance business with a test based on the corporation's insurance liabilities.

For tax years beginning after December 31, 2017, in general, Till would be a PFIC for a tax year if Till's applicable insurance liabilities constituted 25% or less of Till's assets as reported on Till's financial statement for that tax year. Applicable insurance liabilities include loss and loss adjustment expenses and certain reserves, but do not include unearned premium reserves.

Whether Till will be classified as a PFIC for the tax year ended December 31, 2018 or any subsequent tax years will depend, in part, on whether Till maintains applicable insurance liabilities in excess of 25% of Till's assets as reported on Till's financial statements. As such, Till can provide no assurance that it will not be deemed a PFIC for federal income tax purposes as contemplated in Section 1291 of the IRC.

| • | Changes in U.S. federal income tax law could materially adversely affect an investment in Till Shares. |

| 17 |

In the past, legislation has been introduced (but not enacted) in the U.S. Congress that was intended to eliminate certain perceived tax advantages of companies (including insurance companies) that have legal domiciles outside the United States but have certain U.S. connections. We are not able to predict if, when, or in what form any such legislation or guidance might be enacted or provided and whether any such legislation or guidance would have an effect on Till.

| • | Till may be subject to U.S. federal income tax that could have an adverse effect on our financial condition and/or results of operations and on an investment in Till Shares. |

If Till, Holdings, and/or RRL is considered to be engaged in a trade or business in the U.S., we could be subject to U.S. federal income tax and additional taxes on the portion of our earnings that are effectively connected to such U.S. trade or business. Alternatively, if Till, Holdings, and/or RRL is entitled to benefits under an applicable income tax treaty, and if such entity were considered engaged in a trade or business in the United States through a “permanent establishment” (as such term is defined pursuant to such applicable United States income tax treaty), then such entity could be subject to U.S. federal income tax on the portion of its earnings that are attributable to its permanent establishment in the U.S. If any portion of Till’s, Holdings’, and/or RRL’s earnings was determined to be subject to U.S. federal income tax, then such entity’s results of operations could be materially adversely affected.

Till and RRL are Bermuda companies, and Holdings is a Canadian company. We intend to manage our business so that each of these companies operates in such a manner that none of those companies should be treated as engaged in a U.S. trade or business and, thus, should not be subject to U.S. federal taxation (other than the U.S. federal excise tax on insurance and reinsurance premium income attributable to insuring or reinsuring U.S. risks and U.S. federal withholding tax on certain U.S. source investment income). However, there can be no assurance that the IRS will not contend that Till, Holdings, and/or RRL are engaged in a trade or business in the United States that would be subject to U.S. federal taxation.